| Notes to Financial Statements |

| Bretton Fund |

| June 30, 2024 |

| (Unaudited) |

| | | | | | | | | | |

| 1.) ORGANIZATION | | | | | | | | | |

Bretton Fund (the “Fund”) was organized as a non-diversified series of the PFS Funds (the “Trust”) on September 21, 2010. The Trust was established under the laws of Massachusetts by an Agreement and Declaration of Trust dated January 13, 2000, which was amended and restated January 20, 2011. The Trust is registered as an open-end investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust may offer an unlimited number of shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. As of June 30, 2024, there were twelve series authorized by the Trust. The Fund commenced operations on September 30, 2010. The Fund’s investment objective is to seek long-term capital appreciation. The investment adviser to the Fund is Bretton Capital Management, LLC (the “Adviser”).

|

| | | | | | | | | | |

| 2.) SIGNIFICANT ACCOUNTING POLICIES | | | | | | | |

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the significant accounting policies described in this section.

|

| | | | | | | | | | |

| SECURITY VALUATION: | | | | | | | | | |

All investments in securities are valued as described in Note 3. The Trust’s Board of Trustees (the “Board”) has designated the Advisor as “Valuation Designee” pursuant to Rule 2a-5 under the 1940 Act.

|

| | | | | | | | | | |

| SHARE VALUATION: | | | | | | | | | |

The net asset value (the “NAV”) is generally calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. The offering price and redemption price per share are equal to the net asset value per share.

|

| | | | | | | | | | |

| FEDERAL INCOME TAXES: | | | | | | | | | |

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

|

| | | | | | | | | | |

| The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Fund identifies its major tax jurisdictions as U.S. Federal and Massachusetts tax authorities; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. |

| | | | | | | | | | |

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the six month period ended June 30, 2024, the Fund did not incur any interest or penalties.

|

| | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date.

|

| | | | | | | | | | |

| The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset value per share of the Fund. |

| | | | | | | | | | |

| USE OF ESTIMATES: | | | | | | | | | |

The financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

|

| | | | | | | | | | |

| EXPENSES: | | | | | | | | | |

Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis.

|

| | | | | | | | | | |

| CASH: | | | | | | | | | |

The Fund maintains cash and cash equivalents at its custodian which, at times, may exceed United States federally insured limits.

|

| | | | | | | | | | |

| OTHER: | | | | | | | | | |

The Fund records security transactions based on the trade date. Dividend income is recognized on the ex-dividend date. Interest income, if any, is recognized on an accrual basis. The Fund uses the specific identification method in computing gain or loss on sales of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

|

| | | | | | | | | | |

| 3.) SECURITIES VALUATIONS | | | | | | | | | |

As described below, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

|

| | | | | | | | | | |

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

| | | | | | | | | | |

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

|

| | | | | | | | | | |

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

|

| | | | | | | | | | |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

|

| | | | | | | | | | |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

|

| | | | | | | | | | |

| VALUATION OF FUND ASSETS | | | | | | | | | |

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

|

| | | | | | | | | | |

Equity securities (common stocks). Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Valuation Designee believes such prices accurately reflect the fair value of such securities. Securities that are traded on any stock exchange or on the NASDAQ over-the-counter market are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security, and if an equity security is valued by the pricing service at its last bid, it is generally categorized as a level 2 security. When market quotations are not readily available, when the Valuation Designee determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted securities are being valued, such securities are valued as determined in good faith by the Valuation Designee, subject to review of the Board and are categorized in level 2 or level 3, when appropriate.

|

| | | | | | | | | | |

In accordance with the Trust’s good faith pricing guidelines, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. There is no single standard procedure for determining fair value, since fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Valuation Designee would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. The Board maintains responsibilities for the fair value determinations under Rule 2a-5 under the 1940 Act and oversees the Valuation Designee.

|

| | | | | | | | | | |

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of June 30, 2024:

|

| | | | | | | | | | |

| Valuation Input of Assets | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Common Stocks | | $ 94,259,359 | | $ - | | $ - | | $ 94,259,359 | |

| Total Investments in Securities | | $ 94,259,359 | | $ - | | $ - | | $ 94,259,359 | |

| | | | | | | | | | |

| The Fund did not hold any Level 3 assets during the six month period ended June 30, 2024. |

| | | | | | | | | | |

The Fund did not invest in derivative instruments during the six month period ended June 30, 2024.

