Exhibit 99.1

MORGAN STANLEY

NOVEMBER 2012

Forward-Looking Statements

This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without limitation, statements regarding future company-wide or segment sales, earnings and earnings per share, investments, initiatives, capital expenditures, product launches, consumer trends, cost savings related to restructuring projects and the timing of such savings, improvements to working capital levels and the timing and savings associated with such improvements, the impact of price increases, advertising and promotional spending, the impact of foreign currency movements, category value and future growth in our businesses. These statements generally can be identified by the use of forward-looking words or phrases such as “outlook,” “assumes,” “will” or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results, performance or achievements to differ materially from those expressed in or indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation:

General market and economic conditions;

The success of new products and the ability to continually develop new products;

Energizer’s ability to predict category and product consumption trends;

Energizer’s ability to continue planned advertising and other promotional spending;

Energizer’s ability to timely execute its strategic initiatives in a manner that will positively impact our financial condition and results of operations and does not disrupt our business operations;

The impact of strategic initiatives on Energizer’s relationships with its employees, its major customers and vendors;

Energizer’s ability to maintain and improve market share in the categories in which we operate despite competitive pressure;

Energizer’s ability to improve operations and realize cost savings;

The impact of raw material and other commodity costs;

The impact of foreign currency exchange rates and offsetting hedges on Energizer’s profitability for the year with any degree of certainty;

The impact of interest and principal repayment of our existing and any future debt;

The impact of legislative or regulatory determinations or changes by federal, state and local, and foreign authorities, including tax authorities;

The impact of currency movements.

In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in Energizer’s publicly filed documents, including its annual report on Form 10-K for the year ended September 30, 2011as supplemented by the Current Report filed on Form 8-K on December 15, 2011.

Trademarks and Brands

We use “Energizer” and the Energizer logo as our trademarks. Product names and company programs appearing in this presentation are trademarks of Energizer Holdings, Inc. or its subsidiaries. This presentation also may refer to brand names, trademarks, service marks and trade names of other companies and organizations, and these brand names, trademarks, service marks and trade names are the property of their respective owners.

Market and Industry Data

Unless we indicate otherwise, we base the information concerning our industry contained in this presentation on our general knowledge of and expectations concerning the industry. Our market position and market share is based on our estimates using data from various industry sources and assumptions that we believe to be reasonable based on our knowledge of the industry. We have not independently verified data from industry sources and cannot guarantee its accuracy or completeness. In addition, we believe that data regarding the industry and our market position and market share within such industry provides general guidance but is inherently imprecise.

Regulation G – Non-GAAP Financial Measures

While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), this presentation includes non-GAAP measures. These non-GAAP measures are not in accordance with, nor are they a substitute for, GAAP measures. The Company believes these non-GAAP measures provide a more meaningful comparison to the corresponding reported period and assist investors in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. For full reconciliation of non-GAAP financial measures, visit www.energizerholdings.com, Investors, Investor Information, Webcasts and Presentations,

or

http://phx.corporate-ir.net/phoenix.zhtml?c=124138&p=irol-irhome

Agenda

Business Overview

2013 Restructuring Project

Working Capital Initiative

New Compensation Metrics

Financial Summary

Company Profile

2002

Batteries1

100%

Total Sales $1.9 billion

Total Segment $324 million Profit

Categories 1

2012

Feminine Care

4%

Infant Care

4%

Skin Care

9%

Batteries¹

46%

Wet

Shave

37%

$4.6 billion

$871 million

5

Sales by Division

Household Products

46%

Personal Care

54%

Sales by Geography

U.S. 52%

International

48%

Source: Company filings ¹ Represents battery and lighting products

Breadth of Portfolio is Extensive

Household Products

Household & Specialty Batteries

#1 Global

Lighting Products

#1

Personal Care Products

Wet Shave

R & B #2

Prep #1

Tampons #2

Infant Care #1

Sun & Skin Care #1

Note: Market share position based on company estimates

2013

RESTRUCTURING PROJECT

Business Environment

Businesses are under increasing pressure:

Renewed decline in battery category and devices

Increased costs across both Divisions

Increased competition from value brands

Household Division profits declining

Actions going forward:

Reduce production capacity and overheads

Re-focus product line

Bring overhead costs down, enterprise wide

Re-invest part of savings into brands, innovation, and businesses

Device Trends

After seeing signs of a rebound . . ..

