FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 29th, 2003

Commission File Number: 000-28011

Terra Networks, S.A.

(Translation of registrant’s name into English)

Paseo de la Castellana, 92

28.046 Madrid

Spain

(34) 91-452-3900

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):N/A

Terra Networks, S.A.

TABLE OF CONTENTS

TERRA LYCOS

January — June 2003 Results

Graphic

Safe Harbor Statement

This document contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this document and include statements regarding the intent, belief or current expectations of the customer base, estimates regarding future growth in the different business lines and the global business, market share, financial results and other aspects of the activities and situation relating to the Company. The forward-looking statements in this document can be identified, in some instances, by the use of words such as “expects”, “anticipates”, “intends”, “believes” and similar language or the negative thereof or by the forward-looking nature of discussions of strategy, plans or intentions.

Such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward looking statements as a result of various factors.

Analysts and investors are cautioned not to place undue reliance on those forward looking statements, which speak only as of the date of this presentation. Terra Lycos undertakes no obligation to release publicly the results of any revisions to these forward looking statements which may be made to reflect events and circumstances after the date of this document, including, without limitation, changes in Terra Lycos business or acquisition strategy or to reflect the occurrence of unanticipated events. Analysts and investors are encouraged to consult the Company’s Annual Report on Form 20-F as well as periodic filings made on Form 6-K, which are on file with the United States Securities and Exchange Commission.

Graphic

2

Joaquim Agut

Chief Executive Officer

Graphic

3

Aspects of the Bid

On May 28th,

Telefonica

launched a Take-

over Bid to the

holders of

shares in Terra

Networks

| | • | | The Offer was registered with the CNMV on June 19th, 2003 |

| | • | | The acceptance period started on June 23rd and finished on July 23rd |

| | • | | Terra Networks Board of Directors opinion was issued on June 26th concluding |

