SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under 240.14a-12 |

INTERSIL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | $125 per Exchange Act Rules O-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and O-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

INTERSIL CORPORATION

April 14, 2003

DEAR FELLOW SHAREHOLDER:

You are cordially invited to attend the Annual Meeting of Shareholders (“Annual Meeting”) of Intersil Corporation (the “Company”), which will be held at the Beverly Heritage Hotel, located at 1820 Barber Lane, Milpitas, California 95035 on May 14, 2003 at 9:00 a.m.

Details of the business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

If you are not certain that you will attend the Annual Meeting in person, please complete, sign, date and return the enclosed proxy promptly in the accompanying reply envelope. If you decide to attend the Annual Meeting and wish to change your proxy vote, you may do so automatically by voting in person at the Annual Meeting.

We look forward to seeing you at the Annual Meeting. We appreciate your support and continued interest in Intersil Corporation.

Richard M. Beyer | | Milpitas, California |

President, Chief Executive Officer and Director | | April 14, 2003 |

YOUR VOTE IS IMPORTANT

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or by mailing a proxy card. Voting will ensure your representation at the Annual Meeting if you do not attend in person. Please review the instructions on the proxy card concerning each of these voting options. Should you receive more than one proxy, please be sure to sign and return each proxy to ensure that all your shares will be voted. If your shares are held of record by a broker, bank, or other nominee, you will not be able to vote in person at the Annual Meeting unless you first obtain a proxy issued in your name from the record holder.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 14, 2003

The Annual Meeting of Shareholders (“Annual Meeting”) of Intersil Corporation (the “Company”) will be held at the Beverly Heritage Hotel, located at 1820 Barber Lane, Milpitas, California 95035, on May 14, 2003 at 9:00 a.m. for the following purposes:

1. To elect eight directors to serve on the Company’s Board of Directors until the next annual meeting of shareholders, or until their successors are duly elected and qualified.

2. To ratify the appointment of Ernst & Young LLP as the Company’s independent accountants.

3. To increase the number of shares authorized for issuance under the Employee Stock Purchase Plan from 1,333,334 to 2,333,334.

4. To approve the adoption of the Executive Incentive Plan.

5. To transact any other business that may properly come before the Annual Meeting.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return the enclosed proxy promptly in the accompanying reply envelope.

You are entitled to vote if you were a shareholder at the close of business on Monday, March 24, 2003.

By Order of the Board of Directors

Daniel J. Heneghan | | Milpitas, California |

Vice President and Chief Financial Officer | | April 14, 2003 |

Admittance to the meeting will be limited to the shareholders eligible to vote or their authorized representative(s). Beneficial owners holding shares through an intermediary such as a bank or broker will be admitted upon proof of ownership.

INTERSIL CORPORATION

675 TRADE ZONE BLVD

MILPITAS, CA 95035

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are being mailed, beginning April 14, 2003, to owners of shares of Intersil Corporation (the “Company”) Class A Common Stock in connection with the solicitation of proxies by the Board of Directors for the 2003 Annual Meeting of Shareholders. This proxy procedure is necessary to permit all Class A Common Stock shareholders, many of whom live throughout the United States and in foreign countries and are unable to attend the Annual Meeting, to vote. The Board of Directors encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

CONTENTS

VOTING PROCEDURES

Your vote is very important.Your shares can only be voted at the Annual Meeting if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to assure that your shares will be represented. Most shareholders have a choice of voting by means of the Internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible. Also note that proxies submitted by telephone or the Internet must be received by 12:00 midnight, EDT, on Tuesday, May 13, 2003.

You may revoke your proxy at any time before it is voted by (a) giving written notice to the Secretary of the Company, (b) submitting a proxy bearing a later date, or (c) casting a ballot at the Annual Meeting. Properly executed proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided. If no directions are given, your shares will be voted by one of the individuals named on your proxy card as recommended by the Board of Directors. If you wish to give a proxy to someone other than those named on the proxy card, you should cross out those names and insert the name(s) of the person(s), not more than three, to whom you wish to give your proxy.

Who can vote? Shareholders of record as of the close of business on March 24, 2003 are entitled to vote. On that day, approximately 131,165,548 shares of Class A Common Stock were outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the Annual Meeting other than in the election of directors. The Company’s Amended and Restated Certificate of Incorporation provides for cumulative voting for directors. With cumulative voting, at each election for directors, each holder of Class A Common Stock is entitled to as many votes as would equal the number of shares he or she holds, multiplied by the number of directors to be elected. The holder may cast all of his or her votes for a single candidate or may distribute them among any number of candidates. A list of shareholders eligible to vote will be available at the headquarters of Intersil Corporation, located at 675 Trade Zone Blvd., Milpitas, CA, 95035, beginning May 4, 2003. Shareholders may examine this list during normal business hours for any purpose relating to the Annual Meeting.

How does the board recommend I vote? The board recommends a vote FOR each board nominee (Item 1), FOR the ratification of the Board of Directors’ reappointment of Ernst & Young LLP as the independent accountants of the Company for the upcoming year (Item 2), FOR the increase in the number of shares authorized for issuance under the Employee Stock Option Plan (Item 3) and FOR the adoption of the Executive Incentive Plan (Item 4)

What shares are included in the proxy card?The proxy card represents all the shares of Class A Common Stock registered to your account. Each share of Class A Common Stock that you own entitles you to one vote. You may cumulate your votes for directors.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of common stock entitled to vote, is represented. Broker non-votes, votes withheld and abstentions will be counted for purposes of determining whether a quorum has been reached. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners by the tenth day before the Annual Meeting, the nominees may vote those shares only on matters deemed routine by NASDAQ, such as the election of directors and ratification of the appointment of independent accountants. On non-routine matters, nominees cannot vote and there is a so-called “Broker Non-vote” on that matter. Since Item 2, Item 3 and Item 4 must be approved by a majority of the votes cast, broker non-votes have no effect on the outcome of these proposals. Abstentions are counted in tabulations of the votes cast by stockholders on the proposals and will have the effect of a negative vote. Directors are elected by a plurality of the votes cast, and thus, votes withheld from some or all nominees for Director could have an effect on the outcome of the election.

1

Who will count the vote? The Company’s transfer agent, American Stock Transfer & Trust Company, will tally the vote, which will be certified by an independent Inspector of Election.

Is my vote confidential? Proxies, ballots and voting tabulations are available for examination only by the Inspector of Elections and tabulators. Your vote will not be disclosed to the Board of Directors or to our management other than the Inspector of Elections and except as may be required by law.

Who is soliciting this proxy?Solicitation of proxies is made on behalf of the Board of Directorsof the Company, and the cost of preparing, assembling and mailing the notice of Annual Meeting, proxy statement and form of proxy will be borne by the Company. Such cost is estimated at $41,000. In addition to the use of mail, proxies may be solicited by directors, officers and regular employees of the Company, without additional compensation, in person or by telephone or other electronic means. The Company will reimburse brokerage houses and other nominees for their expenses in forwarding proxy material to beneficial owners of the Company’s stock.

CORPORATE GOVERNANCE

In accordance with Delaware General Corporation Law and the Company’s Restated Certificate of Incorporation and Bylaws, the Company’s business, property and affairs are managed under the direction of the Board of Directors. Although directors are not involved in the day-to-day operating details, they are kept informed of the Company’s business through written reports and documents provided to them regularly, as well as by operating, financial and other reports presented by the Chairman and other officers of the Company at meetings of the Board of Directors and committees of the Board of Directors.

Meetings of the Board. The Board of Directors held twelve meetings in 2002. Each of the incumbent directors attended at least 85% of the Board and committee meetings to which the director was assigned. The incumbent directors in the aggregate attended 96% of their Board and assigned committee meetings.

Committees of the Board.The Board of Directors has established three standing committees.

