SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

November 8, 2002

Terra Networks, S.A.

(Exact name of registrant as specified in its charter)

Vía de las Dos Castillas, 33

Complejo Atica

Edificio 1

Pozuelo de Alarcón

28223 Madrid, Spain

(34) 91-452-3000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b):N/A

Terra Networks, S.A.

TABLE OF CONTENTS

Item

| | |

| 1. | | Terra Lycos Third Quarter 2002 Results Presentation |

1. Third Quarter 2002 Results

2. Financial Statements

| | • | | Consolidated Operating P&L |

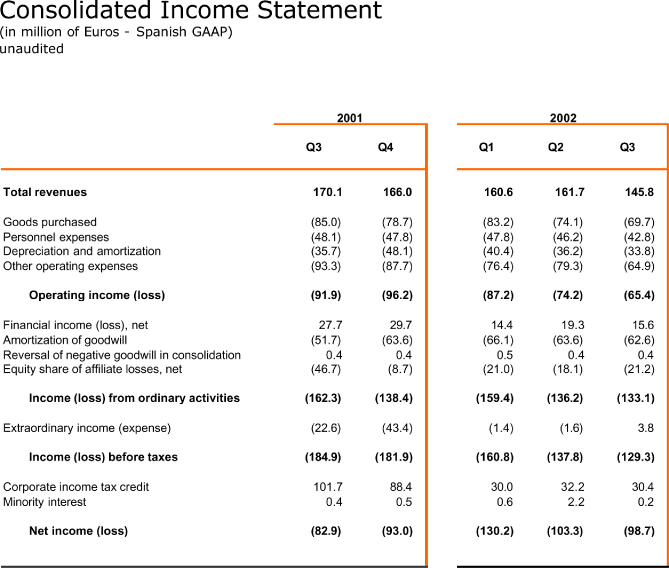

| | • | | Consolidated Income Statement |

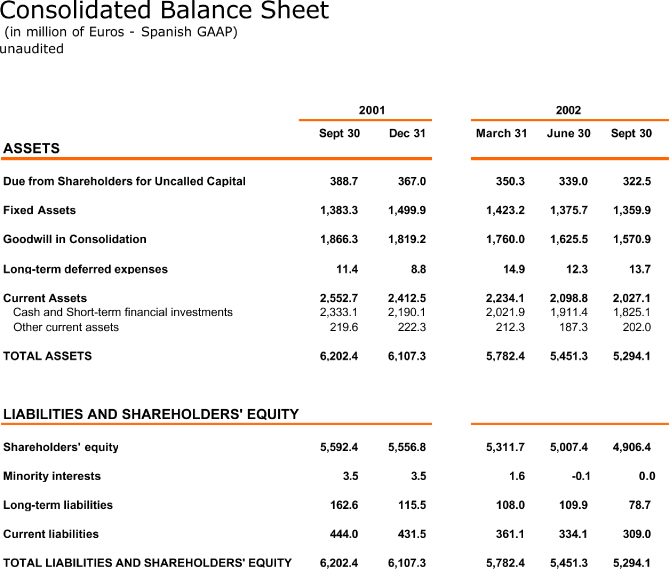

| | • | | Consolidated Balance Sheet |

3. Historic Data

| | • | | Consolidated Operating P&L |

| | • | | Consolidated Income Statement |

| | • | | Consolidated Balance Sheet |

| | • | | Operating Expenses and Margins |

4. Other Information

| | • | | Differences between Spanish and US GAAP |

| | • | | Operating P&L Description |

| | • | | Main Fully and Equity Consolidated Companies |

2

11/07/02

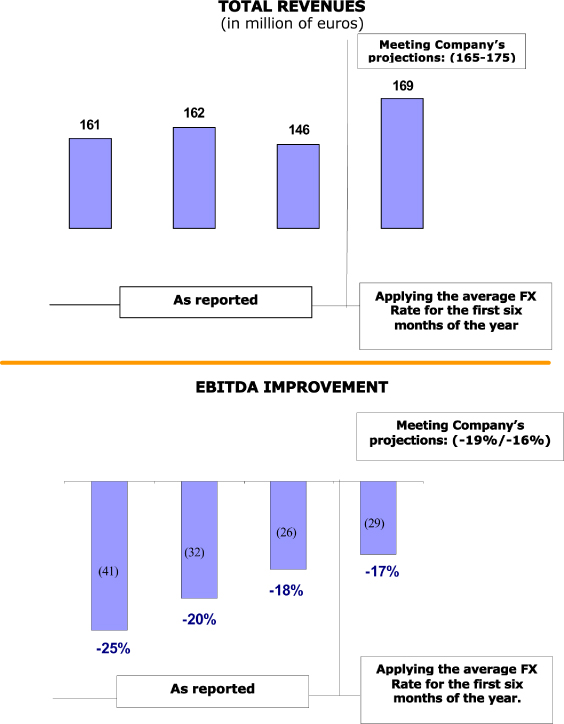

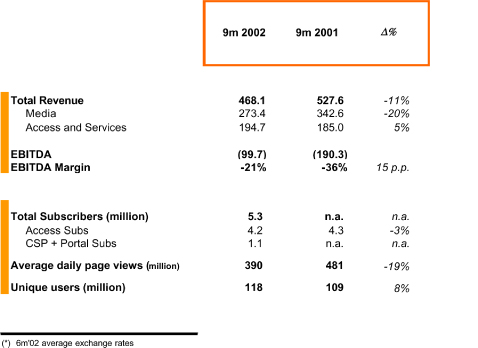

Revenue for the third quarter totaled 169 million in constant second-quarter euros, in line with the Company’s projections and fulfilling our commitment to the markets

TERRA LYCOS IMPROVES EBITDA BY 46% OVER THE

THIRD QUARTER OF LAST YEAR AND 18% OVER THE

PREVIOUS QUARTER

| | • | | In line with Company’s projections provided to analysts last July, revenue for the third quarter of 2002 was 169 million in constant second-quarter euros, an increase over the 162 million euros reported in the second quarter. |

| | • | | In spite of revenue growth during 2002 in local currencies, the effect of the devaluation of all currencies outside the euro zone where Terra Lycos operates, yielded a negative impact of 23 million euros on consolidated third-quarter revenue. |

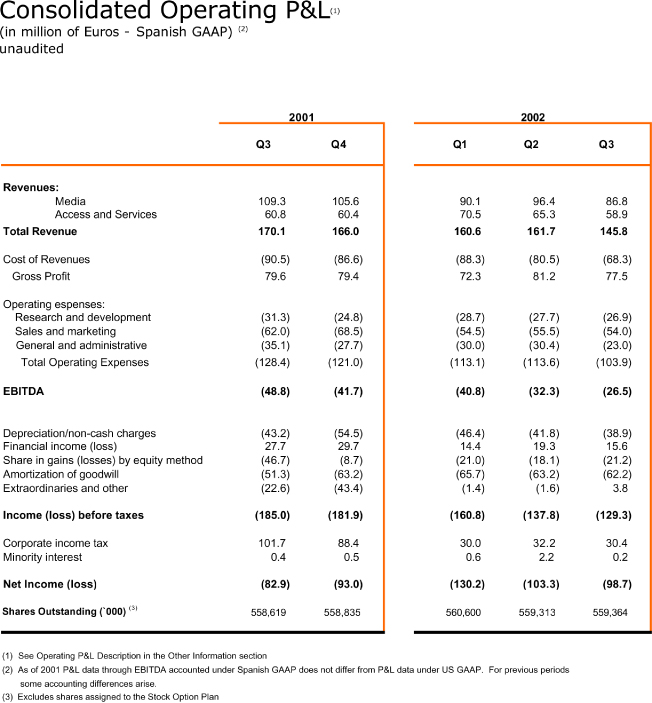

| | • | | Third quarter consolidated revenue in current euros, taking into consideration the monetary effect explained in the previous point, totaled 146 million current euros. |

