|

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A INFORMATION |

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 |

|

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

FARGO ELECTRONICS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

FARGO ELECTRONICS, INC.

6533 Flying Cloud Drive

Eden Prairie, Minnesota 55344

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 3, 2005

To our Stockholders:

The Annual Meeting of Stockholders of Fargo Electronics, Inc., a Delaware corporation, will be held on Tuesday, May 3, 2005, at 1:30 p.m., local time, at Fargo’s Corporate Headquarters, 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344 to:

1. Elect two directors, each to serve for a term of three years until our 2008 annual meeting of stockholders.

2. Transact any other business that properly comes before the meeting.

Only stockholders of record at the close of business on March 11, 2005 will be entitled to notice of, and to vote at, the meeting and any adjournments of the meeting. It is important that your shares be represented at the meeting. Please mark, sign and date the enclose proxy card, and mail it in the postage-paid envelope provided, regardless of whether you plan to attend in person.

| Sincerely, |

|

|

| Jeffrey D. Upin |

| Secretary |

| |

March 30, 2005 | |

Eden Prairie, Minnesota | |

| | |

Important: The prompt return of your proxy card will save the company the expense of further requests for proxies to ensure a quorum at the meeting. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed within the United States.

FARGO ELECTRONICS, INC.

PROXY STATEMENT

TABLE OF CONTENTS

| Page |

General Information | 1 |

Voting of Shares | 2 |

Security Ownership of Certain Beneficial Owners and Management | 3 |

Proposal No. 1: Election of Directors | 5 |

Audit Committee Report | 9 |

Compensation and Human Resources Committee Report | 9 |

Executive Compensation | 11 |

Comparative Stock Performance | 18 |

Independent Registered Pubic Accounting Firm | 19 |

Section 16(a) Beneficial Ownership Reporting Compliance | 19 |

Proposals for the Next Annual Meeting | 20 |

Communications With the Board of Directors | 20 |

Other Business | 20 |

Householding of Annual Meeting Materials | 20 |

Annual Report | 20 |

Appendix A: Fargo Electronics, Inc. Audit Committee Charter | A-1 |

FARGO ELECTRONICS, INC.

6533 Flying Cloud Drive

Eden Prairie, MN 55344

PROXY STATEMENT

The accompanying proxy is solicited on behalf of the Board of Directors of Fargo Electronics, Inc. in connection with our Annual Meeting of Stockholders to be held on Tuesday, May 3, 2005, at 1:30 p.m., local time, at Fargo’s Corporate Headquarters, 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344, for the purposes set forth in the accompanying Notice of Meeting.

Please mark and sign the enclosed proxy card and return it in the accompanying envelope. No postage is required if your returned proxy card is mailed within the United States. We will bear the cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding the materials to the beneficial owners of our common stock. Our directors, officers and employees may, without compensation other than their regular compensation, solicit proxies by telephone, personal conversation or other means of communication. We will reimburse brokerage firms and others for expenses in forwarding proxy material to the beneficial owners of our common stock.

Any proxy given in response to this solicitation and received in time for the Annual Meeting will be voted according to the instructions given in the proxy. Any stockholder giving a proxy may revoke it any time prior to its use at the Annual Meeting by giving a written revocation notice to our Secretary, by filing a revoking instrument or a duly executed proxy bearing a later date with our Secretary or by attending the Annual Meeting and voting in person. Proxies that are signed by stockholders but that lack any specific voting instructions will be voted in favor of the election as directors of each of the nominees listed in this proxy statement.

Our board recommends that you vote FOR each of the nominees named in this proxy statement.

We expect that this proxy statement, the proxy and notice of meeting will first be mailed to our stockholders on or about March 30, 2005.

1

VOTING OF SHARES

Our Board of Directors has fixed the close of business on March 11, 2005 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. On March 11, 2005, 12,630,340 shares of our common stock, $.01 par value, were outstanding. Each share outstanding on that date entitles its holder to one vote in person or by proxy on each matter to be voted on at the Annual Meeting. Holders of shares of common stock are not entitled to cumulative voting rights.

Quorum

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote at the meeting is required for a quorum for the transaction of business. In general, shares of common stock represented by a properly signed and returned proxy card will be counted as shares present and entitled to vote at the meeting for purposes of determining a quorum.

Vote Required for Approval

The two director nominees who receive the greatest number of votes cast for the election of directors at the Annual Meeting will be elected as directors. Votes that are withheld from the election of director nominees will be excluded entirely from the vote and will have no effect.

Abstentions; Broker Non-Votes

Shares voted as abstaining will be treated as voting shares that were not cast in favor of the proposal, and thus will be counted as votes against the particular proposal. Shares represented by a proxy card reflecting any broker non-vote on a matter (i.e., shares held by a broker or nominee that are represented at the meeting but that the broker or nominee is not empowered to vote on a particular proposal) will be treated as shares not voting on that matter, and thus will not be counted in determining whether that matter has been approved.

Shares of common stock represented by properly executed proxy cards will be voted according to the choices specified. Proxies that are signed by stockholders but that lack any voting instructions will be voted in favor of the election of the nominees for director listed in this proxy statement and, with respect to any other business that may properly come before the Annual Meeting, according to the best judgment of the proxies named on the proxy card.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock by (a) each stockholder who is known by us to own beneficially more than 5% of the outstanding common stock, (b) each director and each nominee, (c) each executive officer named in the Summary Compensation Table on page 11 under the heading “Executive Compensation,” and (d) all our executive officers and directors as a group. This ownership information is as of March 11, 2005, unless otherwise indicated in the footnotes.

Unless otherwise noted, each of the stockholders listed in the table possesses sole voting and investment power with respect to the shares indicated. Shares not outstanding but deemed beneficially owned by virtue of the right of a person or member of a group to acquire them within 60 days are treated as outstanding only when determining the amount and percent owned by such person or group. As of March 11, 2005, there were 12,630,340 shares of common stock outstanding.

| | Shares of Common Stock Beneficially Owned | |

Name of Beneficial Owner | | Amount | | Percent of Class | |

| | | | | |

Wells Fargo & Company(1) | | 1,629,375 | | 12.90 | % |

Theodore R. Duncan(2) | | 770,000 | | 6.10 | % |

Thompson, Siegel & Walmsley, Inc.(3) | | 682,752 | | 5.41 | % |

Kayne Anderson Rudnick Investment Management, LLC(4) | | 673,051 | | 5.33 | % |

Gary R. Holland(5) | | 412,070 | | 3.25 | % |

Edward H. Bersoff(6) | | 5,000 | | * | |

William H. Gibbs(7) | | 91,250 | | * | |

Kent O. Lillemoe(8) | | 42,500 | | * | |

David D. Murphy(9) | | 5,000 | | * | |

Elaine A. Pullen(10) | | 33,875 | | * | |

Edward J. Smith(11) | | 8,000 | | * | |

Kathleen L. Phillips(12) | | 38,558 | | * | |

Thomas C. Platner(13) | | 40,187 | | * | |

Paul W.B. Stephenson(14) | | 37,500 | | * | |

Jeffrey D. Upin(15) | | 43,595 | | * | |

All directors and executive officers as a group (11 persons)(16) | | 757,535 | | 5.83 | % |

* Less than 1%.