Audit Committee—maintains the sole responsibility to appoint, determine funding for, and oversee the independence and performance of the Company’s internal and external auditors and has the authority to engage independent counsel and other advisors to assist in such responsibility. In addition, the Audit Committee assists the Board of Directors in monitoring the integrity of our financial statements and compliance with laws and regulations related to our financial statements and has the responsibility to establish procedures for the receipt and treatment of complaints regarding our financial statements, internal accounting controls or other related auditing matters. Each of the members of the Audit Committee is independent under the listing standards of the National Association of Securities Dealers and as that term is used in Section 10A(m)(3) of the Securities Act of 1934, as amended. The Committeeheld eight meetings in 2002. The members of the Committee during this period were Dr. Robert W. Conn, Gary E. Gist and Robert N. Pokelwaldt.

Compensation Committee—reviews and approves salary and other compensation of officers and administers certain benefit plans. The Compensation Committee also has the authority to administer, grant and make awards under the Company’s equity compensation plans. The Committee held six meetings in 2002. The members of the Committee during this period were James A. Urry, Jan Peeters and Gary E. Gist.

Nominating Committee—identifies, reviews, evaluates and recommends potential candidates to serve as directors of the Company. In addition, the Nominating Committee serves as a focal point for communication between such candidates, our Directors who are not members of the Nominating Committee and our management. The current members of the Nominating Committee are Dr. Robert W. Conn, Jan Peeters, Robert N. Pokelwaldt and James A. Urry.

Director Compensation and Other Certain Relationships and Related Transactions. Directors who are also officers of Intersil Corporation or

2

Citicorp Venture Capital Ltd. do not receive compensation for their services as directors. All other directors receive cash compensation in the amount of $40,000 per year paid in quarterly installments of $10,000. Directors also receive non-cash compensation of a one-time appointment grant of options to purchase shares of our Class A Common Stock. The number of options granted is determined in the discretion of the board. Directors also receive an annual grant of options to purchase 15,000 shares of our Class A Common Stock. The directors each received a grant of options to purchase 15,000 shares in 2002. All directors will be reimbursed for traveland other expenses incurred in attending meetings of the Board of Directors or its committees.

Stockholders Agreement. Each shareholder who was a shareholder of the Company prior to the initial public offering is a party to a Securities Purchase and Holders Agreement (the “Stockholders Agreement”) dated August 13, 1999 and amendments thereto, in which the holders agreed to vote their shares in such a manner so as to elect the entire Board of Directors of the Company. The parties to the Stockholders Agreement beneficially own 3.8% of the outstanding Class A Common Stock and 100% of the Class B Common Stock

ELECTION OF DIRECTORS

ITEM 1 ON PROXY CARD

The Company’s directors are elected at each annual meeting and hold office until the next election. The Company’s Amended and Restated Certificate of Incorporation, and the Bylaws of the Company, allow for a Board of Directors of not fewer than three and not more than eight members. The Board has currently fixed the number of directors at eight.

Director candidates are nominated by the Board of Directors upon the recommendation of the nominating committee. The nominating committee has recommended the eight nominees below, each of whom is currently a director of the Company. Shareholders are also entitled to nominate director candidates for the Board of Directors in accordance with the procedures set forth on page 8 under the heading “Submission of Shareholder Proposals and Director Nominations.”

The person named on the accompanying form of proxy will vote the shares FOR the nominees, unless you instruct otherwise. Each nominee has consented to stand for election and the Board does not anticipate that any nominee will be unavailable to serve. In the event that one or more of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for the remaining nominees and any substitute nominee(s) designated by the Board. Shareholders may cumulate their votes for directors, and the director elections are then determined by a plurality of the votes cast.

The following biographies provide a brief description of each nominee’s principal occupation and business experience, age (as of February 28, 2003) and directorships held in other public corporations.

Nominees

| | Positions and Offices held with the Company

|

Gregory L. Williams | | Executive Chairman of the Board of Directors |

Richard M. Beyer | | President, Chief Executive Officer and Director |

Robert W. Conn | | Director |

James V. Diller | | Director |

Gary E. Gist | | Director |

Jan Peeters | | Director |

Robert N. Pokelwaldt | | Director |

James A. Urry | | Director |

BUSINESS EXPERIENCE OF DIRECTORS

Gregory L. Williams, Executive Chairman of the Board of Directors. Mr. Williams has been one of the Company’s directors since Intersil’s inception in August 1999. From August 1999 through May 2002, Mr. Williams also served as President and Chief Executive Officer of the Company. From October 1998 to

3

August 1999, Mr. Williams was President of the semiconductor business of Harris Corporation. From January 1998 to October 1998, Mr. Williams was Vice President and General Manager of the Power Products Division of Harris. From 1984 to 1998, Mr. Williams also served as Vice President and Assistant General Manager of the Semiconductor Components Group, Vice President and General Manager of the Power Products Division, and Vice President and Director of Automotive World Marketing of Motorola Semiconductor, and from 1977 to 1984, Mr. Williams served with General Electric Company. Mr. Williams is 2003 Chairman of the Semiconductor Industry Association and a director of AMI Semiconductor Corporation. Age: 49

Richard M. Beyer, President, Chief Executive Officer, Director. Mr. Beyer was appointed President, Chief Executive Officer and Director of Intersil Corporation following the acquisition of Elantec Semiconductor, Inc. (May 14, 2002). From July 2000 to May 2002, Mr. Beyer was President, Chief Executive Officer and director of Elantec Semiconductor. From January 1999 to July 2000, Mr. Beyer served as President, Chief Executive Officer and director of FVC.COM, Inc. From July 1996 to August 1998, Mr. Beyer served as President, Chief Operating Officer and director of VLSI Technology, Inc. From June 1995 to June 1996, Mr. Beyer was Executive Vice President and Chief Operating Officer of National Semiconductor Corporation. From 1993 to 1995, Mr. Beyer was President of National Semiconductor’s Communications and Computing Group. Before joining National, Beyer served in a number of senior managerial positions in the telecommunications and computer industries. Age: 54

Robert W. Conn, Director. Dr. Conn has been one of the Company’s directors since April 2000. Dr. Conn has been Managing Director of Enterprise Partners Venture Capital since July 2002. From 1994 to July 2002, Dr. Conn was the Dean of the Jacobs School of Engineering, University of California, San Diego, and the Walter J. Zable Endowed Chair in Engineering. Prior to joining the University of California, San Diego, Dr. Conn served as Professor of Engineering and Applied Sciences and founding Director of the Institute of Plasma and Fusion Research at the University of California, Los Angeles. Dr. Conn co-founded a semiconductor equipment company in 1986, Plasma & Material Technologies, now Trikon Technologies, where he served as chairman of the board through 1993. Dr. Conn is a member of the National Academy of Engineering and served as a member of the President’s Committee of Advisors on Science and Technology Panel on Energy R&D Policy for the 21st Century, which service ended in 1998. Age: 60

James V. Diller, Director. Mr. Diller has been one of the Company’s directors since May 2002. Prior to that, Mr. Diller was Chairman of the board of Elantec Semiconductor, Inc. since 1997 and a director since 1986. From November 1998 to July 2000, he served as Elantec’s President and Chief Executive Officer. Mr. Diller is a founder of PMC-Sierra, Inc. and was its President and Chief Executive Officer from 1983 to 1997; he is currently Vice Chairman of the board. Mr. Diller has been a director of Sierra Wireless, Inc., a provider of wireless data communications hardware and software products since 1993. In addition, Mr. Diller is Chairman of the board of Summit Microelectronics, a privately held company. Age: 67

Gary E. Gist, Director. Mr. Gist has been one of the Company’s directors since the Company’s inception in August 1999. Since 1995, Mr. Gist has served as the President and Chief Executive Officer of Palomar Companies, LLC, which focuses on designing and manufacturing electronic products and is composed of the following diverse group of companies: Palomar Display Products, Inc., Palomar Products, Inc. and Palomar Technologies, Inc. From mid-1993 to 1995, he was Division Manager of the Technology Products Division of Hughes Industrial Electronics Company. Prior to that, he was President of Transworld Communications. Age: 56

Jan Peeters, Director. Mr. Peeters has been one of the Company’s directors since April 2000. Mr. Peeters is the founder, Chairman, President, Chief Executive Officer and a major shareholder of Olameter Inc., a communications and data management service provider which he formed in 1998. Mr. Peeters was a founder of Fonorola Inc. where he held the position of President and Chief Executive Officer from 1990 and the position of Vice-Chairman from 1994, until that company was sold to Call-Net Enterprises in June 1998. Mr. Peeters serves on the Board of Directors of Cogeco Inc. Age: 51

