SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under 240.14a-12

INTERSIL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

DEAR INTERSIL SHAREHOLDER:

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Intersil Corporation (“Intersil” or the “Company”), which will be held at 8:00 a.m. Pacific Time on Wednesday, May 10, 2006 at the Company’s headquarters located at 1001 Murphy Ranch Road, Milpitas, California 95035. At this meeting you will be asked to vote on several proposals recommended unanimously by the Board of Directors. In this letter, I am highlighting the importance of Proposal 3 — our 1999 Equity Compensation Plan proposal.

This year we are requesting that you authorize an additional 11.0 million shares (7.8% of our total shares outstanding) for granting under our 1999 Equity Compensation Plan. Intersil is one of the few companies in the semiconductor industry which has begun to tie the distribution of certain stock awards to executives to the financial performance of the Company relative to our peers. As a result, a portion of the 11.0 million shares will only be distributed to executives if Company performance meets financial targets established by the Board of Directors. Also to ensure that our Equity Compensation Plan is used to create and maintain an alignment of interests between shareholders and senior executives, in 2003 the Company established minimum stock “ownership” requirements for senior executives.

Competition for recruiting and retaining outstanding talent necessary to execute our business plans successfully has been fierce over the past several years. However, Intersil has developed a combination of compensation and equity plans which has allowed us to assemble one of the most experienced, talented teams of individuals and management in our industry and over this period our dilution and overhang rate have been more favorable than our peers in the semiconductor sector. Intersil remains committed to continue our management of this dilution while delivering strong revenue and earnings growth relative to our peers.

Our ability to increase shareholder value is heavily dependent upon our ability to retain critical employees as well as attract new employees to support growth. In 2005, Intersil outperformed our peers in several key financial metrics. We have set the stage for continued growth which will require Intersil to add critical talent to our workforce. The ability to attract and retrain technical talent is partially dependent upon the Company offering a competitive compensation and equity package of which stock options are a key component.

Intersil’s Equity Compensation Plan is essential to our future success. It is vital that we continue to utilize stock options to motivate our engineering, operations and sales teams to design, manufacture and sell the high performance analog products that will continue to position Intersil as one of the most successful analog companies.

Our stock option program is focused on rewarding key technical employees and other top performers throughout the organization. We have a philosophy of differentiating the distribution of stock options based on performance, thus ensuring there is a connection between stock option grants and returning shareholder value.

Our Board of Directors and I strongly encourage you to vote to ratify and approve our option program. We look forward to maintaining a workforce which has the competencies necessary to continue to compete successfully in the semiconductor industry.

| | |

Richard M. Beyer | | Milpitas, California |

| Chief Executive Officer and Director | | March 30, 2006 |

YOUR VOTE IS IMPORTANT

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or by mailing a proxy card. Voting will ensure your representation at the Annual Meeting if you do not attend in person. Please review the instructions on the proxy card concerning each of these voting options. Should you receive more than one proxy, please be sure to sign and return each proxy to ensure that all your shares will be voted. If your shares are held of record by a broker, bank, or other nominee, you will not be able to vote in person at the Annual Meeting unless you first obtain a proxy issued in your name from the record holder.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 10, 2006

The Annual Meeting of Shareholders (the “Annual Meeting”) of Intersil Corporation (the “Company”) will be held at the Company’s Headquarters, located at 1001 Murphy Ranch Road, Milpitas, California 95035, on Wednesday, May 10, 2006 at 8:00 a.m. PDT for the following purposes:

| | 1. | To elect nine directors to serve on the Company’s Board of Directors until the next annual meeting of shareholders, or until their successors are duly elected and qualified. |

| | 2. | To ratify the appointment of KPMG LLP as the Company’s independent, registered certified public accountants. |

| | 3. | To increase the number of shares authorized for issuance under the 1999 Equity Compensation Plan from 25,250,000 to 36,250,000. |

| | 4. | To transact any other business that may properly come before the Annual Meeting. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Whether or not you plan to attend the Annual Meeting, please complete, sign, date and return the enclosed proxy promptly in the accompanying reply envelope.

You are entitled to vote if you were a shareholder at the close of business on Friday, March 17, 2006.

| | |

| By Order of the Board of Directors | | |

| |

Thomas C. Tokos Vice President, General Counsel and Secretary | | Milpitas, California March 30, 2006 |

Admittance to the meeting will be limited to shareholders eligible to vote or their authorized representative(s). Beneficial owners holding shares through an intermediary such as a bank or broker will be admitted only upon proof of ownership.

INTERSIL CORPORATION

1001 MURPHY RANCH ROAD

MILPITAS, CA 95035

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are being mailed, beginning on or about April 5, 2006, to owners of shares of Intersil Corporation (“Intersil” or the “Company”) Class A Common Stock in connection with the solicitation of proxies by the Board of Directors for the 2006 Annual Meeting of Shareholders. This proxy procedure is necessary to permit all Class A Common Stock shareholders, many of whom live throughout the United States and in foreign countries and are unable to attend the Annual Meeting, to vote. The Board of Directors encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

CONTENTS

VOTING PROCEDURES

Your vote is very important. Your shares can only be voted at the Annual Meeting if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to assure that your shares will be represented. Most shareholders have a choice of voting by means of the Internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you. Please be aware that if you vote over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible. Also note that proxies submitted by telephone or the Internet must be received by 12:00 midnight, EDT, on Tuesday, May 9, 2006.

You may revoke your proxy at any time before it is voted at the Annual Meeting by (a) giving written notice to the Secretary of the Company, (b) submitting a proxy bearing a later date, or (c) casting a ballot at the Annual Meeting. Properly executed proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided. If no directions are given, your shares will be voted by one of the individuals named on your proxy card as recommended by the Board of Directors. If you wish to give a proxy to someone other than those named on the proxy card, you should cross out those names and insert the name(s) of the person(s), not more than three, to whom you wish to give your proxy.

Who can vote? Shareholders of record as of the close of business on March 17, 2006 are entitled to vote. On that day, 141,287,789 shares of Class A Common Stock were outstanding and eligible to vote. A list of shareholders eligible to vote will be available at the headquarters of Intersil Corporation, located at 1001 Murphy Ranch Road, Milpitas, CA, 95035, beginning April 24, 2006. Shareholders may examine this list during normal business hours for any purpose relating to the Annual Meeting.

How does the board recommend I vote? The board recommends a vote FOR each board nominee (Item 1), FOR the ratification of the Board of Directors’ appointment of KPMG LLP as the independent, registered certified public accountants of the Company for the upcoming year (Item 2), and FOR the increase in the number of shares authorized for issuance under the 1999 Equity Compensation Plan (Item 3).

What shares are included in the proxy card? The proxy card represents all the shares of Class A Common Stock registered to your account. Each share is entitled to one vote on each matter presented at the Annual Meeting other than in the election of directors. The Company’s Amended and Restated Certificate of Incorporation provides for cumulative voting for directors. With cumulative voting, at each election of directors, each holder of Class A Common Stock is entitled to as many votes as would equal the number of shares he or she holds, multiplied by the number of directors to be elected.The holder may cast all of his or her votes for a single candidate or may distribute them among any number of candidates.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of common stock entitled to vote, is represented. Broker non-votes, votes withheld and abstentions will be counted for purposes of determining whether a quorum has been reached. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners by the tenth day before the Annual Meeting, the nominees may vote those shares only on matters deemed routine by the National Association of Securities Dealers and the NASDAQ Stock Market, such as the election of directors and ratification of the appointment of independent accountants. On non-routine matters, nominees cannot vote and there is a so-called “broker non-vote” on that matter. Since Item 3 is considered a non-routine matter, broker non-votes have no effect on the outcome of that proposal. Abstentions are counted in tabulations of the votes cast by stockholders on the proposals and will have the effect of a negative vote. Directors are elected by a plurality of the votes cast, and thus, votes withheld from some or all nominees for Director could have an effect on the outcome of the election.

Who will count the vote? The Company’s transfer agent, American Stock Transfer & Trust Company, will tally the vote, which will be certified by an Inspector of Elections.

