SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | Annual Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2006

or

¨ | Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

COMMISSION FILE NUMBER 000-27915

GENIUS PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE | | 33-0852923 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

2230 BROADWAY, SANTA MONICA, CALIFORNIA | | 90404 |

(Address of principal executive offices) | | (Zip Code) |

(310) 453-1222

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, PAR VALUE $0.0001

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KSB or any amendment to this Form 10-KSB. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant was $68,655,618 as of June 30, 2006 (computed by reference to the average of the bid and asked price of a share of the registrant’s common stock on that date as reported by the Over the Counter Bulletin Board). For purposes of this computation, it has been assumed that the shares beneficially held by directors and officers of registrant were “held by affiliates”; this assumption is not to be deemed to be an admission by such persons that they are affiliates of registrant.

There were 65,421,762 shares of the registrant’s common stock outstanding as of March 31, 2007.

TABLE OF CONTENTS

| | Page |

PART I |

| ITEM 1. | DESCRIPTION OF BUSINESS | 1 |

| ITEM 1A. | RISK FACTORS | 7 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 11 |

| ITEM 2. | DESCRIPTION OF PROPERTY | 11 |

| ITEM 3. | LEGAL PROCEEDINGS | 12 |

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 13 |

| |

PART II |

| ITEM 5. | MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 15 |

| ITEM 6. | SELECTED FINANCIAL DATA | 19 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 20 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 31 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 31 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 31 |

| ITEM 9A. | CONTROLS AND PROCEDURES | 31 |

| ITEM 9B. | OTHER INFORMATION | 34 |

| |

PART III |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 35 |

| ITEM 11. | EXECUTIVE COMPENSATION | 39 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 51 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 53 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 55 |

| | | |

PART I |

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 57 |

| EXHIBIT INDEX | 57 |

This Annual Report on Form 10-K includes “forward-looking statements”. To the extent that the information presented in this Annual Report discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this Annual Report. These cautionary statements identify important factors that could cause actual results to differ materially from those described in the forward-looking statements.

When considering forward-looking statements in this Annual Report, you should keep in mind the cautionary statements in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, and other sections of this Annual Report. Except as required by law, we do not intend to update our forward-looking statements, whether written or oral, to reflect events or circumstances after the date of this Annual Report.

PART I

TRANSACTION WITH THE WEINSTEIN COMPANY

On July 21, 2006, Genius Products, Inc. (“we”, “us”, “our” or the “Company”) completed a strategic transaction (the “TWC Transaction”) with The Weinstein Company LLC (“TWC”) and its parent company, The Weinstein Company Holdings LLC, and formed a venture named Genius Products, LLC (the “Distributor”) to exploit the U.S. home video distribution rights to feature film, television programming, documentary and direct-to-video releases owned or controlled by TWC and other content partners. At the closing of the TWC Transaction on July 21, 2006 (the “Closing”), we contributed to the Distributor all of our operating businesses, including substantially all of our assets, except for approximately $1.0 million in cash, the right to proceeds from the exercise of options and warrants issued prior to the Closing and certain liabilities. At the Closing, the Company received a 30% equity interest in the Distributor and became the managing member of the Distributor.

For the period from July 22, 2006 through December 31, 2006, we accounted for our investment in the Distributor using the equity method of accounting. Under the equity method of accounting, only our investment in and amounts due to and from the Distributor are included in our consolidated balance sheet. As a result, we recorded an asset on our balance sheet related to our investment interest in the Distributor. In our statement of operations, we recorded our 30% share of the Distributor’s loss as equity in net losses from the Distributor. We recorded a gain upon consummation of the TWC Transaction based on the difference between the fair market value of assets contributed and their net book value, reduced for the portion of the gain associated with our retained economic interest in the Distributor. After the Closing, substantially all of our revenues and expenses, including revenues from sales of TWC products, are reflected in the financial statements of the Distributor.

The information in this Annual Report pertaining to our business operations reflects the operations of the Company prior to the Closing and the operations of the Distributor after the Closing. In addition, we are including standalone financial statements of the Distributor, which are located immediately following the financial statements for the Company.

BUSINESS

Overview

We, through the Distributor, are a leading entertainment products distribution company that distributes, licenses, acquires and produces an expanding library of feature films, television programming, family, lifestyle and trend entertainment on digital versatile discs (“DVD”) and other emerging platforms such as the new high-definition DVD formats and digital distribution technologies. The Distributor produces and sells on DVD its own proprietary content, licenses content from third parties for distribution on DVD, and distributes content on DVD from third parties for a fee. To a limited extent, the Distributor also distributes a line of musical compact discs (“CDs”) under recognizable brand names in three categories: Classical, Instrumental, and Vocal.

The Distributor focuses primarily on the following four core, branded content areas, frequently referred to as “Content Verticals”:

| · | Theatrical/Independent Films (includes Independent Film Channel (IFC)®, RHI Entertainment™ (Hallmark library), Tartan, The Weinstein Company® and Wellspring™) |

| · | Sports (includes ESPN® and World Wrestling Entertainment®) |

| · | Lifestyle (includes Animal Planet, The Learning Channel (TLC™) and Wellspring™) |

| · | Family/Faith (includes Classic Media, Discovery Kids™, Entertainment Rights and Sesame Workshop®) |

The following table summarizes the Distributor’s primary brands and content suppliers:

Owned or Licensed Brands and Trademarks | Distributed Content |

| Animal Planet | Amity Entertainment |

| Berliner Film Company | Bauer Martinez Entertainment |

| Genius Entertainment | Brandissimo! |

| Grodfilms | BKN Entertainment |

| Hollywood Classics™ | Classic Media |

| Jillian Michaels | Discovery Kids™ |

| J Horror Library (through Horizon | Entertainment Rights |

| Entertainment and Pony Canyon) | ESPN ® |

| Laugh Factory | ImaginAsian Entertainment |

| Peace Arch Entertainment | Independent Film Channel (IFC) ® |

| Porchlight Entertainment | Legend Film Library |

| Spectrum Connections | Liberation Entertainment Library |

| Taffy Entertainment | Pacific Entertainment |

| The Flockhearts | RHI Entertainment™ (Hallmark Library) |

The Learning Channel (TLC™) | Sesame Workshop® |

| Wellspring Library™ | Seven Arts |

| Workout of Champions | Tartan Video USA |

| | Televisa |

| | The Weinstein Company® |

| | World Wrestling Entertainment® |

The Distributor’s agreements with TWC, ESPN®, Classic Media, Sesame Workshop®, World Wrestling Entertainment, Inc. ® and Discovery Communications, in combination with our acquisition of the Wellspring library in 2005, gives the Distributor a substantial library of high quality content comprising approximately 3,500 feature films and documentaries and 4,000 hours of television programming. We believe that the Distributor’s catalog of titles is integral to a well-balanced content portfolio that can generate substantial revenues with a diverse group of retailers and wholesalers.

The Distributor’s business strategy is to leverage its increasing market share and retail sales volumes from its relationships with TWC and other key content providers to add additional content partners, engage in profitable production and licensing of new content, and expand into complementary businesses such as interactive software (video games), mobile devices and licensing of our proprietary brands and content. The Distributor intends to continue to acquire rights to film and television libraries and enter into distribution agreements with new branded content suppliers.

