QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material under Rule 14a-12 |

PEC SOLUTIONS, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

April 24, 2002

|

PEC Solutions, Inc.

12750 Fair Lakes Circle

Fairfax, VA 22033

(703) 679-4900

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 22, 2002

The annual meeting of stockholders of PEC Solutions, Inc., a Delaware corporation (the "Company"), will be held on Wednesday, May 22, 2002, at 5:30 p.m., local time, at the Hyatt Fair Lakes, 12777 Fair Lakes Circle, Fairfax, VA 22033 for the following purposes:

- 1.

- To elect three directors to serve until the 2005 annual meeting of stockholders, and until their successors are elected and duly qualified;

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2002; and

- 3.

- To transact such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

The foregoing matters are described in more detail in the enclosed proxy statement. The board of directors has fixed the close of business on March 28, 2002, as the record date for the determination of the stockholders entitled to notice of, and to vote at, the annual meeting and any postponement or adjournment thereof. Only those stockholders of record of the Company as of the close of business on that date will be entitled to vote at the annual meeting or any postponement or adjournment thereof.

Fairfax, Virginia

April 24, 2002

PEC Solutions, Inc.

12750 Fair Lakes Circle

Fairfax, VA 22033

(703) 679-4900

PROXY STATEMENT

Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope. This proxy statement has information about the annual meeting and was prepared by our management for the board of directors. This proxy statement and the accompanying proxy card are first being mailed to you on or about April 24, 2002.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares on March 28, 2002. A total of 26,212,003 shares of common stock can vote at the annual meeting. You get one vote for each share of common stock. The enclosed proxy card shows the number of shares you can vote.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the annual meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote for each of the three director nominees and for each of the other proposals to be considered at the meeting.

What if other matters come up at the annual meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares as they see fit.

Can I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you can change your vote either by giving our secretary a written notice revoking your proxy card or by signing, dating, and returning to us a new proxy card. We will honor the proxy card with the latest date.

Can I vote in person at the annual meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you can attend the annual meeting and vote your shares in person.

What do I do if my shares are held in "street name"?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

1

How are votes counted?

We will hold the annual meeting if holders of a majority of the shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

If your shares are held in the name of a nominee, and you do not tell the nominee by May 13, 2002 how to vote your shares (so-called "broker nonvotes"), the nominee can vote them as it sees fit only on matters that are determined to be routine, and not on any other proposal. Broker nonvotes will be counted as present to determine if a quorum exists but will not be counted as present and entitled to vote on any nonroutine proposal.

Who pays for this proxy solicitation?

We do. In addition to sending you these materials, some of our employees may contact you by telephone, by mail, or in person. None of these employees will receive any extra compensation for doing this.

PROPOSAL NO 1: ELECTION OF DIRECTORS

Our board of directors is divided into three classes. The number of directors is determined from time to time by the board of directors and is currently fixed at eight members. A single class of directors is elected each year at the annual meeting. Subject to transition provisions, each director elected at each such meeting will serve for a term ending on the date of the third annual meeting of stockholders after his election and until his successor has been elected and duly qualified.

Three directors are to be elected at this annual meeting to serve until the 2005 annual meeting, and until their successors are elected and duly qualified. In the event any nominee is unable or unwilling to serve as a nominee, the proxies may be voted for any substitute nominee designated by the present board of directors or the proxy holders to fill such vacancy, or the board of directors may be reduced in accordance with our bylaws. The board of directors has no reason to believe that the persons named will be unable or unwilling to serve as nominees or as directors if elected.

Set forth below is certain information concerning the nominees and the other incumbent directors:

Directors to be Elected at the 2002 Annual Meeting

Alan H. Harbitter, age 44, has been our Chief Technology Officer since May 1996 and a Director since October 1985. He was our Senior Vice President, Engineering from January 1991 until April 1996 and the Vice President, Engineering from October 1985 to January 1991. From July 1978 to September 1985, Dr. Harbitter served in various technical management positions at Computer Sciences Corporation. Dr. Harbitter received his B.S. in electrical engineering from Cornell University, his M.S. in computer science from the University of Maryland and a doctorate in information technology from George Mason University.

Stuart R. Lloyd, age 58, has been our Senior Vice President and Chief Financial Officer since December 1998 and a Director since May 1999. Mr. Lloyd was a partner at Gelman, Rosenberg & Freedman, a certified public accounting firm, from February 1993 until December 1998. From September 1981 until February 1993, he was the principal at this own certified public accounting firm. Mr. Lloyd is a certified public accountant and received his B.S. in business administration from The American University.

