UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09645

Columbia Funds Series Trust

(Exact name of registrant as specified in charter)

225 Franklin Street

Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Ryan Larrenaga

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 345-6611

Date of fiscal year end: April 30

Date of reporting period: April 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Columbia Funds Series Trust

Item 1. Reports to Stockholders.

Annual Report

April 30, 2017

Columbia AMT-Free Georgia Intermediate Muni Bond Fund

Not FDIC Insured • No bank guarantee • May lose value

Dear Shareholders,

While emotions have run high following the outcome of the U.S. Presidential election, it remains unclear how the Trump presidency will unfold in terms of policy. We have a sense of the priorities espoused by the President over the past eighteen months, but campaign priorities are not always realized and are often never pursued. What seems certain is that, while some investors have already priced expectations into the market, others have retreated, preferring instead a wait and see approach. The outcome of such behaviors appears to have created conditions ripe for ongoing market volatility.

While volatility in the financial markets can be stressful, volatility itself is not a new phenomenon. Other factors that have been at the root cause of recent volatility include uncertainty following the United Kingdom’s vote to exit the European Union (Brexit), speculation around the Federal Reserve’s decision to increase interest rates, divergent central bank policy and geopolitical unrest. The point is, financial markets have fluctuated for years and may be expected to continue to fluctuate — sometimes wildly. If anything, such volatility seems to be the new normal, perhaps exacerbated by access to information and development of technological tools which have enabled investors to react rapidly to real and perceived change. So what can you do?

Position your portfolio for the reality of market volatility

That there is a historical precedent for market volatility, or even an acceptance that it may persist, offers little comfort. A measured and strategic approach remains the best strategy for investors to stay on track in achieving their investment goals.

Step 1: Review your investment goals

Take this opportunity to review your investment goals and the strategies you are pursuing to achieve those goals in order to remain focused on what’s important to you. It is entirely possible that your goals have changed in response either to your life situation or to changes in the market. Accept what you can’t control — volatility, and focus on what you can — your investment goals and strategies.

Step 2: Reassess your risk tolerance

Sit down with your financial advisor to discuss your investment goals and strategies, as well as any changes to your tolerance for risk. Consider your investment horizon. Increased market volatility and a new investment horizon may impact the strategies that can best help you achieve your investment goals. Remember, achieving your investment goals may require a certain amount of risk. Ultimately, you must maintain vigilance in reassessing your risk tolerance and the strategies you have selected in pursuit of your investment goals, and awareness of how those strategies may react to market volatility.

Step 3: Remain calm and focus on your long-term plan

Remember, investing is about the long game. Short term events are not necessarily evidence of a longer term reality. Investors who attempt to time the market too often end up reacting to a down turn by selling low and then compounding the problem by waiting on the sidelines, ultimately missing the right opportunity to reinvest.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

President’s Message (continued)

As long as there is a market, there will be volatility. How you respond to that volatility can make a big difference in the measure of your success as an investor. Talk to your financial advisor about how working with Columbia Threadneedle Investments may help you position your portfolio for the reality of ongoing volatility and, perhaps, even turn such volatility into investment opportunity.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit investor.columbiathreadneedleus.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2017 Columbia Management Investment Advisers, LLC. All rights reserved.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

Investment objective

Columbia AMT-Free Georgia Intermediate Muni Bond Fund (the Fund) seeks current income exempt from U.S. federal income tax and Georgia individual income tax, consistent with moderate fluctuation of principal.

Portfolio management

Brian McGreevy

Co-manager

Managed Fund since 2011

Paul Fuchs, CFA

Co-manager

Managed Fund since September 2016

| Average annual total returns (%) (for the period ended April 30, 2017) |

| | | Inception | 1 Year | 5 Years | 10 Years |

| Class A | Excluding sales charges | 05/04/92 | -0.93 | 1.78 | 3.19 |

| | Including sales charges | | -3.93 | 1.16 | 2.88 |

| Class B | Excluding sales charges | 06/07/93 | -1.67 | 1.04 | 2.43 |

| | Including sales charges | | -4.55 | 1.04 | 2.43 |

| Class C | Excluding sales charges | 06/17/92 | -1.57 | 1.04 | 2.43 |

| | Including sales charges | | -2.53 | 1.04 | 2.43 |

| Class R4 * | 03/19/13 | -0.68 | 2.04 | 3.45 |

| Class Y * | 03/01/17 | -0.67 | 2.04 | 3.45 |

| Class Z | 03/01/92 | -0.68 | 2.04 | 3.45 |

| Bloomberg Barclays 3-15 Year Blend Municipal Bond Index | | 0.15 | 2.80 | 4.37 |

Returns for Class A are shown with and without the maximum initial sales charge of 3.00%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 3.00% in the first year, declining to 1.00% in the fourth year and eliminated thereafter. The Fund does not accept new investments in Class B shares, except for certain limited transactions. The Fund’s current Class B investors, having held their shares for the requisite time period, are no longer subject to a CDSC upon redemption of their shares. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund’s other classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information. |

The Bloomberg Barclays 3–15 Year Blend Municipal Bond Index is an unmanaged index that tracks the performance of municipal bonds issued after December 31, 1990, with remaining maturities between 2 and 17 years and at least $7 million in principal amount outstanding.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 3 |

Fund at a Glance (continued)

