Santander Securities Corporation has a deferred arrangement profit sharing plan under Section 1165 (e) of the Puerto Rico Code, which became effective January 1, 1997. Employees from Santander Securities Corporation and Santander Asset Management Corporation benefit from the Santander Securities Corporation’s profit sharing plan. Under this plan, Santander Securities Corporation makes contributions to match 50% of employees’ allowable contributions as defined under the Puerto Rico Code. In addition, the plan provides for Santander Securities Corporation to make contributions based on the compensation of eligible employees, as defined therein. Santander Securities Corporation’s contributions to the plan amounted to $557,071 for the matching and $326,016 for the profit sharing provision for the fiscal year ended December 31, 2006. Santander Securities Corporation’s contributions become 100% vested once the employee attains five years of service.

Santander Financial Services, Inc. also has its own defined contribution savings plan under Section 1165 (e) of the Puerto Rico Code for its employees. The Plan complies with ERISA and is qualified under the Puerto Rico Code. The employees of Santander Financial Services, Inc. are eligible to participate in the savings plan after completing six (6) months of service. There is no minimum age requirement to participate. Participating employees may contribute from 1% to 10% of their annual compensation or $8,000, whichever is lower. Under this plan, Santander Financial Services, Inc. makes contributions to match 50% of employees’ allowable contributions up to 6% of the employee’s total compensation. Santander Financial Services, Inc.’s contributions become 100% vested once the employee attains five years of service. Santander Financial Services, Inc.’s contributions to the savings plan for the fiscal year ended December 31, 2006 amounted to $105,501.

The Corporation offers to its NEOs and Expatriated NEOs certain perquisites under the Corporation’s policies and procedures and depending on the terms and conditions of the employment agreements with the NEOs or Expatriated NEOs, if any. These perquisites are offered as part of the Compensation Program as an additional incentive to fulfill the objectives of the Corporation. Following is a brief description of the perquisites offered by the Corporation to the NEOs and Expatriated NEOs.

The Corporation offers car allowance benefits to those executive officers who are not eligible to use company owned cars but whose responsibilities require performing a substantial part of his/her job outside the premises of the Corporation. The amount of the car allowance is determined by the Corporation’s Human Resources Department based on factors such as the position and responsibilities of each executive officer, and based on car allowance policies and procedures approved by the Board of Directors of the Corporation. The car allowance amount is payable in cash in equal monthly installments as part of the compensation package of the executive officer.

The Corporation approved a new Company Owned Car policy on January 17, 2007. Company owned cars are assigned to the President and CEO up to an amount determined by the Board of Directors of the Corporation from time to time and to the First Executive Vice President and Operating Officer and the Executive Vice Presidents up to $60,000. Company owned cars are assigned and may be used in accordance with the company owned car policies and procedures approved by the Board of Directors of the Corporation. Company owned cars are changed every four to five years, depending on the manufacturer’s warranty. The Corporation reimburses all expenses related to the company owned cars, including gasoline, insurance and maintenance.

Social club memberships are offered by the Corporation to its NEOs and Expatriated NEOs to encourage business relationships with existing or prospective customers. To be eligible for the club memberships, the Corporation will evaluate if the NEOs’ participation will increase the business value and if it is closely related with the performance

of the NEOs’ professional responsibilities. Club memberships are assigned and may be used in accordance with the club membership’s policies and procedures approved by the Board of Directors of the Corporation.

Expatriated NEOs’ Perquisites

Under the Expatriated NEOs Compensation Program, the Expatriated NEOs are entitled to certain perquisites such as housing, school payments, utilities, vacations, tax gross-ups and other related expenses. These perquisites are basically offered to compensate the Expatriated NEOs for the difference in the cost of living between his/her country of origin and Puerto Rico. The amount of the perquisites assigned to each Expatriated NEO will be based on the position held, responsibilities, cost of living and status before the transfer to Puerto Rico, and will be specified in the corresponding employment agreement with such Expatriated NEO.

G.Other Benefits

Key Executive Plan

The Key Executive Program was implemented in 1990 to secure the services of certain key officers. The design follows the established parameters of a BOLI Program or Bank Owned Life Insurance Plan, also known as the “Key Man” plan. This is a non-qualified plan and it is exempt from ERISA regulations. The Key Executive Program is currently frozen.

The Bank acquired life insurance policies with an accumulated cash value feature for ten officers (including one executive officer). The Bank is the owner and beneficiary of the policy’s proceeds at all times. If the employee terminates its employment with the Bank, the policy is redeemed for the accumulated cash values. In the event of death of any participant, the Bank receives full payment of the insurance coverage and pays the benefit to the participant’s beneficiaries. The balance will compensate the Bank for the loss of the executive and for the recuperation of premiums paid. The benefit is paid in ten years, drawing one-tenth from the cash value in order to maintain the life insurance policy active and to recuperate premiums paid. The accumulated cash values are reflected in the Bank’s balance sheet as part of its assets. The only executive officer that benefits from this Key Man Plan is Ms. Laura Vázquez, who is not a NEO.

The total future premium payment is approximately $300,000 on a declining balance of annual premium payments. The annual premium for the fiscal year ended December 31, 2006 was $18,358. The prospective premium for fiscal year 2007 is $18,358. The annual payments for the remaining years decline as the participant fulfills the total premium costs to maintain the cash values.