Content Agreements

The Distributor is a party to a number of agreements under which it has the right to distribute and/or co-produce content with a variety of providers, including the following:

The Weinstein Company

The Distributor currently has the exclusive U.S. home video distribution rights to feature film and direct-to-video releases owned or controlled by TWC, a new film company created by Bob and Harvey Weinstein. Through April 10, 2007, the Distributor has released over 50 TWC titles on DVD, including the following titles:

| · | Derailed, starring Jennifer Aniston and Clive Owen, on March 21, 2006; |

| · | Wolf Creek, an Australian horror film, on April 11, 2006; |

| · | Mrs. Henderson Presents, starring Judi Dench and Bob Hoskins, on April 18, 2006; |

| · | Hoodwinked, an updated retelling of the classic story of Red Riding Hood with the voices of Anne Hathaway, Glenn Close and Jim Belushi, on May 2, 2006; |

| · | Doogal, with the voices of Whoopi Goldberg, Jimmy Fallon, William H. Macy and Jon Stewart, on May 16, 2006; |

| · | Transamerica, starring Felicity Huffman, winner of the Golden Globe Award for best actress, on May 23, 2006; |

| · | The Libertine, starring Johnny Depp, on July 4, 2006; |

| · | The Matador, starring Pierce Brosnan, on July 4, 2006; |

| · | Scary Movie 4, directed by David Zucker, on August 15, 2006; |

| · | Lucky Number Slevin, starring Bruce Willis, on September 12, 2006; |

| · | Feast, produced by Wes Craven, Ben Affleck and Matt Damon, on October 17, 2006; |

| · | Clerks II, directed by Kevin Smith, on November 28, 2006; |

| · | School for Scoundrels, starring Billy Bob Thornton, on February 13, 2007; |

| · | Black Christmas, starring Michelle Trachtenberg and Lacey Chabert, on April 3, 2007; and |

| · | Bobby, directed by Emilio Estevez, on April 10, 2007. |

Upcoming scheduled releases include Arthur and the Invisibles, directed by Luc Besson, on May 15, 2007; Hannibal Rising, based on the novel by Thomas Harris, on May 29, 2007; and Miss Potter, starring Renee Zellweger and Ewan McGregor, on June 16, 2007.

The Distributor maintains in perpetuity distribution rights for TWC content released during the term of the Distributor’s distribution agreement with TWC (the “TWC Distribution Agreement”).

Under the TWC Distribution Agreement, TWC granted a license to the Distributor to manufacture, promote and sell in the U.S. and its territories and possessions, through December 31, 2010 (or December 31, 2013 if TWC extends the term), DVDs, videocassettes and other forms of pre-recorded home video of feature films and direct-to-video releases which TWC has the right to distribute on home video. These releases include films produced by TWC as well as films which TWC acquires or obtains the right to distribute on home video. The TWC Distribution Agreement provides that the Distributor will earn a fee of between 3% and 6% on net sales of these home video products, depending on the level of these sales compared to theatrical box office revenues for the same films. The Distributor collects the proceeds from sales of home video products and remits these proceeds to TWC, minus the Distributor’s distribution fee of 3% to 6%, cost of goods sold (including manufacturing expenses) and certain marketing expenses.

The TWC Distribution Agreement contains complex provisions relating to payments, permitted expenses and other adjustments, and the foregoing discussion is intended only as a summary. For further information, the full text of the TWC Distribution Agreement is included as an exhibit to this Annual Report.

Classic/Entertainment Rights

In December 2006, the Distributor entered into multi-year agreements with Gold Key Home Video, Inc. (“Classic”) and Entertainment Rights Distribution Limited (“ER”), for the distribution, co-production and co-financing of multiple home video and videogame productions for the family, children and teen markets. Pursuant to these agreements, the Distributor will be the exclusive North American distributor of home video and certain digital media distribution rights for Classic’s and ER’s catalogs of children’s and faith-based animated films as well as other titles and series totaling, in the aggregate, more than 4,000 programs. These titles include Lassie, Fat Albert, Postman Pat, Rupert Bear, the best-selling holiday specials Rudolph the Red-Nosed Reindeer, Frosty the Snowman and Santa Claus is Comin’ to Town, and VeggieTales®, the world’s most popular faith-based kids’ brand with more than 50 million videos sold. The Distributor will also have North American home video and certain digital distribution rights in new productions, including The Lone Ranger, Gumby and She Ra, and for a slate of up to 12 new videogames to be produced and financed by the Distributor based on titles in the ER and Filmation catalogs. ER, Classic and TWC will be co-producing and co-financing new animated children's productions including Turok, Gumby, Kung Fu Magoo, Lone Ranger, Rupert Bear, Postman Pat and She-Ra. North American home video and digital distribution of co-productions will be handled by the Distributor and ER will distribute internationally. The productions will be managed by the Production and Development Group of TWC.

Sesame Workshop®

In February 2007, the Distributor entered into a multi-year agreement with Sesame Workshop® of New York to be the exclusive North American home entertainment distributor of Sesame Workshop®’s library of more than 100 titles. Included are Sesame Street, Sesame Beginnings, and Elmo's World. The agreement also includes the option to distribute Pinky Dinky Doo, which premiered in April 2006. The Distributor will maintain home video and certain digital distribution rights for the term of the agreement. The transaction will automatically increase the Distributor’s library by over 100 titles and further solidifies its emerging role as a leader in the growing family market.

ESPN®

In July 2006, the Company entered into an Output Distribution Agreement (the “ESPN Distribution Agreement”) with ESPN Enterprises, Inc. (“ESPN”) pursuant to which ESPN granted to the Company, among other things, the right to be the exclusive videogram distributor of all audiovisual productions released by ESPN during the term of the ESPN Distribution Agreement in the United States and Canada. All of the Company’s rights and obligations were assigned to the Distributor effective as of July 21, 2006. The initial term of the ESPN Distribution Agreement commenced on July 6, 2006 and continues, subject to the terms of the ESPN Distribution Agreement, through December 31, 2011 (the “Term”). Commencing immediately at the end of the Term, the Distributor will have an additional six month period as a non-exclusive sell-off period for videograms, during which time the Distributor will have the right to continue to market, distribute and account for all videograms remaining in the Distributor’s inventory at the end of the Term. Pursuant to the terms of the ESPN Distribution Agreement, the Distributor will pay ESPN a minimum guarantee of $4.5 million in each of five “Sales Periods” (as defined in the ESPN Distribution Agreement) during the Term. The Distributor will receive a distribution fee which shall be computed in accordance with the terms of the ESPN Distribution Agreement.

WWE®

In October 2006, the Distributor entered into a multi-year agreement with World Wrestling Entertainment, Inc. (WWE). Under the terms of the multi-year agreement, the Distributor will be the exclusive U.S. distributor for all WWE television and home video content, including the content in its 90,000-hour video library, the largest of its kind in the world, featuring content from RAW®, SmackDown!® and ECW® (Extreme Championship Wrestling™), pay-per-view events, including WrestleMania®, and past and present Superstar profiles, among others. The first title was released on November 14, 2006, and features one of WWE’s greatest legends, Born to Controversy: The Roddy Piper Story. This was followed by the release of The Spectacular Legacy of the AWA on November 21, 2006 and the RAW brand’s pay-per-view event, WWE Cyber Sunday™ on December 5, 2006. We expect to release a minimum of 25 new titles in 2007, and have additional plans to exploit WWE's DVD catalog of more than 100 titles. In 2006, ten of WWE’s DVD releases achieved the No. 1 position on the Sports DVD charts, according to Nielsen VideoScan.

ImaginAsian

In October 2006, the Distributor entered into a five-year agreement with ImaginAsian Entertainment, Inc. to be the exclusive North American home entertainment distributor for ImaginAsian's expanding portfolio of Asian-genre motion pictures and television programs. ImaginAsian Entertainment, Inc., a multimedia company, through its multiple platforms, seeks to reach the major sub-segments of the Asian American community with entertainment, news and information. This community is one of the fastest growing, most economically influential ethnic populations in the U.S.