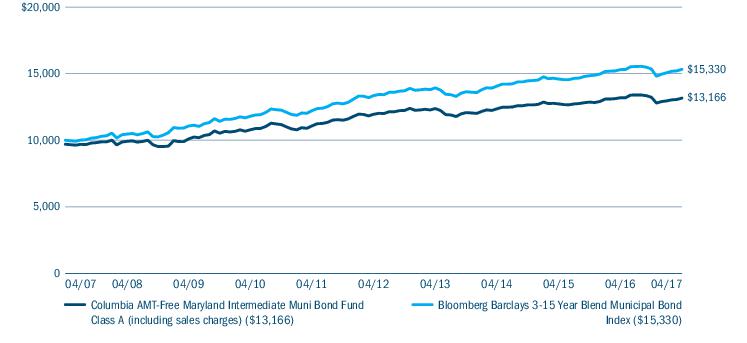

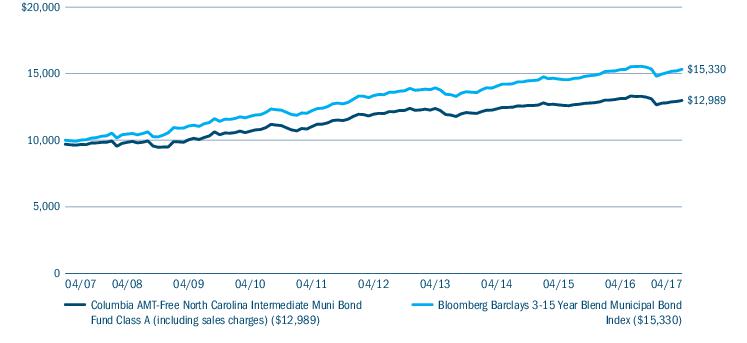

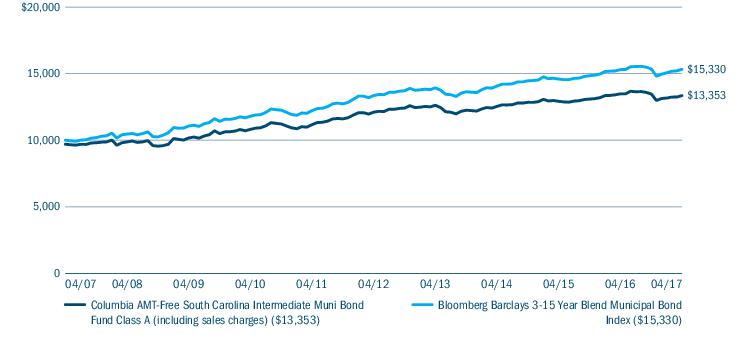

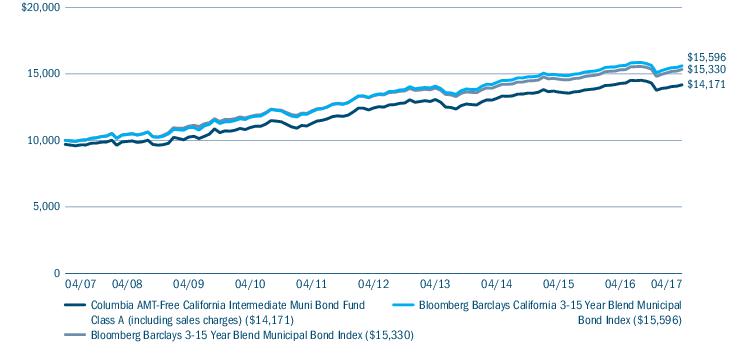

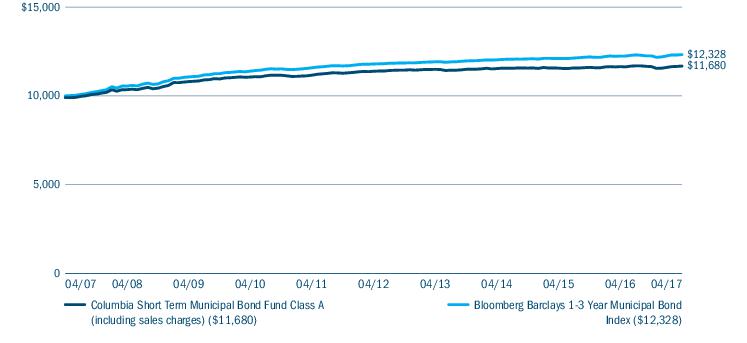

Performance of a hypothetical $10,000 investment (April 30, 2007 — April 30, 2017)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia AMT-Free Georgia Intermediate Muni Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Quality breakdown (%) (at April 30, 2017) |

| AAA rating | 5.8 |

| AA rating | 53.0 |

| A rating | 35.6 |

| BBB rating | 3.6 |

| Not rated | 2.0 |

| Total | 100.0 |

Percentages indicated are based upon total fixed income investments (excluding Money Market Funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Investment Manager and/or Fund’s subadviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to de-leverage (repay) through free cash flow, quality of management, market positioning and access to capital, as well as such security-specific factors as the terms of the security (e.g., interest rate and time to maturity) and the amount and type of any collateral.

| 4 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Manager Discussion of Fund Performance

For the 12-month period that ended April 30, 2017, the Fund’s Class A shares returned -0.93% excluding sales charges. Class Z shares returned -0.68% for the 12-month period. The Fund’s benchmark, the Bloomberg Barclays 3-15 Year Blend Municipal Bond Index, returned 0.15% for the same time period. The Fund underperformed its benchmark due to its exposure to the Virgin Islands and its positions in the hospital sector.

Market overview

Municipal bonds experienced negative total returns during the 12 months ended April 30, 2017, but the bulk of the losses occurred in the weeks immediately following the U.S. election.

The market was relatively stable early in the period, as rates fell slightly at the start of the summer of 2016 (as prices rose) and held in a tight range through September 2016. Municipal bonds weakened somewhat in October as investors began to price in the possibility of an interest rate increase by the U.S. Federal Reserve at its December meeting, but the downturn was fairly modest in nature. This relatively calm environment changed abruptly in November due to the unexpected result of the U.S. election. Donald Trump’s surprising victory, in conjunction with the Republican sweep of Congress, prompted investors to recalibrate their expectations toward a backdrop of stronger economic growth, lower taxes, and more aggressive Fed policy. U.S. Treasury yields spiked higher as a result, and municipals followed suit. The resulting selling pressure was exacerbated by heavy mutual fund liquidations, which compelled managers to sell into the falling market. Volatility subsequently abated in the new year, as the combination of lower new-issue supply and positive fund flows helped the benchmark produce a string of months with positive returns. As a result, the major national indices were able to finish the 12-month period with slight gains. Tax-exempt securities outperformed Treasuries thanks in part to the continued strength in state and local finances.

Short-term issues experienced the best relative performance. While bonds with maturities of five years and below posted small gains, the remainder of the yield curve closed in the red with issues with maturities of 15 years and above registering the weakest returns. Lower quality securities generally outpaced their higher quality peers at the national level due largely to the relative strength of New Jersey and Illinois issues.

Strong growth for Georgia’s economy

Georgia’s economy continued to experience healthy growth during the period. A robust job market, a diverse mix of industries, and beneficial tax policies have led to a steady decline in the unemployment rate and increases in personal income and consumer spending. In addition, the state has benefited from both rising port traffic and the prospects of increased defense spending. These factors have contributed to rising property prices and higher tax revenues, providing a firm foundation for the state’s municipal bond market. Georgia’s municipal bond market performed in line with the national index.

Contributors and detractors

The Fund’s exposure to Virgin Islands bonds was the primary factor in its underperformance. Moody’s downgraded the territory in mid-2016 as the language in the federal oversight bill to aid the distressed island of Puerto Rico was written in such a way as to include other territories. In addition, investors reacted unfavorably to the Virgin Islands’ poor credit fundamentals. After evaluating the outlook for the territory and determining that the risk-reward tradeoff was unfavorable given the way events unfolded in Puerto Rico, we decided to eliminate the position. Historically, the Fund has invested in Virgin Islands credits because they are exempt from federal and state income taxes, and they offered the opportunity to own higher yielding bonds than would typically be found in Georgia.

