UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09645

Columbia Funds Series Trust

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: April 30

Date of reporting period: April 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

April 30, 2023

Columbia North Carolina Intermediate Municipal Bond Fund

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

If you elect to receive the shareholder report for Columbia North Carolina Intermediate Municipal Bond Fund (the Fund) in paper, mailed to you, the Fund mails one shareholder report to each shareholder address, unless such shareholder elects to receive shareholder reports from the Fund electronically via e-mail or by having a paper notice mailed to you (Postcard Notice) that your Fund’s shareholder report is available at the Columbia funds’ website (columbiathreadneedleus.com/investor/). If you would like more than one report in paper to be mailed to you, or would like to elect to receive reports via e-mail or access them through Postcard Notice, please call shareholder services at 800.345.6611 and additional reports will be sent to you.

Proxy voting policies and procedures

The policy of the Board of Trustees is to vote the proxies of the companies in which the Fund holds investments consistent with the procedures as stated in the Statement of Additional Information (SAI). You may obtain a copy of the SAI without charge by calling 800.345.6611; contacting your financial intermediary; visiting columbiathreadneedleus.com/investor/; or searching the website of the Securities and Exchange Commission (SEC) at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities is filed with the SEC by August 31st for the most recent 12-month period ending June 30th of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/, or searching the website of the SEC at sec.gov.

Quarterly schedule of investments

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-PORT, is available on columbiathreadneedleus.com/investor/ or can also be obtained without charge, upon request, by calling 800.345.6611.

Additional Fund information

For more information about the Fund, please visit columbiathreadneedleus.com/investor/ or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the Investment Manager)

290 Congress Street

Boston, MA 02210

Fund distributor

Columbia Management Investment Distributors, Inc.

290 Congress Street

Boston, MA 02210

Fund transfer agent

Columbia Management Investment Services Corp.

P.O. Box 219104

Kansas City, MO 64121-9104

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

Fund at a Glance

(Unaudited)

Investment objective

The Fund seeks current income exempt from U.S. federal income tax and North Carolina individual income tax, consistent with moderate fluctuation of principal.

Portfolio management

Paul Fuchs, CFA

Lead Portfolio Manager

Managed Fund since 2016

Douglas Rangel, CFA

Portfolio Manager

Managed the Fund since June 2022

| Average annual total returns (%) (for the period ended April 30, 2023) |

| | | Inception | 1 Year | 5 Years | 10 Years | |

| Class A | Excluding sales charges | 12/14/92 | 2.37 | 1.16 | 1.11 | |

| | Including sales charges | | -0.70 | 0.55 | 0.80 | |

| Advisor Class | 03/19/13 | 2.72 | 1.43 | 1.36 | |

| Class C | Excluding sales charges | 12/16/92 | 1.62 | 0.43 | 0.35 | |

| | Including sales charges | | 0.62 | 0.43 | 0.35 | |

| Institutional Class | 12/11/92 | 2.62 | 1.41 | 1.36 | |

| Institutional 3 Class* | 03/01/17 | 2.68 | 1.49 | 1.41 | |

| Bloomberg 3-15 Year Blend Municipal Bond Index | | 3.71 | 2.18 | 2.14 | |

Returns for Class A shares are shown with and without the maximum initial sales charge of 3.00%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products /mutual-funds/appended-performance for more information. |

The Bloomberg 3–15 Year Blend Municipal Bond Index is an unmanaged index that tracks the performance of municipal bonds issued after December 31, 1990, with remaining maturities between 2 and 17 years and at least $7 million in principal amount outstanding.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 3 |

Fund at a Glance (continued)

(Unaudited)

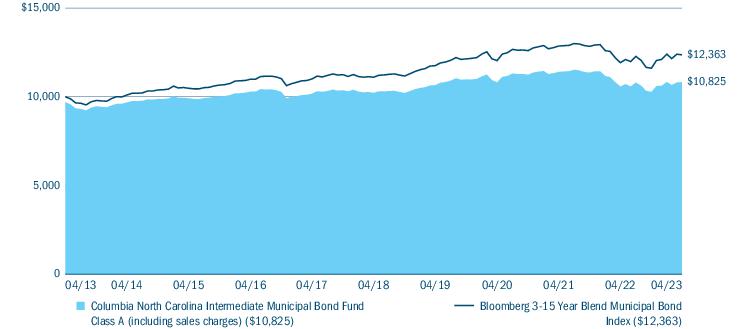

Performance of a hypothetical $10,000 investment (April 30, 2013 — April 30, 2023)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia North Carolina Intermediate Municipal Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

| Portfolio breakdown (%) (at April 30, 2023) |

| Money Market Funds | 100.0 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 4 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Manager Discussion of Fund Performance

(Unaudited)

On May 5, 2023, the Fund was liquidated in accordance with the Plan of Liquidation and Termination approved by the Board of Trustees of the Funds.

For the 12-month period that ended April 30, 2023, Class A shares of Columbia North Carolina Intermediate Municipal Bond Fund returned 2.37% excluding sales charges. Institutional Class shares of the Fund returned 2.62%. During the same time period, the Fund’s benchmark, the Bloomberg 3-15 Year Blend Municipal Bond Index, which is national in scope, returned 3.71%.

Market overview

For fixed-income markets, the period was dominated by the U.S. Federal Reserve’s (Fed) efforts to return inflation to its target levels and the resultant dramatic increase in interest rates. Indeed, the Fed ratcheted its targeted federal funds rate higher by 450 basis points, and municipal bond yields followed suit with yields across most of its spectrum of maturities rising as well. (A basis point is 1/100th of a percentage point.) Municipal bond yields peaked in October 2022, however, and subsequently retraced somewhat, returning most segments of the municipal bond market to positive total returns for the period overall. Still, for the period as a whole, yields on one-year and two-year municipal bonds increased 106 basis points and 47 basis points, respectively. Yields on municipal bonds with maturities of less than one year rose even more significantly, driving an inversion of the short-term end of the yield curve for much of the period. Yields for municipal bonds with maturities of between five years and 13 years declined modestly, and longer term maturity yields rose moderately.

