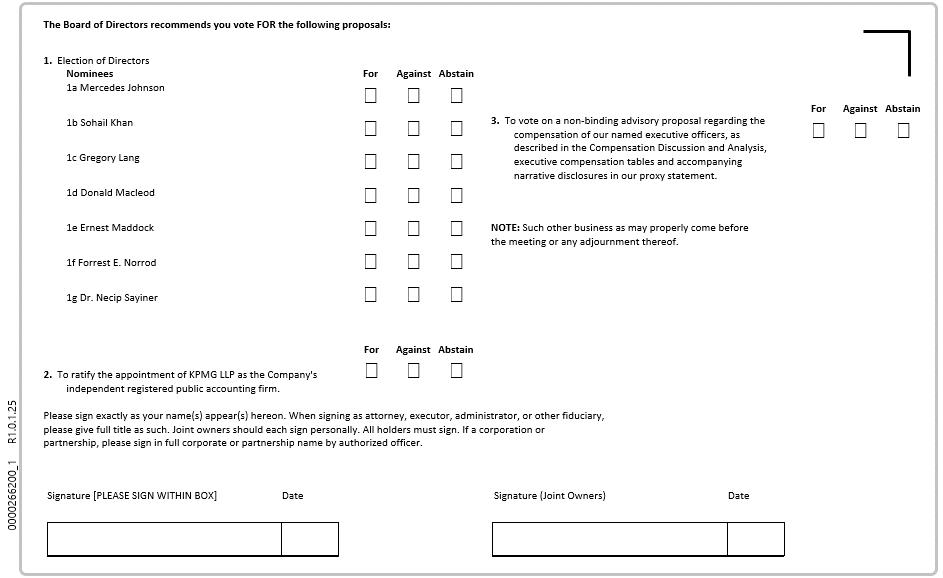

VOTING PROCEDURES

Your vote is very important. Your shares can only be voted at the Annual Meeting if you are present or represented by proxy. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote by proxy to assure that your shares will be represented. Most stockholders have a choice of voting by the Internet, a toll-free telephone number, or requesting and completing a proxy card and mailing it in the postage-paid envelope provided with the proxy card. Please refer to your Notice of Availability of Proxy Materials to see which options are available to you. Proxies submitted by telephone or online must be received by 11:59 P.M., EDT, on Wednesday, April 20, 2016. Proxies submitted by mail must be actually received by us prior to the commencement of the Annual Meeting.

You may revoke your proxy at any time before it is voted at the Annual Meeting by (a) giving written notice to our Secretary, (b) submitting a proxy bearing a later date, or (c) casting a ballot at the Annual Meeting. Properly executed proxies that are received before the Annual Meeting’s adjournment will be voted in accordance with the directions provided. If you submit a proxy without providing directions, your shares will be voted by the individuals named on your proxy card as recommended by our Board. If you wish to give a proxy to someone other than those named on the proxy card, cross out those names and insert the name(s) of the person(s), not more than three, to whom you wish to give your proxy.

Who can vote? Stockholders of record as of the close of business on February 23, 2016 are entitled to vote. On that day, 132,772,969 shares of Class A Common Stock were outstanding and eligible to vote at the Annual Meeting, and no other securities were outstanding and eligible to vote on any matters at the Annual Meeting. A list of stockholders eligible to vote will be available at our headquarters, located at 1001 Murphy Ranch Road, Milpitas, CA, 95035, beginning April 7, 2016. Stockholders may examine this list during normal business hours for any purpose related to the Annual Meeting.

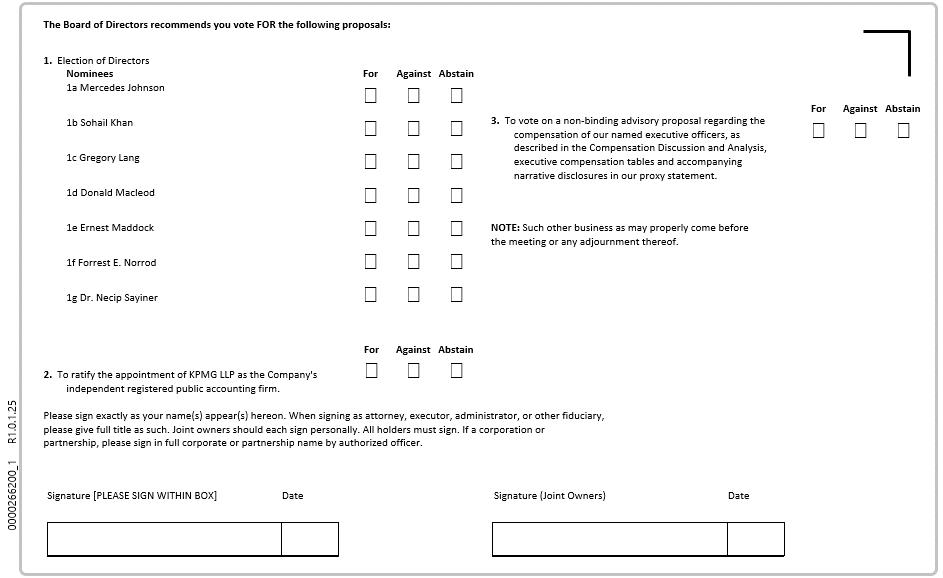

How does the Board recommend I vote? The Board recommends a vote “FOR” each Board nominee (Item 1), “FOR” the ratification of the Board of Directors’ appointment of KPMG LLP as our independent registered public accountant firm for the upcoming year (Item 2), and “FOR” approval of the compensation of our Named Executive Officers, or NEOs (Item 3).

What shares are included in the proxy card? The proxy card represents all the shares of voting stock registered to your account. Each share is entitled to one vote on each matter presented other than in the election of Directors. Our Amended and Restated Certificate of Incorporation provides for cumulative voting for Directors. This means that you may allocate among the director nominees, as you see fit, the total number of votes equal to the Director positions to be filled multiplied by the number of shares you hold. You may not cumulate your votes against a nominee. If you are a stockholder of record and choose to cumulate your votes, you will need to notify our Corporate Secretary in writing prior to the Annual Meeting or, if you vote in person at the Annual Meeting, notify the Chair of the Annual Meeting prior to the commencement of voting. You may not submit your proxy or voting instructions over the Internet or by telephone if you wish to distribute your votes unevenly among two or more Director nominees. If you hold shares beneficially through a broker, trustee, or other nominee and wish to cumulate votes, you should contact your broker, trustee, or nominee. Cumulative voting applies only to the election of Directors.

How are votes counted? The Annual Meeting will be held if a quorum, consisting of a majority of the outstanding shares of common stock entitled to vote, is represented. Broker non-votes and abstentions will be counted for purposes of determining whether a quorum has been reached. The affirmative vote of a majority of eligible shares present, in person or by proxy, at the Annual Meeting, and actually cast, is required to approve all matters. When nominees, such as banks and brokers, holding shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners, the nominees may vote those shares only on routine matters, such as the ratification of the appointment of our independent accounting firm. On all non-routine matters, such as the election of Directors, nominees who have not received instructions from beneficial owners cannot vote and there is a so-called “broker non-vote” on that matter. Broker non-votes and abstentions are not counted in tabulations of the votes cast by stockholders and will have no effect in determining whether there has been an affirmative majority vote on a particular matter.

Who will count the vote? Broadridge Financial Solutions, Inc. will tally the vote, which will be certified by the Inspector of Elections.

Is my vote confidential? Proxies, ballots, and voting tabulations are available for examination only by the Inspector of Elections and tabulators. Your vote will not be disclosed to the Board or to our management other than the Inspector of Elections and except as may be required by law.