Sharon M. Owlett, age 51, has been a Director since January 1990, and is currently Vice President, Corporate Affairs and General Counsel. From March 1999 through March 2000, Ms. Owlett served as

2

a senior consultant. Prior to that position, Ms. Owlett was our Vice President, Corporate Affairs and General Counsel from January 1994 until February 1999. Between 1988 and 1994, Ms. Owlett served as our director of business and legal affairs and as our director of finance and administration. She has a B.A. in political science from The American University and a J.D. from the University of Virginia.

Directors Whose Terms Expire in 2003

David C. Karlgaard, Ph.D., age 55, has been our Chief Executive Officer, President and Chairman of the Board of Directors since October 1985 when he and Mr. Rice and Dr. Harbitter founded the Company. From 1975 to 1984, Dr. Karlgaard held various management positions with Computer Sciences Corporation, where he worked with Mr. Rice and Dr. Harbitter. Dr. Karlgaard received his doctorate degree in electrical engineering and computer science from The George Washington University and his M.B.A. from the Wharton Business School. Dr. Karlgaard has also lectured as a professor at The George Washington University School of Business and Public Management since 1994.

R. Jerry Grossman, age 58, has been a Director since December 2000. Mr. Grossman is the Managing Director of Houlihan, Lokey, Howard & Zukin's Washington, D.C. office. He manages the firm's government and defense technology practices, with complimentary emphasis on commercial technology businesses. Mr. Grossman received his B.S. in Industrial Management from Pennsylvania State University and his X.M.B.A. from Loyola College of Maryland. He is also a Chartered Financial Analyst (CFA).

Directors Whose Terms Expire in 2004

Paul G. Rice, age 48, has been our Chief Operating Officer since January 1996 and has been a Director since October 1985. From October 1985 until December 1995, he was our Vice President and then Senior Vice President, Operations. Prior to the founding of the Company, Mr. Rice served in various technical management positions at Computer Sciences Corporation from June 1975 to September 1985. Mr. Rice received his B.S. in electrical engineering from the University of Virginia.

Frank J. Carr, age 76, has been a Director since December 2000. Mr. Carr retired after serving 11 years as the General Service Administration's commissioner for government-wide policy and planning for computer and telecommunications acquisition and management. He continues to provide assistance to federal agencies in resolving current information technology issues. Mr. Carr received his B.S. in electrical engineering from the University of Pennsylvania.

Unless marked otherwise, proxies received will be voted for the election of the nominees named above.

Recommendation of the Board of Directors

Our board of directors recommends a vote "FOR" the election of the nominees named above.

3

THE BOARD OF DIRECTORS AND COMMITTEES

Our board of directors met three times during 2001. The board acted four times by Written Consents in Lieu of Special Meetings. Each director attended all of the meetings of the board.

The Audit Committee, currently Messrs. Grossman, Brown and Carr, met twice during 2001. The Audit Committee recommends to our board of directors the independent auditors to conduct the annual audit of our books and records; reviews the proposed scope and results of the audit; approves the audit fees to be paid; reviews accounting and financial controls with the independent public accountants and our financial and accounting staff; and reviews and approves transactions between us and our directors, officers and affiliates.

The Compensation Committee, currently Messrs. Grossman, Brown and Carr, met once during 2001. The Compensation Committee reviews and recommends the compensation arrangements for our management, including the compensation for our President and Chief Executive Officer; establishes and reviews general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals; and administers our stock option plans.

The Nominating Committee, currently Messrs. Grossman, Brown and Carr, did not meet during 2001, but met on March 27, 2002 to nominate persons to serve as directors. The Committee will also consider recommendations from you, which should be addressed to Mr. Frank J. Carr, Chairman, Nominating Committee, c/o PEC Solutions, Inc., 12750 Fair Lakes Circle, Fairfax, VA 22033.

Since Mr. Brown resigned from the board effective March 31, 2002, he will be replaced on the board and committees as soon as a suitable candidate is found.

Our non-employee directors received $2,000 for each board meeting and $1,000 for each committee meeting which is not held coincident with a board meeting. We also reimburse them for reasonable expenses they incur to attend board and committee meetings. Our non-employee directors are eligible to receive grants of options to acquire our common stock pursuant to our nonqualified stock option plan. In addition, Ms. Owlett receives wages on an hourly basis for part-time services she provides to us.

EXECUTIVE OFFICERS

In addition to Drs. Karlgaard and Harbitter and Messr. Rice and Lloyd, Messrs. Bratiotis, Owlett and Scharf are executive officers of the Company.

