UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-09999 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 2 |

|

| (This Form N-CSR relates solely to the Registrant’s: PGIM Core Short-Term Bond Fund, PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund) |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 01/31/2023 |

| |

| Date of reporting period: | | 07/31/2022 |

Item 1 – Reports to Stockholders

PGIM CORE SHORT-TERM BOND FUND

PGIM CORE ULTRA SHORT BOND FUND

PGIM INSTITUTIONAL MONEY MARKET FUND

SEMIANNUAL REPORT

JULY 31, 2022

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The information about the Fund’s portfolio holdings is for the period covered by this report and is subject to change thereafter.

The accompanying financial statements as of July 31, 2022 were not audited and, accordingly, no auditor’s opinion is expressed on them.

Mutual funds are distributed by Prudential Investment Management Services LLC , a Prudential Financial company and member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PGIM is a Prudential Financial company. © 2022 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgim.com/investments |

PGIM Core Short-Term Bond Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | | | | | |

| | |

| | | Total Returns as of 7/31/22

(without sales charges) | | Average Annual Total Returns as of 7/31/22

(with sales charges) |

| | | Six Months* (%) | | One Year (%) | | Five Years (%) | | Ten Years (%) |

| | | | |

| Fund | | -0.03 | | -0.17 | | 1.71 | | 1.92 |

|

| ICE US 1-Month Treasury Bill Index ** |

| | | | |

| | 0.20 | | 0.23 | | 1.00 | | 0.56 |

|

| ICE BofA US Dollar 1-Month Deposit Offered Rate Constant Maturity Index |

| | | | |

| | 0.28 | | 0.32 | | 1.18 | | 0.75 |

|

| ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index |

| | | | |

| | 0.08 | | 0.12 | | 1.30 | | 0.87 |

|

| Bloomberg US Short Treasury Index |

| | | | |

| | | 0.00 | | -0.06 | | 1.13 | | 0.70 |

* Not annualized

** The ICE US 1-Month Treasury Bill Index was adopted as the Fund’s primary benchmark in March 2022 due to the pending discontinuation of LIBOR.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

Benchmark Definition

ICE US 1-Month Treasury Bill Index— an unmanaged index that is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not less than, one month from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

ICE BofA US Dollar 1-Month Deposit Offered Rate Constant Maturity Index— an unmanaged index which tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The 1 Month Current Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

| | | | |

Prudential Investment Portfolios 2 | | | 3 | |

PGIM Core Short-Term Bond Fund

Your Fund’s Performance (continued)

ICE BofA US Dollar 3-Month Deposit Offered Rate Constant Maturity Index—tracks the performance of a basket of synthetic assets paying LIBOR to a stated maturity. The index purchases a new instrument each day, priced at par, having exactly its stated maturity and with a coupon equal to that day’s fixing rate. All issues are held to maturity. Therefore, each day the index is comprised of a basket of securities. The index is not marked to market. The returns of the index represent the accrued income generated by the equally weighted average of all the coupons in the basket for a given day.

Bloomberg US Short Treasury Index—The Bloomberg US Short Treasury Index includes aged U.S. Treasury bills, notes and bonds with a remaining maturity from 1 up to (but not including) 12 months. It excludes zero coupon strips.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | | | | | |

|

| Distributions and Yields as of 7/31/22 |

| | Total Distributions

Paid for

Six Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| PGIM Core Short-Term Bond Fund | | 0.06 | | 2.61 | | 2.61 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | |

| 4 | | Visit our website at pgim.com/investments |

| | | | |

| |

| Credit Quality expressed as a percentage of total investments as of 7/31/22 (%) | |

| AAA | | | 13.2 | |

| AA | | | 24.2 | |

| A | | | 29.7 | |

| BBB | | | 21.2 | |

| BB | | | 0.1 | |

| B | | | 0.1 | |

| CCC | | | 0.1 | |

| Not Rated | | | 11.4 | |

| Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | |

Prudential Investment Portfolios 2 | | | 5 | |

PGIM Core Ultra Short Bond Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | | | | | |

| | |

| | | Total Returns as of 7/31/22 | | Average Annual Total Returns as of 7/31/22 |

| | | 6 Months* (%) | | One Year (%) | | Five Years (%) | | Ten Years (%) |

|

| Fund |

| | | | |

| | 0.39 | | 0.45 | | 1.27 | | 0.81 |

|

| ICE US 1-Month Treasury Bill Index ** |

| | | | |

| | 0.20 | | 0.23 | | 1.00 | | 0.56 |

|

| ICE BofA US Dollar 1-Month Deposit Offered Rate Constant Maturity Index |

| | | | |

| | 0.28 | | 0.32 | | 1.18 | | 0.75 |

|

| Bloomberg 1-3 Month US Treasury Bill Index |

| | | | |

| | 0.24 | | 0.26 | | 1.05 | | 0.60 |

|

| iMoneyNet Prime Institutional Funds Average |

| | | | |

| | | 0.26 | | 0.27 | | 1.11 | | 0.67 |

*Not annualized

** The ICE US 1-Month Treasury Bill Index was adopted as the Fund’s primary benchmark in March 2022 due to the pending discontinuation of LIBOR.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

Benchmark Definition

ICE US 1-Month Treasury Bill Index— an unmanaged index that is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not less than, one month from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

ICE BofA US Dollar 1-Month Deposit Offered Rate Constant Maturity Index— an unmanaged index which tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The 1 Month Current Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

| | |

| 6 | | Visit our website at pgim.com/investments |

Bloomberg 1–3 Month US Treasury Bill Index—The Bloomberg 1–3 Month US Treasury Bill Index includes all publicly issued zero-coupon US Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value.

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | | | | | |

|

| Distributions and Yields as of 7/31/22 |

| | | |

| | Total

Distributions

Paid for

Six Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized Yield** (%) |

| | | |

| PGIM Core Ultra Short Bond Fund | | 0.00 | | 1.80 | | 1.80 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

|

| Credit Quality expressed as a percentage of total investments as of 7/31/22 (%) | |

| | |

| A-1+/P-1 | | | 71.2 | |

| | |

| A-1/P-1 | | | 28.8 | |

| | |

| Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | |

Prudential Investment Portfolios 2 | | | 7 | |

PGIM Institutional Money Market Fund

Your Fund’s Performance

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted.

| | | | | | | | | | |

| | | |

| | | Total Returns as of 7/31/22 | | Average Annual Total Returns as of 7/31/22 | | | |

| | | 6 Months* (%) | | One Year (%) | | Five Years (%) | | Since Inception (%) | |

|

| Fund | |

| | | | |

| | 0.34 | | 0.36 | | 1.21 | | | 1.14 (7/19/16) | |

|

| ICE US 1-Month Treasury Bill Index ** | |

| | | | |

| | 0.20 | | 0.23 | | 1.00 | | | 0.91 | |

|

| ICE BofA US Dollar 1-Month Deposit Offered Rate Constant Maturity Index | |

| | | | |

| | 0.28 | | 0.32 | | 1.18 | | | 1.11 | |

|

| iMoneyNet Prime Institutional Funds Average | |

| | | | |

| | | 0.26 | | 0.27 | | 1.11 | | | 0.94 | |

*Not annualized

** The ICE US 1-Month Treasury Bill Index was adopted as the Fund’s primary benchmark in March 2022 due to the pending discontinuation of LIBOR.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