(1) This information is based on a Schedule 13G/A filed with the SEC on January 21, 2005 by Wells Fargo & Company. According to such 13G, Wells Fargo & Company has sole voting power with respect to 1,591,900 of these shares and sole dispositive power with respect to 1,141,475 of these shares and Wells Capital Management Incorporated has sole voting power with respect to 1,104,000 of these shares and sole dispositive power with respect to 1,141,475 of these shares. Wells Fargo & Company is a holding company and Wells Capital Management Incorporated is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. All shares reported in the table are held in discretionary accounts managed by Wells Fargo & Company and Wells Capital Management Incorporated. Wells Fargo & Company and Wells Capital Management Incorporated disclaim beneficial ownership of such shares. No single client account is reported to own more than five percent of our outstanding common stock. The address of Wells Fargo & Company is 420 Montgomery Street, San Francisco, California 94104. The address of Wells Capital Management Incorporated is 525 Market Street, San Francisco, CA 94105.

3

(2) This information is based on information provided to the company on March 11, 2005 by Theodore R. Duncan, 1350 Indian Mound Trail, Vero Beach, Florida 32963.

(3) This information is based on a Schedule 13G/A filed with the SEC on February 15, 2005 by Thompson, Siegel & Walmsley, Inc. According to such 13G/A, Thompson, Siegel & Walmsley, Inc. has sole voting power with respect to 344,715 of these shares, shared voting power with respect to 338,037 of these shares and sole dispositive power with respect to 682,752 of these shares. Thompson, Siegel & Walmsley, Inc. is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. The address of Thompson, Siegel & Walmsley, Inc. is 5000 Monument Avenue, Richmond, Virginia 23230.

(4) This information is based on a Schedule 13G filed with the SEC on February 7, 2005 by Kayne Anderson Rudnick Investment Management, LLC. Kayne Anderson Rudnick Investment Management, LLC is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. The address of Kayne Anderson Rudnick Investment Management, LLC is 1800 Avenue of the Stars, 2nd Floor, Los Angeles, California 90067.

(5) Includes 65,000 shares that Mr. Holland has the right to acquire within 60 days by exercising options.

(6) Represents 5,000 shares that Mr. Bersoff has the right to acquire within 60 days by exercising options.

(7) Includes 63,125 shares that Mr. Gibbs has the right to acquire within 60 days by exercising options.

(8) Includes 26,250 shares that Mr. Lillemoe has the right to acquire within 60 days by exercising options.

(9) Represents 5,000 shares that Mr. Murphy has the right to acquire within 60 days by exercising options.

(10) Represents 33,875 shares that Ms. Pullen has the right to acquire within 60 days by exercising options.

(11) Includes 5,000 shares that Mr. Smith has the right to acquire within 60 days by exercising options.

(12) Includes 37,500 shares that Ms. Phillips has the right to acquire within 60 days by exercising options.

(13) Includes 37,500 shares that Mr. Platner has the right to acquire within 60 days by exercising options.

(14) Represents 37,500 shares that Mr. Stephenson has the right to acquire within 60 days by exercising options.

(15) Includes 42,500 shares that Mr. Upin has the right to acquire within 60 days by exercising options.

(16) The amount beneficially owned by all current directors and executive officers as a group includes 358,250 shares issuable under options that are currently exercisable or will become exercisable within the next 60 days. The address for all current directors and executive officers is Fargo’s Corporate Headquarters, 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Structure

Our bylaws provide that our Board will consist of between one and nine members, with the number of directors determined from time to time by our Board. The number of directors is currently set at seven.

Our Board of Directors is divided into three classes for the purposes of election. One class is elected at each annual meeting of stockholders to serve for a three-year term. Directors elected at the 2005 Annual Meeting of Stockholders will hold office for a three-year term expiring in 2008. Other directors are not up for election this year and will continue in office for the remainder of their terms.

Nomination

Our Governance Committee of the Board has nominated William H. Gibbs and Edward J. Smith to serve as directors for a term of three years expiring at the 2008 annual meeting of our stockholders or until their respective successors are elected and qualified. All of the nominees are current members of our Board.

Vote Required

The two nominees at the Annual Meeting who receive the greatest number of votes cast for the election of directors at the meeting will be elected as directors. In the absence of other instructions, the proxies will be voted FOR Mr. Gibbs and Mr. Smith. If prior to the Annual Meeting our Board should learn that any nominee will be unable to serve by reason of death, incapacity or other unexpected occurrence, the proxies that would have otherwise been voted for such nominee will be voted for a substitute nominee as selected by our Board. Alternatively, the proxies may, at our Board’s discretion, be voted for only the remaining nominee. Our Board has no reason to believe that any of the nominees will be unable to serve.

Directors Nominated For Election This Year for Terms Expiring in 2008

William H. Gibbs, age 61, has been an independent investor and consultant specializing in corporate turnarounds and restructuring since January 1998. From 1985 to 1998, Mr. Gibbs served as Chief Executive Officer and Chairman of the Board of Directors of DH Technology, Inc., a manufacturer of point of sale and bar code printers and smart card systems. Mr. Gibbs is currently a director of Remec Inc. Mr. Gibbs has served as a director of Fargo since April 1999 and also served Fargo in a part time advisory role from April 1999 to March 2000.

Edward J. Smith, age 56, has been President of Barnegat Bay Capital, Inc. since 2001. Barnegat Bay Capital, which Mr. Smith founded in 2001, provides corporate finance advisory services to public and private companies. From 1992 to 2001, Mr. Smith was a Managing Director in the High Technology Group of Investment Banking at Prudential Securities Incorporated. Mr. Smith managed the groups that focused on Electronic Imaging from 1994 to 2001 and the Software and Internet Infrastructure from 2000 to 2001. From 1991 to 1992, Mr. Smith served as a Managing Director of Kidder, Peabody & Co. and from 1987 to 1991 as a Managing Director of Merrill Lynch Capital Markets. Mr. Smith is currently a director of Global Imaging Systems, Inc. Mr. Smith has served as a director of Fargo since August 2003

OUR BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE ABOVE NOMINEES FOR DIRECTOR.

5

Directors Continuing in Office Until the 2006 Annual Meeting

Edward H. Bersoff, age 62, is Chairman of Greenwich Associates, LLC, a business advisory firm. Earlier, he was the managing director of Quarterdeck Investment Partners, LLC, an investment banking firm dedicated to the aerospace, defense, information technology, government services and space marketplaces from July 2002 until June 2003. Prior thereto, he was a principal of Re-route Corporation, an e-mail forwarding service company that catered to consumer and commercial clients where he served as Chairman and Chief Executive Officer from August 2000 to October 2002. From February 1982 until November 2001, he was the Chairman, Chief Executive Officer, President and founder of BTG, Inc., a firm providing computer-based solutions to government and commercial clients. Dr. Bersoff is also a director of Titan Corporation, EFJ, Inc., Potomac Bank of Virginia, MVM, Inc., and Phillips International, Inc. Dr. Bersoff has served as a director of Fargo since August 2003.

