UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investments Portfolios 2 |

|

| (This Form N-CSR relates solely to the Registrant’s: PGIM Core Short-Term Bond Fund, PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

Date of fiscal year end: | | 01/31/2022

|

| |

| Date of reporting period: | | 07/31/2021 |

Item 1 – Reports to Stockholders

PGIM CORE SHORT-TERM BOND FUND

PGIM CORE ULTRA SHORT BOND FUND

PGIM INSTITUTIONAL MONEY MARKET FUND

SEMIANNUAL REPORT

JULY 31, 2021

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The information about the Funds’ portfolio holdings is for the period covered by this report and is subject to change thereafter.

The accompanying financial statements as of July 31, 2021 were not audited and, accordingly, no auditor’s opinion is expressed on them.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PGIM is a Prudential Financial company. © 2021 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgim.com/investments |

PGIM Core Short-Term Bond Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| | |

| | | Total Returns as of 7/31/21 | | Average Annual Total Returns as of 7/31/21 |

| | | 6 Months* (%) | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| PGIM Core Short-Term Bond Fund |

| | 0.38 | | 1.20 | | 2.15 | | 2.15 |

| Bloomberg US Short Treasury Index |

| | 0.03 | | 0.10 | | 1.26 | | 0.72 |

| ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index |

| | | 0.10 | | 0.23 | | 1.46 | | 0.90 |

*Not Annualized

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

Benchmark Definitions

Bloomberg US Short Treasury Index—The Bloomberg US Short Treasury Index includes aged U.S. Treasury bills, notes and bonds with a remaining maturity from 1 up to (but not including) 12 months. It excludes zero coupon strips.

ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index—tracks the performance of a basket of synthetic assets paying Libid to a stated maturity. The index purchases a new instrument each day, priced at par, having exactly its stated maturity and with a coupon equal to that day’s fixing rate. All issues are held to maturity. Therefore each day the index is comprised of a basket of securities. The index is not marked to market. The returns of the index represent the accrued income generated by the equally weighted average of all the coupons in the basket for a given day.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | | | | | |

|

| Distributions and Yields as of 7/31/21 |

| | Total Distributions

Paid for

Six Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| PGIM Core Short-Term Bond Fund | | 0.05 | | 0.67 | | 0.67 |

| | | | |

PGIM Investment Portfolios 2 | | | 3 | |

PGIM Core Short-Term Bond Fund

Your Fund’s Performance (continued)

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 7/31/21 (%) | |

| AAA | | | 21.8 | |

| AA | | | 11.8 | |

| A | | | 39.1 | |

| BBB | | | 10.9 | |

| BB | | | 0.1 | |

| B | | | 0.1 | |

| CCC | | | 0.2 | |

| Not Rated | | | –0.3 | |

| Cash/Cash Equivalents | | | 16.3 | |

| Total Investments | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | |

| 4 | | Visit our website at pgim.com/investments |

PGIM Core Ultra Short Bond Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | |

| | |

| | | Total Returns as of 7/31/21 | | Average Annual Total Returns as of 7/31/21 |

| | | 6 Months* (%) | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| PGIM Core Ultra Short Bond Fund |

| | 0.07 | | 0.20 | | 1.36 | | 0.79 |

| Bloomberg 1-3 Month US Treasury Bill Index |

| | 0.01 | | 0.06 | | 1.10 | | 0.58 |

| iMoneyNet Prime Institutional Funds Average |

| | | 0.01 | | 0.02 | | 1.07 | | 0.57 |

*Not Annualized

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

Benchmark Definition

Bloomberg 1–3 Month US Treasury Bill Index—The Bloomberg 1–3 Month US Treasury Bill Index includes all publicly issued zero-coupon US Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value.

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | | | | | |

|

| Distributions and Yields as of 7/31/21 |

| | Total Distributions

Paid for

Six Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| PGIM Core Ultra Short Bond Fund | | 0.00 | | 0.10 | | 0.10 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

PGIM Investment Portfolios 2 | | | 5 | |

PGIM Core Ultra Short Bond Fund

Your Fund’s Performance (continued)

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 7/31/21 (%) | |

| A-1+/P-1 | | | 79.7 | |

| A-1/P-1 | | | 20.3 | |

| Total Investments | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | |

| 6 | | Visit our website at pgim.com/investments |

PGIM Institutional Money Market Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | |

| | |

| | | Total Returns as of 7/31/21 | | Average Annual Total Returns as of 7/31/21 |

| | | 6 Months* (%) | | One Year (%) | | Since Inception (%) |

| PGIM Institutional Money Market Fund |

| | 0.03 | | 0.11 | | 1.30 (7/19/16) |

| iMoneyNet Prime Institutional Funds Average |

| | | 0.01 | | 0.02 | | 1.07 |

*Not Annualized

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

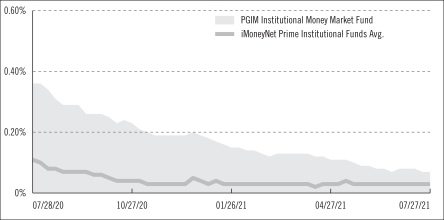

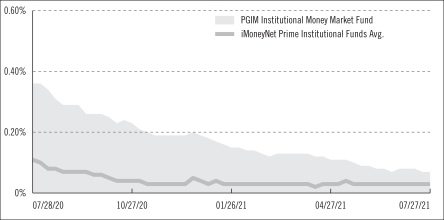

Institutional Money Market Fund Yield Comparison

| | | | |

PGIM Investment Portfolios 2 | | | 7 | |

PGIM Institutional Money Market Fund

Your Fund’s Performance (continued)

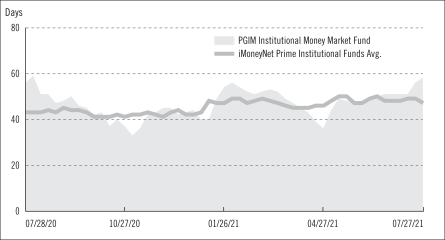

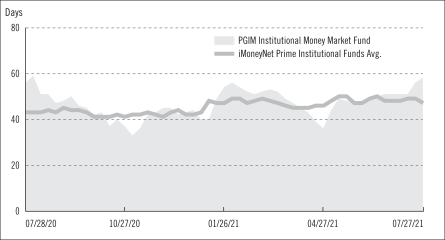

Weighted Average Maturity* (WAM) Comparison

The graphs portray weekly 7-day current yields and weekly WAMs for PGIM Institutional Money Market Fund and the iMoneyNet Prime Institutional Funds Average every Tuesday from July 28, 2020 to July 27, 2021, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the end of the reporting period in the graphs may not match the data portrayed in the Fund’s performance table as of July 31, 2021. Without waiver of fees and/or expense reimbursements, if any, the Fund’s 7-day yield would have been lower.

* Weighted Average Maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding, or redemption provision.

Benchmark Definition

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | |

| 8 | | Visit our website at pgim.com/investments |

Fees and Expenses

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended July 31, 2021. The example is for illustrative purposes only; you should consult the Fund’s Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

PGIM Investment Portfolios 2 | | | 9 | |

Fees and Expenses (continued)

| | | | | | | | | | | | | | | | |

| | | | |

PGIM Core

Short-Term

Bond Fund | | Beginning Account

Value

February 1, 2021 | | | Ending Account

Value

July 31, 2021 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

Actual | | $ | 1,000.00 | | | $ | 1,003.80 | | | | 0.04 | % | | $ | 0.20 | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,024.60 | | | | 0.04 | % | | $ | 0.20 | |

| | | | | | | | | | | | | | | | |

| | | | |

PGIM Core

Ultra Short Bond Fund | | Beginning Account

Value

February 1, 2021 | | | Ending Account

Value

July 31, 2021 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

Actual | | $

| 1,000.00

|

| | $ | 1,000.70 | | |

| 0.01

| %

| | $

| 0.05

|

|

Hypothetical | | $

| 1,000.00

|

| | $ | 1,024.74 | | |

| 0.01

| %

| | $

| 0.05

|

|

| | | | | | | | | | | | | | | | |

| | | | | |

PGIM

Institutional Money

Market Fund | | Beginning Account

Value

February 1, 2021 | | | Ending Account

Value

July 31, 2021 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

Actual | | $

| 1,000.00

|

| | $ | 1,000.30 | | |

| 0.07

| %

| | $ | 0.35 | |

Hypothetical | | $

| 1,000.00

|

| | $ | 1,024.45 | | |

| 0.07

| %

| | $

| 0.35

|

|

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended July 31, 2021, and divided by the 365 days in the Fund’s fiscal year ending January 31, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which each Fund may invest.