| | – | | the Offer in its terms and conditions was fair to the shareholders |

| | – | | the Offer is for the benefit of the Company and of its shareholders |

Graphic

4

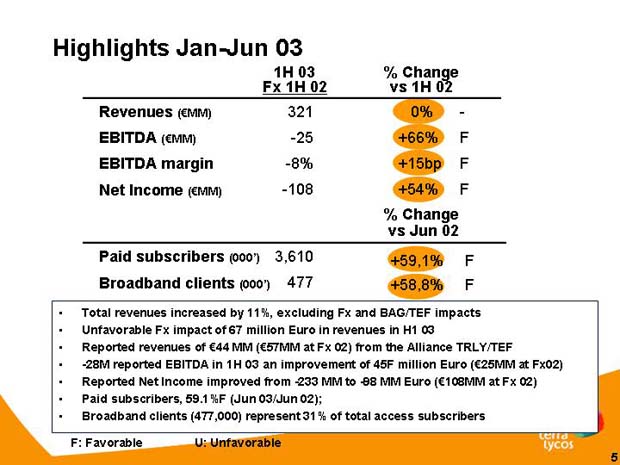

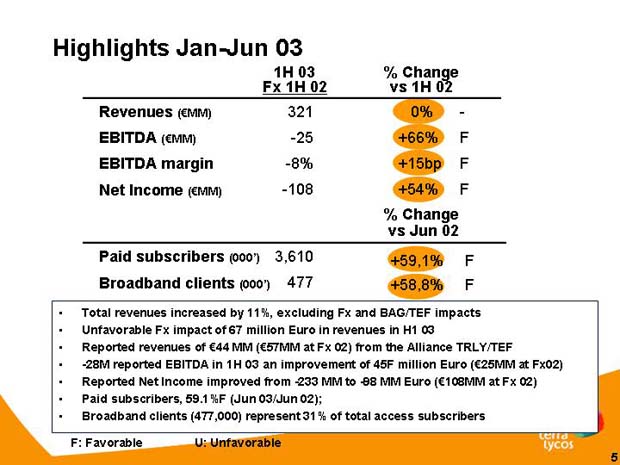

Highlights Jan-Jun 03

| | | 1H 03 Fx 1H 02

| | % Change vs 1H 02 | | | |

Revenues (€MM) | | 321 | | 0% | | | — |

EBITDA (€MM) | | -25 | | +66% | | | F |

EBITDA margin | | -8% | | +15bp | | | F |

Net Income (€MM) | | -108 | | +54% | | | F |

| | | |

| | | | | % Change vs Jun 02 | | | |

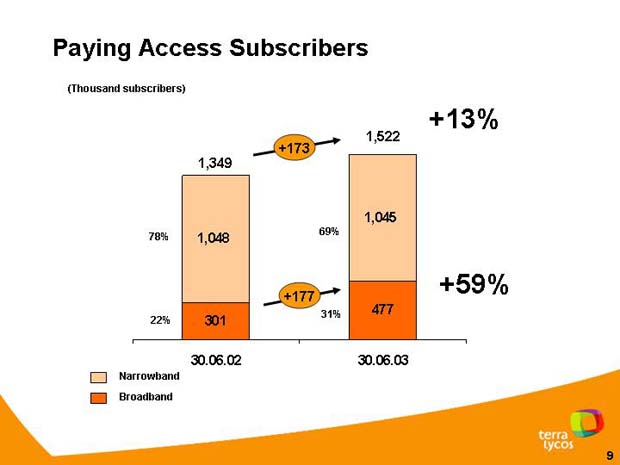

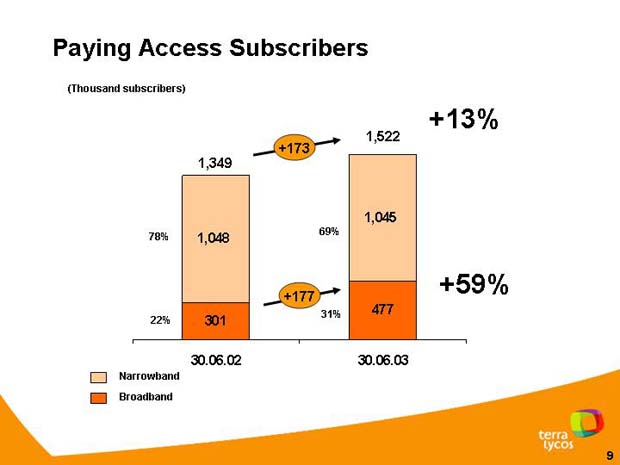

Paid subscribers (000’) | | 3,610 | | +59,1 | % | | F |

Broadband clients (000’) | | 477 | | +58,8 | % | | F |

| • | | Total revenues increased by 11%, excluding Fx and BAG/TEF impacts |

| • | | Unfavorable Fx impact of 67 million Euro in revenues in H1 03 |

| • | | Reported revenues of €44 MM (€57MM at Fx 02) from the Alliance TRLY/TEF |

| • | | -28M reported EBITDA in 1H 03 an improvement of 45F million Euro (€25MM at Fx02) |

| • | | Reported Net Income improved from -233 MM to -98 MM Euro (€108MM at Fx 02) |