The Fund’s allocation to the hospital sector — which lagged the broader market due to the uncertainty regarding the future of the Affordable Care Act — was an additional detractor. We also experienced some weakness in the electric revenue area. The bankruptcy filing of Westinghouse, which is building two nuclear power plants in the state, weighed on the bonds of The Municipal Electric Authority of Georgia due to its ownership interest in the project.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 5 |

Manager Discussion of Fund Performance (continued)

The Fund had a slightly shorter duration (lower interest rate sensitivity) relative to the benchmark, as the low level of yields prompted us to take a conservative stance during the summer of 2016. This aspect of the Fund’s positioning, together with its slight overweight in shorter maturity issues, had a favorable impact on results given the subsequent increase in yields. Near the end of the reporting period, we targeted a more neutral duration positioning as yields had risen and spreads had become more attractive.

At the sector level, investments in the transportation and education sectors added value, as did an allocation to pre-refunded bonds due to their shorter maturities and higher quality. Additionally, the Fund’s investments in bonds in the six- to eight-year range outperformed the corresponding holdings in the benchmark.

Fund positioning

The tone in the municipal market was quite upbeat at the end of the period, highlighted by five consecutive months of positive returns and a favorable combination of strong demand and low new-issue supply. However, we continued to monitor several issues that could affect market performance, including the potential for lower taxes, the possibility of increased new-issue supply stemming from increased infrastructure spending, and likely changes to the Affordable Care Act.

This mixed picture prompted us to remain cautious with regard to issuers that have had persistent pension-funding challenges, as the rating agencies appear to have lost their patience with those that show no sign of making progress in resolving their underfunded pensions. In addition, we continued to favor areas that have dedicated revenue streams. We remained tax-aware, seeking to manage the gains and losses within the portfolio.

Fixed-income securities present issuer default risk. The Fund invests substantially in municipal securities and will be affected by tax, legislative, regulatory, demographic or political changes, as well as changes impacting a state’s financial, economic or other conditions. A relatively small number of tax-exempt issuers may necessitate the Fund investing more heavily in a single issuer and, therefore, be more exposed to the risk of loss than a fund that invests more broadly. The value of the Fund’s portfolio may be more volatile than a more geographically diversified fund. Prepayment and extension risk exists because the timing of payments on a loan, bond or other investment may accelerate when interest rates fall or decelerate when interest rates rise which may reduce investment opportunities and potential returns. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Federal and state tax rules apply to capital gain distributions and any gains or losses on sales. Income may be subject to state or local taxes. Liquidity risk is associated with the difficulty of selling underlying investments at a desirable time or price. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| November 1, 2016 — April 30, 2017 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 992.20 | 1,020.55 | 3.96 | 4.01 | 0.81 |

| Class B | 1,000.00 | 1,000.00 | 989.40 | 1,016.87 | 7.61 | 7.71 | 1.56 |

| Class C | 1,000.00 | 1,000.00 | 989.40 | 1,016.87 | 7.61 | 7.71 | 1.56 |

| Class R4 | 1,000.00 | 1,000.00 | 994.30 | 1,021.77 | 2.74 | 2.78 | 0.56 |

| Class Y | 1,000.00 | 1,000.00 | 1,011.70 (a) | 1,022.41 | 0.68 (a) | 2.13 | 0.43 (a) |

| Class Z | 1,000.00 | 1,000.00 | 993.40 | 1,021.77 | 2.74 | 2.78 | 0.56 |

| (a) | Based on operations from March 1, 2017 (commencement of operations) through the stated period end. |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

The Fund’s annualized expense ratio excludes the impact of an expense reimbursement from a third party due to overbilling.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 7 |

Portfolio of Investments

April 30, 2017

(Percentages represent value of investments compared to net assets)

| Municipal Bonds 98.9% |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Airport 4.0% |

| City of Atlanta Department of Aviation |

| Refunding Revenue Bonds |

General

Series 2010C |

| 01/01/25 | 5.000% | | 1,500,000 | 1,663,695 |

| Revenue Bonds |

| Series 2012B |

| 01/01/27 | 5.000% | | 1,000,000 | 1,138,500 |

| Total | 2,802,195 |

| Higher Education 11.6% |

| Athens Housing Authority |

| Refunding Revenue Bonds |

UGAREF East Campus Housing

Series 2011 |

| 12/01/25 | 5.000% | | 1,000,000 | 1,146,811 |

| Bleckley County & Dodge County Joint Development Authority |

| Revenue Bonds |

Middle Georgia College

Series 2008 |

| 07/01/21 | 5.000% | | 750,000 | 780,000 |

| Bulloch County Development Authority |

| Refunding Revenue Bonds |

Georgia Southern University Housing Foundation

Series 2012 (AGM) |

| 08/01/27 | 5.000% | | 500,000 | 565,670 |

| Revenue Bonds |

Georgia Southern University Housing Foundation

Series 2008 (AGM) |

| 07/01/20 | 5.250% | | 1,000,000 | 1,048,180 |

| Carrollton Payroll Development Authority |

| Refunding Revenue Bonds |

Anticipation Certificates - UWG Campus Center

Series 2012 (AGM) |

| 08/01/25 | 5.000% | | 800,000 | 913,696 |

| Fulton County Development Authority |

| Refunding Revenue Bonds |

Spelman College

Series 2015 |

| 06/01/32 | 5.000% | | 1,000,000 | 1,128,160 |

| Gwinnett County Development Authority(a) |

| Refunding Revenue Bonds |

Georgia Gwinnett College Student Housing

Series 2017 |

| 07/01/34 | 5.000% | | 1,000,000 | 1,141,960 |

| Richmond County Development Authority |

| Refunding Revenue Bonds |

ASU Jaguar Student Housing

Series 2012 (AGM) |

| 02/01/27 | 5.000% | | 750,000 | 849,727 |

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

Georgia Regents University Cancer Center

Series 2014 (AGM) |

| 12/15/32 | 5.000% | | 425,000 | 483,506 |

| Total | 8,057,710 |

| Hospital 11.2% |

| Carroll City-County Hospital Authority |

| Refunding Revenue Bonds |

Tanner Medical Center, Inc. Project

Series 2016 |

| 07/01/30 | 4.000% | | 1,000,000 | 1,055,800 |

| Cedartown Polk County Hospital Authority |

| Revenue Bonds |

Floyd Healthcare Polk Medical Center

RAC Series 2016 |

| 07/01/34 | 5.000% | | 500,000 | 547,710 |

| DeKalb Private Hospital Authority |

| Revenue Bonds |

Children’s Healthcare

Series 2009 |

| 11/15/17 | 5.000% | | 320,000 | 326,829 |

| Fayette County Hospital Authority |

| Revenue Bonds |

Fayette Community Hospital

Series 2009A |

| 06/15/23 | 5.250% | | 2,000,000 | 2,158,160 |

| Gainesville & Hall County Hospital Authority |

| Refunding Revenue Bonds |

Northeast Georgia Health System Project

Series 2017 |

| 02/15/30 | 5.000% | | 300,000 | 345,027 |

| Gwinnett County Hospital Authority |

| Revenue Bonds |

Gwinnet Hospital System

Series 2007A (AGM) |

| 07/01/23 | 5.000% | | 2,000,000 | 2,149,440 |

| Richmond County Hospital Authority |

| Refunding Revenue Bonds |

University Health Services, Inc. Project

Series 2016 |

| 01/01/28 | 5.000% | | 1,000,000 | 1,171,590 |

| Total | 7,754,556 |

| Joint Power Authority 4.3% |

| Municipal Electric Authority of Georgia |

| Refunding Revenue Bonds |

Project One

Subordinated Series 2015A |

| 01/01/32 | 5.000% | | 1,000,000 | 1,115,110 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Portfolio of Investments (continued)

