FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

July 23rd, 2004

Commission File Number: 000-28011

Terra Networks, S.A.

(Translation of registrant’s name into English)

Paseo de la Castellana, 92

28.046 Madrid

Spain

(34) 91-452-3900

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No X

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Terra Networks, S.A.

TABLE OF CONTENTS

| | | | |

Item

| | | | Sequential

Page

Number

|

1 | | Quarterly Earnings Press Release dated 23 of July, 2004 | | 1 to |

07/23/04

Terra Lycos net income improves by 29 million euros compared to the first half 2003

TERRA LYCOS RAISES REVENUES BY 8% AND IMPROVES EBITDA BY 31 MILLION EUROS

Key highlights of the first half 2004 performance compared to the same period in 2003:

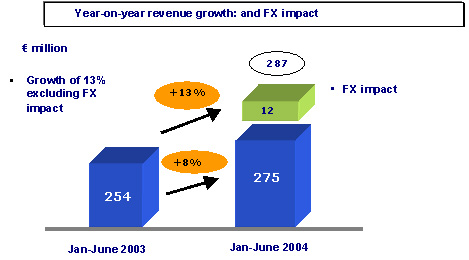

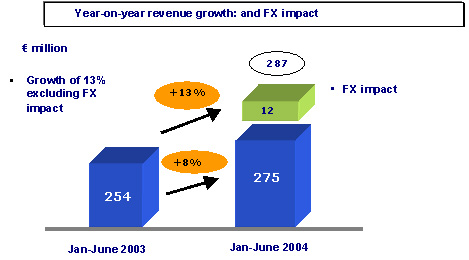

| | • | Terra Lycos group revenues for January-June 2004 stood at 275 million euros, an 8% increase over the same period in 2003. In constant euros (excluding the exchange-rate effect) revenues rose by 13% to 287 million euros. |

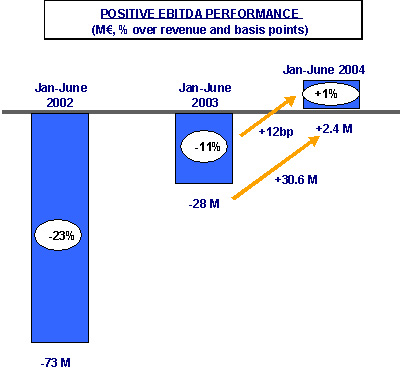

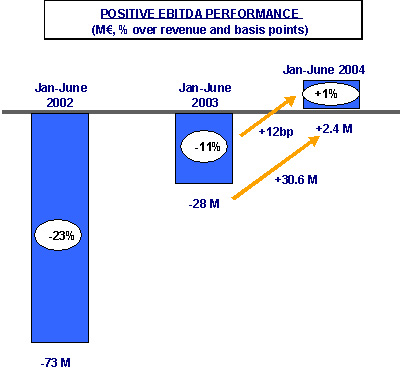

| | • | EBITDA, which has now been positive for three consecutive quarters, was 2.4 million euros, an improvement of 30.6 million euros over the first half of 2003. The EBITDA margin improved by 12 basis points. |

| | • | Net income for the first half improved by 29 million euros compared to the same period in 2003, to –69 million euros. |

| | • | At end-June 2004 the Company had 5.7 million access, communication, content and portal services subscribers, an increase of 59% over June 2003. |

| | • | Terra Lycos had a total of 842,000 broadband clients in June, an increase of 76% over the same period in 2003. Subscribers to communications, portal and content services grew by 86%, to 3.9 million. |

1

Madrid, July 23rd 2004- Terra Lycos (MC: TRR; NASDAQ: TRLY), the world’s leading Spanish and Portuguese internet group today released its financial results for the first half of 2004, and comparisons with the same period in 2003.

Revenues

The Company recorded revenues of 275 million current euros in the first half of 2004, an 8% increase over the same period in 2003. 59% of total consolidated revenues, were contributed by countries outside the euro zone. Revenues were negatively impacted by the exchange rate in the amount of 12 million euros. In constant euros, that is excluding the exchange rate effect, revenues rose to 287 million euros, an improvement of 13% over the 254 million euros revenues posted in June 2003.

The access business accounted for 43% of Terra Lycos’ revenues; advertising and e-commerce accounted for 25%; communication, portal and content services for 22%; and corporate, SME services and other revenues accounted for 10%.

