UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09729

Name of Fund: iShares Trust

Fund Address: c/o BlackRock Fund Advisors, 400 Howard Street, San Francisco, CA 94105

Name and address of agent for service: The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: 07/31/2024

Date of reporting period: 07/31/2024

Item 1 – Reports to Stockholders

(a) The Reports to Shareholders are attached herewith.

iShares ESG Aware Aggressive Allocation ETF

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about iShares ESG Aware Aggressive Allocation ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1-800-iShares (1-800-474-2737).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| iShares ESG Aware Aggressive Allocation ETF | $2Footnote Reference(a) | 0.02%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

How did the Fund perform last year?

Slowing inflationary pressures and hopes of interest rate cuts drove global equities higher for the reporting period.

The U.S. Federal Reserve left rates on hold during the 12-month period as the central bank sought greater confidence in slowing inflationary pressures. As inflation measures became more subdued, expectations increased for interest rate cuts in 2024.

Bonds underperformed equities yet still delivered generally positive total returns during the reporting period. Amid economic growth concerns, central banks began to pivot away from higher interest rates to easing monetary policy, causing volatility in Treasury yields.

What contributed to performance?

U.S. equities were the largest component of the Fund, comprising approximately 55% during the reporting period, and were also the most significant driver of the Fund’s return. Driven by investor demand for artificial intelligence, a handful of U.S. information technology companies dominated market performance as they innovated rapidly, captured significant market share, and generated substantial profits. The U.S. financials sector also advanced, helped by solid earnings results. Stocks in international developed markets also advanced, led by the financials sector.

Bonds comprised approximately 19% of the Fund during the reporting period. As inflation measures began to subside and future interest rate cuts came into view, U.S. investment-grade bonds advanced given their potential for higher yield.

What detracted from performance?

Given the solid performance of both equities and fixed income securities, there were no meaningful detractors to the Fund’s performance during the reporting period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

