UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

GENTIVA HEALTH SERVICES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ¨ | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

March 25, 2014

Dear Shareholder:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders of Gentiva Health Services, Inc. to be held on Wednesday, May 7, 2014, at 8:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339.

Details about the meeting, nominees for the Board of Directors and other matters to be acted upon are presented in the Notice of Annual Meeting of Shareholders and the proxy statement that follow.

Your vote is important. You may vote and submit your proxy via the Internet, by telephone or by signing, dating and returning a proxy card. This will assure that your shares will be represented and voted at the Annual Meeting even if you do not attend.

Thank you for your continued support, and we look forward to greeting you personally at the meeting if you are able to be present.

| | |

| Sincerely, | | Sincerely, |

| |  |

| Rodney D. Windley | | Tony Strange |

| Executive Chairman | | Chief Executive Officer and President |

GENTIVA HEALTH SERVICES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 7, 2014

The 2014 Annual Meeting of Shareholders of Gentiva Health Services, Inc., a Delaware corporation, will be held on Wednesday, May 7, 2014, at 8:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339, for the following purposes:

| | (1) | To elect nine directors, each to serve until the 2015 Annual Meeting of Shareholders; |

| | (2) | To consider and vote upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| | (3) | To consider and conduct a non-binding advisory vote regarding the compensation of our named executive officers; and |

| | (4) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Shareholders are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the meeting in person, we urge you to vote your shares via the toll-free number or over the Internet. If you received a copy of the proxy by mail, you may sign, date and return the proxy in the envelope provided. Only shareholders of record at the close of business on March 10, 2014 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

|

| By Order of the Board of Directors, |

|

|

| John N. Camperlengo |

Senior Vice President, General Counsel and Secretary |

Dated: March 25, 2014

Atlanta, Georgia

IT IS IMPORTANT THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, WHETHER OR NOT YOU PLAN TO ATTEND. PLEASE VOTE VIA THE INTERNET, BY TELEPHONE OR BY COMPLETING AND RETURNING THE PROXY PROMPTLY SO THAT YOUR VOTE MAY BE RECORDED AT THE MEETING IF YOU DO NOT ATTEND PERSONALLY. IF YOU DO ATTEND AND DECIDE TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY.

TABLE OF CONTENTS

PROXY STATEMENT

GENERAL INFORMATION

Introduction

We are providing this proxy statement to the shareholders of Gentiva Health Services, Inc. in connection with the solicitation of proxies by our Board of Directors to be voted at the 2014 Annual Meeting of Shareholders and at any adjournments of that meeting. The 2014 Annual Meeting of Shareholders of Gentiva Health Services, Inc. will be held on Wednesday, May 7, 2014, at 8:30 a.m., at the Renaissance Waverly Hotel, 2450 Galleria Parkway, Atlanta, Georgia 30339, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

In accordance with the rules and regulations of the Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials to each shareholder, we are furnishing such materials to our shareholders on the Internet. If you have received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials other than as described below. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials is first being sent to shareholders on or about March 25, 2014. The proxy statement and the accompanying proxy are first being made available to shareholders on or about March 25, 2014. Only shareholders of record at the close of business on March 10, 2014 are entitled to vote at the Annual Meeting.

When used in this proxy statement, the terms “we,” “us,” “our” and “Gentiva” refer to Gentiva Health Services, Inc.

The securities that can be voted at the Annual Meeting consist of our common stock, $.10 par value per share. At the close of business on March 10, 2014, the record date for determining shareholders entitled to vote at the Annual Meeting, 36,766,018 shares of our common stock were outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote.

Voting Procedures

You may vote on the Internet or by telephone or, if you received a copy of the proxy by mail, by completing, signing, dating and returning the proxy promptly in the envelope provided. Any executed proxies received with no instructions, whether the proxies come from shareholders who are “shareholders of record” (meaning the shares are registered directly in their name) or shareholders who are “beneficial owners” (meaning the shares are held in a stock brokerage account or by a bank or other nominee), will be voted in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends that you vote FOR all of the nominees to the Board of Directors, FOR ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm and FOR the compensation of our named executive officers as described in this proxy statement.

Revocability of Proxies

A shareholder of record who grants a proxy may revoke it at any time before it is voted by giving notice in writing to our Secretary, by subsequently voting on the Internet or by telephone, by granting a subsequent proxy,

1

or by appearing in person and voting at the meeting. Any shareholder attending the meeting and entitled to vote may vote in person whether or not the shareholder has previously submitted a proxy. Please note, however, that under the rules of the national stock exchanges, any beneficial owner of our common stock whose shares are held in street name by a member brokerage firm may revoke his or her proxy and vote his or her shares in person at the meeting only in accordance with applicable rules and procedures of the exchanges as followed by the beneficial owner’s brokerage firm.

Quorum; Broker Non-Votes; Abstentions

Quorum: A majority of all the shares of common stock issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum at the meeting. Proxies marked as abstentions or withhold authority and “broker non-votes” (as explained below) are counted in determining whether a quorum is present.

Broker Non-Vote: Under applicable regulations, if a broker holds shares on your behalf and you do not instruct your broker how to vote those shares on a matter considered “routine,” the broker may generally vote your shares for you. A “broker non-vote” occurs when a broker has not received voting instructions from you on a “non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such matter. We believe that Proposals 1 and 3 are “non-routine” matters and as such the broker is not authorized to vote your shares on such proposals absent instructions from you. A “broker non-vote” will not be considered a vote “for” or a vote “against” a proposal and will have no effect on the outcome of the vote.

Abstentions:An abstention with respect to any of the proposals in this proxy statement is neither a vote cast “for” the proposal nor a vote cast “against” the proposal and, therefore, will have no effect on the outcome of the vote.

Inspector of Election: Broadridge Financial Solutions, Inc. will count the votes and provide an Inspector of Election at the meeting.

Additional Matters

Our principal executive offices are located at 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. Gentiva was incorporated in Delaware in August 1999.

We are making available to you a copy of our 2013 Annual Report to Shareholders, including a copy of our Form 10-K for the fiscal year ended December 31, 2013, with the Notice of Annual Meeting of Shareholders and proxy statement on the website www.proxyvote.com. The Annual Report and Form 10-K are not deemed part of the soliciting material for the proxy.

If you would like directions to attend the Annual Meeting and vote in person, please call us at(770) 951-6450.

2

PROPOSAL 1

ELECTION OF DIRECTORS

All our directors stand for election on an annual basis and serve a one-year term upon election. In addition, any director elected by the Board of Directors to fill a newly created directorship or to fill a vacancy on the Board of Directors will hold office for a term ending at the next annual meeting of shareholders after the director’s election or until such director’s successor shall have been duly elected and qualified.

Our Board of Directors currently consists of nine members, Robert S. Forman, Jr., Victor F. Ganzi, R. Steven Hicks, Philip R. Lochner, Jr., Stuart Olsten, Sheldon M. Retchin, Tony Strange, Raymond S. Troubh and Rodney D. Windley, all of whom are standing for re-election at this year’s Annual Meeting. Each of the members who is standing for re-election has consented to serve another term as a director if re-elected. The Corporate Governance and Nominating Committee of the Board of Directors recommended the slate of nine nominees to the Board of Directors for its approval. The Board of Directors has recommended the slate of nine nominees to the shareholders for approval at the Annual Meeting.

