QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Fargo Electronics, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

FARGO ELECTRONICS, INC.

6533 Flying Cloud Drive

Eden Prairie, Minnesota 55344

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD May 9, 2002

To our Stockholders:

The Annual Meeting of Stockholders of Fargo Electronics, Inc., a Delaware corporation, will be held on Thursday, May 9, 2002, at 3:30 p.m., local time, at Fargo's Corporate Headquarters,

6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344 to:

- 1.

- Elect two Class II directors, each to serve for a term of three years until our 2005 annual meeting of stockholders.

- 2.

- Transact any other business that properly comes before the meeting.

Only stockholders of record at the close of business on March 18, 2002 will be entitled to notice of, and to vote at, the meeting and any adjournments of the meeting.It is important that your shares be represented at the meeting. Please mark, sign, date and mail the enclosed proxy card in the postage-paid envelope provided, regardless of whether you plan to attend in person.

Sincerely,

Jeffrey D. Upin

Secretary

April 9, 2002

Eden Prairie, Minnesota

FARGO ELECTRONICS, INC.

6533 Flying Cloud Drive

Eden Prairie, MN 55344

PROXY STATEMENT

The accompanying proxy is solicited on behalf of the Board of Directors of Fargo Electronics, Inc. in connection with our Annual Meeting of Stockholders to be held on Thursday, May 9, 2002, at 3:30 p.m., local time, at Fargo's Corporate Headquarters, 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344, for the purposes set forth in the accompanying Notice of Meeting.

Please mark and sign the enclosed proxy card and return it in the accompanying envelope. No postage is required if your returned proxy card is mailed within the United States. We will bear the cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding the materials to the beneficial owners of our common stock. Our directors, officers and regular employees may, without compensation other than their regular compensation, solicit proxies by telephone, telegraph, personal conversation or other means of communication. We may reimburse brokerage firms and others for expenses in forwarding proxy material to the beneficial owners of our common stock.

Any proxy given to this solicitation and received in time for the Annual Meeting will be voted according to the instructions given in the proxy. Any stockholder giving a proxy may revoke it any time prior to its use at the Annual Meeting by giving a written revocation notice to our Secretary, by filing a revoking instrument or a duly executed proxy bearing a later date with our Secretary or by attending the Annual Meeting and voting in person. Proxies that are signed by stockholders but that lack any specific voting instructions will be voted in favor of the election as directors of each of the nominees listed in this proxy statement.

Our board recommends that you vote FOR each of the nominees named in this proxy statement.

We expect that this proxy statement, the proxy and notice of meeting will first be mailed to our stockholders on or about April 9, 2002.

1

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of the company's Proxy Statement or Annual Report to Stockholders may have been sent to multiple stockholders in each household. The company will promptly deliver a separate copy of either document to any stockholder upon written or oral request to Investor Relations, Fargo Electronics, Inc., 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344; telephone: (952) 941-9470. Any stockholder who wants to receive separate copies of our Proxy Statement or Annual Report in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder's bank, broker, or other nominee record holder, or the stockholder may contact the company at the above address and phone number.

VOTING OF SHARES

Our Board of Directors has fixed the close of business on March 18, 2002 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. On March 18, 2002, 11,785,900 shares of our common stock, $.01 par value, were outstanding. Each share outstanding on that date entitles its holder to one vote in person or by proxy on each matter to be voted on at the Annual Meeting.

Quorum

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote at the meeting is required for a quorum for the transaction of business. In general, shares of common stock represented by a properly signed and returned proxy card will be counted as shares present and entitled to vote at the meeting for purposes of determining a quorum.

Vote Required for Approval

The two director nominees who receive the greatest number of votes cast for the election of directors at the Annual Meeting will be elected as directors. Votes that are withheld from the election of director nominees will be excluded entirely from the vote and will have no effect. Other proposals require the approval of a majority of the shares present and entitled to vote in person or by proxy on that proposal.

Abstentions; Broker Non-Votes

Shares voted as abstaining will be treated as voting shares that were not cast in favor of the proposal, and thus will be counted as votes against the particular proposal. Shares represented by a proxy card including any broker non-vote on a matter (i.e. shares held by a broker or nominee that are represented at the meeting but that the broker or nominee is not empowered to vote on a particular proposal) will be treated as shares not voting on that matter, and thus will not be counted in determining whether that matter has been approved.

Shares of common stock represented by properly executed proxy cards will be voted according to the choices specified. Proxies that are signed by stockholders but that lack any voting instructions will be voted in favor of the election of the nominees for director listed in this proxy statement and, with respect to any other business that may properly come before the Annual Meeting, according to the best judgment of the proxies named on the proxy card.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock by (a) each stockholder who is known by us to own beneficially more than 5% of the outstanding common stock, (b) each director and each nominee, (c) each executive officer named in the Summary Compensation Table on page 9 under the heading "Executive Compensation," and (d) all our executive officers and directors as a group. This ownership information is as of March 18, 2002, unless otherwise indicated in the footnotes.

