FORM 6K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of: July, 2003

Commission File Number: 0-30456

| CHARTWELL TECHNOLOGY INC. |

| (Translation of registrant’s name into English) |

Suite 700, 407 2nd Street SW

Calgary, Alberta

Canada T2P 2Y3 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b) 82 —

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| September 22, 2003 | signed "Don Gleason"

Don Gleason, CFO |

CHARTWELL TECHNOLOGY INC.

NOTICE OF ANNUAL GENERAL MEETING

OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual General Meeting of the Shareholders of Chartwell Technology Inc. (the “Corporation”) will be held at the offices of the Corporation, Suite 700, 407 — 2nd Street S.W., Calgary, Alberta, T2P 2Y3, on Thursday the 10th day of July, 2003 at 10:30 a.m. (Calgary time) for the following purposes:

| 1. | To receive and consider the Financial Statements of the Corporation for the year ended October 31, 2002 and the Auditor’s Report thereon; |

| 3. | To appoint KPMG LLP, Chartered Accountants, as auditors of the Corporation, and to authorize the directors to fix their remuneration; and |

| 4. | To transact such other business as may be properly brought before the Meeting or any adjournment thereof. |

The specific details of all matters proposed to be put before the Meeting are set forth in the Circular accompanying this Notice.

SHAREHOLDERS OF THE CORPORATION WHO ARE UNABLE TO ATTEND THE MEETING IN PERSON ARE REQUESTED TO DATE AND SIGN THE ENCLOSED FORM OF PROXY AND TO MAIL IT TO OR DEPOSIT IT WITH COMPUTERSHARE TRUST COMPANY OF CANADA, 100 UNIVERSITY AVENUE, 9TH FLOOR, TORONTO, ONTARIO M5J 2Y1, ATTENTION: PROXY DEPARTMENT. PROXIES MAY ALSO BE DELIVERED BY FAX TO: (416) 263-9524 or 1-866-249-7775. IN ORDER TO BE VALID AND ACTED UPON AT THE MEETING, FORMS OF PROXY MUST BE RETURNED TO THE AFORESAID ADDRESS NOT LESS THAN 48 HOURS BEFORE THE TIME SET FOR THE HOLDING OF THE MEETING OR ANY ADJOURNMENT THEREOF.

SHAREHOLDERS ARE CAUTIONED THAT THE USE OF THE MAILS TO TRANSMIT PROXIES IS AT EACH SHAREHOLDERS’ RISK.

The Board of Directors of the Corporation has fixed the record date for the Meeting at the close of business on June 4, 2003 (the “Record Date”). Only shareholders of the Corporation of record as at that date are entitled to receive notice of the Meeting. Shareholders of record will be entitled to vote those shares included in the list of shareholders entitled to vote at the Meeting prepared as at the Record Date, unless any such shareholder transfers shares after the Record Date and the transferee establishes ownership of such shares and demands, not later than the close of business 10 days before the Meeting that the transferee’s name be included in the list of shareholders entitled to vote at the Meeting, in which case such transferee shall be entitled to vote such shares at the Meeting.

DATED at the City of Calgary, in the Province of Alberta, this 4th day of June, 2003.

| | By Order of the Board of Directors,

(signed) “Darold H. Parken”

Darold H. Parken, President |

CHARTWELL TECHNOLOGY INC.

INFORMATION CIRCULAR — PROXY STATEMENT

For the Annual General Meeting

of Shareholders to be held on Thursday, July 10, 2003

SOLICITATION OF PROXIES

This Information Circular — Proxy Statement is furnished in connection with the solicitation of proxies by the Management ofCHARTWELL TECHNOLOGY INC. (hereinafter referred to as the “Corporation” or “Chartwell”) for use at the Annual General Meeting of the Shareholders of the Corporation (the “Meeting”) to be held on the 10th day of July, 2003, at 10:30 a.m. (Calgary time) at the offices of the Corporation, Suite 700, 407 — 2nd Street S.W., Calgary, Alberta, T2P 2Y3, and at any adjournment thereof, for the purpose set forth in the Notice of Annual General Meeting.

