UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

Form 10-K

|

| | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| | | or | | |

| | For the fiscal year ended December 31, 2013 | | | For the transition period from to . |

Commission File Number: 000-28369

Geeknet, Inc.

(Exact name of Registrant as specified in its charter) |

| |

| Delaware | 77-0399299 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

11216 Waples Mill Rd., Suite 100, Fairfax, VA 22030

(Address, including zip code, of principal executive offices)

(877) 433-5638

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Common Stock, $0.001 par value | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

| (Title of Class) | (Name of each exchange on which registered) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (Check one): Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of February 12, 2014, there were 6,657,420 shares of the registrant’s Common Stock outstanding. The aggregate market value of the Common Stock held by non-affiliates of the registrant as of June 30, 2013 (based on the closing price for the Common Stock on the NASDAQ Global Market for such date) was approximately $53 million. Shares of common stock held by each of our officers and directors and by each person or group who owns 5% or more of our outstanding common stock have been excluded in that such persons or groups may be deemed to be our affiliate. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2014 Annual Meeting of Stockholders which will be held on May 7, 2014, and which will be filed pursuant to Regulation 14A within 120 days after the registrant’s year ended December 31, 2013, are incorporated by reference into Part III of this Form 10-K.

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We use words such as “may,” “could,” "believe," "intend," “anticipate,” “potential,” "future," “expect," and variations of such words and similar expressions, to identify such forward-looking statements. Forward-looking statements reflect management's current expectations and are inherently uncertain. Actual results may differ materially from those expressed or implied in such forward-looking statements, which include, but are not limited to, statements regarding: our expectations and beliefs regarding future revenue growth; sources of revenue; wholesale arrangements; financial performance and results of operations; management's strategy, plans and objectives for future operations; our intent to continue to invest in establishing our brand identity; improving product safety and quality assurance testing; improving website user experience and functionality; upgrading technology, infrastructure, support systems and integrated enterprise resource planning system; investing in human resources; development of product offerings; expansion and diversification of our sales and marketing programs; optimization of manufacture and supplier relationships; liquidity and capital resources; our accounting policies; and sufficiency of our cash resources and investments to meet our operating and working capital requirements. We cannot guarantee that any forward-looking statement will be realized. Achievement of future results is subject to risk, uncertainties and assumptions. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, then these and other various factors, including those set forth in this Business section under "Competition" and in the Risk Factors contained in Item 1A "Risk Factors" and elsewhere in our Form 10-K, could cause our actual results to differ significantly from past results and from management's expectations. We undertake no obligation to update the forward-looking statements to reflect events or circumstances occurring after the date of this Form 10-K.

PART I

ITEM 1. Business

Introduction

Geeknet, Inc. ("Geeknet") and its subsidiary, ThinkGeek, Inc. (“ThinkGeek,” and together with Geeknet, "we" or the “Company”), operate a business aimed at the global geek community, which includes technology enthusiasts, pop-culture aficionados, and anyone who turns their interests into passions and feels a connection to other enthusiastic fans. ThinkGeek has sought to provide the tech, gadget and game-obsessed communities with all the things that geeks crave through its ThinkGeek.com website (the "website") and to the Company's wholesale channel customers. ThinkGeek was founded to serve the distinct needs and interests of technology professionals and enthusiasts and today has grown to become the place for innovative and imaginative products that appeal to the geek in everyone.

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore, we file periodic reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

You can access other information at our Investor Relations website at investors.geek.net. The content of this website is not intended to be incorporated by reference into this report or any other report we file with the SEC. We make available, free of charge on our website, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

Business Overview

Geeknet was incorporated in California in January 1995 and reincorporated in Delaware in December 1999. From the date of its incorporation through October 2001, the Company sold Linux-based hardware systems and services under the name VA Linux Systems, Inc. In December 2001, the Company changed its name to VA Software Corporation to reflect its decision to pursue media, e-commerce, software and online images businesses. In May 2007, the Company changed its name to SourceForge, Inc. In November 2009, the Company changed its name to Geeknet to project a more accurate reflection of its business. On September 17, 2012, Geeknet sold its Media business to Dice Holdings, Inc.

Today, Geeknet sells collectibles, apparel, gadgets, electronics, toys and other retail products for technology enthusiasts and general consumers through the website and certain exclusive products to the Company's wholesale channel customers. Some ThinkGeek products are custom made and developed by the Company's product development team ("GeekLabs"). Revenue is generated by offering, in a single web property, a broad range of unique products that are typically not available in traditional brick-and-mortar stores and by introducing new products to the ThinkGeek audience and fans on a regular basis. The Company has several wholesale partnerships with brick-and-mortar retailers that allow the Company to reach a broader consumer audience and expand its unique brand. The Company has recently established and strengthened existing partnerships with certain retail store chains that have locations throughout the United States and Canada.

Due to the growth of our wholesale business, effective for the year ended December 31, 2013, the Company reorganized our management reporting and reportable business segments into two operating segments: Website and Wholesale. Prior to September 17, 2012, the Company had two operating segments: e-Commerce and Media. The Media segment was discontinued in 2012 when it was sold to Dice Holdings, Inc.

Consumers can access information directly through our website or contact our customer care representatives and experts by e-mail at orders@thinkgeek.com or by telephone at 1-888-GEEKSTUFF. A third-party fulfillment and warehouse provider located in Lockbourne, Ohio receives purchased inventory, fulfills customers’ orders, and processes returns.

Sales and Marketing

Our marketing strategy is focused on acquiring new customers efficiently and building brand loyalty with existing customers to encourage repeat purchases. We market to prospects and customers through all core online marketing channels: email, paid search, affiliate marketing, online display advertising, and social media. In 2013, we began exhibiting at relevant trade shows, including PAX (Penny Arcade Expo) East and PAX Prime, San Diego ComicCon, and Minecon (for Minecraft enthusiasts).

We employ a dynamic promotional strategy, testing a diverse range of special offers and sales designed to maximize profitable incremental sales using tried-and-true direct marketing techniques. These offers are programmed around specific themes, including product launches and holidays. In addition to promotions, we continue to offer our Geek Points loyalty program. Through this free program, customers earn 10 points for every dollar they spend on most purchases, which they can redeem for a selection of products.

Our authentic relationship with customers and fans enables us to foster thriving social media communities on Facebook, Twitter, Pinterest, Google+, and YouTube. On our website, we regularly perform testing of navigation, design, and promotional elements in order to improve the experience and increase conversion for desktop, tablet, and mobile customers. In addition, we performed an in-depth audience segmentation study in 2013 that will inform our marketing efforts going forward by providing us with a better understanding of current and potential customers.

In addition to our core business of selling products through our website, we also sell products through our wholesale channel. During 2013, our wholesale channel continued to deliver rapid growth. Our wholesale clients buy our ThinkGeek exclusive products to sell in their brick-and-mortar stores across the United States, in Canada and internationally. Our clients are well-known reputable retailers that have a strong presence in malls and in stand-alone stores. Our notable clients are Target, Walmart, Toys "R" Us, f.y.e., Meijer, Books-A-Million and Hot Topic.