Unless otherwise noted, each of the stockholders listed in the table possesses sole voting and investment power with respect to the shares indicated. Shares not outstanding but deemed beneficially owned by virtue of the right of a person or member of a group to acquire them within 60 days are treated as outstanding only when determining the amount and percent owned by such person or group. As of March 18, 2002, there were 11,785,900 shares of common stock outstanding.

| | Shares of Common Stock

Beneficially Owned

| |

|---|

Name of Beneficial Owner

| |

|---|

| | Amount

| | Percent of Class

| |

|---|

| Entities affiliated with TA Associates, Inc.(1) | | 3,125,000 | | 26.5 | % |

| Entities affiliated with The St. Paul Companies, Inc.(2) | | 1,563,750 | | 13.3 | % |

| Benson Associates, LLC(3) | | 797,400 | | 6.8 | % |

| Theodore R. Duncan(4) | | 770,000 | | 6.5 | % |

| Entities affiliated with Gabelli Asset Management, Inc.(5) | | 723,192 | | 6.1 | % |

| Zebra Technologies Corporation(6) | | 585,000 | | 5.0 | % |

| Gary R. Holland(7) | | 479,060 | | 4.1 | % |

| Jeffrey D. Upin(8) | | 15,404 | | * | |

| Mark S. Andersen(9) | | 24,896 | | * | |

| Thomas C. Platner(10) | | 11,843 | | * | |

| Kent O. Lillemoe(11) | | 47,500 | | * | |

| Michael C. Child(12) | | 3,128,750 | | 26.5 | % |

| Everett V. Cox(13) | | 1,566,250 | | 13.3 | % |

| William H. Gibbs(14) | | 128,750 | | 1.1 | % |

| Elaine A. Pullen(15) | | 16,750 | | * | |

| All directors and executive officers as a group (9 persons)(16) | | 5,419,203 | | 45.9 | % |

- *

- Less than 1%.

- (1)

- This information is based on a Schedule 13G filed with the SEC on February 14, 2001 by entities related to TA Associates, Inc. and includes: (i) 2,304,687 shares held by TA/Advent VIII L.P., (ii) 727,345 shares held by Advent Atlantic and Pacific III L.P., (iii) 46,875 shares held by TA Executives Fund LLC, and (iv) 46,093 shares held by TA Investors LLC. TA/Advent VIII L.P., Advent Atlantic and Pacific III L.P., TA Executives Fund LLC and TA Investors LLC are part of an affiliated group of investment partnerships and limited liability companies referred to, collectively, as the TA Associates Group. The general partner of TA/Advent VIII, L.P. is TA Associates VIII LLC. The general partner of Advent Atlantic and Pacific III L.P. is TA Associates AAP III Partners L.P. TA Associates, Inc. is the manager and general partner of each of TA Associates VIII LLC and TA Associates AAP III Partners L.P. TA Associates, Inc. is also the manager of each of TA Executives Fund LLC and TA Investors LLC. In such capacity, TA Associates, Inc. exercises sole voting and investment power with respect to all of the shares deemed to be beneficially owned by the named investment partnerships and limited liability companies. With the exception of those shares held by TA Investors LLC, individually, no

3

stockholder, director or officer of TA Associates, Inc. is deemed to have or share such voting or investment power. Principals and employees of TA Associates, Inc. (including Mr. Child, a director of Fargo) comprise the general partners of TA Investors LLC. In such capacity, Mr. Child may be deemed to share voting and investment power with respect to the 46,093 shares that may be deemed beneficially owned by TA Investors LLC. Mr. Child disclaims beneficial ownership of all shares, except as to 1,349 shares held by TA Investors LLC, in which he holds a pecuniary interest. The address of the TA Associates Group is High Street Tower, Suite 2500, 125 High Street, Boston, Massachusetts 02110-2720.

- (2)

- This information is based on a Schedule 13G filed with the SEC on January 23, 2002 by entities related to The St. Paul Companies, Inc. and includes: (i) 1,519,530 shares held by St. Paul Venture Capital IV LLC, (ii) 1,250 shares issuable upon exercise of options issued to Everett Cox, a director of Fargo and a member of St. Paul Venture Capital IV LLC and (iii) 42,970 shares held by St. Paul Venture Capital Affiliates Fund I LLC. St. Paul Venture Capital, Inc. is the manager of St. Paul Venture Capital IV, LLC and St. Paul Venture Capital Affiliates Fund I, LLC and exercises sole voting and investment power with respect to these shares. The St. Paul Companies owns a 77% interest in St. Paul Venture Capital, Inc., and St. Paul Fire and Marine Insurance Company, a wholly-owned subsidiary of The St. Paul Companies, Inc., owns 99% of the membership interests in St. Paul Venture Capital IV, LLC. Everett Cox, a director of Fargo Electronics, Inc., is a member of St. Paul Venture Capital IV, LLC and St. Paul Venture Capital Affiliates Fund I, LLC. Mr. Cox disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest therein. The address of St. Paul Venture Capital, Inc. is

10400 Viking Drive, Suite 550, Eden Prairie, Minnesota 55344.

- (3)

- This information is based on a Schedule 13G filed with the SEC on February 14, 2002 by Benson Associates, LLC, 111 S.W. Fifth Avenue, Suite 2130, Portland, Oregon 97204.

- (4)

- This information is based on a Schedule 13G filed with the SEC on October 4, 2000 by Theodore R. Duncan, 1350 Indian Mound Trail, Vero Beach, Florida 32963.

- (5)

- This information is based on a Schedule 13D filed with the SEC on April 1, 2002 by entities related to Gabelli Asset Management Inc. and includes: (i) 73,000 shares held by Gabelli Funds, LLC, (ii) 199,600 shares held by GAMCO Investors, Inc., (iii) 229,592 shares held by Gabelli Associates Limited, (iv) 191,000 shares held by Gabelli Associates Fund, (v) 1,500 shares held by Gabelli Fund LDC, (vi) 26,500 shares held by Gabelli Securities, Inc., and (vii) 2,000 shares held by Gabelli Advisors, Inc. According to the information provided, each of these entities has sole voting and sole dispositive power with respect to the shares held by such entity. The address of Gabelli Asset Management Inc. is One Corporate Center, Rye, New York 10580-1434.

- (6)

- This information is based on a Schedule 13D filed with the SEC on March 27, 2002 by Zebra Technologies Corporation, 333 Corporate Woods Parkway, Vernon Hills, Illinois 60061.

- (7)

- Represents 312,500 shares of restricted stock purchased by Mr. Holland under our Amended and Restated 1998 Stock Option and Grant Plan, 78,125 shares granted to Mr. Holland as a stock bonus, 935 shares Mr. Holland purchased through Fargo's 2001 Employee Stock Purchase Plan and 25,000 shares that Mr. Holland has the right to acquire within 60 days by exercising options.