Gary R. Holland, age 63, has served as our President and Chief Executive Officer since February 1998 and as the Chairman of the Board of Directors since June 1998. From May 1997 to February 1998, Mr. Holland was the general manager of Fargo. From 1992 to 1997, Mr. Holland owned and operated two business and strategy consulting firms, Decision Process International of Minnesota, Inc. and Holland & Associates. From 1982 to 1992, Mr. Holland was the President and CEO of Datacard Corporation. From 1979 to 1982, he was the President and Chief Operating Officer of CPT Corporation. Mr. Holland is also a director of Delphax Technologies, Inc. Mr. Holland has been a director of Fargo since 1998.

Kent O. Lillemoe, age 46, is Chief Financial Officer of Envoy Medical Corporation (formerly known as St. Croix Medical, Inc.), a medical device developer. He served as the Chief Operating Officer of Avanti Optics Corp., an early stage technology company, from June 2000 until January 2003. Mr. Lillemoe served as Fargo’s Chief Financial Officer from March 1998 to June 2000. From September 1996 to March 1998, Mr. Lillemoe was an independent financial advisor and consultant to several companies and was employed by Gentra Systems, Inc., an early stage technology company, as Chief Financial Officer from May 1997 through February 1998. Mr. Lillemoe has been a director of Fargo since August 2000.

Directors Continuing in Office Until the 2007 Annual Meeting

David D. Murphy, age 53, is President and Chief Operating Officer of Red Wing Shoe Company, a worldwide producer of, and marketer of, work and outdoor footwear. Prior to assuming this position in July 2001, Mr. Murphy was President and Chief Executive Officer of Creative Publishing International, a privately held book publishing company. From 1976 to 1998, Mr. Murphy held a number of positions with General Mills, Inc. a marketer of consumer brands across a wide range of food categories, including acting as President of its International Foods operations, President of its Canadian subsidiary and President of the Big G Cereals division. Mr. Murphy was elected as a director of Fargo in December 2003. Mr. Murphy is currently a director of Red Wing Shoe Company, API Group, the Greater Minneapolis Council of Churches and the YMCA of Red Wing, Minnesota.

Elaine A. Pullen, age 51, has served as Chief Technology Officer of Gerber Scientific, Inc. since November 2002. Prior to this, she was President of Gerber Scientific Products, a developer and manufacturer of computerized sign making and specialty graphics systems, software, materials, and accessories, and a division of Gerber Scientific International, a wholly owned subsidiary of Gerber Scientific Inc. Ms. Pullen is also a Senior Vice President of Gerber Scientific, Inc. She was the President of Trident-ITW, a designer and manufacturer of impulse ink jet subsystems, from February 1999 until June 2001. Ms. Pullen was a director and the Chief Executive Officer of Trident International, Inc. from April 1995 to February 1999 when Trident was acquired by Illinois Tool Works. Ms. Pullen has served as a director of Fargo since April 1998.

6

Corporate Governance

Our Board of Directors has established an Audit Committee and a Compensation and Human Resources Committee, each of which became active upon our initial public offering in February 2000. The Board of Directors also established a Governance Committee in October 2002. In 2003, our Board of Directors adopted Guidelines on Corporate Governance Issues. In February 2004, our Audit Committee adopted a Code of Ethics for Senior Financial Officers. All of the Board committees operate under written charters, which were reviewed and updated by our Board of Directors in December 2004. We have posted all of these documents on our website at www.fargo.com. A copy of our updated Audit Committee Charter is also attached to this proxy statement as Appendix A.

We continue to monitor the rules and regulations of the Securities and Exchange Commission and Nasdaq to ensure that a majority of our Board remains composed of “independent” directors. All of our directors except Gary R. Holland are “independent” directors under the recently adopted Nasdaq rules.

Guidelines on Corporate Governance Issues

Our Guidelines on Corporate Governance Issues provide principles which govern the qualifications and conduct of our Board and management. Our standards are consistent with the corporate governance requirements of the Sarbanes-Oxley Act of 2002, and the corporate governance listing requirements applicable to companies whose securities are listed on the Nasdaq National Market.

Pursuant to our guidelines and effective January 1, 2004, the Board established a lead director position. The lead director must be an independent director and ensures that the Board operates independently of management and that directors have an independent leadership contact. Elaine Pullen assumed this role for 2004. Effective January 1, 2005, the lead director role will rotate every two years. Dr. Edward Bersoff has assumed the role of lead director for 2005 and 2006.

Code of Ethics for Senior Financial Officers

We have adopted a Code of Ethics that applies to our principal executive officer, principal financial officer and director of finance. We have posted our Code of Ethics for Senior Financial Officers on our corporate governance page of our web site. The corporate governance page can be accessed on our web site at www.fargo.com.

Additional Information About our Board and its Committees

Our Board held five meetings during fiscal 2004 and each of the directors attended, either in person or by telephonic conference, 75% or more of the total meetings of our Board and all such committees on which such directors served during fiscal 2004. Our Board of Directors recently adopted a policy that all directors are expected to attend our annual meetings of stockholders, and we generally schedule a meeting of the Board on the same day as our annual meeting of stockholders in order to facilitate attendance of all directors at the annual meeting. All directors attended last year’s annual meeting of stockholders.

Audit Committee

The Audit Committee provides assistance to our Board in satisfying its fiduciary responsibilities relating to the Company’s financial statements, financial reporting process, systems of internal accounting and financial controls and the annual independent audit of the Company’s financial statements. The Audit Committee is responsible for appointing or replacing the independent auditors, and approves all audit engagement fees and terms and all non-audit engagements with the independent auditors. The Audit Committee consisted of Kent O. Lillemoe, Everett V. Cox, William H. Gibbs and Edward J. Smith from January 2004 until May 2004 and of Kent O. Lillemoe, William H. Gibbs and Edward J. Smith since May 2004. All of the current members of the Audit Committee are “independent” directors under the Nasdaq

7

rules. In addition, our Board has determined that Kent O. Lillemoe is an “audit committee financial expert” as defined by the rules and regulations of the Securities and Exchange Commission. The Audit Committee met nine times during fiscal 2004.

Compensation and Human Resources Committee

The Compensation and Human Resources Committee reviews general programs of compensation and benefits for all employees and makes recommendations to our Board concerning executive officer compensation. The Compensation and Human Resources Committee also administers our 2003 Stock Incentive Plan, our Amended and Restated 1998 Stock Option and Grant Plan and 2001 Employee Stock Purchase Plan. The Compensation and Human Resources Committee consisted of Edward J. Smith, Everett V. Cox and David D. Murphy from January 2004 until May 2004, of Edward J. Smith and David D. Murphy from May 2004 until February 2005, and of Edward J. Smith, David D. Murphy and Elaine A. Pullen since February 2005. All of the current members of the Compensation and Human Resources Committee are “independent” directors under the Nasdaq rules. The Compensation and Human Resources Committee met three times during fiscal 2004.

Governance Committee

The Governance Committee is responsible for identifying qualified candidates for director; recommending to the Board director nominees for each Board Committee; assuring management succession plans are in place; and developing and recommending to the Board corporate governance guidelines and policies applicable to the Company. The Governance Committee consisted of Edward Bersoff and Elaine Pullen during 2004. All of the members of the Governance Committee are “independent” directors under the Nasdaq rules. The Governance Committee met twice during fiscal 2004.