Report of the Compensation and Nomination Committee

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis for fiscal year 2006. Based on the review and discussions, the Compensation Committee recommended to the Board, and the Board has approved, that the Compensation Discussion and Analysis be included in the Corporation’s Proxy Statement for its 2007 Annual Meeting of Stockholders.

This report is submitted by the Compensation Committee.

Submitted by

| | Mr. Víctor Arbulu

Mr. Gonzalo de las Heras

Mr. Jesús M. Zabalza |

Employee Agreements, Termination of Employment and Change in Control Arrangements

José R. González, Carlos M. García, Fernando Cloppet, James Rodríguez, and Ingrid Schmidt have each entered into employment agreements.

On December 27, 2006, the Board of Directors of the Corporation approved the new employment agreements of José R. González, President and CEO, and Carlos M. García, Senior Executive Vice President and COO, of the Corporation. Both employment agreements were filed with the SEC.

Mr. González’ agreement with the Corporation, executed on December 29, 2006, is effective as of January 1, 2007 and expires on January 1, 2009. Under the terms of the agreement, Mr. González is entitled to receive an

21

annual base salary of $650,000 for 2007 and $700,000 for 2008, and incentive compensation in accordance with the Corporation’s Performance Bonus Plan, which is administered by the Compensation Committee. Upon termination of Mr. González’ employment, for other than just cause, Mr. González will be entitled to receive the greater of: (i) $1,250,000; or (ii) the gross salary pending to be received from the date of termination of the agreement to January 1, 2009. In the event that Mr. González’ agreement is not renewed or extended upon its expiration, Mr. González will be entitled to receive the amount of $1,250,000. Upon the occurrence of a change of control of the Corporation, which means any event whereby SCH reduces its ownership in the outstanding shares of the Corporation to less than 50%, and SCH does not provide Mr. González with employment in a similar position, Mr. González will be entitled to receive $1,250,000. Upon expiration of the agreement, Mr. González shall not provide similar services to the one he is now offering to any other company in the banking or securities industry in Puerto Rico for a period of twelve (12) months following the termination. Mr. González’ agreement also contains certain confidentiality provisions.

Mr. García’s agreement with the Corporation, executed on December 29, 2006, is effective as of January 1, 2007 and expires on January 1, 2009. Under the terms of the agreement, Mr. García is entitled to receive an annual base salary of $525,000 for 2007 and $550,000 for 2008, and incentive compensation in accordance with the Corporation’s Performance Bonus Plan, which is administered by the Compensation Committee. Upon termination of Mr. García’s employment, for other than just cause, Mr. García will be entitled to receive the greater of: (i) $1,000,000; or (ii) the gross salary pending to be received from the date of termination of the agreement to January 1, 2009. In the event that Mr. García’s agreement is not renewed or extended upon its expiration, Mr. García will be entitled to receive the amount of $1,000,000. Upon the occurrence of a change of control of the Corporation, which means any event whereby SCH reduces its ownership in the outstanding shares of the Corporation to less than 50%, and SCH does not provide Mr. García with employment in a similar position, Mr. García will be entitled to receive $1,000,000.00. Upon expiration of the agreement, Mr. García shall not provide professional services to any other company in the banking industry or that enter in competition with Santander Securities Corporation for a period of six (6) months. This non-competition clause of the agreement will not apply upon termination of the agreement as a result of a change in control. Mr. García’s agreement also contains certain confidentiality provisions.

On October 14, 2005, Mr. Cloppet entered into an employment agreement with the Corporation for a period of three years, under the Expatriated Program of SCH, America Division. The employment agreement entitles Mr. Cloppet to receive an annual salary of $225,000 and incentive compensation in accordance with the Corporation’s Performance Bonus Plan. Any increases to the minimum incentive compensation will be determined in accordance with the Performance Bonus Plan, which is administered by the Compensation Committee. Mr. Cloppet is a participant of the health, insurance and disability benefit plans established by the Bank. Mr. Cloppet is also entitled to use a corporate car, a corporate credit card and certain club memberships, all in accordance with human resources policies and procedures, and certain additional perquisites due to his relocation to Puerto Rico, such as housing, school, vacations, and related moving expenses.

On April 25, 2005, Santander Securities Corporation entered into an employment agreement with Mr. Rodríguez. Under the agreement, Mr. Rodríguez is entitled to receive an annual base salary to be determined on a yearly basis and an incentive compensation to be determined in accordance with the Performance Bonus Plan, which is administered by the Compensation Committee, based on the performance of Mr. Rodríguez and the net revenues of Santander Securities Corporation. Mr. Rodríguez is also a participant in the benefit plans established by the Bank and benefits of the Christmas Bonus. In addition, Mr. Rodríguez received a loan in the amount of $300,000 for a term of five (5) years, at an annual interest rate equal to the one-year LIBOR plus 200 basis points, to be paid down during the continuous employment of Mr. Rodríguez in an annual amount of $60,000.