Devices (requiring primary batteries) are declining again

Total Devices

2005-4

2006-4

2007-4

2008-4

2009-4

2010-4

2011-4

2012-4

Source: IPSOS 2012 U.S. Device Inventory

US Battery Category Volumes

US Household Battery volumes have softened

US HHB Volume (% Chg vs PY)

3.0% 2.0% 1.0% 0.0% -1.0% -2.0% -3.0% -4.0% -5.0% -6.0% -7.0% -8.0%

2005 2006 2007 2008 2009 2010 2011 2012

Source: US All Outlet data based upon AC Nielsen and internal company estimates

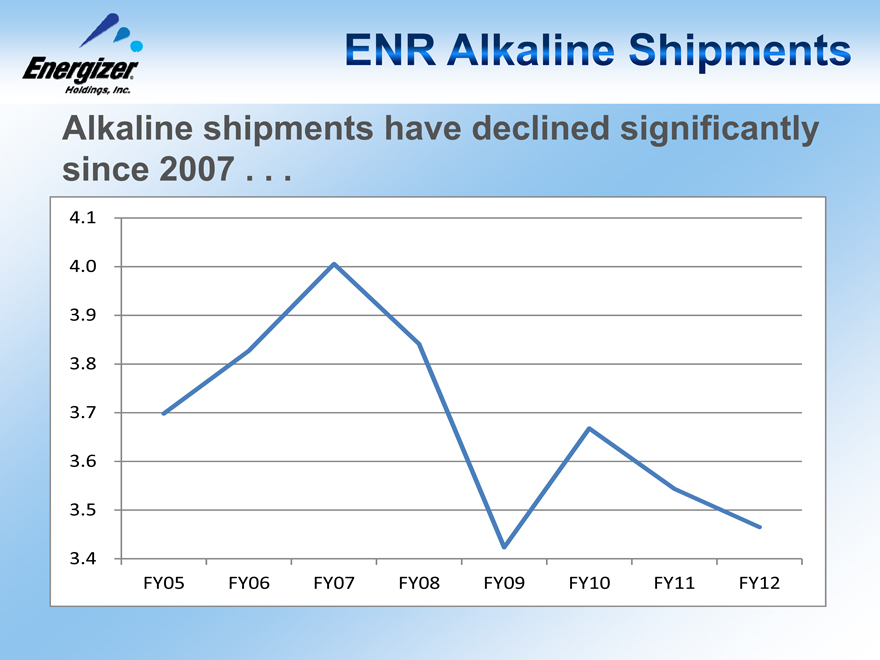

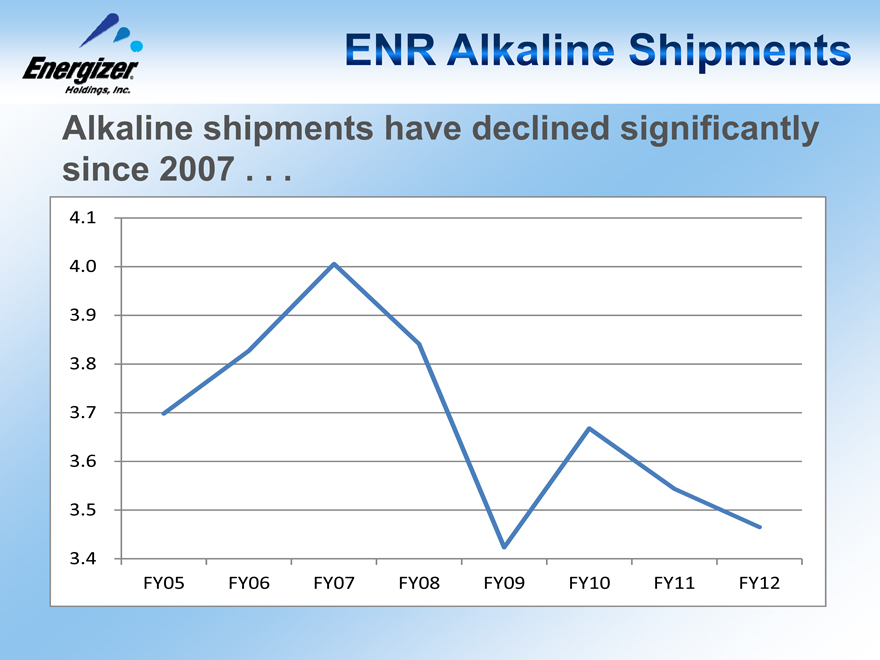

ENR Alkaline Shipments

Alkaline shipments have declined significantly since 2007 . . .

4.1 4.0 3.9 3.8 3.7 3.6 3.5 3.4

FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12

ENR Lithium Shipments

After years of growth, Lithium has steadily declined due to devices . . .

