UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

Form 10-K

|

| | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| | | or | | |

| | For the fiscal year ended December 31, 2012 | | | For the transition period from to . |

Commission File Number: 000-28369

Geeknet, Inc.

(Exact name of Registrant as specified in its charter) |

| |

| Delaware | 77-0399299 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

11216 Waples Mill Rd., Suite 100, Fairfax, VA 22030

(Address, including zip code, of principal executive offices)

(877) 433-5638

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Common Stock, $0.001 par value | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

| (Title of Class) | (Name of each exchange on which registered) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (Check one): Large accelerated filer ¨ Accelerated filer ý Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of February 22, 2013, there were 6,575,633 shares of the registrant’s Common Stock outstanding. The aggregate market value of the Common Stock held by non-affiliates of the registrant as of June 30, 2012 (based on the closing price for the Common Stock on the NASDAQ Global Market for such date) was approximately $74 million. Shares of common stock held by each of our officers and directors and by each person or group who owns 5% or more of our outstanding common stock have been excluded in that such persons or groups may be deemed to be our affiliate. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2012 Annual Meeting of Stockholders which will be held on May 7, 2013, and which will be filed pursuant to Regulation 14A within 120 days after the registrant’s year ended December 31, 2012, are incorporated by reference into Part III of this Form 10-K.

PART I

ITEM 1. Business

Special Note Regarding Forward-Looking Statements

This Form 10-K contains forward-looking statements that involve risks and uncertainties. Words such as “may,” “could,” “anticipate,” “potential,” “intend,” “expect,” “believe,” “in our view,” and variations of such words and similar expressions, are intended to identify such forward-looking statements, which include, but are not limited to, statements regarding our expectations and beliefs regarding future revenue growth; financial performance and results of operations; popularity and demand for our retail products; management's strategy, plans and objectives for future operations; employee relations and our ability to attract and retain highly qualified personnel; our ability to continue to invest in developing new products; competition, competitors and our ability to compete; liquidity and capital resources; and sufficiency of our cash resources and investments to meet our operating and working capital requirements. Actual results may differ materially from those expressed or implied in such forward-looking statements due to various factors, including those set forth in this Business section under “Competition” and in the Risk Factors contained in Item 1A of this Form 10-K. We undertake no obligation to update the forward-looking statements to reflect events or circumstances occurring after the date of this Form 10-K.

Introduction

Geeknet, Inc. (“Geeknet” or the “Company”) is the parent company of ThinkGeek, Inc. an online premier retailer for the global geek community, comprised of technology enthusiasts and general consumers of geek-themed, technology-oriented and popular culture goods. ThinkGeek has sought to provide the tech, gadget and game-obsessed communities with all the things that geeks crave through its ThinkGeek.com website. ThinkGeek was founded to serve the distinct needs and interests of technology professionals and enthusiasts and today has grown to become the place for innovative and imaginative products that appeal to the geek in everyone.

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore, we file periodic reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

You can access other information at our Investor Relations web site at investors.geek.net. The content of this web site is not intended to be incorporated by reference into this report or any other report we file with the SEC. We make available, free of charge on our website, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

On November 10, 2010 we effected a 1-for-10 reverse stock split of all outstanding shares of common stock, reduced the total number of shares of common stock that the Company is authorized to issue to 25,000,000 and reduced the total number of shares of preferred stock that the Company is authorized to issue to 1,000,000. We have adjusted all share and per share amounts in this report to give effect to the reverse stock split.

Business Overview

Geeknet was incorporated in California in January 1995 and reincorporated in Delaware in December 1999. From the date of its incorporation through October 2001, the Company sold Linux-based hardware systems and services under the name VA Linux Systems, Inc. In December 2001, the Company changed its name to VA Software Corporation to reflect its decision to pursue Media, e-commerce, Software and Online Images businesses. In May 2007, the Company changed its name to SourceForge, Inc. In November 2009, the Company changed its name to Geeknet to project a more accurate reflection of its business, primarily to the advertising community.

On September 17, 2012 , Geeknet, Inc. entered into an Asset Purchase Agreement with Dice Holdings, Inc. and two of Dice’s subsidiaries, Dice Career Solutions, Inc. and eFinancialCareers Limited (collectively, the “Buyers”) pursuant to which the Buyers purchased the Company’s Media business, including the SourceForge, Slashdot and Freecode websites and assumed certain related liabilities.

Subsequent to the sale of the Company's Media business, Geeknet, Inc.'s business consists solely of its e-Commerce business that sells geek-themed retail products through its ThinkGeek website and wholesale channel. Some ThinkGeek products are custom made and developed by the Company's product development team, GeekLabs. Revenue is generated by attracting traffic to the ThinkGeek website, by offering a broad range of products that are not available in traditional brick-and-mortar stores and by introducing new products to the ThinkGeek audience and fans on a regular basis.

The Company also sells ThinkGeek products through its wholesale channel. The Company has wholesale partnerships with brick and mortar retailers that allow the Company to reach a new consumer audience and expand ThinkGeek's unique brand. The Company recently established and strengthened existing partnerships with retail store chains that have hundreds of locations throughout the United States and Canada and now has a presence internationally.

We offer a broader range of unique products in a single web property than are typically available in traditional brick-and-mortar stores. We introduce a range of new products to our audience on a regular basis and develop and sell our own “GeekLabs” custom products. Our customers are able to buy electronics, toys, gadgets, apparel, edibles and other specialty items with a single check-out. Consumers can access the information directly through our web site or contact our customer care representatives and experts by e-mail at orders@thinkgeek.com or by telephone at 1-888-GEEKSTUFF. A third-party contract warehouse provider located in Lockbourne, Ohio receives purchased inventory, fulfills customers’ orders, and processes returns.

During the last half of 2012, we transitioned our product safety and quality assurance function in-house. Prior to the transition, we were using various third-party vendors to perform these services. We have invested in certified personnel, who are highly qualified in product development processes and in conducting safety and quality assurance testing. We also began the process of building a testing laboratory. We believe our investment will enable us to improve the quality of our products, minimize defective products, and continue to exceed industry standards.

Sales and Marketing

Our e-Commerce marketing and promotion strategy is focused on acquiring new customers and building brand loyalty with existing customers. This strategy is designed to increase customer traffic to our online store and improve loyalty while increasing revenue opportunities by adding new customers. We will continue to use the unique capabilities of the Internet, including social networking sites such as Facebook, Twitter and YouTube, to increase brand awareness while encouraging new and repeat customers to visit our web site. We participate in traditional online marketing activities such as email, search, affiliates and social media. During 2012, we limited the use of printed catalogs to include in orders shipped to our customers. This is consistent with industry trends and allowed us to redeploy our marketing spend to other channels.