On December 29, 2005, Ms. Schmidt entered into an employment agreement with the Corporation which entitles her to receive an annual base salary of $250,000 and an incentive compensation to be determined in accordance with the Performance Bonus Plan, which is administered by the Compensation Committee, based on the performance of Ms. Schmidt and the net revenues of Santander Mortgage Corporation. Ms. Schmidt will receive a minimum incentive compensation bonus in the amount of $200,000 with respect to 2006. In addition, Ms. Schmidt is entitled to receive an additional incentive bonus of $100,000 payable on or before January 31, 2007, if Santander Mortgage Corporation achieves certain pre-established targets. Ms. Schmidt is a participant in the benefit plans established by the Bank and benefits of the Christmas Bonus. Ms. Schmidt is also entitled to a car allowance and corporate credit card, all in accordance with human resources policies and procedures. If Ms. Schmidt’s employment is terminated by the Bank for other than cause, as defined in the agreement, Ms. Schmidt is entitled to receive the greater of: (i) $250,000; or

22

(ii) the indemnity provided in accordance with Puerto Rico Public Act Number 80 of May 30, 1976, as amended, or pursuant to a determination made by a federal or Commonwealth of Puerto Rico authority.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee operates pursuant to a Charter adopted by the Board of Directors of the Corporation. The Charter was reviewed and amended by the Audit Committee on July 21, 2006, to clarify and amend certain duties of the Audit Committee. A copy of the Audit Committee Charter approved on July 21, 2006 is attached as Exhibit A to this Proxy Statement and is available on our website atwww.santandernet.com.

The role of the Audit Committee is to assist the Corporation’s Board of Directors in its oversight of the Corporation’s financial reporting process and the Corporation’s internal and external audit processes. As set forth in the Charter, management of the Corporation is responsible for the preparation, presentation and integrity of the Corporation’s financial statements, and for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures designed to achieve compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm of the Corporation is responsible for auditing the Corporation’s financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America and the effectiveness of the Corporation’s internal controls over financial reporting. Moreover, as set forth in the Charter, the Audit Committee relies on and makes no independent verification of the financial and other information presented to it or representations made by management or the independent registered public accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles and policies, and internal controls and procedures, designed to achieve compliance with accounting standards and applicable laws and regulations.

In the performance of its oversight function, the Audit Committee has reviewed and discussed with management and the independent registered public accountants the audited financial statements of the Corporation for the fiscal year ended December 31, 2006, management’s assessment of the effectiveness of the Corporation’s internal controls and the independent registered public accounting firm’s report on internal controls over financial reporting. The Audit Committee has also discussed with the independent registered public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently modified or supplemented. The Audit Committee has obtained a report from the independent auditor that addresses certain matters related to quality, quality control, and independence, as required by the NYSE listing standards. Finally, the Audit Committee has received the written disclosures and the letter from D&T required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), as currently modified or supplemented, has considered whether the provision of non-audit services by the independent registered public accounting firm to the Corporation is compatible with maintaining their independence, and has discussed with the independent registered public accounting firm its independence from the Corporation and its management.

Based on the Audit Committee’s review of the audited financial statements, management’s assessment of the effectiveness of internal controls over financial reporting and the independent registered public accounting firm’s report thereon, and the discussions referred to above with management and the independent registered public accounting firm, and subject to the limitations on the role and responsibilities of the Audit Committee set forth in the Charter, the Audit Committee recommended to the Board of Directors that the Corporation’s audited financial statements be included in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2006 for filing with the SEC.

Submitted by:

| | Mr. Víctor Arbulu

Mr. Stephen A. Ferriss

Mr. Roberto H. Valentín | Director

Director

Director |

23

DISCLOSURE OF AUDIT FEES

The following is a description of the fees paid or accrued by the Corporation and its subsidiaries for the audits and other services provided by D&T for the fiscal years ended December 31, 2006 and 2005, respectively.

Audit Fees

The aggregate “Audit Fees” paid or accrued by the Corporation for professional services rendered by D&T in connection with the audits of the Corporation’s annual consolidated financial statements for the fiscal years ended December 31, 2006 and 2005, the attestation of management’s assessment of internal controls, as required by Section 404 of the Sarbanes-Oxley Act of 2002, as amended, as of December 31, 2006 and 2005, and for the reviews of the consolidated financial statements included in the Corporation’s quarterly report on Form 10-Q, were $2,098,343 and $1,349,200, respectively.

Audit-Related Fees

The aggregate fees billed by D&T to the Corporation for the years ended December 31, 2006 and 2005 for audit-related services were $38,775 and $68,100, respectively. These fees relate to consulting services performed in connection with financial accounting and reporting standards.

Tax Fees

D&T does not provide tax services to the Corporation.

All Other Fees

There are no other fees.

In considering the nature of the services provided by D&T, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with D&T and the Corporation’s management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as amended, as well as the provisions of the American Institute of Certified Public Accountants.

Pre-Approval Policy and Procedures

All auditing services and non-audit services must be pre-approved by the Audit Committee. Pre-approval is waived for non-audit services if: (1) the aggregate dollar value of such services does not exceed $10,000; (2) such services were not recognized by the Corporation at the time of the engagement to be non-audit services; and (3) such services are promptly brought to the attention of and approved by the Audit Committee prior to the completion of the audit. All audit and non-audit services were pre-approved by the Audit Committee. The Chairman must update the Audit Committee at the next regularly scheduled meeting of any services that were granted specific pre-approval.

24

TRANSACTIONS WITH RELATED PARTIES

The Audit Committee is responsible for the review, approval or ratification of transactions with related persons that are reportable under Item 404 of Regulation S-K of the Securities Exchange Act of 1934, as amended. The Audit Committee requires that any covered transactions under Item 404 shall be presented to the Audit Committee for consideration, including information related with the type of transaction and a brief description of it, the nature of the related person’s interest, the amount of the transaction, the amount of the related person’s interest and any other relevant information. The Audit Committee evaluates the information presented and determines whether the transaction is in the best interest of the Corporation. The Audit Committee’s policies and procedures for related party transactions are not in writing, but the proceedings are documented in the minutes of the Audit Committee meetings.