Except in the event of a contested election, each director to be elected by shareholders shall be elected by the vote of the majority of the votes cast at a meeting for the election of directors at which a quorum is present. A “majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against.” Votes cast exclude abstentions and any “broker non-votes” with respect to that director’s election. In the event of a contested election, directors shall be elected by the vote of a plurality of the votes cast at a meeting for the election of directors at which a quorum is present. If for any reason any of the nominees is not a candidate when the election occurs (which is not expected), the proxies may be voted for a substitute nominee or nominees.

In addition, our Corporate Governance Guidelines include a resignation policy, which provides, among other things, that if a nominee for our Board of Directors does not receive a majority of the votes cast:

| | • | | such nominee must tender his or her resignation within ten business days; |

| | • | | the Corporate Governance and Nominating Committee of the Board of Directors must recommend to our Board of Directors whether such resignation should be accepted or rejected; and |

| | • | | our Board of Directors must take final action no later than 90 days after the shareholder vote. |

The Board of Directors recommends that you vote FOR the election of Robert S. Forman, Jr., Victor F. Ganzi, R. Steven Hicks, Philip R. Lochner, Jr., Stuart Olsten, Sheldon M. Retchin, Tony Strange, Raymond S. Troubh and Rodney D. Windley.

Information as to Nominees for Director

The following information, as reported to us, is shown below for each nominee for director: name, age and principal occupation; period during which the nominee has served as a director; position, if any, with us; certain business experience; other directorships held; and any committees of our Board of Directors on which the nominee serves. We also include the specific attributes and experience of a nominee on which our Board of Directors focused in nominating that individual for election as director.

Robert S. Forman, Jr.

Mr. Forman has served as a director of Gentiva and a member of the Audit Committee of the Board of Directors since September 2009, serving as chairman of that committee since May 2011, and has served as a member of the Corporate Governance and Nominating Committee of the Board of Directors since May 2012. Mr. Forman was the founder, president and chief executive officer of IMI Systems, Inc., an international computer consulting firm specializing in the design and implementation of service order and billing systems in

3

the telecommunications industry. In 1995, Olsten Corporation acquired IMI Systems, Inc., and Mr. Forman was an executive vice president of Olsten Corporation until 1997. Since leaving Olsten, Mr. Forman served on the boards of several private information technology consulting companies. He currently serves on the Advisory Board of Rensselaer Polytechnic Institute’s IT School. Mr. Forman is 74 years old. In nominating Mr. Forman for re-election as a director, our Board of Directors focused on his past experience as a founder and chief executive officer of IMI Systems, Inc., and his rich and extensive background in technology as important attributes and experience for his continuing to serve as one of our directors.

Victor F. Ganzi

Mr. Ganzi has served as a director of Gentiva since November 1999 and as Lead Director of the Board of Directors since May 2009. He has served as a member of the Audit Committee of the Board of Directors since November 1999, serving as chairman of that committee from November 1999 to May 2009, and has served as chairman of the Compensation Committee of the Board of Directors since May 2012, having previously served as chairman and a member of a predecessor committee of that committee since May 2009. He served as a director of Olsten Corporation from 1998 until 2000. He was president and chief executive officer of The Hearst Corporation, a private diversified communications company with interests in magazine, newspaper and business publishing, television and radio stations and cable programming networks, from 2002 to 2008. He is a director, chairman of the audit committee and member of the nominating and governance committee of Towers Watson & Co. and was a director of Wyeth from 2005 to 2009. Mr. Ganzi is 67 years old. In nominating Mr. Ganzi for re-election as a director, our Board of Directors focused on his past experience as chief executive officer, chief financial officer and chief legal officer of The Hearst Corporation and the knowledge of Gentiva that he has gained and shared from serving as a director and member of our Audit Committee since 1999 as important attributes and experience for his continuing to serve as one of our directors.

R. Steven Hicks

Mr. Hicks has served as a director of Gentiva since October 2013, when he was elected to the Board of Directors and appointed vice chairman of the Board of Directors in connection with our acquisition of Harden Healthcare Holdings, Inc. and in accordance with a Stockholders’ Agreement that Gentiva entered into with certain former stockholders of Harden Healthcare Holdings, including Mr. Hicks. Since 2000, Mr. Hicks has served as executive chairman of Capstar Partners, LLC, a private investment firm, which has invested in a broad range of industries including media and broadcasting, healthcare services, e-commerce, financial services and real estate. Prior to founding Capstar Partners, Mr. Hicks was active in the radio industry for many years and was the founder and chief executive officer of Capstar Broadcasting Corp., a leading consolidator of middle market radio stations across the United States. Mr. Hicks has served as a Regent on The University of Texas System Board of Regents since 2009 and currently serves as the board’s vice chairman. Mr. Hicks was appointed to serve on the Board of Directors of The University of Texas Investment Management Co. (UTIMCO) in 2011 and was reappointed in September 2013. Mr. Hicks was a director of HealthTronics, Inc. from 2004 to 2010. Mr. Hicks is 64 years old. In accordance with the Stockholders’ Agreement, our Board of Directors has nominated Mr. Hicks for re-election as a director. Our Board of Directors has also recognized Mr. Hicks’ acumen and experience in financial, business development and healthcare matters and his entrepreneurial achievements as important attributes for his service as a director.

Philip R. Lochner, Jr.

Mr. Lochner has served as a director of Gentiva since September 2009, as chairman and a member of the Corporate Governance and Nominating Committee of the Board of Directors since May 2012, having previously served as a member of a predecessor committee of that committee since September 2009, and as a member of the Clinical Quality Committee of the Board of Directors since May 2010. Mr. Lochner currently is a director and member of the audit committee and the director affairs/corporate governance committee of CLARCOR Inc., the presiding director and member of the audit committee and the executive committee and chairman of the governance and public responsibility committee of CMS Energy Corporation, and a director and member of the

4

audit committee and the nominating and governance committee of Crane Co. During the past five years, at various times, Mr. Lochner was a director of Apria Healthcare Group Inc., GTECH Holdings Corporation, Monster Worldwide, Inc. and Solutia Inc. From 1991 until 1998, Mr. Lochner was senior vice president and chief administrative officer of Time Warner Inc. Prior to that, from 1990 to 1991, he served as a Commissioner of the Securities and Exchange Commission. He has also previously served as a member of the board of governors of the National Association of Securities Dealers and of the American Stock Exchange. Mr. Lochner is 71 years old. In nominating Mr. Lochner for re-election as a director, our Board of Directors focused on his expertise in the areas of mergers and acquisitions, corporate governance and compensation, his prior service as a Commissioner of the Securities and Exchange Commission and his varied service on the board of directors and board committees of several public companies as important attributes and experience for his continuing to serve as one of our directors.

Stuart Olsten

Mr. Olsten has served as a director of Gentiva since November 1999, as a member of the Audit Committee of the Board of Directors since May 2008 and as a member of the Compensation Committee of the Board of Directors since May 2012, having previously served as a member of a predecessor committee of that committee since May 2009. He served as a director of Olsten Corporation from 1986 until 2000. From 1990 to 2000, at various times, he served as Olsten Corporation’s chairman of the board of directors, vice chairman and president. From 2001 to 2007, Mr. Olsten was the chairman of the operating board of MaggieMoo’s International, LLC and was its president and chief executive officer in 2003. Mr. Olsten serves on the board of private online employment service company IvyExec, Inc. as well as on the board of HarQen, Inc., a voice asset management company, where he also serves as chairman of the compensation committee. He is on the Advisory Board of the Syracuse University School of Management. Mr. Olsten is 61 years old. In nominating Mr. Olsten for re-election as a director, our Board of Directors focused on his extensive background in employment services and the knowledge of Gentiva that he has gained and shared from serving as a director since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Sheldon M. Retchin, M.D., M.S.P.H.

