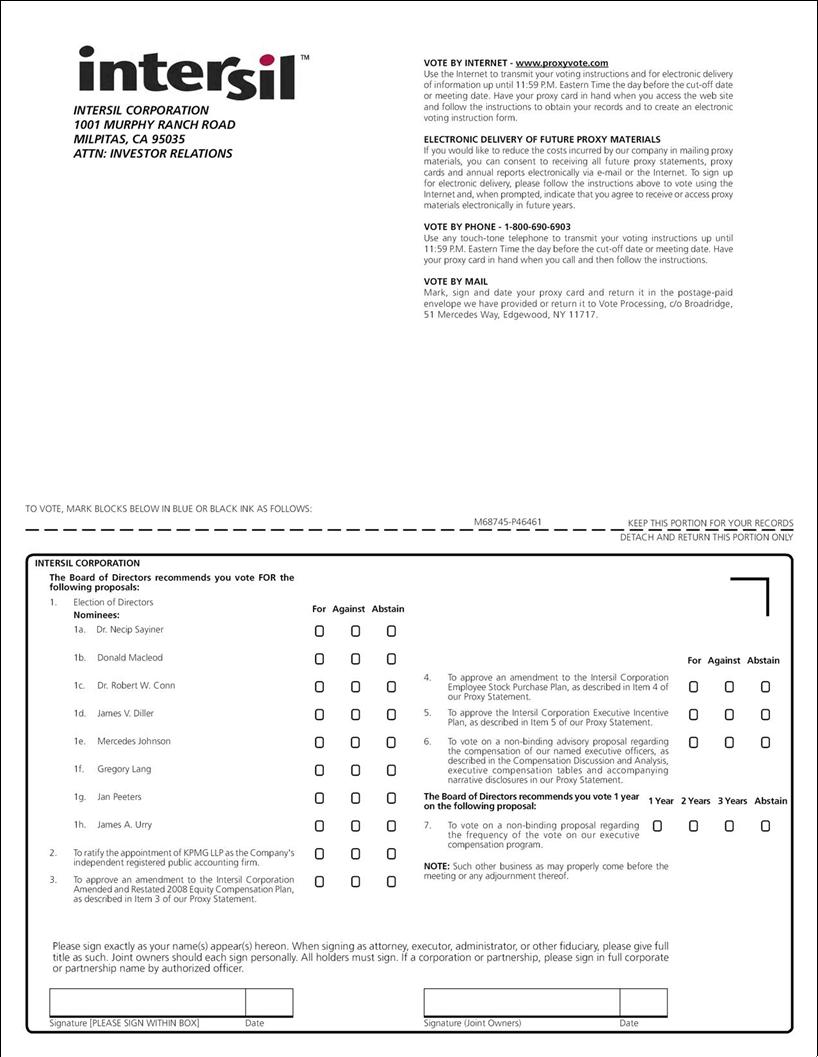

VOTING PROCEDURES

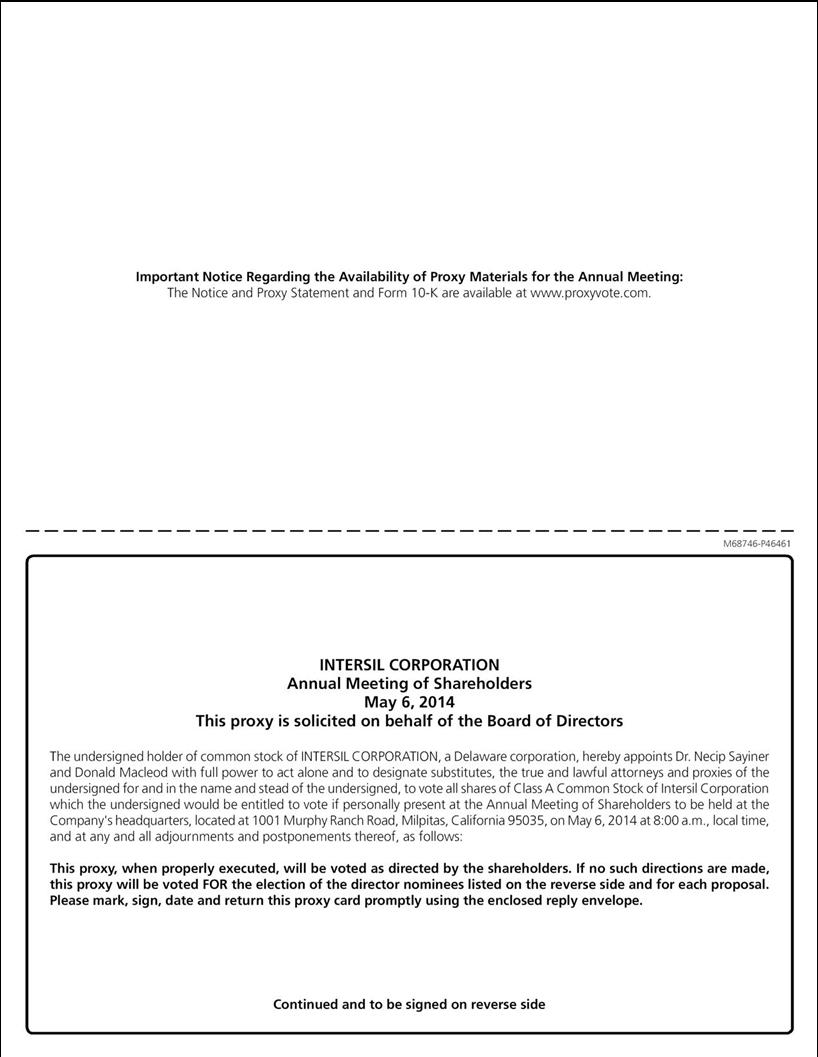

Your vote is very important. Your shares can only be voted at the Annual Meeting if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to assure that your shares will be represented. Most shareholders have a choice of voting by the Internet, a toll-free telephone number or requesting and completing a proxy card and mailing it in the postage-paid envelope provided. Please refer to your Notice of Availability of Proxy Materials to see which options are available to you. Proxies submitted by telephone or online must be received by 12:00 midnight, EDT, on Monday, May 5, 2014.

You may revoke your proxy at any time before it is voted at the Annual Meeting by (a) giving written notice to our Secretary, (b) submitting a proxy bearing a later date, or (c) casting a ballot at the Annual Meeting. Properly executed proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided. If you submit a proxy without providing directions, your shares will be voted by the individuals named on your proxy card as recommended by our Board. If you wish to give a proxy to someone other than those named on the proxy card, cross out those names and insert the name(s) of the person(s), not more than three, to whom you wish to give your proxy.

Who can vote? Shareholders of record as of the close of business on March 10, 2014 are entitled to vote. On that day, 127,795,198 shares of Class A Common Stock were outstanding and eligible to vote. A list of shareholders eligible to vote will be available at our headquarters, located at 1001 Murphy Ranch Road, Milpitas, CA, 95035, beginning April 21, 2014. Shareholders may examine this list during normal business hours for any purpose relating to the Annual Meeting.

How does the Board recommend I vote? The Board recommends a vote “FOR” each Board nominee (Item 1), “FOR” the ratification of the Board of Directors’ appointment of KPMG LLP as our independent registered public accountants for the upcoming year (Item 2), “FOR” the approval of an amendment to our Amended and Restated 2008 Equity Compensation Plan to increase the number of shares authorized for issuance under the Plan (Item 4), “FOR” the approval of an amendment to the Intersil Corporation Employee Stock Purchase Plan to increase the maximum number of shares of Common Stock that may be purchased under the Plan (Item 5), “FOR” the approval of the Intersil Corporation Executive Incentive Plan, “FOR” approval of the compensation of our NEOs (Item 6), and “FOR” approval of a one year frequency of future advisory votes on compensation of our NEOs (Item 7).