- (8)

- Represents 640 shares Mr. Upin purchased through Fargo's 2001 Employee Stock Purchase Plan and 14,764 shares that Mr. Upin has the right to acquire within 60 days by exercising options.

- (9)

- Represents 913 shares Mr. Andersen purchased through Fargo's 2001 Employee Stock Purchase Plan and 23,983 shares that Mr. Andersen has the right to acquire within 60 days by exercising options.

4

- (10)

- Represents 750 shares Mr. Platner purchased through Fargo's 2001 Employee Stock Purchase Plan and 11,093 shares that Mr. Platner has the right to acquire within 60 days by exercising options.

- (11)

- Represents 31,250 shares of restricted stock purchased by Mr. Lillemoe under our Amended and Restated 1998 Stock Option and Grant Plan and 16,250 shares that Mr. Lillemoe has the right to acquire within 60 days by exercising options.

- (12)

- Mr. Child disclaims beneficial ownership of all shares held by affiliates of TA Associates, Inc., of which Mr. Child is a Managing Director, except to the extent of 1,349 shares in which he has a pecuniary interest through TA Investors LLC. Also includes 3,750 shares that Mr. Child has the right to acquire within 60 days by exercising options.

- (13)

- Includes 1,562,500 shares and options to purchase 3,750 shares beneficially owned by St. Paul Venture Capital, Inc. or its affiliated entities, as to which Mr. Cox disclaims beneficial ownership except to the extent of his pecuniary interest therein.

- (14)

- Includes 78,125 shares of restricted stock purchased by Mr. Gibbs under our Amended and Restated 1998 Stock Option and Grant Plan and 50,625 shares that Mr. Gibbs has the right to acquire within 60 days by exercising options.

- (15)

- Represents 16,750 shares that Ms. Pullen has the right to acquire within 60 days by exercising options.

- (16)

- The amount beneficially owned by all current directors and executive officers as a group includes (i) 3,125,000 beneficially owned by TA Associates Group as to which Mr. Child may be deemed to have voting and investment power, (ii) 1,563,750 shares beneficially owned by St. Paul Venture Capital, Inc. as to which Mr. Cox may be deemed to have voting and investment power, and (iii) 165,965 shares issuable under options that are currently exercisable or will become exercisable within the next 60 days.

5

PROPOSAL 1

ELECTION OF CLASS II DIRECTORS

Structure

Our bylaws provide that our Board will consist of between one and nine members, with the number of directors determined from time to time by our Board. The number of directors is currently set at six.

Our Board of Directors is divided into three classes for the purposes of election. One class is elected at each annual meeting of stockholders to serve for a three-year term. Directors elected at the 2002 Annual Meeting of Stockholders will hold office for a three-year term expiring in 2005. Other directors are not up for election this year and will continue in office for the remainder of their terms.

Nomination

Our Board has nominated Michael C. Child and William H. Gibbs to serve as Class II directors for a term of three years expiring at the 2005 annual meeting of our stockholders or until their respective successors are elected and qualified. Both of the nominees are current members of our Board.

Vote Required

The two nominees at the Annual Meeting who receive the greatest number of votes cast for the election of directors at the meeting will be elected as directors. In the absence of other instructions, the proxies will be votedFOR Mr. Child and Mr. Gibbs. If prior to the Annual Meeting our Board should learn that any nominee will be unable to serve by reason of death, incapacity or other unexpected occurrence, the proxies that would have otherwise been voted for such nominee will be voted for a substitute nominee as selected by our Board. Alternatively, the proxies may, at our Board's discretion, be voted for only the remaining nominee. Our Board has no reason to believe that any of the nominees will be unable to serve.

Directors Nominated For Election This Year for Terms Expiring in 2005

Michael C. Child, age 47, currently serves as a Managing Director of TA Associates, Inc., a venture capital investment firm. Mr. Child has been employed by TA Associates, or its predecessor, since July 1982. Mr. Child serves as a director of Finisar Corporation, Manufacturing Technology Inc., IPG Photonics, Inc. and International Microcircuits Inc. He has served as a director of Fargo since November 1999.

William H. Gibbs, age 58, has been an independent consultant and investor since January 1998. From 1985 to 1998, Mr. Gibbs served as Chief Executive Officer and Chairman of the Board of Directors of DH Technology, Inc., a manufacturer of point of sale and bar code printers and smart card systems. From 1981 to 1985, Mr. Gibbs was President of Information Magnetics Inc., a disk drive head manufacturer. Prior to that Mr. Gibbs held various management positions at Datapoint Corporation and the General Electric Company. Mr. Gibbs is currently a director of Remec Inc. and Pro Strategic Solutions, Inc. Mr. Gibbs has served as a director of Fargo since April 1999 and also served Fargo in a part time advisory role from April 1999 to March 2000.

OUR BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE ABOVE NOMINEES FOR DIRECTOR.

6

Class III Directors Continuing in Office Until the 2003 Annual Meeting

Gary R. Holland, age 60, has served as our Chairman of the Board of Directors, President and Chief Executive Officer since February, 1998. From May 1997 to February 1998, Mr. Holland was the general manager of Fargo. From 1992 to 1997, Mr. Holland owned and operated two business and strategy consulting firms, Decision Process International and Holland & Associates. From 1982 to 1992, Mr. Holland was the President and CEO of Datacard Corporation. From 1979 to 1982, he was the President and Chief Operating Officer of CPT Corporation. Mr. Holland also serves as a member of the boards of directors of Check Technology Corporation and DataKey Corporation, where he is the Chairman of the Board. Mr. Holland has been a director of Fargo since 1998.