Dr. Retchin has served as a director of Gentiva and a member of the Clinical Quality Committee of the Board of Directors since September 2009 and as a member of the Corporate Governance and Nominating Committee of the Board of Directors since May 2012. Since 2003, Dr. Retchin has served as the chief executive officer of the Virginia Commonwealth University Health System in Richmond, Virginia, and as senior vice president for health sciences at Virginia Commonwealth University. The Virginia Commonwealth University Health System is a large academic health center in Central Virginia and delivers primary and tertiary health care to the mid-Atlantic region. Dr. Retchin is a professor in the departments of internal medicine, gerontology and health administration and is a national expert in health policy and health care delivery, with special expertise on the costs, quality and alternative financing strategies for the Medicare program. He has over 90 publications on the costs and quality of care and has had appointments on numerous national panels regarding health care and the health professional workforce. Dr. Retchin is 63 years old. In nominating Dr. Retchin for re-election as a director, our Board of Directors focused on his clinical and executive leadership in the health care field and his recognized expertise in health policy and health care delivery, especially regarding the Medicare program, as important attributes and experience for his continuing to serve as one of our directors.

Tony Strange

Mr. Strange has served as a director of Gentiva and our chief executive officer since January 2009, and as our president since November 2007. He served as our chairman of the Board of Directors from May 2011 to February 2013. He served as chief operating officer of Gentiva from November 2007 to May 2009 and as executive vice president of Gentiva and president of our home health division from February 2006 to November 2007. From 2001 to 2006, Mr. Strange served as president and chief operating officer of The Healthfield Group, Inc. Mr. Strange joined Healthfield in 1990 and served in other capacities, including regional

5

manager, vice president of development and chief operating officer, until being named president in 2001. He has served as a director of the National Association for Home Care & Hospice and currently serves as chairman of the Board of the Partnership for Quality Home Healthcare. Mr. Strange is 51 years old. In nominating Mr. Strange for re-election as a director, our Board of Directors focused on his leadership and execution as our chief executive officer in growing Gentiva, his driving and integrating significant acquisitions by Gentiva and his setting and communicating the proper cultural and behavioral tone as important attributes and experience for his continuing to serve as one of our directors.

Raymond S. Troubh

Mr. Troubh has served as a director of Gentiva since November 1999, as a member of the Audit Committee of the Board of Directors since May 2000, serving as chairman of that committee from May 2009 to May 2011, and as a member of the Compensation Committee of the Board of Directors since May 2012, having previously served as a member of its predecessor committees since November 1999. He served as a director of Olsten Corporation from 1993 until 2000. He has been a financial consultant for more than five years. He is a director and member of the compensation committee and the audit committee of Diamond Offshore Drilling Inc., a director and member of the compensation committee of General American Investors Company, and a director and member of the audit committee and the nominating and corporate governance committee of The Wendy’s Company. Mr. Troubh is 87 years old. In nominating Mr. Troubh for re-election as a director, our Board of Directors focused on his seasoned experience from having served on the board of directors and board committees of varied public companies, his vision and expertise in matters of corporate governance, his former selection as Director of the Year by the National Association of Corporate Directors and the knowledge of Gentiva that he has gained and shared as a director and member of our Audit Committee and Compensation Committee (and its predecessor committees) since 1999 as important attributes and experience for his continuing to serve as one of our directors.

Rodney D. Windley

Mr. Windley has served as our executive chairman of the Board of Directors since February 2013. He has served as a director of Gentiva since February 2006, when he was elected to the Board of Directors and appointed vice chairman of the Board of Directors in connection with the completion of our acquisition of The Healthfield Group, Inc. He has served as a member of the Clinical Quality Committee of the Board of Directors since May 2008, serving as chairman since May 2009. Mr. Windley, Healthfield’s founder, had served as its chairman and chief executive officer since its inception in 1986 until the completion of the acquisition. Mr. Windley is the chairman of Prom Queen, LLC, a private real estate holding and restaurant development company, chairman of RDW Ventures, LLC, a private equity firm, and chairman of Gulf Coast Hatteras, Inc., a private yacht and sport fishing dealership. Mr. Windley is president of the Georgia Association for Home Care and is also chair emeritus of Fragile Kids Foundation, Inc., having started the charity in 1992. Mr. Windley is 66 years old. In nominating Mr. Windley for re-election as a director, our Board of Directors focused on his past experience as founder and chief executive officer of Healthfield, his financial and entrepreneurial background, his vision and drive for the growth and success of Gentiva and his expansive knowledge of the health care industry as important attributes and experience for his continuing to serve as one of our directors.

CORPORATE GOVERNANCE

Independent Directors

In accordance with the listing standards of The Nasdaq Stock Market, Inc. (“NASDAQ”), we ensure that at least a majority of our Board of Directors is independent under the NASDAQ definition of independence, and that the members of the Board of Directors as a group maintain the requisite qualifications under NASDAQ listing standards for populating the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee and the Board of Directors have determined that Robert S. Forman, Jr., Victor F. Ganzi, Philip R. Lochner, Jr., Stuart Olsten,

6

Sheldon M. Retchin and Raymond S. Troubh do not have any relationship that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors and are independent in accordance with NASDAQ listing standards. In addition, we define “independent director” in the charters of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee, all of which may be found on our website at www.gentiva.com under the “Investors” section.

The independent directors generally meet in executive session on the dates when regularly scheduled Board of Directors meetings are held. Mr. Ganzi, as Lead Director, presides over the executive sessions of the independent directors.

Meetings of the Board of Directors and its Committees

During the past fiscal year, the Board of Directors held eight meetings. The Board of Directors has four standing committees: an Audit Committee; a Clinical Quality Committee; a Compensation Committee; and a Corporate Governance and Nominating Committee. Except for Mr. Windley’s service as chairman and a member of the Clinical Quality Committee, each member of each committee is “independent.”

During 2013, each incumbent director attended at least 75% of the aggregate number of meetings held by the Board of Directors and all committees on which the director served during the period that the director served, except R. Steven Hicks, who was only a director for one meeting during 2013. All the members of our Board of Directors, who were members at such time, attended the 2013 Annual Meeting of Shareholders, except for one director. It is our policy to encourage the members of our Board of Directors to attend annual meetings of shareholders.

Audit Committee

The principal functions and responsibilities of the Audit Committee include:

| | • | | overseeing our internal control structure, financial reporting and legal and compliance programs; |

| | • | | discussing guidelines and policies with respect to our financial risk assessment and risk management policies with management; |

| | • | | reviewing and selecting the independent registered public accounting firm to audit our consolidated financial statements; |

| | • | | receiving and acting on reports and comments from our independent registered public accounting firm and approving the firm’s fees; |

| | • | | reviewing critical accounting principles and estimates employed in our financial reporting; |

| | • | | reviewing our annual audited consolidated financial statements and unaudited quarterly financial statements with management and our independent registered public accounting firm and recommending inclusion of the audited financial statements in our annual report on Form 10-K and the unaudited financial statements in our quarterly reports on Form 10-Q; |

| | • | | maintaining direct lines of communication with the Board of Directors and our management, internal auditing staff and independent registered public accounting firm; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Forman serves as the chairman, and Messrs. Ganzi, Olsten and Troubh serve as members, of the Audit Committee. The committee met six times in 2013. The Board of Directors has adopted a written charter for the Audit Committee, which is posted on our website at www.gentiva.com under the “Investors” section. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), Exchange Act Rule 10A-3 and applicable NASDAQ listing standards. The Board of Directors has determined that each member of the committee is “independent” under the heightened

7

independence standards required for members of the Audit Committee by NASDAQ listing standards, the rules of the Securities and Exchange Commission and the committee charter. The Board of Directors has also determined that Victor F. Ganzi is an “audit committee financial expert,” as that term is defined by rules and regulations of the Securities and Exchange Commission.

