UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

| | INTERSIL CORPORATION | |

| | (Name of Registrant as Specified In Its Charter) | |

| | | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

| | | |

DEAR FELLOW SHAREHOLDER:

You are cordially invited to attend the Annual Meeting of Shareholders (“Annual Meeting”) of Intersil Corporation (“Intersil”), to be held at our corporate headquarters located at 1001 Murphy Ranch Road, Milpitas, CA 95035 on May 2, 2012 at 8:00 a.m. Pacific Time. At this meeting you will be asked to vote on several proposals recommended unanimously by our Board of Directors. In this letter, I am highlighting the importance of Proposal 4 – our 2008 Equity Compensation Plan proposal and Proposal 5 – the compensation of our Named Executive Officers.

Under Proposal 4 we are requesting that you approve an amendment to our 2008 Equity Compensation Plan which would result in an increase to the number of shares authorized for issuance under the plan by 5.5 million shares (4.3% of our total shares outstanding). The competition for recruiting and retaining outstanding talent necessary to execute our business plans continues to be fierce. Our ability to increase shareholder value is heavily dependent upon our ability to retain key employees as well as attract new employees to support growth. It is vital that we continue to utilize equity grants to motivate our executive, engineering, operations and sales teams as we continue in our efforts to build a great company and increase shareholder value.

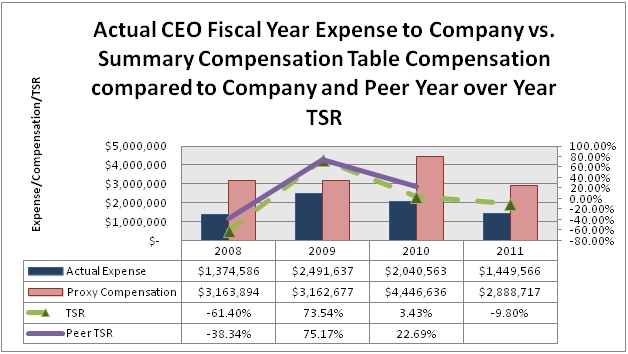

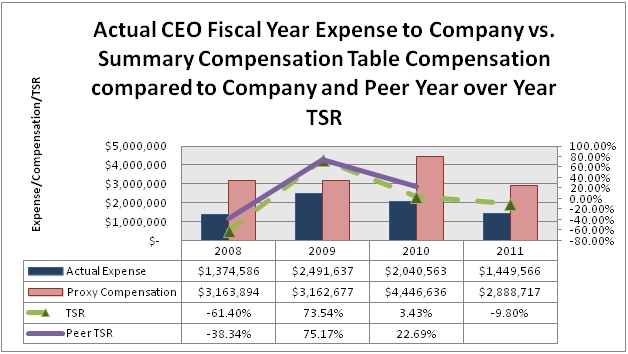

Under Proposal 5 we are requesting that you approve the compensation of our Named Executive Officers (commonly referred to as “Say-on-Pay”). Although Say-on-Pay is a non-binding proposal, we realize the importance of the Say-on-Pay vote. As a result, we have taken proactive steps to address the concerns of our shareholders regarding executive compensation. During the past year, we have communicated directly with several top shareholders regarding executive compensation. We have also closely reviewed compensation analyses we received from organizations that monitor corporate governance. We continue to compare our executive compensation programs with our peer companies to ensure our executive compensation is appropriately positioned in the marketplace. As a result of these actions, we have taken specific steps to address your concerns, including:

| · | Developed and implemented a formal Clawback Provision regarding executive compensation; |

| ·�� | Created a new performance-based equity program focused on Total Shareholder Return; |

| · | At least 50% of the annual equity grants issued to our Named Executive Officers are performance-based equity; |

| · | Removed excise tax provisions from our future executive compensation-related agreements beginning with executives hired in 2011; and |

| · | Removed the automatic renewal provision in the CEO’s employment agreement. |

More extensive information regarding our executive compensation program and actions to address your concerns regarding executive compensation are outlined in our Compensation Discussion and Analysis (“CD&A”). We have proactively communicated with our shareholders and corporate governance organizations, and we believe we have appropriately addressed specific topics pertaining to executive compensation.

We provide access to our proxy materials over the Internet, which we believe expedites delivery of proxy materials, lowers the costs associated with our Annual Meeting and helps conserve natural resources. The Notice you received in the mail contains instructions on how to access this Proxy Statement and the 2011 Annual Report on Form 10-K (“2011 Annual Report”) and vote online. We also encourage you to read our 2011 Annual Report, which includes our audited financial statements and provides information about our business and products. The Notice also provides instructions on how to receive a paper copy of this Proxy Statement and the 2011 Annual Report.

Your vote is important. Please review the instructions described in this Proxy Statement as well as in the Notice you received in the mail.

We look forward to seeing you at the Annual Meeting and appreciate your support and continued interest in Intersil Corporation.

| |

| David B. Bell | Milpitas, California |

| CEO, President and Director | March 13, 2012 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Date: | Wednesday, May 2, 2012 |

| Time: | 8:00 a.m. Pacific Time |

| Place: | Intersil Corporation’s Headquarters, 1001 Murphy Ranch Road, Milpitas, California 95035 |

Purpose of the Meeting:

| 1. | To elect nine directors to serve on our Board of Directors until the next Annual Meeting, or until their successors are duly elected and qualified; |

| 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm; |

| 3. | To approve an amendment to The Intersil Corporation Employee Stock Purchase Plan to increase the number of shares authorized for issuance to 6,533,334, an increase of 2,000,000 shares; |

| 4. | To approve an amendment to the Intersil Corporation Amended and Restated 2008 Equity Compensation Plan to increase the number of shares authorized for issuance to 34,352,316, an increase of 5,500,000 shares; and |

| 5. | To approve, on a non-binding advisory basis, the compensation of our Named Executive Officers (”NEOs”). |

Shareholders will also act on any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof.

The items of business are more fully described in the Proxy Statement accompanying this Notice. Whether or not you plan to attend the Annual Meeting, please cast your vote as instructed in the Notice of Availability of Proxy Materials.

You are entitled to vote if you were a shareholder at the close of business on Thursday, March 8, 2012.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote your shares over the Internet, by telephone, or by requesting and mailing a proxy card. Please review the instructions on the Notice of Availability of Proxy Materials concerning each of these voting options in detail.

Should you receive more than one Notice of Availability of Proxy Materials, please be sure to vote each in response to every proposal so that all your shares will be voted. If your shares are held of record by a broker, bank, or other nominee, you will not be able to vote in person at the Annual Meeting unless you first obtain a ballot issued in your name from the record holder, which you may receive by declaring your intention to vote in person on the website designated in the Notice of Internet Availability of Proxy Materials. Your proxy will not be used if you revoke it either before or at the Annual Meeting.

By Order of the Board of Directors,

| |

| Thomas C. Tokos | Milpitas, California |

| Senior Vice President, General Counsel and Secretary | March 13, 2012 |

Admittance to the Annual Meeting will be limited to shareholders eligible to vote or their authorized representative(s). Beneficial owners holding shares through an intermediary such as a bank or broker will be admitted only upon proof of ownership.

INTERSIL CORPORATION

1001 MURPHY RANCH ROAD

MILPITAS, CA 95035

PROXY STATEMENT

The proxy materials, including this proxy statement, proxy card or voting instruction card and our Annual Report will be mailed on or about March 23, 2012 to owners of shares of Intersil Corporation Class A Common Stock. This proxy statement contains information for you to consider when deciding how to vote on the matters brought before the meeting. The Board of Directors encourages you to read this document thoroughly and take the opportunity to vote on these matters.