Our international wholesale channel grew significantly in 2013. We have partnered with distributors in Australia and the United Kingdom. We believe selling to widely known popular retailers is an opportunity to expand our brand recognition and grow our wholesale business.

Technology and Design

GeekLabs

ThinkGeek has expanded its product offerings with innovative exclusive products created and developed internally by our GeekLabs team. Our talented group of designers and engineers create new and inventive geeky products that are first exclusively retailed on our website, and later offered to select well-known toy and specialty retailers. These additional wholesale channels have become a positive incremental revenue stream in brick-and-

mortar retailers. GeekLabs' innovations continue to be some of the top selling items on our website as the GeekLabs team has creative freedom to design the type of products which interest our customers. We hope to delight our customers with the unique products our GeekLabs team creates.

The portfolio of exclusive products created by our GeekLabs team has substantially increased over the previous year and we continue to sign key new licenses. GeekLabs leverages ThinkGeek's existing cache of over twenty licenses for various notable properties such as Star Wars, Star Trek, Game of Thrones, and Doctor Who. ThinkGeek is one of the few license holders for the popular video game Minecraft.

Currently GeekLabs manufactures products across several product categories including electronics, toys, apparel, housewares, jewelry and candy. Internal company brainstorm sessions are used to determine which products to develop. Some of the top selling GeekLabs products in 2013 included the Star Wars R2-D2 car charger, the Minecraft diamond sword, the Doctor Who TARDIS tea infuser, the Build-on Brick Mug and the Tactical Chef Apron. Minecraft continued its strong performance in 2013, and Doctor Who was one of our most successful new licenses.

ThinkGeek continues to expand our investment in GeekLabs. This includes hiring specialists for our GeekLabs group, expanding our partnership with Asian-based factories and increasing our compliance and safety testing team.

Website Engineering and Technology

We have implemented a broad array of services and systems for customer service, product searching, customer communication, order processing and order fulfillment. These services and systems use a combination of our own proprietary technologies and commercially available, licensed technologies. We focus our internal development efforts on creating and enhancing the specialized, proprietary software to improve our customer experience and ease of use and to increase the functionality of our website. We also invest in cyber security to protect our customers, maintain secure transactions, and minimize business interruptions.

Our core online merchandise catalog, customer interaction, order processing, and back-end systems are proprietary to ThinkGeek. The systems are designed to provide connectivity to our distribution center, and include an inventory tracking system, a real-time order tracking system, an executive information system and an inventory replenishment system. Our Internet servers use secure sockets layer (SSL) technology to help conduct secure communications and transactions.

During the past year, we have improved the search and navigation functions on our website by creating a cleaner, more intuitive product category structure. This became the foundation for our new top level drop down navigation menu. This helps our customers find products that are similar in nature or theme in fewer steps. We also have functionality that identifies products that may interest customers based upon the history of products visited, purchased or added to a wish list. We utilize targeted customer emails that notify customers if a product is in stock, if a new product is available for sale, or to remind customers of a product they recently viewed along with a special promotion or offer. This encourages our customers to revisit the website and potentially purchase that product. We continue to streamline our online shopping cart making it easier to use and consistent with industry practices. In 2013, we added PayPal Express and Bill Me Later as customer payment options. We continuously test website layout and functionality changes to determine the optimal page configurations. In the fourth quarter of 2013 we expanded our support for mobile traffic by creating a tablet optimized version of the website (targeted towards iPad users) that complements our existing smartphone optimized website.

Product Safety

During the second half of 2012, we transitioned part of our product safety and quality assurance function in-house. Prior to the transition we were relying solely on third-party vendors to perform these services. We have invested in certified personnel, who are highly qualified in conducting safety and quality assurance testing. We believe this dedicated in-house function will enable us to improve the quality of our products, minimize defective products, react in a timely manner and continue to exceed industry standards.

Competition

The market for retail products similar to those offered by ThinkGeek is highly competitive, and we compete in different consumer verticals. Our competition includes apparel companies such as Threadless and Zazzle, gadget providers such as Brookstone, and sources for unusual gifts such as Etsy, Fab, Jinx, UncommonGoods, and Vat19.

Large online marketplaces such as Amazon.com and eBay also provide competitive pressure by selling many of the products that are not manufactured exclusively for ThinkGeek.

More recently, some online retailers have developed sites targeted to the computer enthusiast and computer gaming markets. We believe that there are a number of competitive factors in our market, including company credibility, product selection and availability, price, website features, functionality and performance, ease of purchasing, customer service and reliability and speed of order shipment.

Many of the competitors in our e-commerce industry have substantial competitive advantages, including greater resources that can be devoted to the development, promotion and sale of their online products, more established sales channels, greater software and website development experience, and greater name recognition. To be competitive, we must respond promptly and effectively to changes in consumer preferences, technological change, evolving standards and our competitors’ innovations by continuing to enhance our services and products. Any pricing pressures or loss of customers resulting from our failure to compete effectively would reduce our revenue and margin.

Intellectual Property Rights

We protect our intellectual property through a combination of copyright, trademark, patent and trade secret laws, employee and third-party nondisclosure agreements, and other methods of protection. Geeknet, ThinkGeek and their associated logos are some of our trademarks that we use in the United States and in other countries. We have 3 U.S. patents and 15 registered trademarks.

Seasonality

Our business is highly seasonal, reflecting the general pattern associated with the retail industry of peak sales and earnings during the holiday shopping season. As a result, we generated a substantial portion of our revenue in the fourth quarter, which began on October 1, and ended on December 31. As is typical in the retail industry, we generally experience lower revenue during the other quarters. Therefore, our revenue in a particular quarter is not necessarily indicative of future revenue for a subsequent quarter or our full year.

Employees

Our employees are not represented by any collective bargaining organization; we have never experienced a work stoppage; and we believe that our relations with our employees are good. As of December 31, 2013, our employee base totaled 91, including 22 in operations, 18 in sales and marketing, 28 in technology and design and 23 in finance and administration.

Item 1A. Risk Factors

CURRENT AND PROSPECTIVE INVESTORS IN GEEKNET SECURITIES SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED BELOW BEFORE MAKING AN INVESTMENT DECISION. IN ADDITION, THESE RISKS ARE NOT THE ONLY ONES FACING OUR COMPANY. ADDITIONAL RISKS OF WHICH WE ARE NOT PRESENTLY AWARE OR THAT WE CURRENTLY BELIEVE ARE IMMATERIAL MAY ALSO IMPAIR OUR BUSINESS OPERATIONS. OUR BUSINESS COULD BE HARMED BY ANY OF THESE RISKS. THE TRADING PRICE OF OUR COMMON STOCK COULD DECLINE DUE TO ANY OF THESE RISKS, AND INVESTORS MAY LOSE ALL OR PART OF THEIR INVESTMENT.

Risks Related To Our Business

If ThinkGeek fails to launch new and innovative products, the demand for our products may be limited and our revenue will be adversely affected.