| • | | Paid subscribers, 59.1%F (Jun 03/Jun 02); |

| • | | Broadband clients (477,000) represent 31% of total access subscribers |

F: Favorable | U: Unfavorable |

Graphic

5

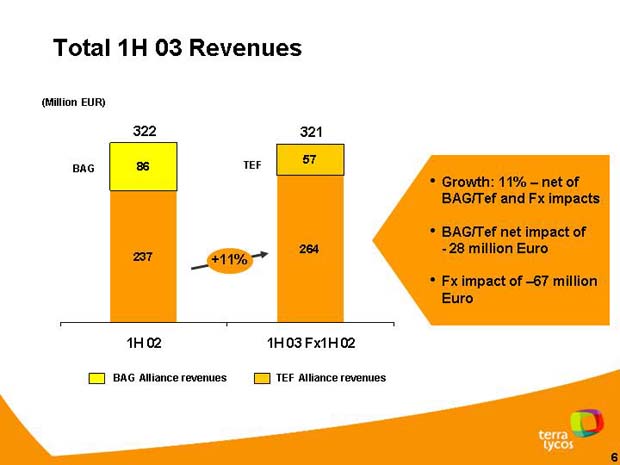

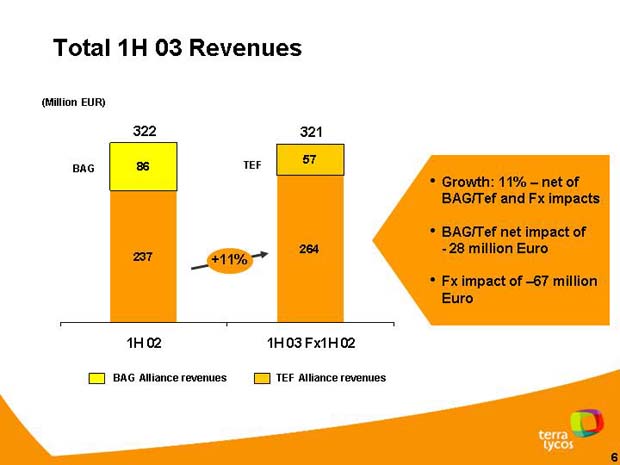

Total 1H 03 Revenues

Graphic

| • | | Growth: 11% – net of BAG/Tef and Fx impacts |

| • | | BAG/Tef net impact of—28 million Euro |

| • | | Fx impact of –67 million Euro |

Graphic

6

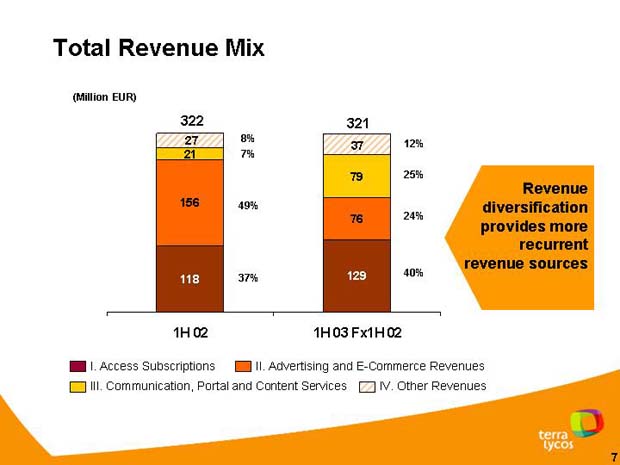

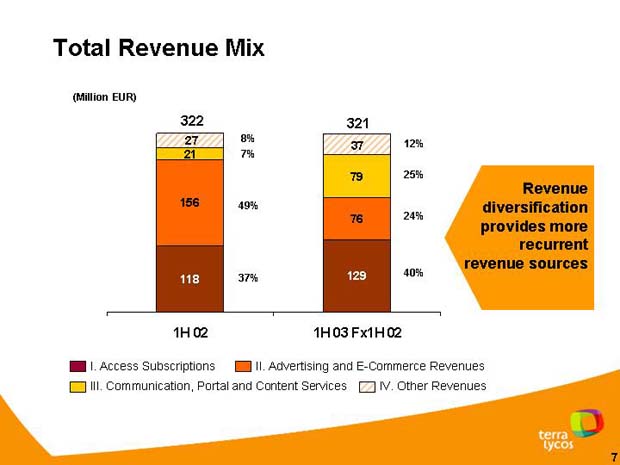

Total Revenue Mix

Graphic

Revenue

diversification

provides more

recurrent

revenue sources

Graphic

7

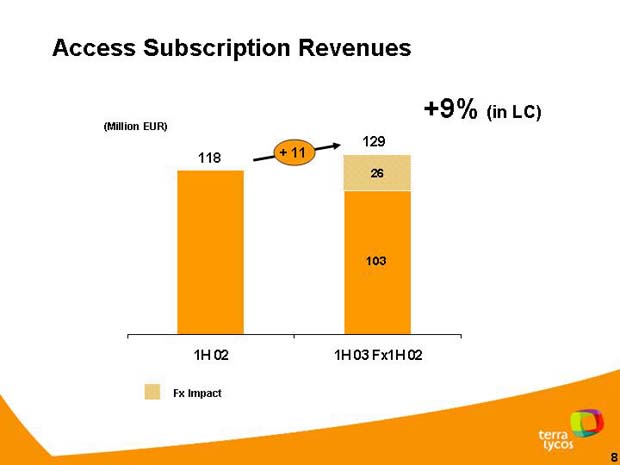