CORPORATE GOVERNANCE

In accordance with Delaware General Corporation Law and our Amended and Restated Certificate of Incorporation and Restated Bylaws, our business, property, and affairs are managed under the direction of the Board. The Board has responsibility for reviewing our overall performance other than day-to-day operations. Its primary responsibility is to oversee the actions of our management, and in doing so, serve the best interests of Intersil and its stockholders. The Board selects and provides for the succession of executive officers, and subject to recommendations by the Nominating and Governance Committee, nominates individuals to serve as directors upon election at our Annual Meeting or to fill any vacancies on the Board. The Board reviews corporate objectives and strategies, and evaluates and approves significant policies and proposed major commitments of corporate resources. The Board participates in decisions that could have a significant economic impact on us. Management keeps the Directors informed of corporate activities through regular written reports and presentations at Board and Board Committee meetings.

The Board believes that good corporate governance practices are essential to fostering good stockholder relations and creating stockholder value. We continually review our governance practices to ensure their relevance and appropriateness for us and all of our stockholders. The Board’s Corporate Governance Guidelines (which includes Director independence criteria), the charters of each of the Board’s Committees, our Code of Corporate Conduct, and our Code of Ethics for Our Chief Executive Officer and Senior Financial Officers are available on the Investor Relations pages of our website at www.intersil.com. Stockholders may request copies of these documents free of charge by writing to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, CA 95035, Attn: Investor Relations.

Board Leadership Structure. The roles of our Chief Executive Officer, or CEO. and Chairman of the Board, or Chairman, are separate in recognition of the differences between the two roles. The CEO provides the strategic direction and day-to-day leadership and is responsible for financial performance, while the Chairman is an independent director. This leadership structure is appropriate given that, among other things, the Chairman provides guidance to the CEO, presides over Board meetings and executive sessions of the independent directors, which take place at each regularly scheduled Board meeting, acts as the liaison between the independent directors and the CEO, and facilitates full and open discussion among management and the independent directors. We believe that this structure allows the Board to fulfill its duties effectively and efficiently.

Members of the Board and its Committees. The table below provides a list of our Directors as well as the Committees on which they served in 2015. Each of the incumbent Directors attended 100% of the total number of Board and Committee meetings on which they served except Robert W. Conn who attended two of the three Board meetings that occurred prior to his retirement from the Board. It has been determined that, other than Dr. Sayiner, all of the Directors listed below are currently independent under the listing standards of The NASDAQ Stock Market.

| | | | | | |

Directors | | Audit Committee | | Compensation Committee | | Nominating and Governance Committee |

Robert W. Conn[2] | | Robert W. Conn[2] | | James V. Diller[2] | | James V. Diller[2] |

James V. Diller[2] | | Sohail Khan | | Gregory Lang[1,4] | | Mercedes Johnson[1] |

Mercedes Johnson | | Donald Macleod | | Donald Macleod | | Gregory Lang |

Sohail Khan | | Ernest Maddock[3] | | Forrest E. Norrod | | Donald Macleod |

Gregory Lang | | Jan Peeters[1] | | James A. Urry | | Forrest E. Norrod |

Donald Macleod (Chairman) | | | | | | Jan Peeters |

Ernest Maddock[3] | | | | | | James A. Urry |

Forrest E. Norrod | | | | | | |

Jan Peeters | | | | | | |

Necip Sayiner | | | | | | |

James A. Urry | | | | | | |

Seven (7) Board meetings were held in 2015; four (4) actions were taken by unanimous written consent | | Five (5) Audit Committee meetings were held in 2015; no actions were taken by unanimous written consent | | Six (6) Compensation Committee meetings were held in 2015; five (5) actions were taken by unanimous written consent | | Four (4) Nominating and Governance Committee meetings were held in 2015; no actions were taken by unanimous written consent |

| [1] | | Chair of the Committee. |

| [2] | | Messrs. Conn and Diller retired from the Board as of April 23, 2015 (the date of our 2015 Annual Meeting) and are no longer members of the Board of Directors or any of its Committees. |

| [3] | | Mr. Maddock joined our Board on July 7, 2015. He was appointed a member of the Audit Committee on October 1, 2015. |

| [4] | | Mr. Lang was appointed Chair of the Compensation Committee on October 1, 2015. |

Directors’ Attendance at the Annual Meeting. We strongly encourage each of our Directors to attend the Annual Meeting. Last year, each of the incumbent Directors attended the Annual Meeting with the exception of James A. Urry.

Committees of the Board. The Board has established three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. The charter of each Committee is available under the “Corporate Governance” link on the Investor Relations section of our website at www.intersil.com.

Audit Committee—maintains the sole responsibility to appoint, approve engagements and compensation of, and oversee the independence and performance of our registered independent public accounting firm. In addition, the Audit Committee oversees the integrity of our financial reporting and compliance with laws and regulations related to our financial reporting. It also has the responsibility to establish procedures for the receipt and treatment of complaints regarding our financial reporting, internal accounting controls or other related matters. The Audit Committee has the authority to engage counsel and other advisors to assist it in carrying out its responsibilities. Messrs. Maddock and Macleod both qualify as an “audit committee financial expert” according to applicable securities laws and SEC regulations, and they have been designated by the Board as such.

Compensation Committee—reviews and approves the compensation of executive officers and certain other highly compensated individuals. In addition, the Compensation Committee administers certain benefit plans and makes recommendations to the Board regarding compensation of Board members. It also has the authority to administer, grant, and issue awards under our equity compensation plan. Pursuant to its Charter, the Compensation Committee has delegated authority to a subcommittee, which is required to be composed of at least two directors, to grant equity awards to executives and establish, administer, and certify the attainment of, performance goals associated with performance-based compensation paid to executives. (the “Subcommittee”). The Subcommittee consists solely of directors who qualify as “outside directors” within the meaning of the Treasury Regulations promulgated under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Board has determined that, other than Mr. Diller, who once served as CEO of Elantec Semiconductor, Inc., now a wholly-owned subsidiary of Intersil, and formerly served as Interim CEO of Intersil, each member of the Compensation Committee qualifies as an “outside director.”

Nominating and Governance Committee—identifies, reviews, evaluates, and recommends potential candidates to serve on the Board, as Chairman, and as members of Committees. In addition, the Nominating and Governance Committee serves as a focal point for communication between such candidates, our Directors who are not members of the Nominating and Governance Committee, and our management. They also monitor, evaluate, and recommend corporate governance guidelines.

The Board’s Role in Risk Oversight. The Board’s role in our risk oversight process includes receiving regular reports from members of senior management on areas of material risk to us, including operational, financial, legal, regulatory, and strategic risks. The Audit Committee of the Board regularly reviews areas of material risk through an ongoing process of Enterprise Risk Management, or ERM, to understand company-wide risk identification, risk management, and risk mitigation strategies. The ERM process reviews areas of material risk at least annually and such reviews are discussed with the Audit Committee on a regular basis. The Chairman of the Audit Committee reports on the discussion during the next full Board meeting. The Board provides management guidance through the ERM process. This process enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. We believe that the practices described above, combined with our current leadership structure, facilitates effective Board oversight of our significant risks.

Stockholder Communications. Parties interested in communicating directly with any of the individual Directors, or the Board as a group, may do so by writing to Investor Relations via e-mail at investor@intersil.com,

or by mail to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, California 95035, Attn: Investor Relations. Our policy is to deliver such communications directly to the Board.

Directors’ Compensation and Related Party Transactions. At the recommendation of the Compensation Committee, effective January 1, 2014, our Board implemented the following annual cash compensation for our non-employee Directors which is payable in quarterly installments:

| | | |

| Annual Cash Compensation |

| Chair | | Members |

Board Members | $80,000 | | $50,000 |

Audit Committee | $20,000 | | $10,000 |

Compensation Committee | $15,000 | | $7,500 |

Nominating and Governance Committee | $10,000 | | $5,000 |

In addition to the above, a meeting fee of $1,000 per meeting will be paid to any Board member attending a Committee meeting where the Committee Chair invites that non-Committee Board member to attend a Committee meeting.