Discovery Kids™

In October 2006, the Distributor entered into an agreement with Discovery Communications, Inc. (DCI) to be the exclusive U.S. home entertainment distributor (outside Discovery direct-to-consumer channels) of Discovery Kids™ television programming, including content from the Ready Set Learn!™ block on TLC™ channels. The Distributor plans to release a minimum of 16 titles per year pursuant to this agreement. Properties for release on DVD include Kenny the Shark™, Tutenstein™ and Flight 29 Down, as seen on the Discovery Kids™ channel and Paz™ and Save-Ums™ from Ready Set Learn!™, the preschool block that airs on TLC™ channel. Home video release dates for the Discovery Kids™ titles will be announced on an ongoing basis.

TWC/Blockbuster

In November 2006, the Distributor announced that it will act as the exclusive distributor for TWC in servicing TWC’s unique four-year strategic agreement with Blockbuster, Inc. (NYSE: BBI, BBI.B), under which TWC provides its theatrical and direct-to-video movies on DVD for rental exclusively through Blockbuster. The Distributor will provide distribution services to TWC in connection with the deal.

Distribution/Supply Chain

The Distributor utilizes third-party distribution facilities located throughout the United States. The Distributor sells its products directly to retailers, rentailers and through key select wholesale distribution companies, including companies such as Alliance Entertainment Corp., Ingram, VPD and Baker & Taylor. The Distributor has excellent relationships with retailers nationwide and is a direct supplier to nearly every major retailer or major wholesaler that carries video and/or music products.

The Distributor has distribution in approximately 25,000 retail locations, and its products can be found at retail outlets nationwide, such as mass retail stores including Target, Wal-Mart, Kmart, Meijers, ShopKo, Costco and Sam’s Club; children’s toy stores including Toys R Us; electronics stores including Best Buy, Fry’s and Circuit City; bookstores including Borders and Barnes & Noble; music retailers including Trans World Entertainment and Virgin; internet retailers including Amazon.com, Netflix and iTunes; rental outlets including Blockbuster, Movie Gallery and Hollywood Video; direct marketing companies including QVC, Castalian Music and Columbia House; and other non-traditional outlets.

The Distributor works with a number of key retail outlets utilizing its Vendor Managed Inventory (“VMI”) system and contract merchandisers to allocate and manage a retailer’s inventory of the Distributor’s products on a store, display and shelf basis. The Distributor’s VMI system drives store level placement, replenishment and in-store displays which highlight and promote its distributed products and brands. The Distributor customizes store level application of products and replenishment strategies based upon the retailer’s inventory plan, store traits, seasonal trends and forecasted store traffic, as well as buying patterns, habits and demographics of the consumers to whom the products are targeted. The Distributor’s retail groups also work with retailers to develop promotional plans, re-price tactics and volume forecasts for catalog as well as recently released titles.

In November 2006, TWC announced an exclusive rental program with Blockbuster, pursuant to which TWC granted to Blockbuster the exclusive right to rent TWC content. The Distributor services TWC’s agreement with Blockbuster pursuant to the TWC Distribution Agreement.

For the 202 days ended July 21, 2006, Wal-Mart accounted for 29% of the Company’s net revenues. For the year ended December 31, 2005, Wal-Mart accounted for 40% of the Company’s net revenues, Target Corporation accounted for 27% of the Company’s net revenues and Dollar Tree Stores accounted for 26% of the Company’s net revenues.

Marketing and Sales

The Distributor’s marketing and sales strategies are designed to support the sale of products for the retail and licensing components of the Distributor’s business. For its proprietary content, the Distributor uses relatively low-cost marketing techniques, including public relations, promotional programs, in-store advertising and merchandising programs and cross-marketing with its branded content partners which are useful for marketing purposes but do not generate revenues directly. The Distributor continues to exhibit its products at select industry trade shows. For TWC content, the Distributor uses marketing programs and strategies consistent with major film studios, including advertising on television and radio, in magazines and newspapers and special promotions with retailers and consumer packaged goods companies.

Third-Party Content Licenses

A substantial portion of the Distributor’s business is dependent upon licenses that it obtains from third parties relating primarily to entertainment content, such as film, video and music. In addition, the Wellspring film library that we acquired in 2005, and which was contributed to the Distributor as part of the TWC Transaction, includes a large number of third-party licenses to films and documentaries.

As the Distributor adds more content to its library, the Distributor intends to distribute, license, acquire or produce products with credible value and brand them for relevance to the consumer. The Distributor attempts to limit financial exposure through (i) a detailed return on investment analysis of potential acquisitions of new content, and (ii) its newly implemented VMI system that provides the Distributor with a scalable infrastructure and cost-effective technology to manage the supply chain process.

Suppliers and Compliance with Environmental Laws

The Distributor is able to obtain its physical DVDs and CDs from a variety of suppliers. These items are readily available, and we would not expect the Distributor’s production to be seriously affected by the failure of any one supplier. We are not aware of any environmental laws that materially affect our business or the business of the Distributor.

Internet Business

Consumers who visit our website at www.geniusproducts.com can learn about us and the Distributor’s products. We are also creating a business-to-business section that will allow smaller independent retailers to order the Distributor’s products for resale in their stores and to gain access to promotional and marketing materials. We believe that a continued internet presence is desirable because it aids in consumer sales, business-to-business sales, brand exposure and retail sales.

Musical CDs

The Distributor distributes a line of musical CDs under recognizable brand names in three categories: Classical, Instrumental and Vocal. This line of business is no longer a material part of the Distributor’s business.

Competition

The retail and internet markets for entertainment products, including DVDs and CDs, are highly competitive. We face significant competition with respect to the number of products currently available, pricing and in securing distribution at retail outlets. The costs of entry into the retail and internet markets for competitive products are low, and there are no significant barriers to entry. There are many companies who could introduce directly competitive products in the short term that have established brand names, are better funded, have established distribution channels and have greater resources than we do.

Established companies who compete with the Distributor include major studios such as Buena Vista (Disney), Fox, Paramount, Sony, Warner Bros. and Universal Studios, as well as certain independent studios and suppliers such as Lionsgate, First Look and Image Entertainment. The Distributor’s portfolio of owned and distributed content from The Weinstein Company®, ESPN®, World Wrestling Entertainment®, Sesame Workshop®, Classic Media and others provides the Distributor with a high volume of major studio quality, theatrically released feature films and direct-to-video releases, which we believe provides the Distributor with a strong competitive position in the marketplace.

Corporate Information

We were organized under the laws of the State of Nevada on January 8, 1996 under a different name. In October 1999, we changed our name to Genius Products, Inc. On March 2, 2005, we changed our state of incorporation to Delaware. Our corporate headquarters are located at 2230 Broadway, Santa Monica, CA 90404, and our telephone number is (310) 453-1222. Our corporate website address is www.geniusproducts.com.

EMPLOYEES

As of March 31, 2007, the Distributor had 149 full-time employees and one part-time employee. Although Genius Products, Inc. has no employees, certain employees of the Distributor act as officers of Genius Products, Inc.

None of the Distributor’s employees are represented by an organized labor union. We believe that the Distributor’s relationship with its employees is good, and neither Genius Products, Inc. nor the Distributor has experienced an employee-related work stoppage.

Our Internet address is www.geniusproducts.com. Through our website, we make available, free of charge, the following reports as soon as reasonably practicable after electronically filing them with, or furnishing them to, the Securities and Exchange Commission (the “SEC”): our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our Current Reports on Form 8-K; and amendments to those reports. Our Proxy Statements for our Stockholder Meetings are also available through our website. Our website and the information contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

We have a history of significant losses, and we may never achieve or sustain profitability.