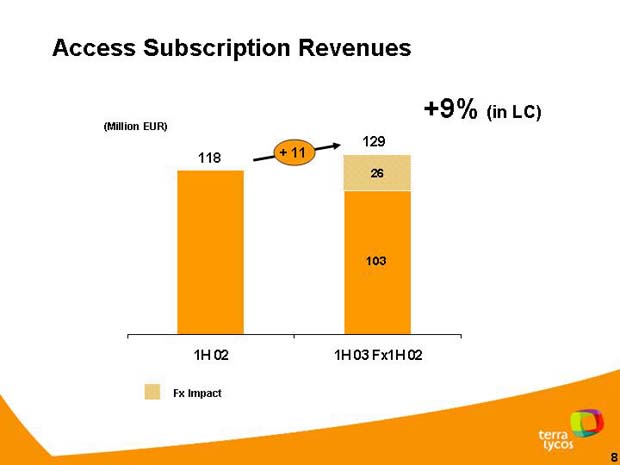

Access Subscription Revenues

Graphic

Graphic

8

Paying Access Subscribers

Graphic

Graphic

9

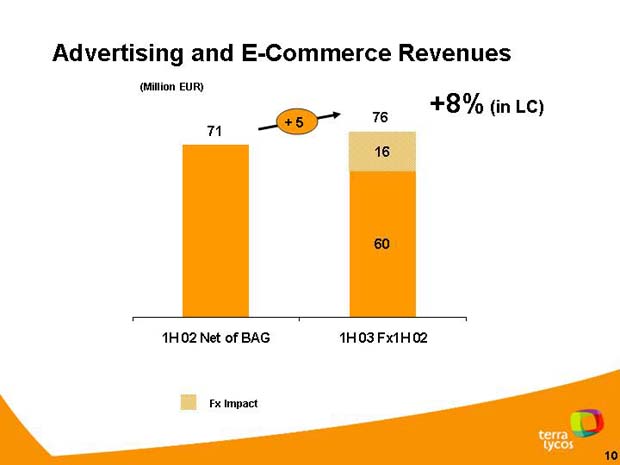

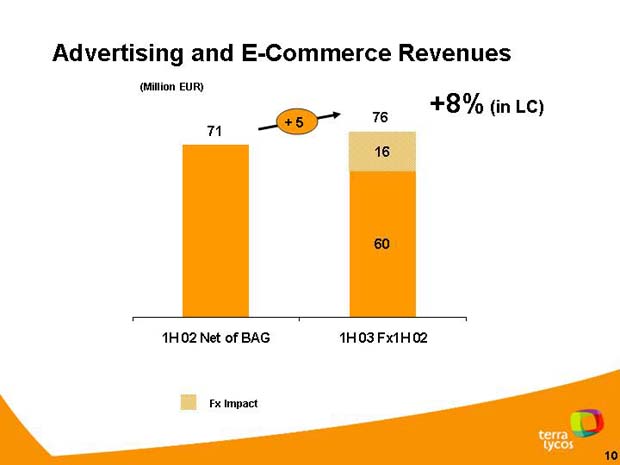

Advertising and E-Commerce Revenues

Graphic

Graphic

10

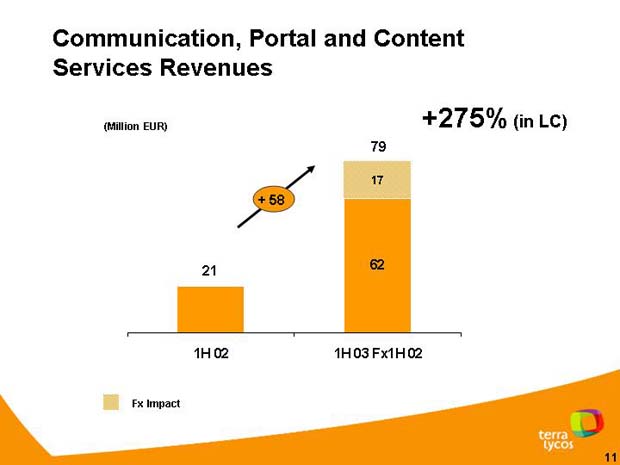

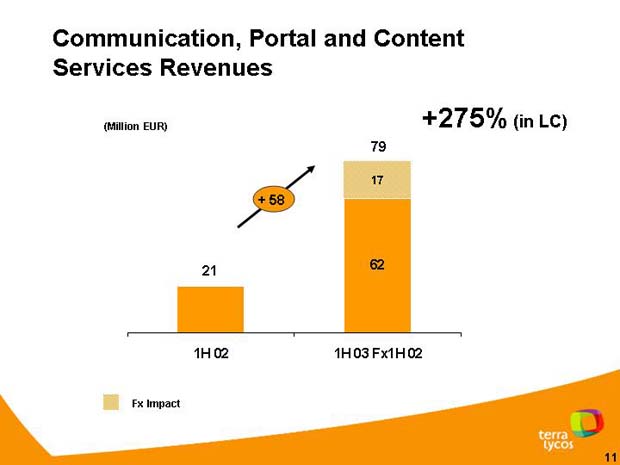

Communication, Portal and Content

Services Revenues

Graphic

Graphic

11

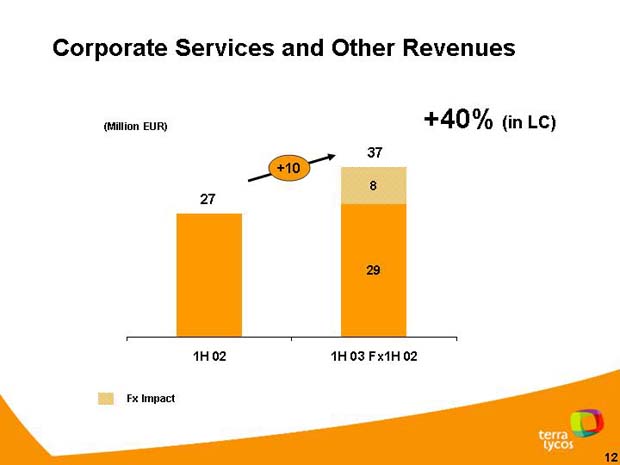

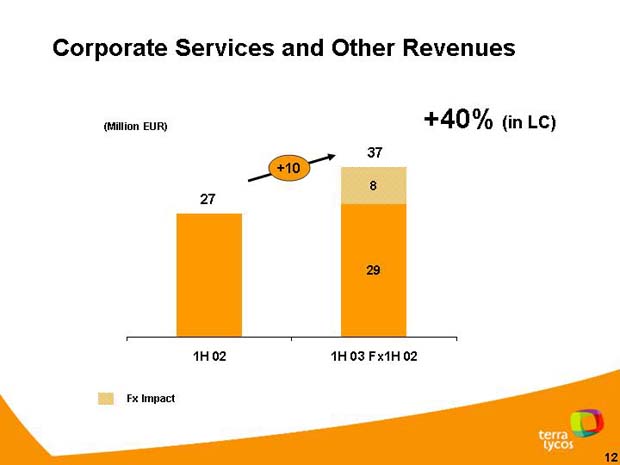

Corporate Services and Other Revenues

Graphic

Graphic

12

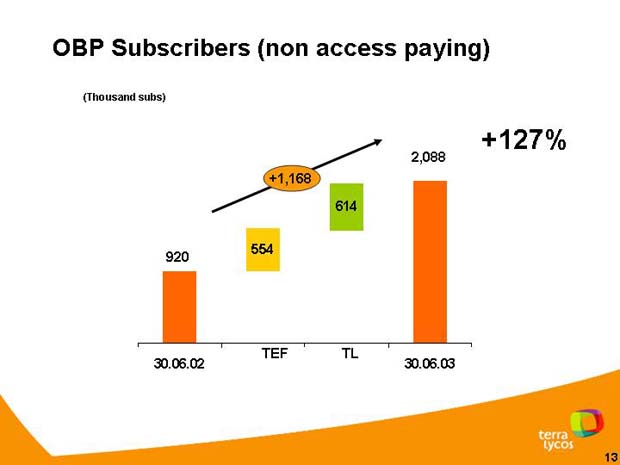

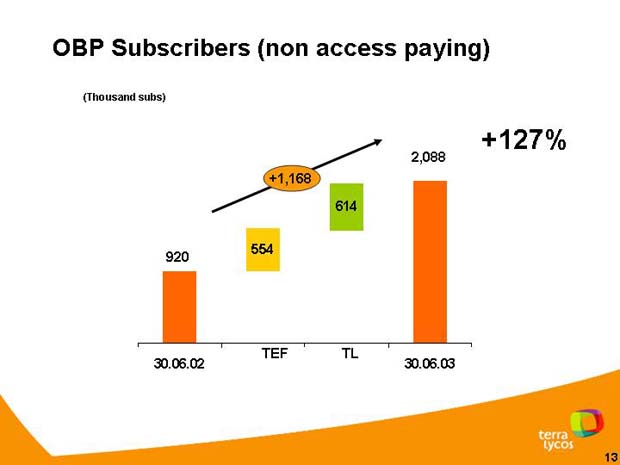

OBP Subscribers (non access paying)