| | |

| 10 | | Visit our website at pgim.com/investments |

Glossary

The following abbreviations are used in the Funds’ descriptions:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

A—Annual payment frequency for swaps

ABS—Asset-Backed Security

ADBB—Asian Development Bank Bonds

BSBY—Bloomberg Short-Term Bank Yield Index

EMTN—Euro Medium Term Note

FFCSB—Federal Farm Credit System Bank

FHLB—Federal Home Loan Bank

FHLMC—Federal Home Loan Mortgage Corporation

FNMA—Federal National Mortgage Association

FRDD—Floating Rate Daily Demand Note

GMTN—Global Medium Term Note

GNMA—Government National Mortgage Association

LIBOR—London Interbank Offered Rate

MASTR—Morgan Stanley Structured Asset Security

MTN—Medium Term Note

OTC—Over-the-counter

Q—Quarterly payment frequency for swaps

REITs—Real Estate Investment Trust

S—Semiannual payment frequency for swaps

SOFR—Secured Overnight Financing Rate

T—Swap payment upon termination

TVA—Tennessee Valley Authority

USOIS—United States Overnight Index Swap

11

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | LONG-TERM INVESTMENTS 85.5% | | | | | | | | | | | | | | |

| | | | | |

| | ASSET-BACKED SECURITIES 7.0% | | | | | | | | | | | | | | |

| | | | | |

| | | Automobiles 3.2% | | | | | | | | | | | | | | |

| | Ally Auto Receivables Trust, | | | | | | | | | | | | | | |

| | Series 2018-03, Class A3 | | 3.000% | | | 01/17/23 | | | | 1,219 | | | $ | 1,221,892 | |

| | Series 2019-02, Class A3 | | 2.230 | | | 01/16/24 | | | | 2,317 | | | | 2,339,804 | |

| | CarMax Auto Owner Trust, | | | | | | | | | | | | | | |

| | Series 2018-01, Class A3 | | 2.480 | | | 11/15/22 | | | | 115 | | | | 114,815 | |

| | Series 2018-02, Class A3 | | 2.980 | | | 01/17/23 | | | | 654 | | | | 655,924 | |

| | Series 2018-03, Class A3 | | 3.130 | | | 06/15/23 | | | | 2,738 | | | | 2,760,335 | |

| | Series 2018-04, Class A3 | | 3.360 | | | 09/15/23 | | | | 4,434 | | | | 4,491,136 | |

| | Series 2019-02, Class A3 | | 2.680 | | | 03/15/24 | | | | 2,464 | | | | 2,503,966 | |

| | Series 2020-04, Class A3 | | 0.500 | | | 08/15/25 | | | | 2,400 | | | | 2,408,578 | |

| | Fifth Third Auto Trust, | | | | | | | | | | | | | | |

| | Series 2019-01, Class A3 | | 2.640 | | | 12/15/23 | | | | 1,363 | | | | 1,377,233 | |

| | Ford Credit Auto Lease Trust, | | | | | | | | | | | | | | |

| | Series 2020-B, Class A2A | | 0.500 | | | 12/15/22 | | | | 1,162 | | | | 1,162,497 | |

| | Series 2020-B, Class A2B, 1 Month LIBOR + 0.260% | | 0.353(c) | | | 12/15/22 | | | | 1,162 | | | | 1,162,185 | |

| | Ford Credit Auto Owner Trust, | | | | | | | | | | | | | | |

| | Series 2017-01, Class A, 144A | | 2.620 | | | 08/15/28 | | | | 4,600 | | | | 4,660,785 | |

| | Ford Credit Floorplan Master Owner Trust, | | | | | | | | | | | | | | |

| | Series 2019-01, Class A | | 2.840 | | | 03/15/24 | | | | 8,400 | | | | 8,536,178 | |

| | Series 2019-03, Class A1 | | 2.230 | | | 09/15/24 | | | | 3,800 | | | | 3,884,146 | |

| | GM Financial Consumer Automobile Receivables Trust, | | | | | | | | | | | | | | |

| | Series 2018-03, Class A3 | | 3.020 | | | 05/16/23 | | | | 987 | | | | 993,833 | |

| | Series 2018-04, Class A3 | | 3.210 | | | 10/16/23 | | | | 2,019 | | | | 2,040,818 | |

| | GMF Floorplan Owner Revolving Trust, | | | | | | | | | | | | | | |

| | Series 2018-04, Class A1, 144A | | 3.500 | | | 09/15/23 | | | | 13,100 | | | | 13,152,602 | |

| | Series 2019-01, Class A, 144A | | 2.700 | | | 04/15/24 | | | | 10,500 | | | | 10,681,322 | |

| | Honda Auto Receivables Owner Trust, | | | | | | | | | | | | | | |

| | Series 2018-02, Class A3 | | 3.010 | | | 05/18/22 | | | | 64 | | | | 64,307 | |

| | Series 2019-02, Class A3 | | 2.520 | | | 06/21/23 | | | | 1,262 | | | | 1,276,230 | |

| | Hyundai Auto Lease Securitization Trust, | | | | | | | | | | | | | | |

| | Series 2020-B, Class A2, 144A | | 0.360 | | | 01/17/23 | | | | 1,855 | | | | 1,856,172 | |

| | Mercedes-Benz Auto Receivables Trust, | | | | | | | | | | | | | | |

| | Series 2018-01, Class A3 | | 3.030 | | | 01/17/23 | | | | 654 | | | | 657,046 | |

| | Nissan Auto Receivables Owner Trust, | | | | | | | | | | | | | | |

| | Series 2018-B, Class A3 | | 3.060 | | | 03/15/23 | | | | 1,187 | | | | 1,198,411 | |

| | Santander Retail Auto Lease Trust, | | | | | | | | | | | | | | |

| | Series 2019-C, Class A2A, 144A | | 1.890 | | | 09/20/22 | | | | 1,227 | | | | 1,228,283 | |

| | Series 2020-B, Class A2, 144A | | 0.420 | | | 11/20/23 | | | | 8,579 | | | | 8,595,135 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Automobiles (cont’d.) | | | | | | | | | | | | | | |

| | | | | |

| | Toyota Auto Receivables Owner Trust, | | | | | | | | | | | | | | |

| | Series 2018-C, Class A3 | | 3.020% | | | 12/15/22 | | | | 1,503 | | | $ | 1,512,116 | |

| | World Omni Auto Receivables Trust, | | | | | | | | | | | | | | |

| | Series 2018-C, Class A3 | | 3.130 | | | 11/15/23 | | | | 2,929 | | | | 2,958,308 | |

| | Series 2018-D, Class A3 | | 3.330 | | | 04/15/24 | | | | 4,012 | | | | 4,067,152 | |

| | Series 2019-A, Class A3 | | 3.040 | | | 05/15/24 | | | | 948 | | | | 959,830 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 88,521,039 | |

| | | | | |

| | | Credit Cards 2.7% | | | | | | | | | | | | | | |

| | American Express Credit Account Master Trust, | | | | | | | | | | | | | | |

| | Series 2018-08, Class A | | 3.180 | | | 04/15/24 | | | | 7,700 | | | | 7,729,191 | |

| | Series 2019-01, Class A | | 2.870 | | | 10/15/24 | | | | 15,000 | | | | 15,252,561 | |

| | Series 2019-02, Class A | | 2.670 | | | 11/15/24 | | | | 6,900 | | | | 7,022,617 | |

| | Series 2019-03, Class A | | 2.000 | | | 04/15/25 | | | | 14,800 | | | | 15,101,244 | |

| | BA Credit Card Trust, | | | | | | | | | | | | | | |

| | Series 2019-A01, Class A1 | | 1.740 | | | 01/15/25 | | | | 16,600 | | | | 16,872,469 | |