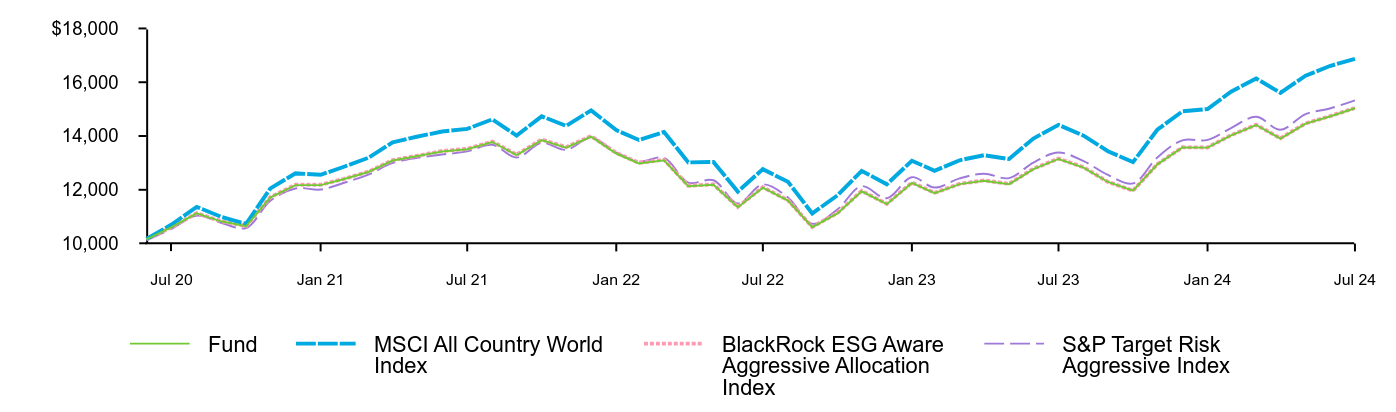

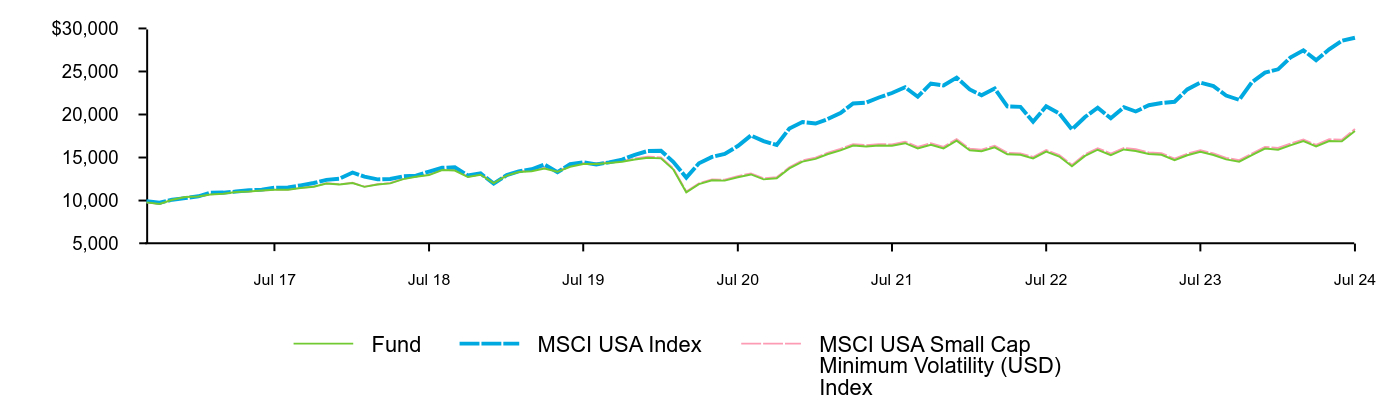

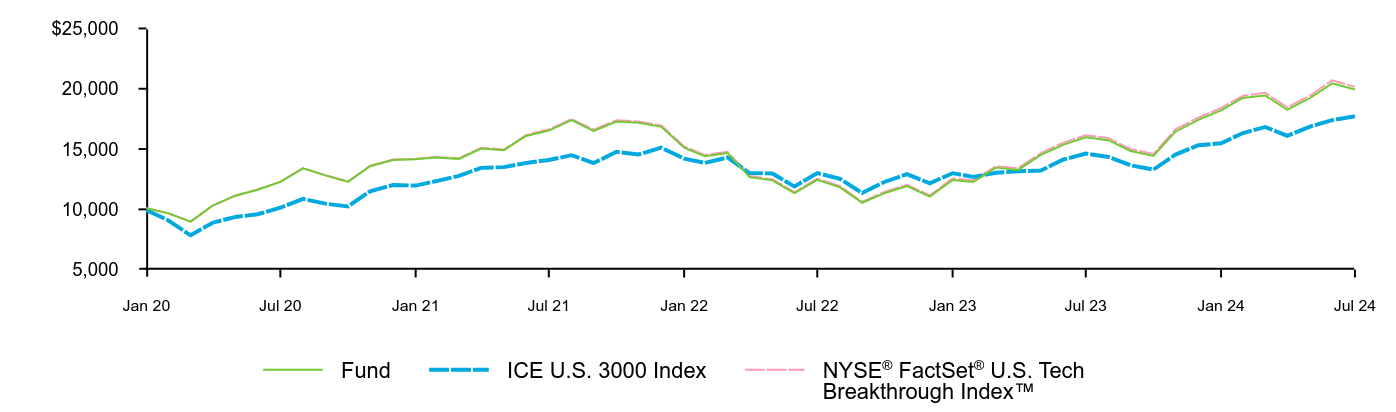

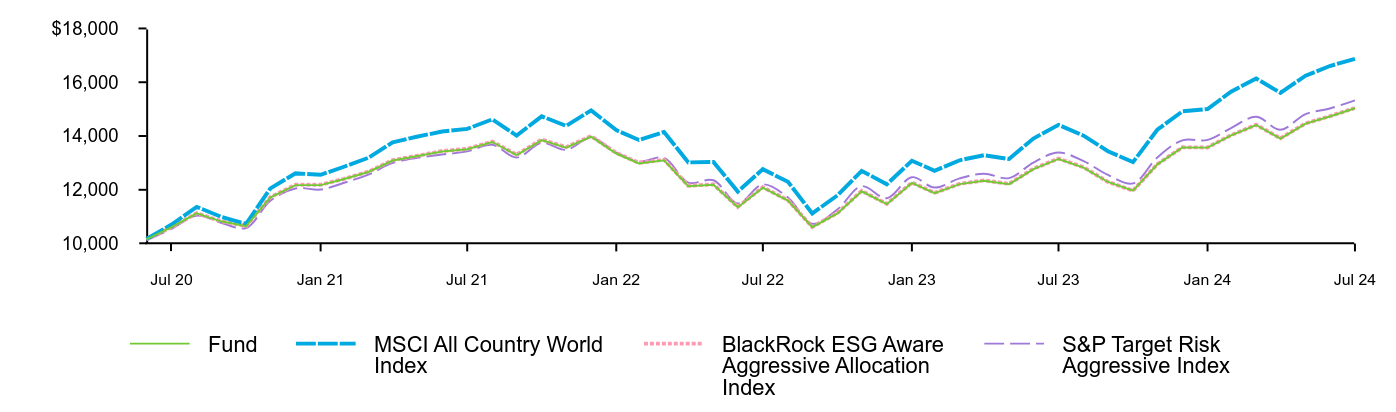

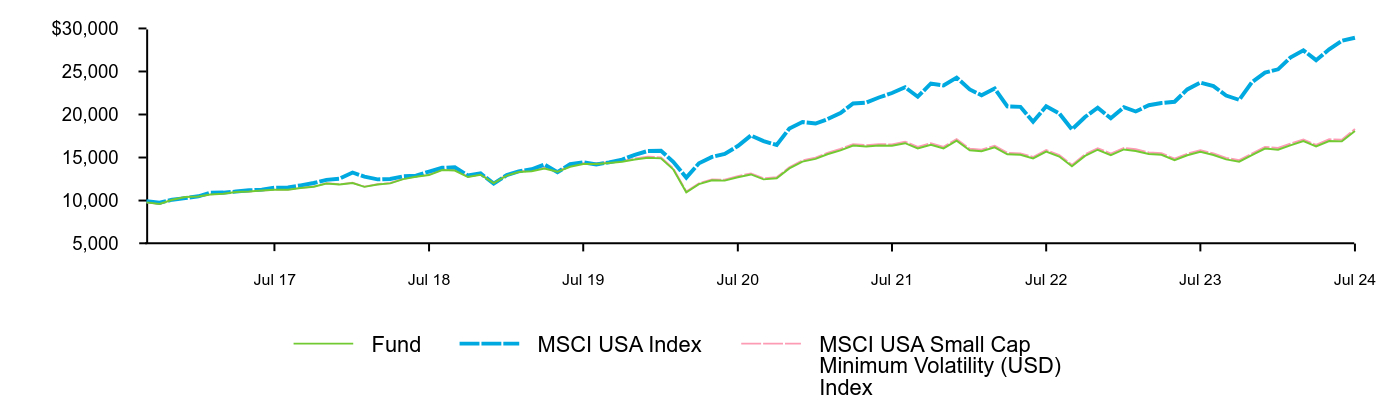

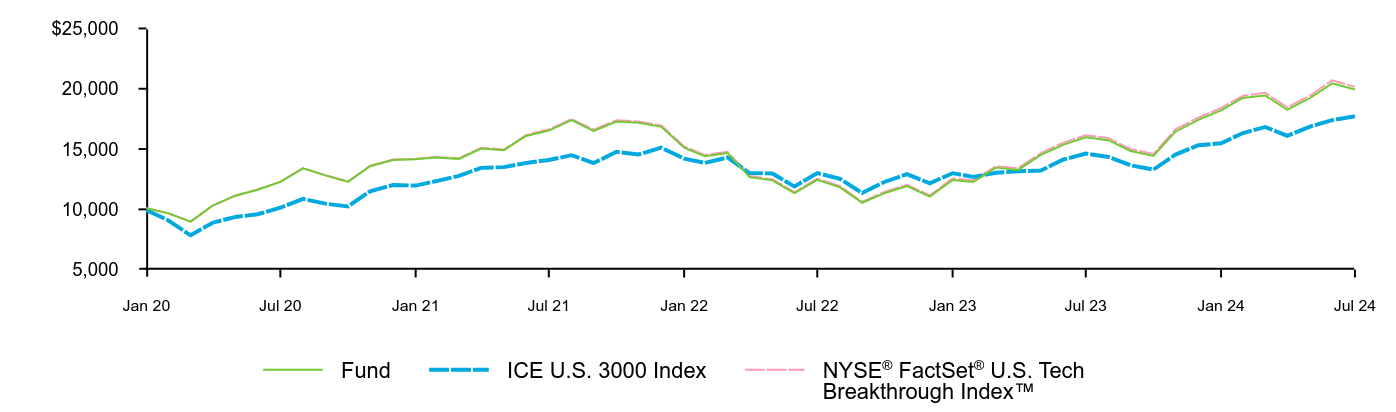

Cumulative performance: June 12, 2020 through July 31, 2024

Initial investment of $10,000

| Fund | MSCI All Country World Index | BlackRock ESG Aware Aggressive Allocation Index | S&P Target Risk Aggressive Index |