We have incurred operating losses in every quarter since we commenced operations. As of December 31, 2006, we had an accumulated deficit of $29.9 million. Our net loss before extraordinary gain for the twelve months ended December 31, 2006 was $45.4 million. Our net loss for the year ended December 31, 2005 was $17.2 million and our net loss for the year ended December 31, 2004 was $6.0 million. We cannot provide assurances that we, or the Distributor, will achieve profitability in the future, even as a result of the TWC Transaction. Our continued operating losses may have a material adverse effect upon the value of our common stock and may jeopardize our ability to continue our operations.

Our business, results of operations and financial condition depend principally on the success of our relationships with The Weinstein Company LLC and our other key content suppliers.

A majority of our revenues are derived from the distribution rights accorded to the Distributor under its distribution agreements with TWC and other key content suppliers. Our business, results of operations, and financial condition therefore depend principally on the success of the relationships between TWC’s, and other key content suppliers’, personnel and those of the Distributor. Any deterioration in or termination of these relationships would have a material adverse effect on our business, results of operations and financial condition. There can be no assurance that the Distributor will be successful in maintaining and developing its relationships with TWC and/or other key content suppliers.

Failure to achieve and maintain effective disclosure controls or internal controls could have a material adverse effect on our ability to report our financial results timely and accurately.

In connection with our internal reviews and audit of our financial results for the year ended December 31, 2006, we discovered material weaknesses. The material weaknesses we identified related to the following items: (i) timely and routine processes for reconciling certain accounts to the general ledger; (ii) detailed documentation and analysis to support certain reserve estimates; (iii) proper presentation of marketing related expenses associated with revenue generated from “Revenue Share” parties; (iv) proper application of stock compensation expense and incomplete record keeping related to stock option grants; (v) proper application of the provisions of SOP 00-2 Accounting by Producers or Distributors of Films for the recognition of revenues and expenses associated with the distribution agreement between TWC and the Distributor; (vi) timely assessment of accounts for realizability or impairment; (vii) accurate valuation and supporting documentation for certain assets as of the closing date of the TWC Transaction; and (viii) formal processes governing changes, access and controls and procedures related to our information technology systems. In light of the material weaknesses related to our internal controls and processes over financial reporting, we and our independent registered public accounting firm concluded that our disclosure controls and procedures and our internal controls and processes over financial reporting were ineffective at December 31, 2006.

We are remediating these material weaknesses and have taken several actions to address these items. Management together with the Audit Committee of the Company’s Board of Directors have dedicated significant resources and have hired an internal control manager and external consultants to support management in its efforts to improve our control environment and to review, remediate and implement controls and procedures to satisfy the Company’s requirement to be compliant with the requirements of Sarbanes Oxley by December 31, 2007. We intend to further expand our internal accounting personnel, information technology systems and personnel and compliance capabilities by attracting additional talent, enhancing training and implementing system and process improvements in our accounting and record keeping. These ongoing efforts are focused on implementing process changes to strengthen our internal control and monitoring activities. However, these measures may not ensure that we will implement and maintain adequate controls over our financial reporting in the future. We have failed to meet the reporting deadline for this Report on Form 10-K. Any failure to implement required new or improved controls, or difficulties encountered in their implementations, could cause us to fail to meet our future reporting obligations. In addition, we may in the future identify further material weaknesses or significant deficiencies in our internal controls over financial reporting. Any of the foregoing could materially and adversely affect our business, our financial condition and the market value of our securities.

TWC’s success depends largely on Robert and Harvey Weinstein.

TWC is substantially dependent upon the services of Robert and Harvey Weinstein, and, therefore, TWC’s business, results of operations and financial condition could be adversely affected if TWC should lose the services of either of these individuals. TWC has entered into employment agreements with the Weinsteins. However, these agreements cannot assure TWC of the continued services of the Weinsteins. The loss of the services of either of the Weinsteins could have a material adverse effect on TWC’s ability to produce and distribute motion pictures, which could have a material adverse effect on the business, operating results and financial condition of the Distributor and its ability to profit from the sale of home video products. This, in turn, would have a material adverse effect on our business, results of operations and financial condition.

If the Distributor does not achieve target home video distribution rates for TWC’s films or meet other performance criteria, TWC may terminate its distribution agreement with the Distributor, which would have a material adverse effect on our business, results of operations and financial condition.

TWC has the right to terminate the TWC Distribution Agreement if the Distributor does not achieve target home video distribution rates for TWC’s films or meet other performance criteria specified in the TWC Distribution Agreement. We cannot assure you that the Distributor will have the financial and other resources necessary to perform adequately. Accordingly, we are subject to the risk that TWC may terminate the TWC Distribution Agreement, which would have a material adverse effect on our business, results of operations and financial condition.

If we cannot ramp up our operations quickly to accommodate the new business from TWC and other key content suppliers, our business may suffer.

The integration of the new titles that the Distributor will be distributing under its distribution agreements with TWC and other key content suppliers will continue to require significant management attention and expansion of our operations and employee base (which have been and will continue to be operated by the Distributor since the closing of the TWC Transaction). The Distributor must maintain adequate operational, financial and management information systems, and motivate and effectively manage an increasing number of employees and base of operations. Our future success will also depend in part on the Distributor’s ability to retain or hire qualified employees to operate its expanded businesses efficiently.

The loss of any of our major customers could harm us.

For the 202 days ended July 21, 2006, Wal-Mart accounted for 29% of the Company’s net revenues. This customer is expected to continue to be the major customer of the Distributor as a result of the TWC Transaction. The loss of any significant customers could have a material adverse effect upon the business of the Distributor and our business, results of operations and financial condition.

Our products are subject to returns.

Customers to which the Distributor sells have in the past returned significant amounts of products if it has not sold in accordance with their expectations or if newer versions of the product were available. We expect that they will continue to do so in the future and anticipate a certain level of returns, accounting for such when recognizing revenue based upon our historic return rates and estimates of returns based upon new product introduction. If product returns experienced by the Distributor are significantly greater than anticipated, it will negatively impact the business of the Distributor and our business, results of operations and financial condition.

Many of the Distributor’s operating expenses relating to the sales, marketing, production and distribution of content are recoupable and if the Distributor does not account for them appropriately to enable recoupment this could impact our profitability.

Many of the Distributor’s agreements with content licensors provide for the Distributor to collect receipts from customers, deduct a reserve for returns, deduct a distribution fee, deduct operating expenses relating to the sales, marketing, production and distribution of the content and remit the balance to the licensor. To the extent that the Distributor fails to account for all expenses related to a licensor in a particular accounting period, it may overstate the amount owed to the licensor and could potentially pay the licensor more than is actually due to the licensor for that accounting period.

There is a risk that the Distributor will not be able to recoup advances paid to its content providers.

In the normal course of its business, the Distributor pays to its content providers advances that are recoupable from the net sales of such content providers’ products. We anticipate that the Distributor will continue to pay such advances to new content providers. To the extent that the Distributor’s sales of these products fall below the Distributor’s projections, this could have a material adverse effect on the Distributor’s ability to recoup such advances and, in turn, the Distributor’s and our business, results of operations and financial condition.

There is a risk that the Distributor’s cash flow will not be sufficient to meet its operational needs.

At December 31, 2006, the Distributor had cash balances of $8.3 million. The Distributor may consider additional issuance of debt financing to fund future growth opportunities. Although we believe that the Distributor’s expanded product line offers the opportunity for significantly improved operating results in future quarters, no assurance can be given that we or the Distributor will operate on a profitable basis in 2007, or ever, as such performance is subject to numerous variables and uncertainties, many of which are out of our control.

There is a risk that the rate at which the Distributor’s inventory becomes obsolete will exceed its estimated allowances.