| | Discover Card Execution Note Trust, | | | | | | | | | | | | | | |

| | Series 2018-A05, Class A5 | | 3.320 | | | 03/15/24 | | | | 10,100 | | | | 10,139,929 | |

| | Series 2019-A01, Class A1 | | 3.040 | | | 07/15/24 | | | | 1,000 | | | | 1,013,218 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 73,131,229 | |

| | | | | |

| | | Home Equity Loans 0.8% | | | | | | | | | | | | | | |

| | Accredited Mortgage Loan Trust, | | | | | | | | | | | | | | |

| | Series 2004-04, Class A2D, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.700%) | | 0.789(c) | | | 01/25/35 | | | | 894 | | | | 885,276 | |

| | ACE Securities Corp. Home Equity Loan Trust, | | | | | | | | | | | | | | |

| | Series 2003-HE01, Class M2, 1 Month LIBOR + 2.550% (Cap N/A, Floor 2.550%) | | 2.639(c) | | | 11/25/33 | | | | 2 | | | | 7,324 | |

| | Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | |

| | Series 2003-11, Class AV2, 1 Month LIBOR + 0.740% (Cap N/A, Floor 0.740%) | | 0.829(c) | | | 12/25/33 | | | | 190 | | | | 188,501 | |

| | Argent Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | |

| | Series 2003-W03, Class M2, 1 Month LIBOR + 2.700% (Cap N/A, Floor 2.700%) | | 2.789(c) | | | 09/25/33 | | | | 5,769 | | | | 5,803,695 | |

| | Asset-Backed Funding Certificate Trust, | | | | | | | | | | | | | | |

| | Series 2003-AHL01, Class A1 | | 4.184 | | | 03/25/33 | | | | 205 | | | | 208,265 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 13 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Home Equity Loans (cont’d.) | | | | | | | | | | | | | | |

| | Asset-Backed Funding Certificate Trust, (cont’d.) | | | | | | | | | | | | | | |

| | Series 2003-OPT01, Class A3, 1 Month LIBOR + 0.680% (Cap N/A, Floor 0.680%) | | 0.769%(c) | | | 04/25/33 | | | | 633 | | | $ | 616,063 | |

| | Series 2004-HE01, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 0.989(c) | | | 03/25/34 | | | | 426 | | | | 419,646 | |

| | Asset-Backed Securities Corp. Home Equity Loan Trust, | | | | | | | | | | | | | | |

| | Series 2003-HE06, Class A2, 1 Month LIBOR + 0.680% (Cap N/A, Floor 0.680%) | | 0.769(c) | | | 11/25/33 | | | | 193 | | | | 190,258 | |

| | Bear Stearns Asset-Backed Securities Trust, | | | | | | | | | | | | | | |

| | Series 2003-03, Class M1, 1 Month LIBOR + 1.230% (Cap 11.000%, Floor 1.230%) | | 1.319(c) | | | 06/25/43 | | | | 264 | | | | 265,309 | |

| | CDC Mortgage Capital Trust, | | | | | | | | | | | | | | |

| | Series 2003-HE03, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 1.139(c) | | | 11/25/33 | | | | 1,077 | | | | 1,065,318 | |

| | Equifirst Mortgage Loan Trust, | | | | | | | | | | | | | | |

| | Series 2003-01, Class M2, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | 2.939(c) | | | 12/25/32 | | | | 33 | | | | 33,195 | |

| | Home Equity Asset Trust, | | | | | | | | | | | | | | |

| | Series 2002-03, Class M1, 1 Month LIBOR + 1.350% (Cap N/A, Floor 1.350%) | | 1.439(c) | | | 02/25/33 | | | | 317 | | | | 319,732 | |

| | Series 2003-02, Class M1, 1 Month LIBOR + 1.320% (Cap N/A, Floor 1.320%) | | 1.409(c) | | | 08/25/33 | | | | 708 | | | | 714,204 | |

| | Series 2003-03, Class M1, 1 Month LIBOR + 1.290% (Cap N/A, Floor 1.290%) | | 1.379(c) | | | 08/25/33 | | | | 597 | | | | 598,242 | |

| | Series 2003-08, Class M1, 1 Month LIBOR + 1.080% (Cap N/A, Floor 1.080%) | | 1.169(c) | | | 04/25/34 | | | | 250 | | | | 250,236 | |

| | MASTR Asset-Backed Securities Trust, | | | | | | | | | | | | | | |

| | Series 2004-OPT02, Class A2, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.700%) | | 0.789(c) | | | 09/25/34 | | | | 140 | | | | 135,826 | |

| | Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | |

| | Series 2004-HE02, Class A1A, 1 Month LIBOR + 0.800% (Cap N/A, Floor 0.800%) | | 0.889(c) | | | 08/25/35 | | | | 45 | | | | 43,908 | |

| | Series 2004-HE02, Class M1, 1 Month LIBOR + 1.200% (Cap N/A, Floor 1.200%) | | 1.289(c) | | | 08/25/35 | | | | 214 | | | | 213,595 | |

| | Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | |

| | Series 2003-NC05, Class M1, 1 Month LIBOR + 1.275% (Cap N/A, Floor 1.275%) | | 1.364(c) | | | 04/25/33 | | | | 848 | | | | 848,970 | |

| | Series 2003-NC05, Class M3, 1 Month LIBOR + 3.450% (Cap N/A, Floor 3.450%) | | 3.539(c) | | | 04/25/33 | | | | 83 | | | | 84,318 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | |

Description | | Interest Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | |

Home Equity Loans (cont’d.) | | | | | | | | | | | | | | |

Morgan Stanley ABS Capital I, Inc. Trust, (cont’d.) | | | | | | | | | | | | | | |

Series 2003-NC08, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 1.139%(c) | | | 09/25/33 | | | | 729 | | | $ | 726,450 | |

Series 2003-NC08, Class M2, 1 Month LIBOR + 2.625% (Cap N/A, Floor 2.625%) | | 2.714(c) | | | 09/25/33 | | | | 12 | | | | 12,347 | |

Series 2003-NC10, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 1.020%) | | 1.109(c) | | | 10/25/33 | | | | 121 | | | | 121,127 | |

Series 2004-HE07, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 0.989(c) | | | 08/25/34 | | | | 2,361 | | | | 2,344,994 | |

New Century Home Equity Loan Trust, | | | | | | | | | | | | | | |

Series 2004-01, Class M1, 1 Month LIBOR + 0.885% (Cap 11.500%, Floor 0.885%) | | 0.974(c) | | | 05/25/34 | | | | 2,653 | | | | 2,634,235 | |

Renaissance Home Equity Loan Trust, | | | | | | | | | | | | | | |

Series 2003-01, Class A, 1 Month LIBOR + 0.860% (Cap N/A, Floor 0.860%) | | 0.949(c) | | | 06/25/33 | | | | 248 | | | | 234,296 | |

Residential Asset Securities Trust, | | | | | | | | | | | | | | |

Series 2004-KS05, Class AI5 | | 4.606(cc) | | | 06/25/34 | | | | 4,004 | | | | 4,088,386 | |

Saxon Asset Securities Trust, | | | | | | | | | | | | | | |

Series 2003-03, Class M2, 1 Month LIBOR + 2.400% (Cap N/A, Floor 2.400%) | | 2.489(c) | | | 12/25/33 | | | | 32 | | | | 32,255 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 23,085,971 | |

| | | | |

Residential Mortgage-Backed Securities 0.3% | | | | | | | | | | | | | | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | |

Series 2004-R05, Class M1, 1 Month LIBOR + 0.870% (Cap N/A, Floor 0.870%) | | 0.959(c) | | | 07/25/34 | | | | 288 | | | | 288,030 | |

Amortizing Residential Collateral Trust, | | | | | | | | | | | | | | |

Series 2002-BC05, Class M2, 1 Month LIBOR + 1.800% (Cap N/A, Floor 1.800%) | | 1.889(c) | | | 07/25/32 | | | | 74 | | | | 74,576 | |

Chase Funding Trust, | | | | | | | | | | | | | | |

Series 2002-02, Class 2A1, 1 Month LIBOR + 0.500% (Cap N/A, Floor 0.500%) | | 0.589(c) | | | 05/25/32 | | | | 289 | | | | 286,168 | |

