FORM 6K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of: June, 2003

Commission File Number: 0-30456

| CHARTWELL TECHNOLOGY INC. |

| (Translation of registrant’s name into English) |

Suite 700, 407 2nd Street SW

Calgary, Alberta

Canada T2P 2Y3 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| September 22, 2003 | signed "Don Gleason"

Don Gleason, CFO |

C h a r t w e l l T e c h n o l o g y I n c .

PRESS RELEASE

CHARTWELL ANNOUNCES RECORD REVENUES FOR 2NDQUARTER 2003

| Chartwell Technology Inc. | TSX-VEN: CWH |

Calgary, Canada, June 12, 2003, Chartwell Technology Inc. (TSX-VEN: CWH) a leading provider of gaming software systems and entertainment content to the online gaming industry, announces financial results for the second quarter ended April 30, 2003.

Revenue growth andprofitability are the important characteristics of Chartwell’s second quarter of operations, building on the strong revenue and profitability reported in the first quarter.

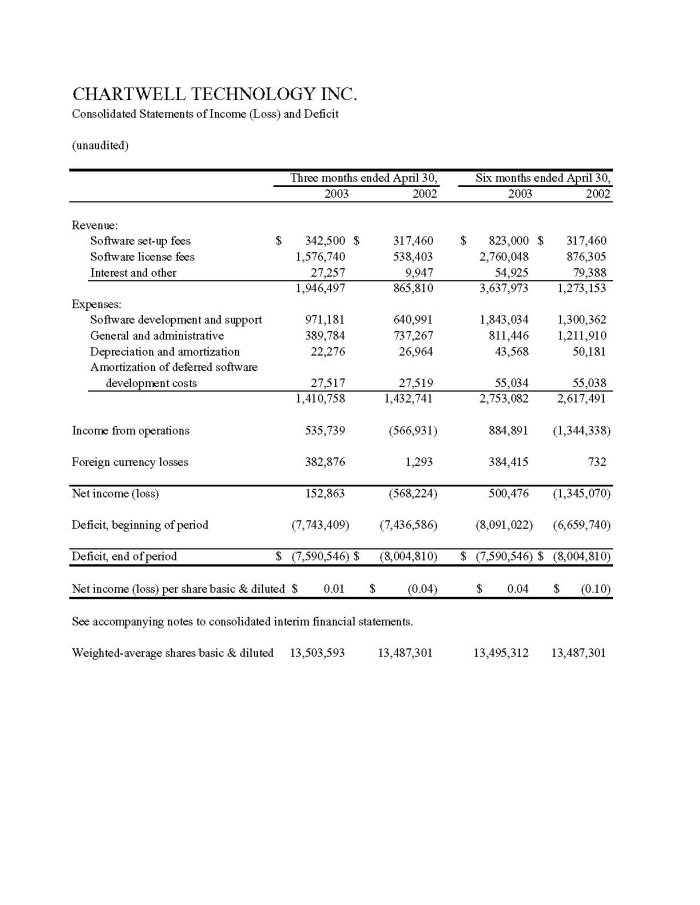

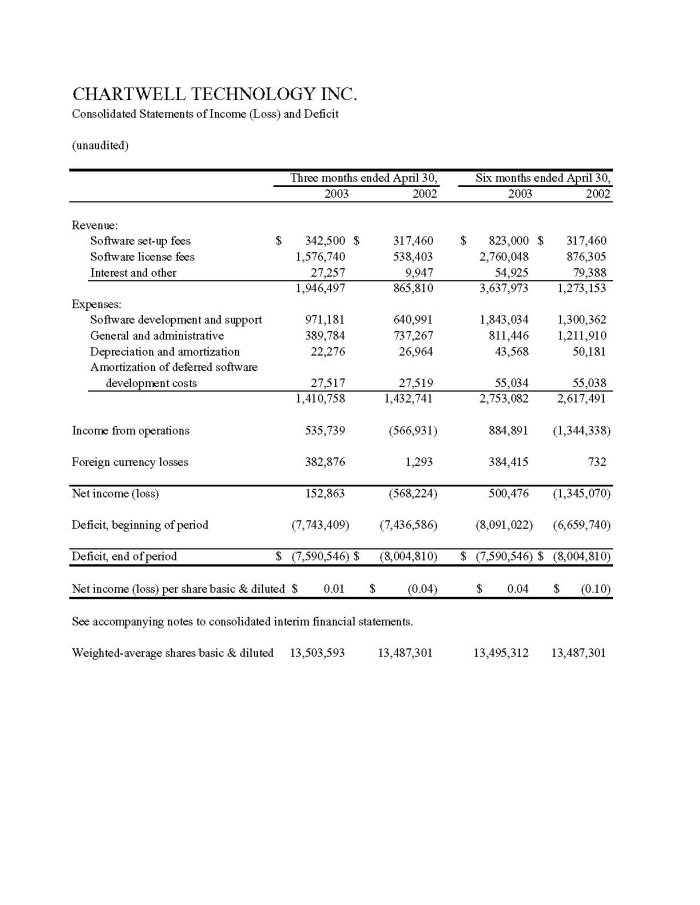

Total revenue for the second quarter 2003 increased 125% to $1,946,497 compared to $865,810 in the same period of 2002. Total revenues for the six months ended April 30 2003 increased 185% to $3,637,973 compared to $1,273,153 for the corresponding period of the previous year. License fee revenue for the second quarter 2003 totaled $1,576,740 compared to $538,403 for the same period of the previous year representing an increase of over 190%. For the six months ending April 30 2003 license fee revenue totaled $2,760,048 compared to $876,305, an increase of over 210% from the previous year.

Expenses for the second quarter 2003 totaled $1,793,634 which included a currency translation expense of $382,876 due to the strengthening Canadian dollar against its US counterpart. While revenues are not affected the Company incurred the currency translation expense due to a revaluation of its US monetary assets.