April 30, 2017

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Revenue Bonds |

Project One

Subordinated Series 2008A |

| 01/01/21 | 5.250% | | 1,395,000 | 1,556,932 |

| Unrefunded Revenue Bonds |

Project One

Subordinated Series 2008D |

| 01/01/23 | 6.000% | | 260,000 | 274,417 |

| Total | 2,946,459 |

| Local Appropriation 1.0% |

| Atlanta Public Safety & Judicial Facilities Authority |

| Refunding Revenue Bonds |

Public Safety Facility Project

Series 2016 |

| 12/01/24 | 5.000% | | 580,000 | 703,337 |

| Local General Obligation 22.7% |

| Cherokee County Board of Education |

| Unlimited General Obligation Bonds |

| Series 2014A |

| 08/01/30 | 5.000% | | 1,000,000 | 1,157,060 |

| City of Atlanta |

| Unlimited General Obligation Refunding Bonds |

| Series 2014A |

| 12/01/26 | 5.000% | | 500,000 | 598,055 |

| City of Decatur |

| Unlimited General Obligation Bonds |

| Series 2016 |

| 08/01/29 | 4.000% | | 750,000 | 833,408 |

| Columbia County School District |

| Unlimited General Obligation Bonds |

| Series 2015 |

| 10/01/22 | 5.000% | | 1,000,000 | 1,179,830 |

| County of Columbia |

| Unlimited General Obligation Bonds |

Sales Tax

Series 2015 |

| 04/01/22 | 5.000% | | 285,000 | 333,555 |

| County of DeKalb |

| Unlimited General Obligation Refunding Bonds |

Special Transportation - Parks Greenspace

Series 2016 |

| 12/01/27 | 5.000% | | 750,000 | 914,490 |

| Forsyth County School District |

| Unlimited General Obligation Bonds |

| Series 2014 |

| 02/01/28 | 5.000% | | 1,000,000 | 1,173,190 |

| Gwinnett County School District |

| Unlimited General Obligation Refunding Bonds |

| Series 2010 |

| 02/01/24 | 5.000% | | 1,500,000 | 1,814,715 |

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Henry County School District |

| Unlimited General Obligation Bonds |

| Series 2016 |

| 08/01/32 | 4.000% | | 1,000,000 | 1,080,280 |

| Sandy Springs Public Facilities Authority |

| Revenue Bonds |

City Center Project

Series 2015 |

| 05/01/28 | 5.000% | | 1,000,000 | 1,202,330 |

| Savannah-Chatham County School District |

| Unlimited General Obligation Refunding Bonds |

| Series 2004 (AGM) |

| 08/01/19 | 5.250% | | 2,000,000 | 2,186,860 |

| South Fulton Municipal Regional Water & Sewer Authority |

| Refunding Revenue Bonds |

| Series 2014 |

| 01/01/31 | 5.000% | | 1,000,000 | 1,136,320 |

| Winder-Barrow Industrial Building Authority |

| Refunding Revenue Bonds |

City of Winder Project

Series 2012 (AGM) |

| 12/01/24 | 5.000% | | 1,900,000 | 2,148,007 |

| Total | 15,758,100 |

| Multi-Family 1.5% |

| Cobb County Development Authority |

| Refunding Revenue Bonds |

Kennesaw State University

Junior Subordinated Series 2014 |

| 07/15/29 | 5.000% | | 980,000 | 1,069,846 |

| Municipal Power 0.4% |

| Guam Power Authority(b) |

| Refunding Revenue Bonds |

| Series 2012A (AGM) |

| 10/01/24 | 5.000% | | 220,000 | 249,198 |

| Other Bond Issue 0.9% |

| Columbus Housing Authority |

| Revenue Bonds |

Eagles Trace Apartments Project

Series 2015 |

| 12/01/25 | 3.250% | | 655,000 | 644,841 |

| Prepaid Gas 0.5% |

| Main Street Natural Gas, Inc. |

| Revenue Bonds |

| Series 2007A |

| 09/15/19 | 5.250% | | 295,000 | 317,960 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 9 |

Portfolio of Investments (continued)

April 30, 2017

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Refunded / Escrowed 8.7% |

| Cherokee County Board of Education |

| Prerefunded 08/01/19 Unlimited General Obligation Bonds |

| Series 2009A |

| 08/01/22 | 5.000% | | 1,600,000 | 1,739,088 |

| DeKalb Newton & Gwinnett Counties Joint Development Authority |

| Prerefunded 07/01/19 Revenue Bonds |

GGC Foundation LLC Project

Series 2009 |

| 07/01/24 | 5.500% | | 2,500,000 | 2,735,725 |

| Municipal Electric Authority of Georgia |

| Prerefunded 07/01/18 Revenue Bonds |

Project One

Subordinated Series 2008D |

| 01/01/23 | 6.000% | | 740,000 | 783,460 |

| State of Georgia |

| Prerefunded 05/01/19 Unlimited General Obligation Bonds |

| Series 2009D |

| 05/01/23 | 5.000% | | 750,000 | 808,830 |

| Total | 6,067,103 |

| Retirement Communities 0.8% |

| Fulton County Residential Care Facilities for the Elderly Authority |

| Refunding Revenue Bonds |

Lenbrook Square Foundation, Inc.