The alliance with Telefónica, signed in February 2003 but effective from January 1st 2003, generated revenues of 59 million euros over the first half of the year. This alliance, signed in replacement of the agreement with Bertelsmann, guarantees profitablility and stability for Terra Lycos’ business model in the medium and long term (minimum six years and the possibility of automatic renewals vs. the remaining 3 years of the previous contract). It generates a minimum of 78.5 million euros in value annually.

2

Operating expenses

The Company maintains its efficient management of operations, backed by a steady improvement in processes and structures, and is steadily bringing down operating costs. Excluding goods purchased, other operating expenses totalled 180 million euros, an improvement of 9% over January-June 2003.

EBITDA

Improvements on the gross profit line, and the firm grip on other operating costs resulted in a sharp rise in operating income or EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), which has now been positive for three consecutive quarters. EBITDA in the period was 2.4 million euros, a 30.6 million euro or 12 basis points improvement over the same period of last year.

Net income

Net income for the first half of 2004 improved by 29 million euros, in current euros, compared to the same period 2003, to –69 million euros.

3

Cash

The Company closed the first half 2004 with 1,615 million euros in cash, up by 20 million euros on the 2003 close. At the June 22nd AGM a majority of shareholders voted to pay an extraordinary dividend charged against the issue premium reserve, of 2 euros before tax for each Terra Lycos share in issue, to be paid on July 30th .

Operating Results

Terra Lycos had 5.7 million paid access, communication, content and portal services subscribers at the end of June 2004, an increase of 59% compared to June 2003.

Of note is the increase in broadband subscribers totalling 842,000 at June 30th , a 76% increase over June 2003. Broadband now provides 46% of all paying access customers, up from 31% at end-June 2003. The broadband subscriber base rose by 83% in Brazil, 42% in Spain and 125% in Chile.

Subscribers for communication, content and portal services rose by 86% to 3.9 million. This was due to both the success of the products and services launched by the Company in the various countries where it operates and the alliance with Telefónica, which generated 2.5 million customers.

Kim Faura, executive chairman of Terra Lycos, said he was very satisfied “with growth achieved throughout all business lines, reflecting the success of our products and our focus on customer satisfaction”. He added, “Continuing improvement in Terra Lycos’ profitability remains our key aim. These results are a positive reflection of our commitment to remain in operating profit this year and to break into net profit next year”.

Telephone numbers:

| | |

• Public Relations | | |

Miguel Angel Garzón | | Ana Sánchez (U.S.) |

+34-91-452-3921 | | +1-781-370-3281 |

miguel.garzon@corp.terra.com | | ana.sanchez@corp.terralycos.com |

| |

• Investor Relations | | |

Miguel von Bernard | | |

+34-91-452-3922 | | |

relaciones.inversores@corp.terralycos.com | | |

4

Annex I

TERRA LYCOS

Consolidated Statement of Operations

(In thousands of euros – Spanish GAAP)

Unaudited

| | | | | | |

| | | Six Months Jun-30

| |

| | | 2004

| | | 2003 (1)

| |

Revenues: | | | | | | |

Access | | 116,833 | | | 104,409 | |

Advertising and e-commerce | | 68,667 | | | 59,933 | |

Communication, portal and content services | | 61,692 | | | 62,333 | |

Corporate & SMEs Services and Other | | 27,709 | | | 27,061 | |

Total revenues | | 274,901 | | | 253,736 | |

| | |

Goods purchased | | (131,600 | ) | | (129,529 | ) |

Gross profit | | 143,301 | | | 124,207 | |

| | |

Personnel expenses | | (54,003 | ) | | (62,712 | ) |

Professional services | | (10,858 | ) | | (11,430 | ) |

Depreciation and amortization | | (38,714 | ) | | (37,492 | ) |

Marketing and Commissions | | (33,347 | ) | | (35,398 | ) |

Maintenance, supplies and leases | | (15,128 | ) | | (23,905 | ) |

Other expenses | | (27,606 | ) | | (27,385 | ) |

Total other operating expenses | | (179,656 | ) | | (198,322 | ) |

| | |

Operating loss | | (36,355 | ) | | (74,115 | ) |

| | |

Financial income (expense) | | 17,410 | | | 21,416 | |

Amortization of goodwill | | (39,388 | ) | | (42,173 | ) |

Equity share in affiliate losses, net | | (8,050 | ) | | (8,608 | ) |

Extraordinary income (expense) and other | | (24,400 | ) | | 5,773 | |

| | |

Income (loss) before taxes | | (90,783 | ) | | (97,707 | ) |

| | |

Corporate income tax | | 19,008 | | | (168 | ) |

Minority interest | | 2,498 | | | 24 | |

| | |

Net Loss (Spanish GAAP) | | (69,277 | ) | | (97,851 | ) |

| | |

Shares excluding Stock Options Plan (’000) | | 561,070 | | | 560,835 | |

| (1) | Revenue by business line and some operating expenses show slight variations from previously reported figures due to reclassifications |