The enclosed proxy is being solicited upon the order of the Board of Directors (the “Board”) and we will incur costs in conjunction with such solicitation. Such costs include the charges of brokerage houses and their custodians, nominees or fiduciaries for forwarding documents to shareholders. We retained Phoenix Advisory Partners, a division of American Stock Transfer and Trust Company, LLC, to assist in soliciting proxies for a fee of $6,000, plus other costs and expenses. In addition, certain of our officers, directors and regular employees, may solicit proxies by mail, in person, by telephone or fax.

| | Page |

| 1 |

| 2 |

| 5 |

| 7 |

| 8 |

| 11 |

| 17 |

| 19 |

| 20 |

| 21 |

| 30 |

| 31 |

| 32 |

| 37 |

| 42 |

| 43 |

| 43 |

| 46 |

| 47 |

| 47 |

| 47 |

| 47 |

| 47 |

| A-1 |

| B-1 |

Your vote is very important. Your shares can only be voted at the Annual Meeting if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to assure that your shares will be represented. Most shareholders have a choice of voting by the Internet, a toll-free telephone number or requesting and completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your Notice of Availability of Proxy Materials to see which options are available to you. Proxies submitted by telephone or online must be received by 12:00 midnight, EDT, on Tuesday, May 1, 2012.

You may revoke your proxy at any time before it is voted at the Annual Meeting by (a) giving written notice to our Secretary, (b) submitting a proxy bearing a later date, or (c) casting a ballot at the Annual Meeting. Properly executed proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided. If you submit a proxy without providing directions, your shares will be voted by the individuals named on your proxy card as recommended by the Board of Directors. If you wish to give a proxy to someone other than those named on the proxy card, cross out those names and insert the name(s) of the person(s), not more than three, to whom you wish to give your proxy.

Who can vote? Shareholders of record as of the close of business on March 8, 2012 are entitled to vote. On that day, 126,643,320 shares of Common Stock were outstanding and eligible to vote. A list of shareholders eligible to vote will be available at our headquarters, located at 1001 Murphy Ranch Road, Milpitas, CA, 95035, beginning April 18, 2012. Shareholders may examine this list during normal business hours for any purpose relating to the Annual Meeting.

How does the Board recommend I vote? The Board recommends a vote “FOR” each Board nominee (Item 1), “FOR” the ratification of the Board of Directors’ appointment of KPMG LLP as our independent registered public accountants for the upcoming year (Item 2), “FOR” the approval of an amendment to The Intersil Corporation Employee Stock Purchase Plan to increase the number of shares authorized for issuance to 6,533,334, an increase of 2,000,000 shares (Item 3), “FOR” the approval of an amendment to our Amended and Restated 2008 Equity Compensation Plan to increase the number of shares authorized for issuance to 35,352,316, an increase of 5,500,000 shares (Item 4), and “FOR” approval of the compensation of our NEOs (Item 5).

What shares are included in the proxy card? The proxy card represents all the shares of voting stock registered to your account. Each share is entitled to one vote on each matter presented other than in the election of Directors. Our Amended and Restated Certificate of Incorporation provides for cumulative voting for Directors. With cumulative voting, at each election of Directors, each holder of Class A Common Stock is entitled to votes equal to the number of shares they hold multiplied by the number of Directors to be elected. The holder may cast all of their votes for a single candidate or may distribute them among any number of candidates.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of common stock entitled to vote, is represented. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum has been reached. The affirmative vote of a majority of eligible shares present, in person or by proxy, at the Annual Meeting, and actually cast, is required to approve all matters. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners, the nominees may vote those shares only on routine matters such as the ratification of the appointment of independent accountants. On all non-routine matters, such as the election of Directors, nominees who have not received instructions from beneficial owners cannot vote and there is a so-called “broker non-vote” on that matter. Broker non-votes and abstentions are not counted in tabulations of the votes cast by shareholders and will have no effect in determining whether there has been an affirmative majority vote on a particular matter.

Who will count the vote? Broadridge Financial Solutions, Inc. will tally the vote, which will be certified by the Inspector of Elections.

Is my vote confidential? Proxies, ballots and voting tabulations are available for examination only by the Inspector of Elections and tabulators. Your vote will not be disclosed to the Board of Directors or to our management other than the Inspector of Elections and except as may be required by law.

In accordance with Delaware General Corporation Law and our Amended and Restated Certificate of Incorporation and Restated Bylaws, our business, property and affairs are managed under the direction of the Board of Directors. The Board has responsibility for reviewing our overall performance rather than day-to-day operations. Its primary responsibility is to oversee the actions of our management, and in so doing, serve the best interests of Intersil and its shareholders. The Board selects and provides for the succession of executive officers, and subject to recommendations by the Nominating and Governance Committee, nominates individuals to serve as directors upon election at our Annual Meeting or to fill any vacancies on the Board. The Board reviews corporate objectives and strategies, and evaluates and approves significant policies and proposed major commitments of corporate resources. The Board participates in decisions that could have a significant economic impact on Intersil. Management keeps the Directors informed of corporate activities through regular written reports and presentations at Board and committee meetings.

The Board believes that good corporate governance practices are essential to fostering good shareholder relations and creating shareholder value. We continually review our governance practices to ensure their relevance and appropriateness for Intersil and all of our shareholders. The Board’s corporate governance guidelines (which includes director independence criteria), the charters of each of the Board’s committees, our code of corporate conduct, and our code of ethics for our Chief Executive Officer and senior financial officers are available on the Investor Relations pages of our website at www.intersil.com. Shareholders may request copies of these documents free of charge by writing to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, CA 95035, Attn: Investor Relations.

Board Leadership Structure. The roles of Chief Executive Officer (“CEO”) and Chairman of the Board are separate in recognition of the differences between the two roles. The CEO provides the strategic direction and the day-to-day leadership and performance of the Company, while the Chairman of the Board is an independent director with well-defined roles and responsibilities. This leadership structure is appropriate given that, among other things, the Chairman provides guidance to the CEO, presides over Board meetings and executive sessions which take place at each regularly scheduled Board meeting, acts as the liaison between the independent directors and the CEO, and facilitates full and open discussion among management and the independent directors. We believe that this structure allows the Board to fulfill its duties effectively and efficiently.

Members of the Board and its Committees. Each of the incumbent Directors attended at least 83% of the total number of Board and Committee meetings on which they served.

| Directors | Audit Committee | Compensation Committee | Nominating and Governance Committee |

| David B. Bell (CEO) | Robert W. Conn1 | James V. Diller1 | James V. Diller1 |

Robert W. Conn1 | Mercedes Johnson1 | Gary E. Gist1 | Jan Peeters1 |

James V. Diller1 | Jan Peeters1, 2 | Gregory Lang1 | Robert N. Pokelwaldt1, 2 |

Gary E. Gist (Chairman)1 | Robert N. Pokelwaldt1 | James A. Urry1, 2 | James A. Urry1 |

Mercedes Johnson1 | | | |

Gregory Lang1 | | | |

Jan Peeters1 | | | |

Robert N. Pokelwaldt1 | | | |

James A. Urry1 | | | |

| | | | |

| Seven meetings were held in 2011 | Nine meetings were held in 2011 | Ten meetings were held in 2011 | Four meetings were held in 2011 |

| Nine actions were taken by unanimous written consent | No actions were taken by unanimous written consent | Five actions were taken by unanimous written consent | No actions were taken by unanimous written consent |

| 1) | The Board has determined that these Directors are independent under the listing standards of The NASDAQ Stock Market. |

| 2) | Chairman of the Committee. |

Directors Attendance at the Annual Meeting. We strongly encourage each of our Directors to attend the Annual Meeting. Last year, each of the incumbent Directors attended the Annual Meeting.

