QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

PEC SOLUTIONS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

PEC Solutions, Inc.

12730 Fair Lakes Circle

Fairfax, VA 22033

April 21, 2005

Dear Stockholder:

You are invited to attend the 2005 Annual Meeting of Stockholders of PEC Solutions, Inc. The meeting will be held on Wednesday, May 25, 2005, at 5:30 p.m. at PEC corporate headquarters, located at 12730 Fair Lakes Circle, Fairfax, Virginia. The Notice of the Annual Meeting of Stockholders and the Proxy Statement accompanying this letter describe the business to be transacted at the meeting.

Your participation in the Annual Meeting is important. Regardless of whether you plan to attend, we urge you to vote your proxy at your earliest convenience. This will help establish a quorum for the meeting and avoid the cost of further solicitation. We hope that you will be able to attend the meeting, and we encourage you to read the enclosed materials.

We look forward to seeing you on May 25th.

| | | Sincerely, |

|

|

|

|

|

Dr. David C. Karlgaard

Chairman of the Board of Directors,

and CEO |

PEC Solutions, Inc.

12730 Fair Lakes Circle

Fairfax, VA 22033

(703) 679-4900

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 25, 2005

The Annual Meeting of Stockholders of PEC Solutions, Inc., a Delaware corporation (the "Company"), will be held on Wednesday, May 25, 2005, at 5:30 p.m., local time, at the Company's headquarters, 12730 Fair Lakes Circle, Fairfax, VA 22033 for the following purposes:

- 1.

- To elect three Class III directors to serve until the 2007 Annual Meeting of Stockholders, and until their successors are elected and duly qualified;

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2005; and

- 3.

- To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The foregoing matters are described in more detail in the accompanying Proxy Statement. The Board of Directors has fixed the close of business on March 30, 2005, as the record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting. Only those stockholders of record of the Company as of the close of business on that date will be entitled to vote at the Annual Meeting or any postponement or adjournment thereof.

| | | By Order of the Board of Directors, |

|

|

|

|

|

Alan H. Harbitter

Secretary |

Fairfax, Virginia

April 21, 2005

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO VOTE YOUR SHARES. VOTE ONLINE USING THE ENCLOSED INTERNET VOTING INSTRUCTIONS OR VOTE BY MAIL BY COMPLETING AND PROMPTLY RETURNING THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED.

PEC Solutions, Inc.

12730 Fair Lakes Circle

Fairfax, VA 22033

(703) 679-4900

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of PEC Solutions, Inc. (the "Company") for use at the 2005 Annual Meeting of Stockholders to be held on Wednesday, May 25, 2005 at 5:30 p.m. local time at the Company's headquarters, 12730 Fair Lakes Circle, Fairfax, Virginia 22033, or at any postponements or adjournments thereof. Your vote at the Annual Meeting is important to us. Please vote your shares of PEC common stock (the "Common Stock"). You may vote online by utilizing the enclosed instructions for Internet voting. Alternatively, you may vote by mail by completing the enclosed proxy card and returning it to us in the enclosed envelope. This Proxy Statement and the accompanying proxy card were first mailed to stockholders on or about April 21, 2005.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the notice of meeting on the cover page of this Proxy Statement, including the election of Class III directors and ratification of the appointment of our Company's independent auditors. In addition, management will report on the performance of the Company and respond to questions from stockholders.

Who is entitled to vote?

Only stockholders of record at the close of business on March 30, 2005, the record date for the meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the Annual Meeting, or any postponements or adjournments of the meeting. Each outstanding share of Common Stock owned by you on March 30, 2005 entitles you to one vote on each matter considered at the Annual Meeting. The enclosed proxy card shows the number of shares owned by you as of the record date.

Who can attend the Annual Meeting?

All stockholders of record as of the record date, or their duly appointed proxies, may attend the meeting.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the aggregate voting power of the Common Stock outstanding on the record date will constitute a quorum. As of the record date, a total of 27,595,370 shares of Common Stock, representing the same number of votes, were outstanding. Thus, the presence of the holders of Common Stock representing at least 13,797,685 votes will be required to establish a quorum for the transaction of business at the Annual Meeting.

How do I vote?

There are two ways you may vote your shares. You can choose to vote electronically online or you may vote by mail. To vote online, follow the enclosed instructions for Internet voting. To vote by mail,

1

complete and properly sign the accompanying proxy card and return it to the Company. Whether your proxy is submitted electronically online or by mail, your shares of Common Stock will be voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. "Street name" stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

If you hold your shares in "street name" through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to matters that are determined to be non-routine. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such "broker non-votes" will, however, be counted in determining whether there is a quorum.

Can I change my vote after I return my proxy?

Yes. Even after you have submitted your proxy, you may revoke or change your vote at any time before the proxy is exercised by providing Alan H. Harbitter, our Corporate Secretary, either a written notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What are the Board's recommendations?

Unless you give other instructions on your proxy, the persons named as proxy holders on the proxy will vote in accordance with the recommendations of the Company's Board of Directors. The Board's recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

- •

- For election of the nominated slate of Class III Directors (see Item 1); and

- •

- For ratification of the appointment of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm for fiscal 2005 (see Item 2).

What vote is required to approve each item?

Election of Directors. The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of the Class III directors. A properly executed proxy marked "Withhold Authority" with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of the holders of a majority of the shares represented in person or by vote and entitled to vote will be required for the ratification of the appointment of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm. A properly executed proxy marked "Abstain" will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

What if other matters come up at the Annual Meeting?

Aside from the election of the Class III directors and the ratification of the selection of our auditors, the Board of Directors knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the meeting upon which a vote properly may be taken, the shares represented by the proxy holders will be voted in the discretion of the proxy holders.

Who pays for this proxy solicitation?

We do. The proxies being solicited in connection with this Proxy Statement are being solicited by the Board of Directors and the costs will be borne by the Company. In addition to sending you these materials, some of our employees may contact you by telephone, by mail, or in person. None of these employees will receive any extra compensation for doing this. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our stock.

2

PRINCIPAL STOCKHOLDERS

The following table shows the number of shares of our Common Stock beneficially owned as of March 30, 2005 by each of our directors, by each executive officer named in the Summary Compensation Table herein, by all directors and executive officers as a group, and by each stockholder who is known by us to own beneficially 5% or more of our Common Stock.

Directors and Named Executive Officers:

| | Number of Shares

Beneficially Owned

| | Percent of Shares

Outstanding(1)

| |

|---|

| David C. Karlgaard(2) | | 6,952,413 | | 24.19 | % |

| Paul G. Rice(3) | | 6,717,155 | | 23.13 | |

| Alan H. Harbitter(4) | | 3,574,799 | | 12.66 | |

| Stuart R. Lloyd(5) | | 204,099 | | * | |

| Christos Bratiotis(6) | | 159,182 | | * | |

| Frank J. Carr(7) | | 18,000 | | * | |

| B. Gary Dando(8) | | 16,500 | | * | |

| R. Jerry Grossman(9) | | 20,000 | | * | |

| John W. Melchner(8) | | 16,000 | | * | |

| Zimri C. Putney(8) | | 15,300 | | * | |

| All executive officers and directors as a group (11 persons)(10) | | 17,740,034 | | 56.91 | % |

- *

- Less than 1%.

