UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 814-00203

UTEK CORPORATION

| | |

| Delaware | | 59-3603677 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2109 Palm Avenue

Tampa, FL 33605

(Address of principal executive offices)

(813) 754-4330

(Registrant’s telephone number)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

TITLE OF EACH CLASS | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

| COMMON STOCK, $.01 PAR VALUE | | AMERICAN STOCK EXCHANGE |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s Common Stock held by non-affiliates at June 30, 2007 was $95,278,827.

As of February 27, 2008, there were 9,165,243 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2008 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

UTEK CORPORATION

Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2007

PART I

Unless the context requires otherwise, reference in this Form 10-K to “UTEK”, the “Company”, “we,” “us” and words of similar import refer to UTEK Corporation and its wholly owned subsidiaries, UTEK-Europe, Ltd. and UTEKip, Ltd.

General

UTEK Corporation (the “Company”) commenced operations in 1997 in the business of technology transfer originally incorporated under the laws of the State of Florida, and subsequently under the laws of the State of Delaware in July 1999.

UTEK is an Open Innovation service company. UTEK’s services enable clients to become stronger innovators, source externally developed technologies and create value from their intellectual property. UTEK is a business development company with operations in the United States, United Kingdom and Israel.

UTEK provides Open Innovation services for its clients, including: technology transfer, intellectual property analysis, online technology exchanges and related consulting services. Open Innovation is a process which refers to enhancing a company’s products through in-licensing external sources of innovation and the creation of additional value through out-licensing intellectual property.

The potential client benefits from UTEK Corporation’s Open Innovation services include:

| | • | | Reduced research and development expense; |

| | • | | Opportunity to leverage external research and development; and |

| | • | | Create value from intellectual property. |

Our services enable companies to acquire externally developed technologies from universities and research laboratories worldwide to augment their internal research and development efforts. In addition, UTEK provides services to help companies create value from their intellectual property. Technology transfer refers to the process by which new technologies, developed in universities, government research facilities, or similar research settings, are licensed to companies for potential commercial development and use. Our goal is to provide our clients an opportunity to acquire and commercialize innovative technologies primarily developed by universities, medical centers, federal research laboratories and select corporations.

We also provide our clients with a full range of complementary Open Innovation related services and products, including the provision of technical and business expertise to help companies analyze, assess, protect and leverage their patents and intellectual property assets to enhance their business.

We are a non-diversified, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 (the “1940 Act”). We do not have a registered investment adviser, and our management, under the supervision of our Board of Directors, makes our investment and management decisions.

Corporate Strategy

Our strategic objective is to increase our net assets by providing Open Innovation services and by effectuating technology transfer transactions with companies pursuant to which we receive securities or cash as compensation for the sale of technology rights. Our strategy incorporates the following key elements:

Develop relationships with companies through our technology acquisition alliance program. Our technology acquisition alliances are designed to help companies enhance their new product pipeline through the

1

acquisition of proprietary technologies primarily from universities, medical centers and federal research laboratories. We normally receive either cash or unregistered shares of common stock from clients as payment for the services we render to them under our technology acquisition alliances. All of our technology transfers are completed pursuant to our technology acquisition alliance agreements with our clients.

Execute technology transfers through our U2B®process. To effectuate a technology transfer, we will typically create a newly formed company to acquire a new technology from a university, medical center or federal research laboratory and then sell this newly formed company to our client for securities or, to a lesser extent, cash. We call this technology transfer process U2B®. It is our plan that the shares we receive in these exchanges will, in the course of our business, be sold for cash or other assets.

A benefit of effectuating technology transfer transactions through our U2B® investment process is that such transactions do not result in a current taxable event for us for income tax purposes. We have not acquired, and do not currently intend to acquire a new technology from a university, medical center or federal research laboratory in connection with our U2B® process without the prior agreement of our client to subsequently acquire such new technology from us. As a result, our technology transfer service is a just-in-time transfer service that does not require maintaining an inventory of licensable technology.

Continue to build strong relationships with research institutions.In order to provide us access to new technologies, we have entered into agreements with universities and research centers worldwide. We intend to continue to build on these relationships and create new relationships with additional universities and research centers.

Provide strategic services and products to companies and research institutions.We seek to provide companies and research institutions with a full range of complementary technology transfer related services and products including the following:

| | • | | KnowledgeExpress.com Website—Used by technology transfer, intellectual property, licensing and business development professionals in universities, corporations and government agencies for access to a comprehensive information platform combining business development and technology resources with expert search and report generation. |

| | • | | Pharma-Transfer.com Website—Tracks the research and development efforts of universities, research institutions and life science companies in order to locate and deliver advanced technology acquisition opportunities to corporate subscribers in the pharmaceutical industry. |

| | • | | TechEx.com Website—Used by technology transfer and research professionals to efficiently exchange biomedical licensing opportunities and innovations available for partnering. This exchange was developed by Yale University. |

| | • | | Uventures.com Website—An Internet-based exchange primarily used for the marketing of physical science technologies developed at universities and research organizations. |

| | • | | Pharmalicensing.com Website—An online, global resource for partnering, licensing and business development within the life science and biopharmaceutical industry. |

| | • | | UTEK Intellectual Capital Consulting (ICC)—Provides strategic intellectual property consulting services to assist our client companies in assessing and leveraging their intellectual property assets. |

Pursue complementary acquisitions. Many of the products and services we offer to companies were acquired by us through strategic acquisitions. We plan to make additional acquisitions of related or synergistic businesses in the future. In considering whether to purchase a company, we evaluate a number of factors including synergy with services that we currently provide, reputation in the industry, the ability to assist our existing business units, quality of service provided, territory that the service is offered in, purchase price, and the strength of relationships with client companies.

2

Leverage the experience and relationships of our management team.We plan to utilize our experience in the field of technology transfer to grow our net assets. We have assembled a management team which has extensive experience in the field of technology transfer. Our management team has experience in identifying, negotiating, structuring and consummating technology transfers. We have approximately ten years of experience in the technology transfer business and have executed more than 100 technology transfers.

Provide new Open Innovation services to assist clients in growing their businesses and reducing R&D associated costs. Through the acquisition of Pharmalicensing.com and potentially other Open Innovation focused businesses, we believe that we will increase our ability to serve our clients in a more comprehensive manner.

According to the Aberdeen Group (www.aberdeen.com), in a December 2007 report entitledProduct Innovation Agenda 2010: Profiting from Innovation Today and Tomorrow, of the more than 300 companies surveyed, approximately 30% said that they will implement an Open Innovation program within the next 24 months. The primary reasons given for this were the desire for increased product revenue (82% of respondents) and decreased product costs (60% of respondents). We believe that the results of this report are consistent with our impression of the current marketplace opportunity as well as our current growth strategy.