|---|

| Jun 20 | 10,154 | 10,171 | 10,157 | 10,119 |

| Jul 20 | 10,610 | 10,709 | 10,614 | 10,551 |

| Aug 20 | 11,122 | 11,364 | 11,128 | 11,038 |

| Sep 20 | 10,828 | 10,998 | 10,835 | 10,777 |

| Oct 20 | 10,648 | 10,731 | 10,654 | 10,580 |

| Nov 20 | 11,718 | 12,054 | 11,726 | 11,598 |

| Dec 20 | 12,174 | 12,614 | 12,186 | 12,051 |

| Jan 21 | 12,174 | 12,557 | 12,186 | 12,008 |

| Feb 21 | 12,390 | 12,848 | 12,399 | 12,252 |

| Mar 21 | 12,662 | 13,191 | 12,673 | 12,565 |

| Apr 21 | 13,088 | 13,768 | 13,100 | 13,000 |

| May 21 | 13,256 | 13,982 | 13,270 | 13,191 |

| Jun 21 | 13,425 | 14,166 | 13,441 | 13,309 |

| Jul 21 | 13,509 | 14,264 | 13,523 | 13,428 |

| Aug 21 | 13,778 | 14,621 | 13,794 | 13,673 |

| Sep 21 | 13,287 | 14,017 | 13,308 | 13,201 |

| Oct 21 | 13,848 | 14,732 | 13,870 | 13,745 |

| Nov 21 | 13,566 | 14,377 | 13,585 | 13,489 |

| Dec 21 | 13,974 | 14,952 | 13,998 | 13,934 |

| Jan 22 | 13,349 | 14,218 | 13,372 | 13,385 |

| Feb 22 | 12,981 | 13,851 | 13,002 | 13,048 |

| Mar 22 | 13,099 | 14,151 | 13,120 | 13,190 |

| Apr 22 | 12,132 | 13,018 | 12,151 | 12,266 |

| May 22 | 12,184 | 13,033 | 12,203 | 12,356 |

| Jun 22 | 11,354 | 11,934 | 11,367 | 11,490 |

| Jul 22 | 12,081 | 12,767 | 12,096 | 12,200 |

| Aug 22 | 11,600 | 12,297 | 11,614 | 11,710 |

| Sep 22 | 10,608 | 11,120 | 10,620 | 10,734 |

| Oct 22 | 11,124 | 11,791 | 11,138 | 11,269 |

| Nov 22 | 11,944 | 12,706 | 11,959 | 12,133 |

| Dec 22 | 11,467 | 12,206 | 11,480 | 11,686 |

| Jan 23 | 12,255 | 13,081 | 12,269 | 12,469 |

| Feb 23 | 11,878 | 12,706 | 11,890 | 12,084 |

| Mar 23 | 12,210 | 13,098 | 12,223 | 12,426 |

| Apr 23 | 12,337 | 13,286 | 12,350 | 12,600 |

| May 23 | 12,210 | 13,144 | 12,222 | 12,434 |

| Jun 23 | 12,771 | 13,907 | 12,785 | 13,014 |

| Jul 23 | 13,147 | 14,416 | 13,162 | 13,383 |

| Aug 23 | 12,824 | 14,013 | 12,838 | 13,064 |

| Sep 23 | 12,291 | 13,434 | 12,294 | 12,556 |

| Oct 23 | 11,966 | 13,030 | 11,969 | 12,237 |

| Nov 23 | 12,946 | 14,233 | 12,951 | 13,203 |

| Dec 23 | 13,572 | 14,917 | 13,579 | 13,838 |

| Jan 24 | 13,568 | 15,004 | 13,575 | 13,857 |

| Feb 24 | 14,021 | 15,648 | 14,028 | 14,297 |

| Mar 24 | 14,410 | 16,139 | 14,418 | 14,714 |

| Apr 24 | 13,907 | 15,607 | 13,915 | 14,233 |

| May 24 | 14,461 | 16,241 | 14,470 | 14,814 |

| Jun 24 | 14,726 | 16,603 | 14,737 | 15,025 |

| Jul 24 | 15,031 | 16,871 | 15,042 | 15,328 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | Since Fund Inception |

|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.34% | 10.35% |

Fund Market........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.39 | 10.36 |

MSCI All Country World Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.02 | 13.48 |

BlackRock ESG Aware Aggressive Allocation Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.37 | 10.40 |

S&P Target Risk Aggressive Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.54 | 10.88 |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $28,116,639 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $5,639 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4% |

The Fund has added the MSCI All Country World Index in response to new regulatory requirements.

The inception date of the Fund was June 12, 2020. The first day of secondary market trading was June 18, 2020.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

| Asset Class | Percent of Total InvestmentsFootnote Reference(a) |

|---|

Domestic Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 55.2% |

International Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 25.4 |

Domestic Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 19.4 |

| Security | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|

iShares ESG Aware MSCI USA ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 50.2% |

iShares ESG Aware U.S. Aggregate Bond ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 19.4 |

iShares ESG Aware MSCI EAFE ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.6 |

iShares ESG Aware MSCI EM ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.8 |

iShares ESG Aware MSCI USA Small-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.0 |

|

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc., S&P Dow Jones Indices LLC or BlackRock Index Services, LLC and its affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock is not affiliated with the companies listed above.

© 2024 BlackRock, Inc or its affiliates. All Rights Reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares ESG Aware Aggressive Allocation ETF

Annual Shareholder Report — July 31, 2024

iShares ESG Aware Conservative Allocation ETF

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about iShares ESG Aware Conservative Allocation ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1-800-iShares (1-800-474-2737).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| iShares ESG Aware Conservative Allocation ETF | $6Footnote Reference(a) | 0.06%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

How did the Fund perform last year?

Slowing inflationary pressures and hopes of interest rate cuts drove global equities higher for the reporting period.

The U.S. Federal Reserve left rates on hold during the 12-month period as the central bank sought greater confidence in slowing inflationary pressures. As inflation measures became more subdued, expectations increased for interest rate cuts in 2024.

Bonds underperformed equities yet still delivered generally positive total returns during the reporting period. Amid economic growth concerns, central banks began to pivot away from higher interest rates to easing monetary policy, causing volatility in Treasury yields.

What contributed to performance?