- (1)

- The number and percentage of shares beneficially owned is determined under rules of the Securities and Exchange Commission (the "SEC") and the information is not necessarily indicative of ownership for any other purpose. Under SEC rules, beneficial ownership includes any shares to which the individual has sole or shared voting power or investment power and also any shares that the individual has the right to acquire within 60 days of March 30, 2005 through the exercise of any option or other right. Unless otherwise indicated, the listed beneficial owner has sole voting power and investment power with respect to the shares shown (or shares such powers in accordance with applicable community property laws).

- (2)

- Includes 1,139,735 shares underlying exercisable options and 1,041,203 shares held in a trust for the benefit of Dr. Karlgaard. In addition, the listed number of shares includes 300,000 shares held in a charitable remainder trust, and 95,000 shares held in a charitable foundation that both benefit Dr. Karlgaard. Does not include 335,040 shares held in an irrevocable trust for the benefit of Dr. Karlgaard over which Dr. Karlgaard does not hold voting or investment power.

- (3)

- Includes 1,443,233 shares underlying exercisable options and 601,200 shares held in a trust for the benefit of Mr. Rice. In addition, the listed number of shares includes 4,000 shares held in a charitable foundation that benefits Mr. Rice.

- (4)

- Includes 651,503 shares underlying exercisable options and 491,500 shares held in a trust for the benefit of Dr. Harbitter. In addition, the listed number of shares includes 29,500 shares held in a charitable remainder trust, and 8,000 shares in a charitable foundation that both benefit Dr. Harbitter.

- (5)

- Includes 117,756 shares underlying exercisable options and 480 shares held in trust for the benefit of Mr. Lloyd's daughter.

- (6)

- Includes 97,757 shares underlying exercisable options.

- (7)

- Represents shares underlying exercisable options.

- (8)

- Includes 15,000 shares underlying exercisable options.

- (9)

- Includes 18,000 shares underlying exercisable options.

- (10)

- Includes 3,577,570 shares underlying exercisable options.

3

ITEM 1: ELECTION OF CLASS III DIRECTORS

Our Board of Directors is currently composed of nine members divided into three classes serving staggered terms of office. The terms of office for the Class III directors expire this year. The terms of office for the Class I directors expire in 2006, and the terms of office for the Class II directors expire in 2007.

Three Class III directors are to be elected at this Annual Meeting to serve until the 2008 Annual Meeting, and until their successors are elected and duly qualified. Upon the recommendation from the Corporate Governance and Nominating Committee, the Board of Directors has nominated Messrs. Alan H. Harbitter, Stuart R. Lloyd and John W. Melchner, who are all currently serving as Class III directors. Each of the nominees has consented to continue to serve on the Board of Directors if elected. If any of them becomes unavailable to serve as a Class III director, the Board of Directors may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

Set forth below is certain information concerning the nominees and the other incumbent directors:

Class III Directors—Nominated to be Re-Elected at the 2005 Annual Meeting

Alan H. Harbitter, Ph.D., age 47, has been our Chief Operating Officer since May 2004 and a member of the Board of Directors since October 1985. From May 1996 to May 2004, he was our Chief Technology Officer. Prior to that he was our Senior Vice President, Engineering, from January 1991 until April 1996; and he was the Vice President, Engineering, from October 1985 to January 1991. Prior to the founding of the Company, Dr. Harbitter served in various technical management positions at Computer Sciences Corporation. Dr. Harbitter received his B.S. in electrical engineering from Cornell University, his M.S. in computer science from the University of Maryland, and his doctorate in computer science from George Mason University.

Stuart R. Lloyd, age 61, has been our Senior Vice President and Chief Financial Officer since December 1998, our Treasurer since May 2004, and a member of the Board of Directors since May 1999. Mr. Lloyd was a partner at Gelman, Rosenberg & Freedman, a certified public accounting firm, from February 1993 until December 1998. From September 1981 until February 1993, he was the principal at his own certified public accounting firm. Mr. Lloyd is a certified public accountant and received his B.S. in business administration from The American University.

John W. Melchner, age 66, has been a member of our Board of Directors since August 2002. Mr. Melchner founded John Melchner & Associates in 1992. His company provides accounting and auditing advice to Government and corporate clients. For the past five years, Mr. Melchner has provided consulting services exclusively to the Los Angeles County Metropolitan Transportation Authority. Previously, Mr. Melchner served as Inspector General of the U.S. Department of Transportation, and prior to that as the Assistant Inspector General for Auditing of the Department of Defense. Mr. Melchner received his B.B.A. from the Manhattan College of New York and his M.B.A. from the University of Dayton.

Class I Directors—Terms of Office Expire at the 2006 Annual Meeting

David C. Karlgaard, Ph.D., age 58, has been our Chief Executive Officer, and Chairman of the Board of Directors since October 1985 when he founded the Company with Mr. Rice and Dr. Harbitter. From October 1985 to May 2004, Dr. Karlgaard held the position of President of the Company. From 1975 to 1984, Dr. Karlgaard held various management positions with Computer Sciences Corporation, where he worked with Mr. Rice and Dr. Harbitter. Dr. Karlgaard is a also a member of the Board of Directors for Argon ST, Inc. and for James Monroe Bancorp, Inc. Dr. Karlgaard received his doctorate degree in electrical engineering and computer science from The

4

George Washington University and his M.B.A. from the Wharton Business School. Since 1994 Dr. Karlgaard has also lectured as a professor at The George Washington University School of Business and Public Management.

R. Jerry Grossman, age 61, has been a member of our Board of Directors since December 2000. Mr. Grossman has been the Managing Director of the Washington, D.C. office of Houlihan, Lokey, Howard & Zukin, an investment banking firm, since 1999. He manages the firm's Government and defense technology practices, with complementary emphasis on commercial technology businesses. Mr. Grossman received his B.S. in industrial management from Pennsylvania State University and his executive M.B.A. from Loyola College of Maryland. He is also a Chartered Financial Analyst (CFA).

B. Gary Dando, age 62, has been a member of our Board of Directors since February 2003. Mr. Dando has served on the Board of Directors of MICROS Systems, Inc. since November 2003. Mr. Dando also serves on the boards of the University System of Maryland Foundation, the University of Maryland College Park Foundation, and is the President of the Board of Directors for the Robert H. Smith School of Business Foundation. Mr. Dando joined Ernst & Young in 1964 and became a partner in 1976. He served in several national and regional positions from 1982 to 1993, and retired after 37 years of service in 2001. Mr. Dando received his B.A. in business and accounting from the University of Maryland at College Park.

Class II Directors—Terms of Office Expire at the 2007 Annual Meeting

Paul G. Rice, age 51, has been our President since May 2004 and has been a member of the Board of Directors since October 1985. He was our Chief Operating Officer from January 1996 until May 2004. From October 1985 until December 1995, he was our Vice President and then Senior Vice President, Operations. Prior to the founding of the Company, Mr. Rice served in various technical management positions at Computer Sciences Corporation from June 1975 to September 1985. Mr. Rice received his B.S. in electrical engineering from the University of Virginia.

Frank J. Carr, age 79, has been a member of our Board of Directors since December 2000. From 1977 until his retirement in 1988, Mr. Carr served as the General Service Administration's commissioner for Government-wide policy and planning, and for computer and telecommunications acquisition and management. From 1988 to the present, he has continued to provide assistance to Federal agencies seeking to resolve pressing information technology issues. Mr. Carr received his B.S. in electrical engineering from the University of Pennsylvania.