Director compensation is generally reviewed annually. In order to enhance the alignment of interests between Directors and stockholders, Directors are required to own a certain minimum dollar value of Intersil common stock. At the recommendation of the Compensation Committee, effective January 1, 2014, our Board implemented a common stock ownership requirement for non-employee Directors in an amount equal to three times the value of the annual cash retainer, which is currently $150,000, and must be attained by the fifth anniversary of the date of the Director’s initial election to the Board. Each of our non-employee Directors, who have served on our Board for more than five years, has met this stock ownership requirement.

Effective January 1, 2014, non-employee directors also receive equity compensation as follows:

| | |

Annual Grants | | Initial Grants for Newly-Elected Directors |

Deferred stock units equal in value to $120,000, determined by using the closing share price of Intersil’s common stock on The NASDAQ Stock Market, on the date of grant. These deferred stock units will generally become vested one year from the date of grant. Annual grants are typically granted the day prior to our Annual Meeting. | | 1. Deferred stock units equal in value to $75,000, determined by using the closing share price of Intersil’s common stock on The NASDAQ Stock Market, on the date of grant. These deferred stock units will vest at a rate of 33-1/3% per year. |

| | 2. Options to purchase Intersil’s common stock equal in value to $75,000, determined by using a generally accepted method of option valuation, on the date of grant. These stock options will vest at a rate of 33-1/3% per year. |

| | 3. Deferred stock units in an amount equal to the Annual Grant, pro-rated for time served as a director during the year of election, with vesting occurring the day prior to the next Annual Meeting. |

Directors may elect to defer the receipt of shares that vest under their deferred stock unit awards. Directors are reimbursed for travel expenses incurred while attending Board and Committee meetings. Non-employee directors do not participate in any cash incentive plans, or participate in any pension plan or deferred cash compensation plan. Related party transactions, if any, are reviewed by the Audit Committee. There were no related party transactions during 2015.

Compensation Committee Interlocks and Insider Participation. During 2015, no member of the Compensation Committee, while serving as such, was an officer or employee of Intersil, or any of its subsidiaries, or was formerly an officer of Intersil or any of its subsidiaries, other than Mr. Diller, who was formerly the CEO of Elantec Semiconductor, Inc., an Intersil subsidiary and formerly the Interim CEO of Intersil. Mr. Diller retired from the Board as of April 23, 2015. No member of the Compensation Committee had any relationship requiring disclosure under any paragraph of Item 404 or Item 402(j)(3) of Regulation S-K.

Submission of Director Nominations. The Nominating and Governance Committee will consider Director nominees submitted by stockholders in accordance with the procedures set forth in our Restated Bylaws. Those procedures require a stockholder to deliver notice to our Secretary or an Assistant Secretary at our principal executive offices. Delivery generally must be not less than 90 or more than 120 days prior to the first anniversary of the preceding year’s annual meeting of stockholders. If the date of the Annual Meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the stockholder must be delivered between 90 and 120 days prior to the annual meeting or, if the first public announcement of the date of the annual meeting is less than 100 days prior to the annual meeting, the 10th day following the public announcement.

Such notice must be in writing and must include:

| (i) | | the name and address of the nominating stockholder, as they appear in the stockholder listings, |

| (ii) | | the class and number of shares of Intersil stock which are owned beneficially and of record by the nominating stockholder, |

| (iii) | | the nominee’s written consent to being listed in the proxy statement as a nominee and to serving as a director if elected, |

| (iv) | | any information regarding the nominee that is required under Regulation 14A of the Exchange Act to be included in a proxy statement relating to the election of Directors. Candidates recommended by the stockholders are evaluated on the same basis as other candidates (other than Directors standing for re-election) recommended by our Directors, officers, third party search firms, or other sources, and |

| (v) | | as to the stockholder giving the notice and any beneficial owner on whose behalf the nomination is made, a description of any proxy, contract, agreement, arrangement, or understanding between or among such stockholder and any such beneficial owner, any of their respective affiliates or associates, and any other person or persons in connection with the proposal of such nomination, (I) a description of any agreement, arrangement, or understanding (including any derivative or short positions, profits interests, options, warrants, stock appreciation or similar rights, hedging transactions, and borrowed or loaned shares) that has been entered into by or on behalf of, or any other agreement, arrangement, or understanding that has been made, the effect or intent of which is to mitigate loss to, manage risk, or benefits of share price changes for, or increase or decrease the voting power of, such stockholder or any such beneficial owners with respect to Intersil’s securities, (II) a representation that the stockholder is a holder of record of our stock and entitled to vote at such meeting to bring such nomination before the meeting, and (III) a representation as to whether such stockholder or any such beneficial owner intends or is part of a group that intends to (x) deliver a proxy statement and/or form of proxy to holders of at least the percentage of the voting power of our outstanding capital stock required to elect each such nominee and/or (y) otherwise to solicit proxies from stockholders in support of such a proposal. Such information shall be supplemented by such stockholder and any such beneficial owner promptly, and in no event later than three (3) business days following any change to the information required under such clauses. |

Criteria and Diversity. Among the minimum qualifications, skills, and attributes that the Nominating and Governance Committee looks for in nominees are the following:

| (a) | | integrity, competence, and judgment essential to effective decision-making, |

| (b) | | ability and willingness to commit the necessary time and energy to prepare for, attend, and participate in meetings of the Board and one or more of its standing Committees, |

| (c) | | freedom from other outside involvements that would materially interfere with the individual’s responsibilities as a Director, |

| (d) | | background and experience that complements or supplements the background and experience of our other Board members, |

| (e) | | freedom from interests that would present the appearance of being adverse to, or in conflict with, the interests of Intersil, and |

| (f) | | a proven record of accomplishment through demonstrated leadership in business, education, government service, finance, manufacturing, or other relevant experiences that would tend to enhance Board effectiveness. |

The evaluation process may include a comprehensive background and reference check, a series of personal interviews with members of the Board and the Nominating and Governance Committee, and a thorough review by the Committee of the nominee’s qualifications and other relevant characteristics, taking into consideration the criteria set forth above. In addition, the Nominating and Governance Committee considers gender, cultural, and geographical diversity in the Director identification and nomination process as described in our Corporate Governance Guidelines. If the Committee determines that a candidate should be nominated for election to the Board, it will present its findings and recommendation to the full Board for approval.

Majority Voting for Directors. In February 2012, our Board amended our Bylaws to provide for a majority voting standard for the election of our Directors in uncontested elections. Previously, our Bylaws were silent as to the voting standard for Directors, and Directors were elected using a plurality standard set forth in the Delaware General Corporation Law. In contested Director elections, the plurality standard will apply, which means the nominees receiving the greatest numbers of votes will be elected to serve as Directors. A contested election is one in which the number of Director nominees exceeds the number of Directors to be elected. To be elected in an uncontested election, the votes “for” a Director must exceed the votes “against” (or “withheld” from) the Director. Abstentions and any broker non-votes will have no effect on the election of Directors. If an incumbent Director is not elected and no successor has been elected at the meeting, he or she will promptly tender his or her conditional resignation following certification of the vote. The Nominating and Governance Committee will consider the resignation offer and recommend to the Board whether to accept such offer. The Board will act on the recommendation within 90 days following receipt of the tender. After coming to a decision, the Board will publicly disclose its decision whether to accept the Director’s resignation offer (and the reasons for rejecting the offer, if applicable). If the Board does not accept the resignation, the Director will continue to serve until the next annual meeting and until a successor has been elected and qualified or until his or her earlier resignation, removal, or death. If the Board accepts the resignation, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board. The election of Directors at this Annual Meeting is an uncontested election and thus the majority voting standard applies.

ITEM 1

ELECTION OF DIRECTORS

Directors are elected at each annual meeting and hold office until the election held at the following annual meeting. A majority of the votes of eligible shares present in person or by proxy and actually cast is required for the election of directors. Our Amended and Restated Certificate of Incorporation provides for a Board of not fewer than five and not more than eleven members. The Board currently consists of nine Directors, but will be reduced to seven Directors effective immediately prior to the commencement of the Annual Meeting.