In order to attract customers, we must continually release new and innovative products, including signature products internally developed by GeekLabs. In addition to the direct revenue we derive from product sales, the release of new and innovative products attracts media coverage and drives customers to our business. The successful development, sourcing, manufacturing and merchandising of products is subject to numerous risks and uncertainties, including certain factors specific to our business over which we have limited or no control.

There can be no assurance that our new products will appeal to customers or that demand for these products will be sufficient to generate revenue consistent with our estimates. In addition, there can be no assurance that new products will be developed in a timely or cost-effective manner, or that we will be able to procure appropriate quantities of such products. If we are unable to deliver new and innovative products that allow us to increase demand, we may not be able to generate sufficient revenue to grow our business. See also additional risks related to competition set forth elsewhere in these Risk Factors.

Our business is highly seasonal. In addition, we are exposed to significant inventory risks as a result of seasonality, new product launches, rapid changes in product cycles and changes in consumer tastes.

Our business is highly seasonal, with a disproportionate amount of our sales occurring in the fourth quarter which begins on October 1 and ends on December 31. To be successful, we must accurately predict our customers' tastes and demands to avoid purchasing too much or not enough inventory. If we purchase too much inventory, we may be required to discount those products or write-off products we are unable to sell, reducing our gross margins. If we do not purchase enough inventory, we may fail to meet customer demand and lose potential orders, which will adversely affect our financial results.

In addition, when we launch a new product, it is difficult to accurately forecast customer demand. Certain products, especially custom manufactured products or products purchased from outside the United States may require significant lead-time, payment or partial payment prior to shipment, and may not be returnable. We carry a broad selection of products and significant inventory levels of certain products and we may be unable to sell products in sufficient quantities or during the relevant selling seasons. Failure to properly assess our inventory needs could adversely affect our financial results.

We are dependent upon a single third-party fulfillment and warehouse provider. Any decrease in the quality of service offered by our fulfillment and warehouse provider will adversely affect our reputation and the growth of our business. If we fail to realize anticipated operating efficiencies at our third-party fulfillment and warehouse provider, our operating results will be adversely affected.

Our ability to receive inbound inventory and ship completed orders efficiently and in a timely manner to our customers is substantially dependent on a single third-party fulfillment and warehouse provider. We ship products to customers worldwide using the services of Exel, Inc. (“Exel”), located in Lockbourne, Ohio.

If Exel fails to meet our distribution and fulfillment needs, our relationship with and reputation among our customers will suffer and this will adversely affect our revenue. Additionally, if Exel is unable to meet our distribution and fulfillment needs, particularly during the holiday season, or our contract with Exel is terminated, we may be required to secure a second-source or replacement fulfillment and warehouse provider. If we fail to secure such a fulfillment and warehouse provider or are unable to secure a fulfillment and warehouse provider on comparable terms, our reputation and our financial results would be adversely affected.

If we do not continually enhance our website and order processing systems or respond to rapid technological changes, we could lose customers and our net revenues could decline.

If we are unable to continually upgrade our website in a timely manner to accommodate higher volumes of traffic, our website performance could suffer and we may lose customers. In addition, if we are unable to expand the computer systems that we use to process and ship customer orders and process customer payments, we may not be able to fulfill any potential growth in customer orders from the website successfully. As a result, we could lose customers and our net revenues could decline. Further, to remain competitive, we must continue to enhance and improve the functionality and features of our website. The Internet and the online commerce industry are subject to rapid technological change. If competitors introduce new features and website enhancements, or if new industry standards and practices emerge, our existing website and systems may become obsolete or unattractive. Developing and enhancing our website and other systems entails significant technical and business risks. We may use new technologies ineffectively or we may fail to adapt our website, our transaction processing systems and our computer network to meet customer requirements or emerging industry standards. If we are unsuccessful in upgrading our systems to accommodate higher traffic or developing or implementing new technologies that enable us to meet evolving industry standards and remain competitive, our operating results would be seriously harmed.

If we do not successfully and cost-effectively implement one or more of these intended upgrades or modified processes or if we do not achieve desired efficiencies or cost savings as a result of these changes or if attempts to

enhance our website are unsuccessful or are not appealing to our customers, our business and operating results could be harmed, perhaps significantly.

Unplanned system interruptions and capacity constraints could harm our revenue and reputation.

Our business is dependent on the uninterrupted and highly-available operation of our website. We experience periodic service interruptions with our website. Service interruptions may be caused by a variety of factors, including capacity constraints, software design flaws and bugs, and third party denial of service attacks, such as the attack we experienced in March 2013. If we fail to provide customers with such access to our website at the speed and performance at which they require, our sales and business reputation will be adversely affected.

Our systems and operations remain vulnerable to damage or interruption from fire, power loss, telecommunications failure and similar events. If our website experiences frequent or lengthy service interruptions, our business and reputation could be adversely affected.

Privacy concerns relating to our technology could damage our reputation and deter current and potential customers from using our website.

Concerns about our practices with regard to the collection, use, disclosure, or security of personal information, or other privacy related matters, even if unfounded, could damage our reputation and operating results. While we strive to comply with all applicable data protection laws and regulations, as well as our own posted privacy policies, any failure or perceived failure to comply may result in proceedings or actions against us by government entities or others, or could cause us to lose customers, which could potentially have an adverse affect on our business.

Regulatory authorities around the world are considering a number of legislative and regulatory proposals concerning data protection. In addition, the interpretation and application of consumer and data protection laws in the U.S., Europe and elsewhere are often uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change our data practices, which could have an adverse affect on our business and results of operations. Complying with these various laws could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.

Our business could be adversely affected by cyber-attacks leading to misappropriation of sensitive personally identifiable information or our proprietary business information.

As our business sells goods and operates online, we are at risk of cyber-attacks. Our business involves the use of our proprietary information as well as the storage and transmission of customers' personally identifiable and proprietary information, and security breaches could expose us to a risk of loss of this information, litigation, and potential liability. While we take measures to protect personally identifiable information from unauthorized access or disclosure, it is possible that our security controls over personally identifiable information may not prevent improper access or disclosure. Our security measures may be breached due to the actions of outside parties, employee error, malfeasance, or otherwise. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. As a result, an unauthorized party may be able to disrupt our operations or obtain access to our data or our customers' personally identifiable information or proprietary data. Due to the nature of sophisticated cyber-attacks, there is a risk that such attack may remain undetected for a period of time.

A party who is able to circumvent our security measures could misappropriate proprietary information or cause interruptions or malfunctions in our Internet operations. In addition, a security breach that leads to disclosure of our proprietary information may compromise our ability to compete in the marketplace by allowing others to use our proprietary information to develop similar or competitive products. A security breach that leads to disclosure of user or consumer information (including sensitive personally identifiable information) could harm our reputation, compel us to comply with disparate breach notification laws in various jurisdictions and otherwise subject us to liability under laws that protect personal data, resulting in increased costs or loss of revenue. A cyber-attack, such as a denial of service attack, that renders our site inoperable would result in adverse consequences, including significant loss of revenues. Any security breach may also cause us to expend significant resources to restore system functionality and incur costs to deploy additional personnel, protection technologies and third party consultants to defend against a future security breach.