Series 2003-01, Class 2A2, 1 Month LIBOR + 0.660% (Cap N/A, Floor 0.660%) | | 0.749(c) | | | 11/25/32 | | | | 249 | | | | 247,340 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | | | |

Series 2003-BC04, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 1.139(c) | | | 07/25/33 | | | | 123 | | | | 122,937 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 15 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Residential Mortgage-Backed Securities (cont’d.) | | | | | | | | | | | | | | |

| | Countrywide Asset-Backed Certificates, (cont’d.) | | | | | | | | | | | | | | |

| | Series 2004-01, Class M1, 1 Month LIBOR + 0.750% (Cap N/A, Floor 0.750%) | | 0.839%(c) | | | 03/25/34 | | | | 113 | | | $ | 113,143 | |

| | Credit-Based Asset Servicing & Securitization LLC, | | | | | | | | | | | | | | |

| | Series 2003-CB05, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 1.020%) | | 1.109(c) | | | 11/25/33 | | | | 452 | | | | 447,940 | |

| | Equity One Mortgage Pass-Through Trust, | | | | | | | | | | | | | | |

| | Series 2003-01, Class M1 | | 4.860(cc) | | | 08/25/33 | | | | 46 | | | | 47,255 | |

| | First Franklin Mortgage Loan Trust, | | | | | | | | | | | | | | |

| | Series 2004-FF05, Class A1, 1 Month LIBOR + 0.720% (Cap N/A, Floor 0.720%) | | 0.809(c) | | | 08/25/34 | | | | 156 | | | | 155,461 | |

| | GSAMP Trust, | | | | | | | | | | | | | | |

| | Series 2003-FM01, Class M2, 1 Month LIBOR + 2.775% (Cap N/A, Floor 2.775%) | | 2.859(c) | | | 03/20/33 | | | | 4 | | | | 6,228 | |

| | HSI Asset Securitization Corp. Trust, | | | | | | | | | | | | | | |

| | Series 2006-OPT04, Class 2A4, 1 Month LIBOR + 0.500% (Cap N/A, Floor 0.500%) | | 0.589(c) | | | 03/25/36 | | | | 965 | | | | 961,829 | |

| | Long Beach Mortgage Loan Trust, | | | | | | | | | | | | | | |

| | Series 2003-03, Class M1, 1 Month LIBOR + 1.125% (Cap N/A, Floor 1.125%) | | 1.214(c) | | | 07/25/33 | | | | 715 | | | | 716,519 | |

| | Series 2003-04, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 1.020%) | | 1.109(c) | | | 08/25/33 | | | | 278 | | | | 276,340 | |

| | Series 2004-02, Class M1, 1 Month LIBOR + 0.795% (Cap N/A, Floor 0.795%) | | 0.884(c) | | | 06/25/34 | | | | 1,726 | | | | 1,704,555 | |

| | Series 2004-03, Class M1, 1 Month LIBOR + 0.855% (Cap N/A, Floor 0.855%) | | 0.944(c) | | | 07/25/34 | | | | 2,261 | | | | 2,243,625 | |

| | Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | |

| | Series 2003-WMC02, Class M2, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | 2.939(c) | | | 02/25/34 | | | | 197 | | | | 199,813 | |

| | Series 2004-WMC01, Class M2, 1 Month LIBOR + 1.650% (Cap N/A, Floor 1.650%) | | 1.739(c) | | | 10/25/34 | | | | 643 | | | | 644,206 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Residential Mortgage-Backed Securities (cont’d.) | | | | | | | | | | | | | | |

| | Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | |

| | Series 2004-NC05, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 0.989%(c) | | | 05/25/34 | | | | 391 | | | $ | 380,562 | |

| | Structured Asset Investment Loan Trust, | | | | | | | | | | | | | | |

| | Series 2003-BC01, Class A2, 1 Month LIBOR + 0.680% (Cap N/A, Floor 0.680%) | | 0.769(c) | | | 01/25/33 | | | | 91 | | | | 90,735 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 9,007,262 | |

| | | | | | | | | | | | | | | | |

| | TOTAL ASSET-BACKED SECURITIES

(cost $188,010,794) | | | | | | | | | | | | | 193,745,501 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | CERTIFICATES OF DEPOSIT 2.8% | | | | | | | | | | | | | | |

| | Bank of Montreal, 3 Month LIBOR + 0.110% | | 0.229(c) | | | 12/13/21 | | | | 10,000 | | | | 10,003,641 | |

| | Canadian Imperial Bank of Commerce, Certificate of Deposit, 3 Month LIBOR + 0.110% | | 0.248(c) | | | 01/03/22 | | | | 7,000 | | | | 7,001,599 | |

| | Credit Agricole Corporate & Investment Bank, 3 Month LIBOR + 0.480% | | 0.599(c) | | | 09/13/21 | | | | 10,000 | | | | 10,004,086 | |

| | Nordea Bank Abp, 3 Month LIBOR + 0.200% | | 0.354(c) | | | 02/14/22 | | | | 20,000 | | | | 20,009,921 | |

| | Royal Bank of Canada, 3 Month LIBOR + 0.110% | | 0.228(c) | | | 12/16/21 | | | | 10,000 | | | | 10,003,724 | |

| | Svenska Handelsbanken, 3 Month LIBOR + 0.200% | | 0.355(c) | | | 02/18/22 | | | | 20,000 | | | | 20,009,273 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | TOTAL CERTIFICATES OF DEPOSIT

(cost $76,999,415) | | | | | | | | | | | | | 77,032,244 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | COMMERCIAL MORTGAGE-BACKED SECURITIES 14.3% | | | | | | | | | | | | | | |

| | BANK, | | | | | | | | | | | | | | |

| | Series 2017-BNK05, Class A1 | | 1.909 | | | 06/15/60 | | | | 242 | | | | 242,452 | |

| | Barclays Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

| | Series 2018-TALL, Class A, 144A, 1 Month LIBOR + 0.722% (Cap N/A, Floor 0.722%) | | 0.815(c) | | | 03/15/37 | | | | 37,270 | | | | 37,234,467 | |

| | Benchmark Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2018-B03, Class A2 | | 3.848 | | | 04/10/51 | | | | 2,160 | | | | 2,251,637 | |

| | Series 2018-B05, Class A2 | | 4.077 | | | 07/15/51 | | | | 1,800 | | | | 1,896,517 | |

| | BX Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2018-BIOA, Class A, 144A, 1 Month LIBOR + 0.671% (Cap N/A, Floor 0.648%) | | 0.764(c) | | | 03/15/37 | | | | 35,000 | | | | 35,054,148 | |

| | Series 2020-BXLP, Class A, 144A, 1 Month LIBOR + 0.800% (Cap N/A, Floor 0.800%) | | 0.893(c) | | | 12/15/36 | | | | 5,686 | | | | 5,693,539 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 17 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | BX Trust, | | | | | | | | | | | | | | |

| | Series 2018-EXCL, Class A, 144A, 1 Month LIBOR + 1.088% (Cap N/A, Floor 1.088%) | | 1.181%(c) | | | 09/15/37 | | | | 8,553 | | | $ | 8,457,395 | |

| | CAMB Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2019-LIFE, Class A, 144A, 1 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | 1.163(c) | | | 12/15/37 | | | | 9,500 | | | | 9,520,705 | |

| | Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2014-GC25, Class A3 | | 3.372 | | | 10/10/47 | | | | 13,536 | | | | 14,384,990 | |

| | Series 2016-P04, Class A2 | | 2.450 | | | 07/10/49 | | | | 8,844 | | | | 8,875,082 | |

| | Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2014-CR15, Class A2 | | 2.928 | | | 02/10/47 | | | | 82 | | | | 81,503 | |

| | Series 2014-UBS05, Class A2 | | 3.031 | | | 09/10/47 | | | | 638 | | | | 637,709 | |

| | Series 2018-HCLV, Class A, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 1.000%) | | 1.093(c) | | | 09/15/33 | | | | 11,508 | | | | 11,457,710 | |

| | Credit Suisse Mortgage Capital Certificates, | | | | | | | | | | | | | | |

| | Series 2019-ICE04, Class A, 144A, 1 Month LIBOR + 0.980% (Cap N/A, Floor 0.980%) | | 1.073(c) | | | 05/15/36 | | | | 35,000 | | | | 35,078,802 | |