| |

| | | | | | | | | | |

| 4.) INVESTMENT ADVISORY AGREEMENT AND RELATED PARTY TRANSACTIONS | | | |

The Fund has entered into an investment advisory agreement (“Management Agreement”) with the Adviser. The Adviser manages the investment portfolio of the Fund, subject to policies adopted by the Trust’s Board of Trustees, and, at its own expense and without reimbursement from the Fund, furnishes office space and all necessary office facilities, equipment, and executive personnel necessary for managing the Fund. The Adviser pays the expenses of the Fund except for the management fee, all brokerage fees and commissions, taxes, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), fees and expenses of acquired funds, extraordinary or non-recurring expenses as may arise, including litigation to which the Fund may be a party and indemnification of the Trust’s Trustees and officers with respect thereto. For its services, effective January 1, 2020, the Adviser receives a management fee equal to 1.35% of the average daily net assets of the Fund. Prior to January 1, 2020, the Adviser received a management fee equal to 1.50% of the average daily net assets of the Fund.

|

| | | | | | | | | | |

For the six month period ended June 30, 2024, the Adviser earned management fees totaling $610,651, of which $104,056 was due to the Adviser at June 30, 2024.

|

| | | | | | | | | | |

| 5.) RELATED PARTY TRANSACTIONS | | | | | | | |

Certain officers and a Trustee of the Trust are also officers of Premier Fund Solutions, Inc. (the “Administrator”). These individuals receive benefits from the Administrator resulting from administration fees paid to the Administrator of the Fund by the Adviser.

|

| | | | | | | | | | |

The Trustees who are not interested persons of the Fund were each paid $750, for a total of $3,000, in Trustees’ fees plus travel and related expenses related to the Bretton Fund for the six month period ended June 30, 2024. Under the Management Agreement, the Adviser pays these fees.

|

| | | | | | | | | | |

| 6.) PURCHASES AND SALES OF SECURITIES | | | | | | | |

For the six month period ended June 30, 2024, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $4,389,015 and $1,366,113, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

|

| | | | | | | | | | |

| 7.) CONTROL OWNERSHIP | | | | | | | | | |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting shares of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of June 30, 2024, Thao Dodson, held, in aggregate, approximately 42.95% of the Fund and therefore, may be deemed to control the Fund.

|

| | | | | | | | | | |

| 8.) TAX MATTERS | | | | | | | | | |

For Federal income tax purposes, the cost of investments owned at June 30, 2024, was $40,882,430.

|

| | | | | | | | | | |

| At June 30, 2024, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) was as follows: |

| | | | | | | | | | |

| Appreciation | | Depreciation | Net Appreciation/(Depreciation) |

| $53,772,871 | | ($395,942) | | $53,376,929 | |

| | | | | | | | | | |

As of June 30, 2024, there were no differences between book and tax basis unrealized appreciation.

|

| | | | | | | | | | |

| The tax character of distributions was as follows: | | | | | | | |

| | | | | | | | | | |

| | Six Month Period | | Calendar Year | | |

| | Ended June 30, 2024 | | Ended 2023 | | |

| Ordinary Income . | | $ - | | | | $ - | | | |

| Long-Term Capital Gain | | - | | | | - | | | |

| | | $ - | | | | $ - | | | |

| | | | | | | | | | |

| 9.) SECTOR CONCENTRATION RISK | | | | | | | | |

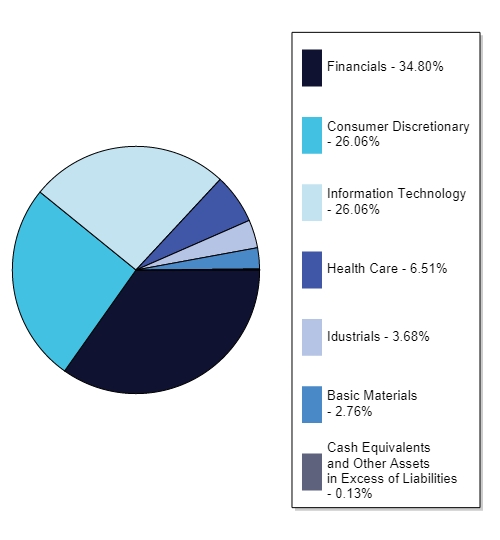

If the Fund has significant investments in the securities of issuers in industries within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, and technological or other developments may negatively impact all companies in a particular sector and therefore the value of a Fund’s portfolio will be adversely affected. As of June 30, 2024, the Fund had 34.80%, 26.06% and 26.06%, respectively, of the value of its net assets invested in stocks within the Financials, Consumer Discretionary and Information Technology sectors.

|

| | | | | | | | | | |

| 10.) SUBSEQUENT EVENTS | | | | | | | | | |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there are no items requiring adjustment to or disclosure in the financial statements.

