UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09645

Columbia Funds Series Trust

(Exact name of registrant as specified in charter)

290 Congress Street

Boston, MA 02210

(Address of principal executive offices) (Zip code)

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, MA 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: February 29

Date of reporting period: February 29, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Convertible Securities Fund

Annual Report

February 29, 2024

In October 2022, the Securities and Exchange Commission (SEC) adopted a final rule, "Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements." The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendments.

Each Tailored Shareholder Report will be share-class specific and will highlight key fund information the SEC believes is most relevant to investors in assessing their investment in the Fund. Much of the information, including a Fund’s financial statements, that is currently disclosed in a Fund’s shareholder reports will instead be made available on the Fund’s website and filed on Form N-CSR on an annual and semiannual basis. This information will be delivered to investors free of charge upon request. Columbia Fund reports will follow the Tailored Shareholder Report approach beginning with reports covering the period ending May 31, 2024.

The new rule also requires the Fund to mail a printed version of the Tailored Shareholder Report to all shareholders who have not elected to receive shareholder reports electronically. Rather than receiving a postcard notifying investors that the shareholder report for Funds in which they invest is available online, investors will begin receiving the Tailored Shareholder Report in the mail unless they have elected to receive their Fund documents electronically.

| No Financial Institution Guarantee | |

If you elect to receive the shareholder report for Columbia Convertible Securities Fund (the Fund) in paper, mailed to you, the Fund mails one shareholder report to each shareholder address, unless such shareholder elects to receive shareholder reports from the Fund electronically via e-mail or by having a paper notice mailed to you (Postcard Notice) that your Fund’s shareholder report is available at the Columbia funds’ website (columbiathreadneedleus.com/investor/). If you would like more than one report in paper to be mailed to you, or would like to elect to receive reports via e-mail or access them through Postcard Notice, please call shareholder services at 800.345.6611 and additional reports will be sent to you.

Proxy voting policies and procedures

The policy of the Board of Trustees is to vote the proxies of the companies in which the Fund holds investments consistent with the procedures as stated in the Statement of Additional Information (SAI). You may obtain a copy of the SAI without charge by calling 800.345.6611; contacting your financial intermediary; visiting columbiathreadneedleus.com/investor/; or searching the website of the Securities and Exchange Commission (SEC) at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities is filed with the SEC by August 31st for the most recent 12-month period ending June 30th of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/, or searching the website of the SEC at sec.gov.

Quarterly schedule of investments

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-PORT, is available on columbiathreadneedleus.com/investor/ or can also be obtained without charge, upon request, by calling 800.345.6611.

Additional Fund information

For more information about the Fund, please visit columbiathreadneedleus.com/investor/ or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the Investment Manager)

290 Congress Street

Boston, MA 02210

Fund distributor

Columbia Management Investment Distributors, Inc.

290 Congress Street

Boston, MA 02210

Fund transfer agent

Columbia Management Investment Services Corp.

P.O. Box 219104

Kansas City, MO 64121-9104

Columbia Convertible Securities Fund | Annual Report 2024

Fund at a Glance(Unaudited) Investment objective

The Fund seeks total return, consisting of capital appreciation and current income.

Portfolio management

Yan Jin

Lead Portfolio Manager

Managed Fund since 2006

David King, CFA

Portfolio Manager

Managed Fund since 2010

Grace Lee, CAIA

Portfolio Manager

Managed Fund since 2020

Average annual total returns (%) (for the period ended February 29, 2024) |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

ICE BofA US Convertible Index | | | | |

Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the 1.00% contingent deferred sales charge for the first year only. The Fund’s other share classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each share class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.345.6611.

*

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The ICE BofA US Convertible Index tracks the performance of publicly issued US dollar denominated convertible securities of US companies. Effective July 1, 2022 the ICE BofA US Convertible Index now includes transaction costs.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes, other expenses of investing or, for periods prior to July 2022, transaction costs. Securities in the Fund may not match those in an index.