The Bank has entered into loan transactions with the Corporation’s directors and executive officers and the immediate family members of the directors and executive officers, and proposes to continue such transactions in the ordinary course of its business, on substantially the same terms, including interest rates and collateral, as those prevailing for comparable loan transactions with other persons not related to the Corporation. The extensions of credit have not involved and do not currently involve more than normal risks of collectibility or present other unfavorable features.

The Corporation and its subsidiaries have entered, in the ordinary course of business, into information technology services agreements and other related services with the following affiliates and subsidiaries of SCH, holder of 90.59% of the Corporation’s Common Stock: America Latina Tecnología de Chile, S.A. (“ALTEC Chile”), America Latina Tecnología de Mexico, S.A. (“ALTEC Mexico”), ALTEC Puerto Rico, a division of CREFISA, Inc. (“ALTEC Puerto Rico”), and Produban Servicios Informáticos Generales, S.L. (“Produban”). During fiscal year 2006, the Corporation and its subsidiaries made the following payments for services rendered during 2006 by the abovementioned companies: $3,888,244 to ALTEC Chile, $6,025,879 to ALTEC Mexico, $1,967,520 to ALTEC Puerto Rico, and $340,541 to Produban. All of the foregoing transactions are subject to usual trade terms and have been duly approved by the Audit Committee.

Other entities related with immediate family members of the directors or executive officers of the Corporation were engaged by the Corporation or its subsidiaries, in the ordinary course of business, to provide services to the Corporation or its subsidiaries during fiscal year 2006. The fees paid to each said entities during fiscal year 2006 did not exceed $120,000.

PROPOSAL TWO: INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders at the Meeting, the Audit Committee has appointed D&T to audit the Corporation’s consolidated financial statements for the fiscal year ending December 31, 2007, and management’s assessment of the effectiveness of internal controls over financial reporting as of December 31, 2007. D&T audited the Corporation’s consolidated financial statements for the fiscal years ended December 31, 2005 and 2006, and management’s assessment of the effectiveness of internal controls over financial reporting as of December 31, 2005 and 2006. Representatives of D&T will be present at the Meeting and have the opportunity to make a statement if they so desire, and will also be available to respond to appropriate questions.

If the stockholders do not ratify the appointment of D&T, the selection of our independent registered public accountants will be reconsidered by the Audit Committee.

The Board of Directors of the Corporation recommends that you voteFOR ratification of the appointment of D&T as the independent registered public accounting firm for the Corporation for the fiscal year ending December 31, 2007.

The vote of the holders of the majority of the total votes eligible to be cast at the Meeting is required for the approval of this Proposal.

25

PROPOSALS OF SECURITY HOLDERS TO BE PRESENTED AT THE

2008 ANNUAL MEETING OF STOCKHOLDERS

Stockholders’ proposals intended to be presented at the 2008 annual meeting of Stockholders must be received by the Secretary of the Corporation, at its principal executive offices, Santander BanCorp, 207 Ponce de León Avenue, San Juan, Puerto Rico, 00918, not later than November 23, 2007, for inclusion in the Corporation’s Proxy Statement and Form of Proxy relating to the 2008 annual meeting of Stockholders. If a Stockholder who otherwise desires to bring a proposal before the 2008 annual meeting of stockholders does not notify the Corporation of its intent to do so on or before February 8, 2008, then the proposal will be untimely and the proxies will be able to vote on the proposal at their discretion.

COMMUNICATION WITH DIRECTORS

The Corporation has established procedures for stockholders or other interested parties to communicate directly with the Board of Directors. Such parties may contact the Board of Directors by mail at: Santander BanCorp, Investor Relations, Attention: Mr. Gonzalo de las Heras, Chairman of the Board, P.O. Box 362589, San Juan, P.R. 00936-2589. All communications made by this means will be received by the Chairman of the Board.

CORPORATE GOVERNANCE GUIDELINES

The Corporation has adopted a Code of Business Conduct within the meaning of Item 406(b) of Regulation S-K of the Securities Exchange Act of 1934, as amended. This Code applies to the Directors, the President and CEO, the COO, the CAO, and other executive officers of the Corporation and its subsidiaries in order to achieve a conduct that reflects the Corporation’s ethical principles. The Corporation’s Code of Business Conduct was amended during fiscal year 2005 to expressly apply to the Directors of the Corporation, as required by the NYSE’s Corporate Governance Rule 303A.10. The Corporation has posted a copy of the Code of Business Conduct, as amended, on its website atwww.santandernet.com. The Corporation also adopted Corporate Governance Guidelines which are available on the Investor Relation website atwww.santandernet.com, as required by the NYSE’s Corporate Governance Rule 303A.09. Copies of the Code of Business Conduct and the Corporate Governance Guidelines may be obtained free of charge from the Corporation’s website at the abovementioned internet address.

26

ANNUAL REPORT AND OTHER MATTERS

Enclosed with this Proxy Statement is the Corporation’s Annual Report to Stockholders including the Annual Report on Form 10-K, the consolidated financial statements of the Corporation for the year ended December 31, 2006 and management’s assessment of the effectiveness of internal controls over financial reporting as of December 31, 2006 duly certified by D&T as the independent registered public accountants of the Corporation. Such Annual Report to Stockholders is not a part of these proxy solicitation materials.