Business Model

Open Innovation: Technology Transfer Process

Our technology transfer process generally follows a specific series of steps, which our management believes provides the greatest opportunity for creating value for our client companies. This process is designed to search and, when appropriate, transfer technologies from research institutions to our client companies.

Our technology transfer process generally involves the following steps:

| | (1) | We enter into technology acquisition alliance agreements with clients to learn about their technology needs and identify new discoveries that they may want to acquire. |

| | (2) | Our scientific team works with our clients to create a profile describing the new technologies they would like to acquire. |

| | (3) | Using our relationships with universities and research laboratories worldwide combined with our database of over 53,000 technologies available for immediate license, we search, filter and present to our client companies what our science team feels are the best two to three possible discoveries per month which are available for immediate license. |

| | (4) | Once we identify the technologies, we assist our technology acquisition alliance clients in conducting their own due diligence on the technologies. |

| | (5) | If a client wants to acquire the presented technology, UTEK will provide a term sheet describing the transaction. Upon mutual agreement of terms, UTEK will then seek to purchase the technology with our own capital and subsequently sell or transfer the technology to our client for unregistered stock or cash. |

| | (6) | If needed, UTEK can also provide additional resources at the time of transfer to help accelerate the commercialization of new products based on the transferred technology. These may include pre-paid sponsored research agreements to advance the technology, pre-paid consulting agreements with the inventor(s) of the technology and financing for prototype development and product launch. |

| | (7) | Often, the process does not end once the first technology transfer is complete. We continue, per our client’s needs and specifications, to present several technologies each month throughout the term of the technology acquisition alliance agreement. |

3

In the past, many of the clients with which we engage in such transactions frequently have had little or no prior operating history. When we engage in transactions with smaller capitalization companies, we seek to limit the downside potential of working with such clients by, among other things, requiring that such clients pay us a more significant premium over our cost than mid-cap and large capitalization companies for the new technologies they acquire from us in connection with the technology transfer. During 2007, we have endeavored to diversify our client base to include mid-cap and large capitalization companies. It is our hope that improved client diversification will result in more stable growth, improved cash flow and reduced volatility in future periods.

Client Technology Selection

We conduct technology transfers with clients that our management believes are positioned to benefit from the acquisition of new technology. Prior to completing a technology transfer with a client, our management and, to the extent it is deemed to be advisable by our management, our Scientific Advisory Council will review the scientific merit and risks of the potential technology transfer. For more information about our Scientific Advisory Council, see “Business—Scientific Advisory Council.”

When we assist a client in evaluating a new technology, we review the technology to make sure that it meets some or all of the following criteria:

| | • | | the technology should represent a significant advance over existing technologies; |

| | • | | there should be an existing global market for the technology once it is commercialized; and |

| | • | | the technology should be socially responsible (i.e., not intended for destructive or harmful purposes). |

In addition, we consider some or all of the following additional matters in connection with our decision to conduct a technology transfer:

| | • | | financial requirements to commercialize the technology; |

| | • | | the operating record and quality of the entrepreneurial group associated with the client. |

If, in our management’s view, a technology meets some or all of the criteria discussed above, then we will commence negotiations with the technology developer to arrange for a license of the technology. Normally, we seek to acquire a worldwide exclusive license for the fields of use that are important for our client, although non-exclusive licenses are also considered when appropriate. These licenses usually have an upfront fee, royalty provision, and minimum annual royalties. Pursuant to the terms of these license agreements, all rights to royalties remain with the university or research institute that grants the license. The term for most agreements is for the useful life of the intellectual property underlying the license. Our management will review license agreements and advise our client as to license terms and requirements.

Acquisitions

We continually investigate opportunities to grow by acquisition. In particular, we are currently actively pursuing strategic acquisitions that support Open Innovation. During the three years ended December 31, 2006, we made six acquisitions in cash and shares of UTEK stock valued at $4,835,000. We did not have any acquisitions during 2007. Our goal for 2008 is to acquire additional companies in the Open Innovation field.

When investigating a potential acquisition target, we evaluate a number of characteristics, including management strength, profitability, synergy with our existing consulting and technology strengths. We do not limit our discussions with potential target companies by size, field or geography although we target primarily those companies with a commitment to Open Innovation, that utilize technology as a core competency and that

4

are experienced in providing innovative product applications, as well as those that can help us expand our suite of client services. In making acquisitions, we seek to utilize stock rather than cash as consideration in order to leverage our capabilities and provide incentives to the management or consulting personnel who typically join UTEK as part of the transaction. Depending on the size of the company and the number of acquisitions we consummate, the value of UTEK's stock may temporarily be adversely affected. While we attempt to make acquisitions that we believe will be accretive to our shareholders, because these acquisitions represent long-term investments, there may be a short-term negative impact on our earnings per share.

Recent Developments

In January 2008, we acquired Pharmalicensing.com, a leading biopharmaceutical Open Innovation resource designed for professionals involved with partnering, licensing and business development worldwide. Actively supporting in- and out-licensing activities, Pharmalicensing provides partnering services, business development reports and industry news. Pharmalicensing is actively utilized by over 1,000,000 pharmaceutical and life science industry professionals each year. We believe that this acquisition will enable us to expand our Open Innovation strategy by increasing our range of client services, especially in the life sciences. Through Pharmalicensing, we will be able to provide clients with the following services:

| | • | | Out-licensing: Pharmalicensing offers a resource for clients to out-license their intellectual property, minimizing the time and costs associated with this activity. |

| | • | | Profiling: Designed to complement the client’s business development strategy, a Pharmalicensing profile exposes the client’s licensing requirements to a focused and targeted audience of the key decision-makers within the pharmaceutical and biotech industry. |

| | • | | Reports: Pharmalicensing publishes and distributes a range of business intelligence reports specializing in life sciences covering strategy, deal making trends and more. |

| | • | | Partnering tools: Provides clients with business critical information designed to enhance deal making effectiveness, including company and deal information and up to date industry news. |

TekScout™ Open Innovation Network (www.tekscout.com) was launched in March 2008. TekScout helps companies look outside of their internal R&D departments to address the challenge of completing R&D projects that they may not have the time or the internal capabilities to solve. The TekScout Open Innovation Network makes it easy for companies to post these projects in a secure environment and find scientists and engineers around the world who can complete them. It also helps qualified scientists and engineers find R&D challenges that need solving, and provides them both financial and intellectual rewards for their solutions. In addition, we recently hired an experienced software executive to manage this business.

Strategos, Inc., a strategic innovation consulting firm that provides consulting services, primarily to large companies has agreed to be acquired by us. The transaction is expected to close in March 2008, subject to certain conditions and approvals. Strategos is based in Chicago, IL, and was established in 1995. Under the terms of the Stock Purchase Agreement, Strategos will be acquired for 1,248,960 shares of UTEK Corporation unregistered common stock. Strategos shareholders shall receive one third of the shares at closing and the remaining UTEK shares will be held in escrow and paid upon achieving certain performance milestones over the next two years. The shareholders of Strategos have agreed not to sell any of the unregistered shares for 12 months following close of the transaction, which is expected to take place in March 2008.