Columbia Convertible Securities Fund | Annual Report 2024

3

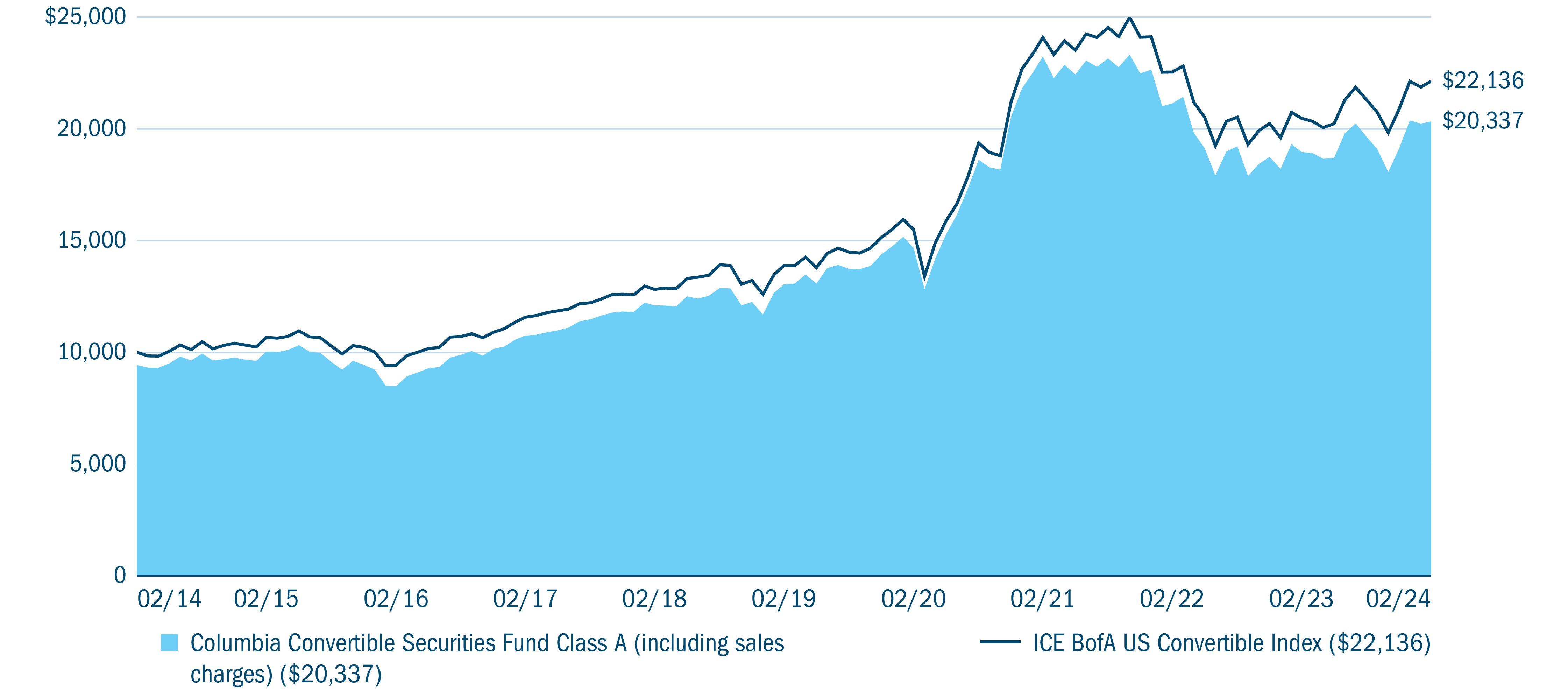

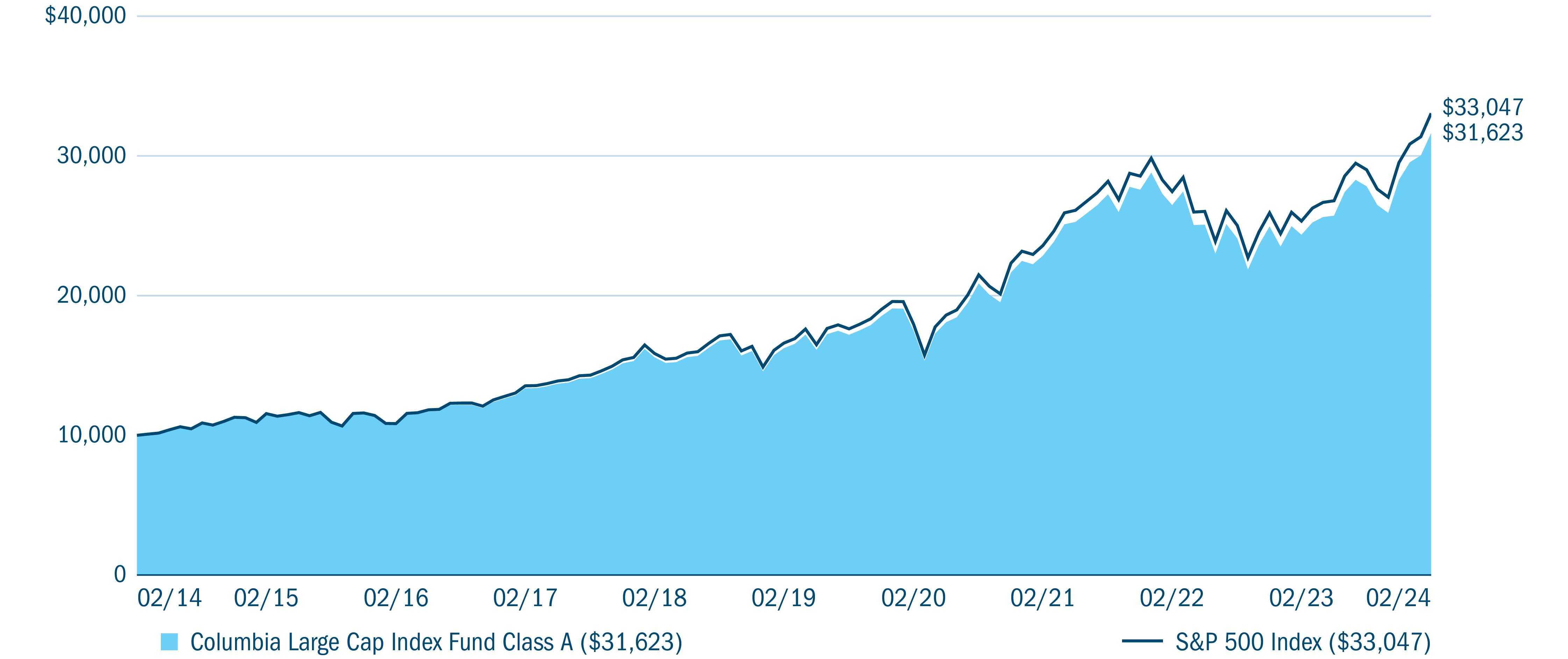

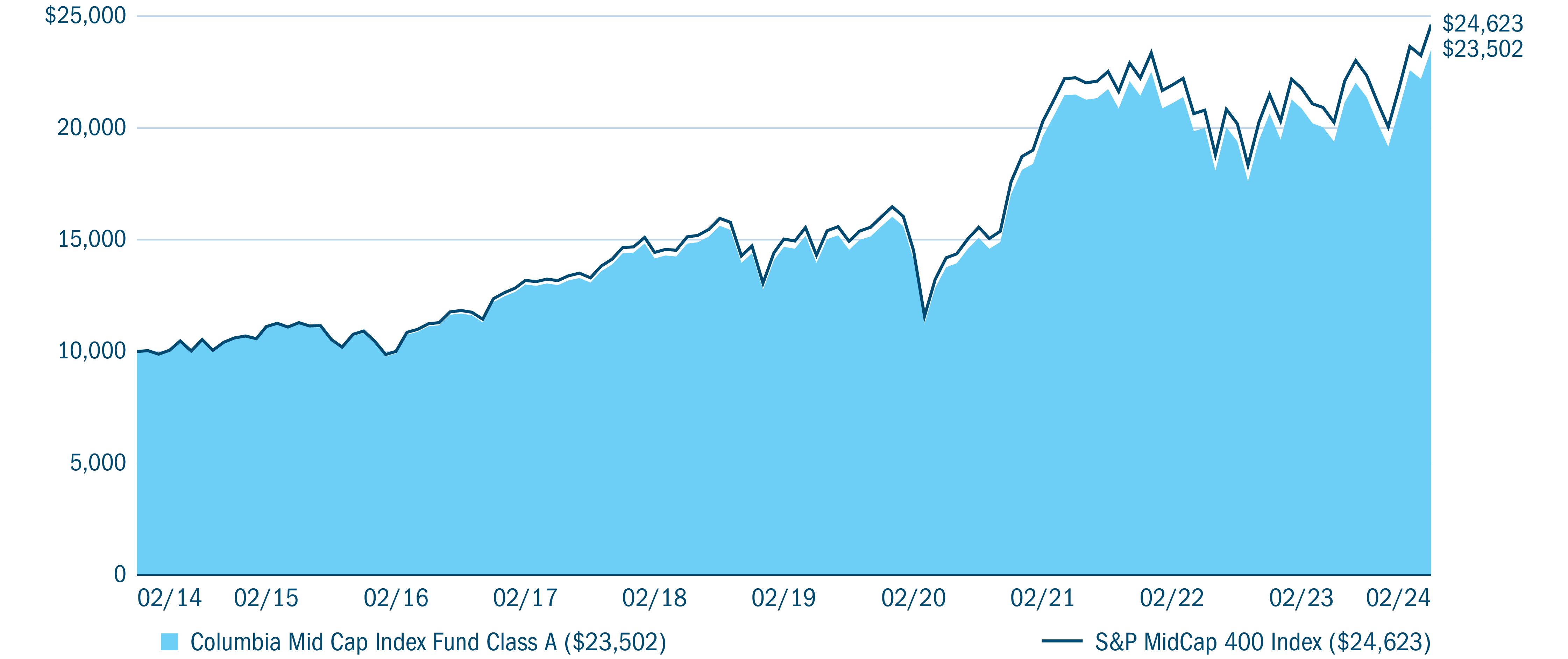

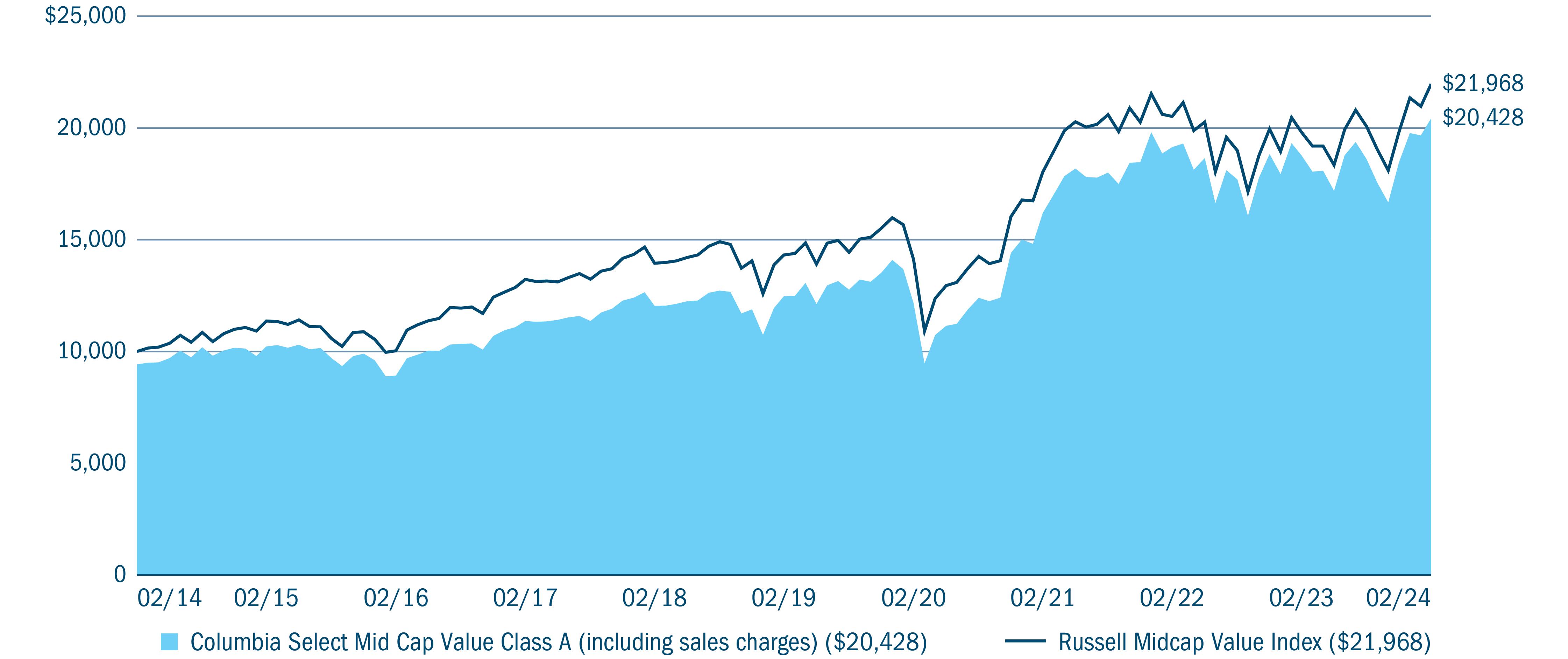

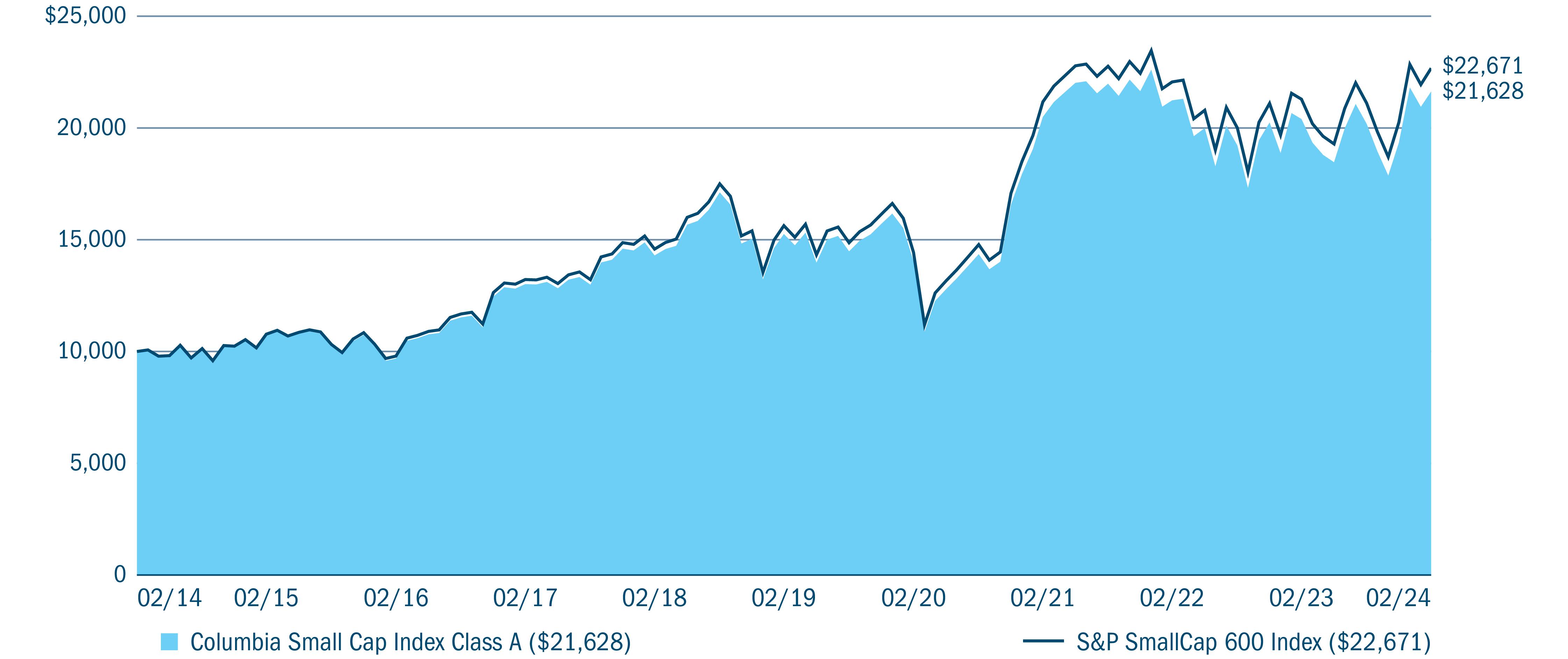

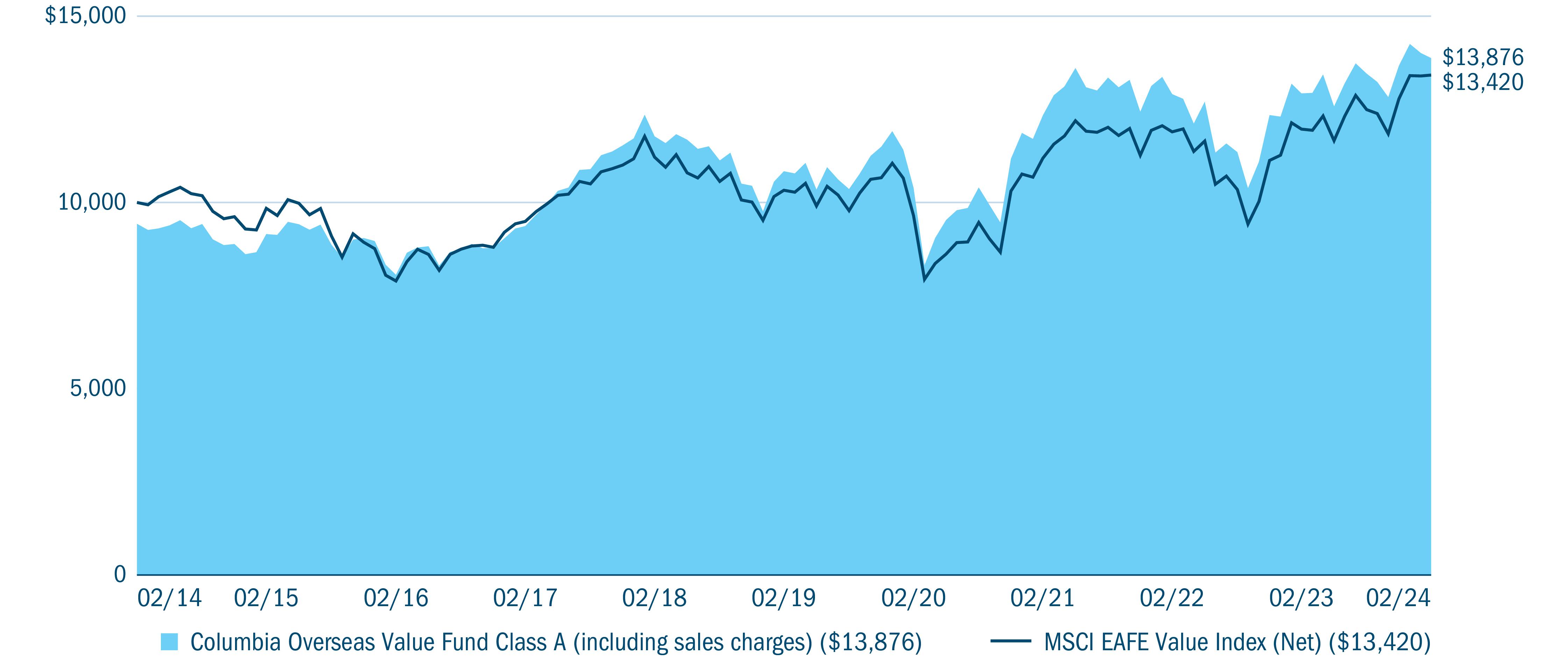

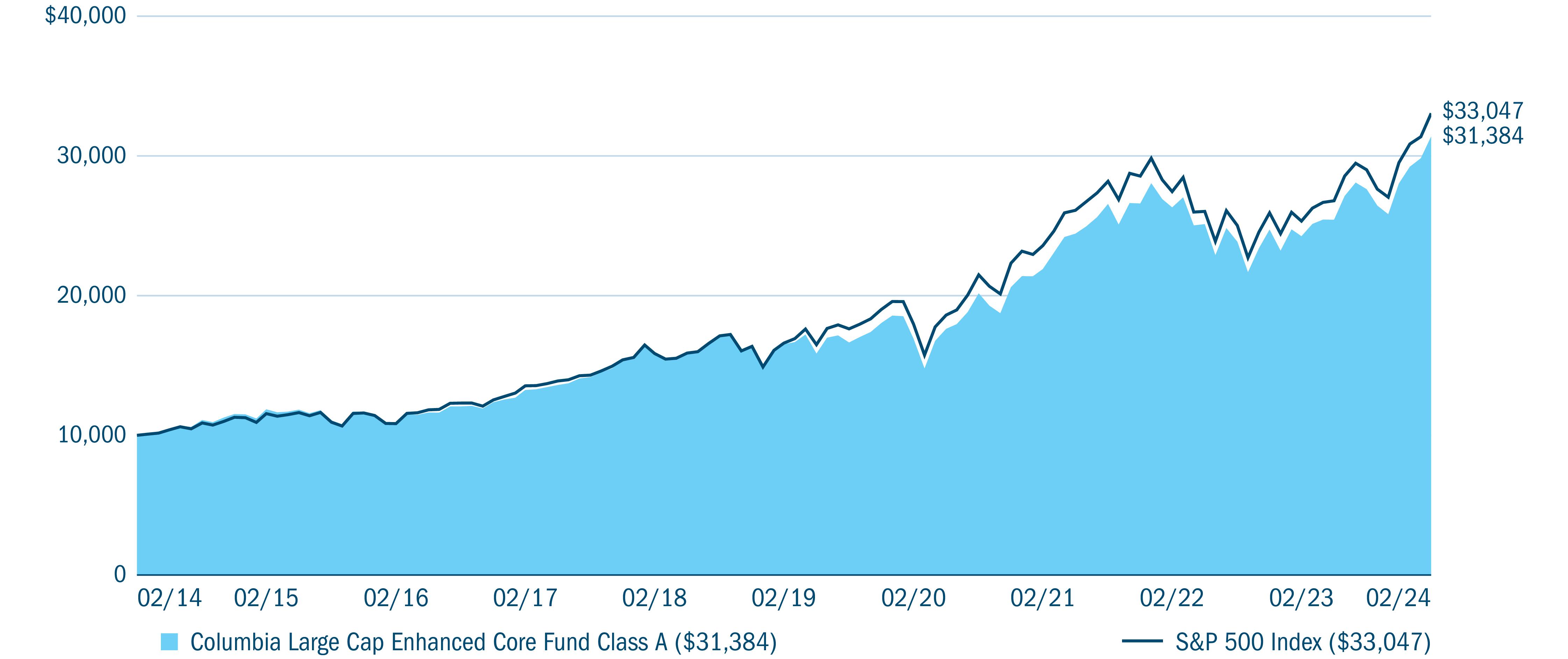

Fund at a Glance (continued)(Unaudited) Performance of a hypothetical $10,000 investment (February 28, 2014 — February 29, 2024)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Convertible Securities Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Portfolio breakdown (%) (at February 29, 2024) |

| |

| |

Convertible Preferred Stocks | |

| |

| |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

4

Columbia Convertible Securities Fund | Annual Report 2024

Manager Discussion of Fund Performance(Unaudited) For the 12-month period that ended February 29, 2024, Class A shares of Columbia Convertible Securities Fund returned 7.25% excluding sales charges. The Fund’s benchmark, the ICE BofA US Convertible Index, returned 8.10% for the same time period.

Market overview

Convertible securities delivered solid returns in the annual period, albeit with elevated volatility. The ICE BofA US Convertible Index generally fluctuated in tandem with shifts in the interest rate outlook. From the beginning of the period through the end of August 2023, the market performed well on expectations that the U.S. Federal Reserve (Fed) would begin to cut interest rates by the end of 2023. This sentiment reversed in mid-summer, however, as better-than-expected economic growth and persistent inflation raised concerns that the Fed would in fact need to keep rates higher for longer. Convertible securities sold off along with other risk assets in response, erasing all of their previous gains by their low in late October 2023.

The environment shifted yet again in November after a report showing slower-than-expected inflation prompted investors to re-think the higher-for-longer narrative. In December, Fed Chair Powell seemingly confirmed this sentiment by indicating that the central bank may in fact begin to cut rates in 2024. The financial markets surged in response, and the ICE BofA US Convertible Index posted an impressive total return in the final two months of 2023 to close at its high for the year. Convertibles continued to tick higher in January and February 2024, enabling the asset class to register a healthy gain for the full 12 months.