The United States represented approximately 21% of the Fund on average during the reporting period and was the most significant driver of the Fund’s return. Driven by investor demand for artificial intelligence, a handful of information technology companies dominated market performance as they innovated rapidly, captured significant market share, and generated substantial profits. The financials sector also advanced, helped by solid earnings results. Stocks in international developed markets also advanced, led by the financials sector.

Bonds comprised approximately 68% of the Fund on average during the reporting period. As inflation measures began to subside and future interest rate cuts came into view, U.S. investment-grade bonds advanced given their potential for higher yield.

What detracted from performance?

Given the solid performance of both equities and fixed income securities, there were no meaningful detractors to the Fund’s performance during the reporting period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

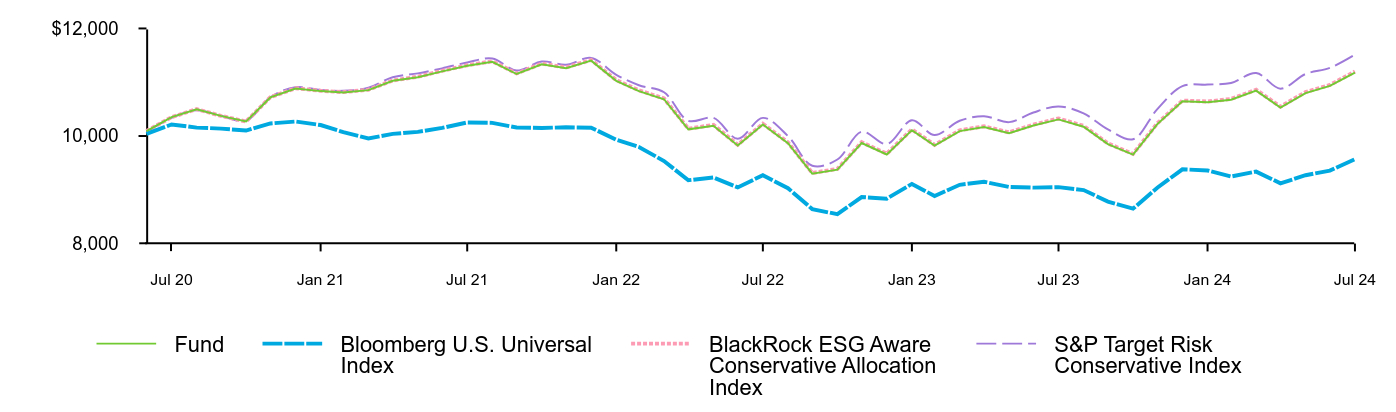

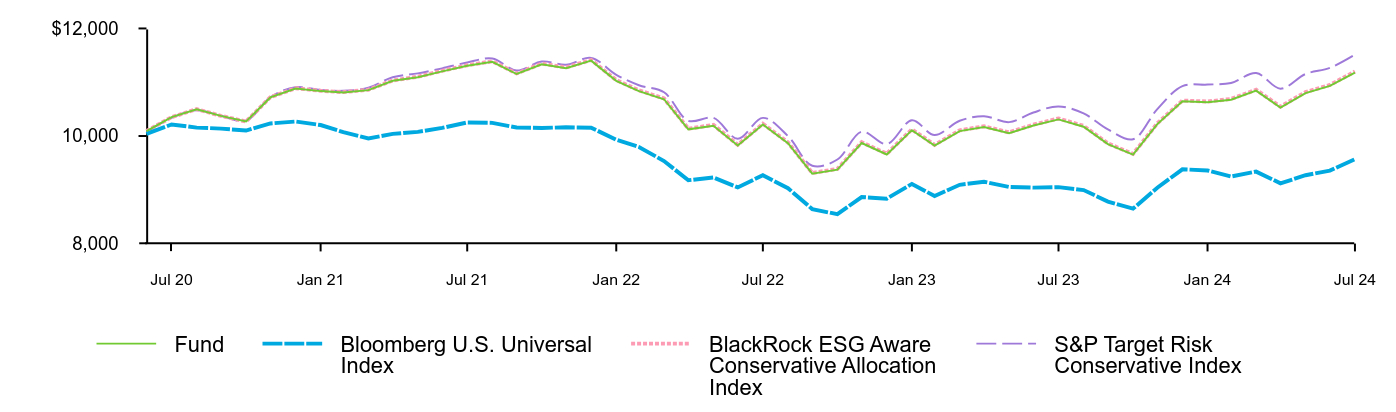

Cumulative performance: June 12, 2020 through July 31, 2024

Initial investment of $10,000

| Fund | Bloomberg U.S. Universal Index | BlackRock ESG Aware Conservative Allocation Index | S&P Target Risk Conservative Index |