Zimri C. Putney, age 63, has been a member of our Board of Directors since July 2002. Since 1997, Mr. Putney has been the Managing Director and CEO of NextGen Capital, L.L.C., a venture capital management company. At NextGen, he oversees targeting investment opportunities and assisting in the financial and management support for two venture funds with more than 15 investments in the technology sector. He previously held several management and scientific positions with IBM Corporation. Mr. Putney also serves on the boards of several private companies. Mr. Putney received his B.S. in physics from Syracuse University and his Sc.M. from Brown University.

Unless marked otherwise, proxies received will be voted for the election of the Class III director nominees named above.

Recommendation of the Board of Directors

The Board of Directors recommends a vote "FOR" the election of the Class III director nominees named above.

5

CORPORATE GOVERNANCE AND BOARD MATTERS

Board of Directors

During the fiscal year ended December 31, 2004, the Board of Directors held a total of six meetings (including regularly scheduled and special meetings) and took action six times by unanimous written consent. Each incumbent director attended all of the meetings of the Board held in 2004, except that Dr. Harbitter was absent from two meetings and Mr. Melchner and Mr. Carr were absent from one meeting. The Board of Directors has four standing committees: an Executive Committee, Audit Committee, Corporate Governance and Nominating Committee, and Compensation Committee. No incumbent director attended fewer than 75% of the total number of meetings held by all committees on which such director served, other than Messrs. Carr (68%) and Putney (68%).

Director Independence

The Board of Directors has determined that each of the five non-management directors, Messrs. Carr, Dando, Grossman, Melchner and Putney, is independent within the meaning of the director independence standards adopted by the Board of Directors and the director independence standards of the NASDAQ Stock Market. Therefore, a majority of our Company's nine-person Board of Directors is currently independent as so defined.

Given that these same five non-management directors constitute the full membership of the Audit Committee, the Corporate Governance and Nominating Committee, the Compensation Committee, and the Executive Committee of the Board of Directors, the foregoing independence determination included the conclusion that each of them is respectively:

- •

- Independent for purposes of membership on the Audit Committee under Rule 4350(d) of the NASDAQ listing standards, that includes the independence requirements of NASD Marketplace Rule 4200 and additional independence requirements under SEC Rule 10A-3(b);

- •

- Independent under the NASDAQ listing standards for purposes of membership on the Corporate Governance and Nominating Committee; and

- •

- Independent under the NASDAQ listing standards for purposes of membership on the Compensation Committee.

Executive Committee

In accordance with requirements of the NASDAQ listing standards, the Executive Committee is currently composed of the five non-management directors: Messrs. Melchner, Carr, Dando, Grossman and Putney. The Executive Committee met three times during 2004 and each of the committee's members participated in all of the meetings, except that Mr. Carr was absent from one meeting. Mr. Grossman serves as the Chairman of the Executive Committee.

The charter of the Executive Committee is available on our Company's Website as described below under "Corporate Governance and Website Information." The primary purposes of the Executive Committee are to (1) advise management on Board meeting agendas and information provided to the Board, (2) monitor corporate management processes in key areas, (3) review related party transactions and (4) perform such other functions regarding issues best addressed by the independent members of the Board of Directors as a group.

Audit Committee

The Audit Committee is currently composed of Messrs. Melchner, Carr, Dando, Grossman and Putney. The Audit Committee met twelve times during 2004 and each of the committee's members participated in all of the meetings, except that Mr. Carr and Mr. Putney were absent from four

6

meetings, and Mr. Grossman was absent from three meetings. Mr. Dando serves as the Chairman of the Audit Committee and Mr. Melchner serves as Vice-Chairman.

The primary purposes of this committee are to (1) recommend to our Board of Directors the independent auditors to conduct the annual audit of our books and records, (2) review the proposed scope and results of the annual audit as well as the quarterly interim reviews, (3) approve the audit fees to be paid, (4) review accounting and financial controls with the independent public accountants and our financial and accounting staff, (5) review and discuss the internal audit function, and (6) such other matters as provided by its charter.

As previously described, the Board of Directors has determined that the members of this committee are independent. The Board of Directors has also determined that all of the members of the Audit Committee meet the requirement of the NASDAQ listing standards that each member be able to read and understand fundamental financial statements, including a company's balance sheet, income statement and cash flow statement. Additionally, the Board of Directors has determined that Mr. Dando, the Chairman of the Audit Committee, meets the requirement of the NASDAQ listing standards: that at least one member of the committee has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background which results in the individual's financial sophistication. The Board of Directors has also determined that Mr. Dando is an "audit committee financial expert" as defined in SEC Regulation S-K, Item 401(h).

Corporate Governance and Nominating Committee/Director Nomination Process

The Corporate Governance and Nominating Committee (the "Nominating Committee") is currently composed of Messrs. Carr, Dando, Grossman, Melchner and Putney. The Nominating Committee did not meet during 2004, but rather took action by unanimous written consent. Mr. Carr serves as Chairman of the Nominating Committee.

The charter of the Nominating Committee is available on our Company's Website as described below under "Corporate Governance and Website Information." The primary purposes of this committee are to (1) recommend to the Board of Directors the individuals qualified to serve on the Board and (2) develop, recommend to the Board, and assess corporate governance policies for the Company.

The SEC requires disclosure of the Nominating Committee's policy for considering director nominations by stockholders (if there is a policy) and related information concerning the committee.

While the Nominating Committee will consider recommendations for director nominations received from the stockholders, the committee has not adopted any formal policies with respect to such recommendations because Section 1.11 of our Company's Bylaws provides a procedure by which stockholders may directly nominate nominees for election to the Board of Directors. This stockholder nomination procedure specified in our Bylaws is separate and apart from the process by which the Nominating Committee submits its recommendations for nominations to the Board. The Nominating Committee has no role in the stockholder nomination procedure provided by the Bylaws.

Director Nominations Made by Stockholders. Any stockholder intending to nominate a candidate for director to stand for election at the 2006 Annual Meeting must submit a written nomination notice to the Company meeting the requirements of Section 1.11 of the Bylaws, including certain specified information about the nominee and the stockholder proposing the nomination. To be included in the Proxy Statement and related materials for the 2006 Annual Meeting, a nomination notice must be received on or before December 31, 2005 and meet the applicable requirements of SEC Rule 14a-8. If a nomination notice is received after December 31, 2005, but before January 27, 2006 (120 days prior to the anniversary date of the 2005 Annual Meeting) and otherwise meets the requirements of the

7

Bylaws, the recommended candidate would be presented for election at the meeting, but his or her name would not be included in the Proxy Statement and proxy card mailed to stockholders.

In accordance with Section 1.11(b) of the Bylaws, the nomination notice must include, among other information, the nominee's name, a description of the nominee's business experience during the previous five years, and all other information relating to the recommended candidate that would be required to be disclosed under Section 14 of the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder.

Process for Identifying and Recommending Director Candidates. The Nominating Committee is responsible for identifying qualified candidates for election to the Board of Directors. This committee's general criteria and process for evaluating and identifying the candidates that it recommends to the full Board as director nominees are as follows:

- •

- Regularly reviews the current composition and size of the Board of Directors and its standing committees.