1

Is my vote confidential? Proxies, ballots and voting tabulations are available for examination only by the Inspector of Elections and tabulators. Your vote will not be disclosed to the Board of Directors or to our management other than the Inspector of Elections and except as may be required by law.

Who is soliciting this proxy? Solicitation of proxies is made on behalf of the Company and its Board of Directors, and the Company will pay the expense of soliciting proxies to be voted at the Annual Meeting. Such costs are estimated at $75,000. The Company and/or its agents, in person or by mail, telephone ortelegram, may also solicit proxies. The Company has hired a proxy solicitation firm, Mellon, to assist with the soliciting of proxies. Following the initial mailing of the proxies and other soliciting materials, the Company will request brokers, custodians, nominees and other record holders to forward copies of the proxies and other soliciting materials to persons for whom they hold shares of Class A Common Stock and to request authority for the exercise of proxies. In such cases, the Company, upon the request of the record shareholders, will reimburse such holders for their reasonable expenses.

CORPORATE GOVERNANCE

In accordance with Delaware General Corporation Law and the Company’s Amended and Restated Certificate of Incorporation and Restated Bylaws, the Company’s business, property and affairs are managed under the direction of the Board of Directors. Although directors are not involved in the day-to-day operating details, they are kept informed of the Company’s business through written reports and documents provided to them regularly, as well as by operating, financial and other reports presented by the Chairman and officers of the Company at meetings of the Board of Directors and committees of the Board of Directors.

Meetings of the Board and its Committees. The Board of Directors met seven (7) times and acted by unanimous written consent four (4) times during fiscal year 2005. Each of the incumbent directors attended at least 75% of the total number of meetings of the Board of Directors and of the committees of the Board on which he or she served, with the exception of Robert Pokelwaldt who attended 64% of the Audit Committee meetings.

Attendance at the Annual Meeting. The Company strongly encourages each of its directors to attend its Annual Meeting of Shareholders. Last year, each of the incumbent directors attended the Annual Meeting of Shareholders.

Director Independence. The Board of Directors has determined that the following directors are independent under the listing standards of the National Association of Securities Dealers (the “NASD”): Ms. Johnson, Dr. Conn, and Messrs. Diller, Gist, Lang, Peeters, Pokelwaldt and Urry.

Committees of the Board. The Board of Directors has established three standing committees.

Audit Committee — maintains the sole responsibility to appoint, determine funding for, and oversee theindependence and performance of the Company’s independent accountants and has the authority to engage counsel and other advisors to assist in such responsibility. In addition, the Audit Committee monitors the integrity of our financial statements and compliance with laws and regulations related to our financial statements and has the responsibility to establish procedures for the receipt and treatment of complaints regarding our financial statements, internal accounting controls or other related auditing matters. The Board of Directors of the Company has adopted a written charter for the Audit Committee, which is publicly available on the Company’s website at http://www.intersil.com/Corporate_Governance/Intersil_Audit_Committee.pdf. The Audit Committee held fourteen (14) meetings and acted by unanimous written consent two (2) times in fiscal year 2005. The members of the Audit Committee during this period were Gary E. Gist, Mercedes Johnson, Jan Peeters and Robert N. Pokelwaldt. The Board of Directors has determined that each of the members of the Audit Committee is independent under the listing standards of the NASD and as that term is used in Section 10A(m)(3) of the Securities Act of 1934, as amended. The Board of Directors has determined that Mssrs. Peeters, Pokelwaldt, Gist and Ms. Johnson all qualify as the audit committee “financial expert” as that term is defined by applicable securities laws and

2

SEC regulations, and has designated both Mssrs. Peeters and Pokelwaldt as the Audit Committee’s financial experts.

Compensation Committee — reviews and approves salary and other compensation of executive officers and administers certain benefit plans and compensation of the Board of Directors. The Compensation Committee also has the authority to administer, grant and make awards under the Company’s equity compensation plan. A copy of the Compensation Committee’s written charter is publicly available on the Company’s website at http://www.intersil.com/Corporate_Governance/Intersil_Compensation_Committee.pdf. The Compensation Committee held twelve (12) meetings and acted by unanimous written consent seven (7) times in fiscal year 2005. The members of the Compensation Committee during this period were Dr. Robert W. Conn, Gary E. Gist and James A. Urry. The Board of Directors has determined that each of the members of the Compensation Committee is independent under the listing standards of the NASD, and each member is an “outside director” within the meaning of the Treasury Regulations promulgated under Section 162m of the Internal Revenue Code, as amended.

Nominating and Governance Committee — identifies, reviews, evaluates and recommends potential candidates to serve as Chairman of the Board and directors of the Company and members of Board committees and monitors, evaluates and recommends guidelines for the Company’s corporate governance practices. In addition, the Nominating and Governance Committee serves as a focal point for communication between such candidates, our Directors who are not members of the Nominating and Governance Committee, and our management. A copy of the Nominating and Governance Committee’s written charter is publicly available on the Company’s website at http://www.intersil.com/Corporate_Governance/Intersil_N&G_Committee.pdf. The Nominating and Governance Committee held five (5) meetings and took no action by unanimous written consent in fiscal year 2005. The current members of the Nominating and Governance Committee are Dr. Robert W. Conn, James V. Diller, Jan Peeters, Robert N. Pokelwaldt and James A. Urry. The Board of Directors has determined that each of the members of the Nominating and Governance Committee is independent under the listing standards of the NASD.

Shareholder Communications. Shareholders and other parties interested in communicating directly with any of the individuals who are directors of the Company or the Board of Directors as a group may do so by writing to Investor Relations, Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, California 95035. The Company’s policy is to deliver such communications directly to the Board of Directors.

Director Compensation and Other Certain Relationships and Related Transactions. Directors who are also officers of the Company do not receive compensation for their services as directors. The Chairman of the Board, receives cash compensation in the amount of $75,000 per year paid in quarterly installments of $18,750. All other directors, except for Mr. Urry, received cash compensation in the amount of $45,000 per year paid in quarterly installments of $11,250, except for members of the Audit Committee who receive an additional cash retainer of $5,000 annually ($1,250 quarterly) and the Audit Committee Chairman who receives an additional cash retainer of $15,000 annually ($3,750 quarterly). In the case of Mr. Urry, an employee of Citigroup, cash compensation payable for Board and committee memberships was paid directly to Citigroup Venture Capital Ltd. prior to 2006. Directors are required to own a certain minimum number of ISIL shares to enhance the alignment of interests between shareholders and directors. In fiscal year 2005, the ownership requirement was two times the annual retainer, which must be attained within a five-year period. All directors who are not employees of the Company receive non-cash compensation of a one-time appointment grant of options to purchase 25,000 shares of our Class A Common Stock and 4,000 deferred stock units (“DSUs”). Such directors elected at the last annual meeting also receive an annual grant of options to purchase 15,000 shares of our Class A Common Stock and 4,000 DSUs, and each of them received a grant of options to purchase 15,000 shares and 4,000 DSUs in fiscal year 2005. All directors who held seats on Intersil’s Board for at least three years received an additional 4,000 DSUs in fiscal year 2005. Additionally, all directors are reimbursed for travel and other expenses incurred in attending meetings of the Board of Directors or its committees.

Submission of Director Nominations. The Nominating and Governance Committee will consider director nominees submitted by shareholders to the Board of Directors in accordance with the procedures

3

set forth in the Company’s Restated Bylaws. Those procedures require a shareholder to deliver notice to the Company’s Secretary or Assistant Secretary at the principal executive offices of the Company not less than 60 nor more than 90 days prior to the first anniversary of the preceding year’s Annual Meeting of Shareholders, except that in the case where the size of the Board of Directors is increased without public notice, such notice shall be considered timely if made no later than the close of business on the tenth day following the public announcement of such by the Company. Such notice must be in writing and must include (i) the name and address of the nominating shareholder, as they appear on the Company’s books, (ii) the class and number of shares of the Company’s stock which are owned beneficially and of record by the nominating shareholder, (iii) the nominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected, and (iv) any information regarding the nominee that is required under Regulation 14A of the Securities Exchange Act of 1934 to be included in a proxy statement relating to the election of directors. Candidates recommended by the shareholders of the Company are evaluated on the same basis as other candidates (other than directors standing for re-election) recommended by the Company’s directors, officers, third party search firms or other sources.