To avoid delays in ballot taking and counting, and in order to assure that your Proxy is voted in accordance with your wishes, compliance with the following instructions is respectfully requested: upon signing a Proxy as attorney, executor, administrator, trustee, guardian, authorized officer of a corporation, or on behalf of a minor, please give full title; if shares are in the name of more than one record holder, all should sign.

Whether or not you plan to attend the Meeting, it is very important that your shares be represented and voted in the Meeting. Accordingly, you are urged to properly complete, sign, date and return your Proxy Card.

San Juan, Puerto Rico, April 24, 2007.

| By Order of the Board of Directors |

| |  |

| | Rafael Bonilla, Esq.

Secretary |

27

Exhibit A

AUDIT COMMITTEE CHARTER

PURPOSE

The Audit Committee of the Board of Directors (the “Committee”) of Santander Bancorp and its subsidiaries (collectively, the “Corporation”) shall represent and assist the full Board of Directors (the “Board”) in discharging its oversight responsibility regarding: (1) the Corporation’s accounting principles, financial reporting practices and policies, and system of internal control over financial reporting; (2) the integrity of the Corporation’s financial statements and the independent audit thereof; and (3) the Corporation’s compliance with legal and regulatory requirements. The Committee shall also evaluate the performance of the Corporation’s internal audit department (the “Internal Audit Department”) and the qualifications, independence and performance of the Corporation’s independent public accountants (“IPA”), and shall be directly responsible for the appointment, compensation and oversight of the work of the IPA.

The Committee shall also act as an overseer of: (a) the discharge by the Corporation’s management (“Management”) of its responsibility for the preparation, presentation and integrity of the Corporation’s financial statements, (b) Management’s responsibility for maintaining appropriate accounting and financial reporting principles and policies, and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations, (c) the Internal Audit Department’s responsibility for examining and evaluating the adequacy and effectiveness of the Corporation’s and its subsidiaries’ internal control systems to ensure (i) the reliability and integrity of information, (ii) compliance with the Corporation’s policies, plans and procedures, as well as laws and regulations, and (iii) the safekeeping of assets; and (d) the Corporation’s disclosure controls system and internal controls system, which Management and the Board have established, regarding finance, accounting, legal compliance and ethics.

The Committee shall cause to be prepared any report or other disclosure, including any report of the Committee, required by the rules of the Securities and Exchange Commission (“SEC”) to be included in the Corporation’s annual proxy statement or other periodic reports or disclosures.

The Committee shall establish procedures for and continually monitor: the receipt, retention and treatment of complaints received by or from employees and shareholders regarding accounting controls, auditing matters, or any other relevant matter that may result in damage or liability to the Corporation and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

AUTHORITY

The Committee shall have the resources and authority appropriate to discharge its responsibilities, including the authority to engage outside auditors for the annual audit, special audits, reviews and other procedures and, as appropriate, to obtain advice and assistance from special counsels and other experts or consultants without seeking approval of the full Board or Management.

1

The Corporation shall provide appropriate funding, as determined by the Committee, for compensation to the IPA and to any advisors that the Committee chooses to engage.

The Committee may request any officer or employee of the Corporation or the Corporation’s outside counsel or outside auditors to attend any meeting of the Committee or to meet with any members of, or consultants to, the Committee.

The Committee may determine whether to allow any internal or external attorneys to practice before the SEC on behalf of the Corporation. Should the Committee elect to do so, the Committee shall have the authority to: (a) verify or ascertain if such attorneys comply with the professional standards set forth by the SEC; and (b) verify or ascertain that the Corporation’s attorneys have reported evidence of material violations of securities law or breach of fiduciary duty or similar violation by the Corporation or any agent thereof to the chief legal counsel, the Corporation’s Chief Executive Officer (“CEO”) and the Committee (if necessary actions have not otherwise been taken).

COMPOSITION

The Committee shall be comprised only of three or more members of the Board who are independent directors. Each member shall not be an officer or employee of the Corporation, its subsidiaries or affiliates, and shall not have any relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The members of the Committee shall be financially literate.

At least one member of the Committee must be a “financial expert,” as such term is defined by the SEC pursuant to rules promulgated under Section 407 of the Sarbanes Oxley Act of 2002, as amended (the “SOA”). The members of the Committee shall satisfy the applicable requirements under the rules of the New York Stock Exchange and the SEC, as such requirements are interpreted by the full Board in its business judgment. The Corporation must disclose the name of the Committee’s financial expert and whether such expert is independent of Management.

The Board shall designate the members of the Committee and a chairperson of the Committee from among its members, who shall preside over the meetings of the Committee and shall inform the Board of the actions taken by the Committee. In the event of a vacancy or an absence in the Committee, the Board may designate any member of the Board as a substitute, provided such person complies with the requisites established herein.

MEETINGS

The Committee will meet at least once per month or more frequently if circumstances dictate to discuss the matters set forth in the Duties and Responsibilities section of this Charter. Members

2

of the Committee may participate in meetings of the Committee by means of a conference call or similar communications equipment whereby all persons participating in the meeting can converse with each other.

The Committee will designate a Secretary from among its members. The Secretary may delegate his (her) functions to any officer of the Corporation designated by the Secretary. The Secretary, or the person so designated, will notify the members of the Committee of the place, date and time of the meetings of the Committee on a timely basis, as well as prepare and submit the agenda, reports and documents required for each meeting of the Committee.