We outsource the operation of our network connectivity and work actively to maintain up-to-date security and defense measures. If any of our outsourcing providers do not perform adequately, we may be exposed to greater risk of a cyber-attack. In addition to utilizing third party providers, we periodically review our security and privacy practices and we are continuing to implement and update policies and practices as a result of these reviews. We may not adequately identify risks and the policies and practices we implement may not be effective.

We are subject to risks as a result of our reliance on foreign sources of production for certain products.

In order to offer cost-effective and innovative products, we rely on manufacturers located outside of the United States, most of which are located in China, to supply us with sufficient quantities of these products based on our forecasts and to deliver these products in a timely manner.

Our arrangements with these manufacturers are generally limited to purchase orders tied to specific lots of goods. We are subject to the risks of relying on products manufactured outside of the United States, including political unrest, trade restrictions, customs and import/export regulations, local business practice and geo-political issues, such as political and social unrest and economic instability. Additionally, significant reliance on foreign sources of production increases the risks relating to compliance with domestic or international labor standards, customs and import/export laws and regulations, compliance with domestic or international manufacturing and product safety standards, currency fluctuations, restrictions on the transfer of funds, work stoppages or slowdowns and other labor issues, economic uncertainties including inflation and government regulations, availability and costs of raw materials, potentially adverse tax consequences and other uncertainties. China has experienced rapid social, political and economic change and further changes may adversely affect our ability to procure our products from Chinese suppliers.

Our ability to obtain goods on a cost effective basis is also subject to our ability to maintain relationships with our suppliers and our ability to negotiate and maintain supply arrangements on favorable terms. The Chinese Yuan (“CNY”) exchange rate to the U.S. Dollar (“USD”) has not historically been volatile. In the event that the CNY/USD exchange rate changes substantially, our suppliers could attempt to renegotiate our purchase orders with them and increase our costs. In addition, because our purchases are usually on a case by case basis, we are subject to the risk of unexpected changes in pricing or supply from these suppliers. We may also be unable to develop beneficial relationships with new vendors in the future.

We may be subject to product liability claims if people or property are harmed by the products we sell, which could be costly to defend and subject us to significant damage claims.

Some of the products we offer for sale may expose us to product liability or product safety claims relating to personal injury, death or property damage caused by such products and may require us to take actions such as product recalls, which could involve significant expense incurred by the Company. Although we maintain liability insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all. The successful assertion of an uninsured product liability or other claim against us could cause us to incur significant expenses to pay such a claim and could adversely affect our financial results. Even a successfully defended product liability claim could cause us to incur significant expenses to defend and could adversely affect our financial results. In addition, some of our vendor agreements with our suppliers do not indemnify us from product liability and even if some agreements provide for indemnification, it may not be possible or practical to avail ourselves of the benefits of the protection.

As a seller of consumer products, we are subject to various government regulations and may be subject to additional regulations in the future, violation of which could subject us to sanctions or otherwise harm our business.

As an Internet retailer of consumer products, we are subject to significant government regulations, including, in the United States, the Consumer Products Safety Act, the Federal Hazardous Substances Act, the Flammable Fabrics Act, and the Fair Disclosure under the Federal Trade Commission, as well as product safety and consumer protection statutes in our international markets. In addition, certain of our products are subject to regulation by the Food and Drug Administration or similar international authorities. In addition, collecting information from children is subject to regulation by the Federal Trade Commission under the Children's Online Privacy Protection Act. We are taking steps we believe are necessary to comply with these acts, but there can be no assurance that we will be in compliance, and failure to comply with these acts could result in sanctions which could have a negative impact on our business, financial condition and results of operations. We may also be subject to involuntary product recalls or may voluntarily conduct a product recall. While costs associated with product recalls have generally not been material to

our business, the costs associated with future product recalls individually or in the aggregate in any given fiscal year, could be significant. In addition, any product recall, regardless of direct costs of the recall, may harm consumer perceptions of our products and have a negative impact on our future revenues and results of operations.

Governments and regulatory agencies in the markets where we manufacture and sell products may enact additional regulations relating to product safety and consumer protection in the future, and may also increase the penalties for failure to comply with product safety and consumer protection regulations. Complying with any such additional regulations or requirements could impose increased costs on our business. Similarly, increased penalties for non-compliance could subject us to greater expense in the event any of our products were found to not comply with such regulations, and could have a negative impact on our future results of operations.

Increased focus on sales and use tax could subject us to liability for past sales and cause our future sales to decrease.

We currently collect sales taxes for merchandise shipped to Florida, Minnesota, Ohio, Virginia, and Washington, but we do not collect sales or other taxes on shipments of our goods into the remaining states in the United States or internationally. The relocation of our fulfillment center or customer service centers or any future expansion of them, along with other aspects of our business, may result in additional sales and other tax obligations. We do not collect consumption tax (including value added tax, goods and services tax, and provincial sales tax) as applicable on goods and services sold that are delivered outside of the United States as our terms of sale provide that the customer is responsible for such expenses. One or more states or foreign countries may seek to impose sales or other tax collection obligations on out-of-jurisdiction e-commerce companies. A successful assertion by one or more states or foreign countries that we should collect sales or other taxes on the sale of merchandise or services could result in substantial tax liabilities for past sales, decrease our ability to compete with traditional retailers, and otherwise harm our business.

Currently, U.S. Supreme Court decisions restrict the imposition of obligations to collect state and local sales and use taxes with respect to sales made over the Internet. However, a number of states and the U.S. Congress continue to consider initiatives that could limit or supersede the Supreme Court's position regarding sales and use taxes on Internet sales, and some states have adopted laws that attempt to impose obligations on out-of-state retailers to collect taxes on their behalf. If any of these initiatives are successful, we could be required to collect sales and use taxes in additional states. The imposition by state and local governments of various taxes upon Internet commerce could create administrative burdens for us, put us at a competitive disadvantage if they do not impose similar obligations on all of our online competitors and decrease our future sales.

Risks Related To Our Financial Results

We have a history of losses and may incur net losses in the foreseeable future. If we are unable to attain consistent profitability, the market price of our common stock and our ability to raise capital and continue operations may be materially and adversely affected.

We have an accumulated deficit of $743.4 million as of December 31, 2013. We may continue to incur net losses in the future. If we are unable to attain profitability on a sustained basis, the market price of our common stock and our ability to raise capital and continue operations may be materially and adversely affected.

Our ability to use net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes is subject to limitation and may be limited further.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), a corporation that undergoes an “ownership change” is subject to limitations on its ability to utilize its net operating losses (“NOLs”), to offset future taxable income. In general, an ownership change occurs if the aggregate stock ownership of certain stockholders increases by more than 50 percentage points over such stockholders' lowest percentage ownership during the testing period (generally three years). We determined that such an ownership change occurred as of November 2008. This ownership change resulted in limitations on the utilization of tax attributes, including net operating loss carryforwards and tax credits.