Instruments of Proxy must be addressed to the Secretary of the Corporation and must reach Computershare Trust Company of Canada, Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours before the time for the holding of the Meeting or any adjournment thereof. Proxies may also be delivered by fax to: (416) 263-9524 or 1-866-249-7775. Pursuant to the Business Corporations Act (Alberta), the record date for the Meeting is the close of business on June 4, 2003. Only shareholders of the Corporation of record as at that date are entitled to receive notice of and to vote at the Meeting unless after that date a shareholder of record transfers his shares and the transferee, upon producing properly endorsed certificates evidencing such shares or otherwise establishing that he owns such shares, requests not later than ten (10) days prior to the Meeting that the transferee’s name be included in the list of shareholders entitled to vote, in which case, such transferee is entitled to vote such shares at the Meeting.

The instrument appointing a proxy shall be in writing and shall be executed by the shareholder or his attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized.

THE PERSONS NAMED IN THE ENCLOSED FORM OF PROXY ARE DIRECTORS AND/OR OFFICERS OF THE CORPORATION. A SHAREHOLDER SUBMITTING THE PROXY HAS THE RIGHT TO APPOINT A PERSON TO REPRESENT HIM AT THE MEETING (WHO NEED NOT BE A SHAREHOLDER OF THE CORPORATION) OTHER THAN THE PERSON OR PERSONS DESIGNATED IN THE FORM OF PROXY FURNISHED BY THE CORPORATION. TO EXERCISE SUCH RIGHT, THE NAMES OF THE PERSONS DESIGNATED BY MANAGEMENT SHOULD BE CROSSED OUT AND THE NAME OF THE SHAREHOLDER’S APPOINTEE SHOULD BE LEGIBLY PRINTED IN THE BLANK SPACE PROVIDED.

REVOCABILITY OF PROXY

A shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof. If a person who has given a proxy attends personally at the Meeting at which such proxy is to be voted, such person may revoke the proxy and vote in person. In addition to the revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the shareholder or his attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized and deposited either at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof, and upon either of such deposits, the proxy is revoked.

BENEFICIAL HOLDERS OF SHARES

The information set forth in this section is of significant importance to beneficial holders of Common Shares of Corporation who do not hold their Common Shares in their own name (“Beneficial

1

Shareholders”). Beneficial Shareholders should note that only proxies deposited by shareholders whose names appear on the records of the Corporation as the registered holders of shares can be recognized and acted upon at the Meeting. If shares are listed in an account statement provided to a Beneficial Shareholder by a broker, then in almost all cases those shares will not be registered in the Beneficial Shareholder’s name on the records of the Corporation. Such shares will more likely be registered under the name of the Beneficial Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominees for many Canadian brokerage firms). Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, the broker/nominees are prohibited from voting shares for their clients. The Corporation does not know for whose benefit the shares registered in the name of CDS & Co. are held.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that there shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its broker is a voting instruction form or a form which is identical to the form of proxy provided to registered shareholders. In either case, its purpose is limited to instructing the registered shareholder how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to adp Investor Communications (“ADP”). ADP typically mails the voting instruction forms or proxy forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the forms to ADP. ADP then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting.A Beneficial Shareholder receiving a voting instruction request or a proxy form cannot use that voting instruction request or proxy form to vote Common Shares directly at the Meeting as the voting instruction request or proxy form must be returned as directed by ADP well in advance of the Meeting in order to have the shares voted. Accordingly, it is strongly suggested that Beneficial Shareholders return their completed instructions or proxies as directed by ADP well in advance of the Meeting.

PERSONS MAKING THE SOLICITATION

THIS SOLICITATION IS MADE ON BEHALF OF THE MANAGEMENT OF THE CORPORATION. The costs incurred in the preparation and mailing of the Form of Proxy, Notice of Annual General Meeting and this Information Circular — Proxy Statement will be borne by the Corporation. In addition to the use of mails, proxies may be solicited by personal interviews, telephone or fax by directors and officers of the Corporation, who will not be remunerated therefor.

EXERCISE OF DISCRETION BY PROXY

The shares represented by proxy in favour of management nominees shall be voted on any ballot at the Meeting and where the shareholder specifies a choice with respect to any matter to be acted upon, the shares shall be voted on any ballot in accordance with the specification so made.