What shares are included in the proxy card? The proxy card represents all the shares of voting stock registered to your account. Each share is entitled to one vote on each matter presented other than in the election of Directors. Our Amended and Restated Certificate of Incorporation provides for cumulative voting for Directors. With cumulative voting, at each election of Directors, each holder of Class A Common Stock is entitled to votes equal to the number of shares they hold multiplied by the number of Directors to be elected. The holder may cast all of their votes for a single candidate or may distribute them among any number of candidates.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of common stock entitled to vote, is represented. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum has been reached. The affirmative vote of a majority of eligible shares present, in person or by proxy, at the Annual Meeting, and actually cast, is required to approve all matters. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners, the nominees may vote those shares only on routine matters such as the ratification of the appointment of independent accountants. On all non-routine matters, such as the election of Directors, nominees who have not received instructions from beneficial owners cannot vote and there is a so-called “broker non-vote” on that matter. Broker non-votes and abstentions are not counted in tabulations of the votes cast by shareholders and will have no effect in determining whether there has been an affirmative majority vote on a particular matter.

Who will count the vote? Broadridge Financial Solutions, Inc. will tally the vote, which will be certified by the Inspector of Elections.

Is my vote confidential? Proxies, ballots and voting tabulations are available for examination only by the Inspector of Elections and tabulators. Your vote will not be disclosed to the Board or to our management other than the Inspector of Elections and except as may be required by law.

CORPORATE GOVERNANCE

In accordance with Delaware General Corporation Law and our Amended and Restated Certificate of Incorporation and Restated Bylaws, our business, property and affairs are managed under the direction of the Board. The Board has responsibility for reviewing our overall performance rather than day-to-day operations. Its primary responsibility is to oversee the actions of our management, and in so doing, serve the best interests of Intersil and its shareholders. The Board selects and provides for the succession of executive officers, and subject to recommendations by the Nominating and Governance Committee, nominates individuals to serve as directors upon election at our Annual Meeting or to fill any vacancies on the Board. The Board reviews corporate objectives and strategies, and evaluates and approves significant policies and proposed major commitments of corporate resources. The Board participates in decisions that could have a significant economic impact on Intersil. Management keeps the Directors informed of corporate activities through regular written reports and presentations at Board and committee meetings.

The Board believes that good corporate governance practices are essential to fostering good shareholder relations and creating shareholder value. We continually review our governance practices to ensure their relevance and appropriateness for Intersil and all of our shareholders. The Board’s Corporate Governance Guidelines (which includes director independence criteria), the charters of each of the Board’s committees, our Code of Corporate Conduct, and our Code of Ethics for Our Chief Executive Officer and Senior Financial Officers are available on the Investor Relations pages of our website at www.intersil.com. Shareholders may request copies of these documents free of charge by writing to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, CA 95035, Attn: Investor Relations.

Board Leadership Structure. The roles of Chief Executive Officer (“CEO”) and Chairman of the Board are separate in recognition of the differences between the two roles. The CEO provides the strategic direction and the day-to-day leadership and performance, while the Chairman of the Board is an independent director with well-defined roles and responsibilities. This leadership structure is appropriate given that, among other things, the Chairman provides guidance to the CEO, presides over Board meetings and executive sessions which take place at each regularly scheduled Board meeting, acts as the liaison between the independent directors and the CEO, and facilitates full and open discussion among management and the independent directors. We believe that this structure allows the Board to fulfill its duties effectively and efficiently.

Members of the Board and its Committees. The table below provides a list of our Directors as well as the Committee(s) on which they served in 2013. Each of the incumbent Directors attended at least 79% of the total number of Board and Committee meetings on which they served. It has been determined that, other than Dr. Sayiner, all of the Directors listed below are currently independent under the listing standards of The NASDAQ Stock Market.

| | | | | | |

Directors | | Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

Robert W. Conn | | Robert W. Conn | | James V. Diller[3] | | James V. Diller[3] |

James V. Diller | | Mercedes Johnson[1] | | Gary E. Gist | | Gregory Lang[4] |

Gary E. Gist | | Jan Peeters[2] | | Mercedes Johnson[1] | | Donald Macleod[5] |

Mercedes Johnson | | Robert N. Pokelwaldt | | Gregory Lang[4] | | Jan Peeters |

Gregory Lang | | | | Donald Macleod[5] | | Robert N. Pokelwaldt[2] |

Donald Macleod (Chairman) | | | | James A. Urry[2] | | James A. Urry |

Jan Peeters | | | | | | |

Robert N. Pokelwaldt | | | | | | |

Necip Sayiner | | | | | | |

James A. Urry | | | | | | |

| | | | | | |

Seven Board of Director meetings were held in 2013; five actions were taken by unanimous written consent | | Nine Audit Committee meetings were held in 2013; no actions were taken by unanimous written consent | | Six Compensation Committee meetings were held in 2013; eleven actions were taken by unanimous written consent | | Four meetings were held by the Nominating and Governance Committee in 2013; two actions were taken by unanimous written consent |

| [1] | | Ms. Johnson served as a member of the Audit Committee from January 2013, and the Compensation Committee from February 2013, until her appointment as Interim Chief Financial Officer on April 1, 2013 at which time she became ineligible to serve as a member of those Committees under applicable NASDAQ Listing Rules. |

| [2] | | Chairman of the Committee. |

| [3] | | Mr. Diller served as Interim CEO of Intersil from December 9, 2012 through March 13, 2013 during which time he was ineligible to serve on Committees of the Board. He resumed his positions as a member of the Nominating and Governance Committee on March 14, 2013, upon his resignation as Interim CEO, and the Compensation Committee on May 5, 2013. |

| [4] | | Mr. Lang was a member of the Compensation Committee through February 5, 2013. He was appointed a member of the Nominating and Governance Committee on February 6, 2013. |

| [5] | | Mr. Macleod was appointed a member of the Compensation Committee on February 6, 2013 and a member of the Nominating and Governance Committee on May 9, 2013. |

Directors Attendance at the Annual Meeting. We strongly encourage each of our Directors to attend the Annual Meeting. Last year, each of the incumbent Directors attended the Annual Meeting.

Committees of the Board. The Board has established three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The charter of each committee is available under “Corporate Governance” on the Investor Relations section of our website at www.intersil.com.

Audit Committee—maintains the sole responsibility to appoint, approve engagements of, and oversee the independence and performance of our independent accountants. In addition, the Audit Committee oversees the integrity of our financial reporting and compliance with laws and regulations related to our financial reporting. They also have the responsibility to establish procedures for the receipt and treatment of complaints regarding our financial reporting, internal accounting controls or other related auditing matters. The Audit Committee has the authority to engage counsel and other advisors to assist in carrying out its responsibilities. Mr. Peeters qualifies as a “financial expert” according to applicable securities laws and SEC regulations, and he has been designated by the Board as the financial expert.

Compensation Committee—reviews and approves the compensation of executive officers and certain other highly compensated individuals. In addition, the Compensation Committee administers certain benefit plans and makes recommendations to the Board regarding compensation of Board members. It also has the authority to administer, grant and issue awards under our equity compensation plan. Pursuant to its Charter, the Compensation Committee has delegated authority to a subcommittee, composed of at least two directors, to grant equity awards to executives and establish, administer, and certify the attainment of, performance goals associated with performance-based compensation paid to executives. (the “Subcommittee”). The Subcommittee consists solely of directors who qualify as “outside directors” within the meaning of the Treasury Regulations promulgated under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Board has determined that, other than Mr. Diller, who once served as CEO of Elantec Semiconductor, Inc., now a wholly-owned subsidiary of Intersil, each member of the Compensation Committee qualifies as an “outside director.”

Nominating and Governance Committee—identifies, reviews, evaluates and recommends potential candidates to serve on the Board, as Chairman and as members of committees. In addition, the Nominating and Governance Committee serves as a focal point for communication between such candidates, our Directors who are not members of the Nominating and Governance Committee, and our management. They also monitor, evaluate and recommend corporate governance guidelines.

The Board’s Role in Risk Oversight. The Board’s role in our risk oversight process includes receiving regular reports from members of senior management on areas of material risk to Intersil, including operational, financial, legal, regulatory, and strategic risks. The Audit Committee of the Board regularly reviews areas of material risk through an ongoing process of Enterprise Risk Management (“ERM”) to understand company-wide risk identification, risk management and risk mitigation strategies. The ERM process reviews areas of material risk at least annually and such reviews are discussed with the Audit Committee on a regular basis. The Chairman of the Audit Committee reports on the discussion during the next full Board meeting. The Board provides management guidance through the ERM process. This process enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. We believe that the practices described above combined with our current leadership structure facilitate effective Board oversight of our significant risks.