Committees of the Board. The Board has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The charter of each committee is available on the Investor Relations section of our website at www.intersil.com.

Audit Committee—maintains the sole responsibility to appoint, approve engagements of, and oversee the independence and performance of our independent accountants. In addition, the Audit Committee oversees the integrity of our financial reporting and compliance with laws and regulations related to our financial reporting. They also have the responsibility to establish procedures for the receipt and treatment of complaints regarding our financial reporting, internal accounting controls or other related auditing matters. The Audit Committee has the authority to engage counsel and other advisors to assist in carrying out its responsibilities. Messrs. Peeters and Pokelwaldt, and Ms. Johnson qualify as “financial experts” according to applicable securities laws and SEC regulations, and each has been designated by the Board as a financial expert.

Compensation Committee—reviews and approves the compensation of executive officers and certain other highly compensated individuals. In addition, the Compensation Committee administers certain benefit plans and makes recommendations to the Board regarding compensation of Board members. They also have the authority to administer, grant and issue awards under the Company’s equity compensation plan. The Compensation Committee has delegated limited authority to a subcommittee to grant and issue certain awards to employees who are not executive officers. The Board has determined that each member, other than Mr. Diller, is an “outside director” within the meaning of the Treasury Regulations promulgated under Section 162(m) of the Internal Revenue Code of 1986, as amended, (the “Code”.)

Nominating and Governance Committee—identifies, reviews, evaluates and recommends potential candidates to serve on the Board, as Chairman and as members of committees. In addition, the Nominating and Governance Committee serves as a focal point for communication between such candidates, our Directors who are not members of the Nominating and Governance Committee, and our management. They also monitor, evaluate and recommend corporate governance guidelines.

The Board’s Role in Risk Oversight. The Board’s role in our risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, regulatory, and strategic risks. The Audit Committee of the Board regularly reviews areas of material risk through an ongoing process of Enterprise Risk Management (“ERM”) to understand the Company’s risk identification, risk management and risk mitigation strategies. The ERM process reviews areas of material risk at least annually and such reviews are discussed with the Audit Committee on a regular basis. The Chairman of the Audit Committee reports on the discussion during the next full Board meeting. The Board provides management guidance through the ERM process. This process enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. We believe that the practices described above combined with our current leadership structure facilitate effective Board oversight of our significant risks.

Shareholder Communications. Parties interested in communicating directly with any of the individual Directors or the Board as a group may do so by writing to Investor Relations via e-mail at investorrelations@intersil.com, or by mail to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, California 95035. Our policy is to deliver such communications directly to the Board.

Director Compensation and Related Party Transactions. Outside Directors are compensated in quarterly installments at the below annual amounts. These amounts are paid directly to each Director with the exception of Mr. James A. Urry, an employee of Augusta Columbia Capital Group LLC, whose cash compensation payable for Board and committee memberships was paid directly to Augusta Columbia Capital Group LLC beginning in the fourth quarter of 2011.

| | | Chairman | | | Members | |

| Board Members | | $ | 75,000 | | | $ | 45,000 | |

| Audit Committee | | $ | 20,000 | | | $ | 10,000 | |

| Compensation Committee | | $ | 12,000 | | | $ | 6,000 | |

| Nominating and Governance Committee | | $ | 10,000 | | | $ | 5,000 | |

Director compensation is generally reviewed annually. In order to enhance alignment of interest between Directors and shareholders, Directors are required to own a certain minimum dollar value of Intersil common stock. In 2011, the common stock ownership requirement was twice the value of the annual retainer, which must be attained by the fifth anniversary of the date of the Director’s initial election to the Board .

Outside Directors also receive equity compensation consisting of a one-time appointment grant of 4,000 deferred stock units (“DSUs”) and stock options to purchase 25,000 shares of Intersil common stock. Thereafter, Outside Directors receive an annual grant of 4,000 DSUs and stock options to purchase 5,000 shares of Intersil common stock.

Directors are reimbursed for travel expenses incurred while attending Board and committee meetings. Related party transactions, if any, are reviewed by the Audit Committee. There were no related party transactions during fiscal year 2011.

Compensation Committee Interlocks and Insider Participation. During fiscal year 2011, no member of the Compensation Committee was an officer or employee of Intersil, or any of its subsidiaries, or was formerly an officer of Intersil or any of its subsidiaries, other than Mr. Diller, who was formerly the CEO of Elantec Semiconductor, Inc., a Company subsidiary. No member of the Compensation Committee had any relationship requiring disclosure under any paragraph of Item 404 or Item 402(j)(3) of Regulation S-K.

Submission of Director Nominations. The Nominating and Governance Committee will consider director nominees submitted by shareholders in accordance with the procedures set forth in our Restated Bylaws. Those procedures require a shareholder to deliver notice to our Secretary or Assistant Secretary at our principal executive offices. Delivery generally must be not less than 90 or more than 120 days prior to the first anniversary of the preceding year’s Annual Meeting of Shareholders. If the date of the Annual Meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the shareholder must be delivered between 90 and 120 days prior to the Annual Meeting or, if the first public announcement of the date of the Annual Meeting is less than 100 days prior to the Annual Meeting, the 10th day following the public announcement.

Such notice must be in writing and must include:

| (i) | the name and address of the nominating shareholder, as they appear in shareholder listings, |

| (ii) | the class and number of shares of Intersil stock which are owned beneficially and of record by the nominating shareholder, |

| (iii) | the nominee’s written consent to being listed in the proxy statement as a nominee and to serving as a director if elected, and |

| (iv) | any information regarding the nominee that is required under Regulation 14A of the Exchange Act to be included in a proxy statement relating to the election of Directors. Candidates recommended by the shareholders are evaluated on the same basis as other candidates (other than Directors standing for re-election) recommended by our Directors, officers, third party search firms or other sources. |

Criteria and Diversity. Among the minimum qualifications, skills, and attributes that the Nominating and Governance Committee looks for in nominees are the following:

| (a) | integrity, competence, and judgment essential to effective decision-making, |

| (b) | ability and willingness to commit the necessary time and energy to prepare for, attend, and participate in meetings of the Board and one or more of its standing committees, |

| (c) | freedom from other outside involvements that would materially interfere with the individual’s responsibilities as a director, |

| (d) | background and experience that complements or supplements the background and experience of other Board members, |

| (e) | freedom from interests that would present the appearance of being adverse to, or in conflict with, the interests of Intersil, and |

| (f) | a proven record of accomplishment through demonstrated leadership in business, education, government service, finance, manufacturing or other relevant experiences that would tend to enhance Board effectiveness. |

The evaluation process may include a comprehensive background and reference check, a series of personal interviews with members of the Board and the Nominating and Governance Committee, and a thorough review by the Committee of the nominee’s qualifications and other relevant characteristics, taking into consideration the criteria set forth above. In addition, the Nominating and Governance Committee considers cultural and geographical diversity in the director identification and nomination process as described in our Corporate Governance Guidelines. If the Committee determines that a candidate should be nominated for election to the Board of Directors, it will present its findings and recommendation to the full Board for approval.