Competition

The Open Innovation service business is highly competitive. We expect that if our service model proves to be successful, our current competitors in the market may duplicate our strategy, and new competitors may enter. We currently compete against other technology transfer companies, including IP Group plc, Competitive Technologies, Inc., BTG plc, Sagentia Group AG and many private firms, some of which are much larger and

5

have significantly greater financial resources than we do. In addition, these companies will be competing with us to acquire technologies from universities and government research laboratories. We also compete against large companies that seek to license university-developed technologies themselves. We cannot assure you that we will be able to successfully compete against these competitors in the acquisition of technology licenses, funding of technology development or marketing to potential client companies. We believe we have developed a competitive advantage by assembling a large, robust database of university discoveries available for license combined with our experience in technology transfer. In addition, we have developed a search engine for university discoveries that facilitate the finding of relevant new discoveries for our client companies. Also, we believe that our U2B® model makes it easier for companies of all sizes to acquire technologies from universities and research institutions.

Financial Information about Financial Segments and Geographic Areas

Information concerning sales and segment income attributable to each of the Company’s business segments and geographic areas is set forth in Note 11 of our Notes to Consolidated Financial Statements under Item 8. “Financial Statements and Supplementary Data” and is incorporated herein by reference.

Employees

As of February 19, 2008, we had 68 employees. We believe our relations with our employees are good.

Scientific Advisory Council

The principal purpose of our Scientific Advisory Council is to assist our management in the evaluation of new technologies for our clients. Our Scientific Advisory Council is comprised of more than 40 experts in a broad range of scientific, medical and engineering disciplines.

Regulation

We have elected to be regulated as a BDC under the 1940 Act. Pursuant to the 1940 Act, a BDC must be organized in the United States for the purpose of investing in or lending to private or thinly traded public companies and making managerial assistance available to them. A BDC may use capital provided by public shareholders and from other sources to make long-term, private investments in businesses.

As a BDC, we may not acquire any asset other than “qualifying assets” unless at the time we make the acquisition, the value of our qualifying assets represent at least 70% of the value of our total assets. The principal categories of qualifying assets relevant to our business are:

| | • | | Securities in an eligible portfolio company that are purchased in transactions not involving any public offering. An eligible portfolio company is defined under the 1940 Act to include any issuer that: |

| | • | | is organized and has its principal place of business in the U.S.; |

| | • | | is not an investment company or a company operating pursuant to certain exemptions under the 1940 Act, other than a small business investment company wholly owned by a BDC; and |

| | • | | does not have any class of securities listed on a national securities exchange; |

| | • | | Securities received in exchange for or distributed with respect to securities described in the bullet above or pursuant to the exercise of options, warrants, or rights relating to those securities; and |

| | • | | Cash, cash items, government securities, or high quality debt securities (as defined in the 1940 Act), maturing in one year or less from the time of investment. |

6

In October 2006, the SEC re-proposed rules providing for an additional definition of eligible portfolio company. As re-proposed, the rule would expand the definition of eligible portfolio company to include certain public companies that list their securities on a national securities exchange. The SEC is seeking comment regarding the application of this proposed rule to companies with: (1) a public float of less than $75 million; (2) a market capitalization of less than $150 million; or (3) a market capitalization of less than $250 million. There is no assurance that such proposal will be adopted or what the final proposal will entail.

To include certain securities described above as qualifying assets for the purpose of the 70% test, a business development company must offer to make available to the issuer of those securities significant managerial assistance such as providing guidance and counsel concerning the management, operations, or business objectives and policies of a portfolio company. We offer to provide managerial assistance to each of our portfolio companies.

As a BDC, we are required to meet a coverage ratio of the value of total assets to total senior securities, which include all of our borrowings and any preferred stock we may issue in the future, of at least 200%. We may also be prohibited under the 1940 Act from knowingly participating in certain transactions with our affiliates without the prior approval of our directors who are not interested persons and, in some cases, prior approval by the SEC.

Except as described below or otherwise permitted by the 1940 Act, we are not able to issue and sell our common stock at a price below our net asset value per share. We may, however, sell our common stock, warrants, options or rights to acquire our common stock, at a price below the net asset value of the common stock if our Board of Directors determines that such sale is in our best interests and that of our stockholders, and our stockholders approve such sale. In any such case, the price at which our securities are to be issued and sold may not be less than a price which, in the determination of our Board of Directors, closely approximates the market value of such securities (less any distributing commission or discount). We may also make rights offerings to our stockholders at prices per share less than the net asset value per share, subject to applicable requirements of the 1940 Act.

The 1940 Act prohibits us from acquiring (i) more than 3% of the total outstanding shares of another investment company; (ii) shares of another investment company having an aggregate value in excess of 5% of the value of our total assets; or (iii) shares of another registered investment company and all other investment companies having an aggregate value in excess of 10% of the value of our total assets.

Our Board of Directors has appointed a chief compliance officer pursuant to the requirements of the 1940 Act. We are periodically examined by the SEC for compliance with the 1940 Act.

As with other companies regulated by the 1940 Act, a BDC must adhere to certain substantive regulatory requirements. A majority of our directors must be persons who are not interested persons, as that term is defined in the 1940 Act. Additionally, we are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to our company or our shareholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

As required by the 1940 Act, we maintain a code of ethics that establishes procedures for personal investment and restricts certain transactions by our personnel. Personnel subject to the code of ethics may invest in securities for their personal investment accounts, so long as such investments are made in accordance with the code’s requirements.

We may not change the nature of our business so as to cease to be, or withdraw our election as, a BDC unless authorized by vote of a “majority of the outstanding voting securities,” as defined in the 1940 Act.

7

Income Tax Matters

For federal and state income tax purposes, we are taxed at regular corporate rates on ordinary income and recognize gains on distributions of appreciated property. We are not entitled to the special tax treatment available to BDCs that elect to be treated as regulated investment companies under the Internal Revenue Code because, among other reasons, we do not distribute at least 90% of “investment company taxable income” as required by the Internal Revenue Code for such treatment. Distributions of cash or property by us to our stockholders, if any, will be taxable as dividends only to the extent that we have current or accumulated earnings and profits. Distributions in excess of current or accumulated earnings and profits will be treated first as a return of capital to the extent of the holder’s tax basis and then as gain from the sale or exchange of property.

Determination of Net Asset Value

Quarterly Net Asset Value Determination

We determine the net asset value per share of our common stock quarterly. We disclose these net asset values in the periodic reports we file with the SEC. The net asset value per share of our common stock is equal to the value of our total assets minus total liabilities divided by the total number of shares of common stock outstanding.

