SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

November 7, 2002

Terra Networks, S.A.

(Exact name of registrant as specified in its charter)

Vía de las Dos Castillas, 33

Complejo Atica

Edificio 1

Pozuelo de Alarcón

28223 Madrid, Spain

(34) 91-452-3000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b):N/A

Terra Networks, S.A.

TABLE OF CONTENTS

Item

| | |

| 1. | | Press Release, dated November 7, 2002, entitled“Revenue for the third quarter totaled 169 million in constant second-quarter euros, in line with the Company’s projections for fulfilling our commitment to the markets” |

| 2. | | Terra Lycos Third Quarter 2002 Results |

Item 1

Item 2

11/07/02

Revenue for the third quarter totaled 169 million in constant second-quarter euros, in line with the Company’s projections and fulfilling our commitment to the markets

TERRA LYCOS IMPROVES EBITDA BY 46% OVER THE THIRD QUARTER OF LAST YEAR AND 18% OVER THE PREVIOUS QUARTER

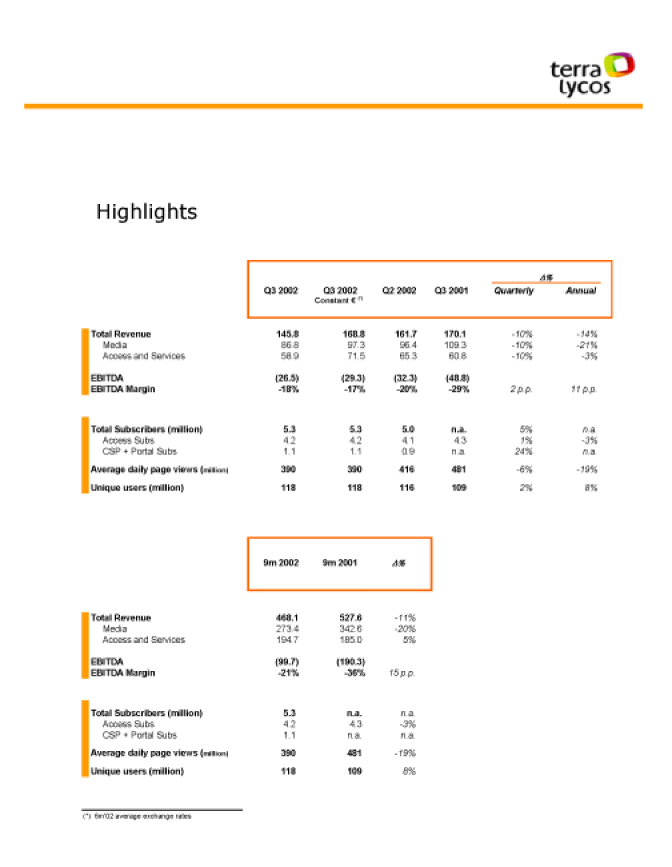

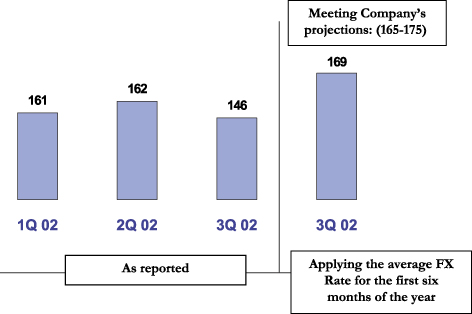

• | | In line with Company’s projections provided to analysts last July, revenue for the third quarter of 2002 was 169 million in constant second-quarter euros, an increase over the 162 million euros reported in the second quarter. |

• | | In spite of revenue growth during 2002 in local currencies, the effect of the devaluation of all currencies outside the euro zone where Terra Lycos operates, yielded a negative impact of 23 million euros on consolidated third-quarter revenue. |

• | | Third quarter consolidated revenue in current euros, taking into consideration the monetary effect explained in the previous point, totaled 146 million current euros. |

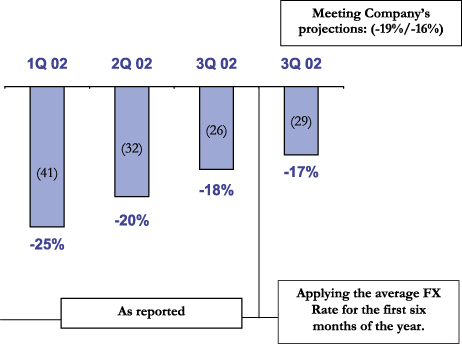

• | | Earnings before interest, taxes, depreciation and amortization (EBITDA) was –26 million euros, a margin of –18%, which is also in line with the Company’s projections. (See Appendix I) |