Director candidates are nominated by the Board upon the recommendation of the Nominating and Governance Committee. The Nominating and Governance Committee has recommended the seven nominees listed below, each of whom is currently a Director. Stockholders are also entitled to submit the names of Director candidates for consideration by the Nominating and Governance Committee in accordance with the procedures set forth in our Restated Bylaws and summarized under the heading “Corporate Governance—Submission of Director Nominations.”

The person named on the form of proxy will vote the shares “FOR” the nominees, unless you instruct otherwise. Each nominee has consented to stand for election. In the event that one or more of the nominees should become unavailable to serve at the time of the Annual Meeting, the shares represented by proxy will be voted for the remaining nominees and any substitute nominee(s) designated by the Board. Stockholders may cumulate their votes for Directors, and the Director elections are then determined by a majority of the votes cast.

Director Qualifications

Our Director nominees have a reputation for integrity, honesty, and adherence to high ethical standards. Each Director has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of services to Intersil and our Board. Finally, we value their significant experience on other boards of directors.

The following biographies provide a brief description of each nominee’s age, principal occupation, business experience (as of February 23, 2016), and directorships held in other corporations.

| | |

Nominees | | Positions and Offices Held with Intersil |

Donald Macleod | | Chairman of the Board |

Mercedes Johnson | | Director |

Sohail Khan | | Director |

Gregory Lang | | Director |

Ernest Maddock | | Director |

Forrest E. Norrod | | Director |

Necip Sayiner | | President, CEO and Director |

BUSINESS EXPERIENCE OF DIRECTORS

Donald Macleod, Chairman of the Board. Mr. Macleod, age 67, has been Chairman of the Board since December 2012. Mr. Macleod joined our Board as a Director on September 4, 2012. Mr. Macleod served as President and CEO of National Semiconductor Corporation, an analog semiconductor company, from November 2009 to September 2011, when National Semiconductor was acquired by Texas Instruments Incorporated. Mr. Macleod joined National Semiconductor in 1978 and served in a variety of executive positions prior to becoming CEO, including Chief Operating Officer and Chief Financial Officer, or CFO. He served as the Chairman of the Board of National Semiconductor from May 2010 to September 2011. Mr. Macleod currently serves on the Board of Directors of Broadcom Ltd. (formerly known as Avago Technologies Limited), a global manufacturer of optoelectronics and analog interface components, a position he has held since November 2007. In February 2014, Mr. Macleod was appointed to the Board of Directors of Knowles Corporation, a global supplier of advanced micro-acoustic solutions and specialty components for the mobile communications, consumer electronics, medical technology, military, aerospace, and industrial end markets. In addition, Mr. Macleod also serves on the Board of Directors of two privately-held companies. Mr. Macleod’s qualifications to serve as a Director include his more than 30 years of experience in senior management and executive positions in the semiconductor industry (both in Europe and the United States), his experience as a financial executive at a semiconductor company, and as a board member of other publicly traded semiconductor companies.

Mercedes Johnson, Director. Ms. Johnson, age 61, has been a Director since August 2005. From April 1, 2013 through September 22, 2013 she served as the Interim CFO of Intersil. Ms. Johnson was previously the Senior Vice President of Finance and CFO at Avago Technologies from December 2005 until her retirement in August 2008. Prior to her employment with Avago, Ms. Johnson worked for Lam Research Corporation, serving as its Senior Vice President of Finance from June 2004 to January 2005, and as its CFO from April 1997 to May 2004. Ms. Johnson has served as a member of the Board of Directors of Micron Technology, Inc. since June 2005, Juniper Networks since May 2011, and Teradyne, Inc. since July 2014. She also served on the Board of Directors for Storage Technology Corporation from January 2004 until its sale in August 2005. Ms. Johnson’s qualifications to serve as a Director include her experience as a senior financial executive at semiconductor and semiconductor equipment companies, and as a board member of other publicly traded semiconductor companies.

Sohail Khan, Director. Mr. Khan, age 61, has been a Director since October 2014. He is currently the President and CEO of ViXS Systems Inc. and previously served as the President and CEO of Lilliputian Systems Inc., a fuel cell company from May 2013 through July 2014. From 2007 to 2011, he served as president and CEO of SiGe Semiconductor where he refocused the company on specific core markets, and secured the top market share position in the highly competitive WiFi segment. In 2011, Mr. Khan oversaw the acquisition and integration of SiGe Semiconductor by Skyworks Solutions. Mr. Khan has also held several senior executive positions at Agere Systems and Lucent Technologies. Mr. Khan has served as a member of the Board of Directors of LightPath Technologies since February 2005. Mr. Khan’s qualifications to serve as a Director include his experience in senior management and executive positions in the semiconductor and technology industries.

Gregory Lang, Director. Mr. Lang, age 52, has been a Director since February 2006. Mr. Lang served from May 2008 through January 15, 2016 as President, CEO and Director of PMC-Sierra, Inc., a company that engaged in the design, development, market, and support of semiconductor solutions for storage, mobile, and optical networks. In March 2008, Mr. Lang resigned his position as President, CEO and Director of Integrated Device Technology Inc., or IDT. Mr. Lang joined IDT as President in October 2001, was appointed CEO in January 2003 and elected to the IDT Board of Directors in September 2003. Prior to joining IDT, Mr. Lang held the position of Vice President and General Manager of Intel Corporation’s platform networking group. Previously he managed Intel’s Ethernet, storage I/O processing, home networking, and broadband businesses. Mr. Lang’s qualifications to serve as a Director include his more than 25 years of experience in the semiconductor industry in positions including CEO, President, Vice President, and General Manager.

Ernest Maddock, Director. Mr. Maddock, age 57 has been a Director since July 2015. He is CFO and Vice President of Finance at Micron Technology. Prior to joining Micron in 2015, Mr. Maddock served as CFO at multiple global companies, including Riverbed Technology and Lam Research. His career includes executive experience in manufacturing and supply chain management, global operations, international business, and information technology. He has also held leadership roles at NCR Corporation and Lockheed Corporation. Mr.

Maddock’s qualifications to serve as a Director include his experience in senior management and executive positions in the semiconductor and other technology industries.

Forrest E. Norrod, Director. Mr. Norrod, age 50, has been a Director at Intersil since October 2014. He has also served as Senior Vice President and General Manager of the Enterprise, Embedded and Semi-Custom, or EESC, business group at AMD since October 2014. From 2009 to 2014 he served as Vice President and General Manager of Dell’s server business, driving the business to market share leadership in several key geographies and markets while delivering consistent revenue and profitability growth. Prior to Dell, Mr. Norrod worked at Cyrix Corporation and National Semiconductor leading the integrated x86 CPU businesses supporting the PC and computer industries. Mr. Norrod’s qualifications to serve as a Director include his more than 25 years of technology industry experience across a number of engineering and business management roles at both the chip and system level.

Dr. Necip Sayiner, President, CEO and Director. Dr. Sayiner, age 50, has served as our President, CEO and Director since March 14, 2013. Prior to joining Intersil, from September 2005 to April 2012, he served as President and Chief Executive Officer, and Director of Silicon Laboratories, a fabless semiconductor company engaged in the design of analog-intensive, mixed-signal integrated circuits. Prior to joining Silicon Laboratories, Dr. Sayiner held various leadership positions at Agere Systems Inc., which included Executive Vice President and General Manager, Enterprise and Networking Division from August 2004 to September 2005; and Vice President and General Manager, Networking ICs Division from March 2002 to August 2004. In December 2015, Dr. Sayiner was appointed Chairman of the Semiconductor Industry Association, or SIA. Prior to this, Dr. Sayiner was Vice Chairman of the SIA from November 2014 – December 2015. Dr. Sayiner was initially appointed to the Board of the SIA in September 2013. Dr. Sayiner’s qualifications to serve as a Director include his analog IC company management experience, including President, CEO and Director at a publicly traded semiconductor company and his product development and engineering experience.