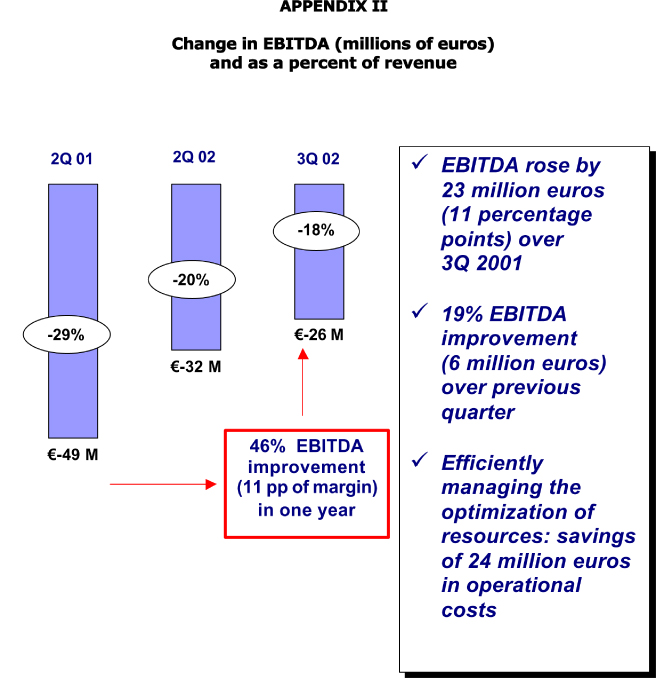

| | • | | Earnings before interest, taxes, depreciation and amortization (EBITDA) was –26 million euros, a margin of –18%, which is also in line with the Company’s projections. (See Appendix I) |

| | • | | Net income for the first nine months of the year improved 30% compared to the same period the previous year. Net income for the third quarter improved 4% over the previous quarter to –99 million euros. Amortization of goodwill, totaling 62 million euros, represented 63% of net income. |

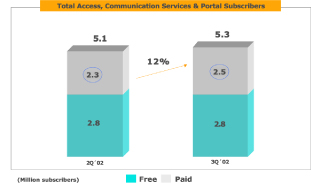

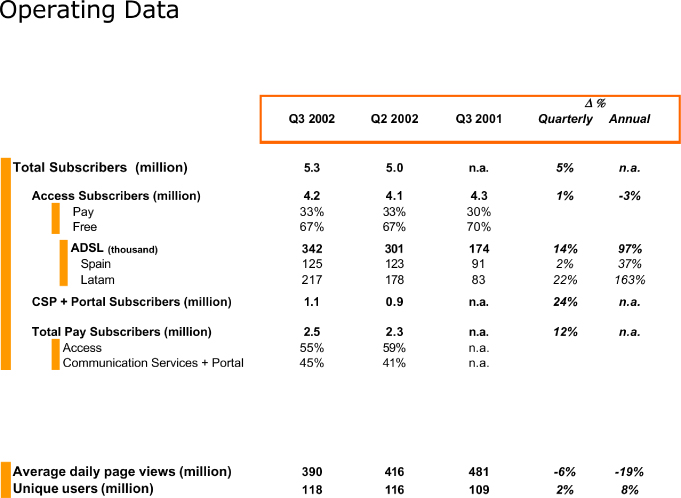

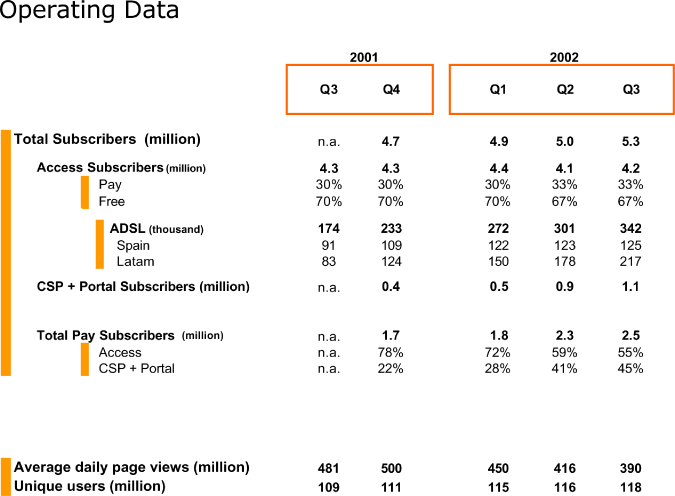

| | • | | In September 2002, Terra Lycos had a total of 2.5 million paying customers for access, communications and portal services, an increase of 12% over the previous quarter. |

| | • | | The Company ended the quarter with 342,000 ADSL customers, 97% more than in the third quarter of 2001. The number of unique users totaled 118 million. |

Madrid, November 7, 2002.—Terra Lycos (MC: TRR; NASDAQ: TRLY), the leading global Internet network, today presented its financial results for the third quarter of fiscal year 2002.