| | |

| 8 | | Visit our website at pgim.com/investments |

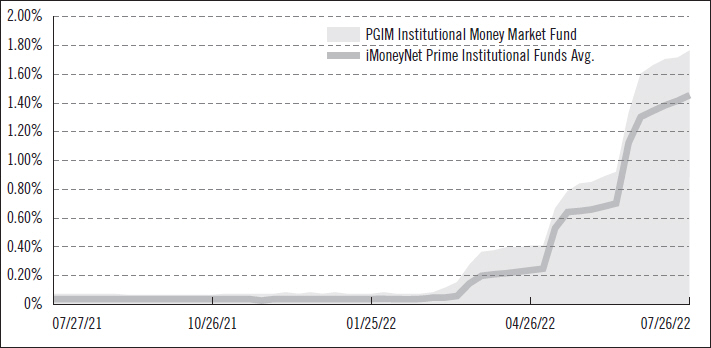

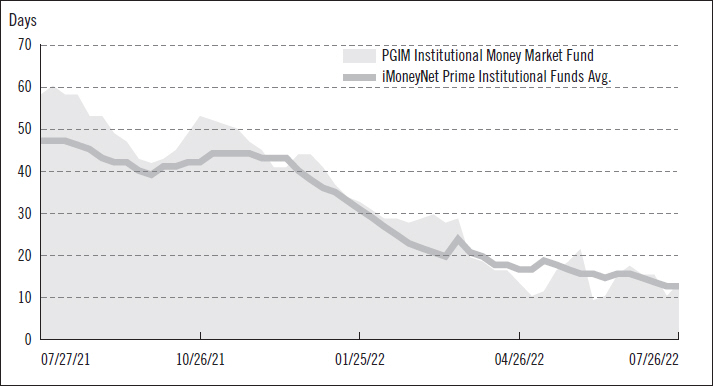

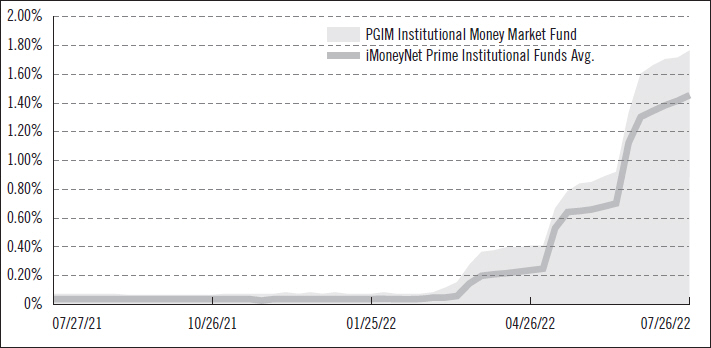

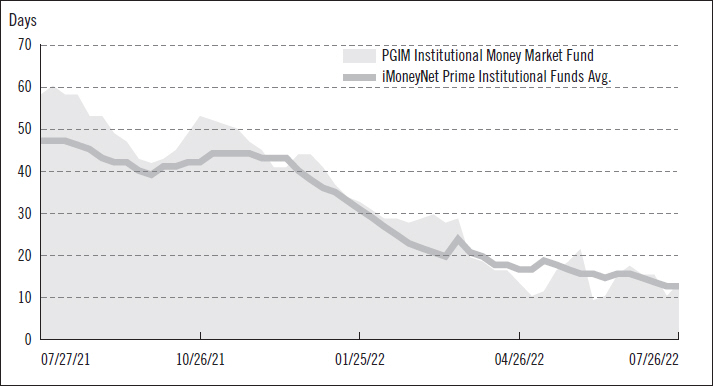

Institutional Money Market Fund Yield Comparison

Weighted Average Maturity* (WAM) Comparison

The graphs portray weekly 7-day current yields and weekly WAMs for PGIM Institutional Money Market Fund and the iMoneyNet Prime Institutional Funds Average every Tuesday from July 27, 2021 to July 26, 2022, the closest dates prior to the beginning and end of the Fund’s reporting period. Note: iMoneyNet, Inc. regularly reports a 7-day current yield and WAM on Tuesdays. As a result, the data portrayed for the Fund at the

| | | | |

Prudential Investment Portfolios 2 | | | 9 | |

PGIM Institutional Money Market Fund

Your Fund’s Performance (continued)

end of the reporting period in the graphs may not match the data portrayed in the Fund’s performance table as of July 31, 2022.

* Weighted Average Maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding, or redemption provision.

Benchmark Definition

ICE BofA US Dollar 1-Month Deposit Offered Rate Constant Maturity Index— an unmanaged index which tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The 1 Month Current Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

ICE US 1-Month Treasury Bill Index— an unmanaged index that is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not less than, one month from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

iMoneyNet Prime Institutional Funds Average—The iMoneyNet Prime Institutional Funds Average is based on the average return of all funds in the iMoneyNet Prime Institutional Funds universe for the periods noted. Funds in the iMoneyNet Prime Institutional Funds Average primarily invest in a variety of taxable short-term corporate and bank debt securities.

| | |

| 10 | | Visit our website at pgim.com/investments |

Fees and Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended July 31, 2022. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

| | | | |

Prudential Investment Portfolios 2 | | | 11 | |

Fees and Expenses (continued)

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | | |

PGIM Core Short-Term

Bond Fund | | Beginning

Account Value

February 1, 2022 | | Ending Account Value

July 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | |

| Actual | | $1,000.00 | | $ 999.70 | | 0.04% | | $0.20 |

| Hypothetical | | $1,000.00 | | $1,024.60 | | 0.04% | | $0.20 |

| | | | | | | | |

| | | | |

PGIM Core Ultra Short

Bond Fund | | Beginning

Account Value

February 1, 2022 | | Ending Account Value

July 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | |

| Actual | | $1,000.00 | | $1,003.90 | | 0.01% | | $0.05 |

| Hypothetical | | $1,000.00 | | $1,024.74 | | 0.01% | | $0.05 |

| | | | | | | | |

| | | | |

PGIM Institutional

Money Market Fund | | Beginning

Account Value

February 1, 2022 | | Ending Account Value

July 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | |

| Actual | | $1,000.00 | | $1,003.40 | | 0.07% | | $0.35 |

| Hypothetical | | $1,000.00 | | $1,024.45 | | 0.07% | | $0.35 |

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended July 31, 2022, and divided by the 365 days in the Fund’s fiscal year ending January 31, 2023 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 12 | | Visit our website at pgim.com/investments |

Glossary

The following abbreviations are used in the Funds’ descriptions:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

A—Annual payment frequency for swaps

ABS—Asset-Backed Security

BSBY—Bloomberg Short-Term Bank Yield Index

FFCSB—Federal Farm Credit System Bank

FHLB—Federal Home Loan Bank

FHLMC—Federal Home Loan Mortgage Corporation

FNMA—Federal National Mortgage Association

GMTN—Global Medium Term Note

GNMA—Government National Mortgage Association

LIBOR—London Interbank Offered Rate

LP—Limited Partnership

MASTR—Morgan Stanley Structured Asset Security

MTN—Medium Term Note

OTC—Over-the-counter

Q—Quarterly payment frequency for swaps

REITs—Real Estate Investment Trust

S—Semiannual payment frequency for swaps

SOFR—Secured Overnight Financing Rate

TVA—Tennessee Valley Authority

USOIS—United States Overnight Index Swap

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 64.0% | | | | | | | | | | | | |

| | |

| ASSET-BACKED SECURITIES 2.4% | | | | | | |

| | | | |

| Automobiles 0.3% | | | | | | | | | | |

Ally Auto Receivables Trust, | | | | | | | | | | | | |

Series 2019-02, Class A3 | | 2.230% | | 01/16/24 | | | 339 | | | $ | 338,313 | |

CarMax Auto Owner Trust, | | | | | | | | | | | | |

Series 2019-02, Class A3 | | 2.680 | | 03/15/24 | | | 515 | | | | 514,590 | |

Series 2020-04, Class A3 | | 0.500 | | 08/15/25 | | | 2,260 | | | | 2,204,260 | |

Fifth Third Auto Trust, | | | | | | | | | | | | |

Series 2019-01, Class A3 | | 2.640 | | 12/15/23 | | | 21 | | | | 21,344 | |

Ford Credit Floorplan Master Owner Trust, | | | | | | | | | | | | |

Series 2019-03, Class A1 | | 2.230 | | 09/15/24 | | | 3,800 | | | | 3,796,919 | |

Honda Auto Receivables Owner Trust, | | | | | | | | | | | | |

Series 2019-02, Class A3 | | 2.520 | | 06/21/23 | | | 113 | | | | 113,250 | |

Santander Retail Auto Lease Trust, | | | | | | | | | | | | |

Series 2020-B, Class A2, 144A | | 0.420 | | 11/20/23 | | | 1,550 | | | | 1,545,003 | |

World Omni Auto Receivables Trust, | | | | | | | | | | | | |

Series 2018-D, Class A3 | | 3.330 | | 04/15/24 | | | 420 | | | | 419,958 | |

Series 2019-A, Class A3 | | 3.040 | | 05/15/24 | | | 157 | | | | 157,104 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 9,110,741 | |

| | | | |

| Credit Cards 1.2% | | | | | | | | | | |

American Express Credit Account Master Trust, | | | | | | | | | | | | |

Series 2019-03, Class A | | 2.000 | | 04/15/25 | | | 14,800 | | | | 14,791,173 | |