Our Geek Points customer retention program is designed to build customer loyalty. Through this program, customers are rewarded for shopping with us. When customers sign up for Geek Points, they earn points on certain purchases. Rewards for Geek Points participants include special promotions and discounts. We also have developed marketing programs that include special offers to promote sales or sales of certain products. We ran programs such as discounting certain products or product lines, offering a dollar amount off of an order if it reached a certain dollar threshold and free upgraded shipping. We also offered free shipping on certain days during the holiday seasons and we had a free t-shirt giveaway program. Certain of these programs were offered to all customers while others were for a targeted audience. Our programs are more frequently run during certain holiday peak seasons such as Christmas, April Fool's Day, Father's Day and Halloween. This maximizes our sales potential while rewarding our customers. We continue to evaluate and measure the success of all of our marketing programs and redesign or adjust as needed. During the first half of 2013, we will be modifying our Geek Points loyalty program.

In addition to our core business of selling products through our ThinkGeek website, we also sell products through our wholesale channel. During 2012, our wholesale channel continued to deliver rapid growth. Our wholesale clients buy our ThinkGeek exclusive products to sell in their brick and mortar stores across the United States, in Canada and internationally. Our clients are well-known reputable retailers that have a strong presence in malls and in stand-alone stores. Our notable clients are f.y.e., HMV (in Canada), Books-A-Million and Urban Outfitters (primarily United States locations). f.y.e, is a successful entertainment and pop culture mall-based chain store with locations across the United States. HMV, an established entertainment retailer in Canada similar to f.y.e., has over one hundred stores in Canada. Books-A-Million is the second largest book retailer in the United States, with over 250 locations and Urban Outfitters has over 150 stores throughout the country.

Our international wholesale channel grew significantly in 2012. We have partnered with distributors in Australia, Germany, Japan and the United Kingdom. We believe our international wholesale business will grow in future years. We believe selling to widely known popular retailers is an opportunity to expand our brand recognition and grow our wholesale business. We believe that continuing to build our wholesale channel client base and strengthening our existing relationships will result in a positive impact on future revenues.

Technology and Design

During the fourth quarter of 2012, we changed the name of our Research and Development to Technology and Design. We believe that the name Technology and Design conforms to similar naming conventions used in our industry for similar activities, as described below.

GeekLabs

We have strengthened our focus and investment on the development of new and innovative products developed by GeekLabs. We have a talented group of artists and engineers who use their expertise, creativity and imagination to design, build and test original geek-themed products to offer to our customers. Our unique product ideas are originated via brainstorm sessions by the GeekLabs team and internal staff focus groups. Customers can suggest ideas and be compensated for them via our IdeaFactory program featured on the ThinkGeek website.

GeekLabs leverages ThinkGeek's formidable cache of licenses for various notable properties such as Star Wars, Star Trek, Game of Thrones, Minecraft and Portal. Selected ideas will transition to our GeekLabs engineering team for design, prototype and development. We then work with our manufacturing partners overseas to complete and deliver the finished products. GeekLabs products are exclusively launched on the ThinkGeek website. Some of these products are sold by our wholesale clients in non-competing channels. We hope to delight our customers and the media by the unique, unexpected, exciting and sometimes humorous geeky products our GeekLabs team create.

Website Engineering and Technology

We have implemented a broad array of services and systems for customer service, product searching, customer communication, order processing and order fulfillment functions. These services and systems use a combination of our own proprietary technologies and commercially available, licensed technologies. We focus our internal development efforts on creating and enhancing the specialized, proprietary software to improve our customer experience and ease of use and to increase the functionality of our ThinkGeek.com web site.

Our core online merchandise catalog, customer interaction, order collection, fulfillment and back-end systems are proprietary to ThinkGeek. The systems are designed to provide connectivity to our distribution center allowing for same day shipment of in-stock items. These include an inventory tracking system, a real-time order tracking system, an executive information system and an inventory replenishment system. Our Internet servers use secure sockets layer (SSL) technology to help conduct secure communications and transactions.

During the past two years, we have greatly improved the search function and product categorizations on our website. This helps our customers find products they are seeking that are similar in nature or theme. Additionally, we have developed functionality that identifies products that may interest a customer based upon the history of products customers have visited, purchased or added to their wish list. We have also developed targeted customer emails that notify customers if a product is in stock, if a new product is available for sale, or to remind customers of a product they recently viewed along with a special promotion or offer. This encourages our customers to revisit the website and potentially purchase that product. We have also streamlined our online shopping cart so there are fewer steps to check out, making it easier to use and is consistent with industry practices. We continue to invest in improving our site, our customer service, order processing, shipping and tracking systems.

Competition

The market for retail products similar to those offered by ThinkGeek is highly competitive. We compete with a variety of companies in different consumer verticals. Our competition includes apparel companies such as Threadless and Zazzle and gadget and home goods stores such as Brookstone, Best Buy and Bed Bath and Beyond. We also compete with gifting companies such as RedEnvelope, UncommonGoods, Perpetual Kid and larger online marketplaces such as Amazon.com, Buy.com, and Overstock.com.

More recently, some online retailers have developed sites targeted to the computer enthusiast and computer gaming markets. We believe that there are a number of competitive factors in our market, including company credibility, product selection and availability, convenience, price, web site features, functionality and performance, ease of purchasing, customer service and reliability and speed of order shipment.

Many of the competitors in our e-Commerce industry have substantial competitive advantages, including greater resources that can be devoted to the development, promotion and sale of their online products, more established sales channels, greater software and web site development experience, and greater name recognition. To be competitive, we must respond promptly and effectively to changes in consumer preferences, the challenges of technological change, evolving standards and our competitors’ innovations by continuing to enhance our services and products. Any pricing pressures or loss of customers resulting from our failure to compete effectively would reduce our revenue and margin.

Intellectual Property Rights

We protect our intellectual property through a combination of copyright, trademark, patent and trade secret laws, employee and third-party nondisclosure agreements, and other methods of protection. Geeknet, ThinkGeek and their associated logos are some of our trademarks that we use in the United States and in other countries.

Seasonality

Our business is highly seasonal, reflecting the general pattern associated with the retail industry of peak sales and earnings during the holiday shopping season. As a result, a substantial portion of our 2012 e-Commerce revenue occurred in our fourth quarter, which began on October 1, 2012 and ended on December 31, 2012. As is typical in the retail industry, we generally experience lower e-Commerce revenue during the other quarters. Therefore, our e-Commerce revenue in a particular quarter is not necessarily indicative of future revenue for a subsequent quarter or our full year.

Employees

Our employees are not represented by any collective bargaining organization; we have never experienced a work stoppage; and we believe that our relations with our employees are good. As of December 31, 2012, our employee base totaled 76, including 21 in operations, 16 in sales and marketing, 20 in technology and design and 19 in finance and administration.

Item 1A. Risk Factors

CURRENT AND PROSPECTIVE INVESTORS IN GEEKNET SECURITIES SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED BELOW BEFORE MAKING AN INVESTMENT DECISION. IN ADDITION, THESE RISKS ARE NOT THE ONLY ONES FACING OUR COMPANY. ADDITIONAL RISKS OF WHICH WE ARE NOT PRESENTLY AWARE OR THAT WE CURRENTLY BELIEVE ARE IMMATERIAL MAY ALSO IMPAIR OUR BUSINESS OPERATIONS. OUR BUSINESS COULD BE HARMED BY ANY OF THESE RISKS. THE TRADING PRICE OF OUR COMMON STOCK COULD DECLINE DUE TO ANY OF THESE RISKS, AND INVESTORS MAY LOSE ALL OR PART OF THEIR INVESTMENT.