Among the minimum qualifications, skills, and attributes that the Nominating and GovernanceCommittee looks for in nominees are the following: (a) integrity, competence, and judgment essential to effective decision making, (b) ability and willingness to commit the necessary time and energy to prepare for, attend, and participate in meetings of the Board and one or more of its standing committees, (c) freedom from other outside involvements that would materially interfere with the individual’s responsibilities as a director of the Company, (d) background and experience that complements or supplements the background and experience of other Board members, (e) freedom from interests that would present the appearance of being adverse to, or in conflict with, the interests of the Company, and (f) a proven record of accomplishment through demonstrated leadership in business, education, government service, finance, manufacturing or other relevant experiences that would tend to enhance Board effectiveness.

The evaluation process may include a comprehensive background and reference check, a series of personal interviews with the Board and the Chairman of the Nominating and Governance Committee or designated members of the Board, and a thorough review by the Committee of the nominee’s qualifications and other relevant characteristics, taking into consideration the criteria set forth above. If the Committee determines that a candidate should be nominated for election to the Board, it will present its findings and recommendation to the full Board for approval.

4

ELECTION OF DIRECTORS

ITEM 1 ON PROXY CARD

The Company’s directors are elected at each annual meeting and hold office until the next election. The Company’s Amended and Restated Certificate of Incorporation, and the Restated Bylaws of the Company, allow for a Board of Directors of not fewer than five and not more than eleven members. On February 7, 2006, the Board of Directors voted to increase the size of the Board from eight members to nine members and elected Mr. Gregory Lang to the Board. Therefore, the Board of Directors currently consists of nine directors.

Director candidates are nominated by the Board of Directors upon the recommendation of the Nominating and Governance Committee. The Nominating and Governance Committee has recommended the nine nominees below, each of whom is currently a director of the Company. Shareholders are also entitled to nominate director candidates for the Board of Directors in accordance with the procedures set forth on page 3 under the heading “Submission of Director Nominations.”

The person named on the accompanying form of proxy will vote the shares FOR the nominees, unless you instruct otherwise. Each nominee has consented to stand for election and the Board does not anticipate that any nominee will be unavailable to serve. In the event that one or more of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for the remaining nominees and any substitute nominee(s) designated by the Board. Shareholders may cumulate their votes for directors, and the director elections are then determined by a plurality of the votes cast.

The following biographies provide a brief description of each nominee’s principal occupation and business experience, age (as of March 17, 2006) and directorships held in other public corporations.

| | |

Nominees | | Positions and Offices held with the Company |

| |

Richard M. Beyer | | Chief Executive Officer and Director |

Robert W. Conn | | Director |

James V. Diller | | Director |

Gary E. Gist | | Chairman of the Board |

Mercedes Johnson | | Director |

Gregory Lang | | Director |

Jan Peeters | | Director |

Robert N. Pokelwaldt | | Director |

James A. Urry | | Director |

BUSINESS EXPERIENCE OF DIRECTORS

Richard M. Beyer, Chief Executive Officer and Director. Mr. Beyer is the Chief Executive Officer and Director of Intersil Corporation. Following the acquisition of Elantec Semiconductor, Inc. on May 14, 2002 and until January 25, 2006, Mr. Beyer was the President, Chief Executive Officer and director of Intersil Corporation. From July 2000 to May 2002, Mr. Beyer was President, Chief Executive Officer and director of Elantec Semiconductor. Mr. Beyer has served on the Board of Directors of Credence Systems Corp. since late 2003, and is also on the board of directors of a privately-held company. Age: 57

Robert W. Conn, Director. Dr. Conn has been one of the Company’s directors since April 2000. Dr. Conn has been Managing Director of Enterprise Partners Venture Capital since July 2002. From 1994 to July 2002, Dr. Conn was the Dean of the Jacobs School of Engineering, University of California, San Diego, and the Walter J. Zable Endowed Chair in Engineering. Dr. Conn served on the Board of Directors of ChipPAC, Inc. from 2002 through 2004, and is currently on the Board of Directors of STATS ChipPAC, Inc. Presently, he is a member of the National Academy of Engineering and also serves on the Board of Directors of several privately-held companies. Age: 63

5

James V. Diller, Director. Mr. Diller has been one of the Company’s directors since May 2002. Mr. Diller is a retired Chairman of the Board of Elantec Semiconductor, Inc., a post he held from 1997 to May 2002. Mr. Diller served as a director of Elantec Semiconductor, Inc. beginning in 1986. From November 1998 to July 2000, he served as Elantec’s President and Chief Executive Officer. Mr. Diller is a founder of PMC-Sierra, Inc. and was its President and Chief Executive Officer from 1983 to 1997; he is currently Vice Chairman of the Board of Directors. Mr. Diller has been a director of Sierra Wireless, Inc., a provider of wireless data communications hardware and software products since 1993. In addition, Mr. Diller is Chairman of the Board of a privately-held company. Age: 70

Gary E. Gist, Director. Mr. Gist has been the Company’s Chairman of the Board since May 2005. Prior to this Mr. Gist served as a director since the Company’s inception in August 1999. From 1995 to 2005, Mr. Gist has served as the President and Chief Executive Officer of a privately-held company that focuses on designing and manufacturing electronic products. Age: 59

Mercedes Johnson, Director. Ms. Johnson has been one of the Company’s Directors since August 2005. Ms. Johnson holds the position of Senior Vice President of Finance and Chief Financial Officer at Avago Technologies. Prior to Avago, Ms. Johnson worked for Lam Research Corporation, serving as its Senior Vice President of Finance from June 2004 to January 2005, and as its Chief Financial Officer from May 1997 to June 2004. Ms. Johnson has served on Micron’s Board of Directors since June 2005. She also served on the Board of Directors for Storage Technology Corporation from January 2004 to August 2005. Age: 52

Gregory Lang, Director. Mr. Lang has been one of the Company’s Directors since February 2006. Mr. Lang is president and Chief Executive Officer of Integrated Device Technology Inc. (“IDT”), a leading supplier of preemptive semiconductor solutions that accelerate packet processing for advanced network services. Mr. Lang joined IDT as president in October 2001, was appointed Chief Executive Officer in January 2003 and elected to the IDT Board of Directors in September 2003. Prior to joining IDT, Mr. Lang held the position of vice president and general manager of Intel’s platform networking group. Previously he managed Intel’s industry leading Ethernet, storage I/O processing, home networking and broadband businesses. Age: 42

Jan Peeters, Director. Mr. Peeters has been one of the Company’s directors since April 2000. Mr. Peeters is Chairman and Chief Executive Officer of Olameter Inc., a meter asset and data management company, which he formed in 1998. Mr. Peeters served on the Board of Directors of Call-Net, a publicly-traded Canadian telecommunications company, from 1999 to 2002. He presently serves as Chairman of Cogeco Inc. and Cogeco Cable Inc., publicly-traded Canadian companies in the areas of broadcasting and cable. He has been a Governor of McGill University since 1999. Age: 54

Robert N. Pokelwaldt, Director. Mr. Pokelwaldt has been one of the Company’s directors since April 2000. Mr. Pokelwaldt was previously Chairman and Chief Executive Officer of YORK International Corporation. He retired from the Board of Directors of Carpenter Tech in May 2004 and presently serves on the Board of Directors of Mohawk Industries, Inc. and First Energy, Inc. Age: 69

James A. Urry, Director. Mr. Urry has been one of the Company’s directors since the Company’s inception in August 1999. Mr. Urry is a Partner at Citigroup Venture Capital Ltd., where he has worked since 1989. Mr. Urry serves on the Board of Directors of AMI Semiconductor. Age: 52

The Board of Directors recommends a vote FOR each of the nominees listed.

6

RATIFICATION OF APPOINTMENT OF

INDEPENDENT, REGISTERED CERTIFIED PUBLIC ACCOUNTANTS

ITEM 2 ON PROXY CARD

The Board of Directors, acting upon the recommendation of the Audit Committee, asks that the shareholders ratify the selection of KPMG LLP as the Company’s independent, registered certified public accountants to audit and report upon the financial statements of the Company for the 2006 fiscal year. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting, in person or by proxy, and voting thereon. Unless otherwise specified by the shareholders, the shares of stock represented by the proxy will be voted FOR ratification of the appointment of KPMG LLP as the Company’s independent accountants.