The convertible market was helped by the favorable backdrop for growth stocks, given the prevalence of issuers in the health care and information technology sectors. With this said, new issuance was very active both from refinancings and new companies entering the space. We believe this was partly a reflection of the fact that issuers saw an attractive cost of capital in convertibles and used the market as a way to reduce interest expenses. A larger number of issuers that would typically be classified as being in the value category therefore came into the convertible space, including those in the financials, utilities and industrials sectors. We believe this trend has augmented the category’s diversification and reduced its sensitivity to the performance of the growth style in general, and to the information technology and biotechnology sectors in particular.

The Fund’s notable detractors during the period

•

The French online luxury platform Farfetch Ltd. was the Fund’s largest detractor. The company announced a sale to a Korean firm to avoid bankruptcy, a deal that essentially wiped out the value of its unsecured convertible debt.

•

A position in DISH Network Corp. cost the Fund some relative performance, as well. The company’s securities continued to struggle amid worries about DISH Network’s heavy debt burden and high leverage.

•

Wolfspeed, Inc., a producer of specialty semiconductors, was a key Fund detractor. The company’s convertibles declined as higher interest rates increased the cost of acquiring the financing needed to pay for increased capital spending.

•

Infinera Corp., a supplier to major telecommunications companies and data center operators, also lagged due to slower spending by its customers.

The Fund’s notable contributors during the period

•

The Fund benefited from its holdings in the cybersecurity companies Palo Alto Networks, Inc., Zscaler, Inc. and Rapid7, Inc. Network security is expected to remain a top priority for enterprises, leading to continued growth in spending on the related technology.

•