Risks Related To Our e-Commerce Business

If ThinkGeek fails to launch new and innovative products, the demand for our products may be limited and our revenue will be adversely affected.

In order to attract customers to our site, we must continually release new and innovative products, including products internally developed by GeekLabs. In addition to the direct revenue we derive from product sales, the release of new and innovative products attracts media coverage and drives customers to our site. The successful development, sourcing, manufacturing and merchandising of products is subject to numerous risks and uncertainties, including:

| |

| • | specific economic conditions relating to our business |

| |

| • | the spending habits of our customers |

| |

| • | the performance of our suppliers |

| |

| • | execution by our third party fulfillment center |

| |

| • | our ability to retain qualified merchandising, sales and product development personnel |

There can be no assurance that our new products will appeal to customers or that demand for these products will be sufficient to generate revenue consistent with our estimates. In addition, there can be no assurance that new products will be developed in a timely or cost-effective manner, or that we will be able to procure appropriate quantities of such products. If we are unable to deliver new and innovative products that allow us to increase demand, we may not be able to generate sufficient revenue to grow our ThinkGeek business. See also additional risks related to competition set forth elsewhere in these Risk Factors.

Our e-Commerce business is highly seasonal. In addition, we are exposed to significant inventory risks as a result of seasonality, new product launches, rapid changes in product cycles and changes in consumer tastes.

Our business is highly seasonal, with a disproportionate amount of our sales occurring in the fourth quarter which begins on October 1 and ends on December 31. To be successful, we must accurately predict our customers' tastes and demands to avoid purchasing too much or too little inventory. If we purchase too much inventory, we may be required to discount those products or write off products we are unable to sell, reducing our gross margins. If we purchase too little inventory, we may fail to meet customer demand and lose potential orders, which will adversely affect our financial results.

In addition, when we launch a new product, it is difficult to accurately forecast customer demand. Certain products, especially custom manufactured products or products purchased from outside the United States may require significant lead-time, payment or partial payment prior to shipment, and may not be returnable. We carry a broad selection of products and significant inventory levels of certain products and we may be unable to sell products in sufficient quantities or during the relevant selling seasons. Failure to properly assess our inventory needs could adversely affect our financial results.

We are dependent upon a single third-party fulfillment and warehouse provider. Our customer satisfaction is highly dependent upon fulfillment of orders in a professional and timely manner. Any decrease in the quality of service offered by our fulfillment and warehouse provider will adversely affect our reputation and the growth of our ThinkGeek e-Commerce business. If we fail to realize anticipated operating efficiencies at our third-party fulfillment and warehouse provider, our operating results will be adversely affected.

Our business' ability to receive inbound inventory and ship completed orders efficiently and in a timely manner to our customers is substantially dependent on a single third-party fulfillment and warehouse provider. We ship products to customers worldwide using the services of Exel, Inc. (“Exel”), located in Lockbourne, Ohio. Our contract with Exel ends April 26, 2016.

If Exel fails to meet our distribution and fulfillment needs, our relationship with and reputation among our customers will suffer and this will adversely affect our revenue. Additionally, if Exel is unable to meet our distribution and fulfillment needs, particularly during the holiday season, or our contract with Exel is terminated, we may be required to secure a second-source or replacement fulfillment and warehouse provider. If we fail to secure such a fulfillment and warehouse provider or are unable to secure a fulfillment and warehouse provider on comparable terms our reputation and our financial results would be adversely affected.

If we fail to maintain and continuously improve our ThinkGeek website and customer loyalty program, we may not attract or retain customers.

If potential or existing customers do not find our website an entertaining and convenient place to shop, we may not attract or retain customers and our sales may suffer. To encourage the use of our website, it must continuously improve in accessibility, content and ease of use. Customer traffic and our business would be adversely affected if competitors' websites are perceived as easier to use or better able to satisfy customer needs. In addition, if we fail to maintain a customer loyalty program that is competitive in our industry, we may not attract or retain customers and our sales may suffer.

Unplanned system interruptions and capacity constraints could harm our revenue and reputation.

Our business is dependent on the uninterrupted and highly-available operation of our website. We experience periodic service interruptions with our ThinkGeek web site. Service interruptions may be caused by a variety of factors, including capacity constraints, software design flaws and bugs, and third party denial of service attacks. If we fail to provide customers with such access to our web site at the speed and performance which they require, our sales and business reputation will be adversely affected.

Our systems and operations remain vulnerable to damage or interruption from fire, power loss, telecommunications failure and similar events. If our web site experiences frequent or lengthy service interruptions, our business and reputation could be adversely affected. In the third quarter of 2012, we moved our disaster recovery site to Dallas, Texas from Chicago, Illinois. Failure of our new disaster recovery location to perform effectively could adversely affect our business and reputation.

We are subject to risks as a result of our reliance on foreign sources of production for certain products.

In order to offer cost-effective and innovative products, we rely on manufacturers located outside of the United States, most of which are located in Asia (primarily China), to supply us with sufficient quantities of these products based on our forecasts and to deliver these products in a timely manner.

Our arrangements with these manufacturers are generally limited to purchase orders tied to specific lots of goods. We are subject to the risks of relying on products manufactured outside of the United States, including political unrest, trade restrictions, customs and import/export regulations, local business practice and geo-political issues, such as political and social unrest and economic instability. Additionally, significant reliance on foreign sources of production increases the risks relating to compliance with domestic or international labor standards, customs and import/export laws and regulations, compliance with domestic or international manufacturing and product safety standards, currency fluctuations, restrictions on the transfer of funds, work stoppages or slowdowns and other labor issues, economic uncertainties including inflation and government regulations, availability and costs of raw materials, potentially adverse tax consequences and other uncertainties. China, in particular, has recently experienced rapid social, political and economic change and further changes may adversely affect our ability to procure our products from Chinese suppliers.

Our ability to obtain goods on a cost effective basis is also subject to our ability to maintain relationships with our suppliers and our ability to negotiate and maintain supply arrangements on favorable terms. The Chinese Yuan (“CNY”) exchange rate to the U.S. Dollar (“USD”) has not historically been volatile. In the event that the CNY/USD exchange rate changes substantially, our suppliers could attempt to renegotiate our purchase orders with them and increase our costs. In addition, because our purchases are usually on a case by case basis, we are subject to the risk of unexpected changes in pricing or supply from these suppliers. We may also be unable to develop beneficial relationships with new vendors in the future.

We may be subject to product liability claims if people or property are harmed by the products we sell on our ThinkGeek website, which could be costly to defend and subject us to significant damage claims.

Some of the products we offer for sale on our ThinkGeek website may expose us to product liability or product safety claims relating to personal injury, death or property damage caused by such products and may require us to take actions such as product recalls, which could involve significant expense incurred by the Company. Although we maintain liability insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all. The successful assertion of an uninsured product liability or other claim against us could cause us to incur significant expenses to pay such a claim and could adversely affect our financial results. Even a successfully defended product liability claim could cause us to incur significant expenses to defend such a claim and could adversely affect our financial results. In addition, some of our vendor agreements with our suppliers do not indemnify us from product liability and even if some agreements provide for indemnification, it may not be possible or practical to avail ourselves of the benefits of the protection.