Christos Bratiotis, age 58, has been our Senior Vice President, Engineering Operations since April 1999. Mr. Bratiotis was our Vice President, Engineering Division from April 1996 to April 1999. Prior to that, he served as Vice President, Information Systems for Synetics, a federal information technology company, from January 1992 until April 1996. Mr. Bratiotis received a B.A. in mathematics from Clark University and an M.B.A. from the University of Utah.

Charles E. Owlett, age 48, has served as our Senior Vice President, Development Operations since April 1999. Mr. Owlett was our Vice President, Systems Integration Division from January 1996 until March 1999 and our Vice President, Systems Development Division from January 1990 until December 1995. Prior to joining us, he served in various technical and management positions with Computer Sciences Corporation from 1975 to 1988. He received his B.S. in electrical engineering from the Florida Institute of Technology.

William J. Scharf, age 55, has been our Senior Vice President, Enterprise Resource Operations since April 1999. Mr. Scharf was our Vice President, Information Technology Management Division from January 1996 until March 1999 and our Vice President, Applied Systems Division from January 1990 until December 1995. Prior to joining us, he served as a program director with CACI

4

International, a technology consulting services company, from 1985 to 1987. Mr. Scharf received his B.A. in mathematics from the University of Dayton and his M.S. in applied statistics from Villanova University.

Our officers are elected by the board of directors on an annual basis and serve until their successors have been duly elected and qualified.

Sharon M. Owlett, one of our directors and Vice President, Corporate Affairs and General Counsel, is married to Charles E. Owlett, our Senior Vice President, Development Operations.

5

EXECUTIVE COMPENSATION

The following summary compensation table sets forth the compensation paid by us during the last three completed years to our chief executive officer and the other four most highly compensated officers whose total compensation for services in all capacities exceeded $100,000 during such year, whom we refer to as our Named Executive Officers.

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

| |

|

|---|

| | Year

| | Salary

| | Bonus

| | Securities Underlying Options

| | All Other

Compensation (a)

|

|---|

David C. Karlgaard

Chief Executive Officer, President and Chairman of the Board of Directors | | 2001

2000

1999 | | $

| 318,219

276,682

261,019 | | $

| 106,900

93,222

77,217 | | 18,462

31,539

360,000 | | $

| 47,629

40,421

38,711 |

Paul G. Rice

Chief Operation Officer and Director |

|

2001

2000

1999 |

|

|

233,605

203,112

191,610 |

|

|

106,900

93,222

77,217 |

|

18,462

31,539

360,000 |

|

|

50,711

43,617

39,723 |

Alan H. Harbitter

Chief Technology Officer and Director |

|

2001

2000

1999 |

|

|

204,006

177,424

167,378 |

|

|

106,900

93,222

77,217 |

|

18,462

31,539

180,000 |

|

|

45,296

40,085

38,246 |

Stuart R. Lloyd

Chief Financial Officer, Senior Vice President and Director |

|

2001

2000

1999 |

|

|

167,419

155,000

131,025 |

|

|

53,500

46,430

40,051 |

|

12,307

21,026

90,000 |

|

|

36,855

34,769

27,715 |

Christos Bratiotis

Senior Vice President |

|

2001

2000

1999 |

|

|

163,379

151,174

137,426 |

|

|

55,500

50,000

40,750 |

|

12,307

21,026

48,000 |

|

|

33,001

31,342

28,739 |

- (a)

- Represents (i) dollar value of life and health insurance premiums we paid of $6,976 for Dr. Karlgaard, $6,281 for Mr. Rice, $6,365 for Dr. Harbitter, $8,610 for Mr. Lloyd and $7,131 for Mr. Bratiotis; (ii) automobile allowance of $3,413 for Dr. Karlgaard, $7,190 for Mr. Rice, $1,691 for Dr. Harbitter, $5,960 for Mr. Lloyd and $4,651 for Mr. Bratiotis; (iii) contributions we made to the executive supplemental retirement plan in the amount of $27,040 for each of Drs. Karlgaard and Harbitter and Mr. Rice, $12,085 for Mr. Lloyd and $11,019 for Mr. Bratiotis; and (iv) contributions we made under our 401(k) plan for each named executive officer in the amount of $10,200.