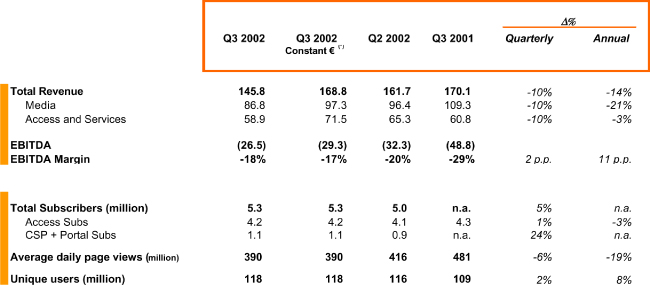

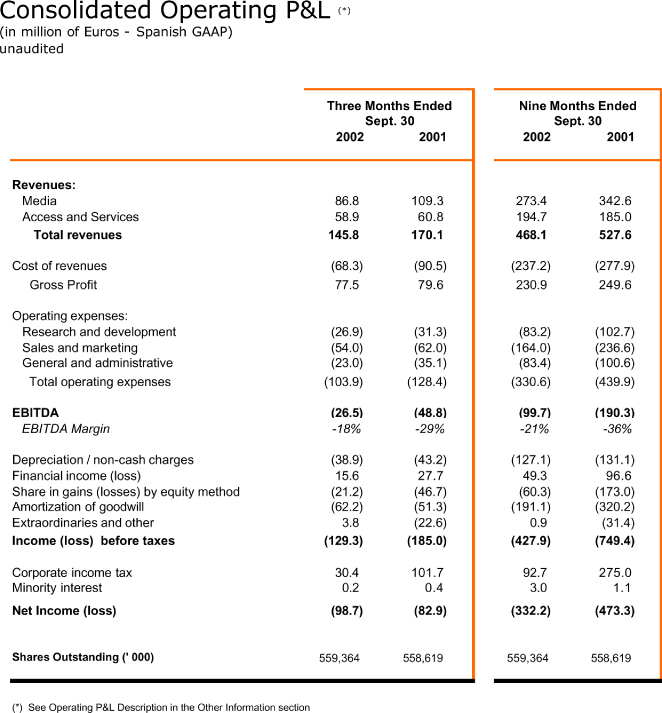

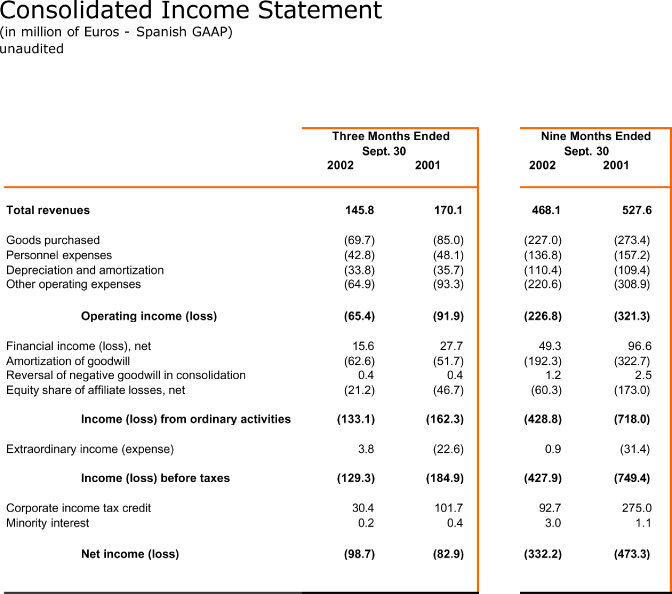

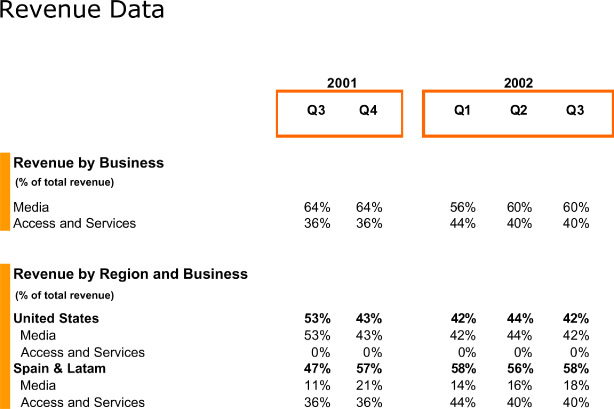

Revenue

In the third quarter of 2002, Terra Lycos earned revenue of 169 million in constant second-quarter euros, thereby meeting the Company’s revenue projections (between 165 and 175 million in constant second-quarter euros) announced for the quarter. Total revenue, after consolidation of the different local currencies, suffered a negative exchange rate effect of 23 million euros due to appreciation of the euro since 78% of revenue originated from currencies other than the euro. The figure for equivalent revenue in current euros, taking into account the exchange rate effect, was 146 million euros.

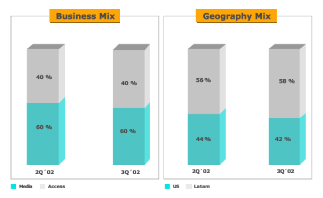

3

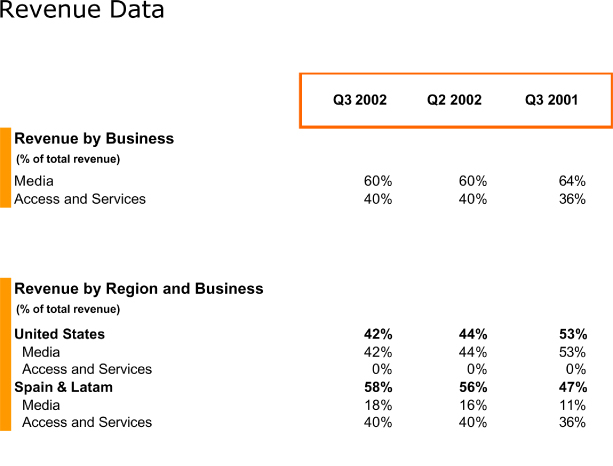

During the quarter, 60% of total revenue originated from the media business, including advertising, integrated marketing solutions, electronic commerce and content and portal services subscriptions, and 40% came from the access business and communications services.

The Company’s move toward charging for services and content through the “O.B.P.” (Open, Basic, Premium) model yielded positive results, and revenue from paying subscribers for services other than access represented 11% of total revenue this quarter. Communications services and portal subscriptions thus continue to contribute to the diversification of Terra Lycos’ sources of revenue. Among other examples of O.B.P., a for-pay e-mail service was launched in Brazil, which offers the protection of anti-virus and anti-spam filters and already has nearly 100,000 customers. Similarly, for personal pages, functionality was improved on products such as Domains, Tripod and Angelfire to meet customer needs. In addition, the enterprise version of Hosted Site Search was also launched.

During the quarter, Terra Lycos signed alliances with leading companies in other sectors. An Internet integration agreement was reached with Grupo Intereconomía, a leading radio producer of specialized economic/financial information, and an alliance was formed with Ebro Puleva, Spain’s largest food-sector group, under which it will join the Terra Food Channel. After the close of the quarter, Terra Lycos and IBM announced an agreement that will allow Terra Lycos users to enjoy IBM’s instant messaging service and communicate with Lotus Sametime users around the world.

In October, Terra Lycos acquired Get Relevant’s direct marketing technology in the United States, increasing the Company’s ability to make particular offers to a specified target audience and consequently improve audience segmentation.

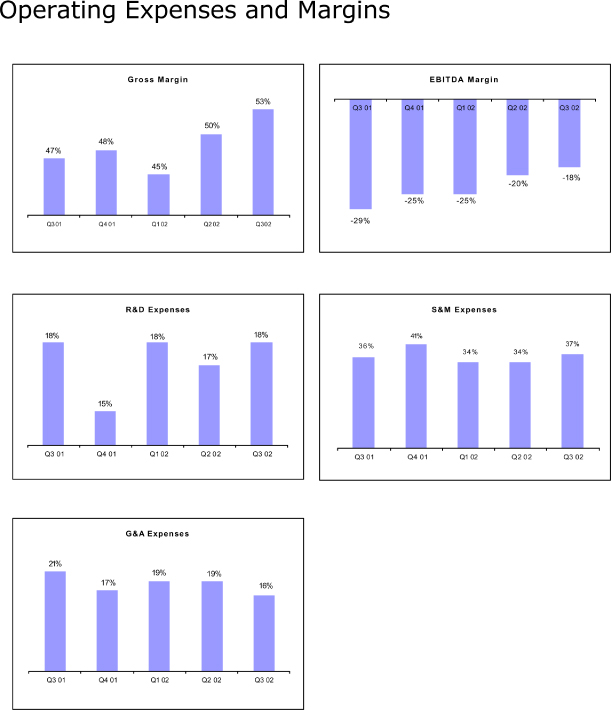

Operating Expenses

In the third quarter of 2002, Terra Lycos efficiently managed its resources with ongoing process improvement, allowing it to continue to gradually reduce operating costs. During the quarter, the Company reduced expenses by 19% over the same period the previous year, yielding a savings of 24 million euros.

Operating Margin—EBITDA

Earnings before interest, taxes, depreciation and amortization (EBITDA) for the third quarter of 2002 improved by 23 million euros over the same period the previous year, to –26 million euros, the best performance to date and in line with the ongoing positive trend in EBITDA over the previous eight quarters. EBITDA margin was –18%, meeting the Company’s projections for the quarter (between –19% and –16%), and an improvement of 11 percentage points over the same period last year. (See Appendix II)

Net Income

Net income for the third quarter of 2002 was –99 million euros, a 4% improvement over the previous quarter. In the first nine months of the year, net income improved by 30% over the same period the previous year, and now stands at –332 million euros.