4

Robert N. Pokelwaldt, Director. Mr. Pokelwaldt has been one of the Company’s directors since April 2000. In November 1999, Mr. Pokelwaldt retired as the Chairman and Chief Executive Officer of YORK International Corporation (“YORK��), an independent supplier of heating, ventilating, air conditioning and refrigeration products in the U.S. and internationally. He became President and Chief Executive Officer of YORK in 1991, and Chairman of YORK in January 1993. Mr. Pokelwaldt joined YORK as President of Applied Systems Worldwide, a YORK Division, in 1988, and two years later was appointed President and Chief Operating Officer of YORK International. Mr. Pokelwaldt serves on the Board of Directors of Mohawk Industries, First Energy and Carpenter Technology. Age: 66

James A. Urry, Director. Mr. Urry has been one of the Company’s directors since the Company’s inception in August 1999. Mr. Urry is a Partner at Citicorp Venture Capital Ltd., which is an affiliate of Intersil Corporation. Prior to 1989, he was with Citibank, N.A. Mr. Urry serves on the Board of Directors of Airxcel, Inc., AMI Semiconductor and York International Corporation. Age: 49

The Board of Directors recommends a vote FOR each of the nominees listed.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT ACCOUNTANTS

ITEM 2 ON PROXY CARD

The Board of Directors, acting upon the recommendation of the Audit Committee, asks that the shareholders ratify the Board’s reappointment of the firm of Ernst & Young LLP as independent accountants to examine the financial statements of the Company for fiscal year 2002. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting, in person or by proxy, and voting thereon. Unless otherwise specified by the shareholders, the shares of stock represented by the proxy will be voted FOR ratification of the appointment of Ernst & Young LLP as independent accountants to audit and report upon the financial statements of the Company for fiscal year 2002. If this appointment is not ratified by shareholders, the Audit Committee may reconsider its recommendation.

One or more representatives of Ernst & Young LLP are expected to be at the Annual Meeting. They will have an opportunity to make a statement and will be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR ratification of the appointment of Ernst & Young as the independent accountant for the Company for the coming year.

INCREASE IN SHARES AVAILABLE UNDER THE

EMPLOYEE STOCK PURCHASE PLAN

ITEM 3 ON PROXY CARD

The Company’s Employee Stock Purchase Plan, as amended (the “ESPP”), was approved by the Board of Directors and by the shareholders of the Company in February 2000, with a total of 1,333,334 shares of Common Stock reserved for issuance under the ESPP. Subject to shareholder approval, the Compensation Committee of the Board of Directors has approved an increase in the number of shares authorized for issuance under the Equity Plan from 1,333,334 to 2,333,334. A summary description of the ESPP is attached to this proxy statement as Exhibit A. This summary is qualified in its entirety by the full text of the ESPP, copies of which may be obtained by the Company’s shareholders upon request to the Office of the Secretary of the Company.

As of March 3, 2003, 782,882 shares of Common Stock had been purchased under the ESPP, and 550,446 shares remain available for future purchases. However, the Company believes that the remaining shares may be utilized during the next year. The closing price of the Common Stock on March 3, 2003 was $15.44.

5

The Board of Directors believes that this proposed increase in the number of shares authorized for purchase under the ESPP is in the best interest of the Company. The Board of Directors believes that this increase will strengthen the Company’s ability to attract and retain individuals with the desired training, experience and expertise in a highly competitive market. The Board of Directors also believes that this increase will allow the Company to furnish additional incentives to its employees to promote the Company’s financial success and motivate them to increase shareholder value.

The Board of Directors recommends a vote FOR the increase.

APPROVAL OF THE INTERSIL CORPORATION

EXECUTIVE INCENTIVE PLAN

ITEM 4 ON PROXY CARD

The Executive Incentive Plan is intended to promote the growth and performance of Intersil by linking a portion of the total compensation for certain key employees to the attainment of applicable financial objectives. The Executive Incentive Plan has the further purpose of fulfilling Intersil’s objective of offering a competitive total compensation package to its employees, thus enabling Intersil to attract and retain employees of high caliber and ability.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) generally limits to $1 million per year the federal income tax deduction for compensation paid by a public company to certain key individuals. This $1 million per year limit does not apply to compensation that qualifies as “performance-based compensation” under regulations adopted under the Code (“Regulations”). One condition for payments to be qualified as performance-based compensation is that a majority of the shareholders of Intersil approve the material terms of the Executive Incentive Plan. Intersil adopted the Executive Incentive Plan before it was a publicly-held company. When a company adopts a plan, prior to being publicly held, the Regulations require that shareholder approval be obtained on or before the first shareholders meeting that occurs after the end of the third year following the year that the company became publicly-held. Intersil became a publicly held company in 2000. Therefore, the board of directors has decided to seek shareholder approval of the Executive Incentive Plan at this meeting so that compensation payable pursuant to the Executive Incentive Plan will be deductible performance-based compensation under Code Section 162(m).

If shareholder approval is not received at this Annual Meeting, the Executive Incentive Plan will remain effective until further amended. In such case, Intersil has made no determination as to what action it might take with respect to the “covered employees.”

Summary of Certain Terms of the Executive Incentive Plan

The following summary of the principal features of the Executive Incentive Plan is subject to the complete terms of the Executive Incentive Plan, a copy of which is attached to this proxy statement as Exhibit B.

Eligible Participants.All salaried employees of Intersil its subsidiaries and affiliates are eligible to be selected to participate in the Executive Incentive Plan. Currently, approximately 12 employees participate.

Administration. With respect to the Chief Executive Officer and President, the Executive Incentive Plan is administered by the outside directors of the board of directors, and with respect to other executive officers of Intersil the Executive Incentive Plan is administered by the Compensation Committee. With respect to participants that are not executive officers, the Board, the Compensation Committee, or the Chief Executive Officer is able to administer the Executive Incentive Plan. For purposes of this section, the term “Committee” refers to the outside directors of the Board, the Compensation Committee, or the Chief Executive Officer, as applicable to the particular plan participants.

Performance Goals and Awards.Pursuant to the Executive Incentive Plan, the Committee establishes a “target annual incentive award” for each participant for the performance period and selects performance goals for

6

the participants from among the following measurements: Intersil’s revenue, earnings per share, net income, operating income, return on equity, return on capital, return on assets, total stockholder return or cash flow, or any combination thereof. For each performance period, the Committee also establishes a formula or matrix prescribing the extent to which a participant’s target annual incentive award may be earned based on the degree of achievement of such performance goal or goals. The maximum amount of an actual executive incentive payout that may be awarded to a participant may not exceed 200% of the target annual incentive award. The Committee also may determine that the annual incentive award payable will be based upon the attainment of performance goals comparable to those specified above, but in whole or in part applied to the results of a subsidiary, business unit or other such business entity of Intersil for which a participant has substantial management responsibility. Except in the case of executive officers of Intersil, the committee may also designate any other factor or factors to serve as performance goals.

Each executive officer’s target annual incentive award and performance goal or goals for a plan year will be established by the Committee, as permitted by the Regulations, not later than 90 days after the period for which performance is to be measured has commenced, and the goal or goals will not thereafter be changed. A target annual incentive award payable to an executive officer may be reduced (but not increased) by the Committee in its sole discretion and in any event will not exceed $2,000,000 for any plan year.

Adjustments. The Committee has authority to make adjustments in the method of calculating achievement of performance goals in recognition of the effects of changes in accounting standards or methods and unusual or nonrecurring events that would have the effect of reducing an incentive award otherwise payable under the Executive Incentive Plan. However, these adjustments must be made in a manner consistent with Section 162(m) and the Regulations, and no adjustment may impair the rights of any participant without his or her consent.

Payment. Benefits or amounts that will be received by or allocated to participants in the Executive Incentive Plan are not determinable until the completion of the performance period. The Committee may permit partial payments to participants based upon quarterly results, but the final payments are determined after completion of the performance period.