A number of positions in the health care sector helped Fund results as well. Cytokinetics, Inc. was the top contributor in both the sector and the Fund as a whole. The company announced a successful trial for its heart-failure treatment in late December, causing its convertible securities to surge in price. BridgeBio Pharma, Inc., a smaller company that reported a successful trial for a key drug and was the subject of takeover speculation, was another top performer for the Fund in the sector.

Columbia Convertible Securities Fund | Annual Report 2024

5

Manager Discussion of Fund Performance (continued)(Unaudited) •

The consumer sector was another area of strength, thanks to an improving outlook for personal spending. Cruise line operators, including NCL Corp., Ltd. (parent of Norwegian Cruise Lines), Royal Caribbean Cruises Ltd. and Carnival Corp., performed particularly well on anticipation of increased bookings.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Convertible securities are subject to issuer default risk. A rise in interest rates may result in a price decline of fixed-income instruments held by the Fund, negatively impacting its performance and NAV. Falling rates may result in the Fund investing in lower yielding debt instruments, lowering the Fund’s income and yield. These risks may be heightened for longer maturity and duration securities. The Fund may also be forced to convert a convertible security at an inopportune time, which may decrease the Fund’s return. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Short positions (where the underlying asset is not owned) can create unlimited risk. Market or other (e.g., interest rate) environments may adversely affect the liquidity of Fund investments, negatively impacting their price. Generally, the less liquid the market at the time the Fund sells a holding, the greater the risk of loss or decline of value to the Fund. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties who have contributed to this report. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

6

Columbia Convertible Securities Fund | Annual Report 2024

Understanding Your Fund’s Expenses(Unaudited) As an investor, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

September 1, 2023 — February 29, 2024 |

| Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

Columbia Convertible Securities Fund | Annual Report 2024

7

Portfolio of InvestmentsFebruary 29, 2024(Percentages represent value of investments compared to net assets)