Majority Voting for Directors. In February 2012, our Board of Directors amended our Bylaws to provide for a majority voting standard for the election of our directors in uncontested elections. Previously, our Bylaws were silent as to the voting standard for directors, and directors were elected using a plurality standard set forth in the Delaware General Corporation Law. In contested director elections, the plurality standard will apply, which means the nominees receiving the greatest numbers of votes will be elected to serve as directors. To be elected in an uncontested election, the votes “for” a director must exceed the votes “against” the director. Abstentions and any broker non-votes will have no effect on the election of directors. If an incumbent director is not elected and no successor has been elected at the meeting, he or she will promptly tender his or her conditional resignation following certification of the vote. The Nominating and Governance Committee will consider the resignation offer and recommend to the Board of Directors whether to accept such offer. The Board of Directors will act on the recommendation within 90 days following receipt of the tender. After coming to a decision, the Board of Directors will publicly disclose its decision whether to accept the director’s resignation offer (and the reasons for rejecting the offer, if applicable). If the Board of Directors does not accept the resignation, the director will continue to serve until the next annual meeting and until a successor has been elected and qualified or until his or her earlier resignation, removal or death. If the Board of Directors accepts the resignation, then the Board of Directors, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board of Directors. The election of directors at the Annual Meeting is an uncontested election and thus the majority voting standard applies.

ITEM 1 ON PROXY BALLOT

Directors are elected at each Annual Meeting and hold office until the election held at the following Annual Meeting. A majority of the votes of eligible shares present in person or by proxy and actually cast is required for the election of directors. Our Amended and Restated Certificate of Incorporation, and our Restated Bylaws, provide for a Board of not fewer than five and not more than eleven members. The Board currently consists of nine Directors.

Director candidates are nominated by the Board upon the recommendation of the Nominating and Governance Committee. The Nominating and Governance Committee has recommended the nine nominees below, each of whom is currently a Director. Shareholders are also entitled to submit the names of director candidates for consideration by the Nominating and Governance Committee in accordance with the procedures set forth in our Restated Bylaws and summarized under the heading “Corporate Governance—Submission of Director Nominations.”

The person named on the form of proxy will vote the shares “FOR” the nominees, unless you instruct otherwise. Each nominee has consented to stand for election. In the event that one or more of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for the remaining nominees and any substitute nominee(s) designated by the Board. Shareholders may cumulate their votes for Directors, and the Director elections are then determined by a majority of the votes cast.

Director Qualifications

Our Director nominees have a reputation for integrity, honesty and adherence to high ethical standards. Each Director has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of services to Intersil and our Board. Finally, we value their significant experience on other boards of directors.

The following biographies provide a brief description of each nominee’s age, principal occupation and business experience, (as of March 8, 2012) and Directorships held in other corporations.

| Nominees | Positions and Offices Held with Intersil |

David B. Bell | CEO, President, and Director |

Robert W. Conn | Director |

James V. Diller | Director |

Gary E. Gist | Chairman of the Board |

Mercedes Johnson | Director |

Gregory Lang | Director |

Jan Peeters | Director |

Robert N. Pokelwaldt | Director |

James A. Urry | Director |

Business Experience of Directors

David B. Bell, CEO, President, and Director. Mr. Bell, age 55, has served as our CEO, President and Director since February 13, 2008. Prior to this, Mr. Bell served as President, Chief Operating Officer, and Director of Intersil from April 2, 2007 to February 12, 2008. Prior to joining Intersil, Mr. Bell was employed for 12 years with Linear Technology Corporation (“LTC”), most recently, from June 2003 to January 2007, as its President. Prior to becoming President of LTC, from January 2002 to June 2003, Mr. Bell served as LTC’s Vice President and General Manager of Power Products and, from February 1999 to January 2002, as LTC’s General Manager of Power Products. From June 1994 to January 1999, he held the position of LTC’s Manager of Strategic Product Development. Mr. Bell has served on the Board of Directors of the Semiconductor Industry Association since March 2008, the Board of Open-Silicon, Inc., a semiconductor design and manufacturing company since March 2010, and the Board of the Global Semiconductor Alliance since November 2011. Mr. Bell joined the Board of the Silicon Valley Leadership Group in September 2011. Mr. Bell’s qualifications to serve as a Director include his more than 30 years of management experience at analog companies in positions including CEO, President, Chief Operating Officer and Research and Development Manager.

Robert W. Conn, Director. Dr. Conn, age 69, has been a Director since April 2000. Dr. Conn was appointed President and director of the Kavli Foundation, a philanthropic organization, in April 2009. Dr. Conn has been President of Conn Engineering & Consulting, Inc. since 2002. In addition, he has been a Professor and Dean of Engineering, Emeritus, at the University of California, San Diego since 2004. From 2002 to 2008, Dr. Conn was Managing Director of Enterprise Partners Venture Capital. From 1994 to July 2002, Dr. Conn was the Dean of the Jacobs School of Engineering, University of California, San Diego, and the Walter J. Zable Endowed Chair in Engineering. Dr. Conn served on the Board of Directors of ChipPAC, Inc. from 2002 through 2004, and on the Board of Directors of STATS ChipPAC, Inc. from 2004 through 2007. Presently, he is a member of the National Academy of Engineering. Dr. Conn has previously served on the Board of Directors of several privately-held companies. Dr. Conn’s qualifications to serve as a Director include his academic experience as Professor of Engineering and Dean of a major university engineering department and his experience as a venture capitalist specializing in technology companies.

James V. Diller, Director. Mr. Diller, age 76, has been a Director since May 2002. Mr. Diller is a retired Chairman of the Board of Elantec Semiconductor, Inc., a post he held from 1997 to May 2002. Mr. Diller served as a Director of Elantec Semiconductor, Inc. from 1986 to May 2002 when Elantec was acquired by Intersil. From November 1998 to July 2000, he served as Elantec’s President and CEO. Mr. Diller is a founder of PMC-Sierra, Inc., a company that engages in the design, development, marketing, and support of communications semiconductors, storage semiconductors, and microprocessors and was its President and CEO from 1983 to 1997; he is currently Vice Chairman of the Board of Directors. In addition, Mr. Diller became Chairman of the Board of Avago Technologies Limited, a leading global manufacturer of optoelectronics and analog interface components, in January 2010 and previously served on the Board of Avago since December 2005. He was a Director of Sierra Wireless, Inc. from 1993 through 2003. Mr. Diller also serves on the Board of Directors of a privately-held company. Mr. Diller’s qualifications to serve as a Director include his extensive analog IC company management experience in positions such as Chairman of the Board, CEO, President and General Manager, and his experience as a product development engineer.

Gary E. Gist, Director. Mr. Gist, age 65, has been Chairman of the Board since May 2005. Prior to this, Mr. Gist served as a Director since our inception in August 1999. Mr. Gist has served as vice president of Palomar Display Products, a privately held company that engages in the development and integration of displays and computer systems for demanding applications used in harsh environments, since January 2009. He has also served as a member of the Board of Directors of Palomar Display Products since May 2009. From 1995 to 2008, Mr. Gist served as the President and CEO of Palomar Technological Companies. Mr. Gist also serves on the Board of Directors of a privately-held company. Mr. Gist’s qualifications to serve as a Director include his management experience as Director, CEO and President of a technology company providing products to the semiconductor industry and his financial experience as a CPA with a prominent public accounting firm.

Mercedes Johnson, Director. Ms. Johnson, age 58, has been a Director since August 2005. Ms. Johnson was previously the Senior Vice President of Finance and Chief Financial Officer (“CFO”) at Avago Technologies from November 2005 until her retirement in August 2008. Prior to her employment with Avago, Ms. Johnson worked for Lam Research Corporation, serving as its Senior Vice President of Finance from June 2004 to January 2005, and as its CFO from April 1997 to May 2004. Ms. Johnson has served as a member of the Board of Directors of Micron Technology, Inc. since June 2005 and has served as a member of the Board of Directors of Juniper Networks since May 2011. She also served on the Board of Directors for Storage Technology Corporation from January 2004 to August 2005. Ms. Johnson’s qualifications to serve as a Director include her experience as a senior financial executive at semiconductor and semiconductor equipment companies, and as a board member of a publicly-traded semiconductor company.