Shareholder Communications. Parties interested in communicating directly with any of the individual Directors or the Board as a group may do so by writing to Investor Relations via e-mail at investor@intersil.com, or by mail to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, California 95035. Our policy is to deliver such communications directly to the Board.

Directors’ Compensation and Related Party Transactions. At the recommendation of the Compensation Committee, effective January 1, 2014, our Board implemented the following annual cash compensation for our non-employee directors which is payable in quarterly installments:

| | | |

| Annual Cash Compensation |

| | | |

| Chairman | | Members |

Board Members | $80,000 | | $50,000 |

Audit Committee | $20,000 | | $10,000 |

Compensation Committee | $15,000 | | $7,500 |

Nominating and Governance Committee | $10,000 | | $5,000 |

Director compensation is generally reviewed annually. In order to enhance the alignment of interests between Directors and shareholders, Directors are required to own a certain minimum dollar value of Intersil common stock. At the recommendation of the Compensation Committee, effective January 1, 2014, our Board implemented a common stock ownership requirement for non-employee directors in an amount equal to three times the value of the annual cash retainer (currently $150,000), which must be attained by the fifth anniversary of the date of the Director’s initial election to the Board.

Effective January 1, 2014, non-employee directors also receive equity compensation as follows:

| | |

Annual Grants | | Initial Grants for Newly-Elected Directors |

Deferred stock units equal in value to $120,000, determined by using the closing share price of Intersil’s common stock on The NASDAQ Stock Market, on the date of grant. These deferred stock units will generally become vested one year from the date of grant. | | 1. Deferred stock units equal in value to $75,000, determined by using the closing share price of Intersil’s common stock on The NASDAQ Stock Market, on the date of grant. These deferred stock units will vest at a rate of 33 1/3% per year. |

| | 2. Options to purchase Intersil’s common stock equal in value to $75,000, determined by using a generally accepted method of option valuation, on the date of grant. These stock options will vest at a rate of 33 1/3% per year. |

| | 3. Deferred stock units in an amount equal to the Annual Grant, pro-rated for time served as a director during the year of election, with vesting occurring the day prior to the next Annual Meeting. |

Directors are reimbursed for travel expenses incurred while attending Board and committee meetings. Non-employee directors do not participate in any cash incentive plans, or participate in any pension plan or deferred compensation plan. Related party transactions, if any, are reviewed by the Audit Committee. There were no related party transactions during fiscal year 2013.

The following table provides compensation information for 2013 for each non-employee member of our Board.

| | | | | | | | | | | |

Directors' Compensation Table |

| | | | | | | | | | | |

| | Fees Earned or Paid in Cash | | Stock Awards | | Option Awards | | All Other Compensation | | Total |

Director | | ($) | | ($) [1] | | ($) [2] | | ($) [3] | | ($) |

Robert W. Conn | | 55,000 | | 33,520 | | 8,350 | | 3,840 | | 100,710 |

James V. Diller | | 43,077 | | 33,520 | | 8,350 | | 3,840 | | 88,787 |

Gary E. Gist | | 51,000 | | 33,520 | | 8,350 | | 3,840 | | 96,710 |

Mercedes Johnson | | 27,710 | | - | | - | | 3,840 | | 31,551 |

Gregory Lang | | 50,986 | | 33,520 | | 8,350 | | 3,840 | | 96,697 |

Donald Macleod | | 85,425 | | 33,520 | | 8,350 | | 640 | | 127,935 |

Jan Peeters | | 70,000 | | 33,520 | | 8,350 | | 16,880 | | 128,750 |

Robert N. Pokelwaldt | | 65,000 | | 33,520 | | 8,350 | | 3,840 | | 110,710 |

James A. Urry | | 62,000 | | 33,520 | | 8,350 | | 13,040 | | 116,910 |

| | | | | | | | | | | |

| | | | | | | | | | | |

[1] | DSUs awarded at a price of $8.38 on April 1, 2013. The 2013 grants will vest incrementally over a three year period at

33 1/3% per year on the date of the grant. Ms. Johnson did not receive an Annual Grant in 2013 associated with her director role. |

| | | | | | | | | | | |

[2] | Stock options issued on April 1, 2013 with a strike price of $8.38 and a calculated fair value of $1.67. Options vest 100% on the first anniversary of the date of grant. Ms. Johnson did not receive an Annual Grant in 2013 associated with her director role. |

| | | | | | | | | | | |

[3] | Dividends paid on Deferred Stock Units ("DSUs") in 2013. Dividends paid to Messrs. Peeters and Urry include dividends from their 2005 DSUs which were deferred and released in 2013. |

Compensation Committee Interlocks and Insider Participation. During fiscal year 2013, no member of the Compensation Committee while serving as such was an officer or employee of Intersil, or any of its subsidiaries, or was formerly an officer of Intersil or any of its subsidiaries, other than Mr. Diller, who was formerly the CEO of Elantec Semiconductor, Inc., an Intersil subsidiary and formerly the Interim CEO of Intersil. For the period of December 9, 2012 through May 5, 2013, Mr. Diller was not a member of the Compensation Committee due to his appointment as our Interim CEO from December 9, 2012 through March 13, 2013. No member of the Compensation Committee had any relationship requiring disclosure under any paragraph of Item 404 or Item 402(j)(3) of Regulation S-K.

Submission of Director Nominations. The Nominating and Governance Committee will consider director nominees submitted by shareholders in accordance with the procedures set forth in our Restated Bylaws. Those procedures require a shareholder to deliver notice to our Secretary or Assistant Secretary at our principal executive offices. Delivery generally must be not less than 90 or more than 120 days prior to the first anniversary of the preceding year’s Annual Meeting of Shareholders. If the date of the Annual Meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the shareholder must be delivered between 90 and 120 days prior to the Annual Meeting or, if the first public announcement of the date of the Annual Meeting is less than 100 days prior to the Annual Meeting, the 10th day following the public announcement.

Such notice must be in writing and must include:

| (i) | | the name and address of the nominating shareholder, as they appear in shareholder listings, |

| (ii) | | the class and number of shares of Intersil stock which are owned beneficially and of record by the nominating shareholder, |

| (iii) | | the nominee’s written consent to being listed in the proxy statement as a nominee and to serving as a director if elected, and |

| (iv) | | any information regarding the nominee that is required under Regulation 14A of the Exchange Act to be included in a proxy statement relating to the election of Directors. Candidates recommended by the shareholders are evaluated on the same basis as other candidates (other than Directors standing for re-election) recommended by our Directors, officers, third party search firms or other sources, |

| (v) | | as to the shareholder giving the notice and any beneficial owner on whose behalf the nomination is made, a description of any proxy, contract, agreement, arrangement or understanding between or among such shareholder and any such beneficial owner, any of their respective affiliates or associates, and any other person or persons in connection with the proposal of such nomination, (I) a description of any agreement, arrangement or understanding (including any derivative or short positions, profits interests, options, warrants, stock appreciation or similar rights, hedging transactions and borrowed or loaned shares) that has been entered into by or on behalf of, or any other agreement, arrangement or understanding that has been made, the effect or intent of which is to mitigate loss to, manage risk or benefits of share price changes for, or increase or decrease the voting power of, such shareholder or any such beneficial owners with respect to Intersil’s securities, (II) a representation that the shareholder is a holder of record of our stock and entitled to vote at such meeting to bring such nomination before the meeting and (III) a representation as to whether such shareholder or any such beneficial owner intends or is part of a group that intends to (x) deliver a proxy statement and/or form of proxy to holders of at least the percentage of the voting power of our outstanding capital stock required to elect each such nominee and/or (y) otherwise to solicit proxies from shareholders in support of such a proposal. Such information shall be supplemented by such shareholder and any such beneficial owner promptly, and in no event later than three (3) business days following any change to the information required under such clauses. |

Criteria and Diversity. Among the minimum qualifications, skills, and attributes that the Nominating and Governance Committee looks for in nominees are the following:

| (a) | | integrity, competence, and judgment essential to effective decision-making, |

| (b) | | ability and willingness to commit the necessary time and energy to prepare for, attend, and participate in meetings of the Board and one or more of its standing committees, |

| (c) | | freedom from other outside involvements that would materially interfere with the individual’s responsibilities as a director, |

| (d) | | background and experience that complements or supplements the background and experience of other Board members, |

| (e) | | freedom from interests that would present the appearance of being adverse to, or in conflict with, the interests of Intersil, and |

| (f) | | a proven record of accomplishment through demonstrated leadership in business, education, government service, finance, manufacturing or other relevant experiences that would tend to enhance Board effectiveness. |

The evaluation process may include a comprehensive background and reference check, a series of personal interviews with members of the Board and the Nominating and Governance Committee, and a thorough review by the Committee of the nominee’s qualifications and other relevant characteristics, taking into consideration the criteria set forth above. In addition, the Nominating and Governance Committee considers gender, cultural and geographical diversity in the director identification and nomination process as described in our Corporate Governance Guidelines. If the Committee determines that a candidate should be nominated for election to the Board, it will present its findings and recommendation to the full Board for approval.