- •

- In its evaluation of director candidates, including members of the Board of Directors eligible for re-election, the Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers such factors as character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and such other factors as the committee may consider appropriate.

- •

- While the Nominating Committee has not established specific minimum qualifications for director candidates, the committee believes that nominees must reflect a Board that is comprised of directors who (a) are predominantly independent, (b) are of high integrity, (c) have broad knowledge and experience at the policy making level in business or Government, including, if possible, specific knowledge and understanding of the challenges of providing advanced information technology solutions to Government clients, and (d) meet all requirements of applicable laws and regulations (such as financial literacy for Audit Committee members). Candidates with special qualifications that will increase the Board's overall effectiveness will be given preferential treatment.

- •

- The Nominating Committee will review the qualifications of all candidates, which review may, at the committee's discretion, include interviewing references for the candidate, direct interviews with the candidate, background checks, or other actions that the committee deems necessary or appropriate.

- •

- These same principles would be applied when identifying candidates to fill a vacancy on the Board of Directors. Since the Nominating Committee has not received any stockholder recommendations for director candidates in the past, the committee has not considered whether there would be any differences in the manner in which the committee would evaluate such candidates.

- •

- After completing its review and evaluation of director candidates, the Nominating Committee makes its recommendations for director nominees to the full Board of Directors.

Source of Recommendation for Current Nominees. The Class III director nominees included in this Proxy Statement have been formally recommended by the Nominating Committee (the members of which include some of the nominees). Our Company did not pay a fee to any third party to identify or evaluate or assist in identifying or evaluating potential nominees.

Compensation Committee

The Compensation Committee is currently composed of Messrs. Putney, Carr, Dando, Grossman and Melchner. The Compensation Committee met two times during 2004 and each of the committee's

8

members participated in all of the meetings. Mr. Putney serves as Chairman of the Compensation Committee.

The charter of the Compensation Committee is available on our Company's Website as described below under "Corporate Governance and Website Information." The primary purposes of this committee are to (1) review and recommend the compensation arrangements for our management, including the compensation for our President and Chief Executive Officer, (2) establish and review general compensation policies with the objective to attract and retain superior talent, to reward individual performance, and to achieve our financial goals, and (3) administer our stock option plans.

Compensation of Directors

Cash Compensation. Directors who are employees of the Company do not receive additional compensation for their service on the Board of Directors. Effective January 20, 2005, our non-employee directors each receive annual retainers of $26,000, covering six Board meetings and four committee meetings. The non-employee directors are paid for their participation at additional Board and committee meetings at the rate of $2,000 and $1,000 per meeting, respectively. In addition, the Board member serving as Chairman of the Audit Committee receives an annual fee of $6,000 and the Board member serving as Vice-Chairman of the Audit Committee receives an annual fee of $3,000. Board members serving as Chairman of other standing committees of the Board of Directors (i.e., Executive, Compensation, Corporate Governance and Nominating) receive an annual fee of $3,000.

Stock Options. Upon being elected to the Board of Directors, new non-employee members of the Board receive an initial stock option grant for the purchase of 15,000 shares of Common Stock. Three years after this initial grant and annually thereafter, the non-employee directors receive stock option grants for the purchase of 3,000 shares.

Stockholder Communications to the Board of Directors

Stockholders who have concerns about accounting, internal accounting controls, or auditing matters relating to our Company or are interested in communicating with the non-management directors, individually or as a group, may contact the Audit Committee directly by writing to: Chairman of the Audit Committee, PEC Solutions, Inc., 12730 Fair Lakes Circle, Fairfax, VA 22033. To the extent such communications are addressed to individual members of the Board, the Chairman of the Audit Committee shall ensure that it is received by the addressee. The communications process described above does not modify or relieve any requirements for stockholder proposals intended to be presented at a meeting of stockholders.

Board Attendance at the Annual Meeting

Our Company encourages all members of the Board of Directors to attend our annual stockholder meetings but has not adopted a formal policy requiring this attendance. Seven members of the Board attended the 2004 Annual Meeting.

Corporate Governance and Website Information

Our Company believes that it is in compliance with the corporate governance requirements of the NASDAQ listing standards. The principle elements of these governance requirements as implemented by the Company are:

- •

- Adoption of a "Corporate Governance Statement" by the Board of Directors;

- •

- Affirmative determination by the Board of Directors that a majority of directors is independent;

- •

- Regularly scheduled executive sessions of independent directors;

9

- •

- An Audit Committee, Corporate Governance and Nominating Committee, and Compensation Committee, each comprised of independent directors and having the purposes and charters described above under the separate committee headings;

- •

- Specific Audit Committee authority and procedures outlined in the charter of the Audit Committee; and

- •

- An Ethics Policy applicable to directors, officers and employees of our Company that meets the definition of a code of ethics set forth in SEC Regulation S-K, Item 406.

The Corporate Governance Statement (which includes the charters of the three committees described above) and the Ethics Policy are available without charge on the Investor Relations section of our Company's Website at http://www.pec.com.

EXECUTIVE OFFICERS

In addition to Drs. Karlgaard and Harbitter and Messrs. Rice and Lloyd, Messrs. Bratiotis and Veschi constitute the Company's executive officers.

Christos Bratiotis, age 61, has been the President of our Civilian Government Sector since May 2004. Prior to that he served as Senior Vice President and General Manager, Criminal Justice and Intelligence Solutions Operation, from July 2002 to May 2004. Mr. Bratiotis was our Senior Vice President, Engineering Operations from April 1999 through June 2002. Mr. Bratiotis was our Vice President, Engineering Division, from April 1996 to April 1999. Prior to that, he served as Vice President, Information Systems for Synetics, a Federal information technology company, from January 1992 until April 1996. Mr. Bratiotis received his B.A. in mathematics from Clark University and his M.B.A. from the University of Utah.

Robert L. Veschi, age 65, has served as the President of our Defense Sector since June 2004. Prior to joining us, Mr. Veschi was a consultant in private practice. Previously, Mr. Veschi held a succession of leadership position with leading information technology companies, including serving as President of the Integrated Business Solutions division of Lockheed Martin Corporation; serving as Executive Vice President of ACS Government Solutions, a subsidiary of Affiliated Computer Services, Inc.; and serving as President of CDSI Solutions, a division of Computer Data Systems, Inc. Earlier in his career, Mr. Veschi held a variety of senior technology development and management positions within the Department of Defense. He received his B.S. in computer science from the American Technological University and is also a graduate of the Defense Systems Management College.

Our executive officers are elected by the Board of Directors on an annual basis and serve until their successors have been duly elected and qualified.

10

EXECUTIVE COMPENSATION

The following Summary Compensation Table sets forth the compensation paid by us during the last three completed years to our Chief Executive Officer and the other four most highly compensated executive officers whose total compensation for services in all capacities exceeded $100,000 during such year, whom we refer to as our "Named Executive Officers."