|---|

| Jun 20 | 10,091 | 10,039 | 10,092 | 10,077 |

| Jul 20 | 10,350 | 10,215 | 10,351 | 10,336 |

| Aug 20 | 10,498 | 10,156 | 10,500 | 10,479 |

| Sep 20 | 10,374 | 10,138 | 10,375 | 10,376 |

| Oct 20 | 10,269 | 10,102 | 10,269 | 10,284 |

| Nov 20 | 10,717 | 10,234 | 10,722 | 10,720 |

| Dec 20 | 10,883 | 10,269 | 10,889 | 10,908 |

| Jan 21 | 10,835 | 10,204 | 10,842 | 10,854 |

| Feb 21 | 10,809 | 10,072 | 10,816 | 10,841 |

| Mar 21 | 10,853 | 9,955 | 10,861 | 10,897 |

| Apr 21 | 11,027 | 10,039 | 11,033 | 11,093 |

| May 21 | 11,094 | 10,077 | 11,103 | 11,165 |

| Jun 21 | 11,201 | 10,150 | 11,212 | 11,258 |

| Jul 21 | 11,306 | 10,252 | 11,316 | 11,368 |

| Aug 21 | 11,380 | 10,245 | 11,390 | 11,440 |

| Sep 21 | 11,153 | 10,158 | 11,163 | 11,219 |

| Oct 21 | 11,333 | 10,150 | 11,347 | 11,386 |

| Nov 21 | 11,262 | 10,162 | 11,275 | 11,325 |

| Dec 21 | 11,401 | 10,155 | 11,414 | 11,452 |

| Jan 22 | 11,026 | 9,932 | 11,040 | 11,138 |

| Feb 22 | 10,835 | 9,797 | 10,849 | 10,944 |

| Mar 22 | 10,684 | 9,534 | 10,698 | 10,813 |

| Apr 22 | 10,124 | 9,178 | 10,136 | 10,283 |

| May 22 | 10,192 | 9,228 | 10,206 | 10,337 |

| Jun 22 | 9,825 | 9,044 | 9,837 | 9,948 |

| Jul 22 | 10,215 | 9,271 | 10,228 | 10,337 |

| Aug 22 | 9,868 | 9,030 | 9,881 | 9,999 |

| Sep 22 | 9,301 | 8,641 | 9,313 | 9,447 |

| Oct 22 | 9,375 | 8,546 | 9,388 | 9,563 |

| Nov 22 | 9,869 | 8,865 | 9,884 | 10,080 |

| Dec 22 | 9,657 | 8,835 | 9,671 | 9,850 |

| Jan 23 | 10,109 | 9,109 | 10,124 | 10,293 |

| Feb 23 | 9,822 | 8,885 | 9,836 | 10,018 |

| Mar 23 | 10,092 | 9,093 | 10,106 | 10,283 |

| Apr 23 | 10,166 | 9,149 | 10,180 | 10,368 |

| May 23 | 10,053 | 9,054 | 10,068 | 10,258 |

| Jun 23 | 10,196 | 9,040 | 10,211 | 10,437 |

| Jul 23 | 10,309 | 9,049 | 10,326 | 10,549 |

| Aug 23 | 10,173 | 8,995 | 10,188 | 10,421 |

| Sep 23 | 9,850 | 8,781 | 9,862 | 10,122 |

| Oct 23 | 9,655 | 8,649 | 9,667 | 9,939 |

| Nov 23 | 10,222 | 9,038 | 10,235 | 10,500 |

| Dec 23 | 10,645 | 9,381 | 10,659 | 10,927 |

| Jan 24 | 10,626 | 9,359 | 10,641 | 10,956 |

| Feb 24 | 10,674 | 9,247 | 10,689 | 10,985 |

| Mar 24 | 10,844 | 9,338 | 10,860 | 11,171 |

| Apr 24 | 10,529 | 9,120 | 10,545 | 10,880 |

| May 24 | 10,799 | 9,271 | 10,816 | 11,153 |

| Jun 24 | 10,931 | 9,356 | 10,949 | 11,267 |

| Jul 24 | 11,180 | 9,568 | 11,199 | 11,514 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | Since Fund Inception |

|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.44% | 2.73% |

Fund Market........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.33 | 2.71 |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.72 | (1.06) |

BlackRock ESG Aware Conservative Allocation Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.49 | 2.78 |

S&P Target Risk Conservative Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.15 | 3.47 |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $8,360,143 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $4,289 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4% |

The Fund has added the Bloomberg U.S. Universal Index in response to new regulatory requirements.

The inception date of the Fund was June 12, 2020. The first day of secondary market trading was June 18, 2020.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

| Asset Class | Percent of Total InvestmentsFootnote Reference(a) |

|---|

Domestic Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 69.2% |

Domestic Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 21.1 |

International Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.7 |

| Security | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|

iShares ESG Aware U.S. Aggregate Bond ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 69.2% |

iShares ESG Aware MSCI USA ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 19.2 |

iShares ESG Aware MSCI EAFE ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.7 |

iShares ESG Aware MSCI EM ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

iShares ESG Aware MSCI USA Small-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.9 |

|

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by S&P Dow Jones Indices LLC, Bloomberg Index Services Limited or BlackRock Index Services, LLC and its affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock is not affiliated with the companies listed above.

© 2024 BlackRock, Inc or its affiliates. All Rights Reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares ESG Aware Conservative Allocation ETF

Annual Shareholder Report — July 31, 2024

iShares ESG Aware Growth Allocation ETF

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about iShares ESG Aware Growth Allocation ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1-800-iShares (1-800-474-2737).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| iShares ESG Aware Growth Allocation ETF | $4Footnote Reference(a) | 0.04%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

How did the Fund perform last year?

Slowing inflationary pressures and hopes of interest rate cuts drove global equities higher for the reporting period.

The U.S. Federal Reserve left rates on hold during the 12-month period as the central bank sought greater confidence in slowing inflationary pressures. As inflation measures became more subdued, expectations increased for interest rate cuts in 2024.

Bonds underperformed equities yet still delivered generally positive total returns during the reporting period. Amid economic growth concerns, central banks began to pivot away from higher interest rates to easing monetary policy, causing volatility in Treasury yields.

What contributed to performance?

U.S. equities comprised approximately 42% of the Fund on average during the reporting period and were the most significant driver of performance. Driven by investor demand for artificial intelligence, a handful of information technology companies dominated market performance as they innovated rapidly, captured significant market share, and generated substantial profits. The financials sector also advanced, helped by solid earnings results. Stocks in international developed markets also advanced, led by the financials sector.

Bonds comprised approximately 38% of the Fund on average during the reporting period. As inflation measures began to subside and future interest rate cuts came into view, U.S. investment-grade bonds advanced given their potential for higher yield.

What detracted from performance?

Given the solid performance of both equities and fixed income securities, there were no meaningful detractors to the Fund’s performance during the reporting period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