In evaluating and determining whether to recommend a person as a candidate for election as a director, the Governance Committee’s criteria reflects the requirements of the recently adopted Nasdaq rules with respect to independence and the following factors: personal and professional integrity of the candidate, competence, age and experience, commitment and dedication, collegiality, diversity, technical and industry background and international skills. The Committee will use these criteria to evaluate potential nominees and will not evaluate proposed nominees differently depending upon who has made the recommendation.

The Governance Committee will consider proposed nominees whose names are submitted to it by stockholders; however, it does not have a formal process for that consideration. The Governance Committee has not adopted a formal process because it believes that its informal consideration process has been adequate because historically stockholders have not proposed any nominees. The Governance Committee intends to review periodically whether a more formal policy should be adopted.

Any stockholder who desires to recommend a nominee for director must submit a letter, addressed to our Secretary at the address at the beginning of this proxy statement providing the candidate’s name, biographical data and qualifications, and which is clearly identified as a “Director Nominee Recommendation.” All recommendation letters must identify the author as a stockholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the stockholder. Stockholders who wish to make a recommendation for a nominee to be elected at our 2006 Annual Meeting must submit their recommendation by November 30, 2005 to assure time for meaningful consideration and evaluation of the nominees by the Governance Committee.

Director Compensation

Directors who are employees receive no separate compensation for their service as directors. During 2005, non-employee directors will receive a $20,000 annual retainer fee. Members of Fargo’s Audit Committee will receive an annual fee of $3,000, members of Fargo’s other Board committees will receive an annual fee of $2,000, and the Lead Director of the Board, the chair of the Audit Committee and the chair of each other Board committee will receive annual stipends of $8,000, $7,000 and $3,000 each,

8

respectively. All cash compensation will be paid quarterly. As in 2004, directors will be reimbursed for travel expenses for attending meetings of the board and any board or advisory committees.

In addition to the cash compensation, each non-employee director will receive a stock option grant of 5,000 shares on the date of Fargo’s 2005 annual meeting. These option grants will vest ratably over four years.

Prior to the increase, non-employee directors received a $10,000 annual retainer fee, $1,000 for each regular meeting of the board of directors, $500 for each committee meeting and $250 for each meeting by teleconference. The chair of each committee received $750 for each in person committee meeting and $500 for each committee meeting by teleconference. The Lead Director also received additional annual compensation of $4,000.

Our 2003 Stock Incentive Plan provides for the grant of stock based awards to eligible key employees, officers and directors. On May 4, 2004, the date of our 2004 Annual Meeting, we granted each non-employee director a ten year option to purchase 5,000 shares of common stock at an exercise price of $9.84 per share, the fair market value of our common stock on that date. All of these option grants vest ratably over four years.

Audit Committee Report

The Audit Committee has reviewed and discussed Fargo’s audited financial statements for the year ended December 31, 2004 with our management. The Audit Committee has discussed with PricewaterhouseCoopers LLP, Fargo’s independent registered public accounting firm, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) as amended by Statement on Auditing Standards No. 90 (Audit Committee Communications). The Audit Committee has also received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), and the Audit Committee has discussed the independence of PricewaterhouseCoopers LLP with them.

Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to our Board of Directors that Fargo’s audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the SEC.

Audit Committee

Kent O. Lillemoe, Chairman

William H. Gibbs

Edward J. Smith

Compensation and Human Resources Committee Report on Executive Compensation

Our executive compensation policies are recommended and administered by the Compensation and Human Resources Committee of the Board of Directors. The Compensation and Human Resources Committee is currently composed of three independent, outside directors.

The principal objective of our compensation policy is to increase stockholder value by providing an incentive to officers and employees to maximize our performance. Generally, we have set the salaries of our executive officers at industry averages and provided for variable compensation through stock options and cash bonuses. The form of compensation provided to members of our management varies based on their position and their ability to influence performance.

The Compensation and Human Resources Committee has discretion to set executive compensation at levels warranted by external, internal and individual circumstances. The Committee has solicited through Mr. Holland, and reviewed annually, compensation surveys for officer positions in the electronics industry. Although such data provides a base for comparison, it is not necessarily used as the basis for the

9

compensation actually awarded.

Executive Officer Compensation Program. Our executive officer compensation program can be separated into several elements: base salary, annual cash incentive compensation, long-term incentive compensation in the form of stock options, and various benefits, including medical and retirement savings plans generally available to employees.

Base Salary. Our policy is to set the base salaries of our executives at the industry average. Mr. Holland’s base salary during 2004 was set at $319,815, and was approved by the Committee at the beginning of the fiscal year. The Committee believes this is consistent for chief executives with similar experience for similarly sized companies.

Cash Incentive Compensation. The Compensation and Human Resources Committee establishes a bonus plan annually for our Chief Executive Officer and all other Fargo employees. The bonus plan is directly related to Fargo’s overall financial performance. Bonuses for 2004 are determined by multiplying the particular individual’s base salary by (1) his or her designated bonus percentage and (2) a performance factor based upon Fargo’s achievement of targeted levels of operating profit, sales growth and asset utilization. Designated bonus percentages are based upon relative positions within Fargo’s organizational structure.

Mr. Holland earned a cash bonus of $63,963 for 2004 that was paid in 2005 based upon the company’s performance against its targets for 2004.

Stock Incentive Compensation. Prior to 2003, we provided long-term incentive to our executive officers primarily through our Amended and Restated 1998 Stock Option and Grant Plan. We began using our 2003 Stock Incentive Plan following its approval at our 2003 Annual Meeting. Under the Incentive Plan, the Compensation and Human Resources Committee awards stock options to executive officers based on the number of options and shares currently held by the executive and also on performance factors similar to those used to determine salaries and annual cash incentives. Our options generally vest over a period of four years and expire after seven to ten years. Options are generally granted with an exercise price equal to the fair market value on the date of grant. The Compensation and Human Resources Committee has not fixed, or predetermined, the amount of shares to be available for options grants in any year.

The Committee believes that the current equity holdings of our executive officers and employees are enough to align the interests of our executive officers and employees with those of our stockholders, and, as a result, did not grant any stock options to executive officers or employees in 2004.

Benefits. We provide medical and retirement savings benefits to executive officers on terms generally available to employees. No executive officer received perquisites in excess of 10% of their salary during 2004.

Summary. The Compensation and Human Resources Committee believes that the compensation program for executive officers during 2004 achieved the principal objectives for which it was designed.

Section 162(m). Section 162(m) of the Internal Revenue Code of 1986 limits our ability to deduct certain compensation in excess of $1 million paid to our chief executive officer and each of our four other most highly compensated executives. In 2004, we did not pay “compensation” within the meaning of Section 162(m) in excess of $1 million to our executive officers, and we do not believe that we will do so in the near future. As a result, we have not established a policy for qualifying compensation paid to our executive officers for deductibility under Section 162(m), but will formulate such a policy if compensation levels ever approach $1 million.