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation

| |

| |

|---|

| | Year

| | Salary

| | Bonus

| | Securities

Underlying

Options

| | All Other

Compensation

| |

|---|

David C. Karlgaard

Chief Executive Officer and

Chairman of the Board of Directors | | 2004

2003

2002 | | $

| 384,301

384,301

334,131 | | $

| 30,500

31,639

131,600 | | —

5,017

78,989 | | $

| 39,356

18,758

48,892 | (1)

(1)

(1) |

Paul G. Rice

President and Director |

|

2004

2003

2002 |

|

|

282,110

282,110

245,294 |

|

|

30,500

31,639

131,600 |

|

—

5,017

78,989 |

|

|

50,925

16,304

53,044 |

(2)

(2)

(2) |

Alan H. Harbitter

Chief Operating Officer and Director |

|

2004

2003

2002 |

|

|

246,314

246,314

214,198 |

|

|

30,500

31,639

131,600 |

|

—

5,017

78,989 |

|

|

39,247

16,112

49,152 |

(3)

(3)

(3) |

Stuart R. Lloyd

Chief Financial Officer,

Senior Vice President and Director |

|

2004

2003

2002 |

|

|

229,429

218,504

190,008 |

|

|

67,000

64,000

72,500 |

|

5,899

3,344

77,658 |

|

|

36,357

16,780

42,102 |

(4)

(4)

(4) |

Christos Bratiotis

President—Civilian Government Sector |

|

2004

2003

2002 |

|

|

217,352

207,002

180,003 |

|

|

67,000

64,000

70,000 |

|

5,899

3,344

77,658 |

|

|

37,954

16,351

33,224 |

(5)

(5)

(5) |

- (1)

- Includes for 2004, $11,823 for life and health insurance, $2,121 automobile allowance, $19,262 for contribution to the Executive Supplemental Retirement Plan and $6,150 for the contribution to the 401(k) Plan; for 2003, $9,082 for life and health insurance, $1,676 for automobile allowance, $0 for contribution to the Executive Supplemental Retirement Plan and $8,000 for the contribution to the 401(k) Plan; and for 2002, $6,660 for life and health insurance, $1,456 for automobile allowance, $30,433 for contribution to the Executive Supplemental Retirement Plan and $12,000 for the contribution to the 401(k) Plan.

- (2)

- Includes for 2004, $13,507 for life and health insurance, $12,006 automobile allowance, $19,262 for contribution to the Executive Supplemental Retirement Plan and $6,150 for the contribution to the 401(k) Plan; for 2003, $8,304 for life and health insurance, $6,568 for automobile allowance, $0 for contribution to the Executive Supplemental Retirement Plan and $8,000 for the contribution to the 401(k) Plan; and for 2002, $4,679 for life and health insurance, $6,792 for automobile allowance, $30,433 for contribution to the Executive Supplemental Retirement Plan and $11,500 for the contribution to the 401(k) Plan.

- (3)

- Includes for 2004, $11,068 for life and health insurance, $2,767 automobile allowance, $19,262 for contribution to the Executive Supplemental Retirement Plan and $6,150 for the contribution to the 401(k) Plan; for 2003, $8,112 for life and health insurance, $4,299 for automobile allowance, $0 for contribution to the Executive Supplemental Retirement Plan and $8,000 for the contribution to the 401(k) Plan; and for 2002, $5,681 for life and health insurance, $2,900 for automobile allowance,

11

$30,433 for contribution to the Executive Supplemental Retirement Plan and $11,500 for the contribution to the 401(k) Plan.

- (4)

- Includes for 2004, $11,979 for life and health insurance, $2,714 automobile allowance, $15,514 for contribution to the Executive Supplemental Retirement Plan and $6,150 for the contribution to the 401(k) Plan; for 2003, $8,780 for life and health insurance, $5,990 for automobile allowance, $0 for contribution to the Executive Supplemental Retirement Plan and $8,000 for the contribution to the 401(k) Plan; and for 2002, $8,172 for life and health insurance, $6,509 for automobile allowance, $16,453 for contribution to the Executive Supplemental Retirement Plan and $12,000 for the contribution to the 401(k) Plan.

- (5)

- Includes for 2004, $11,954 for life and health insurance, $5,447 automobile allowance, $14,403 for contribution to the Executive Supplemental Retirement Plan and $6,150 for the contribution to the 401(k) Plan; for 2003, $8,351 for life and health insurance, $3,873 for automobile allowance, $0 for contribution to the Executive Supplemental Retirement Plan and $8,000 for the contribution to the 401(k) Plan; and for 2002, $6,035 for life and health insurance, $3,180 for automobile allowance, $13,041 for contribution to the Executive Supplemental Retirement Plan and $12,000 for the contribution to the 401(k) Plan.

Options Granted in 2004

The following table sets forth information regarding stock options granted to the Named Executive Officers during the fiscal year ended December 31, 2004.

| | Individual

Grants(1)

| |

| |

| |

| |

|

|---|

| |

| |

| | Potential Realizable

Value at Assumed

Annual Rates

of Stock Price

Appreciation for Option(2)

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total Options

Granted to

Employees in

2004

| |

| |

|

|---|

Name

| | Exercise

Price

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| David C. Karlgaard | | — | | — | | | — | | — | | | — | | | — |

| Paul G. Rice | | — | | — | | | — | | — | | | — | | | — |

| Alan H. Harbitter | | — | | — | | | — | | — | | | — | | | — |

| Stuart R. Lloyd | | 5,899 | | 0.78 | % | $ | 16.95 | | 12/31/13 | | $ | 62,883 | | $ | 159,351 |

| Christos Bratiotis | | 5,899 | | 0.78 | % | | 16.95 | | 12/31/13 | | | 62,883 | | | 159,351 |

- (1)

- All stock options reflected in this table were granted under our 2000 Stock Incentive Plan and have exercise prices equal to the fair market value of our Common Stock on the date of the grant. All such stock options vested immediately on the date of grant and have ten-year terms. Stock options exercisable into a total of 751,972 shares of our Common Stock were granted to employees and non-employee directors during 2004.

- (2)

- The potential realizable value is based on a 10-year term of each option at the time of grant. Assumed stock price appreciation of 5% and 10% is mandated by SEC rules and is not intended to forecast actual future financial performance. The potential realizable value is calculated by assuming that the price of our Common Stock appreciates at the indicated rates for the entire term of the option. Actual gains, if any, on stock option exercises are dependent on the timing of such exercises and the performance of our stock price. There can be no assurance that the rates of appreciation assumed in this table can be achieved or that the amounts reflected will be received by the individuals.

12

Option Exercises in 2004 and Year-End Value Table

The following table sets forth, for each of our Named Executive Officers, certain information concerning stock options exercised during 2004 and the number of shares subject to both exercisable and unexercisable stock options as of December 31, 2004. Also reported are values for "in-the-money" options based upon the positive spread between the respective exercise prices of outstanding stock options and the fair market value of the Company's Common Stock as of December 31, 2004.

| |

| |

| | Number of Securities

Underlying Unexercised

Options at

December 31, 2004

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

in-the-Money Options

at December 31, 2004(1)

|

|---|

| | Shares

Acquired on

Exercise

| | Value

Received

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David C. Karlgaard. | | — | | — | | 1,079,149 | | 50,000 | | $ | 12,368,434 | | — |

| Paul G. Rice | | 53,250 | | 712,041 | | 1,382,647 | | 50,000 | | | 16,408,498 | | — |

| Alan H. Harbitter | | — | | — | | 590,647 | | 50,000 | | | 6,517,478 | | — |

| Stuart R. Lloyd | | 30,000 | | 322,300 | | 51,001 | | 55,899 | | | 91,087 | | — |

| Christos Bratiotis | | — | | — | | 31,002 | | 55,899 | | | — | | — |

- (1)

- The value of unexercised in-the-money options is based on the closing price of our Common Stock on the NASDAQ National Market on December 31, 2004, which was $14.17, less the exercise price payable for such shares, multiplied by the number of shares underlying the option.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information regarding the Company's equity compensation plans as of December 31, 2004.