Graphic

Graphic

13

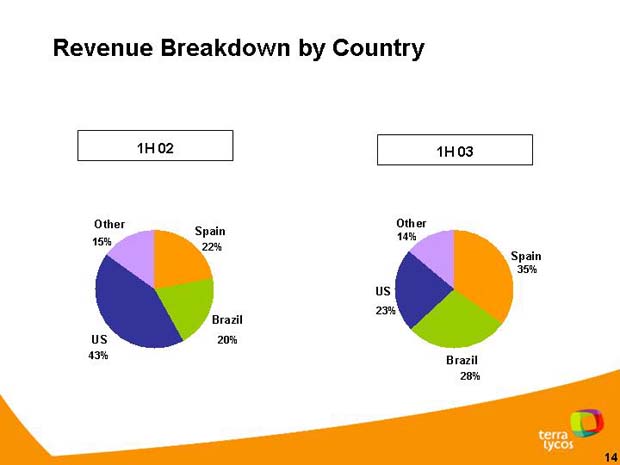

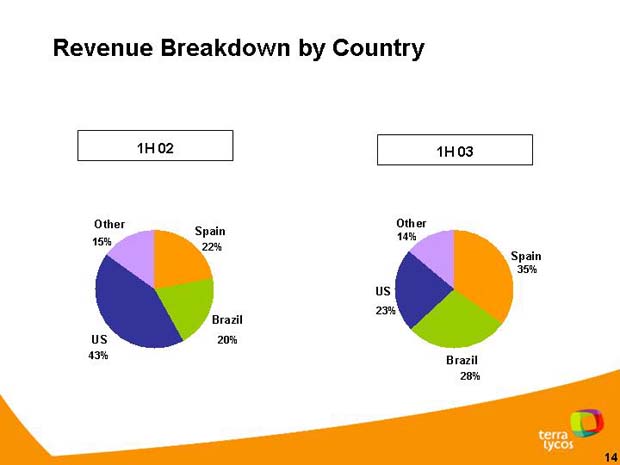

Revenue Breakdown by Country

Graphic

Graphic

14

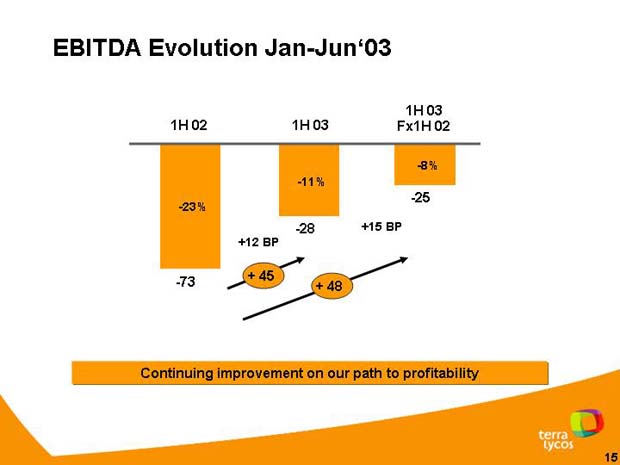

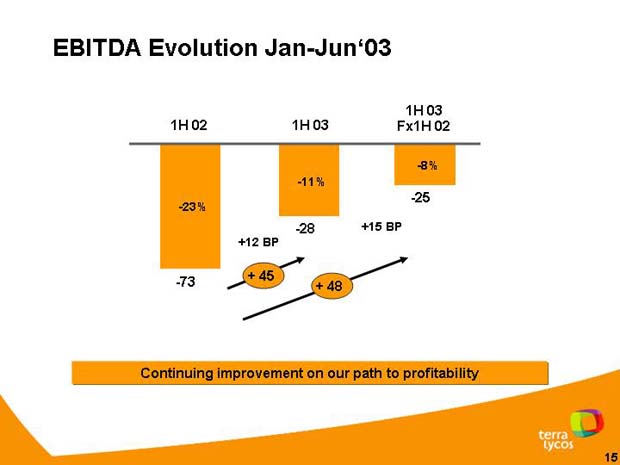

EBITDA Evolution Jan-Jun’03

Graphic

Continuing improvement on our path to profitability

Graphic

15

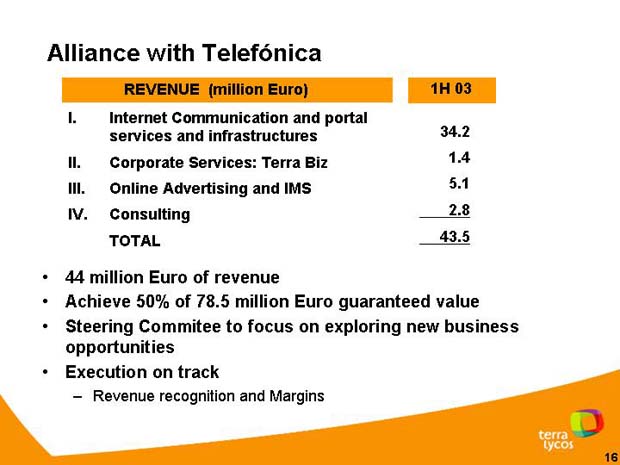

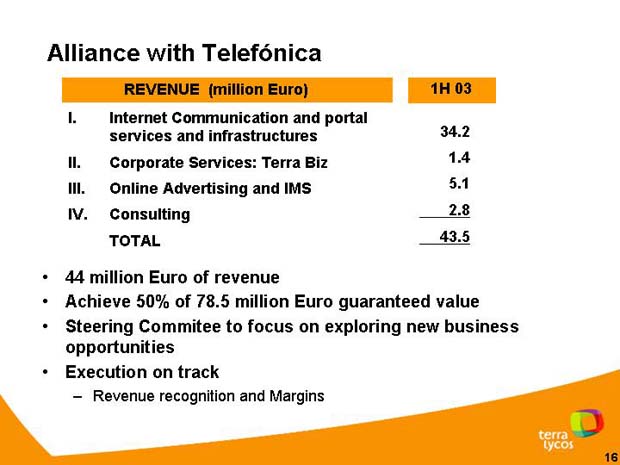

Alliance with Telefónica

| REVENUE (million Euro) | | 1H 03 |

I. Internet Communication and portal services and infrastructures | | 34.2 |

II. Corporate Services: Terra Biz | | 1.4 |

III. Online Advertising and IMS | | 5.1 |

IV. Consulting | | 2.8 |

| | |

|

TOTAL | | 43.5 |

| | |

|

| • | | 44 million Euro of revenue |

| • | | Achieve 50% of 78.5 million Euro guaranteed value |

| • | | Steering Commitee to focus on exploring new business opportunities |

| | – | | Revenue recognition and Margins |

Graphic

16

Global Operations