The occurrence of an additional ownership change could limit the ability to utilize NOLs that are not currently subject to limitation, and could further limit the ability to utilize NOLs that are currently subject to limitation. The amount of the annual limitation generally is equal to the value of the stock of the corporation immediately prior to the ownership

change multiplied by the adjusted federal tax-exempt rate, set by the Internal Revenue Service. Limitations imposed on the ability to use NOLs to offset future taxable income could cause U.S. federal income taxes to be paid earlier than otherwise would be paid if such limitations were not in effect and could cause such NOLs to expire unused, in each case reducing or eliminating the benefit of such NOLs. Similar rules and limitations may apply for state income tax purposes.

Certain factors specific to our business over which we have limited or no control may nonetheless adversely impact our total revenue and financial results.

The primary factors over which we have limited or no control that may adversely impact our total revenue and financial results include the following:

| |

• | specific economic conditions relating to our business |

| |

• | the spending habits of our customers |

| |

• | the performance of our suppliers |

| |

• | execution by our third party fulfillment center |

| |

• | our ability to retain qualified merchandising, sales and product development personnel. |

If our revenue and operating results fall below our expectations, the expectations of securities analysts or the expectations of investors, the trading price of our common stock will likely be materially and adversely affected. You should not rely on the results of our business in any past periods as an indication of our future financial performance.

If we are unable to maintain or acquire licenses to include intellectual property owned by others in our products, revenues and operating results could suffer.

A material portion of our revenue is derived from sales of products related to popular online or video games, films and television shows. We rely on our ability to acquire rights related to popular online or video games, films and television shows and pay royalties to branded content owners for the use of their content on these products. Competition for these licenses can be intense, and we may not be able to acquire or renew desirable licenses at reasonable rates or at all. In addition, while part of our business strategy involves predicting future trends, may be unsuccessful in predicting which video games, films, television shows or other pop culture phenomena will be popular in the future and target our license-acquisition activities accordingly. Our failure to maintain our existing licenses or acquire successful new licenses at reasonable rates could significantly impact our content sales or interrupt our supply chain and require use to modify our products or business plans and could adversely impact our results of operations.

Our wholesale business is heavily dependent on sales to several large retailers.

Our wholesale business grew significantly during 2013, primarily as a result of sales to several large retailers. These large retailers could reduce their purchasing levels or cease buying products from us at any time for any reason. They could also bring to market products that compete with our successful products. In addition, our wholesale customers have a variety of suppliers to choose from and therefore can make substantial demands on us, including demands on product pricing and returns. We have not experienced a material level of product returns to date, but the risk exists. If we lose a significant wholesale customer or if sales of our products to a significant wholesale customer materially decrease, it could have an adverse effect on our business and financial results.

Increased shipping costs and labor stoppages may adversely affect sales of our products.

Many of our products are delivered to customers from our fulfillment center located in Ohio. We have established relationships with reputable common carriers for the delivery of these products. If these carriers were to increase the prices they charge to ship our goods, and we pass these increases on to our customers, our customers might choose to buy comparable products locally to avoid shipping charges. In addition, these carriers may experience labor stoppages or other issues, which could impact our ability to deliver products on a timely basis to our customers and adversely affect customer relationships.

Changes to financial accounting standards may affect our results of operations.

We prepare our financial statements to conform to accounting principles generally accepted in the United States of America. These accounting principles are subject to interpretation by the Financial Accounting Standards Board, the Securities and Exchange Commission, and various bodies formed to interpret and create appropriate accounting standards. A change in an accounting policy can have a significant effect on our reported results and may even affect our reporting of transactions completed before a change is announced. Changes to those rules or the questioning of current practices may adversely affect our reported financial results.

Risks Related To Competition

Our competition is intense. Our failure to compete successfully could adversely affect our revenue and financial results.

Our business is rapidly evolving and operates in an intensely competitive industry. We have many competitors, including other e-commerce businesses as well as traditional brick-and-mortar retailers. Increases in shipping costs or the taxation of Internet commerce may make our products less competitive when compared with traditional brick- and-mortar retailers. Additionally, our current and future competitors may have greater resources, more customers and greater brand recognition than we do. These competitors may secure better terms from vendors and adopt more competitive pricing for their products. They may also devote more resources to their technology infrastructure, product development, order fulfillment, distribution facilities and marketing and advertising campaigns. In addition, as we expand into new markets and broaden our product offering, our competition may intensify as our current and future competitors enter into similar markets and offer similar products. Local competitors in these new markets may have substantial competitive advantages because of greater focus on and knowledge of local customers and their preferences and greater brand recognition. Further, if we fail to maintain a customer loyalty program that is competitive in our industry, we may not attract or retain customers, and our sales may suffer.

Increased competition is likely to result in price reductions, reduced gross margins and loss of market share, any of which could seriously harm our net revenues and results of operations. We expect competition to intensify in the future because current and new competitors can enter our market with little difficulty and can launch new websites at a relatively low cost.

Risks Related To Intellectual Property

We are vulnerable to claims that our website and software infringe third-party intellectual property rights. Any resulting claims against us could be costly to defend or subject us to significant damages.

We expect that our website will increasingly be subject to infringement claims as the number of competitors in our industry segment grows and the functionality of web properties in different Internet industry segments overlap. The scope of United States patent protection for software is not well-defined and will evolve as the United States Patent and Trademark Office grants additional patents. Because patent applications in the United States are not publicly disclosed until the patent is issued, applications may have been filed that would relate to our products. We may also receive patent infringement claims as companies increasingly seek to patent their software. Our developers may unknowingly infringe on third-party patent rights. We cannot prevent current or future patent holders or other owners of intellectual property from suing us and others seeking monetary damages or an injunction against our web offerings. We may seek licenses from such parties, but they could refuse to grant us a license or demand commercially unreasonable terms. We might not have sufficient resources to pay for the licenses. Such infringement claims could also cause us to incur substantial liabilities and to suspend or permanently cease the use of critical technologies or processes or the production or sale of major products. In either event, our operating results could be seriously harmed. In recent years, companies have also been subject to patent infringement claims from non-practicing entities, or "patent trolls." In addition, employees hired from competitors might utilize proprietary and trade secret information from their former employers without our knowledge, even though our employment agreements and policies clearly prohibit such practices.

Any litigation regarding our intellectual property, with or without merit, could be costly and time consuming to defend, divert the attention of our management and key personnel from our business operations and cause interruption in our website. Claims of intellectual property infringement may require us to enter into royalty and licensing agreements that may not be available on acceptable terms. In addition, parties making claims against us may be able to obtain injunctive or other equitable relief that could effectively block our ability to offer our products in the United States and

abroad and could result in an award of substantial damages against us. Defense of any lawsuit or failure to obtain any required license could delay release of our products and increase our costs. If a successful claim is made against us and we fail to develop or license a substitute technology, our business, results of operations, financial condition or cash flows could be immediately and materially adversely affected.