• | | Net income for the first nine months of the year improved 30% compared to the same period the previous year. Net income for the third quarter improved 4% over the previous quarter to –99 million euros. Amortization of goodwill, totaling 62 million euros, represented 63% of net income. |

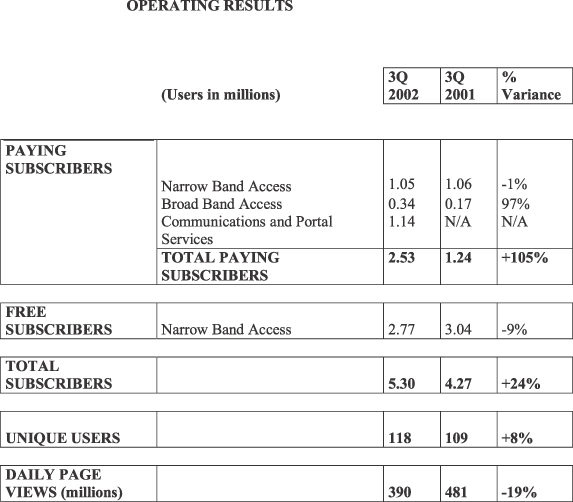

• | | In September 2002, Terra Lycos had a total of 2.5 million paying customers for access, communications and portal services, an increase of 12% over the previous quarter. |

• | | The Company ended the quarter with 342,000 ADSL customers, 97% more than in the third quarter of 2001. The number of unique users totaled 118 million. |

Madrid, November 7, 2002.- Terra Lycos (MC: TRR; NASDAQ: TRLY), the leading global Internet network, today presented its financial results for the third quarter of fiscal year 2002.

1

Revenue

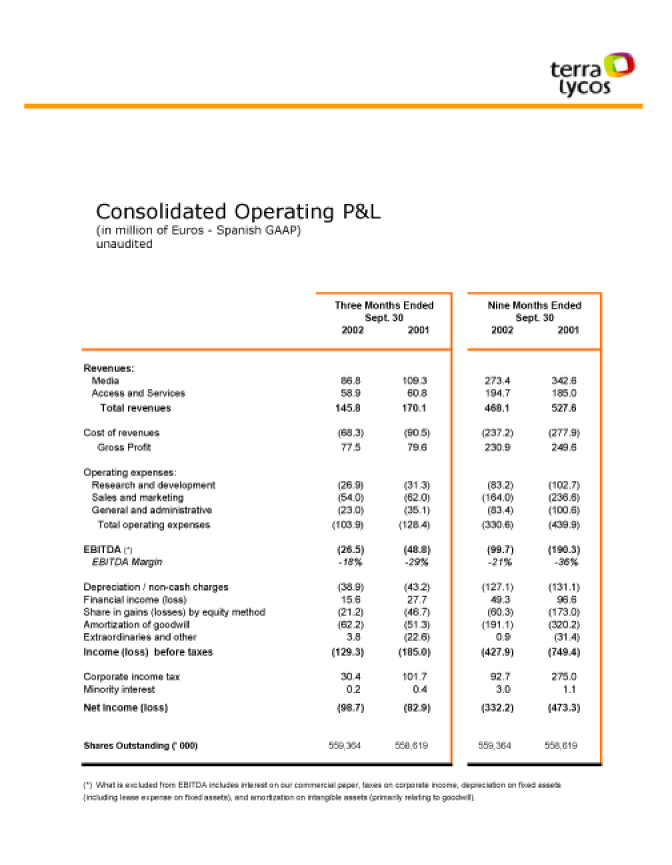

In the third quarter of 2002, Terra Lycos earned revenue of 169 million in constant second-quarter euros, thereby meeting the Company’s revenue projections (between 165 and 175 million in constant second-quarter euros) announced for the quarter. Total revenue, after consolidation of the different local currencies, suffered a negative exchange rate effect of 23 million euros due to appreciation of the euro since 78% of revenue originated from currencies other than the euro. The figure for equivalent revenue in current euros, taking into account the exchange rate effect, was 146 million euros.

During the quarter, 60% of total revenue originated from the media business, including advertising, integrated marketing solutions, electronic commerce and content and portal services subscriptions, and 40% came from the access business and communications services.