5

Annex II

TERRA LYCOS

Notes to P&L

EBITDA

(in thousand of Euros-Spanish GAAP)

Unaudited

| | | | | | | | | |

| | | Jun-30

| | | | |

| | | 2004

| | | 2003

| | | D%

| |

Operating loss | | (36,355 | ) | | (74,115 | ) | | 51 | % |

Depreciation and amortization | | 38,714 | | | 37,492 | | | -3 | % |

Leases on fixed assets (1) | | 0 | | | 8,404 | | | 100 | % |

| | | |

EBITDA (2) | | 2,359 | | | (28,219 | ) | | 108 | % |

EBITDA Margin | | 0.9 | % | | -11 | % | | 12 p.p. | |

| (1) | In all prior periods reported and for EBITDA guidance calculation purposes, expenses related to equipment leases recorded in Lycos are deemed to be depreciation costs. |

| (2) | See EBITDA description in the Other Information section |

OPERATING DATA

(in thousands)

| | | | | | | |

| | | Jun-30

| | | |

| | | 2004

| | 2003

| | D%

| |

Total Paid Subscribers (1) | | 5,726 | | 3,610 | | 59 | % |

| | | |

Access: | | | | | | | |

Narrowband | | 992 | | 1,045 | | -5 | % |

Broadband | | 842 | | 477 | | 76 | % |

Total | | 1,833 | | 1,522 | | 20 | % |

| | | |

OBP (CSP/Portal): | | 3,893 | | 2,088 | | 86 | % |

| | | |

Broadband Access Subscribers: | | | | | | | |

Spain | | 192 | | 135 | | 42 | % |

Latam | | 650 | | 342 | | 90 | % |

Total | | 842 | | 477 | | 76 | % |

| (1) | Based on number of services delivered. Some subscribers may be contracting access and OBP product/services at the same time. |

6

Annex III

TERRA LYCOS

Other Information

Revenues

Access: subscriptions, traffic-inducement fees and call center revenues from residential clients.

Advertising and e-commerce: advertising, slotting fees and transaction commissions.

Communication, Portal and Content Services: value-added service fees related to communication, portal and content services and software package licenses provided to residential customers, professionals or SMEs and paid to us by the final user, or the companies through which we distribute them to the final user.

Corporate Services & SMEs and Other: primarily services to corporations and SMEs both access and media related. It excludes fees paid to us by the companies that distribute our value-added services, which are included under the communication, portal and content services line.

Goods Purchased

Include telecommunication expenses, technical help desk expenses, purchase of customer connection kits and modems, cost of e-commerce products sold, ad-serving costs, purchase of content, operating outsourcing and any other purchase.

Personnel Expenses

Include salaries, associated expenses and other employee benefits, regardless of the job classification of the employee.

Professional Services

Include, among others, consulting, legal advisors’, auditors’ fees.

Depreciation and Amortization Expenses

Include depreciation charges relating to tangible assets and amortization charges relating to intangible assets (not including goodwill), intangible rights and start-up costs.

Marketing and Commissions

Include expenses related to advertising and marketing.

Maintenance, Supplies and Leases

Include rental expenses, equipment leases, repairs and maintenance expenses, as well as expenses related to internal communications and other office expenses.

7

Other Expenses

These expenses include bad debt, tax (other than income tax), travel expenses, insurance policies and other expenses.

EBITDA

EBITDA is defined as operating income (loss) before depreciation on fixed assets, lease expense on fixed assets and amortization on intangible assets.

Other below the line items that are not included in EBITDA represent costs that are either not directly related to our core business or are non-recurring in nature including our share of gains and losses on equity method investments, goodwill amortization and other one time charges we believe to be outside the normal course of business and which may change from period to period, as well as income taxes.

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | | Terra Networks, S.A. |

| | |

Date: 23rd of July 2004 | | By: | | /s/ Elías Rodríguez-Viña Cancio

|

| | | | | Name: | | Elías Rodríguez-Viña Cancio |

| | | | | Title: | | Chief Financial Officer Terra Networks, S.A. |