Kent O. Lillemoe, age 43, has been the Chief Operating Officer of Avanti Optics Corp. since June 2000. Mr. Lillemoe served as Fargo's Chief Financial Officer from March, 1998 to June 2000. From September 1996 to March 1998, Mr. Lillemoe was an independent financial advisor and consultant to several companies and was employed by Gentra Systems, Inc. as Chief Financial Officer from May 1997 through February 1998. From 1985 to 1996, Mr. Lillemoe served as the Vice President of Finance and Administration for CyberOptics Corporation. Mr. Lillemoe has been a director of Fargo since August 2000.

Class I Directors Continuing in Office Until the 2004 Annual Meeting

Elaine A. Pullen, age 48, was President of Trident International, Inc. until June 2001. Ms. Pullen was a director and the Chief Executive Officer of Trident International, Inc. from April 1995 to February 1999 when Trident was acquired by ITW. From August 1994 to April 1995 she also served as President and Chief Operating Officer of Trident International. Prior to joining Trident International, Inc., Ms. Pullen served as a director of Linx Printing Technologies, PLC from September 1992 to August 1994, where she also served as Business Operations Director from February 1994 to August 1994 and as Engineering Director from September 1992 to February 1994. From 1991 to 1992, Ms. Pullen served as President of Linx USA, and as Vice President of Applied Research and Engineering of VideoJet Systems International, Inc. from 1988 to 1991. Ms. Pullen has served as a director of Fargo since April 1998.

Everett V. Cox, age 46, was a General Partner of St. Paul Venture Capital from 1992 to January 2002. Prior to that, he spent nine years with Security Pacific Capital, a California based venture capital firm, as Senior Vice President. Previously, he held technical positions with McDonnell Douglas Corporation and Garrett AiResearch. Mr. Cox is currently a director of Domain Pharma, POMS Corporation, Consensus Health Care and Novalis Corporation. Mr. Cox has served as a director of Fargo since February 1998.

Additional Information About our Board and its Committees

Our Board of Directors has established an Audit Committee and a Compensation Committee, each of which became active upon our initial public offering in February 2000. We have not established a standing nominating committee.

The Audit Committee provides assistance to our Board in satisfying its fiduciary responsibilities relating to accounting, auditing, operating and reporting practices and reviews the annual financial statements, the selection and work of our independent auditors and the adequacy of internal controls for compliance with corporate policies and directives. The Audit Committee, comprised of Michael C. Child, Everett V. Cox and William H. Gibbs, met six times during fiscal 2001.

The Compensation Committee reviews general programs of compensation and benefits for all employees and makes recommendations to our Board concerning executive officer and director compensation. The Compensation Committee also administers our Amended and Restated 1998 Stock

7

Option and Grant Plan and 2001 Employee Stock Purchase Plan. The Compensation Committee, comprised of Michael C. Child and Elaine A. Pullen, met twice during fiscal 2001.

Our Board held ten meetings during fiscal 2001 and each of the directors attended, either in person or by telephonic conference, 75% or more of the total meetings of our Board and all such committees on which such director served during fiscal 2001.

Director Compensation

Directors who are employees receive no separate compensation for their service as directors. Our non-employee directors receive a $5,000 annual retainer fee, $1,000 for each regular meeting of the Board of Directors, $500 for each committee meeting and $250 for each meeting by teleconference. In addition, directors are reimbursed for travel expenses for attending meetings of the Board and any Board or advisory committees.

Our Amended and Restated 1998 Stock Option and Grant Plan provides for the grant of stock based awards to eligible key employees, officers and directors. On May 3, 2001, we granted each non-employee director a seven-year option to purchase 5,000 shares of common stock at an exercise price of $3.93 per share, the fair market value of our common stock on that date. These options vest ratably over four years.

Audit Committee Report

The Audit Committee consists of Michael C. Child, Everett V. Cox and William H. Gibbs, each of whom is a member of our Board of Directors and qualifies as "independent" as defined under the National Association of Securities Dealers' listing standards. The Audit Committee operates under a written charter adopted by our Board of Directors.

The primary function of the Audit Committee is to provide advice with respect to our financial matters and to assist our Board of Directors in fulfilling its oversight responsibilities regarding finance, accounting, tax and legal compliance. The Audit Committee's primary duties and responsibilities are to:

- •

- serve as an independent and objective party to monitor Fargo's financial reporting process and internal control system;

- •

- review and appraise the audit efforts of Fargo's independent accountants;

- •

- evaluate Fargo's quarterly financial performance as well as its compliance with laws and regulations;

- •

- oversee management's establishment and enforcement of financial policies and business practices; and

- •

- provide an open avenue of communication among the independent accountants, financial and senior management, counsel and our Board of Directors.

The Audit Committee has reviewed and discussed Fargo's audited financial statements for the fiscal year ended December 31, 2001 with our management. The Audit Committee has discussed with PricewaterhouseCoopers LLP, Fargo's independent public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee has also received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and the Audit Committee has discussed the independence of PricewaterhouseCoopers LLP with them.

8

Based on the Audit Committee's review and discussions noted above, the Audit Committee recommended to our Board of Directors that Fargo's audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2001 for filing with the SEC.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash and non-cash compensation paid or earned during fiscal 1999, 2000 and 2001 by our Chief Executive Officer and our four other most highly compensated executive officers who received or earned cash and non-cash salary and bonus of more than $100,000 for fiscal 2001.

| | Annual Compensation

| | Long Term

Compensation

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation(1)

| | Securities

Underlying

Options (#)

|

|---|

Gary R. Holland

Chief Executive Officer | | 2001

2000

1999 | | $

| 275,000

275,000

271,876 | | $

| 38,529

5,500

— | | $

| 15,270

15,090

15,090 | | —

50,000

— |

Paul W. B. Stephenson

Former Chief Financial Officer(2) |

|

2001 |

|

$ |

130,000 |

|

$ |

12,987 |

|

$ |

1,000 |

|

40,000 |

Jeffrey D. Upin

General Counsel |

|

2001

2000

1999 |

|

$

|

145,000

115,000

98,000 |

|

$

|

14,502

8,771

10,511 |

|

$

|

1,000

1,000

1,000 |

|

—

35,000

— |

Mark S. Andersen

Sales |

|

2001

2000 |

|

$

|

138,000

130,000 |

|

$

|

13,957

10,288 |

|

$

|

1,000

1,000 |

|

—

25,000 |

Thomas C. Platner

Engineering and Manufacturing |

|

2001 |

|

$ |

145,000 |

|

$ |

14,485 |

|

$ |

1,000 |

|

— |

- (1)

- Amounts for Mr. Holland include $12,000 annually for a car allowance.