140.0

120.0

100.0

80.0

60.0

40.0

FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12

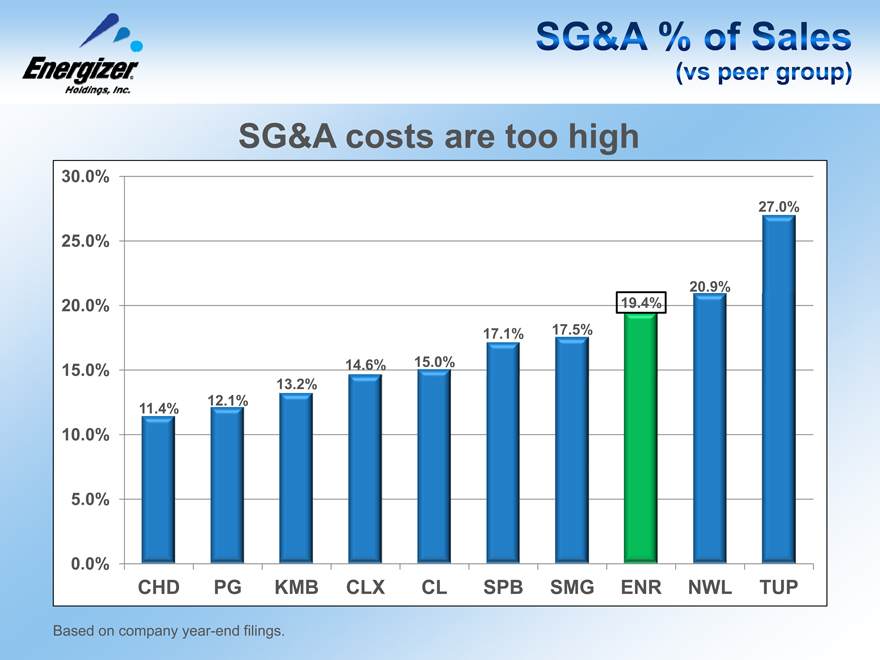

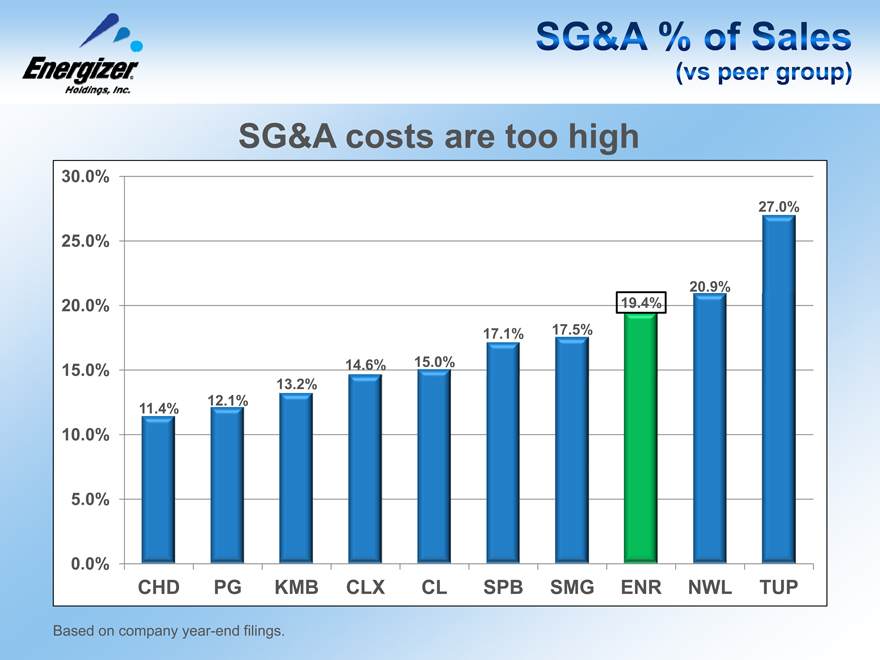

SG&A % of Sales (vs peer group)

SG&A costs are too high

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

11.4%

12.1%

13.2%

14.6%

15.0%

17.1%

17.5%

19.4%

20.9%

27.0%

CHD PG KMB CLX CL SPB SMG ENR NWL TUP

Based on company year-end filings.

Total Shareholder Returns Are Lagging

From ‘03 to ‘08, ENR was a leader within our Peer Group1 driving Total Shareholder Returns . . .

FY03 – FY08

TSR >

. . . Since then, we have ranked in the bottom of our Peer Group1

FY09 – FY12

EPC >

TSR >

EHP >

1Peer Group Includes: CHD, PG, KMB, CLX, CL, AVP, SMG, NWL, and TUP

2013 Restructuring

Actions:

Rationalize & streamline operations facilities in Household Products

Close Maryville, MO battery manufacturing facility

Close St. Albans, VT battery manufacturing facility

Close Tampoi, Malaysia battery packaging facility

Streamline

Asheboro, NC battery manufacturing and packaging facilities

Walkerton, Canada packaging facility

Lights manufacturing in China

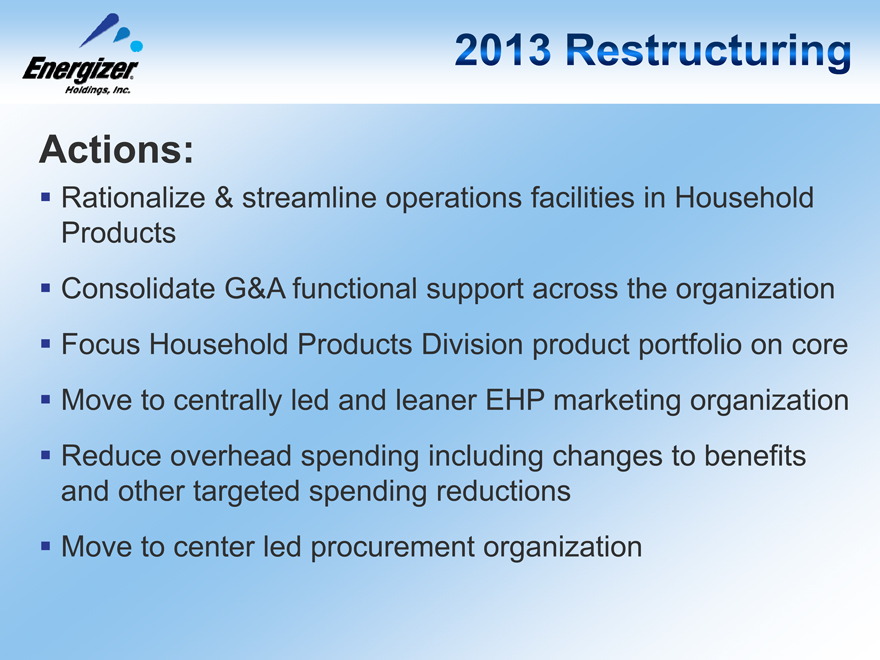

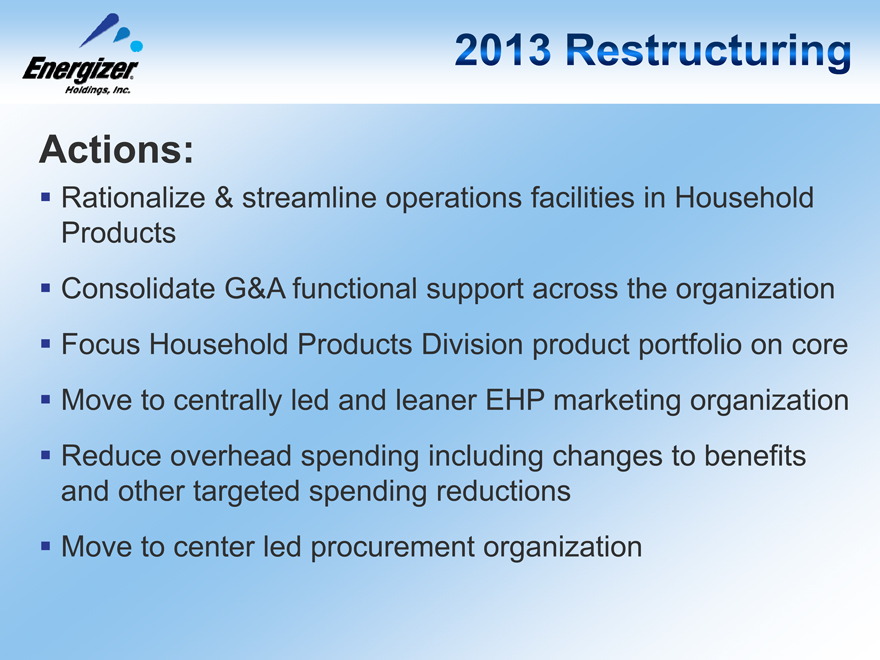

2013 Restructuring

Actions:

Rationalize & streamline operations facilities in Household Products

Consolidate G&A functional support across the organization

Focus Household Products Division product portfolio on core

Move to centrally led and leaner EHP marketing organization

Reduce overhead spending including changes to benefits and other targeted spending reductions

Move to center led procurement organization

2013 Restructuring

Actions:

Targeted annual pre-tax savings of $200 million

25% of savings re-invested in the business to drive long-term growth

Costs of approximately $250 million

Ongoing savings fully realized in Fiscal 2015

Incremental Capital Expenditures of $50 million

WORKING CAPITAL INITIATIVE

Working Capital Initiative

Project Approach:

DSO

DII

DPO

Undertook benchmarking efforts focused on 6 key markets

Identified opportunities in Sun Care, Wet Shave, Alkaline and Lights

Implemented standardized, center-led terms policy across global supplier base

Targeted

400 Basis Point

Reduction

WORKING CAPITAL INITIATIVE

Days

105 95 85 75 65 55 45 35 25

49

48

102

100

37

43

Days Sales Outstanding

Days Inventory

Days Payable Outstanding

22.9%

21.4%

24.0 23.5 23.0 22.5 22.0 21.5 21.0 20.5 20.0

WC % 0f Sales

2011

2012

Source: Energizer internal estimates (Sept 30, 2012)