Clinical Quality Committee

The principal functions and responsibilities of the Clinical Quality Committee include:

| | • | | providing oversight of our clinical leadership in the development of leading edge clinical strategies and practices; |

| | • | | monitoring our performance against established internal and external benchmarking regarding clinical performance and outcomes; |

| | • | | facilitating the development of industry best practices based on internal and external data comparisons; |

| | • | | fostering enhanced awareness of our clinical performance by the Board of Directors and external sources; |

| | • | | establishing a long term, strategic clinical vision for Gentiva; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Windley serves as the chairman, and Mr. Lochner and Dr. Retchin serve as members, of the Clinical Quality Committee. The committee met three times in 2013. The Board of Directors has adopted a written charter for the Clinical Quality Committee, which is posted on our website at www.gentiva.com under the “Investors” section.

Compensation Committee

The principal functions and responsibilities of the Compensation Committee include:

| | • | | overseeing and administering our executive compensation policies, plans and practices and establishing and adjusting from time to time compensation for our Chief Executive Officer and our other executive officers; |

| | • | | administering and authorizing the issuance of stock options, stock awards and other awards under our 2004 Equity Incentive Plan (amended and restated as of March 16, 2011), as amended by Amendments No. 1 and 2 thereto, and awards under our Executive Officers Bonus Plan; |

| | • | | overseeing succession planning for our Chief Executive Officer and other key executives; |

| | • | | advising the Board of Directors on trends in compensation programs for directors, with a view towards aligning such compensation with shareholder interests; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Ganzi serves as the chairman, and Messrs. Olsten and Troubh serve as members, of the Compensation Committee. The committee met five times in 2013. The Board of Directors has adopted a written charter for the Compensation Committee, which is posted on our website at www.gentiva.com under the “Investors” section. The Compensation Committee has been established in accordance with Exchange Act Rule 10C-1 and applicable NASDAQ listing standards. The Board of Directors has determined that each member of the committee is “independent” under the heightened independence standards required for members of the Compensation Committee by NASDAQ listing standards, the rules of the Securities and Exchange Commission and the committee charter, is a “non-employee director” as defined in the committee charter and in Rule 16b-3 under the Exchange Act, and is an “outside director” as defined under Section 162(m) of the Internal Revenue Code and related regulations.

8

Compensation Committee Process

In addition to the functions and responsibilities discussed above, the Compensation Committee is responsible for establishing goals and objectives relevant to executive compensation, evaluating our executive officers’ performance and proposing guidelines regarding director compensation matters. The committee makes recommendations to our Board of Directors regarding our incentive compensation and equity compensation plans and approves awards under our equity compensation plans. The committee also oversees our benefit plans and evaluates any proposed new retirement or executive benefit plans. The committee may delegate its plan administrative duties and has delegated certain authority to administer Gentiva’s Employee Stock Purchase Plan to our Benefits Plan Administrative Committee, which is appointed by the Board of Directors.

The Compensation Committee has the sole authority, without action of our Board of Directors, to retain and terminate compensation consultants, independent legal counsel and other advisors, and considers the factors laid out in Exchange Act Rule 10C-1 and NASDAQ listing standards before selecting, or receiving services from, a compensation consultant, independent legal counsel or other advisor. The committee has engaged a compensation consultant to provide information and recommendations regarding executive officer compensation as discussed in more detail in the Compensation Discussion and Analysis below.

The Compensation Committee generally receives proposals and information from its compensation consultant and from our Chief Executive Officer for its consideration regarding executive compensation. Our Chief Executive Officer works closely with the committee to maintain an open dialogue regarding our goals, progress towards achievement of those goals and expectations for future performance, and makes recommendations regarding the compensation of our executive officers other than himself. However, our Chief Executive Officer may not be present during the committee’s deliberation or voting related to his compensation.

Early in the year, the Compensation Committee generally reviews our executive officers’ compensation, approves any salary increases (unless approved at the end of the prior year) and long-term incentives, evaluates and approves discretionary contributions and the annual bonuses for the prior year, and establishes the performance goals for the upcoming year. Throughout the year, the committee oversees recruiting for senior executive positions and approves compensation for newly hired or promoted senior executives. The committee also reviews our general employee benefit plans and approves changes as needed. At the end of the year, the committee generally meets to review executive compensation and discuss potential compensation to be approved for the following year, and may approve salary increases or other compensation matters for the following year.

Compensation Risk Assessment

The Compensation Committee has evaluated our compensation program to ensure that our policies and practices do not create risks that are reasonably likely to have a material adverse effect on Gentiva.

We believe that we have minimized the potential for excessive risk taking in our annual bonuses (Executive Officer Bonus Plan) by:

| | • | | setting performance goals for our executive officers and other employee participants that generally include quantitative and qualitative criteria, some of which would conflict with taking excessive risks to achieve short-term gain; and |

| | • | | retaining the ability to utilize negative discretion in determining an annual bonus if an executive officer or other employee participant takes unnecessary or inappropriate risks. |

The other two principal elements of our compensation program—base salaries and long-term incentives—are either risk neutral or help lower risk. Annual base salary increases for our executive officers and other employees are based on a number of factors that reward performance that improves Gentiva’s business and reputation for clinical excellence, but are tempered by the employee’s historical compensation as well as competitive market data. Our long-term incentive awards utilize a balanced portfolio of compensation elements, such as cash and equity, and focus on sustained performance over time. These awards vest or are earned over

9

several years and the potential compensation an executive officer or other participating employee can receive through them is generally tied directly to our stock price and/or other corporate performance metrics. The committee believes that this discourages taking excessive risk for a short-term gain because it is incompatible with maximizing the value of these incentive awards over the long-term. In addition, we have adopted and implemented stock ownership guidelines for our executive officers.

Compensation Committee Interlocks and Insider Participation

None of the directors on the Compensation Committee is or was formerly an officer or employee of Gentiva or had any relationship or related party transaction requiring disclosure under the rules of the Securities and Exchange Commission. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Corporate Governance and Nominating Committee

The principal functions and responsibilities of the Corporate Governance and Nominating Committee include:

| | • | | monitoring and safeguarding the independence of our Board of Directors; |

| | • | | seeking, considering and recommending qualified candidates for election as directors and recommending a slate of nominees for election by the shareholders at the annual meeting, subject to the approval of the Board of Directors; |

| | • | | devising and proposing to the Board of Directors corporate governance guidelines and a code of business conduct and ethics for directors, officers and employees; and |

| | • | | reporting to the Board of Directors a summary of its findings and recommendations. |

Mr. Lochner serves as the chairman, and Mr. Forman and Dr. Retchin serve as members, of the Corporate Governance and Nominating Committee. The committee met five times in 2013. The Board of Directors has adopted a written charter for the Corporate Governance and Nominating Committee, which is posted on our website at www.gentiva.com under the “Investors” section. The Board of Directors has determined that each member of the committee is an “independent director” as defined under NASDAQ listing standards and the committee charter.