IN THE ABSENCE OF SUCH SPECIFICATION, SHARES WILL BE VOTED IN FAVOUR OF ALL OF THE PROPOSED RESOLUTIONS. THE PERSONS APPOINTED UNDER THE FORM OF PROXY FURNISHED BY THE CORPORATION ARE CONFERRED WITH DISCRETIONARY AUTHORITY WITH RESPECT TO AMENDMENTS OR VARIATIONS OF THOSE MATTERS SPECIFIED IN THE PROXY AND NOTICE OF ANNUAL GENERAL MEETING. AT THE TIME OF MAILING OF THIS INFORMATION CIRCULAR ��� PROXY STATEMENT, MANAGEMENT OF THE CORPORATION KNOWS OF NO SUCH AMENDMENT, VARIATION, OR OTHER MATTER.

2

INFORMATION CONCERNING THE CORPORATION

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

As of the date hereof, 15,842,701 common shares without nominal or par value of the Corporation are issued and outstanding, each such share carrying the right to one vote on any ballot at the Meeting.

As at the date hereof, to the knowledge of the directors and senior officers of the Corporation, no person or Corporation beneficially owns, directly or indirectly, or exercises control or direction over, voting shares carrying more than 10% of the voting rights attached to the common shares.

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

Except as described herein or in a previous Information Circular, there were no material interests, direct or indirect, of directors or senior officers of the Corporation, any shareholder who beneficially owns more than 10% of the common shares of the Corporation, or any known associate or affiliate of these persons in any transaction since the commencement of the Corporation’s last completed fiscal year or in any proposed transaction which has materially affected or would materially affect the Corporation.

STATEMENT OF EXECUTIVE COMPENSATION

The following sets forth the aggregate remuneration paid or payable by the Corporation in respect of the last completed fiscal year ended October 31, 2002 to the Directors of the Corporation in their capacity as Directors and to the Executive Officers of the Corporation in their capacity as Executive Officers or Employees of the Corporation.

Directors

No cash compensation has been paid during the last completed fiscal year to Directors in their capacity as directors. Directors are reimbursed for out-of-pocket expenses incurred in carrying out their duties. During the last fiscal year ended October 31, 2002, 50,000 options were granted to a director who is not also an officer of the Corporation.

Executive Officers

The following table sets forth certain information regarding the compensation paid to Chartwell’s Chief Executive Officer and the other executive officers of Chartwell who had total annual salary and bonus exceeding $100,000 for the fiscal year ended October 31, 2002 (collectively, the “Named Executive Officers”).

Compensation Summary Table

| | Annual | Long-term |

|---|

| |

|---|

Name and

Principal

Occupation | Year | Salary | Bonus | Other | Stock Options

Granted | All

Other |

|---|

| |

|---|

| Darold H. Parken(1) | | 2002 | | $105,000 | | $ 2,000 | | nil | | nil | | nil | |

| President and Chief | | 2001 | | $105,000 | | $ 2,000 | | nil | | 300,000 | | nil | |

| Executive Officer | | 2000 | | $ 73,500 | | $ 2,000 | | nil | | 325,000 | | nil | |

| |

|---|

| Darcy E. Krogh, | | 2002 | | $165,000 | | $ 2,000 | | nil | | nil | | nil | |

| Vice President, | | 2001 | | $165,000 | | $ 2,000 | | nil | | nil | | nil | |

| Business Development | | 2000 | | $127,500 | | $ 2,000 | | nil | | 100,000 | | nil | |

| |

|---|

| Donald Harold, | | 2002 | | $110,000 | | $ 2,000 | | nil | | nil | | nil | |

| Vice President, | | 2001 | | $110,000 | | $ 2,000 | | nil | | nil | | nil | |

| Operations | | 2000 | | $ 36,667 | | $ 2,000 | | nil | | 100,000 | | nil | |

| |

|---|

3

| | Annual | Long-term |

|---|

| |

|---|

Name and

Principal

Occupation | Year | Salary | Bonus | Other | Stock Options

Granted | All

Other |

|---|

| | | | | | | | | | | | | nil | |

| Andrew Smith, | | 2002 | | $125,000 | | $ 2,000 | | nil | | nil | | nil | |

| Technical Director | | 2001 | | $107,292 | | $ 2,000 | | nil | | 50,000 | | nil | |

| | | 2000 | | $ 43,750 | | $ 2,000 | | nil | | 100,000 | | nil | |

| |

|---|

| Dave Acorn, | | 2002 | | $100,000 | | $ 2,000 | | nil | | nil | | nil | |

| Vice President, | | 2001 | | $ 91,375 | | $ 2,000 | | nil | | nil | | nil | |

| Software Development | | 2000 | | $ 59,750 | | $12,000 | | nil | | 40,600 | | nil | |