| • | | Savings of about 4 million Euro in H2’03 due to data center rationalization and price renegotiations in the US |

| • | | Examples of Products launched in the quarter include; |

– Parental Control in Spain,

– Disney in Spain,

– Terra Messenger version 3.2 in Brazil, Chile, US and Spain,

– Greeting cards in Latam, among several other products

| • | | New global project and time tracking tools allow for better global product roadmap implementation and efficient resource prioritization |

Graphic

17

Terra Biz. Internet as a channel

(online transactional activities)

| | • | | We are consolidating our investments mainly in three key sectors: |

– Finance,

– Travel and

– Education

| | • | | We are developing new projects in those three sectors as well as in new ones like entertainment and commerce. |

Leverage TL users base and strategic partners

know-how and infrastructure

Graphic

18

Elías Rodríguez –Viña

Chief Financial Officer

Graphic

19

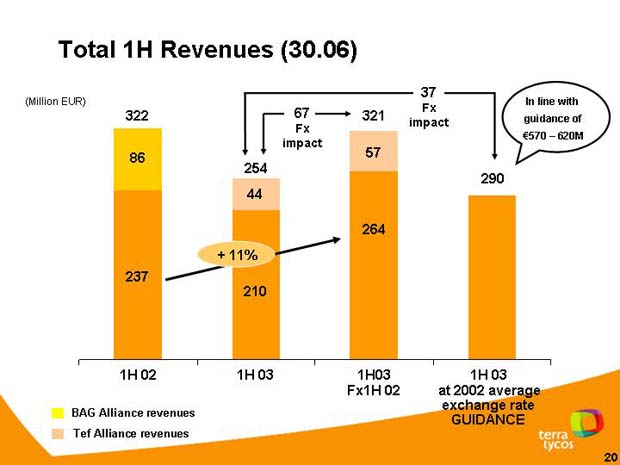

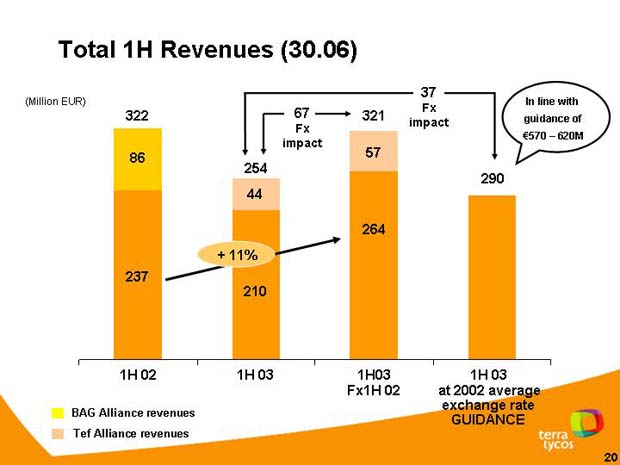

Total 1H Revenues (30.06)