- (2)

- Mr. Stephenson resigned as Chief Financial Officer effective January 31, 2002.

9

Option Grants and Exercises

The following tables summarize option grants and exercises during the fiscal year ended December 31, 2001 to or by each of the executive officers named in the Summary Compensation Table above, and the potential realizable value of the options held by such persons at December 31, 2001.

| | Individual Grants

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation

for Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise or

Base Price

($/Sh)

| | Expiration

Date

| | 5% ($)

| | 10% ($)

|

|---|

| Gary R. Holland | | — | | — | | — | | — | | — | | — |

Paul W. B. Stephenson |

|

40,000 |

|

56.6 |

% |

3.93 |

|

1/31/02 |

|

— |

|

— |

Jeffrey D. Upin |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Mark S. Andersen |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Thomas C. Platner |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

The options reported in this table were granted under Fargo's Amended and Restated 1998 Stock Option and Grant Plan and had an original term of seven years after the grant date. The per share exercise price of this option was equal to the market value (average of the high and low sales price on the NASDAQ National Market) of a share of Fargo common stock on the date of grant. These options were cancelled without being exercised as a result of Mr. Stephenson's resignation of employment with Fargo.

The following table summarizes the value of in-the-money options held at December 31, 2001 by our Chief Executive Officer and each of the executive officers named in the Summary Compensation Table on page 9.

Aggregated Option Exercises In

Last Fiscal Year and Fiscal Year-End Option Values

| |

| |

| | Number of Securities

Underlying Unexercised

Options at

December 31, 2001

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money Options

at December 31, 2001(2)

|

|---|

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized ($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Gary R. Holland | | — | | — | | 12,500 | | 37,500 | | | — | | | — |

Paul W. B. Stephenson(3) |

|

— |

|

— |

|

— |

|

40,000 |

|

|

— |

|

$ |

114,920 |

Jeffrey D. Upin |

|

— |

|

— |

|

11,015 |

|

28,672 |

|

$ |

33,451 |

|

$ |

71,872 |

Mark S. Andersen |

|

— |

|

— |

|

16,327 |

|

28,985 |

|

$ |

63,938 |

|

$ |

82,124 |

Thomas C. Platner |

|

— |

|

— |

|

8,593 |

|

26,094 |

|

$ |

27,359 |

|

$ |

77,964 |

- (1)

- The value realized is calculated based on the closing price of Fargo's common stock as reported by the Nasdaq National Market on the date of exercise minus the exercise price of the option, and does not necessarily indicate that the optionee sold such stock.

- (2)

- The value of unexercised in-the-money options is based on the difference between the fair market value of the shares of common stock underlying the options at December 31, 2001, and the exercise price of such options. Options are in-the-money if the market price of the shares exceeds the option exercise price.

- (3)

- These options were cancelled without being exercised as a result of Mr. Stephenson's resignation of employment with Fargo.

10

Agreements with Employees

In June 2001, Fargo and Gary R. Holland, Fargo's Chairman of the Board of Directors, President and Chief Executive Officer, entered into an Amended and Restated Employment Agreement. The agreement provides Mr. Holland with an annual base salary of at least $275,000 and an annual performance bonus based upon the achievement of certain financial thresholds. The initial term of the employment agreement with Mr. Holland expires on December 18, 2003. The agreement renews automatically every year thereafter unless either party decides not to renew it and gives the other party notice of non-renewal. If Fargo terminates Mr. Holland without cause or if he terminates his employment agreement for good reason before the expiration of his agreement, Mr. Holland will be entitled to receive base salary payments for 15 months after his termination and will be entitled to accrued bonus amounts.

We have confidentiality and non-competition agreements with all of our employees. The confidentiality obligations under these agreements continue indefinitely and the non-competition restrictions survive for a period of between six and eighteen months after termination of employment depending on the type of employee.

Change in Control Arrangements

Under the Amended and Restated Employment Agreement Mr. Holland will be entitled to certain benefits if: (i) he is terminated either within the period that begins on the date of the change in control and ends on the last day of the 30th month that begins after the month in which the change in control occurs or before the effective date of the change in control if the termination was either a condition to the change in control or was at the request or insistence of a person related to the change in control, or (ii) he terminates his employment with Fargo for any reason within the period beginning on the first day of the 12th month that begins after the month during which a change in control of Fargo occurs and ending on the last day of the 30th month that begins after the month during which the change in control occurs. Mr. Holland will not be considered "terminated" for purposes of this agreement if he dies or is terminated for cause. He will, however, be considered "terminated" if he voluntarily leaves Fargo's employ for "good reason." "Good reason" means any of the following:

- •

- an adverse and material change in his duties or responsibilities as an executive (other than, if applicable, any such change directly attributable to the fact that Fargo is no longer a public company);

- •

- reduction in his base salary or an adverse change in the form or timing of the payment of such salary;

- •

- failure to cover Mr. Holland under similar benefit plans at a substantially similar total cost to Mr. Holland;

- •

- relocation of Mr. Holland to more than 30 miles from Mr. Holland's existing office;

- •

- failure to obtain a successor's assent to Fargo's fulfillment of its obligations under the agreement; or

- •

- refusal to allow Mr. Holland to continue to attend to matters or engage in activities not directly related to Fargo's business which Mr. Holland was attending to or engaging in prior to the date of the agreement.