Consideration of Director Nominees

The Corporate Governance and Nominating Committee will consider recommendations for director nominees from an array of sources, including members of our Board of Directors, management and shareholders. Shareholders who would like the Corporate Governance and Nominating Committee to consider a prospective candidate should act in accordance with our Bylaws and submit the candidate’s name, age, business and residence address, biographical data and qualifications, and provide an accounting of the number of shares of stock held, beneficially or of record, by the prospective candidate, as well as a written statement from the individual of his or her consent to be named as a candidate and, if nominated and elected, to serve as a director, to Gentiva’s Secretary, Gentiva Health Services, Inc., 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. Submissions of names (and other required information) by shareholders of prospective candidates for consideration by the committee for nomination and election at our 2015 Annual Meeting of Shareholders must be received in writing by us at the above address on or after October 3, 2014 and on or before December 3, 2014. The committee reserves the right to request additional information from the candidate to assist the committee in the evaluation process.

The Corporate Governance and Nominating Committee believes that all members of the Board of Directors should have a high level of professional and personal ethics and values and outstanding ability and sound

10

judgment. Directors should be committed to enhancing shareholder value and have sufficient time to attend meetings and participate effectively on the Board of Directors. Each director is expected to represent the interests of all shareholders.

While there is no firm requirement of minimum qualifications or skills that a director candidate must possess, the Corporate Governance and Nominating Committee seeks to identify candidates with a diversity of background and experience as it deems appropriate given the then current needs of the Board of Directors. Director candidates have been identified by current directors and executive search firms. The committee evaluates director candidates based on a number of factors, including their independence, business judgment, leadership ability, experience in developing and analyzing business strategies, experience in the health care industry, strategic vision and financial literacy, and, for incumbent directors, their past performance. All members of the Board of Directors may interview the final candidates. The same identifying and evaluating procedures apply to all candidates for director nomination, including candidates submitted by shareholders.

Once the Corporate Governance and Nominating Committee has evaluated the director candidates as described above, it recommends the slate of nominees to the Board of Directors for its approval. The Board of Directors then recommends the slate of nominees to the shareholders for their approval at the next annual meeting of shareholders.

Board of Directors Leadership Structure and Role in Risk Oversight

Rodney D. Windley serves as our executive Chairman of our Board of Directors and as chairman of the Clinical Quality Committee and R. Steven Hicks serves as our non-executive Vice Chairman of our Board of Directors. Our Chief Executive Officer, Tony Strange, is a member of our Board of Directors, but he does not serve on any committees of the Board of Directors. Our Board of Directors also has an independent Lead Director, Victor F. Ganzi. Among other responsibilities, the Lead Director:

| | • | | convenes and chairs regular and special executive sessions of the independent directors; |

| | • | | serves as liaison between the independent directors and the Chairman of the Board of Directors and the Chief Executive Officer; |

| | • | | presides at meetings of the Board of Directors in the absence of the Chairman and Vice Chairman; and |

| | • | | performs such other duties as agreed by the Board of Directors or the independent directors from time to time. |

We believe that our leadership structure is appropriate given the independent leadership that our Board of Directors has in the form of our Lead Director.

The Board of Directors administers its risk oversight function through the Audit Committee of the Board of Directors. Through its charter, the Audit Committee is charged, among other things, with:

| | • | | overseeing our compliance programs and meeting with our Chief Compliance Officer; |

| | • | | reviewing with our General Counsel, on a regular basis, all material litigation and other significant legal matters; |

| | • | | meeting with our independent auditors, internal auditors and financial management and reviewing the scope of audit procedures of the proposed audit and, at the completion of the audit, meeting again with the independent auditors to review audit results; and |

| | • | | reporting to the Board of Directors at regular intervals on the committee’s activities. |

Shareholder Communications

The Board of Directors has established a process for shareholders to send communications to the Board of Directors. Shareholders may communicate with the Board of Directors generally or with a specific director at any

11

time by writing to Gentiva’s Secretary, Gentiva Health Services, Inc., 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339. The Secretary will forward communications to the director to whom they are addressed, or, if addressed to the Board of Directors generally, to the chair of the Corporate Governance and Nominating Committee.

Code of Ethics and Corporate Governance Guidelines

We have adopted two codes of ethics, a Code of Ethics for Senior Financial Officers (including the Executive Chairman and the Chief Executive Officer) and a Code of Business Conduct and Ethics, the latter being applicable to all of our employees, officers and directors. The codes are designed to promote honest and ethical conduct by our employees, officers and directors, and each is posted on our website at www.gentiva.com under the “Investors” section.

We have also adopted Corporate Governance Guidelines, which address, among other things: director and Board of Directors responsibilities to Gentiva and its shareholders; Lead Director responsibilities and independent director sessions; director qualification standards, including “independence” requirements; and director stock ownership guidelines. The Corporate Governance Guidelines are also posted on our website at www.gentiva.com under the “Investors” section.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 10, 2014, the record date for the Annual Meeting (unless otherwise indicated), the amount of beneficial ownership of our common stock held by:

| | • | | our named executive officers in the Summary Compensation Table; |

| | • | | each current director and nominee for director; |

| | • | | each beneficial owner of more than five percent of our common stock; and |

| | • | | all of our executive officers and directors as a group. |

For the purpose of the table, a person or group of persons is deemed to have “beneficial ownership” of any shares that such person or group has the right to acquire within 60 days after March 10, 2014 through the exercise of stock options or exchange or conversion rights, but such shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

| | | | | | | | |

Name of Beneficial Owner | | Amount of Shares

of Common Stock and

Nature of Beneficial

Ownership(1)(2)(3)(4) | | | Percent of Class

Owned (if more

than 1%) | |

David A. Causby | | | 269,980 | | | | — | |

Jeff Shaner | | | 243,955 | | | | — | |

Eric R. Slusser | | | 385,113 | | | | — | |

Tony Strange | | | 1,345,265 | | | | 3.6 | % |

Rodney D. Windley(5) | | | 496,373 | | | | 1.3 | % |

Robert S. Forman, Jr.(6) | | | 114,518 | | | | — | |

Victor F. Ganzi(7) | | | 169,835 | | | | — | |

R. Steven Hicks(8) | | | 3,222,917 | | | | 8.8 | % |

Philip R. Lochner, Jr. | | | 40,095 | | | | — | |

Stuart Olsten(9) | | | 257,498 | | | | — | |

Sheldon M. Retchin | | | 41,095 | | | | — | |

Raymond S. Troubh | | | 194,896 | | | | — | |

BlackRock, Inc.(10)

40 East 52nd Street

New York, NY 10022 | | | 3,492,219 | | | | 9.5 | % |

Wells Fargo & Company(11)

420 Montgomery Street

San Francisco, CA 94104 | | | 2,949,142 | | | | 8.0 | % |

The Vanguard Group – 23 – 1945930(12)

100 Vanguard Blvd.

Malvern, PA 19355 | | | 2,091,044 | | | | 5.7 | % |

Dimensional Fund Advisors LP(13)

Palisades West, Building One

6300 Bee Cave Road

Austin, TX 78746 | | | 1,909,924 | | | | 5.2 | % |

All executive officers and directors as a group (14 persons)(14) | | | 7,274,109 | | | | 18.8 | % |

| (1) | Unless otherwise indicated, the shareholders identified in this table have sole voting and investment power with respect to the shares beneficially owned by them. |

| (2) | Includes beneficial ownership of the following number of shares that may be acquired upon exercise of presently exercisable stock options under our 2004 Equity Incentive Plan: Mr. Causby—141,699; Mr. Shaner—134,133; Mr. Slusser—199,767; and Mr. Strange—798,751. |