The Secretary or his (her) designee will prepare accurate minutes of each meeting of the Committee, indicating which members of the Committee were present and summarizing the decisions, recommendations and agreements reached. The Chairperson of the Committee will submit the minutes and the attachments considered necessary to the Board for their review and ratification.

The members of the Committee shall hold office from the time of designation until the next election of directors at the annual meeting of stockholders of the Corporation. The Board may, however, extend such period for any or all designated members who continue to meet the requirements for membership in the Committee.

A quorum shall consist of the majority of the members of the Committee. The decisions of the Committee shall be adopted by an affirmative vote of the majority of the members participating in the meeting in which the decision is considered. In the event of a tie, the matter will be submitted to the Board for its consideration at their next meeting and no action will be taken until the Board makes a decision on such matter.

As part of its efforts to foster open communication, the Committee should meet periodically with Management, the director of the internal auditing function and the IPA, in separate executive sessions, to discuss any matters that the Committee or each of these groups believe should be discussed privately. In addition, the Committee shall meet quarterly with the IPA and Management to discuss the annual audited financial statements and quarterly financial statements, including the Corporation’s disclosure contained therein under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”).

DUTIES AND RESPONSIBILITIES

In fulfilling their responsibilities hereunder, it is recognized that the members of the Committee are not employees of the Corporation. It is not the duty or responsibility of the Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures. Each member of the Committee shall be entitled to rely on: (i) the integrity of those persons and organizations within and outside the Corporation from which it receives information; (ii) the accuracy of the financial and other information provided to the Committee by such persons or organizations, absent actual knowledge to the contrary (which shall be promptly reported to the Board); and (iii) all representations made by Management as to any information technology, internal audit and other non-audit services provided by the IPA to the Corporation.

3

It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles (“GAAP”) and applicable rules and regulations. This is the responsibility of management and the IPA. Furthermore, while the Audit Committee is responsible for reviewing the Corporation’s policies and practices with respect to risk assessment and management, it is the responsibility of the CEO and senior management to determine the appropriate level of the Company’s exposure to risk.

The Committee will carry out the following responsibilities:

Financial Statements

• | Advise Management, the Internal Audit Department and the IPA that they are expected to provide to the Committee a timely analysis of significant financial reporting issues and practices. The Committee shall review these analyses with regard to: (a) the integrity of the Corporation’s financial statements, critical accounting policies and practices, alternative treatments of financial information within GAAP (including their ramifications and the methods preferred by the IPA); (b) Management’s responsibilities for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (c) assessment, as of the end of the most recent fiscal year of the Corporation, of the effectiveness of the internal control structure and procedures of the Corporation for financial reporting. |

• | Ascertain that Management has reviewed the MD&A to ensure information presented is consistent with the financial statements, related footnote disclosures and the accounting records of the Corporation. |

• | Discuss with Management and the IPA the audited financial statements, including their treatment of any transaction or group of transactions which, individually or in the aggregate, may have a material effect on the financial statements of the Corporation, or any transaction subject to the approval of the Corporation’s Investment Committee. |

• | Discuss significant changes to the Corporation’s accounting principles, policies, controls, procedures and practices proposed or contemplated by the IPA, the Internal Audit Department or Management. |

• | Review quarterly press releases and ascertain the absence of misleading information or omission of material facts prior to issuance. |

• | Review periodic reports (10Q, 10K, 8K, proxy, etc.). |

• | Discuss the schedule of unadjusted differences and Management’s actions with respect to such schedule and any other material written communication between the IPA and Management (including, but not limited to, management letters). |

4

Internal Control

• | Meet with the Corporation’s chief accounting officer (“CAO”) and chief operations officer (“COO”) at least twice per year. Establish a prohibition of cross hiring (e.g. any individual who was employed by an IPA and participated in an audit of the Corporation within the last 12 months cannot be hired as the CEO, CAO, COO or comptroller). Ensure that the CAO, COO and CEO certification process is adequate and appropriate to the needs and commercial complexity of the Corporation, and is comprehensively documented. Consider having an independent third party assess the process. Consider whether additional documentation is required for certification to be completed. Evaluate the current state of reporting on internal controls to evaluate whether any changes are necessary. |

Internal Audit

• | Review the appointment, replacement, reassignment or dismissal of the Director of the Internal Audit Department (the “DIA”). Advise the DIA that he or she is expected to provide to the Committee summaries of and, as appropriate, the significant reports to Management prepared by the Internal Audit Department and Management’s responses thereto. Instruct internal auditors that they (in conjunction with the IPA) are ultimately accountable to the Board through the Committee. |

• | Review activities, organizational structure and qualifications of the internal audit function. |

• | Annually, review and recommend changes (if any) to the Internal Audit Department’s charter. |

• | Periodically review with the DIA any significant difficulties, disagreements with Management or scope restrictions encountered in the course of the function’s work. |

• | Periodically review with the IPA the budget, staffing and responsibilities of the Internal Audit Department. |

External Audit

• | The IPA shall annually submit to the Committee a formal written statement delineating all relationships between the IPA and the Corporation (“Statement as to Independence”) addressing each non-audit service provided to the Corporation and the matters set forth in Independence Standards Board Standard No. 1. |