4

Amortization of goodwill, totaling 62 million euros for the quarter, resulting from past acquisitions and involving no cash disbursement, represented 63% of net income.

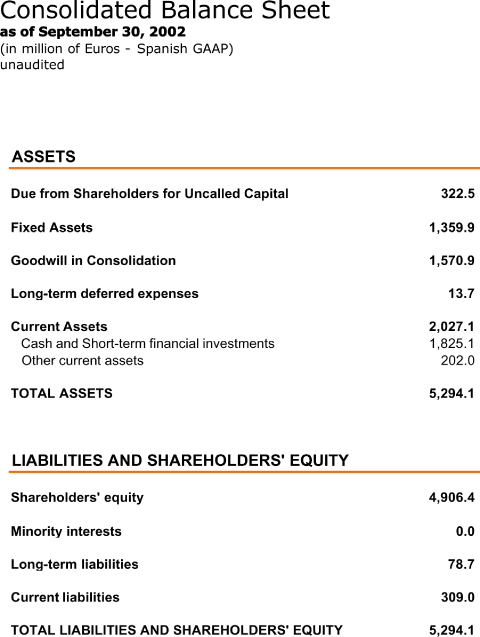

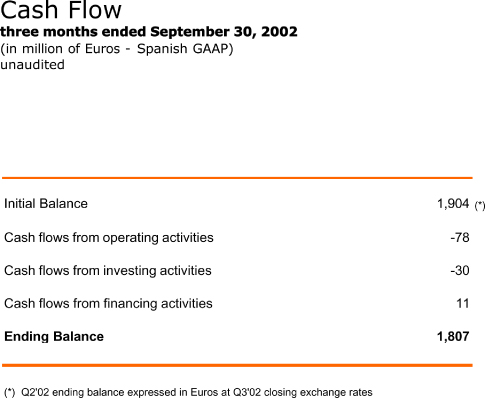

Cash

Terra Lycos has one of the strongest cash positions in the sector, allowing it to finance its operations and explore business opportunities with a view to continued improvement in profitability. Efficient cash management allowed the Company to close the third quarter with 1.8 billion euros.

Operating Results

Terra Lycos closed September 2002 with a total of 5.3 million subscribers, 2.5 million of which, or 48%, are paying subscribers to access, communications and portal services. This is an increase of 12% over the previous quarter in the number of paying subscribers, while the number of free subscribers remains at 2.8 million. As of September 30, the number of ADSL customers was 342,000, an increase of 97% over the third quarter of 2001, and 14% over the previous quarter.

In addition to access subscribers, as of the close of third quarter, the Company had recurring revenue from the 1.1 million subscribers to communications and portal services, an increase of 24% over the previous quarter.

The number of unique users in September totaled 118 million. The average number of daily page views was 390 million.

Terra Lycos Executive Chairman Joaquim Agut said that “our primary objective remains to continue to grow profitably, and these results reflect the fact that we are maintaining the positive growth of recent quarters, through efficient resource management and ongoing process improvement.” Joaquim Agut said that “without a doubt, the unfavorable advertising market environment is continuing to affect us, although our recurring revenue from paying subscribers continues to increase as a result of our commitment to innovation and customer satisfaction.”

About Terra Lycos

Terra Lycos is a global Internet group with a presence in 42 countries in 19 languages, reaching 118 million unique users per month worldwide. The group, which grew out of the acquisition by Terra Networks, S.A. of Lycos, Inc., which took place in October 2000, operates some of the most widely visited Web sites in the United States, Europe, Asia and Latin America, and is the largest access provider in Spain and Latin America.

The Terra Lycos network of sites includes Terra in 17 countries, Lycos in 25 countries, Angelfire.com, Atrea.com, Azeler.es, Bumeran.com, Direcciona.es, Educaterra.com, Emplaza.com, Gamesville.com, HotBot.com, Ifigenia.com, Invertia.com, Lycos Zone, Maptel.com, Matchmaker.com, Quote.com, RagingBull.com, Rumbo.com, Tripod.com, Uno-e.com and Wired News (Wired.com), among others.

Terra Lycos, headquartered in Barcelona and with operating centers in Madrid and Boston, as well as elsewhere, is traded on the Madrid stock exchange (TRR) and the Nasdaq electronic market (TRLY).

5

APPENDIX I

6

7

3Q’02 Revenues

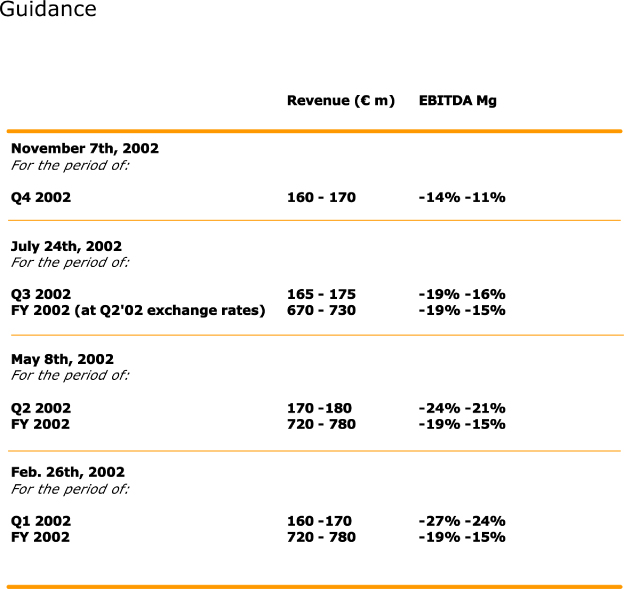

Please, note that when guidance was provided for the rest of the year on July 24th, it was specifically mentioned and filed in the CNMV that we were applying a Q2’02 constant euro exchange rate, that is, the average exchange rate for the first six months of the year. This is very important in order to have a meaningful comparison base.

The revenue figure for the quarter was 169 million euros, if applying the FX rate for the first six months of the year, within the guidance Terra defined of 165 to 175 million euros.

Reported revenues were 146 million euros, which is affected by the fact that 78% of revenues are in currencies other than the euro.

There was a 23 million euro negative exchange rate impact in the third quarter, 6 million unfavorable coming from the US, 12 million unfavorable from Brazil and the rest primarily from Mexico and Chile. However, because 3Q revenues are calculated based on the difference between 9 months revenues at the average exchange rate for the period, less reported earnings in Q1 and Q2, Q3 revenues are suffering a FX impact that corresponds to the previous quarters.

A better way to see the performance of Terra’s business is analyzing the evolution in local currencies. By comparing with Q2 in local currencies, in Brazil revenues grew 8%, in Mexico revenues grew 7%, Spain increased 3%, Chile increased 14% and in the US revenues decreased 7%.

The company continues to exercise tight fiscal controls and discipline. For the quarter, reported EBITDA was –26 million euros, representing a -18% EBITDA margin, an improvement of 11 percentage points from Q3’01, and within the guidance of -16% to -19% defined in the Q2 call.

From a cash perspective, at September 30th Terra had over 1.8 billion euros.

Terra continues executing on its strategy of evolving its business through the OBP model, standing for Open, Basic, and Premium. The OBP model will lessen our reliance on media revenue and increases our focus on value added services that consumers are willing to pay for. This has been a significant initiative for the Company in 2002 because today 11% of Terra’s revenues come from OBP products versus only 7% in 2001.