Amid these conditions, investor sentiment within the municipal bond market was negative for much of the period. Rising rates and negative total returns through much of 2022 precipitated the largest outflow cycle ever experienced by the municipal bond market. Fund flows then stabilized and slowed into year-end but any optimism around a resumption of inflows in 2023 was quashed as another $6 billion of outflows through the end of April showed investors were still cautious about returning to the market. Consequently, technicals, or supply/demand dynamics, were not favorable within the municipal bond market during the period, largely driven by this lack of demand. Short-term municipal bond funds were not spared the effects of the outflow cycle. However, they were less impacted than their long-term, high-yield and intermediate fund counterparts, as short-term municipal bond funds generally hold more liquid positions, and shorter maturities inherently provide ample cash flow. Supply, or lack thereof during the period, proved a bright spot. Rate volatility coupled with healthy balance sheets sidelined many issuers, with tax-exempt issuance approximately 10% to 15% lower during the period than long-term averages. Not having to contend with an oversupply of new issuance likely buoyed the market as whatever new issues did come to market were well received.

All that said, fundamental factors were broadly supportive of the municipal bond market during the period. Municipal credit health benefited from positive U.S. economic growth, outperformance of tax collections, and strong reserve positions by most state and local governments, owing partly to COVID-19 policies stimulus. Revenue sectors, however, were more mixed. Essential services, such as water & sewer and utilities, held steady, and transportation sectors, such as airports and toll roads, rebounded strongly with increased traffic levels. Public mass transit was the exception, as subway/bus traffic across most major cities remained well below pre-pandemic levels. Fundamental credit health for hospitals and other health care sectors, such as senior living facilities and continuing care retirement communities (CCRCs), was modestly weaker overall. Higher labor costs, lighter balance sheets due to repayment of Medicare acceleration payments and investment market losses served to weaken health care fundamentals as did the full expenditure of any COVID-19 funding. As a whole, higher quality municipal bonds outperformed lower quality securities during the period.

The Fund’s notable detractors during the period

| • | During the second half of the period, the Fund’s below benchmark duration prevented the Fund from fully participating in the sharp turn in interest rates and market rally. As yields declined from November 2022 through April 2023, the Fund’s benchmark returned an impressive 6.52% as the 10-year municipal benchmark yield declined by roughly 80 basis points. |

| • | The Fund’s underweighted allocation, relative to its benchmark, to maturities on the long portion (15+ years) of the yield curve also hampered returns. |

| • | The Fund’s underweighted allocation to airports, special tax and state and local general obligation (GO) bonds also detracted from relative returns during the period, as did Fund holdings within those sectors. |

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 5 |

Manager Discussion of Fund Performance (continued)

(Unaudited)

| • | Persistent outflows across the municipal bond market also detracted from Fund performance as the funding of shareholder liquidity required price concessions at times. Related to this, the Fund was liquidated soon after the close of the period due to lack of interest. |

The Fund’s notable contributors during the period

| • | During the first half of the period, the Fund’s below benchmark duration helped to limit price declines. As yields rose from May 2022 through October 2022, the Fund’s benchmark returned -2.64% as the 10 year municipal benchmark yield rose roughly 70 basis points. |

| • | The Fund’s allocation to shorter maturities was additive, as were Fund holdings in the 12-15 year portion of the yield curve. |

| • | The Fund’s sector allocation saw positive contributions from overweights within education, water & sewer and leasing. While issue selection was largely negative, the Fund did realize some modest contributions from performance within leasing and local GOs. |

Fixed-income securities present issuer default risk. The Fund invests substantially in municipal securities and will be affected by tax, legislative, regulatory, demographic or political changes, as well as changes impacting a state’s financial, economic or other conditions. A relatively small number of tax-exempt issuers may necessitate the Fund investing more heavily in a single issuer and, therefore, be more exposed to the risk of loss than a fund that invests more broadly. The value of the Fund’s portfolio may be more volatile than a more geographically diversified fund. Prepayment and extension risk exists because the timing of payments on a loan, bond or other investment may accelerate when interest rates fall or decelerate when interest rates rise which may reduce investment opportunities and potential returns. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Federal and state tax rules apply to capital gain distributions and any gains or losses on sales. Income may be subject to state or local taxes. Liquidity risk is associated with the difficulty of selling underlying investments at a desirable time or price. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties who have contributed to this report. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Understanding Your Fund’s Expenses

(Unaudited)

As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| November 1, 2022 — April 30, 2023 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,053.50 | 1,020.55 | 4.08 | 4.01 | 0.81 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,056.00 | 1,021.73 | 2.87 | 2.83 | 0.57 |

| Class C | 1,000.00 | 1,000.00 | 1,051.00 | 1,016.87 | 7.85 | 7.71 | 1.56 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,054.80 | 1,021.73 | 2.87 | 2.83 | 0.57 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,055.00 | 1,022.07 | 2.52 | 2.48 | 0.50 |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 7 |

Portfolio of Investments

April 30, 2023

(Percentages represent value of investments compared to net assets)

Investments in securities

| Money Market Funds 100.6% |

| | Shares | Value ($) |

| JPMorgan Institutional Tax Free Money Market Fund, Institutional Shares, 3.136%(a) | 47,254,525 | 47,265,877 |

Total Money Market Funds

(Cost $47,265,877) | 47,265,877 |

Total Investments in Securities

(Cost: $47,265,877) | 47,265,877 |

| Other Assets & Liabilities, Net | | (282,435) |

| Net Assets | 46,983,442 |

Notes to Portfolio of Investments

| (a) | The rate shown is the seven-day current annualized yield at April 30, 2023. |

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| ■ | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments. |

| ■ | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| ■ | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The Fund’s Board of Trustees (the Board) has designated the Investment Manager, through its Valuation Committee (the Committee), as valuation designee, responsible for determining the fair value of the assets of the Fund for which market quotations are not readily available using valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. Representatives of Columbia Management Investment Advisers, LLC report to the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The accompanying Notes to Financial Statements are an integral part of this statement.