13

| (3) | Includes beneficial ownership of the following number of whole shares acquired and currently held under our Employee Stock Purchase Plan, as amended: Mr. Causby—3,060; Mr. Shaner—344; and Mr. Strange—12,978. |

| (4) | Includes beneficial ownership of the following number of shares representing the equivalent of units deferred under our Stock & Deferred Compensation Plan for Non-Employee Directors: Mr. Forman—40,095; Mr. Ganzi—64,402; Mr. Hicks—6,542; Mr. Lochner—40,095; Mr. Olsten—64,402; Dr. Retchin—40,095; Mr. Troubh—61,372; and Mr. Windley—35,415. |

| (5) | In addition to the shares referred to in footnote (4), Mr. Windley’s holdings include 460,958 shares owned indirectly through trusts. |

| (6) | In addition to the shares referred to in footnote (4), Mr. Forman’s holdings include 72,998 shares owned directly, and 25 shares owned by his wife and 1,400 shares owned by his wife’s trust, as to which shares he disclaims beneficial ownership. |

| (7) | In addition to the shares referred to in footnote (4), Mr. Ganzi’s holdings include 52,633 shares owned directly and 52,800 shares owned indirectly through a trust. |

| (8) | In addition to the shares referred to in footnote (4), Mr. Hicks’ holdings include 2,279,698 shares owned directly, 484,715 shares owned indirectly through trusts, 441,962 shares over which he has voting control, as to which shares he disclaims beneficial ownership, and 10,000 shares owned by his wife, as to which shares he disclaims beneficial ownership. |

| (9) | In addition to the shares referred to in footnote (4), Mr. Olsten’s holdings include 192,796 shares owned directly and 300 shares owned by his wife, as to which shares he disclaims beneficial ownership. |

| (10) | The amount shown and the following information are derived from Amendment No. 5 to Schedule 13G filed with the Securities and Exchange Commission on January 31, 2014 by BlackRock, Inc. on behalf of itself and certain of its subsidiaries (“BlackRock”), reporting beneficial ownership as of December 31, 2013. According to the amended Schedule 13G, BlackRock reported beneficial ownership of 3,492,219 shares of our common stock with sole voting power as to 3,414,338 shares and sole dispositive power as to all of the shares. |

| (11) | The amount shown and the following information are derived from Amendment No. 6 to Schedule 13G filed with the Securities and Exchange Commission on January 28, 2014 by Wells Fargo & Company on behalf of itself and certain of its subsidiaries (“Wells Fargo”), reporting beneficial ownership as of December 31, 2013. According to the amended Schedule 13G, Wells Fargo reported beneficial ownership of 2,949,142 shares of our common stock, with sole voting and dispositive power as to five shares, shared voting power as to 2,949,115 shares, and shared dispositive power as to 2,949,137 shares. |

| (12) | The amount shown and the following information are derived from Amendment No. 1 to Schedule 13G filed with the Securities and Exchange Commission by The Vanguard Group – 23 – 1945930 (the “Vanguard Group”) on February 11, 2014, reporting beneficial ownership as of December 31, 2013. According to the amended Schedule 13G, the Vanguard Group reported beneficial ownership as to 2,091,044 shares of our common stock, with sole voting power as to 46,730 of the shares, sole dispositive power as to 2,045,214 of the shares and shared dispositive power as to 45,830 of the shares. |

| (13) | The amount shown and the following information are derived from Amendment No. 6 to Schedule 13G filed with the Securities and Exchange Commission on February 10, 2014 by Dimensional Fund Advisors LP (“Dimensional”), reporting beneficial ownership as of December 31, 2013. According to the amended Schedule 13G, Dimensional reported beneficial ownership of 1,909,924 shares of our common stock, with sole dispositive power as to all of the shares and sole voting power as to 1,883,025 of the shares. Dimensional, a registered investment advisor, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as investment manager to certain other commingled group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). Dimensional reported that, in its role as investment advisor or manager, Dimensional does not possesses investment and/or voting power over the shares of our common stock which are held by the Funds, but may be deemed to be the beneficial owner of such shares. Dimensional disclaims beneficial ownership of the shares. |

| (14) | Includes 5,342,007 shares owned directly and indirectly by current executive officers and directors, 1,579,684 shares that may be acquired upon exercise of presently exercisable stock options and 352,418 shares representing shares deferred as share units. |

14

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis, or CD&A, describes our 2013 executive compensation program. It summarizes our executive compensation structure, including design changes following our 2013 Say-on-Pay vote, and our shareholder outreach efforts. This CD&A is intended to be read in conjunction with the tables beginning on page 36, which provide detailed historical compensation information for our following named executive officers, or NEOs.

| | |

Name | | Title |

Tony Strange | | Chief Executive Officer and President1 |

Eric R. Slusser | | Executive Vice President, Chief Financial Officer and Treasurer |

Rodney D. Windley | | Executive Chairman2 |

David A. Causby | | Executive Vice President and Chief Operating Officer3 |

Jeff Shaner | | Senior Vice President and President of Operations4 |

| 1 | Mr. Strange also served as Chairman of the Board of Directors until February 5, 2013. |

| 2 | Elected Executive Chairman on February 5, 2013. |

| 3 | Promoted from Senior Vice President and President of Home Health Division on October 28, 2013. |

| 4 | Served as Senior Vice President and President of Hospice Division through October 28, 2013. |

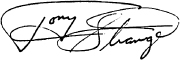

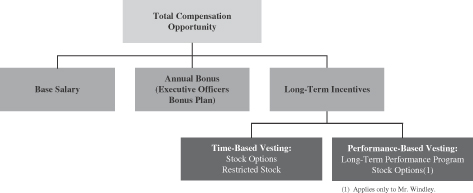

Our executive compensation structure consists of three primary components: base salary, annual bonus (our Executive Officers Bonus Plan), and long-term incentives (under our 2004 Equity Incentive Plan). Within the long-term incentive component, we utilize both time-based and performance-based incentives. Our structure is as follows:

15

This CD&A is organized as follows:

Executive Summary

2013 Say-on-Pay Vote—Our Response

At our 2013 annual meeting of shareholders, our proposal on NEO compensation received a 37.1% favorable vote, and therefore was not approved. The concerns of our shareholders, as expressed through the Say-on-Pay vote, prompted us to re-evaluate components of our executive compensation program. Responding to the Say-on-Pay vote was a significant priority of our Compensation Committee (the “Committee”) and management in 2013 and early 2014. To address shareholders’ concerns, our response was three-fold:

| 1. | Shareholder outreach: In 2013, management contacted shareholders holding approximately 78% of our outstanding shares of common stock and held one-on-one discussions with shareholders holding approximately 69% of our outstanding shares of common stock. |

The purpose of these discussions was to understand their perspectives on our executive compensation structure. Based on these discussions and the 2013 shareholder advisory firms’ reports, we understood that their issues were the lack of a double trigger in our change-in-control coverage, the lack of an incentive “clawback” provision, and the use of a one-year performance measure in our long-term performance program. See the section entitled “Program design changes in response to say-on-pay vote” below.

| 2. | Shareholder advisory firm outreach: In July 2013, our Lead Director, our Executive Chairman, and our Chief Executive Officer met in person with representatives from Institutional Shareholder Services (“ISS Research”) to discuss and evaluate the issues raised in its recommendations to vote against our 2012 and 2013 Say-on-Pay proposals. The meeting provided context for our subsequent compensation decisions and enhanced overall understanding of the rationale for our program structure. |

| 3. | Program design changes in response to say-on-pay vote: During 2013, after our shareholder and shareholder advisory firm outreach, the Committee, our Board of Directors, and management implemented the following executive compensation program design changes to address the concerns cited during our |