At December 31, 2007, approximately 66% of our net assets were in investments recorded at fair value. Value, as defined in Section 2(a)(41) of the 1940 Act, is (i) the market price for those securities for which a market quotation is readily available and (ii) for all other securities and assets, fair value as determined in good faith by our Board of Directors. Since there is typically no readily available market value for the investments in our portfolio, we value substantially all of our investments at fair value as determined in good faith by the Board of Directors. In making its determination, our Board of Directors considers valuation appraisals provided by independent valuation service providers. Because of the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of our investments determined in good faith by our Board of Directors may differ significantly from the values that would have been used had a ready market existed for the investments, and the differences could be material.

There is no single standard for determining fair value in good faith. As a result, determining fair value requires that judgment be applied to the specific facts and circumstances of each portfolio investment while employing a consistently applied valuation process for the types of investments we hold. We will record unrealized depreciation on investments when we believe that an investment has become impaired, including where realization of an equity security is doubtful. Conversely, we will record unrealized appreciation if we have an indication that the underlying company has appreciated in value and, therefore, our equity security has also appreciated in value, where appropriate.

With respect to equity securities in private companies, each investment is valued using industry valuation benchmarks, and then the value is assigned a discount reflecting the illiquid nature of the investment, as well as our minority, non-control position. When an external event such as a purchase transaction, public offering, or subsequent equity sale occurs, the pricing indicated by the external event is used to corroborate our valuation. Equity securities in public companies that carry certain restrictions on sale are generally valued at a discount from the public market value of the securities.

The Board of Directors bases its determination upon, among other things, applicable quantitative and qualitative factors. These factors may include, but are not limited to, type of securities, nature of business, marketability, market price of unrestricted securities of the same issue (if any), comparative valuation of securities of publicly-traded companies in the same or similar industries, current financial conditions and operating results, sales and earnings growth, operating revenues, competitive conditions and current and prospective conditions in the overall stock market.

8

We have retained an independent valuation service provider, Klaris, Thomson & Schroeder, Inc., to supply us with quarterly valuations of our portfolio of investments. Our Board of Directors uses these valuations to aid in its determination of the fair value of our investments. Our Board of Directors retains its responsibility for determining the fair value of our portfolio of investments.

Determinations in Connection with Offerings

In connection with each offering of shares of our common stock, our Board of Directors or a committee thereof is required to make the determination that we are not selling shares of our common stock at a price below the then current net asset value of our common stock at the time at which the sale is made. Our Board of Directors considers the following factors, among others, in making such determination:

| | • | | the net asset value of our common stock disclosed in the most recent periodic report we filed with the SEC; |

| | • | | our management’s assessment of whether any material change in the net asset value of our common stock has occurred (including through the realization of gains on the sale of our portfolio securities) from the period beginning on the date of the most recently disclosed net asset value of our common stock to the period ending two days prior to the date of the sale of our common stock; and |

| | • | | the magnitude of the difference between the net asset value of our common stock disclosed in the most recent periodic report we filed with the SEC and our management’s assessment of any material change in the net asset value of our common stock since the date of the most recently disclosed net asset value of our common stock in the proposed offering. |

Importantly, this determination does not require that we calculate the net asset value of our common stock in connection with each offering of shares of our common stock, but instead it involves the determination by our Board of Directors or a committee thereof that we are not selling shares of our common stock at a price below the then current net asset value of our common stock at the time at which the sale is made.

Moreover, to the extent that there is even a remote possibility that we may (i) issue shares of our common stock at a price below the then current net asset value of our common stock at the time at which the sale is made or (ii) trigger the undertaking (which we are required to provide in certain registration statements we may file from time to time with the SEC) to suspend the offering of shares of our common stock if the net asset value of our common stock fluctuates by certain amounts in certain circumstances until the prospectus relating to such offering is amended, our Board of Directors will elect, in the case of clause (i) above, either to postpone the offering until such time that there is no longer the possibility of the occurrence of such event or to undertake to determine the net asset value of our common stock within two days prior to any such sale to ensure that such sale will not be below our then current net asset value, and, in the case of clause (ii) above, to comply with such undertaking or to undertake to determine the net asset value of our common stock to ensure that such undertaking has not been triggered.

These processes and procedures are part of our compliance policies and procedures. Records will be made contemporaneously with all determinations described in this section, and these records will be maintained with other records we are required to maintain under the 1940 Act.

Corporate Offices and Available Information

Our executive offices are located at 2109 Palm Avenue, Tampa, Florida 33605 and our telephone number is (813) 754-4330. We also have offices in Pennsylvania, Israel and the United Kingdom.

Our Internet address is www.utekcorp.com. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our website is not incorporated by reference into this Annual Report on Form 10-K, and you should not consider information contained on our website to be part of this Annual Report on Form 10-K.

9

Investing in our common stock involves a high degree of risk. As a result, there can be no assurance that we will achieve our strategic objective. You should consider carefully the risks described below. In addition to the risk factors described below, other factors that could cause actual results to differ materially include:

| | • | | Changes in the economy; |

| | • | | Changes in the market for technology transfer and Open Innovation services; |

| | • | | Risk associated with possible disruption in our operations due to terrorism; |

| | • | | Future regulatory actions and conditions in our operating areas; and |

| | • | | Other risks and uncertainties as may be detailed from time to time in our public announcements and SEC filings. |

We may not be able to sell the securities we receive in connection with our technology acquisition alliance agreements and technology transfers for an amount equal to the revenue we previously recognized in connection with such transactions.

We recognize revenue in connection with our technology acquisition alliances and technology transfers in an amount equal to the fair value of the securities we receive in connection with such transactions. With respect to our technology acquisition alliance agreements, we recognize such revenue as earned in accordance with the contractual terms of each technology acquisition alliance agreement. With respect to our technology transfers, we recognize such revenue upon the consummation of each technology transfer. Because the securities we receive in connection with such transactions are subject to legal restrictions on resale and are mainly issued by thinly traded public companies or private companies, our ability to sell such securities may be limited. Given these facts as well as the subjective judgments and estimates inherent in fair value accounting, we may not be able to sell the securities we receive in connection with our technology acquisition alliances and technology transfers for an amount equal to the revenue we previously recognized in connection with such transactions.

Our quarterly and annual results fluctuate significantly.

Our quarterly and annual operating results fluctuate significantly due to a number of factors. These factors include the small number and range of values of the transactions that are completed each quarter, fluctuations in the values of our investments, the timing of the recognition of unrealized gains and losses, the degree to which we encounter competition in our markets, the volatility of the stock market and its impact on our unrealized gains and losses, as well as other general economic conditions. As a result of these factors, quarterly and annual results are not necessarily indicative of our performance in future quarters and years.