If we fail to adequately protect our intellectual property rights, competitors may use our technology and trademarks, which could weaken our competitive position, reduce our revenue, and increase our costs.

We rely on a combination of copyright, trademark, patent and trade secret laws, employee and third-party nondisclosure agreements, and other arrangements to protect our proprietary rights. Despite these precautions, it may be possible for unauthorized third parties to copy our website, products and/or services offered thereon or obtain and use information that we regard as proprietary to create sites that compete against ours. Some license provisions protecting against unauthorized use, copying, transfer, and disclosure of our licensed programs may be unenforceable under the laws of certain jurisdictions and foreign countries.

In addition, the laws of some countries do not protect proprietary rights to the same extent as do the laws of the United States. To the extent that we increase our international activities, our exposure to unauthorized copying and use of our website, proprietary information and original products will increase. Additionally, we manufacture most of our original products in China, where there is a risk that such products would be copied and enforcement of our intellectual property rights would be difficult.

Our collection of trademarks is important to our business. The protective steps we take or have taken may be inadequate to deter misappropriation of our trademark rights. We have filed applications for registration of and registered some of our trademarks in the United States and internationally. Effective trademark protection may not be available in every country in which we offer or intend to offer our products and services. Failure to protect our trademark rights adequately could damage our brand identity and impair our ability to compete effectively. Furthermore, defending or enforcing our trademark rights could result in the expenditure of significant financial and managerial resources.

Our success depends significantly upon our proprietary technology and information. Despite our efforts to protect our proprietary technology and information, it may be possible for unauthorized third parties to copy certain portions of our offerings or to reverse engineer or otherwise obtain and use our proprietary technology or information. We periodically discover products that are counterfeit reproductions of our products or designs, or that otherwise infringe our intellectual property rights. The actions we take to establish and protect our intellectual property rights may not be adequate to prevent imitation of our offerings by others or prevent others from seeking to block sales of our offerings as violations of proprietary rights. Existing copyright laws afford only limited protection, and the laws of certain foreign countries may not protect intellectual property rights to the same extent as do United States laws. Litigation may be necessary to protect our proprietary technology and information. Such litigation may be costly and time-consuming and if we are unsuccessful in challenging a party on the basis of intellectual property infringement, our sales and intellectual property rights could adversely be affected and result in a shift of customer preference away from our offerings.

In addition, we cannot be certain that others will not develop substantially equivalent or superseding proprietary technology, or that equivalent offerings will not be marketed in competition with our offerings, thereby substantially reducing the value of our proprietary rights. We may not be able to protect our proprietary offerings or technologies via intellectual property rights and any patents not issued might not provide us with any competitive advantages or might be challenged by third parties.

Other Risks Related To Our Overall Business

We are exposed to risks associated with worldwide economic slowdowns and related uncertainties.

We are subject to macroeconomic fluctuations in the U.S. economy and elsewhere. Concerns about consumer and investor confidence, volatile corporate profits and reduced capital spending, international conflicts, terrorist and military activity, civil unrest and pandemic illness could cause a slowdown in sales revenue. In addition, political and social turmoil related to international conflicts and terrorist acts may put further pressure on economic conditions in the United States and abroad.

Macroeconomic issues involving the broader financial markets, including elevated unemployment, consumer access to credit for housing and other purposes, government debt and spending levels and general liquidity issues in the securities markets, have negatively impacted the economy and may negatively affect our business. In addition, weak economic conditions and declines in consumer spending and consumption may harm our operating results. Purchases of our products are discretionary. If the economic climate deteriorates, customers or potential customers could delay, reduce or suspend their purchases of our products. This could impact our business in a number of ways, including lowering prices for our products and reduced or delayed sales. There could be a number of follow-on effects from the recent financial crisis on our business, including insolvency of key suppliers resulting in product delays; customer insolvencies; counterparty failures; and increased expense or inability to obtain future financing.

If weak macroeconomic conditions persist or worsen, our results of operations may be harmed.

Government laws and regulations are evolving and unfavorable changes could harm our business.

We are subject to general business regulations and laws, as well as regulations and laws specifically governing the Internet and e-commerce. Existing and future laws and regulations may impede our growth. These regulations and laws may cover taxation, privacy, data protection, pricing, content, copyrights, distribution, mobile communications, electronic device certification, electronic waste, electronic contracts and other communications, consumer protection, web services, the design and operation of websites, and the characteristics and quality of products and services. It is not clear how existing laws governing issues such as property ownership, libel, and personal privacy apply to the Internet and e-commerce.

Legislation and regulation in the United States as well as international laws and regulations could result in compliance costs which may reduce our revenue and income, as well as governmental action should our compliance measures not be deemed satisfactory.

We depend on third parties to provide a number of products and services, subjecting us to significant operational risks.

We currently depend on a number of third-party providers, and this reliance subjects us to significant operational risks, any of which could impair our ability to deliver products to our customers should they occur. These risks include:

| |

| • | reduced management and control of our data, including the risk of unauthorized disclosure of customer and/or other protected information |

| |

| • | reduced control over delivery schedule and quality assurance |

| |

| • | misappropriation of our intellectual property |

| |

| • | failures by the third parties on whom we rely to comply with all domestic and foreign laws relating to our business |

We have identified a continued material weakness in our internal control over financial reporting. We may not detect other weaknesses in our internal control over financial reporting in a timely manner, or at all.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 ("Section 404"), we are required to evaluate the effectiveness of our internal control over financial reporting as well as our disclosure controls and procedures each fiscal year.

Management identified a material weakness in the Company's internal control over financial reporting as of December 31, 2012, that is not yet fully remediated. The demand on the corporate accounting resources continues to be significant due to the manual nature of controls necessary to maintain effective control over our non-integrated legacy system.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company's annual or interim consolidated financial statements would not be prevented or detected on a timely basis. In reaching the conclusion that, as of December 31, 2013, a material weakness existed, management evaluated the criteria established in Internal Control

- Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (1992 framework).

As described in Item 9A(b). Controls and Procedures - Management's Report on Internal Control Over Financial Reporting, management has made progress in addressing the material weakness but, while these improvements in internal controls are substantial, they have not eliminated our material weakness due to our continued reliance on manual controls and non-integrated legacy systems. Management believes we are addressing those areas of weakness through the implementation of our new integrated enterprise resource planning system beginning in the first quarter of 2014. Given the complexity of the new systems, the implementation may encounter problems and delays which require our continued reliance on manual control procedures.

We cannot be certain in future periods that other control deficiencies that may constitute one or more “significant deficiencies” (as defined by the relevant auditing standards) or material weaknesses in our internal control over financial reporting will not be identified. If we fail to maintain the adequacy of our internal controls, including any failure to implement or difficulty in implementing required or new or improved controls, our business and results of operations could be harmed, the results of operations we report could be subject to adjustments, we may not be able to provide reasonable assurance as to our financial results or the effectiveness of our internal controls, we may not be able to meet our reporting obligations, we may experience a loss of investor confidence and any of the foregoing could have a negative impact on the trading price of our common stock.