Change in Accountants during Fiscal Year 2006

The Audit Committee of the Board of Directors (“Audit Committee”) of the Company decided in February of 2006 that, in accordance with sound corporate governance practices, it would issue a request for proposal (the “RFP”) with regard to the audit engagement of the Company. Ernst & Young LLP had been the Company’s independent registered public accounting firm since the inception of the Company in 1999. The Audit Committee decided to issue the RFP because it wanted the opportunity to review other auditing firms as prospective independent auditors for the Company and to consider the benefits and detriments of changing independent auditors. This decision was not related to the quality of services provided by Ernst & Young LLP. The RFP was issued to six large public accounting firms, including Ernst & Young LLP, in February 2006. Effective March 15, 2006, the Audit Committee unanimously approved the dismissal of Ernst & Young LLP as the Company’s independent registered public accounting firm and the appointment of KPMG LLP as the Company’s independent registered public accounting firm.

Ernst & Young LLP’s reports on the financial statements of the Company for fiscal years 2005 and 2004 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. Further, in connection with the audits of the Company’s financial statements for each of the two fiscal years ended December 30, 2005 and December 31, 2004, and the subsequent interim period through March 15, 2006, which was the date of dismissal of Ernst & Young LLP, there were no disagreements between the Company and Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which were not resolved to the satisfaction of Ernst & Young LLP.

During the Company’s two most recent fiscal years and the subsequent interim period though March 15, 2006, neither the Company nor anyone on its behalf consulted with KPMG LLP regarding (i) an audit opinion of the Company’s financial statements; (ii) the application of accounting principles to a specific transaction; or (iii) any matter that was either the subject of a disagreement or a reportable event, as those terms are defined in Item 304(a)(1)(iv) and (v) of Regulation S-K.

In the event the shareholders fail to ratify the appointment, the Board of Directors will reconsider its selection. Even if the selection is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Board of Directors determines that such a change would be in the best interests of the Company and its shareholders.

One or more representatives of KPMG LLP are expected to be at the Annual Meeting. They will have an opportunity to make a statement and will be available to respond to appropriate questions.

The Board of Directors recommends that the shareholders vote FOR the ratification of the selection of KPMG LLP to serve as the Company’s independent, registered certified public accountants for the 2006 fiscal year.

7

INCREASE IN SHARES AVAILABLE UNDER THE

1999 EQUITY COMPENSATION PLAN

ITEM 3 ON PROXY CARD

The Company’s 1999 Equity Compensation Plan, as amended (the “1999 Equity Plan”), was approved by the Board of Directors and by the shareholders of the Company in 1999, with a total of 7,500,000 shares of Common Stock initially reserved for issuance under the 1999 Equity Plan. The number of shares of Common Stock reserved for issuance under the 1999 Equity Plan was increased from 22,250,000 to 25,250,000 in 2005. Subject to shareholder approval, the Compensation Committee of the Board of Directors has approved an increase in the number of shares authorized for issuance under the 1999 Equity Plan from 25,250,000 to 36,250,000. A summary description of the 1999 Equity Plan is attached to this proxy statement as Exhibit A. This summary is qualified in its entirety by the full text of the 1999 Equity Plan, a copy of which is attached to this proxy statement as Exhibit B.

As of March 1, 2006, options to purchase 20,056,129 shares of Common Stock (net of cancelled or forfeited options) had been granted under the 1999 Equity Plan, and 5,193,871 shares remained available for future grants. However, the Company believes that the remaining shares may be utilized during the next year for annual grants, grants to new hires and grants made pursuant to acquisitions. The closing price of the Common Stock on March 1, 2006 was $29.59. Presented below is a three-year year history of grants issued under the 1999 Equity Plan:

| | | | | | |

| | | Historical Run Rate (Shares in Thousands) |

| | | Year Ended |

| | | January 2,

2004 | | December 31,

2004 | | December 30,

2005 |

| | | (Fiscal ’03) | | (Fiscal ’04) | | (Fiscal ’05) |

Options Granted from 1999 Equity Plan | | 3,572 | | 4,556 | | 4,805 |

Acquisition Options (Granted in Exchange for Options

of Acquired Companies) | | — | | 6,283 | | — |

| | | | | | |

Total Options Granted | | 3,572 | | 10,839 | | 4,805 |

Deferred Stock Units (DSUs) Granted | | 133 | | 192 | | 101 |

| | | | | | |

Total Options and DSUs Granted | | 3,705 | | 11,031 | | 4,906 |

| | | | | | |

Run Rate, Excluding Acquisition Options | | 2.7% | | 3.3% | | 3.5% |

Cancellations | | 2,526 | | 2,054 | | 2,421 |

Run Rate (Net of Cancellations), Excluding Acquisition Options | | 0.8% | | 1.7% | | 1.7% |

| | | |

Total Shares Outstanding | | 139,331 | | 144,927 | | 141,051 |

The Board of Directors believes that this increase will strengthen the Company’s ability to attract and retain individuals with the desired training, experience and expertise in a highly competitive market. The Board of Directors also believes that this increase will allow the Company to furnish additional incentives to its employees to promote the Company’s financial success and motivate them to increase shareholder value. Accordingly, the Board of Directors believes that this proposed increase in the number of shares authorized for issuance under the 1999 Equity Plan is in the best interest of the Company.

The Board of Directors recommends a vote FOR an increase in the number of shares authorized for issuance under the 1999 Equity Plan.

8

SUBMISSION OF SHAREHOLDER PROPOSALS AND

DIRECTOR NOMINATIONS

The next shareholder meeting will be held on or about May 9, 2007. Shareholders wishing to have a proposal included in the Board of Directors’ 2007 Proxy Statement must submit the proposal so that the Secretary of the Company receives it no later than December 6, 2006, 120 days prior to the first anniversary of the date this proxy statement was released to shareholders. The Securities and Exchange Commission rules set forth standards as to what shareholder proposals are required to be included in a proxy statement.

For any proposal that is not submitted for inclusion in next year’s proxy statement (as described above) but is instead sought to be presented directly at next year’s annual meeting, Securities and Exchange Commission rules permit management to vote proxies in its discretion if (a) the Company receives notice of the proposal before the close of business on February 19, 2007 and advises stockholders in next year’s proxy statement about the nature of the matter and how management intends to vote on such matter, or (b) the Company does not receive notice of the proposal prior to the close of business on February 19, 2007. Notices of intention to present proposals at the 2007 Annual Meeting should be addressed to the Vice President, Secretary and General Counsel of Intersil Corporation.

AUDIT COMMITTEE

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

ON THE FINANCIAL STATEMENTS OF THE COMPANY

AND THE INDEPENDENCE OF THE COMPANY’S AUDITORS

Report of the Audit Committee to the Full Board of Directors of Intersil Corporation

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee appoints the independent accounting firm to be retained to audit the Company’s financial statements, and once retained, the independent accounting firm reports directly to the Audit Committee. The Audit Committee consults with and reviews recommendations made by the accounting firm with respect to financial statements, financial records and financial controls of the Company and makes recommendations to the Board of Directors as it deems appropriate from time to time. The Audit Committee is responsible for pre-approving both audit and non-audit engagements with the independent accountants. The Board of Directors has adopted a written charter setting forth the functions the Audit Committee is to perform, and this report is made pursuant to that charter.

The Audit Committee oversees the Company’s financial reporting process on behalf of Intersil’s Board of Directors. Management is responsible for the Company’s financial reporting process including its system of internal control, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent accountants are responsible for auditing those financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America. The Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews.

The Audit Committee met with management periodically during fiscal year 2005 to consider the adequacy of the Company’s internal controls, and discussed these matters and the overall scope and plans for the audit of the Company with the Company’s independent accountants during that time period, Ernst & Young LLP. The Audit

9

Committee also discussed with senior management and Ernst & Young LLP the Company’s disclosure controls and procedures and the certifications by the Company’s Chief Executive Officer and Chief Financial Officer, which are required by the Securities and Exchange Commission under the Sarbanes-Oxley Act of 2002 for certain of the Company’s filings with the Securities and Exchange Commission.