As a distributor of consumer products, we are subject to various government regulations and may be subject to additional regulations in the future, violation of which could subject us to sanctions or otherwise harm our business.

As a distributor of consumer products, we are subject to significant government regulations, including, in the United States, under The Consumer Products Safety Act, The Federal Hazardous Substances Act, and The Flammable Fabrics Act, as well as under product safety and consumer protection statutes in our international markets. In addition, certain of our products are subject to regulation by the Food and Drug Administration or similar international authorities. In addition, collecting information from children is subject to regulation by the Federal Trade Commission under the Children's Online Privacy Protection Act. We are taking steps we believe are necessary to comply with these acts, but there can be no assurance that we will be in compliance, and failure to comply with these acts could result in sanctions which could have a negative impact on our business, financial condition and results of operations. We may also be subject to involuntary product recalls or may voluntarily conduct a product recall. While costs associated with product recalls have generally not been material to our business, the costs associated with future product recalls individually or in the aggregate in any given fiscal year, could be significant. In addition, any product recall, regardless of direct costs of the recall, may harm consumer perceptions of our products and have a negative impact on our future revenues and results of operations.

Governments and regulatory agencies in the markets where we manufacture and sell products may enact additional regulations relating to product safety and consumer protection in the future, and may also increase the penalties for failure to comply with product safety and consumer protection regulations. Complying with any such additional regulations or requirements could impose increased costs on our business. Similarly, increased penalties for non-compliance could subject us to greater expense in the event any of our products were found to not comply with such regulations. Such increased costs or penalties could harm our business.

Increased focus on sales and use tax could subject us to liability for past sales and cause our future sales to decrease.

We do not collect sales or other taxes on shipments of our goods into most states in the United States or internationally. The relocation of our fulfillment center or customer service centers or any future expansion of them, along with other aspects of our business, may result in additional sales and other tax obligations. We do not collect consumption tax (including value added tax, goods and services tax, and provincial sales tax) as applicable on goods and services sold that are delivered outside of the United States as our terms of sale provide that the customer is responsible for such expenses. One or more states or foreign countries may seek to impose sales or other tax collection obligations on out-of-jurisdiction e-Commerce companies. A successful assertion by one or more states or foreign countries that we should collect sales or other taxes on the sale of merchandise or services could result in substantial tax liabilities for past sales, decrease our ability to compete with traditional retailers, and otherwise harm our business.

Currently, U.S. Supreme Court decisions restrict the imposition of obligations to collect state and local sales and use taxes with respect to sales made over the Internet. However, a number of states and the U.S. Congress continue to consider initiatives that could limit or supersede the Supreme Court's position regarding sales and use taxes on Internet sales, and some states have adopted laws that attempt to impose obligations on out-of-state retailers to collect taxes on their behalf. If any of these initiatives are successful, we could be required to collect sales and use taxes in additional states. The imposition by state and local governments of various taxes upon Internet commerce could create administrative burdens for us, put us at a competitive disadvantage if they do not impose similar obligations on all of our online competitors and decrease our future sales.

Risks Related To Our Financial Results

Certain factors specific to our business over which we have limited or no control may nonetheless adversely impact our total revenue and financial results.

The primary factors over which we have limited or no control that may adversely impact our total revenue and financial results include the following:

| |

| • | specific economic conditions relating to our business |

| |

| • | the spending habits of our customers |

| |

| • | our ability to keep our website operational at a reasonable cost |

If our revenue and operating results fall below our expectations, the expectations of securities analysts or the expectations of investors, the trading price of our common stock will likely be materially and adversely affected. You should not rely on the results of our business in any past periods as an indication of our future financial performance.

Future changes in financial accounting standards, including pronouncements and interpretations of accounting pronouncements on revenue recognition, may cause adverse unexpected revenue fluctuations and/or affect our reported results of operations.

From time to time, the Financial Accounting Standards Board (“FASB”) may issue updates to the FASB Accounting Standards Codification. A change in an accounting policy can have a significant effect on our reported results and may even affect our reporting of transactions completed before a change is announced. Accounting policies affecting our business, including rules relating to revenue recognition have recently been revised or are under review. The SEC has issued a work plan regarding the potential use of financial statements prepared in accordance with International Financial Reporting Standards (“IFRS“). IFRS is a comprehensive series of accounting standards published by the International Accounting Standards Board (“IASB”).

If we fail to adequately monitor and minimize our use of existing cash, we may need additional capital to fund continued operations beyond the next 12 months.

We must continue to closely monitor the use of our existing cash, cash equivalents and marketable securities. In addition, our existing marketable securities may not provide us with adequate liquidity when needed. While we believe we will not require additional capital to fund continued operations for the next 12 months, we may require additional funding within this time frame, and this additional funding, if needed, may not be available on terms acceptable to us, or at all. A slowdown in ThinkGeek spending or an increased working capital requirement for our ThinkGeek inventory, as well as other factors that may arise, could affect our future capital requirements and the adequacy of our available funds. As a result, we may be required to raise additional funds through private or public financing facilities, strategic relationships or other arrangements. Any additional equity financing would likely be dilutive to our stockholders. Debt financing, if available, may involve restrictive covenants on our operations and financial condition. Our inability to raise capital when needed could seriously harm our business.

Furthermore, if we fail to adequately deploy or invest the cash we received in our September 17, 2012 sale of our former Media business, our financial results could be adversely affected.

We have a history of losses and may incur net losses in the foreseeable future. Failure to attain consistent profitability may materially and adversely affect the market price of our common stock and our ability to raise capital and continue operations.

We have an accumulated deficit of $743.2 million as of December 31, 2012. We may continue to incur net losses in the future. Failure to attain profitability on a sustained basis may materially and adversely affect the market price of our common stock and our ability to raise capital and continue operations beyond the next 12 months.

Our ability to use net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes is subject to limitation and may be limited further.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), a corporation that undergoes an “ownership change” is subject to limitations on its ability to utilize its net operating losses (“NOLs”), to offset future taxable income. In general, an ownership change occurs if the aggregate stock ownership of certain stockholders increases by more than 50 percentage points over such stockholders' lowest percentage ownership during the testing period (generally three years). We determined that such an ownership change occurred as of November 2008. This ownership change resulted in limitations on the utilization of tax attributes, including net operating loss carryforwards and tax credits.

The occurrence of a additional ownership change could limit the ability to utilize NOLs that are not currently subject to limitation, and could further limit the ability to utilize NOLs that are currently subject to limitation. The amount of the annual limitation generally is equal to the value of the stock of the corporation immediately prior to the ownership change multiplied by the adjusted federal tax-exempt rate, set by the Internal Revenue Service. Limitations imposed on the ability to use NOLs to offset future taxable income could cause U.S. federal income taxes to be paid earlier than otherwise would be paid if such limitations were not in effect and could cause such NOLs to expire unused, in

each case reducing or eliminating the benefit of such NOLs. Similar rules and limitations may apply for state income tax purposes.