Series 2016 |

| 07/01/25 | 4.000% | | 500,000 | 523,785 |

| Sales Tax 1.3% |

| Metropolitan Atlanta Rapid Transit Authority |

| Refunding Revenue Bonds |

3rd Indenture

Series 2014A |

| 07/01/24 | 5.000% | | 750,000 | 893,520 |

| Single Family 1.4% |

| Georgia Housing & Finance Authority |

| Revenue Bonds |

| Series 2014B-1 |

| 12/01/29 | 3.000% | | 1,000,000 | 997,460 |

| Special Non Property Tax 5.3% |

| Cobb-Marietta Coliseum & Exhibit Hall Authority |

| Refunding Revenue Bonds |

| Series 2005 (NPFGC) |

| 10/01/19 | 5.250% | | 1,500,000 | 1,624,455 |

| Metropolitan Atlanta Rapid Transit Authority |

| Refunding Revenue Bonds |

Third Indenture

Series 2012A |

| 07/01/30 | 5.000% | | 1,500,000 | 1,726,515 |

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Territory of Guam(b) |

| Revenue Bonds |

| Series 2011A |

| 01/01/31 | 5.000% | | 300,000 | 313,179 |

| Total | 3,664,149 |

| Special Property Tax 6.3% |

| Atlanta & Fulton County Recreation Authority |

| Refunding Revenue Bonds |

Park Improvement

Series 2014A |

| 12/01/28 | 5.000% | | 525,000 | 615,032 |

Park Improvement

Series 2014A |

| 12/01/33 | 5.000% | | 1,000,000 | 1,141,420 |

| City of Atlanta |

| Refunding Tax Allocation Bonds |

Atlanta Station Project

Series 2007 (AGM) |

| 12/01/20 | 5.250% | | 1,545,000 | 1,580,690 |

Eastside Project

Series 2016 |

| 01/01/28 | 5.000% | | 300,000 | 349,755 |

Eastside Project

Series 2016 |

| 01/01/29 | 5.000% | | 300,000 | 347,007 |

Eastside Project

Series 2016 |

| 01/01/30 | 5.000% | | 300,000 | 343,791 |

| Total | 4,377,695 |

| Transportation 1.6% |

| Georgia State Road & Tollway Authority |

| Revenue Bonds |

Federal Highway Grant

Series 2009A |

| 06/01/21 | 5.000% | | 1,000,000 | 1,075,840 |

| Turnpike / Bridge / Toll Road 0.9% |

| Georgia State Road & Tollway Authority(c),(d) |

| Revenue Bonds |

I-75 S Express Lanes Project

Series 2014 |

| 06/01/24 | 0.000% | | 1,000,000 | 650,790 |

| Water & Sewer 14.5% |

| Augusta Water & Sewerage |

| Refunding Revenue Bonds |

| Series 2007 (AGM) |

| 10/01/22 | 5.000% | | 2,000,000 | 2,054,520 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Portfolio of Investments (continued)

April 30, 2017

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| Cherokee County Water & Sewer Authority |

| Refunding Revenue Bonds |

| Series 2016 |

| 08/01/31 | 5.000% | | 250,000 | 295,468 |

| City of Atlanta Water & Wastewater |

| Refunding Revenue Bonds |

| Series 2015 |

| 11/01/30 | 5.000% | | 1,000,000 | 1,179,630 |

| City of Atlanta Water & Wastewater(a) |

| Refunding Revenue Bonds |

| Series 2017A |

| 11/01/34 | 5.000% | | 1,000,000 | 1,179,860 |

| City of Columbus Water & Sewerage |

| Refunding Revenue Bonds |

| Series 2016 |

| 05/01/32 | 5.000% | | 350,000 | 411,848 |

| City of Gainesville Water & Sewerage |

| Refunding Revenue Bonds |

| Series 2014 |

| 11/15/26 | 5.000% | | 1,500,000 | 1,782,705 |

| Municipal Bonds (continued) |

| Issue Description | Coupon

Rate | | Principal

Amount ($) | Value ($) |

| County of DeKalb Water & Sewage |

| Refunding Revenue Bonds |

| Series 2006B |

| 10/01/21 | 5.250% | | 2,000,000 | 2,325,480 |

| Villa Rica Public Facilities Authority |

| Refunding Revenue Bonds |

Water & Sewer Project

Series 2015 |

| 03/01/31 | 5.000% | | 750,000 | 855,577 |

| Total | 10,085,088 |

Total Municipal Bonds

(Cost $66,190,940) | 68,639,632 |

Total Investments

(Cost: $66,190,940) | 68,639,632 |

| Other Assets & Liabilities, Net | | 792,353 |

| Net Assets | 69,431,985 |

Notes to Portfolio of Investments

| (a) | Represents a security purchased on a when-issued basis. |

| (b) | Municipal obligations include debt obligations issued by or on behalf of territories, possessions, or sovereign nations within the territorial boundaries of the United States. At April 30, 2017, the value of these securities amounted to $562,377 which represents 0.81% of net assets. |

| (c) | Represents privately placed and other securities and instruments exempt from SEC registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid. Private placements may be determined to be liquid under guidelines established by the Fund’s Board of Trustees. At April 30, 2017, the value of these securities amounted to $650,790 which represents 0.94% of net assets. |

| (d) | Zero coupon bond. |

Abbreviation Legend

| AGM | Assured Guaranty Municipal Corporation |

| NPFGC | National Public Finance Guarantee Corporation |

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| • | Level 1 – Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments. |

| • | Level 2 – Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| • | Level 3 – Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 11 |

Portfolio of Investments (continued)

April 30, 2017

Fair value measurements (continued)

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund’s Board of Trustees (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The following table is a summary of the inputs used to value the Fund’s investments at April 30, 2017:

| | Level 1

quoted prices in active

markets for identical

assets ($) | Level 2

other significant

observable inputs ($) | Level 3

significant

unobservable inputs ($) | Total ($) |

| Investments | | | | |

| Municipal Bonds | — | 68,639,632 | — | 68,639,632 |

| Total Investments | — | 68,639,632 | — | 68,639,632 |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical assets.

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Statement of Assets and Liabilities

April 30, 2017

| Assets | |

| Investments, at cost | |

| Unaffiliated issuers, at cost | $66,190,940 |

| Total investments, at cost | 66,190,940 |

| Investments, at value | |

| Unaffiliated issuers, at value | 68,639,632 |

| Total investments, at value | 68,639,632 |

| Cash | 2,423,628 |

| Receivable for: | |

| Investments sold | 35,568 |

| Capital shares sold | 87,135 |

| Interest | 895,563 |

| Expense reimbursement due from Investment Manager | 134 |

| Prepaid expenses | 625 |

| Other assets | 761 |

| Total assets | 72,083,046 |

| Liabilities | |

| Payable for: | |

| Investments purchased on a delayed delivery basis | 2,322,410 |

| Capital shares purchased | 21,897 |

| Distributions to shareholders | 158,972 |

| Management services fees | 893 |

| Distribution and/or service fees | 233 |

| Transfer agent fees | 6,608 |

| Compensation of board members | 104,435 |

| Other expenses | 35,613 |

| Total liabilities | 2,651,061 |

| Net assets applicable to outstanding capital stock | $69,431,985 |

| Represented by | |

| Paid in capital | 67,033,308 |

| Undistributed net investment income | 105,247 |

| Accumulated net realized loss | (155,262) |

| Unrealized appreciation (depreciation) on: | |

| Investments - unaffiliated issuers | 2,448,692 |

| Total - representing net assets applicable to outstanding capital stock | $69,431,985 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 13 |