Gregory Lang, Director. Mr. Lang, age 48, has been a Director since February 2006. Mr. Lang has served as President, CEO and Director of PMC-Sierra, Inc., a company that engages in the design, development, market and support of semiconductor solutions for storage, mobile and optical networks, since May 2008. In March 2008, Mr. Lang resigned his position as President, CEO and Director of Integrated Device Technology Inc. (“IDT”). Mr. Lang joined IDT as President in October 2001, was appointed CEO in January 2003 and elected to the IDT Board of Directors in September 2003. Prior to joining IDT, Mr. Lang held the position of Vice President and General Manager of Intel’s platform networking group. Previously he managed Intel’s Ethernet, storage I/O processing, home networking and broadband businesses. Mr. Lang’s qualifications to serve as a Director include his 25 years of experience in the semiconductor industry in positions including CEO, President and Vice President and General Manager.

Jan Peeters, Director. Mr. Peeters, age 60, has been a Director since April 2000. Mr. Peeters is Chairman and CEO of Olameter Inc., a meter asset and data management company, which he formed in 1998. He presently serves, since 1998, as Chairman of Cogeco Inc. and Cogeco Cable Inc., publicly-traded Canadian companies in the areas of broadcasting and cable. In addition, Mr. Peeters serves as Chairman, since 2009, on the Board of GFFI, a small-cap financing company. Mr. Peeters served as Chairman on the Board of iNovia Capital, a venture capital company from 1999 to 2011. He also served as Governor of McGill University from 1999 to 2009 and he served on the Board of Directors of Call-Net, a publicly-traded Canadian telecommunications company, from 1999 to 2002. He was previously founder, vice-chairman, president and CEO of Fonorola Inc., a facilities-based long-distance telephone company from 1988 to 1998, at which time it was acquired by Call-Net Enterprises Inc. Mr. Peeters’ qualifications to serve as a Director include his senior executive experience at public and private companies in positions such as Chairman, Director and CEO.

Robert N. Pokelwaldt, Director. Mr. Pokelwaldt, age 75, has been a Director since April 2000. Mr. Pokelwaldt was previously Chairman and CEO of YORK International Corporation, a manufacturer of air conditioning and cooling systems from January 1993 until his retirement in October 1999. While at YORK International Corporation, he also served as President, CEO and Director from June 1991 to January 1993 and was President and Chief Operating Officer from January 1990 to June 1991. Mr. Pokelwaldt retired from the Board of Directors of Carpenter Tech in May 2004 and he retired from the Board of Directors of Mohawk Industries, Inc. in May 2011. Mr. Pokelwaldt’s qualifications to serve as a Director include his senior executive experience at public and private companies in positions such as Chairman, Director and CEO.

James A. Urry, Director. Mr. Urry, age 58, has been a Director since our inception in August 1999. Mr. Urry has served as Chief Investment Officer and Managing Partner at Augusta Columbia Capital Group LLC since May 2011. Prior to this, Mr. Urry was a Partner at Court Square Capital Partners, a private equity firm from July 2007 to May 2011. Court Square Capital Partners was established as a result of a spin-off from Citigroup Venture Capital Ltd. in 2007. Previous to this, Mr. Urry was a Partner at Citigroup Venture Capital Ltd. from 1989 to June 2007. Mr. Urry served on the Board of Directors of Lyris, Inc. from June 2007 to August 2011 He also served as a Director of AMI Semiconductor prior to the merger of AMI and ON Semiconductor on March 12, 2008. Mr. Urry’s qualifications to serve as a Director include his experience as a senior executive at private equity firms, and as a Director at a public semiconductor firm.

The Board of Directors recommends a vote “FOR” each of the nominees listed.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

ITEM 2 ON PROXY BALLOT

The Board of Directors, acting upon the recommendation of the Audit Committee, asks that the shareholders ratify the selection of KPMG LLP as Intersil’s independent registered public accounting firm to audit and report upon our financial statements for the 2012 fiscal year. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting in person or by proxy and actually cast. Unless otherwise specified by the shareholders, the shares of stock represented by the proxy will be voted FOR ratification of the appointment of KPMG LLP as our independent accountants.

In the event the shareholders fail to ratify the appointment, the Board of Directors will reconsider its selection. Even if the selection is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Board of Directors determines that such a change would be in the best interests of Intersil and our shareholders.

One or more representatives of KPMG LLP are expected to be at the Annual Meeting. They will have an opportunity to make a statement and will be available to respond to appropriate questions.

The Board of Directors recommends that the shareholders vote “FOR” the

ratification of the selection of KPMG LLP to serve as Intersil’s independent

registered public accounting firm for the 2012 fiscal year.

THE INTERSIL CORPORATION

EMPLOYEE STOCK PURCHASE PLAN

ITEM 3 ON PROXY BALLOT

The Board of Directors has approved, subject to shareholder approval, an amendment to increase the number of shares of Common Stock reserved for issuance under The Intersil Corporation Employee Stock Purchase Plan (the “ESPP”) by 2,000,000 shares to a total of 6,533,334 shares. The affirmative vote of the majority of shares present at the Annual Meeting in person or by proxy, and actually cast is required for approval of the amendment to the ESPP.

Prior to the effectiveness of the proposed amendment, a total of 4,533,334 shares of Common Stock had been reserved for issuance under the ESPP. As of March 8, 2012, approximately 508,165 shares were available for purchase under the ESPP.

A summary description of the ESPP is provided below. This summary is qualified in its entirety by the full text of the ESPP, a copy of which is attached to this Proxy Statement as Exhibit A. The closing price of our Common Stock on March 8, 2012 was $11.00 per share.

The Board of Directors believes that the proposed amendment to the ESPP will permit us to continue to offer a competitive compensation package.

The Board of Directors recommends that the shareholders vote “FOR” the amendment to

The Intersil Corporation Employee Stock Purchase Plan.

Summary of the Employee Stock Purchase Plan

Purpose. Our Board of Directors adopted the ESPP to provide eligible employees with the opportunity to acquire an ownership interest through participation in a payroll deduction based employee stock purchase plan designed to qualify under Section 423 of the Internal Revenue Code (the “Code”).

Eligibility and Participation. Generally, any employee, including of our affiliates, on active payroll status who customarily works more than 20 hours per week for more than five months each calendar year is eligible to participate in the ESPP. However, employees who are five-percent owners are not eligible to participate in the ESPP. An election to participate in the ESPP must be made during a semi-annual enrollment period, in accordance with the enrollment procedures prescribed by the ESPP’s administrator. The semi-annual enrollment periods will occur at the times specified by the ESPP’s administrator. As of March 8, 2012, there were approximately 1,652 employees were eligible to participate in the ESPP.

Administration. The ESPP is administered by our Board of Directors or by a committee appointed by the Board (the “Committee”). The Committee consists of at least two individuals, all of whom qualify as “outside directors” and “non-employee directors,” as those terms are defined by section 162(m) of the Code and Rule 16b-3 of the Securities Exchange Act of 1934, respectively.

The Committee may make such rules and regulations and establish such procedures for the administration of the ESPP, as it deems appropriate. The Committee has the authority to interpret the ESPP, with such interpretations to be conclusive and binding on all persons and otherwise accorded the maximum deference permitted by law. Additionally, the Committee may take any other actions and make any other determinations or decisions that it deems necessary or appropriate in connection with the ESPP or the administration or interpretation thereof.

Shares of Stock Available Under the ESPP. A total of 4,533,334 shares of Common Stock are currently reserved for issuance under the ESPP. As of March 8, 2012, approximately 508,165 shares remained available for purchase. If the proposed amendment to the ESPP is approved, both the shares reserved under the ESPP and the shares available for purchase under the ESPP will increase by 2,000,000 shares to a total of 6,533,334 shares. Available shares are authorized but unissued or reacquired Common Stock, including Common Stock purchased on the open market. The number of available shares is subject to adjustment in the event of a stock dividend, stock split, combination of shares, exchange of shares or other similar changes affecting the outstanding Common Stock.