For the quarter, Media accounted for 60% of revenues, while Access and services accounted for the remaining 40%. This is consistent with the mix seen in the second quarter.

8

Geographically, for the quarter, LATAM and Spain accounted for 58% of revenues, while the U.S. accounted for the remaining 42%. In Q2’02, LATAM and Spain accounted for 56% of revenues, while the US accounted for the remaining 44%.

Subscribers

In the second quarter Terra started reporting its communication services and portal subscribers in addition to its paid and free access subscribers. The company exited the third quarter with 2.5 million paying clients, 260,000 more than Q2, and 700.000 more that at the end of Q4’01, a 79% increase.

Paying Communication Services and Portal subscribers grew 24% to 1.1 million at September 30th from 920.000 at June 30th. The revenue derived from these non-access subscription services for all of 2001 was 7%, and this quarter alone amounted to 11%.

Quarterly Media Business Update

United States

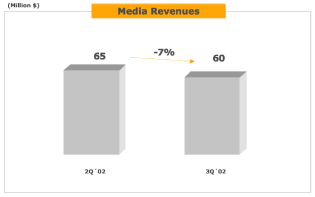

Third quarter media revenues in the United States were 60 million dolares, down 7% from Q2´02.

In order to stabilize the revenue line, the company has concentrated its efforts on subscription based services. In the third quarter, Lycos increased its paying subscriber base by over 18,000 subscribers to 124,000, a 18% increase over Q2.

9

Terra also continue to focus on a few key verticals including Search, dating, Communities, Personal Finance and Games, to name a few. These areas hold the greatest opportunity for Lycos.

Lycos extended the power and service of the Lycos InSite Search product. The company launched an Enterprise version of its Hosted Site Search offering in the third quarter, with the USA Today as its first partner. This new service allows larger web sites to easily submit up to 100,000 URLs for inclusion in the Lycos catalogue and also gives them powerful reporting capabilities to monitor their complete campaign performance.

In September Lycos launched InSite AdBuyer to capitalize on the expanding cost-per-click market. This product allows the InSite subscribers to create and manage advertising campaigns to promote their products by purchasing keywords through an auction interface.

In Matchmaker, the dating service, Lycos continues to aggressively invest in online acquisition campaigns to drive the Matchmaker subscriber base. The trend is favorable in terms of increasing net new trials while decreasing its cost per acquisition and improving its conversion rates.

In the Quote.com financial service Lycos started offering a more robust news and charting functionality, launching LiveCharts Plus in September. For 19.95 dollars a month, our subscribers can view streaming charts, portfolios, news stories, and market indices—all on one screen. Best of all, this product is entirely web based and does not require the user to install a new application.

Also in the quarter, the company launched CheckM8 capability in the U.S which is already available in other Terra Lycos geographies. CheckM8 is a Web-based application for the rapid and easy production of innovative media units including floating ads, preview ads, footer and margin ads, watermarks and many more and is already being used in campaigns for Taco Bell, Nexium and Barnes and Noble, to name just a few.

Also furthering efforts to diversify the revenue stream, Lycos continues our approach towards selling integrated and direct marketing solutions.

This past quarter a campaign with BMG was launched to promote the release of “Elvis 1”, a commemorative album of thirty Number 1 hits from “The King.” This integrated online/offline marketing program delivered huge results, bringing in over half a million registered users to the Lycos Network.

Also, a campaign called “Watch a Championship with a Champion” was launched, including an innovative sponsorship component whereby Taco Bell sponsored the Elway (american football) promotion and Verizon sponsored the McGwire (baseball) promotion. This type of integrated online/offline offering is what advertisers are looking for today.

Building on the company’s Direct Marketing capabilities, on October 4th, Lycos completed the acquisition of Get Relevants’ direct marketing technology. Such technology optimizes the distribution and targeting of co-registration offers. Also part of the acquisition was a co-registration network, and a collection of websites whose “opt-in” offers are managed by Get Relevant.

One of the company’s key priorities is efficiency. It has developed a new Global Operations group which includes most product and all technology and operations resources throughout the entire organization.

10

Due to the focus on only a few key verticals in the US, and to the efficiencies from the Global Operation team, in October Lycos decided to reduce its US operation by 174 employees or 21%.

Also in the US, through the terra.com portal, in the third quarter, revenues grew 35% over the second quarter, having outperformed our closest competitor, in every quarter since 2001 and planning to keep doing so.

On the Marketing side, the first ever syndicated Hispanic Internet measurement tool has been launched by comScore Research, an initiative that will bring credibility and reliable measurement to the Hispanic Internet sector.

Lycos continues to attract blue chip advertisers and new non-traditional Hispanic advertisers. This quarter Lycos closed Power Channel, Ford, Miller Lite, AMD, Nissan, Verizon/Superpages, H&R Block, and the United States Postal Service.

In addition to attracting new advertisers, the company has been very successful in retaining existing clients to repeat business, as 57% of our sales closed in Q3 were from repeat customers.

LATAM and Spain

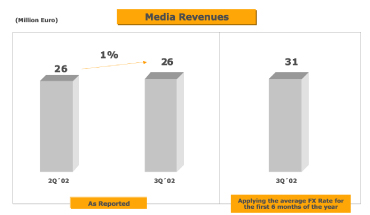

Third quarter media revenues in LATAM and Spain were 26 million euros, up 1% from Q2’02. Applying a constant Q2 euro exchange rate to the local revenues, revenue would have been 31 million euros. Compared with the same quarter of last year, media revenues were up 31%.

In LATAM and Spain Terra is the preferred media solution for multinational advertisers because of its deep penetration of the LATAM and Spanish markets and its unique internet know how in these regions.

Terra has reinforced its regional sales structure. Most of the big advertisers are headquartered in different LATAM countries and therefore it is assigning regional sales people to the different countries where its major clients are. One of the main strengths of Terra Lycos in the region remains being its unique reach and presence.

A new business partnership with Heineken was recently signed to webhost Heineken’s live events, conduct market research and execute joint online promotions to be implemented in Brazil, Chile and Argentina.

11

Spain

Existing the quarter, Terra maintained its strong leadership position in Spain with a 54.9% reach according to Net Ratings.

During the third quarter, Terra decided to discontinue OJD auditing its page views. The reason being is that our clients are demanding us other metrics like unique users and duration that OJD was not ready to deliver.

Terra opened the center Navega Web together with Telefónica Telecomunicaciones Públicas where our games platform was included.

Terra reached an agreement, through Invertia, our leading Spanish financial portal, with Radio Intereconomía, also a leading Spanish financial news radio, to share content and jointly promote the services of both companies.

In the third quarter, the company also decided to change the look and feel of its home page in order to improve navigation and have a more user friendly interface.

Brazil

In Brazil, the economic environment continues to be complex. However, Terra was able to double media revenues versus the same quarter of last year and increase 10% over the previous quarter.

Terra estimates that around 90% of the online advertisers in Brazil are its clients, which has to do with its 52% reach in the country.

Almas Gemeas, our dating vertical and our leisure channel have been awarded by IDG as the best ones in each category.

Mexico

In Mexico, Terra continues to see success in selling integrated marketing solutions to brick and mortar companies that include not only selling online advertising but also helping them with content development, direct marketing and eCommerce. Our list of clients include Scotiabank Inverlat, LG Electronics, General Motors, BBVA Bancomer among others.