Notes:

(1) |

A law firm in which Mr. Parken is principal received fees and disbursements for legal services of $60,000 during the last completed fiscal year, $66,944 in fiscal 2001 and $62,000 in fiscal 2000.

|

Options Exercised And Granted During the Fiscal Year Ended October 31, 2002

No options to purchase common shares were exercised during the last completed fiscal year. No options to purchase common shares were granted during the most recently completed fiscal year.

Termination of Employment, Changes in Responsibility and Employment Contracts:

Chartwell has no employment contracts with any Named Executive Officer. Chartwell has no compensatory plan or arrangement in respect of compensation received or that may be received by any Named Executive Officer in Chartwell’s most recently completed or current fiscal year to compensate such executive officer in the event of the termination of employment (resignation, retirement, change of control) or in the event of a change in responsibilities following a change in control.

STOCK OPTIONS

The Corporation has an approved stock option plan (the ” Plan”) for directors, officers, employees and consultants of the Corporation and its subsidiaries. The Plan provides that the total number of Common Shares issuable shall not exceed 3,110,000 Common Shares without shareholder approval.

The exercise price of any option subject to the Plan shall not be less than the discounted market price of the Common Shares, which shall mean the most recent closing price per share for Common Shares on the last trading day preceding the date of grant on which there was a closing price on the TSX Venture Exchange (or if the Common Shares are not listed on the TSX Venture Exchange, on such stock exchange as the Common Shares are then traded, less the permitted discounts pursuant to policies of TSX Venture Exchange or such stock exchange on which the Common Shares are listed for trading).

The exercise period of options shall be a period of time fixed by the Board of Directors, not to exceed five (5) years. If a holder shall cease to be a director, officer, employee or consultant for any reason other than death, the options will expire if not exercised within a maximum of 45 days following such cessation. In the event of the death of a holder, the options are exercisable for a period of 12 months following the date of death by the person or persons to whom the holder’s rights under the options pass by will or by law.

As of June 4, 2003, stock options have been granted on 2,667,766 Common Shares and are held as follows:

4

Held By

_________________

Date of

Grant | Date of Expiry | Directors Not

Executive

Officers | Executive

Officers | Others | Exercise

Price | Market Price

At Date of

Grant |

|---|

|

|---|

| Nov. 1/98 | | Oct. 31/03 | | 86,666 | | -- | | -- | | $1.00 | | $1.00 | |

| Dec. 15/98 | | Dec. 14/03 | | -- | | -- | | 50,000 | | $1.50 | | $1.50 | |

| Feb. 1/99 | | Jan. 31/04 | | -- | | -- | | 50,000 | | $1.06 | | $1.77 | (1) |

| Feb. 10/99 | | Feb. 9/04 | | -- | | 25,000 | | -- | | $1.06 | | $2.10 | (1) |

| June 7/99 | | June 6/04 | | -- | | 200,000 | | 25,000 | | $1.06 | | $3.40 | (1) |

| Nov. 1/99 | | Oct. 31/04 | | -- | | -- | | 56,200 | | $1.06 | | $4.00 | (1) |

| Nov. 1/99 | | Oct. 31/04 | | 50,000 | | -- | | -- | | $1.06 | | $4.00 | (1) |

| Jan. 5/00 | | Jan. 4/05 | | -- | | 75,000 | | -- | | $1.06 | | $3.11 | (1) |

| May 6/00 | | May 5/05 | | -- | | -- | | 50,000 | | $1.06 | | $4.20 | (1) |

| June 7/00 | | June 6/05 | | -- | | 140,600 | | -- | | $1.06 | | $3.65 | (1) |

| July 11/00 | | July 10/05 | | -- | | -- | | 100,000 | | $1.06 | | $3.80 | (1) |

| July 14/00 | | July 13/05 | | -- | | -- | | 100,000 | | $1.06 | | $4.00 | (1) |

| Sept. 18/00 | | Sept. 17/05 | | -- | | 350,000 | | 20,000 | | $1.06 | | $2.35 | (1) |