Investments in securities

|

| | |

|

Oil, Gas & Consumable Fuels 0.8% |

Ascent Resources, Class B(a),(b),(c),(d) | | |

| | |

| | |

| |

|

|

Clovis Liquidation Trust(a),(b),(d) | | |

| |

|

|

| | |

| |

|

|

| | |

| | |

| | |

| | |

| |

Total Common Stocks

(Cost $38,555,042) | |

|

| | | | |

|

|

| | | | |

|

| | | | |

| |

|

American Airlines Group, Inc. |

| | | | |

|

| | | | |

| |

Convertible Bonds (continued) |

| | | | |

|

|

| | | | |

Rivian Automotive, Inc.(e) |

| | | | |

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

Liberty Media Corp.-Liberty Formula One |

| | | | |

| |

Consumer Cyclical Services 3.3% |

|

| | | | |

Match Group FinanceCo 3, Inc.(e) |

| | | | |

Uber Technologies, Inc.(e) |

| | | | |

|

| | | | |

| |

|

|

| | | | |

Diversified Manufacturing 2.8% |

Advanced Energy Industries, Inc.(e) |

| | | | |

|

| | | | |

|

| | | | |

Greenbrier Companies, Inc. (The) |

| | | | |

| |

The accompanying Notes to Financial Statements are an integral part of this statement.

8

Columbia Convertible Securities Fund | Annual Report 2024

Portfolio of Investments (continued)February 29, 2024 Convertible Bonds (continued) |

| | | | |

|

CenterPoint Energy, Inc.(g) |

|

| | | | |

NextEra Energy Partners LP(e) |

| | | | |

|

| | | | |

| |

|

Chefs’ Warehouse, Inc. (The) |

| | | | |

|

| | | | |

| |

|

DraftKings Holdings, Inc.(f) |

| | | | |

|

| | | | |

| |

|

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

Merit Medical Systems, Inc.(e) |

| | | | |

|

| | | | |

Shockwave Medical, Inc.(e) |

| | | | |

Convertible Bonds (continued) |

| | | | |

|

| | | | |

| |

|

|

| | | | |

|

Chesapeake Energy Escrow(f) |

| | | | |

Northern Oil and Gas, Inc. |

| | | | |

| |

|

|

| | | | |

Live Nation Entertainment, Inc. |

| | | | |

|

| | | | |

Royal Caribbean Cruises Ltd. |

| | | | |

| |

Media and Entertainment 4.0% |

|

| | | | |

|

| | | | |

|

| | | | |

| |

|

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

| |

|

Nabors Industries, Inc.(e) |

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

9

Portfolio of Investments (continued)February 29, 2024 Convertible Bonds (continued) |

| | | | |

Other Financial Institutions 0.7% |

Encore Capital Group, Inc.(e) |

| | | | |

|

|

| | | | |

|

Starwood Property Trust, Inc. |

| | | | |

|

American Water Capital Corp.(e) |

| | | | |

|

|

| | | | |

Collegium Pharmaceutical, Inc. |

| | | | |

|

| | | | |

Esperion Therapeutics, Inc. |

| | | | |

Halozyme Therapeutics, Inc. |

| | | | |

|

| | | | |

Ionis Pharmaceuticals, Inc.(e) |

| | | | |

|

| | | | |

Mirum Pharmaceuticals, Inc.(e) |

| | | | |

|

| | | | |

Sarepta Therapeutics, Inc. |

| | | | |

| |

|

|

| | | | |

|

Burlington Stores, Inc.(e) |

| | | | |

Convertible Bonds (continued) |

| | | | |

|

| | | | |

| | | | |

|

| | | | |

|

| | | | |

| | | | |

| |

|

Akamai Technologies, Inc.(e) |

| | | | |

|

| | | | |

|

| | | | |

BigCommerce Holdings, Inc. |

| | | | |

Bill.com Holdings, Inc.(f) |

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

indie Semiconductor, Inc.(e) |

| | | | |

|

| | | | |

|

| | | | |

MACOM Technology Solutions Holdings, Inc. |

| | | | |

Marathon Digital Holdings, Inc. |

| | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

10

Columbia Convertible Securities Fund | Annual Report 2024

Portfolio of Investments (continued)February 29, 2024 Convertible Bonds (continued) |

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

ON Semiconductor Corp.(e) |

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

SMART Global Holdings, Inc. |

| | | | |

|

| | | | |

Veeco Instruments, Inc.(e) |

| | | | |

Vishay Intertechnology, Inc.(e) |

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

|

| | | | |

| |

Transportation Services 1.5% |

Air Transport Services Group, Inc.(e) |

| | | | |

Convertible Bonds (continued) |

| | | | |

|

| | | | |

| |

Total Convertible Bonds

(Cost $1,231,238,438) | |

Convertible Preferred Stocks 3.8% |

| | | |

|

|

| | | |

|

Apollo Global Management, Inc. | | | |

| |

|

Health Care Providers & Services 0.3% |

BrightSpring Health Services, Inc. | | | |

| |

|

|

Chart Industries, Inc., ADR | | | |

| |

Total Convertible Preferred Stocks

(Cost $48,782,040) | |

|

| | |

Columbia Short-Term Cash Fund, 5.557%(k),(l) | | |

Total Money Market Funds

(Cost $22,984,658) | |

Total Investments in Securities

(Cost: $1,341,560,178) | |

Other Assets & Liabilities, Net | | |

| |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

11

Portfolio of Investments (continued)February 29, 2024 Notes to Portfolio of Investments

| Represents fair value as determined in good faith under procedures approved by the Board of Trustees. At February 29, 2024, the total value of these securities amounted to $3,300,869, which represents 0.24% of total net assets. |

| Non-income producing investment. |

| Denotes a restricted security, which is subject to legal or contractual restrictions on resale under federal securities laws. Disposal of a restricted investment may involve time-consuming negotiations and expenses, and prompt sale at an acceptable price may be difficult to achieve. Private placement securities are generally considered to be restricted, although certain of those securities may be traded between qualified institutional investors under the provisions of Section 4(a)(2) and Rule 144A. The Fund will not incur any registration costs upon such a trade. These securities are valued at fair value determined in good faith under consistently applied procedures approved by the Fund’s Board of Trustees. At February 29, 2024, the total market value of these securities amounted to $2,295,715, which represents 0.17% of total net assets. Additional information on these securities is as follows: |

| | | | |

Ascent Resources, Class B | | | | |

| Valuation based on significant unobservable inputs. |

| Represents privately placed and other securities and instruments exempt from Securities and Exchange Commission registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. At February 29, 2024, the total value of these securities amounted to $441,426,907, which represents 32.41% of total net assets. |

| |

| Represents a variable rate security with a step coupon where the rate adjusts according to a schedule for a series of periods, typically lower for an initial period and then increasing to a higher coupon rate thereafter. The interest rate shown was the current rate as of February 29, 2024. |

| Represents a security in default. |

| Represents a security purchased on a when-issued basis. |

| Perpetual security with no specified maturity date. |

| The rate shown is the seven-day current annualized yield at February 29, 2024. |

| As defined in the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. The value of the holdings and transactions in these affiliated companies during the year ended February 29, 2024 are as follows: |

| | | | Net change in

unrealized

appreciation

(depreciation)($) | | | | |

Columbia Short-Term Cash Fund, 5.557% |

| | | | | | | | |

Abbreviation Legend

| American Depositary Receipt |

Fair value measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

■

Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments.

■

Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

■

Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

The accompanying Notes to Financial Statements are an integral part of this statement.

12

Columbia Convertible Securities Fund | Annual Report 2024

Portfolio of Investments (continued)February 29, 2024 Fair value measurements (continued)

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The Fund’s Board of Trustees (the Board) has designated the Investment Manager, through its Valuation Committee (the Committee), as valuation designee, responsible for determining the fair value of the assets of the Fund for which market quotations are not readily available using valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. Representatives of Columbia Management Investment Advisers, LLC report to the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

The following table is a summary of the inputs used to value the Fund’s investments at February 29, 2024:

| | | | |

Investments in Securities | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Convertible Preferred Stocks | | | | |

| | | | |

| | | | |

| | | | |

Total Convertible Preferred Stocks | | | | |

| | | | |

Total Investments in Securities | | | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical assets.