6

Options Granted in 2001

The following table sets forth information regarding options granted to the named executive officers during the 2001 fiscal year. All option grants were made under the Employee Option Plan. In accordance with the rules of the SEC, the table shows the hypothetical "gains" that would exist for the respective options based on assumed rates of annual stock price appreciation of 5% and 10%, from the date the options were granted, over the full option term.

| | Individual Grants

| |

| |

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation for

Option Term

|

|---|

Name

| | Number of

Securities

Underlying

Options

Granted (a)

| | Percent of

Total Options

Granted to

Employees in

2001 (b)

| | Exercise

Price (c)

| | Expiration

Date

| | 5%

| | 10%

|

|---|

| David C. Karlgaard | | 18,462 | | 5.1% | | $ | 8.13 | | 12/31/10 | | $ | 94,394 | | $ | 239,214 |

| Paul G. Rice | | 18,462 | | 5.1% | | | 8.13 | | 12/31/10 | | | 94,394 | | | 239,214 |

| Alan H. Harbitter | | 18,462 | | 5.1% | | | 8.13 | | 12/31/10 | | | 94,394 | | | 239,214 |

| Stuart R. Lloyd | | 12,307 | | 3.4% | | | 8.13 | | 12/31/10 | | | 62,924 | | | 159,463 |

| Christos Bratiotis | | 12,307 | | 3.4% | | | 8.13 | | 12/31/10 | | | 62,924 | | | 159,463 |

- (a)

- All options were granted under our stock option agreement and nonqualified stock option plan. Options granted under the stock option agreement vest two years from the date of grant. Options for the above individuals granted under the nonqualified stock option plan vest on the date of grant.

- (b)

- Based on options to purchase 359,653 shares of our common stock granted to employees in 2001.

- (c)

- The options were granted at an exercise price equal to the fair market value of the underlying common stock on the respective dates of grant.

Option Exercises in 2001 and Year-End Value Table

The following table provides information concerning option exercises in 2001 and unexercised options held as of December 31, 2001, by our Named Executive Officers.

| |

| |

| | Number of Securities

Underlying

Unexercised Options at

December 31, 2001

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

in-the-Money Options

at December 31, 2001(1)

|

|---|

| | Shares

Acquired

on Exercise

| | Value

Received

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David C. Karlgaard | | — | | $ | — | | 1,077,189 | | — | | $ | 37,971,217 | | | — |

| Paul G. Rice | | — | | | — | | 1,433,937 | | — | | | 51,093,953 | | | — |

| Alan H. Harbitter | | — | | | — | | 588,687 | | — | | | 20,669,948 | | | — |

| Stuart R. Lloyd | | — | | | — | | 100,004 | | 12,307 | | | 3,377,426 | | $ | 362,810 |

| Christos Bratiotis | | 34,134 | | | 1,121,302 | | 55,088 | | 12,307 | | | 1,779,442 | | | 362,810 |

- (1)

- Calculated on the basis of $37.61 per share, the closing price of our common stock on the Nasdaq National Market on December 31, 2001, less the exercise price payable for such shares, multiplied by the number of shares underlying the option.

7

PERFORMANCE GRAPH

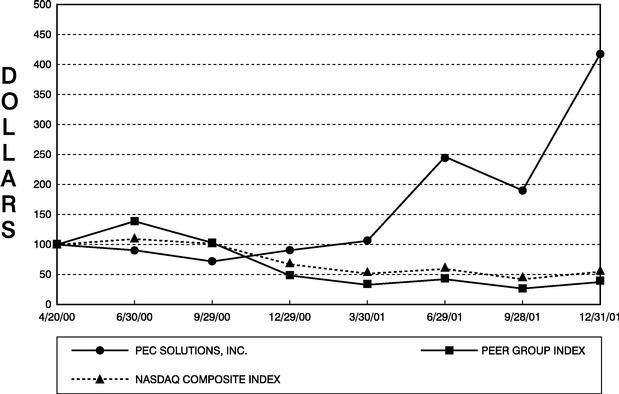

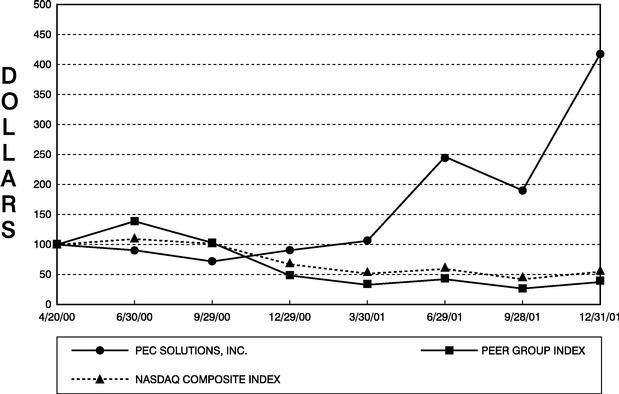

The following chart shows how $100 invested in the Company's Common Stock as of April 20, 2000, the day our common stock began trading on the Nasdaq Stock Market, would have grown through the period ended December 31, 2001, compared with: (a) $100 invested in the Nasdaq Composite Index, and in the Company-selected peer group of companies ("Company Peer Group").

