FORM 6K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of: March, 2003

Commission File Number: 0-30456

| CHARTWELL TECHNOLOGY INC. |

| (Translation of registrant’s name into English) |

Suite 700, 407 2nd Street SW

Calgary, Alberta

Canada T2P 2Y3 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| September 22, 2003 | signed "Don Gleason"

Don Gleason, CFO |

C h a r t w e l l T e c h n o l o g y I n c .

PRESS RELEASE

CHARTWELL REPORTS CONTINUED GROWTH

| Chartwell Technology Inc. | TSX-VEN: CWH |

Calgary, Canada, March 6, 2003, Chartwell Technology Inc. (TSX-VEN: CWH) a leading provider of gaming systems and entertainment content to the online gaming industry, announces financial results for the first quarter ended January 31, 2003 and fiscal year ended October 31, 2002.

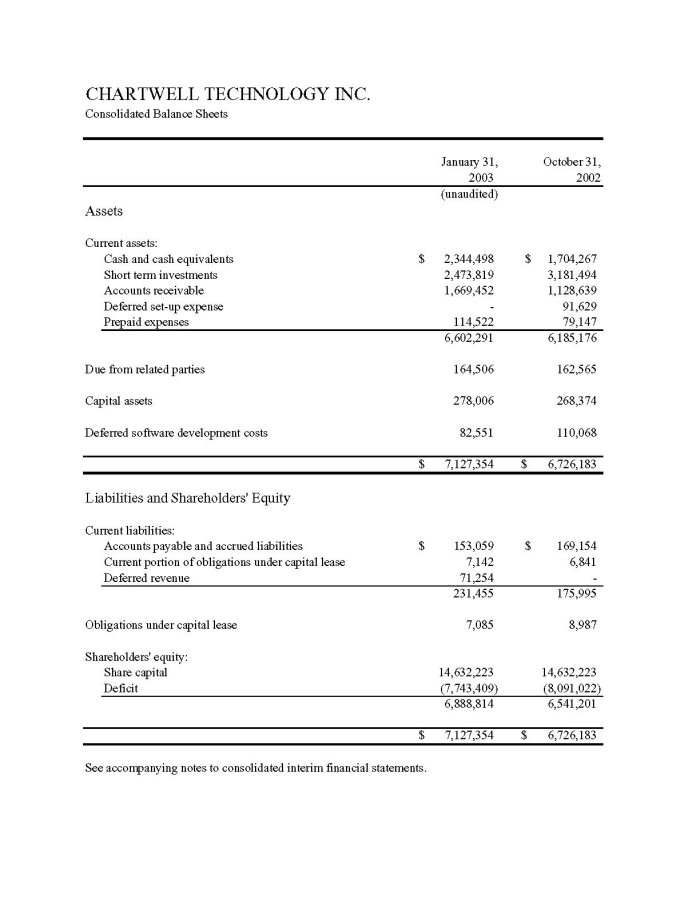

First Quarter 2003 Results

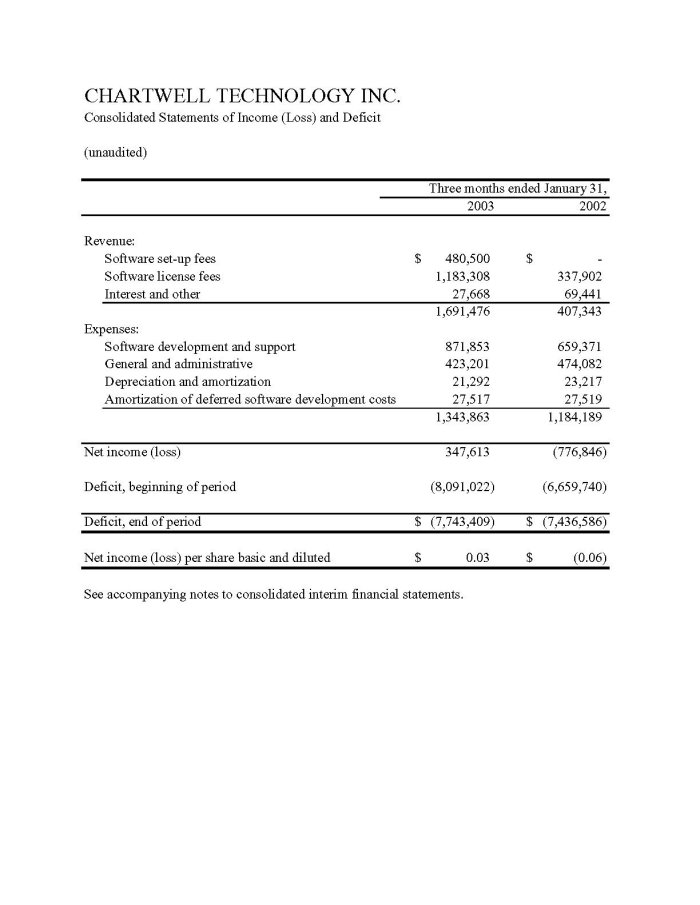

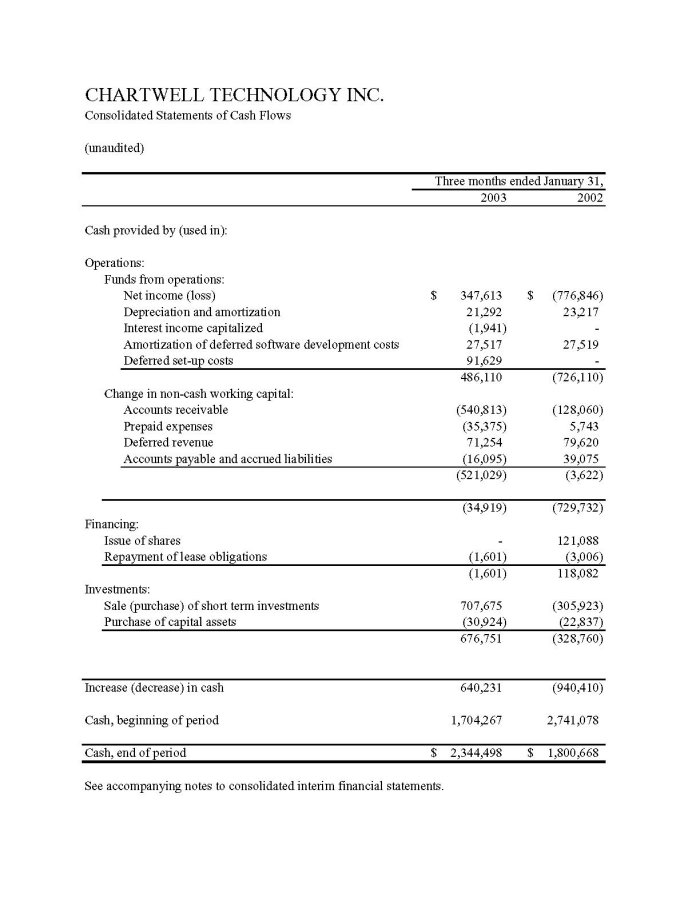