Plan Category

| | (a)

Number of

securities to be

issued upon

exercise of

outstanding options,

warrants and rights

| | (b)

Weighted-average

exercise price per

share of outstanding

options, warrants and

rights

| | (c)

Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in

column (a))

| |

|---|

| Equity compensation plans approved by security holders | | 5,193,240 | | $ | 8.38 | | 6,560,781 | (1) |

| Equity compensation plans not approved by security holders | | — | | | — | | — | |

| | |

| |

| |

| |

| Total: | | 5,193,240 | | $ | 8.38 | | 6,560,781 | (1) |

| | |

| |

| |

| |

- (1)

- The Company's 2000 Stock Incentive Plan (the "Plan") incorporates an evergreen formula pursuant to which the aggregate number of shares reserved for issuance under the Plan for a particular year cannot exceed the sum of (a) 6.25% of the number of shares of our Common Stock outstanding on January 1 of that year, plus (b) the number of shares available for awards in the prior calendar year that were not awarded under the Plan.

13

PERFORMANCE GRAPH

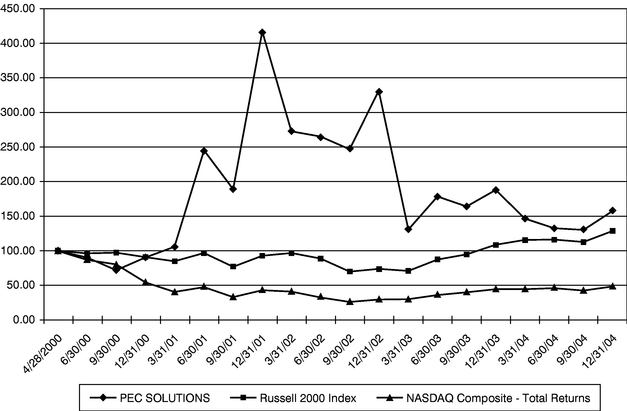

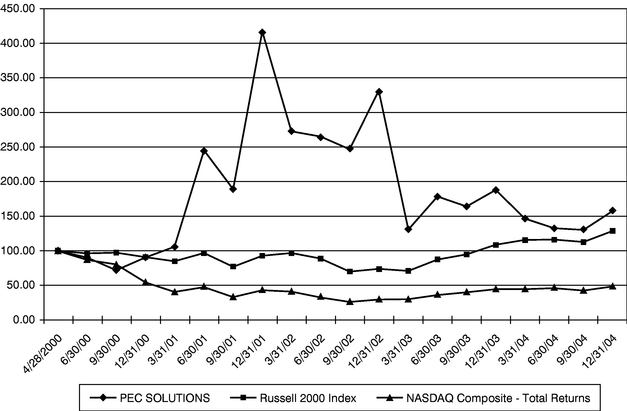

The following chart shows how $100 invested in the Company's Common Stock as of April 20, 2000 (the day our Common Stock began trading on the NASDAQ Stock Market) would have grown through the period ended December 31, 2004, compared with $100 invested in: (a) the NASDAQ Composite Index, and (b) the Russell 2000 Index, assuming all dividends were reinvested.

The NASDAQ Composite Index was chosen as a basis of comparison because it represents companies of a comparable market capitalization and consists of a large number of companies listed on the NASDAQ Stock Market. The Russell 2000 Index was chosen because it represents companies of a comparable market capitalization and consists of a large number of companies listed on public stock exchanges.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG PEC SOLUTIONS, INC.,

NASDAQ COMPOSITE INDEX AND THE RUSSELL 2000 INDEX

ASSUMES $100 INVESTED ON APR. 20, 2000

ASSUMES DIVIDENDS REINVESTED

FISCAL YEAR ENDING DEC. 31, 2004

14

EMPLOYMENT ARRANGEMENTS

On January 1, 2000, we entered into employment agreements with our three founders: Drs. Karlgaard and Harbitter and Mr. Rice. While the agreements had initial terms of two years, they are automatically extended for additional one-year terms on the anniversary of the expiration of the initial term. If any of the three founders is terminated for any reason other than for cause or terminates his agreement for good reason, the employment agreements provide that he is entitled to receive severance payments over a period equal to the greater of the remaining term of his agreement or one year. The employment agreements restrict Drs. Karlgaard and Harbitter and Mr. Rice from competing with us for a period of two years following termination of employment. Each of the three founders have also signed an agreement with the Company in accordance with the Key Executive Severance Plan which provides payment, in the event of a change in control, of an amount equal to the product of (a) 0.5 and (b) their actual annual base salary plus the average of their annual bonus payments for the three previous years. Drs. Karlgaard and Harbitter and Mr. Rice each have the right to receive the greater of the payment from their employment agreement or the Key Executive Severance Plan, but not both.

On December 31, 1998, we entered into an employment agreement with our Chief Financial Officer, Stuart Lloyd. The agreement had an initial term of five years and is automatically extended for additional one-year terms unless we, by providing one year's notice, elect not to renew the agreement. Mr. Lloyd, by providing 90 days notice, can terminate the agreement before the end of the current renewal term. Under this agreement, Mr. Lloyd received an initial annual base salary that increased at specified rates through 2001 and now is subject to adjustment by our Board of Directors and our Compensation Committee on an annual basis. He also may receive an annual cash bonus of up to 30% of his then current salary under our fall bonus plan, based upon performance objectives set by our senior management, and another cash bonus under our spring bonus plan not to exceed our net income margin as a percentage of his base salary. Mr. Lloyd, along with the other named executive officers, also receives beneficial use of an automobile.

If, during the term of his employment agreement, we terminate Mr. Lloyd's employment without cause, he will be entitled to, in one lump sum, the base salary, bonus, all employee benefits and stock options he would have received over the remainder of the term of the agreement. In addition, if we terminate Mr. Lloyd's employment without good reason following a change of control, he will be entitled to the compensation he would have received had the agreement been fully performed for a period two years beyond the expiration of the current renewal term. Mr. Lloyd has agreed to a non-competition provision that will be in effect during the term of his agreement and for two years after the agreement is terminated unless terminated as a result of a breach by us of one of the agreement's provisions or change in control.

We do not have an employment agreement with Mr. Bratiotis. His annual base salary for 2004 was $217,352 and his salary as approved by the Compensation Committee for 2005 is $239,117. He also may receive an annual cash bonus of up to 30% of his then current salary under our fall bonus plan, based upon performance objectives set by our senior management, and another cash bonus under our spring bonus plan not to exceed our net income margin as a percentage of his base salary. Mr. Bratiotis, along with the other named executive officers, also receives beneficial use of an automobile. Mr. Bratiotis is also covered by an agreement with the Company under the Key Executive Severance Plan as described above.

Each Named Executive Officer has agreed to preserve the confidentiality and the proprietary nature of all information relating to our business during and after the term of his employment.