Amendment.The board of directors or the Compensation Committee may amend, suspend, or terminate the Executive Incentive Plan at any time provided that no such termination or amendment may alter a participant’s right to receive a distribution previously earned by such participant under the Executive Incentive Plan.

NEW PLAN BENEFITS

(in thousands)

Name and Position | | Executive Incentive Plan Dollar Value ($) (1)

|

Gregory L. Williams, Executive Chairman of the Board | | $ | 584.1 |

Richard M. Beyer, President and Chief Executive Officer | | $ | 411.5 |

Daniel J. Heneghan, Vice President, Chief Financial Officer and Assistant Secretary | | $ | 327.3 |

Larry J. Ciaccia, Vice President and General Manager, Wireless Networking | | $ | 295.8 |

Rick E. Furtney, Vice President and General Manager, High Performance Analog Stephen M. Moran, Vice President and General Counsel and Secretary | | $ $ | 239.0 165.0 |

|

Executive Group (2): | | $ | 2,302.0 |

|

Non-Executive Officer Employee Group: | | | None |

|

Non-Executive Director Group: | | | None |

| (1) | | Dollar values are based on amounts granted to executive officers in fiscal year 2002. |

| (2) | | Includes $411.5 thousand granted to Richard M. Beyer, $327.3 thousand granted to Daniel J. Heneghan, $295.8 thousand granted to Larry J. Ciaccia and $239.0 thousand granted to Rick E. Furtney, as listed above. |

The Board of Directors recommends a vote FOR approval.

7

SUBMISSION OF SHAREHOLDER PROPOSALS AND

DIRECTOR NOMINATIONS

The next shareholder meeting will be held on or about May 14, 2004. Shareholders wishing to have a proposal included in the Board of Directors’ 2003 Proxy Statement must submit the proposal so that the Secretary of the Company receives it no later than December 16, 2003, 120 days prior to the date of the Company’s proxy statement released to shareholders in 2003. The Securities and Exchange Commission rules set forth standards as to what shareholder proposals are required to be included in a proxy statement.

For any proposal that is not submitted for inclusion in next year’s proxy statement (as described above) but is instead sought to be presented directly at next year’s annual meeting, Securities and Exchange Commission rules permit management to vote proxies in its discretion if (a) the Company receives notice of the proposal before the close of business on February 29, 2004 and advises stockholders in next year’s proxy statement about the nature of the matter and how management intends to vote on such matter, or (b) the Company does not receive notice of the proposal prior to the close of business on February 29, 2004. Notices of intention to present proposals at the 2004 Annual Meeting should be addressed to the Vice President, Secretary and General Counsel of Intersil Corporation.

AUDIT COMMITTEE

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

ON THE FINANCIAL STATEMENTS OF THE COMPANY

AND THE INDEPENDENCE OF THE COMPANY’S AUDITORS

Report of the Audit Committee to the Full Board of Directors of Intersil Corporation

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee appoints the accounting firm to be retained to audit the Company’s financial statements, and once retained, the accounting firm reports directly to the Audit Committee. The Audit Committee consults with and reviews recommendations made by the accounting firm with respect to financial statements, financial records and financial controls of the Company and makes recommendations to the Board of Directors as it deems appropriate from time to time. The Audit Committee is responsible for approving both audit and non-audit services to be provided by the independent auditors. The Board of Directors has adopted a written charter setting forth the functions the Audit Committee is to perform, and this report is made pursuant to that charter.

The Audit Committee oversees the Company’s financial reporting process on behalf of Intersil’s Board of Directors. Management is responsible for the Company’s financial reporting process including its system of internal control, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors are responsible for auditing those financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America. Our responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews.

The Audit Committee met with management periodically during fiscal year 2002 to consider the adequacy of the Company’s internal controls, and discussed these matters and the overall scope and plans for the audit of the Company with the Company’s independent auditors, Ernst & Young LLP. The Audit Committee also

8

discussed with senior management and Ernst & Young LLP the Company’s disclosure controls and procedures and the certifications by the Company’s Chief Executive Officer and Chief Financial Officer, which are required by the Securities and Exchange Commission under the recently enacted Sarbanes-Oxley Act of 2002 for certain of the Company’s filings with the Securities and Exchange Commission.

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the 2002 Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under auditing standards generally accepted in the United States, including the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee received the written disclosures and the letter from the Company’s independent auditors required by Independence Standards Board Standard No. 1. In addition, the Audit Committee discussed with the independent auditors their independence, including the compatibility of nonaudit services with the auditor’s independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit Committee held eight (8) meetings in fiscal year 2002.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Annual Report and the Form 10-K for the 53 weeks ended January 3, 2002 for filing with the Securities and Exchange Commission.

The Audit Committee has reappointed, subject to stockholder ratification, the firm of Ernst & Young LLP, certified public accountants, as independent accountants to audit and report upon the Company’s financial statements for 2003. In appointing Ernst & Young LLP as the Company’s auditors for the fiscal year ending January 2, 2004, the Audit Committee has considered whether Ernst & Young LLP’s provision of services other than audit services are compatible with maintaining their independence.

| | | AUDIT COMMITTEE |

| | | Gary Gist, Committee Chairman |

| | | Dr. Robert W. Conn |

| | | Robert Pokelwaldt |

9

EXECUTIVE COMPENSATION

REPORT OF THE COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS OF INTERSIL CORPORATION

FOR FISCAL YEAR 2002

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee during fiscal year 2002 was an officer or employee of the Company, or any of its subsidiaries, or was formerly an officer of the Company or any of its subsidiaries. No member of the Compensation Committee had any relationship requiring disclosure by the Company under any paragraph of Item 404 of Regulation S-K. Furthermore, no member of the Compensation Committee had a relationship that requires disclosure under Item 402(j)(3) of Regulation S-K.

Report of the Compensation Committee of the Board of Directors on Executive Compensation

Role of Committee.The Compensation Committee of the Board of Directors establishes, oversees and directs the Company’s executive compensation programs and policies and administers the Company’s equity compensation plans. The Compensation Committee seeks to align executive compensation with Company objectives and strategies, management programs and business financial performance in order to enhance shareholder value. The Compensation Committee consists of three non-employee directors.

The Compensation Committee reviews and approves generally all compensation and fringe benefit programs of the Company and also reviews and determines the actual compensation of the Company’s executive officers, as well as all stock option grants and cash incentive awards to all key employees. The Compensation Committee also reviews and makes recommendations to the Board of Directors on policies and programs for the development of management personnel and management structure and organization.

The Compensation Committee’s objectives include (i) attracting and retaining exceptional individuals as senior executives and (ii) providing key executives with motivation to perform to the full extent of their abilities in an effort to maximize Company performance and deliver enhanced value to the Company’s shareholders. The Compensation Committee believes it is important to place a greater percentage of senior executives’ compensation at risk than that of non-executives by tying senior executives’ compensation directly to the performance of the business and value of the common stock. Accordingly, executive compensation consists primarily of an annual salary, bonuses linked to the performance of the Company and long-term equity-based compensation. The Compensation Committee considers the compensation program’s impact on each operating business unit as well as the effect on growth, profitability, market position and goals set for each year as well as changes in corporate market focus, strategic goals and key results expected (“KRE’s”) set for the next fiscal year. The Compensation Committee reviews with management the business plans for the new fiscal year and compares them to the prior year.

Compensation.The annual salaries of the Company’s senior executives are set at levels designed to attract and retain exceptional individuals by rewarding them for individual and Company achievements. The Compensation Committee reviews the annual salary of each senior executive in relation to such executive’s performance, previous salaries, general market and industry conditions or trends and makes appropriate adjustments. The Compensation Committee reviews senior executives’ salaries annually to adjust such salaries based on each senior executive’s past performance, expected future contributions, scope and nature of responsibilities, including changes in such responsibilites, and competitive compensation data relating to such senior executive.

The Compensation Committee believes that a portion of the executives’ compensation should be tied to the financial results of the Company in order to reward individual performance and overall Company success.

10

Objective targets are established for six-month performance periods during each calendar year based on the Company’s financial targets, such as revenue, earnings and return on assets, as well as individual strategic and operating targets.