| Oct. 27/00 | | Oct. 26/05 | | -- | | -- | | 64,000 | | $1.17 | | $2.00 | (1) |

| Nov. 2/00 | | Nov. 1/05 | | -- | | -- | | 25,000 | | $1.17 | | $2.00 | (1) |

| Apr. 23/01 | | Apr. 22/06 | | -- | | 300,000 | | 18,600 | | $1.06 | | $1.06 | |

| May 8/01 | | May 7/06 | | -- | | -- | | 50,000 | | $1.00 | | $1.00 | |

| Aug. 24/01 | | Aug. 23/06 | | -- | | -- | | 50,000 | | $2.09 | | $2.09 | |

| Sept. 6/01 | | Sept. 5/06 | | -- | | -- | | 61,000 | | $2.00 | | $2.00 | |

| Oct. 4/01 | | Oct. 3/06 | | -- | | -- | | 50,000 | | $2.00 | | $2.00 | |

| Dec. 19/01 | | Dec. 18/06 | | -- | | -- | | 58,100 | | $1.72 | | $1.72 | |

| Mar. 11/02 | | Mar. 10/07 | | -- | | -- | | 125,000 | | $1.60 | | $1.60 | |

| Apr. 10/02 | | Apr. 9/07 | | -- | | -- | | 8,400 | | $1.60 | | $1.60 | |

| Apr. 19/02 | | Apr. 16/07 | | 50,000 | | -- | | -- | | $1.63 | | $1.63 | |

| Apr. 24/02 | | Apr. 23/07 | | -- | | -- | | 100,000 | | $1.60 | | $1.60 | |

| Sept. 5/02 | | Sept. 4/07 | | -- | | -- | | 60,300 | | $1.00 | | $0.81 | |

| Mar. 31/03 | | Mar. 30/08 | | -- | | -- | | 185,900 | | $1.00 | | $0.85 | |

5

| | | | | | | | | | | | | | |

| Apr. 1/03 | | Mar. 31/08 | | -- | | -- | | 65,000 | | $1.00 | | $1.00 | |

| Apr 30/03 | | Apr. 29/08 | | -- | | -- | | 28,000 | | $1.00 | | $0.95 | |

Note:

(1) |

Approval to reprice stock options was granted at a Special and Annual General Meeting of shareholders held on July 10, 2001 |

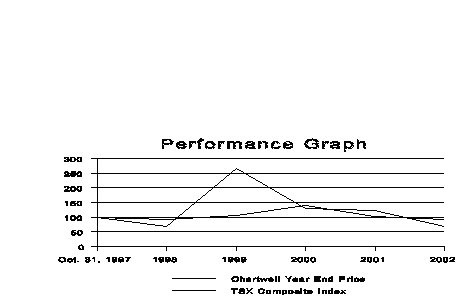

Performance Graph

The following graph compares the total cumulative shareholder return for $100 invested in common shares of the Corporation on October 31, 1997 with the cumulative total return on the TSE 300 Index. The common shares of the Corporation are traded on the TSX Venture Exchange however information for the presentation of the same return on investment for such exchange and its predecessor, the Alberta Stock Exchange, was not available.

6

| Oct. 31,

1997 | 1998 | 1999 | 2000 | 2001 | 2002 |

|---|

| |

|

| Chartwell Year End Price | | $100.00 | | $66.67 | | $266.67 | | $130.00 | | $123.33 | | $66.67 | |

| | |

| TSE 300 Index | | $100.00 | | $90.73 | | $106.05 | | $140.88 | | $100.63 | | $91.33 | |

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

One director of the Corporation was indebted to the Corporation in the amount of $132,658 as at the end of the last completed fiscal year. The indebtedness is evidenced by an interest bearing demand promissory note. One director of the Corporation was indebted to the Corporation in the amount of $29,907 as at the end of the last completed fiscal year. This indebtedness is evidenced by a non-interest bearing demand promissory note.

BUSINESS OF THE MEETING

Regular Business

At the Meeting, shareholders will consider the items of regular business as follows:

1. Financial Statements

The shareholders will receive and consider the audited financial statements of the Corporation for the fiscal year ended October 31, 2002 together with the auditor’s report thereon.