The company is the official site and internet access provider of the reality show Operación Triunfo, which is broadcasted by Televisa with great success. Our participation has helped Terra to reinforce its position as one of the leaders in the industry.

Argentina

As part of the strategic goal of developing the tourism segment, Terra Argentina launched interactive guides sold by TPI’s sales force and promoted actively on the portal.

12

In Argentina, Terra also began the production of sites for Popstars second edition (Admira) and Fantasías (canal 13) in exchange for content, promotion and oppotunities to attract advertisers (such as Pepsi or Impulse).

The company produces for Latam & Spain a content channel on health issues, partnership with Bibliomed.

Centroamerica

Terra Centroamerica signed several co-branded content agreements, based only on a revenue sharing basis that will add important traffic and reinforce local content, being of great relevance La Republica, Costa Rica’s second newspaper, and Guianos.com, leader on entertainment content in Guatemala.

In September Terra Costa Rica developed and launched the first multimedia portal of the country for Amnet, which in conjunction with RACSA, the local Government Internet monopoly, offer broadband access.

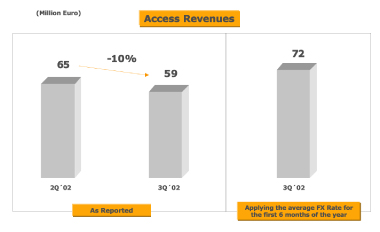

Quarterly Access and Services Business Update

Third quarter access and communication services revenues were 59 million euros, down 10% from the 65 million euros of Q2’02. Applying a Q2 constant euro exchange rate to the local revenues, Access revenue would have been 72 million euros.

Terra continues executing the new communication services and OBP model across all the geographies. As already mentioned, Terra has today 1.1 million communication services and OBP clients which represent 11% of the revenues of the quarter.

13

Spain

Terra has 125.000 ADS clients, a 37% more than one year ago and 2% increase in the quarter which is affected by seasonality.

By the end of the quarter, the company launched a marketing campaign which together with a new one starting now, should have a positive impact in the next quarter.

Brazil

In Brazil, Terra has over 200.000 ADSL clients exiting the quarter, 148% more than one year ago and a 19% increase in the quarter.

As it is known, Terra discontinued its free access offering last year, although in order to compete with other free ISPs, the company launched a new narrowband paid access product, Terra Light, currently sold for 9.9 reals, which offers better quality, more reliability than a regular free ISPand a strong brand.

The company continued launching new OBP products. During the quarter it launched three new packages called Kit Plus, Kit Ejecutivo and Kit Fotomania, bundling different combinations of our individual communication services to our Brazillian audience.

Due to its excellent ISP offering, Carta Capital Magazine awarded Terra as the ‘most admired’ ISP provider in Brazil.

Mexico

In Mexico, a new price strategy for our access services was released in order to improve the ARPU. It consists on a fixed fee for the basic connectivity service and extra charges for additional OBP products.

Terra is now using various distributions channels to sell our products. In the case of our prepaid Internet access card called Terra Prepago, we are now selling this product through Mexican retailers and Shopping malls throughout Mexico. As already known, Terra stopped our free access offering in Mexico in the first quarter of this year and launched this prepaid Internet access card called Terra Prepago.

Argentina

In Argentina, the company launched a voice portal with Telefónica de Argentina that includes horoscope, weather, sports information and other features. It uses voice recognition for navigation and is available through regular phone lines.

14

Peru

In Peru, Terra launched the “Speedy Terra” ADSL product, product that includes several services such as PC and E-mail antivirus and five e-mail boxes. Telefónica also decided to purchase our services and include them in their ADLS product, so Terra receives a monthly fee of every model the company or Telefónica sells.

Telefónica Data and Terra Perú signed a contract offering a product, Cabinet, directed to the Cabinas Públicas Internet. Telefónica Data offers connectivity and Terra, its services (DDV, E-mail boxes, Antivirus, Virtual Agenda).

Chile

Two new products were launched in Chile: Total Flat Tarif and an upgraded ADSL which increased speed from 256 kbps to 512 kbps.

Terra Chile has 15% market share in broadband.

Technology

Technology continues to be a core competency at Terra Lycos. As mentioned, it recently reorganized all product, technology and operations around a new Global Operations group. This organization will enable Terra Lycos to streamline the production and roll-out process for existing and new products, allow for growth and create significant efficiencies in this area in the future.

In the third quarter, Terra expanded the CRM capabilities of ‘My Lycos’ to enable it to immediately present useful information to each specific user, catering to their interests (push technology). In addition, ‘My Lycos’ users now have the ability to see their last 10 search results as well as related links to similar content, manage all of their email from a single interface, and be alerted to newly available relevant online content for the user.

As the 4th largest Internet Network, Terra continues to leverage its expertise by providing hosting services to other businesses, it launched a new Web login tool for FOX Sports at foxsportsfans.com. This is a complete system based on Tripod and has a FOX Sports look and feel, which will allow users to journal and share insights on their favorite teams.

As the leading Enterprise Business portal in Latin America, in the third quarter Terra launched hosting services for several businesses in Venezuela and Colombia including ProExport and Tecnoquimicas. For each of these companies the company provides mail, chat, and forums; in addition to webhosting.

15

EBITDA

Terra achieved -18% EBITDA margin in current euros in the third quarter, versus a -29% in the same quarter of last year, the best performance ever and in line with analysts expectations. This EBITDA margin is within the guidance the company provided last July of -16% to -19%, which represents 23 million improvement versus the same quarter of last year.