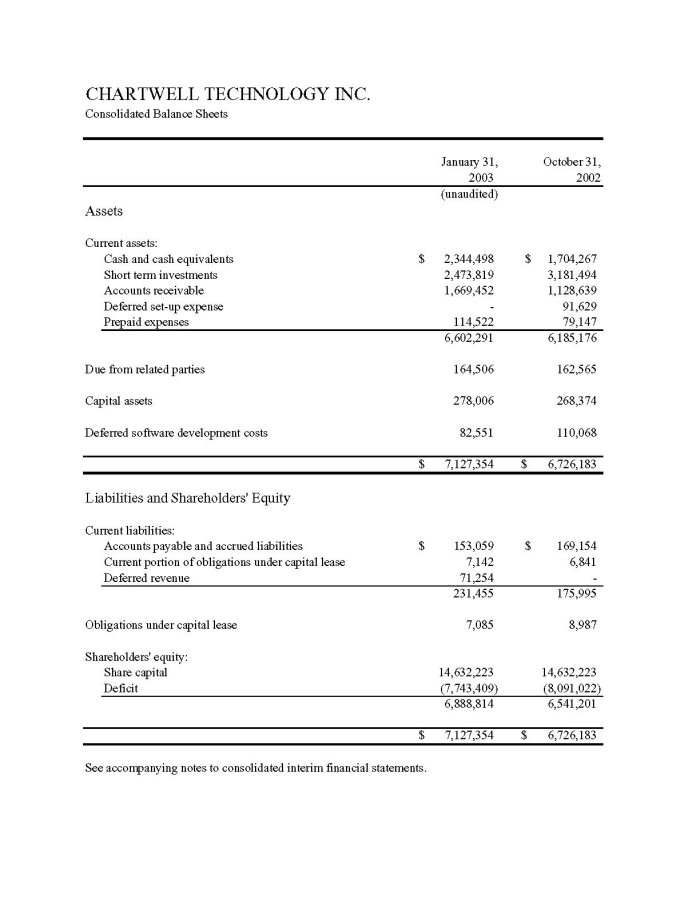

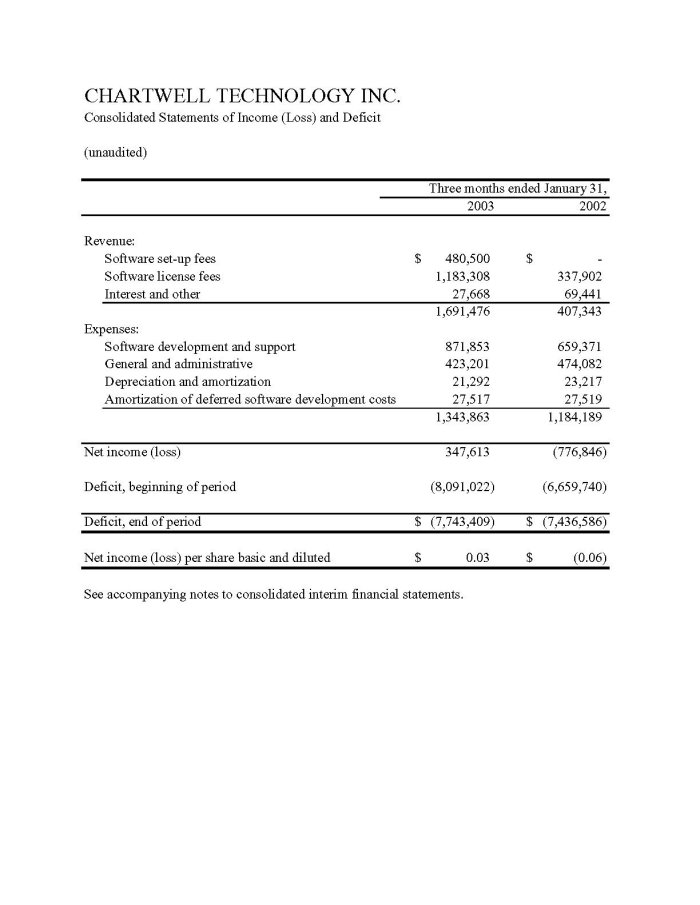

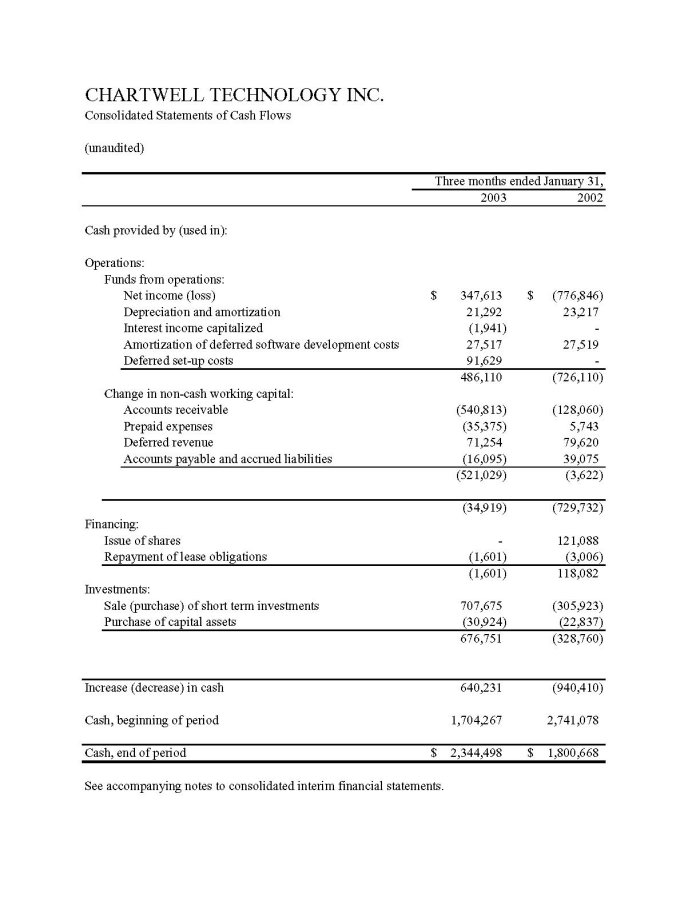

Revenues: For the first quarter ended January 31, 2003, revenue rose 315% to $1,691,476 compared to $407,343 in the same period of 2002. License fee revenues rose 250% to $1,183,308 compared to $337,902 in the same prior year period. The balance of revenues were made up of software set up fees of $480,500 and interest and other revenues of $27,668.