The Audit Committee established procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters.

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the 2005 Annual Report on Form 10-K with management, including a review of the quality, in addition to the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent accountants, who are responsible for expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under auditing standards generally accepted in the United States, including the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee has received the written disclosures and the letter from the Company’s independent accountants required by Independence Standards Board Standard No. 1. In addition, the Audit Committee reviewed with the independent accountants their independence, including the compatibility of non-audit services performed with the accountant’s independence.

The Audit Committee discussed with the Company’s independent accountants the overall scope and plans for their audit. The Audit Committee met with the independent accountants, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit Committee held fourteen (14) meetings and acted by unanimous written consent two (2) times in fiscal year 2005.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Annual Report and the Form 10-K for the fiscal year ended December 30, 2005 for filing with the Securities and Exchange Commission.

The Audit Committee has appointed the firm of KPMG LLP, registered, certified public accountants, as independent accountants to audit and report upon the Company’s financial statements for the fiscal year ending December 29, 2006, replacing Ernst & Young LLP, which was dismissed on March 15, 2006. The Company is requesting stockholder ratification of the appointment of KPMG LLP. In appointing KPMG LLP as the Company’s auditors for fiscal year 2006, the Audit Committee has considered whether KPMG LLP’s provision of services other than audit services are compatible with maintaining their independence.

|

AUDIT COMMITTEE |

|

Jan Peeters, Committee Chairman |

Gary E. Gist |

Mercedes Johnson |

Robert N. Pokelwaldt |

10

EXECUTIVE COMPENSATION

REPORT OF THE COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS OF INTERSIL CORPORATION

FOR FISCAL YEAR 2005

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee during fiscal year 2005 was an officer or employee of the Company, or any of its subsidiaries, or was formerly an officer of the Company or any of its subsidiaries. No member of the Compensation Committee had any relationship requiring disclosure by the Company under any paragraph of Item 404 of Regulation S-K. Furthermore, no member of the Compensation Committee had a relationship that requires disclosure under Item 402(j)(3) of Regulation S-K.

Report of the Compensation Committee of the Board of Directors on Executive Compensation

Role of Committee. The Compensation Committee of the Board of Directors establishes, oversees and directs the Company’s executive compensation programs and policies and administers the Company’s equity compensation plan. The Compensation Committee seeks to align executive compensation with competitive survey data and the Company’s financial performance in order to enhance shareholder value. The Compensation Committee consists of three non-employee directors.

The Compensation Committee reviews and approves generally all compensation and fringe benefit programs of the Company and also reviews and determines the actual compensation of the Company’s executive officers, as well as all stock option grants and cash incentive awards to all key employees. The Compensation Committee also reviews and makes recommendations to the Board of Directors on policies and programs for the development of management personnel and management structure and organization.

The Compensation Committee’s objectives include (i) attracting and retaining exceptional individuals as senior executives and (ii) providing key executives with motivation to perform to the full extent of their abilities in an effort to maximize Company performance and deliver enhanced value to the Company’s shareholders. The Compensation Committee believes it is important to place a greater percentage of senior executives’ compensation at risk than that of non-executives by tying senior executives’ compensation directly to the performance of the business and value of the common stock. Accordingly, executive compensation consists primarily of an annual salary, bonuses linked to the performance of the Company and long-term equity-based compensation. The Compensation Committee considers the compensation program’s impact on each operating product group as well as the effect on growth, profitability, market position and goals set for each year as well as changes in corporate market focus, strategic goals and key results expected (“KREs”) set for the next fiscal year. The Compensation Committee reviews with management the business plans for the new fiscal year and compares them to the prior year.

Compensation. Total compensation for senior executives is structured to deliver, at target levels of performance, competitive pay balanced between three primary components: annual base salary, annual incentive compensation and equity compensation. The annual base salaries of the Company’s senior executives are set at levels designed to attract and retain exceptional individuals by rewarding them for individual and Company achievements. The Compensation Committee reviews senior executives’ base salaries on an annual basis and may, in its discretion, adjust the base salary of each of the senior executives in accordance with each senior executive’s past performance, expected future contributions, scope and nature of responsibilities, including changes in such responsibilities, and competitive compensation data relating to such senior executive.

The Compensation Committee believes that a portion of the executives’ annual compensation should be tied to the financial results of the Company in order to reward individual performance and overall Company success. Annual incentive compensation is delivered through the Company’s shareholder approved Executive Incentive Plan. Objective targets are established for six-month performance periods during each calendar year based on the Company’s financial targets, such as revenue, earnings and return on capital, as well as individual strategic and operating targets. Performance against the objective targets is measured at the end of each performance period and payouts are approved in accordance with the terms of the Executive Incentive Plan.

11

Equity compensation is used to create and maintain an alignment of interests between shareholders and the senior executives. To the extent that shareholder value is increased through stock price appreciation, the senior executives experience an increase in the value of this component of their compensation. In 2003, to enhance the alignment of interests between shareholders and senior executives, the Compensation Committee established minimum ownership requirements for the senior executives. Tabled below are the ownership requirements, expressed as a multiple of base salary, that must be established by the senior executive:

| | | | |

Position | | Multiple of Base

Salary | | Time to Attain |

| | |

Chief Executive Officer | | 4X | | 5 years |

| | |

Senior Executives | | 2X | | 5 years |

The Compensation Committee authorizes the issuance of equity grants and awards under the shareholder approved Intersil 1999 Equity Compensation Plan (the “1999 Equity Plan”). Awards under the 1999 Equity Plan may be in the form of, but not limited to, stock options, deferred stock units (“DSUs”), restricted stock or stock appreciation rights. Options, which have an exercise price equal to the NASDAQ Market closing price of Intersil Common Stock on the date of grant and typically vest over a four-year period, were granted to senior executives and other key employees.

In 2003, the Compensation Committee approved the issuance of DSUs as a form of restricted stock under the Plan. DSU awards, in tandem with stock option grants, enable the Company to deliver competitive values of equity compensation while reducing the total number of shares issued under the 1999 Equity Plan on an annual basis. In addition, the vesting schedule increases the retentive value of the equity compensation. Generally, the DSUs fully vest at the end of the third anniversary of the award, with no interim vesting, subject to the recipient satisfying the employment requirements set forth in the terms and conditions of the award. Recipients may elect to defer receipt of the common stock represented by the DSU award for five-year deferral periods, subject to the terms and conditions of the award. Dividend equivalents will accrue during the vesting and/or deferral period and be paid out following the vesting date or the expiration of the deferral period.

Fiscal Year 2005 Chief Executive Officer. Mr. Richard M. Beyer is the Chief Executive Officer and a director of Intersil Corporation. Following the acquisition of Elantec Semiconductor, Inc. on May 14, 2002 and until January 25, 2006, Mr. Beyer was the President, Chief Executive Officer and a director of Intersil Corporation. On January 26, 2006, Mr. Louis DiNardo was appointed President and Chief Operating Officer of the Company with Mr. Beyer retaining his position as Chief Executive Officer and director. Mr. Beyer’s cash compensation during fiscal year 2005 consisted of an annual base salary of $550,000 and a target annual incentive under the Executive Incentive Plan of $600,000. Mr. Beyer is also eligible to receive stock options and DSUs at the discretion of the Board of Directors. For fiscal year 2005, Mr. Beyer earned a total annual incentive payout under the Executive Incentive Plan of $770,280, based upon the accomplishment of Company financial performance goals determined by the Board of Directors. During fiscal year 2005, Mr. Beyer also was granted stock options to purchase 256,250 shares of our Class A common stock and 18,500 DSUs. The use of stock options and DSUs as a portion of Mr. Beyer’s compensation accomplishes the Compensation Committee’s objective that a significant portion of our executives’ compensation be at risk and dependent upon our long-term stock performance.