Compensation and Human Resources Committee

Edward J. Smith, Chairman

David D. Murphy

Elaine A. Pullen

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash and non-cash compensation paid to or earned by our Chief Executive Officer and our four other most highly compensated executive officers who received or earned cash and non-cash salary and bonus of more than $100,000 for fiscal 2004.

| | Annual Compensation | | Long Term Compensation | | |

Name and Principal Position | | Year | | Salary | | Bonus

(1) | | Other Annual Compensation

(2) | | All Other Compensation

(3) | | Securities Underlying Options (#) | |

| | | | | | | | | | | | | |

Gary R. Holland Chairman of the Board of

Directors, President

and Chief Executive Officer | | 2004 | | $ | 319,815 | | $ | 63,963 | | $ | 13,000 | | $ | 28,362 | | — | |

| 2003 | | 310,500 | | 37,260 | | 13,000 | | — | | — | |

| 2002 | | 300,000 | | 72,000 | | 15,270 | | — | | 30,000 | |

| | | | | | | | | | | | | |

Kathleen L. Phillips Marketing and Distribution | | 2004 | | $ | 160,000 | | $ | 24,000 | | $ | 1,000 | | $ | 14,752 | | — | |

| 2003 | | 149,000 | | 13,410 | | 1,000 | | — | | — | |

| 2002 | | 144,000 | | 25,931 | | 1,000 | | — | | 15,000 | |

| | | | | | | | | | | | | |

Thomas C. Platner Engineering and Manufacturing | | 2004 | | $ | 161,500 | | $ | 24,225 | | $ | 1,507 | | $ | — | | — | |

| 2003 | | 155,250 | | 13,973 | | 1,000 | | — | | — | |

| 2002 | | 150,000 | | 27,000 | | 1,000 | | — | | 15,000 | |

| | | | | | | | | | | | | |

Paul W.B. Stephenson Chief Financial Officer | | 2004 | | $ | 165,500 | | $ | 24,825 | | $ | 1,000 | | $ | — | | — | |

| 2003 | | 160,700 | | 14,463 | | 1,000 | | — | | — | |

| | | | | | | | | | | | | |

Jeffrey D. Upin Business Development, General Counsel and Secretary | | 2004 | | $ | 160,000 | | $ | 24,000 | | $ | 1,000 | | $ | 10,022 | | — | |

| 2003 | | 155,250 | | 13,973 | | 1,000 | | — | | — | |

| 2002 | | 150,000 | | 27,000 | | 1,000 | | — | | 15,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

(1) Bonus numbers represent fiscal 2004 earned bonus paid out in March 2005.

(2) “Other Annual Compensation” includes 401k match of $1,000, car allowance of $12,000 for Holland and 5 year anniversary award for Platner.

(3) “All Other Compensation” amounts represent payout for accrued and unused paid-time off arising from policy change to cap the amount of hours that may be carried over by an employee from one year to the next to 120 hours.

11

Option Grants and Exercises

There were no option grants made during the fiscal year ended December 31, 2004 to any of the executive officers named in the Summary Compensation Table on page 11.

The following table summarizes the value of in-the-money options held at December 31, 2004 by our Chief Executive Officer and each of the executive officers named in the Summary Compensation Table on page 11.

Aggregated Option Exercises In

Last Fiscal Year and Fiscal Year-End Option Values

| | Shares Acquired on | | | | Number of Securities Underlying Unexercised Options at December 31, 2004 | | Value of Unexercised In-the-Money Options at December 31, 2004 (2) | |

Name | | Exercise (#) | | Value Realized

(1) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| | | | | | | | | | | | | |

Gary R. Holland | | — | | — | | 65,000 | | 15,000 | | $ | 291,125 | | $ | 109,875 | |

Kathleen L. Phillips | | 1,125 | | $ | 15,154 | | 37,500 | | 7,500 | | $ | 328,688 | | $ | 54,938 | |

Thomas C. Platner | | — | | — | | 42,187 | | 7,500 | | $ | 389,736 | | $ | 54,938 | |

Paul W.B. Stephenson | | — | | — | | 27,500 | | 27,500 | | $ | 154,938 | | $ | 154,938 | |

Jeffrey D. Upin | | 2,187 | | $ | 28,409 | | 42,500 | | 7,500 | | $ | 346,813 | | $ | 54,938 | |

| | | | | | | | | | | | | | | | | | | | |

(1) The value realized is calculated based on the closing price of Fargo’s common stock as reported by the Nasdaq National Market on the date of exercise minus the exercise price of the option.

(2) The value of unexercised in-the-money options is based on the difference between the fair market value of the shares of common stock underlying the options at December 31, 2004 ($14.625), and the exercise price of such options ranging from $1.60 to $11.00 per share. Options are in-the-money if the market price of the shares exceeds the option exercise price.

12

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information, as of December 31, 2004, concerning shares of common stock that may be issued under Company compensation plans, including shares issuable upon the exercise of options outstanding under Fargo’s Amended and Restated 1998 Stock Option and Grant Plan, its 2003 Stock Incentive Plan and shares issuable under Fargo’s 2001 Employee Stock Purchase Plan. Each of these plans was approved by the Company’s stockholders.

Plan Category | | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | (b) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | | (c) Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) (1) | |

| | | | | | | |

Equity compensation plans approved by security holders | | 839,000 | | $ | 8.08 | | 1,103,000 | |

Equity compensation plans not approved by security holders | | None | | None | | None | |

| | | | | | | |

Total | | 839,000 | | $ | 8.08 | | 1,103,000 | |

(1) Includes 178,000 shares issuable under Fargo’s 2001 Employee Stock Purchase Plan and 925,000 shares issuable under Fargo’s 2003 Stock Incentive Plan.

Agreements with Employees

On June 19, 2001 (the “Effective Date”), Fargo and Gary R. Holland, Fargo’s Chairman, President and Chief Executive Officer, entered into an Amended and Restated Employment Agreement. The agreement provides Mr. Holland with an annual base salary of at least $275,000 and an annual performance bonus based upon the achievement of certain financial thresholds. Effective January 1, 2004, Mr. Holland’s base salary was increased to $ 319,815. The agreement had an initial term expiring in December 2003 and was renewed automatically. The agreement renews automatically thereafter on the anniversary of the Effective Date (the “Renewal Date”) unless either party gives the other written notice prior to such Renewal Date of his or its determination not to extend the agreement, whereupon this agreement shall terminate on the anniversary of such Renewal Date. If Fargo terminates Mr. Holland without cause or if he terminates his employment agreement for good reason before the expiration of his agreement, Mr. Holland will be entitled to receive base salary payments, group health, dental and life insurance benefits and a monthly cash allowance of $1,000 for 15 months after his termination and will be entitled to accrued bonus amounts and full vesting of any restricted stock or stock options held.

We have confidentiality and non-competition agreements with all of our employees. The confidentiality obligations under these agreements continue indefinitely and the non-competition restrictions survive for a period of between six and eighteen months after termination of employment depending on the type of employee.

Change in Control Arrangements

Holland Employment Agreement

Under the Amended and Restated Employment Agreement, Mr. Holland will be entitled to certain benefits if: (i) he is terminated either within the period that begins on the date of the change in control and

13

ends on the last day of the 30th month that begins after the month in which the change in control occurs or before the effective date of the change in control if the termination was either a condition to the change in control or was at the request or insistence of a person related to the change in control, or (ii) he terminates his employment with Fargo for any reason within the period beginning on the first day of the 12th month that begins after the month during which a change in control of Fargo occurs and ending on the last day of the 30th month that begins after the month during which the change in control occurs. Mr. Holland will not be considered “terminated” for purposes of this agreement if he dies or is terminated for cause. He will, however, be considered “terminated” if he voluntarily leaves Fargo’s employ for “good reason.” “Good reason” means any of the following:

• an adverse and material change in his duties or responsibilities as an executive (other than, if applicable, any such change directly attributable to the fact that Fargo is no longer a public company);

• reduction in his base salary or an adverse change in the form or timing of the payment of such salary;

• failure to cover Mr. Holland under similar benefit plans at a substantially similar total cost to Mr. Holland;

• relocation of Mr. Holland to more than 30 miles from Mr. Holland’s existing office;

• failure to obtain a successor’s assent to Fargo’s fulfillment of its obligations under the agreement; or

• refusal to allow Mr. Holland to continue to attend to matters or engage in activities not directly related to Fargo’s business which Mr. Holland was attending to or engaging in prior to the date of the agreement.