| 8 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Portfolio of Investments (continued)

April 30, 2023

Fair value measurements (continued)

The following table is a summary of the inputs used to value the Fund’s investments at April 30, 2023:

| | Level 1 ($) | Level 2 ($) | Level 3 ($) | Total ($) |

| Investments in Securities | | | | |

| Money Market Funds | 47,265,877 | — | — | 47,265,877 |

| Total Investments in Securities | 47,265,877 | — | — | 47,265,877 |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 9 |

Statement of Assets and Liabilities

April 30, 2023

| Assets | |

| Investments in securities, at value | |

| Unaffiliated issuers (cost $47,265,877) | $47,265,877 |

| Receivable for: | |

| Capital shares sold | 38,247 |

| Dividends | 39,716 |

| Expense reimbursement due from Investment Manager | 316 |

| Prepaid expenses | 1,094 |

| Total assets | 47,345,250 |

| Liabilities | |

| Payable for: | |

| Capital shares purchased | 158,861 |

| Distributions to shareholders | 72,185 |

| Management services fees | 608 |

| Distribution and/or service fees | 87 |

| Transfer agent fees | 1,957 |

| Compensation of board members | 108,954 |

| Other expenses | 19,156 |

| Total liabilities | 361,808 |

| Net assets applicable to outstanding capital stock | $46,983,442 |

| Represented by | |

| Paid in capital | 53,267,217 |

| Total distributable earnings (loss) | (6,283,775) |

| Total - representing net assets applicable to outstanding capital stock | $46,983,442 |

| Class A | |

| Net assets | $9,412,818 |

| Shares outstanding | 965,138 |

| Net asset value per share | $9.75 |

| Maximum sales charge | 3.00% |

| Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | $10.05 |

| Advisor Class | |

| Net assets | $2,601,721 |

| Shares outstanding | 267,176 |

| Net asset value per share | $9.74 |

| Class C | |

| Net assets | $824,213 |

| Shares outstanding | 84,551 |

| Net asset value per share | $9.75 |

| Institutional Class | |

| Net assets | $8,844,803 |

| Shares outstanding | 907,696 |

| Net asset value per share | $9.74 |

| Institutional 3 Class | |

| Net assets | $25,299,887 |

| Shares outstanding | 2,588,792 |

| Net asset value per share | $9.77 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 10 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Statement of Operations

Year Ended April 30, 2023

| Net investment income | |

| Income: | |

| Dividends — unaffiliated issuers | $62,968 |

| Interest | 2,881,990 |

| Total income | 2,944,958 |

| Expenses: | |

| Management services fees | 481,955 |

| Distribution and/or service fees | |

| Class A | 33,453 |

| Class C | 13,687 |

| Transfer agent fees | |

| Class A | 10,292 |

| Advisor Class | 2,022 |

| Class C | 1,048 |

| Institutional Class | 16,186 |

| Institutional 3 Class | 4,032 |

| Compensation of board members | 7,467 |

| Custodian fees | 1,420 |

| Printing and postage fees | 14,652 |

| Registration fees | 12,946 |

| Accounting services fees | 30,090 |

| Legal fees | 13,989 |

| Interest on interfund lending | 3,484 |

| Compensation of chief compliance officer | 17 |

| Other | 15,142 |

| Total expenses | 661,882 |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | (86,159) |

| Total net expenses | 575,723 |

| Net investment income | 2,369,235 |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Investments — unaffiliated issuers | (5,529,752) |

| Net realized loss | (5,529,752) |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — unaffiliated issuers | 5,017,204 |

| Net change in unrealized appreciation (depreciation) | 5,017,204 |

| Net realized and unrealized loss | (512,548) |

| Net increase in net assets resulting from operations | $1,856,687 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 11 |

Statement of Changes in Net Assets

| | Year Ended

April 30, 2023 | Year Ended

April 30, 2022 |

| Operations | | |

| Net investment income | $2,369,235 | $3,630,876 |

| Net realized loss | (5,529,752) | (460,218) |

| Net change in unrealized appreciation (depreciation) | 5,017,204 | (16,041,904) |

| Net increase (decrease) in net assets resulting from operations | 1,856,687 | (12,871,246) |

| Distributions to shareholders | | |

| Net investment income and net realized gains | | |

| Class A | (271,980) | (283,914) |

| Advisor Class | (59,672) | (62,331) |

| Class C | (17,545) | (21,526) |

| Institutional Class | (483,641) | (495,087) |

| Institutional 3 Class | (1,489,096) | (2,777,311) |

| Total distributions to shareholders | (2,321,934) | (3,640,169) |

| Decrease in net assets from capital stock activity | (113,079,257) | (18,411,052) |

| Total decrease in net assets | (113,544,504) | (34,922,467) |

| Net assets at beginning of year | 160,527,946 | 195,450,413 |

| Net assets at end of year | $46,983,442 | $160,527,946 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 12 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Statement of Changes in Net Assets (continued)