16

| | outreach efforts. With the consent of participating NEOs, we retroactively amended their outstanding 2013 grants to incorporate the changes described below. Further, the design changes will apply to future compensation arrangements: |

| | • | | Long-term performance program grants: Two primary design modifications were approved by the Committee for both future grants and the amended 2013 grants of our NEOs, including: |

| | • | | Performance measurement period: We eliminated the one-year performance measurement period. The original 2013 grants were based 50% on one-year EPS performance for fiscal year 2013 (with a two-year additional hold for earned amounts) and 50% on EPS performance for fiscal year 2015. The grant for our NEOs is now based entirely on EPS at the end of the three-year measurement period (EPS performance for fiscal year 2015). |

| | • | | Total shareholder return (“TSR”): We implemented a TSR modifier, measuring TSR performance against our four primary publicly-traded competitors. The objective of the TSR modifier is to calibrate payments earned for EPS performance by comparing our three-year TSR performance to that of our primary competition. The TSR modifier adjusts earned amounts by +20% if we rank first (or tied for first) in three-year TSR, and -20% if we rank last (or tied for last) in three-year TSR. If our actual three-year TSR is zero or negative, the TSR modifier cannot be positive, regardless of ranking. See “Considerations Regarding 2013 Compensation—Long-Term Incentives—Long-term performance program” below for additional disclosure regarding the competitors used for our TSR modifier. |

| | • | | Recoupment (“Clawback”) Policy: We adopted a policy to recoup incentive compensation paid to certain covered employees for a material restatement of our financial statements or an award of incentive compensation based on inaccurate financial statements or inaccurate performance measurements/calculations. Our 2004 Equity Incentive Plan and our Executive Officers Bonus Plan were both amended to incorporate the new recoupment policy. We also amended the existing 2013 award agreements with our NEOs to be subject to the new policy. |

| | • | | Double trigger requirement for accelerated vesting in the event of a change in control: We amended both our 2004 Equity Incentive Plan and the existing 2013 long-term incentive award agreements with our NEOs to add a double trigger requirement for vesting to accelerate following a change in control. Outstanding long-term incentive grants (e.g., stock options, restricted stock, and performance awards) will automatically vest only upon the participant’s termination of service without cause or for good reason within two years following a change in control. |

2013 Corporate Governance Highlights

| | • | | Leadership Structure: In 2013, we separated the roles of Chairman and Chief Executive Officer. In addition, we have an independent Lead Director. |

| | • | | Recoupment (“Clawback”) Policy: As described in “2013 Say-on-Pay Vote—Our Response” above, we adopted and implemented an incentive compensation recoupment policy. |

| | • | | Performance goal disclosure: We enhanced disclosure in this CD&A of the performance criteria for our long-term performance program. In addition to the goal disclosure for our annual bonus, we also disclose the EPS performance goals (threshold, target, and maximum) and actual performance achievement for the portion of the January 2011 long-term performance program grant based on fiscal year 2013 performance. |

| | • | | Change-in-Control coverage: We believe that this coverage provides for management continuity and alignment of executive and shareholder interests in the event of a change in control of Gentiva. Our coverage does not provide (a) severance multiples in excess of three times salary and target bonus, (b) single trigger cash payments, (c) modified single trigger provisions, or (d) excise tax gross-up protection. In 2013, we modified our 2004 Equity Incentive Plan and existing 2013 award agreements with our NEOs to require a double trigger for vesting acceleration. |

17

| | • | | Stock Ownership Guidelines: We have stock ownership guidelines for our executive officers, which are four times base salary for our Chief Executive Officer and President, three times base salary for our Executive Chairman, and two times base salary for the other executive officers. |

| | • | | Insider Trading Policy: Our employees, officers and directors are prohibited from trading in our securities when they are aware of material, nonpublic information about Gentiva. |

| | • | | Blackout Policy: Our officers, directors and certain other employees are prohibited from trading our securities beginning the first day of each final calendar month of a quarter and ending two full trading days after the quarterly earnings release. |

| | • | | Hedging Policy: We have a policy that prohibits our directors, officers and employees from engaging in hedging transactions in our securities. |

| | • | | Pledging Policy: We have a policy that (i) prohibits our directors, officers, and employees from holding our securities in margin accounts or pledging more than 50% of their Gentiva securities, and (ii) requires that any documents evidencing any proposed pledge must be pre-approved and must provide that securities may not be sold at a time when the pledgor is not permitted to trade in our securities. |

| | • | | Tally sheets: The Committee periodically reviews tally sheets in order to analyze our NEOs’ total compensation opportunities based on historical grant practices and the potential compensation payments under various termination scenarios. |

| | • | | Incentive payment thresholds and maximums: Our annual bonus and long-term performance program have threshold performance requirements which must be achieved in order to earn an incentive payment. Maximum payments are capped. Further, the TSR modifier for the long-term performance program cannot increase awards if our three-year TSR is zero or negative, regardless of our ranking versus our primary competitors. |

| | • | | Limited executive perquisites and other benefits: Perquisites are limited to an executive physical and company-paid life insurance. See “Benefits and Perquisites” on page 34. |

| | • | | Independent compensation consultant: Aon Hewitt is retained directly by the Committee as its independent compensation consultant. Aon Hewitt provides competitive benchmarking and advice on all NEO pay decisions and keeps the Committee apprised of compensation best practices. |

| | • | | Compensation risk assessment: The Committee conducts an annual risk assessment of our compensation policies and practices to ensure that our programs are not reasonably likely to have a material adverse effect on Gentiva. |

| | • | | No employment agreements: We have not entered into employment agreements with any of our NEOs. We do have a letter agreement with Tony Strange. See “Grants of Plan-Based Awards During Fiscal Year 2013—Letter Agreement with Tony Strange” below. |

2013 Business and Performance Highlights

Executive Chairman

Mr. Windley was elected Executive Chairman on February 5, 2013. The Board expanded Mr. Windley’s role at Gentiva to navigate Gentiva through our industry’s significant regulatory and reimbursement uncertainties. He is a seasoned healthcare services executive and strategic visionary. Through his 35 years of healthcare leadership experience, Mr. Windley has a successful track record of building shareholder value in difficult environments.

Home Health, Hospice and Community Care Industry

We are a leading provider of home health services, hospice services, and community care services serving patients through approximately 550 locations in 40 states. Our revenues, and the revenues of our direct

18

competitors, are derived primarily from Medicare and Medicaid. These federal and state government programs, under which we generate a majority of our net revenues, are subject to legislative reimbursement uncertainties on an annual basis.

During 2013, our industry continued to operate in an environment of significant regulatory and reimbursement rate uncertainty. For the third consecutive year, the United States Centers for Medicare and Medicaid Services (“CMS”) reduced reimbursement rates (more than 5% in calendar year 2011, approximately 5% in 2012, and approximately 3% in 2013, including a 2% sequestration reduction).