Our investment portfolio is highly concentrated in a limited number of portfolio companies and, as a result, our financial results are largely dependent upon the performance of these companies.

Our investment portfolio is highly concentrated in a limited number of portfolio companies and, as a result, our financial results are largely dependent upon the performance of these companies. If one or more of these companies fails to perform as expected, our financial results could be negatively affected.

Our portfolio companies are development stage companies dependent upon the successful commercialization of new technologies. Each of our portfolio companies is subject to a high degree of risk, and we may not be able to sell securities we receive in connection with our technology acquisition alliances or technology transfers.

We enter into technology acquisition alliance and technology transfer agreements with development stage companies that our management believes can benefit from our expertise in technology transfer. Development stage companies are subject to all of the risks associated with new businesses. In addition, our portfolio companies are

10

also subject to the risks associated with research and development of new technologies. These risks include the risk that new technologies cannot be identified, developed or commercialized, may not work, or may become obsolete. Our portfolio companies must successfully acquire licenses to new technologies, and in some cases, further develop new technologies. We cannot assure you that any of our portfolio companies will be successful. Our portfolio companies will be competing with larger, established companies with greater access to, and resources for, further development of these new technologies. We may not be able to sell the securities we receive in connection with our technology acquisition alliances or technology transfers if our portfolio companies are not successful.

Our portfolio companies depend upon the research and development activities of universities, medical research centers and federal research laboratories, over which neither our portfolio companies nor we have any control.

Our portfolio companies depend upon the research activities of universities, medical research centers and federal research laboratories. Neither we, nor our portfolio companies, have any control over the research activities of universities, medical research centers and federal research laboratories. As neither we nor our portfolio companies provide supervision of any universities, medical research centers and federal research laboratories, and we cannot ensure that the research will be done properly and that the results, which we may license, will be reproducible. In addition, we have no control over what types of technologies are presented to us by universities, medical research centers and federal research laboratories for evaluation and commercial development. Further, the licenses to technologies that our portfolio companies obtain may be non-exclusive.

Technologies acquired by our portfolio companies may become obsolete before we can sell their securities.

Neither our portfolio companies nor we have any control over the pace of technology development. There is a significant risk that a portfolio company could acquire the rights to a technology that is currently, or is subsequently made, obsolete by other technological developments. If this were to occur, we may be unable to sell or otherwise dispose of the securities we received in connection with our technology acquisition alliances and technology transfer transactions with such companies.

The patents on the technologies that our portfolio companies license may infringe upon the rights of others and patent applications that have been submitted may not be granted.

Many of our portfolio companies rely upon patents to protect the technologies that they license. If the patents on technologies that they license are found to infringe upon the rights of others, or are held to be invalid, then the licenses to such technologies will have little or no value to our portfolio companies. In addition, if a patent to a technology licensed by a portfolio company is found to infringe upon the rights of others, the portfolio company may be liable for monetary damages. Our portfolio companies are dependent upon the universities, medical centers or government research facilities to file, secure and protect patents on licensed technologies. In the event that a patent is challenged or violated, our portfolio companies may not have the financial resources to defend the patent either in the preliminary stages of litigation or in court. In addition, if our portfolio companies acquire licenses to technologies with patents pending, we cannot assure you that such patents will be granted. If any such events were to occur, we may be unable to sell or otherwise dispose of the securities we received in connection with our technology acquisition alliances and technology transfers with such companies.

Technologies that have been developed with funding from the U.S. government may have limits on their use, which could affect the value of the technology to a portfolio company.

Technologies developed with funds provided by the U.S. government have restrictions regarding where they may be sold and have limits on exclusivity. A portfolio company that acquires a technology developed with federal funding may be limited as to where it can sell the technology. The technology may only be allowed to be sold or manufactured within the U.S. In addition, the U.S. government has the right to use technologies that it has funded regardless of whether the technology has been licensed to a third party. Such regulations may limit the marketability of a technology and therefore reduce the value of the technology to our portfolio companies.

11

The securities we hold in our portfolio companies are subject to restriction on resale and we may not be able to sell the securities we hold for amounts equal to their recorded value, if at all.

Our portfolio companies are mainly thinly traded public companies or private companies, and we acquire securities in our portfolio companies in private transactions. As a result, substantially all of the securities we hold in our portfolio companies are subject to legal restrictions on resale. Furthermore, our ability to sell the securities in our portfolio may be limited by, and subject to, the lack of or limited nature of a trading market for such securities. Therefore, we cannot assure you that we will be able to sell our portfolio company securities for amounts equal to the values that we have ascribed to them at the time we desire to sell.

We are dependent on sales transactions structured as tax-free exchanges to sell the new companies we form to acquire new technologies. A change in the Internal Revenue Code or a negative interpretation of the Internal Revenue Code affecting tax-free exchanges could have a significant negative impact on our business and financial results.

To effectuate a technology transfer, we typically create a newly formed company to acquire a new technology from a university, medical center or federal research laboratory and then exchange the securities of such newly formed company for securities in the company that acquires such newly formed company and the technology held by such newly formed company. We call this unique technology transfer process U2B®. We anticipate that most, if not all, of such transactions will be structured as tax-free exchanges under Section 368 of the Internal Revenue Code. A benefit of structuring our technology transfers as tax-free exchanges under Section 368 is that such transactions do not result in a current taxable event for us for income tax purposes. If Section 368 were to be amended so that we were no longer able to structure our technology transfers as tax-free exchanges or the Internal Revenue Service took a negative position regarding our tax treatment of our technology transfers as tax-free exchanges, we may not be able to effectuate our technology transfers on commercially reasonable terms without suffering adverse tax consequences. In such event, we may be required to significantly alter the use of our U2B® investment process, which could have a significant negative impact on our business and financial results.

The agreements we have with universities, medical research centers and federal research laboratories do not guarantee that such entities will grant licenses to us or other companies.

The agreements that we have entered into with universities, medical research centers and federal research laboratories provide us with the ability to evaluate the commercial potential for technologies at an early stage of development. These agreements, however, do not provide us with any guarantee that following our evaluation, the university, medical research center or federal research laboratory will grant a license to us or other companies. As a result, we may expend time and resources evaluating a technology and not be able to secure a license to such technology.

We are dependent upon and have little or no control over the efforts of portfolio companies to successfully commercialize the acquired technologies or to retain the licenses to such technologies.