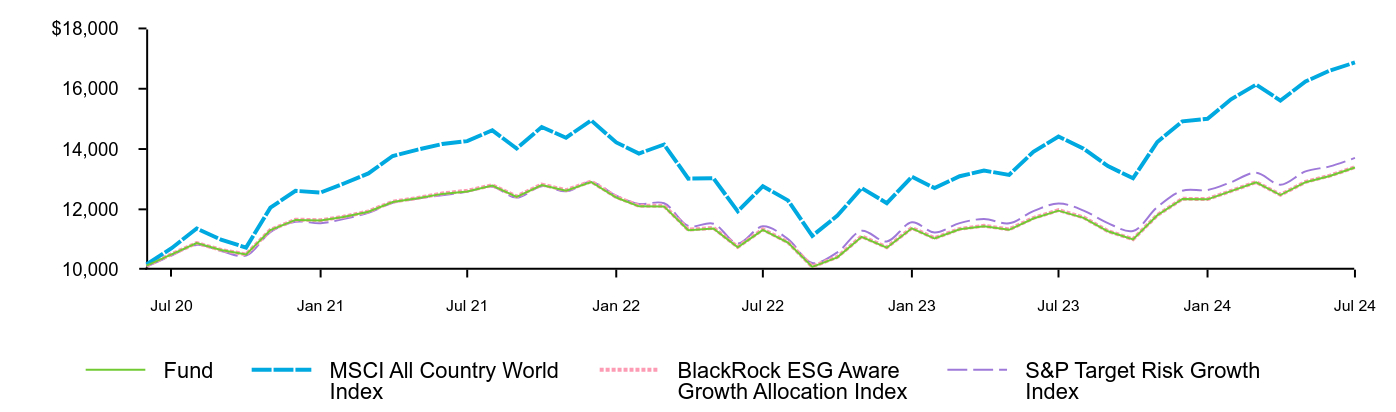

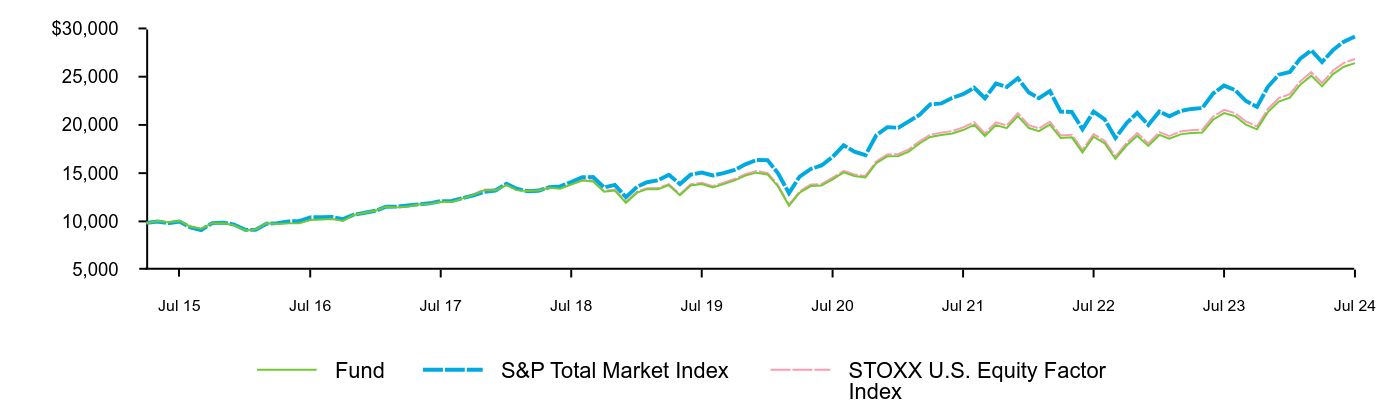

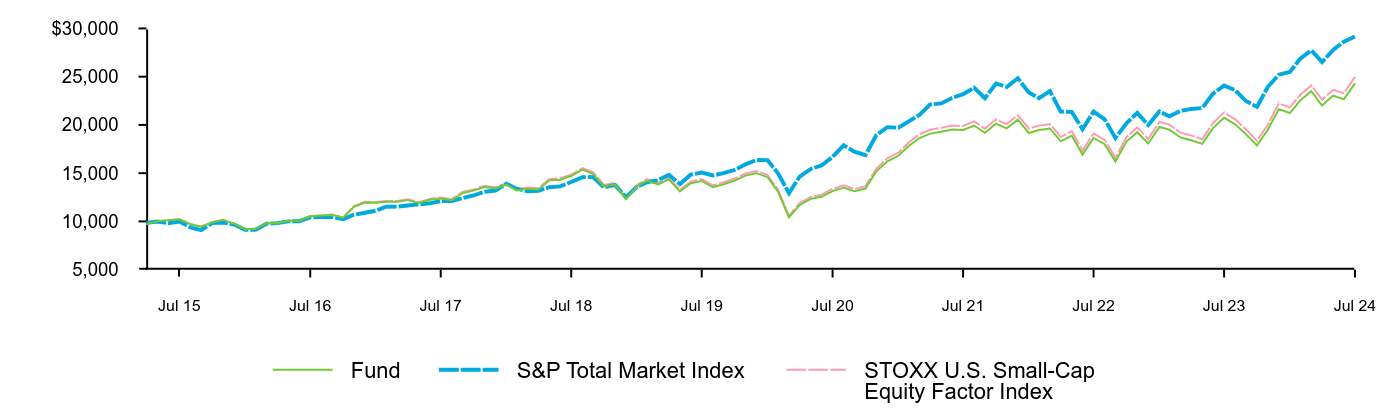

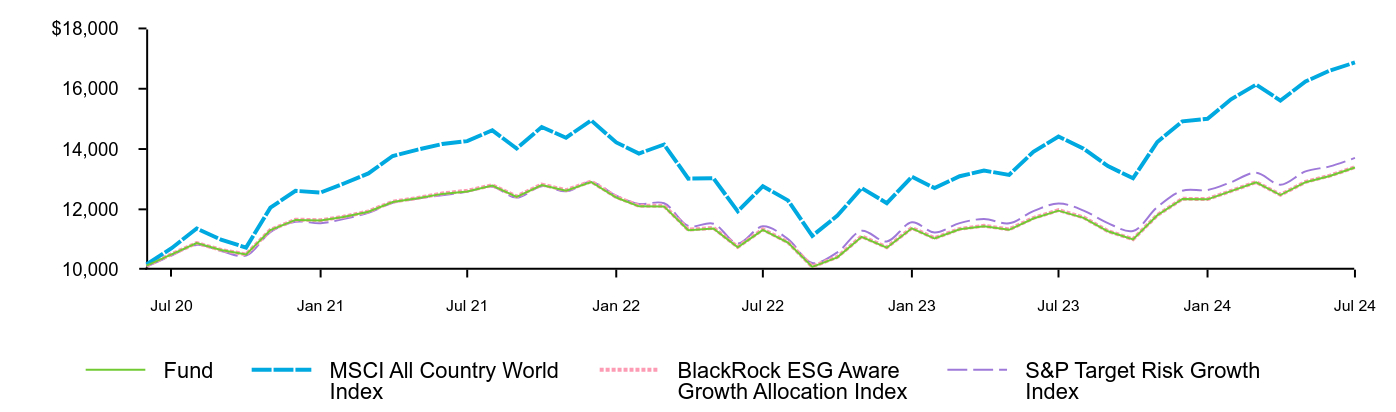

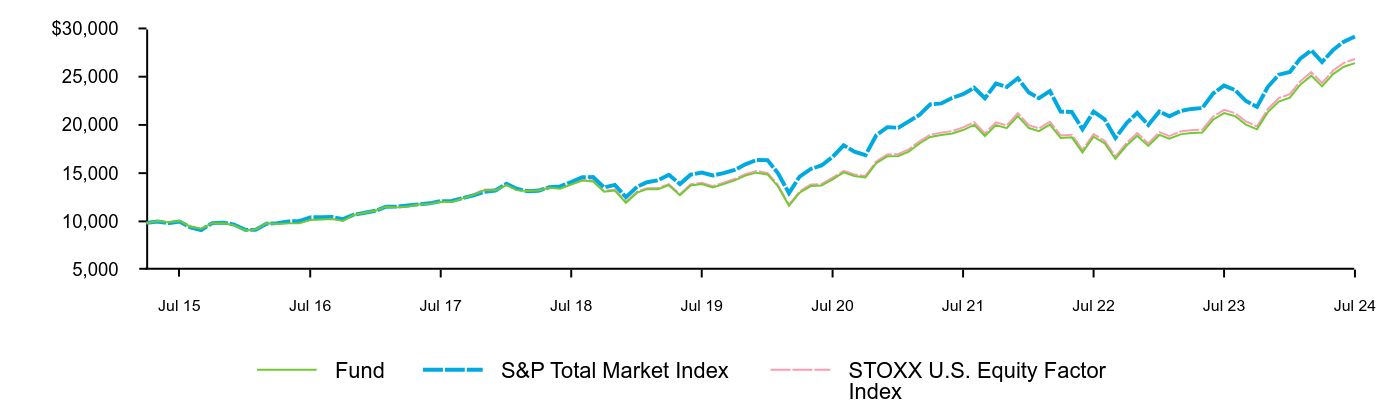

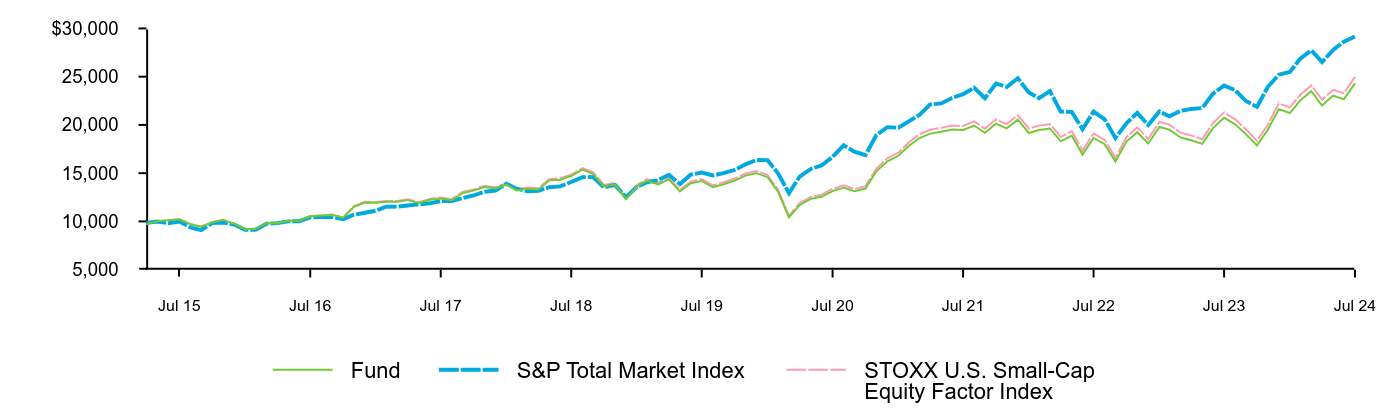

Cumulative performance: June 12, 2020 through July 31, 2024

Initial investment of $10,000

| Fund | MSCI All Country World Index | BlackRock ESG Aware Growth Allocation Index | S&P Target Risk Growth Index |

|---|

| Jun 20 | 10,131 | 10,171 | 10,131 | 10,102 |

| Jul 20 | 10,508 | 10,709 | 10,512 | 10,467 |

| Aug 20 | 10,878 | 11,364 | 10,884 | 10,820 |

| Sep 20 | 10,652 | 10,998 | 10,656 | 10,620 |

| Oct 20 | 10,500 | 10,731 | 10,504 | 10,464 |

| Nov 20 | 11,314 | 12,054 | 11,320 | 11,242 |

| Dec 20 | 11,649 | 12,614 | 11,659 | 11,586 |

| Jan 21 | 11,629 | 12,557 | 11,639 | 11,539 |

| Feb 21 | 11,745 | 12,848 | 11,753 | 11,676 |

| Mar 21 | 11,922 | 13,191 | 11,932 | 11,883 |

| Apr 21 | 12,243 | 13,768 | 12,254 | 12,219 |

| May 21 | 12,367 | 13,982 | 12,380 | 12,358 |

| Jun 21 | 12,512 | 14,166 | 12,525 | 12,466 |

| Jul 21 | 12,592 | 14,264 | 12,617 | 12,582 |

| Aug 21 | 12,786 | 14,621 | 12,801 | 12,752 |

| Sep 21 | 12,411 | 14,017 | 12,428 | 12,388 |

| Oct 21 | 12,806 | 14,732 | 12,825 | 12,768 |

| Nov 21 | 12,616 | 14,377 | 12,634 | 12,598 |

| Dec 21 | 12,908 | 14,952 | 12,926 | 12,903 |

| Jan 22 | 12,392 | 14,218 | 12,410 | 12,456 |

| Feb 22 | 12,100 | 13,851 | 12,119 | 12,181 |

| Mar 22 | 12,097 | 14,151 | 12,116 | 12,201 |

| Apr 22 | 11,308 | 13,018 | 11,325 | 11,448 |