| | Year Ended | Year Ended |

| | April 30, 2023 | April 30, 2022 |

| | Shares | Dollars ($) | Shares | Dollars ($) |

| Capital stock activity |

| Class A | | | | |

| Subscriptions | 143,852 | 1,383,785 | 131,657 | 1,339,765 |

| Distributions reinvested | 23,345 | 225,649 | 22,081 | 230,301 |

| Redemptions | (837,306) | (8,054,273) | (173,908) | (1,803,504) |

| Net decrease | (670,109) | (6,444,839) | (20,170) | (233,438) |

| Advisor Class | | | | |

| Subscriptions | 92,951 | 895,577 | 47,588 | 504,984 |

| Distributions reinvested | 6,162 | 59,463 | 5,963 | 62,141 |

| Redemptions | (129,707) | (1,250,529) | (75,134) | (789,925) |

| Net decrease | (30,594) | (295,489) | (21,583) | (222,800) |

| Class C | | | | |

| Subscriptions | 6,578 | 64,351 | 19,227 | 204,915 |

| Distributions reinvested | 1,577 | 15,237 | 1,840 | 19,188 |

| Redemptions | (118,345) | (1,140,428) | (64,901) | (666,623) |

| Net decrease | (110,190) | (1,060,840) | (43,834) | (442,520) |

| Institutional Class | | | | |

| Subscriptions | 642,739 | 6,201,569 | 516,703 | 5,310,747 |

| Distributions reinvested | 43,709 | 421,988 | 40,420 | 420,845 |

| Redemptions | (2,307,100) | (22,377,800) | (485,514) | (4,986,226) |

| Net increase (decrease) | (1,620,652) | (15,754,243) | 71,609 | 745,366 |

| Institutional 3 Class | | | | |

| Subscriptions | 325,313 | 3,146,858 | 662,796 | 7,037,929 |

| Distributions reinvested | 7,220 | 69,950 | 5,911 | 61,644 |

| Redemptions | (9,583,483) | (92,740,654) | (2,481,764) | (25,357,233) |

| Net decrease | (9,250,950) | (89,523,846) | (1,813,057) | (18,257,660) |

| Total net decrease | (11,682,495) | (113,079,257) | (1,827,035) | (18,411,052) |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 13 |

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The ratios of expenses and net investment income are annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | Net asset value,

beginning of

period | Net

investment

income | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Total

distributions to

shareholders |

| Class A |

| Year Ended 4/30/2023 | $9.72 | 0.20 | 0.03(c) | 0.23 | (0.20) | (0.20) |

| Year Ended 4/30/2022 | $10.65 | 0.17 | (0.93) | (0.76) | (0.17) | (0.17) |

| Year Ended 4/30/2021 | $10.27 | 0.18 | 0.38 | 0.56 | (0.18) | (0.18) |

| Year Ended 4/30/2020 | $10.33 | 0.21 | (0.06) | 0.15 | (0.21) | (0.21) |

| Year Ended 4/30/2019 | $10.14 | 0.24 | 0.19 | 0.43 | (0.24) | (0.24) |

| Advisor Class |

| Year Ended 4/30/2023 | $9.70 | 0.23 | 0.03(c) | 0.26 | (0.22) | (0.22) |

| Year Ended 4/30/2022 | $10.64 | 0.20 | (0.94) | (0.74) | (0.20) | (0.20) |

| Year Ended 4/30/2021 | $10.26 | 0.20 | 0.38 | 0.58 | (0.20) | (0.20) |

| Year Ended 4/30/2020 | $10.32 | 0.24 | (0.06) | 0.18 | (0.24) | (0.24) |

| Year Ended 4/30/2019 | $10.12 | 0.26 | 0.20 | 0.46 | (0.26) | (0.26) |

| Class C |

| Year Ended 4/30/2023 | $9.72 | 0.13 | 0.03(c) | 0.16 | (0.13) | (0.13) |

| Year Ended 4/30/2022 | $10.65 | 0.09 | (0.93) | (0.84) | (0.09) | (0.09) |

| Year Ended 4/30/2021 | $10.27 | 0.10 | 0.38 | 0.48 | (0.10) | (0.10) |

| Year Ended 4/30/2020 | $10.33 | 0.13 | (0.06) | 0.07 | (0.13) | (0.13) |

| Year Ended 4/30/2019 | $10.13 | 0.16 | 0.20 | 0.36 | (0.16) | (0.16) |

| Institutional Class |

| Year Ended 4/30/2023 | $9.71 | 0.23 | 0.02(c) | 0.25 | (0.22) | (0.22) |

| Year Ended 4/30/2022 | $10.64 | 0.20 | (0.93) | (0.73) | (0.20) | (0.20) |

| Year Ended 4/30/2021 | $10.26 | 0.20 | 0.38 | 0.58 | (0.20) | (0.20) |

| Year Ended 4/30/2020 | $10.32 | 0.24 | (0.06) | 0.18 | (0.24) | (0.24) |

| Year Ended 4/30/2019 | $10.13 | 0.26 | 0.19 | 0.45 | (0.26) | (0.26) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 14 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Class A |

| Year Ended 4/30/2023 | $9.75 | 2.37% | 0.90%(d) | 0.81%(d) | 2.09% | 2% | $9,413 |

| Year Ended 4/30/2022 | $9.72 | (7.20%) | 0.86%(d) | 0.80%(d) | 1.65% | 6% | $15,892 |

| Year Ended 4/30/2021 | $10.65 | 5.45% | 0.88% | 0.81% | 1.68% | 15% | $17,634 |

| Year Ended 4/30/2020 | $10.27 | 1.43% | 0.85% | 0.81% | 2.01% | 7% | $17,176 |

| Year Ended 4/30/2019 | $10.33 | 4.26% | 0.87%(e) | 0.81%(e) | 2.32% | 23% | $16,469 |

| Advisor Class |

| Year Ended 4/30/2023 | $9.74 | 2.72% | 0.66%(d) | 0.56%(d) | 2.36% | 2% | $2,602 |

| Year Ended 4/30/2022 | $9.70 | (7.07%) | 0.61%(d) | 0.55%(d) | 1.90% | 6% | $2,889 |

| Year Ended 4/30/2021 | $10.64 | 5.72% | 0.63% | 0.56% | 1.93% | 15% | $3,396 |

| Year Ended 4/30/2020 | $10.26 | 1.69% | 0.60% | 0.56% | 2.26% | 7% | $4,928 |

| Year Ended 4/30/2019 | $10.32 | 4.62% | 0.62%(e) | 0.56%(e) | 2.57% | 23% | $5,505 |

| Class C |

| Year Ended 4/30/2023 | $9.75 | 1.62% | 1.65%(d) | 1.56%(d) | 1.32% | 2% | $824 |

| Year Ended 4/30/2022 | $9.72 | (7.90%) | 1.61%(d) | 1.55%(d) | 0.90% | 6% | $1,892 |