The Company’s move toward charging for services and content through the “O.B.P.” (Open, Basic, Premium) model yielded positive results, and revenue from paying subscribers for services other than access represented 11% of total revenue this quarter. Communications services and portal subscriptions thus continue to contribute to the diversification of Terra Lycos’ sources of revenue. Among other examples of O.B.P., a for-pay e-mail service was launched in Brazil, which offers the protection of anti-virus and anti-spam filters and already has nearly 100,000 customers. Similarly, for personal pages, functionality was improved on products such as Domains, Tripod and Angelfire to meet customer needs. In addition, the enterprise version of Hosted Site Search was also launched.

During the quarter, Terra Lycos signed alliances with leading companies in other sectors. An Internet integration agreement was reached with Grupo Intereconomía, a leading radio producer of specialized economic/financial information, and an alliance was formed with Ebro Puleva, Spain’s largest food-sector group, under which it will join the Terra Food Channel. After the close of the quarter, Terra Lycos and IBM announced an agreement that will allow Terra Lycos users to enjoy IBM’s instant messaging service and communicate with Lotus Sametime users around the world.

In October, Terra Lycos acquired Get Relevant’s direct marketing technology in the United States, increasing the Company’s ability to make particular offers to a specified target audience and consequently improve audience segmentation.

Operating Expenses

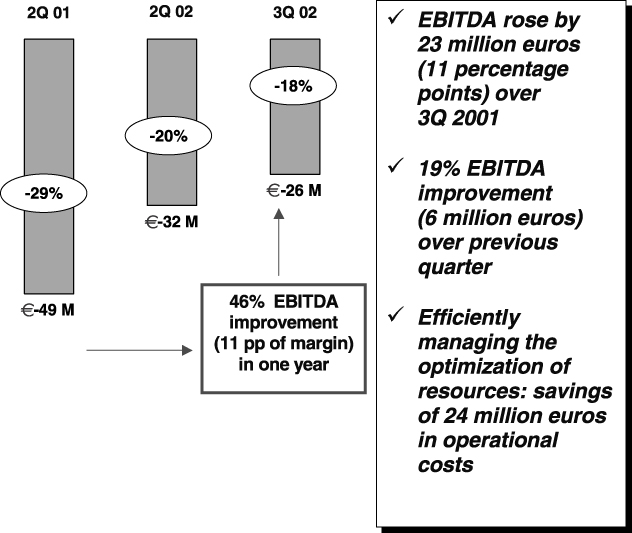

In the third quarter of 2002, Terra Lycos efficiently managed its resources with ongoing process improvement, allowing it to continue to gradually reduce operating costs. During the quarter, the Company reduced expenses by 19% over the same period the previous year, yielding a savings of 24 million euros.

2

Operating Margin—EBITDA

Earnings before interest, taxes, depreciation and amortization (EBITDA) for the third quarter of 2002 improved by 23 million euros over the same period the previous year, to –26 million euros, the best performance to date and in line with the ongoing positive trend in EBITDA over the previous eight quarters. EBITDA margin was –18%, meeting the Company’s projections for the quarter (between –19% and –16%), and an improvement of 11 percentage points over the same period last year. (See Appendix II)

Net Income

Net income for the third quarter of 2002 was –99 million euros, a 4% improvement over the previous quarter. In the first nine months of the year, net income improved by 30% over the same period the previous year, and now stands at –332 million euros.

Amortization of goodwill, totaling 62 million euros for the quarter, resulting from past acquisitions and involving no cash disbursement, represented 63% of net income.