Upon a termination in connection with a change in control, Mr. Holland will be entitled to receive the following payments and benefits:

• cash payment equal to two and one-half times the sum of Mr. Holland’s (1) base salary plus (2) 50% of his maximum target cash bonus for the year during which the change in control occurs;

• group health, dental and term life insurance benefits to Mr. Holland, his family members and dependents for a period of 30 months, at a substantially similar total cost to Mr. Holland;

• $1,000 per month cash allowance for a period of 30 months; and

• full vesting of any restricted stock or stock options held by Mr. Holland.

Officers Agreements

On December 8, 2004, all of Fargo’s executive officers, other than Gary R. Holland, executed Officers Agreements pursuant to which Fargo agreed to provide certain benefits to these executives if they are terminated in connection with a change in control of Fargo. These Officers Agreements are effective January 1, 2005 until December 31, 2005, and are substantially similar to and replace the Direct Report Agreements originally executed in April 2001 and May 2002, which expired by their terms December 31, 2004.

Under these agreements, these officers are entitled to certain benefits if they are terminated either

14

within 12 months of the effective date of a change in control or before the effective date of the change in control if the termination was either a condition to the change in control or was at the request or insistence of a person related to the change in control. These executives will not be considered “terminated” for purposes of these agreements if they die or are terminated for cause. They will, however, be considered “terminated” if they voluntarily leave Fargo’s employ for “good reason.” “Good reason” means any of the following:

• an adverse and material change in the title, status, position, authority, duties or responsibilities as an executive (not including any such change directly attributable to the fact that Fargo is no longer a public company);

• reduction in base salary or an adverse change in the form or timing of the payment of such salary, subject to certain exceptions;

• failure to cover the executive under substantially similar benefit plans at a substantially similar total cost to the executive;

• relocation of the executive to a different metropolitan area (other than the Minneapolis or St. Paul metropolitan area) than the executive’s existing office;

• failure to obtain a successor’s assent to Fargo’s fulfillment of its obligations under the agreement; or

• any purported termination by Fargo or any successor company of the executive’s employment that is not properly effected.

Upon a termination in connection with a change in control, these executives will be entitled to receive a lump sum cash payment up to 150% of their base salary. In addition, these executives will receive a cash payment in the full amount of any options granted under the 1998 Stock Option Plan at the time of the change in control and any other Fargo stock option plan, whether vested or unvested if the Officer is terminated or leaves due to “good reason.” The cash payout is dependent upon the price of the options and the price paid for the Company. The Board of Directors has accelerated all options for all employees under the 1998 Stock Option plan in the event of a change in control.

These Officers Agreements have terms ending on December 31, 2005 and do not provide for any extension or renewal.

Stock Incentive Plans

Under our 2003 Stock Incentive Plan, if a “change in control” of the company occurs, then, if approved by our Board of Directors or a committee thereof (either at the time of the grant of the incentive award or at any time thereafter):

• all options that have been outstanding for at least six months will become immediately exercisable in full and will remain exercisable for the remainder of their terms;

• all outstanding restricted stock awards that have been outstanding for at least six months will become immediately fully vested and non-forfeitable.

For purposes of the 2003 Plan a “Change in Control” of the Company generally occurs if:

• all or substantially all of our assets are sold, leased, exchanged or transferred to any successor;

15

• our stockholders approve any plan or proposal to liquidate or dissolve the company;

• any successor, other than a bona fide underwriter in a securities offering, becomes the beneficial owner of:

• 20% or more, but not 50% or more, of our outstanding securities ordinarily having the right to vote at elections of directors, unless the transaction has been approved in advance by “continuity directors,” who are members of our Board at the time of the Annual Meeting or whose nomination for election meets certain approval requirements related to continuity with our current Board; or

• more than 50% of our outstanding securities ordinarily having the right to vote at elections of directors (regardless of any approval by the continuity directors).

• we are a party to a merger or consolidation that results in our stockholders beneficially owning securities representing:

• 50% or more, but not more than 80%, of the combined voting power ordinarily having the right to vote at elections of directors of the surviving corporate, unless such merger or consolidation has been approved in advance by the continuity directors, or

• less than 50% of the combined voting power ordinarily having the right to vote at elections of directors of the surviving corporation (regardless of any approval by the continuity directors); or

• the continuity directors cease to constitute at least a majority of our Board.

Under our Amended and Restated 1998 Stock Option and Grant Plan and pursuant to certain resolutions by our Board of Directors, if a “change in control” of Fargo occurs, then:

• all stock options and other awards granted under the plan that are unvested as of the effective date of such transaction will become fully vested as of such effective date; and

• in the event of such termination, each optionee will be permitted to exercise, for a period of at least 15 days prior to the date of such transaction, all outstanding options and other awards held by the optionee that are then exercisable or become exercisable upon the effectiveness of the transaction.

For purposes of the plan, a change in control of Fargo will be deemed to have occurred, among other things, upon:

• the sale or transfer of all or substantially all of our assets; or

• a merger or consolidation of Fargo with or into another corporation whereby less than a majority of the outstanding voting power of the surviving or consolidated corporation is held by our original stockholders immediately prior to such event; or

• any purchase by a party or group of affiliated parties of shares of capital stock, the effect of which is that such party that did not beneficially own a majority of the voting power of the outstanding shares of capital stock of Fargo immediately prior to such purchase beneficially owns at least a majority of such voting power immediately after such purchase.

16

Certain Transactions

Pursuant to a Stockholders’ Agreement entered into in connection with our recapitalization in February 1998, certain holders of our common stock had registration rights with respect to their shares. The only party who is an officer or director of Fargo that still has these registration rights is Gary Holland, our Chairman of the Board of Directors, President and Chief Executive Officer.