| | Deutsche Bank Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2016-C03, Class A1 | | 1.502 | | | 08/10/49 | | | | 47 | | | | 47,093 | |

| | GS Mortgage Securities Corp. Trust, | | | | | | | | | | | | | | |

| | Series 2021-RENT, Class A, 144A, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.700%) | | 0.785(c) | | | 11/21/35 | | | | 5,415 | | | | 5,418,404 | |

| | GS Mortgage Securities Trust, | | | | | | | | | | | | | | |

| | Series 2018-GS09, Class A1 | | 2.861 | | | 03/10/51 | | | | 8 | | | | 7,971 | |

| | Series 2018-HART, Class A, 144A, 1 Month LIBOR + 1.090% (Cap N/A, Floor 1.090%) | | 1.190(c) | | | 10/15/31 | | | | 21,300 | | | | 21,306,675 | |

| | JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

| | Series 2013-C15, Class ASB | | 3.659 | | | 11/15/45 | | | | 555 | | | | 573,463 | |

| | Series 2014-C18, Class A4A2, 144A | | 3.794 | | | 02/15/47 | | | | 6,949 | | | | 7,356,117 | |

| | Series 2014-C24, Class A3 | | 3.098 | | | 11/15/47 | | | | 19,500 | | | | 20,200,116 | |

| | Series 2014-C24, Class A4A2, 144A | | 3.373 | | | 11/15/47 | | | | 25,000 | | | | 26,463,625 | |

| | JPMDB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

| | Series 2020-COR07, Class A2 | | 2.215 | | | 05/13/53 | | | | 25,000 | | | | 25,990,240 | |

| | JPMorgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

| | Series 2017-FL11, Class A, 144A, 1 Month LIBOR + 0.850% (Cap N/A, Floor 0.850%) | | 0.943(c) | | | 10/15/32 | | | | 9,482 | | | | 9,410,361 | |

| | Series 2018-WPT, Class AFL, 144A, 1 Month LIBOR + 0.950% (Cap N/A, Floor 0.950%) | | 1.290(c) | | | 07/05/33 | | | | 19,358 | | | | 19,394,706 | |

| | Series 2019-BKWD, Class A, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 1.000%) | | 1.093(c) | | | 09/15/29 | | | | 4,600 | | | | 4,606,708 | |

| | Ladder Capital Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

| | Series 2017-LC26, Class A2, 144A | | 3.128 | | | 07/12/50 | | | | 4,609 | | | | 4,629,918 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | |

| | LSTAR Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2017-05, Class A2, 144A | | 2.776% | | | 03/10/50 | | | | 10,124 | | | $ | 10,166,897 | |

| | Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | |

| | Series 2012-C06, Class A4 | | 2.858 | | | 11/15/45 | | | | 3,444 | | | | 3,509,915 | |

| | Series 2013-C07, Class A3 | | 2.655 | | | 02/15/46 | | | | 5,849 | | | | 5,917,192 | |

| | Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | |

| | Series 2012-C04, Class A4 | | 3.244 | | | 03/15/45 | | | | 1,987 | | | | 2,000,000 | |

| | Series 2016-UB12, Class A2 | | 2.932 | | | 12/15/49 | | | | 12,659 | | | | 12,709,976 | |

| | Series 2018-H03, Class A2 | | 3.997 | | | 07/15/51 | | | | 2,250 | | | | 2,372,677 | |

| | One New York Plaza Trust, | | | | | | | | | | | | | | |

| | Series 2020-01NYP, Class A, 144A, 1 Month LIBOR + 0.950% (Cap N/A, Floor 0.950%) | | 1.043(c) | | | 01/15/26 | | | | 11,900 | | | | 11,974,067 | |

| | UBS Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2018-C08, Class A2 | | 3.713 | | | 02/15/51 | | | | 2,400 | | | | 2,486,309 | |

| | UBS-Barclays Commercial Mortgage Trust, | | | | | | | | | | | | | | |

| | Series 2012-C03, Class A4 | | 3.091 | | | 08/10/49 | | | | 8,120 | | | | 8,285,203 | |

| | Series 2012-C04, Class A3 | | 2.533 | | | 12/10/45 | | | | 11,714 | | | | 11,736,552 | |

| | Series 2012-C04, Class A5 | | 2.850 | | | 12/10/45 | | | | 4,512 | | | | 4,615,174 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $391,311,045) | | | | | | | | | | | | | 392,046,015 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | CORPORATE BONDS 61.4% | | | | | | | | | | | | | | |

| | | | | |

| | | Aerospace & Defense 0.2% | | | | | | | | | | | | | | |

| | Lockheed Martin Corp., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 3.350 | | | 09/15/21 | | | | 5,263 | | | | 5,282,117 | |

| | | | | |

| | | Agriculture 0.1% | | | | | | | | | | | | | | |

| | Cargill, Inc., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 1.375 | | | 07/23/23 | | | | 3,000 | | | | 3,057,553 | |

| | | | | |

| | | Airlines 0.7% | | | | | | | | | | | | | | |

| | Southwest Airlines Co., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 4.750 | | | 05/04/23 | | | | 17,500 | | | | 18,744,278 | |

| | | | | |

| | | Apparel 0.6% | | | | | | | | | | | | | | |

| | VF Corp., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.050 | | | 04/23/22 | | | | 15,000 | | | | 15,182,298 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 19 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Auto Manufacturers 3.7% | | | | | | | | | | | | | | |

| | American Honda Finance Corp., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.350% | | 0.526%(c) | | | 11/05/21 | | | | 3,410 | | | $ | 3,412,726 | |

| | BMW US Capital LLC (Germany), | | | | | | | | | | | | | | |

| | Gtd. Notes, 144A, SOFR + 0.530% | | 0.580(c) | | | 04/01/24 | | | | 8,500 | | | | 8,574,749 | |

| | Gtd. Notes, 144A | | 1.850 | | | 09/15/21 | | | | 8,000 | | | | 8,009,638 | |

| | Gtd. Notes, 144A | | 3.400 | | | 08/13/21 | | | | 7,000 | | | | 7,006,264 | |

| | Gtd. Notes, 144A | | 3.800 | | | 04/06/23 | | | | 10,000 | | | | 10,553,578 | |

| | Daimler Finance North America LLC (Germany), | | | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 0.750 | | | 03/01/24 | | | | 31,500 | | | | 31,587,000 | |

| | Toyota Motor Credit Corp., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, SOFR + 0.300% | | 0.350(c) | | | 06/13/22 | | | | 10,000 | | | | 10,007,069 | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.290% | | 0.428(c) | | | 10/07/21 | | | | 11,000 | | | | 11,005,862 | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.690% (Cap N/A, Floor 0.000%) | | 0.809(c) | | | 01/11/22 | | | | 550 | | | | 551,607 | |

| | Volkswagen Group of America Finance LLC (Germany), | | | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 2.900 | | | 05/13/22 | | | | 10,000 | | | | 10,195,903 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 100,904,396 | |

| | | | | |

| | | Banks 16.2% | | | | | | | | | | | | | | |

| | Australia & New Zealand Banking Group Ltd. (Australia), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.490% | | 0.639(c) | | | 11/21/22 | | | | 20,434 | | | | 20,542,458 | |

| | Banco Santander SA (Spain), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 1.560% | | 1.679(c) | | | 04/11/22 | | | | 12,200 | | | | 12,312,847 | |

| | Sr. Unsec’d. Notes | | 3.500 | | | 04/11/22 | | | | 4,000 | | | | 4,088,586 | |

| | Bank of America Corp., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month BSBY + 0.430% | | 0.536(c) | | | 05/28/24 | | | | 33,500 | | | | 33,526,368 | |

| | Bank of New York Mellon Corp. (The), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 1.050% | | 1.179(c) | | | 10/30/23 | | | | 1,927 | | | | 1,950,127 | |

| | Sr. Unsec’d. Notes, MTN | | 1.950 | | | 08/23/22 | | | | 6,700 | | | | 6,822,782 | |