16

17

Financial Statements

18

19

20

21

22

23

24

Historic Data

25

26

27

28

29

30

31

Other Information

32

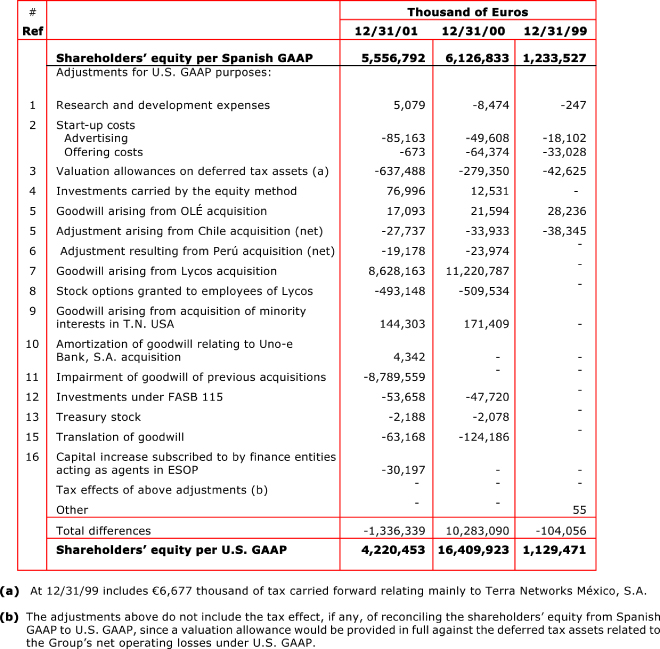

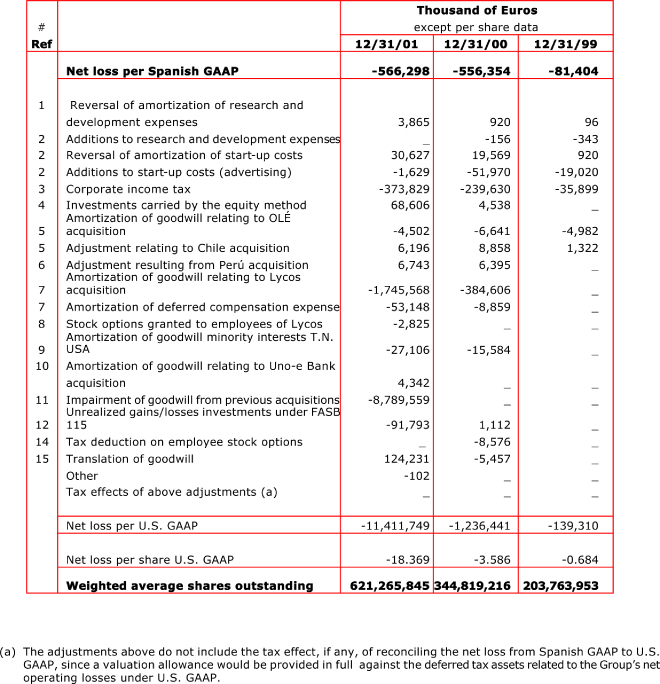

Differences between Spanish and United States Generally Accepted Accounting Principles

As described in Note (21) of the Company’s Annual report on Form 20-F, the generally accepted accounting principles in Spain (“Spanish GAAP”) differ in some respects from generally accepted accounting principles in the United States (“U.S. GAAP”). Some of the most significant differences are:1

| 1. | | Research and development | | 16. | | Shares in Deposit at Finance Entities acting as Agents in Stock Option Plans |

|

| 2. | | Accruals and deferrals | | 17. | | Change in the accounting estimate |

|

| 3. | | Corporate income tax | | 18. | | Comprehensive income |

|

| 4. | | Consolidated method | | 19. | | Statement of cash flows |

|

| 5. | | Goodwill from acquisitions from related parties and others | | 20. | | Advertising |

|

| 6. | | Capital contribution to parent company | | 21. | | Disclosure of fair value of financial instruments |

|

| 7. | | Acquisition of Lycos Virginia, Inc | | 22. | | Stock option plan |

|

| 8. | | Stock options granted to employees of Lycos | | 23. | | Earnings Per Share |

|

| 9. | | Acquisition of minority interests in Terra Networks USA | | 24. | | Business segment data |

|

| 10. | | Acquisition of Uno-e Bank, S.A. | | 25. | | Pro Forma Effect of Acquisitions |

|

| 11. | | Allocation of Purchase Price and Goodwill Impairment | | 26. | | Classification Differences |

|

| 12. | | Investments under FASB 115 | | 27. | | Significant accounting policies |

|

| 13. | | Treasury stock | | 28. | | New Accounting Standards |

|

| 14. | | Tax deduction benefit of stock options | | 29. | | Related Party Transactions |

|

| 15. | | Translation of goodwill | | 30. | | Use of estimates |

The most relevant differences in 2001 financial statements are:

Corporate income tax

1 | | For further detail please consult Form 20-F filed with the US SEC |

33

In accordance with Spanish GAAP and with Corporate Income Tax Law 43/1995, tax losses may be carried forward for ten years from the commencement of the tax period following that in which the tax losses were incurred. However, under Article 23.3 of said law, newly formed entities may calculate the period for the offset from the first tax period when their taxable base is positive. Under Spanish GAAP tax credits are only recorded when there is true and total certainty that these tax credits will be realized. Under U.S. GAAP, valuation allowances are not provided on deferred tax assets, including tax credits and carry forwards, to the extent that the assets are more likely than not to be realized.

Specifically, Spanish GAAP permit the recognition of deferred tax assets, including those arising from net operating loss carry forwards, if the deferred tax assets can be reasonably realized within a ten-year period from the date on which the assets were generated. For the 2001, 2000 and 1999 financial statements, the Group has recognized such tax assets under Spanish GAAP, since the business plan prepared by management indicates that these assets will be realized within a ten-year period.

Under U.S. GAAP, deferred tax assets should be recognized if it is “more likely than not” that these assets will be realized. In making a determination of whether it is more likely than not that a deferred tax asset is realizable, all available evidence, both positive and negative, should be considered. Companies should look to both objective evidence, such as a company’s operating history, as well as subjective evidence, such as a company’s budgets and business plans, to determine whether a valuation allowance is needed. The weight given to the potential effect of negative and positive evidence should be commensurate with the extent to which it can be objectively verified.

Under U.S. GAAP, reaching a conclusion that a valuation allowance is not needed is difficult when there is significant objective negative evidence, such as cumulative losses, in recent years. Each of the companies in the Group have incurred such losses in each tax-reporting period since its inception. Moreover, the Group does not have other objective, positive evidence such as existing contracts or a firm sales backlog, that will produce more than enough taxable income to realize the deferred tax asset based on existing sales prices and cost structures. Based on this evidence, a valuation allowance would be provided in full against the deferred tax assets related to the Group’s net operating losses under U.S. GAAP.

Allocation of Purchase Price and Goodwill Impairment

The Group, under Spanish GAAP, has recorded the difference between the purchase price of acquired companies such as Lycos Virginia, Inc. (subsequently renamed Lycos, Inc.), Terra Networks México, S.A. de C.V., Terra Networks Brasil, S.A. (formerly Nutec Informatica, S.A.) and Ordenamiento de Links Especializados, S.L. (OLÉ) and the fair value of the net assets acquired in these entities as goodwill. This goodwill is being amortized over a period of ten years beginning from the date of each acquisition.

34

The table below summarizes the allocation of the purchase price for Lycos, Inc. according to U.S. GAAP.

| | | Fair value (thousands of Euros)

| | Estimated useful life (years)

|

| Net assets (excluding intangible assets) | | 1,085,686 | | |

| Web visitors and customer base | | 389,568 | | 3 to 5 |

| Developed technology | | 376,302 | | 3 to 5 |

| Other intangible | | 196,593 | | 5 |

| Goodwill1 | | 12,429,998 | | 10 |

Total | | 14,478,147 | | |

| | |

| | |

Spanish GAAP requires that amounts paid to acquire companies in excess of the fair value of the assets acquired (including identified intangible assets) at their purchase date be accounted for as goodwill and amortized over a period not exceeding 20 years. The Group amortizes its goodwill over its estimated useful life of ten years for Spanish GAAP and for U.S. GAAP purposes.

Subsequent to acquisition (for U.S. GAAP purposes), according to APB 17, the carrying value is reviewed if the facts and circumstances, such as significant declines in sales, earnings or cash flows, suggest that it may be impaired. If this review indicates that goodwill will not be recoverable, impairment is measured by comparing the carrying value of goodwill to fair value. Fair value is determined based on discounted cash flows.

In 2001 the Controlling Company has carried out a study of the evolution of the acquired companies’ business plans in order to ascertain whether or not it was necessary to write down the goodwill arising from the acquisitions of companies in prior years. As a result of the study, the balance of the “Goodwill in Consolidation” caption was written down by €35,083,000 for Spanish and U.S. GAAP purposes. The primary facts and circumstances leading to the impairment are described in Note 4 a.

