evaluate if the NEOs’ participation will increase the business value and if it is closely related with the performance of the NEOs’ professional responsibilities. Club memberships are assigned and may be used in accordance with the club membership’s policies and procedures.

Under the Expatriated NEOs Compensation Program, the Expatriated NEOs are entitled to certain perquisites such as housing, school payments, utilities, vacations, tax gross-ups and other related expenses. These perquisites are basically offered to compensate the Expatriated NEOs for the difference in the cost of living between his/her country of origin and Puerto Rico. The amount of the perquisites assigned to each Expatriated NEO will be based on the position held, responsibilities, cost of living and status before the transfer to Puerto Rico, and will be specified in the corresponding employment agreement with such Expatriated NEO.

The following Summary Compensation Table provides information regarding reportable compensation for each of the Corporation’s NEOs.

Includes Christmas bonuses earned for the corresponding fiscal year.

Represents the dollar amount recognized for financial statement purposes pursuant to FAS 123R in connection with the I09 and I10 Plans.

Represents the dollar amount recognized for financial statement purposes under FAS 123R in connection with the I06 Plan. For fiscal year 2008 there was a reversal of expenses reported for years 2006 and 2007 due to BSSA stock price declines when the options were exercised.

The amounts included as non-equity incentive compensation correspond to performance bonuses earned for each fiscal year.

Includes changes in pension plan value for fiscal years 2006, 2007, and 2008. Does not include non-qualified deferred compensation earnings since the Corporation understands they are not above-market or preferential earnings.

Mr. González received salary compensation until August 28, 2008, on which date he resigned as President and CEO of the Corporation.

Mr. González will not receive shares under the I09 and I10 Plans.

(8)

Includes: $4,000 (Corporation’s contributions to the employees’ savings plan); $5,654 (health insurance premiums); $387 (disability insurance premiums); $990 (life insurance); $16,821 (estimated perquisite value for use of company car at 50% of company car depreciation, costs and expenses for 2008); $6,437 (estimated value for personal use of Club Memberships at 50% of memberships’ payments); $77,605 (compensation pursuant to consulting services agreement with the Corporation); and $2,250,000 (severance compensation of $1,250,000 agreed per employment contract and $1,000,000 additional severance compensation); and $100,827 (book value of company car transferred to Mr. González upon his termination).

(9)

Includes: $4,000 (Corporation’s contributions to the employees’ savings plan); $4,327 (health insurance premiums); $580 (disability insurance premiums); $1,485 (life insurance); $10,024 (estimated perquisite value for use of company car at 50% of company car depreciation, costs and expenses for 2007); $6,474 (estimated value for personal use of Club Memberships at 50% of memberships’ payments).

(10)

Includes: $4,000 (Company’s contributions to the employees’ savings plan); $5,506 (health insurance premiums); $594 (disability insurance premiums); $1,572 (life insurance); $18,040 (estimated perquisite value for use of company car at 50% of company car costs and expenses for 2006); $2,040 (estimated value for personal use of Club Memberships at 50% of memberships’ payments).

(11)

Santander Securities Corporation paid $233,625 of Mr. García’s total base salary and the remaining $322,625 was paid by the Bank.

(12)

The amount of $350,000 was paid by the Bank as a performance bonus for fiscal year 2008.

(13)

Includes: $4,000 (Santander Securities Corporation’s contributions to the employees’ savings plan); $9,000 (2008 Santander Securities Corporation’s profit sharing under Santander Securities Corporation’s deferred arrangement profit sharing plan); $5,654 (health insurance premiums); $580 (disability insurance premiums); $693 (life insurance); and the amount of $550,000 paid by Santander Overseas Bank upon Mr. García’s resignation as severance compensation for services rendered by Mr. García to BSSA and its affiliates other than the Bank and the Corporation. Mr. García participated in the employees saving plan of Santander Securities Corporation but did not participate in the employee savings plan offered by the Corporation.

(14)

Santander Securities Corporation paid $220,516 of Mr. García’s total base salary and the remaining $304,500 was paid by the Bank.

(15)

Includes: $4,000 (Santander Securities Corporation’s contributions to the employees’ savings plan);$9,000 (2007 Santander Securities Corporation’s profit sharing under Santander Securities Corporation’s deferred arrangement profit sharing plan); $4,327 (health insurance premiums); $580 (disability insurance premiums); $693 (life insurance). Mr. García participated in the employees saving plan and profit sharing plan of Santander Securities Corporation but did not participate in the employee savings plan offered by the Corporation.

(16)

Includes: $4,000 (Santander Securities Corporation’s contributions to the employees’ savings plan); $7,500 (2006 Santander Securities Corporation’s profit sharing under Santander Securities Corporation’s deferred arrangement profit sharing plan); $5,506 (health insurance premiums); $607 (disability insurance premiums); $735 (life insurance).

(17)

Mr. Moreno commenced as President and CEO on October, 2008. The amount of $143,077 was paid by the Bank and the amount of $106,564 was paid by BSSA (76,449.99 € converted at December 31, 2008 at the exchange rate of 1.3939). The amount paid by BSSA corresponds to the months of September to December 2008, including the period prior to his appointment as President and CEO of the Corporation and the Bank, during which Mr. Moreno acted as Director of the Corporation.

(18)

Includes: $8,008 (car allowance); $25,500 (rent); $96,394 (relocation costs); and $2,320 (estimated perquisite value for use of company car at 50% of company car costs and expenses for 2008); the following amounts paid by BSSA in Euros, converted at December 31, 2008 at the exchange rate of 1.3939: $663 (475.41 € health insurance); $781 (560.04 € BSSA employees pension plan); $48 (34.30 € life insurance); $1,403 (1,006.83€ car); $1,012 (726.37 € expenses and utilities); $10,913 (7,828.95 € housing assistance); and $626 (448.96 € social security); and the amount of $17,982 contributed by Banco Santander Serfin in Mexico under a defined contribution plan (245,873.40 MXN converted at December 31, 2008 at the exchange rate of 13.6733). The amounts paid by BSSA and Banco Santander Serfin correspond to the months of September to December 2008, including the period prior to his appointment as President and CEO of the Corporation and the Bank, during which Mr. Moreno acted as Director of the Corporation.