The Board of Directors recommends that stockholders vote “FOR” each of the nominees listed.

ITEM 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board, acting upon the recommendation of the Audit Committee, asks that the stockholders ratify the selection of KPMG LLP, our independent registered public accounting firm since 2006, as Intersil’s independent registered public accounting firm to audit and report upon our financial statements for the 2016 fiscal year. Ratification requires the affirmative vote of a majority of eligible shares present at the Annual Meeting in person or by proxy and actually cast.

Unless otherwise specified by the stockholders, the shares of stock represented by the proxy will be voted “FOR” ratification of the appointment of KPMG LLP as our independent registered public accounting firm.

In the event the stockholders fail to ratify the appointment, the Board will reconsider its selection. Even if the selection is ratified, the Board, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Board determines that such a change would be in the best interests of Intersil and our stockholders.

One or more representatives of KPMG LLP are expected to be at the Annual Meeting. They will have an opportunity to make a statement and will be available to respond to appropriate questions.

AUDIT AND OTHER FEES PAID TO KPMG LLP

The aggregate fees incurred by the Company with KPMG LLP for the annual audit and other services for the fiscal year ended 2015 and 2014 were as follows:

| Fiscal Year |

| 2015

($) | | 2014

($) |

Audit fees | 1,420,000 | | 1,436,000 |

Audit-related fees | 1,000 | | 19,000 |

Tax fees | 103,000 | | 375,000 |

All other fees | | | |

Our Audit Committee is responsible for the negotiation and approval of our auditor’s fees. All of the audit engagements relating to audit services, audit-related services, and non-audit services described above were pre-approved by our Audit Committee in accordance with its Pre-Approval Policy. The policy authorizes the Audit Committee to delegate one or more of its members with pre-approval authority with respect to permitted engagements. Our Audit Committee has reviewed the fees described above and believes that such fees are compatible with maintaining the independence of KPMG LLP.

The Board of Directors recommends that stockholders vote “FOR” the

ratification of the selection of KPMG LLP to serve as Intersil’s independent

registered public accounting firm for the 2016 fiscal year.

ITEM 3

ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

As required by Section 14A of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Board of Directors is seeking a non-binding stockholder advisory vote on the compensation of our Named Executive Officers, or NEOs, in 2015 as set forth on the Summary Compensation Table in the Compensation Discussion and Analysis, or CD&A, below. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs, as disclosed in the Executive Compensation section, the accompanying tables, and the narrative disclosures of this Proxy Statement.

Results of Prior Annual Meetings. The Compensation Committee considers your vote when evaluating our compensation programs and practices applicable to our NEOs and in determining future compensation. At our 2015 Annual Meeting, stockholders representing approximately 97% of our shares voting at such meeting voted in favor of the 2014 compensation of our NEOs, commonly referred to as the Say-on-Pay vote. At our 2014 Annual Meeting, stockholders representing approximately 69% of our shares voting at such meeting voted in favor of the 2013 compensation of our NEOs. At our 2013 Annual Meeting, stockholders representing approximately 98% of our shares voting at such meeting voted in favor of the 2012 compensation of our NEOs.

Highlights of our Executive Compensation Program. Below are some of the changes to our executive compensation program that we have implemented over the past three years to ensure that executive compensation is aligned with our performance.

| · | | Our equity grants are issued in the form of time-based deferred stock units, or DSUs, and performance-based market stock units, or MSUs. We have not issued stock options to NEOs since April 2012. |

| · | | In 2013, our MSU Program was modified such that the peer comparisons for total stockholder return, or TSR, are now based on the S&P Semiconductor Select Index rather than a smaller and finite group of company selected peers. In 2015, we continued the practice of ensuring that at least 50% of our NEOs’ annual equity grants are performance-based. Also, in 2015, the total equity grants, which include performance-based grants at target, were granted at a level that corresponded to approximately the 60th percentile of the market data. |

| · | | Annually, we review and modify, as appropriate, our peer group of companies to ensure the companies in aggregate are sized more closely to us; however, we continue to believe that some of the larger peer companies in our compensation peer group need to be included as we tend to compete with these companies for executive talent, as well as in the markets we serve. |

| · | | Our short-term incentive program continues to align employee compensation with our financial goals and emphasizes our pay for performance philosophy. In addition, this incentive program provides greater visibility and transparency to our stockholders on our incentive compensation practices. |

| · | | We periodically reach out to our stockholders to seek detailed feedback regarding our executive compensation program and engage in discussions regarding any potential concerns. Our Compensation Committee carefully considers this feedback when making decisions regarding executive compensation. |

| · | | During 2015, members of our Compensation Committee spent considerable time reviewing our compensation components, including examining benchmark data, and compensation practices with Radford, the Compensation Committee’s independent compensation consultant. |

Our compensation program is designed to pay our NEOs for performance. As described in the CD&A, our compensation program for our NEOs is heavily weighted toward “at-risk” performance-based pay. Approximately 50% of our CEO’s new hire equity grant in 2013 and his on-going annual equity grants are performance-based and thus are deemed to be “at risk” since the grants are tied to performance metrics. In addition, approximately 50% of

our other NEOs’ on-going annual equity grants are performance-based and thus are deemed “at risk” since they are earned only if we outperform a specified percentage of our peers in TSR. Further, our NEOs short-term quarterly cash bonuses are performance-based since payment is made only if we achieve certain financial targets established as part of our annual operating plan. For our 2015 equity grants, we issued time-based DSUs and performance-based MSUs which, when combined, equaled approximately the 60th percentile of the market data if performance-based MSUs pay out at target. Under our MSU Program, our TSR performance has to meet the 25th percentile of peer performance as a minimum threshold, and our TSR performance has to meet the 50th percentile of peer performance for target level payout. In addition, as described in the CD&A, our NEOs’ 2015 cash incentives were largely based on our adjusted or non-GAAP operating margin, non-GAAP gross margin, and revenue, because we believe that these three financial metrics are important factors in the creation of stockholder value. Consistent with our emphasis on performance-based compensation, none of our NEOs received discretionary bonuses in 2015.

Our compensation program is designed to align our NEOs’ interests with our stockholders’ interests. Equity awards granted to our NEOs comprise a substantial portion of their annual compensation. Performance-based equity grants, in the form of MSUs, are generally subject to cliff vest at three years from the date of grant. Time-based equity, in the form of DSUs, Restricted Stock Units, or RSUs, are generally subject to vesting over a period of four years. We believe that these multi-year vesting periods help align the interests of our NEOs with those of our stockholders because a substantial portion of their compensation is tied to our long-term success. Moreover, our CEO and CFO are required to maintain certain levels of ownership of our stock as described in the CD&A.

Our compensation program is designed to be fair and competitive. Our Compensation Committee is responsible for establishing the compensation of our NEOs. In addition, our Compensation Committee retains an independent compensation consultant to advise it on competitive market practices and other areas of NEO compensation. We generally benchmark our compensation against our peer companies to ensure our compensation program is fair and competitive.

Based on the foregoing, the Board recommends that our stockholders approve the following resolution, or the Executive Compensation Resolution:

RESOLVED, that the compensation paid to our NEOs, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion is hereby APPROVED.

The Board of Directors recommends that stockholders vote “FOR” approval

of the Executive Compensation Resolution.

SUBMISSION OF STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS

The stockholder meeting for the next fiscal year will be held on or about April 20, 2017. Stockholders wishing to have a proposal included in our 2017 Proxy Statement must submit the proposal so that our Secretary receives it no later than November 6, 2016, which is 120 days prior to the first anniversary of the date this Proxy Statement was released to stockholders. The SEC rules set forth standards describing which stockholder proposals are required to be included in a proxy statement.