The Nasdaq Composite Index was chosen because it represents companies of a comparable market capitalization and consists of a large number of companies listed on the Nasdaq Stock Market.

The peer group consists of six companies, each of whose business focus is similar to that of PEC. While not all of the companies provide services to the federal government, the services provided are similar to those provided by PEC, but in different vertical markets. The return of each peer group company has been weighted according to its respective stock market capitalization for the purpose of arriving at a peer group average. Dividends paid by those companies that pay dividends are assumed to be reinvested at the end of the ex-dividend month without any transaction cost. The members of the peer group are as follows: Sapient Corporation; Diamond Cluster International, Inc.; The Management Network Group, Inc.; Tanning Technology Corporation; American Management Systems, Inc.; and Maximus, Inc.

COMPARE CUMULATIVE TOTAL RETURN

AMONG PEC SOLUTIONS, INC.,

NASDAQ COMPOSITE INDEX AND PEER GROUP INDEX

ASSUMES $100 INVESTED ON APR. 20, 2000

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING DEC. 31, 2001

8

EMPLOYMENT ARRANGEMENTS

We have entered into employment agreements with Drs. Karlgaard and Harbitter and Mr. Rice. The agreements have initial terms of two years and are automatically extended for additional one year terms. If Dr. Karlgaard, Mr. Rice or Dr. Harbitter is terminated for any reason other than for cause or terminates his agreement for good reason, the employment agreements provide that he is entitled to receive severance payments over a period equal to the greater of the remaining term of his agreement or one year. The employment agreements restrict Drs. Karlgaard and Harbitter and Mr. Rice from competing with us for a period of two years following termination of employment.

On December 31, 1998, we entered into an employment agreement with Stuart Lloyd. The agreement has an initial term of five years and is automatically extended for additional one year terms unless we, by providing one year's notice, elect not to renew the agreement. Mr. Lloyd, by providing 90 days notice, can terminate the agreement before the end of the current term. Under this agreement, Mr. Lloyd receives an initial annual base salary that will be increased at specified rates through 2001 and will be subject to adjustment by our board of directors and our compensation committee thereafter. He also may receive an annual cash bonus of up to 20% of his then current salary under our fall bonus plan, based upon performance objectives set by our senior management, and another cash bonus under our spring bonus plan not to exceed our net income margin as a percentage of his base salary. Mr. Lloyd, along with the other named executive officers, also receives beneficial use of an automobile.

Upon signing his employment agreement, Mr. Lloyd was granted options to purchase 60,000 shares of common stock at $2.04 per share. In the event that Mr. Lloyd determines to exercise any of these options through the use of proceeds borrowed from a third party lender, we have agreed that we will guarantee the loan on the condition that we receive a collateral security interest in the common stock acquired upon exercise. If, during the term of his employment agreement, we terminate Mr. Lloyd's employment without cause, he will be entitled to, in one lump sum, the base salary, bonus, all employee benefits and stock options he would have received over the remainder of the term of the agreement. In addition, if we terminate Mr. Lloyd's employment without good reason following a change of control, he will be entitled to the compensation he would have received had the agreement been fully performed. Mr. Lloyd has agreed to a non-competition provision that will be in effect during the term of his agreement and for two years after the agreement is terminated unless terminated as a result of a breach by us of one of the agreement's provisions.

Each named executive officer has agreed to preserve the confidentiality and the proprietary nature of all information relating to our business during and after the term of his employment.

9

AUDIT COMMITTEE REPORT ON

DECEMBER 31, 2001 AUDITED FINANCIAL STATEMENTS

The Audit Committee of the Board of Directors of the Company is composed of three independent directors, as required by Nasdaq listing standards. The Audit Committee operates under a written charter adopted by the Board of Directors, and is responsible for overseeing the Company's financial reporting process on behalf of the Board of Directors. The members of the Audit Committee are Messrs. Grossman, Brown and Carr. Each year, the Audit Committee recommends to the Board of Directors, subject to stockholder ratification, the selection of the Company's independent auditors.

Management is responsible for the Company's financial statements and the financial reporting process, including internal controls. The independent auditors are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In this context, the Audit Committee has met and held discussions with management and PricewaterhouseCoopers LLP, the Company's independent auditors. Management represented to the Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) and Statement on Auditing Standards 90 (Audit Committee Communications). These matters included a discussion of PricewaterhouseCoopers LLP's judgments about the quality (not just the acceptability) of the Company's accounting principles as applied to financial reporting.

PricewaterhouseCoopers LLP also provided the Audit Committee with the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with PricewaterhouseCoopers LLP that firm's independence. The Audit Committee further considered whether the provision by PricewaterhouseCoopers LLP of the non-audit services described elsewhere in this Proxy Statement is compatible with maintaining the auditors' independence.