Risks Related To Competition

Our competition is intense. Our failure to compete successfully could adversely affect our revenue and financial results.

Our ThinkGeek business is rapidly evolving and operates in an intensely competitive industry. We have many competitors, including other e-Commerce businesses as well as traditional brick and mortar retailers. Increases in shipping costs or the taxation of Internet commerce may make our products uncompetitive when compared with traditional brick and mortar retailers. Additionally, our current and future competitors may have greater resources, more customers and greater brand recognition than we do. These competitors may secure better terms from vendors and adopt more competitive pricing for their products. They may also devote more resources to their technology infrastructure, product development, order fulfillment, distribution facilities and marketing and advertising campaigns. In addition, as we expand into new markets and broaden our product offering, our competition may intensify as our current and future competitors enter into similar markets and offer similar products. Local competitors in these new markets may have substantial competitive advantages because of greater focus on and knowledge of local customers and their preferences and greater brand recognition.

Increased competition in our ThinkGeek business could result in price reductions, reduced margins or loss of market share, any of which could have a material adverse effect on our future revenue and financial results.

Risks Related To Intellectual Property

We are vulnerable to claims that our ThinkGeek website infringes third-party intellectual property rights. Any resulting claims against us could be costly to defend or subject us to significant damages.

We expect that our ThinkGeek website will increasingly be subject to infringement claims as the number of competitors in our industry segment grows and the functionality of web properties in different Internet industry segments overlap. The scope of United States patent protection for software is not well defined and will evolve as the United States Patent and Trademark Office grants additional patents. Because patent applications in the United States are not publicly disclosed until the patent is issued, applications may have been filed that would relate to our products. In addition, we may receive patent infringement claims as companies increasingly seek to patent their software. Our developers may unknowingly infringe on third-party patent rights. We cannot prevent current or future patent holders or other owners of intellectual property from suing us and others seeking monetary damages or an injunction against our web offerings. A patent holder may deny us a license or force us to pay royalties. In either event, our operating results could be seriously harmed. In addition, employees hired from competitors might utilize proprietary and trade secret information from their former employers without our knowledge, even though our employment agreements and policies clearly prohibit such practices.

Any litigation regarding our intellectual property, with or without merit, could be costly and time consuming to defend, divert the attention of our management and key personnel from our business operations and cause interruption in our ThinkGeek website. Claims of intellectual property infringement may require us to enter into royalty and licensing agreements that may not be available on acceptable terms. In addition, parties making claims against us may be able to obtain injunctive or other equitable relief that could effectively block our ability to offer our products in the United States and abroad and could result in an award of substantial damages against us. Defense of any lawsuit or failure to obtain any required license could delay release of our products and increase our costs. If a successful claim is made against us and we fail to develop or license a substitute technology, our business, results of operations, financial condition or cash flows could be immediately and materially adversely affected.

If we fail to adequately protect our intellectual property rights, competitors may use our technology and trademarks, which could weaken our competitive position, reduce our revenue, and increase our costs.

We rely on a combination of copyright, trademark, patent and trade secret laws, employee and third-party nondisclosure agreements, and other arrangements to protect our proprietary rights. Despite these precautions, it may be possible for unauthorized third parties to copy our ThinkGeek website, or products and services offered thereon or obtain and use information that we regard as proprietary to create sites that compete against ours. Some license

provisions protecting against unauthorized use, copying, transfer, and disclosure of our licensed programs may be unenforceable under the laws of certain jurisdictions and foreign countries.

In addition, the laws of some countries do not protect proprietary rights to the same extent as do the laws of the United States. To the extent that we increase our international activities, our exposure to unauthorized copying and use of our ThinkGeek website, proprietary information and original products will increase. Additionally, we manufacture most of our original products in Asia, primarily in China, where there is a risk that such products would be copied and enforcement of our intellectual property rights would be difficult.

Our collection of trademarks is important to our business. The protective steps we take or have taken may be inadequate to deter misappropriation of our trademark rights. We have filed applications for registration of and registered some of our trademarks in the United States and internationally. Effective trademark protection may not be available in every country in which we offer or intend to offer our products and services. Failure to protect our trademark rights adequately could damage our brand identity and impair our ability to compete effectively. Furthermore, defending or enforcing our trademark rights could result in the expenditure of significant financial and managerial resources.

Our success depends significantly upon our proprietary technology and information. Despite our efforts to protect our proprietary technology and information, it may be possible for unauthorized third parties to copy certain portions of our offerings or to reverse engineer or otherwise obtain and use our proprietary technology or information. We periodically discover products that are counterfeit reproductions of our products or designs, or that otherwise infringe our intellectual property rights. The actions we take to establish and protect our intellectual property rights may not be adequate to prevent imitation of our offerings by others or prevent others from seeking to block sales of our offerings as violations of proprietary rights. Existing copyright laws afford only limited protection, and the laws of certain foreign countries may not protect intellectual property rights to the same extent as do United States laws. Litigation may be necessary to protect our proprietary technology and information. Such litigation may be costly and time-consuming and if we are unsuccessful in challenging a party on the basis of intellectual property infringement, our sales and intellectual property rights could adversely be affected and result in a shift of customer preference away from our offerings.

In addition, we cannot be certain that others will not develop substantially equivalent or superseding proprietary technology, or that equivalent offerings will not be marketed in competition with our offerings, thereby substantially reducing the value of our proprietary rights. Currently, we do not have any software, utility, or design patents and we may not be able to develop proprietary offerings or technologies that are patentable, that any patent, if issued, would provide us with any competitive advantages or would not be challenged by third parties, or that the patents of others will not adversely affect our ability to do business.

Other Risks Related To Our Overall Business

We are exposed to risks associated with worldwide economic slowdowns and related uncertainties.

We are subject to macroeconomic fluctuations in the U.S. economy and elsewhere. Concerns about consumer and investor confidence, volatile corporate profits and reduced capital spending, international conflicts, terrorist and military activity, civil unrest and pandemic illness could cause a slowdown in sales revenue. In addition, political and social turmoil related to international conflicts and terrorist acts may put further pressure on economic conditions in the United States and abroad.

Recent macroeconomic issues involving the broader financial markets, including elevated unemployment, consumer access to credit for housing and other purposes, anticipated U.S. government spending cuts, European sovereign debt market and general liquidity issues in the securities markets, have negatively impacted the economy and may negatively affect our business. In addition, weak economic conditions and declines in consumer spending and consumption may harm our operating results. Purchases of our ThinkGeek products are discretionary. If the economic climate deteriorates, customers or potential customers could delay, reduce or suspend their purchases of our products. This could impact our business in a number of ways, including lower prices for our products and reduced or delayed sales. There could be a number of follow-on effects from the recent financial crisis on our business, including insolvency of key suppliers resulting in product delays; customer insolvencies; counterparty failures; and increased expense or inability to obtain future financing.

If negative macroeconomic conditions persist, or if the economy enters a prolonged period of limited growth, our results of operations may be harmed.

Our business could be adversely affected if our consumer data protection measures are not seen as adequate or unauthorized persons disrupt or access our systems.