Statement of Assets and Liabilities (continued)

April 30, 2017

| Class A | |

| Net assets | $18,933,870 |

| Shares outstanding | 1,810,988 |

| Net asset value per share | $10.45 |

| Maximum offering price per share(a) | $10.77 |

| Class B | |

| Net assets | $58,867 |

| Shares outstanding | 5,628 |

| Net asset value per share | $10.46 |

| Class C | |

| Net assets | $3,732,796 |

| Shares outstanding | 356,956 |

| Net asset value per share | $10.46 |

| Class R4 | |

| Net assets | $274,896 |

| Shares outstanding | 26,332 |

| Net asset value per share | $10.44 |

| Class Y | |

| Net assets | $10,070 |

| Shares outstanding | 961 |

| Net asset value per share | $10.48 |

| Class Z | |

| Net assets | $46,421,486 |

| Shares outstanding | 4,441,037 |

| Net asset value per share | $10.45 |

| (a) | The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 3.00% for Class A. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Statement of Operations

Year Ended April 30, 2017

| Net investment income | |

| Income: | |

| Interest | $2,546,087 |

| Total income | 2,546,087 |

| Expenses: | |

| Management services fees | 356,944 |

| Distribution and/or service fees | |

| Class A | 52,858 |

| Class B | 883 |

| Class C | 45,925 |

| Transfer agent fees | |

| Class A | 34,394 |

| Class B | 148 |

| Class C | 7,533 |

| Class R4 | 431 |

| Class Z | 81,000 |

| Compensation of board members | 25,738 |

| Custodian fees | 1,726 |

| Printing and postage fees | 18,566 |

| Registration fees | 10,979 |

| Audit fees | 32,393 |

| Legal fees | 7,565 |

| Compensation of chief compliance officer | 17 |

| Other | 12,560 |

| Total expenses | 689,660 |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | (163,717) |

| Total net expenses | 525,943 |

| Net investment income | 2,020,144 |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | (33,598) |

| Net realized loss | (33,598) |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | (2,837,667) |

| Net change in unrealized appreciation (depreciation) | (2,837,667) |

| Net realized and unrealized loss | (2,871,265) |

| Net decrease in net assets resulting from operations | $(851,121) |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 15 |

Statement of Changes in Net Assets

| | Year Ended

April 30, 2017 (a) | Year Ended

April 30, 2016 |

| Operations | | |

| Net investment income | $2,020,144 | $2,206,234 |

| Net realized gain (loss) | (33,598) | 351,587 |

| Net change in unrealized appreciation (depreciation) | (2,837,667) | 424,166 |

| Net increase (decrease) in net assets resulting from operations | (851,121) | 2,981,987 |

| Distributions to shareholders | | |

| Net investment income | | |

| Class A | (538,681) | (551,222) |

| Class B | (1,564) | (3,015) |

| Class C | (82,024) | (96,802) |

| Class R4 | (7,498) | (6,445) |

| Class Y | (49) | — |

| Class Z | (1,394,944) | (1,554,637) |

| Net realized gains | | |

| Class A | (121,817) | (68,634) |

| Class B | (505) | (498) |

| Class C | (26,364) | (17,023) |

| Class R4 | (1,501) | (623) |

| Class Z | (281,718) | (178,493) |

| Total distributions to shareholders | (2,456,665) | (2,477,392) |

| Decrease in net assets from capital stock activity | (5,348,816) | (1,509,052) |

| Total decrease in net assets | (8,656,602) | (1,004,457) |

| Net assets at beginning of year | 78,088,587 | 79,093,044 |

| Net assets at end of year | $69,431,985 | $78,088,587 |

| Undistributed net investment income | $105,247 | $134,881 |

| (a) | Class Y shares are based on operations from March 1, 2017 (commencement of operations) through the stated period end. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | April 30, 2017 (a) | April 30, 2016 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| Class A | | | | |

| Subscriptions (b) | 324,953 | 3,540,943 | 130,384 | 1,404,666 |

| Distributions reinvested | 36,799 | 389,042 | 38,098 | 410,631 |

| Redemptions | (423,385) | (4,422,404) | (151,849) | (1,637,945) |

| Net increase (decrease) | (61,633) | (492,419) | 16,633 | 177,352 |

| Class B | | | | |

| Subscriptions | 8 | 89 | 1,051 | 11,290 |

| Distributions reinvested | 159 | 1,681 | 189 | 2,036 |

| Redemptions (b) | (8,459) | (90,569) | (2,418) | (25,951) |

| Net decrease | (8,292) | (88,799) | (1,178) | (12,625) |

| Class C | | | | |

| Subscriptions | 32,466 | 349,629 | 108,840 | 1,171,124 |

| Distributions reinvested | 8,148 | 86,019 | 8,524 | 91,875 |

| Redemptions | (142,622) | (1,490,856) | (85,007) | (914,610) |

| Net increase (decrease) | (102,008) | (1,055,208) | 32,357 | 348,389 |

| Class R4 | | | | |

| Subscriptions | 2,695 | 29,187 | 5,421 | 58,325 |

| Distributions reinvested | 822 | 8,668 | 625 | 6,734 |

| Redemptions | (160) | (1,678) | (3,482) | (37,466) |

| Net increase | 3,357 | 36,177 | 2,564 | 27,593 |

| Class Y | | | | |

| Subscriptions | 961 | 10,000 | — | — |

| Net increase | 961 | 10,000 | — | — |

| Class Z | | | | |

| Subscriptions | 890,510 | 9,547,486 | 769,419 | 8,308,660 |

| Distributions reinvested | 23,091 | 244,108 | 22,919 | 247,056 |

| Redemptions | (1,280,672) | (13,550,161) | (983,808) | (10,605,477) |

| Net decrease | (367,071) | (3,758,567) | (191,470) | (2,049,761) |

| Total net decrease | (534,686) | (5,348,816) | (141,094) | (1,509,052) |

| (a) | Class Y shares are based on operations from March 1, 2017 (commencement of operations) through the stated period end. |

| (b) | Includes conversions of Class B shares to Class A shares, if any. |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 17 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| Year ended | Net asset value,