Graphic

Graphic

20

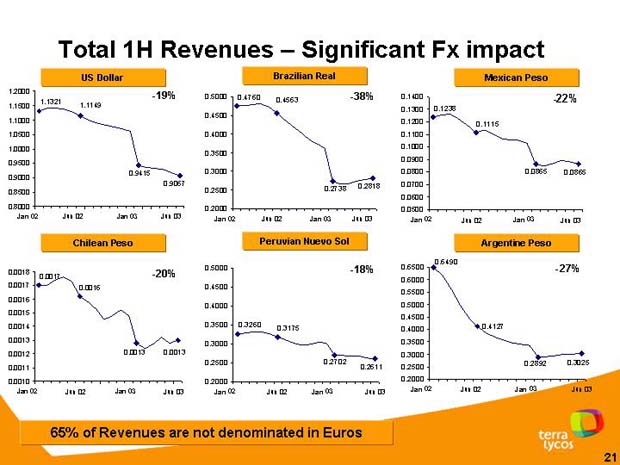

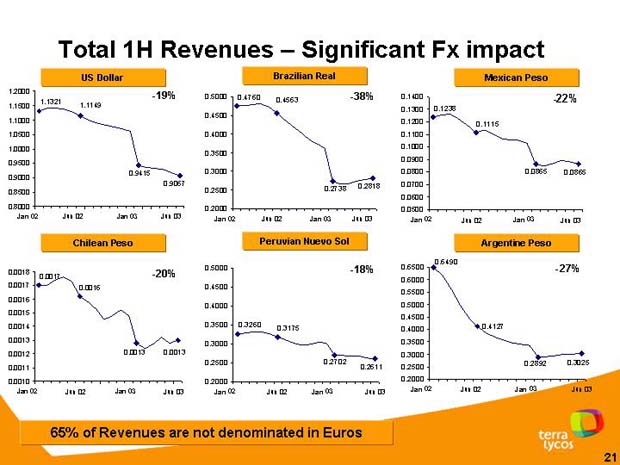

Total 1H Revenues — Significant Fx impact

Graphic

65% of Revenues are not denominated in Euros

Graphic

21

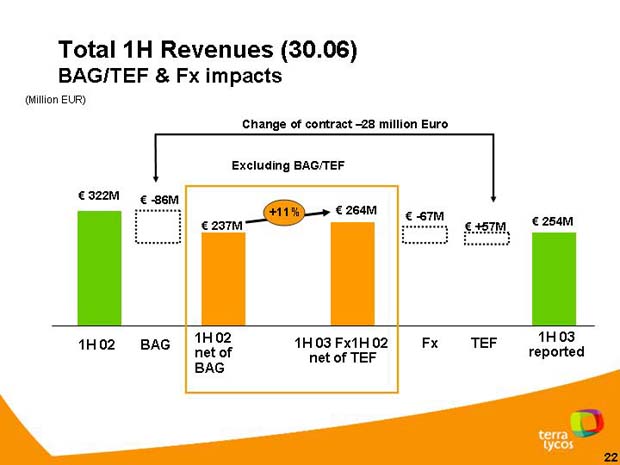

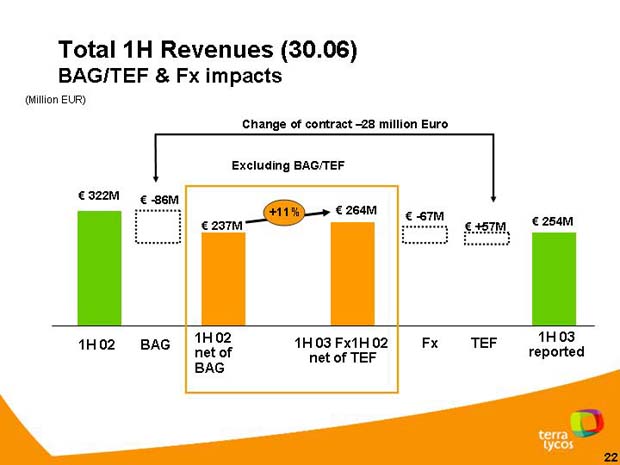

Total 1H Revenues (30.06)