We receive common stock from our clients based upon the mutually agreed upon values of the new companies we form to acquire new technologies, their licensed technology and the portfolio companies. We then intend to sell the securities that we acquire at some time in the future. Therefore, our ability to profit from an investment is ultimately dependent upon the price we receive for the shares of the portfolio company. In most cases, the value of the portfolio companies will be dependent upon successfully commercializing the technologies they acquire. We do not have control over the portfolio companies. These portfolio companies may face intense competition, including competition from companies with greater financial resources, more extensive research and development, manufacturing, marketing and service capabilities and a greater number of qualified and experienced managerial and technical personnel. They may need additional financing which they are unable to secure and which we are unable or unwilling to provide, or they may be subject to adverse developments

12

unrelated to the technologies they acquire. They may lose the rights granted to them for the technology for failure to comply with the license agreement. We cannot assure you that any of the portfolio companies will be successful or that we will be able to sell the securities we receive at a profit or for sufficient amounts to even recover our cash outlay in connection with our technology acquisition alliances and technology transfers or that our portfolio companies will not take actions that could be detrimental to us.

Our investments in our portfolio companies may be concentrated in one or more industries, and if these industries should decline or fail to develop as expected, our cash outlay in connection with our technology acquisition alliances and technology transfers will be lost.

Our investments in our portfolio companies may be concentrated in one or more industries. This concentration will mean that our investments will be particularly dependent on the development and performance of those industries. Accordingly, our investments may not benefit from any advantages that might be obtained with greater diversification of the industries in which our portfolio companies operate. If those industries should decline or fail to develop as expected, our investments in our portfolio companies in those industries will be subject to loss.

Substantially all our portfolio investments are recorded at fair value as determined in good faith by our Board of Directors, and as a result, there is uncertainty regarding the value of our portfolio investments.

At December 31, 2007 and December 31, 2006, investments amounting to $28.9 million or 66% of our net assets and $33.3 million or 65% of our net assets, respectively, have been valued at fair value as determined by our Board of Directors. Pursuant to the requirements of the 1940 Act, our Board of Directors is responsible for determining in good faith the fair value of our investments for which market quotations are not readily available. Because there is typically no readily available market value for the investments in our portfolio, our Board of Directors determines in good faith the fair value of these investments pursuant to a valuation policy and a consistently applied valuation process. There is no single standard for determining fair value in good faith. As a result, determining fair value requires that judgment be applied to the specific facts and circumstances of each portfolio investment while employing a consistently applied valuation process for the types of investments we hold. If we were required to sell any such investments, there is no assurance that the fair value, as determined by the Board of Directors, would be obtained. If we were unable to obtain fair value for such investments, there would be an adverse effect on our net asset value and on the price of our common stock.

We adjust quarterly the valuation of our portfolio to reflect the Board of Directors’ determination of the fair value of each investment in our portfolio. As a result, the value of our portfolio securities and earnings change significantly from quarter to quarter. Any changes in fair value are recorded in our statements of operations as “Change in net unrealized appreciation (depreciation) of investments.”

Our business depends on key personnel.

We rely on, and will continue to be substantially dependent upon, the continued services of our management, principally our Chief Executive Officer and Chairman, Clifford M. Gross, Ph.D., our Chief Operating Officer, Douglas Schaedler, and our Chief Financial Officer, Carole R. Wright. We also depend upon our management’s key contacts with universities, medical research centers and federal research laboratories to maintain our access to new technologies and our relationships with companies in the private sector in order to effectuate the sale of technologies through our U2B® process. Therefore, a change in our executive management team could have a negative impact on the company.

Additional equity or debt financing may not be available to our portfolio companies, which could result in our losing our cash outlay in connection with our technology acquisition alliances and technology transfers with the portfolio company if the portfolio company fails.

We expect that many of our portfolio companies will require additional equity or debt financing to ensure their continued viability. The amount of additional financing needed will depend upon the maturity and objectives of the particular portfolio company. The availability of financing is generally a function of conditions

13

that are beyond the control of our portfolio companies. We cannot assure that our portfolio companies will be able to predict accurately the future financing requirements necessary for their success or that additional financing will be available to our portfolio companies from any source. If additional equity or debt financing is not available, some of our portfolio companies may be forced to cease operations, which could adversely affect our success and result in the loss of a substantial portion or all of our cash outlay in connection with our technology acquisition alliances and technology transfers with the portfolio company.

Changes in the laws or regulations that govern us could have a material impact on our operations.

Any change in the laws or regulations that govern our business could have a material impact on us or on our operations. Laws and regulations may be changed from time to time, and the interpretations of the relevant laws and regulations also are subject to change.

We are subject to certain risks associated with our foreign operations and investments.

We have operations in the United Kingdom and Israel and make investments in foreign companies. As of December 31, 2007, approximately 2% of our assets were comprised of assets in foreign operations and investments in foreign companies.

Certain risks are inherent in foreign operations, including:

| | • | | difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; |

| | • | | foreign customers may have longer payment cycles than customers in the U.S.; |

| | • | | tax rates in certain foreign countries may exceed those in the U.S. and foreign earnings may be subject to withholding requirements, exchange controls or other restrictions; |

| | • | | general economic and political conditions in countries where we operate may have an adverse effect on our operations; |

| | • | | exposure to risks associated with changes in foreign exchange rates; |

| | • | | difficulties associated with managing a large organization spread throughout various countries; |

| | • | | difficulties in enforcing intellectual property rights; and |

| | • | | required compliance with a variety of foreign laws and regulations. |

Investing in foreign companies may expose us to additional risks not typically associated with investing in U.S. companies. These risks include changes in foreign exchange rates, exchange control regulations, political and social instability, expropriation, imposition of foreign taxes, less liquid markets and less available information than is generally the case in the U.S., higher transaction costs, less government supervision of exchanges, brokers and issuers, less developed bankruptcy laws, difficulty in enforcing contractual obligations, lack of uniform accounting and auditing standards and greater price volatility.

As we continue to expand our business globally, our success will depend, in part, on our ability to anticipate and effectively manage these and other risks. We cannot assure you that these and other factors will not have a material adverse effect on our international operations or our business as a whole.

Our common stock may not continue to trade at a premium to our net asset value.

Our common stock continues to trade in excess of our net asset value. See Note 16 “Selected Per Share Data and Ratios” to our consolidated financial statements included in this Form 10-K. There can be no assurance, however, that our common stock will continue to trade at a premium to our net asset value. The possibility that our common stock will trade at premiums that are unsustainable over the long term is separate and distinct from the risk that our net asset value will decrease.

14

We may issue shares of our common stock at a discount to the market price for such shares, which may put downward pressure on the market price for shares of our common stock.

If we issue shares of our common stock at a discount to the market price for such shares, it may put downward pressure on the market price for shares of our common stock. Such downward pressure could in turn encourage short sales or similar trading with respect to shares of our common stock, which could in itself, place further downward pressure on the market price for shares of our common stock.

We may issue shares of our common stock in conjunction with the acquisition of other businesses, which may put downward pressure on the market price for shares of our common stock and create additional dilution of the current shares outstanding.