BA Credit Card Trust, | | | | | | | | | | | | |

Series 2019-A01, Class A1 | | 1.740 | | 01/15/25 | | | 16,600 | | | | 16,592,791 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 31,383,964 | |

| | | | |

| Home Equity Loans 0.7% | | | | | | | | | | |

Accredited Mortgage Loan Trust, | | | | | | | | | | | | |

Series 2004-04, Class A2D, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.700%) | | 2.959(c) | | 01/25/35 | | | 784 | | | | 753,631 | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | |

Series 2003-11, Class AV2, 1 Month LIBOR + 0.740% (Cap N/A, Floor 0.740%) | | 2.999(c) | | 12/25/33 | | | 166 | | | | 156,739 | |

Argent Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | |

Series 2003-W03, Class M2, 1 Month LIBOR + 2.700% (Cap N/A, Floor 2.700%) | | 4.959(c) | | 09/25/33 | | | 4,541 | | | | 4,443,841 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | |

| ASSET-BACKED SECURITIES (Continued) | | | | | | | |

| | | | |

| Home Equity Loans (cont’d.) | | | | | | | | | | | |

Asset-Backed Funding Certificate Trust, | | | | | | | | | | | | | | |

Series 2003-AHL01, Class A1 | | 4.184%(cc) | | | 03/25/33 | | | | 140 | | | $ | 135,247 | |

Series 2003-OPT01, Class A3, 1 Month LIBOR + 0.680% (Cap N/A, Floor 0.680%) | | 2.939(c) | | | 04/25/33 | | | | 576 | | | | 533,182 | |

Series 2004-HE01, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 3.159(c) | | | 03/25/34 | | | | 325 | | | | 313,774 | |

Asset-Backed Securities Corp. Home Equity Loan Trust, | | | | | | | | | | | | | | |

Series 2003-HE06, Class A2, 1 Month LIBOR + 0.680% (Cap N/A, Floor 0.680%) | | 2.939(c) | | | 11/25/33 | | | | 161 | | | | 158,915 | |

Bear Stearns Asset-Backed Securities Trust, | | | | | | | | | | | | | | |

Series 2003-03, Class M1, 1 Month LIBOR + 1.230% (Cap 11.000%, Floor 1.230%) | | 3.489(c) | | | 06/25/43 | | | | 175 | | | | 174,873 | |

CDC Mortgage Capital Trust, | | | | | | | | | | | | | | |

Series 2003-HE03, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 3.309(c) | | | 11/25/33 | | | | 809 | | | | 788,663 | |

Equifirst Mortgage Loan Trust, | | | | | | | | | | | | | | |

Series 2003-01, Class M2, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | 5.109(c) | | | 12/25/32 | | | | 16 | | | | 16,418 | |

Home Equity Asset Trust, | | | | | | | | | | | | | | |

Series 2002-03, Class M1, 1 Month LIBOR + 1.350% (Cap N/A, Floor 1.350%) | | 3.609(c) | | | 02/25/33 | | | | 270 | | | | 262,701 | |

Series 2003-02, Class M1, 1 Month LIBOR + 1.320% (Cap N/A, Floor 1.320%) | | 3.579(c) | | | 08/25/33 | | | | 597 | | | | 577,275 | |

Series 2003-03, Class M1, 1 Month LIBOR + 1.290% (Cap N/A, Floor 1.290%) | | 3.549(c) | | | 08/25/33 | | | | 499 | | | | 486,925 | |

Series 2003-08, Class M1, 1 Month LIBOR + 1.080% (Cap N/A, Floor 1.080%) | | 3.339(c) | | | 04/25/34 | | | | 203 | | | | 196,199 | |

MASTR Asset-Backed Securities Trust, | | | | | | | | | | | | | | |

Series 2004-OPT02, Class A2, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.700%) | | 2.959(c) | | | 09/25/34 | | | | 108 | | | | 101,458 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | | | |

Series 2004-HE02, Class A1A, 1 Month LIBOR + 0.800% (Cap N/A, Floor 0.800%) | | 3.059(c) | | | 08/25/35 | | | | 45 | | | | 42,499 | |

Series 2004-HE02, Class M1, 1 Month LIBOR + 1.200% (Cap N/A, Floor 1.200%) | | 3.459(c) | | | 08/25/35 | | | | 149 | | | | 144,649 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | |

Series 2003-NC05, Class M1, 1 Month LIBOR + 1.275% (Cap N/A, Floor 1.275%) | | 3.534(c) | | | 04/25/33 | | | | 380 | | | | 376,870 | |

Series 2003-NC05, Class M3, 1 Month LIBOR + 3.450% (Cap N/A, Floor 3.450%) | | 5.709(c) | | | 04/25/33 | | | | 82 | | | | 81,520 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 15 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| ASSET-BACKED SECURITIES (Continued) | | | | | | |

| | | | |

| Home Equity Loans (cont’d.) | | | | | | | | | | |

Morgan Stanley ABS Capital I, Inc. Trust, (cont’d.) | | | | | | | | | | | | |

Series 2003-NC08, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 3.309%(c) | | 09/25/33 | | | 569 | | | $ | 555,583 | |

Series 2003-NC10, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 1.020%) | | 3.279(c) | | 10/25/33 | | | 94 | | | | 91,517 | |

Series 2004-HE07, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 3.159(c) | | 08/25/34 | | | 2,063 | | | | 1,970,119 | |

New Century Home Equity Loan Trust, | | | | | | | | | | | | |

Series 2004-01, Class M1, 1 Month LIBOR + 0.885% (Cap 11.500%, Floor 0.885%) | | 3.144(c) | | 05/25/34 | | | 2,239 | | | | 2,152,636 | |

Renaissance Home Equity Loan Trust, | | | | | | | | | | | | |

Series 2003-01, Class A, 1 Month LIBOR + 0.860% (Cap N/A, Floor 0.860%) | | 3.119(c) | | 06/25/33 | | | 229 | | | | 209,692 | |

Residential Asset Securities Trust, | | | | | | | | | | | | |

Series 2004-KS05, Class AI5 | | 4.502(cc) | | 06/25/34 | | | 2,833 | | | | 2,724,775 | |

Saxon Asset Securities Trust, | | | | | | | | | | | | |

Series 2003-03, Class M2, 1 Month LIBOR + 2.400% (Cap N/A, Floor 2.400%) | | 3.931(c) | | 12/25/33 | | | 17 | | | | 15,630 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 17,465,331 | |

| | | | |

| Residential Mortgage-Backed Securities 0.2% | | | | | | | | | | |

Ameriquest Mortgage Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | |

Series 2004-R05, Class M1, 1 Month LIBOR + 0.870% (Cap N/A, Floor 0.870%) | | 3.129(c) | | 07/25/34 | | | 180 | | | | 177,093 | |

Amortizing Residential Collateral Trust, | | | | | | | | | | | | |

Series 2002-BC05, Class M2, 1 Month LIBOR + 1.800% (Cap N/A, Floor 1.800%) | | 4.059(c) | | 07/25/32 | | | 65 | | | | 63,044 | |

Chase Funding Trust, | | | | | | | | | | | | |

Series 2002-02, Class 2A1, 1 Month LIBOR + 0.500% (Cap N/A, Floor 0.500%) | | 2.759(c) | | 05/25/32 | | | 216 | | | | 210,679 | |

Series 2003-01, Class 2A2, 1 Month LIBOR + 0.660% (Cap N/A, Floor 0.660%) | | 2.919(c) | | 11/25/32 | | | 158 | | | | 154,381 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | |

Series 2003-BC04, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 1.050%) | | 3.309(c) | | 07/25/33 | | | 93 | | | | 91,449 | |

Series 2004-01, Class M1, 1 Month LIBOR + 0.750% (Cap N/A, Floor 0.750%) | | 3.009(c) | | 03/25/34 | | | 73 | | | | 70,661 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| ASSET-BACKED SECURITIES (Continued) | | | | | | |

| | |

| Residential Mortgage-Backed Securities (cont’d.) | | | | | | |

Equity One Mortgage Pass-Through Trust, | | | | | | | | | | | | |

Series 2003-01, Class M1 | | 4.860%(cc) | | 08/25/33 | | | 25 | | | $ | 24,011 | |

First Franklin Mortgage Loan Trust, | | | | | | | | | | | | |

Series 2004-FF05, Class A1, 1 Month LIBOR + 0.720% (Cap N/A, Floor 0.720%) | | 2.979(c) | | 08/25/34 | | | 123 | | | | 119,329 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | |

Series 2003-03, Class M1, 1 Month LIBOR + 1.125% (Cap N/A, Floor 1.125%) | | 3.384(c) | | 07/25/33 | | | 529 | | | | 510,854 | |

Series 2003-04, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 1.020%) | | 3.279(c) | | 08/25/33 | | | 161 | | | | 159,426 | |

Series 2004-02, Class M1, 1 Month LIBOR + 0.795% (Cap N/A, Floor 0.795%) | | 3.054(c) | | 06/25/34 | | | 1,462 | | | | 1,392,945 | |

Series 2004-03, Class M1, 1 Month LIBOR + 0.855% (Cap N/A, Floor 0.855%) | | 3.114(c) | | 07/25/34 | | | 2,098 | | | | 1,995,282 | |

Merrill Lynch Mortgage Investors Trust, | | | | | | | | | | | | |

Series 2003-WMC02, Class M2, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | 5.109(c) | | 02/25/34 | | | 126 | | | | 124,693 | |

Series 2004-WMC01, Class M2, 1 Month LIBOR + 1.650% (Cap N/A, Floor 1.650%) | | 3.909(c) | | 10/25/34 | | | 466 | | | | 451,074 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | |

Series 2004-NC05, Class M1, 1 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | 3.159(c) | | 05/25/34 | | | 346 | | | | 323,460 | |

Structured Asset Investment Loan Trust, | | | | | | | | | | | | |

Series 2003-BC01, Class A2, 1 Month LIBOR + 0.680% (Cap N/A, Floor 0.680%) | | 2.939(c) | | 01/25/33 | | | 69 | | | | 67,253 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 5,935,634 | |

| | | | | | | | | | | | |

| | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $62,302,936) | | | | | | | | | | | 63,895,670 | |

| | | | | | | | | | | | |

| | | |

| CERTIFICATES OF DEPOSIT 2.2% | | | | | | | | |

Lloyds Bank Corporate Markets PLC (United Kingdom), SOFR + 0.540% | | 2.820(c) | | 01/31/24 | | | 17,000 | | | | 16,937,183 | |

Standard Chartered Bank (United Kingdom), SOFR + 0.420% | | 2.700(c) | | 07/28/23 | | | 16,000 | | | | 15,951,041 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 32,888,224 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 17 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CERTIFICATES OF DEPOSIT (Continued) | | | | | | |

Skandinaviska Enskilda Banken AB (Sweden), SOFR + 0.730% | | 3.010%(c) | | 03/17/23 | | | 10,000 | | | $ | 10,007,818 | |

Svenska Handelsbanken (Sweden), SOFR + 0.700% | | 2.980(c) | | 03/15/23 | | | 15,000 | | | | 15,007,763 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 25,015,581 | |

| | | | | | | | | | | | |

| | | | |

TOTAL CERTIFICATES OF DEPOSIT

(cost $57,995,675) | | | | | | | | | | | 57,903,805 | |

| | | | | | | | | | | | |

| | | | |

| COMMERCIAL MORTGAGE-BACKED SECURITIES 10.7% | | | | | | | | | | |

Barclays Commercial Mortgage Securities Trust, | | | | | | | | | | | | |

Series 2018-TALL, Class A, 144A, 1 Month LIBOR + 0.722% (Cap N/A, Floor 0.722%) | | 2.721(c) | | 03/15/37 | | | 22,479 | | | | 21,291,452 | |

Benchmark Mortgage Trust, | | | | | | | | | | | | |

Series 2018-B03, Class A2 | | 3.848 | | 04/10/51 | | | 957 | | | | 953,174 | |

Series 2018-B05, Class A2 | | 4.077 | | 07/15/51 | | | 1,800 | | | | 1,787,083 | |

BX Trust, | | | | | | | | | | | | |

Series 2018-EXCL, Class A, 144A, 1 Month LIBOR + 1.088% (Cap N/A, Floor 1.088%) | | 3.087(c) | | 09/15/37 | | | 4,994 | | | | 4,845,100 | |

CAMB Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2019-LIFE, Class A, 144A, 1 Month LIBOR + 1.070% (Cap N/A, Floor 1.070%) | | 3.069(c) | | 12/15/37 | | | 9,500 | | | | 9,367,083 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2014-GC25, Class A3 | | 3.372 | | 10/10/47 | | | 12,223 | | | | 12,003,744 | |

Series 2016-P04, Class A2 | | 2.450 | | 07/10/49 | | | 8,422 | | | | 8,265,194 | |

Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2014-UBS05, Class A2 | | 3.031 | | 09/10/47 | | | 347 | | | | 344,110 | |

Credit Suisse Mortgage Capital Certificates, | | | | | | | | | | | | |

Series 2019-ICE04, Class A, 144A, 1 Month LIBOR + 0.980% (Cap N/A, Floor 0.980%) | | 2.979(c) | | 05/15/36 | | | 35,000 | | | | 34,492,335 | |

CSAIL Commercial Mortgage Trust, | | | | | | | | | | | | |

Series 2015-C03, Class A4 | | 3.718 | | 08/15/48 | | | 12,000 | | | | 11,852,851 | |

GS Mortgage Securities Corp. Trust, | | | | | | | | | | | | |

Series 2021-RENT, Class A, 144A, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.700%) | | 2.862(c) | | 11/21/35 | | | 5,359 | | | | 5,228,188 | |

GS Mortgage Securities Trust, | | | | | | | | | | | | |

Series 2014-GC18, Class A3 | | 3.801 | | 01/10/47 | | | 5,981 | | | | 5,932,728 | |

Series 2014-GC22, Class A4 | | 3.587 | | 06/10/47 | | | 4,400 | | | | 4,358,863 | |

Series 2014-GC24, Class A4 | | 3.666 | | 09/10/47 | | | 5,853 | | | | 5,780,145 | |

Series 2018-HART, Class A, 144A, 1 Month LIBOR + 1.090% (Cap N/A, Floor 1.090%) | | 3.090(c) | | 10/15/31 | | | 11,300 | | | | 11,030,118 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | | Principal

Amount

(000)# | | | Value | |

| | |

| COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2013-C15, Class ASB | | 3.659% | | | 11/15/45 | | | | 293 | | | $ | 292,550 | |

Series 2014-C18, Class A4A2, 144A | | 3.794 | | | 02/15/47 | | | | 6,600 | | | | 6,512,756 | |

Series 2014-C24, Class A3 | | 3.098 | | | 11/15/47 | | | | 19,500 | | | | 19,080,298 | |

Series 2014-C24, Class A4A2, 144A | | 3.373 | | | 11/15/47 | | | | 28,310 | | | | 27,802,056 | |

Series 2020-COR07, Class A2 | | 2.215 | | | 05/13/53 | | | | 25,000 | | | | 23,883,642 | |

JPMorgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | |

Series 2018-WPT, Class AFL, 144A, 1 Month LIBOR + 1.200% (Cap N/A, Floor 0.950%) | | 2.320(c) | | | 07/05/33 | | | | 19,358 | | | | 19,223,730 | |

Series 2019-BKWD, Class A, 144A, 1 Month LIBOR + 1.000% (Cap N/A, Floor 1.000%) | | 2.999(c) | | | 09/15/29 | | | | 3,959 | | | | 3,893,975 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | |

Series 2012-C06, Class A4 | | 2.858 | | | 11/15/45 | | | | 924 | | | | 922,454 | |

Series 2013-C07, Class A3 | | 2.655 | | | 02/15/46 | | | | 3,323 | | | | 3,300,003 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | |

Series 2018-H03, Class A2 | | 3.997 | | | 07/15/51 | | | | 1,180 | | | | 1,175,735 | |

One New York Plaza Trust, | | | | | | | | | | | | | | |

Series 2020-01NYP, Class A, 144A, 1 Month LIBOR + 0.950% (Cap N/A, Floor 0.950%) | | 2.949(c) | | | 01/15/36 | | | | 11,900 | | | | 11,429,017 | |

UBS Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2018-C08, Class A2 | | 3.713 | | | 02/15/51 | | | | 151 | | | | 150,123 | |

UBS-Barclays Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2012-C04, Class A5 | | 2.850 | | | 12/10/45 | | | | 6,693 | | | | 6,684,042 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | |

Series 2013-LC12, Class A4 | | 4.218(cc) | | | 07/15/46 | | | | 17,884 | | | | 17,837,360 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $290,031,766) | | | | | | | | | | | | | 279,719,909 | |

| | | | | | | | | | | | | | |

| | | | |

| CORPORATE BONDS 48.7% | | | | | | | | | | | |

| | | | |

| Agriculture 0.4% | | | | | | | | | | | |

Cargill, Inc., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 1.375 | | | 07/23/23 | | | | 3,000 | | | | 2,946,863 | |

Sr. Unsec’d. Notes, 144A | | 3.500 | | | 04/22/25 | | | | 6,750 | | | | 6,749,310 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | 9,696,173 | |

| | | | |

| Airlines 0.7% | | | | | | | | | | | |

Southwest Airlines Co., | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.750 | | | 05/04/23 | | | | 17,500 | | | | 17,626,795 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 19 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | | |

| Auto Manufacturers 3.4% | | | | | | | | | | |

American Honda Finance Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 0.750% | | 08/09/24 | | | 7,500 | | | $ | 7,133,734 | |

BMW US Capital LLC (Germany), | | | | | | | | | | | | |

Gtd. Notes, 144A, SOFR Index + 0.530% | | 2.578(c) | | 04/01/24 | | | 8,500 | | | | 8,439,414 | |

Gtd. Notes, 144A | | 3.250 | | 04/01/25 | | | 2,750 | | | | 2,726,775 | |

Gtd. Notes, 144A | | 3.800 | | 04/06/23 | | | 10,000 | | | | 10,024,194 | |

Mercedes-Benz Finance North America LLC (Germany), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 0.750 | | 03/01/24 | | | 31,500 | | | | 30,080,805 | |

Toyota Motor Credit Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 3.950 | | 06/30/25 | | | 18,750 | | | | 19,043,815 | |

Volkswagen Group of America Finance LLC (Germany), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 3.950 | | 06/06/25 | | | 13,250 | | | | 13,159,834 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 90,608,571 | |

| | | | |

| Banks 12.0% | | | | | | | | | | |

Bank of America Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month BSBY + 0.430% | | 1.938(c) | | 05/28/24 | | | 33,500 | | | | 32,894,326 | |

Bank of New York Mellon Corp. (The), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 1.950 | | 08/23/22 | | | 6,700 | | | | 6,698,406 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 1.050% | | 3.856(c) | | 10/30/23 | | | 1,927 | | | | 1,928,356 | |

Bank of Nova Scotia (The) (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.625 | | 05/01/23 | | | 14,000 | | | | 13,829,091 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.620% | | 2.716(c) | | 09/19/22 | | | 1,750 | | | | 1,749,807 | |

Banque Federative du Credit Mutuel SA (France), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.650 | | 02/27/24 | | | 17,750 | | | | 16,906,935 | |

Canadian Imperial Bank of Commerce (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR + 0.800% | | 2.749(c) | | 03/17/23 | | | 21,000 | | | | 20,959,856 | |

Commonwealth Bank of Australia (Australia), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN, 3 Month LIBOR + 0.680% | | 2.776(c) | | 09/18/22 | | | 250 | | | | 249,877 | |

Cooperatieve Rabobank UA (Netherlands), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR Index + 0.300% (Cap N/A, Floor 0.000%) | | 2.421(c) | | 01/12/24 | | | 14,000 | | | | 13,873,101 | |

Credit Agricole Corporate & Investment Bank SA (France), | | | | | | | | | | | | |

Bank Gtd. Notes, MTN | | 0.400 | | 01/15/23 | | | 8,200 | | | | 8,077,378 | |

Credit Suisse AG (Switzerland), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR Index + 0.390% | | 2.677(c) | | 02/02/24 | | | 7,500 | | | | 7,376,025 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | | |

| Banks (cont’d.) | | | | | | | | | | |

Fifth Third Bank NA, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 1.800% | | 01/30/23 | | | 7,000 | | | $ | 6,963,600 | |

Goldman Sachs Group, Inc. (The), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.627(ff) | | 11/17/23 | | | 20,000 | | | | 19,813,103 | |

JPMorgan Chase & Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.768(ff) | | 08/09/25 | | | 25,000 | | | | 23,351,942 | |

KeyBank NA, | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.250 | | 03/10/23 | | | 12,500 | | | | 12,353,944 | |

Morgan Stanley, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, GMTN | | 3.750 | | 02/25/23 | | | 10,000 | | | | 10,022,947 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 1.400% | | 4.183(c) | | 10/24/23 | | | 11,551 | | | | 11,553,709 | |

National Australia Bank Ltd. (Australia), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.500 | | 06/09/25 | | | 7,250 | | | | 7,243,136 | |

National Securities Clearing Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.400 | | 12/07/23 | | | 12,750 | | | | 12,266,514 | |

Sr. Unsec’d. Notes, 144A | | 1.200 | | 04/23/23 | | | 5,000 | | | | 4,928,938 | |

NatWest Markets PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, SOFR + 1.450% | | 3.402(c) | | 03/22/25 | | | 15,000 | | | | 15,011,132 | |

Royal Bank of Canada (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, GMTN | | 3.970 | | 07/26/24 | | | 20,000 | | | | 20,116,701 | |

Skandinaviska Enskilda Banken AB (Sweden), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.650 | | 09/09/24 | | | 9,750 | | | | 9,138,276 | |

Toronto-Dominion Bank (The) (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, SOFR + 0.350% | | 2.147(c) | | 09/10/24 | | | 20,000 | | | | 19,570,072 | |

Sr. Unsec’d. Notes, MTN, SOFR + 0.480% | | 2.742(c) | | 01/27/23 | | | 2,750 | | | | 2,746,235 | |

Truist Bank, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR + 0.730% (Cap N/A, Floor 0.000%) | | 2.511(c) | | 03/09/23 | | | 2,750 | | | | 2,746,804 | |

UBS AG (Switzerland), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A, MTN | | 0.450 | | 02/09/24 | | | 5,000 | | | | 4,766,463 | |

Sr. Unsec’d. Notes, 144A, MTN, SOFR + 0.360% | | 1.602(c) | | 02/09/24 | | | 7,500 | | | | 7,452,002 | |

Westpac Banking Corp. (Australia), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.720% | | 2.131(c) | | 05/15/23 | | | 175 | | | | 175,307 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 314,763,983 | |

| | | | |

| Beverages 1.8% | | | | | | | | | | |

Coca-Cola Europacific Partners PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.500 | | 05/05/23 | | | 8,000 | | | | 7,814,837 | |

Sr. Unsec’d. Notes, 144A | | 0.800 | | 05/03/24 | | | 3,000 | | | | 2,850,160 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 21 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | | |

| Beverages (cont’d.) | | | | | | | | | | |

Keurig Dr. Pepper, Inc., | | | | | | | | | | | | |

Gtd. Notes | | 0.750% | | 03/15/24 | | | 25,000 | | | $ | 23,920,831 | |

PepsiCo, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.400 | | 10/07/23 | | | 14,500 | | | | 14,078,045 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 48,663,873 | |

| | | | |

| Biotechnology 0.2% | | | | | | | | | | |

Gilead Sciences, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.750 | | 09/29/23 | | | 4,500 | | | | 4,372,269 | |

| | | | |

| Building Materials 0.1% | | | | | | | | | | |

Martin Marietta Materials, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.650 | | 07/15/23 | | | 3,750 | | | | 3,639,994 | |

| | | | |

| Chemicals 0.4% | | | | | | | | | | |

Air Liquide Finance SA (France), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 2.250 | | 09/27/23 | | | 2,780 | | | | 2,750,325 | |

Nutrien Ltd. (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.900 | | 05/13/23 | | | 5,000 | | | | 4,946,738 | |

Westlake Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.875 | | 08/15/24 | | | 4,000 | | | | 3,814,308 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 11,511,371 | |

| | | | |

| Computers 0.2% | | | | | | | | | | |

Apple, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.700 | | 09/11/22 | | | 5,000 | | | | 4,994,902 | |

| | | | |

| Cosmetics/Personal Care 0.9% | | | | | | | | | | |

GSK Consumer Healthcare Capital US LLC, | | | | | | | | | | | | |

Gtd. Notes, 144A, SOFR + 0.890% | | 2.877(c) | | 03/24/24 | | | 6,250 | | | | 6,223,385 | |

Procter & Gamble Co. (The), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.150 | | 08/11/22 | | | 6,499 | | | | 6,498,177 | |