Purchase of Common Stock. Shares of Common Stock will be offered to eligible employees during the purchase periods established by the ESPP. There are two six-month purchase periods: (1) beginning with the first trading day in April and ending on the last trading day in September, and (2) beginning with the first trading day in October and ending on the last trading day in March.

Each participant enrolls in the ESPP for a given purchase period by authorizing payroll deductions designating a percentage of compensation – from 1% to 10%, in 1% increments – to be withheld and credited to an account in his or her name. These contributions are made on an after-tax basis. No interest is credited to this account. An election to participate in the ESPP for a particular purchase period applies to subsequent purchase periods, unless it is revoked as described below. A participant may revoke the election entirely in accordance with the procedure described below, but otherwise may not change his or her elected payroll deduction percentage during a purchase period.

Participants have the right to purchase shares of Common Stock on the purchase date occurring at the end of each purchase period during which they participated in the ESPP. On the purchase date, the participant’s accumulated payroll deductions are used to purchase shares of Common Stock. The purchase price of each share of Common Stock will be eighty-five percent (85%) of the fair market value per share of Common Stock on the applicable purchase date. The number of shares of Common Stock which will be purchased on behalf of a participant on the purchase date will be that whole and fractional number of shares obtained by dividing the total amount of the participant’s payroll deductions for that purchase period by the purchase price in effect for that purchase date. The maximum number of shares of Common Stock which may be purchased is subject to the limitations described below. Any payroll deductions not used because of these limitations are refunded to the participant or rolled over for subsequent purchase periods at the discretion of the ESPP’s administrator.

Stock Purchase Limits. The Code and the ESPP impose certain limits on the amount of Common Stock that can be purchased with payroll deductions under the ESPP. Under the Code and the ESPP, a participant may not purchase Common Stock under the ESPP in an aggregate amount which exceeds $25,000 in fair market value of Common Stock (determined as of the first trading day of the relevant purchase period) during a calendar year. The ESPP also limits the maximum number of shares that may be purchased by a single participant on any one purchase date to 16,667 shares. Such limitation is subject to adjustment for stock dividends, stock splits, combinations of shares, exchanges of shares or other similar changes affecting the outstanding Common Stock.

Termination of Participation. A participant may revoke a payroll deduction election at any time before the last two weeks of the purchase period. Participants who make this revocation will not be allowed to purchase shares on the purchase date. In addition, no further payroll deductions will be collected with respect to that purchase period, and any payroll deductions already collected will be refunded to the participant without interest. A revocation is irrevocable with respect to a particular purchase period. However, a participant may choose to begin participating again by enrolling during the semi-annual enrollment period occurring before the start date of the next purchase period for which he or she is eligible to participate.

If a participant is on a leave of absence, the participant will be deemed to be an employee for a period of up to 90 days. If the leave of absence is paid, the participant’s payroll deduction election in effect at the time of leave will continue. If the leave is unpaid, no deductions or contributions will be permitted during the leave. If the participant returns to work within 90 days after the leave of absence, payroll deductions under the ESPP will automatically resume at the rate in effect at the time the leave began. If the participant’s leave lasts longer than 90 days, the participant will cease to be an eligible employee under the ESPP.

Should a participant cease to be an eligible employee for any reason (including being on leave of absence for more than 90 days, death, long-term disability or lay-off) during any purchase period for which the participant has made an election, his or her payroll deductions with respect to that purchase period will terminate and the participant’s previous payroll deductions will be refunded in cash (without interest).

Shareholder Rights. Participants have all of the rights and privileges of a stockholder with respect to the shares of Common Stock purchased under the ESPP. A participant will only receive dividends paid on the Common Stock purchased if the purchase occurred before the applicable record date for such dividend.

Amendment. The Board of Directors may amend the ESPP at any time and for any reason. However, unless approved by our stockholders, no amendment can:

| · | Increase the maximum number of shares of Common Stock that may be purchased under the ESPP or the maximum number of shares that may be purchased by a participant on any one purchase date; |

| · | Change the purchase price formula so as to reduce the purchase price; or |

| · | Materially increase the benefits payable under the ESPP or materially modify the requirements for eligibility to participate under the ESPP. |

Effective Date and Termination. The effective date of the ESPP was March 1, 2000 and our shareholders approved an amendment of the ESPP on May 6, 2009 to extend the term of our ESPP by an additional nine years. The ESPP is scheduled to terminate on February 28, 2019; however, the Board of Directors may earlier terminate the ESPP at any time at its discretion.

Plan Benefits

The number of shares of Common Stock that will be purchased or received in the future by participants in the ESPP is not currently determinable. Since benefits to be received in the future are not determinable, the below table reflects the benefits received by the stated individual(s) under the ESPP in the 2011 fiscal year.

All shares that are currently outstanding under the ESPP are reflected in the Equity Compensation Plan Information table in this Proxy Statement.

| Intersil Corporation Employee Stock Purchase Plan 2011 | |

| Name | | Dollar Value | | | Number of Units | |

| David B. Bell | | $ | — | | | | — | |

| Jonathan A. Kennedy | | $ | 14,659 | | | | 1,532 | |

| Susan J. Hardman | | $ | 21,153 | | | | 2,124 | |

| Peter R. Oaklander | | $ | 23,066 | | | | 2,180 | |

| Andrew M. Cowell | | $ | — | | | | — | |

| Executive Group | | $ | 44,840 | | | | 4,322 | |

| Non-Executive Officer Employee Group | | $ | 6,490,319 | | | | 682,548 | |

Summary of U.S. Federal Income Tax Consequences

Federal Tax Treatment. A participant recognizes no taxable income and Intersil is not entitled to a deduction for the year in which the participant enrolls in the ESPP nor for the year in which he or she purchases stock under the ESPP.

Section 423 of the Code establishes a holding period which is important in determining how any gain or loss on disposition of shares acquired under the ESPP is to be treated. This holding period is effectively two years from the beginning of the purchase period for shares purchased at the end of such period. If a participant sells or otherwise disposes of shares prior to the expiration of the required holding period (a “disqualifying disposition”), the participant will recognize compensation income at that time equal to the excess of the fair market value of the shares on the purchase date over the purchase price of the shares. Any amount recognized upon a disqualifying disposition in excess of the fair market value of the shares on the purchase date will be treated as short-term or long-term capital gain, depending on whether the shares have been held for more than one year. If the sale price is less than the sum of the purchase price and the amount included in income as a result of the disqualifying disposition, this amount will be treated as a short-term or long-term capital loss, depending on whether the shares have been held for more than one year.

If a participant sells his or her shares after the holding period described above, he or she will recognize compensation income in an amount equal to the lesser of (i) 15% of the fair market value of the Common Stock determined as of the first day of the purchase period or (ii) the excess, if any, of the fair market value of the Common Stock on the date of sale over the purchase price. If the purchase price exceeds the fair market value on the date of sale, no amount is reported as compensation income. If the fair market value of the Common Stock on the date of sale exceeds the sum of the purchase price plus any amount recognized as compensation income, as described above, the amount of such excess is recognized as a long-term capital gain. If the purchase price exceeds the fair market value on the date of sale, such excess is a long-term capital loss.

Withholding. We deduct from participants’ payroll checks all federal, state, local and other taxes required by law to be withheld with respect to any income attributed to participants as a result of their participation in the ESPP.

If a participant makes a disqualifying disposition, and, if we have a tax-withholding obligation because of such disposition, the participant must reimburse Intersil an amount equal to any such withholding tax.