As described in Notes 21.5, 21.7 and 21.9 of the Form 20-F, there are significant differences between Spanish and U.S. GAAP in the value of goodwill associated with the acquisitions of OLÉ, Lycos, Inc. and the minority interests in Terra Networks USA. Under Spanish GAAP, the value of the shares issued to consummate the acquisition of Lycos, Inc. was €11 per share, while for U.S. GAAP purposes the shares were valued at €50.20 per share, which was the average market price of the Terra Networks, S.A. common stock around the time the merger was agreed and announced, in accordance with EITF 99-12 (see Note 21.7). Due to this difference in the purchase price, there is a goodwill of €1,766 million arising from the acquisition of Lycos, Inc. for Spanish GAAP purposes and a goodwill amounting to €13,441 million arising from this transaction for U.S. GAAP purposes. In the fourth quarter of 2001, the Controlling Company determined which amount of the goodwill (for U.S. GAAP purposes) associated with Lycos, Inc., Terra Networks USA and OLÉ was impaired. The write-off of the goodwill was based on an analysis of projected discounted cash flows, which were no longer deemed adequate to support the value of goodwill associated with OLÉ, Terra Networks USA and Lycos, Inc. under U.S. GAAP.

35

The following is a summary of the impairment charges in the consolidated statement of operations for the year ended December 31, 2001:

| | | Thousands of Euros

|

| Impairment of goodwill arising from OLÉ acquisition | | 17,093 |

| Impairment of goodwill arising from acquisition of Lycos, Inc. | | 8,628,163 |

| Impairment of goodwill arising from acquisition of minority interests in Terra Networks USA | | 144,303 |

Total goodwill impairment charge | | 8,789,559 |

36

Reconciliation of shareholders’ equity from Spanish GAAP to U.S. GAAP

37

Reconciliation of net loss from Spanish GAAP to U.S. GAAP

38

Operating P&L Description

Cost of salesrepresents the direct cost of supporting the Terra Lycos networks including all direct employee costs, product delivery and content, customer service, Ad servicing costs, and hosting and bandwidth and general office overhead.

Research and developmentincludes the direct cost of developing new and supporting existing products and services, primarily direct employee costs, consulting, content, software and general office overhead.

Sales and marketingincludes all direct costs of promoting the brand and selling against that brand including direct employee costs, marketing development and promotion, research, public relations, general office overhead.

General and Administrativeincludes all those costs which act as a support function to the company.

What is excluded from EBITDA includes interest on our commercial paper, taxes on corporate income, depreciation on fixed assets (including lease expense on fixed assets), and amortization on intangible assets (primarily relating to goodwill).

Other below the line items that are not included in EBITDA represent costs that are either not directly related to our core business or are non-recurring in nature including our share of gains and losses on strategic investments, equity losses on affiliates, and other one time charges we believe to be outside the normal course of business and which may change from period to period.

39

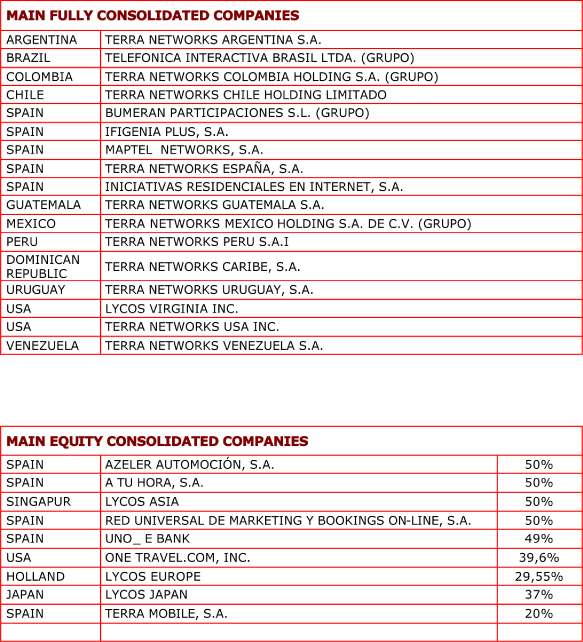

Main Fully and Equity Consolidated Companies

40

41

Press Releases

| | • | | July 1st 2002: Terra Lycos launches Lycos Search 6.0, with several new product features and enhancements to Lycos Search. Lycos Search 6.0 dramatically enhances the relevancy of its search results and launches powerful new features and functionality. |

| | • | | July 3rd 2002: Rumbo launches a new portal in Peru. |

| | • | | July 15th 2002: Terra.com launches Mi Terra, for Terra.com users to personalize their start page by select content like new headlines, sports updates and entertainment news in Spanish = Personalization tool for the Hispanic Internet user. |

| | • | | August 5th 2002: Terra Lycos and MovieTickets announce the launch of a co-branded movie tickets transaction site on Lycos Entertainment |

| | • | | August 12th 2002: Terra Lycos launches Lycos InSite AdBuyer, creating an integrated platform of paid inclusion and keywork advertising services, allowing online marketers to promote their sites to million of Terra Lycos Network users. |

| | • | | August 19th 2002: Lycos Enterprise Services expands its offerings to corporate clients with the addition of television-class content creation from program design through production and distribution. |

| | • | | September 4th 2002: Lycos implements CheckM8 rich media technology across network for fast, flexible, high-impact advertising. CheckM8 is an end-to-end rich media and integrated marketing solution. With the new technology, Lycos can dramatically compress the time it takes to implement creative online advertising, allowing clients to quickly realize the benefits of high impact messaging and to easily adjust the creative to suit their needs. |

| | • | | September 24th 2002: Rumbo launches new portals in Colombia and Venezuela. It is already present in the 7 main Latin American countries. |

| | • | | September 26th 2002: Terra Lycos launches Terra Puerto Rico. |

After the Period:

| | • | | October 7th 2002: Terra Lycos acquires GetRelevant, an online direct marketing services provider. The acquisition adds a powerful suit of products to Terra Lycos’ robust direct marketing services. GetRelevant offers online customer acquisition technology which provides managed co-registration software for content sites and co-registration inventory. |

42

Contact Information

Terra Lycos

Investor Relations

Claudia Sierra | | Investor Relations |

| Phone: | | 34.91. 452.3308 |

| e-mail: | | claudia.sierra@corp.terra.com |

| | | |

Concha López | | Investor Relations |

| Phone: | | 34.91. 452.3020 |

| e-mail: | | concha.lopez@corp.terra.com |

| | | |

Justine Alonzo | | Investor Relations USA |

| Phone | | 1.781. 370.28.07 |

| e-mail: | | justine.alonzo@corp.terralycos.com |

Terra Lycos

Shareholders Office

Cristina García | | Shareholders Office |

| Phone: | | 900.500.525 |

| e-mail: | | oficina.accionistas@corp.terra.com |

43

Safe-Harbour

This document contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this document and include statements regarding the intent, belief or current expectations of the customer base, estimates regarding future growth in the different business lines and the global business, market share, financial results and other aspects of the activities and situation relating to the Company.

Such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward looking statements as a result of various factors.

Analysts and investors are cautioned not to place undue reliance on those forward looking statements, which speak only as of the date of this presentation. Terra Lycos undertakes no obligation to release publicly the results of any revisions to these forward looking statements which may be made to reflect events and circumstances after the date of this presentation, including, without limitation, changes in Terra Lycos business or acquisition strategy or to reflect the occurrence of unanticipated events. Analysts and investors are encouraged to consult the Company’s Annual Report on Form 20-F as well as periodic filings made on Form 6-K, which are on file with the United States Securities and Exchange Commission.

44

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Terra Networks, S.A. | | |

|

| Date: | | November 8, 2002 | | By: | | /s/ Elías Rodríguez-Viña

| | |

| | | | | | | Name: | | Elías Rodríguez-Viña | | |

| | | | | | | Title: | | Chief Financial Officer | | |