The Fund does not hold any significant investments (greater than one percent of net assets) categorized as Level 3.

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

13

Statement of Assets and LiabilitiesFebruary 29, 2024

| |

Investments in securities, at value | |

Unaffiliated issuers (cost $1,318,575,520) | |

Affiliated issuers (cost $22,984,658) | |

| |

| |

| |

| |

| |

Expense reimbursement due from Investment Manager | |

| |

| |

| |

| |

| |

Investments purchased on a delayed delivery basis | |

| |

| |

Distribution and/or service fees | |

| |

Compensation of chief compliance officer | |

Compensation of board members | |

| |

Deferred compensation of board members | |

| |

Net assets applicable to outstanding capital stock | |

| |

| |

Total distributable earnings (loss) | |

Total - representing net assets applicable to outstanding capital stock | |

The accompanying Notes to Financial Statements are an integral part of this statement.

14

Columbia Convertible Securities Fund | Annual Report 2024

Statement of Assets and Liabilities (continued)February 29, 2024 | |

| |

| |

Net asset value per share | |

| |

Maximum offering price per share (calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge for Class A shares) | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

| |

| |

| |

Net asset value per share | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

15

Statement of OperationsYear Ended February 29, 2024

| |

| |

Dividends — unaffiliated issuers | |

Dividends — affiliated issuers | |

| |

| |

| |

| |

| |

Distribution and/or service fees | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Printing and postage fees | |

| |

| |

| |

Compensation of chief compliance officer | |

Compensation of board members | |

Deferred compensation of board members | |

| |

| |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | |

| |

| |

| |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments — unaffiliated issuers | |

Investments — affiliated issuers | |

Foreign currency translations | |

| |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | |

Investments — affiliated issuers | |

Foreign currency translations | |

Net change in unrealized appreciation (depreciation) | |

Net realized and unrealized gain | |

Net increase in net assets resulting from operations | |

The accompanying Notes to Financial Statements are an integral part of this statement.

16

Columbia Convertible Securities Fund | Annual Report 2024

Statement of Changes in Net Assets

| Year Ended

February 29, 2024 | Year Ended

February 28, 2023 |

| | |

| | |

| | |

Net change in unrealized appreciation (depreciation) | | |

Net increase (decrease) in net assets resulting from operations | | |

Distributions to shareholders | | |

Net investment income and net realized gains | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Total distributions to shareholders | | |

Decrease in net assets from capital stock activity | | |

Total decrease in net assets | | |

Net assets at beginning of year | | |

Net assets at end of year | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

17

Statement of Changes in Net Assets (continued)

The accompanying Notes to Financial Statements are an integral part of this statement.

18

Columbia Convertible Securities Fund | Annual Report 2024

[THIS PAGE INTENTIONALLY LEFT BLANK]

Columbia Convertible Securities Fund | Annual Report 2024

19

The following table is intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The ratios of expenses and net investment income are annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| Net asset value,

beginning of

period | | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

20

Columbia Convertible Securities Fund | Annual Report 2024

Financial Highlights (continued)

| Net

asset

value,

end of

period | | Total gross

expense

ratio to

average

| Total net

expense

ratio to

average

| Net investment

income

ratio to

average

net assets | | Net

assets,

end of

period

(000’s) |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

21

Financial Highlights (continued)

| Net asset value,

beginning of

period | | Net

realized

and

unrealized

gain (loss) | Total from

investment

operations | Distributions

from net

investment

income | Distributions

from net

realized

gains | Total

distributions to

shareholders |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Notes to Financial Highlights |

| In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

| The benefits derived from expense reductions had an impact of less than 0.01%. |

| Ratios include interfund lending expense which is less than 0.01%. |

The accompanying Notes to Financial Statements are an integral part of this statement.

22

Columbia Convertible Securities Fund | Annual Report 2024

Financial Highlights (continued)

| Net

asset

value,

end of

period | | Total gross

expense

ratio to

average

| Total net

expense

ratio to

average

| Net investment

income

ratio to

average

net assets | | Net

assets,

end of

period

(000’s) |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Columbia Convertible Securities Fund | Annual Report 2024

23

Notes to Financial StatementsFebruary 29, 2024 Note 1. Organization

Columbia Convertible Securities Fund (the Fund), a series of Columbia Funds Series Trust (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

Fund shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers each of the share classes listed in the Statement of Assets and Liabilities. Although all share classes generally have identical voting, dividend and liquidation rights, each share class votes separately when required by the Trust’s organizational documents or by law. Each share class has its own expense and sales charge structure. Different share classes may have different minimum initial investment amounts and pay different net investment income distribution amounts to the extent the expenses of distributing such share classes vary. Distributions to shareholders in a liquidation will be proportional to the net asset value of each share class.

As described in the Fund’s prospectus, Class A and Class C shares are offered to the general public for investment. Class C shares automatically convert to Class A shares after 8 years. Advisor Class, Institutional Class, Institutional 2 Class, Institutional 3 Class and Class R shares are available for purchase through authorized investment professionals to omnibus retirement plans or to institutional investors and to certain other investors as also described in the Fund’s prospectus.

The Fund’s Board of Trustees approved a proposal to liquidate Class R shares of the Fund. Effective on March 11, 2024, Class R shares of the Fund were closed to new and existing investors and effective on April 19, 2024, Class R shares of the Fund were liquidated. For federal tax purposes, this liquidation was treated as a redemption of fund shares.

Note 2. Summary of significant accounting policies

Basis of preparation

The Fund is an investment company that applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services - Investment Companies (ASC 946). The financial statements are prepared in accordance with U.S. generally accepted accounting principles (GAAP), which requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security valuation

Equity securities listed on an exchange are valued at the closing price or last trade price on their primary exchange at the close of business of the New York Stock Exchange. Securities with a closing price not readily available or not listed on any exchange are valued at the mean between the closing bid and ask prices. Listed preferred stocks convertible into common stocks are valued using an evaluated price from a pricing service.

Debt securities generally are valued based on prices obtained from pricing services, which are intended to reflect market transactions for normal, institutional-size trading units of similar securities. The services may use various pricing techniques that take into account, as applicable, factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as approved independent broker-dealer quotes. Debt securities for which quotations are not readily available or not believed to be reflective of market value may also be valued based upon a bid quote from an approved independent broker-dealer. Debt securities maturing in 60 days or less are valued primarily at amortized market value, unless this method results in a valuation that management believes does not approximate fair value.

Investments in open-end investment companies (other than exchange-traded funds (ETFs)), are valued at the latest net asset value reported by those companies as of the valuation time.

24

Columbia Convertible Securities Fund | Annual Report 2024

Notes to Financial Statements (continued)February 29, 2024 Investments for which market quotations are not readily available, or that have quotations which management believes are not reflective of market value or reliable, are valued at fair value as determined in good faith under procedures approved by the Board of Trustees. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the quoted or published price for the security, if available.

The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine fair value.

GAAP requires disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category. This information is disclosed following the Fund’s Portfolio of Investments.

Foreign currency transactions and translations

The values of all assets and liabilities denominated in foreign currencies are generally translated into U.S. dollars at exchange rates determined at the close of regular trading on the New York Stock Exchange. Net realized and unrealized gains (losses) on foreign currency transactions and translations include gains (losses) arising from the fluctuation in exchange rates between trade and settlement dates on securities transactions, gains (losses) arising from the disposition of foreign currency and currency gains (losses) between the accrual and payment dates on dividends, interest income and foreign withholding taxes.

For financial statement purposes, the Fund does not distinguish that portion of gains (losses) on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations are included with the net realized and unrealized gains (losses) on investments in the Statement of Operations.

Delayed delivery securities

The Fund may trade securities on other than normal settlement terms, including securities purchased or sold on a “when-issued” or "forward commitment" basis. This may increase risk to the Fund since the other party to the transaction may fail to deliver, which could cause the Fund to subsequently invest at less advantageous prices. The Fund designates cash or liquid securities in an amount equal to the delayed delivery commitment.