For any proposal that is not submitted for inclusion in next year’s Proxy Statement (as described above) but is instead sought to be presented directly at next year’s annual meeting, SEC rules permit our management to vote proxies in our discretion if (a) we receive notice of the proposal before the close of business on January 28, 2017 and we advise stockholders in next year’s Proxy Statement about the nature of the matter and how management intends to vote on such matter, or (b) we do not receive notice of the proposal prior to the close of business on January 28, 2017. Notices of intention to present proposals at the 2017 Annual Meeting should be addressed to Intersil Corporation, 1001 Murphy Ranch Road, Milpitas, CA 95035, Attention: Vice President, General Counsel & Secretary.

AUDIT COMMITTEE REPORT

Report of the Audit Committee to the Full Board of Directors of Intersil Corporation

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee appoints our independent registered public accounting firm, which reports directly to the Audit Committee, to audit our financial statements. The Audit Committee consults with, and reviews recommendations made by, the independent registered public accounting firm with respect to our financial statements, financial records, and financial controls and makes recommendations to the Board as it deems appropriate from time to time. Pre-approving both audit and non-audit engagements with the independent registered public accounting firm is also the responsibility of the Audit Committee. The Board adopted a written charter setting forth the responsibilities of the Audit Committee and this report is made pursuant to that charter.

The Audit Committee oversees our financial reporting process on behalf of the Board. Our management is responsible for the financial reporting process including our system of internal controls, and for the preparation of our consolidated financial statements in accordance with generally accepted accounting principles. The independent registered public accounting firm is responsible for auditing those financial statements and expressing an opinion on whether those financial statements conform with the accounting principles generally accepted in the United States. The Committee’s responsibility is to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews.

In 2015, the Audit Committee held five (5) meetings and took no actions by unanimous written consent. In addition, the Audit Committee met with management periodically during 2015 to consider the adequacy of our internal controls, and discussed these matters and the overall scope and plans for the audit with KPMG LLP, our independent registered public accounting firm during that time period. The Audit Committee also discussed with senior management and KPMG LLP our disclosure controls and procedures and the certifications by our CEO and CFO, which are required by the SEC.

The Audit Committee established procedures for the receipt, retention, and treatment of complaints received regarding accounting, internal accounting controls, or auditing matters and for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the 2015 Annual Report on Form 10-K with our management, including a review of the quality, in addition to the

acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with KPMG LLP its judgments as to the quality, in addition to the acceptability, of our accounting principles and other matters required to be discussed with the Audit Committee under auditing standards generally accepted in the United States, including the matters required to be discussed pursuant to the Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 16 “Communications with Audit Committees.” The Audit Committee has received the written disclosures, as well as a letter from KPMG LLP as required by the applicable requirements of the PCAOB, regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee reviewed auditor independence with KPMG LLP, including the compatibility and effect on KPMG LLP’s independence of non-audit services performed by KPMG LLP for us.

The Audit Committee discussed with KPMG LLP the overall scope and plans for KPMG LLP’s audit. The Audit Committee met with KPMG LLP, with and without management present, to discuss the results of KPMG LLP’s examination, KPMG LLP’s evaluation of our internal controls, and the overall quality of our financial reporting.

In reliance on the results of the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended January 1, 2016 for filing with the SEC.

The Audit Committee has appointed the firm of KPMG LLP, an independent registered public accounting firm, to audit and report upon our financial statements for the fiscal year ending December 30, 2016. We are requesting stockholder ratification of the appointment of KPMG LLP. In appointing KPMG LLP as our auditors for 2016, the Audit Committee has considered whether KPMG LLP’s provision of services other than audit services are compatible with maintaining their independence.

| |

| AUDIT COMMITTEE |

| |

| Jan Peeters, Committee Chair |

| Sohail Khan |

| Donald Macleod |

| Ernest Maddock |

EXECUTIVE OFFICERS AND KEY EMPLOYEES

As of January 1, 2016, our executive officers and key employees were as follows:

Dr. Necip Sayiner, President, CEO and Director. Dr. Sayiner is described above as a nominee for Director.

Richard Crowley, Senior Vice President, CFO and Treasurer. Mr. Crowley, age 59, has served as our Senior Vice President and Chief Financial Officer, or CFO, since September 23, 2013 and as Treasurer since April 2015. Prior to joining Intersil, he was Senior Vice President of Finance and CFO for Integrated Device Technology from October 2008 to September 2013, where he drove major restructuring efforts to improve operating results. Prior to joining IDT, Mr. Crowley was the Vice President of Finance and CFO for Micrel Incorporated from September 1999 to September 2008, where he played a key role in improving profitability and the company’s capital structure. He also served as Vice President and CFO at Vantis Corporation from December 1998 to August 1999. Prior to this, Mr. Crowley served as Vice President, Corporate Controller and Chief Accounting Officer at National Semiconductor Corporation from October 1995 to November 1998. In addition, Mr. Crowley held various finance management positions during his tenure at National Semiconductor which began in 1980.

Andrew Micallef, Senior Vice President, Worldwide Operations. Mr. Micallef, age 50, has served as our Senior Vice President, Worldwide Operations since January 26, 2015. From July 2010 to January 2015, he served as the Vice President of Customer Engineering and Operations at Audience, Inc., a fabless semiconductor and software designer, where he oversaw all applications engineering, manufacturing, procurement, supply chain management, quality control, product engineering, and facilities. Prior to Audience, he served as Executive Vice President of Worldwide Manufacturing and Operations at LSI Corporation, assuming this role through LSI's acquisition of Agere Systems in 2007 until February 2010. At Agere he was also responsible for global operations. Prior to that, Mr. Micallef held several finance and operations positions at Fujitsu-ICL Systems, and also IBM. He began his career at General Dynamics, where he worked as a mechanical and fluid systems design engineer.

Thomas C. Tokos, Senior Vice President, General Counsel. Mr. Tokos, age 63, served as a Senior Vice President of the Company from November 10, 2015 until his retirement on December 31, 2015. He served as our Senior Vice President, General Counsel and Secretary from September 13, 2008 through November 9, 2015. From May 27, 2003 to September 12, 2008, he served as Intersil’s Vice President, General Counsel and Secretary. Previously, Mr. Tokos served as general counsel to semiconductor and technology companies and as an attorney with private law firms.

Roger Wendelken, Senior Vice President, Worldwide Sales. Mr. Wendelken, age 49, has served as our Senior Vice President, Worldwide Sales since October 14, 2013. Prior to joining Intersil, he was the Senior Vice President, Worldwide Sales for Volex Corporation from January 2013 to October 2013. Prior to this, Mr. Wendelken served as Senior Vice President, Worldwide Sales for Standard Microsystems Corporation, or SMSC, from June 2009 to August 2012, where he led the global sales organization building a presence in a variety of competitive consumer, industrial, and automotive markets for SMSC before it was acquired by Microchip in August 2012. Mr. Wendelken also served as Vice President of Worldwide Sales at Applied Micro Circuits Corporation from May 2006 to May 2009 and Vice President of Worldwide Sales at Marvell Semiconductor from September 2003 to March 2006. Prior to this, Mr. Wendelken held sales management roles at various technology companies from June 1994 to March 2000.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis, or CD&A, provides an overview of our executive compensation programs, describes the material factors underlying our 2015 compensation provided to our NEOs, and provides greater clarity to the information presented in the tables which follow this CD&A. This CD&A contains statements regarding certain performance targets and goals we have used or may use to determine appropriate compensation. These targets and goals are disclosed in the limited context of our compensation program and should not be understood to be statements of management’s expectations or estimates of financial results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Our executive compensation program is designed to motivate and retain our officers to increase stockholder value and balance short-term and long-term performance. We accomplish this goal by employing a “pay-for-performance” approach to the compensation of our NEOs. As a result, a significant portion of the compensation of our NEOs is “at-risk,” as their compensation is specifically dependent upon our short-term and long-term performance. The compensation elements deemed to be “at-risk” are performance-based MSUs since they are earned only if we outperform a specified percentage of our peers in TSR, and short-term quarterly cash bonuses since payment is made only if we achieve certain non-GAAP operating margin, non-GAAP gross margin, or revenue targets, or meet certain management business objectives.