The Company has employee stock option plans in order to offer key employees the opportunity to acquire an equity interest in the Company, thereby aligning the interests of these employees more closely with the long term interests of shareholders. Awards under these employee stock option plans may be in the form of options, restricted stock or stock appreciation rights. Options, which have a fixed exercise price, vest over a four- or five-year period and have an exercise price equal to the market value of the Common Stock on the date of grant, were granted to senior executives and other key employees in 1999. Similar options which typically vest over a four-year period were granted in 2000, 2001 and 2002.

Fiscal Year 2002 President and Chief Executive Officer. Mr. Richard M. Beyer has served as our President and Chief Executive Officer since the Company’s merger with Elantec Semiconductor in May 2002. Mr. Beyer’s compensation during 2002 was based on the employment agreement entered into at the time of the merger. Under that agreement, Mr. Beyer is paid an annual salary of $550,000 and is eligible to receive bonus compensation and stock options at the discretion of the Compensation Committee. In 2002, Mr. Beyer earned a bonus of $411,500, based upon the accomplishment of Company financial performance goals that are determined by the Compensation Committee. During 2002, Mr. Beyer also was granted stock options to purchase 600,000 shares of our Class A common stock. The use of stock options as a portion of Mr. Beyer’s compensation accomplishes the Compensation Committee’s objective that a significant portion of our executives’ compensation be at risk and dependent upon our long-term stock performance.

Deductibility of Compensation.Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), limits our ability to deduct compensation in excess of $1,000,000 paid during a tax year individually to our executive officers at year end. Certain performance-based compensation is not subject to such deduction limit. It is the Compensation Committee’s intent to maximize the deductibility of executive compensation while retaining the discretion necessary to compensate executive officers in a manner commensurate with performance and the competitive market for executive talent.

| | | COMPENSATION COMMITTEE |

| | | James A. Urry |

| | | Jan Peeters |

| | | Gary E. Gist |

11

COMPENSATION TABLES

Executive Compensation

The following table sets forth certain information concerning the compensation received by our five most highly compensated officers for services rendered in fiscal year 2000, the transition period from July 1, 2000 to December 29, 2000 (2000(S)), fiscal year 2001 and fiscal year 2002.

Summary Compensation Table

Calendar Year 2002

Dollars In Thousands | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Long-Term Compensation

| | |

Name and Principal Position

| | | | | Annual Compensation

| | Awards

| | | | |

| | Fiscal Year(1)

| | | Salary

| | Bonus(2)

| | Other Annual Compensation (3)(4)(5)(6)

| | Securities Underlying Options(7)(8)

| | LTIP Payouts

| | All Other Compensation(9)

|

Gregory L. Williams Executive Chairman of the Board | | 2002 2001 2000 2000 | (S) | | $ $ $ $ | 643.1 550.0 270.2 399.6 | | $ $ $ $ | 584.1 770.5 274.2 577.7 | | $ | — — — 430.1 | | 450,000 250,000 100,000 140,000 | | | — — — | | $ $ $ $ | 76.0 98.3 52.1 29.3 |

|

Richard M. Beyer President and Chief Executive Officer | | 2002 2001 2000 2000 | (S) | | $ | 456.0 — — — | | $ | 411.5 — — — | | | — — — — | | 615,409 — — — | | | — — — — | | $ | 17.1 — — — |

|

Daniel J. Heneghan Vice President, Chief Financial Officer and Assistant Secretary | | 2002 2001 2000 2000 | (S) | | $ $ $ $ | 328.3 300.0 150.0 179.7 | | $ $ $ $ | 327.3 348.2 83.1 212.6 | | $ | — — 273.6 — | | 240,000 100,000 40,000 63,334 | | $ | — — 17.2 | | $ $ $ $ | 40.6 45.1 20.7 10.4 |

|

Larry J. Ciaccia Vice President and General Manager, Wireless Networking | | 2002 2001 2000 2000 | (S) | | $ $ $ $ | 289.8 225.0 110.4 147.4 | | $ $ $ $ | 295.8 165.4 105.8 149.6 | | | — — — — | | 205,000 80,000 25,000 63,334 | | | — — — | | $ $ $ $ | 35.9 30.4 15.9 0.3 |

|

Rick E. Furtney Vice President and General Manager, High Performance Analog | | 2002 2001 2000 2000 | (S) | | $ $ $ $ | 279.8 205.3 98.6 121.7 | | $ $ $ $ | 256.6 204.7 85.5 31.3 | | | — — — — | | 215,000 80,000 25,000 23,334 | | | — — — | | $ $ $ $ | 32.9 30.3 3.9 13.5 |

|

Steven M. Moran Vice President and General Counsel and Secretary | | 2002 2001 2000 2000 | (S) | | $ $ $ $ | 244.6 227.7 100.0 83.1 | | $ $ $ $ | 165.0 177.3 42.3 50.0 | | $ $ | — 71.1 — 68.0 | | 115,000 47,500 17,500 23,334 | | | — — — | | $ $ $ $ | 4.6 5.2 1.7 0.2 |

| (1) | | 2002 is the fiscal year ended January 3, 2003; 2001 is the fiscal year ended December 28, 2001; 2000(S) is the transition period which extended from July 1, 2000 through December 29, 2000; and 2000 is the fiscal year ended June 30, 2000. Mr. Beyer became Elantec’s Chief Executive Officer in July 2000 and subsequently Chief Executive Officer of Intersil in May 2002. |

| (2) | | This category includes Executive Incentive Plan bonuses for all officers. It also includes an additional bonus paid in fiscal year 2002 to Mr. Furtney ($17,630.10) and additional bonuses paid in fiscal year 2001 to Mr. Williams ($300,000), Mr. Heneghan ($160,000), Mr. Ciaccia ($28,000), Mr. Furtney ($32,000) and Mr. Moran ($81,250). Combined year 2000 amounts reflect a disruption bonus for Mr. Heneghan of $25,000 and a signing bonus for Mr. Moran of $50,000. |

| (3) | | None of the executive officers named in the Summary Compensation table received personal benefits in excess of $50,000 or 10% of annual salary and bonus for fiscal year 2002. |

12

| (4) | | Except for Mr. Moran, none of the executive officers named in the Summary Compensation table received personal benefits in excess of $50,000 or 10% of annual salary and bonus for fiscal year 2001. Mr. Moran’s personal benefit included a tax equalization payment ($68,136.14) and estate planning fees ($3,000). |

| (5) | | Except for Mr. Heneghan, none of the executive officers named in the Summary Compensation table received personal benefits in excess of $50,000 or 10% of annual salary and bonus for the 2000(S) reporting period. Mr. Heneghan’s personal benefit for the 2000(S) reporting period included relocation expenses and applicable taxes associated with his relocation to the corporate offices in Irvine, CA. |

| (6) | | Except for Mr. Williams, none of the executive officers named in the Summary Compensation table received personal benefits in excess of $50,000 or 10% of annual salary and bonus for combined year 2000. Mr. Williams’ personal benefits for combined year 2000 included relocation expenses and applicable taxes associated with his relocation to the Irvine, CA office. |

| (7) | | Stock options granted to Messrs. Williams, Heneghan, Ciaccia, Furtney and Moran were granted under the Intersil Corporation 1999 Equity Compensation Plan. The stock option grants terminate ten years from date of grant. Grants issued prior to August 2000 vest over a five year period—20% upon each of the first five anniversary dates of the grant. Grants issued from August 2000 to date, including those reflected in the table for fiscal year 2002, vest over a four year period—25% upon each of the first four anniversary dates of the grant except for a supplemental stock option grant to Mr. Heneghan (60,000), Mr. Ciaccia (40,000), Mr. Furtney (50,000) and Mr. Moran (25,000) which vest over a four year period—25% after the first anniversary and 6.25% quarterly thereafter until fully vested—as authorized by the Compensation Committee of the Intersil Board of Directors. |

| (8) | | The stock options granted to Mr. Beyer in fiscal year 2002 reflect 600,000 options granted under the Intersil Corporation 1999 Equity Compensation Plan. The stock option grant terminates ten years from date of grant. The grant vests over a four year period—25% after the first anniversary and 6.25% quarterly thereafter until fully vested. In addition, the fiscal year 2002 option total reflects 15,409 stock options, on a post conversion basis, granted by Elantec, and converted in accordance with the terms of the Merger Agreement. |

| (9) | | Amounts reported reflect contributions and allocations to defined contribution retirement plans and the value of insurance premiums for term life insurance and disability insurance. |

13

Stock Options

The following table provides information concerning stock options granted to the executive officers named in the Summary Compensation Table during fiscal year 2002.