15

AUDIT COMMITTEE REPORT ON

DECEMBER 31, 2004 AUDITED FINANCIAL STATEMENTS

The Audit Committee of the Board of Directors of the Company is composed of five independent directors, each meeting the criteria for independence of audit committee members set forth in the NASDAQ listing standards and SEC Rule 10A-3(b). The Audit Committee operates under a written charter adopted by the Board of Directors which was amended and restated in 2004 (the full text of which is attached to this Proxy Statement as Exhibit A), and is responsible for overseeing the Company's financial reporting process and related matters on behalf of the Board of Directors. The Audit Committee charter is reviewed on an annual basis. The members of the Audit Committee are Messrs. Melchner, Grossman, Carr, Putney and Dando. Mr. Dando, who is independent of management, has been designated by the Board of Directors as an "audit committee financial expert" as the term is defined in Item 401(h) of SEC Regulation S-K. Each year, the Audit Committee recommends to the Board of Directors, subject to stockholder ratification, the selection of the Company's independent auditors.

The Audit Committee's responsibility is to assist the Board of Directors in overseeing the accounting and financial reporting process, including internal controls and reviews of the quarterly financial information and audits of the annual financial statements of the Company.

In this context, the Audit Committee has met twelve times in 2004 (including six times for matters principally related to Sarbanes-Oxley Section 404 as discussed below) and held discussions with management, internal audit and PricewaterhouseCoopers LLP, the Company's independent registered public accounting firm. Management represented to the committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) and Statement on Auditing Standards No. 90 (Audit Committee Communications). These matters included a discussion of PricewaterhouseCoopers LLP's judgments about the quality (not just the acceptability) of the Company's accounting principles as applied to financial reporting.

PricewaterhouseCoopers LLP also provided the Audit Committee with the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with PricewaterhouseCoopers LLP that firm's independence. The Audit Committee further considered and concluded that the non-audit services, described elsewhere in this Proxy Statement, provided by PricewaterhouseCoopers LLP are compatible with maintaining the auditors' independence.

During 2004 the Audit Committee met with the Board of Directors, management, internal audit, outside consultants and PricewaterhouseCoopers LLP to review and discuss the effectiveness of management's process for the reviews of internal controls over financial reporting as required by Section 404 of the Sarbanes-Oxley Act. The Audit Committee also met with management and the Board of Directors to establish Company procedures involving concerns or complaints regarding questionable accounting or auditing matters as required by Section 301 of the Sarbanes-Oxley Act.

Based upon the Audit Committee's discussion with management and the independent auditors, the Audit Committee's review of the representation of management, and the disclosures by the independent auditors to the Audit Committee, the Audit Committee recommended to the Board of Directors that the Company's audited consolidated financial statements and Management's Report on Internal Control Over Financial Reporting (as required under Rule 13a-15 promulgated under the Securities Exchange Act of 1934) be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors have also recommended the selection of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm for 2005, subject to stockholder ratification.

16

COMPENSATION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION

The Compensation Committee reviews and recommends the compensation arrangements for management, establishes and reviews general compensation policies, and administers the Company's stock incentive plan and restricted stock program. The Compensation Committee, established in March 2000, is comprised of five members, all of whom qualify as independent under applicable SEC rules and the listing standards of the NASDAQ Stock Market.

The Compensation Committee seeks to achieve two broad goals in connection with executive compensation programs and decisions regarding individual compensation. These goals and the general means of achieving them are:

First, to provide executives with a performance-oriented environment by tying individual compensation in part to particular goals. Executives are to be rewarded for meeting performance goals that contribute in a significant way to the accomplishment of business objectives. Also, linking a portion of compensation with the performance of common stock provides executives an incentive through an equity interest in the performance of the Company.

Second, to attract and retain key executives by structuring executive compensation programs with appropriate attention to the standards and practices of comparable companies in the Government-IT and related industries that employ professionals with similar technical skills.

The executive compensation programs established by the Compensation Committee consist of three elements tied to the foregoing objectives: base salary, annual cash bonus, and stock-based equity incentives achieved primarily through participation in our 2000 Stock Incentive Plan. In establishing base salaries for executives, the Compensation Committee monitors standards at comparable companies, particularly those that are in the same industry or related industries and/or are located in the Company's general geographical area; considers historic salary levels of the individual and the nature of the individual's responsibilities and compares the individual's base salary with those of other companies' executives. To the extent determined appropriate, the Compensation Committee also considers general conditions and financial performance in establishing base salaries of executives. In deciding to award options, the Compensation Committee considers the number of options outstanding or previously granted and the aggregate size of current awards.

For the year ended December 31, 2004 in response to performance against the Company's business plan, the base salaries, cash bonuses and stock option awards of CEO David Karlgaard, President Paul Rice and COO Alan Harbitter were within the ranges determined by the analysis described above, with cash bonuses awarded below plan. The base salaries, cash bonuses and stock option awards of other executives were held at plan.

Based on its evaluation of individual performance, the Compensation Committee believes that our executive officers are committed to achieving positive long-term financial performance and enhanced stockholder value, and that the compensation policies and programs discussed in this report have motivated them to work toward these goals.

Section 162(m) of the Internal Revenue Code disallows a tax deduction to public corporations for compensation over $1,000,000 paid for any year to the corporation's chief executive officer or to any of the four other most highly compensated executive officers. The statute exempts qualifying performance-based compensation from the deduction limit if certain requirements are met. The Compensation Committee currently intends to structure its executive compensation packages to meet these requirements.

17

CODE OF ETHICS

The Company has had an Ethics Policy since 1989 that covers all employees of the Company. This policy has been amended to also apply to our non-management members of the Board of Directors and to emphasize its application to our senior financial officers, including the Chief Executive Officer and the Chief Financial Officer. No waivers of the policy's application are permitted to be granted under the Ethics Policy. The Ethics Policy is available on the Investor Relations section of our Company's Website athttp://www.pec.com. A copy of the Ethics Policy may also be obtained without charge by written request to the Company's Corporate Secretary.

ITEM 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PricewaterhouseCoopers LLP ("PWC") has served as our independent registered public accounting firm since October 4, 1999 and has been selected by our Board of Directors as our independent auditors for the year ending December 31, 2005 pursuant to the recommendation of the Audit Committee. In the event that ratification of this selection of auditors is not approved by a majority of the shares of Common Stock voting thereon, the appointment will be reconsidered by the Audit Committee and the Board.

Representatives of PWC will be present at the 2005 Annual Meeting and therefore will be available to respond to appropriate questions and make such statements as they may desire.

Audit Fees

The following is a summary of the fees incurred by the Company for the services of PWC in 2004 and 2003. The Audit Committee pre-approves all audit and non-audit services provided to the Company by PWC.

| | Audit Fees(1)

| | Audit

Related Fees(2)

| | Tax Fees(3)

| | All Other

Fees

| | Total

Fees

|

|---|

| 2004 | | $ | 1,055,000 | | $ | 33,206 | | $ | 70,300 | | $ | — | | $ | 1,158,506 |

| 2003 | | $ | 183,760 | | $ | 36,613 | | $ | 47,334 | | $ | — | | $ | 267,707 |

- (1)

- Includes audit fees related to Section 404 of the Sarbanes-Oxley Act.

- (2)

- Includes employee benefit plan compliance in 2004 and 2003.

- (3)

- Includes tax compliance and tax consultation services in 2004 and 2003.