Majority Voting for Directors. In February 2012, our Board amended our Bylaws to provide for a majority voting standard for the election of our directors in uncontested elections. Previously, our Bylaws were silent as to the voting standard for directors, and directors were elected using a plurality standard set forth in the Delaware General Corporation Law. In contested director elections, the plurality standard will apply, which means the nominees receiving the greatest numbers of votes will be elected to serve as directors. To be elected in an uncontested election, the votes “for” a director must exceed the votes “against” the director. Abstentions and any broker non-votes will have no effect on the election of directors. If an incumbent director is not elected and no successor has been elected at the meeting, he or she will promptly tender his or her conditional resignation following certification of the vote. The Nominating and Governance Committee will consider the resignation offer and recommend to the Board whether to accept such offer. The Board will act on the recommendation within 90 days following receipt of the tender. After coming to a decision, the Board will publicly disclose its decision whether to accept the director’s resignation offer (and the reasons for rejecting the offer, if applicable). If the Board does not accept the resignation, the director will continue to serve until the next annual meeting and until a successor has been elected and qualified or until his or her earlier resignation, removal or death. If the Board accepts the resignation, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board. The election of directors at the Annual Meeting is an uncontested election and thus the majority voting standard applies.

ELECTION OF DIRECTORS

ITEM 1 ON PROXY BALLOT

Directors are elected at each Annual Meeting and hold office until the election held at the following Annual Meeting. A majority of the votes of eligible shares present in person or by proxy and actually cast is required for the election of directors. Our Amended and Restated Certificate of Incorporation provides for a Board of not fewer than five and not more than eleven members. The Board currently consists of ten Directors, but will be reduced to eight Directors effective as of the election of Directors at this Annual Meeting.

Director candidates are nominated by the Board upon the recommendation of the Nominating and Governance Committee. The Nominating and Governance Committee has recommended the eight nominees below, each of whom is currently a Director. Shareholders are also entitled to submit the names of director candidates for consideration by the Nominating and Governance Committee in accordance with the procedures set forth in our Restated Bylaws and summarized under the heading “Corporate Governance—Submission of Director Nominations.”

The person named on the form of proxy will vote the shares “FOR” the nominees, unless you instruct otherwise. Each nominee has consented to stand for election. In the event that one or more of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for the remaining nominees and any substitute nominee(s) designated by the Board. Shareholders may cumulate their votes for Directors, and the Director elections are then determined by a majority of the votes cast.

Director Qualifications

Our Director nominees have a reputation for integrity, honesty and adherence to high ethical standards. Each Director has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of services to Intersil and our Board. Finally, we value their significant experience on other boards of directors.

The following biographies provide a brief description of each nominee’s age, principal occupation and business experience, (as of March 10, 2014) and Directorships held in other corporations.

| | |

Nominees | | Positions and Offices Held with Intersil |

Donald Macleod | | Chairman of the Board |

Robert W. Conn | | Director |

James V. Diller | | Director |

Mercedes Johnson | | Director |

Gregory Lang | | Director |

Jan Peeters | | Director |

James A. Urry | | Director |

Necip Sayiner | | President, CEO and Director |

BUSINESS EXPERIENCE OF DIRECTORS

Donald Macleod, Chairman of the Board. Mr. Macleod, age 65, has been Chairman of the Board since December 2012. Mr. Macleod joined our Board as a Director on September 4, 2012. Mr. Macleod served as President and CEO of National Semiconductor Corporation, an analog semiconductor company, from November 2009 to September 2011, when National Semiconductor was acquired by Texas Instruments Incorporated. Mr. Macleod joined National Semiconductor in 1978 and served in a variety of executive positions prior to becoming CEO, including Chief Operating Officer and CFO. He served as the Chairman of the Board of National Semiconductor from May 2010 to September 2011. Mr. Macleod currently serves on the Board of Directors of Avago Technologies Limited, a global manufacturer of optoelectronics and analog interface components, a position he has held since November 2007. In February 2014, Mr. Macleod was appointed to the Board of Directors of Knowles Corporation, a global supplier of advanced micro-acoustic, specialty components, and human interface solutions for the mobile communications, consumer electronics, medical technology, military/space and other industrial end markets. In addition, Mr. Macleod also serves on the Board of Directors of a privately-held company. Mr. Macleod’s qualifications to serve as a Director include his more than 30 years of experience in senior management and executive positions in the semiconductor industry (both in Europe and the United States), his experience as a financial executive at a semiconductor company and as a board member of publicly-traded semiconductor companies.

Robert W. Conn, Director. Dr. Conn, age 71, has been a Director since April 2000. Dr. Conn was appointed President, CEO and director of the Kavli Foundation, a philanthropic organization, in April 2009. Dr. Conn has been President of Conn Engineering & Consulting, Inc. since 2002. In addition, he has been a Professor and Dean of Engineering, Emeritus, at the University of California, San Diego since 2004. From 2002 to 2008, Dr. Conn was Managing Director of Enterprise Partners Venture Capital. From 1994 to July 2002, Dr. Conn was the Dean of the Jacobs School of Engineering, University of California, San Diego, and the Walter J. Zable Endowed Chair in Engineering. Dr. Conn served on the Board of Directors of ChipPAC, Inc. from 2002 through 2004, and on the Board of Directors of STATS ChipPAC, Inc. from 2004 through 2007. Presently, he is a member of the National Academy of Engineering. Dr. Conn has previously served on the Board of Directors of several privately-held companies. Dr. Conn’s qualifications to serve as a Director include his academic experience as Professor of Engineering and Dean of a major university engineering department and his experience as a venture capitalist specializing in technology companies.

James V. Diller, Director. Mr. Diller, age 78, has been a Director since May 2002. He served as Interim President and CEO of Intersil from December 9, 2012 to March 13, 2013. Mr. Diller is a retired Chairman of the Board of Elantec Semiconductor, Inc., a post he held from 1997 to May 2002. Mr. Diller served as a Director of Elantec Semiconductor, Inc. from 1986 to May 2002 when Elantec was acquired by Intersil. From November 1998 to July 2000, he served as Elantec’s President and CEO. Mr. Diller is a founder of PMC-Sierra, Inc., a company that engages in the design, development, marketing, and support of communications semiconductors, storage semiconductors, and microprocessors and was its President and CEO from 1983 to 1997; he was Vice Chairman of the Board of Directors until December 2013. In addition, Mr. Diller became Chairman of the Board of Avago Technologies Limited, a global manufacturer of optoelectronics and analog interface components, in January 2010 and previously served on the Board of Avago since December 2005. He was a Director of Sierra Wireless, Inc. from 1993 through 2003. Mr. Diller’s qualifications to serve as a Director include his extensive analog IC company management experience in positions such as Chairman of the Board, CEO, President and General Manager, and his experience as a product development engineer.

Mercedes Johnson, Director. Ms. Johnson, age 60, has been a Director since August 2005. From April 1, 2013 through September 22, 2013 she served as the Interim CFO of Intersil. Ms. Johnson was previously the Senior Vice President of Finance and Chief Financial Officer (“CFO”) at Avago Technologies from November 2005 until her retirement in August 2008. Prior to her employment with Avago, Ms. Johnson worked for Lam Research Corporation, serving as its Senior Vice President of Finance from June 2004 to January 2005, and as its CFO from April 1997 to May 2004. Ms. Johnson has served as a member of the Board of Directors of Micron Technology, Inc. since June 2005 and has served as a member of the Board of Directors of Juniper Networks since May 2011. She also served on the Board of Directors for Storage Technology Corporation from January 2004 to August 2005. Ms. Johnson’s qualifications to serve as a Director include her experience as a senior financial executive at semiconductor and semiconductor equipment companies, and as a board member of publicly-traded semiconductor companies.