The foregoing discussion is for general informational purposes only and does not purport to address specific federal income tax considerations that may apply to an ESPP participant based on his or her particular circumstances, nor does it address state or local income tax or other tax considerations that may be relevant to a participant.

ITEM 4 ON PROXY BALLOT

The Board of Directors has approved, subject to shareholder approval, an amendment to increase the number of shares of Common Stock authorized for issuance under the Intersil Corporation Amended and Restated 2008 Equity Compensation Plan, as amended and restated from time to time (the “2008 Equity Plan”) by 5,500,000 shares to a total of 34,352,316 shares. As of the date of this Proxy Statement, 28,852,316 shares are reserved for issuance under the 2008 Equity Plan and approximately 8,396,666 of these shares remain available for future awards. If this Proposal is approved by our shareholders, approximately 13,896,666 shares will be available for awards under the 2008 Equity Plan. The affirmative vote of the majority of shares present at the Annual Meeting in person or by proxy and actually cast is required for approval of the amendment to the 2008 Equity Plan.

A summary description of the 2008 Equity Plan is provided below. This summary is qualified in its entirety by the full text of the 2008 Equity Plan, a copy of which is attached to this Proxy Statement as Exhibit B.

The Board of Directors believes that approval of the proposed amendment to the 2008 Equity Plan is necessary to permit Intersil to continue to offer a competitive compensation package.

The Board of Directors recommends that the shareholders vote “FOR” the amendment to

the Intersil Corporation Amended and Restated 2008 Equity Compensation Plan.

Summary of the 2008 Equity Plan

Purpose. The Board adopted the 2008 Equity Plan to enable key employees, directors and consultants to participate in the equity ownership of Intersil through awards of options, restricted stock, stock appreciation rights, deferred stock units, phantom shares and other stock-based awards. The purpose of the 2008 Equity Plan is to (i) align the interests of the eligible individuals with the interests of our shareholders, (ii) provide incentives for eligible individuals to exert maximum efforts for our success, (iii) attract and retain the best available talent, and (iv) reward key personnel for their part in increasing shareholder value.

Effective Date and Termination. Our Board adopted the 2008 Equity Plan on February 9, 2011, and our shareholders approved an amendment and restatement of the 2008 Equity Plan on May 4, 2011 at our 2011 Annual Meeting. The 2008 Equity Plan will terminate on May 4, 2021, unless earlier terminated by the Board.

Administration. The 2008 Equity Plan is administered by a sub-committee of our Compensation Committee of the Board (the “Committee”). The Committee is currently composed of three members, each of whom is a “non-employee director” as defined under Rule 16b-3(b)(3) promulgated by the SEC under the Exchange Act and an “outside director” as defined under Section 162(m) of the Code and the regulations thereunder. The Board has designated certain members or officers to serve as a Secondary Committee and has delegated to the Secondary Committee authority to grant awards to eligible individuals who are not subject to the requirements of Rule 16b-3 under the Exchange Act or section 162(m) of the Code, subject to compliance with all legal requirements. The Secondary Committee has the same authority with respect to selecting the individuals to whom awards are granted and establishing the terms and conditions of awards as the Committee has under the terms of the 2008 Equity Plan.

The Committee has the following powers and authority with regard to the 2008 Equity Plan:

| (i) | to interpret and administer the 2008 Equity Plan; |

| (ii) | to select the employees, directors and consultants to receive awards under the 2008 Equity Plan; |

| (iii) | to determine the type and amount of awards to be granted to participants; |

| (iv) | to determine the times at which awards will be granted; |

| (v) | to determine the terms and conditions of awards granted under the 2008 Equity Plan (including, but not limited to, restrictions as to vesting, transferability or forfeiture, exercisability or settlement of an award and waivers or accelerations thereof, and waivers of or modifications to performance goals relating to an award, based in each case on such considerations as the Committee shall determine) and the terms of agreements which will be entered into with participants with respect to the 2008 Equity Plan; |

| (vi) | to adopt regulations for carrying out the 2008 Equity Plan and make changes in such regulations as it shall from time to time, think advisable; and |

| (vii) | to amend the 2008 Equity Plan if such power is so delegated by the Board. |

Participation. All of our employees and consultants and all of our Directors are eligible to participate in the 2008 Equity Plan.

Shares of Stock Available for Grant. The 2008 Equity Plan currently authorizes 28,852,316 shares for issuance under our general share pool, 23,728,692 shares of which have been issued as of the date of this Proxy Statement. If the amendment to the 2008 Equity Plan is approved, the number of shares authorized for issuance under our general share pool will increase to 34,352,316 shares, which represents an increase of 5,500,000 shares. Each share issued pursuant to an award other than a stock option or stock appreciation right (“SAR”) will reduce the number of shares available for issuance by 2.33 shares. For example, if all awards under the 2008 Equity Plan are made in the form of restricted stock grants, approximately 14,743,483 shares will be available for issuance pursuant to such grants. The shares may be treasury shares or authorized but unissued shares. The maximum number of shares that may be granted to any one individual may not exceed 666,667 during any calendar year, or in the case of awards payable in cash, $2,000,000.

Term of Awards. The maximum term of any option or stock appreciation right granted under the 2008 Equity Plan is seven years from the date of grant.

Certain Vesting Requirements. Subject to the terms of the 2008 Equity Plan, awards of deferred stock units, other stock-based awards, phantom shares and restricted stock shall vest ratably over a period of not less than three years unless the vesting of such awards is based upon the achievement of performance criteria, in which case such awards will vest over a period of not less than one year. Notwithstanding the foregoing, the Committee may, in its sole discretion, grant awards of deferred stock units, other-stock-based awards, phantom shares and restricted stock representing, in the aggregate, not more than 10% of the number of shares reserved for issuance under the 2008 Equity Plan that are not subject to any minimum vesting period requirement.

Changes in Capital Structure. In the event of certain changes in our capital structure, such as a merger, consolidation, reorganization, share exchange, sale of substantially all of our assets or stock, stock dividend, stock split or other similar event, the Committee will make appropriate adjustments in the number and kind of shares authorized by the 2008 Equity Plan and other adjustments to outstanding awards as it deems appropriate.

Change of Control. In the event of a change in control (as defined in the 2008 Equity Plan), the Committee may, at its discretion (i) cancel any outstanding vested options and SARs in exchange for a cash payment of an amount equal to the difference, if any, between the then fair market value of the stock underlying the award less the exercise price of the award, (ii) after having given the award holder a chance to exercise any outstanding options or SARs, terminate any or all of the award holder’s unexercised options or SARs, (iii) where we are not the surviving corporation, cause the surviving corporation to assume or replace all outstanding options or SARs with awards involving the common stock of the successor corporation on terms necessary to preserve the rights of award holders, (iv) accelerate the vesting of options, SARs, restricted stock and other awards made under the 2008 Equity Plan, or (v) take any other actions it deems appropriate. In addition, unless otherwise provided by the Committee, all phantom shares, deferred stock units and other stock-based awards will generally be settled in a lump sum payment upon a change in control.

Amendment and Termination of the 2008 Equity Plan. The Board (or the Committee, if such power is so delegated by the Board) may amend, modify, suspend or terminate the 2008 Equity Plan, provided that shareholder approval of any amendment is obtained as required by applicable laws or regulations. The Committee may also amend any outstanding award without a participant’s consent, but an amendment to a participant’s award may not adversely impact the participant without his or her consent unless the amendment is required by law. However, neither the Board nor the Committee may, without approval of our shareholders, implement a program that provides for the repricing, replacing or cash buy-back, of underwater awards.