(19)

Represents the amount of base salary earned by Ms. Calero during fiscal year 2008, a portion of which was deferred pursuant to her Optional Deferred Compensation Benefit Agreement with the Bank. For information about the amount deferred by Ms. Calero, please see Ms. Calero’s Deferred Compensation Table under the “Optional Deferred Compensation Benefit” heading in the CD&A.

(20)

Includes: $2,283 (health insurance premiums); $424 (disability insurance premiums); $507 (life insurance).

(21)

Represents the amount of base salary earned by Ms. Calero during fiscal year 2007, a portion of which was deferred pursuant to her Optional Deferred Compensation Benefit Agreement with the Bank.

(22)

Includes: $1,747 (health insurance premiums); $580 (disability insurance premiums); $507 (life insurance).

(23)

Represents the amount of base salary earned by Ms. Calero during fiscal year 2006, a portion of which was deferred pursuant to her Optional Deferred Compensation Benefit Agreement with the Bank. The Summary Compensation Table for the 2006 Proxy Statement showed the amount paid to Ms. Calero net of the portion deferred during 2006. Pursuant to the new SEC rules, the 2006 base salary has been modified in this Summary Compensation Table to reflect the amount earned (including the amount deferred) instead of the amount received by Ms. Calero during fiscal year 2006.

(24)

Includes: $2,154 (health insurance premiums); $514 (disability insurance premiums); $418 (life insurance).

(25)

Mr. Jara’s assignment was effective December 1, 2008. The base salary corresponds to the month of December 2008.

(26)

Relocation bonus paid by the Bank.

(27)

The I09 and I10 Plans were granted to Mr. Jara directly by Banco Santander Chile, and the Corporation did not recognize any compensation expense in connection with such plans. The amount shown in this column represents the dollar amount that would have been recognized for financial statement purposes under FAS 123R in connection with the I09 and I10 Plans if granted by the Corporation.

(28)

Banco Santander Chile paid Mr. Jara a performance bonus of $120,000 for services rendered to Banco Santander Chile.

(29)

Includes: $15,000 (rent); $29,432 (travel expenses); $60,000 (installation expenses); $1,124 (vacations); $477 (health insurance); $502 (savings plan); and $1,144 (other benefits); and the following amount paid by BSSA: $3,997 (health insurance in the amount of 2,867.58 € and converted at the exchange rate of 1.3939 as of December 31, 2008).

(30)

Mr. Alvarez’s base salary was increased to $208,000, effective on January 1, 2008. The amount of $208,000 was paid by the Corporation and the amount of $25,087 was paid by BSSA (the amount paid was 17,997.95 €, converted at December 31, 2008 at the exchange rate of 1.3939).

(31)

Mr. Alvarez’s options were granted directly by BSSA and BSSA recognized the corresponding compensation expense in accordance with its accounting practices. Since the Corporation did not grant the options to Mr. Alvarez, the Corporation did not recognize any compensation expense in connection with such options. The amount shown for Mr. Alvarez in the "Option Award" column represents the dollar amount that would have been recognized for financial statement purposes under FAS 123R in connection with the I06 Plan if the options had been granted by the Corporation.

(32)

Includes: $580 (disability insurance premiums); $159,000 (tax gross-ups); and the following perquisites: Housing - $72,000; School payments - $2,893; Utilities - $8,298; Currency changes - $28,141; Car Allowance - $18,000 ; Vacations - $24,222; Expenses: $1,367; $2,541 (estimated value for personal use of Club Memberships at 50% of memberships’ payments); and the following amounts paid by BSSA in Euros, converted at December 31, 2008 at the exchange rate of 1.3939: $21,446 (15,385.31 € health insurance); $3,138 (2,251.32 € life insurance); $781 (560.04 € employees pension plan); and $512,389 (367,593.60 € defined contribution plan for executive officers).

(33)

Mr. Alvarez’s base salary was increased to $200,000, effective on February 15, 2007.

(34)

Includes: $20,556 (health insurance premiums); $580 (disability insurance premiums); $3,091 (life insurance); $100,654 (tax gross-ups); and the following perquisites: Housing - $72,000; School payments - $19,154; Utilities - $6,115; Currency changes - $6,446; Car Allowance - $18,000 and Vacations - $19,260.

23

(35)

Includes: $4,000 (Company’s contributions to the employees’ savings plan); $9,000 (2008 Santander Securities Corporation’s profit sharing under Santander Securities Corporation’s deferred arrangement profit sharing plan); $5,654 (health insurance premiums); $580 (disability insurance premiums); $867 (life insurance).

(36)

Mr. Rodríguez’s base salary was increased effective on January 1, 2007.

(37)

Includes: $4,000 (Corporation’s contributions to the employees’ savings plan); $9,000 (2007 Santander Securities Corporation’s profit sharing under Santander Securities Corporation’s deferred arrangement profit sharing plan); $4,327 (health insurance premiums); $580 (disability insurance premiums); $867 (life insurance).

(38)

Includes: $4,000 (Company’s contributions to the employees’ savings plan); $7,500 (2006 Santander Securities Corporation’s profit sharing under Santander Securities Corporation’s deferred arrangement profit sharing plan); $5,506 (health insurance premiums); $593 (disability insurance premiums); $735 (life insurance).

(39)

Includes $215,000 paid by Santander Insurance Agency, Inc. and $11,193 paid by BSSA (the amount paid was 8,030.10 €, converted at December 31, 2008 at the exchange rate of 1.3939).