As our e-Commerce business sells goods and operates online, we are at risk of cyber-attacks. Our e-Commerce business involves the use of our proprietary information as well as the storage and transmission of customers' personally identifiable and proprietary information, and security breaches could expose us to a risk of loss of this information, litigation, and potential liability. While we take measures to protect personally identifiable information from unauthorized access or disclosure, it is possible that our security controls over personally identifiable information may not prevent improper access or disclosure. Our security measures may be breached due to the actions of outside parties, employee error, malfeasance, or otherwise. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. As a result, an unauthorized party may be able to disrupt our operations or obtain access to our data or our customers' personally identifiable information or proprietary data. Due to the nature of sophisticated cyber-attacks, there is a risk that such attack may remain undetected for a period of time.

A party who is able to circumvent our security measures could misappropriate proprietary information or cause interruptions or malfunctions in our Internet operations. In addition, a security breach that leads to disclosure of our proprietary information may compromise our ability to compete in the marketplace by allowing others to use our proprietary information to develop similar or competitive products. A security breach that leads to disclosure of user or consumer information (including sensitive personally identifiable information) could harm our reputation, compel us to comply with disparate breach notification laws in various jurisdictions and otherwise subject us to liability under laws that protect personal data, resulting in increased costs or loss of revenue. A cyber-attack, such as a denial of service attack, that renders our site inoperable would result in adverse consequences, including significant loss of revenues. Any security breach may also cause us to expend significant resources to restore system functionality and incur costs to deploy additional personnel, protection technologies and third party consultants to defend against a future security breach.

We outsource the operation of our network connectivity and work actively to maintain up-to-date security and defense measures. If any of our outsourcing providers do not perform adequately, we may be exposed to greater risk of a cyber-attack. In addition to utilizing third party providers, we periodically review our security and privacy practices and we are continuing to implement and update policies and practices as a result of these reviews. We may not adequately identify risks and the policies and practices we implement may not be effective.

Government laws and regulations are evolving and unfavorable changes could harm our business.

We are subject to general business regulations and laws, as well as regulations and laws specifically governing the Internet and e-commerce. Existing and future laws and regulations may impede our growth. These regulations and laws may cover taxation, privacy, data protection, pricing, content, copyrights, distribution, mobile communications, electronic device certification, electronic waste, electronic contracts and other communications, consumer protection, web services, the design and operation of websites, and the characteristics and quality of products and services. It is not clear how existing laws governing issues such as property ownership, libel, and personal privacy apply to the Internet and e-commerce.

Legislation and regulation in the United States as well as international laws and regulations could result in compliance costs which may reduce our revenue and income, as well as governmental action should our compliance measures not be deemed satisfactory.

We depend on third parties to provide a number of products and services, subjecting us to significant operational risks.

We currently depend on a number of third-party providers, and this reliance subjects us to significant operational risks, any of which could impair our ability to deliver products to our customers should they occur. These risks include:

| |

| • | reduced management and control of our data, including the risk of unauthorized disclosure of customer and/or other protected information |

| |

| • | reduced control over delivery schedule and quality assurance |

| |

| • | misappropriation of our intellectual property |

| |

| • | failures by the third parties on whom we rely to comply with all domestic and foreign laws relating to our business |

We have identified a material weakness in our internal control over financial reporting. We may not detect other weaknesses in our internal control over financial reporting in a timely manner, or at all.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 ("Section 404"), we are required to evaluate the effectiveness of our internal control over financial reporting as well as our disclosure controls and procedures each fiscal year.

Management identified a material weakness in the Company's internal control over financial reporting as of December 31, 2012. Specifically, we did not maintain a sufficient complement of corporate accounting personnel necessary to consistently operate management review controls. The demand on the corporate accounting resources is significant due to the manual nature of controls necessary to maintain effective control over our legacy system, and intensified in 2012 as a result of the increased volume of our sales activity and the complexity of the disposal of our Media business. As a result of this material weakness, we made a number of adjustments to cost of goods sold, share based compensation and presentation to discontinued operations in connection with our financial statement audit in order to prepare the consolidated financial statements and footnotes included in this Form 10-K.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company's annual or interim consolidated financial statements would not be prevented or detected on a timely basis. In reaching the conclusion that, as of December 31, 2012, a material weakness existed, management evaluated the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.

As described in “Item 9A(b). Controls and Procedures - Management's Report on Internal Control Over Financial Reporting,” in order to address the material weakness that was identified, we will determine the appropriate complement of corporate accounting personnel required to consistently operate management review controls. We are currently in the process of hiring additional personnel and/or contractors with appropriate accounting experience. This hiring process may take longer than anticipated and could delay our ability to remediate this material weakness. We will also continue to transition toward a new integrated enterprise resource planning system. Given the complexity of the new systems, the implementation may not be completed prior to December 31, 2013. We will continue to operate manual controls until the new system is implemented.

We cannot be certain in future periods that other control deficiencies that may constitute one or more “significant deficiencies” (as defined by the relevant auditing standards) or material weaknesses in our internal control over financial reporting will not be identified. If we fail to maintain the adequacy of our internal controls, including any failure to implement or difficulty in implementing required or new or improved controls, our business and results of operations could be harmed, the results of operations we report could be subject to adjustments, we may not be able to provide reasonable assurance as to our financial results or the effectiveness of our internal controls, we may not be able to meet our reporting obligations, we may experience a loss of investor confidence and any of the foregoing could have a negative impact on the trading price of our common stock.

If we are unable to implement appropriate systems, procedures and controls, we may not be able to successfully offer our products and grow our business and account for transactions in an appropriate and timely manner.

Our ability to successfully offer our products, grow our business and account for transactions in an appropriate and timely manner requires an effective planning and management process. We currently do not have an integrated enterprise resource planning system. We periodically update our operations and financial systems, procedures and controls; however; we still rely on manual processes and procedures that may not scale commensurately with our business growth. Our systems will continue to require automation, modifications and improvements to respond to current and future changes in our business. If we cannot grow our businesses, and manage that growth effectively, or if we fail to implement in a timely manner appropriate internal systems, procedures, controls and necessary automation and improvements to these systems, our business will suffer and our financial results could be adversely affected.

If we lose key personnel or fail to integrate replacement personnel successfully, our ability to manage our business could be impaired.

Our future success depends upon the continued service of our key management, technical, sales, and other critical personnel. Our officers and other key personnel are employees-at-will, and we may not be able to retain them. Key personnel have left our company in the past and there likely will be additional departures of key personnel from time to time in the future. The loss of any key employee could result in significant disruptions to our operations, including adversely affecting the timeliness of product releases, the successful implementation and completion of company initiatives, and the results of our operations. Competition for these individuals is intense, and we may not be able to attract, assimilate or retain highly qualified personnel. Competition for qualified personnel in our industry, as well as other geographic markets, in which we recruit, is intense. In the Internet and high technology industries, qualified candidates often consider equity awards in compensation arrangements and fluctuations in our stock price may make it difficult to recruit, retain, and motivate employees. In addition, the integration of replacement personnel could be time consuming, may cause additional disruptions to our operations, and may be unsuccessful.