NEW

COMPENSATION

METRICS

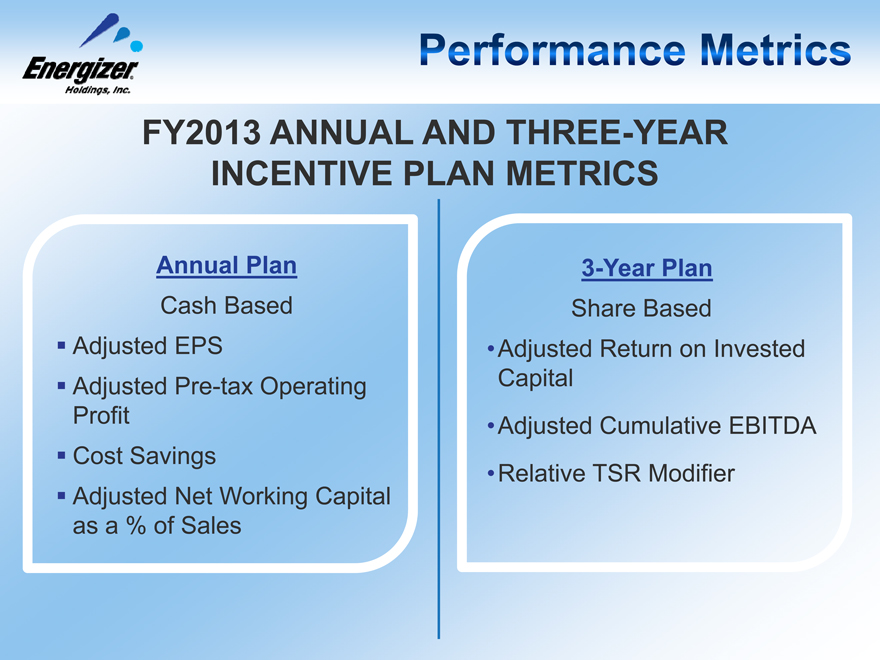

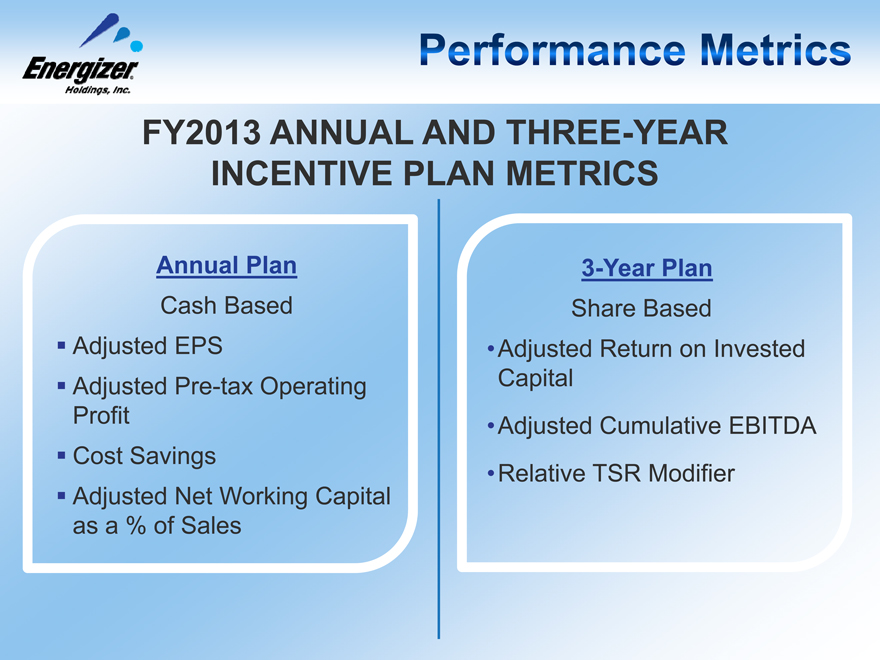

Performance Metrics

FY2013 Annual and Three-year incentive plan metrics

Annual Plan

Cash Based

Adjusted EPS

Adjusted Pre-tax Operating Profit

Cost Savings

Adjusted Net Working Capital as a % of Sales

3-Year Plan

Share Based

Adjusted Return on Invested Capital

Adjusted Cumulative EBITDA

Relative TSR Modifier

Performance Metrics

Short-term incentive plan—Drive Delivery of annual results and major initiatives

Company Goals

Performance Metrics

Multi-Year Restructuring Initiative

Net Working Capital Initiative

Operating results

EPS

Operating Profit

Performance Metrics

Long-term incentive plan—maintain focus on profitable growth and total shareholder return

Grow operating earnings

Through profitable investment

To deliver strong total shareholder returns

Cumulative EBITDA

Return on Invested Capital

Relative TSR

Rewards growth in core operating earnings over 3 yr performance period

Supports focus on cash flow, improved working capital performance, and capital allocation

Incents business performance leading to delivery of relative TSR in excess of peer group

FINANCIAL SUMMARY

Fiscal 2012 Results

Adjusted Diluted Earnings per Share of $6.20

Up 19% versus fiscal 2011

At top end of outlook range

Division Results

Personal Care: segment profit +16.8%, ex-currencies

Household Products: segment profit +3.0%, ex-currencies

Other Factors:

Higher corporate expenses

Favorable effective income tax rate

Positive impact from share repurchases (5.9 million shares)

Fiscal 2013 Outlook

Initial Outlook of $6.75 to $7.00 Adjusted Earnings per Diluted Share

Assumes:

Organic Sales:

EPC – mid-single digit growth

EHP – low-single digit declines (including Hurricane Sandy)

Minimal year-over-year impact from:

Currencies

Commodities

A&P % of sales in line with Fiscal 2012

Tax Rate – 30% to 31%

No additional share repurchases

$25 to $35 million savings from announced 2013 Restructuring Project

Growth vs. prior year concentrated in back half of year

CONCLUDING COMMENTS

Delivering Value to Shareholders

Consistent earnings growth

Successful execution of 2013 Restructuring Project

Ongoing dividend

Opportunistic share repurchases

Continuing communication with investors

Energizer Holdings, Inc.

Regulation G Non-GAAP Reconciliation

Non-GAAP Financial Measures. While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), these presentation slides include non-GAAP measures. These non-GAAP measures, such as historical and forward-looking adjusted diluted earnings per share, which exclude the impact of currencies, the acquisition of ASR including related integration and transaction costs, the costs associated with restructuring, a gain on the sale of a facility closed as a result of restructuring, unusual litigation items, costs associated with the early retirement of debt and early termination of related interest rate swaps, the impact of accounting rules on our Venezuelan operations, prior years' tax accruals and certain other items as outlined in the table below are not in accordance with, nor are they a substitute for, GAAP measures. The Company believes these non-GAAP measures provide a meaningful comparison to the corresponding historical or future period and assist investors in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures.

| | | | | | | | |

| | | Fiscal Year Ended

September 30,

| |

| | | 2012

| | | 2011

| |

Diluted EPS—GAAP | | $ | 6.22 | | | $ | 3.72 | |

Impacts, net of tax: Expense/(Income) | | | | | | | | |

Household Products restructuring | | | (0.09 | ) | | | 0.89 | |

Early debt retirement / duplicate interest | | | — | | | | 0.21 | |

Other realignment / integration | | | 0.15 | | | | 0.15 | |

Acquisition inventory valuation | | | — | | | | 0.06 | |

Venezuela devaluation/other impacts | | | — | | | | 0.03 | |

Litigation provision | | | — | | | | — | |

Early termination of interest rate swap | | | 0.02 | | | | — | |

Adjustment to prior years' tax accruals | | | (0.10 | ) | | | 0.14 | |

| | |

|

|

| |

|

|

|

Diluted EPS—adjusted (Non-GAAP) | | $ | 6.20 | | | $ | 5.20 | |

| | |

|

|

| |

|

|

|

Segment Profit—Personal Care (In millions—Unaudited)

Quarter and Fiscal Year Ended September 30, 2012

| | | | | | | | |

| | | Fiscal Year

| | | %Chg

| |

Segment Profit—FY '11 | | $ | 408.4 | | | | | |

Operations | | | 68.3 | | | | 16.8 | % |

Impact of currency | | | (6.0 | ) | | | -1.5 | % |

Segment Profit—FY '12 | | $ | 470.7 | | | | 15.3 | % |

Segment Profit—Household Products (In millions—Unaudited)

Quarter and Fiscal Year Ended September 30, 2012

| | | | | | | | |

| | | Fiscal Year

| | | %Chg

| |

Segment Profit—FY '11 | | $ | 410.6 | | | | | |

Operations | | | 12.1 | | | | 3.0 | % |

Impact of currency | | | (22.5 | ) | | | -5.5 | % |

Segment Profit—FY '12 | | $ | 400.2 | | | | -2.5 | % |

On a GAAP basis, the Company's initial financial outlook for GAAP diluted earnings per share is in the range of $5.30 to $5.70, inclusive of pre-tax restructuring costs in the range of $120 to $140 million. Our initial outlook range for GAAP diluted earnings per share is somewhat wider due to the complexity of estimating the timing of costs during a significant restructuring program.