Unilever Capital Corp. (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes | | 0.375 | | 09/14/23 | | | 10,000 | | | | 9,710,720 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 22,432,282 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | |

| Diversified Financial Services 2.8% | | | | | | | | |

AIG Global Funding, | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 0.650% | | 06/17/24 | | | 21,000 | | | $ | 19,894,592 | |

Air Lease Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.350% | | 2.179(c) | | 12/15/22 | | | 25,000 | | | | 24,948,312 | |

American Express Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.950 | | 08/01/25 | | | 10,000 | | | | 10,089,563 | |

Capital One Bank USA NA, | | | | | | | | | | | | |

Sub. Notes | | 3.375 | | 02/15/23 | | | 20,000 | | | | 19,989,725 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 74,922,192 | |

| | | | |

| Electric 5.1% | | | | | | | | | | |

American Electric Power Co., Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, Series A, 3 Month LIBOR + 0.480% | | 3.262(c) | | 11/01/23 | | | 12,000 | | | | 11,925,070 | |

CenterPoint Energy, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR Index + 0.650% | | 1.990(c) | | 05/13/24 | | | 13,500 | | | | 13,198,779 | |

DTE Energy Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.250 | | 11/01/22 | | | 27,000 | | | | 26,922,615 | |

Entergy Louisiana LLC, | | | | | | | | | | | | |

First Mortgage | | 0.620 | | 11/17/23 | | | 6,498 | | | | 6,284,615 | |

Florida Power & Light Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR Index + 0.250% | | 1.530(c) | | 05/10/23 | | | 11,250 | | | | 11,230,162 | |

NextEra Energy Capital Holdings, Inc., | | | | | | | | | | | | |

Gtd. Notes | | 2.940 | | 03/21/24 | | | 15,000 | | | | 14,865,549 | |

OGE Energy Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.703 | | 05/26/23 | | | 6,750 | | | | 6,590,885 | |

PPL Electric Utilities Corp., | | | | | | | | | | | | |

First Mortgage, SOFR + 0.330% | | 2.320(c) | | 06/24/24 | | | 4,750 | | | | 4,665,334 | |

First Mortgage | | 2.500 | | 09/01/22 | | | 9,000 | | | | 8,986,876 | |

Southern California Edison Co., | | | | | | | | | | | | |

First Mortgage, Series C | | 4.200 | | 06/01/25 | | | 14,250 | | | | 14,457,866 | |

WEC Energy Group, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.800 | | 03/15/24 | | | 17,000 | | | | 16,250,780 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 135,378,531 | |

| | | | |

| Entertainment 0.3% | | | | | | | | | | |

Magallanes, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A, SOFR Index + 1.780% | | 3.661(c) | | 03/15/24 | | | 7,500 | | | | 7,473,076 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 23 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | |

| Foods 0.6% | | | | | | | | |

Hormel Foods Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.650% | | 06/03/24 | | | 6,000 | | | $ | 5,740,581 | |

Nestle Holdings, Inc., | | | | | | | | | | | | |

Gtd. Notes, 144A | | 0.375 | | 01/15/24 | | | 10,000 | | | | 9,607,870 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 15,348,451 | |

| | | | |

| Forest Products & Paper 0.5% | | | | | | | | | | |

Georgia-Pacific LLC, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 3.734 | | 07/15/23 | | | 14,126 | | | | 14,135,903 | |

| | | | |

| Gas 0.5% | | | | | | | | | | |

Atmos Energy Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.380% | | 2.070(c) | | 03/09/23 | | | 12,000 | | | | 11,972,909 | |

| | | | |

| Healthcare-Products 1.1% | | | | | | | | | | |

Baxter International, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.868 | | 12/01/23 | | | 19,237 | | | | 18,555,866 | |

Stryker Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.600 | | 12/01/23 | | | 4,750 | | | | 4,578,423 | |

Thermo Fisher Scientific, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR Index + 0.530% | | 2.702(c) | | 10/18/24 | | | 5,000 | | | | 4,908,026 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 28,042,315 | |

| | | | |

| Healthcare-Services 0.4% | | | | | | | | | | |

UnitedHealth Group, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.550 | | 05/15/24 | | | 12,000 | | | | 11,494,312 | |

| | | | |

| Household Products/Wares 0.4% | | | | | | | | | | |

Avery Dennison Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.850 | | 08/15/24 | | | 12,000 | | | | 11,320,165 | |

| | | | |

| Insurance 3.8% | | | | | | | | | | |

Berkshire Hathaway, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.750 | | 03/15/23 | | | 13,000 | | | | 12,970,340 | |

Equitable Financial Life Global Funding, | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 0.800 | | 08/12/24 | | | 3,000 | | | | 2,811,694 | |

Sec’d. Notes, 144A, SOFR + 0.390% | | 2.489(c) | | 04/06/23 | | | 25,000 | | | | 24,885,652 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | |

| CORPORATE BONDS (Continued) | | | | | | |

| | | |

| Insurance (cont’d.) | | | | | | | | |

New York Life Global Funding, | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 2.900% | | 01/17/24 | | | 2,000 | | | $ | 1,985,532 | |

Pacific Life Global Funding II, | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | 0.500 | | 09/23/23 | | | 12,000 | | | | 11,619,610 | |

Principal Life Global Funding II, | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 0.500 | | 01/08/24 | | | 17,750 | | | | 16,992,636 | |

Sec’d. Notes, 144A, SOFR + 0.450% | | 2.571(c) | | 04/12/24 | | | 2,750 | | | | 2,738,568 | |

Protective Life Global Funding, | | | | | | | | | | | | |

Sec’d. Notes, 144A | | 0.631 | | 10/13/23 | | | 10,750 | | | | 10,409,210 | |

Sr. Sec’d. Notes, 144A | | 0.473 | | 01/12/24 | | | 15,000 | | | | 14,323,359 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 98,736,601 | |

| | | | |

| Iron/Steel 0.3% | | | | | | | | | | |

Nucor Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.950 | | 05/23/25 | | | 8,000 | | | | 8,098,953 | |

| | | | |

| Machinery-Construction & Mining 0.6% | | | | | | | | | | |

Caterpillar Financial Services Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN | | 0.450 | | 09/14/23 | | | 15,000 | | | | 14,597,202 | |

| | | | |

| Machinery-Diversified 0.4% | | | | | | | | | | |

CNH Industrial Capital LLC, | | | | | | | | | | | | |

Gtd. Notes | | 3.950 | | 05/23/25 | | | 11,000 | | | | 10,975,445 | |

| | | | |

| Media 0.3% | | | | | | | | | | |

Walt Disney Co. (The), | | | | | | | | | | | | |

Gtd. Notes, 3 Month LIBOR + 0.390% | | 1.970(c) | | 09/01/22 | | | 8,000 | | | | 7,996,043 | |

| | | | |

| Oil & Gas 1.6% | | | | | | | | | | |

Exxon Mobil Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.571 | | 04/15/23 | | | 21,000 | | | | 20,799,836 | |

Phillips 66, | | | | | | | | | | | | |

Gtd. Notes | | 0.900 | | 02/15/24 | | | 16,000 | | | | 15,397,320 | |

Pioneer Natural Resources Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.550 | | 05/15/23 | | | 6,750 | | | | 6,596,199 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 42,793,355 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 25 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

| CORPORATE BONDS (Continued) | | | | | | | | | | |

| | | | |

| Pharmaceuticals 2.8% | | | | | | | | | | |

AbbVie, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.650% | | 2.155%(c) | | 11/21/22 | | | 4,000 | | | $ | 3,994,785 | |

AmerisourceBergen Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.737 | | 03/15/23 | | | 17,810 | | | | 17,490,991 | |

Astrazeneca Finance LLC (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes | | 0.700 | | 05/28/24 | | | 21,500 | | | | 20,502,633 | |

Bristol-Myers Squibb Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.537 | | 11/13/23 | | | 20,000 | | | | 19,408,745 | |

GlaxoSmithKline Capital PLC (United Kingdom), | | | | | | | | | | | | |

Gtd. Notes | | 0.534 | | 10/01/23 | | | 13,500 | | | | 13,115,779 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 74,512,933 | |

| | | | |

| Pipelines 0.9% | | | | | | | | | | |

Enterprise Products Operating LLC, | | | | | | | | | | | | |

Gtd. Notes | | 3.900 | | 02/15/24 | | | 4,376 | | | | 4,389,839 | |

Southern Natural Gas Co. LLC, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.625 | | 04/28/23 | | | 4,250 | | | | 4,126,845 | |