We may face liability under our agreement to sell our Media Business.

Under the terms of our Asset Purchase Agreement, we have agreed to indemnify the buyers against specified losses that might be incurred in connection with our former Media business, including losses that the buyers may incur as a result of certain breaches of the representations, warranties and covenants we made to buyers in the Asset Purchase Agreement, and certain liabilities related to our Media business not expressly assumed by the buyers. The Purchase Agreement generally limits our liability for breaches of representations and warranties made in the Purchase Agreement to an aggregate of $10.0 million. There is $3.0 million of the $20 million purchase price held in escrow through September 2013.

If a buyer makes a claim for indemnification against us, we may incur expenses to contest or resolve the claim that could adversely affect our financial results. These expenses may include costs to defend the buyer if the buyer is sued by a third party and such suit, if adversely decided, could result in an indemnifiable loss to buyer. In addition, indemnity claims may divert management attention from our continuing business. The Purchase Agreement generally limits the Company's liability for breaches of representations and warranties made in the Purchase Agreement to an aggregate of $10.0 million.

Our stock price has been volatile historically and may continue to be volatile.

The trading price of our common stock has been and may continue to be subject to wide fluctuations. During the year ended December 31, 2012, the closing sale prices of our common stock on the NASDAQ Global Market ranged from $12.68 to $21.42 per share and the closing sale price on December 31, 2012, the last trading day of the year, was $16.10 per share. Our stock price may fluctuate in response to a number of events and factors, such as quarterly variations in operating results, announcements of technological innovations or new products by us or our competitors, changes in financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable to us, and news reports relating to trends in our markets or general economic conditions.

In addition, the stock market in general and the market prices for Internet-related companies in particular have experienced volatility that often has been unrelated to the operating performance of such companies. These broad market and industry fluctuations may adversely affect the price of our stock, regardless of our operating performance. Additionally, volatility or a lack of positive performance in our stock price may adversely affect our ability to retain key employees, all of whom have been granted stock options.

Sales of our common stock by a significant stockholder may cause the price of our common stock to decrease.

Several of our stockholders own significant portions of our common stock. If these stockholders were to sell substantial amounts of their holdings of our common stock, then the market price of our common stock could be negatively impacted. The effect of such sales, or of significant portions of our stock being offered or made available for sale, could result in strong downward pressure on our stock price. Investors should be aware that they could experience significant short-term volatility in our stock if such stockholders decide to sell a substantial amount of their holdings of our common stock at once or within a short period of time.

System disruptions could adversely affect our future operating results.

Our ability to attract and maintain relationships with customers, merchants and strategic partners will depend on the satisfactory performance, reliability and availability of our Internet channels and network infrastructure. In the past year, our ThinkGeek website has experienced unplanned service interruptions. We will continue to suffer future interruptions from time to time whether due to capacity constraints, natural disasters, telecommunications failures, other system failures, rolling blackouts, viruses, hacking or other events. System interruptions or slower response times could have a material adverse effect on our revenue and financial condition.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our principal location is as follows: |

| | | | | | | |

| Location | | Purpose | | Approximate Size (in square feet) | | Expiration of Lease |

| Fairfax, Virginia | | Corporate headquarters; finance and administration, and e-Commerce operations | | 17,699 |

| | 2014 |

We relocated our corporate headquarters from Mountain View, California to Fairfax, Virginia effective March 1, 2011. We believe that our existing properties are in good condition and are adequate and suitable for the conduct of our business.

Item 3. Legal Proceedings

The disclosure under the caption “Litigation” in Note 5. Commitments and Contingencies to the Consolidated Financial Statements is incorporated by reference into this Item 3.

Item 4. Mine Safety Disclosure

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NASDAQ Global Market under the symbol GKNT. As of February 8, 2013, there were 430 holders of record of our common stock. We have not declared any cash dividends since our inception and do not expect to pay any dividends in the foreseeable future. The high and low closing sales prices, as reported by NASDAQ, of our common stock are as follows:

|

| | | | | | | | | | | | | | | | |

| | | Year Ended

December 31, 2012 | | Year Ended

December 31, 2011 |

| Quarter | | High | | Low | | High | | Low |

| Fourth Quarter | | $ | 19.09 |

| | $ | 14.68 |

| | $ | 20.84 |

| | $ | 15.44 |

|

| Third Quarter | | $ | 21.42 |

| | $ | 17.11 |

| | $ | 27.00 |

| | $ | 15.46 |

|

| Second Quarter | | $ | 19.82 |

| | $ | 12.68 |

| | $ | 30.00 |

| | $ | 24.10 |

|

| First Quarter | | $ | 18.57 |

| | $ | 14.35 |

| | $ | 29.59 |

| | $ | 16.94 |

|

The foregoing reflects interdealer prices without retail markup, markdown, or commissions and may not necessarily reflect actual transactions.

On October 14, 2010, our shareholders approved an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect a 1-for-10 reverse stock split of all outstanding shares of our common stock, reduce the total number of shares of common stock that we are authorized to issue to 25,000,000 and reduce the total number of shares of preferred stock that we are authorized to issue to 1,000,000. The reverse stock split became effective on November 10, 2010.

Issuer Purchases of Equity Securities

The following table sets forth information regarding the Company's purchases of its common stock during the three months ended December 31, 2012.

|

| | | | | | | |

| Period | | Total Number of Shares Purchased (1) | | Average Price Paid Per Share |

| October 1, 2012 to October 31, 2012 | | — |

| | $ | — |

|

| November 1, 2012 to November 30, 2012 | | 478 |

| | $ | 17.13 |

|

| December 1, 2012 to December 31, 2012 | | 136 |

| | $ | 16.40 |

|

| Total | | 614 |

| | |

(1) All shares were repurchased to satisfy tax withholding obligations from restricted stock vestings.

Stock Performance Graph

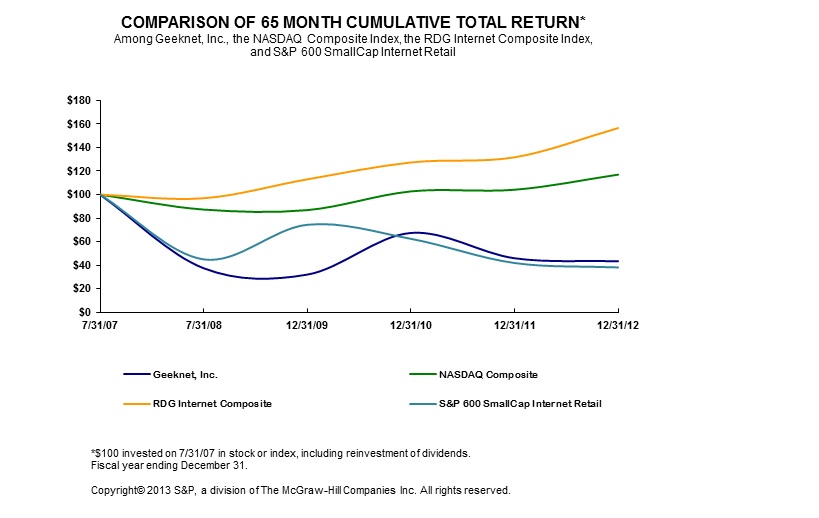

Set forth below is a line graph comparing the percentage change in the cumulative return to the stockholders of our Common Stock with the cumulative return of the NASDAQ Stock Market (U.S.) Index, the S&P 600 SmallCap Internet Retail Index and the RDG Internet Composite (“RDG”) Index for the period commencing July 31, 2007 and ending on December 31, 2012. Returns for the indices are weighted based on market capitalization at the beginning of each measurement point.