Performance Goals. Awards may be granted or vested contingent upon attaining goals related to our performance or the performance of any of our subsidiaries, divisions or business units (including divisions and business units of subsidiaries). Performance goals will be based upon one or more of the following: revenue; revenue growth; earnings before interest, taxes, depreciation and amortization (“EBITDA”); operating income; net operating income after tax; pre- or after-tax income; cash flow; cash flow per share; net earnings; earnings per share; return on equity; return on capital employed; return on assets; economic value added (or an equivalent metric); share price performance; total shareholder return; improvement in or attainment of expense levels; improvement in or attainment of working capital levels; or debt reduction.

Options. The Committee may grant options that are intended to be incentive stock options under Section 422 of the Code and non-qualified stock options. The price per share at which our common stock may be purchased upon exercise of an option may not be less than the fair market value of a share of common stock on the date of grant (or 110% of the fair market value of a share of common stock on the date of grant in the case of an incentive stock option granted to a more than 10% shareholder). The option price of an option awarded under the 2008 Equity Plan may not be reduced after the grant of such option except in the case of a change in our capital structure, unless the reduction is approved by a majority of the shares present and voted at a duly called meeting of the shareholders. The maximum term of an option is seven years from the date of grant (or 5 years from the date of grant in the case of an incentive stock option granted to a more than 10% shareholder).

A participant may pay the option price: (i) in cash or with a certified or bank cashier’s check at the time of exercise, (ii) with the consent of the Committee, by delivery of an assignment of a sufficient amount of the proceeds from the sale of shares of common stock to be acquired pursuant to such exercise, or (iii) with the consent of the Committee, in whole or in part in common stock held by the participant and valued at their fair market value on the date of exercise. The ability of a participant to exercise his or her options following termination of employment is addressed in the relevant award agreements.

The Committee may include in an option agreement a provision enabling the participant to exercise shares subject to options prior to the full vesting of the option. Any shares so acquired will remain subject to the vesting schedule of the underlying option and, prior to the time those shares become vested and following the participant’s termination of employment, we will be permitted to repurchase any shares so acquired for an amount equal to the lesser of the exercise price paid or the fair market value of the shares on the date of the repurchase.

Stock Appreciation Rights. A SAR allows a recipient to receive, upon exercise of the right, the increase in the fair market value of a specified number of shares of common stock from the date of grant to the date of exercise. Payment upon exercise of a SAR may be made in cash or common stock (including restricted stock). The ability of a participant to exercise his or her SARs following termination of employment is addressed in the relevant award agreements.

Restricted Stock. In a restricted stock award, the Committee grants to a participant shares of common stock that are subject to forfeiture upon specified events and/or the failure to achieve specified performance goals during a specified restriction period. During the restriction period, holders of restricted stock have the right to receive dividends from (which dividends are subject to the same restrictions as the underlying shares) and to vote the shares of restricted stock. Unless otherwise determined by the Committee, shares of restricted stock that have not yet become vested will be forfeited when a participant’s service is terminated for any reason.

Phantom Shares. The award of a phantom share gives a participant the right to receive payment of the fair market value of a share of common stock (or such lesser amount as determined by the Committee) upon the vesting of such phantom share award (or such later date as may be elected by the participant). The Committee establishes the terms and conditions of a phantom share award in an award agreement at the time the award is granted, including when such shares vest. Phantom shares will be settled upon vesting or at the end of a deferral period, either in cash or in shares of common stock or in any combination of the foregoing, as determined by the Committee. Payment will generally be made in a single lump sum, except that the Committee may allow a participant to elect to receive payment in installments over a period not to exceed 10 years. Unless otherwise determined by the Committee, phantom shares that are not vested upon a participant’s separation from service will be forfeited.

Deferred Stock Units. In a deferred stock unit (“DSU”) award, we will deliver, subject to certain conditions, a fixed number of shares of common stock to the participant at the end of a vesting period, or if elected by the participant, at the end of a deferral period which occurs after the award has vested. During the vesting and deferral period(s), the participant has no voting rights with respect to any shares deliverable in connection with the DSU. Amounts equal to any dividends declared prior to vesting, and post-vesting during the deferral period(s), will be paid to the participant, without interest, at the time when the shares are no longer subject to vesting or a deferral period(s). Unless otherwise determined by the Committee, all unvested DSUs will be forfeited upon a participant’s separation from service.

Other Stock-Based Awards. The Committee is authorized to grant any other type of stock-based award that is payable in, or valued in whole or in part by reference to, shares of our common stock and that is deemed by the Committee to be consistent with the purposes of the 2008 Equity Plan.

New Plan Benefits. Because grants of awards will be made from time to time by the Committee to those persons whom the Committee determines in its discretion should receive grants of awards, the benefits and amounts that may be received in the future by persons eligible to participate in the 2008 Equity Plan are not presently determinable.

Summary of U.S. Federal Income Tax Consequences

The following discussion is a summary of certain federal income tax considerations that may be relevant to participants in the 2008 Equity Plan. The discussion is for general informational purposes only and does not purport to be complete or address specific federal income tax considerations that may apply to a participant based on his or her particular circumstances, nor does it address state or local income tax or other tax considerations that may be relevant to a participant.

PARTICIPANTS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE PARTICULAR FEDERAL INCOME TAX CONSEQUENCES TO THEM OF PARTICIPATING IN THE 2008 EQUITY PLAN, AS WELL AS WITH RESPECT TO ANY APPLICABLE STATE OR LOCAL INCOME TAX OR OTHER TAX CONSIDERATIONS.

Incentive Stock Options

Upon the grant of an incentive stock option (as defined in Section 422(b) of the Code), the option holder does not recognize any income and the Company (or a subsidiary, as applicable) is not entitled to a deduction. In addition, no income for regular income tax purposes will be recognized by an option holder upon the exercise of an incentive stock option if the requirements of the 2008 Equity Plan and the Code are satisfied, including, without limitation, the requirement that the option holder remain employed by the Company or a subsidiary during the period beginning on the date of grant and ending on the day three months (or, in the case of the option holder’s disability, one year) before the date the option is exercised. If an option holder has not remained an employee of the Company or a subsidiary during the period beginning on the date of grant of an incentive stock option and ending on the day three months (or one year in the case of the option holder’s disability) before the date the option is exercised, the exercise of such option will be treated as the exercise of a non-qualified stock option and will have the tax consequences described below in the section entitled “Non-Qualified Stock Options.”

The federal income tax consequences of a disposition of the shares of common stock acquired pursuant to the exercise of an incentive stock option depends upon when the disposition of such shares occurs.

If the disposition of such shares occurs more than two years after the date of grant of the incentive stock option and more than one year after the date of exercise, any gain or loss recognized upon such disposition will be long-term capital gain or loss and neither the Company nor a subsidiary, as applicable, will be entitled to any income tax deduction with respect to such incentive stock option.

If the disposition of such shares occurs within two years after the date of grant of the incentive stock option or within one year after the date of exercise (a “Disqualifying Disposition”), the excess, if any, of the amount realized over the option price will be treated as taxable ordinary income to the option holder and, subject to Section 162(m) of the Code, the Company or a subsidiary, as applicable, will be entitled to a deduction equal to the amount of ordinary income recognized by the option holder on such disposition. The amount of ordinary income recognized by the option holder in a Disqualifying Disposition (and the corresponding deduction, if any, to the Company or a subsidiary, as applicable) is limited to the lesser of the gain on such sale and the difference between the fair market value of the shares on the date of exercise and the option price. Any gain realized in excess of this amount will be treated as short-term or long-term capital gain (depending upon whether the shares have been held for more than one year). If the option price exceeds the amount realized upon such a disposition, the difference will be short-term or long-term capital loss (depending upon whether the shares have been held for more than one year).