| Year Ended 4/30/2021 | $10.65 | 4.67% | 1.62% | 1.55% | 0.93% | 15% | $2,541 |

| Year Ended 4/30/2020 | $10.27 | 0.68% | 1.60% | 1.56% | 1.26% | 7% | $3,070 |

| Year Ended 4/30/2019 | $10.33 | 3.58% | 1.62%(e) | 1.56%(e) | 1.57% | 23% | $4,096 |

| Institutional Class |

| Year Ended 4/30/2023 | $9.74 | 2.62% | 0.65%(d) | 0.56%(d) | 2.34% | 2% | $8,845 |

| Year Ended 4/30/2022 | $9.71 | (6.98%) | 0.61%(d) | 0.55%(d) | 1.90% | 6% | $24,549 |

| Year Ended 4/30/2021 | $10.64 | 5.72% | 0.63% | 0.56% | 1.93% | 15% | $26,145 |

| Year Ended 4/30/2020 | $10.26 | 1.69% | 0.60% | 0.56% | 2.26% | 7% | $23,700 |

| Year Ended 4/30/2019 | $10.32 | 4.52% | 0.62%(e) | 0.56%(e) | 2.57% | 23% | $22,897 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 15 |

Financial Highlights (continued)

| | Net asset value,

beginning of

period | Net

investment

income | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Total

distributions to

shareholders |

| Institutional 3 Class |

| Year Ended 4/30/2023 | $9.74 | 0.23 | 0.03(c) | 0.26 | (0.23) | (0.23) |

| Year Ended 4/30/2022 | $10.67 | 0.21 | (0.93) | (0.72) | (0.21) | (0.21) |

| Year Ended 4/30/2021 | $10.29 | 0.21 | 0.38 | 0.59 | (0.21) | (0.21) |

| Year Ended 4/30/2020 | $10.36 | 0.25 | (0.07) | 0.18 | (0.25) | (0.25) |

| Year Ended 4/30/2019 | $10.16 | 0.27 | 0.20 | 0.47 | (0.27) | (0.27) |

| Notes to Financial Highlights |

| (a) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (b) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| (c) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

| (d) | Ratios include interfund lending expense which is less than 0.01%. |

| (e) | Ratios include line of credit interest expense which is less than 0.01%. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 16 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Financial Highlights (continued)

| | Net

asset

value,

end of

period | Total

return | Total gross

expense

ratio to

average

net assets(a) | Total net

expense

ratio to

average

net assets(a),(b) | Net investment

income

ratio to

average

net assets | Portfolio

turnover | Net

assets,

end of

period

(000’s) |

| Institutional 3 Class |

| Year Ended 4/30/2023 | $9.77 | 2.68% | 0.57%(d) | 0.49%(d) | 2.36% | 2% | $25,300 |

| Year Ended 4/30/2022 | $9.74 | (6.88%) | 0.53%(d) | 0.48%(d) | 1.98% | 6% | $115,305 |

| Year Ended 4/30/2021 | $10.67 | 5.79% | 0.55% | 0.48% | 2.00% | 15% | $145,734 |

| Year Ended 4/30/2020 | $10.29 | 1.67% | 0.52% | 0.48% | 2.34% | 7% | $141,450 |

| Year Ended 4/30/2019 | $10.36 | 4.70% | 0.53%(e) | 0.48%(e) | 2.65% | 23% | $120,551 |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 17 |

Notes to Financial Statements

April 30, 2023

Note 1. Organization

Columbia North Carolina Intermediate Municipal Bond Fund (the Fund), a series of Columbia Funds Series Trust (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers each of the share classes listed in the Statement of Assets and Liabilities. Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Each share class has its own expense and sales charge structure. Different share classes may have different minimum initial investment amounts and pay different net investment income distribution amounts to the extent the expenses of distributing such share classes vary. Distributions to shareholders in a liquidation will be proportional to the net asset value of each share class.

As described in the Fund’s prospectus, Class A and Class C shares are offered to the general public for investment. Class C shares automatically convert to Class A shares after 8 years. Advisor Class, Institutional Class and Institutional 3 Class shares are available through authorized investment professionals to omnibus retirement plans or to institutional investors and to certain other investors as also described in the Fund’s prospectus.

The Board of Trustees of the Fund approved a Plan of Liquidation and Termination pursuant to which the Fund was liquidated and terminated. Effective at the open of business on April 14, 2023, the Fund was closed to new investors, and any applicable contingent deferred sales charges were waived on redemptions and exchanges out of the Fund. The Fund was liquidated on May 5, 2023, at which time the Fund’s shareholders received a liquidating distribution in an amount equal to the net asset value of their Fund shares.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Investments in open-end investment companies (other than exchange-traded funds (ETFs)), are valued at the latest net asset value reported by those companies as of the valuation time.

Investments for which market quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by the Board of Trustees. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published price for the security, if available.

The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine fair value.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

| 18 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

April 30, 2023

Security transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income recognition

Interest income is recorded on an accrual basis. Market premiums and discounts, including original issue discounts, are amortized and accreted, respectively, over the expected life of the security on all debt securities, unless otherwise noted.

The Fund may place a debt security on non-accrual status and reduce related interest income when it becomes probable that the interest will not be collected and the amount of uncollectible interest can be reasonably estimated. The Fund may also adjust accrual rates when it becomes probable the full interest will not be collected and a partial payment will be received. A defaulted debt security is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Dividend income is recorded on the ex-dividend date.

Expenses

General expenses of the Trust are allocated to the Fund and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of class net asset value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Fund on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal income tax status

The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its net tax-exempt and investment company taxable income and net capital gain, if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Fund intends to distribute in each calendar year substantially all of its ordinary income, capital gain net income and certain other amounts, if any, such that the Fund should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Distributions to shareholders

Distributions from net investment income, if any, are declared daily and paid monthly. Net realized capital gains, if any, are distributed at least annually. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

Guarantees and indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust or its funds. In addition, certain of the Fund’s contracts with its service providers contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

Recent accounting pronouncement

Tailored Shareholder Reports

In October 2022, the Securities and Exchange Commission (SEC) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 19 |

Notes to Financial Statements (continued)

April 30, 2023

that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment.