BAG/TEF & Fx impacts

Graphic

Graphic

22

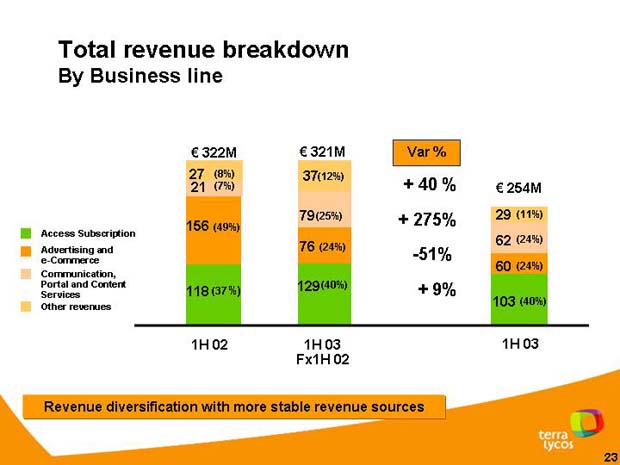

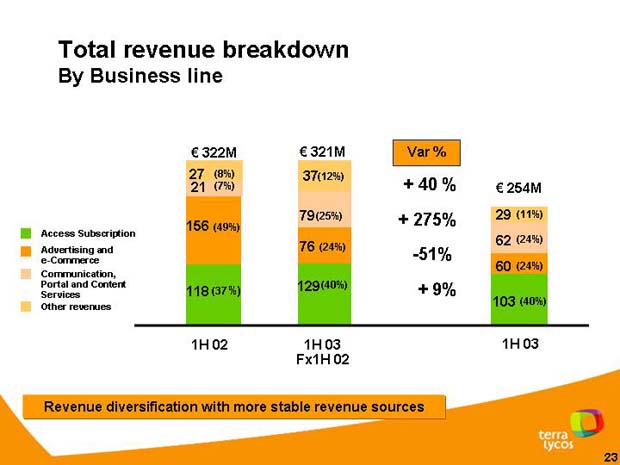

Total revenue breakdown

By Business line

Graphic

Revenue diversification with more stable revenue sources

Graphic

23

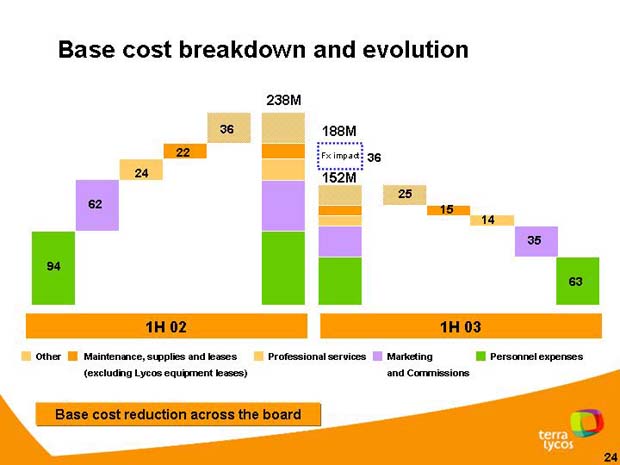

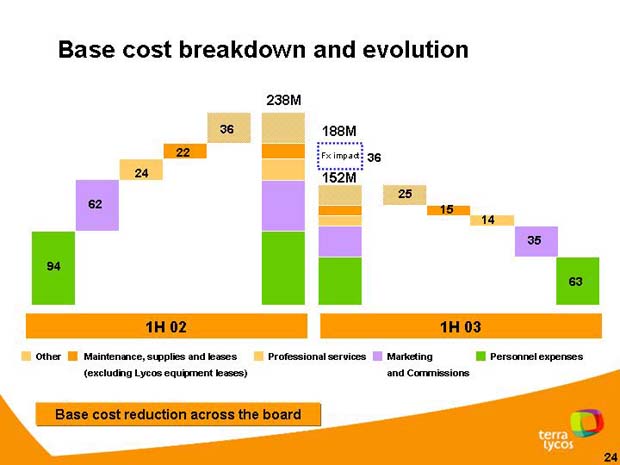

Base cost breakdown and evolution

Graphic

Base cost reduction across the board

Graphic

24

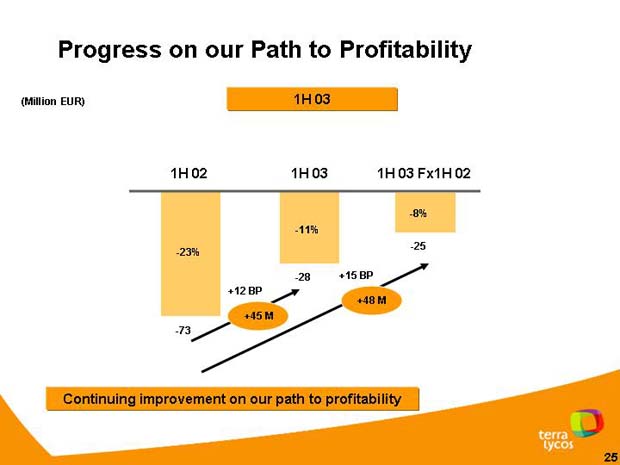

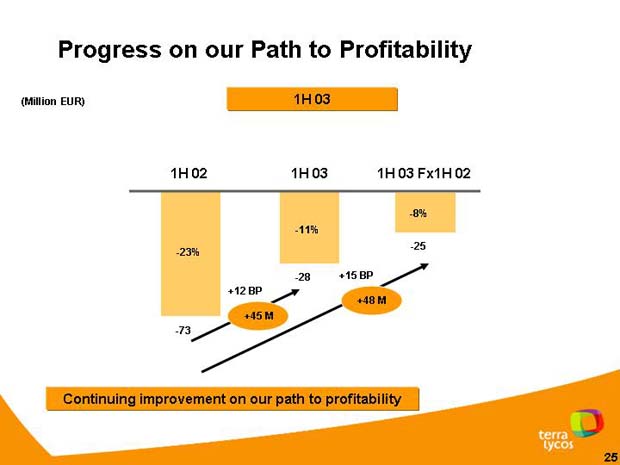

Progress on our Path to Profitability

Graphic

Continuing improvement on our path to profitability

Graphic

25

Q & A Session

Graphic

Graphic

26

TERRA LYCOS

January – June 2003 Results

Graphic

27

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Terra Networks, S.A. |

| |

| Date: 7/30/2003 | | By: /s/ Elías Rodríguez-Viña Cancio |

| | | Name: Elías Rodríguez-Viña Cancio |

| | | Title: Chief Financial Officer |

| | | Terra Networks, S.A. |