Consistent with our current strategy, we may seek to acquire other businesses through the issuances of common stock and or cash. If common stock is used in these transactions, it would create additional dilution of the current shares outstanding. Further, such issuances may result in downward pressure on our share price as a result of these additional shares being issued. Also, there is the potential that the market may not respond favorably to potential new acquisitions, which could also negatively affect our share price.

One of our current stockholders has significant influence over our management and affairs.

Clifford M. Gross, Ph.D., our Chief Executive Officer and Chairman, beneficially owns approximately 22% of our common stock as of December 31, 2007. Therefore, Dr. Gross may be able to exert influence over our management and policies. Dr. Gross may acquire additional equity in our company in the future. The concentration of ownership may also have the effect of delaying, preventing or deterring a change of control of our company, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of the sale of our company and might ultimately affect the market price of our common stock.

We may need additional capital in the future and it may not be available on acceptable terms.

We have historically relied on equity financing and, to a lesser extent, cash flow from the sale of our investments and debt financing to fund our operations, capital expenditures and expansion. However, we may require additional capital in the future to fund our operations or respond to competitive pressures or strategic opportunities. We cannot assure that additional financing will be available on terms favorable to us, or at all. In addition, the terms of available financing may place limits on our financial and operating flexibility. If we are unable to obtain sufficient capital in the future, we may:

| | • | | be forced to reduce our operations; |

| | • | | not be able to expand or acquire complementary businesses; and |

| | • | | not be able to develop new services or otherwise respond to changing business conditions or competitive pressures. |

Regulations governing our operation as a business development company will affect our ability to and the way in which we raise additional capital.

We may require additional capital in the future to fund our operations or respond to competitive pressures or strategic opportunities. We may acquire additional capital from the following sources:

Senior Securities and Other Indebtedness. We may issue debt securities or preferred stock and/or borrow money from banks or other financial institutions, which we refer to collectively as senior securities, up to the maximum amount permitted by the 1940 Act. If we issue senior securities, including debt or preferred stock, we will be exposed to additional risks, including the following:

| | • | | Under the provisions of the 1940 Act, we will be permitted, as a BDC, to issue senior securities only in amounts such that our asset coverage, as defined in the 1940 Act, equals at least 200% after each |

15

| | issuance of senior securities. If the value of our assets declines, we may be unable to satisfy this test. If that happens, we may be required to sell a portion of our investments and, depending on the nature of our leverage, repay a portion of our debt at a time when such sales and/or repayments may be disadvantageous; |

| | • | | It is likely that any senior securities or other indebtedness we issue will be governed by an indenture or other instrument containing covenants restricting our operating flexibility; |

| | • | | We, and indirectly, our stockholders will bear the cost of issuing and servicing such securities and other indebtedness; and |

| | • | | Preferred stock or any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of our common stock, including separate voting rights and could delay or prevent a transaction or a change in control to the detriment of the holders of our common stock. |

Additional Common Stock. We are not generally able to issue and sell our common stock at a price below our net asset value per share. We may, however, sell our common stock, warrants, options or rights to acquire our common stock, at a price below our net asset value of the common stock if our Board of Directors determines that such sale is in our best interests and that of our stockholders, and our stockholders approve such sale. In any such case, the price at which our securities are to be issued and sold may not be less than a price which, in the determination of our Board of Directors, closely approximates the market value of such securities (less any distributing commission or discount). We may also make rights offerings to our stockholders at prices per share less than the net asset value per share, subject to applicable requirements of the 1940 Act. If we raise additional funds by issuing more common stock or senior securities convertible into, or exchangeable for, our common stock, the percentage ownership of our stockholders at that time would decrease and they may experience dilution. Moreover, we can offer no assurance that we will be able to issue and sell additional equity securities in the future, on favorable terms or at all.

We are focusing our business on providing Open Innovation services to our clients which is a new and uncertain trend in our industry.

We are focused on providing Open Innovation services to our clients. While these services utilize our well established technology transfer capabilities, they also incorporate additional products and services which in their entirety are as yet unproven in their ability to generate significant revenue. As a result, if our Open Innovation services are not well received by our clients or if industry changes its focus off of Open Innovation, this may result in reduced revenue and profitability for us.

Our common stock price may be volatile.

The trading price of our common stock has fluctuated significantly and may continue to fluctuate substantially, depending on many factors, many of which are beyond our control and may not be directly related to operating performance. These factors include the following:

| | • | | price and volume fluctuations in the overall stock market from time to time; |

| | • | | significant volatility in the market price and trading volume of securities of BDCs or technology transfer companies; |

| | • | | changes in regulatory policies, accounting or tax guidelines with respect to BDCs or technology transfer companies; |

| | • | | actual or anticipated changes in our sales or earnings or fluctuations in our operating results; |

| | • | | actual or anticipated changes in the value of our investments; |

16

| | • | | changes in financial reporting requirements; |

| | • | | general economic conditions and trends; |

| | • | | loss of a major funding source; |

| | • | | departures of key personnel; |

| | • | | changes to the market or shareholder’s acceptance of our unique technology transfer business; or |

| | • | | the consummation of mergers or acquisitions of related businesses. |

| Item 1B. | Unresolved Staff Comments |

Not applicable.

Our principal office is located in Tampa, Florida. We lease this office space from Ybor City Group, Inc., a subsidiary of UTEK Real Estate Holdings, Inc., one of our portfolio companies. This property is adequate for our current domestic office needs. If our office requirements increase beyond our current expectations, we believe that additional office space may be available for lease at this location.

We also lease office space in Pennsylvania, Israel and the United Kingdom. These properties are adequate for our current needs.

We may be a party from time to time in certain lawsuits in the normal course of our business. While the outcome of these legal proceedings cannot at this time be predicted with certainty, we do not expect that these proceedings will have a material effect upon our financial condition or results of operations.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of shareholders during the quarter ended December 31, 2007.

17

PART II

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our shares of common stock trade on the American Stock Exchange (AMEX) and the AIM market of the London Stock Exchange under the symbol “UTK”. Computershare Trust Company, Inc., 350 Indiana Street, Suite 800, Golden, CO 80401; 303-262-0600, serves as transfer agent for our common stock.

We had approximately 3,000 stockholders of record at February 25, 2008. The net asset value per share of our common stock at December 31, 2007 was $4.85.