beginning of

period | Net

investment

income | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains |

| Class A |

| 4/30/2017 | $10.88 | 0.27 | (0.37) | (0.10) | (0.27) | (0.06) |

| 4/30/2016 | $10.81 | 0.29 | 0.11 | 0.40 | (0.29) | (0.04) |

| 4/30/2015 | $10.82 | 0.31 | 0.01 | 0.32 | (0.31) | (0.02) |

| 4/30/2014 | $11.21 | 0.31 | (0.32) | (0.01) | (0.31) | (0.07) |

| 4/30/2013 | $11.18 | 0.31 | 0.04 | 0.35 | (0.31) | (0.01) |

| Class B |

| 4/30/2017 | $10.89 | 0.19 | (0.37) | (0.18) | (0.19) | (0.06) |

| 4/30/2016 | $10.81 | 0.21 | 0.12 | 0.33 | (0.21) | (0.04) |

| 4/30/2015 | $10.82 | 0.23 | 0.01 | 0.24 | (0.23) | (0.02) |

| 4/30/2014 | $11.22 | 0.23 | (0.33) | (0.10) | (0.23) | (0.07) |

| 4/30/2013 | $11.18 | 0.23 | 0.05 | 0.28 | (0.23) | (0.01) |

| Class C |

| 4/30/2017 | $10.88 | 0.19 | (0.36) | (0.17) | (0.19) | (0.06) |

| 4/30/2016 | $10.81 | 0.21 | 0.11 | 0.32 | (0.21) | (0.04) |

| 4/30/2015 | $10.82 | 0.23 | 0.01 | 0.24 | (0.23) | (0.02) |

| 4/30/2014 | $11.22 | 0.23 | (0.33) | (0.10) | (0.23) | (0.07) |

| 4/30/2013 | $11.18 | 0.23 | 0.04 | 0.27 | (0.22) | (0.01) |

| Class R4 |

| 4/30/2017 | $10.87 | 0.30 | (0.38) | (0.08) | (0.29) | (0.06) |

| 4/30/2016 | $10.79 | 0.32 | 0.12 | 0.44 | (0.32) | (0.04) |

| 4/30/2015 | $10.80 | 0.33 | 0.02 | 0.35 | (0.34) | (0.02) |

| 4/30/2014 | $11.20 | 0.34 | (0.33) | 0.01 | (0.34) | (0.07) |

| 4/30/2013 (c) | $11.12 | 0.04 | 0.08 | 0.12 | (0.04) | — |

| Class Y |

| 4/30/2017 (e) | $10.41 | 0.05 | 0.07 | 0.12 | (0.05) | — |

| Class Z |

| 4/30/2017 | $10.88 | 0.30 | (0.37) | (0.07) | (0.30) | (0.06) |

| 4/30/2016 | $10.81 | 0.32 | 0.11 | 0.43 | (0.32) | (0.04) |

| 4/30/2015 | $10.82 | 0.34 | 0.01 | 0.35 | (0.34) | (0.02) |

| 4/30/2014 | $11.22 | 0.34 | (0.33) | 0.01 | (0.34) | (0.07) |

| 4/30/2013 | $11.18 | 0.34 | 0.05 | 0.39 | (0.34) | (0.01) |

| Notes to Financial Highlights |

| (a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| (c) | Class R4 shares commenced operations on March 19, 2013. Per share data and total return reflect activity from that date. |

| (d) | Annualized. |

| (e) | Class Y shares commenced operations on March 1, 2017. Per share data and total return reflect activity from that date. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 18 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Total

distributions to

shareholders | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| |

| (0.33) | $10.45 | (0.93%) | 1.03% | 0.81% | 2.54% | 14% | $18,934 |

| (0.33) | $10.88 | 3.78% | 1.04% | 0.81% | 2.73% | 13% | $20,377 |

| (0.33) | $10.81 | 2.98% | 1.06% | 0.81% | 2.83% | 19% | $20,060 |

| (0.38) | $10.82 | 0.02% | 1.07% | 0.81% | 2.89% | 5% | $16,728 |

| (0.32) | $11.21 | 3.16% | 1.03% | 0.81% | 2.77% | 16% | $21,517 |

| |

| (0.25) | $10.46 | (1.67%) | 1.77% | 1.56% | 1.77% | 14% | $59 |

| (0.25) | $10.89 | 3.10% | 1.80% | 1.56% | 1.99% | 13% | $152 |

| (0.25) | $10.81 | 2.21% | 1.81% | 1.56% | 2.09% | 19% | $163 |

| (0.30) | $10.82 | (0.82%) | 1.83% | 1.56% | 2.15% | 5% | $212 |

| (0.24) | $11.22 | 2.48% | 1.78% | 1.56% | 2.04% | 16% | $216 |

| |

| (0.25) | $10.46 | (1.57%) | 1.78% | 1.56% | 1.78% | 14% | $3,733 |

| (0.25) | $10.88 | 3.01% | 1.79% | 1.56% | 1.98% | 13% | $4,996 |

| (0.25) | $10.81 | 2.21% | 1.81% | 1.56% | 2.08% | 19% | $4,612 |

| (0.30) | $10.82 | (0.82%) | 1.82% | 1.56% | 2.14% | 5% | $3,501 |

| (0.23) | $11.22 | 2.48% | 1.78% | 1.56% | 2.02% | 16% | $4,301 |

| |

| (0.35) | $10.44 | (0.68%) | 0.77% | 0.56% | 2.79% | 14% | $275 |

| (0.36) | $10.87 | 4.14% | 0.79% | 0.56% | 2.98% | 13% | $250 |

| (0.36) | $10.79 | 3.24% | 0.81% | 0.56% | 3.09% | 19% | $220 |

| (0.41) | $10.80 | 0.18% | 0.88% | 0.56% | 3.21% | 5% | $37 |

| (0.04) | $11.20 | 1.07% | 0.72% (d) | 0.53% (d) | 3.12% (d) | 16% | $3 |

| |

| (0.05) | $10.48 | 1.17% | 0.64% (d) | 0.43% (d) | 3.04% (d) | 14% | $10 |

| |

| (0.36) | $10.45 | (0.68%) | 0.78% | 0.56% | 2.79% | 14% | $46,421 |

| (0.36) | $10.88 | 4.04% | 0.79% | 0.56% | 2.98% | 13% | $52,315 |

| (0.36) | $10.81 | 3.24% | 0.81% | 0.56% | 3.09% | 19% | $54,037 |

| (0.41) | $10.82 | 0.18% | 0.82% | 0.56% | 3.14% | 5% | $58,973 |

| (0.35) | $11.22 | 3.51% | 0.78% | 0.56% | 3.02% | 16% | $73,154 |

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 19 |

Notes to Financial Statements

April 30, 2017

Note 1. Organization

Columbia AMT-Free Georgia Intermediate Muni Bond Fund (the Fund), a series of Columbia Funds Series Trust (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Different share classes pay different distribution amounts to the extent the expenses of such share classes differ, and distributions in liquidation will be proportional to the net asset value of each share class. Each share class has its own expense and sales charge structure. The Fund offers each of the share classes identified below.

Class A shares are subject to a maximum front-end sales charge of 3.00% based on the initial investment amount. Class A shares purchased without an initial sales charge are subject to a contingent deferred sales charge (CDSC) of 0.75% on certain investments of $500,000 or more if redeemed within 12 months after purchase.