(40)

Includes: $116,888 (tax gross-ups); and the following perquisites: Housing - $66,000; Utilities - $9,355; Currency changes - $51,786; Car Allowance - $18,000; Expenses: $682; and the following amounts paid by BSSA in Euros, converted at December 31, 2008 at the exchange rate of 1.3939: $7,796 (5,593.14 € preferential interest rate in housing loan); $4,740 (3,400 € life insurance); $22,916 (16,440.29 € health insurance); and $781 (560.04 € employees pension plan).

| | | | | | | | | | |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END |

| OPTION AWARDS | STOCK AWARDS |

Name

| Plan Name (1) | Number of Securities Underlying Unexercised Options

(#)

Exercisable

| Number of Securities Underlying Unexercised Options

(#)

Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options

(#) | Option Exercise Price

($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested

(#) | Market Value of Shares or Units of Stock That Have Not Vested

($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested(2)

(#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(3)

($) |

José R. González(4) Former President and CEO | I09 | - | - | - | - | - | - | - | - | - |

I10 | - | - | - | - | - | - | - | - | - |

Carlos M. García(5) Interim President and CEO; Former Senior Executive Vice President and COO | I09 | - | - | - | - | - | - | - | 7,904 | $74,367 |

I10 | - | - | - | - | - | - | - | 12,000 | 112,906 |

Juan S. Moreno(6) President and CEO | I09 | - | - | - | - | - | - | - | 20,748 | 195,214 |

I10 | - | - | - | - | - | - | - | 31,500 | 296,378 |

María Calero Former CAO; Senior Executive Vice President and Chief Compliance Officer

| I09 | - | - | - | - | - | - | - | 2,964 | 27,888 |

I10 | - | - | - | - | - | - | - | 4,500 | 42,340 |

Roberto Jara(7) Executive Vice President and Chief Accounting Officer | I09 | - | - | - | - | - | - | - | 1,200 | 11,291 |

I10 | - | - | - | - | - | - | - | 1,800 | 16,936 |

José Alvarez Executive Vice President and Director of Operations and Information Technology

| I09 | - | - | - | - | - | - | - | 6,422 | 60,423 |

I10 | - | - | - | - | - | - | - | 10,000 | 94,088 |

James Rodríguez President of Santander Securities Corporation | I09 | - | - | - | - | - | - | - | 6,422 | 60,423 |

I10 | - | - | - | - | - | - | - | 10,000 | 94,088 |

Héctor Calvo Former President of Santander Insurance Agency, Inc. | I09 | - | - | - | - | - | - | - | 1,976 | 18,592 |

I10 | - | - | - | - | - | - | - | 3,000 | 28,226 |

24

(1)

The shares under the I09 Plan and I10 Plan will be vested on June 30, 2009 and June 30, 2010, respectively, provided that certain conditions are met.

(2)

The estimated number of BSSA shares to be obtained by each NEO was computed based on the I09 and I10 Plans formula using the BSSA’s rankings as of December 31, 2008. The I09 and I10 Plans’s formula is described in the “I09 Plan and I10 Plan” description under the “Long Term Incentive Plan” caption of the CD&A.

(3)

The estimated market value of the shares under the I09 and I10 Plans was computed based on the I09 and I10 Plans’s formula and using BSSA’s ranking as of December 31, 2008, multiplied by the market value of the BSSA shares as of December 31, 2008, which was €6.75 and the exchange rate of 1.3939 at December 31, 2008.

(4)

Mr. González terminated employment on August, 2008 and will not receive any awards under the I09 and I10 plans.

(5)

Receipt of the incentive compensation under the I09 and I10 Plans by Mr. García is subject to, and in accordance with the terms of each such plan, as agreed in the separation agreement executed by Mr. García.

(6)

Mr. Moreno received his rights under the I09 and I10 Plans directly from BSSA.

(7)

Mr. Jara received his rights under the I09 and I10 Plans directly from Banco Santander Chile.

| | | | |

OPTION EXERCISES AND STOCK VESTED |

Name | OPTION AWARDS | STOCK AWARDS |

Number of Shares

Acquired on Exercise (#)(1) | Value Realized on Exercise ($)(2) | Number of Shares

Acquired on Vesting (#) | Value Realized on Vesting ($) |

José R. González Former President and CEO | 38,994 | $766,031(3) | - | - |

Carlos M. García Interim President and CEO; Former Senior Executive Vice President and COO | 32,200 | 632,564(4) | - | - |

Juan S. Moreno President and CEO | - | - | | |

María Calero Former CAO; Senior Executive Vice President and Chief Compliance Officer | 13,345 | 262,161(5) | - | - |

Roberto Jara Executive Vice President and Chief Accounting Officer | 6,276 | N/A(6) | | |

José Alvarez Executive Vice President and Director of Operations and Information Technology | 11,068 | 318,676(7) | - | - |

James Rodríguez President of Santander Securities Corporation | - | - | - | - |

Héctor Calvo Former President of Santander Insurance Agency, Inc. | - | - | - | - |

25

____________________________

(1)

Number of BSSA shares acquired on exercise was calculated based on the I06 Plan formula. The formula is described in the “I06 Plan” description under the “Long Term Incentive Plan” caption of the CD&A.

(2)

The value disclosed is the aggregate dollar value realized upon vesting, following the description of the I06 Plan, and, except for Mr. Alvarez’s amount, is net of Spain’s 18% applicable tax withholding.

(3)

The exchange rate used for Mr. González was 1.5779, which was the exchange rate applicable for March 27, 2008, Mr. González’s Settlement Date under the I06 Plan. The opening market price of the BSSA share as of March 27, 2008 was 12.45 €, and the gross value realized by Mr. González on exercise was 592,043.05 €. The 18% applicable tax withholding was 106,567.75 €.

(4)

The exchange rate used for Mr. García was 1.5779, which was the exchange rate applicable for March 27, 2008, Mr. García’s Settlement Date under the I06 Plan. The opening market price of the BSSA share as of March 27, 2008 was 12.45 €, and the gross value realized by Mr. García on exercise was 488,890.24 €. The 18% applicable tax withholding was 88,000.24 €.

(5)

The exchange rate used for Ms. Calero was 1.5779, which was the exchange rate applicable for March 27, 2008, Ms. Calero’s Settlement Date under the I06 Plan. The opening market price of the BSSA share as of March 27, 2008 was 12.45 €, and the gross value realized by Ms. Calero on exercise was 202,616.16 €. The 18% applicable tax withholding was 36,470.91 €.

(6)

Mr. Jara’s options were granted to him directly by Banco Santander Chile. Mr. Jara exercised his options on May 5, 2008, Mr. Jara’s Settlement Date, at which date he had not yet been assigned to the Corporation, realizing a net value of $137,224. The gross value realized by Mr. Jara on exercise was 147,590.60 €, calculated using an opening market price of 14.11 € at Mr. Jara’s Settlement Date. The 40% Chilean applicable tax withholding was 59,036.24 €. The exchange rate used for Mr. Jara was 1.5496, which was the exchange rate applicable at Mr. Jara’s Settlement Date.

(7)

The exchange rate used for Mr. Alvarez was 1.5595 which was the exchange rate applicable for July 31, 2008, Mr. Alvarez’s Settlement Date under the I06 Plan. The opening market price of the BSSA share as of July 31, 2008 was 12.37 €, and the gross value realized by Mr. Alvarez on exercise was 204,345 €. The tax rate applicable to Mr. Alvarez is 33%.

Report of the Compensation and Nomination Committee

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis for fiscal year 2008. Based on the review and discussions, the Compensation Committee recommended to the Board, and the Board has approved, that the Compensation Discussion and Analysis be included in the Corporation’s Proxy Statement for its 2008 Annual Meeting of Stockholders.

This report is submitted by the Compensation Committee.

Submitted by

Mr. Víctor Arbulu

Mr. Gonzalo de Las Heras

Mr. Jesús M. Zabalza

Employee Agreements, Termination of Employment and Change in Control Arrangements

Mr. Juan S. Moreno and Mr. James Rodríguez, have each entered into employment agreements. Mr. Jose Alvarez, Mr. Héctor Calvo and Mr. Roberto Jara are under the Expatriated Program as set forth in their corresponding letters of conditions.

On August 28, 2008, the Board of Directors appointed Mr. Juan Moreno as President and Chief Executive Officer of the Corporation and Chief Executive Officer of the Bank. Mr. Moreno’s appointment was subject to the approval of his non-immigrant visa petition. On August 28, 2008, the Board of Directors appointed Mr. Carlos M. García to serve as interim President and Chief Executive Officer of theCorporation. Mr. García also was appointed interim Chief Executive Officer of the Bank. These appointments were effective until Mr. Moreno’s non-immigrant visa petition was approved.

Mr. Moreno’s agreement with the Corporation for his employment as President and Chief Executive Officer of the Corporation and Chief Executive Officer of the Bank, was executed on October 27, 2008, with effective date as of October 22, 2008 and expiration date of October 21, 2011. The employment agreement was approved by the Compensation

26

Committee of the Corporation and was filed with the SEC. Under the terms of the agreement, Mr. Moreno is entitled to receive an annual base salary of $775,000 for the first year of employment, and incentive compensation in accordance with the Corporation’s compensation program for expatriated officers, which is administered by the Compensation Committee. Mr. Moreno’s base salary may be increased for subsequent contract years at the discretion of the Compensation Committee. Under the Corporation’s compensation program, Mr. Moreno will also be eligible to participate in the Corporation’s Performance Bonus Incentive Plan, and may receive certain perquisites such as housing, vehicle, moving expenses, life and health care insurance, school tuition, utilities, vacations, tax gross-ups and other related expenses as determined by the Compensation Committee. The Corporation may terminate Mr. Moreno’s employment for “cause” or other than for “cause.” If the Corporation terminates Mr. Moreno’s employment other than for “cause”, Mr. Moreno will be entitled to receive a severance payment in the amount required under applicable Puerto Rico law. In addition, Mr. Moreno may be entitled to receive additional severance and pension benefits from BSSA, or its affiliates (collectively, “Santander Group”), for prior years of service with Santander Group, following the termination of his employment. Any such additional benefits would be payable by Santander Group and not by the Corporation. Mr. Moreno’s agreement also contains certain confidentiality and arbitration provisions.

On April 25, 2005, Santander Securities Corporation entered into an employment agreement with Mr. Rodríguez. Under the agreement, Mr. Rodríguez is entitled to receive an annual base salary to be determined on a yearly basis and an incentive compensation to be determined in accordance with the Performance Bonus Plan, which is administered by the Compensation Committee, based on the performance of Mr. Rodríguez and the net revenues of Santander Securities Corporation. Mr. Rodríguez is also a participant in the benefit plans established by the Bank and benefits of the Christmas Bonus. In addition, Mr. Rodríguez received a loan in the amount of $300,000 for a term of five (5) years, at an annual interest rate equal to the one-year LIBOR plus 200 basis points, to be paid down during the continuous employment of Mr. Rodríguez in an annual amount of $60,000.

On May 19, 2004, Mr. Alvarez entered into a letter of condition under which he was assigned to the Corporation for an initial period of three years, under the Expatriated Program of BSSA. The employment agreement was effective on August 1, 2004. The letter entitles Mr. Alvarez to receive a base annual salary, currently in the amount of $208,000, approximately, and incentive compensation in accordance with the Corporation’s Performance Bonus Plan, administered by the Compensation Committee. Mr. Alvarez participates in the disability benefit plan established by the Bank and health and life insurances benefits under BSSA’s health and life insurance plans. Mr. Alvarez is also entitled to use a corporate car, a corporate credit card and certain club memberships, all in accordance with human resources policies and procedures, and certain additional perquisites due to his relocation to Puerto Rico, such as housing, school, vacations, and related moving expenses.

On November 30, 2006, Mr. Calvo entered into a letter of condition under which he was assigned to the Corporation for an initial period of three years, under the Expatriated Program of BSSA. The employment agreement was effective on March 26, 2007. The letter entitled Mr. Calvo to receive a base annual salary of $215,000, and incentive compensation in accordance with the Bonus Plan of the Santander Group composed of BSSA and its affiliates. Mr. Calvo participated in the disability benefit plan established by the Bank and health and life insurances benefits under BSSA’s health and life insurance plans. Mr. Calvo was also entitled to use a corporate car in accordance with human resources policies and procedures, and certain additional perquisites due to his relocation to Puerto Rico, such as housing, vacations, and related moving expenses. Mr. Calvo ended his employment in Puerto Rico effective on March 2, 2009.

On September 16, 2008, Mr. Jara entered into a letter of condition under which he was assigned to Puerto Rico under the Expatriated Program of BSSA for an initial term of three-years, subject to early termination upon three-months’ prior notice to Mr. Jara. On November 25, 2008, he was appointed as Executive Vice President and Chief Accounting Officer, subject to the approval of his non-immigrant visa petition. Mr. Jara’s visa was approved with a valid date as of December 1, 2008. As Executive Vice President and Chief Accounting Officer, Mr. Jara is entitled to receive an annual base salary of $422,022. Mr. Jara has the benefit of an exchange rate guarantee with respect to 60% of his base salary to protect Mr. Jara from fluctuations in the value of the U.S. Dollar relative to the Chilean Peso. Mr. Jara is also entitled to a one-time relocation bonus of $200,000, and to annual retention bonuses of $120,000 payable in January 2010 and 2011. Mr. Jara is also eligible to receive incentive compensation in accordance with the Corporation’s compensation program for expatriated officers, which is administered by the Compensation Committee. Under the Corporation’s compensation program, Mr. Jara will receive certain perquisites such as housing, utilities, vacations, tax gross-ups and other related expenses, as determined by the Compensation Committee.

27

Mr. Jose R. González and Mr. Carlos M. García, have each entered into agreements regarding termination of employment.

On August 28, 2008, Mr. José R. González resigned as President and Chief Executive Officer of the Corporation and the Bank, effective immediately. Mr. González will continue to serve as Director of the Corporation and the Bank. The Corporation has also retained Mr. González as a consultant pursuant to a one-year consulting services agreement. Under the consulting agreement, Mr. González will receive a monthly fee of $20,833.

On August 28, 2008, Mr. González, his spouse and the Corporation entered into an agreement setting forth the terms of Mr. González’s separation from the Corporation. Pursuant to the agreement, Mr. González received severance compensation in a mix of cash payments and property with an aggregate value of approximately $2,350,827, composed of: $2,250,000 (severance compensation of $1,250,000 agreed per employment contract and $1,000,000 additional severance compensation), and $100,827 (book value of company car transferred to Mr. González upon his termination). Mr. González and his dependents are also entitled, at the Corporation’s expense, to health insurance coverage under the Bank’s group health insurance policy until the earlier of August 31, 2011 or the date Mr. González obtains coverage under a different health insurance policy. Under the agreement, Mr. González and his spouse waive any and all claims they may have against the Corporation, including employment and labor related claims. Mr. González further agrees not to disclose or use information obtained during his employment with the Corporation and to maintain the confidentiality of the terms of the agreement. The agreement became effective on September 5, 2008.

Effective on December 31, 2008, Mr. García resigned as Senior Executive Vice President, Chief Operating Officer and member of the Board of Directors of the Corporation, and as President of the Bank. Mr. García’s departure was based on his nomination as President and Chairman of the Board of Directors of the Government Development Bank for Puerto Rico, announced on November 13, 2008 by Puerto Rico’s Governor-elect.

In connection with Mr. García’s resignation and departure, Mr. García and his spouse, the Corporation, the Bank and Santander Overseas Bank, Inc., an affiliate of the Corporation (“Santander Overseas”), entered into an agreement setting forth the terms of Mr. García’s separation from the Corporation. Under the agreement, in December 31, 2008, Mr. García received a one-time lump payment of $900,000 for services rendered. Of the amount paid under the agreement, the Bank paid $350,000 as a performance bonus earned for fiscal year 2008 and Santander Overseas paid $550,000 as severance for services rendered by Mr. García to BSSA and its affiliates (the “Santander Group”) other than the Bank and the Corporation. Mr. García provided a general release to the Corporation for any claims he might have against the Corporation or any of its affiliates as part of the agreement. Mr. García also is subject to certain confidentiality and non-disclosure obligations. Mr. García continues to be eligible to receive his vested benefits under Santander Group’s employee savings plan and certain benefits under the Santander Group’s welfare benefit plan. In addition, Mr. García is eligible to receive incentive compensation under the first and second cycles of the long-term incentive plans of BSSA, subject to and in accordance with the terms of each such plan. As mentioned above, payouts under the BSSA long-term incentive plans depend on the performance of BSSA and its consolidated entities, including the Corporation, over the corresponding plan years, compared to that of a peer group of international financial institutions determined by BSSA. Please refer to the description of the plans under the caption “I09 Plan and I10 Plan” above.

PROPOSAL TWO: INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders at the Meeting, the Audit Committee has appointed D&T to audit the Corporation’s consolidated financial statements for the fiscal year ending December 31, 2009, and the effectiveness of the Corporation’s of internal controls over financial reporting as of December 31, 2009. D&T audited the Corporation’s consolidated financial statements for the fiscal years ended December 31, 2007 and 2008, and the effectiveness of the Corporation’s internal controls over financial reporting as of December 31, 2007 and 2008. Representatives of D&T will be present at the Meeting and have the opportunity to make a statement if they so desire, and will also be available to respond to appropriate questions.

If the stockholders do not ratify the appointment of D&T, the selection of our independent registered public accountants will be reconsidered by the Audit Committee.

The Board of Directors of the Corporation recommends that you voteFOR ratification of the appointment of D&T as the independent registered public accounting firm for the Corporation for the fiscal year ending December 31, 2009.

The vote in favor of the majority of the shares of Common Stock eligible to be voted at the Meeting is required for the approval of this Proposal Two.

28

DISCLOSURE OF AUDIT FEES

The following is a description of the fees paid or accrued by the Corporation and its subsidiaries for the audits and other services provided by D&T for the fiscal years ended December 31, 2008 and 2007, respectively.

Audit Fees

The aggregate “Audit Fees” paid or accrued by the Corporation for professional services rendered by D&T in connection with the audits of the Corporation’s annual consolidated financial statements for the fiscal years ended December 31, 2008 and 2007, the audit of the effectiveness of the Corporation’s internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002, as amended, as of December 31, 2008 and 2007, and for the reviews of the consolidated financial statements included in the Corporation’s quarterly reports on Form 10-Q, were approximately $2,282,743 and $2,287,970, respectively.

Audit-Related Fees

The aggregate fees billed by D&T to the Corporation for the years ended December 31, 2008 and 2007 for audit-related services were approximately $127,000 and $186,000, respectively. These fees relate to consulting services performed in connection with financial accounting and reporting standards.

Tax Fees

D&T does not provide tax services to the Corporation.

All Other Fees

There are no other fees.

In considering the nature of the services provided by D&T, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with D&T and the Corporation’s management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as amended, as well as the provisions of the American Institute of Certified Public Accountants.

Pre-Approval Policy and Procedures

All auditing services and non-audit services must be pre-approved by the Audit Committee. Pre-approval is waived for non-audit services if: (1) the aggregate dollar value of such services does not exceed $10,000; (2) such services were not recognized by the Corporation at the time of the engagement to be non-audit services; and (3) such services are promptly brought to the attention of and approved by the Audit Committee prior to the completion of the audit. All audit and non-audit services were pre-approved by the Audit Committee. The Chairman must update the Audit Committee at the next regularly scheduled meeting of any services that were granted specific pre-approval.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee operates pursuant to a Charter adopted by the Board of Directors of the Corporation. The Charter is reviewed on a yearly basis by the Audit Committee and the Board of Directors. The most recent amendment to the Charter was made on November 25, 2008; however, no material changes were made. The Charter is available on our website atwww.santandernet.com.

The role of the Audit Committee is to assist the Corporation’s Board of Directors in its oversight of the Corporation’s financial reporting process and the Corporation’s internal and external audit processes. As set forth in the Charter, management of the Corporation is responsible for the preparation, presentation and integrity of the Corporation’s financial statements, and for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures designed to achieve compliance with accounting standards and applicable laws and regulations. The Internal Audit Department is responsible for examining and evaluating the adequacy and effectiveness of the

29

Corporation’s internal control systems. The independent registered public accounting firm of the Corporation is responsible for auditing the Corporation’s financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America and the effectiveness of the Corporation’s internal controls over financial reporting. Moreover, as set forth in the Charter, the Audit Committee relies on and makes no independent verification of the financial and other information presented to it or representations made by management or the independent registered public accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles and policies, and internal controls and procedures, designed to achieve compliance with accounting standards and applicable laws and regulations.

In the performance of its oversight function, the Audit Committee has reviewed and discussed with management and the independent registered public accountants the audited consolidated financial statements of the Corporation for the fiscal year ended December 31, 2008, management’s assessment of the effectiveness of the Corporation’s internal controls and the independent registered public accounting firm’s report on internal controls over financial reporting. The Audit Committee has also discussed with the independent registered public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently modified or supplemented. The Audit Committee has obtained a report from the independent registered public accountants that addresses certain matters related to quality, quality control, and independence, as required by the NYSE listing standards. Finally, the Audit Committee has received the written disclosures and the letter from D&T required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communication with the Audit Committee concerning independence, has considered whether the provision of non-audit services by the independent registered public accounting firm to the Corporation is compatible with maintaining their independence, and has discussed with the independent registered public accounting firm its independence from the Corporation and its management. These considerations and discussion, however, do not assure that the audit of the Corporation’s financial statements has been carried in accordance with the standards of the Public Company Accounting Oversight Board, that the financial statements are presented in accordance with Generally Accepted Accounting Principles or that the Corporation’s independent registered public accounting firm are in fact “independent.”

Based on the Audit Committee’s review of the audited financial statements, management’s assessment of the effectiveness of internal controls over financial reporting and the independent registered public accounting firm’s report, and the discussions referred to above with management and the independent registered public accounting firm, and subject to the limitations on the role and responsibilities of the Audit Committee set forth in the Charter, the Audit Committee recommended to the Board of Directors that the Corporation’s audited financial statements be included in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2008 for filing with the SEC.

Submitted by:

Mr. Víctor Arbulu

Director

Mr. Stephen A. Ferriss

Director

Mr. Roberto H. Valentín

Director

TRANSACTIONS WITH RELATED PARTIES

Transactions between the Corporation, its subsidiaries and/or affiliates and management or persons related to management are regulated by the Code of Business Conduct and Ethics (“Code of Business Conduct”). The Code of Business Conduct requires impartiality and objectivity in adopting decisions that involve personnel of the Corporation and its subsidiaries and/or affiliates. The Management’s Compliance Committee is in charge of monitoring the Corporation’s compliance with the Code of Business Conduct.

The Board of the Corporation has adopted the Insiders Transaction Policy (the “Regulation O Policy”) in writing which applies to extensions of credit to insiders, defined to include directors, executive officers, principal shareholders (shares owned or controlled by a member of an individual’s immediate family are considered to be held by the individual), and related interests of any of them. Related interest refers to a company that is controlled by that person, or a political or campaign committee that is controlled by that person or the funds or services of which will benefit that person. All extensions of credit shall be on substantially the same terms and conditions (including interest rate and collateral requirements) as those prevailing at the time for comparable transactions available to any other client of the Bank, shall be within the lending limits established in Regulation O adopted by the Federal Reserve Board, codified in 12 CFR Part 215,

30

and shall be approved by the Board of Directors of the Corporation. The transactions that fall within the Regulation O Policy were reviewed and approved by the Board of the Corporation as required by the Regulation O Policy.

In addition, the Bank has adopted the Transactions with Affiliates Policy (the “Regulation W Policy”) in writing. The Regulation W Policy adopted by the Bank applies to transactions between the Bank and an affiliate covered under Sections 23A and 23B of the Federal Reserve Act (the “Act”) and Regulation W adopted by the Federal Reserve Board, codified in 12 CFR Part 223 (“Regulation W”), and applies to transactions in which the Bank accepts securities issued by an affiliate as collateral; transactions in which the Bank purchases a security issued by an affiliate; transactions by the Bank with any person in which the proceeds or benefits are transferred to an affiliate; transactions by the Bank in which an affiliate is acting as an agent or broker; transactions by the Bank in which an affiliate receives a fee for its services to the Bank or a third party; transactions by the Bank in which an affiliate has an interest in the customer or counterparty; transactions in which the Bank purchases, as principal or fiduciary, a security for which an affiliate is a principal underwriter during the existence of the underwriting or selling syndicate; loans and other extensions of credit by the Bank to its affiliates; and other transactions by the Bank in which an affiliate is involved. The standard to be applied under the Regulation W Policy is that all affiliate transactions must be conducted at arm's length and in accordance with applicable laws and regulations. The Bank may not engage in any affiliate transaction unless the affiliate transaction is on terms and conditions that are consistent with safe and sound banking practices. The Legal and the Compliance Departments assure compliance with the Regulation W Policy, and the Audit Committee is responsible for the review and approval of the transactions. The transactions between affiliates reported hereunder were reviewed and approved by the Audit Committee as required by the Regulation W Policy.

The Bank has entered into loan transactions with the Corporation’s directors and executive officers and the immediate family members of the directors and executive officers, and proposes to continue such transactions in the ordinary course of its business, on substantially the same terms, including interest rates and collateral, as those prevailing for comparable loan transactions with other persons not related to the Corporation. The extensions of credit have not involved and do not currently involve more than normal risks of collectibility or present other unfavorable features.

In addition, the Bank has entered from time to time into loan sale transactions with its affiliate CREFISA, Inc., a subsidiary of BSSA. During fiscal year 2008, the Bank sold loans to CREFISA, Inc. for an aggregate sales price of $300.1 million. These loan sale transactions were made at net book value. The loan sale transactions were consistent with applicable banking laws and regulations, and were duly approved by the Audit Committee.

The Corporation and its subsidiaries have entered, in the ordinary course of business, into information technology development, licensing and services agreements and other related services with the following affiliates and subsidiaries of BSSA, holder of 90.59% of the Corporation’s Common Stock: ALTEC, S.A. (“ALTEC Chile”), America Latina Tecnología de Mexico, S.A. (“ALTEC Mexico”); ALTEC Puerto Rico, a division of CREFISA, Inc. (“ALTEC Puerto Rico”); and PRODUBAN Servicios Informáticos Generales, S.L. (“PRODUBAN”). During fiscal year 2008, the Corporation and its subsidiaries made the following payments for services rendered by the abovementioned companies during 2008: $1,760,573 to ALTEC Chile, $6,490,738 to ALTEC Mexico, $8,993,502 to ALTEC Puerto Rico; and $256,526 to PRODUBAN. These transactions are subject to usual trade terms.

The Bank has entered into a lease with ALTEC Puerto Rico under which ALTEC Puerto Rico paid a rental of $411,090 to the Bank during fiscal year 2008. This transaction is considered to be on market terms.

The Bank has entered into Master Management and Services Agreements with Santander Overseas, an affiliate of the Corporation, 100% indirectly owned by BSSA, and with CREFISA, Inc., to provide general services which generally include but are not limited to: (i) services relating to personnel and human resources management, including, but not limited to salaries processing, completing tax returns and tax reporting for employees; (ii) consulting assistance and support relating to compliance and legal functions, (iii) services relating to operations, including, but not limited to fund transfers and general supervisory and managerial services, which may include collections, management of loans and letters of credit; (iv) reconciliation services for bank accounts, accounts payable, accounts receivable; (v) services relating to the structuring and funding of financial transactions; (vi) services relating to risk analysis, including, but not limited to analysis and approval of customer credit and preparation and presentation of cases; (vii) services relating to market risk; (viii) services related to accounting and information technology; (ix) auditing services; (x) record keeping; (xi) cash management services; and (xii) general organizational services. The amounts paid by Santander Overseas and by CREFISA to the Bank for fiscal year 2008 were $3,416,781 and $484,171 respectively. The foregoing transactions are on market terms.

Also, on December 10, 2008, the Bank issued and sold to CREFISA, Inc. a subordinated capital note (“Note”) in the amount of $60,000,000 with an interest rate of 7.50% with a maturity of 20 years, callable at any time after 5 years

31

beginning on December 15, 2013. CREFISA, Inc. purchased the Note at the purchase price of one-hundred percent (100%) of the principal amount of the Note. The interest rate was determined fair based on market conditions current at that time in the Puerto Rico capital market.

All of the foregoing transactions with affiliates have been duly approved by the Audit Committee.

PROPOSALS OF SECURITY HOLDERS TO BE PRESENTED AT THE

2010 ANNUAL MEETING OF STOCKHOLDERS

Stockholders’ proposals intended to be presented at the 2010 annual meeting of Stockholders must be received by the Secretary of the Corporation, at its principal executive offices, Santander BanCorp., 207 Ponce de León Avenue, San Juan, Puerto Rico, 00918, not later than November 30, 2009, for inclusion in the Corporation’s Proxy Statement and Form of Proxy relating to the 2010 annual meeting of Stockholders. If a stockholder who otherwise desires to bring a proposal before the 2010 annual meeting of Stockholders does not notify the Corporation of its intent to do so on or before February 12, 2010, then the proposal will be untimely and the proxies will be able to vote on the proposal at their discretion.

COMMUNICATION WITH DIRECTORS

The Corporation has established procedures for stockholders or other interested parties to communicate directly with the Board of Directors. Such parties may contact the Board of Directors by mail at: Santander BanCorp, Investor Relations, Attention: Mr. Gonzalo de Las Heras, Chairman of the Board, P.O. Box 362589, San Juan, P.R. 00936-2589. All communications made by this means will be received by the Chairman of the Board.

CORPORATE GOVERNANCE GUIDELINES

The Corporation has adopted a Code of Business Conduct within the meaning of Item 406(b) of Regulation S-K of the Securities Exchange Act of 1934, as amended. This Code applies to the directors, the President and CEO, the CAO, and other executive officers of the Corporation and its subsidiaries in order to achieve a conduct that reflects the Corporation’s ethical principles. The Corporation’s Code of Business Conduct was amended during fiscal year 2005 to expressly apply to the directors of the Corporation, as required by the NYSE’s Corporate Governance Rule 303A.10. The Corporation has posted a copy of the Code of Business Conduct, as amended, on its website at www.santandernet.com. The Corporation also adopted Corporate Governance Guidelines which are available on the Investor Relations website atwww.santandernet.com , as required by the NYSE’s Corporate Governance Rule 303A.09. Copies of the Code of Business Conduct and the Corporate Governance Guidelines may be obtained free of charge from the Corporation’s website at the abovementioned internet address.

INTERNET AVAILABILITY

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting to be held on April 30, 2009: This proxy statement, the notice of annual meeting and the Corporation’s Annual Report to Shareholders are available athttp://bnymellon.mobular.net/bnymellon/sbp.

ANNUAL REPORT AND OTHER MATTERS

Enclosed with this Proxy Statement is the Corporation’s Annual Report to Stockholders, which includes the Annual Report on Form 10-K, the Corporation’s consolidated financial statements and management’s assessment of the effectiveness of the Corporation’s internal controls over financial reporting for the year ended December 31, 2008. The Corporation’s consolidated financial statements for the year ended December 31, 2008 and the effectiveness of the Corporation’s internal control over financial reporting as of December 31, 2008 have been duly certified by D&T as the independent registered public accountants of the Corporation. The Annual Report to Stockholders is not a part of these proxy solicitation materials.

To avoid delays in ballot taking and counting, and in order to assure that your Proxy is voted in accordance with your wishes, compliance with the following instructions is respectfully requested: upon signing a Proxy as attorney, executor, administrator, trustee, guardian, authorized officer of a corporation, or on behalf of a minor, please give full title; if shares are in the name of more than one record holder, all should sign.

32

Whether or not you plan to attend the Meeting, it is very important that your shares be represented and voted in the Meeting. Accordingly, you are urged to properly complete, sign, date and return your Proxy Card.

San Juan, Puerto Rico, March 30, 2009.

By Order of the Board of Directors

![[d24614007.gif]](https://capedge.com/proxy/DEF 14A/0001145443-09-000684/d24614007.gif)

Rafael Bonilla, Esq.

Secretary

32

| | | |

Matters intended to be acted at the meeting are the following | | Please mark

your votes as

indicated in

this example | x |

| | | | | | |

| | | | VOTE GRANTED

FOR all

nominees | | VOTE WITHHELD

FOR all

nominees | | | *EXCEPTIONS |

1. To elect three (3) directors for a three year term, ending on April 2012: | o | | o | | | o |

| | | | |

Nominees: | | | | |

01 Gonzalo de las Heras | | | | | |

02 Jesús Zabalza | | | | | |

03 Juan S. Moreno | | | | | |

| | | | | | |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the “Exceptions” box and write that nominee’s name in the space provided below.) |

|

*Exceptions

______________________________________________

| |

| | | | | | | |

| | | FOR | | AGAINST | | ABSTAIN |

2. | To ratify the appointment of Deloitte & Touche LLP as the company’s independent accountants for fiscal year 2009. | | o | | o | | o |

| | | | | | | |

3. | To vote with respect to (i) the approval of minutes of the last meeting of stockholders, (ii) the election of any person as director if any nominee is unable to serve or for good cause will not serve, (iii) matters incident to the conduct of the meeting, and (iv) such other business as may properly come before the meeting. |

| | | |

The Board of Directors of Santander BanCorp. recommends votingFOR the Items 1 and 2. |

| | |

| | This proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” THE ITEMS 1 AND 2. |

| |

| | | |

| | Mark Here for Address

Change or Comments | o |

| | SEE REVERSE |

| Signature | | Signature | | Date | | |

| Please sign exactly as your name appears hereon. When shares are held by joint tenants or by tenants in common, each holder should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, the president or other authorized officer should sign under the full corporate name, and the position of such authorized officer should appear below the signature. If a partnership, please sign in partnership name by authorized person. |

5 FOLD AND DETACH HERE 5 |

Important Notice of Internet Availability of Proxy Materials for the

Stockholders Meeting to be held on Thursday, April 30th, 2009

The proxy card, the proxy statement, the notice of annual

meeting and Santander BanCorp’s Annual Report to

Stockholders are available at

http://bnymellon.mobular.net/bnymellon/sbp.

43724

SANTANDER BANCORP

This Proxy is solicited on behalf of the Board of Directors.

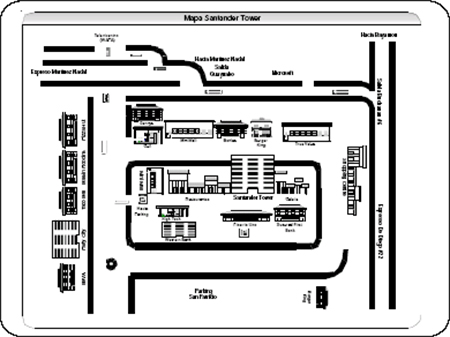

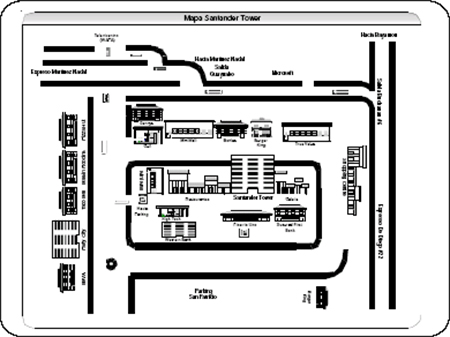

The undersigned hereby appoints any member of the Board of Directors as Proxy, each with the power to appoint his/her substitute, and authorizes them to represent and to vote as designated on the reverse side all the shares of common stock of Santander BanCorp held on record by the undersigned on April 30, 2009, at the Annual Meeting of Shareholders to be held at 10:00 a.m. on April 30, 2009 at the Conference Room located at the parking level of Santander Tower, B7 Tabonuco St., Guaynabo, Puerto Rico.

(Continued on reverse side) |

| | |

BNY MELLON SHAREOWNER SERVICES

P.O. BOX 3550

SOUTH HACKENSACK, NJ 07606-9250 | | |

Address Change/Comments

(Mark the corresponding box on the reverse side) |

| |

ANNUAL MEETING

OF

SANTANDER BANCORP

Thursday, April 30, 2009

10:00 a.m.

Santander Tower, B-7 Tabonuco Street, Conference Room located at the parking level,

Guaynabo, Puerto Rico

PARKING FEES WILL BE PAID BY SANTANDER BANCORP.

43724

![[d24614002.gif]](https://capedge.com/proxy/DEF 14A/0001145443-09-000684/d24614002.gif)

![[d24614003.jpg]](https://capedge.com/proxy/DEF 14A/0001145443-09-000684/d24614003.jpg)

![[d24614005.gif]](https://capedge.com/proxy/DEF 14A/0001145443-09-000684/d24614005.gif)

![[d24614007.gif]](https://capedge.com/proxy/DEF 14A/0001145443-09-000684/d24614007.gif)