2. Election of Directors

At the Meeting, the shareholders will be asked to determine that the board of directors consist of five (5) directors and will be asked further to elect five (5) directors to succeed the present directors, whose terms of office expire on the day of the Meeting, to serve until the next annual general meeting, or until their respective successors have been elected or appointed. At the Meeting, shareholders may determine that a greater number of directors is desirable and, if so, additional nominations from shareholders will be considered for election.

Unless otherwise directed it is the intention of management to vote proxies in the accompanying form in favour of the election as directors of the five (5) nominees hereinafter set forth, provided that in the event a vacancy among such nominees occurs because of death or for any reason prior to the Meeting, the Proxy shall not be voted with respect to such vacancy:

| | Rene G. Carrier

Darcy E. Krogh

Steven W. Latham

Darold H. Parken

Roderick A. Ferguson |

The names of all the persons nominated for election as directors, all other positions and offices with the Corporation held by them, their principal occupations, dates on which they became directors of the Corporation and the number of common shares of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised, by each of them as of June 4, 2003 are as follows:

7

Name and

Position with

the Corporation | Principal Occupation During Past Five

Years | Director Since | Shares Held

as of June 4,

2003(1) |

|---|

| |

|---|

| Darold H. Parken, | | President and Chief Executive Officer of the | | Oct. 26/94 | | 793,100 | (1) |

| President, Chief | | Corporation. Prior thereto, Barrister & Solicitor, | | | | | |

| Executive Officer | | Parken & Corporation since February 1989. | | | | | |

| and Director | | Prior thereto, partner with Burnet, Duckworth | | | | | |

| | & Palmer, Barristers & Solicitors. | | | | | |

| |

|---|

| Darcy E. Krogh | | Vice President, Business Development of the | | June 7/99 | | 10,500 | (1) |

| Vice President, | | Corporation. Prior thereto, registered | | | | | |

| Business | | representative with various Canadian | | | | | |

| Development and | | investment dealers for 18 years. | | | | | |

| Director | | | | | | | |

| |

|---|

| Rene G. Carrier | | President, Euro-American Capital Corporation | | July 29/91 | | 111,300 | (1) |

| Director | | (a private investment Corporation). Prior | | | | | |

| | thereto, Vice President of Pacific | | | | | |

| | International Securities Inc. (a brokerage | | | | | |

| | firm) from 1982 to 1991. | | | | | |

| |

|---|

| Steven W. Latham | | President, Gateway Technology Inc., since | | Aug. 25/98 | | 550,000 | (1) |

| Director | | 1996. Prior thereto, Product Development | | | | | |

| | Manager with Corel Corporation (computer | | | | | |

| | software and hardware developer) from June | | | | | |

| | 1995 to June 1997. | | | | | |

| |

|---|

| Roderick A. Ferguson, | | Partner, Heenan Blaikie LLP, Barristers and | | July 10/01 | | 10,000 | |

| Director | | Solicitors since 2001 and prior thereto | | | | | |

| | Partner, Burnet Duckworth & Palmer, Barristers | | | | | |

| | and Solicitors. | | | | | |

Notes:

(1) |

Messrs. Parken, Latham, Krogh, Carrier and Ferguson hold options to purchase 625,000, 86,666, 200,000, 50,000 and 50,000 shares respectively. |

The information as to shares beneficially owned, directly or indirectly, is based upon information furnished to the Corporation by the respective directors and nominees.

3. Appointment of Auditors

The Management of the Corporation proposes to nominate KPMG LLP, Chartered Accountants, as auditors of the Corporation to hold office until the next annual general meeting at a remuneration to be fixed by the Board of Directors. KPMG LLP were first appointed auditors of the Corporation on April 27, 2000.

INTEREST OF CERTAIN PERSONS AND COMPANIES IN MATTERS TO BE ACTED UPON

Management of the Corporation is not aware of any material interests of any director or senior officer of the Corporation, any shareholder who beneficially owns more than 10% of the common shares of the Corporation, or any known associate or affiliate of those persons, in any matter to be acted upon at the Meeting, except as disclosed herein.

OTHER MATTERS

Management knows of no amendment, variation or other matter to come before the Meeting other than those

8

set forth in the Notice of Annual General Meeting. If any other matter properly comes before the Meeting, however, the accompanying proxy will be voted on such matter in accordance with the best judgement of the person or persons voting the proxy.