| May 22 | 11,367 | 13,033 | 11,385 | 11,523 |

| Jun 22 | 10,741 | 11,934 | 10,754 | 10,867 |

| Jul 22 | 11,320 | 12,767 | 11,335 | 11,437 |

| Aug 22 | 10,896 | 12,297 | 10,911 | 11,013 |

| Sep 22 | 10,090 | 11,120 | 10,102 | 10,222 |

| Oct 22 | 10,409 | 11,791 | 10,423 | 10,572 |

| Nov 22 | 11,089 | 12,706 | 11,105 | 11,287 |

| Dec 22 | 10,727 | 12,206 | 10,741 | 10,934 |

| Jan 23 | 11,371 | 13,081 | 11,386 | 11,571 |

| Feb 23 | 11,032 | 12,706 | 11,045 | 11,232 |

| Mar 23 | 11,338 | 13,098 | 11,352 | 11,542 |

| Apr 23 | 11,441 | 13,286 | 11,456 | 11,678 |

| May 23 | 11,320 | 13,144 | 11,335 | 11,536 |

| Jun 23 | 11,696 | 13,907 | 11,713 | 11,939 |

| Jul 23 | 11,956 | 14,416 | 11,974 | 12,195 |

| Aug 23 | 11,715 | 14,013 | 11,732 | 11,960 |

| Sep 23 | 11,273 | 13,434 | 11,279 | 11,543 |

| Oct 23 | 11,005 | 13,030 | 11,010 | 11,283 |

| Nov 23 | 11,804 | 14,233 | 11,811 | 12,072 |

| Dec 23 | 12,342 | 14,917 | 12,351 | 12,617 |

| Jan 24 | 12,332 | 15,004 | 12,340 | 12,641 |

| Feb 24 | 12,603 | 15,648 | 12,611 | 12,898 |

| Mar 24 | 12,895 | 16,139 | 12,904 | 13,213 |

| Apr 24 | 12,475 | 15,607 | 12,483 | 12,815 |

| May 24 | 12,900 | 16,241 | 12,910 | 13,258 |

| Jun 24 | 13,105 | 16,603 | 13,116 | 13,426 |

| Jul 24 | 13,387 | 16,871 | 13,398 | 13,706 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

| Average Annual Total Returns | 1 Year | Since Fund Inception |

|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.97% | 7.31% |

Fund Market........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.05 | 7.32 |