The Distributor’s estimated allowances for obsolete or unmarketable inventory are based upon management’s understanding of market conditions and forecasts of future product demand, which are subject to change. If the actual amount of obsolete or unmarketable inventory significantly exceeds estimated allowances, it could have a material adverse effect upon the business of the Distributor and our business, results of operations and financial condition. As discussed in Item 7 below under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, we recently restated our quarterly financial statements for 2006 due to non-cash adjustments necessary to properly reflect the amount of inventory that the Distributor believes it will be able to sell.

Rapid technological change could render the Distributor’s current products obsolete.

The market for cassettes, CDs and DVD technology is subject to change. There can be no assurance that over time these technologies will not be affected by competition from another form of information storage and retrieval technology, such as on-line information services. A further strong advance in the technology surrounding cable and satellite that would give consumers access to information and entertainment may limit the expansion of the market for applications based on cassettes, CDs, and DVDs. The replacement of the Distributor’s technology by another information storage and retrieval technology, or the replacement of existing technology by a new technology at a pace too rapid for production adjustments, may also have a material adverse effect on the business of the Distributor and our business, financial condition and results of operations.

There is a risk that our business may be adversely affected because we and the Distributor are required to present content acquisition opportunities to TWC before pursuing those opportunities.

Subject to limited exceptions, if we or the Distributor are presented with a content acquisition opportunity that is above a certain dollar amount, then we or the Distributor, as applicable, must present the content acquisition opportunity to TWC, and the TWC parties will have the right to engage in the content acquisition opportunity. This requirement restricts our future business opportunities and may have a material adverse effect on the business of the Distributor and our business, results of operations and financial condition.

If we cease to serve as the managing member of the Distributor, we could become subject to the Investment Company Act of 1940, which could have a material adverse effect on our business.

The Amended and Restated Limited Liability Company Agreement of the Distributor (the “Distributor LLC Agreement”) contemplates that The Weinstein Company Holdings LLC (“TWC Holdings”) or its designee will become the managing member of the Distributor, instead of the Company, if we become insolvent or bankrupt, if we violate the membership interest transfer restrictions in the Distributor LLC Agreement or if a lender forecloses on a security interest granted with respect to our Class G Units in the Distributor. If we cease to serve as the managing member of the Distributor, then we could become subject to the Investment Company Act of 1940 (the “1940 Act”), which could have a material adverse effect on our business.

Under the 1940 Act, a company may be deemed to be an investment company if it owns investment securities with a value exceeding 40% of its total assets, subject to certain exclusions. If we ceased to serve as the managing member of the Distributor and were deemed an investment company, we would become subject to the requirements of the 1940 Act. As a consequence, among other things, we would likely incur significant expenses and could be prohibited from engaging in our business or issuing our securities as we have in the past.

The motion picture industry is rapidly evolving, and recent trends have shown that audience response to both traditional and emerging distribution channels is volatile and difficult to predict. Neither we nor TWC can accurately predict the effect that changing audience demands, technological change or the availability of alternative forms of entertainment may have on the business of the Distributor, our business or the motion picture industry.

The entertainment industry in general, and the motion picture industry in particular, continues to undergo significant changes, due both to shifting consumer tastes and to technological developments. New technologies, such as video-on-demand and Internet distribution of films, have provided motion picture companies with new channels through which to distribute their films. However, accurately forecasting both the changing expectations of movie audiences and market demand within these new channels has proven challenging.

We cannot accurately predict the overall effect that shifting audience tastes, technological change or the availability of alternative forms of entertainment may have on the Distributor’s and, in turn, our business. In addition to uncertainty regarding the growth of the DVD market, we similarly cannot be certain that other developing distribution channels and formats, including video-on-demand, Internet distribution of films and high-definition, will attain expected levels of public acceptance or, if such channels or formats are accepted by the public, that the Distributor will be successful in exploiting the business opportunities they provide. Moreover, to the extent that these emerging distribution channels and formats gain popular acceptance, it is possible that demand for delivery through DVDs will decrease. Under the TWC Distribution Agreement, the Distributor may not have the right to distribute films from TWC through these other distribution channels.

As part of the TWC Transaction, the Distributor assumed the financial risk of customers’ nonpayment or delay in payment under the TWC Distribution Agreement, which could have a material adverse effect on our business, results of operations and financial condition.

The TWC Distribution Agreement provides that the Distributor will bear (and will not be entitled to recoup as distribution expenses) all bad debt expense and collection costs arising from its distribution of TWC titles. If the bad debt expense and collection costs are significant, then they could have a material adverse effect on the Distributor’s business, results of operations and financial condition, which, in turn, would have a material adverse effect on our business, results of operations and financial condition.

Our common stock is traded on the OTCBB, which may be detrimental to investors.

Our shares of common stock are currently traded on the Over the Counter Bulletin Board, or the OTCBB. Stocks traded on the OTCBB generally have limited trading volume and exhibit a wide spread between the bid/ask quotation, which could reduce investor liquidity and the value realized upon share sales.

Our common stock is subject to penny stock rules which may be detrimental to investors.

Our common stock is subject to Rules 15g-1 through 15g-9 under the Securities Exchange Act of 1934, as amended, which impose certain sales practice requirements on broker-dealers which sell our common stock to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or an annual income exceeding $200,000 individually or $300,000 together with their spouses). For transactions covered by these rules, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. This rule adversely affects the ability of broker-dealers to sell our common stock and purchasers of our common stock to sell their shares of such common stock. Additionally, our common stock is subject to the SEC regulations for “penny stock”. Penny stock includes any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. The regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule set forth by the SEC relating to the penny stock market must be delivered to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for the common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information about the limited market for penny stocks. These requirements adversely affect the market liquidity of our common stock.

None.

On January 17, 2007, the Distributor entered into a lease agreement with Del Mar Investors, L.P., under which the Distributor rents approximately 493 square feet of office space located in Del Mar, California, for a monthly rent of $1,800 per month. The Distributor has leased this office space on a month-to-month basis. This office space is used by certain of the Distributor’s executive officers and employees.

On January 23, 2007, the Distributor entered into a lease agreement with Maguire Properties, L.P., under which the Distributor rents approximately 5,050 square feet of office space located in Santa Monica, California, for a monthly rent of $31,300 per month. The Distributor has the right to terminate this lease at any time upon five (5) business days’ prior written notice. The Distributor’s accounting and finance departments are currently housed on a temporary basis in this office space.

On March 8, 2006, we entered into a lease agreement for a 17,400 square foot facility located in Santa Monica, California. This lease was assigned to the Distributor as part of the TWC Transaction. This facility has been used as our, and the Distributor’s, principal executive offices. This lease is for a five-year term which commenced in March 2006. Monthly rent for this space is as follows:

MONTH OF TERM | | AMOUNT | |

| 1-12 | | $ | 54,800 | |

| 13-24 | | $ | 56,500 | |

| 25-36 | | $ | 58,100 | |

| 37-48 | | $ | 59,900 | |

| 49-60 | | $ | 61,700 | |

On March 22, 2005, as part of the acquisition of American Vantage Media Corporation and Wellspring Media, Inc., we assumed office space in New York and Santa Monica on a month-to-month basis. Effective as of April 30, 2006, we terminated our lease for the Santa Monica space. Effective as of the closing of the TWC Transaction, the Distributor assumed all of our rights and obligations under the New York lease, and continues to occupy the New York space for monthly rent of $17,800.