Based upon the Audit Committee's discussion with management and the independent auditors and the Audit Committee's review of the representation of management and the disclosures by the independent auditors to the Audit Committee, the Audit Committee recommended to the Board of Directors that the Company's audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors have also recommended the selection of PricewaterhouseCoopers LLP as the company's independent auditors for 2002, subject to stockholder ratification.

10

COMPENSATION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION

The Compensation Committee reviews and recommends the compensation arrangements for our management, establishes and reviews general compensation policies and administers our stock incentive plan and our restricted stock program. The Compensation Committee, established in March 2000, comprises three members, all of whom are outside directors. None of the directors has any interlocking or other relationship with us that would call into question his independence as a Compensation Committee member.

The Compensation Committee seeks to achieve two broad goals in connection with our executive compensation programs and decisions regarding individual compensation. These goals and the general means of achieving them are:

First, we want to provide our executives with a performance-oriented environment by tying individual compensation in part to particular goals. More specifically, our executives are to be rewarded for meeting specific individual performance goals that contribute in a significant way to the accomplishment of our business objectives. Also, by linking a portion of their compensation with the performance of our common stock, we intend to provide our executives with an equity interest in the performance of the Company.

Second, we seek to attract and retain key executives by structuring the executive compensation programs with appropriate attention to the standards and practices at comparable companies in the government-IT industry or related industries comprised of companies that employ professionals with similar technical skills.

The compensation programs for our executives established by the Compensation Committee consist of three elements tied to the foregoing objectives: base salary, annual cash bonus, and stock-based equity incentives achieved primarily through participation in our 2000 Stock Incentive Plan. In establishing base salaries for executives, the Compensation Committee monitors standards at comparable companies, particularly those that are in the same industry or related industries and/or are located in the same general geographical area as us, considers historic salary levels of the individual and the nature of the individual's responsibilities and compares the individual's base salary with those of our other executives. To the extent determined appropriate, the Compensation Committee also considers general conditions and our financial performance in establishing base salaries of executives. In deciding to award options, the Compensation Committee also considers the number of options outstanding or previously granted and the aggregate size of current awards.

For the year ended December 31, 2001 the Compensation Committee determined that Dr. Karlgaard's compensation was comparable to that of other chief executive officers of companies surveyed in the same industry and that his 2001 bonus award properly reflected our actual performance against our business plan and the other qualitative objectives previously discussed. The base salaries and bonuses of Dr. Harbitter and Messrs. Rice, Lloyd, Bratiotis, Scharf and Owlett were increased in 2001 as warranted by their relative individual contribution to the accomplishment of our business objectives. In addition, they were granted options that were designed to be a meaningful portion of their overall compensation and would contribute to the retention of our key executives.

Based on its evaluation of the performance of the executive officers, the Compensation Committee believes that our executive officers are committed to achieving positive long-term financial performance and enhanced stockholder value, and that the compensation policies and programs discussed in this report have motivated our executive officers to work toward these goals.

Section 162(a) of the Internal Revenue Code disallows a tax deduction to public corporations for compensation over $1,000,000 paid for any year to the corporation's chief executive officer or to any of the four other most highly compensated executive officers. The statute exempts qualifying performance-

11

based compensation from the deduction limit if certain requirements are met. The Compensation Committee currently intends to structure its executive-compensation packages to meet these requirements.

12

COMPENSATION COMMITTEE INTERLOCKS AND

INSIDER PARTICIPATION

The Compensation Committee of the board of directors was formed in March 2000, and the current members of the Compensation Committee are Messrs. Brown, Grossman and Carr. None of the members was, during 2001, an officer or employee at any time.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company did not have any relationships or related transaction during fiscal 2001 which required disclosure.

PRINCIPAL STOCKHOLDERS

The following table shows the number of shares of our common stock beneficially owned as of March 28, 2002 by:

- •

- each person who we know beneficially owns more than 5% of the common stock;

- •

- each member of our board of directors;

- •

- each of our Named Executive Officers; and

- •

- the directors and executive officers as a group.

Unless otherwise indicated (i) the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable, and (ii) the address for the persons named in the table is c/o PEC Solutions, Inc., 12750 Fair Lakes Circle, Fairfax, Virginia 22033.