APPROVAL AND CERTIFICATION

The contents and sending of this Information Circular — Proxy Statement have been approved by the directors of the Corporation.

The foregoing contains no untrue statement of a material fact and does not omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in the light of the circumstances in which it was made.

DATED at Calgary, Alberta, this 4th day of June, 2003.

| | (signed) "Darold H. Parken"

Darold H. Parken

Director | (signed) "Roderick A. Ferguson"

Roderick A. Ferguson

Director |

9

CHARTWELL TECHNOLOGY INC.

FORM OF PROXY FOR THE ANNUAL GENERAL MEETING

OF SHAREHOLDERS SOLICITED BY MANAGEMENT

The undersigned shareholder of CHARTWELL TECHNOLOGY INC. (the “Corporation”) hereby appoints Darold H. Parken, President and CEO of the Corporation, of Calgary, Alberta, or, failing him, Darcy Krogh, Vice President, Business Development of the Corporation, of Vancouver, British Columbia, or instead of either of the foregoing _______________________________, as proxy of the undersigned at the Annual General Meeting of the Shareholders of the Corporation to be held on the 10th day of July, 2003 (the “Meeting”) and at any adjournment thereof and at every ballot that may take place in consequence thereof to the same extent and with the same powers as if the undersigned were personally present at the Meeting with authority to vote at the said Proxy’s discretion, except as otherwise specified below. Without limiting the general powers conferred, I hereby direct the said proxy to vote the shares represented by this proxy as follows, on the following matters:

| 1. | On the resolution regarding the election of Directors as specified in the Information Circular — Proxy Statement dated June 4, 2003 (the “Circular”): |

| 2. | On the resolution for the appointment of KPMG LLP, Chartered Accountants, as auditors of the Corporation for the ensuing year and to authorize the directors to fix their remuneration: |

| 3. | At the discretion of the said Proxy, to vote upon any amendment or variation of the above matters or any other matter properly brought before the Meeting or any adjournment thereof in such manner as such Proxy in his sole judgement may determine. |

I HEREBY REVOKE ANY PROXIES HERETOFORE GIVEN.

THIS PROXY IS SOLICITED ON BEHALF OF THE MANAGEMENT OF CHARTWELL TECHNOLOGY INC. THE SHARES REPRESENTED BY THIS PROXY SHALL BE VOTED AS DIRECTED IN THE SPACES PROVIDED ABOVE OR, IF NO DIRECTION IS GIVEN, SHALL BE VOTED IN FAVOUR OF ALL OF THE ABOVE MATTERS.

THE PERSONS NAMED IN THIS PROXY ARE DIRECTORS AND/OR OFFICERS OF THE CORPORATION. EACH SHAREHOLDER HAS THE RIGHT TO APPOINT A PERSON, WHO NEED NOT BE A SHAREHOLDER OF THE CORPORATION, TO ATTEND AND TO ACT FOR HIM AND ON HIS BEHALF AT THE MEETING, OTHER THAN THE PERSONS DESIGNATED ABOVE. TO EXERCISE SUCH RIGHT, THE NAMES OF THE PERSONS DESIGNATED BY THE MANAGEMENT SHOULD BE CROSSED OUT AND THE NAME OF THE SHAREHOLDER’S APPOINTEE SHOULD BE LEGIBLY PRINTED IN THE BLANK SPACE PROVIDED.

DATED this _____ day of __________, 2003.

| |

Name of Shareholder (please print) |

Instructions:

| | | | 4. | | The signature of the shareholder should be exactly the same as the name in which the shares are registered. |

| | | | 5. | | If the appointer is a corporation, its corporate seal must be affixed or it must be signed by an officer or attorney thereof duly authorized. |

| | | | 6. | | Persons signing as executors, administrators, trustee, etc. should so indicate and give their full title as such. |

| | | | 7. | | This Proxy will not be valid and will not be acted upon or voted unless it is signed and dated and delivered to the attention of the Corporation’s Secretary, c/o Computershare Trust Company of Canada, Attention: Proxy Department, 100 University Avenue,9th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours before the time for the holding of the Meeting or any adjournment thereof. Proxies may also be delivered by fax to: (416) 263-9524 or 1-866-249-7775. |

| | | | 8. | | This Proxy is valid only at the Meeting in respect of which it is given or any adjournment thereof. |