On January 5, 2007, the Distributor entered into a sublease agreement with The Advantage Network, LLC, under which the Distributor subleased to The Advantage Network, LLC its leasehold interest in a 5,603 square foot facility located in Solana Beach, California. This sublease is for a term commencing February 1, 2007 and ending December 31, 2008, and provides for monthly rent of $10,600 from February 1, 2007 through December 31, 2007, and $11,000 from January 1, 2008 through December 31, 2008. Until March 2006, we used this facility as our principal executive offices pursuant to a sublease agreement entered into in November 2003. The November 2003 sublease is for a five-year term which commenced in January 2004, and was assigned to the Distributor as part of the TWC Transaction. Monthly rent for this space is as follows:

MONTH OF TERM | | AMOUNT | |

| 1-12 | | $ | 11,200 | |

| 13-24 | | $ | 11,600 | |

| 25-36 | | $ | 12,000 | |

| 37-48 | | $ | 12,400 | |

| 49-60 | | $ | 12,900 | |

In addition to the monthly rent, the Distributor is required to pay for increases in common area expenses over the base year of 2004. The Distributor also has the option to extend the lease for an additional five-year period, although we do not anticipate that the Distributor will exercise this option upon expiration of the term. Under the Distributor’s sublease agreement with The Advantage Network, LLC, the Distributor remains obligated to pay any rent and common area expenses under the November 2003 sublease in excess of the monthly rent paid by The Advantage Network, LLC.

On October 15, 2004, we entered into a sublease agreement for a 1,670 square foot facility located in Bentonville, Arkansas. This sublease has a term of 5 years and expires in October 2009. The monthly rent for this facility is $1,900 with an annual increase of 3 percent. This sublease was assigned to the Distributor as part of the TWC Transaction.

Except as described below, neither we nor the Distributor are a party to any legal or administrative proceedings, other than routine litigation incidental to our business and that of the Distributor that we do not believe, individually or in the aggregate, would be likely to have a material adverse effect on our, or the Distributor’s, financial condition or results of operations.

NEBG

On December 11, 2006, NEBG, LLC, a national organization whose members are independent video retailers, Nolan Anaya, dba Captain Video, and Todd Zaganiacz, dba Video Zone (collectively, “Plaintiffs”), filed a complaint (the “Complaint”) in the Superior Court of Massachusetts naming TWC Holdings, Genius Products, Inc. and Genius Products, LLC, as defendants (collectively, “Defendants”). The Complaint alleged that Defendants, in connection with an exclusive revenue sharing agreement between TWC Holdings and Blockbuster for the rental of DVDs of TWC product (“TWC DVDs”), planned to include a message on such TWC DVDs urging consumers to call a toll-free number if they rented the TWC DVDs from Plaintiffs. The Complaint alleged that such a message would suggest that Plaintiffs were engaged in wrongdoing by renting such TWC DVDs to their customers, which would amount to false advertising and violate the First Sale Doctrine of the Copyright Act. The Complaint alleged Massachusetts state law counts of unfair competition, unfair or deceptive acts or practices, and untrue and misleading advertising, as well as counts of negligent misrepresentation and tortuous interference with advantageous business relationships, and requested that the court enjoin Defendants from distributing any TWC DVDs with the toll-free number message.

On January 4, 2007, Defendants removed the case to the U.S. District Court of Massachusetts. The court denied Plaintiffs’ motion for a temporary restraining order on January 5, 2007, and denied Plaintiffs’ motion for a preliminary injunction on January 18, 2007. Defendants filed a motion to dismiss the Complaint on February 2, 2007, and the court heard oral arguments on the motion on March 9, 2007. In the hearing, Plaintiffs conceded that there is nothing improper or misleading with respect to the message currently contained on TWC DVDs, “This DVD is intended for sale only”. The court focused on the issue of ripeness and questioned whether the Complaint states a cause of action given that the Defendants have not (and are not alleged to have) included a toll-free number message on any of the TWC DVDs. The court is considering the parties’ arguments, and Defendants are awaiting a ruling on the motion to dismiss.

Wellspring

On March 21, 2005, we completed our acquisition of American Vantage Media Corporation and its subsidiary, Wellspring Media, Inc. (“Wellspring”). On or about March 14, 2005, a complaint was filed in U.S. Bankruptcy Court for the District of Delaware against Wellspring requesting a judgment in excess of $3,000,000. The complaint was filed by the Chapter 7 Trustee of the Winstar Communications, Inc. Estate (“Winstar”). The details of this matter are discussed below.

In September 2001 (prior to the acquisition of Wellspring by American Vantage Media Corporation), Winstar (or its predecessor) sold a subsidiary, Winstar TV & Video (“TV & Video”), to Wellspring in exchange for $2,000,000 in cash and a promissory note in the amount of $3,000,000. The merger agreement provided that in the event the working capital of TV & Video was determined to be less than $3,000,000 at the closing of the merger, the sole remedy of Wellspring was a reduction in the principal amount of the promissory note by the difference between $3,000,000 and the actual amount of the working capital. The accountants for Wellspring determined that at the time of the closing of the merger, TV & Video had a working capital deficit. Based upon this determination and the provisions of the merger agreement, Wellspring determined that the amount due under the promissory note should be reduced to zero, and as a result no payment was made. On November 30, 2001, Wellspring informed Winstar of its determination regarding the working capital deficit, and Winstar subsequently advised Wellspring that it disputed the determination. Since 2001, Wellspring and Winstar have engaged in discussions in an effort to settle the dispute over the working capital calculation, but no settlement has been reached.

We believe that, if an adverse judgment against Wellspring occurs or an adverse settlement is reached, our direct and indirect subsidiaries, the Distributor, American Vantage Media Corporation and Wellspring, will be entitled to full indemnification against any such losses by the initial owners of Wellspring (prior to American Vantage Media Corporation), and we will be entitled to indemnification by American Vantage Companies, the former owners of American Vantage Media Corporation.

Falcon Picture Group

On October 3, 2005, Falcon Picture Group, LLC (“Falcon”) commenced litigation against the Company in the Circuit Court of Cook County, Illinois, Case No. 05H16850 (the “Illinois Proceeding”), based upon allegations, among other things, that the Company breached the terms of a license agreement between Falcon and the Company by refusing to pay certain royalties to which Falcon supposedly was entitled. Falcon seeks damages of approximately $83,332, as well as an accounting of royalties supposedly due to Falcon.

The Company’s primary defense is that Falcon breached the license agreement by delivering defective content to the Company, double billing for content and failing to honor a provision in the license agreement requiring Falcon to indemnify the Company in the event of claims by third parties that the Company did not possess the legal right to sell Falcon content. The Company believes the evidence will demonstrate that there was no monetary default on its part under the license agreement insofar as, at the time of the alleged default, Falcon was indebted to the Company for an amount substantially in excess of the sum Falcon claims was past due. Accordingly, the Company has commenced litigation against Falcon and its owner, Carl Amari, in the form of a counter claim seeking damages of $975,000 arising out of, among other claims for relief, Falcon’s breach of the license agreement. Discovery is in its early stages and the action has not been scheduled for trial.