In addition to performance, the Compensation Committee places an emphasis on retention. Equity-based awards granted to our NEOs generally have a vesting period of three to four years, and thus serve as a valuable retention tool, while also tying a substantial portion of our NEOs’ compensation to our long-term success. The Compensation Committee has also established stock ownership guidelines for our CEO and CFO to align their financial interests to those of our stockholders.

During 2015, the Compensation Committee engaged Radford, an Aon Hewitt Company, or Radford, as an independent compensation consultant to provide non-biased advice regarding executive compensation. In addition, in setting NEO compensation, the Compensation Committee reviews compensation information from peer companies as well as other companies that compete with us for talent. Generally, base salary is targeted at or near the 50th percentile of our peer group, total cash compensation is targeted at or near the 60th percentile of our peer group, and overall equity compensation is targeted at or near the 60th percentile of our peer group. The Compensation Committee believes that providing compensation based on the above relative to our peer group is appropriate and allows us to attract and retain the talent necessary to execute our business plans and achieve our goals.

Below is a description, purpose, and expected performance relationship of the primary elements of NEO compensation. This table is a summary description and should be reviewed in conjunction with the remainder of this CD&A.

Compensation Type | Purpose and Value | Performance Relationship |

Short-Term Compensation: | | |

Base Salary | To provide a competitive source of income throughout the year. | Merit-based increases in base salary are provided in recognition of individual performance and contributions to our success. |

Quarterly Cash Bonuses | To motivate and reward for achieving non-GAAP financial performance goals. The use of quarterly performance periods focuses the NEOs on achieving the desired operating margin, gross margin, or revenue performance goals. | Quarterly cash bonuses are provided under our Executive Incentive Plan, or EIP, only if minimum levels of performance are attained during the relevant quarterly performance period. Targets under our EIP are not set each quarter but are established as part of our annual operating plan. |

| | |

Long-Term Compensation: | | |

Performance-Based Market Stock Units, or MSUs | To retain and motivate executives to outperform the average TSR of our peer companies. | MSUs were granted in 2015. In order for executives to receive a 100% MSU payout, our TSR must be at or above the 50th percentile of our peer group of companies. The 2015 MSUs will vest in 2018. |

Deferred Stock Units, or DSUs | To retain and motivate executives to increase stockholder value. | Because each DSU has a value equal to one share of our Common Stock, the value of an award will increase after grant only if stockholder value is created. Similarly, if our stock price decreases after grant, the value of the award will also decrease. |

Below are some actions we have taken in the last three years to ensure that executive compensation is aligned with our performance and is consistent with the Compensation Committee’s executive compensation philosophy.

| · | | Our equity grants are issued in the form of time-based Deferred Stock Units, or DSUs, and performance-based Market Stock Units, or MSUs. We have not issued stock options to NEOs since April 2012. |

| · | | In 2015, we continued the practice of ensuring at least 50% of our NEOs’ annual equity grants are performance-based. Also, in 2015, the total equity grants, which include performance grants at target, were granted at a level that corresponded to approximately the 60th percentile of the market data. |

| · | | Annually, we review and modify, as appropriate, our peer group of companies to ensure the companies, in the aggregate, are sized more closely to us; however, we continue to believe that some of the larger peer companies in our compensation peer group need to be included as we tend to compete with these companies for executive talent, as well as in the markets we serve. |

| · | | Our short term incentive program continues to align employee compensation with financial goals and emphasizes our pay for performance philosophy, and gives greater visibility and transparency to our stockholders on our incentive compensation practices. |

| · | | We periodically reach out to our stockholders to seek detailed feedback regarding our executive compensation program and engage in discussions regarding any potential concerns. Our |

Compensation Committee carefully considers this feedback when making decisions regarding executive compensation. |

| · | | During 2015, members of our Compensation Committee spent considerable time reviewing our compensation components, including examining benchmark data and compensation practices with Radford, the Compensation Committee’s independent compensation consultant. |

We pay careful attention to any feedback we receive from our stockholders pertaining to our executive compensation program and continually analyze our pay structure to ensure it appropriately aligns with our performance and is competitive within the industry.

Compensation Committee Consideration of 2015 Stockholder Vote on Executive Compensation

In determining and approving the compensation of our NEOs, the Compensation Committee monitors the results of our annual advisory vote on executive compensation. At our 2015 Annual Meeting of Stockholders, approximately 97% of the shares that were voted approved the advisory vote on our NEOs’ 2014 compensation, which is commonly referred to as the “Say-on-Pay” vote. Although this vote is non-binding, the Compensation Committee viewed this endorsement of our executive compensation decisions and policies as an additional factor supporting the Compensation Committee’s conclusion that our current approach to executive compensation has been successful.

Role of Compensation Committee

The Compensation Committee:

| · | | reviews and approves our executive compensation philosophy; |

| · | | establishes, oversees, and directs our executive compensation programs and policies; |

| · | | reviews and approves the salary and other compensation (such as incentive pay) of our officers and other key executives (including the NEOs); and |

| · | | administers our Amended and Restated 2008 Equity Compensation Plan and our Executive Incentive Plan. |

In determining the forms and amount of compensation to be provided to our executive officers, the Compensation Committee seeks to align executive compensation with our financial performance in order to enhance stockholder value. The Compensation Committee also considers our overall business plan (which is approved on an annual basis by the Board) in setting our NEOs’ compensation to ensure that our compensation practices and policies remain consistent with our business goals. At the end of 2015, the Compensation Committee members consisted of Messrs. Lang, Macleod, Norrod, and Urry. The full background of each member of the Compensation Committee can be found under the “Business Experience of Directors” section.

In 2015, the Compensation Committee retained Radford to act as an independent compensation advisor. Radford reported directly to the Compensation Committee and assisted the Compensation Committee in evaluating and designing our executive and director compensation and equity programs. Radford also assists the Compensation Committee by evaluating compensation data, and by making recommendations to the Compensation Committee on such proposals. In addition, Radford was engaged to assist in determining our peer group of companies, provide and analyze market data, advice regarding executive and director compensation plan design, and conduct risk assessments of our executive compensation program. In connection with its work for the Compensation Committee, Radford was invited to attend the Compensation Committee’s meetings and, upon request of the Compensation Committee, attend executive sessions with the Compensation Committee in which no member of management was present. Radford provided an independence letter to the Compensation Committee stating that they meet the independence standards prescribed by the Securities and Exchange Commission, or SEC, and Nasdaq for all work performed for the Compensation Committee during 2015. The Compensation Committee, based upon its own assessment, determined that Radford was independent under the applicable SEC regulations and Nasdaq rules. The Compensation Committee believes that Radford provides valuable data on executive compensation by leveraging its

extensive database and significant industry expertise. Through Radford’s services, the Compensation Committee is able to not only compare its practices with the high technology industry, but can specifically use their data and expertise to compare its compensation practices with an identified list of peer semiconductor industry companies.

In 2015, the Compensation Committee held six (6) meetings and acted by unanimous written consent five (5) times. Generally, the management team, consisting of the Senior Vice President of Human Resources, the Director of Compensation and Benefits, and the CEO, reviews data from Radford and prepares recommendations for the Compensation Committee related to cash and equity compensation for the NEOs, other than the CEO, and in some cases, other executives. The Compensation Committee, the management team, and Radford then meet to discuss these recommendations and other specific compensation issues. Final decisions on compensation matters are then made by the Compensation Committee with Radford, its independent advisor, participating in the discussion, or, in cases involving our CEO, by the Board, without the participation of management.

The Compensation Committee, at times, met in executive session without the management team. Radford was generally present at these executive sessions to provide independent guidance on any material or data presented, including advice on decisions, guidance on executive compensation trends, or interpretation of data. The Compensation Committee also met regularly with Radford and key executives, such as the Senior Vice President of Human Resources and the Director of Compensation and Benefits, to review best practices and marketplace trends in order to remain informed regarding compensation issues, and to review recommendations from Radford and/or management regarding compensation and equity for executives and other employees. In addition, each year, the management team works with the Chairman of the Compensation Committee to develop a full compensation agenda for the following year for consideration by the Compensation Committee.