11

Upon a termination in connection with a change in control, Mr. Holland will be entitled to receive the following payments and benefits:

- •

- cash payment equal to two and one-half times the sum of Mr. Holland's (1) base salary plus (2) 50% of his maximum target cash bonus for the year during which the change in control occurs;

- •

- group health, dental and term life insurance benefits to Mr. Holland, his family members and dependents until the last day of the 30th month following termination, at a substantially similar total cost to Mr. Holland;

- •

- $1,000 per month cash allowance until the last day of the 30th month following termination; and

- •

- full vesting of any restricted stock held by Mr. Holland.

In April 2001, Fargo entered into Direct Report Agreements with each of its executive officers (other than Mr. Holland) pursuant to which Fargo agreed to provide certain benefits to these executives if they are terminated in connection with a change in control of Fargo. Under these agreements, these officers are entitled to certain benefits if they are terminated either within 12 months of the effective date of a change in control or before the effective date of the change in control if the termination was either a condition to the change in control or was at the request or insistence of a person related to the change in control. These executives will not be considered "terminated" for purposes of these agreements if they die or are terminated for cause. They will, however, be considered "terminated" if they voluntarily leave Fargo's employ for "good reason." "Good reason" means any of the following:

- •

- an adverse and material change in the title, status, position, authority, duties or responsibilities as an executive (not including any such change directly attributable to the fact that Fargo is no longer a public company);

- •

- reduction in base salary or an adverse change in the form or timing of the payment of such salary, subject to certain exceptions;

- •

- failure to cover the executive under substantially similar benefit plans at a substantially similar total cost to the executive;

- •

- relocation of the executive to a different metropolitan area (other than the Minneapolis or St. Paul metropolitan area) than the executive's existing office;

- •

- failure to obtain a successor's assent to Fargo's fulfillment of its obligations under the agreement; or

- •

- any purported termination by Fargo or any successor company of the executive's employment that is not properly effected.

Upon a termination in connection with a change in control, these executives will be entitled to receive a lump sum cash payment equal to 100% of their base salary. In addition, these executives will receive an additional cash payment in an amount that assumes that their former stock options had become 100% (not 50%) fully vested in connection with the change in control.

In April 2001, Fargo entered into Management Agreements with several of its employees pursuant to which Fargo agreed to provide certain benefits to these employees if they are terminated in connection with a change in control of Fargo. Under these agreements, these employees are entitled to certain benefits if they are terminated either within 12 months of the effective date of a change in control or before the effective date of the change in control if the termination was either a condition to

12

the change in control or was at the request or insistence of a person related to the change in control. These employees will not be considered "terminated" for purposes of these agreements if they die or are terminated for cause. They will, however, be considered "terminated" if they voluntarily leave Fargo's employ for "good reason." The definition of "good reason" is substantially similar to the definition above under the heading "Direct Report Agreements" but does not include an adverse and material change in the title, status, position, authority, duties or responsibilities as an employee. Upon a termination in connection with a change in control, these employees will be entitled to receive a lump sum cash payment equal to 50% of their base salary. In addition, these employees will receive an additional cash payment in an amount that assumes that their former stock options had become 100% (not 50%) fully vested in connection with the change in control.

Under our Amended and Restated 1998 Stock Option and Grant Plan, if a "change in control" of Fargo occurs, then, unless otherwise approved by our Board of Directors or a committee thereof:

- •

- fifty percent of stock options and other awards granted under the plan that are unvested as of the effective date of such transaction will become fully vested as of such effective date;

- •

- the option plan and all outstanding options and other awards will terminate; and

- •

- in the event of such termination, each optionee will be permitted to exercise, for a period of at least 15 days prior to the date of such transaction, all outstanding options and other awards held by the optionee that are then exercisable or become exercisable upon the effectiveness of the transaction.

For purposes of the plan, a change in control of Fargo will be deemed to have occurred, among other things, upon:

- •

- the sale or transfer of all or substantially all of our assets; or

- •

- a merger or consolidation of Fargo with or into another corporation whereby less than a majority of the outstanding voting power of the surviving or consolidated corporation is held by our original stockholders immediately prior to such event; or

- •

- any purchase by a party or group of affiliated parties of shares of capital stock, the effect of which is that such party that did not beneficially own a majority of the voting power of the outstanding shares of capital stock of Fargo immediately prior to such purchase beneficially owns at least a majority of such voting power immediately after such purchase.

Compensation Committee Report On Executive Compensation

Our executive compensation policies are recommended and administered by the Compensation Committee of the Board of Directors. The Compensation Committee is currently composed of two independent, outside directors.

The principal objective of our compensation policy is to increase stockholder value by providing an incentive to officers and employees to maximize our performance. Generally, we have set the salaries of our executive officers at industry averages and provided for variable compensation through stock options and cash bonuses. The form of compensation provided to members of our management varies based on their position and their ability to influence performance.

The Compensation Committee has discretion to set executive compensation at levels warranted by external, internal and individual circumstances. The Committee has solicited through Mr. Holland, and reviewed annually, compensation surveys for officer positions in the electronics industry. Although such data provides a base for comparison, it is not necessarily used as the basis for the compensation actually awarded.

13

Executive Officer Compensation Program. Our executive officer compensation program can be separated into several elements: base salary, annual cash incentive compensation, long-term incentive compensation in the form of stock options, and various benefits, including medical and retirement savings plans generally available to employees.