Note 3. Fees and other transactions with affiliates

Management services fees

The Fund has entered into a Management Agreement with Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). Under the Management Agreement, the Investment Manager provides the Fund with investment research and advice, as well as administrative and accounting services. The management services fee is an annual fee that is equal to a percentage of the Fund’s daily net assets that declines from 0.47% to 0.31% as the Fund’s net assets increase. The effective management services fee rate for the year ended April 30, 2023 was 0.47% of the Fund’s average daily net assets.

Compensation of board members

Members of the Board of Trustees who are not officers or employees of the Investment Manager or Ameriprise Financial are compensated for their services to the Fund as disclosed in the Statement of Operations. Under a Deferred Compensation Plan (the Deferred Plan), these members of the Board of Trustees may elect to defer payment of up to 100% of their compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of certain funds managed by the Investment Manager. The Fund’s liability for these amounts is adjusted for market value changes and remains in the Fund until distributed in accordance with the Deferred Plan. All amounts payable under the Deferred Plan constitute a general unsecured obligation of the Fund. The expense for the Deferred Plan, which includes Trustees’ fees deferred during the current period as well as any gains or losses on the Trustees’ deferred compensation balances as a result of market fluctuations, is included in "Compensation of board members" in the Statement of Operations.

Compensation of Chief Compliance Officer

The Board of Trustees has appointed a Chief Compliance Officer for the Fund in accordance with federal securities regulations. As disclosed in the Statement of Operations, a portion of the Chief Compliance Officer’s total compensation is allocated to the Fund, along with other allocations to affiliated registered investment companies managed by the Investment Manager and its affiliates, based on relative net assets.

Transfer agency fees

Under a Transfer and Dividend Disbursing Agent Agreement, Columbia Management Investment Services Corp. (the Transfer Agent), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, is responsible for providing transfer agency services to the Fund. The Transfer Agent has contracted with SS&C GIDS, Inc. (SS&C GIDS) to serve as sub-transfer agent. Prior to January 1, 2023, SS&C GIDS was known as DST Asset Manager Solutions, Inc. The Transfer Agent pays the fees of SS&C GIDS for services as sub-transfer agent and SS&C GIDS is not entitled to reimbursement for such fees from the Fund (with the exception of out-of-pocket fees).

The Fund pays the Transfer Agent a monthly transfer agency fee based on the number or the average value of accounts, depending on the type of account. In addition, the Fund pays the Transfer Agent a fee for shareholder services based on the number of accounts or on a percentage of the average aggregate value of the Fund’s shares maintained in omnibus accounts up to the lesser of the amount charged by the financial intermediary or a cap established by the Board of Trustees from time to time.

The Transfer Agent also receives compensation from the Fund for various shareholder services and reimbursements for certain out-of-pocket fees. Total transfer agency fees for Institutional 3 Class shares are subject to an annual limitation of not more than 0.02% of the average daily net assets attributable to Institutional 3 Class shares.

| 20 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

April 30, 2023

For the year ended April 30, 2023, the Fund’s effective transfer agency fee rates as a percentage of average daily net assets of each class were as follows:

| | Effective rate (%) |

| Class A | 0.08 |

| Advisor Class | 0.08 |

| Class C | 0.08 |

| Institutional Class | 0.08 |

| Institutional 3 Class | 0.01 |

An annual minimum account balance fee of $20 may apply to certain accounts with a value below the applicable share class’s initial minimum investment requirements to reduce the impact of small accounts on transfer agency fees. These minimum account balance fees are remitted to the Fund and recorded as part of expense reductions in the Statement of Operations. For the year ended April 30, 2023, no minimum account balance fees were charged by the Fund.

Distribution and service fees

The Fund has entered into an agreement with Columbia Management Investment Distributors, Inc. (the Distributor), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, for distribution and shareholder services. The Board of Trustees has approved, and the Fund has adopted, distribution and shareholder service plans (the Plans) applicable to certain share classes, which set the distribution and service fees for the Fund. These fees are calculated daily and are intended to compensate the Distributor and/or eligible selling and/or servicing agents for selling shares of the Fund and providing services to investors.

Under the Plans, the Fund pays a monthly combined distribution and service fee to the Distributor at the maximum annual rate of 0.25% of the average daily net assets attributable to Class A shares of the Fund. Also under the Plans, the Fund pays a monthly service fee to the Distributor at the maximum annual rate of 0.25% of the average daily net assets attributable to Class C shares of the Fund and a monthly distribution fee to the Distributor at the maximum annual rate of 0.75% of the average daily net assets attributable to Class C shares of the Fund.

Sales charges (unaudited)

Sales charges, including front-end charges and contingent deferred sales charges (CDSCs), received by the Distributor for distributing Fund shares for the year ended April 30, 2023, if any, are listed below:

| | Front End (%) | CDSC (%) | Amount ($) |

| Class A | 3.00 | 0.75(a) | 1,986 |

| Class C | — | 1.00(b) | 11 |

| (a) | This charge is imposed on certain investments of $500,000 or more if redeemed within 12 months after purchase. |

| (b) | This charge applies to redemptions within 12 months after purchase, with certain limited exceptions. |

The Fund’s other share classes are not subject to sales charges.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 21 |

Notes to Financial Statements (continued)