17

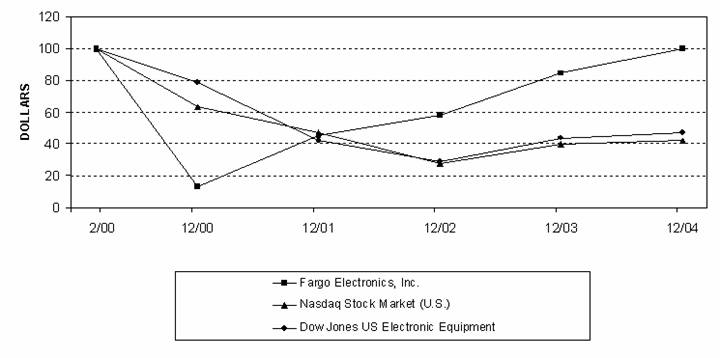

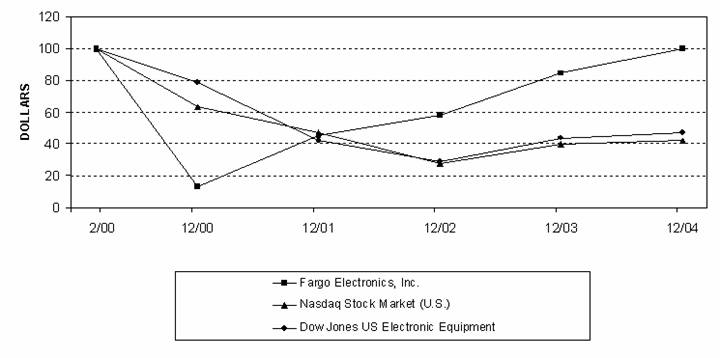

COMPARATIVE STOCK PERFORMANCE

The graph below compares the cumulative total stockholder return on our common stock to the total cumulative return on the Nasdaq Market Index and the Dow Jones U.S. Electronic Equipment Index during the period from our initial public offering on February 11, 2000 to December 31, 2004. The graph assumes a $100 investment in common stock, the Nasdaq Market Index and the Dow Jones U.S. Electronic Equipment Index on February 11, 2000 and the reinvestment of all dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG FARGO ELECTRONICS, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE DOW JONES US ELECTRONIC EQUIPMENT INDEX

* $100 invested on 2/11/00 in stock or on 1/31/00 in index-

including reinvestment of dividends.

Fiscal year ending December 31.

5 Year Cumulative Total Return | | 2/11/00 | | 12/31/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | |

| | | | | | | | | | | | | |

Fargo Electronics, Inc. | | 100.00 | | 13.33 | | 45.60 | | 58.20 | | 84.33 | | 99.93 | |

Nasdaq Stock Market (U.S.) | | 100.00 | | 63.33 | | 47.02 | | 27.29 | | 39.65 | | 41.88 | |

Dow Jones US Electronic Equipment | | 100.00 | | 78.67 | | 42.05 | | 28.98 | | 43.56 | | 47.26 | |

18

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Appointment of Auditors

The Audit Committee of our Board of Directors has appointed PricewaterhouseCoopers LLP, our independent registered public accounting firm, as our auditors for the year ending December 31, 2005.

Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Audit Fees

The following table presents the aggregate fees billed for professional services rendered by PricewaterhouseCoopers LLP for the fiscal years ended December 31, 2004 and 2003. All services rendered by PricewaterhouseCoopers LLP were permissible under applicable laws and regulations, and all services provided after May 6, 2003 were approved in advance by the Audit Committee in accordance with the rules adopted by the Securities and Exchange Commission in order to implement requirements of the Sarbanes-Oxley Act of 2002. Our Audit Committee has adopted policies and procedures pursuant to which audit, audit-related and tax services, and all permissible non-audit services, are pre-approved, and our Audit Committee is informed of each service actually rendered that was approved through its pre-approval process.

| | Aggregate Amount Billed | |

Services Rendered | | 2004 | | 2003 | |

Audit Fees (1) | | $ | 198,455 | | $ | 101,000 | |

Audit-Related Fees (2) | | 25,785 | | 21,000 | |

Tax Fees (3) | | 21,375 | | 42,000 | |

All Other Fees | | — | | — | |

| | | | | | | |

(1) These fees consisted of the annual audit of our financial statements for 2004 and 2003, the audit of internal control over financial reporting for 2004 and the reviews of our financial statements included in our Form 10-Q’s for the first, second and third quarters for 2004 and 2003.

(2) These fees consist of the annual audit of our 401K Plan and consultation fees concerning financial accounting and reporting standards.

(3) These fees related to corporate tax compliance services.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers, and stockholders holding more than 10% of our outstanding common stock, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in beneficial ownership of our common stock. Executive officers, directors and greater-than-10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. To our knowledge, based solely on review of the copies of such reports furnished to us for the period ended December 31, 2004, all Section 16(a) reports required to be filed by our executive officers, directors and greater-than-10% stockholders were filed on a timely basis.

19

PROPOSALS FOR THE NEXT ANNUAL MEETING

Stockholder proposals intended to be presented in the proxy materials relating to the next Annual Meeting of Stockholders must be received by us on or before November 30, 2005 and must satisfy the requirements of the proxy rules promulgated by the Securities and Exchange Commission.

In accordance with our Bylaws, a stockholder who wishes to make a proposal at the next Annual Meeting without including the proposal in our proxy statement must notify us by February 13, 2006. If a stockholder fails to give notice by this date, then the persons named as proxies in the proxies solicited by us for the next Annual Meeting will not have discretionary authority to vote on the proposal. In addition, the proposal must contain the specific information required by our Bylaws, a copy of which may be obtained by writing to our Secretary.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholders may communicate with the Board of Directors by sending correspondence, addressed to Jeffery D. Upin, Secretary, at our corporate headquarters with an instruction to forward the communication to a particular director. Our Secretary will receive the correspondence and forward it to any individual director or directors to whom the communication is directed.

OTHER BUSINESS

We know of no business that will be presented for consideration at the Annual Meeting other than that described in this proxy statement. As to other business, if any, that may properly come before the Annual Meeting, it is intended that proxies solicited by our Board will be voted according to the judgment of the person or persons voting the proxies.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the company’s Proxy Statement or Annual Report to Stockholders may have been sent to multiple stockholders in each household. The company will promptly deliver a separate copy of either document to any stockholder upon written or oral request to Investor Relations, Fargo Electronics, Inc., 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344; telephone: (952) 941-9470. Any stockholder who wants to receive separate copies of our Proxy Statement or Annual Report in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder’s bank, broker, or other nominee record holder, or the stockholder may contact the company at the above address and phone number.

ANNUAL REPORT

Upon written request, we will furnish without charge a copy of our Annual Report on Form 10-K (exclusive of exhibits) for the fiscal year ended December 31, 2004 to each person who was a stockholder of Fargo Electronics as of March 11, 2005. Request should be sent to: Fargo Electronics, Inc., 6533 Flying Cloud Drive, Eden Prairie, MN 55344 Attn: Investor Relations.

| BY ORDER OF THE BOARD OF DIRECTORS |

|

|

| Gary R. Holland |

| Chairman of the Board of Directors, |

| President and Chief Executive Officer |

March 30, 2005 | |

Eden Prairie, Minnesota | |

20

Appendix A

FARGO ELECTRONICS, INC

AUDIT COMMITTEE CHARTER

Organization

This charter governs the operations of the Fargo Electronics, Inc. Audit Committee (the “committee”). The committee shall review and reassess the charter annually and submit changes to the board of directors for approval. The committee shall be appointed by the board of directors and shall serve until their successors are appointed and qualify. Each committee member may be removed by the Board at any time. The committee shall be comprised of at least three directors, each of whom shall be independent as required by Section 10A(m) of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended by the Sarbanes-Oxley Act of 2002, and the rules promulgated thereunder, and the rules of the Nasdaq Stock Market, Inc. (the “Nasdaq Rules”).

All members of the committee shall be able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement, and otherwise meet any qualifications for members of an audit committee pursuant to Nasdaq Rules. At least one member of the committee must be an “audit committee financial expert,” as defined in rules promulgated under the Exchange Act.