Deductibility of Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), limits our ability to deduct compensation in excess of $1,000,000 paid during a tax year individually to our executive officers at year end. Certain performance-based compensation is not subject to such deduction limit. It is the Compensation Committee’s intent to maximize the deductibility of executive compensation while retaining the discretion necessary to compensate executive officers in a manner commensurate with performance and the competitive market for executive talent.

COMPENSATION COMMITTEE

James A. Urry, Committee Chairman

Robert W. Conn

Gary E. Gist

12

COMPENSATION TABLES

Executive Compensation

The following table sets forth certain information concerning the compensation earned by our Chief Executive Officer, our four most highly compensated executive officers (other than our Chief Executive Officer) and Daniel Heneghan, former Chief Financial Officer of the Company, who is no longer an executive officer or employee of the Company, for services rendered during the last three fiscal years:

| | | | | | | | | | | | | | |

Summary Compensation Table Calendar Year 2005 |

| Dollars In Thousands |

| | | | | Annual Compensation | | Long-Term

Compensation | | |

Name and

Principal Position | | Calendar

Year (1) | | Salary $ | | Bonus

$ (2) | | Other Annual

Compensation

$ (3) | | Restricted

Stock

Awards

($) (4) | | Options

(# of Shares)

(5) (6) (7) | | All Other

Compensation

$ (8) |

Richard M. Beyer President and

Chief Executive Officer | | 2005

2004

2003 | | 550.0

550.0

560.6 | | 770.3

312.5

502.0 | | 1,297.3

442.4

30.0 | | 316.0

683.1

372.2 | | 256,250

206,250

468,000 | | 22.7

56.6

40.4 |

| | | | | | | |

Louis DiNardo Executive Vice President and General Manager, Power Management Products Group | | 2005

2004

2003 | | 350.0

350.0

350.0 | | 477.4

350.0

240.0 | | 5,585.4

2,225.0

— | | 256.2

500.1

— | | 103,750

300,000

300,000 | | 1.7

—

— |

| | | | | | | |

Alden Chauvin Vice President, Worldwide Sales | | 2005

2004

2003 | | 257.8

257.4

252.3 | | 275.3

101.5

168.8 | | 649.5

1.6

903.3 | | 85.4

177.6

121.0 | | 68,750

67,500

54,600 | | 18.2

24.3

32.0 |

| | | | | | | |

Rajeeva Lahri Chief Technical Officer and Executive Vice President of Operations | | 2005

2004

2003 | | 297.7

280.9

260.7 | | 340.8

96.3

137.3 | | 264.4

4.3

906.6 | | 128.1

136.6

93.1 | | 148,750

82,500

42,000 | | 14.7

16.8

21.5 |

| | | | | | | |

Mohan Maheswaran Executive Vice President and General Manager, Analog Signal Processing Products Group | | 2005

2004

2003 | | 300.0

279.1

252.3 | | 313.1

151.4

220.3 | | 612.9

4.9

1,144.5 | | 119.6

204.9

139.6 | | 108,750

151,250

69,250 | | 3.9

22.1

29.0 |

| | | | | | | |

Daniel J. Heneghan (9) Vice President and Chief Financial Officer | | 2005

2004

2003 | | 208.8

325.0

334.8 | | 165.7

140.6

367.3 | | 598.5

1.1

— | | —

327.9

223.3 | | 30,000

90,000

100,800 | | 303.2

29.4

35.8 |

| (1) | 2005 is the fiscal year ended December 30, 2005; 2004 is the fiscal year ended December 31, 2004; and 2003 is the fiscal year ended January 2, 2004. |

| (2) | This category includes Executive Incentive Plan bonuses earned for all officers. It also includes additional bonuses paid in fiscal year 2005 to Mr. Chauvin ($25,000) and Mr. Lahri ($25,000) and in fiscal year 2003 to Mr. Heneghan ($130,000). Mr. DiNardo fiscal year 2003 bonus amount was paid under the Xicor, Inc. management bonus plan. |

| (3) | None of the executive officers named in the Summary Compensation Table received personal benefits in excess of $50,000 or 10% of annual salary and bonus for fiscal years 2005, 2004 and 2003. For fiscal year 2005, amounts include gain on sale of stock options for Mr. Beyer ($1,297,337), Mr. DiNardo ($5,585,445), Mr. Chauvin ($649,533), Mr. Lahri ($263,046), Mr. Maheswaran ($610,129) and Mr. Heneghan ($53,220). In addition, for fiscal year 2005, Mr. Heneghan’s amount includes gain on the sale of common stock underlying deferred stock unit awards ($540,576). For fiscal year 2004, Mr. Beyer’s amount includes $440,800 gain on sale of common stock and Mr. DiNardo’s amount represents gain on sale of stock options of $2,224,982. For fiscal year 2003, amounts include gain on sale of stock options for Messrs. Chauvin ($895,874), Lahri ($906,630) and Maheswaran ($1,144,544). |

13

| (4) | Deferred stock units (“DSUs”) were awarded to Messrs. Beyer (18,500), DiNardo (15,000), Chauvin (5,000), Lahri (7,500), and Maheswaran (7,000) on April 1, 2005. The awards vest upon the third anniversary of the grants, subject to the recipient satisfying the employment requirements set forth in the terms and conditions of the award. A recipient may elect to defer receipt of the common stock represented by a DSU award for a five-year deferral period, subject to the terms and conditions of the award. Dividend equivalents will accrue during the vesting period and, if applicable, the deferral period and will be paid out following the vesting date or the expiration of the deferral period. At the end of fiscal year 2005, Mr. Beyer held 72,500 DSUs, having a value of $1,803,800; Mr. DiNardo held 45,000 DSUs, having a value of $1,119,600; Mr. Chauvin held 20,600 DSUs, having a value of $512,528; Mr. Lahri held 19,500 DSUs, having a value of $485,160; and Mr. Maheswaran held 25,000 DSUs, having a value of $622,000. |

| (5) | Fiscal year 2005 stock options were granted under the Intersil Corporation 1999 Equity Compensation Plan. Each stock option grant terminates seven years from the date of each grant. Annual grants are issued in quarterly installments, assuming continued service on the part of the executive, on the first trading day of the months of April, July, October and January. Each annual grant installment vests 25% on April 1, 2006 and 6.25% quarterly thereafter until fully vested. Supplemental stock option grants were issued on September 1, 2005 to Messrs. Beyer (75,000 shares), DiNardo (10,000), Chauvin (5,000), Lahri (25,000), and Maheswaran (25,000). The supplemental stock option grants vests over a four year period at a rate of 25% upon the first anniversary of the grant and 6.25% quarterly thereafter until fully vested. The supplemental stock option grants terminate seven years from the date of grant. |

| (6) | Fiscal year 2004 stock options were granted under the Intersil Corporation 1999 Equity Compensation Plan. Each stock option grant terminates seven years from the date of each grant except for 18,750 shares granted to Mr. Maheswaran which terminate ten years from the date of the grant. Each grant vests over a four year period at a rate of 25% upon the first anniversary of the grant and 6.25% quarterly thereafter until fully vested) as authorized by the Compensation Committee of the Intersil Board of Directors. |

| (7) | Fiscal year 2003 stock options were granted under the Intersil Corporation 1999 Equity Compensation Plan. Each stock option grant terminates ten years from the date of the grant. The grants vest over a four year period at a rate of 25% upon each of the first four anniversary dates of the grant (except for 6,250 options issued to Mr. Maheswaran that vests over a four year period at a rate of 25% upon the first anniversary of the grant and 6.25% quarterly thereafter until fully vested). Mr. DiNardo’s options represent Xicor, Inc. stock options granted in 2003 and converted pursuant to the terms and conditions of the Agreement and Plan of Merger between Intersil Corporation and Xicor, Inc. |

| (8) | Amounts reported reflect contributions and allocations to defined contribution retirement plans and the value of insurance premiums for term life insurance and disability insurance except for Mr. Heneghan who’s fiscal year 2005 amount reflects $288,346 in separation payments made in accordance with the terms of his employment agreement. |

| (9) | Mr. Heneghan’s employment with the Company terminated on July 1, 2005. |

14

Stock Options

The following table provides information concerning stock options granted to the executive officers named in the Summary Compensation Table during fiscal year 2005:

Fiscal Year 2005 Option/SAR Grants

| | | | | | | | | | | | | | | | | |

| | | Individual Grants (1) | | | | |

| | | Number of

Securities

Underlying

Options | | | Percentage of

Options

Granted to All

Employees (5) | | | Exercise

Price | | Expiration

Date | | Realizable Value at

Assumed Annual Rates

of Stock Price

Appreciation on over

Option Term (6) |

Richard Beyer | | 68,750 | (2) | | 1.4 | % | | $ | 16.21 | | 01/03/12 | | $ | 453,688 | | $ | 1,057,267 |

| | 37,500 | (3) | | 0.8 | % | | $ | 17.08 | | 04/01/12 | | $ | 260,748 | | $ | 607,642 |

| | 37,500 | (3) | | 0.8 | % | | $ | 19.00 | | 07/01/12 | | $ | 290,059 | | $ | 675,949 |

| | 75,000 | (4) | | 1.6 | % | | $ | 20.73 | | 09/01/12 | | $ | 632,939 | | $ | 1,474,991 |

| | 37,500 | (3) | | 0.8 | % | | $ | 22.06 | | 10/03/12 | | $ | 336,773 | | $ | 784,812 |

| | | | | | |

Louis DiNardo | | 31,250 | (2) | | 0.7 | % | | $ | 17.08 | | 04/01/12 | | $ | 217,290 | | $ | 506,369 |

| | 31,250 | (3) | | 0.7 | % | | $ | 19.00 | | 07/01/12 | | $ | 241,716 | | $ | 563,291 |

| | 10,000 | (4) | | 0.2 | % | | $ | 20.73 | | 09/01/12 | | $ | 84,392 | | $ | 196,666 |

| | 31,250 | (3) | | 0.7 | % | | $ | 22.06 | | 10/03/12 | | $ | 280,645 | | $ | 654,010 |

| | | | | | |

Alden Chauvin | | 22,500 | (2) | | 0.5 | % | | $ | 16.21 | | 01/03/12 | | $ | 148,480 | | $ | 346,015 |

| | 13,750 | (3) | | 0.3 | % | | $ | 17.08 | | 04/01/12 | | $ | 95,607 | | $ | 222,802 |

| | 13,750 | (3) | | 0.3 | % | | $ | 19.00 | | 07/01/12 | | $ | 106,355 | | $ | 247,848 |

| | 5,000 | (4) | | 0.1 | % | | $ | 20.73 | | 09/01/12 | | $ | 42,196 | | $ | 98,333 |

| | 13,750 | (3) | | 0.3 | % | | $ | 22.06 | | 10/03/12 | | $ | 123,484 | | $ | 287,764 |

| | | | | | |

Rajeeva Lahri | | 17,500 | (2) | | 0.4 | % | | $ | 16.21 | | 01/03/12 | | $ | 115,484 | | $ | 269,122 |

| | 18,750 | (3) | | 0.4 | % | | $ | 17.08 | | 04/01/12 | | $ | 130,374 | | $ | 303,821 |

| | 50,000 | (4) | | 1.0 | % | | $ | 18.65 | | 06/01/12 | | $ | 379,621 | | $ | 884,663 |

| | 18,750 | (3) | | 0.4 | % | | $ | 19.00 | | 07/01/12 | | $ | 145,029 | | $ | 337,974 |

| | 25,000 | (4) | | 0.5 | % | | $ | 20.73 | | 09/01/12 | | $ | 210,980 | | $ | 491,664 |

| | 18,750 | (3) | | 0.4 | % | | $ | 22.06 | | 10/03/12 | | $ | 168,387 | | $ | 392,406 |

| | | | | | |

Mohan Maheswaran | | 27,500 | (2) | | 0.6 | % | | $ | 16.21 | | 01/03/12 | | $ | 181,475 | | $ | 422,907 |

| | 18,750 | (3) | | 0.4 | % | | $ | 17.08 | | 04/01/12 | | $ | 130,374 | | $ | 303,821 |

| | 18,750 | (3) | | 0.4 | % | | $ | 19.00 | | 07/01/12 | | $ | 145,029 | | $ | 337,974 |

| | 25,000 | (4) | | 0.5 | % | | $ | 20.73 | | 09/01/12 | | $ | 210,980 | | $ | 491,664 |

| | 18,750 | (3) | | 0.4 | % | | $ | 22.06 | | 10/03/12 | | $ | 168,387 | | $ | 392,406 |

| | | | | | |

Daniel J. Heneghan | | 30,000 | (2) | | 0.6 | % | | $ | 16.21 | | 01/03/12 | | $ | 197,973 | | $ | 461,353 |

| (1) | The fiscal year annual stock option grant is delivered in four installments with each installment treated as a separate grant with its own grant price, vesting schedule and expiration date. For the fiscal year 2005 annual grant, the installment grants were issued on the first trading days of the months of April 2005, July 2005, October 2005 and January 2006. For the fiscal year 2005 annual grant, the table reflects the three installments issued during the fiscal year ended December 31, 2005. |

| (2) | Represents the fourth installment of the fiscal year 2004 annual option grant issued during fiscal year 2005. The grant vested 25% on April 1, 2005 and continues to vest at a rate of 6.25% quarterly thereafter until fully vested. |

| (3) | Each fiscal year 2005 annual grant installment vests 25% on April 1, 2006 and 6.25% quarterly thereafter until fully vested. Each annual grant installment terminates seven years from the date of grant. |

15

| (4) | Supplemental stock option grants vest over a four year period at a rate of 25% upon the first anniversary of the grant and 6.25% quarterly thereafter until fully vested. The supplemental stock option grants terminate seven years from the date of grant. |

| (5) | A total of 4,805,305 options were granted to Intersil employees under the Intersil 1999 Equity Compensation Plan during the fiscal year ended December 30, 2005. |

| (6) | Represents the potential realizable value of the underlying shares of Intersil common stock at the expiration date based on an assumed annual appreciation rate of 5% and 10% of the exercise price, set by the Securities and Exchange Commission. The amounts shown are not intended to forecast future appreciation in the price of our Class A Common Stock. |

The following table sets forth information regarding the number and value of options held by the executive officers named in the Summary Compensation Table during fiscal year 2005:

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values

The following sets forth information regarding the number and value of options granted to or held by the Named Executive Officers during fiscal 2005 and at December 30, 2005. The Company does not currently have stock appreciation rights (SAR’s) outstanding:

| | | | | | | | | | | | | | | |

| | | Shares

Acquired on

Exercise (#) | | Value

Realized ($) | | Number of Securities

Underlying Unexercised

Options at Year-End | | Net Value of

Unexercised In-the-Money

Options

at Year-End (1) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Richard M. Beyer | | 150,000 | | $ | 1,297,397 | | 2,178,353 | | 431,157 | | $ | 1,194,078 | | $ | 3,061,775 |

| | | | | | |

Alden J. Chauvin | | 32,593 | | $ | 649,533 | | 422,658 | | 95,263 | | $ | 2,701,841 | | $ | 618,702 |

| | | | | | |

Louis DiNardo | | 350,000 | | $ | 5,585,445 | | 362,139 | | 384,528 | | $ | 5,471,511 | | $ | 3,631,313 |

| | | | | | |

Rajeeva Lahri | | 47,436 | | $ | 263,046 | | 387,599 | | 194,939 | | $ | 935,306 | | $ | 1,198,828 |

| | | | | | |

Mohan R. Maheswaran | | 153,111 | | $ | 642,111 | | 329,033 | | 181,313 | | $ | 780,945 | | $ | 1,177,040 |

| | | | | | |

Daniel J. Heneghan | | 3,029 | | $ | 53,220 | | 664,134 | | — | | $ | 2,578,820 | | $ | — |

| (1) | Reflects net pre-tax amounts determined by subtracting the exercise price from $24.88 per share, which was the fair market value of our common stock at December 30, 2005. |