Item 6. Selected Financial Data

You should read the selected consolidated financial data set forth below in conjunction with Part II Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and with Part II Item 8. Financial statements and Financial Data and the related notes. Historical amounts have been restated to present the results of the Media business sold on September 17, 2012 and Geek.com, which was sold in December 2010, as discontinued operations. The historical results are not necessarily indicative of results that may be expected for any future period.

Summary Financial Information

(In thousands, except per share data)

|

| | | | | | | | | | | | | | | | | |

|

| | Five Months Ended | | Year Ended |

| | Year Ended December 31, | | December 31, | | July 31, |

| | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | | 2008 |

| Selected Consolidated Statements of Operations Data: | | | | | �� | | | | | | |

Net revenue from continuing operations (1) | $118,913 | | $99,057 | | $76,335 | | $49,091 | | $23,994 | | $36,820 |

| Cost of revenue from continuing operations | 97,848 |

| | 83,602 |

| | 63,036 |

| | 38,343 |

| | 18,655 |

| | 27,860 |

|

Gross margin from continuing operations (2) | 21,065 |

| | 15,455 |

| | 13,299 |

| | 10,748 |

| | 5,339 |

| | 8,960 |

|

Income (loss) from continuing operations (3) | 1,805 |

| | (3,447 | ) | | (4,259 | ) | | (7,678 | ) | | 1,526 |

| | (3,978 | ) |

Income (loss) from discontinued operations (4) | 12,102 |

| | 1,932 |

| | (595 | ) | | (6,535 | ) | | (727 | ) | | (348 | ) |

Net income (loss) (5) | 13,907 |

| | (1,515 | ) | | (4,854 | ) | | (14,213 | ) | | 799 |

| | (4,326 | ) |

| Income (loss) per share from continuing operations: |

| | | | | | | | | | |

| Basic | 0.28 |

| | (0.55 | ) | | (0.70 | ) | | (1.26 | ) | | 0.23 |

| | (0.59 | ) |

| Diluted | 0.28 |

| | (0.55 | ) | | (0.70 | ) | | (1.26 | ) | | 0.23 |

| | (0.59 | ) |

| Income (loss) per share from discontinued operations: | | | | | | | | | | | |

| Basic | 1.87 |

| | 0.31 |

| | (0.10 | ) | | (1.07 | ) | | (0.11 | ) | | (0.05 | ) |

| Diluted | 1.85 |

| | 0.31 |

| | (0.10 | ) | | (1.07 | ) | | (0.11 | ) | | (0.05 | ) |

| Net income (loss) per share: | | | | | | | | | | | |

| Basic | 2.15 |

| | (0.24 | ) | | (0.80 | ) | | (2.34 | ) | | 0.12 |

| | (0.64 | ) |

| Diluted | 2.12 |

| | (0.24 | ) | | (0.80 | ) | | (2.34 | ) | | 0.12 |

| | (0.64 | ) |

| Shares used in per share calculation: | | | | | | | | | | | |

| Basic | 6,466 |

| | 6,319 |

| | 6,073 |

| | 6,080 |

| | 6,653 |

| | 6,747 |

|

| Diluted | 6,556 |

| | 6,319 |

| | 6,073 |

| | 6,080 |

| | 6,665 |

| | 6,747 |

|

| Selected Balance Sheet data: | | | | | | | | | | | |

| Cash, cash equivalents and investments | 57,294 |

| | 36,910 |

| | 35,341 |

| | 38,351 |

| | 50,021 |

| | 52,702 |

|

| Working capital | 65,254 |

| | 40,318 |

| | 37,198 |

| | 40,360 |

| | 40,140 |

| | 42,933 |

|

| Total assets | 85,872 |

| | 64,292 |

| | 66,757 |

| | 60,151 |

| | 74,166 |

| | 74,533 |

|

| Non-current liabilities | 29 |

| | 343 |

| | 302 |

| | 225 |

| | 1,423 |

| | 166 |

|

| Total stockholders’ equity | $69,083 | | $49,781 | | $46,993 | | $47,792 | | $62,286 | | $63,652 |

| |

| (1) | Net revenue from continuing operations has increased significantly over the last five years. Revenues increased 223 percent when comparing the year ended December 31, 2012 to the year ended July 31, 2008. |

| |

| (2) | Certain prior period amounts have been adjusted as a result of the review of our accounting treatment for accruing liabilities related to our Geek Points loyalty program at the end of each reporting period presented. Our adjustments include a decrease in gross margins of $0.3 million, $0.4 million, $0.2 million and $0.3 million during the years ended December 31, 2011, 2010, 2009 and the five months ended December 31, 2008, each respectively. During the fourth quarter of 2012, we reversed $0.6 million of our Geek Points liability due to management's decision to change the program effective the first half of 2013. |

| |

| (3) | Loss from continuing operations in the year ended December 31, 2009 includes the write down of our investment in CollabNet of $4.6 million and the write down of internally developed software of $1.2 million. The loss from continuing operations in the year ended December 31, 2010 includes severance related to leadership changes and the decision to move our corporate headquarters from Mountain View, California to Fairfax, VA. The loss from continuing operations in the year ended December 31, 2011 includes investments in our ThinkGeek business, investments in new leadership and severance costs. Income from continuing operations in the year ended December 31, 2012 is primarily due to the sale of our investment in CollabNet that resulted in a gain on sale of $4.0 million. |

| |

| (4) | Income (loss) from discontinued operations in each of the periods presented include Media business revenues, cost of sales and operating and non operating expenses, excluding general corporate costs. The year ended December 31, 2010 also includes $0.2 million of losses from discontinued operations from the sale of Geek.com. |

(5) Net income of $13.9 million for the year ended December 31, 2012 included a gain of $13.7 million for the sale of the Company's Media business.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with “Selected Consolidated Financial Data” and our financial statements and the related notes included elsewhere in this Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors including the risks discussed in “Item 1A. Risk Factors” and elsewhere in this Form 10-K. See Part I — Item 1 — “Special Note Regarding Forward-Looking Statements.”

Overview

We sell technology-themed retail products for technology enthusiasts and general consumers through our ThinkGeek.com website and to our wholesale channel customers. We offer a broad range of unique products in a single web property that are not available in traditional brick-and-mortar stores. We introduce a range of new products to our audience on a regular basis and sell our own innovative GeekLabs products developed in-house. We have several wholesale partnerships with brick and mortar retailers that allow us to reach a new consumer audience and expand our unique brand. We have recently established and strengthened existing partnerships with certain retail store chains that have hundreds of locations throughout the United States and Canada.