We may encounter difficulties in the implementation or operation of our new enterprise resource planning system.

We are in the process of implementing a new enterprise resource planning (ERP) system for our Company. We expect that, once fully implemented, the ERP system will enable us to improve our productivity, stream line processes, make our operations more cost efficient and obtain website, inventory and other financial data timely and accurately. The implementation of the new ERP system has required, and will continue to require, the involvement of significant financial and human resources. In addition, we may not be able to successfully complete the implementation of the new ERP system without experiencing difficulties. Any disruptions, delays or deficiencies in the design and implementation of the new ERP system could adversely affect the Company's business and our financial results.

If we lose key personnel or fail to integrate replacement personnel successfully, our ability to manage our business could be impaired.

Our future success depends, in part, on our ability to attract and retain certain key personnel, including management, technical, sales, and other critical personnel. The competition for attracting and retaining key employees is intense. In the Internet and high technology industries, qualified candidates often consider equity awards in compensation arrangements and fluctuations in our stock price may make it difficult to recruit, retain, and motivate employees. The loss of any key employee could result in significant disruptions to our operations, including adversely affecting the timeliness of product releases, the successful implementation and completion of company initiatives, and the results of our operations. In addition, the integration of replacement personnel could be time consuming, may cause additional disruptions to our operations, and may be unsuccessful.

Our stock price has been volatile historically and may continue to be volatile.

The trading price of our common stock has been and may continue to be subject to wide fluctuations. During the year ended December 31, 2013, the closing sale prices of our common stock on the NASDAQ Global Market ranged from $12.51 to $19.84 per share and the closing sale price on December 31, 2013, the last trading day of the year, was $18.09 per share. Our stock price may fluctuate in response to a number of events and factors, such as quarterly variations in operating results, announcements of technological innovations or new products by us or our competitors, changes in financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable to us, and news reports relating to trends in our markets or general economic conditions.

In addition, the stock market in general and the market prices for Internet-related companies in particular have experienced volatility that often has been unrelated to the operating performance of such companies. These broad market and industry fluctuations may adversely affect the price of our stock, regardless of our operating performance. Additionally, volatility or a lack of positive performance in our stock price may adversely affect our ability to retain key employees, all of whom have been granted stock options.

Sales of our common stock by a significant stockholder may cause the price of our common stock to decrease.

Several of our stockholders own significant portions of our common stock. If these stockholders were to sell substantial amounts of their holdings of our common stock, then the market price of our common stock could be negatively impacted. The effect of such sales, or of significant portions of our stock being offered or made available for sale, could result in strong downward pressure on our stock price. Investors should be aware that they could experience significant short-term volatility in our stock if such stockholders decide to sell a substantial amount of their holdings of our common stock at once or within a short period of time.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our principal location is as follows: |

| | | | | | | |

| Location | | Purpose | | Approximate Size (in square feet) | | Expiration of Lease |

| Fairfax, Virginia | | Corporate headquarters; finance and administration, and business operations | | 17,699 |

| | 2014 |

We believe that our existing properties are in good condition and are adequate and suitable for the conduct of our business.

Item 3. Legal Proceedings

In the normal course of business, we experience routine claims and legal proceedings. The disclosure under the caption “Legal Proceedings” in Note 4. Commitments and Contingencies to the Consolidated Financial Statements is incorporated by reference into this Item 3.

Item 4. Mine Safety Disclosure

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NASDAQ Global Market under the symbol GKNT. As of February 7, 2014, there were 368 holders of record of our common stock. We have not declared any cash dividends since our inception and do not expect to pay any dividends in the foreseeable future. The high and low closing sales prices, as reported by NASDAQ, of our common stock are as follows:

|

| | | | | | | | | | | | | | | | |

| | | Year Ended

December 31, 2013 | | Year Ended

December 31, 2012 |

| Quarter | | High | | Low | | High | | Low |

| Fourth Quarter | | $ | 19.84 |

| | $ | 16.86 |

| | $ | 19.09 |

| | $ | 14.68 |

|

| Third Quarter | | $ | 17.17 |

| | $ | 13.90 |

| | $ | 21.42 |

| | $ | 17.11 |

|

| Second Quarter | | $ | 14.72 |

| | $ | 12.51 |

| | $ | 19.82 |

| | $ | 12.68 |

|

| First Quarter | | $ | 17.67 |

| | $ | 14.77 |

| | $ | 18.57 |

| | $ | 14.35 |

|

The foregoing reflects interdealer prices without retail markup, markdown, or commissions and may not necessarily reflect actual transactions.

On June 17, 2013, the Company announced the commencement of a modified Dutch tender offer to repurchase up to 400,000 shares of its common stock at a price of not less than $12.00 nor greater than $14.00 per share. The Company's Board of Directors determined it was in the best interest of its stockholders to repurchase shares at that time given its cash position and stock price and the likelihood that the Company's common stock may be removed from the Russell 2000 Index. The Company was subsequently removed from the Russell 2000 Index on June 28, 2013. The tender offer expired on July 15, 2013. Pursuant to the terms of the tender offer, the Company purchased 53,884 shares at $14.00 per share for a total cost of $0.8 million, excluding fees and expenses related to the tender offer. These shares represented approximately 0.81% of the shares outstanding as of July 15, 2013.

Issuer Purchases of Equity Securities

The following table sets forth information regarding the Company's purchases of its common stock during the three months ended December 31, 2013.

|

| | | | | | | |

| Period | | Total Number of Shares Purchased (1) | | Average Price Paid Per Share |

| October 1, 2013 to October 31, 2013 | | 159 |

| | $ | 19.18 |

|

| November 1, 2013 to November 30, 2013 | | — |

| | $ | — |

|

| December 1, 2013 to December 31, 2013 | | — |

| | $ | — |

|

| Total | | 159 |

| | |

(1) All shares were repurchased to satisfy tax withholding obligations from restricted stock vestings.