Fiscal Year 2002 Option/SAR Grants

| | | Individual Grants

| | | | |

| | | Number of Securities Underlying Options(1)

| | Percentage of All Options Granted to All Employees in Period(2)

| | | Exercise Price

| | Expiration Date(3)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (4)

|

| | | | | | | 5%

| | 10%

|

Gregory L. Williams | | 75,000 75,000 75,000 75,000 75,000 75,000 | | 0.5 0.5 0.5 0.5 0.5 0.5 | % % % % % % | | $ $ $ $ $ $ | 33.38 28.58 24.24 19.80 12.87 14.45 | | 1/2/2012 4/1/2012 5/9/2012 7/1/2012 10/1/2012 1/2/2013 | | $ $ $ $ $ $ | 1,574,438 1,348,036 1,143,330 933,909 607,041 930,785 | | $ $ $ $ $ $ | 3,989,934 3,416,187 2,897,424 2,366,708 1,538,360 2,124,061 |

|

Richard M. Beyer (5) | | 945,403 138,689 3,082 169,509 15,409 600,000 | | 6.1 0.9 0.0 1.1 0.1 3.9 | % % % % % % | | $ $ $ $ $ $ | 37.64 26.29 16.80 24.25 26.45 30.21 | | 7/12/2010 1/16/2011 4/17/2011 12/20/2011 1/14/2012 5/14/2012 | | $ $ $ $ $ $ | 22,379,196 2,293,034 32,563 2,585,130 256,317 11,399,344 | | $ $ $ $ $ $ | 56,713,276 5,810,998 82,520 6,551,227 649,559 28,888,176 |

|

Daniel J. Heneghan | | 30,000 30,000 30,000 30,000 30,000 60,000 30,000 | | 0.2 0.2 0.2 0.2 0.2 0.4 0.2 | % % % % % % % | | $ $ $ $ $ $ $ | 33.38 28.58 24.24 19.80 12.87 16.49 14.45 | | 1/2/2012 4/1/2012 5/9/2012 7/1/2012 10/1/2012 10/29/2012 1/2/2013 | | $ $ $ $ $ $ $ | 629,775 539,214 457,332 373,563 242,816 622,228 272,626 | | $ $ $ $ $ $ $ | 1,595,974 1,366,475 1,158,970 946,683 615,344 1,576,849 690,887 |

|

Larry J. Ciaccia | | 27,500 27,500 27,500 27,500 27,500 40,000 27,500 | | 0.2 0.2 0.2 0.2 0.2 0.3 0.2 | % % % % % % % | | $ $ $ $ $ $ $ | 33.38 28.58 24.24 19.80 12.87 16.49 14.45 | | 1/2/2012 4/1/2012 5/9/2012 7/1/2012 10/1/2012 10/29/2012 1/2/2013 | | $ $ $ $ $ $ $ | 577,294 494,280 419,221 342,433 222,582 414,819 249,907 | | $ $ $ $ $ $ $ | 1,462,976 1,252,602 1,062,389 867,793 564,065 1,051,233 633,313 |

|

Rick E. Furtney | | 27,500 27,500 27,500 27,500 27,500 50,000 27,500 | | 0.2 0.2 0.2 0.2 0.2 0.3 0.2 | % % % % % % % | | $ $ $ $ $ $ $ | 33.38 28.58 24.24 19.80 12.87 16.49 14.45 | | 1/2/2012 4/1/2012 5/9/2012 7/1/2012 10/1/2012 10/29/2012 1/2/2013 | | $ $ $ $ $ $ $ | 577,294 494,280 419,221 342,433 222,582 518,524 249,907 | | $ $ $ $ $ $ $ | 1,462,976 1,252,602 1,062,389 867,793 564,065 1,314,041 633,313 |

|

Stephen M. Moran | | 15,000 15,000 15,000 15,000 15,000 25,000 15,000 | | 0.1 0.1 0.1 0.1 0.1 0.2 0.1 | % % % % % % % | | $ $ $ $ $ $ $ | 33.38 28.58 24.24 19.80 12.87 16.49 14.45 | | 1/2/2012 4/1/2012 5/9/2012 7/1/2012 10/1/2012 10/29/2012 1/2/2013 | | $ $ $ $ $ $ $ | 314,888 269,607 228,666 186,782 121,408 259,262 136,313 | | $ $ $ $ $ $ $ | 797,987 683,237 579,485 473,342 307,672 657,020 345,444 |

| (1) | | These options vest in twenty-five percent increments on the first four anniversaries of the grant date. |

| (2) | | A total of 6,550,065 options were granted to Intersil employees under the Intersil 1999 Equity Compensation Plan during the fiscal year ended January 3, 2002. Also, a total of 8,969,763 Elantec options were converted to Intersil options in accordance with the merger agreement. In total, 15,519,828 options were granted during the fiscal year ended January 3, 2003. |

14

| (3) | | The options will expire ten years after the grant date. |

| (4) | | Represents the potential realizable value of the underlying shares of Intersil common stock at the expiration date based on an assumed annual appreciation rate of 5% and 10%, set by the Securities and Exchange Commission. The amounts shown are not intended to forecast future appreciation in the price of our Class A Common Stock. |

| (5) | | A portion of Richard M. Beyer’s stock option grants represent prior Elantec options converted during 2002 to Intersil options due to the merger with Elantec Semiconductor, Inc. and Intersil on May 14, 2002. |

The following table sets forth information regarding the number and value of options held by the executive officers named in the Summary Compensation Table during fiscal year 2002:

Aggregated Option/SAR Exercises in Last Fiscal Year and

Fiscal Year-End Option/SAR Values

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Year-End

| | Net Value of Unexercised In-the-Money Options at Year-End(1)

|

| | | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Gregory L. Williams | | $ | — | | $ | — | | 214,892 | | 740,250 | | $ | 111,445 | | $ | 106,500 |

Richard M. Beyer | | $ | | | $ | — | | 683,097 | | 1,188,995 | | $ | — | | $ | — |

Daniel J. Heneghan | | $ | — | | $ | — | | 85,862 | | 360,501 | | $ | 22,293 | | $ | 42,600 |

Larry J. Ciaccia | | $ | — | | $ | — | | 67,833 | | 305,501 | | $ | — | | $ | 39,050 |

Rick E. Furtney | | $ | — | | $ | — | | 51,833 | | 291,501 | | $ | — | | $ | 39,050 |

Stephen M. Moran | | $ | — | | $ | — | | 35,895 | | 167,439 | | $ | — | | $ | 21,300 |

| (1) | | Reflects net pre-tax amounts determined by subtracting the exercise price from $14.29 per share, the fair market value of common stock at the end of fiscal year 2002. |

OTHER FORMS OF COMPENSATION

The table below summarizes the status of our equity compensation plans (shares in millions):

| | | (a)

| | (b)

| | (c)

|

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

Equity compensation plans approved

by security holders: | | | | | | | |

|

SiCOM Dutch Converted Plan | | 0.130 | | $ | 9.11 | | 0.000 |

Elantec, Inc. 1994 Equity Incentive Plan | | 0.139 | | $ | 1.50 | | 0.000 |

Elantec 1995 Directors Stock Option Plan | | 0.000 | | $ | 0.00 | | 0.000 |

Elantec 1995 Equity Incentive Plan | | 6.299 | | $ | 17.06 | | 0.000 |

Elantec 2001 Equity Incentive Plan | | 1.477 | | $ | 23.97 | | 0.000 |

1999 Equity Compensation Plan | | 11.262 | | $ | 24.21 | | 5.514 |

No Wires Needed BV

Stock Option Plan | | 0.037 | | $ | 2.00 | | 0.000 |

|

Equity compensation plans not approved by security holders | | None | | | | | |

|

Total | | 19.344 | | | | | 5.514 |

15

RETIREMENT PLANS

Retirement and Savings Program

Intersil Corporation provides retirement benefits to substantially all employees primarily through a retirement plan having profit-sharing and savings elements. Contributions by the Company to the retirement plan are based on profits and employees’ savings with no other funding requirements. Intersil Holding is able to make additional contributions to the fund at its discretion.