Expenses: Expenses for the quarter rose to $1,343,863 compared to $1,184,189 in the same quarter of 2002. This 14% increase was attributed to higher software development costs relating to the Company’s casino software as well as development of new bingo and poker software for expansion into new gaming verticals. Consistent with its expansion into new regulated markets, the Company also increased expenditures toward its eventual certification in targeted jurisdictions. General and administrative expenses for the quarter were $423,201, a decrease of 11% over the same period of the prior year.

Gain: The first quarter of 2003 was Chartwell’s most profitable quarter to date with net income of $347,613 or $0.03 per share compared to a loss of $776,846 or $0.06 per share for the corresponding quarter of the prior year.

“Strong revenue growth from established gaming clients, particularly in Europe, continues to have a very positive effect on our financial performance,” states Darold H. Parken, President and CEO of Chartwell. “Our mandate has been to deliver solid revenue growth across a core of branded customers and we are pleased to report that we are meeting those objectives.” Mr. Parken adds, ” Given that our recurring license fee revenues continue to increase as a component of total revenues and our firm control over expenses, we are confident in our goal of achieving profitability this fiscal year.”

Fiscal Year 2002 Results

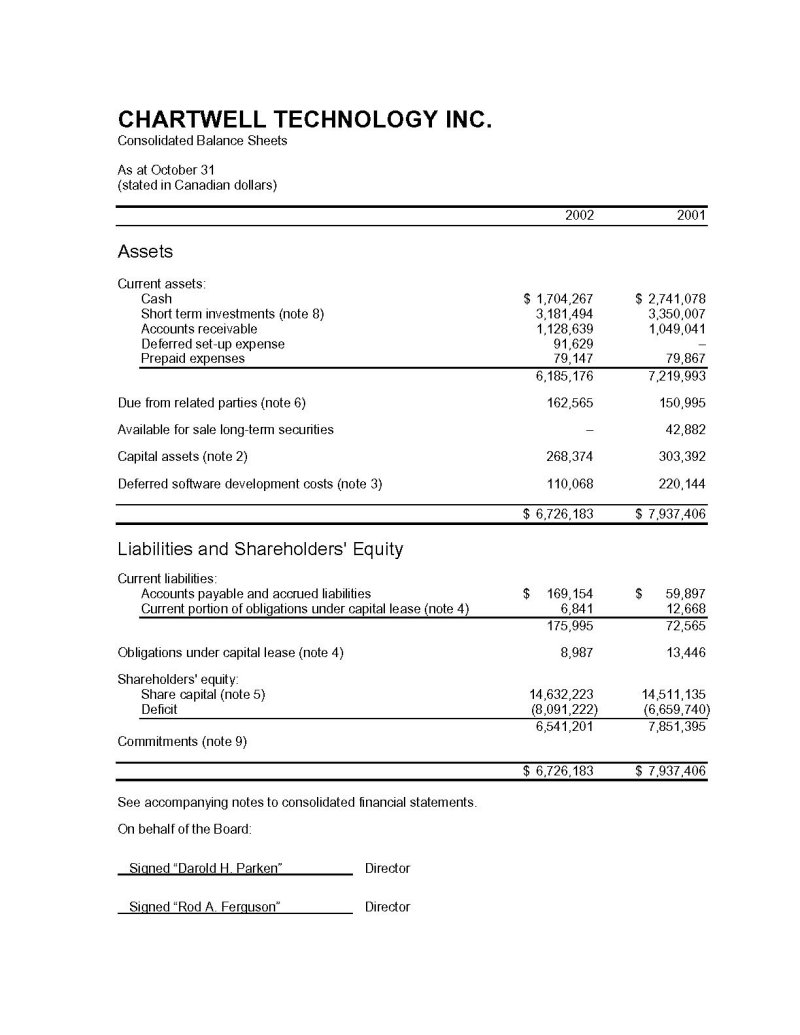

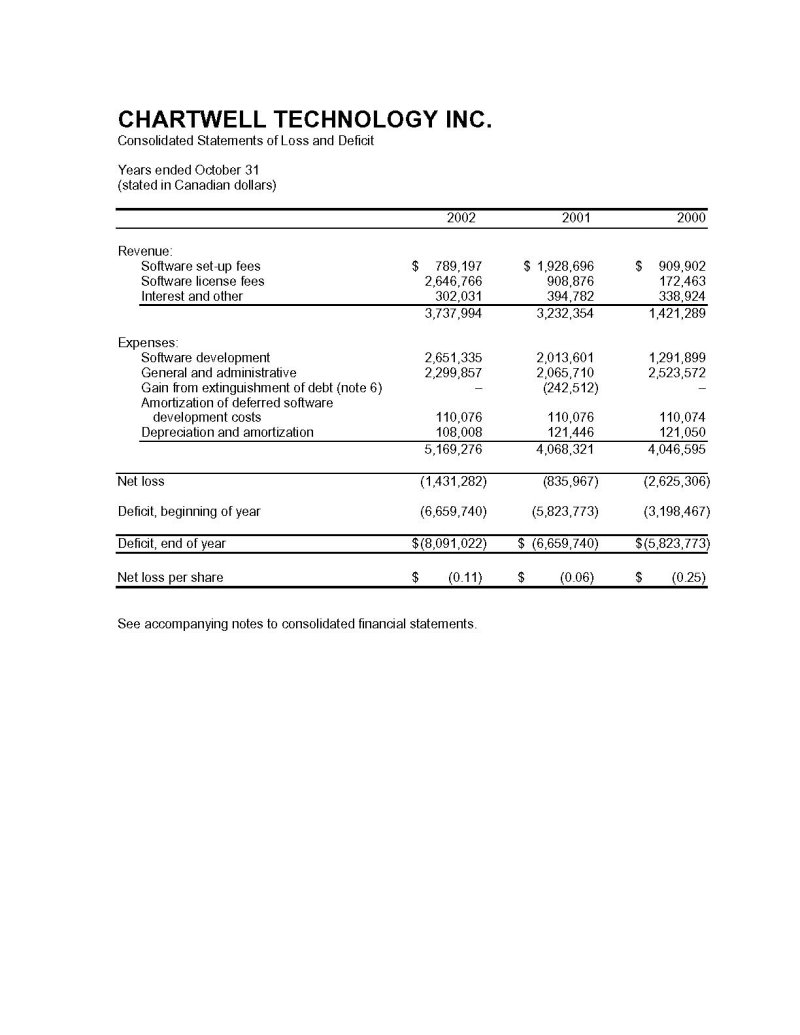

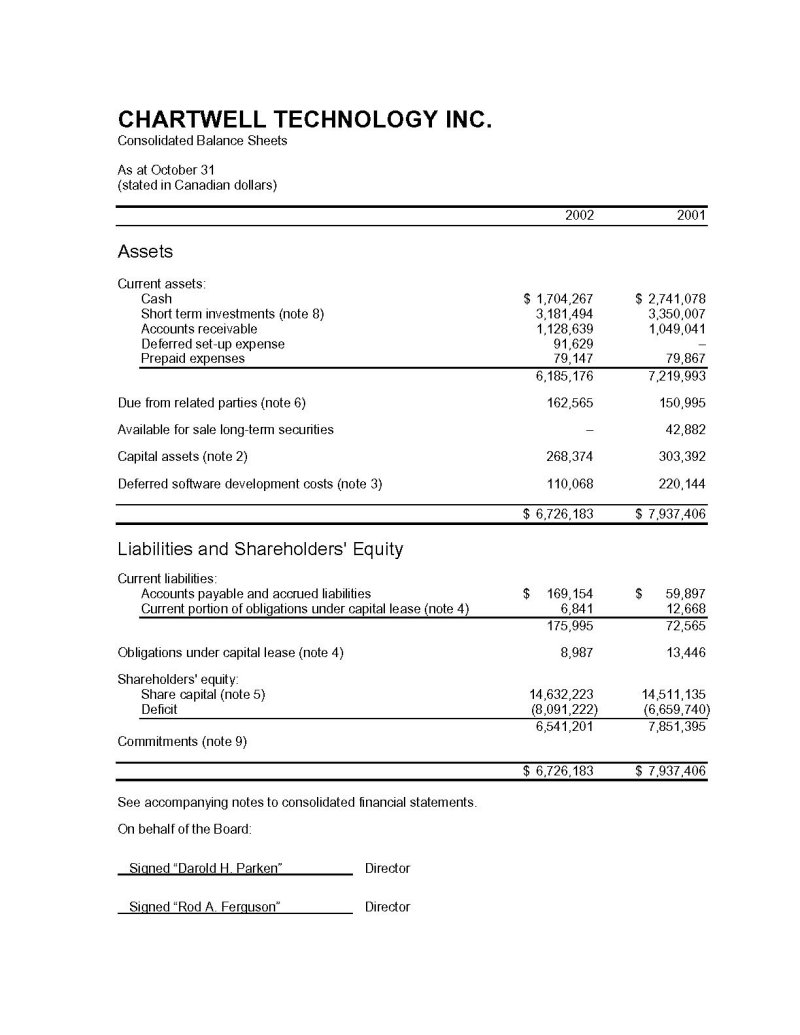

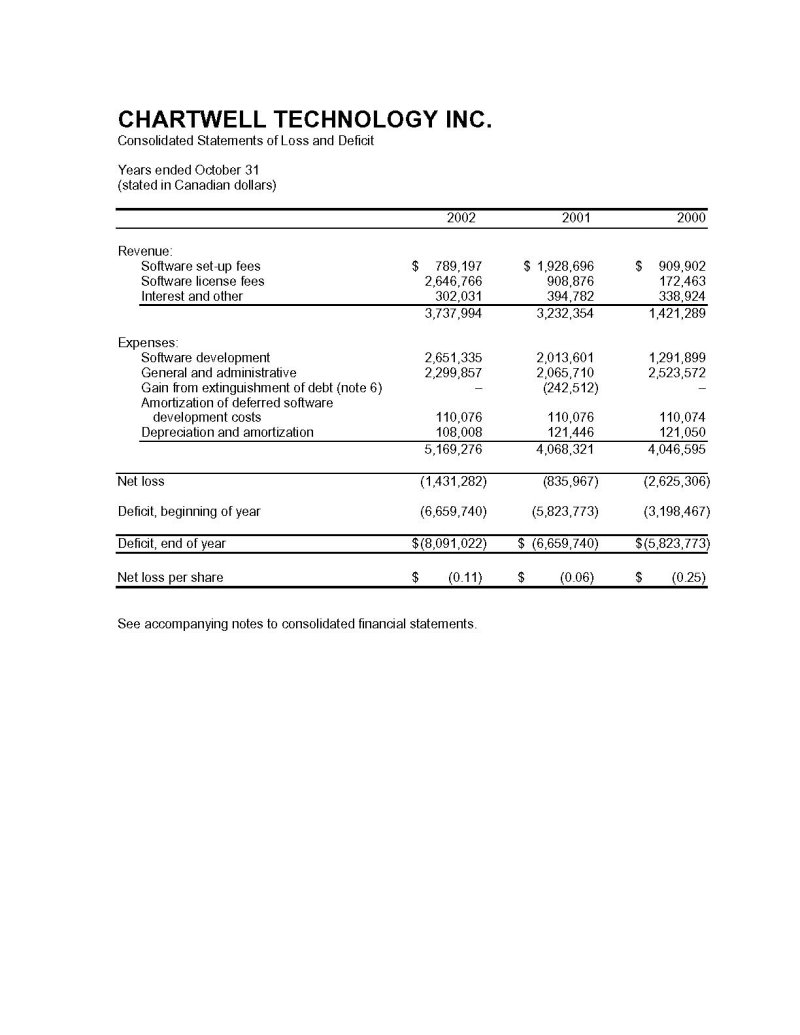

Revenues: Revenues increased to $3,737,994 for the year ended October 31, 2002, compared with $3,232,354 for the prior year an increase of 16%. Operating revenues consisted of software set-up fees and software licensing fees. Software licensing fees for the year ended October 31, 2002 were $2,646,766 compared to $908,876 in the prior year, an increase of 191%. Software set-up fees for the year were $789,197 compared to $1,928,696 in 2001, a decrease of 59%. Interest and other revenues for the fiscal year ended October 31, 2002 were $302,031, compared to $394,782 of the prior year.

Expenses: Expenses increased from $4,068,321 during the fiscal year ended October 31, 2001, to $5,169,276 in 2002. The software development component of expenses increased to $2,651,335 during the fiscal year ended October 31, 2002, compared to $2,013,601 for 2001, representing an increase of 32%, due to an expansion of our product offering. General and administrative expenses increased $234,147 (11%) from

$2,065,710 during the fiscal year ended October 31, 2001, to $2,299,857 in 2002. Higher general and administrative expenses reflect increased sales and marketing efforts.