Gregory Lang, Director. Mr. Lang, age 50, has been a Director since February 2006. Mr. Lang has served as President, CEO and Director of PMC-Sierra, Inc., a company that engages in the design, development, market and support of semiconductor solutions for storage, mobile and optical networks, since May 2008. In March 2008, Mr. Lang resigned his position as President, CEO and Director of Integrated Device Technology Inc. (“IDT”). Mr. Lang joined IDT as President in October 2001, was appointed CEO in January 2003 and elected to the IDT Board of Directors in September 2003. Prior to joining IDT, Mr. Lang held the position of Vice President and General Manager of Intel’s platform networking group. Previously he managed Intel’s Ethernet, storage I/O processing, home networking and broadband businesses. Mr. Lang’s qualifications to serve as a Director include his more than 25 years of experience in the semiconductor industry in positions including CEO, President and Vice President and General Manager.

Jan Peeters, Director. Mr. Peeters, age 62, has been a Director since April 2000. Mr. Peeters is Chairman and CEO of Olameter Inc., a meter asset and data management company, which he formed in 1998. He presently serves, since 1998, as Chairman of Cogeco Inc. and Cogeco Cable Inc., publicly-traded Canadian companies in the areas of broadcasting and cable. In addition, Mr. Peeters serves as Chairman, since 2009, on the Board of GFFI, a small-cap financing company. Mr. Peeters served as Chairman on the Board of iNovia Capital, a venture capital company from 1999 to 2011. He also served as Governor of McGill University from 1999 to 2009 and he served on the Board of Directors of Call-Net, a publicly-traded Canadian telecommunications company, from 1999 to 2002. He was previously founder, vice-chairman, president and CEO of Fonorola Inc., a facilities-based long-distance telephone company from 1988 to 1998, at which time it was acquired by Call-Net Enterprises Inc. Mr. Peeters’ qualifications to serve as a Director include his senior executive experience at public and private companies in positions such as Chairman, Director and CEO.

James A. Urry, Director. Mr. Urry, age 60, has been a Director since our inception in August 1999. Mr. Urry has served as Senior Advisor at Augusta Columbia Capital Group LLC since May 2011. Prior to this, Mr. Urry was a Partner at Court Square Capital Partners, a private equity firm from July 2007 to May 2011. Court Square Capital Partners was established as a result of a spin-off from Citigroup Venture Capital Ltd. in 2007. Previous to this, Mr. Urry was a Partner at Citigroup Venture Capital Ltd. from 1989 to June 2007. In February 2013, Mr. Urry was appointed to the Board of Directors of Kofax Limited, a provider of software and applications that simplify information-intensive customer interactions. Mr. Urry served on the Board of Directors of Lyris, Inc. from June 2007 to August 2011 He also served as a Director of AMI Semiconductor prior to the merger of AMI and ON Semiconductor on March 12, 2008. Mr. Urry’s qualifications to serve as a Director include his experience as a senior executive at private equity firms, and as a Director at a public semiconductor firm.

Dr. Necip Sayiner, President, CEO and Director, age 48, has served as our President, CEO and Director since March 14, 2013. Prior to joining Intersil, from September 2005 to April 2012, he served as President and Chief Executive Officer, and Director of Silicon Laboratories, a fabless semiconductor company engaged in the design of analog-intensive, mixed-signal integrated circuits. Prior to joining Silicon Laboratories, Dr. Sayiner held various leadership positions at Agere Systems Inc., which included Executive Vice President and General Manager, Enterprise and Networking Division from August 2004 to September 2005; and Vice President and General Manager, Networking ICs Division from March 2002 to August 2004. In September 2013, Dr. Sayiner was appointed to the Board of Directors of the Semiconductor Industry Association (SIA). Dr. Sayiner’s qualifications to serve as a Director include his analog IC company management experience, including President, CEO and Director at a publicly-traded semiconductor company and his product development and engineering experience.

The Board of Directors recommends a vote “FOR” each of the nominees listed.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

ITEM 2 ON PROXY BALLOT

The Board, acting upon the recommendation of the Audit Committee, asks that the shareholders ratify the selection of KPMG LLP as Intersil’s independent registered public accounting firm to audit and report upon our financial statements for the 2014 fiscal year. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting in person or by proxy and actually cast.

Unless otherwise specified by the shareholders, the shares of stock represented by the proxy will be voted FOR ratification of the appointment of KPMG LLP as our independent accountants.

In the event the shareholders fail to ratify the appointment, the Board will reconsider its selection. Even if the selection is ratified, the Board, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Board determines that such a change would be in the best interests of Intersil and our shareholders.

One or more representatives of KPMG LLP are expected to be at the Annual Meeting. They will have an opportunity to make a statement and will be available to respond to appropriate questions.

AUDIT AND OTHER FEES PAID TO KPMG LLP

The aggregate fees incurred by the Company with KPMG LLP for the annual audit and other services for the fiscal year ended 2013 and 2012 were as follows:

| | | | | |

| | Fiscal Year | |

| | | | | |

| | 2013

($) | | 2012

($) | |

| Audit service fees | 1,657,000 | | 1,900,000 | |

| Audit-related fees | 10,000 | | 10,000 | |

| Tax fees | 450,000 | | 1,186,000 | |

| All other fees | - | | - | |

All of the audit engagements relating to audit services, audit-related services and non-audit services described above were pre-approved by our Audit Committee in accordance with its Pre-Approval Policy. The Audit Committee Pre-Approval Policy provides for pre-approval by the Committee of audit, audit-related, tax and other accounting engagements. The policy authorizes the Audit Committee to delegate one or more of its members pre-approval authority with respect to permitted engagements. Our Audit Committee has reviewed the fees described above and believes that such fees are compatible with maintaining the independence of KPMG LLP.

The Board of Directors recommends that shareholders vote “FOR” the

ratification of the selection of KPMG LLP to serve as Intersil’s independent

registered public accounting firm for the 2014 fiscal year.

APPROVAL OF AN AMENDMENT TO THE INTERSIL CORPORATION

AMENDED AND RESTATED

2008 EQUITY COMPENSATION PLAN

ITEM 3 ON PROXY BALLOT

The Board of Directors has approved, subject to shareholder approval, an amendment to increase the number of shares of Common Stock authorized for issuance under the Intersil Corporation Amended and Restated 2008 Equity Compensation Plan, as amended and restated from time to time (the “2008 Equity Plan”) by 12,000,000 shares to a total of 46,352,316 shares. As of the date of this Proxy Statement, 34,352,316 shares are reserved for issuance under the 2008 Equity Plan and approximately 10,032,935 of these shares remain available for future awards. If this Proposal is approved by our shareholders, approximately 22,032,935 shares will be available for awards under the 2008 Equity Plan. The Board of Directors believes that approval of the proposed amendment to the 2008 Equity Plan is necessary to permit Intersil to continue to offer a competitive compensation package.

The affirmative vote of the majority of shares present at the Annual Meeting in person or by proxy and actually cast is required for approval of the amendment to the 2008 Equity Plan.

A summary description of the 2008 Equity Plan is provided below. This summary is qualified in its entirety by the full text of the 2008 Equity Plan, a copy of which is attached to this Proxy Statement as Exhibit A.

The Board of Directors recommends that shareholders vote “FOR” the amendment to

the Intersil Corporation Amended and Restated 2008 Equity Compensation Plan.

Summary of the 2008 Equity Plan

Purpose. The Board adopted the 2008 Equity Plan to enable key employees, directors and consultants to participate in the equity ownership of Intersil through awards of options, restricted stock, stock appreciation rights, deferred stock units, phantom shares and other stock-based awards. The purpose of the 2008 Equity Plan is to (i) align the interests of the eligible individuals with the interests of our shareholders, (ii) provide incentives for eligible individuals to exert maximum efforts for our success, (iii) attract and retain the best available talent, and (iv) reward key personnel for their part in increasing shareholder value.