Required Vote

The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2005 requires the affirmative vote of the holders of a majority of the shares of our Common Stock present at the Annual Meeting in person or by proxy and entitled to vote.

Unless marked otherwise, proxies received will be voted for the ratification of the appointment of our independent auditors.

Recommendation of the Board of Directors

Our Board of Directors recommends a vote "FOR" ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors.

18

STOCKHOLDER PROPOSALS

Stockholders may present proper proposals for consideration at the 2005 Annual Meeting of Stockholders by submitting their proposals in writing to the Company in a timely manner. In accordance with Section 1.11 (a) of the Company's Bylaws, the notice must include certain specified information about the proposal and the stockholder submitting the proposal. In order to be included in the Company's proxy materials for our next annual meeting, stockholder proposals must be received by our Corporate Secretary no later than December 31, 2005, and must otherwise comply with the applicable requirements of SEC Rule 14a-8. If a stockholder proposal is received after December 31, 2005, but before January 20, 2005 (120 days prior to the anniversary date of the 2005 Annual Meeting) and otherwise meets the requirements of the Bylaws, the stockholder proposal would be presented for consideration at the meeting, but would not be included in the Proxy Statement and proxy card mailed to stockholders. Stockholder proposals should be directed to the attention of Alan H. Harbitter, our Corporate Secretary or Stuart R. Lloyd, our Chief Financial Officer.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934, our directors and executive officers must file reports with the SEC indicating the number of shares of our Common Stock they beneficially own and any changes in their beneficial ownership. Copies of these reports must be provided to the Company. To our knowledge, based solely on a review of the reports submitted to us, we believe all required reports were filed on a timely basis during 2004, except that Messrs. Carr and Grossman each reported a stock option grant received during 2004 on a Form 5 filed in January 2005.

OTHER MATTERS

The Audit Committee Report, the Compensation Committee Report, and the Stock Performance Graph are not deemed to be "soliciting material" or "filed" with the Securities and Exchange Commission, are not subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and shall not be deemed incorporated by reference into any of the filings previously made or made in the future by our Company under the Exchange Act or the Securities Act of 1933, as amended, except to the extent that our Company specifically incorporates any such information into a document that is filed.

An Annual Report to Stockholders, containing financial statements for the fiscal year ended December 31, 2004, was mailed together with this Proxy Statement to all stockholders entitled to vote at the Annual Meeting. Our Annual Report on Form 10-K/A for the year ended December 31, 2004 was filed with the SEC on March 18, 2005. A copy of the Form 10-K (without exhibits) was included in the package of materials sent to stockholders in connection with the Annual Meeting. You may obtain, free of charge, a copy of the Form 10-K/A by writing to our Chief Financial Officer, Stuart R. Lloyd, at our Company's headquarters at the following address: PEC Solutions, Inc., 12730 Fair Lakes Circle, Fairfax, Virginia 22033. Our Form 10-K/A is also available on our Company's Website at http://www.pec.com.

19

PEC SOLUTIONS, INC.

12730 FAIR LAKES CIRCLE

FAIRFAX, VA 22033 |

|

VOTE BY INTERNET -www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on May 24, 2005. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

IMPORTANT NOTICE REGARDING DELIVERY

OF SECURITY HOLDER DOCUMENTS (HH)

AUTO DATA PROCESSING

INVESTOR COMM SERVICES

ATTENTION:

TEST PRINT

51 MERCEDES WAY

EDGEWOOD, NY

11717 |

|

ELECTRONIC DELIVERY OF FUTURE STOCKHOLDER COMMUNICATIONS

If you would like to reduce the costs incurred by PEC Solutions, Inc., in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access stockholder communications electronically in future years. |

|

|

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on May 24, 2005. Have your proxy card in hand when you call and then follow the simple instructions the Vote Voice provides you. |

|

|

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to PEC Solutions, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11707. |

|

|

000000000000 |

NAME |

|

A/C |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

| PEC SOLUTIONS INC | | 1234567890123456789 123,456,789,012.12345 |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: ý |

|

PAGE 1 OF 2 |

| | | PECSL1 KEEP THIS PORTION FOR YOUR RECORDS |

|

| | | DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

|

PEC SOLUTIONS, INC.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF ALL OF THE LISTED NOMINEES AND "FOR" PROPOSAL 2. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE. |

|

02 000000000 214853447668 |

| | | | | For All | | Withhold All | | For All Except | | To withhold authority to vote for any individual nominees, mark "FOR ALL EXCEPT" and write the nominee's number on the line below. |

| Vote On Directors | | | | | | | | |

1. |

|

To elect three Class III directors to serve until the 2008 Annual Meeting of Stockholders and until their successors are elected and duly qualified. |

|

o |

|

o |

|

o |

|

|

|

|

NOMINEES:

01) Alan H. Harbitter

02) Stuart R. Lloyd

03) John W. Melchner |

|

|

|

|

|

|

|

|

| | | | | For | | Against | | Abstain |

| Vote on Proposal | | | | | | |

2. |

|

To ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending 2005. |

|

o |

|

o |

|

o |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting or any adjournment or continuation thereof. |

|

|

|

|

|

|

Please sign exactly as the name or names appear on stock certificate (as indicated thereon). If the shares are issued in the names of two or more persons, all such persons should sign the proxy. A proxy executed by a corporation should be signed in its name by its authorized officers. Executors, administrators, trustees, guardians, and partners should indicate their position when signing.

|

|

|

|

|

|

|

AUTO DATA PROCESSING

INVESTOR COMM SERVICES

ATTENTION:

TEST PRINT |

|

|

| | | Yes | | No | | 51 MERCEDES WAY | | |

| Please indicate if you plan to attend this meeting. | | o | | o | | EDGEWOOD, NY

11717 | | |

HOUSEHOLDING ELECTION - Please indicate if you consent to receive certain future investor communications in a single package per household. |

|

o |

|

o |

|

|

|

|

| | | | | | | | | 123,456,789,012

705107100

83 |

|

|

P10328 |

|

|

|

|

Signature [PLEASE SIGN WITHIN BOX] Date |

|

|

|

|

|

Signature (Joint Owners) Date

|

ANNUAL MEETING OF STOCKHOLDERS OF

PEC SOLUTIONS, INC.

May 25, 2005

YOUR VOTE IS IMPORTANT

Please take a moment to vote your shares of PEC Solutions, Inc. common stock for the upcoming

Annual Meeting of Stockholders.

Please review the proxy statement and accompanying materials and vote today in one of three ways:

- 1.

- VOTE BY INTERNET—Accesshttp:/www.proxyvote.com. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on May 24, 2005. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

- 2.

- VOTE BY MAIL. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided, or return it to PEC Solutions, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

- 3.

- VOTE BY PHONE—1-800-690-6903—Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on May 24, 2005. Have your proxy card in hand when you call and then follow the simple instructions the Vote Voice provides you.

PEC SOLUTIONS, INC.

12730 Fair Lakes Circle

Fairfax, Virginia 22033

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints DR. DAVID C. KARLGAARD and DR. ALAN H. HARBITTER, and each of them, as proxies for the undersigned with full power of substitution, to attend, represent and vote for the undersigned, all of the shares of the Company which the undersigned would be entitled to vote, at the Annual Meeting of Stockholders of the Company to be held on May 25, 2005 and any postponement or adjournments thereof.