Stock Performance Graph

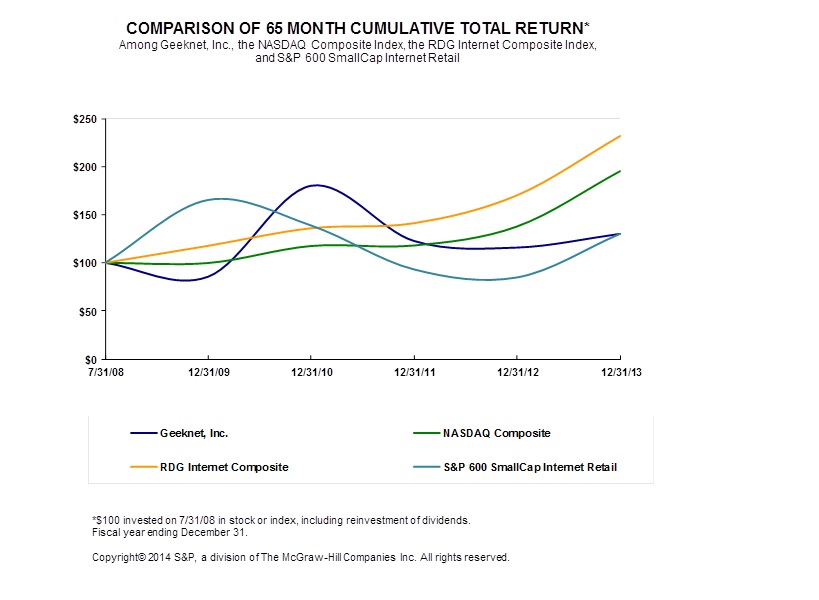

Set forth below is a line graph comparing the percentage change in the cumulative return to the stockholders of our Common Stock with the cumulative return of the NASDAQ Stock Market (U.S.) Index, the S&P 600 SmallCap Internet Retail Index and the RDG Internet Composite (“RDG”) Index for the period commencing July 31, 2008 and ending on December 31, 2013. Returns for the indices are weighted based on market capitalization at the beginning of each measurement point.

Item 6. Selected Financial Data

You should read the selected consolidated financial data set forth below in conjunction with Part II Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and with Part II Item 8. Financial statements and Financial Data and the related notes. Historical amounts have been restated to present the results of the Media business sold on September 17, 2012 and Geek.com, which was sold in December 2010, as discontinued operations. The historical results are not necessarily indicative of results that may be expected for any future period.

Summary Financial Information

(In thousands, except per share data)

|

| | | | | | | | | | | | | | |

| | |

| | Year Ended December 31, |

| | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| Selected Consolidated Statements of Operations Data: | | | | | | | | | |

Net revenue from continuing operations (1) | $138,262 | | $118,913 | | $99,057 | | $76,335 | | $49,091 |

| Cost of revenue from continuing operations | 111,145 |

| | 97,848 |

| | 83,602 |

| | 63,036 |

| | 38,343 |

|

| Gross margin from continuing operations | 27,117 |

| | 21,065 |

| | 15,455 |

| | 13,299 |

| | 10,748 |

|

Net (loss) income from continuing operations (2) | (167 | ) | | 1,805 |

| | (3,447 | ) | | (4,259 | ) | | (7,678 | ) |

(Loss) income from discontinued operations, net of tax (3) | (67 | ) | | 12,102 |

| | 1,932 |

| | (595 | ) | | (6,535 | ) |

Net (loss) income (4) | (234 | ) | | 13,907 |

| | (1,515 | ) | | (4,854 | ) | | (14,213 | ) |

| (Loss) income per share from continuing operations: |

| | | | | | | | |

| Basic | (0.03 | ) | | 0.28 |

| | (0.55 | ) | | (0.70 | ) | | (1.26 | ) |

| Diluted | (0.03 | ) | | 0.28 |

| | (0.55 | ) | | (0.70 | ) | | (1.26 | ) |

| (Loss) income per share from discontinued operations: | | | | | | | | | |

| Basic | (0.01 | ) | | 1.87 |

| | 0.31 |

| | (0.10 | ) | | (1.07 | ) |

| Diluted | (0.01 | ) | | 1.85 |

| | 0.31 |

| | (0.10 | ) | | (1.07 | ) |

| Net (loss) income per share: | | | | | | | | | |

| Basic | (0.04 | ) | | 2.15 |

| | (0.24 | ) | | (0.80 | ) | | (2.34 | ) |

| Diluted | (0.04 | ) | | 2.12 |

| | (0.24 | ) | | (0.80 | ) | | (2.34 | ) |

| Shares used in per share calculation: | | | | | | | | | |

| Basic | 6,620 |

| | 6,466 |

| | 6,319 |

| | 6,073 |

| | 6,080 |

|

| Diluted | 6,620 |

| | 6,556 |

| | 6,319 |

| | 6,073 |

| | 6,080 |

|

| Selected Balance Sheet data: | | | | | | | | | |

| Cash, cash equivalents and investments | 53,084 |

| | 57,294 |

| | 36,910 |

| | 35,341 |

| | 38,351 |

|

| Working capital | 67,452 |

| | 65,254 |

| | 40,318 |

| | 37,198 |

| | 40,360 |

|

| Total assets | 89,706 |

| | 85,872 |

| | 64,292 |

| | 66,757 |

| | 60,151 |

|

| Non-current liabilities | — |

| | 29 |

| | 343 |

| | 302 |

| | 225 |

|

| Total stockholders’ equity | $69,967 | | $69,083 | | $49,781 | | $46,993 | | $47,792 |

| |

| (1) | Net revenue from continuing operations has increased significantly over the last five years. Revenues increased 182% percent when comparing the year ended December 31, 2013 to the year ended December 31, 2009. |

| |

| (2) | Net income from continuing operations in the year ended December 31, 2012 is primarily due to the sale of our investment in CollabNet that resulted in a gain on sale of $4.0 million. Net loss from continuing operations in the year ended December 31, 2011 includes investments in our ThinkGeek business, investments in new leadership and severance costs. Net loss from continuing operations in the year ended December 31, 2010 includes severance related to leadership changes and the decision to move our corporate headquarters from Mountain View, California to Fairfax, Virginia. Net loss from continuing operations in the year ended December 31, 2009 includes the write down of our investment in CollabNet of $4.6 million and the write down of internally developed software of $1.2 million. |

| |

| (3) | (Loss) income from discontinued operations, net of tax in each of the periods presented include Media business revenues, cost of sales and operating and non operating expenses, excluding general corporate costs. The year ended December 31, 2010 also includes $0.2 million of losses from discontinued operations from the sale of Geek.com. |

| |

| (4) | Net income of $13.9 million for the year ended December 31, 2012 included a gain of $13.7 million for the sale of the Company's Media business. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with “Selected Consolidated Financial Data” and our financial statements and the related notes included elsewhere in this Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors including the risks discussed in “Item 1A. Risk Factors” and elsewhere in this Form 10-K. See “Special Note Regarding Forward-Looking Statements.”

Overview

We sell collectibles, apparel, gadgets, electronics, toys and other retail products for technology enthusiasts and general consumers through our website and certain exclusive products to our wholesale customers. We offer a broad range of unique products in a single web property that are typically not available in traditional brick-and-mortar stores. We introduce a range of new products to our audience on a regular basis and sell our own innovative GeekLabs products developed in-house. We have several wholesale partnerships with brick-and-mortar retailers that allow us to reach a broader consumer audience and expand our unique brand awareness. We have recently established new relationships and strengthened existing partnerships with certain specialty retail store chains with locations throughout the United States and Canada.

Our business is highly seasonal, reflecting the general pattern associated with the retail industry of peak sales and earnings during the calendar year-end holiday shopping season. In the past several years, a substantial portion of ThinkGeek revenue has occurred in the fourth quarter ending December 31. As is typical in the retail industry, we generally experience lower monthly revenue during the first nine months of the year.