| | Bank of Nova Scotia (The) (Canada), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.620% | | 0.755(c) | | | 09/19/22 | | | | 1,750 | | | | 1,761,102 | |

| | Sr. Unsec’d. Notes | | 1.625 | | | 05/01/23 | | | | 14,000 | | | | 14,324,726 | |

| | Banque Federative du Credit Mutuel SA (France), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 0.650 | | | 02/27/24 | | | | 17,750 | | | | 17,756,493 | |

| | Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.730% | | 0.864(c) | | | 07/20/22 | | | | 960 | | | | 966,025 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Banks (cont’d.) | | | | | | | | | | | | | | |

| | Barclays Bank PLC (United Kingdom), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.700% | | | 05/12/22 | | | | 26,000 | | | $ | 26,267,896 | |

| | Canadian Imperial Bank of Commerce (Canada), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.720% | | 0.838(c) | | | 06/16/22 | | | | 2,260 | | | | 2,273,295 | |

| | Sr. Unsec’d. Notes, SOFR + 0.800% | | 0.850(c) | | | 03/17/23 | | | | 21,000 | | | | 21,210,389 | |

| | Commonwealth Bank of Australia (Australia), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.700% | | 0.828(c) | | | 03/10/22 | | | | 5,000 | | | | 5,020,190 | |

| | Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.680% | | 0.805(c) | | | 09/18/22 | | | | 250 | | | | 251,755 | |

| | Cooperatieve Rabobank UA (Netherlands), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, SOFR + 0.300% | | 0.350(c) | | | 01/12/24 | | | | 14,000 | | | | 14,019,760 | |

| | Credit Agricole Corporate & Investment Bank SA (France), | | | | | | | | | | | | | | |

| | Bank Gtd. Notes, MTN | | 0.400 | | | 01/15/23 | | | | 8,200 | | | | 8,203,590 | |

| | Credit Suisse AG (Switzerland), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, SOFR + 0.390% | | 0.440(c) | | | 02/02/24 | | | | 7,500 | | | | 7,500,631 | |

| | Sr. Unsec’d. Notes, SOFR + 0.450% | | 0.480(c) | | | 02/04/22 | | | | 18,000 | | | | 18,010,127 | |

| | Sr. Unsec’d. Notes | | 2.100 | | | 11/12/21 | | | | 9,000 | | | | 9,048,154 | |

| | Fifth Third Bank NA, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN | | 1.800 | | | 01/30/23 | | | | 7,000 | | | | 7,151,893 | |

| | Goldman Sachs Group, Inc. (The), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.627(ff) | | | 11/17/23 | | | | 20,000 | | | | 20,011,082 | |

| | Huntington National Bank (The), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.800 | | | 02/03/23 | | | | 8,000 | | | | 8,168,129 | |

| | ING Groep NV (Netherlands), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 1.150% | | 1.296(c) | | | 03/29/22 | | | | 4,000 | | | | 4,028,401 | |

| | KeyBank NA, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.250 | | | 03/10/23 | | | | 12,500 | | | | 12,693,435 | |

| | Mitsubishi UFJ Financial Group, Inc. (Japan), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.623 | | | 07/18/22 | | | | 20,000 | | | | 20,454,894 | |

| | Mizuho Financial Group, Inc. (Japan), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.273 | | | 09/13/21 | | | | 9,210 | | | | 9,231,427 | |

| | Morgan Stanley, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, GMTN, SOFR + 0.700% | | 0.750(c) | | | 01/20/23 | | | | 9,167 | | | | 9,187,953 | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 1.400% | | 1.525(c) | | | 10/24/23 | | | | 11,551 | | | | 11,723,721 | |

| | Sr. Unsec’d. Notes, MTN | | 2.625 | | | 11/17/21 | | | | 3,500 | | | | 3,524,439 | |

| | National Australia Bank Ltd. (Australia), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.890% | | 1.009(c) | | | 01/10/22 | | | | 400 | | | | 401,515 | |

| | National Securities Clearing Corp., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 0.400 | | | 12/07/23 | | | | 12,750 | | | | 12,768,927 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 21 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | | | |

| | | | | |

| | | Banks (cont’d.) | | | | | | | | | | | | | | |

| | National Securities Clearing Corp., (cont’d.) | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 1.200% | | | 04/23/23 | | | | 5,000 | | | $ | 5,075,042 | |

| | PNC Bank NA, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.325% | | 0.475(c) | | | 02/24/23 | | | | 14,000 | | | | 14,016,626 | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.500% | | 0.629(c) | | | 07/27/22 | | | | 350 | | | | 351,615 | |

| | Santander UK PLC (United Kingdom), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.660% | | 0.816(c) | | | 11/15/21 | | | | 9,000 | | | | 9,012,583 | |

| | Standard Chartered PLC (United Kingdom), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 1.200% | | 1.328(c) | | | 09/10/22 | | | | 19,800 | | | | 19,820,966 | |

| | Toronto-Dominion Bank (The) (Canada), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, SOFR + 0.480% | | 0.530(c) | | | 01/27/23 | | | | 2,750 | | | | 2,762,503 | |

| | Truist Bank, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.590% | | 0.746(c) | | | 05/17/22 | | | | 15,000 | | | | 15,053,549 | |

| | Sr. Unsec’d. Notes, SOFR + 0.730% (Cap N/A, Floor 0.000%) | | 0.776(c) | | | 03/09/23 | | | | 2,750 | | | | 2,770,115 | |

| | UBS AG (Switzerland), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, MTN, SOFR + 0.360% | | 0.391(c) | | | 02/09/24 | | | | 7,500 | | | | 7,524,768 | |

| | Sr. Unsec’d. Notes, 144A, MTN | | 0.450 | | | 02/09/24 | | | | 5,000 | | | | 4,983,612 | |

| | US Bank NA, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.440% | | 0.590(c) | | | 05/23/22 | | | | 6,300 | | | | 6,317,908 | |

| | Wells Fargo Bank NA, | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.082(ff) | | | 09/09/22 | | | | 12,000 | | | | 12,021,331 | |

| | Westpac Banking Corp. (Australia), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.720% | | 0.876(c) | | | 05/15/23 | | | | 175 | | | | 176,943 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 445,090,678 | |

| | | | | |

| | | Beverages 0.9% | | | | | | | | | | | | | | |

| | Coca-Cola Europacific Partners PLC (United Kingdom), | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 0.500 | | | 05/05/23 | | | | 8,000 | | | | 7,996,758 | |

| | Sr. Unsec’d. Notes, 144A | | 0.800 | | | 05/03/24 | | | | 3,000 | | | | 2,999,562 | |

| | PepsiCo, Inc., | | | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.400 | | | 10/07/23 | | | | 14,500 | | | | 14,532,785 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | 25,529,105 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Biotechnology 0.4% | | | | | | | | | | | | |

| | Gilead Sciences, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.520% | | 0.666%(c) | | 09/29/23 | | | 6,000 | | | $ | 6,003,124 | |

| | Sr. Unsec’d. Notes | | 0.750 | | 09/29/23 | | | 6,000 | | | | 6,003,510 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 12,006,634 | |

| | | | | |

| | | Building Materials 0.1% | | | | | | | | | | | | |

| | Martin Marietta Materials, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.650 | | 07/15/23 | | | 3,750 | | | | 3,756,935 | |

| | | | | |

| | | Chemicals 0.3% | | | | | | | | | | | | |

| | Air Liquide Finance SA (France), | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 2.250 | | 09/27/23 | | | 2,780 | | | | 2,882,416 | |

| | Nutrien Ltd. (Canada), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.900 | | 05/13/23 | | | 5,000 | | | | 5,121,971 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 8,004,387 | |

| | | | | |

| | | Commercial Services 0.3% | | | | | | | | | | | | |

| | PayPal Holdings, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.350 | | 06/01/23 | | | 9,000 | | | | 9,167,555 | |

| | | | | |

| | | Computers 0.2% | | | | | | | | | | | | |

| | Apple, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.700 | | 09/11/22 | | | 5,000 | | | | 5,083,174 | |

| | | | | |

| | | Cosmetics/Personal Care 0.6% | | | | | | | | | | | | |

| | Procter & Gamble Co. (The), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.150 | | 08/11/22 | | | 6,499 | | | | 6,629,734 | |