Effective Date and Termination. Our Board adopted the 2008 Equity Plan on February 9, 2011, and our shareholders approved the 2008 Equity Plan on May 4, 2011 at our 2011 Annual Meeting. Our shareholders approved amendments to the 2008 Equity Plan on May 2, 2012 at our 2012 Annual Meeting and on May 8, 2013 at our 2013 Annual Meeting. The 2008 Equity Plan will terminate on May 4, 2021, unless earlier terminated by the Board.

Administration. The 2008 Equity Plan is administered by the Compensation Committee of the Board (the “Committee”). The Committee is currently composed of four members, each of whom is a “non-employee director” as defined under Rule 16b-3(b)(3) promulgated by the SEC under the Exchange Act. Three members qualify as an “outside director” as defined under Section 162(m) of the Code and the regulations thereunder. The Board has designated certain members or officers to serve as a Secondary Committee and has delegated to the Secondary Committee authority to grant awards to eligible individuals who are not subject to the requirements of Rule 16b-3 under the Exchange Act or section 162(m) of the Code, subject to compliance with all legal requirements. The Secondary Committee has the same authority with respect to selecting the individuals to whom awards are granted and establishing the terms and conditions of awards as the Committee has under the terms of the 2008 Equity Plan.

The Committee has the following powers and authority with regard to the 2008 Equity Plan:

| (i) | | to interpret and administer the 2008 Equity Plan; |

| (ii) | | to select the employees, directors and consultants to receive awards under the 2008 Equity Plan; |

| (iii) | | to determine the type and amount of awards to be granted to participants; |

| (iv) | | to determine the times at which awards will be granted; |

| (v) | | to determine the terms and conditions of awards granted under the 2008 Equity Plan (including, but not limited to, restrictions as to vesting, transferability or forfeiture, exercisability or settlement of an award and waivers or accelerations thereof, and waivers of or modifications to performance goals relating to an award, based in each case on such considerations as the Committee shall determine) and the terms of agreements which will be entered into with participants with respect to the 2008 Equity Plan; |

| (vi) | | to adopt regulations for carrying out the 2008 Equity Plan and make changes in such regulations as it shall from time to time, think advisable; and |

| (vii) | | to amend the 2008 Equity Plan if such power is so delegated by the Board. |

Participation. All of our employees and consultants and all of our Directors are eligible to participate in the 2008 Equity Plan. As of March 10, 2014, we had approximately 1,007 employees, 0 consultants and 9 non-employee directors.

Shares of Stock Available for Grant. If this amendment is approved by our shareholders, the 2008 Equity Plan will authorize 46,352,316 shares for issuance under our general share pool, 24,319,384 shares of which have been issued as of the date of this Proxy Statement. An additional 2,913,705 shares are available for issuance under the 2008 Equity Plan solely with respect to the exercise of options granted in connection with our 2009 stock option exchange program. Each share issued pursuant to an award other than a stock option or stock appreciation right (“SAR”) will reduce the number of shares available for issuance by 2.33 shares. For example, if all awards under the 2008 Equity Plan are made in the form of restricted stock grants, approximately 19,893,697 shares will be available for issuance pursuant to such grants. The shares may be treasury shares or authorized but unissued shares. The maximum number of shares that may be granted to any one individual may not exceed 2,500,000 during any calendar year, or in the case of awards payable in cash, such awards granted to any one individual may not exceed $4,000,000 during any calendar year.

Term of Awards. The maximum term of any option or stock appreciation right granted under the 2008 Equity Plan is seven years from the date of grant.

Certain Vesting Requirements. Subject to the terms of the 2008 Equity Plan, awards of deferred stock units, other stock-based awards, phantom shares and restricted stock shall vest ratably over a period of not less than three years unless the vesting of such awards is based upon the achievement of performance criteria, in which case such awards will vest over a period of not less than one year. Notwithstanding the foregoing, the Committee may, in its sole discretion, grant awards of deferred stock units, other-stock-based awards, phantom shares and restricted stock representing, in the aggregate, not more than 10% of the number of shares reserved for issuance under the 2008 Equity Plan that are not subject to any minimum vesting period requirement.

Changes in Capital Structure. In the event of certain changes in our capital structure, such as a merger, consolidation, reorganization, share exchange, sale of substantially all of our assets or stock, stock dividend, stock split or other similar event, the Committee will make appropriate adjustments in the number and kind of shares authorized by the 2008 Equity Plan and other adjustments to outstanding awards as it deems appropriate.

Change of Control. In the event of a change-in-control (as defined in the 2008 Equity Plan), the Committee may, at its discretion (i) cancel any outstanding vested options and SARs in exchange for a cash payment of an amount equal to the difference, if any, between the then fair market value of the stock underlying the award less the exercise price of the award, (ii) after having given the award holder a chance to exercise any outstanding options or SARs, terminate any or all of the award holder’s unexercised options or SARs, (iii) where we are not the surviving corporation, cause the surviving corporation to assume or replace all outstanding options or SARs with awards involving the common stock of the successor corporation on terms necessary to preserve the rights of award holders, (iv) accelerate the vesting of options, SARs, restricted stock and other awards made under the 2008 Equity Plan, or (v) take any other actions it deems appropriate. In addition, unless otherwise provided by the Committee, all phantom shares, deferred stock units and other stock-based awards will generally be settled in a lump sum payment upon a change-in-control.

Amendment and Termination of the 2008 Equity Plan. The Board (or the Committee, if such power is so delegated by the Board) may amend, modify, suspend or terminate the 2008 Equity Plan, provided that shareholder approval of any amendment is obtained as required by applicable laws or regulations. The Committee may also amend any outstanding award without a participant’s consent, but an amendment to a participant’s award may not adversely impact the participant without his or her consent unless the amendment is required by law. However, neither the Board nor the Committee may, without approval of our shareholders, implement a program that provides for the repricing, replacing or cash buy-back, of underwater awards.

Performance Goals. Awards may be granted or vested contingent upon attaining goals related to our performance or the performance of any of our subsidiaries, divisions or business units (including divisions and business units of subsidiaries). Performance goals will be based upon one or more of the following: revenue; revenue growth; earnings before interest, taxes, depreciation and amortization (“EBITDA”); operating income; net operating income after tax; pre- or after-tax income; cash flow; cash flow per share; net earnings; earnings per share; return on equity; return on capital employed; return on assets; economic value added (or an equivalent metric); share price performance; total shareholder return; improvement in or attainment of expense levels; improvement in or attainment of working capital levels; or debt reduction.

Options. The Committee may grant options that are intended to be incentive stock options under Section 422 of the Code and non-qualified stock options. The price per share at which our common stock may be purchased upon exercise of an option may not be less than the fair market value of a share of common stock on the date of grant (or 110% of the fair market value of a share of common stock on the date of grant in the case of an incentive stock option granted to a more than 10% shareholder). The option price of an option awarded under the 2008 Equity Plan may not be reduced after the grant of such option except in the case of a change in our capital structure, unless the reduction is approved by a majority of the shares present and voted at a duly called meeting of the shareholders. The maximum term of an option is seven years from the date of grant (or 5 years from the date of grant in the case of an incentive stock option granted to a more than 10% shareholder).

A participant may pay the option price: (i) in cash or with a certified or bank cashier’s check at the time of exercise, (ii) with the consent of the Committee, by delivery of an assignment of a sufficient amount of the proceeds from the sale of shares of common stock to be acquired pursuant to such exercise, or (iii) with the consent of the Committee, in whole or in part in common stock held by the participant and valued at their fair market value on the date of exercise. The ability of a participant to exercise his or her options following termination of employment is addressed in the relevant award agreements.

The Committee may include in an option agreement a provision enabling the participant to exercise shares subject to options prior to the full vesting of the option. Any shares so acquired will remain subject to the vesting schedule of the underlying option and, prior to the time those shares become vested and following the participant’s termination of employment, we will be permitted to repurchase any shares so acquired for an amount equal to the lesser of the exercise price paid or the fair market value of the shares on the date of the repurchase.