April 30, 2023

Expenses waived/reimbursed by the Investment Manager and its affiliates

The Investment Manager and certain of its affiliates have contractually agreed to waive fees and/or reimburse expenses (excluding certain fees and expenses described below) for the period(s) disclosed below, unless sooner terminated at the sole discretion of the Board of Trustees, so that the Fund’s net operating expenses, after giving effect to fees waived/expenses reimbursed and any balance credits and/or overdraft charges from the Fund’s custodian, do not exceed the following annual rate(s) as a percentage of the classes’ average daily net assets:

| | September 1, 2022

through

August 31, 2023 | Prior to

September 1, 2022 |

| Class A | 0.81% | 0.81% |

| Advisor Class | 0.56 | 0.56 |

| Class C | 1.56 | 1.56 |

| Institutional Class | 0.56 | 0.56 |

| Institutional 3 Class | 0.50 | 0.48 |

Under the agreement governing these fee waivers and/or expense reimbursement arrangements, the following fees and expenses are excluded from the waiver/reimbursement commitment, and therefore will be paid by the Fund, if applicable: taxes (including foreign transaction taxes), expenses associated with investments in affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange-traded funds), transaction costs and brokerage commissions, costs related to any securities lending program, dividend expenses associated with securities sold short, inverse floater program fees and expenses, transaction charges and interest on borrowed money, interest, costs associated with shareholder meetings, infrequent and/or unusual expenses and any other expenses the exclusion of which is specifically approved by the Board of Trustees. This agreement may be modified or amended only with approval from the Investment Manager, certain of its affiliates and the Fund. Any fees waived and/or expenses reimbursed under the expense reimbursement arrangements described above are not recoverable by the Investment Manager or its affiliates in future periods.

Note 4. Federal tax information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP because of temporary or permanent book to tax differences.

At April 30, 2023, these differences were primarily due to differing treatment for capital loss carryforwards, trustees’ deferred compensation, distributions and re-characterization of distributions for investments. To the extent these differences were permanent, reclassifications were made among the components of the Fund’s net assets. Temporary differences do not require reclassifications.

The following reclassifications were made:

Undistributed net

investment

income ($) | Accumulated

net realized

(loss) ($) | Paid in

capital ($) |

| (1) | 1 | — |

Net investment income (loss) and net realized gains (losses), as disclosed in the Statement of Operations, and net assets were not affected by this reclassification.

The tax character of distributions paid during the years indicated was as follows:

| Year Ended April 30, 2023 | Year Ended April 30, 2022 |

Ordinary

income ($) | Tax-exempt

income ($) | Long-term

capital gains ($) | Total ($) | Ordinary

income ($) | Tax-exempt

income ($) | Long-term

capital gains ($) | Total ($) |

| 19,498 | 2,302,436 | — | 2,321,934 | 667 | 3,639,502 | — | 3,640,169 |

Short-term capital gain distributions, if any, are considered ordinary income distributions for tax purposes.

| 22 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

April 30, 2023

At April 30, 2023, the components of distributable earnings on a tax basis were as follows:

Undistributed

ordinary income ($) | Undistributed tax-

exempt income ($) | Undistributed

long-term

capital gains ($) | Capital loss

carryforwards ($) | Net unrealized

appreciation ($) |

| — | 954,578 | — | (7,058,432) | — |

At April 30, 2023, the cost of all investments for federal income tax purposes along with the aggregate gross unrealized appreciation and depreciation based on that cost was:

Federal

tax cost ($) | Gross unrealized

appreciation ($) | Gross unrealized

(depreciation) ($) | Net unrealized

appreciation ($) |

| 47,265,877 | — | — | — |

Tax cost of investments and unrealized appreciation/(depreciation) may also include timing differences that do not constitute adjustments to tax basis.

The following capital loss carryforwards, determined at April 30, 2023, may be available to reduce future net realized gains on investments, if any, to the extent permitted by the Internal Revenue Code. In addition, for the year ended April 30, 2023, capital loss carryforwards utilized, if any, were as follows:

No expiration

short-term ($) | No expiration

long-term ($) | Total ($) | Utilized ($) |

| (637,155) | (6,421,277) | (7,058,432) | — |

Management of the Fund has concluded that there are no significant uncertain tax positions in the Fund that would require recognition in the financial statements. However, management’s conclusion may be subject to review and adjustment at a later date based on factors including, but not limited to, new tax laws, regulations, and administrative interpretations (including relevant court decisions). Generally, the Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Note 5. Portfolio information

The cost of purchases and proceeds from sales of securities, excluding short-term investments and derivatives, if any, aggregated to $1,809,339 and $157,696,903, respectively, for the year ended April 30, 2023. The amount of purchase and sale activity impacts the portfolio turnover rate reported in the Financial Highlights.

Note 6. Interfund lending

Pursuant to an exemptive order granted by the Securities and Exchange Commission, the Fund participates in a program (the Interfund Program) allowing each participating Columbia Fund (each, a Participating Fund) to lend money directly to and, except for closed-end funds and money market funds, borrow money directly from other Participating Funds for temporary purposes. The amounts eligible for borrowing and lending under the Interfund Program are subject to certain restrictions.

Interfund loans are subject to the risk that the borrowing fund could be unable to repay the loan when due, and a delay in repayment to the lending fund could result in lost opportunities and/or additional lending costs. The exemptive order is subject to conditions intended to mitigate conflicts of interest arising from the Investment Manager’s relationship with each Participating Fund.

The Fund’s activity in the Interfund Program during the year ended April 30, 2023 was as follows:

| Borrower or lender | Average loan

balance ($) | Weighted average

interest rate (%) | Number of days

with outstanding loans |

| Borrower | 1,241,935 | 3.36 | 31 |

Interest expense incurred by the Fund is recorded as Interfund lending in the Statement of Operations. The Fund had no outstanding interfund loans at April 30, 2023.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 23 |

Notes to Financial Statements (continued)