Statement of Policy

The audit committee is a committee of the board of directors. The committee’s primary function is to provide assistance to the board of directors in fulfilling its oversight responsibility to the shareholders relating to the Company’s annual and quarterly financial statements provided to shareholders and the Securities and Exchange Commission (the SEC), the financial reporting process and the systems of internal accounting and financial controls, which management has established, and the annual independent audit of the Company’s financial statements. In so doing, it is the responsibility of the committee to maintain free and open communication between the committee, independent auditors and management of the Company.

The committee should have a clear understanding with the independent auditors that the Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent auditors, and that the ultimate accountability of the independent auditors is to the Audit Committee and to the Board of Directors. In discharging its oversight role, the committee is empowered to investigate any matter brought to its attention by the auditors, an employee, the disclosure committee of the Company, the CEO, the CFO or any outside party with full access to all books, records, facilities, and personnel of the Company and the power to retain outside counsel or other experts for this purpose. The committee will make regular reports to the Board of Directors concerning its activities.

Responsibilities and Processes

The committee shall have the sole authority to appoint or replace the independent auditors, and shall pre-approve all audit engagement fees and terms and all non-audit engagements with the independent auditors. The committee shall consult with management but shall not delegate these responsibilities, except that pre-approvals of non-audit services may be delegated to a single member of the committee. In its capacity as a committee of the board, the committee shall be directly responsible for the appointment, determination of compensation of, retention and oversight of the work of the independent auditors (including the resolution of disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or related work, and the independent auditors shall report

A-1

directly to the committee. The committee shall have the authority, to the extent it deems necessary or appropriate, to retain special legal, accounting or other consultants to advise the committee and carry out its duties and to conduct or authorize investigations into any matters within its scope of responsibilities. The Company will provide funding for the payment of the fees and expense of such special legal, accounting or other consultants and for the ordinary administrative expense of the committee. The committee shall meet periodically with the independent auditors in separate executive sessions in furtherance of its purpose.

The primary responsibility of the committee is to provide assistance to the board of directors in fulfilling its oversight responsibility concerning the Company’s financial reporting process and report the results of their activities to the board. While the committee has the responsibilities and powers set forth in this charter, it is not the duty of the committee to prepare financial statements, plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles and applicable rules and regulations. These are the responsibilities of management and the independent auditors, as applicable.

The following shall be the principal recurring processes of the audit committee in carrying out its oversight responsibilities. The committee in carrying out its responsibilities believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The following processes are set forth as a guide with the understanding that the committee may supplement them as appropriate.

• The committee shall have a clear understanding with management and the independent auditors that the independent auditors report to the board and the audit committee, as representatives of the Company’s shareholders. The committee shall review and discuss with the auditors (a) their independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board Standard No. 1, (b) the matters required to be discussed by Statement on Auditing Standards (SAS) No. 61, and as amended by SAS No. 90, and (c) the independence requirements for auditors of the Sarbanes-Oxley Act. Annually, the committee shall review and recommend to the board the selection of the Company’s independent auditors.

• The committee shall review and discuss with the independent auditors (a) all critical accounting policies and practices, used by the Company; (b) alternative accounting treatments within GAAP related to material items that have been discussed with management, including the ramifications of the use of the alternative treatments and the treatment preferred by the independent auditor; and (c) other material written communications between the independent auditor and management.

• The committee shall review and discuss with management and the independent auditors, as applicable (a) major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles; (b) any significant matters regarding internal controls over financial reporting that come to the attention of the independent auditors during the conduct of their audit; (c) any problems, difficulties or differences encountered in the course of audit work, including any disagreements with management or restrictions on the scope of the independent auditors’ activities or on access to requested information and management’s response thereto; and (d) any management letter provided by the independent auditors and the Company’s response to that letter.

• The committee shall establish procedures regarding the receipt, retention and treatment of complaints and other concerns received from employees or others regarding accounting, internal control or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

A-2

• The committee shall discuss with the independent auditors the overall scope and plan for their respective audits, including the adequacy of staffing and compensation.

• The committee will meet prior to the quarterly press release, either telephonically or in person, and discuss the results of the review of the interim quarterly financial statements and any other matters required to be communicated to the audit committee by the independent auditors under generally accepted auditing standards. The committee shall meet, either telephonically or in person, with management and the independent auditors to discuss the financial statements, including the company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” to be included in the Company’s Quarterly Report on Form 10-Q.

• The committee shall review with management and the independent auditors the financial statements, including the company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” to be included in the Company’s Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of Form 10-K), including the judgment of management and the independent auditors about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the committee shall discuss the results of the annual audit and any other matters required to be communicated to the committee by the independent auditors under generally accepted auditing standards.

• The committee shall review and discuss with management and the independent auditors the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

• The committee shall provide a report in the Company’s annual proxy statement as required by the Securities and Exchange Commission.

Indemnification

The committee members will be indemnified by the Company to the maximum extent provided under Delaware law or in accordance with any indemnification agreements between the Company and such committee members.

A-3

Fargo Electronics, Inc.

Meeting Location:

Fargo Electronics, Inc.

Corporate Headquarters

6533 Flying Cloud Drive

Eden Prairie, Minnesota 55344

May 3, 2005

1:30 p.m. Local Time

Fargo Electronics, Inc. | | |

6533 Flying Cloud Drive | | |

Eden Prairie, Minnesota 55344 USA | | PROXY |

COMMON STOCK PROXY

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 3, 2005

The undersigned hereby appoints GARY R. HOLLAND and JEFFREY D. UPIN, and each of them, with full powers of substitution, as proxies to represent and vote, as designated below, all shares of Common Stock of Fargo Electronics, Inc., registered in the name of the undersigned as of March 11, 2005, at the Annual Meeting of Stockholders of the Company to be held at the Fargo Electronics, Inc. Corporate Headquarters, 6533 Flying Cloud Drive, Eden Prairie, Minnesota 55344 at 1:30 p.m. (Local Time) on May 3, 2005, and at any adjournment thereof, and the undersigned hereby revokes all proxies previously given with respect to the meeting.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

See reverse side for voting instructions.

VOTE BY MAIL

Mark, sign, and date your proxy card and return it in the postage paid envelope provided.

ò Please Detach Here ò

The Board of Directors Recommends That You Vote FOR the Proposal Below.

Proposal 1: | Election of the nominees listed to serve | 01 William H. Gibbs | o | FOR | o | WITHHOLD AUTHORITY |

| as directors for a term of three-years | 02 Edward J. Smith | | all nominees | | from all nominees |

| | | | (except as marked) | |

| | | | | |

| | | | | |

| | | | | |

(Instructions: To withhold authority to vote for any indicated nominee write the number(s) of the nominee(s) in the box provided to the right.) | |

|

Proposal 2: In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR EACH NOMINEE LISTED ABOVE IN PROPOSAL 1.

Address Change? Mark Box o | | Dated: , 2005 |

Indicate Changes Below: | | |

| | |

|

|

| Signature(s) in Box (if there are co-owners, both must sign) |

| | PLEASE DATE AND SIGN ABOVE exactly as name appears at the left, indicating, where appropriate, office position or representative capacity. For stock held in joint tenancy, each joint owner should sign. |

| | |