Our 2006 Annual Meeting of Stockholders was held on December 12, 2006. Of the 61,534,357 shares eligible to vote, 44,894,525 appeared by proxy and established a quorum for the meeting. The singular matter considered at the annual meeting was the election of directors, with the holders of our common stock entitled to appoint two directors and the holders of our Series W Preferred Stock entitled to appoint four directors. The items listed in the table below were approved by, respectively, a majority of the common stockholders appearing at the meeting and a majority of the Series W Preferred stockholders appearing at the meeting.

| | | | | | | | | | | |

| | | | | VOTES FOR | | VOTES AGAINST | | VOTES WITHHELD | | NOT VOTED |

| 1. | | Election of Directors by Common Stockholders | | | | | | | | |

| | | Stephen K. Bannon | | 38,106,421 | | 1,751,000 | | 5,037,104 | | 0 |

| | | Trevor Drinkwater | | 38,115,396 | | 1,742,025 | | 5,037,104 | | 0 |

| | | | | VOTES FOR | | VOTES AGAINST | | VOTES WITHHELD | | NOT VOTED |

| 2. | | Election of Directors by Series W Preferred Stockholders | | | | | | | | |

| | | James G. Ellis | | 100 | | 0 | | 0 | | 0 |

| | | Herbert Hardt | | 100 | | 0 | | 0 | | 0 |

| | | Larry Madden | | 100 | | 0 | | 0 | | 0 |

| | | Irwin Reiter | | 100 | | 0 | | 0 | | 0 |

Also on December 12, 2006, the holders of our Series W Preferred Stock, pursuant to their rights under our Amended and Restated Certificate of Incorporation to elect up to five of our directors, appointed Bradley A. Ball as a director by unanimous written consent.

PART II

Our stock trades on the over-the-counter bulletin board (“OTCBB”) under the symbol “GNPI”. The market represented by the OTCBB is extremely limited and the price for our common stock quoted on the OTCBB is not necessarily a reliable indication of the value of our common stock. The following table sets forth the high and low bid prices for shares of our common stock for the periods noted, as reported on the OTCBB. Quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

YEAR | PERIOD | HIGH | LOW |

| Calendar Year 2005 | First Quarter | $ 2.48 | $ 1.35 |

| | Second Quarter | 2.55 | 1.65 |

| | Third Quarter | 2.10 | 1.41 |

| | Fourth Quarter | 2.61 | 1.37 |

| | | | |

| Calendar Year 2006 | First Quarter | $ 2.35 | $ 1.62 |

| | Second Quarter | 2.08 | 1.55 |

| | Third Quarter | 2.12 | 1.63 |

| | Fourth Quarter | 2.72 | 1.78 |

Our common stock is subject to Rules 15g-1 through 15g-9 under the Securities Exchange Act of 1934, as amended, which impose certain sales practice requirements on broker-dealers who sell our common stock to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or an annual income exceeding $200,000 individually or $300,000 together with their spouses). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale.

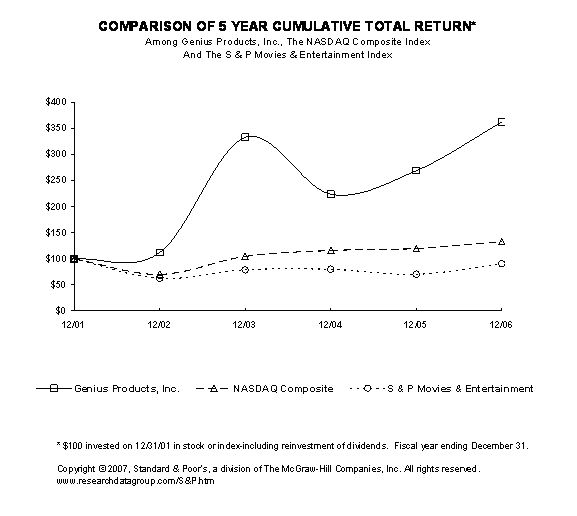

Stock Performance Graph

The following graph compares the performance of our common stock over the five preceding fiscal years to the weighted average performance over the same period of the stock of companies included in the NASDAQ Composite Index and the S&P Movies and Entertainment Index. The graph assumes $100 was invested at the close of trading on December 31, 2001 in our common stock and in each of the indices and that all dividends were reinvested. The stockholder return shown on the graph below should not be considered indicative of future stockholder returns, and we will not make or endorse any predictions of future stockholder returns.

Stockholders

As of March 31, 2007, we had approximately 65,421,762 shares of common stock issued and outstanding which were held by approximately 221 stockholders of record, including the holders that have their shares held in a depository trust in “street” name. The transfer agent for our common stock is Interwest Transfer Company, 1981 East 4800 South, Suite 100, Salt Lake City, Utah 84117.

Equity Compensation Plans

The following table provides information concerning our equity compensation plans as of December 31, 2006.

(Securities in thousands)

| | Number of securities to be issued Upon exercise of outstanding options, warrants and rights (a) | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance under Equity Compensation Plans (excluding securities reflected in column (a)) (c) |

| Equity compensation plans approved by security holders | 32,771 | | $ | 1.99 | | 7,928 |

| Equity compensation plans not approved by security holders | — | | | — | | 0 |

| Total | 32,771 | | $ | 1.99 | | 7,928 |

Dividend Policy

Our Board of Directors determines any payment of dividends. We have never declared or paid cash dividends on our common or preferred stock. We do not expect to authorize the payment of cash dividends on our shares of common or preferred stock in the foreseeable future. Any future decision with respect to dividends will depend on future earnings, operations, capital requirements and availability, restrictions in future financing agreements and other business and financial considerations.

Sales of Unregistered Securities

On March 2, 2005, we engaged in a private placement of 6,518,987 shares of our common stock and five-year warrants to purchase 1,303,797 shares of common stock, half at an exercise price of $2.56 per share and half at an exercise price of $2.78 per share. The transaction closed on March 3, 2005 and we realized gross proceeds of $10.3 million from the financing, before deducting commissions and other expenses. We agreed to register for resale the shares of common stock issued in the private placement and shares issuable upon exercise of warrants. Such registration statement became effective on May 11, 2005.

On March 22, 2005, in connection with the Company’s acquisition of American Vantage Corporation from American Vantage Companies (“AVC”), the Company issued to AVC (i) 7,000,000 shares of the Company’s common stock valued at $2.27 per share and (ii) warrants to purchase 1,400,000 shares of the Company’s common stock, half at an exercise price of $2.56 per share and half at an exercise price of $2.78 per share.

In May 2005, we engaged in a private placement of 3,000,000 shares of our common stock and five-year warrants to purchase 270,000 shares of our common stock at an exercise price of $2.56 per share. The transaction closed on May 20, 2005, and we realized gross proceeds of $5.25 million from the financing before deducting commissions and other expenses.

On December 5, 2005, we engaged in a private placement of 16,000,000 shares of our common stock and five-year warrants to purchase 4,800,000 shares of common stock with an exercise price of $2.40 per share. The transaction closed on December 6, 2005 and we realized gross proceeds of $32 million from the financing, before deducting commissions and other expenses.

On October 4, 2005, we entered into a Note and Warrant Purchase Agreement with a group of investors (collectively, the “Investors”). Under the Note and Warrant Purchase Agreement, the Investors loaned a total of $4.0 million to the Company in exchange for (i) promissory notes in favor of the Investors with a total principal balance of $4.0 million and (ii) five-year warrants to purchase a total of 280,000 shares of our common stock at an exercise price of $1.88 per share.

From time to time, the Company has awarded stock options to certain individuals outside of the Company’s stock option plans.

The aforementioned sales of securities were not registered under the Securities Act of 1933, as amended (the “Act”), or any state securities laws, and were sold in private transactions exempt from registration pursuant to Section 4(2) of the Act and Regulation D promulgated thereunder.

ITEM 6. SELECTED FINANCIAL DATA

You should read the financial data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (included in Item 7) and our consolidated financial statements and the related notes included in this Annual Report.