Cash

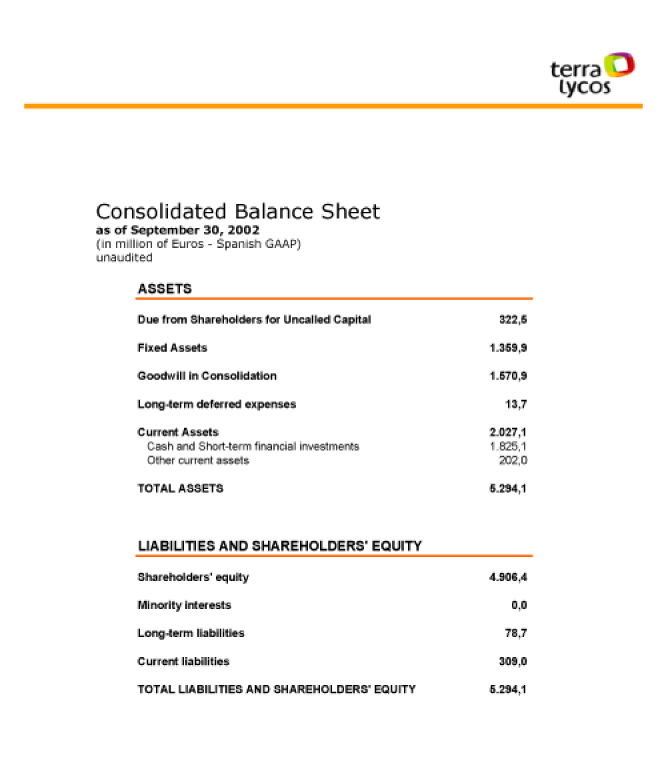

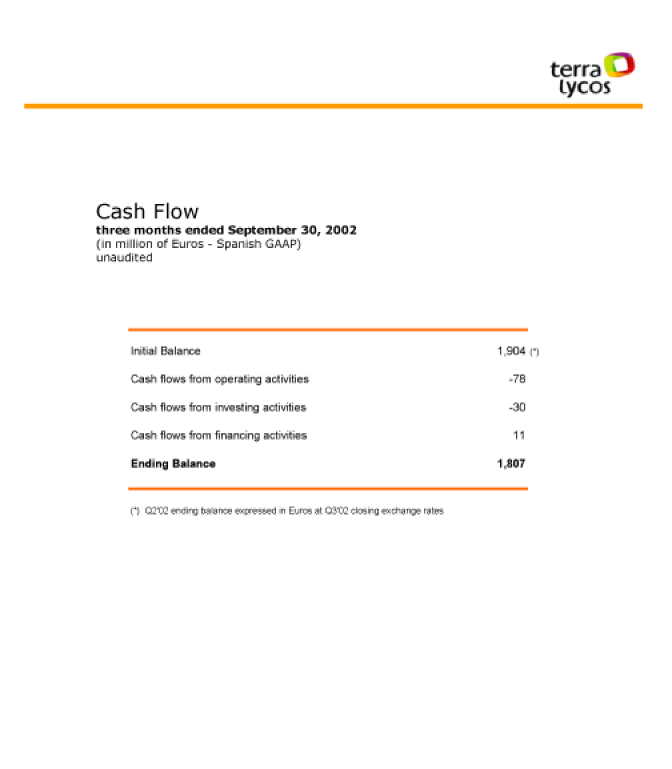

Terra Lycos has one of the strongest cash positions in the sector, allowing it to finance its operations and explore business opportunities with a view to continued improvement in profitability. Efficient cash management allowed the Company to close the third quarter with 1.8 billion euros.

Operating Results

Terra Lycos closed September 2002 with a total of 5.3 million subscribers, 2.5 million of which, or 48%, are paying subscribers to access, communications and portal services. This is an increase of 12% over the previous quarter in the number of paying subscribers, while the number of free subscribers remains at 2.8 million. As of September 30, the number of ADSL customers was 342,000, an increase of 97% over the third quarter of 2001, and 14% over the previous quarter.

In addition to access subscribers, as of the close of third quarter, the Company had recurring revenue from the 1.1 million subscribers to communications and portal services, an increase of 24% over the previous quarter.

The number of unique users in September totaled 118 million. The average number of daily page views was 390 million.

3

Terra Lycos Executive Chairman Joaquim Agut said that “our primary objective remains to continue to grow profitably, and these results reflect the fact that we are maintaining the positive growth of recent quarters, through efficient resource management and ongoing process improvement.” Joaquim Agut said that “without a doubt, the unfavorable advertising market environment is continuing to affect us, although our recurring revenue from paying subscribers continues to increase as a result of our commitment to innovation and customer satisfaction.”

About Terra Lycos

Terra Lycos is a global Internet group with a presence in 42 countries in 19 languages, reaching 118 million unique users per month worldwide. The group, which grew out of the acquisition by Terra Networks, S.A. of Lycos, Inc., which took place in October 2000, operates some of the most widely visited Web sites in the United States, Europe, Asia and Latin America, and is the largest access provider in Spain and Latin America.