Security transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income recognition

Interest income is recorded on an accrual basis. Market premiums and discounts, including original issue discounts, are amortized and accreted, respectively, over the expected life of the security on all debt securities, unless otherwise noted. For convertible securities, premiums attributable to the conversion feature are not amortized.

The Fund may place a debt security on non-accrual status and reduce related interest income when it becomes probable that the interest will not be collected and the amount of uncollectible interest can be reasonably estimated. The Fund may also adjust accrual rates when it becomes probable the full interest will not be collected and a partial payment will be received. A defaulted debt security is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Corporate actions and dividend income are recorded on the ex-dividend date.

The Fund may receive distributions from holdings in equity securities, business development companies (BDCs), exchange-traded funds (ETFs), limited partnerships (LPs), other regulated investment companies (RICs), and real estate investment trusts (REITs), which report information as to the tax character of their distributions annually. These distributions are allocated to dividend income, capital gain and return of capital based on actual information reported. Return of capital is recorded as a reduction of the cost basis of securities held. If the Fund no longer owns the applicable securities, return of

Columbia Convertible Securities Fund | Annual Report 2024

25

Notes to Financial Statements (continued)February 29, 2024 capital is recorded as a realized gain. With respect to REITs, to the extent actual information has not yet been reported, estimates for return of capital are made by Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). The Investment Manager’s estimates are subsequently adjusted when the actual character of the distributions is disclosed by the REITs, which could result in a proportionate change in return of capital to shareholders.

Awards from class action litigation are recorded as a reduction of cost basis if the Fund still owns the applicable securities on the payment date. If the Fund no longer owns the applicable securities on the payment date, the proceeds are recorded as realized gains.

Expenses

General expenses of the Trust are allocated to the Fund and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of class net asset value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Fund on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal income tax status

The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its investment company taxable income and net capital gain, if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Fund intends to distribute in each calendar year substantially all of its ordinary income, capital gain net income and certain other amounts, if any, such that the Fund should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Distributions to shareholders

Distributions from net investment income, if any, are declared and paid each calendar quarter. Net realized capital gains, if any, are distributed at least annually. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

Guarantees and indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust or its funds. In addition, certain of the Fund’s contracts with its service providers contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

Recent accounting pronouncements and regulatory updates

Tailored Shareholder Reports

In October 2022, the Securities and Exchange Commission adopted a final rule, "Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements." The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendments.

26

Columbia Convertible Securities Fund | Annual Report 2024

Notes to Financial Statements (continued)February 29, 2024 Note 3. Fees and other transactions with affiliates

Management services fees

The Fund has entered into a Management Agreement with Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly-owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial). Under the Management Agreement, the Investment Manager provides the Fund with investment research and advice, as well as administrative and accounting services. The management services fee is an annual fee that is equal to a percentage of the Fund’s daily net assets that declines from 0.82% to 0.65% as the Fund’s net assets increase. The effective management services fee rate for the year ended February 29, 2024 was 0.77% of the Fund’s average daily net assets.

Compensation of Board members

Members of the Board of Trustees who are not officers or employees of the Investment Manager or Ameriprise Financial are compensated for their services to the Fund as disclosed in the Statement of Operations. Under a Deferred Compensation Plan (the Deferred Plan), these members of the Board of Trustees may elect to defer payment of up to 100% of their compensation. Deferred amounts are treated as though equivalent dollar amounts had been invested in shares of certain funds managed by the Investment Manager. The Fund’s liability for these amounts is adjusted for market value changes and remains in the Fund until distributed in accordance with the Deferred Plan. All amounts payable under the Deferred Plan constitute a general unsecured obligation of the Fund. The expense for the Deferred Plan, which includes Trustees’ fees deferred during the current period as well as any gains or losses on the Trustees’ deferred compensation balances as a result of market fluctuations, is included in "Deferred compensation of board members" in the Statement of Operations.

Compensation of Chief Compliance Officer

The Board of Trustees has appointed a Chief Compliance Officer for the Fund in accordance with federal securities regulations. As disclosed in the Statement of Operations, a portion of the Chief Compliance Officer’s total compensation is allocated to the Fund, along with other allocations to affiliated registered investment companies managed by the Investment Manager and its affiliates, based on relative net assets.

Transfer agency fees

Under a Transfer and Dividend Disbursing Agent Agreement, Columbia Management Investment Services Corp. (the Transfer Agent), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, is responsible for providing transfer agency services to the Fund. The Transfer Agent has contracted with SS&C GIDS, Inc. (SS&C GIDS) to serve as sub-transfer agent. The Transfer Agent pays the fees of SS&C GIDS for services as sub-transfer agent and SS&C GIDS is not entitled to reimbursement for such fees from the Fund (with the exception of out-of-pocket fees).

The Fund pays the Transfer Agent a monthly transfer agency fee based on the number or the average value of accounts, depending on the type of account. In addition, the Fund pays the Transfer Agent a fee for shareholder services based on the number of accounts or on a percentage of the average aggregate value of the Fund’s shares maintained in omnibus accounts up to the lesser of the amount charged by the financial intermediary or a cap established by the Board of Trustees from time to time.

The Transfer Agent also receives compensation from the Fund for various shareholder services and reimbursements for certain out-of-pocket fees. Total transfer agency fees for Institutional 2 Class and Institutional 3 Class shares are subject to an annual limitation of not more than 0.07% and 0.02%, respectively, of the average daily net assets attributable to each share class.

Columbia Convertible Securities Fund | Annual Report 2024

27

Notes to Financial Statements (continued)February 29, 2024 For the year ended February 29, 2024, the Fund’s effective transfer agency fee rates as a percentage of average daily net assets of each class were as follows:

An annual minimum account balance fee of $20 may apply to certain accounts with a value below the applicable share class’s initial minimum investment requirements to reduce the impact of small accounts on transfer agency fees. These minimum account balance fees are remitted to the Fund and recorded as part of expense reductions in the Statement of Operations. For the year ended February 29, 2024, these minimum account balance fees reduced total expenses of the Fund by $420.

Distribution and service fees

The Fund has entered into an agreement with Columbia Management Investment Distributors, Inc. (the Distributor), an affiliate of the Investment Manager and a wholly-owned subsidiary of Ameriprise Financial, for distribution and shareholder services. The Board of Trustees has approved, and the Fund has adopted, distribution and shareholder service plans (the Plans) applicable to certain share classes, which set the distribution and service fees for the Fund. These fees are calculated daily and are intended to compensate the Distributor and/or eligible selling and/or servicing agents for selling shares of the Fund and providing services to investors.

Under the Plans, the Fund pays a monthly combined distribution and service fee to the Distributor at the maximum annual rate of 0.25% of the average daily net assets attributable to Class A shares of the Fund. Also under the Plans, the Fund pays a monthly service fee to the Distributor at the maximum annual rate of 0.25% of the average daily net assets attributable to Class C shares of the Fund and a monthly distribution fee to the Distributor at the maximum annual rates of 0.75% and 0.50% of the average daily net assets attributable to Class C and Class R shares of the Fund, respectively.

Sales charges (unaudited)

Sales charges, including front-end charges and contingent deferred sales charges (CDSCs), received by the Distributor for distributing Fund shares for the year ended February 29, 2024, if any, are listed below:

| This charge is imposed on certain investments of between $1 million and $50 million redeemed within 18 months after purchase, as follows: 1.00% if redeemed within 12 months after purchase, and 0.50% if redeemed more than 12, but less than 18, months after purchase, with certain limited exceptions. |

| This charge applies to redemptions within 12 months after purchase, with certain limited exceptions. |

The Fund’s other share classes are not subject to sales charges.