Compensation Philosophy and Objectives

Our compensation philosophy consists of developing programs and practices that:

| (i) | | attract and retain exceptional executives; |

| (ii) | | motivate and reward behavior consistent with our values that will yield desired financial results; |

| (iii) | | maximize stockholder value by emphasizing both the short-term and long-term focus of the business; |

| (iv) | | are highly responsive to our performance; and |

| (v) | | facilitate congruence between stockholder interests and employee interests through ownership of the common stock. |

Consistent with this philosophy, the Compensation Committee believes that a substantial percentage of our NEOs’ compensation should be in the form of incentive compensation and long-term equity awards that are tied directly to performance and the value of our common stock. The Compensation Committee believes that tying the NEOs’ compensation to our performance will better align the interests of the NEOs with our stockholders.

Compensation Analysis

The Compensation Committee engages in market analysis to determine appropriate compensation in our industry. In determining appropriate compensation, the Compensation Committee, with input from Radford, used a comparative framework to identify peer companies and utilize data sources to assess job levels and compensation programs and practices. This framework draws information primarily from the semiconductor industry, but also considers a broader base from the overall high technology industry. The information utilized in making these determinations is provided by Radford through its extensive survey network, as well as from public filings of peer companies regarding executive pay. The following factors are used by the Compensation Committee to establish an appropriate group of peer companies within our industry in comparing compensation, benefits, and equity information:

| (i) company revenue (typically considering companies in the $300 million – $2.0 billion range); |

| (ii) company size (typically 500 – 4,000 employees); |

| (iii) company products (preliminary business is to design and manufacture semiconductor |

components); and

The aforementioned criteria was designed to identify companies that are similar in revenue and employee population with us and that would typically compete for talent with us, making them appropriate for measuring compensation practices. In 2015, our peer group included the following companies:

| | |

Cirrus Logic | Maxim Integrated Products | PMC-Sierra |

Cypress Semiconductor | Micrel | Power Integrations |

Fairchild Semiconductor | Microchip Technology | Semtech |

Integrated Device Technology | Microsemi | Silicon Laboratories |

Linear Technology | Monolithic Power Systems | Skyworks Solutions |

Note: In May 2015, Micrel was acquired by Microchip Technology.

Compensation Components

We utilize three main components to compensation: base pay, cash incentive pay, and equity compensation. Our philosophy is to pay base salary at approximately the 50th percentile of market and approximately the 60th percentile of market for total cash earning opportunities when individual and company performance meets or exceeds specified targets. We believe this strengthens our ability to attract and retain talent from both larger and smaller peer companies. This philosophy is applied consistently to executives and non-executives alike. In addition to comparing compensation to our peer group, an individual’s incentive and equity compensation is based upon individual and company performance for a defined performance period, as explained below.

Base Salary

The annual base salaries are set at levels designed to provide the NEOs with a competitive source of income throughout the year, while recognizing that a substantial portion of their compensation will be contingent on performance, generally in the form of quarterly and annual cash incentives and equity-based awards. Dr. Sayiner’s base salary was determined by the Compensation Committee taking into consideration benchmark data of our peer group of companies as well as input from Radford, the Compensation Committee’s independent compensation consultant. Base salaries of other NEOs are recommended by our CEO, then reviewed and approved annually by the Compensation Committee and may be adjusted in accordance with the following:

| · | | Base salary data provided by Radford regarding our defined peer group and our industry. |

| · | | Internal review performed by the Senior Vice President of Human Resources and CEO and presented to the Compensation Committee both individually and relative to our other executives. |

| · | | Individual performance of the executive, expected future contributions, and the scope and nature of responsibilities. |

Base salaries for our NEOs were increased in 2015 as shown below:

| | | | | | |

NEO | | Percent Increase | | Beginning | | Ending |

Necip Sayiner | | 6.3% | | $640,000 | | $680,000 |

Richard Crowley | | 3.0% | | $370,000 | | $381,000 |

Andrew Micallef[1] | | n/a | | $340,000 | | $340,000 |

Thomas C. Tokos | | 2.0% | | $322,000 | | $328,500 |

Roger Wendelken | | 4.0% | | $347,000 | | $361,000 |

[1] Mr. Micallef joined Intersil on January 26, 2015, thus, no adjustment in base salary was made.

Short-Term Cash Incentive

Our compensation philosophy supports that a substantial portion of the NEOs’ annual compensation should be tied to our financial results in order to reward only exceptional individual performance and overall company success. Cash incentive compensation for NEOs is delivered through our Executive Incentive Plan, or EIP.

In 2015, we utilized a performance-based quarterly cash incentive plan based upon several factors depending on the individual NEOs’ position. The table below illustrates how each NEOs’ incentive is calculated:

| Corporate Metrics (% of Target) | Individual Metrics | Total |

Position | Revenue | Non-GAAP Operating Margin | Non-GAAP Gross Margin | Management Business Objectives (“MBOs”) |

President and CEO | 50.0% | 50.0% | | | 100.0% |

SVP, CFO and Treasurer | 33.3% | 33.3% | | 33.3% | 100.0% |

SVP, Worldwide Sales | 33.3% | | 33.3% | 33.3% | 100.0% |

SVP, Worldwide Operations | 33.3% | | 33.3% | 33.3% | 100.0% |

SVP, General Counsel | 33.3% | 33.3% | | 33.3% | 100.0% |

| Payout Quarterly | Payout Annually | |

Incentive payouts in 2015 were based upon performance measured against goals using the following financial metrics: Revenue, Non-GAAP Operating Margin or Non-GAAP Gross Margin. For all NEOs, except our CEO, incentives are also based on other objectively determinable non-financial management business objectives. Non-GAAP operating margin is non-GAAP operating income divided by revenue. Non-GAAP Operating Income is based on GAAP operating income and excludes amortization of purchased intangibles, costs associated with restructuring, asset impairment charges, acquisition-related expenses, equity-based compensation, significant unforeseen legal costs or settlements, and other adjustments deemed appropriate by the Compensation Committee. In 2015, the maximum payout possible for each executive was 175% of target.

Management Business Objectives, or MBOs. As described above, each NEO also had other objectively determinable non-financial management business objectives. The CEO works with each NEO to develop challenging MBOs taking into consideration our annual operating plan, or AOP, which is approved by the Board. In 2015, no NEO received the full payout on the MBO portion of their incentive. Specific MBOs included metrics such as revenue growth year over year (whole company and product line specific), design wins, new product development, reduction of expenses, product quality improvements, product release timelines, process improvements, and recruiting/retention statistics.

The table below shows each NEOs’ target and maximum bonus opportunity for 2015, as well as the amount of the incentive payout earned by each NEO in 2015. These bonuses are listed in the Summary Compensation Table, under the column entitled “Non-Equity Incentive Plan Compensation”.

| | | | |

NEO | | 2015 Target/Maximum Incentive | | 2015 Incentive Payout |

Necip Sayiner | | $850,000 / $1,487,500 | | $482,081 |

Richard Crowley | | $285,750 / $500,063 | | $175,711 |

Andrew Micallef | | $255,000 / $446,250 | | $155,953 |

Thomas C. Tokos | | $197,100 / $344,925 | | $122,919 |

Roger Wendelken | | $270,750 / $473,813 | | $174,884 |

Total Cash Compensation. Our philosophy is to target executive cash compensation at approximately the 50th percentile of market for base salary and at approximately the 60th percentile of market for target total cash compensation. In 2015, our NEOs received base pay at an average of approximately the 55th percentile of market and target total cash compensation at an average of approximately the 60th percentile of market. We expect to continue with this general philosophy for base salary and total cash compensation in 2016. The Compensation Committee believes that providing base salary and total cash compensation within this range relative to our peer group will allow us to attract and retain the talent necessary to execute our business plans and achieve our goals.

Equity Compensation