• | Pre-approve all audit and non-audit services performed by the IPA, and periodically (not less frequently than annually) review all audit and non-audit services performed for the Corporation by the IPA. The IPA shall annually submit to the Corporation a formal written statement of the fees billed for services rendered. The following categories shall be included: (i) the audit of the Corporation’s annual financial statements for the most recent fiscal year, and the reviews of the financial statements included in the Corporation’s Quarterly Reports on Form 10-Q for that fiscal year and services normally provided by the IPA in connection with statutory and regulatory filings; (ii) the provision of assurance and related services that are reasonably related to the performance of the audit or review of the Corporation’s financial statements for the most recent fiscal year, in the aggregate and by |

5

| each service; (iii) the provision of professional services rendered for tax compliance, tax advice and tax planning, but excluding those tax services relating to the audit, for the most recent fiscal year, in the aggregate and by each service; and (iv) all other services rendered by the IPA for the most recent fiscal year, in the aggregate and by each service. |

• | Require that Management provide a list of payments to be made to the IPA or any other accounting firm for services other than financial statement audits. With regard to such services, the Committee must prospectively and as part of the pre-approval process: (i) assess whether such services can be provided by the IPA, (ii) assess which “no conflict” suppliers can perform such services, and (iii) communicate to Management which services must be discontinued in compliance with the SOA. Information regarding fees paid to the IPA shall be segregated into four categories: Audit Fees, Audit Related Fees, Tax Fees, and all other fees. At least annually, the Committee shall also review all the Corporation’s payments to accounting firms other than the IPA for non-audit services. |

• | The Committee shall be directly responsible for the appointment, compensation and oversight of the work of the IPA. In this regard the Committee shall appoint, retain, compensate, evaluate and terminate, when appropriate, the IPA, which shall report directly to the Committee. |

• | Ensure that the IPA prepare and deliver annually a Statement as to Independence (it being understood that the IPA are responsible for the accuracy and completeness of such Statement). Discuss with the IPA any relationships or services disclosed in such Statement that may affect the objectivity and independence of the IPA, taking into consideration the opinion of Management and the Internal Audit Department. |

• | Consider, if applicable, whether the IPA’s provision of any non-audit services to the Corporation (including, without limitation, information technology consulting services relating to financial information systems design and implementation) is compatible with maintaining the independence of the IPA. |

• | Instruct the IPA that they are ultimately accountable to the Board through the Committee. |

• | Consider all reports or communications (and Management’s and/or the Internal Audit Department’s responses thereto) submitted to the Committee by the IPA required by or referred to in SAS 61 (Codification of Statements on Auditing Standards, AU Section 380), as the same may be modified or supplemented. |

• | Discuss restrictions on scope of the IPA’s activities or access to requested information. |

• | Discuss any significant matters arising from any audit, report or communication referred, whether raised by Management, the Internal Audit Department or the IPA, relating to the Corporation’s financial statements. |

• | Review the form of opinion the IPA propose to render to the Board and shareholders. |

6

• | Obtain from the IPA assurance that the audit was conducted in a manner consistent with Section 10A of the Securities Exchange Act of 1934, as amended, which sets forth certain procedures to be followed in any audit of financial statements required under the Securities Exchange Act of 1934. |

• | Confirm that the external auditor has registered with the Public Company Accounting Oversight Board (the “PCAOB”). Have the external auditor confirm, quarterly, that they are in compliance with the rules and regulations of, and are in good standing with the PCAOB. |

• | Document the policy of rotation of the lead audit partner every five years, or as required by applicable regulation, and ascertain that the engagement team has complied with this policy. |

• | Evaluate whether there is excessive or extravagant entertaining by Management of IPA or vice-versa. |

• | Set clear hiring policies, compliant with governing laws or regulations, for employees or former employees of the IPA. |

• | At least annually, obtain and review a report by the IPA describing: |

o | the IPA’s internal quality control procedures; |

o | any material issues raised by the most recent internal quality-control review, peer review, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the IPA, and any steps taken to deal with any such issues; and |

o | all relationships between the IPA and the Corporation. |

Ethical Compliance, Legal Compliance, and Risk Management

• | Review the Corporation’s code of ethics to determine compliance with SOA’s requirement relating to code of ethics for senior financial officers, and that all senior financial officers have acknowledged receipt and having read the code of ethics. |

• | Discuss with the Corporation’s General Counsel, or if required by the Committee with independent counsel of its selection, any significant legal matters that may have a material effect on the financial statements of the Corporation and the Corporation’s compliance policies, including material notices to or inquiries received from governmental agencies. |

• | Review Management’s monitoring of the Corporation’s compliance with the Corporation’s Code of Ethics, and ensure that Management has the proper review system in place to ensure that Corporation’s financial statements, reports and other financial information disseminated to governmental organizations and the public satisfy legal requirements. |

7

• | Review, with the Corporation’s counsel, legal compliance matters including corporate securities trading policies. |

• | Discuss policies with respect to risk assessment and risk management. Such discussions should include the Corporation’s major financial and accounting risk exposures and the steps Management has undertaken to control them. |

Reporting Responsibilities

• | Report its activities to the Board on a regular basis and make such recommendations with respect to the above and other matters, as the Committee may deem necessary or appropriate. |

• | Review this Charter at least annually and recommend to the Board any changes warranted by new laws and regulations or as the Committee deems appropriate. |

Other Responsibilities

• | Review, on a quarterly basis, transactions in the Corporation’s securities by the Corporation’s pension plans and by executives of the Corporation to ensure that none occurred during designated blackout periods. Ensure trustees are aware of blackout periods. |