The Terra Lycos network of sites includes Terra in 17 countries, Lycos in 25 countries, Angelfire.com, Atrea.com, Azeler.es, Bumeran.com, Direcciona.es, Educaterra.com, Emplaza.com, Gamesville.com, HotBot.com, Ifigenia.com, Invertia.com, Lycos Zone, Maptel.com, Matchmaker.com, Quote.com, RagingBull.com, Rumbo.com, Tripod.com, Uno-e.com and Wired News (Wired.com), among others.

Terra Lycos, headquartered in Barcelona and with operating centers in Madrid and Boston, as well as elsewhere, is traded on the Madrid stock exchange (TRR) and the Nasdaq electronic market (TRLY).

Contact telephone numbers:

• Public Relations | | |

| Miguel Angel Garzón | | Kirsten Rankin (U.S.) |

| +34-91-452-3021 | | +1-781-370-2691 |

miguel.garzon@corp.terralycos.com | | kirsten.rankin@corp.terralycos.com |

|

• Investor Relations | | |

| Claudia Sierra | | |

| +34-91-452-3278 | | |

relaciones.inversores@corp.terralycos.com | | |

4

APPENDIX I

TOTAL REVENUE

(in million of euros)

EBIDTA IMPROVEMENT

5

APPENDIX II

Change in EBITDA (millions of euros)

and as a percent of revenue

6

TERRA LYCOS

Consolidated Income Statement

(Figures in millions of euros – Spanish GAAP - unaudited)

| | | July- September 2002 | | | April- June 2002 | | | Var. % | |

|

|

|

|

|

|

|

| Revenue: | | | | | | | | | |

| Media | | 86.8 | | | 96.4 | | | -10 | % |

| Access and Services | | 58.9 | | | 65.3 | | | -10 | % |

Total Revenue | | 145.8 | | | 161.7 | | | -10 | % |

(*) (constant 2Q 02 euros) | | 169 | | | | | | | |

|

|

|

|

|

|

|

| Cost of revenue | | (68.3 | ) | | (80.5 | ) | | -15 | % |

|

Gross Profit | | 77.5 | | | 81.2 | | | -5 | % |

| Gross Profit % | | 53 | % | | 50 | % | | 3 p.p | |

|

| Operating Expenses: | | | | | | | | | |

| Research and Development | | (26.9 | ) | | (27.7 | ) | | -3 | % |

| Marketing and Sales | | (54.0 | ) | | (55.5 | ) | | -3 | % |

| General and Administrative | | (23.0 | ) | | (30.4 | ) | | -24 | % |

|

Total Operating Expenses | | (103.9 | ) | | (113.6 | ) | | -8 | % |

EBITDA ** | | (26.5 | ) | | (32.3 | ) | | 18 | % |

|

|

|

|

|

|

|

EBITDA Margin | | -18 | % | | -20 | % | | 2 p.p. | |

|

| Depreciation / Non-cash Charges | | (38.9 | ) | | (41.8 | ) | | -7 | % |

|

| Financial income | | 15.6 | | | 19.3 | | | -19 | % |

| Shares in gains by equity method | | (21.2 | ) | | (18.1 | ) | | 17 | % |

|

| Amortization of goodwill | | (62.2 | ) | | (63.2 | ) | | -2 | % |

|

| Extraordinaries and other | | 3.8 | | | (1.6 | ) | | | |

|

Income before taxes | | (129.3 | ) | | (137.8 | ) | | 6 | % |

|

|

|

|

|

|

|

| Corporate Income Tax | | 30.4 | | | 32.2 | | | 6 | % |

| Minority Interest | | 0.2 | | | 2.2 | | | 93 | % |

|

|

|

|

|

|

|

Net income for the period | | (98.7 | ) | | (103.3 | ) | | 4 | % |

(*) Revenue for the third quarter of 2002 was 169 million in constant second quarter euros. The conversion to euros of the financial statements in foreign currencies for consolidation represents a negative impact of 23 million euros on third quarter revenue. This impact is calculated by the difference between the accumulated revenue of the first three quarters of 2002 (applying an average exchange rate from January to September 2002) and reported revenue of the previous quarters.

(**) The EBITDA figure in both periods does not include operating leases in the US, which are included under Depreciation.

7

8

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Terra Networks, S.A. | | |

|

| Date: | | November 7, 2002 | | By: | | /s/ Elías Rodríguez-Viña

| | |

| | | | | | | Name: | | Elías Rodríguez-Viña | | |

| | | | | | | Title: | | Chief Financial Officer | | |