Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | |

| | Filed by the Registrantý |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

|

ý |

|

Preliminary Proxy Statement |

|

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

|

Definitive Proxy Statement |

|

o |

|

Definitive Additional Materials |

|

o |

|

Soliciting Material Pursuant to §240.14a-12

|

| | | | |

BEACON POWER CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

BEACON POWER CORPORATION

65 Middlesex Road

Tyngsboro, MA 01879

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held July 21, 2010

To the Stockholders of

Beacon Power Corporation:

We are hereby notifying you that Beacon Power Corporation will be holding its Annual Meeting of Stockholders at our corporate headquarters located at 65 Middlesex Road, Tyngsboro, Massachusetts 01879, on Wednesday, July 21, 2010 at 1:00 p.m., local time, for the following purposes:

- (1)

- To elect six members of our Board of Directors for the ensuing year and until each of their successors is duly elected and qualified;

- (2)

- To approve the Beacon Power Corporation 2010 Stock Incentive Plan, constituting an amendment, restatement and renaming of our Third Amended and Restated 1998 Stock Incentive Plan;

- (3)

- To authorize our Board of Directors to implement, in its discretion, a reverse stock split of our outstanding shares of common stock with a ratio within a range of between one-for two to one-for-ten, inclusive and to file an amendment to our Certificate of Incorporation to effect the reverse split at the ratio chosen by the Board, together with an amendment to reduce the number of shares of common stock authorized under the Certificate of Incorporation;

- (4)

- To ratify the selection of Miller Wachman LLP as independent auditors to audit our books and accounts for the fiscal year ending December 31, 2010; and

- (5)

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible. You may vote by mailing a completed proxy card, by telephone, or over the Internet. For specific voting instructions, please refer to the information provided with your proxy card and in this proxy statement.

| | |

| | By Order of the Board of Directors, |

| | Beacon Power Corporation |

| | James M. Spiezio

Secretary |

June , 2010

Tyngsboro, Massachusetts

TABLE OF CONTENTS

| | | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | 4 |

PROXY STATEMENT | |

5 |

| | Introduction | | 5 |

| | Methods of Voting | | 5 |

| | Solicitation of Proxies | | 5 |

| | Voting Rights | | 6 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

7 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

9 |

CORPORATE GOVERNANCE | |

10 |

| | Executive Officers | | 10 |

| | Board Leadership Structure | | 10 |

| | Board's Role in Risk Oversight | | 11 |

| | Board of Directors' Meetings and Committees | | 11 |

| | Director Independence | | 12 |

| | Limitation of Liability and Indemnification | | 12 |

| | Communication with Our Board of Directors | | 13 |

AUDIT COMMITTEE REPORT | |

14 |

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION | |

15 |

| | Compensation Discussion and Analysis | | 15 |

| | Compensation Committee Report | | 29 |

| | Summary Compensation Table | | 30 |

| | Grants of Plan-Based Awards | | 33 |

| | Outstanding Equity Awards at Fiscal Year-End | | 34 |

| | Option Exercises and Stock Vested | | 36 |

| | Potential Payments Upon Termination or Change in Control | | 37 |

| | Consideration of Risk in Compensation Programs | | 49 |

| | Director Compensation | | 49 |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | |

51 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

52 |

PROPOSAL 1—ELECTION OF DIRECTORS | |

54 |

PROPOSAL 2—APPROVAL OF 2010 STOCK INCENTIVE PLAN | |

57 |

| | Purpose of the Plan | | 57 |

| | Description of the 2010 Plan | | 58 |

| | Federal Income Tax Consequences Relating to Awards | | 60 |

| | Registration with the SEC | | 62 |

| | Required Vote | | 62 |

PROPOSAL 3—REVERSE STOCK SPLIT | |

63 |

| | Overview | | 63 |

| | Reasons for the Reverse Split | | 64 |

| | Board Discretion to Implement the Reverse Stock Split | | 65 |

| | Certain Risks Associated With the Reverse Stock Split | | 65 |

| | Effects of the Reverse Stock Split | | 66 |

| | Effective Date | | 67 |

| | Payment for Fractional Shares | | 67 |

| | Effect on Beneficial Holders of Common Stock | | 68 |

| | Effect on Registered "Book-Entry" Holders of Common Stock | | 68 |

| | Effect on Certificated Shares | | 68 |

| | Accounting Consequences | | 69 |

| | No Appraisal Rights | | 69 |

2

| | | |

| | Certain United States Federal Income Tax Consequences of the Reverse Stock Split | | 69 |

| | Required Vote | | 71 |

PROPOSAL 4—RATIFICATION OF AUDITORS | |

72 |

| | Principal Accounting Fees and Services | | 72 |

| | Audit Fees | | 72 |

| | