UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

GENTIVA HEALTH SERVICES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

March 28, 2013

Dear Shareholder:

You are cordially invited to attend the 2013 Annual Meeting of Shareholders of Gentiva Health Services, Inc. to be held on Thursday, May 9, 2013, at 8:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339.

Details about the meeting, nominees for the Board of Directors and other matters to be acted upon are presented in the Notice of Annual Meeting of Shareholders and the proxy statement that follow.

Your vote is important. You may vote and submit your proxy via the Internet, by telephone or by signing, dating and returning a proxy card. This will assure that your shares will be represented and voted at the Annual Meeting even if you do not attend.

Thank you for your continued support, and we look forward to greeting you personally at the meeting if you are able to be present.

| | |

| Sincerely, | | Sincerely, |

| |  |

| Rodney D. Windley | | Tony Strange |

| Executive Chairman | | Chief Executive Officer and President |

GENTIVA HEALTH SERVICES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 9, 2013

The 2013 Annual Meeting of Shareholders of Gentiva Health Services, Inc., a Delaware corporation, will be held on Thursday, May 9, 2013, at 8:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339, for the following purposes:

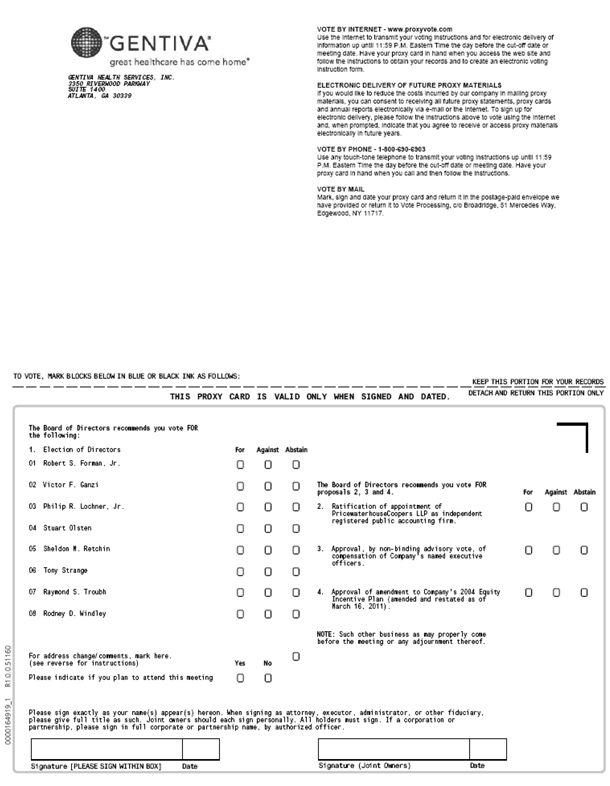

| | (1) | To elect eight directors, each to serve until the 2014 Annual Meeting of Shareholders; |

| | (2) | To consider and vote upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; |

| | (3) | To consider and conduct a non-binding advisory vote regarding the compensation of our named executive officers; |

| | (4) | To consider and vote upon a proposal to amend the Gentiva Health Services, Inc. 2004 Equity Incentive Plan (amended and restated as of March 16, 2011); and |

| | (5) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Shareholders are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the meeting in person, we urge you to vote your shares via the toll-free number or over the Internet. If you received a copy of the proxy by mail, you may sign, date and return the proxy in the envelope provided. Only shareholders of record at the close of business on March 11, 2013 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

|

| By Order of the Board of Directors, |

|

|

| John N. Camperlengo |

Senior Vice President, General Counsel and Secretary |

Dated: March 28, 2013

Atlanta, Georgia

IT IS IMPORTANT THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, WHETHER OR NOT YOU PLAN TO ATTEND. PLEASE VOTE VIA THE INTERNET, BY TELEPHONE OR BY COMPLETING AND RETURNING THE PROXY PROMPTLY SO THAT YOUR VOTE MAY BE RECORDED AT THE MEETING IF YOU DO NOT ATTEND PERSONALLY. IF YOU DO ATTEND AND DECIDE TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY.

PROXY STATEMENT

GENERAL INFORMATION

Introduction

We are providing this proxy statement to the shareholders of Gentiva Health Services, Inc. in connection with the solicitation of proxies by our Board of Directors to be voted at the 2013 Annual Meeting of Shareholders and at any adjournments of that meeting. The 2013 Annual Meeting of Shareholders of Gentiva Health Services, Inc. will be held on Thursday, May 9, 2013, at 8:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

In accordance with the rules and regulations of the Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials to each shareholder, we are furnishing such materials to our shareholders on the Internet. If you have received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials other than as described below. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials is first being sent to shareholders on or about March 28, 2013. The proxy statement and the accompanying proxy are first being made available to shareholders on or about March 28, 2013. Only shareholders of record at the close of business on March 11, 2013 are entitled to vote at the Annual Meeting.

When used in this proxy statement, the terms “we,” “us,” “our” and “Gentiva” refer to Gentiva Health Services, Inc.

The securities that can be voted at the Annual Meeting consist of our common stock, $.10 par value per share. At the close of business on March 11, 2013, the record date for determining shareholders entitled to vote at the Annual Meeting, 30,891,615 shares of our common stock were outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote.

Voting Procedures

You may vote on the Internet or by telephone or, if you received a copy of the proxy by mail, by completing, signing, dating and returning the proxy promptly in the envelope provided. Any executed proxies received with no instructions, whether the proxies come from shareholders who are “shareholders of record” (meaning the shares are registered directly in their name) or shareholders who are “beneficial owners” (meaning the shares are held in a stock brokerage account or by a bank or other nominee), will be voted in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends that you vote FOR all of the nominees to the Board of Directors, FOR ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, FOR the compensation of our named executive officers as described in this proxy statement and FOR the approval of the amendment to the Gentiva Health Services, Inc. 2004 Equity Incentive Plan (amended and restated as of March 16, 2011).

1

Revocability of Proxies

A shareholder of record who grants a proxy may revoke it at any time before it is voted by giving notice in writing to our Secretary, by subsequently voting on the Internet or by telephone, by granting a subsequent proxy, or by appearing in person and voting at the meeting. Any shareholder attending the meeting and entitled to vote may vote in person whether or not the shareholder has previously submitted a proxy. Please note, however, that under the rules of the national stock exchanges, any beneficial owner of our common stock whose shares are held in street name by a member brokerage firm may revoke his or her proxy and vote his or her shares in person at the meeting only in accordance with applicable rules and procedures of the exchanges as followed by the beneficial owner’s brokerage firm.

Quorum; Broker Non-Votes; Abstentions

Quorum: A majority of all the shares of common stock issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum at the meeting. Proxies marked as abstentions or withhold authority and “broker non-votes” (as explained below) are counted in determining whether a quorum is present.

Broker Non-Vote: Under applicable regulations, if a broker holds shares on your behalf and you do not instruct your broker how to vote those shares on a matter considered “routine,” the broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such matter. We believe that Proposals 1, 3 and 4 are “non-routine” matters and as such the broker is not authorized to vote your shares on such proposals absent instructions from you. A “broker non-vote” will not be considered a vote “for” or a vote “against” a proposal and will have no effect on the outcome of the vote.

Abstentions:An abstention with respect to any of the proposals in this proxy statement is neither a vote cast “for” the proposal nor a vote cast “against” the proposal and, therefore, will have no effect on the outcome of the vote.

Inspector of Election: Broadridge Financial Solutions, Inc. will count the votes and provide an Inspector of Election at the meeting.

Additional Matters

Our principal executive offices are located at 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. Gentiva was incorporated in Delaware in August 1999.

We are making available to you a copy of our 2012 Annual Report to Shareholders, including a copy of our Form 10-K for the fiscal year ended December 31, 2012, with the Notice of Annual Meeting of Shareholders and proxy statement on the website www.proxyvote.com. The Annual Report and Form 10-K are not deemed part of the soliciting material for the proxy.

If you would like directions to attend the Annual Meeting and vote in person, please call us at (770) 951-6450.

2

PROPOSAL 1

ELECTION OF DIRECTORS

All our directors stand for election on an annual basis and serve a one-year term upon election. In addition, any director elected by the Board of Directors to fill a newly created directorship or to fill a vacancy on the Board of Directors will hold office for a term ending at the next annual meeting of shareholders after the director’s election or until such director’s successor shall have been duly elected and qualified.

Our Board of Directors currently consists of eight members, Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Stuart Olsten, Sheldon M. Retchin, Tony Strange, Raymond S. Troubh and Rodney D. Windley, all of whom are standing for re-election at this year’s Annual Meeting. Each of the members who is standing for re-election has consented to serve another term as a director if re-elected. The Corporate Governance and Nominating Committee of the Board of Directors recommended the slate of eight nominees to the Board of Directors for its approval. The Board of Directors has recommended the slate of eight nominees to the shareholders for approval at the Annual Meeting.

Except in the event of a contested election, each director to be elected by shareholders shall be elected by the vote of the majority of the votes cast at a meeting for the election of directors at which a quorum is present. A “majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against.” Votes cast exclude abstentions and any “broker non-votes” with respect to that director’s election. In the event of a contested election, directors shall be elected by the vote of a plurality of the votes cast at a meeting for the election of directors at which a quorum is present. If for any reason any of the nominees is not a candidate when the election occurs (which is not expected), the proxies may be voted for a substitute nominee or nominees.

In addition, our Corporate Governance Guidelines include a resignation policy, which provides, among other things, that if a nominee for our Board of Directors does not receive a majority of the votes cast:

| | • | | such nominee must tender his or her resignation within ten business days; |

| | • | | the Corporate Governance and Nominating Committee of the Board of Directors must recommend to our Board of Directors whether such resignation should be accepted or rejected; and |

| | • | | our Board of Directors must take final action no later than 90 days after the shareholder vote. |

|

The Board of Directors recommends that you vote FOR the election of Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Stuart Olsten, Sheldon M. Retchin, Tony Strange, Raymond S. Troubh and Rodney D. Windley. |

Information as to Nominees for Director

The following information, as reported to us, is shown below for each nominee for director: name, age and principal occupation; period during which the nominee has served as a director; position, if any, with us; certain business experience; other directorships held; and any committees of our Board of Directors on which the nominee serves. We also include the specific attributes and experience of a nominee on which our Board of Directors focused in nominating that individual for election as director.

Robert S. Forman, Jr.

Mr. Forman has served as a director of Gentiva and a member of the Audit Committee of the Board of Directors since September 2009, serving as chairman of that committee since May 2011, and has served as a member of the Corporate Governance and Nominating Committee of the Board of Directors since May 2012. Mr. Forman was the founder, president and chief executive officer of IMI Systems, Inc., an international computer consulting firm specializing in the design and implementation of service order and billing systems in

3

the telecommunications industry. In 1995, Olsten Corporation acquired IMI Systems, Inc. and Mr. Forman was an executive vice president of Olsten Corporation until 1997. Since leaving Olsten, Mr. Forman served on the boards of several private information technology consulting companies. He currently serves on the Advisory Board of Rensselaer Polytechnic Institute’s IT School. Mr. Forman is 73 years old. In nominating Mr. Forman for re-election as a director, our Board of Directors focused on his past experience as a founder and chief executive officer of IMI Systems, Inc., and his rich and extensive background in technology as important attributes and experience for his continuing to serve as one of our directors.

Victor F. Ganzi

Mr. Ganzi has served as a director of Gentiva since November 1999 and as Lead Director of the Board of Directors since May 2009. He has served as a member of the Audit Committee of the Board of Directors since November 1999, serving as chairman of that committee from November 1999 to May 2009, and has served as chairman of the Compensation Committee of the Board of Directors since May 2012, having previously served as chairman and a member of a predecessor committee of that committee since May 2009. He served as a director of Olsten Corporation from 1998 until March 2000. He was president and chief executive officer of The Hearst Corporation, a private diversified communications company with interests in magazine, newspaper and business publishing, television and radio stations and cable programming networks, from 2002 to 2008. He is a director, chairman of the audit committee and member of the nominating and governance committee of Towers Watson & Co. and was a director of Hearst-Argyle Television, Inc. from 1997 to 2008 and a director of Wyeth from 2005 to 2009. Mr. Ganzi is 66 years old. In nominating Mr. Ganzi for re-election as a director, our Board of Directors focused on his past experience as chief executive officer, chief financial officer and chief legal officer of The Hearst Corporation and the knowledge of Gentiva that he has gained and shared from serving as a director and member of our Audit Committee since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Philip R. Lochner, Jr.

Mr. Lochner has served as a director of Gentiva since September 2009, as chairman and a member of the Corporate Governance and Nominating Committee of the Board of Directors since May 2012, having previously served as a member of a predecessor committee of that committee since September 2009, and as a member of the Clinical Quality Committee of the Board of Directors since May 2010. Mr. Lochner currently is a director and member of the audit committee and the director affairs/corporate governance committee of CLARCOR Inc., the presiding director and member of the audit committee and the executive committee and chairman of the governance and public responsibility committee of CMS Energy Corporation and a director and member of the audit committee and the nominating and governance committee of Crane Co. During the past five years, at various times, Mr. Lochner was a director of Apria Healthcare Group Inc., GTECH Holdings Corporation, Monster Worldwide, Inc. and Solutia Inc. From 1991 until 1998, Mr. Lochner was senior vice president and chief administrative officer of Time Warner Inc. Prior to that, from 1990 to 1991, he served as a Commissioner of the Securities and Exchange Commission. He has also previously served as a member of the board of governors of the National Association of Securities Dealers and of the American Stock Exchange. Mr. Lochner is 70 years old. In nominating Mr. Lochner for re-election as a director, our Board of Directors focused on his expertise in the areas of mergers and acquisitions, corporate governance and compensation, his prior service as a Commissioner of the Securities and Exchange Commission and his varied service on the board of directors and board committees of several public companies as important attributes and experience for his continuing to serve as one of our directors.

Stuart Olsten

Mr. Olsten has served as a director of Gentiva since November 1999, as a member of the Audit Committee of the Board of Directors since May 2008 and as a member of the Compensation Committee of the Board of Directors since May 2012, having previously served as a member of a predecessor committee of that committee since May 2009. He served as a director of Olsten Corporation from 1986 until 2000. From 1990 to 2000, at

4

various times, he served as Olsten Corporation’s chairman of the board of directors, vice chairman and president. From 2001 to 2007, Mr. Olsten was the chairman of the operating board of MaggieMoo’s International, LLC and was its president and chief executive officer in 2003. Mr. Olsten serves on the board of private online employment service company IvyExec, Inc., as well as on the board of HarQen, Inc., a voice asset management company, where he also serves as chairman of the compensation committee. He is on the Advisory Board of the Syracuse University School of Management. Mr. Olsten is 60 years old. In nominating Mr. Olsten for re-election as a director, our Board of Directors focused on his extensive background in employment services and the knowledge of Gentiva that he has gained and shared from serving as a director since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Sheldon M. Retchin, M.D., M.S.P.H.

Dr. Retchin has served as a director of Gentiva and a member of the Clinical Quality Committee of the Board of Directors since September 2009 and as a member of the Corporate Governance and Nominating Committee of the Board of Directors since May 2012. Since 2003, Dr. Retchin has served as the chief executive officer of the Virginia Commonwealth University Health System in Richmond, Virginia, and as vice president for health sciences at Virginia Commonwealth University. The Virginia Commonwealth University Health System is a large academic health center in Central Virginia and delivers primary and tertiary health care to the mid-atlantic region. Dr. Retchin is a professor in the departments of internal medicine, gerontology and health administration and is a national expert in health policy and health care delivery, with special expertise on the costs, quality and alternative financing strategies for the Medicare program. He has over 80 publications on the costs and quality of care and has had appointments on numerous national panels regarding health care and the health professional workforce. Dr. Retchin is 62 years old. In nominating Dr. Retchin for re-election as a director, our Board of Directors focused on his clinical and executive leadership in the health care field and his recognized expertise in health policy and health care delivery, especially regarding the Medicare program, as important attributes and experience for his continuing to serve as one of our directors.

Tony Strange

Mr. Strange has served as a director of Gentiva and our chief executive officer since January 2009, and as our president since November 2007. He served as our chairman of the Board of Directors from May 2011 to February 2013. He served as chief operating officer of Gentiva from November 2007 to May 2009 and as executive vice president of Gentiva and president of our home health division from February 2006 to November 2007. From 2001 to 2006, Mr. Strange served as president and chief operating officer of The Healthfield Group, Inc. Mr. Strange joined Healthfield in 1990 and served in other capacities, including regional manager, vice president of development and chief operating officer, until being named president in 2001. He is a director of the National Association for Home Care & Hospice. Mr. Strange is 50 years old. In nominating Mr. Strange for re-election as a director, our Board of Directors focused on his leadership and execution as our chairman and chief executive officer in growing Gentiva, driving and integrating Gentiva’s acquisition of Odyssey HealthCare, Inc. and setting and communicating the proper cultural and behavioral tone as important attributes and experience for his continuing to serve as one of our directors.

Raymond S. Troubh

Mr. Troubh has served as a director of Gentiva since November 1999, as a member of the Audit Committee of the Board of Directors since May 2000, serving as chairman of that committee from May 2009 to May 2011, and as a member of the Compensation Committee of the Board of Directors since May 2012, having previously served as a member of its predecessor committees since November 1999. He served as a director of Olsten Corporation from 1993 until March 2000. He has been a financial consultant for more than five years. He is a director, member of the compensation committee and member of the audit committee of Diamond Offshore Drilling Inc., a director and member of the compensation committee of General American Investors Company, and a director and member of the audit committee and the nominating and corporate governance committee of

5

The Wendy’s Company. Mr. Troubh is 86 years old. In nominating Mr. Troubh for re-election as a director, our Board of Directors focused on his seasoned experience from having served on the board of directors and board committees of varied public companies, his vision and expertise in matters of corporate governance, his former selection as Director of the Year by the National Association of Corporate Directors and the knowledge of Gentiva that he has gained and shared as a director and member of our Audit Committee and Compensation Committee (and its predecessor committees) since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Rodney D. Windley

Mr. Windley has served as our executive chairman of the Board of Directors since February 2013. He has served as a director of Gentiva since February 2006, when he was elected to the Board of Directors and appointed vice chairman of the Board of Directors in connection with the completion of our acquisition of The Healthfield Group, Inc. He has served as a member of the Clinical Quality Committee of the Board of Directors since May 2008, serving as chairman since May 2009. Mr. Windley, Healthfield’s founder, had served as its chairman and chief executive officer since its inception in 1986 until the completion of the acquisition. Mr. Windley is the chairman of Prom Queen, LLC, a private real estate holding and restaurant development company, chairman of RDW Ventures, LLC, a private equity firm, and chairman of Gulf Coast Hatteras, Inc., a private yacht and sport fishing dealership. Mr. Windley is president of the Georgia Association for Home Care and is also chair emeritus of Fragile Kids Foundation, Inc., having started the charity in 1992. Mr. Windley is 65 years old. In nominating Mr. Windley for re-election as a director, our Board of Directors focused on his past experience as founder and chief executive officer of Healthfield, his financial and entrepreneurial background and his expansive knowledge of the health care industry as important attributes and experience for his continuing to serve as one of our directors.

CORPORATE GOVERNANCE

Independent Directors

In accordance with the listing standards of The Nasdaq Stock Market, Inc. (“NASDAQ”), we ensure that at least a majority of our Board of Directors is independent under the NASDAQ definition of independence, and that the members of the Board of Directors as a group maintain the requisite qualifications under NASDAQ listing standards for populating the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee and the Board of Directors have determined that Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Stuart Olsten, Sheldon M. Retchin and Raymond S. Troubh do not have any relationship that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors and are independent in accordance with NASDAQ listing standards. In addition, we define “independent director” in the charters of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee, all of which may be found on our website at www.gentiva.com under the “Investors” section. Each member of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee is independent in accordance with NASDAQ listing standards and, in the case of a member of the Audit Committee or the Compensation Committee, in accordance with the rules of the Securities and Exchange Commission, and satisfies the definition of “independent director” set forth in the respective committee charter.

The independent directors generally meet in executive session on the dates when regularly scheduled Board of Directors meetings are held. Mr. Ganzi, the Lead Director, presides over the executive sessions of the independent directors.

Meetings of the Board of Directors and its Committees

During the past fiscal year, the Board of Directors held five meetings. During our 2012 fiscal year, our Compensation, Corporate Governance and Nominating Committee was split into two separate committees: the

6

Compensation Committee and the Corporate Governance and Nominating Committee. As a result of that change, the Board of Directors now has four standing committees: an Audit Committee; a Clinical Quality Committee; a Compensation Committee; and a Corporate Governance and Nominating Committee. Except for Mr. Windley’s service as chairman and a member of the Clinical Quality Committee, each member of each committee is “independent.”

During 2012, each incumbent director attended at least 75% of the aggregate number of meetings held by the Board of Directors and all committees on which the director served during the period that the director served. All the members of our Board of Directors attended the 2012 Annual Meeting of Shareholders, except for one director. It is our policy to encourage the members of our Board of Directors to attend annual meetings of shareholders.

Audit Committee

The principal functions and responsibilities of the Audit Committee include:

| | • | | overseeing our internal control structure, financial reporting and legal and compliance programs; |

| | • | | discussing guidelines and policies with respect to our financial risk assessment and risk management policies with management; |

| | • | | reviewing and selecting the independent registered public accounting firm to audit our consolidated financial statements; |

| | • | | receiving and acting on reports and comments from our independent registered public accounting firm and approving the firm’s fees; |

| | • | | reviewing critical accounting principles and estimates employed in our financial reporting; |

| | • | | reviewing our annual audited consolidated financial statements and unaudited quarterly financial statements with management and our independent registered public accounting firm and recommending inclusion of the audited financial statements in our annual report on Form 10-K and the unaudited financial statements in our quarterly reports on Form 10-Q; |

| | • | | maintaining direct lines of communication with the Board of Directors and our management, internal auditing staff and independent registered public accounting firm; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Forman serves as the chairman, and Messrs. Ganzi, Olsten and Troubh serve as members, of the Audit Committee. The committee met seven times in 2012. The Board of Directors has adopted a written charter for the Audit Committee, which is posted on our website at www.gentiva.com under the “Investors” section. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), Exchange Act Rule 10A-3 and applicable NASDAQ listing standards. The Board of Directors has determined that each member of the Audit Committee is “independent” under the heightened independence standards required for members of the Audit Committee by NASDAQ listing standards, the rules of the Securities and Exchange Commission and the Audit Committee charter. The Board of Directors has also determined that Victor F. Ganzi is an “audit committee financial expert,” as that term is defined by rules and regulations of the Securities and Exchange Commission.

Clinical Quality Committee

The principal functions and responsibilities of the Clinical Quality Committee include:

| | • | | providing oversight of our clinical leadership in the development of leading edge clinical strategies and practices; |

| | • | | monitoring our performance against established internal and external benchmarking regarding clinical performance and outcomes; |

7

| | • | | facilitating the development of industry best practices based on internal and external data comparisons; |

| | • | | fostering enhanced awareness of our clinical performance by the Board of Directors and external sources; |

| | • | | establishing a long term, strategic clinical vision for Gentiva; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Windley serves as the chairman, and Mr. Lochner and Dr. Retchin serve as members, of the Clinical Quality Committee. The committee met three times in 2012. The Board of Directors has adopted a written charter for the Clinical Quality Committee, which is posted on our website at www.gentiva.com under the “Investors” section.

Compensation Committee

The principal functions and responsibilities of the Compensation Committee include:

| | • | | overseeing and administering our executive compensation policies, plans and practices and establishing and adjusting from time to time compensation for our Chief Executive Officer and our other executive officers; |

| | • | | administering and authorizing the issuance of stock options, stock awards and other awards under our 2004 Equity Incentive Plan (amended and restated as of March 16, 2011) and awards under our Executive Officers Bonus Plan; |

| | • | | overseeing succession planning for our Chief Executive Officer and other key executives; |

| | • | | advising the Board of Directors on trends in compensation programs for directors, with a view towards aligning such compensation with shareholder interests; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Ganzi serves as the chairman, and Messrs. Olsten and Troubh serve as members, of the Compensation, Committee. The committee met six times in 2012, four of which were prior to the committee split. The Board of Directors has adopted a written charter for the Compensation Committee, which is posted on our website at www.gentiva.com under the “Investors” section. The Compensation Committee has been established in accordance with Exchange Act Rule 10C-1 and applicable NASDAQ listing standards. The Board of Directors has determined that each of the members of the committee is “independent” under the heightened independence standards required for members of the Compensation Committee by NASDAQ listing standards, the rules of the Securities and Exchange Commission and the committee charter, is a “non-employee director” as defined in the committee charter and in Rule 16b-3 under the Exchange Act, and is an “outside director” as defined under Section 162(m) of the Internal Revenue Code and related regulations.

Compensation Committee Process

In addition to the functions and responsibilities discussed above, the Compensation Committee is responsible for establishing goals and objectives relevant to executive compensation, evaluating our executive officers’ performance and proposing guidelines regarding director compensation matters. The committee makes recommendations to our Board of Directors regarding our incentive compensation and equity compensation plans and approves awards under our equity compensation plans. The committee also oversees our benefit plans and evaluates any proposed new retirement or executive benefit plans. The committee may delegate its plan administrative duties and has delegated certain authority to administer Gentiva’s Employee Stock Purchase Plan to our Benefits Plan Administrative Committee, which is appointed by the Board of Directors.

8

The Compensation Committee has the sole authority, without action of our Board of Directors, to retain and terminate compensation consultants, independent legal counsel and other advisors, and considers the factors laid out in Exchange Act Rule 10C-1 and NASDAQ listing standards before selecting, or receiving services from, a compensation consultant, independent legal counsel or other advisor. The committee has engaged compensation consultants to provide information and recommendations regarding executive officer compensation, including equity grants and performance cash awards, as discussed in more detail in the Compensation Discussion and Analysis below.

The Compensation Committee generally receives proposals and information from its compensation consultant and from our Chief Executive Officer for its consideration regarding executive compensation. As discussed below in the Compensation Discussion and Analysis, our Chief Executive Officer works closely with the committee to maintain an open dialogue regarding our goals, progress towards achievement of those goals and expectations for future performance, and makes recommendations regarding the compensation of our executive officers other than himself. However, our Chief Executive Officer may not be present during the committee’s deliberation or voting related to his compensation.

Early in the year, the Compensation Committee generally reviews our executive officers’ compensation, approves any salary increases (unless approved at the end of the prior year) and long-term incentives, evaluates and approves discretionary contributions and the annual cash incentive awards for the prior year, and establishes the performance goals for the upcoming year. Throughout the year, the committee oversees recruiting for senior executive positions and approves compensation for newly hired or promoted senior executives. The committee also reviews our general employee benefit plans and approves changes as needed. At the end of the year, the committee generally meets to review executive compensation and discuss potential compensation to be approved for the following year, and may approve salary increases or other compensation matters for the following year.

Compensation Risk Assessment

The Compensation Committee has evaluated our compensation program to ensure that our policies and practices do not create risks that are reasonably likely to have a material adverse effect on Gentiva.

We believe that we have minimized the potential for excessive risk taking in our annual cash incentive program by:

| | • | | setting performance goals for our executive officers and other employee participants that generally include quantitative and qualitative criteria, some of which would conflict with taking excessive risks to achieve short-term gain; and |

| | • | | retaining the ability to utilize negative discretion in determining annual cash incentive awards if an executive officer or other employee participant takes unnecessary or inappropriate risks. |

The other two principal elements of our compensation program—base salaries and long-term incentive awards—are either risk neutral or help lower risk. Annual base salary increases for our executive officers and other employees are based on a number of factors that reward performance that improves Gentiva’s business and reputation for clinical excellence, but are tempered by the employee’s historical compensation as well as competitive market data. Our long-term incentive awards utilize a balanced portfolio of compensation elements, such as cash and equity, and focus on sustained performance over time. These awards vest or are earned over several years and the potential compensation an executive officer or other participating employee can receive through them is generally tied directly to our stock price and/or other corporate performance metrics. The committee believes that this discourages taking excessive risk for a short-term gain because it is incompatible with maximizing the value of these incentive awards over the long-term. In addition, we have adopted and implemented share ownership guidelines for our executive officers.

9

Compensation Committee Interlocks and Insider Participation

None of the directors on the Compensation Committee (or the Compensation, Corporate Governance and Nominating Committee prior to the split in the committees) is or was formerly an officer or employee of Gentiva or had any relationship or related party transaction requiring disclosure under the rules of the Securities and Exchange Commission. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Corporate Governance and Nominating Committee

The principal functions and responsibilities of the Corporate Governance and Nominating Committee include:

| | • | | monitoring and safeguarding the independence of our Board of Directors; |

| | • | | seeking, considering and recommending qualified candidates for election as directors and recommending a slate of nominees for election by the shareholders at the annual meeting, subject to the approval of the Board of Directors; |

| | • | | devising and proposing to the Board of Directors corporate governance guidelines and a code of business conduct and ethics for directors, officers and employees; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Lochner serves as the chairman, and Mr. Forman and Dr. Retchin serve as members, of the Corporate Governance and Nominating Committee. The committee met six times in 2012, four of which were prior to the committee split. The Board of Directors has adopted a written charter for the Corporate Governance and Nominating Committee, which is posted on our website at www.gentiva.com under the “Investors” section. The Board of Directors has determined that each of the members of the committee is an “independent director” as defined under NASDAQ listing standards and the committee charter.

Consideration of Director Nominees

The Corporate Governance and Nominating Committee will consider recommendations for director nominees from an array of sources, including members of our Board of Directors, management and shareholders. Shareholders who would like the Corporate Governance and Nominating Committee to consider a prospective candidate should act in accordance with our Bylaws and submit the candidate’s name, age, business and residence address, biographical data and qualifications, and provide an accounting of the number of shares of stock held, beneficially or of record, by the prospective candidate, as well as a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a director, to Gentiva’s Secretary, Gentiva Health Services, Inc., 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. Submissions of names (and other required information) by shareholders of prospective candidates for consideration by the committee for nomination and election at our 2014 Annual Meeting of Shareholders must be received in writing by us at the above address on or after October 4, 2013 and on or before December 4, 2013. The committee reserves the right to request additional information from the candidate to assist the committee in the evaluation process.

The Corporate Governance and Nominating Committee believes that all members of the Board of Directors should have a high level of professional and personal ethics and values and outstanding ability and sound judgment. Directors should be committed to enhancing shareholder value and have sufficient time to attend meetings and participate effectively on the Board of Directors. Each director is expected to represent the interests of all shareholders.

While there is no firm requirement of minimum qualifications or skills that a director candidate must possess, the Corporate Governance and Nominating Committee seeks to identify candidates with a diversity of

10

background and experience as it deems appropriate given the then current needs of the Board of Directors. Director candidates have been identified by current directors and executive search firms. The committee evaluates director candidates based on a number of factors, including their independence, business judgment, leadership ability, experience in developing and analyzing business strategies, experience in the health care industry, strategic vision and financial literacy, and, for incumbent directors, their past performance. All members of the Board of Directors may interview the final candidates. The same identifying and evaluating procedures apply to all candidates for director nomination, including candidates submitted by shareholders.

Once the Corporate Governance and Nominating Committee has evaluated the director candidates as described above, it recommends the slate of nominees to the Board of Directors for its approval. The Board of Directors then recommends the slate of nominees to the shareholders for their approval at the next annual meeting of shareholders.

Board of Directors Leadership Structure and Role in Risk Oversight

Our Chief Executive Officer, Tony Strange, is a member of our Board of Directors, but he does not serve on any committees of the Board of Directors. Rodney D. Windley serves as our executive Chairman of our Board of Directors and as chairman of the Clinical Quality Committee. Our Board of Directors has an independent Lead Director, Victor F. Ganzi. Among other responsibilities, the Lead Director:

| | • | | convenes and chairs regular and special executive sessions of the independent directors; |

| | • | | serves as liaison between the independent directors and the Chairman of the Board of Directors and the Chief Executive Officer; |

| | • | | presides at meetings of the Board of Directors in the absence of the Chairman and Vice Chairman; and |

| | • | | performs such other duties as agreed by the Board of Directors or the independent directors from time to time. |

We believe that our leadership structure is appropriate given the independent leadership that our Board of Directors has in the form of our Lead Director.

The Board of Directors administers its risk oversight function through the Audit Committee of the Board of Directors. Through its charter, the Audit Committee is charged, among other things, with:

| | • | | overseeing our compliance programs and meeting with our Chief Compliance Officer; |

| | • | | reviewing with our General Counsel, on a regular basis, all material litigation and other significant legal matters; |

| | • | | meeting with our independent auditors, internal auditors and financial management and reviewing the scope of audit procedures of the proposed audit and, at the completion of the audit, meeting again with the independent auditors to review audit results; and |

| | • | | reporting to the Board of Directors at regular intervals on the committee’s activities. |

Shareholder Communications

The Board of Directors has established a process for shareholders to send communications to the Board of Directors. Shareholders may communicate with the Board of Directors generally or with a specific director at any time by writing to Gentiva’s Secretary, Gentiva Health Services, Inc., 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. The Secretary will forward communications to the director to whom they are addressed, or, if addressed to the Board of Directors generally, to the chair of the Corporate Governance and Nominating Committee.

11

Code of Ethics and Corporate Governance Guidelines

We have adopted two codes of ethics, a Code of Ethics for Senior Financial Officers (including the Chief Executive Officer) and a Code of Business Conduct and Ethics, the latter being applicable to all of our employees, officers and directors. The codes are designed to promote honest and ethical conduct by our employees, officers and directors, and each is posted on our website at www.gentiva.com under the “Investors” section.

We have also adopted Corporate Governance Guidelines, which address, among other things: director and Board of Directors responsibilities to Gentiva and its shareholders; Lead Director responsibilities and independent director sessions; director qualification standards, including “independence” requirements; and director stock ownership guidelines. The Corporate Governance Guidelines are also posted on our website at www.gentiva.com under the “Investors” section.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 11, 2013, the record date for the Annual Meeting (unless otherwise indicated), the amount of beneficial ownership of our common stock held by:

| | • | | our named executive officers in the Summary Compensation Table; |

| | • | | each current director and nominee for director; |

| | • | | each beneficial owner of more than five percent of our common stock; and |

| | • | | all of our executive officers and directors as a group. |

For the purpose of the table, a person or group of persons is deemed to have “beneficial ownership” of any shares that such person or group has the right to acquire within 60 days after March 11, 2013 through the exercise of stock options or exchange or conversion rights, but such shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

| | | | | | | | |

Name of Beneficial Owner | | Amount of Shares

of Common Stock and

Nature of Beneficial

Ownership(1)(2)(3)(4) | | | Percent of Class

Owned (if more

than 1%) | |

John N. Camperlengo | | | 201,071 | | | | — | |

David A. Causby | | | 164,278 | | | | — | |

Jeff Shaner | | | 150,883 | | | | — | |

Eric R. Slusser | | | 258,102 | | | | — | |

Tony Strange | | | 1,054,448 | | | | 3.3 | % |

Robert S. Forman, Jr.(5) | | | 110,710 | | | | — | |

Victor F. Ganzi (6) | | | 159,103 | | | | — | |

Philip R. Lochner, Jr. | | | 29,363 | | | | — | |

Stuart Olsten(7) | | | 246,766 | | | | — | |

Sheldon M. Retchin | | | 30,363 | | | | — | |

Raymond S. Troubh | | | 184,164 | | | | — | |

Rodney D. Windley(8) | | | 536,373 | | | | 1.7 | % |

BlackRock, Inc.(9)

40 East 52nd Street

New York, NY 10022 | | | 3,341,519 | | | | 10.8 | % |

Wells Fargo & Company(10)

420 Montgomery Street

San Francisco, CA 94104 | | | 3,253,102 | | | | 10.5 | % |

Dimensional Fund Advisors LP(11)

Palisades West, Building One

6300 Bee Cave Road

Austin, TX 78746 | | | 2,138,690 | | | | 6.9 | % |

The Vanguard Group – 23 – 1945930 (12)

100 Vanguard Blvd.

Malvern, PA 19355 | | | 1,855,502 | | | | 6.0 | % |

All executive officers and directors as a group (13 persons)(13) | | | 3,271,244 | | | | 10.1 | % |

| (1) | Unless otherwise indicated, the shareholders identified in this table have sole voting and investment power with respect to the shares beneficially owned by them. |

| (2) | Includes beneficial ownership of the following number of shares that may be acquired upon exercise of presently exercisable stock options under our 2004 Equity Incentive Plan: Mr. Camperlengo— 115,710; Mr. Causby—89,376; Mr. Shaner—76,810; Mr. Slusser—114,418; and Mr. Strange—601,218. |

| (3) | Includes beneficial ownership of the following number of whole shares acquired and currently held under our Employee Stock Purchase Plan, as amended: Mr. Camperlengo—6,014; Mr. Causby—2,835; Mr. Shaner—2,010; and Mr. Strange—10,492. |

13

| (4) | Includes beneficial ownership of the following number of shares representing the equivalent of units deferred under our Stock & Deferred Compensation Plan for Non-Employee Directors: Mr. Forman—29,363; Mr. Ganzi—53,760; Mr. Lochner—29,363; Mr. Olsten—53,670; Dr. Retchin—29,363; Mr. Troubh—50,640; and Mr. Windley—35,415. |

| (5) | In addition to the shares referred to in footnote (4), Mr. Forman’s holdings include 79,922 shares owned directly, and 25 shares owned by his wife and 1,400 shares owned by his wife’s trust, as to which shares he disclaims beneficial ownership. |

| (6) | In addition to the shares referred to in footnote (4), Mr. Ganzi’s holdings include 52,633 shares owned directly and 52,800 shares owned indirectly through a trust. |

| (7) | In addition to the shares referred to in footnote (4), Mr. Olsten’s holdings include 192,796 shares owned directly and 300 shares owned by his wife, as to which shares he disclaims beneficial ownership. |

| (8) | In addition to the shares referred to in footnote (4), Mr. Windley’s holdings include 500,958 shares owned indirectly through trusts. |

| (9) | The amount shown and the following information are derived from Amendment No. 4 to Schedule 13G filed with the Securities and Exchange Commission on January 11, 2013 by BlackRock, Inc. on behalf of itself and certain of its subsidiaries (“BlackRock”), reporting beneficial ownership as of December 31, 2012. According to the amended Schedule 13G, BlackRock reported beneficial ownership of 3,341,519 shares of our common stock with sole voting and dispositive power as to all of the shares. |

| (10) | The amount shown and the following information are derived from Amendment No. 4 to Schedule 13G filed with the Securities and Exchange Commission on February 13, 2013 by Wells Fargo & Company on behalf of itself and certain of its subsidiaries (“Wells Fargo”), reporting beneficial ownership as of December 31, 2012. According to the amended Schedule 13G, Wells Fargo reported beneficial ownership of 3,253,102 shares of our common stock, with sole voting and dispositive power as to five shares, shared voting power as to 3,268,726 shares, and shared dispositive power as to 5,830,149 shares. |

| (11) | The amount shown and the following information are derived from an amended Schedule 13G filed with the Securities and Exchange Commission on February 11, 2013 by Dimensional Fund Advisors LP (“Dimensional”), reporting beneficial ownership as of December 31, 2012. According to the amended Schedule 13G, Dimensional reported beneficial ownership of 2,138,690 shares of our common stock, with sole dispositive power as to all of the shares and sole voting power as to 2,097,083 of the shares. Dimensional, a registered investment advisor, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as investment manager to certain other commingled group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). Dimensional reported that, in its role as investment advisor or manager, Dimensional does not possesses investment and/or voting power over the shares of our common stock which are held by the Funds, but may be deemed to be the beneficial owner of such shares. Dimensional disclaims beneficial ownership of the shares. |

| (12) | The amount shown and the following information are derived from Schedule 13G filed with the Securities and Exchange Commission by The Vanguard Group – 23 – 1945930, reporting beneficial ownership as of December 31, 2012 of 1,855,502 shares of our common stock, with sole voting power as to 48,694 of the shares, sole dispositive power as to 1,809,708 of the shares and shared dispositive power as to 45,794 of the shares. |

| (13) | Includes 1,892,252 shares owned directly and indirectly by current executive officers and directors, 1,097,508 shares that may be acquired upon exercise of presently exercisable stock options and 281,484 shares representing shares deferred as share units. |

14

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

Our Business

We are a leading provider of home health and hospice services serving patients through approximately 430 locations in 40 states. Our revenues are generated from federal and state government programs, commercial insurance and individual consumers.

During 2012, we continued to operate in an environment with a significant amount of reimbursement rate and regulatory uncertainty, which had a significant impact on our financial results and stock price. Notwithstanding these uncertainties, our executive team executed on important strategic initiatives, resolved certain outstanding legal matters and returned value to our shareholders.

| | • | | We increased admission growth in our Home Health division by 5.4% in 2012 versus 2011 (excluding the impact of closed or sold locations). |

| | • | | We completed three acquisitions, which increased our market density and geographic coverage. |

| | • | | We generated $114.2 million in free cash flow based on improved operating results and tight control over working capital and capital expenditures. |

| | • | | We amended our senior secured credit agreement to increase financial covenant flexibility through the remaining term of the facility. |

| | • | | We invested significant resources into training and technological advancements to ensure that our employees have the training and tools to outperform our competitors. |

| | • | | We were advised by the staff of the Securities and Exchange Commission that its investigation related to our participation in the Medicare Home Health Prospective Payment System is complete and that it does not intend to recommend any enforcement action. |

| | • | | We obtained dismissal, with prejudice, of the state court shareholder derivative action filed against us. |

| | • | | For 2012, Gentiva’s one-year total shareholder return increased by 48.9%, versus a 12.3% increase in the one-year total shareholder return of the NASDAQ composite index. |

In determining executive compensation for 2012, the Compensation Committee considered, among other things, the level of the accomplishments listed above, Gentiva’s operating performance and financial results for prior years, and the existing and the anticipated economic and regulatory environment.

Compensation and Corporate Governance Highlights

The following are some of the key highlights from our compensation and corporate governance practices during the last fiscal year and in the current fiscal year:

| | • | | In 2012, 66% of the targeted total compensation for our NEOs was performance-based and dependent on our financial performance; |

| | • | | In 2012 and 2013, our NEOs did not receive increases in their base salaries, which have remained the same since November 2010; |

| | • | | In 2012, our NEOs did not receive any equity awards or discretionary cash bonus awards; |

| | • | | Our NEOs received long-term performance cash awards which are earned by meeting certain performance measures based on fully-diluted earnings per share and vest generally in three years if earned; |

15

| | • | | Our Executive Officers Bonus Plan contains specific performance criteria, including quantitative financial measures, such as revenues, operating profit margin and operating income; |

| | • | | We have stock ownership guidelines for our NEOs and directors which further align the interests of our NEOs and directors with the interests of our shareholders; |

| | • | | We have a policy that prohibits all directors, officers and employees from engaging in hedging transactions in our securities; |

| | • | | We have a policy that (i) prohibits all directors, officers and employees from holding our securities in margin accounts or pledging more than 50% of their Gentiva securities and (ii) requires that any documents evidencing any proposed pledge must be pre-approved and must provide that securities may not be sold at a time when the pledgor is not permitted to trade in our securities; |

| | • | | The roles of our Chairman and Chief Executive Officer have been separated and we also have an independent Lead Director; and |

| | • | | Each year the Compensation Committee conducts a risk assessment of our compensation policies and practices. |

Shareholder Outreach and Feedback

In an effort to better understand our shareholders’ views regarding our executive compensation practices, management conducted a shareholder outreach effort prior to our 2012 Annual Meeting, during which senior management engaged in discussions with most of our 20 largest shareholders. During these discussions, many shareholders indicated that although they understood that the Compensation Committee had accelerated the 2012 equity grant of stock options to November of 2011 in order to retain and motivate the executive team, they would still elect not to vote in favor of our say on pay proposal. Consistent with such feedback, at our 2012 Annual Meeting, our shareholders did not approve, on an advisory basis, the compensation for our NEOs as presented in our 2012 proxy statement. The Compensation Committee takes this advisory vote into account when developing the compensation for our NEOs. The discussions that we had with our shareholders prior and subsequent to our 2012 Annual Meeting affirmed the Compensation Committee’s decision to award no equity grants in 2012 to our NEOs.

Compensation Program Objectives

Our executive compensation program is intended to attract, motivate and retain executive officers and to align the interests of our executive officers with the interests of our shareholders. Our executive officers’ decisions and behaviors help drive performance at Gentiva, and our executive compensation program is an important part of focusing our executives on the achievement of key performance metrics and fostering a high performance culture that includes providing superior quality care, ensuring a culture of compliance and treating all employees and patients with respect.

In developing the executive compensation program, the Compensation Committee takes into consideration the following objectives:

| | • | | Enhancing shareholder value by focusing our executives’ efforts on the specific performance metrics that help drive shareholder value; |

| | • | | Attracting, motivating and retaining executive talent willing to commit to long-term shareholder value creation; |

| | • | | Incorporating meaningful input from our shareholders based on our shareholder outreach efforts; |

| | • | | Aligning executive decision making with our business strategy and goal setting; |

16

| | • | | Reflecting industry standards, offering competitive total compensation opportunities and balancing the need for talent with reasonable compensation expense; and |

| | • | | Providing executives with information so that they understand their total compensation and how rewards are generally a function of both organizational and individual performance. |

Principal Elements of Our Compensation Program

The principal elements of our compensation program are as follows:

| | • | | Annual cash incentives, which we believe are designed to motivate our executive officers to meet our objectives and focus on our priorities and core values; and |

| | • | | Long-term incentives, which we believe are an important part of a competitive compensation structure needed to attract and retain talented executives and to focus our executive officers on long-term performance. |

Role of the Compensation Committee

During our 2012 fiscal year, our Compensation, Corporate Governance and Nominating Committee was split into two separate committees: a Compensation Committee and a Corporate Governance and Nominating Committee. References to “the committee” in this CD&A mean the Compensation, Corporate Governance and Nominating Committee for matters occurring prior to this split in May 2012 and the Compensation Committee after this split. The committee oversees our executive compensation program, including our compensation process and decisions for our NEOs. Our NEOs for 2012 are:

| | • | | Tony Strange, our Chief Executive Officer and President; |

| | • | | Eric R. Slusser, our Executive Vice President, Chief Financial Officer and Treasurer; |

| | • | | David A. Causby, our Senior Vice President and President of our Home Health division; |

| | • | | Jeff Shaner, our Senior Vice President and President of our Hospice division; and |

| | • | | John N. Camperlengo, our Senior Vice President, General Counsel and Secretary. |

Compensation Consultant

In 2012, the committee again engaged Aon Hewitt as its independent compensation consultant to provide the committee with competitive market data and to assist the committee in evaluating compensation for our executive officers for 2012. The compensation consultant meets regularly, and as needed, with the committee in executive sessions and has direct access to the committee chair during and between meetings. The compensation consultant works with management to gather data required in preparing historical analyses for committee review, and provides the committee with market trend information.

In addition to their performance of services for the committee, in 2012 management used Aon Hewitt to provide additional services to Gentiva that were unrelated to executive compensation, including human resource consulting and brokerage services related to employee benefit insurance products, such as group life, home and automobile, and legal services that were offered to employees. Aon Hewitt’s fees for these additional services totaled approximately $1,367,000 in 2012. We have separate relationships with each of the service teams providing these non-executive compensation consulting services, and relationships with the different service teams are overseen by different management employees. The compensation consultant’s service team that advises the committee does not receive any compensation based on any other work that Aon Hewitt performs for Gentiva, and the compensation service team does not perform any other services on behalf of Gentiva. Aon

17

Hewitt annually certifies to the committee the independence of its executive compensation services and the adherence of its executive compensation consultants to Aon Hewitt’s independence policies, practices and procedures. The committee has reviewed the relationship with Aon Hewitt and considered relevant factors to determine whether there existed a conflict of interest as to the compensation consultant and concluded there was no such conflict. The committee has sole authority to retain and terminate any independent compensation consultant. Aon Hewitt’s fees were approximately $253,000 for the executive compensation services it provided to the committee in 2012.

Peer Group Analysis

The committee annually reviews, with the assistance of its consultant and management, the composition of the peer group that it uses for analysis of competitive market compensation data. Although market compensation data from the peer group is a principal factor that we considered to understand competitive compensation, industry trends and best practices regarding various compensation developments, we did not follow a particular benchmark with regard to competitive data in 2012. This decision was based in large part upon our desire for flexibility in designing our compensation program. Instead, the competitive data provided us with a general gauge with which to assess current market compensation levels and practices. In addition, we did not use any particular benchmark or guideline for the mix of various elements of compensation in 2012, although we did take into consideration market trends.

In formulating executive compensation for 2012, the committee conducted its annual review of the peer group in August 2011. As part of this review, the committee’s compensation consultant provided information for a peer group focusing on companies that provide services similar in nature to those provided by Gentiva, as well as companies that are competitors for our talent. The peer group approved by the committee in August 2011, and used by the committee for evaluating and approving 2012 executive compensation, consisted of the following companies:

| | |

Amedisys, Inc. | | Kinetic Concepts, Inc. |

Brookdale Senior Living Inc. | | LHC Group, Inc. |

Centene Corporation | | Lifepoint Hospitals, Inc. |

Chemed Corporation | | Lincare Holdings, Inc. |

DaVita Inc. | | MEDNAX |

Emeritus Corporation | | Resmed, Inc. |

HealthSouth Corporation | | Select Medical Holdings Corporation |

Health Management Associates, Inc. | | Sun Healthcare Group, Inc. |

Invacare Corporation | | Varian Medical Systems Inc. |

Kindred Healthcare, Inc. | | |

The committee’s determination of the peer group included an assessment of the following factors:

| | • | | the representation of the potential members of our peer group in our industry, as well as each company’s Global Industry Classification Standard (GICS) code; |

| | • | | the companies that we consider to be competitors in our industry, as well as for our talent; |

| | • | | those companies with annual revenues of approximately 0.5 times to 2.5 times our annual revenues; |

| | • | | the business model utilized by potential members of our peer group; and |

| | • | | those companies naming Gentiva as a member of their peer group. |

Our peer group consists of companies of varying size. To address the differences in size, we use regression analysis. Regression analysis is a statistical technique that, for compensation purposes, is used to develop a “size adjusted” estimated market value for each executive position studied. This estimated market value is used for comparisons of total compensation opportunity at Gentiva against our peer companies.

18

Though the committee believes the peer group is appropriate for Gentiva’s purposes, it should be noted that no two companies, even in the same industry, are exactly alike, and all comparisons with other companies, for compensation or other purposes, are, at best, informative. Compensation decisions necessarily involve complex qualitative judgments by the committee.

Base Salary

Base salary is a fundamental element of compensation and is integral to competitive employment arrangements. The committee reviews, with the advice of its compensation consultant, the base salary for our Chief Executive Officer and our other executive officers each year, including our NEOs. In approving the base salaries for 2012, the committee considered the relative importance of each officer’s position; the officer’s individual performance and contributions to Gentiva; and for the base salaries of officers other than himself, the recommendations of Mr. Strange, our Chief Executive Officer.

The committee also reviewed historical compensation information for each of the NEOs, the historical progression of each NEO’s compensation and variations in compensation levels among the NEOs. The committee also reviewed additional information provided by the compensation consultant, including competitive market data from the peer group.

In January 2012, the committee determined there would be no increase in the base salaries of the NEOs, which have remained unchanged since November 2010, because the committee believed the base salaries remained competitive. As such, 2012 base salaries were as follows:

| | | | |

Named Executive Officer | | 2012 Base Salary | |

Tony Strange | | $ | 875,000 | |

Eric R. Slusser | | $ | 475,000 | |

David A. Causby | | $ | 425,000 | |

Jeff Shaner | | $ | 425,000 | |

John N. Camperlengo | | $ | 400,000 | |

In February 2013, the committee determined that the base salaries for the NEOs for 2013 would be the same as their 2012 base salaries.

Annual Cash Incentives

Under our compensation program, an important part of each executive officer’s annual cash compensation is provided under our Executive Officers Bonus Plan and is generally dependent on the achievement of both quantitative corporate performance goals and, with the exception of Mr. Strange, individual qualitative performance goals. The corporate performance goals are based on performance criteria included in the Executive Officers Bonus Plan. We believe that this element of compensation is part of the basic compensation package provided by companies with which we compete for executive talent, and therefore helps us remain competitive.

Early each year, based largely on the recommendations from our Chief Executive Officer, the committee establishes corporate performance goals and individual performance goals for each executive officer. The committee also establishes a target annual cash incentive amount for each executive officer as a percentage of base salary, which is used at the end of the year as the base point for determining any actual annual cash incentive payments.

19

In setting the target annual cash incentive amounts for 2012, the committee considered information from the peer group data mentioned above and, with respect to the NEOs other than the CEO, the recommendations of Mr. Strange. In February 2012, the committee set the following target annual cash incentive amounts as a percentage of base salary:

| | | | |

Named Executive Officer | | Target Annual Cash

Incentive Amount | |

Tony Strange | | | 100 | % |

Eric R. Slusser | | | 75 | % |

David A. Causby | | | 75 | % |

Jeff Shaner | | | 75 | % |

John N. Camperlengo | | | 70 | % |

The committee believed that the 2012 percentages, which were identical to the 2011 percentages, continued to be appropriate for the executives as these levels of annual incentives were competitive with the market and provided internal consistency among our executive officers based on their levels of responsibility and contributions to our performance.

The actual amount payable for annual cash incentives is determined by the committee after the end of each fiscal year, based on the extent to which the previously established performance goals were met or exceeded. For 2012, the committee approved corporate performance goals that were based on the following criteria: net revenues, operating profit margin and operating income. The committee approved financial goals that reflect key components of our corporate financial performance and that provide added incentives for achievement that benefit Gentiva and ultimately should benefit our shareholders. In addition, the quantitative measures approved by the committee reflect the standards that Gentiva sets for itself in its business plan. The committee considers all annual cash incentives at its February meeting because it believes it is an appropriate time both to assess our executive officers’ performance during the prior year and to appropriately set targets and motivate the executive officers for the new year.

The committee approved the following target performance levels for the 2012 corporate performance goals for Mr. Strange and Messrs. Slusser, Causby, Shaner and Camperlengo and the following individual performance goals for Messrs. Slusser, Causby, Shaner and Camperlengo:

| | | | | | | | | | | | |

2012 Corporate Financial Goals and Results and 2012 Individual Goals and Results | |

Goal | | Weight of

Goals at Target | | | Adjusted Target

Performance Level | | Adjusted Actual

Results | | Contribution to

Incentive

Performance | |

Mr. Strange | | | | | | | | | | | | |

Net revenues:(1) | | | 35.0 | % | | $1,711 million | | $1,684 million | | | 0.0 | %(2) |

Operating profit margin:(3) | | | 20.0 | % | | 10.9% | | 11.1% | | | 30.0 | %(4) |

Operating income:(5) | | | 45.0 | % | | $186.0 million | | $187 million | | | 49.5 | %(6) |

Total: | | | 100.0 | % | | | | | | | 79.5 | %(8) |

Messrs. Slusser, Causby, Shaner and Camperlengo | | | | | | | | | | | | |

Net revenues:(1) | | | 25.0 | % | | $1,711 million | | $1,684 million | | | 0.0 | %(2) |

Operating profit margin:(3) | | | 15.0 | % | | 10.9% | | 11.1% | | | 22.5 | %(4) |

Operating income:(5) | | | 30.0 | % | | $186.0 million | | $187 million | | | 33.0 | %(6) |

Individual Goals | | | 30.0 | % | | 30.0% | | *(7) | | | * | (8) |

Total(7) | | | 100 | % | | | | | | | * | (8) |

| (1) | Adjusted target net revenues and adjusted actual net revenues are calculated by excluding 2012 acquisitions and dispositions. |

20

| (2) | Contribution to Incentive Performance is based on a pre-approved formula of adding 2.5% of the weight of the net revenues performance goal for each $1 million increase in adjusted actual net revenues over the $1,711 million adjusted Target Performance Level. For example, if Gentiva’s adjusted actual net revenues were $1,721 million, the weight of Mr. Strange’s net revenues goal would increase from 35.0% to 43.75% and the weight of the other NEOs’ net revenues goal would increase from 25.0% to 31.25%. The Contribution to Incentive Performance of the net revenues performance goal for 2012 was 0.0% because Gentiva’s adjusted actual net revenues did not exceed the threshold amount set by the committee in February 2012. |

| (3) | For purposes of setting this corporate performance goal, adjusted target operating profit margin and adjusted actual operating profit margin are defined as EBITDA (earnings before interest, taxes, depreciation and amortization) divided by net revenues for fiscal 2012, as adjusted to exclude the following items occurring during fiscal 2012: (i) all items of gain, loss or expense determined to be extraordinary or non-recurring in nature; (ii) all items of gain, loss or expense related to restructurings and discontinued operations, as determined in accordance with generally accepted accounting principles; and (iii) any profit or loss attributable to the business operations of any entity acquired by Gentiva and the related integration cost. |