TransCanada PipeLines Ltd. (Canada), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.000 | | 10/12/24 | | | 8,000 | | | | 7,517,915 | |

Sr. Unsec’d. Notes | | 2.500 | | 08/01/22 | | | 7,000 | | | | 6,999,943 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 23,034,542 | |

| | | | |

| Real Estate Investment Trusts (REITs) 0.8% | | | | | | | | | | |

Public Storage, | | | | | | | | | | | | |

Sr. Unsec’d. Notes, SOFR + 0.470% | | 2.699(c) | | 04/23/24 | | | 20,000 | | | | 19,877,921 | |

| | | | |

| Retail 0.6% | | | | | | | | | | |

7-Eleven, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.625 | | 02/10/23 | | | 5,000 | | | | 4,922,097 | |

Sr. Unsec’d. Notes, 144A | | 0.800 | | 02/10/24 | | | 7,000 | | | | 6,690,030 | |

Home Depot, Inc. (The), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.700 | | 04/15/25 | | | 5,000 | | | | 4,946,835 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 16,558,962 | |

| | | | |

| Savings & Loans 0.9% | | | | | | | | | | |

Nationwide Building Society (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 0.550 | | 01/22/24 | | | 25,000 | | | | 23,899,080 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

| CORPORATE BONDS (Continued) | | | | | | | | | | |

| | | | |

| Semiconductors 1.0% | | | | | | | | | | |

Microchip Technology, Inc., | | | | | | | | | | | | |

Sr. Sec’d. Notes | | 0.972% | | 02/15/24 | | | 28,500 | | | $ | 27,197,418 | |

| | | | |

| Software 0.6% | | | | | | | | | | |

Fidelity National Information Services, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.600 | | 03/01/24 | | | 14,250 | | | | 13,568,633 | |

Infor, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | 1.450 | | 07/15/23 | | | 1,800 | | | | 1,751,438 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 15,320,071 | |

| | | | |

| Telecommunications 2.1% | | | | | | | | | | |

NTT Finance Corp. (Japan), | | | | | | | | | | | | |

Gtd. Notes, 144A | | 0.583 | | 03/01/24 | | | 15,250 | | | | 14,548,936 | |

Sr. Unsec’d. Notes, 144A | | 4.142 | | 07/26/24 | | | 2,000 | | | | 2,019,126 | |

Verizon Communications, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 0.750 | | 03/22/24 | | | 12,000 | | | | 11,544,946 | |

Sr. Unsec’d. Notes, SOFR Index + 0.500% | | 2.452(c) | | 03/22/24 | | | 23,000 | | | | 22,722,176 | |

Vodafone Group PLC (United Kingdom), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 2.500 | | 09/26/22 | | | 3,600 | | | | 3,597,041 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | 54,432,225 | |

| | | | |

| Transportation 0.2% | | | | | | | | | | |

United Parcel Service, Inc., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.450% | | 2.727(c) | | 04/01/23 | | | 5,144 | | | | 5,139,469 | |

| | | | | | | | | | | | |

| | | | |

TOTAL CORPORATE BONDS

(cost $1,306,350,415) | | | | | | | | | | | 1,281,568,287 | |

| | | | | | | | | | | | |

| | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $1,716,680,792) | | | | | | | | | | | 1,683,087,671 | |

| | | | | | | | | | | | |

| | | | |

| SHORT-TERM INVESTMENTS 35.9% | | | | | | | | | | |

| | | | |

| CERTIFICATES OF DEPOSIT 3.6% | | | | | | | | | | |

BNP Paribas SA(France), SOFR + 0.510% | | 2.790(c) | | 09/21/22 | | | 6,500 | | | | 6,501,675 | |

Credit Agricole Corporate & Investment Bank | | 2.380 | | 09/22/22 | | | 22,000 | | | | 21,995,089 | |

Mitsubishi UFJ Trust & Banking Corp.(Japan) | | 1.830 | | 08/02/22 | | | 15,000 | | | | 14,999,205 | |

Nordea Bank Abp(Finland), SOFR + 0.500% | | 2.780(c) | | 09/09/22 | | | 20,000 | | | | 20,005,382 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 27 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

| CERTIFICATES OF DEPOSIT (Continued) | | | | | | | | | | |

Sumitomo Mitsui Trust Bank Ltd.(Japan), SOFR + 0.340% | | 2.620%(c) | | 10/13/22 | | | 30,000 | | | $ | 29,998,020 | |

| | | | | | | | | | | | |

| | | | |

TOTAL CERTIFICATES OF DEPOSIT

(cost $93,500,000) | | | | | | | | | | | 93,499,371 | |

| | | | | | | | | | | | |

| | | | |

| COMMERCIAL PAPER 18.7% | | | | | | | | | | |

Alexandria Real Estate Equities, Inc.,

144A | | 2.252(n) | | 08/03/22 | | | 9,000 | | | | 8,997,029 | |

144A | | 2.502(n) | | 08/10/22 | | | 41,000 | | | | 40,967,269 | |

Alimentation Couche-Tard, Inc.,

144A | | 2.656(n) | | 08/18/22 | | | 10,000 | | | | 9,985,178 | |

144A | | 2.709(n) | | 09/01/22 | | | 15,000 | | | | 14,961,424 | |

BNP Paribas SA(France),

144A, SOFR + 0.420% | | 2.594(c) | | 12/07/22 | | | 20,000 | | | | 20,000,056 | |

Consolidated Edison, Inc.,

144A | | 2.115(n) | | 08/01/22 | | | 5,000 | | | | 4,998,950 | |

Enbridge, Inc.,

144A | | 2.308(n) | | 08/15/22 | | | 25,000 | | | | 24,967,594 | |

144A | | 2.583(n) | | 08/08/22 | | | 9,000 | | | | 8,993,155 | |

Enel Finance America LLC,

144A | | 1.805(n) | | 08/01/22 | | | 16,500 | | | | 16,496,534 | |

144A | | 2.654(n) | | 08/05/22 | | | 7,750 | | | | 7,746,157 | |

144A | | 3.370(n) | | 09/23/22 | | | 16,500 | | | | 16,428,441 | |

Federation Des Caisses Desjardins,

144A | | 2.414(n) | | 10/03/22 | | | 25,000 | | | | 24,880,375 | |

Glencore Funding LLC,

144A | | 2.204(n) | | 08/08/22 | | | 25,000 | | | | 24,982,438 | |

HCP, Inc.,

144A | | 2.259(n) | | 08/16/22 | | | 15,000 | | | | 14,980,290 | |

144A | | 2.308(n) | | 08/17/22 | | | 15,000 | | | | 14,979,163 | |

Hitachi America Capital Ltd.,

144A | | 2.591(n) | | 08/04/22 | | | 25,000 | | | | 24,989,650 | |

Kreditanstalt fuer Wiederaufbau,

144A | | 2.006(n) | | 08/16/22 | | | 26,000 | | | | 25,981,267 | |

Mitsubishi Corp.,

144A | | 1.823(n) | | 08/08/22 | | | 22,500 | | | | 22,485,475 | |

Nutrien Ltd.,

144A | | 2.156(n) | | 08/02/22 | | | 20,000 | | | | 19,994,291 | |

Ontario Teachers’ Finance Trust,

144A | | 3.151(n) | | 01/12/23 | | | 10,000 | | | | 9,847,056 | |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

| COMMERCIAL PAPER (Continued) | | | | | | | | | | |

Realty Income Corp.,

144A | | 2.258%(n) | | 08/12/22 | | | 6,000 | | | $ | 5,993,978 | |

Suncor Energy, Inc.,

144A | | 2.184(n) | | 08/10/22 | | | 18,500 | | | | 18,484,139 | |

Swedbank AB(Sweden), SOFR + 0.410% | | 2.602(c) | | 11/14/22 | | | 15,000 | | | | 15,000,433 | |

TotalEnergies Capital Canada Ltd.,

144A | | 2.052(n) | | 08/03/22 | | | 20,000 | | | | 19,993,536 | |

144A | | 2.103(n) | | 08/08/22 | | | 15,000 | | | | 14,990,150 | |

TransCanada PipeLines Ltd.,

144A | | 2.204(n) | | 08/09/22 | | | 5,000 | | | | 4,996,077 | |

144A | | 2.308(n) | | 08/16/22 | | | 5,000 | | | | 4,993,505 | |

Virginia Electric & Power Co. | | 2.034(n) | | 08/02/22 | | | 20,000 | | | | 19,994,667 | |