Stock Appreciation Rights. A SAR allows a recipient to receive, upon exercise of the right, the increase in the fair market value of a specified number of shares of common stock from the date of grant to the date of exercise. Payment upon exercise of a SAR may be made in cash or common stock (including restricted stock). The ability of a participant to exercise his or her SARs following termination of employment is addressed in the relevant award agreements.

Restricted Stock. In a restricted stock award, the Committee grants to a participant shares of common stock that are subject to forfeiture upon specified events and/or the failure to achieve specified performance goals during a specified restriction period. During the restriction period, holders of restricted stock have the right to receive dividends from (which dividends are subject to the same restrictions as the underlying shares) and to vote the shares of restricted stock. Unless otherwise determined by the Committee, shares of restricted stock that have not yet become vested will be forfeited when a participant’s service is terminated for any reason.

Phantom Shares. The award of a phantom share gives a participant the right to receive payment of the fair market value of a share of common stock (or such lesser amount as determined by the Committee) upon the vesting of such phantom share award (or such later date as may be elected by the participant). The Committee establishes the terms and conditions of a phantom share award in an award agreement at the time the award is granted, including when such shares vest. Phantom shares will be settled upon vesting or at the end of a deferral period, either in cash or in shares of common stock or in any combination of the foregoing, as determined by the Committee. Payment will generally be made in a single lump sum, except that the Committee may allow a participant to elect to receive payment in installments over a period not to exceed 10 years. Unless otherwise determined by the Committee, phantom shares that are not vested upon a participant’s separation from service will be forfeited.

Deferred Stock Units. In a deferred stock unit (“DSU”) award, we will deliver, subject to certain conditions, a fixed number of shares of common stock to the participant at the end of a vesting period, or if elected by the participant, at the end of a deferral period which occurs after the award has vested. During the vesting and deferral period(s), the participant has no voting rights with respect to any shares deliverable in connection with the DSU. Amounts equal to any dividends declared prior to vesting, and post-vesting during the deferral period(s), will be paid to the participant, without interest, at the time when the shares are no longer subject to vesting or a deferral period(s). Unless otherwise determined by the Committee, all unvested DSUs will be forfeited upon a participant’s separation from service.

Other Stock-Based Awards. The Committee is authorized to grant any other type of stock-based award that is payable in, or valued in whole or in part by reference to, shares of our common stock and that is deemed by the Committee to be consistent with the purposes of the 2008 Equity Plan.

New Plan Benefits; Closing Price of Common Stock. Because grants of awards will be made from time to time by the Committee to those persons whom the Committee determines in its discretion should receive grants of awards, the benefits and amounts that may be received in the future by persons eligible to participate in the 2008 Equity Plan are not presently determinable. On March 10, 2014, the closing price of our common stock was $12.64 per share.

Certain Awards Granted Under the 2008 Equity Plan. The table set forth below indicates, as of March 10, 2014, for each of the named executive officers and the various groups indicated, the number of shares of our common stock underlying awards that have been granted (even if not currently outstanding) under the 2008 Equity Plan since its approval by shareholders at our 2012 Annual Shareholders Meeting.

| | | | | | | | | | | | |

Name and

Position | | Number of Shares Subject to Time-Based Stock Options | | Number of Shares Subject to Time-Based Stock Awards | | Number of Shares Subject to Performance-Based Stock Options (Target) | | Number of Shares Subject to Performance-Based Stock Options (Maximum) | | Number of Shares Subject to Performance-Based Stock Awards (Target) | | Number of Shares Subject to Performance-Based Stock Awards (Maximum) |

Necip Sayiner

President and Chief Executive Officer | | - | | 433,000 | | - | | - | | 433,000 | | 866,000 |

Richard Crowley

Senior Vice President and Chief Financial Officer | | - | | 100,000 | | - | | - | | - | | - |

Andrew M. Cowell

Senior Vice President and

GM Mobile Power Products | | - | | 40,000 | | - | | - | | 41,000 | | 82,000 |

Susan J. Hardman

Senior Vice President and

GM Specialty Products | | - | | 40,000 | | - | | - | | 41,000 | | 82,000 |

Mark Downing

Senior Vice President, Corporate Strategy and GM Infrastructure Power Products | | - | | 80,000 | | - | | - | | 80,000 | | 160,000 |

All Current Executive Officers as a Group | | | | 856,000 | | - | | - | | 670,500 | | 1,341,000 |

All Current Directors who are not Executive Officers as a Group | | 340,000 | | 32,000 | | - | | - | | - | | - |

Robert W. Conn

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

James V. Diller

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

Gary E. Gist

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

Mercedes Johnson

Director | | 300,000 | | 0 | | - | | - | | - | | - |

Gregory Lang

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

Donald Macleod

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

Jan Peeters

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

Robert N. Pokelwaldt

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

James A. Urry

Director | | 5,000 | | 4,000 | | - | | - | | - | | - |

Each Associate of any Director, Executive Officer or Nominee | | - | | - | | - | | - | | - | | - |

Each Other Person who Received or is to Receive 5 Percent of such Options, Warrants or Rights | | - | | - | | - | | - | | - | | - |

All Employees, including All Current Officers who are not Executive Officers, as a Group | | - | | 2,272,180 | | - | | - | | 76,600 | | 153,200 |

Summary of U.S. Federal Income Tax Consequences

The following discussion is a summary of certain federal income tax considerations that may be relevant to participants in the 2008 Equity Plan. The discussion is for general informational purposes only and does not purport to be complete or address specific federal income tax considerations that may apply to a participant based on his or her particular circumstances, nor does it address state or local income tax or other tax considerations that may be relevant to a participant.

PARTICIPANTS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE PARTICULAR FEDERAL INCOME TAX CONSEQUENCES TO THEM OF PARTICIPATING IN THE 2008 EQUITY PLAN, AS WELL AS WITH RESPECT TO ANY APPLICABLE STATE OR LOCAL INCOME TAX OR OTHER TAX CONSIDERATIONS.

Incentive Stock Options

Upon the grant of an incentive stock option (as defined in Section 422(b) of the Code), the option holder does not recognize any income and we (“Intersil or a subsidiary, as applicable”) are not entitled to a deduction. In addition, no income for regular income tax purposes will be recognized by an option holder upon the exercise of an incentive stock option if the requirements of the 2008 Equity Plan and the Code are satisfied, including, without limitation, the requirement that the option holder remain employed by Intersil or a subsidiary during the period beginning on the date of grant and ending on the day three months (or, in the case of the option holder’s disability, one year) before the date the option is exercised. If an option holder has not remained an employee of Intersil or a subsidiary during the period beginning on the date of grant of an incentive stock option and ending on the day three months (or one year in the case of the option holder’s disability) before the date the option is exercised, the exercise of such option will be treated as the exercise of a non-qualified stock option and will have the tax consequences described below in the section entitled “Non-Qualified Stock Options.”

The federal income tax consequences of a disposition of the shares of common stock acquired pursuant to the exercise of an incentive stock option depends upon when the disposition of such shares occurs.

If the disposition of such shares occurs more than two years after the date of grant of the incentive stock option and more than one year after the date of exercise, any gain or loss recognized upon such disposition will be long-term capital gain or loss and we will not be entitled to any income tax deduction with respect to such incentive stock option.

If the disposition of such shares occurs within two years after the date of grant of the incentive stock option or within one year after the date of exercise (a “Disqualifying Disposition”), the excess, if any, of the amount realized over the option price will be treated as taxable income to the option holder and, subject to Section 162(m) of the Code, we will be entitled to a deduction equal to the amount of ordinary income recognized by the option holder on such disposition. The amount of ordinary income recognized by the option holder in a Disqualifying Disposition (and the corresponding deduction, if any, to us) is limited to the lesser of the gain on such sale and the difference between the fair market value of the shares on the date of exercise and the option price. Any gain realized in excess of this amount will be treated as short-term or long-term capital gain (depending upon whether the shares have been held for more than one year). If the option price exceeds the amount realized upon such a disposition, the difference will be short-term or long-term capital loss (depending upon whether the shares have been held for more than one year).