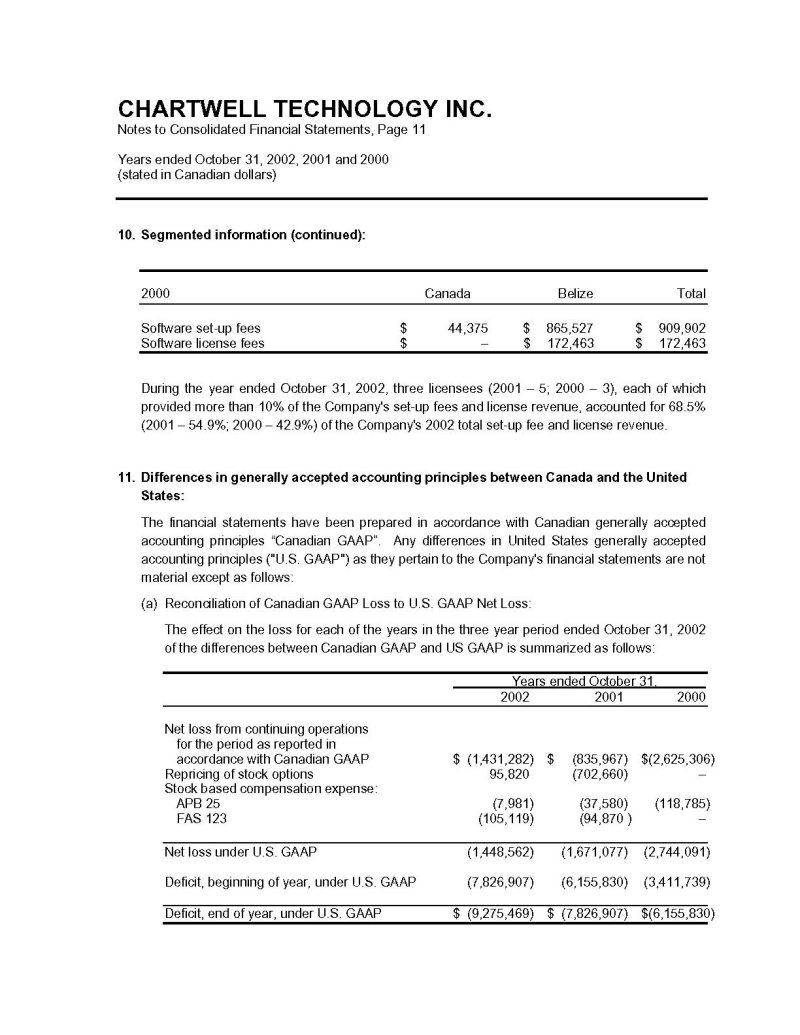

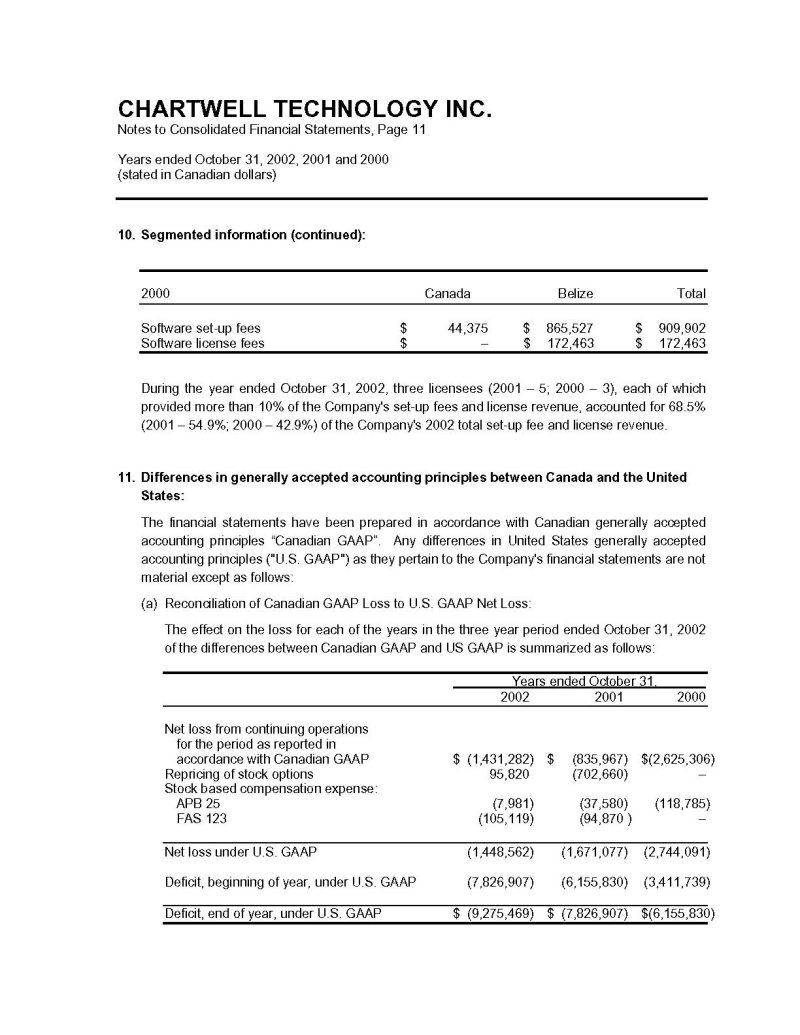

Loss: Net loss from continuing operations increased $595,315, from $835,697 during the year ended October 31, 2001 to $1,431,282 for the fiscal year ended October 31, 2002 ($0.11 per share).