The savings element of the retirement plan is a defined contribution plan, which is qualified under Internal Revenue Service Code Section 401(k). All employees of the Company may elect to participate in the 401(k) retirement plan (the “401(k) plan”). Under the 401(k) plan, participating employees may defer a portion of their pretax earnings up to certain limits prescribed by the Internal Revenue Service. The Company provides matching contributions under the provisions of the plan. Employees fully vest in the Company’s matching contributions upon the completion of seven years of service.

Retirement benefits also include an unfunded limited healthcare plan for U.S.-based retirees and employees on long-term disability. Intersil Holding Company accrues the estimated cost of these medical benefits, which are not material, during an employee’s active service life.

16

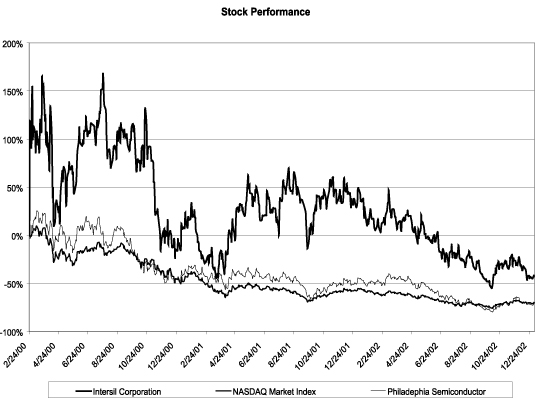

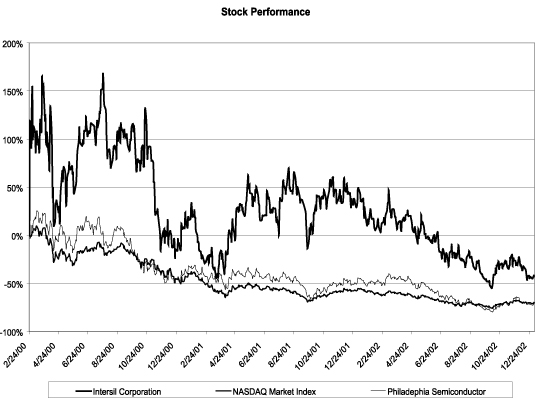

STOCK PERFORMANCE GRAPH

COMPARISON OF THREE QUARTER CUMULATIVE TOTAL RETURN

AMONG INTERSIL CORPORATION, THE NASDAQ COMPOSITE

AND THE PHILADELPHIA SEMICONDUCTOR INDEX

The following graph presents a comparison of the Company’s stock performance with that of the NASDAQ Market Index and the Philadelphia Semiconductor Index from February 24, 2000 through January 3, 2003.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND DIRECTORS AND OFFICERS

The following table sets forth information as of February 28, 2003 with respect to shares of each class of Common Stock beneficially owned by (i) each person or group that is known to the Company to be the beneficial owner of more than 5% of each class of outstanding Common Stock, (ii) each director and named executive officer of the Company and (iii) all directors and executive officers of the Company as a group. Unless otherwise specified, all shares are directly held. In general, each share of Class A Common Stock is convertible into one share of Class B Common Stock, and each share of Class B Common Stock is convertible into one share of Class A Common Stock. This table does not include shares of the Company’s Class A Common Stock issuable upon conversion of the warrants issued in connection with the 13.5% Subordinated Holding PIK Note.

Unless otherwise indicated, the address of each person owning more than 5% of the Company’s outstanding shares is c/o Intersil Corporation, 675 Trade Zone Blvd., Milpitas, CA 95035.

| | | Class A Common Stock(1)

| | | Class B Common Stock(2)

| | | Combined

| |

| | | Shares Owned

| | Percent(3)

| | | Shares Owned

| | Percent(3)

| | | Shares Owned

| | Percent(4)

| |

Sterling Holding Company, LLC (5) | | 1,571,500 | | 1.22 | % | | 7,786,719 | | 100 | % | | 9,358,219 | | 6.85 | % |

FMR Corp. (6) | | 9,935,244 | | 7.71 | % | | — | | — | | | 9,935,244 | | 7.27 | % |

Gregory L. Williams (7) | | 1,302,802 | | 1.01 | % | | — | | — | | | 1,302,802 | | * | |

Richard M. Beyer (8) | | 857,323 | | * | | | | | | | | 857,323 | | * | |

Daniel J. Heneghan (9) | | 392,783 | | * | | | — | | — | | | 392,783 | | * | |

Lawrence J. Ciaccia (10) | | 307,738 | | * | | | — | | — | | | 307,738 | | * | |

Rick E. Furtney (11) | | 162,682 | | * | | | — | | — | | | 162,682 | | * | |

Mohan Maheswaran (12) | | 197,504 | | * | | | — | | — | | | 197,504 | | * | |

Alden Chauvin (13) | | 315,327 | | * | | | — | | — | | | 315,327 | | * | |

James A. Urry (14) | | 47,024 | | * | | | — | | — | | | 47,024 | | * | |

Gary E. Gist (15) | | 57,825 | | * | | | — | | — | | | 57,825 | | * | |

Robert W. Conn (16) | | 22,500 | | * | | | — | | — | | | 22,500 | | * | |

Jan Peeters (16) | | 22,500 | | * | | | — | | — | | | 22,500 | | * | |

Robert N. Pokelwaldt (16) | | 22,500 | | * | | | — | | — | | | 22,500 | | * | |

James V. Diller (17) | | 1,216,599 | | * | | | | | | | | 1,216,599 | | * | |

All directors and executive officers

as a group (13 persons) | | 4,925,107 | | 3.82 | % | | — | | — | | | 4,925,107 | | 3.61 | % |

| * | | Represents less than 1% |

| (1) | | Does not include shares of Class A Common Stock issuable upon conversion of Class B Common Stock. A holder of Class B Common Stock may convert any or all of his shares into an equal number of shares of Class A Common Stock, provided that such conversion would be permitted only to the extent that the holder of shares to be converted would be permitted under applicable law to hold the total number of shares of Class A Common Stock which would be held after giving effect to the conversion. |

| (2) | | Does not include shares of Class B Common Stock issuable upon conversion of Class A Common Stock. A holder of Class A Common Stock may convert any or all of his shares into an equal number of shares of Class B Common Stock. |

| (3) | | Percentages are derived using the number of shares of Class A or Class B Common Stock and common stock outstanding as of February 28, 2003. |

| (4) | | Percentages are derived using the total number of shares of Class A and Class B Common Stock outstanding as of February 28, 2003. |

| (5) | | Citicorp Venture Capital Ltd. owns an interest in Sterling, but disclaims beneficial ownership of the shares reported herein. The address of Sterling Holding Company, LLC is c/o Citicorp Venture Capital Ltd., 399 Park Avenue, New York, NY 10022. |