Shareholder Value and Financial Highlights

In spite of these ongoing industry challenges, our executive management team has delivered the following results:

| | • | | Two-year TSR and CEO compensation—2012 and 2013: Gentiva’s stock price has significantly outperformed the healthcare industry and the broader market over the past two years (2012 and 2013). Our two-year TSR was 36%, compared to our peer group median of 24%, our industry median of 26%, and the Russell 3000 median of 25%. |

Our specific two-year TSR ranking against each group was as follows:

| | • | | 76th percentile vs. our peer group; |

| | • | | 68th percentile vs. our industry (GICS code 3510 for Healthcare Equipment and Services; 172 companies); and |

| | • | | 68th percentile vs. the Russell 3000 companies. |

Conversely, for that same period, our CEO’s target compensation did not change and actual compensation earned was well-below target.

| | • | | Salary, target bonus, and target long-term incentive value have remained the same since 2010. |

| | • | | 2012 performance: Earned 77% of target |

| | • | | 2013 performance: Earned 0% of target |

| | • | | Long-term performance-based incentives |

| | • | | 2009 stock option grant, 1/4 vesting based on 2012 performance: Did not vest |

| | • | | 2010 performance share grant, 1/3 portion based on 2012 performance: None earned |

| | • | | 2011 performance cash grant, all based on 2013 performance: None earned |

| | • | | 2012 performance cash grant, 1/2 portion based on 2012 performance: 85% of target earned |

| | • | | Three-year TSR and CEO compensation—2011 through 2013: 2011 was an extraordinary year in our industry, with many external forces outside of our management team’s control that significantly impacted our stock price. Our stock price dropped from approximately $27.00 at the beginning of 2011 to as low as $2.81 in the fourth quarter of 2011, resulting in a negative three-year TSR. Our CEO was not paid an annual bonus in 2011. |

We addressed the events of 2011 in last year’s proxy statement and in the May 2, 2013 letter to our shareholders from our Lead Director and our Executive Chairman. In summary, during the spring of

19

2010, a national newspaper published an article that suggested Gentiva and other home healthcare companies were manipulating Medicare reimbursements. The article resulted in a Senate Finance Committee inquiry and a Securities and Exchange Commission (“SEC”) investigation. Our stock was trading in the neighborhood of $30.00 per share at the time of the 2010 published article. The Senate Finance Committee issued its report in late 2011, at which time our stock dropped to as low as $2.81 per share. The precipitous drop in our stock price was tied to the published article, the Senate Finance Committee inquiry and the SEC investigation, but was also compounded by significant reductions in Medicare reimbursement rates by CMS with respect to home healthcare.

In late 2012, the staff of the SEC issued a letter stating that the investigation had been completed and would not recommend any enforcement action against Gentiva. Our stock price, while not fully recovered from the events of 2011, by the end of 2013 had increased approximately 4.5 times higher than our 2011 low point. We are fully aware of our low three-year TSR due to the external events of 2011, but we have taken significant action to redesign our executive compensation structure in response to shareholder concerns.

| | • | | Our net revenue increased to $1.73 billion in fiscal year 2013 despite significant reimbursement cuts and the impact of the federally mandated sequestration cuts to our home health and hospice businesses. Additionally, home health episodic revenue grew to $846.9 million for 2013. |

Strategic Highlights

In 2013, our executive management team:

| | • | | Completed the acquisition of Harden Healthcare Holdings, Inc., a leading provider of home health, hospice and community care services, which expands our participation into the dually-eligible population; |

| | • | | Completed three additional acquisitions of home health and hospice companies, which extended our geographic footprint; |

| | • | | Continued as an industry leader with admission growth in home health of 6.3% during 2013; |

| | • | | Successfully implemented a point-of-care system, known as GentivaLink, into more than 250 home health locations and into the hands of more than seven thousand caregivers. GentivaLink reduces paperwork demands and the cost of forms, and streamlines clinical supervision by our clinical managers; |

| | • | | Created the “One Gentiva” identity which streamlined our business processes, eliminated duplicative divisional roles, and created a platform whereby Gentiva can capitalize on referral source synergies; and |

| | • | | Continued a leadership role as an advocate for home health and hospice with both federal and state legislators. |

20

2013 Key NEO Compensation Decision Highlights—Target Compensation

| | |

Pay Component | | Comments on Target Compensation |

| Base Salary | | • Our NEO base salaries have not increased since November 2010 (other than Mr. Causby’s 2013 promotional increase) • Mr. Causby’s base salary was increased from $425,000 to $550,000, effective October 28, 2013, to recognize his promotion to Executive Vice President and Chief Operating Officer • Our Executive Chairman was named effective February 5, 2013 at a base salary of $750,000 |

| |

| Target Annual Bonus | | • Our NEO target annual bonus percentages have not increased since November 2010 (other than Mr. Causby’s promotional increase) • Mr. Causby’s target annual bonus was increased from 70% of base salary to 85% of base salary to recognize his promotion to Executive Vice President and Chief Operating Officer • Our Executive Chairman does not participate in the Executive Officers Bonus Plan |

| |

Long-Term Incentives (“LTI”) | | • Our NEO targeted LTI values have not increased since November 2010 (other than Mr. Causby’s promotional increase) |

| |

Long-Term Performance Program Design Changes | | • Mr. Causby’s target LTI value was increased from 200% of base salary to 250% of base salary to recognize his promotion to Executive Vice President and Chief Operating Officer |

| |

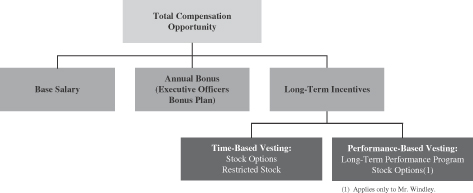

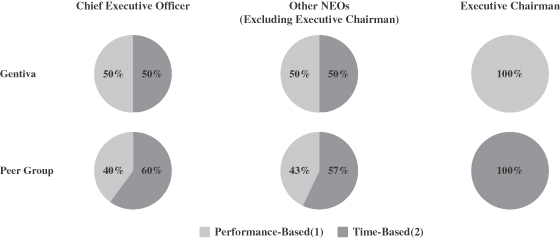

| Based solely on performance achievement at the end of a three-year measurement period (e.g., 2013 grants are based solely on EPS performance for fiscal year 2015) | | • The following chart summarizes our 2013 LTI mix. Competitive market data from our peer companies was used as a guide for establishing these weightings: |

| | | | | | | | | | | | | | | | | | |

TSR modifier: Added to

adjust final payouts based on

our TSR performance vs.

direct competitors | | | | Long-Term

Performance

Program | | | Time-Based

Stock Options | | | Restricted

Stock | | | Performance-

Based

Stock Options | |

| | CEO | | | 50 | % | | | 25 | % | | | 25 | % | | | — | |

| | | | | |

| | Other NEOs | | | 50 | % | | | 15 | % | | | 35 | % | | | — | |

| | | | | |

| | Executive Chairman | | | — | | | | — | | | | — | | | | 100 | %1 |

| | | | | | | | |

| | 1 Vesting requirements are performance-based. See “Executive Chairman—2013 Performance-Based Stock Option Grant” for a detailed description of the performance-based criteria for this 2013 grant. |

21

| | |

Pay Component | | Comments on Target Compensation |

| Executive Chairman Compensation Structure | | • Aon Hewitt studied competitive market data for approximately 175 U.S. companies reporting an Executive Chairman / Chief Executive Officer organizational structure. The median total compensation value for the Executive Chairman was approximately 65% of the value for the Chief Executive Officer. Based on the market data, Mr. Windley’s total compensation opportunity was set at 65% of our Chief Executive Officer, with the following components: • Base salary: Consistent with our previous Executive Chairman’s base salary • Target annual bonus: Mr. Windley does not participate in our Executive Officers Bonus Plan • LTI: Mr. Windley received a grant of 375,000 performance-based stock options representing 75% of his total compensation opportunity, at an exercise price of $10.24. Mr. Windley will not receive the full value of this grant unless our stock price increases 76% from the stock price on the grant date and three years have elapsed since the grant date. See “Executive Chairman—2013 Performance-Based Stock Option Grant” for a detailed description of this 2013 grant |

| |