(In thousands, except per share information) | | Years Ended December 31, | |

| | | 2006* | | 2005 | | 2004 | | 2003 | | 2002 | |

Statement of Operations data: | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Revenues, net of sales returns, discounts and allowances | | $ | 119,011 | | $ | 22,328 | | $ | 16,630 | | $ | 3,069 | | $ | 2,144 | |

| Cost of revenues | | | 130,870 | | | 22,883 | | | 13,893 | | | 2,150 | | | 1,592 | |

| Gross profit (loss) | | | (11,859 | ) | | (555 | ) | | 2,737 | | | 919 | | | 552 | |

| Operating expenses (income): | | | | | | | | | | | | | | | | |

| General and administrative | | | 19,867 | | | 14,747 | | | 8,231 | | | 3,531 | | | 3,304 | |

| Restructuring | | | - | | | 2,745 | | | - | | | - | | | - | |

| Gain on sale, related party | | | (63 | ) | | (1,352 | ) | | - | | | - | | | - | |

| Equity in net loss from Distributor | | | 7,989 | | | - | | | - | | | - | | | - | |

| Total operating expenses | | | 27,793 | | | 16,140 | | | 8,231 | | | 3,531 | | | 3,304 | |

| Loss from operations | | | (39,652 | ) | | (16,695 | ) | | (5,494 | ) | | (2,612 | ) | | (2,752 | ) |

| Interest expense and other, net | | | 86 | | | (465 | ) | | (551 | ) | | (130 | ) | | (35 | ) |

| Loss before provision for income taxes | | | (39,566 | ) | | (17,160 | ) | | (6,045 | ) | | (2,742 | ) | | (2,787 | ) |

| Provision for income taxes | | | 5,797 | | | 1 | | | 1 | | | 1 | | | 1 | |

| Extraordinary gain, net of taxes | | | 54,203 | | | - | | | - | | | - | | | - | |

| Net income (loss) | | $ | 8,840 | | $ | (17,161 | ) | $ | (6,046 | ) | $ | (2,743 | ) | $ | (2,788 | ) |

| | | | | | | | | | | | | | | | | |

Basic and diluted EPS | | | | | | | | | | | | | | | | |

| Loss before extraordinary item | | $ | (0.74 | ) | $ | (0.42 | ) | $ | (0.25 | ) | $ | (0.16 | ) | $ | (0.20 | ) |

| Extraordinary item | | | 0.89 | | | - | | | - | | | - | | | - | |

| Net income (loss) | | $ | 0.15 | | $ | (0.42 | ) | $ | (0.25 | ) | $ | (0.16 | ) | $ | (0.20 | ) |

| Basic and diluted weighted average shares | | | 60,949 | | | 40,400 | | | 23,827 | | | 17,574 | | | 13,839 | |

| | | | | | | | | | | | | | | | | |

Balance Sheet data: | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 3,745 | | $ | 30,597 | | $ | 1,224 | | $ | 941 | | $ | 746 | |

| Working capital | | | 3,707 | | | 21,441 | | | 60 | | | 1,150 | | | 590 | |

| Investment in Distributor | | | 84,796 | | | - | | | - | | | - | | | - | |

| Total assets | | | 89,428 | | | 76,365 | | | 12,996 | | | 5,575 | | | 2,283 | |

| Redeemable common stock | | | - | | | 414 | | | 395 | | | 491 | | | 466 | |

| Deferred gain, related party | | | - | | | 1,212 | | | - | | | - | | | - | |

| Total stockholders' equity | | | 75,483 | | | 55,188 | | | 4,432 | | | 2,723 | | | 1,053 | |

* For 2006, the financial data reflects results from the Company's new venture with The Weinstein Company, and will not be comparable to prior years. Results reflect operations of Genius Products, Inc. from January 1 through July 21, 2006 and the Company's equity in net loss from Distributor from July 22 through December 31, 2006.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

UNAUDITED RESTATEMENTS OF 2006 QUARTERLY FINANCIAL STATEMENTS

On April 12, 2007, the Audit Committee of the Board of Directors of the Company determined that it was necessary to restate the Company’s unaudited consolidated financial statements and other financial information at and for the fiscal quarters ended March 31, June 30 and September 30, 2006. The majority of the restatement adjustments relate to non-cash items. The restatements are reflected in the financial statements included in this Report on Form 10-K, and the Company intends to file shortly amendments to its Form 10-Qs for the quarterly periods in 2006. The restatements relate to the correction of the following errors in the Company’s financial statements at and for these dates (See also Note 9 to the consolidated financial statements of the Company included elsewhere):

1. The Company revised the computation of its stock option non-cash compensation expense under the provisions of FAS 123(R) Accounting for Stock Based Compensation and EITF 96-18 Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods or Services (“Stock Option Compensation Expense”), for the fiscal quarters ended March 31, June 30 and September 30, 2006. The revised computation changed Stock Option Compensation Expense in each of the three above-mentioned fiscal quarters.

Additionally, the Company revised its computation of Stock Option Compensation Expense in the fiscal quarter ended September 30, 2006 to properly reflect the accelerated vesting of employee and non-employee awards of stock options which occurred upon the closing of the TWC Transaction as of July 21, 2006. This non-cash adjustment was necessary as the Stock Option Compensation Expense related to the accelerated vesting was recorded in the records of the Distributor. For the three months ended March 31, 2006, the Company decreased its Stock Option Compensation Expense by $0.1 million. For the three months ended June 30 and September 30, 2006, the Company increased Stock Option Compensation Expense by $0.4 million and $4.1 million, respectively.

2. The Company revised its reported net revenue amounts for the fiscal quarters ended March 31, June 30 and September 30, 2006 to properly reflect net revenue in the appropriate periods. The need for these corrections resulted from cut-offs due to the closing of the TWC Transaction on July 21, 2006 (as opposed to a month-end cut-off date), cut-offs at June 30 and errors in the timing of recognition of invoices and expenses. For the three months ended June 30 and September 30, 2006, the Company increased its revenue in the amount of $2.3 million and decreased its revenue in the amount of $2.0 million, respectively. In addition, the Company identified errors in the treatment of revenue from revenue-sharing agreements and revised its reported net revenue to comply with the provisions of EITF 01-09 Accounting for Consideration Given by a Vendor to a Customer. The total non-cash adjustments required to decrease revenue for the three months ended March 31, June 30 and September 30, 2006, were $0.7 million, $1.2 million and $0.3 million, respectively.

3. The Company revised its advertising and marketing expense to properly expense advertising and marketing related items as incurred and revised participations expense to comply with the provisions of SOP 00-2, Accounting by Producers or Distributors of Films. The Company increased advertising and marketing expense by $2.6 million for the three months ended March 31, 2006, and decreased advertising and marketing expenses by $1.6 million for the three months ended June 30, 2006. For the three months ended March 31 and June 30, 2006, the Company reduced participation expense by $1.5 million and increased participation expense by $0.4 million, respectively.

4. The Company reduced an accrued liability on its balance sheet by approximately $0.4 million for the fiscal quarter ended March 31, 2006, to reflect that the Company does not have any obligation associated with redeemable common stock that had been accrued for and disclosed in prior fiscal periods. The redeemable common stock was reclassified to additional paid-in capital.

5. The Company revised its operating results for the fiscal quarter ended June 30, 2006 to account for the impairment of its film library, advances made to participants and physical inventory based upon the Company’s shift in its business from value-priced product to branded content. These non-cash adjustments were necessary to properly reflect the realizability of such assets as of June 30, 2006. The total non-cash adjustments required to decrease film library, advances made to participants and physical inventory as of June 30, 2006 were $11.6 million, $2.2 million and $4.6 million, respectively.

6. The Company increased by $10.0 million the amount it recorded as an extraordinary gain associated with the TWC Transaction as of July 21, 2006, primarily as a result of the restatement item in paragraph 5 above. This non-cash adjustment was necessary since adjustments that the Company recorded in the fiscal quarters ended March 31 and June 30, 2006 changed the carrying amount of certain assets and liabilities that were contributed to the Distributor.