“Despite the challenges experienced by many of our competitors over the past year, Chartwell actually saw positive growth during 2002, with revenues increasing 16% over the previous year”, states Mr. Parken. “An important indicator of our long-term potential is the substantial growth we achieved in the recurring portion of revenue,” he continues. “We are pleased to report that recurring software license revenues now comprise approximately 70% of our total revenue stream.” These recurring software license fees amounted to $2,646,766 in 2002 representing an increase of 191% over the previous year.”

Throughout the last year Chartwell continued to invest in new products and platforms that will provide access to new gaming markets and add significant new revenue streams. Correspondingly, expenses during 2002 rose to $5,169,276 representing a 27% increase over the previous year. The largest single area of expense growth during 2002 was in software development, which rose by 32% due to the expansion of our programming team and the development of new gaming products and features.

New Products and Platforms

Chartwell was one of the first companies to provide a complete no-download casino suite with its first Java-based product. Since entering the market in 1999, Chartwell has continued to maintain its leading position in no-download technology with the release of its V4.0 Flash-based casino during the past year.

Chartwell will soon be launching its latest product initiative, multi-player poker. With a global poker player market numbering in the millions, Chartwell is poised to tap into this relatively new gaming revenue stream. “Many of our current licensees have a player base that is eager to try our latest product offering,” states Darcy Krogh, Chartwell’s Vice President of Business Development, “and we are now in the final stages of testing before rolling out this exciting new gaming product which includes five popular poker games with full tournament functionality.”

Java-enabled wireless devices such as cellular phones are increasingly popular as gaming platforms and Chartwell has been a leader in bringing casino style games to this rapidly growing market. “As a follow-up to our earlier launch with a major cellular phone manufacturer, we are actively pursuing new deals that will bring our games to users of a multitude of Java-enabled handsets,” states Mr. Krogh.

Chartwell will also soon be releasing the download version of its casino suite, which will give players the option of saving the client-side application to their computer desktop. “While this latest addition to our product portfolio is not revolutionary in concept, it was a logical step in rounding out our product offering to address all player preferences and platforms,” states Mr. Krogh.

Looking Ahead

The 2003 International Casino Exhibition (ICE), held in London in January, was further confirmation of Chartwell’s market strategy. ICE is one of the world’s largest gaming industry trade shows where Chartwell’s products and services garnered an unprecedented level of interest, fueled largely by a gaming friendly European market, and the much-anticipated regulation of the online gaming environment in the U.K. The ICE venue also allowed Chartwell to unveil its kiosk-based gaming system, which promises to provide access to new gaming channels and add considerable revenue streams in the months and years ahead.

Chartwell looks to continued growth of its branded client base and to deploying new games and features that it has invested in over the past year to achieve its objective of providing our clients with every game for every

platform. Sales of our wireless gaming system will not only provide an additional revenue stream for the Company but will also enhance Chartwell’s position as the leader in cutting edge technologies. Chartwell’s Poker, Bingo and Kiosk gaming products offer many new market opportunities and are expected to be strong contributors to revenue growth.

About Chartwell

Chartwell Technology Inc. specializes in the development of leading edge gaming applications and entertainment content for the Internet and wireless platforms. Chartwell’s Java and Flash based software products and games are designed for deployment in gaming, entertainment, advertising and promotional applications. Chartwell does not participate in the online gaming business of its clients. Chartwell’s team of highly trained professionals is committed to delivering the highest quality software and maintaining its leading edge through continuous development and unparalleled customer support.

Chartwell invites you to preview and play our games at:www.chartwelltechnology.com

For further information, please contact: Chartwell Technology Inc.

| | Darold H Parken, President

(877) 261-6619 or (403) 261-6619

dhp@chartwelltechnology.com | David Bajwa, Investor Relations

(877) 669-4180 or (604) 669-4180

info@chartwelltechnology.com |

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements contained herein which are not historical fact are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including, but not limited to, certain delays in testing and evaluation of products, regulation of the online gaming industry, and other risks detailed from time to time in Chartwell’s filings with the Securities & Exchange Commission. We assume no responsibility for the accuracy and completeness of these statements and are under no duty to update any of the forward-looking statements contained herein to conform these statements to actual results. This is not an offer to sell or a solicitation of an offer to purchase any securities.