Name of Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percent of Shares

Outstanding(1)

|

|---|

| Gilder, Gagnon, Howe & Co. LLC (a) | | 1,752,172 | | 6.68 |

| David C. Karlgaard (b) | | 6,951,810 | | 25.47 |

| Paul G. Rice (c) | | 6,913,313 | | 25.01 |

| Alan H. Harbitter (d) | | 3,641,426 | | 13.59 |

| Stuart R. Lloyd (e) | | 102,306 | | 0.39 |

| Christos Bratiotis (f) | | 140,870 | | 0.54 |

| Sharon M. Owlett (g) | | 574,198 | | 2.18 |

| Jesse Brown (h) | | 30,375 | | 0.12 |

| R. Jerry Grossman (i) | | 10,000 | | 0.04 |

| Frank J. Carr (i) | | 10,000 | | 0.04 |

| All executive officers and directors as a group (11 persons) (j) | | 20,232,828 | | 68.06 |

- (1)

- As of March 28, 2002, we had outstanding 26,212,003 shares of common stock. The persons named in this table have sole voting power with respect to all shares of common stock. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock, which that person could purchase by exercising outstanding options and options which will become exercisable within 60 days of April 24, 2002, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

- (a)

- The address of Gilder, Gagnon, Howe & Co. LLC is 1775 Broadway, 26th Floor, New York, NY 10019.

13

- (b)

- Includes 1,081,178 shares underlying exercisable options and 1,121,203 shares held in a trust for the benefit of Dr. Karlgaard. In addition, it includes 300,000 shares held in a charitable remainder trust, and 70,000 shares held in a charitable foundation that both benefit Dr. Karlgaard. Does not include 335,040 shares held in an irrevocable trust for the benefit of Dr. Karlgaard over which Dr. Karlgaard does not hold voting or investment power. See note (g).

- (c)

- Includes 1,433,937 shares underlying exercisable options and 722,700 shares held in a trust for the benefit of Mr. Rice. In addition, it includes 55,000 shares held in a charitable foundation that benefits Mr. Rice.

- (d)

- Includes 592,676 shares underlying exercisable options and 514,000 shares held in a trust for the benefit of Dr. Harbitter. In addition, it includes 59,000 shares held in a charitable remainder trust that benefits Dr. Harbitter.

- (e)

- Includes 100,004 shares underlying exercisable options and 480 shares held in trust for the benefit of Mr. Lloyd's daughter.

- (f)

- Includes 55,088 shares underlying exercisable options.

- (g)

- Includes 145,088 shares underlying exercisable options and 335,040 shares held in an irrevocable trust for the benefit of Dr. Karlgaard for which Ms. Owlett is trustee. Ms. Owlett disclaims all beneficial ownership of the shares held in the trust.

- (h)

- Mr. Brown resigned from the board effective March 31, 2002.

- (i)

- Represents shares underlying exercisable options.

- (j)

- Includes 3,517,193 shares underlying exercisable options.

14

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF AUDITORS

PricewaterhouseCoopers LLP ("PWC") has served as our independent auditors since October 4, 1999 and has been selected by our board of directors as our independent auditors for the year ending December 31, 2002. In the event that ratification of this selection of auditors is not approved by a majority of the shares of common stock voting thereon, management will review its future selection of auditors.

Representatives of PWC will be present at the annual meeting and therefore will be available to respond to questions.

Audit Fees. PWC billed the Company an aggregate of $120,175 for professional services rendered for the audit of the Company's financial statements for calendar year ended December 31, 2001 and its reviews of the Company's financial statements included in the Company's Forms 10-Q during the 2001 calendar year.

Financial Information Systems Design and Implementation Fees. During the calendar year ended December 31, 2001, PWC provided no services and therefore billed no fees to the Company in connection with financial information systems design and implementation.

All Other Fees. During the calendar year ended December 31, 2001, PWC billed the Company an aggregate of $98,285 for services rendered in connection with our follow-on public offering, acquisition due diligence assistance, benefit plan audit and tax compliance and consulting.

The Audit Committee of the Board of Directors has determined that the provision of services by PWC described in the preceding two paragraphs are compatible with maintaining PWC's independence as the Company's principal accountant.

Required Vote

The ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2002 requires the affirmative vote of the holders of a majority of the shares of our common stock present at the annual meeting in person or by proxy and entitled to vote.

Recommendation of the Board of Directors

Our board of directors recommends a vote "FOR" ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors.

15

STOCKHOLDER PROPOSALS

Pursuant to Rule 14a-8 promulgated under the Exchange Act, PEC Solutions stockholders may present proposals for inclusion in the PEC Solutions' proxy statement for consideration at the next annual meeting of its stockholders by submitting their proposals to PEC Solutions in a timely manner. Any such proposal must comply with Rule 14a-8.

SEC rules set forth standards for what stockholder proposals PEC Solutions is required to include in a proxy statement for an annual meeting.