Base Salary. Our policy is to set the base salaries of its executives at the industry average. Mr. Holland's base salary during 2001 was set at $275,000 by his employment contract dated June 19, 2001 and approved by the Committee at the beginning of the fiscal year, which the Committee believes is consistent for Chief Executives with similar experience for similarly sized companies. Such salary was equal to Mr. Holland's base salary for 2000.

Cash Incentive Compensation. The Compensation Committee establishes a bonus plan annually for our Chief Executive Officer and all other Fargo employees. The bonus plan is directly related to Fargo's overall financial performance. Bonuses are determined by multiplying the particular individual's base salary by (1) his or her designated bonus percentage and (2) a performance factor based upon Fargo's achievement of targeted levels of operating profit, sales growth and asset utilization for 2001. Designated bonus percentages are based upon relative positions within Fargo's organizational structure.

Mr. Holland earned a cash bonus of $38,529 for 2001 that was paid in 2002. The bonus reflects achieving targeted levels of operating profit, sales growth and asset utilization for 2001.

Stock Incentive Compensation. We provide long-term incentive to our executive officers primarily through our Amended and Restated 1998 Stock Option and Grant Plan. Under the Option Plan, the Compensation Committee awards stock options to executive officers based on the number of options and shares currently held by the executive and also on performance factors similar to those used to determine salaries and annual cash incentives. The Compensation Committee has not fixed, or predetermined, the amount of shares to be available for options grants in any year. The Committee has, however, reviewed industry statistics regarding the appropriate size of the option plan in terms of outstanding shares and the appropriate size of grants to executive officers and to employees as a whole.

Stock options are granted to encourage an executive to seek the same objectives as shareholders, to retain executives through vesting and to lower the overall cash cost of compensation. Our options generally vest over a period of four years and expire after seven to ten years. Options are generally granted with an exercise price equal to the fair market value on the date of grant.

Benefits. We provide medical and retirement savings benefits to executive officers on terms generally available to employees. No executive officer received perquisites in excess of 10% of their salary during 2001.

Summary. The Compensation Committee believes that the compensation program for executive officers during the 2001 year achieved the principal objectives for which it was designed.

Section 162(m). Section 162(m) of the Internal Revenue Code of 1986 limits our ability to deduct certain compensation in excess of $1 million paid to our chief executive officer and each of our four other most highly compensated executives. In 2001, we did not pay "compensation" within the meaning of Section 162(m) in excess of $1 million to our executive officers, and we do not believe that we will do so in the near future. As a result, we have not established a policy for qualifying compensation paid to our executive officers for deductibility under Section 162(m), but will formulate such a policy if compensation levels ever approach $1 million.

14

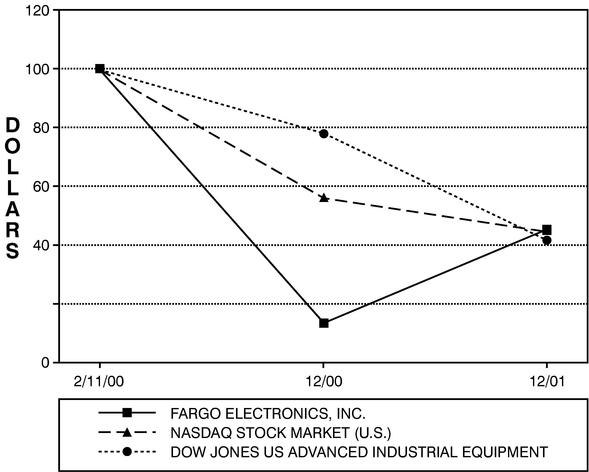

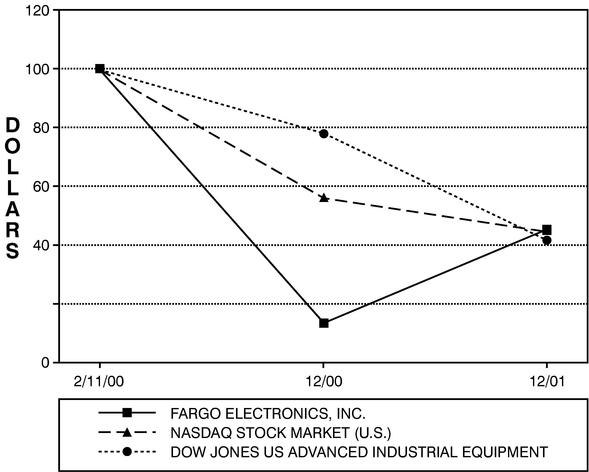

Comparative Stock Performance

The graph below compares the cumulative total stockholder return on our common stock to the total cumulative return on the Nasdaq Market Index and the Dow Jones U.S. Advanced Industrial Equipment Index during the period from our initial public offering on February 11, 2000 to December 31, 2001. The graph assumes a $100 investment in common stock, the Nasdaq Market Index and the Dow Jones U.S. Advanced Industrial Equipment Index on February 11, 2000 and the reinvestment of all dividends.

COMPARISON OF 22 MONTH CUMULATIVE TOTAL RETURN

AMONG FARGO ELECTRONICS, INC.,

THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE DOW JONES US ADVANCED INDUSTRIAL EQUIPMENT INDEX

22 Month Cumulative Total Return

| | 2/11/00

| | 12/31/00

| | 12/31/01

|

|---|

| Fargo Electronics, Inc. | | 100.00 | | 13.33 | | 45.60 |

| Nasdaq Stock Market (U.S.) | | 100.00 | | 56.22 | | 44.58 |

| Dow Jones Advanced Industrial Equipment | | 100.00 | | 78.39 | | 41.89 |

15

Certain Transactions

Stockholders' Agreement. Pursuant to a Stockholders' Agreement entered into in connection with our recapitalization in February 1998, certain holders of our common stock have registration rights with respect to their shares. Holders of registration rights include (i) Gary Holland, our Chairman of the Board of Directors, President and Chief Executive Officer, (ii) various entities affiliated with TA Associates, Inc., of which Michael Child, a director of Fargo, is a Managing Director, and (iii) various entities affiliated with St. Paul Venture Capital, Inc., of which Everett Cox, a director of Fargo, was an executive officer and shareholder until January 2002.