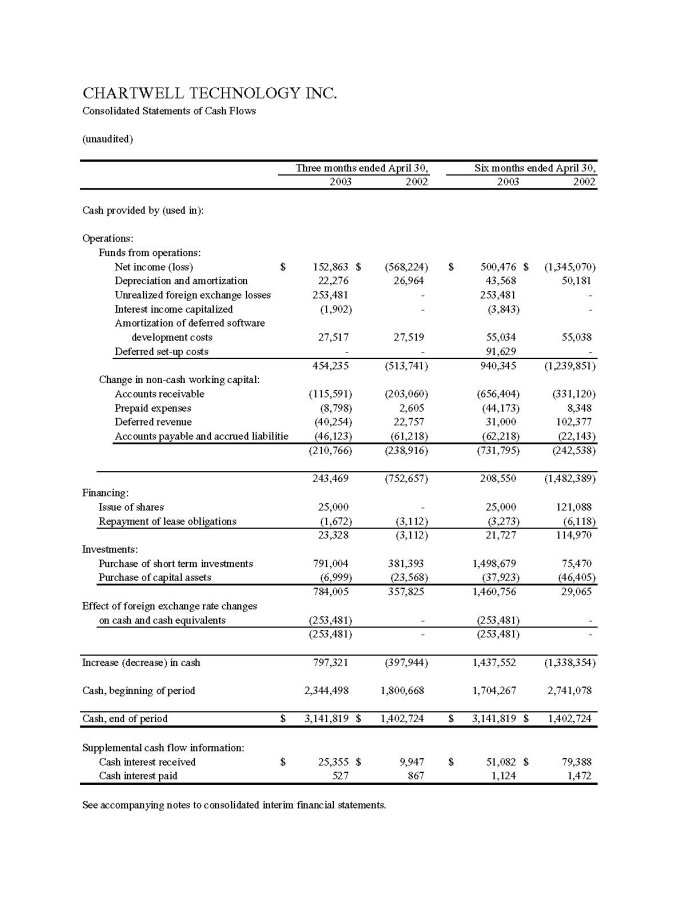

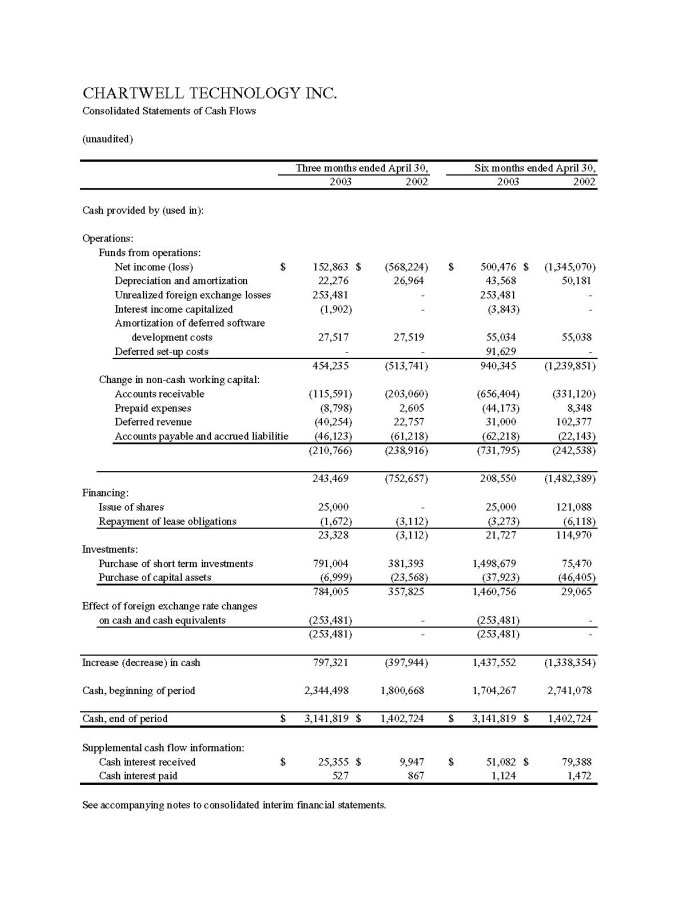

The net income for the period, after the currency translation expense, was $152,863 or $0.01 per share compared with a loss $568,224 for the corresponding period of the previous year. For the six months ending April 30 2003 the company’s net income totals $500,476 or $.04 per share compared to a loss of $1,345,070 or ($0.09) per share for the same period in the previous year. Chartwell remains debt free and strengthened its cash position ending the quarter with working capital of $ 6,618,605.

“Our consistently strong revenue growth reflects the success which we have achieved by remaining true to our unique business model and by concentrating on the development of our unique gaming systems.”, states Darold Parken, President and CEO. “This quarter marks an important milestone for the Company where license fee revenues exceed operational expenses achieving the initial profitability target which we will now build on. We look forward to continued revenue growth in future quarters as the company expands its European client base and deploys additional technologies such as itwireless gaming system and itsmulti-player poker andbingo products to provide additional revenue streams and corresponding profit for the Company”.

For the balance of the fiscal year, Chartwell will continue to focus on specific innovative software development projects, responsible gaming functionality and further European market expansion. These are important components of Chartwell’s plan for ongoing success and accelerated profitability.

About Chartwell

Chartwell Technology Inc.specializes in the development of leading edge gaming applications and entertainment content for the Internet and wireless platforms. Chartwell’s Java and Flash based software products and games are designed for deployment in gaming, entertainment, advertising and promotional applications. Chartwell does not participate in the online gaming business of its clients.

Chartwell’s team of highly trained professionals is committed to delivering the highest quality software and maintaining its leading edge through continuous development and unparalleled customer support.

Chartwell invites you to preview and play our games at:www.chartwelltechnology.com

For further information, please contact: Chartwell Technology Inc.

| | Darold H Parken, President

(877) 261-6619 or (403) 261-6619

dhp@chartwelltechnology.com | David Bajwa, Investor Relations

(877) 669-4180 or (604) 669-4180

info@chartwelltechnology.com |

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements contained herein which are not historical fact are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including, but not limited to, certain delays in testing and evaluation of products, regulation of the online gaming industry, and other risks detailed from time to time in Chartwell’s filings with the Securities & Exchange Commission. We assume no responsibility for the accuracy and completeness of these statements and are under no duty to update any of the forward-looking statements contained herein to conform these statements to actual results. This is not an offer to sell or a solicitation of an offer to purchase any securities.