28

Columbia Convertible Securities Fund | Annual Report 2024

Notes to Financial Statements (continued)February 29, 2024 Expenses waived/reimbursed by the Investment Manager and its affiliates

The Investment Manager and certain of its affiliates have contractually agreed to waive fees and/or reimburse expenses (excluding certain fees and expenses described below) for the period(s) disclosed below, unless sooner terminated at the sole discretion of the Board of Trustees, so that the Fund’s net operating expenses, after giving effect to fees waived/expenses reimbursed and any balance credits and/or overdraft charges from the Fund’s custodian, do not exceed the following annual rate(s) as a percentage of the classes’ average daily net assets:

| July 1, 2023

through

June 30, 2024 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Under the agreement governing these fee waivers and/or expense reimbursement arrangements, the following fees and expenses are excluded from the waiver/reimbursement commitment, and therefore will be paid by the Fund, if applicable: taxes (including foreign transaction taxes), expenses associated with investments in affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange-traded funds), transaction costs and brokerage commissions, costs related to any securities lending program, dividend expenses associated with securities sold short, inverse floater program fees and expenses, transaction charges and interest on borrowed money, interest, costs associated with shareholder meetings, infrequent and/or unusual expenses and any other expenses the exclusion of which is specifically approved by the Board of Trustees. This agreement may be modified or amended only with approval from the Investment Manager, certain of its affiliates and the Fund. Any fees waived and/or expenses reimbursed under the expense reimbursement arrangements described above are not recoverable by the Investment Manager or its affiliates in future periods.

Note 4. Federal tax information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP because of temporary or permanent book to tax differences.

At February 29, 2024, these differences were primarily due to differing treatment for deferral/reversal of wash sale losses, investments in certain convertible securities, deemed distributions, defaulted securities/troubled debt, capital loss carryforwards, trustees’ deferred compensation and foreign currency transactions. To the extent these differences were permanent, reclassifications were made among the components of the Fund’s net assets. Temporary differences do not require reclassifications.

The following reclassifications were made:

Undistributed net

investment

income ($) | Accumulated

net realized

(loss) ($) | |

| | |

Net investment income (loss) and net realized gains (losses), as disclosed in the Statement of Operations, and net assets were not affected by this reclassification.

Columbia Convertible Securities Fund | Annual Report 2024

29

Notes to Financial Statements (continued)February 29, 2024 The tax character of distributions paid during the years indicated was as follows:

Year Ended February 29, 2024 | Year Ended February 28, 2023 |

| Long-term

capital gains ($) | | | Long-term

capital gains ($) | |

| | | | | |

Short-term capital gain distributions, if any, are considered ordinary income distributions for tax purposes.

At February 29, 2024, the components of distributable earnings on a tax basis were as follows:

Undistributed

ordinary income ($) | Undistributed

long-term

capital gains ($) | Capital loss

carryforwards ($) | Net unrealized

appreciation ($) |

| | | |

At February 29, 2024, the cost of all investments for federal income tax purposes along with the aggregate gross unrealized appreciation and depreciation based on that cost was:

| Gross unrealized

appreciation ($) | Gross unrealized

(depreciation) ($) | Net unrealized

appreciation ($) |

| | | |

Tax cost of investments and unrealized appreciation/(depreciation) may also include timing differences that do not constitute adjustments to tax basis.

The following capital loss carryforwards, determined at February 29, 2024, may be available to reduce future net realized gains on investments, if any, to the extent permitted by the Internal Revenue Code. In addition, for the year ended February 29, 2024, capital loss carryforwards utilized, if any, were as follows:

No expiration

short-term ($) | No expiration

long-term ($) | | |

| | | |

Management of the Fund has concluded that there are no significant uncertain tax positions in the Fund that would require recognition in the financial statements. However, management’s conclusion may be subject to review and adjustment at a later date based on factors including, but not limited to, new tax laws, regulations, and administrative interpretations (including relevant court decisions). Generally, the Fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Note 5. Portfolio information

The cost of purchases and proceeds from sales of securities, excluding short-term investments and derivatives, if any, aggregated to $1,010,706,527 and $1,120,958,760, respectively, for the year ended February 29, 2024. The amount of purchase and sale activity impacts the portfolio turnover rate reported in the Financial Highlights.

Note 6. Affiliated money market fund

The Fund invests in Columbia Short-Term Cash Fund, an affiliated money market fund established for the exclusive use by the Fund and other affiliated funds (the Affiliated MMF). The income earned by the Fund from such investments is included as Dividends - affiliated issuers in the Statement of Operations. As an investing fund, the Fund indirectly bears its proportionate share of the expenses of the Affiliated MMF. The Affiliated MMF prices its shares with a floating net asset value. The Securities and Exchange Commission has adopted amendments to money market fund rules requiring institutional prime money market funds like the Affiliated MMF to be subject, by April 2, 2024, to a discretionary liquidity fee of up to 2% if the imposition of such a fee is determined to be in the best interest of the Affiliated MMF and, by October 2, 2024, to a mandatory liquidity fee if daily net redemptions exceed 5% of net assets.

30

Columbia Convertible Securities Fund | Annual Report 2024

Notes to Financial Statements (continued)February 29, 2024 Note 7. Interfund lending

Pursuant to an exemptive order granted by the Securities and Exchange Commission, the Fund participates in a program (the Interfund Program) allowing each participating Columbia Fund (each, a Participating Fund) to lend money directly to and, except for closed-end funds and money market funds, borrow money directly from other Participating Funds for temporary purposes. The amounts eligible for borrowing and lending under the Interfund Program are subject to certain restrictions.

Interfund loans are subject to the risk that the borrowing fund could be unable to repay the loan when due, and a delay in repayment to the lending fund could result in lost opportunities and/or additional lending costs. The exemptive order is subject to conditions intended to mitigate conflicts of interest arising from the Investment Manager’s relationship with each Participating Fund.

The Fund’s activity in the Interfund Program during the year ended February 29, 2024 was as follows:

| | Weighted average

interest rate (%) | Number of days

with outstanding loans |

| | | |

Interest income earned by the Fund is recorded as interfund lending in the Statement of Operations. The Fund had no outstanding interfund loans at February 29, 2024.

Note 8. Line of credit

The Fund has access to a revolving credit facility with a syndicate of banks led by JPMorgan Chase Bank, N.A., Citibank, N.A. and Wells Fargo Bank, N.A. whereby the Fund may borrow for the temporary funding of shareholder redemptions or for other temporary or emergency purposes. Pursuant to an October 26, 2023 amendment and restatement, the credit facility, which is an agreement between the Fund and certain other funds managed by the Investment Manager or an affiliated investment manager, severally and not jointly, permits aggregate borrowings up to $900 million. Interest is currently charged to each participating fund based on its borrowings at a rate equal to the higher of (i) the federal funds effective rate, (ii) the secured overnight financing rate plus 0.10% and (iii) the overnight bank funding rate plus, in each case, 1.00%. Each borrowing under the credit facility matures no later than 60 days after the date of borrowing. The Fund also pays a commitment fee equal to its pro rata share of the unused amount of the credit facility at a rate of 0.15% per annum. The commitment fee is included in other expenses in the Statement of Operations. This agreement expires annually in October unless extended or renewed. Prior to the October 26, 2023 amendment and restatement, the Fund had access to a revolving credit facility with a syndicate of banks led by JPMorgan Chase Bank, N.A., Citibank, N.A. and Wells Fargo Bank, N.A. which permitted collective borrowings up to $950 million. Interest was charged to each participating fund based on its borrowings at a rate equal to the higher of (i) the federal funds effective rate, (ii) the secured overnight financing rate plus 0.10% and (iii) the overnight bank funding rate plus, in each case, 1.00%.

The Fund had no borrowings during the year ended February 29, 2024.

Note 9. Significant risks

Convertible securities risk

Convertible securities are subject to the usual risks associated with debt instruments, such as interest rate risk and credit risk. Convertible securities also react to changes in the value of the common stock into which they convert, and are thus subject to market risk. The Fund may also be forced to convert a convertible security at an inopportune time, which may decrease the Fund’s return.

Credit risk

Credit risk is the risk that the value of debt instruments in the Fund’s portfolio may decline because the issuer defaults or otherwise becomes unable or unwilling, or is perceived to be unable or unwilling, to honor its financial obligations, such as making payments to the Fund when due. Credit rating agencies assign credit ratings to certain debt instruments to indicate their credit risk. Lower-rated or unrated debt instruments held by the Fund may present increased credit risk as compared to higher-rated debt instruments.

Columbia Convertible Securities Fund | Annual Report 2024

31