| | Unilever Capital Corp. (United Kingdom), | | | | | | | | | | | | |

| | Gtd. Notes | | 0.375 | | 09/14/23 | | | 10,000 | | | | 10,020,914 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 16,650,648 | |

| | | | | |

| | | Diversified Financial Services 2.8% | | | | | | | | | | | | |

| | AIG Global Funding, | | | | | | | | | | | | |

| | Sr. Sec’d. Notes, 144A | | 0.650 | | 06/17/24 | | | 21,000 | | | | 21,003,147 | |

| | Air Lease Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.350% | | 0.484(c) | | 12/15/22 | | | 25,000 | | | | 25,019,472 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 23 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Diversified Financial Services (cont’d.) | | | | | | | | | | | | |

| | American Express Co., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 3.700% | | 11/05/21 | | | 24,000 | | | $ | 24,144,094 | |

| | American Express Credit Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.700% | | 0.829(c) | | 03/03/22 | | | 1,561 | | | | 1,566,148 | |

| | Capital One Bank USA NA, | | | | | | | | | | | | |

| | Sub. Notes | | 3.375 | | 02/15/23 | | | 6,000 | | | | 6,266,977 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 77,999,838 | |

| | | | | |

| | | Electric 5.0% | | | | | | | | | | | | |

| | American Electric Power Co., Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, Series A, 3 Month LIBOR + 0.480% | | 0.606(c) | | 11/01/23 | | | 12,000 | | | | 12,009,457 | |

| | Sr. Unsec’d. Notes, Series I | | 3.650 | | 12/01/21 | | | 5,051 | | | | 5,107,760 | |

| | CenterPoint Energy, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, SOFR + 0.650% | | 0.684(c) | | 05/13/24 | | | 13,500 | | | | 13,512,115 | |

| | DTE Energy Co., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.250 | | 11/01/22 | | | 27,000 | | | | 27,616,385 | |

| | Duke Energy Florida LLC, | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, Series A, 3 Month LIBOR + 0.250% | | 0.391(c) | | 11/26/21 | | | 345 | | | | 345,199 | |

| | Entergy Louisiana LLC, | | | | | | | | | | | | |

| | First Mortgage | | 0.620 | | 11/17/23 | | | 10,750 | | | | 10,755,619 | |

| | Florida Power & Light Co., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, SOFR + 0.250% | | 0.282(c) | | 05/10/23 | | | 11,250 | | | | 11,241,142 | |

| | NextEra Energy Capital Holdings, Inc., | | | | | | | | | | | | |

| | Gtd. Notes | | 2.900 | | 04/01/22 | | | 17,500 | | | | 17,807,509 | |

| | OGE Energy Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.703 | | 05/26/23 | | | 6,750 | | | | 6,752,716 | |

| | PPL Electric Utilities Corp., | | | | | | | | | | | | |

| | First Mortgage, SOFR + 0.330% | | 0.381(c) | | 06/24/24 | | | 4,750 | | | | 4,751,248 | |

| | First Mortgage | | 2.500 | | 09/01/22 | | | 9,000 | | | | 9,151,605 | |

| | WEC Energy Group, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.800 | | 03/15/24 | | | 17,000 | | | | 17,087,838 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 136,138,593 | |

| | | | | |

| | | Foods 2.3% | | | | | | | | | | | | |

| | Hormel Foods Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.650 | | 06/03/24 | | | 6,000 | | | | 6,020,038 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Foods (cont’d.) | | | | | | | | | | | | |

| | Mondelez International Holdings Netherlands BV, | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 2.000% | | 10/28/21 | | | 10,000 | | | $ | 10,027,283 | |

| | Mondelez International, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.625 | | 07/01/22 | | | 21,900 | | | | 21,983,107 | |

| | Nestle Holdings, Inc., | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 0.375 | | 01/15/24 | | | 10,000 | | | | 9,976,799 | |

| | Gtd. Notes, 144A | | 3.100 | | 09/24/21 | | | 15,500 | | | | 15,529,508 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 63,536,735 | |

| | | | | |

| | | Forest Products & Paper 0.5% | | | | | | | | | | | | |

| | Georgia-Pacific LLC, | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 3.734 | | 07/15/23 | | | 14,126 | | | | 14,916,628 | |

| | | | | |

| | | Gas 0.4% | | | | | | | | | | | | |

| | Atmos Energy Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.380% | | 0.503(c) | | 03/09/23 | | | 12,000 | | | | 12,003,600 | |

| | | | | |

| | | Healthcare-Products 0.2% | | | | | | | | | | | | |

| | Stryker Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.600 | | 12/01/23 | | | 4,750 | | | | 4,751,479 | |

| | | | | |

| | | Healthcare-Services 0.4% | | | | | | | | | | | | |

| | UnitedHealth Group, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.550 | | 05/15/24 | | | 12,000 | | | | 12,008,555 | |

| | | | | |

| | | Household Products/Wares 0.7% | | | | | | | | | | | | |

| | Reckitt Benckiser Treasury Services PLC

(United Kingdom), | | | | | | | | | | | | |

| | Gtd. Notes, 144A, 3 Month LIBOR + 0.560% | | 0.694(c) | | 06/24/22 | | | 18,050 | | | | 18,128,877 | |

| | | | | |

| | | Insurance 6.1% | | | | | | | | | | | | |

| | AIA Group Ltd. (Hong Kong), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.520% | | 0.655(c) | | 09/20/21 | | | 24,400 | | | | 24,401,028 | |

| | Berkshire Hathaway, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.750 | | 03/15/23 | | | 13,000 | | | | 13,480,028 | |

| | Equitable Financial Life Global Funding, | | | | | | | | | | | | |

| | Sec’d. Notes, 144A, SOFR + 0.390% | | 0.440(c) | | 04/06/23 | | | 25,000 | | | | 25,036,162 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 25 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Insurance (cont’d.) | | | | | | | | | | | | |

| | Metropolitan Life Global Funding I, | | | | | | | | | | | | |

| | Sec’d. Notes, 144A | | 3.450% | | 10/09/21 | | | 9,250 | | | $ | 9,305,517 | |

| | Sec’d. Notes, 144A, MTN | | 3.375 | | 01/11/22 | | | 13,750 | | | | 13,944,503 | |

| | New York Life Global Funding, | | | | | | | | | | | | |

| | Sec’d. Notes, 144A, 3 Month LIBOR + 0.320% | | 0.495(c) | | 08/06/21 | | | 5,500 | | | | 5,500,170 | |

| | Sec’d. Notes, 144A | | 2.900 | | 01/17/24 | | | 2,000 | | | | 2,118,343 | |

| | Sr. Sec’d. Notes, 144A, 3 Month LIBOR + 0.440% | | 0.559(c) | | 07/12/22 | | | 16,760 | | | | 16,822,652 | |

| | Pacific Life Global Funding II, | | | | | | | | | | | | |

| | Sr. Sec’d. Notes, 144A | | 0.500 | | 09/23/23 | | | 12,000 | | | | 12,049,001 | |

| | Principal Life Global Funding II, | | | | | | | | | | | | |

| | Sec’d. Notes, 144A | | 0.500 | | 01/08/24 | | | 17,750 | | | | 17,762,015 | |

| | Sec’d. Notes, 144A, SOFR + 0.450% | | 0.500(c) | | 04/12/24 | | | 2,750 | | | | 2,759,000 | |

| | Protective Life Global Funding, | | | | | | | | | | | | |

| | Sec’d. Notes, 144A | | 0.631 | | 10/13/23 | | | 10,750 | | | | 10,797,249 | |

| | Sr. Sec’d. Notes, 144A | | 0.473 | | 01/12/24 | | | 15,000 | | | | 14,962,934 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 168,938,602 | |

| | | | | |

| | | Machinery-Construction & Mining 0.6% | | | | | | | | | | | | |

| | Caterpillar Financial Services Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.700 | | 08/09/21 | | | 1,471 | | | | 1,471,381 | |

| | Sr. Unsec’d. Notes, MTN | | 0.450 | | 09/14/23 | | | 15,000 | | | | 15,038,572 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 16,509,953 | |