The Fund no longer accepts investments by new or existing investors in the Fund’s Class B shares, except in connection with the reinvestment of any dividend and/or capital gain distributions in Class B shares of the Fund and exchanges by existing Class B shareholders of certain other funds within the Columbia Family of Funds. Class B shares are typically subject to a maximum CDSC of 3.00% based upon the holding period after purchase. However, the Fund’s current Class B investors, having held their shares for the requisite time period, are no longer subject to a CDSC upon redemption of their shares. Effective on or about July 17, 2017, Class B shares will automatically convert to Class A shares and the Fund will no longer accept investments by new or existing investors in Class B shares.

Class C shares are subject to a 1.00% CDSC on shares redeemed within 12 months after purchase.

Class R4 shares are not subject to sales charges and are generally available only to omnibus retirement plans and certain investors as described in the Fund’s prospectus.

Class Y shares are not subject to sales charges or distribution and service (12b-1) fees, and are available to institutional and certain other investors as described in the Fund’s prospectus. Class Y shares commenced operations on March 1, 2017.

Class Z shares are not subject to sales charges and are generally available only to eligible investors, which are subject to different investment minimums as described in the Fund’s prospectus.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Debt securities generally are valued by pricing services approved by the Board of Trustees based upon market transactions for normal, institutional-size trading units of similar securities. The services may use various pricing techniques that take into account, as applicable, factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as approved independent broker-dealer quotes. Debt securities for which quotations are not readily available or

| 20 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Notes to Financial Statements (continued)

April 30, 2017

not believed to be reflective of market value may also be valued based upon a bid quote from an approved independent broker-dealer. Debt securities maturing in 60 days or less are valued primarily at amortized cost value, unless this method results in a valuation that management believes does not approximate market value.

Investments for which market quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by and under the general supervision of the Board of Trustees. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published price for the security.

The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine fair value.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Security transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income recognition

Interest income is recorded on an accrual basis. Market premiums and discounts, including original issue discounts, are amortized and accreted, respectively, over the expected life of the security on all debt securities, unless otherwise noted.

The Fund may place a debt security on non-accrual status and reduce related interest income when it becomes probable that the interest will not be collected and the amount of uncollectible interest can be reasonably estimated. A defaulted debt security is removed from non-accrual status when the issuer resumes interest payments or when collectibility of interest is reasonably assured.

Expenses

General expenses of the Trust are allocated to the Fund and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of class net asset value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Fund on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal income tax status

The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its tax exempt and taxable income (including net short-term capital gains), if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Fund intends to distribute in each calendar year substantially all of its net investment income, capital gains and certain other amounts, if any, such that the Fund should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Distributions to shareholders

Distributions from net investment income, if any, are declared daily and paid monthly. Net realized capital gains, if any, are distributed at least annually. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017

| 21 |

Notes to Financial Statements (continued)

April 30, 2017

Guarantees and indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust or its funds. In addition, certain of the Fund’s contracts with its service providers contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

Investment company reporting modernization

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and forms, and amendments to certain current rules and forms, to modernize reporting and disclosure of information by registered investment companies. The amendments to Regulation S-X will require standardized, enhanced disclosure about derivatives in investment company financial statements, and will also change the rules governing the form and content of such financial statements. The amendments to Regulation S-X take effect on August 1, 2017. At this time, management is assessing the anticipated impact of these regulatory developments.

Note 3. Fees and other transactions with affiliates

Management services fees

The Fund entered into a Management Agreement with Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). Under the Management Agreement, the Investment Manager provides the Fund with investment research and advice, as well as administrative and accounting services. The management services fee is an annual fee that is equal to a percentage of the Fund’s average daily net assets that declines from 0.47% to 0.31% as the Fund’s net assets increase. The effective management services fee rate for the year ended April 30, 2017 was 0.47% of the Fund’s average daily net assets.

Other expenses

Other expenses are for, among other things, miscellaneous expenses of the Fund or the Board of Trustees, including payments to Board Services Corp., a company providing limited administrative services to the Fund and the Board of Trustees. That company’s expenses include boardroom and office expense, employee compensation, employee health and retirement benefits, and certain other expenses.

Compensation of board members

Members of the Board of Trustees, who are not officers or employees of the Investment Manager or Ameriprise Financial, are compensated for their services to the Fund as disclosed in the Statement of Operations. Under a Deferred Compensation Plan (the Plan), these members of the Board of Trustees may elect to defer payment of up to 100% of their compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of certain funds managed by the Investment Manager. The Fund’s liability for these amounts is adjusted for market value changes and remains in the Fund until distributed in accordance with the Plan. All amounts payable under the Plan constitute a general unsecured obligation of the Fund.

Compensation of Chief Compliance Officer

The Board of Trustees has appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations. A portion of the Chief Compliance Officer’s total compensation is allocated to the Fund, along with other affiliated funds governed by the Board of Trustees, based on relative net assets. The total amount allocated to all affiliated funds governed by the Board of Trustees will not exceed $40,000 annually.

| 22 | Columbia AMT-Free Georgia Intermediate Muni Bond Fund | Annual Report 2017 |

Notes to Financial Statements (continued)

April 30, 2017

Transfer agency fees

Under a Transfer and Dividend Disbursing Agent Agreement, Columbia Management Investment Services Corp. (the Transfer Agent), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, is responsible for providing transfer agency services to the Fund. The Transfer Agent has contracted with Boston Financial Data Services (BFDS) to serve as sub-transfer agent. The Transfer Agent pays the fees of BFDS for services as sub-transfer agent and BFDS is not entitled to reimbursement for such fees from the Fund (with the exception of out-of-pocket fees).

The Fund pays the Transfer Agent a monthly transfer agency fee based on the number or the average value of accounts, depending on the type of account. In addition, prior to October 1, 2016, the Transfer Agent also received sub-transfer agency fees based on a percentage of the average aggregate value of the Fund’s shares maintained in omnibus accounts (other than omnibus accounts for which American Enterprise Investment Services Inc. is the broker of record or accounts where the beneficial shareholder is a customer of Ameriprise Financial Services, Inc., for which the Transfer Agent receives a per account fee). Effective October 1, 2016, the Fund pays the Transfer Agent a fee for shareholder services based on the number of accounts or on a percentage of the average aggregate value of the Fund’s shares maintained in omnibus accounts up to the lesser of the amount charged by the financial intermediary or a cap established by the Board of Trustees from time to time.

The Transfer Agent also receives compensation from the Fund for various shareholder services and reimbursements for certain out-of-pocket fees. Total transfer agency fees for Class Y shares are subject to an annual limitation of not more than 0.025% of the average daily net assets attributable to Class Y shares.

For the year ended April 30, 2017, the Fund’s effective transfer agency fee rates as a percentage of average daily net assets of each class were as follows:

| | Effective rate (%) |

| Class A | 0.16 |

| Class B | 0.17 |

| Class C | 0.16 |

| Class R4 | 0.16 |

| Class Y | 0.025 (a) |

| Class Z | 0.16 |