Price Range of Common Stock and Dividends

The following table reflects the high and low closing prices for our common stock as reported on the AMEX and the cash dividends declared per common share for the period indicated:

| | | | | | | | | |

| | | High | | Low | | Dividends |

Fiscal year 2007 | | | | | | | | | |

First quarter | | $ | 13.84 | | $ | 10.55 | | | — |

Second quarter | | $ | 17.90 | | $ | 13.16 | | | — |

Third quarter | | $ | 17.57 | | $ | 13.00 | | | — |

Fourth quarter | | $ | 16.49 | | $ | 12.72 | | | — |

| | | |

Fiscal year 2006 | | | | | | | | | |

First quarter | | $ | 14.50 | | $ | 11.90 | | $ | 0.02 |

Second quarter | | $ | 20.40 | | $ | 12.65 | | | — |

Third quarter | | $ | 23.80 | | $ | 18.22 | | | — |

Fourth quarter | | $ | 19.99 | | $ | 10.78 | | $ | 0.02 |

Our Board of Directors has sole discretion in determining whether to declare and pay cash dividends in the future. The declaration of cash dividends will depend on our profitability, financial condition, cash requirements, future prospects and other factors deemed relevant by our Board of Directors. Our ability to pay cash dividends in the future could be limited or prohibited by regulatory requirements and the terms of financing agreements that we may enter into or by the terms of any preferred stock that we may authorize and issue.

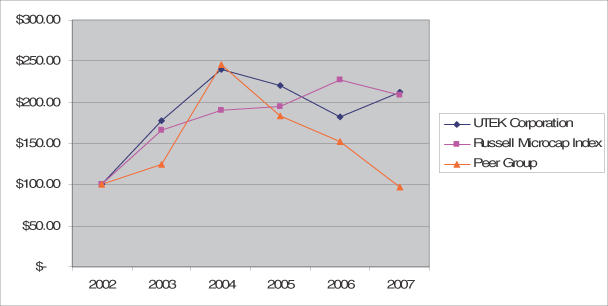

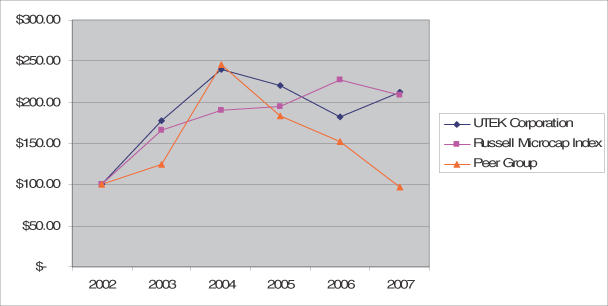

Performance Graph

The following graph shows a comparison of the five-year cumulative total return, assuming the reinvestment of dividends, on our common stock with that of the Russell Microcap Index and the Company’s peer group including British Technology Group plc, Competitive Technologies, Inc., IP Group plc, and Sagentia Group AG. The graph assumes $100 was invested on December 31, 2002 in our common stock, the Russell Microcap Index companies, and the companies in the peer group. Note that historical stock price performance is not necessarily indicative of future stock price performance.

18

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG UTEK, RUSSELL MICROCAP INDEX AND THE COMPANY’S PEER GROUP

| Item 6. | Selected Financial Data |

The following table presents our selected consolidated financial and other data and has been derived from our audited financial statements for the years ended December 31, 2007, 2006, 2005, 2004 and 2003. The information below should be read in conjunction with “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto, each of which is included in another section of this annual report on Form 10-K. Our acquisitions have not had a material effect on the trends reflected in the selected financial data.

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | |

Income from operations | | $ | 20,300,949 | | $ | 56,952,937 | | $ | 22,743,823 | | $ | 7,188,615 | | $ | 3,805,177 |

Net income from operations | | | 3,776,742 | | | 19,944,207 | | | 5,887,830 | | | 942,722 | | | 180,568 |

Net income from operations per diluted common share | | $ | 0.42 | | $ | 2.27 | | $ | 0.80 | | $ | 0.15 | | $ | 0.04 |

Weighted average shares: | | | | | | | | | | | | | | | |

Diluted | | | 8,989,234 | | | 8,786,605 | | | 7,325,312 | | | 6,098,537 | | | 4,266,918 |

Cash dividends declared per common share | | | — | | $ | 0.04 | | | — | | | — | | | — |

| | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Balance Sheet Data: | | | | | | | | | | | | | | | |

Total assets | | $ | 45,221,077 | | $ | 53,040,810 | | $ | 49,005,960 | | $ | 25,879,644 | | $ | 12,549,448 |

Long-term obligations | | | — | | | — | | | — | | | — | | | 847,890 |

Net asset per share | | $ | 4.85 | | $ | 5.71 | | $ | 5.58 | | $ | 3.85 | | $ | 2.33 |

19

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

Special Note Regarding Forward-Looking Statements

The following discussion should be read in conjunction with our consolidated financial statements and the notes thereto included elsewhere in this annual report on Form 10-K. This annual report on Form 10-K contains forward-looking statements regarding the plans and objectives of management for future operations. These forward-looking statements may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and we cannot assure you that the projections included in these forward-looking statements will come to pass. Our actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors.

Overview

Executive Summary

Our financial condition is dependent on a number of factors including our ability to effectuate technology transfers and the performance of the equity investments that we receive in connection with these transfers. Substantially all of our investments are in development stage and start-up companies and thinly traded public companies. These businesses are thinly capitalized, unproven, small companies that lack management depth, are dependent on new, commercially unproven technologies and have no or a limited history of operations.

Our total assets were $45.2 million and our net assets were $43.7 million at December 31, 2007, compared to $53.0 million and $51.0 million at December 31, 2006, respectively. Net asset value per share was $4.85 at December 31, 2007 and $5.71 at December 31, 2006. At the end of fiscal year 2007, we had no long-term debt outstanding and $5.3 million in cash and cash equivalents.

Income from operations for fiscal year 2007 totaled approximately $20.3 million, as compared to $57.0 million in 2006. Net income from operations for fiscal year 2007 totaled approximately $3.8 million as compared to $19.9 million in 2006. Net realized losses on investments, net of deferred tax effect, totaled approximately $1.4 million in 2007 as compared to net realized gains of $900,000 in 2006. In this regard, we received gross proceeds of $1.9 million in 2007 and $9.7 million in 2006 in connection with the sale of the securities we received in connection with our technology acquisition alliance agreements and technology transfers. Net change in unrealized depreciation of investments, net of deferred tax benefit, was $10.8 million in 2007 as compared to $25.8 million in 2006.

On June 15, 2007, the Company’s stockholders voted to approve an amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares of common stock from 19,000,000 to 29,000,000. The additional 10,000,000 shares are part of the existing class of common stock and will have the same rights and privileges as the shares of common stock currently issued and outstanding. The Board of Directors deemed it desirable to increase the number of shares of common stock the Company is authorized to issue in order to provide adequate flexibility in the future. The holders of common stock are not entitled to preemptive rights or cumulative voting, and accordingly, the issuance of additional common shares will dilute the ownership and voting rights of shareholders.

20

Recently, we have taken steps to improve the efficiency of our technology transfer business model and refocused it on Open Innovation. Some of the improvements we have made include:

| | • | | Expanded our scientific review team for technology due diligence; |

| | • | | Hired an experienced head of business development formerly employed by IBM to oversee our sales efforts; |