MSCI All Country World Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.02 | 13.48 |

BlackRock ESG Aware Growth Allocation Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.01 | 7.36 |

S&P Target Risk Growth Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.38 | 7.92 |

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $20,234,180 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $6,361 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6% |

The Fund has added the MSCI All Country World Index in response to new regulatory requirements.

The inception date of the Fund was June 12, 2020. The first day of secondary market trading was June 18, 2020.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit iShares.com for more recent performance information.

What did the Fund invest in?

| Asset Class | Percent of Total InvestmentsFootnote Reference(a) |

|---|

Domestic Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 41.7% |

Domestic Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 39.1 |

International Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 19.2 |

| Security | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|

iShares ESG Aware U.S. Aggregate Bond ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 39.0% |

iShares ESG Aware MSCI USA ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 38.0 |

iShares ESG Aware MSCI EAFE ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.3 |

iShares ESG Aware MSCI EM ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.9 |

iShares ESG Aware MSCI USA Small-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.8 |

|

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding is an option available to certain fund investors. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Please contact your broker-dealer if you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents, or if you are currently enrolled in householding and wish to change your householding status.

The Fund is not sponsored, endorsed, issued, sold, or promoted by MSCI Inc., S&P Dow Jones Indices LLC or BlackRock Index Services, LLC and its affiliates, nor do these companies make any representation regarding the advisability of investing in the Fund. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock is not affiliated with the companies listed above.

© 2024 BlackRock, Inc or its affiliates. All Rights Reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iShares ESG Aware Growth Allocation ETF

Annual Shareholder Report — July 31, 2024

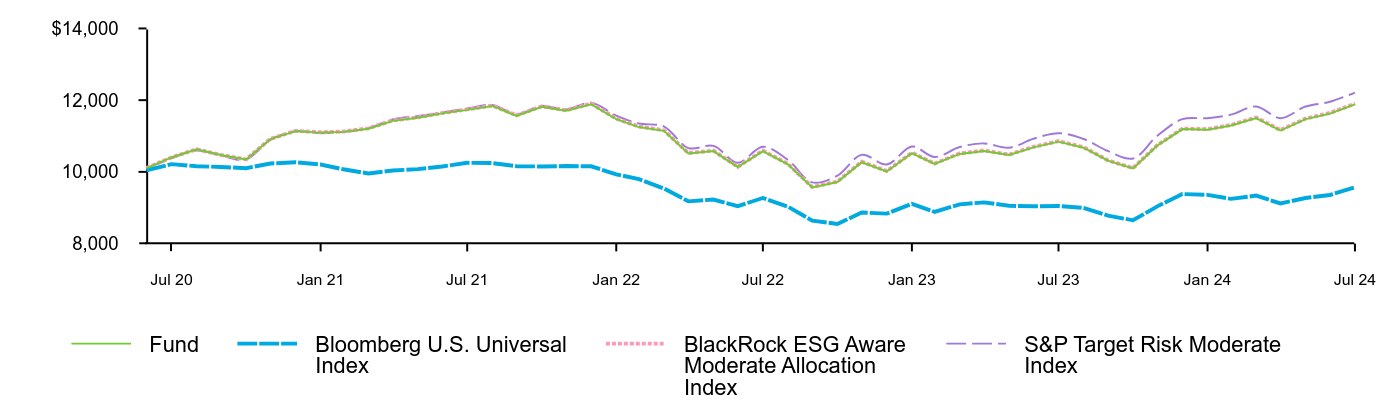

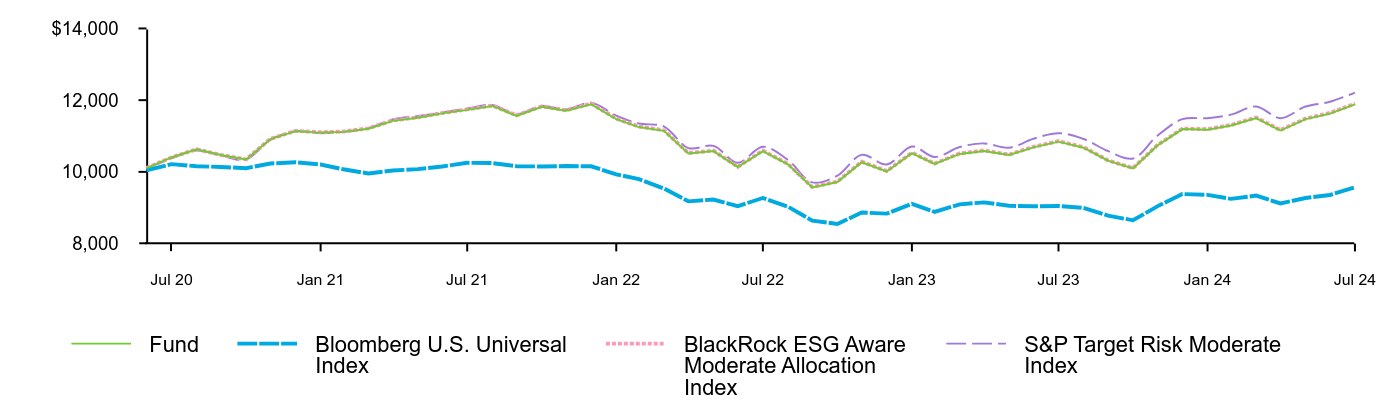

iShares ESG Aware Moderate Allocation ETF

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about iShares ESG Aware Moderate Allocation ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at 1-800-iShares (1-800-474-2737).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| iShares ESG Aware Moderate Allocation ETF | $5Footnote Reference(a) | 0.05%Footnote Reference(a) |

| Footnote | Description |