If a participant is subject to the Alternative Minimum Tax (“AMT”), the tax consequences to the participant may differ than provided above. For purposes of calculating the AMT, upon the exercise of an incentive stock option, a taxpayer is required to include in his “alternative minimum taxable income” for the taxable year in which such exercise occurs an amount equal to the amount of income the taxpayer would have recognized if the option had not been an incentive stock option (i.e., the difference between the fair market value of the shares of common stock on the date of exercise and the option price). As a result, unless the shares of common stock acquired upon the exercise of the incentive stock option are disposed of in a taxable transaction in the same year in which such option is exercised, the option holder may incur AMT as a result of the exercise of an incentive stock option.

Except as provided in the paragraph immediately below, if an option holder elects to tender shares of common stock in partial or full payment of the option price for shares to be acquired upon the exercise of an incentive stock option, the option holder will not recognize any gain or loss on such tendered shares. No income will be recognized by the option holder in respect of the shares received by the option holder upon the exercise of an incentive stock option if the requirements of the 2008 Equity Plan and the Code described above are met. The number of shares received equal to the number of shares surrendered will have a tax basis equal to the tax basis of the surrendered shares. Shares of common stock received in excess of the number of shares surrendered will have a tax basis of zero. The holding period of the shares received equal to the number of shares tendered will be the same as such tendered shares’ holding period, and the holding period for the excess shares received will begin just after the date of exercise. Solely for purposes of determining whether a Disqualifying Disposition has occurred with respect to such shares received upon the exercise of the incentive stock option, all shares are deemed to have been acquired on the date of exercise.

If an option holder tenders shares of common stock that were previously acquired upon the exercise of an incentive stock option in partial or full payment of the option price for shares to be acquired upon the exercise of another incentive stock option, and the tender of such shares occurs within two years after the date of grant of the first such incentive stock option or within one year after such shares were transferred to the option holder on the exercise of such incentive stock option, the tender of such shares will be a Disqualifying Disposition with the tax consequences described above regarding Disqualifying Dispositions. The shares of common stock acquired upon such exercise will be treated as shares of common stock acquired upon the exercise of an incentive stock option.

Non-Qualified Stock Options

Upon the grant of a non-qualified stock option, an option holder does not recognize taxable income, and we are not entitled to a deduction. Upon the exercise of a non-qualified stock option, an option holder will recognize compensation taxable as ordinary income equal to the excess of the fair market value of the shares received over the option price of the non-qualified stock option and, subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. An option holder’s tax basis in the shares of common stock received upon the exercise of a non-qualified stock option will be equal to the amount paid for such shares plus the amount required to be included in income, and the option holder’s holding period for such shares will begin at the date just after such exercise. Upon the sale of the shares received from the exercise of a non-qualified stock option, the option holder will recognize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year. The amount of such gain or loss will be equal to the difference between the amount realized in connection with the sale of the shares and the option holder’s tax basis in such shares.

If a non-qualified stock option is exercised in whole or in part with shares of common stock held by the option holder, the option holder will not recognize any gain or loss on such tendered shares. The number of shares received by the option holder upon such an exchange that are equal in number to the number of tendered shares will retain the tax basis and the holding period of the tendered shares for capital gain purposes, and the number of shares received by the option holder upon such exchange that are in excess of the number of shares tendered will have a tax basis equal to the fair market value of such shares on the date of exercise (and the holding period of such shares will begin just after the exercise date).

Stock Appreciation Rights

Upon the grant of a stock appreciation right, a participant does not recognize taxable income, and we are not entitled to a deduction. Upon exercise or settlement of a stock appreciation right, a participant will recognize compensation taxable as ordinary income in an amount equal to the cash or the fair market value of the shares received and, subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. A participant’s tax basis in shares of common stock received upon the exercise of a stock appreciation right will be equal to the fair market value of such shares on the exercise date, and the participant’s holding period for such shares will begin just after the exercise or settlement date. Upon the sale of shares of common stock received in exercise of a stock appreciation right, the participant will recognize short-term or long-term capital gain or loss, depending on whether the shares have been held for more than one year. The amount of such gain or loss will be equal to the difference between the amount realized in connection with the sale of the shares and the participant’s tax basis in such shares.

Restricted Stock

Restricted stock will be considered subject to a substantial risk of forfeiture for federal income tax purposes. If a participant who receives such restricted stock does not make the election described below, the participant will not recognize any taxable income upon the grant of restricted stock and we are not entitled to a deduction at such time. When the forfeiture restrictions with respect to the restricted stock lapse, the participant will recognize compensation taxable as ordinary income equal to the fair market value of the shares at that time, less any amount paid for the shares and, subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. A participant’s tax basis in restricted stock will be equal to the fair market value of such restricted stock on the date on which the forfeiture restrictions lapse, and the participant’s holding period for the shares will begin just after such date. Upon a sale of the shares, the participant will recognize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year at the time of sale. Such gain or loss will be equal to the difference between the amount realized upon the sale of the shares and the participant’s tax basis in such shares.

Participants granted restricted stock may make an election under Section 83(b) of the Code to recognize compensation taxable as ordinary income with respect to the shares when such shares are received rather than when the forfeiture restrictions lapse. The amount of such compensation income will be equal to the fair market value of the shares on the date of grant (valued without taking into account restrictions other than restrictions that by their terms will never lapse), less any amount paid for the shares. Subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. By making a Section 83(b) election, the participant will recognize no additional ordinary compensation income with respect to the shares when the forfeiture restrictions lapse, and will instead recognize short-term or long-term capital gain or loss with respect to the shares when they are sold, depending upon whether the shares have been held for more than one year. The participant’s tax basis in the shares with respect to which a Section 83(b) election is made will be equal to their fair market value on the date of grant, and the participant’s holding period for such shares will begin just after that date. If the shares are subsequently forfeited, the participant will not be entitled to a deduction as a result of such forfeiture, but will be entitled to claim a short-term or long-term capital loss (depending upon whether the shares have been held for more than one year prior to forfeiture) with respect to the shares, but only to the extent of the consideration paid, if any, by the participant for such shares.

Generally, during the restriction period, dividends and distributions paid with respect to restricted stock will be treated as compensation taxable as ordinary income (not dividend income) received by the participant and, subject to Section 162(m) of the Code, we will receive a corresponding deduction. Dividend payments received with respect to shares of restricted stock for which a Section 83(b) election has been made or which are paid after the restriction period lapses generally will be treated and taxed as dividend income.

Deferred Stock Units

Upon the grant of a deferred stock unit award, a participant does not recognize taxable income and we are not entitled to a deduction. When the award is settled (either upon vesting or when the deferral period for the award ends) and the participant receives shares of common stock, the participant will recognize compensation taxable as ordinary income equal to the fair market value of the shares on the settlement date and, subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. A participant’s tax basis in shares of common stock received at the end of a vesting or deferral period will be equal to the fair market value of such shares, and the participant’s holding period will begin just after such date. Upon the sale of such shares, the participant will recognize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year. Such gain or loss will be equal to the difference between the amount realized upon the sale of the shares and the tax basis of the shares. Dividend equivalents will be taxable to participants upon distribution as compensation, and accordingly, the participant will recognize compensation taxable as ordinary income (not dividend income) in such amount and, subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. In addition, as discussed below, some deferred stock unit awards may be considered deferred compensation and must comply with the requirements of Section 409A of the Code in order to avoid early income inclusion, additional taxes and interest.

Phantom Shares

Upon the grant of a phantom share award, a participant does not recognize taxable income and we are not entitled to a deduction. When a participant receives payment of a phantom share award (which may occur on the vesting date or a later date), the participant will recognize compensation taxable as ordinary income in an amount equal to the cash or fair market value of the shares received and, subject to Section 162(m) of the Code, we will be entitled to a corresponding deduction. If a participant receives shares of common stock in settlement of phantom shares, the participant will have a tax basis in such shares equal to their fair market value on the date of settlement and the participant’s holding period with respect to such shares will begin just after such date. Upon the sale of shares received by the participant in settlement of phantom shares, the participant will recognize short-term or long-term capital gain or loss, depending upon whether the shares have been held for more than one year. Such gain or loss will be equal to the difference between the amount realized upon the sale of the shares and the tax basis of the shares. In addition, as discussed below, some phantom share awards may be considered deferred compensation and must comply with the requirements of Section 409A of the Code in order to avoid early income inclusion, additional taxes and interest.

Other Stock-Based Awards