To be considered for presentation to the annual meeting to be held in 2003, a stockholder proposal must be received by Stuart R. Lloyd, our Chief Financial Officer, c/o PEC Solutions, Inc., 12750 Fair Lakes Circle, Fairfax, Virginia 22033, or by Alan H. Harbitter, our corporate secretary, c/o PEC Solutions, Inc., 12750 Fair Lakes Circle, Fairfax, Virginia 22033, no later than December 16, 2002.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Our directors and executive officers must file reports with the Securities and Exchange Commission indicating the number of shares of our common stock they beneficially own and any changes in their beneficial ownership. Copies of these reports must be provided to us. Based on our review of these reports and written representations from the persons required to file them, we believe each of our directors and executive officers filed all the required reports during 2001.

OTHER MATTERS

Our board of directors knows of no other business which will be presented at the annual meeting. If any other business is properly brought before the annual meeting, proxies in the enclosed form will be voted in respect thereof in accordance with the judgments of the persons voting the proxies.

It is important that the proxies be returned promptly and that your shares be represented. You are urged to sign, date and promptly return the enclosed proxy card in the enclosed envelope.

We have filed an Annual Report on Form 10-K for the year ended December 31, 2001, with the Securities and Exchange Commission. You may obtain, free of charge, a copy of the Form 10-K by writing to our Chief Financial Officer, Stuart Lloyd, c/o PEC Solutions, Inc., 12750 Fair Lakes Circle, Fairfax, Virginia 22033. Our Form 10-K is also available through our website at www.pec.com.

16

Please date, sign and mail your

proxy card back as soon as possible!

Annual Meeting of Stockholders

PEC SOLUTIONS, INC.

May 22, 2002

/ Please Detach and Mail in the Envelope Provided /

| A | ý | Please mark your

votes as in this

example

| | |

| | | | | FOR | | WITHHELD | | | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| 1. | | To elect those directors listed at | | o | | o | | Nominees: | | Dr. Alan H. Harbitter

Stuart R. Lloyd | | 2. | | To ratify the appointment of PricewaterhouseCoopers LLP as our | | o | | o | | o |

| | | right to serve until the 2005 annual meeting of stockholders, and until their successors are elected and duly qualified: | | | | Sharon M. Owlett | | | | independent auditors for the year ending December 31, 2002, and |

| | | | | | | | | | | | | 3. | | To transact such other business as may property come before the annual meeting and any adjournment or postponement thereof. |

| For, except vote withheld from the following nominee(s): | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | PLEASE COMPLETE, SIGN AND DATE YOUR PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. |

| Note: | | Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President of other authorized officer. If a partnership, please sign in partnership name by authorized person. |

PEC SOLUTIONS, INC.

12750 Fair Lakes Circle

Fairfax, Virginia 22033

The undersigned, a holder of Common Stock of PEC SOLUTIONS, INC., a Delaware corporation (the "Company"), hereby appoints DR. DAVID C. KARLGAARD and DR. ALAN H. HARBITTER, and each of them, the proxy of the undersigned, with full power of substitution, to attend, represent and to vote for the undersigned, all of the shares of the Company which the undersigned would be entitled to vote, at the Annual Meeting of Stockholders of the Company, to be held on May 22, 2002, and any adjournments thereof, as follows:

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN ACCORDANCE WITH THE INSTRUCTIONS ON THE OTHER SIDE HEREOF. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE THREE DIRECTORS NAMED IN PROPOSAL 1, AND FOR THE ADOPTION OF PROPOSALS 2 THROUGH 3 AND AS SAID PROXIES SHALL DEEM ADVISABLE ON SUCH OTHER BUSINESS AS MAY COME BEFORE THE MEETING.

The undersigned hereby revokes any other proxy to vote at such Annual Meeting, and hereby ratifies and confirms all that said attorneys and proxies, and each of them, may lawfully do by virtue hereof. With respect to matters not known at the time of the solicitations hereby, said proxies are authorized to vote in accordance with their best judgement.

(Continued and to be signed on Reserve Side)

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 22, 2002PROXY STATEMENTGENERAL INFORMATION ABOUT VOTINGPROPOSAL NO 1: ELECTION OF DIRECTORSTHE BOARD OF DIRECTORS AND COMMITTEESEXECUTIVE OFFICERSEXECUTIVE COMPENSATIONOptions Granted in 2001Option Exercises in 2001 and Year-End Value TablePERFORMANCE GRAPHEMPLOYMENT ARRANGEMENTSAUDIT COMMITTEE REPORT ON DECEMBER 31, 2001 AUDITED FINANCIAL STATEMENTSCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSPRINCIPAL STOCKHOLDERSPROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF AUDITORSSTOCKHOLDER PROPOSALSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEOTHER MATTERS