Selection of Auditors

We have not yet selected an accounting firm to perform an independent audit for fiscal year 2002 because our Board of Directors generally makes this selection later in the calendar year. We have requested and expect, however, one or more representatives of PricewaterhouseCoopers LLP, our independent public accountants for fiscal year 2001, to be present at the Annual Meeting. Such representatives will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Audit Fees

The fees paid PricewaterhouseCoopers LLP for our 2001 annual audit and review of our quarterly financial statements were $74,500.

Financial Systems Design and Implementation Fees

We did not pay any fees to PricewaterhouseCoopers LLP for financial systems design and implementation services in 2001.

All Other Fees

All other fees paid to PricewaterhouseCoopers LLP for services in 2001 totaled approximately $53,000.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers, and stockholders holding more than 10% of our outstanding common stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in beneficial ownership of our common stock. Executive officers, directors and greater-than-10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. To our knowledge, based solely on review of the copies of such reports furnished to us for the period ended December 31, 2001, all Section 16(a) reports required to be filed by our executive officers, directors and greater-than-10% stockholders were filed on a timely basis, except that Mr. Tony Dick, our Acting Chief Financial Officer, failed to timely file an initial Form 3 reporting his initial beneficial ownership.

PROPOSALS FOR THE NEXT ANNUAL MEETING

Stockholder proposals intended to be presented in the proxy materials relating to the next Annual Meeting of Stockholders must be received by us on or before December 9, 2002 and must satisfy the requirements of the proxy rules promulgated by the Securities and Exchange Commission.

A stockholder who wishes to make a proposal at the next Annual Meeting without including the proposal in our proxy statement must notify us by January 8, 2003. If a stockholder fails to give notice

16

by this date, then the persons named as proxies in the proxies solicited by us for the next Annual Meeting will have discretionary authority to vote on the proposal.

OTHER BUSINESS

We know of no business that will be presented for consideration at the Annual Meeting other than that described in this proxy statement. As to other business, if any, that may properly come before the Annual Meeting, it is intended that proxies solicited by our Board will be voted according to the judgment of the person or persons voting the proxies.

ANNUAL REPORT

UPON WRITTEN REQUEST, WE WILL FURNISH WITHOUT CHARGE A COPY OF OUR ANNUAL REPORT ON FORM 10-K (EXCLUSIVE OF EXHIBITS) FOR THE FISCAL YEAR ENDED DECEMBER 31, 2001 TO EACH PERSON WHO WAS A STOCKHOLDER OF FARGO ELECTRONICS AS OF MARCH 18, 2002. REQUESTS SHOULD BE SENT TO: FARGO ELECTRONICS, INC., 6533 FLYING CLOUD DRIVE, EDEN PRAIRIE, MN 55344 ATTN: INVESTOR RELATIONS.

BY ORDER OF THE BOARD OF DIRECTORS

Gary R. Holland

Chairman of the Board of Directors,

President and Chief Executive Officer

April 9, 2002

Eden Prairie, Minnesota

17

Fargo Electronics, Inc.

Meeting Location:

Fargo Electronics, Inc.

Corporate Headquarters

6533 Flying Cloud Drive

Eden Prairie, Minnesota 55344

May 9, 2002

3:30 p.m. Local Time

Fargo Electronics, Inc.

6533 Flying Cloud Drive

Eden Prairie, Minnesota 55344 USA | | PROXY |

|

COMMON STOCK PROXY

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 9, 2002.

The undersigned hereby appoints GARY R. HOLLAND and JEFFREY D. UPIN, and each of them, with full powers of substitution, as proxies to represent and vote, as designated below, all shares of Common Stock of Fargo Electronics, Inc., registered in the name of the undersigned at the Annual Meeting of Stockholders of the Company to be held at the Fargo Electronics, Inc. Corporate Headquarters, 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344 at 3:30 p.m. (Local Time) on May 9, 2002, and at any adjournment thereof, and the undersigned hereby revokes all proxies previously given with respect to the meeting.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

See reverse for voting instructions.

VOTE BY MAIL

Mark, sign, and date your proxy card and return it in the postage paid envelope provided.

\*/Please detach here \*/

The Board of Directors Recommends That You Vote FOR Each of the Proposals Below.

| Proposal 1: | Election of the nominees listed to serve as Class II directors for a term of three-years. | | 01 Michael C. Child

02 William H. Gibbs | | o | | Vote FOR all nominees (except as marked) | | o | | Vote WITHHELD from all nominees |

|

|

|

|

|

|

|

|

|

|

|

|

| (Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) | |

|

| | | | | |

|

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR EACH NOMINEE LISTED ABOVE.

Address Change? Mark Box

Indicate changes below: | | o | | Dated |

| | , 2002 |

|

|

|

|

|

|

|

|

|

|

| | | | | Signature(s) in Box (if there are co-owners, both must sign)

PLEASE DATE AND SIGN ABOVE exactly as name appears at the left, indicating, where appropriate, office position or representative capacity. For stock held in joint tenancy, each joint owner should sign. |

QuickLinks

HOUSEHOLDING OF ANNUAL MEETING MATERIALSVOTING OF SHARESSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTPROPOSAL 1 ELECTION OF CLASS II DIRECTORSEXECUTIVE COMPENSATIONAggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option ValuesCOMPARISON OF 22 MONTH CUMULATIVE TOTAL RETURN AMONG FARGO ELECTRONICS, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX AND THE DOW JONES US ADVANCED INDUSTRIAL EQUIPMENT INDEXSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEPROPOSALS FOR THE NEXT ANNUAL MEETINGOTHER BUSINESSANNUAL REPORT