16

OTHER FORMS OF COMPENSATION

The table below summarizes the status of our equity compensation plans (shares in thousands):

| | | | | | |

| | | (a) | | (b) | | (c) |

Plan Category | | Number of

securities to be

issued upon

exercise of

outstanding

options, warrants,

and rights (#) | | Weighted-average

exercise price of

outstanding

options, warrants,

and rights ($) | | Number of securities

remaining available

for future issuance

under equity

compensation plans |

Equity compensation plans approved by shareholders: | | | | | | |

Elantec, Inc. 1994 Equity Incentive Plan (1) | | 66 | | $ 1.38 | | None |

Elantec 1995 Equity Incentive Plan (1) | | 4,705 | | $ 22.21 | | None |

Elantec 2001 Equity Incentive Plan (1) | | 98 | | $ 21.69 | | None |

Xicor 1990 Equity Incentive Plan (1) | | 1,103 | | $ 6.78 | | None |

Xicor 1998 Equity Incentive Plan (1) | | 1,141 | | $ 6.51 | | None |

Xicor 2002 Equity Incentive Plan (1) | | 1,470 | | $ 17.21 | | None |

1999 Equity Compensation Plan | | 15,030 | | $ 21.69 | | 6,215 |

Equity compensation plans not approved by shareholders | | None | | | | |

Total | | 23,613 | | $ 20.03 | | 6,215 |

| (1) | Each of these plans has been acquired by an acquisition made by Intersil. Although there are still additional securities to be issued under these plans, Intersil will not make any additional grants under these plans. All future grants will be made under the 1999 Equity Compensation Plan. |

RETIREMENT PLANS

Retirement and Savings Program

Intersil Corporation provides retirement benefits to substantially all employees primarily through a defined contribution retirement plan. Contributions by the Company to the retirement plan are based on employees’ savings with no other funding requirements. The Company is able to make additional contributions to the fund at its discretion.

The savings element of the retirement plan is a defined contribution plan, which is qualified under Internal Revenue Service Code Section 401(k). All employees of the Company may elect to participate in the 401(k) retirement plan (the “401(k) plan”). Under the 401(k) plan, participating employees may defer a portion of their pretax earnings up to certain limits prescribed by the Internal Revenue Service. The Company provides matching contributions under the provisions of the plan. Employees fully vest in the Company’s matching contributions upon the completion of five years of service.

Retirement benefits also include an unfunded limited healthcare plan for U.S.-based retirees and employees on long-term disability. Over the next several years, the cost for retiree benefits is gradually being assumed by the retirees. Intersil Corporation accrues the estimated cost of these medical benefits, which are not material, during an employee’s active service life.

17

STOCK PRICE PERFORMANCE GRAPH

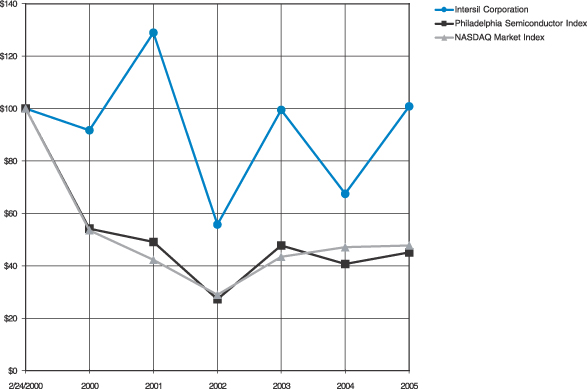

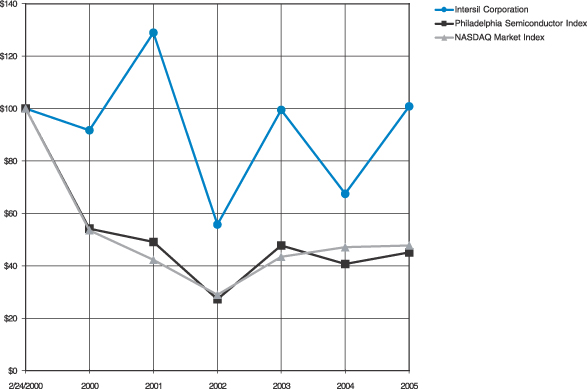

The following graph presents a comparison of the cumulative total stockholder return on the Company’s stock with the cumulative total return of the NASDAQ Market Index and the Philadelphia Semiconductor Index for the period of six fiscal years commencing February 24, 2000 and ending December 31, 2005. The graph assumes that $100 was invested on February 24, 2000 in each Intersil common stock, the NASDAQ Market Index, and the Philadelphia Semiconductor Index, and that all dividends were reinvested. Cumulative total stockholder returns are based on Intersil’s fiscal year.

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND DIRECTORS AND OFFICERS

The following table sets forth information as of March 17, 2006 with respect to shares of each class of Common Stock beneficially owned by (i) each person or group that is known to the Company to be the beneficial owner of more than 5% of each class of outstanding Common Stock, (ii) each director and named executive officer of the Company and (iii) all directors and executive officers of the Company as a group. Unless otherwise specified, all shares are directly held.

The number of shares of common stock beneficially owned by each person is determined under rules promulgated by the Securities and Exchange Commission, or SEC. Under these rules, a person is deemed to have “beneficial ownership” of any shares over which that person has or shares voting or investment power.

Unless otherwise indicated, the address of each person owning more than 5% of the Company’s outstanding shares is c/o Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, CA 95035.

| | | | | |

| | | Class A Common Stock | |

| | Shares Beneficially Owned | | Percent (1) | |

Capital Research and Management Company (2) | | 13,532,550 | | 8.8 | % |

TCW Group, Inc. (3) | | 10,821,453 | | 7.0 | % |

T. Rowe Price Associates, Inc. (4) | | 9,067,582 | | 5.8 | % |

Richard M. Beyer (5) | | 2,214,919 | | 1.5 | % |

James V. Diller (6) | | 776,598 | | * | |

Alden Chauvin (7) | | 489,494 | | * | |

Louis DiNardo (8) | | 403,951 | | * | |

Rajeeva Lahri (9) | | 373,415 | | * | |

Mohan Maheswaran (10) | | 249,647 | | * | |

Thomas Tokos (11) | | 122,002 | | * | |

Gary Gist (12) | | 116,590 | | * | |

James A. Urry (13) | | 107,024 | | * | |

Robert Conn (14) | | 82,500 | | * | |

Jan Peeters (15) | | 82,500 | | * | |

Robert Pokelwaldt (16) | | 82,500 | | * | |

David Zinsner (17) | | 71,312 | | * | |

Mercedes Johnson (18) | | 0 | | * | |

Gregory Lang (19) | | 0 | | * | |

| | |

All directors and executive officers as a group (15 persons) | | 5,172,452 | | 3.5 | % |

| * | Less than 1% of the outstanding Class A Common Stock |

| (1) | Percentages are derived using the number of shares of Class A Common Stock outstanding as of March 17, 2006. |

| (2) | Based solely on information obtained from a Schedule 13-G filed by Capital Research and Management Company for the period ending December 30, 2005. The address of Capital Research and Management Co. is 333 South Hope Street, 55th Floor, Los Angeles, CA 90071. |

| (3) | Based solely on information obtained from a Schedule 13-G filed by TCW Group, Inc., on behalf of the TCW Business Unit for the period ending December 31, 2005. The address of TCW Group, Inc. is 865 South Figueroa Street, Los Angeles, CA 90017. |

19

| (4) | Based solely on information obtained from a Schedule 13-G filed by T. Rowe Price Associates, Inc. for the period ending December 31, 2005. The address of T. Rowe Price Associates, Inc. is 100 East Pratt Street, Baltimore, MD 21202. |

| (5) | Includes 1,284 shares owned by Richard M. Beyer. Also includes a Deferred Stock Unit award for 24,000 shares and 2,189,635 shares subject to options exercisable within 60 days of March 17, 2006. |

| (6) | Includes 344,074 shares owned by the James V. Diller & June P. Diller Trust. Also includes 432,524 shares subject to options exercisable within 60 days of March 17, 2006. |

| (7) | Includes 91,617 shares owned by the Chauvin Family Trust dated February 12, 1997 and 68 shares owned by the Scott Chauvin IRA Account for which Mr. Chauvin is Custodian of this account. Also includes a Deferred Stock Unit award for 7,800 shares and 390,009 shares subject to options exercisable within 60 days of March 17, 2006. |