|

| Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract. | |

| | | | | | | | | | |

| At a meeting held on March 7, 2024 (the “Meeting”), the Board of Trustees (the “Board” and the “Trustees”) considered the renewal of the Management Agreement (the “Management Agreement”) between the Trust and Bretton Capital Management, LLC (“Bretton”) on behalf of the Bretton Fund. In approving the continuation of the Management Agreement, the Board of Trustees considered and evaluated the following factors: (i) the nature, extent and quality of the services provided by Bretton to the Bretton Fund; (ii) the investment performance of the Bretton Fund; (iii) the cost of the services to be provided and the profits to be realized by Bretton from the relationship with the Bretton Fund; (iv) the extent to which economies of scale will be realized as the Bretton Fund grows and whether the fee levels reflect these economies of scale to the benefit of shareholders; and (v) Bretton’s practices regarding possible conflicts of interest. |

| | | | | | | | | | |

| In assessing these factors and reaching its decisions, the Board took into consideration information furnished throughout the year at its regular Board meetings, as well as information specifically prepared and/or presented in connection with the annual renewal process. The Board also considered the presentation made by a representative of Bretton at the Meeting. The Board requested and was provided with information and reports relevant to the annual renewal of the Management Agreement, as well as information relevant to their consideration of the Management Agreement including: (i) information regarding the services and support provided to the Bretton Fund and its shareholders by Bretton; (ii) assessments of the investment performance of the Bretton Fund by the principals of Bretton; (iii) commentary on the reasons for the performance; (iv) presentations addressing Bretton’s investment philosophy, investment strategy, personnel and operations; (v) compliance and audit related information concerning the Bretton Fund and Bretton; (vi) disclosure information contained in the registration statement of the Trust and the Form ADV of Bretton; and (vii) a memorandum from Counsel that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Management Agreement, including the material factors set forth above and the types of information included in each factor that should be considered by the Board in order to make an informed decision. The Board also requested and received various informational materials including, without limitation: (i) documents containing information about Bretton, including financial information, a description of personnel and the services provided to the Bretton Fund, information on investment advice, performance, summaries of Bretton Fund expenses, compliance program, current legal matters, and other general information; (ii) comparative expense and performance information for other mutual funds with strategies similar to the Bretton Fund; (iii) the anticipated effect of size on the Bretton Fund’s performance and expenses; and (iv) benefits to be realized by Bretton from its relationship with the Bretton Fund. The Board did not identify any particular information that was most relevant to its consideration to approve the Management Agreement and each Trustee may have afforded different weight to the various factors. |

| |

| 1. Nature, Extent, and Quality of the Services Provided by Bretton |

| | | | | | | | | | |

| In considering the nature, extent, and quality of the services provided by Bretton, the Trustees reviewed the responsibilities of Bretton under the Management Agreement. The Trustees reviewed the services being provided by Bretton including, without limitation: the quality of investment advisory services (including research and recommendations with respect to portfolio securities); the process for formulating investment recommendations and assuring compliance with the Bretton Fund’s investment objective, strategies, and limitations, as well as for ensuring compliance with regulatory requirements. The Trustees considered the coordination of services for the Bretton Fund among Bretton and the service providers and the Independent Trustees; and the efforts of Bretton to promote the Bretton Fund and grow its assets. The Trustees noted the quality of Bretton’s principals and their commitment to the Bretton Fund and the continued cooperation with the Independent Trustees and legal counsel for the Bretton Fund. The Trustees evaluated Bretton’s principals, including their education and experience. After reviewing the foregoing information and further information in the materials provided by Bretton, the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by Bretton were satisfactory and adequate for the Bretton Fund. |