April 30, 2023

Note 7. Line of credit

The Fund has access to a revolving credit facility with a syndicate of banks led by JPMorgan Chase Bank, N.A., Citibank, N.A. and Wells Fargo Bank, N.A. whereby the Fund may borrow for the temporary funding of shareholder redemptions or for other temporary or emergency purposes. Pursuant to an October 27, 2022 amendment and restatement, the credit facility, which is an agreement between the Fund and certain other funds managed by the Investment Manager or an affiliated investment manager, severally and not jointly, permits aggregate borrowings up to $950 million. Interest is currently charged to each participating fund based on its borrowings at a rate equal to the higher of (i) the federal funds effective rate, (ii) the secured overnight financing rate plus 0.10% and (iii) the overnight bank funding rate, plus in each case, 1.00%. Each borrowing under the credit facility matures no later than 60 days after the date of borrowing. The Fund also pays a commitment fee equal to its pro rata share of the unused amount of the credit facility at a rate of 0.15% per annum. The commitment fee is included in other expenses in the Statement of Operations. This agreement expires annually in October unless extended or renewed. Prior to the October 27, 2022 amendment and restatement, the Fund had access to a revolving credit facility with a syndicate of banks led by JPMorgan Chase Bank, N.A., Citibank, N.A. and Wells Fargo Bank, N.A. which permitted collective borrowings up to $950 million. Interest was charged to each participating fund based on its borrowings at a rate equal to the higher of (i) the federal funds effective rate, (ii) the secured overnight financing rate plus 0.11448% and (iii) the overnight bank funding rate, plus in each case, 1.00%.

The Fund had no borrowings during the year ended April 30, 2023.

Note 8. Significant risks

Market risk

The Fund may incur losses due to declines in the value of one or more securities in which it invests. These declines may be due to factors affecting a particular issuer, or the result of, among other things, political, regulatory, market, economic or social developments affecting the relevant market(s) more generally. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Fund’s ability to price or value hard-to-value assets in thinly traded and closed markets and could cause significant redemptions and operational challenges. Global economies and financial markets are increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies worldwide. As a result, local, regional or global events such as terrorism, war, natural disasters, disease/virus outbreaks and epidemics or other public health issues, recessions, depressions or other events – or the potential for such events – could have a significant negative impact on global economic and market conditions.

Money market fund investment risk

An investment in a money market fund is not a bank deposit and is not insured or guaranteed by any bank, the FDIC or any other government agency. Certain money market funds float their net asset value while others seek to preserve the value of investments at a stable net asset value (typically, $1.00 per share). An investment in a money market fund, even an investment in a fund seeking to maintain a stable net asset value per share, is not guaranteed and it is possible for the Fund to lose money by investing in these and other types of money market funds. If the liquidity of a money market fund’s portfolio deteriorates below certain levels, the money market fund may suspend redemptions (i.e., impose a redemption gate) and thereby prevent the Fund from selling its investment in the money market fund or impose a fee of up to 2% on amounts the Fund redeems from the money market fund (i.e., impose a liquidity fee). These measures may result in an investment loss or prohibit the Fund from redeeming shares when the Investment Manager would otherwise redeem shares. In addition to the fees and expenses that the Fund directly bears, the Fund indirectly bears the fees and expenses of any money market funds in which it invests, including affiliated money market funds. By investing in a money market fund, the Fund will be exposed to the investment risks of the money market fund in direct proportion to such investment. To the extent the Fund invests in instruments such as derivatives, the Fund may hold investments, which may be significant, in money market fund shares to cover its obligations resulting from the Fund’s investments in such instruments. Money market funds and the securities they

| 24 | Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023 |

Notes to Financial Statements (continued)

April 30, 2023

invest in are subject to comprehensive regulations. The enactment of new legislation or regulations, as well as changes in interpretation and enforcement of current laws, may affect the manner of operation, performance and/or yield of money market funds.

Shareholder concentration risk

At April 30, 2023, two unaffiliated shareholders of record owned 69.1% of the outstanding shares of the Fund in one or more accounts. The Fund has no knowledge about whether any portion of those shares was owned beneficially. Subscription and redemption activity by concentrated accounts may have a significant effect on the operations of the Fund. In the case of a large redemption, the Fund may be forced to sell investments at inopportune times, including its liquid positions, which may result in Fund losses and the Fund holding a higher percentage of less liquid positions. Large redemptions could result in decreased economies of scale and increased operating expenses for non-redeeming Fund shareholders.

Note 9. Subsequent events

Management has evaluated the events and transactions that have occurred through the date the financial statements were issued. Other than as noted in Note 1 above, there were no items requiring adjustment of the financial statements or additional disclosure.

Note 10. Information regarding pending and settled legal proceedings

Ameriprise Financial and certain of its affiliates are involved in the normal course of business in legal proceedings which include regulatory inquiries, arbitration and litigation, including class actions concerning matters arising in connection with the conduct of their activities as part of a diversified financial services firm. Ameriprise Financial believes that the Fund is not currently the subject of, and that neither Ameriprise Financial nor any of its affiliates are the subject of, any pending legal, arbitration or regulatory proceedings that are likely to have a material adverse effect on the Fund or the ability of Ameriprise Financial or its affiliates to perform under their contracts with the Fund. Ameriprise Financial is required to make quarterly (10-Q), annual (10-K) and, as necessary, 8-K filings with the Securities and Exchange Commission (SEC) on legal and regulatory matters that relate to Ameriprise Financial and its affiliates. Copies of these filings may be obtained by accessing the SEC website at www.sec.gov.

There can be no assurance that these matters, or the adverse publicity associated with them, will not result in increased Fund redemptions, reduced sale of Fund shares or other adverse consequences to the Fund. Further, although we believe proceedings are not likely to have a material adverse effect on the Fund or the ability of Ameriprise Financial or its affiliates to perform under their contracts with the Fund, these proceedings are subject to uncertainties and, as such, we are unable to estimate the possible loss or range of loss that may result. An adverse outcome in one or more of these proceedings could result in adverse judgments, settlements, fines, penalties or other relief that could have a material adverse effect on the consolidated financial condition or results of operations of Ameriprise Financial or one or more of its affiliates that provides services to the Fund.

Columbia North Carolina Intermediate Municipal Bond Fund | Annual Report 2023

| 25 |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Columbia Funds Series Trust and Shareholders of Columbia North Carolina Intermediate Municipal Bond Fund

Opinion on the Financial Statements