| | | | | |

| | | Machinery-Diversified 0.9% | | | | | | | | | | | | |

| | John Deere Capital Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.260% | | 0.388(c) | | 09/10/21 | | | 10,600 | | | | 10,602,893 | |

| | Otis Worldwide Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.450% | | 0.595(c) | | 04/05/23 | | | 13,225 | | | | 13,224,199 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 23,827,092 | |

| | | | | |

| | | Media 0.5% | | | | | | | | | | | | |

| | TWDC Enterprises 18 Corp., | | | | | | | | | | | | |

| | Gtd. Notes, MTN, 3 Month LIBOR + 0.390% | | 0.524(c) | | 03/04/22 | | | 3,750 | | | | 3,757,960 | |

| | Walt Disney Co. (The), | | | | | | | | | | | | |

| | Gtd. Notes, 3 Month LIBOR + 0.250% | | 0.385(c) | | 09/01/21 | | | 3,000 | | | | 3,000,649 | |

| | Gtd. Notes, 3 Month LIBOR + 0.390% | | 0.525(c) | | 09/01/22 | | | 8,000 | | | | 8,027,847 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 14,786,456 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Oil & Gas 4.4% | | | | | | | | | | | | |

| | BP Capital Markets America, Inc., | | | | | | | | | | | | |

| | Gtd. Notes | | 2.112% | | 09/16/21 | | | 11,126 | | | $ | 11,141,402 | |

| | Exxon Mobil Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.370% | | 0.501(c) | | 03/06/22 | | | 1,362 | | | | 1,364,920 | |

| | Sr. Unsec’d. Notes | | 1.571 | | 04/15/23 | | | 21,000 | | | | 21,447,743 | |

| | Phillips 66, | | | | | | | | | | | | |

| | Gtd. Notes | | 0.900 | | 02/15/24 | | | 16,000 | | | | 16,010,904 | |

| | Gtd. Notes | | 3.700 | | 04/06/23 | | | 7,200 | | | | 7,580,458 | |

| | Gtd. Notes | | 4.300 | | 04/01/22 | | | 4,000 | | | | 4,103,751 | |

| | Pioneer Natural Resources Co., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.550 | | 05/15/23 | | | 6,750 | | | | 6,757,550 | |

| | Sr. Unsec’d. Notes | | 0.750 | | 01/15/24 | | | 10,750 | | | | 10,752,701 | |

| | Saudi Arabian Oil Co. (Saudi Arabia), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A, MTN | | 2.750 | | 04/16/22 | | | 13,020 | | | | 13,237,846 | |

| | Valero Energy Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 1.150% | | 1.269(c) | | 09/15/23 | | | 15,000 | | | | 15,007,553 | |

| | Sr. Unsec’d. Notes | | 2.700 | | 04/15/23 | | | 12,000 | | | | 12,428,361 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 119,833,189 | |

| | | | | |

| | | Pharmaceuticals 3.6% | | | | | | | | | | | | |

| | AbbVie, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.460% | | 0.610(c) | | 11/19/21 | | | 5,000 | | | | 5,005,641 | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.650% | | 0.799(c) | | 11/21/22 | | | 4,000 | | | | 4,026,015 | |

| | Sr. Unsec’d. Notes | | 3.375 | | 11/14/21 | | | 4,000 | | | | 4,035,277 | |

| | AmerisourceBergen Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.737 | | 03/15/23 | | | 26,500 | | | | 26,547,641 | |

| | Astrazeneca Finance LLC (United Kingdom), | | | | | | | | | | | | |

| | Gtd. Notes | | 0.700 | | 05/28/24 | | | 21,500 | | | | 21,527,893 | |

| | Bristol-Myers Squibb Co., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.380% | | 0.536(c) | | 05/16/22 | | | 4,000 | | | | 4,011,088 | |

| | Sr. Unsec’d. Notes | | 0.537 | | 11/13/23 | | | 20,000 | | | | 20,013,637 | |

| | EMD Finance LLC (Germany), | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 2.950 | | 03/19/22 | | | 1,500 | | | | 1,518,875 | |

| | GlaxoSmithKline Capital PLC (United Kingdom), | | | | | | | | | | | | |

| | Gtd. Notes | | 0.534 | | 10/01/23 | | | 13,500 | | | | 13,532,416 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 100,218,483 | |

See Notes to Financial Statements.

| | |

| Prudential Investment Portfolios 2/PGIM Core Short-Term Bond Fund | | 27 |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Pipelines 1.4% | | | | | | | | | | | | |

| | Enterprise Products Operating LLC, | | | | | | | | | | | | |

| | Gtd. Notes | | 3.500% | | 02/01/22 | | | 21,259 | | | $ | 21,596,473 | |

| | Gtd. Notes | | 3.900 | | 02/15/24 | | | 4,376 | | | | 4,703,550 | |

| | Southern Natural Gas Co. LLC, | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 0.625 | | 04/28/23 | | | 4,250 | | | | 4,250,865 | |

| | TransCanada PipeLines Ltd. (Canada), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 2.500 | | 08/01/22 | | | 7,000 | | | | 7,152,122 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 37,703,010 | |

| | | | | |

| | | Real Estate Investment Trusts (REITs) 0.7% | | | | | | | | | | | | |

| | Public Storage, | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, SOFR + 0.470% | | 0.520(c) | | 04/23/24 | | | 20,000 | | | | 20,037,795 | |

| | | | | |

| | | Retail 1.5% | | | | | | | | | | | | |

| | 7-Eleven, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 0.625 | | 02/10/23 | | | 5,000 | | | | 5,002,917 | |

| | Sr. Unsec’d. Notes, 144A | | 0.800 | | 02/10/24 | | | 7,000 | | | | 6,999,557 | |

| | AutoZone, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 3.700 | | 04/15/22 | | | 15,610 | | | | 15,847,302 | |

| | Home Depot, Inc. (The), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.310% | | 0.445(c) | | 03/01/22 | | | 2,419 | | | | 2,422,970 | |

| | Sr. Unsec’d. Notes | | 2.625 | | 06/01/22 | | | 6,000 | | | | 6,110,194 | |

| | McDonald’s Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.430% | | 0.562(c) | | 10/28/21 | | | 3,100 | | | | 3,102,935 | |

| | Starbucks Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 1.300 | | 05/07/22 | | | 2,000 | | | | 2,016,253 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 41,502,128 | |

| | | | | |

| | | Savings & Loans 0.9% | | | | | | | | | | | | |

| | Nationwide Building Society (United Kingdom), | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 0.550 | | 01/22/24 | | | 25,000 | | | | 24,969,203 | |

| | | | | |

| | | Semiconductors 0.4% | | | | | | | | | | | | |

| | Intel Corp., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 3 Month LIBOR + 0.350% | | 0.510(c) | | 05/11/22 | | | 10,000 | | | | 10,023,406 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2021

| | | | | | | | | | | | | | |

| | | | | |

| | | Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | | |

| | CORPORATE BONDS (Continued) | | | | | | | | | | | | |

| | | | | |

| | | Software 0.6% | | | | | | | | | | | | |

| | Fidelity National Information Services, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes | | 0.600% | | 03/01/24 | | | 14,250 | | | $ | 14,251,680 | |

| | Infor, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, 144A | | 1.450 | | 07/15/23 | | | 1,800 | | | | 1,823,209 | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | 16,074,889 | |

| | | | | |

| | | Telecommunications 2.4% | | | | | | | | | | | | |

| | NTT Finance Corp. (Japan), | | | | | | | | | | | | |

| | Gtd. Notes, 144A | | 0.583 | | 03/01/24 | | | 15,250 | | | | 15,259,041 | |

| | Rogers Communications, Inc. (Canada), | | | | | | | | | | | | |

| | Gtd. Notes, 3 Month LIBOR + 0.600% | | 0.735(c) | | 03/22/22 | | | 10,400 | | | | 10,428,061 | |

| | Verizon Communications, Inc., | | | | | | | | | | | | |

| | Sr. Unsec’d. Notes, SOFR + 0.500% | | 0.550(c) | | 03/22/24 | | | 23,000 | | | | 23,135,592 | |

| | Sr. Unsec’d. Notes | | 0.750 | | 03/22/24 | | | 12,000 | | | | 12,054,545 | |