| | | | | | | | | | |

| 2. Investment Performance of the Bretton Fund and Bretton |

| | | | | | | | | | |

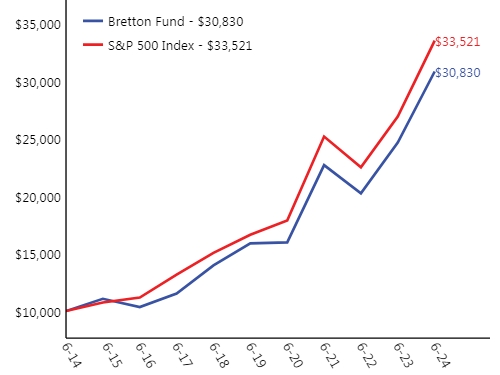

| In considering the investment performance of the Bretton Fund and Bretton, the Trustees compared the short-term and long-term performance of the Bretton Fund with the performance of funds with similar objectives managed by other investment advisers, as well as with aggregated peer group data. As to the performance of the Bretton Fund, the Trustees compared the Bretton Fund’s performance to its Morningstar’s category, the U.S. Fund Large Blend category (the “Category”) and to a group of funds of similar size, style, and objective, derived from the Category with assets ranging from $50 million to $125 million (the “Peer Group”). The Trustees noted that for the 1-, 3-, 5- and 10- year periods ended December 31, 2023, the Bretton Fund outperformed the average fund in both Category and the Peer Group. They also compared the Bretton Fund’s performance to its benchmark index, the S&P 500 Index (the “S&P Index”), noting that the Fund outperformed the S&P Index for the 1-, 3- and 5-year periods ended December 31, 2023, but underperformed the S&P Index for the 10-year period ended December 31, 2023. The Trustees reflected on the management style utilized for the Bretton Fund, noting that Bretton’s long-term investment strategy has performed well since the Fund’s inception. They discussed Bretton Fund’s portfolio, noting that the Fund typically maintains a portfolio of 20 positions or less. The Trustees considered the potential volatility of a portfolio the size of the Bretton Fund and the impact that can have on performance. They discussed Bretton’s ongoing analysis of the investment strategy used to manage the Bretton Fund and Bretton’s willingness to modify the investment strategy as deemed necessary and prudent. After reviewing and discussing the investment performance of the Bretton Fund further, Bretton’s experience managing the Bretton Fund, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Bretton Fund and Bretton was satisfactory. |

| | | | | | | | | | |

| 3. Costs of the Services to be provided and profits to be realized by Bretton |

| | | | | | | | | | |

| In considering the costs of the services to be provided and profits to be realized by Bretton from the relationship with the Bretton Fund, the Trustees considered: (1) Bretton’s financial condition and the level of commitment to the Bretton Fund and Bretton by the principals of Bretton; (2) the asset level of the Bretton Fund; (3) the overall expenses of the Bretton Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by Bretton regarding its profits associated with managing the Bretton Fund. The Trustees also considered potential benefits for Bretton in managing the Bretton Fund. The Trustees then compared the fees and expenses of the Bretton Fund (including the management fee) to other comparable mutual funds. The Trustees reviewed the fees under the Management Agreement and compared them to the average management fee of the Category and Peer Group, noting that the Bretton Fund’s management fee was higher than the average management fee for the Category and Peer Group. They also noted that the Bretton Fund’s expense ratio was higher than the average expense ratio for the Category and Peer Group, but it was within the range of expense ratios of the Category and Peer Group. The Trustees also recognized that Bretton was obligated to pay certain operating expenses of the Bretton Fund out of its management fee, and that after paying those expenses, Bretton’s relationship with the Bretton Fund was profitable. Based on the foregoing, the Board concluded that the fees to be paid to Bretton and the profits to be realized by Bretton, considering all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Bretton. |

| | | | | | | | | | |

| 4. Economies of Scale |

| | | | | | | | | | |

| The Trustees next considered the impact of economies of scale on the Bretton Fund’s size and whether management fee levels reflect those economies of scale for the benefit of the Bretton Fund’s investors. The Trustees considered that while the management fee remained the same at all asset levels, the Bretton Fund’s shareholders had experienced benefits from the fact that Bretton was obligated to pay certain of the Bretton Fund’s operating expenses which had the effect of limiting the overall fees paid by the Bretton Fund. In light of its ongoing consideration of the Bretton Fund’s asset levels, expectations for growth in the Fund, Bretton’s commitment to consider adding fee breakpoints as the Fund grows, and fee levels, the Board determined that the Bretton Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Bretton. |

| | | | | | | | | | |

| 5. Possible conflicts of interest and benefits to Bretton | | | | |

| | | | | | | | | | |

| In considering Bretton’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the principals of Bretton; the basis of decisions to buy or sell securities for the Bretton Fund; and the substance and administration of Bretton’s code of ethics. The Trustees also considered disclosure in the registration statement of the Trust related to Bretton’s potential conflicts of interest. The Board noted that Bretton does not use “soft dollars,” has no affiliated companies and does not manage any other accounts for clients. The Trustees noted and accepted Bretton’s representation that it does not realize any benefits from advising the Bretton Fund other than the direct benefit of being compensated by the Bretton Fund for serving as its investment adviser. Based on the foregoing, the Board determined that Bretton’s standards and practices relating to the identification and mitigation of possible conflicts of interest were satisfactory. |

| | | | | | | | | | |

| The Independent Trustees met in executive session with Counsel at the end of the Meeting to discuss the continuation of the Management Agreement. The officers of the Trust and others present were excused during this discussion. |

| | | | | | | | | | |

| After further review and discussion, it was the Trustees’ determination that the best interests of the Bretton Fund’s shareholders were served by the renewal of the Agreements. |