• | Review, annually, the procedure for related party transactions and conflicts of interest (or potential conflicts of interest) to be reported to the Board. |

• | Review and approve, on a quarterly basis, all related party transactions for compliance with established policies and procedures. |

• | Review with the IPA, the Internal Audit Department and Management the extent to which changes or improvements in financial or accounting practices, as approved by the Committee, have been implemented. (This review should be conducted at an appropriate time subsequent to implementation of changes or improvements, as decided by the Committee.) |

• | Prepare the report that the SEC requires be included in the Corporation’s annual proxy statement. |

• | Work with Management to determine if current employee loan policies and procedures are in compliance with SOA. Adjust procedures as required to ascertain compliance with current regulations. |

• | Ensure that adequate insurance arrangements are in place for identified risks, in accordance with usual commercial practice. |

• | Review regular updates on accounting and corporate governance developments with an objective perspective of their impact to the Corporation and the Committee. |

8

• | Review the types of presentations made to analysts and rating agencies. |

• | Annually, perform a self-assessment relative to the Committee’s purpose, duties and responsibilities outlined herein. |

• | Perform any other activities consistent with this Charter, the Corporation’s by-laws and applicable law, as the Committee or the Board deems necessary or appropriate. |

This Charter may be amended by means of an express resolution of the Board.

This Charter will be effective immediately after its approval by the Board. The Secretary of the Board will certify it with his (her) signature and the corporate seal, indicating the date it was approved.

Approved by the Audit Committee Members and the Board of Directors

Revised as of July 21, 2006

9

SANTANDER BANCORP

This proxy is solicited on behalf of the Board of Directors.

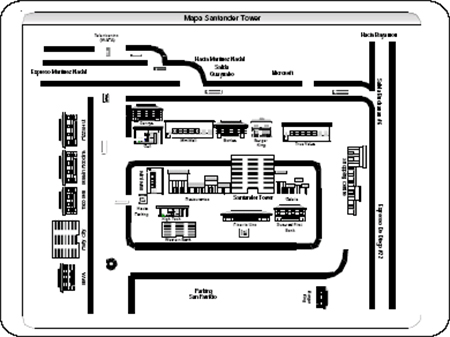

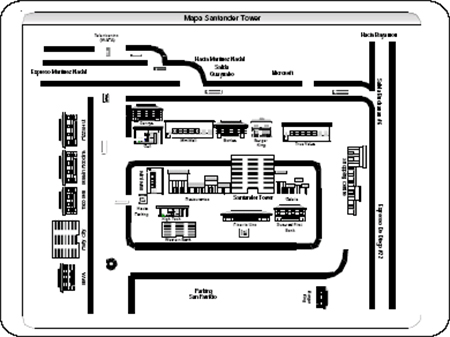

The undersigned hereby appoints any member of the Board of Directors as Proxy, each with the power to appoint his/her substitute, and authorizes them to represent and to vote as designated on the reverse side all the shares of common stock of Santander BanCorp held on record by the undersigned on April 5, 2007, at the Annual Meeting of Shareholders to be held at the Conference Room located at the parking level of Santander Tower, B7 Tabonuco St., Guaynabo, Puerto Rico.

|

(Continued on reverse side) |

| | |

| Address Change/Comments (Mark the corresponding box on the reverse side) |

| |

| |

| |

| |

| |

5 FOLD AND DETACH HERE 5

ANNUAL MEETING

OF

SANTANDER BANCORP

Thursday, May 24, 2007

10:00 a.m.

Guaynabo, Puerto Rico

PARKING FEES WILL BE PAID BY SANTANDER BANCORP.

| | | |

| Please

Mark Here

for Address

Change or

Comments | o | |

| SEE REVERSE SIDE | |

| | |

| 1. | To elect three (3) directors for a three-year term, ending on April 2010: |

| | |

| | Nominees: 01 Víctor Arbulu, 02 Stephen A. Ferriss, 03 María Calero. |

| | | | | |

| VOTE GRANTED

FOR all nominees | | VOTE WITHHELD

FOR all nominees | | VOTE GRANTED,

except for the

following nominee(s) |

| o | | o | | o |

(Insert in the space provided below the names of those nominees for whom you do not wish to vote) |

|

| | | | | | | | | | |

| | | | | | | | |

| | | | FOR | | AGAINST | | ABSTAIN | | |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the company’s independent accountants for fiscal year 2007; | | o | | o | | o | | |

| | | | | | | | | |

| | | | | | | | | | |

| 3. | AT THEIR DISCRETION, the proxies are authorized to vote upon such other business as may properly come before the meeting. This proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. IF NO DIRECTION IS MADE,

THIS PROXY WILL BE VOTED “FOR” ITEM 1 and 2. Please refer to instructions below. | | |

PLEASE SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN UNITED STATES, PUERTO RICO OR U.S. VIRGIN ISLANDS.

Please sign exactly as your name appears hereon. When shares are held by joint tenants or by tenants in common, each holder should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, the president or other authorized officer should sign under the full corporate name and the position of such authorized officer should appear below the signature. If a partnership, please sign in partnership name by authorized person.

5FOLD AND DETACH HERE5

|

ChooseMLinkSM for fast, easy and secure 24/7 online access to your future proxy materials, investment plan statements, tax documents and more. Simply log on toInvestor ServiceDirect® atwww.melloninvestor.com/isd where step-by-step instructions will prompt you through enrollment. |