18

| (6) | | Based solely on information obtained from a Schedule 13G amendment filed by FMR Corp. on January 10, 2003. The address of FMR Corp. is 82 Devonshire Street, Boston, MA 02109. |

| (7) | | Includes 1,006,862 shares owned by Gregory L. Williams and Linda M. Williams. Includes 21,798 shares owned by DLJSC, as Trustee for Gregory L. Williams IRA Account. Includes currently exercisable options to purchase 274,142 shares of our Class A Common Stock. |

| (8) | | Includes currently exercisable options to purchase 792,379 shares of Class A Common Stock. Includes 63,660 shares owned by the Richard and Nikki Beyer Family Trust. |

| (9) | | Includes 281,754 shares owned by the Heneghan Family Trust. Includes currently exercisable options to purchase 111,029 shares of Class A Common Stock. |

| (10) | | Includes 150,570 shares owned by Lawrence J. Ciaccia and Marcia R. Ciaccia, 66,668 shares owned by the Lawrence J. Ciaccia and Marcia R. Ciaccia Trust dated 1/20/00. Includes currently exercisable options to purchase 90,500 shares of Class A Common Stock. |

| (11) | | Includes currently exercisable options to purchase 66,500 shares of Class A Common Stock. |

| (12) | | Includes currently exercisable options to purchase 197,504 shares of Class A Common Stock. |

| (13) | | Includes 20,102 shares owned by the Chauvin Family Trust. Includes currently exercisable options to purchase 271,884 shares of Class A Common Stock. Does not include 68 shares owned by the Mark Chauvin IRA Account, 68 shares owned by the Amy Chauvin IRA Account, 68 shares owned by the Kristin Chauvin IRA Account and 68 shares owned by the Scott Chauvin IRA Account for which Mr. Chauvin disclaims beneficial ownership. |

| (14) | | James A. Urry, a director of Intersil Holding Company, is affiliated with Sterling in the capacities described under “Election of directors — Nominees” and footnote 5 above. Mr. Urry disclaims beneficial ownership of all shares held by Sterling, which he may be deemed to beneficially own as a result of his affiliation with Sterling, except for those shares reported for Mr. Urry. Includes currently exercisable options to purchase 15,000 shares of Class A Common Stock. |

| (15) | | Includes 42,825 shares owned by the Gist Family Living Trust. Includes currently exercisable options to purchase 15,000 shares of Class A Common Stock. |

| (16) | | Includes currently exercisable options to purchase 22,500 shares of Class A Common Stock. |

| (17) | | Includes 344,075 shares owned by the James V. Diller & June P. Diller Trust. Includes currently exercisable options to purchase 872,524 shares of Class A Common Stock. |

19

EXECUTIVE OFFICERS AND KEY EMPLOYEES

The executive officers and key employees of the Company are as follows:

Richard M. Beyer, President, Chief Executive Officer, Director. Mr. Beyer is described above as a nominee for director.

Daniel J. Heneghan, Vice President, Chief Financial Officer and Assistant Secretary. From 1996 to August 1999, Mr. Heneghan was Vice President and Controller of the semiconductor business at Harris Corporation. From 1994 to 1996, Mr. Heneghan was Vice President and General Manager of Digital Products in the semiconductor business at Harris. Mr. Heneghan also served at various times as Division Controller of the semiconductor business, Director of Planning and Director of Finance at Harris. Age: 47

Lawrence J. Ciaccia, Vice President, General Manager, Wireless Networking. From February 1998 to August 1999, Mr. Ciaccia was Vice President and Director of Engineering for the PRISM® Wireless Products business at Harris. From 1997 to 1998, Mr. Ciaccia was Director of Strategic and Product Marketing for the Multimedia Products business at Harris. Mr. Ciaccia also served at various times from 1993 to 1997 as Director of Engineering for several different semiconductor businesses at Harris. Age: 44

Rick E. Furtney, Vice President, General Manager, Analog. From 1999 until July 2000, Mr. Furtney was Vice President for Power Management products. From 1997 until 1999, Mr. Furtney was Director of Marketing for Harris. From 1985 through 1997, Mr. Furtney held numerous management positions in engineering and marketing at Harris. Age: 43

Mohan R. Maheswaran, Vice President, General Manager, Elantec Product Group. From June 2001 to May 2002, Mr. Maheswaran was Vice President of Marketing and Business Development for Elantec Inc. From January 2001 to June 2001, Mr. Maheswaran was Vice President of Business Development for Elantec Inc. From January 2000 to December 2000 Mr. Maheswaran served as Vice President of Marketing and Business Development for Allayer Communications, a communications chip startup, which was acquired by Broadcom in November 2000. From November 1997 to October 1999 Mr. Maheswaran served as Vice President of strategy for IBM Microelectronics. From January 1988 to October 1997 Mr. Maheswaran served in a number of different marketing, applications and engineering related positions at Texas Instruments. Prior to this Mr. Maheswaran also worked in a number of different design and program management positions for Hewlett Packard and Nortel Communications. Age: 39

Alden Chauvin, Vice President, Worldwide Sales. Mr. Chauvin was most recently Vice President of Worldwide Sales for Elantec Semiconductor, Inc., prior to Intersil’s acquisition of Elantec in May, 2002. Previously, Mr. Chauvin has held various North American and Worldwide sales vice-presidencies with Tritech Microelectronics, based in Singapore, and Sierra Semiconductor Corporation (now PMC-Sierra). His professional experience also includes various sales and marketing management positions that span a 17-year period at Texas Instruments, Inc. Age: 57

20

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The rules of the Securities and Exchange Commission require the Company to disclose late filings of stock transaction reports by its executive officers and Directors. Based solely on a review of reports filed by the Company on these individuals’ behalf and written representations from them that no other reports were required, all Section 16(a) filing requirements have been met during the 53 weeks ended January 3, 2003, except that Alden Chauvin was late reporting one sale of common stock which was reported on his Form 5.

EMPLOYMENT AGREEMENTS

Intersil Corporation entered into an employment agreement with Mr. Beyer for him to serve as the Company’s President and Chief Executive Officer and a member of the Board of Directors. His employment agreement provides for an annual base salary of $550,000, subject to increases and annual performance bonuses at the discretion of the Compensation Committee of the Board of Directors. The agreement also provides for Mr. Beyer to receive the Company’s standard benefits. The term of the agreement extends until December 31, 2004, subject to automatic renewal for successive one year terms, unless either the Company or Mr. Beyer gives prior notice of non-renewal. Mr. Beyer is subject to a non-competition covenant during the term of his agreement and for a period of one year following termination or expiration of the agreement. In the event the Company terminates Mr. Beyer’s employment for any reason other than for cause, death or disability, or if Mr. Beyer terminates his employment because of an adverse change in his compensation, title, duties or location of employment, or status as a director, Mr. Beyer will receive severance benefits that include the payment of a lump sum equal to twelve months of his then current base salary and a prorated portion of his target bonus and full vesting of options and restricted stock granted prior to the merger of Elantec Semiconductor, Inc. and Intersil and any new grants of options by Intersil (with only one year of vesting for new Intersil stock option grants in the case of death or disability). Mr. Beyer will also receive upon a change in control of Intersil a lump sum severance payment equal to 12 months of his current base salary plus a target bonus equal to 100% of his base salary and vesting of options and restricted stock, along with a reimbursement by Intersil to Mr. Beyer of any excise taxes owed by Mr. Beyer upon termination as described above following such change of control.

Intersil Corporation entered into an employment agreement with Mr. Williams for him to serve as the Executive Chairman of the Board of Directors of the Company. His employment agreement provides for an annual base salary of $550,000. The agreement also provides for Mr. Williams to receive the Company’s standard benefits. The term of the agreement extends until May 10, 2004. Mr. Williams is subject to a non-competition covenant during the term of his agreement and for a period of one year following termination or expiration of the agreement. In the event the Company terminates Mr. Williams’ status as a director for any reason other than for cause, death or disability, Mr. Williams will receive severance benefits that include the payment of a lump sum equal to his base salary and full vesting of options (with only one year of vesting for new Intersil stock option grants in the case of death or disability). Mr. Williams is entitled to terminate his status as a director at any time upon thirty days advance written notice to the Company, at which time he will be entitled to receive all base salary earned and accrued to that date. Mr. Williams will receive upon a change in control of Intersil a lump sum severance payment equal to three times his then-current base salary, if his employment with the Company is terminated in connection with such change of control or if he resigns within 90 days after such change of control. If Mr. Williams resigns within thirty days of a demotion that occurs in connection with a significant acquisition or business combination by Intersil, he will receive an amount equal to three times his then-current base salary.

Intersil Corporation entered into an employment agreement with Mr. Heneghan for him to serve as Intersil’s vice president and chief financial officer. His employment agreement provides for an annual base salary of $300,000, subject to increases and annual performance bonuses at the discretion of the Compensation Committee of their Board of Directors, and reimbursement for reasonable business expenses, legal expenses and tax and estate planning expenses. The agreement also provides for Mr. Heneghan to receive the Company’s standard

21