WEC Energy Group, Inc.,

144A | | 2.601(n) | | 08/02/22 | | | 8,000 | | | | 7,997,752 | |

Welltower, Inc.,

144A | | 2.103(n) | | 08/04/22 | | | 20,500 | | | | 20,491,311 | |

| | | | | | | | | | | | |

| | | | |

TOTAL COMMERCIAL PAPER

(cost $490,707,656) | | | | | | | | | | | 490,597,340 | |

| | | | | | | | | | | | |

| | | | |

| CORPORATE BONDS 2.1% | | | | | | | | | | |

| | | | |

| Aerospace & Defense 0.4% | | | | | | | | | | |

Boeing Co. (The), | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 1.167% | | 02/04/23 | | | 11,200 | | | | 11,055,561 | |

| | | | |

| Computers 0.6% | | | | | | | | | | |

Hewlett Packard Enterprise Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 4.400% | | 10/15/22 | | | 17,000 | | | | 17,007,662 | |

| | | | |

| Diversified Financial Services 0.4% | | | | | | | | | | |

American Express Co., | | | | | | | | | | | | |

Sr. Unsec’d. Notes | | 3.400% | | 02/27/23 | | | 11,000 | | | | 11,026,371 | |

| | | | |

| Electric 0.5% | | | | | | | | | | |

Southern California Edison Co., | | | | | | | | | | | | |

First Mortgage, Series D | | 3.400% | | 06/01/23 | | | 12,500 | | | | 12,454,246 | |

See Notes to Financial Statements.

| | | | |

Prudential Investment Portfolios 2 | | | 29 | |

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

| | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000)# | | | Value | |

| | | | |

| CORPORATE BONDS (Continued) | | | | | | | | | | |

| | | | |

| Machinery-Construction & Mining 0.2% | | | | | | | | | | |

Caterpillar Financial Services Corp., | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, SOFR + 0.150% | | 1.542%(c) | | 11/17/22 | | | 4,400 | | | $ | 4,392,963 | |

| | | | | | | | | | | | |

| | | | |

TOTAL CORPORATE BONDS

(cost $56,109,478) | | | | | | | | | | | 55,936,803 | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | Shares | | | | |

| UNAFFILIATED FUND 11.5% | | | | | | | | | | |

Dreyfus Government Cash Management (Institutional Shares)

(cost $303,222,716) | | | | | | | 303,222,716 | | | | 303,222,716 | |

| | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $943,539,850) | | | | | | | | | | | 943,256,230 | |

| | | | | | | | | | | | |

| | | | |

TOTAL INVESTMENTS 99.9%

(cost $2,660,220,642) | | | | | | | | | | | 2,626,343,901 | |

Other assets in excess of liabilities(z) 0.1% | | | | | | | | | | | 3,423,659 | |

| | | | | | | | | | | | |

| | | | |

NET ASSETS 100.0% | | | | | | | | | | $ | 2,629,767,560 | |

| | | | | | | | | | | | |

See the Glossary for a list of the abbreviation(s) used in the semiannual report.

| # | Principal or notional amount is shown in U.S. dollars unless otherwise stated. |

| (c) | Variable rate instrument. The interest rate shown reflects the rate in effect at July 31, 2022. |

| (cc) | Variable rate instrument. The rate shown is based on the latest available information as of July 31, 2022. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| (ff) | Variable rate security. Security may be issued at a fixed coupon rate, which converts to a variable rate at a specified date. Rate shown is the rate in effect as of period end. |

| (n) | Rate shown reflects yield to maturity at purchased date. |

| (z) | Includes net unrealized appreciation/(depreciation) and/or market value of the below holdings which are excluded from the Schedule of Investments: |

Interest rate swap agreements outstanding at July 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Notional

Amount

(000)# | | | Termination

Date | | | Fixed

Rate | | | Floating

Rate | | | Value at

Trade Date | | | Value at

July 31,

2022 | | | Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Centrally Cleared Interest Rate Swap Agreements: | | | | | |

| | 18,500 | | | | 08/22/22 | | | | 1.421%(S) | | | | 3 Month LIBOR(1)(Q) | | | $ | (17,603 | ) | | $ | (59,429 | ) | | $ | (41,826 | ) |

See Notes to Financial Statements.

PGIM Core Short-Term Bond Fund

Schedule of Investments (unaudited) (continued)

as of July 31, 2022

Interest rate swap agreements outstanding at July 31, 2022 (continued):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Notional

Amount

(000)# | | | Termination

Date | | | Fixed

Rate | | | Floating

Rate | | | Value at

Trade Date | | | Value at

July 31,

2022 | | | Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Centrally Cleared Interest Rate Swap Agreements (cont’d.): | | | | | |

| | 59,800 | | | | 09/03/22 | | | | 1.919%(S) | | | | 3 Month LIBOR(1)(Q) | | | $ | (586,731 | ) | | $ | (323,659 | ) | | $ | 263,072 | |

| | 15,000 | | | | 01/30/23 | | | | 1.467%(S) | | | | 3 Month LIBOR(1)(Q) | | | | — | | | | 77,599 | | | | 77,599 | |

| | 65,700 | | | | 05/11/23 | | | | 2.250%(A) | | | | 1 Day USOIS(1)(A) | | | | (3,959,253 | ) | | | 271,584 | | | | 4,230,837 | |

| | 100,000 | | | | 07/26/23 | | | | 0.192%(A) | | | | 1 Day USOIS(1)(A) | | | | — | | | | 2,842,981 | | | | 2,842,981 | |

| | 70,000 | | | | 11/26/23 | | | | 2.447%(A) | | |

| 1 Day

SOFR(1)(A) |

| | | — | | | | 352,982 | | | | 352,982 | |

| | 20,000 | | | | 12/01/23 | | | | 2.634%(A) | | |

| 1 Day

SOFR(1)(A) |

| | | — | | | | 21,485 | | | | 21,485 | |

| | 19,250 | | | | 02/04/24 | | | | 0.133%(A) | | |

| 1 Day

USOIS(1)(A) |

| | | 24,122 | | | | 875,629 | | | | 851,507 | |

| | 47,000 | | | | 03/01/24 | | | | 0.230%(A) | | |

| 1 Day

USOIS(1)(A) |

| | | 58,857 | | | | 2,127,202 | | | | 2,068,345 | |

| | 28,500 | | | | 03/01/24 | | | | 2.478%(A) | | |

| 1 Day

SOFR(1)(A) |

| | | — | | | | 146,779 | | | | 146,779 | |

| | 12,000 | | | | 03/15/24 | | | | 0.276%(A) | | |

| 1 Day

USOIS(1)(A) |

| | | — | | | | 543,288 | | | | 543,288 | |

| | 17,000 | | | | 03/18/24 | | | | 0.278%(A) | | |

| 1 Day

USOIS(1)(A) |

| | | — | | | | 772,253 | | | | 772,253 | |

| | 25,000 | | | | 03/31/24 | | | | 2.305%(A) | | |

| 1 Day

SOFR(1)(A) |

| | | 150,637 | | | | 139,023 | | | | (11,614 | ) |

| | 3,000 | | | | 04/26/24 | | | | 0.305%(A) | | |

| 1 Day

USOIS(1)(A) |

| | | — | | | | 141,499 | | | | 141,499 | |

| | 9,750 | | | | 05/11/24 | | | | 0.300%(A) | | |

| 1 Day

SOFR(1)(A) |

| | | (2,320 | ) | | | 463,027 | | | | 465,347 | |

| | 90,000 | | | | 05/11/24 | | | | 2.603%(A) | | |

| 1 Day

SOFR(1)(A) |

| | | (14,235 | ) | | | 192,943 | | | | 207,178 | |

| | 12,000 | | | | 05/20/24 | | | | 0.296%(A) | | |

| 1

Day USOIS(1)(A) |

| | | — | | | | 581,912 | | | | 581,912 | |

| | 21,000 | | | | 06/16/24 | | | | 0.304%(A) | | |

| 1 Day

USOIS(1)(A) |

| | | — | | | | 1,039,667 | | | | 1,039,667 | |

| | 25,000 | | | | 08/05/24 | | | | 0.261%(A) | | |

| 1 Day

SOFR(1)(A) |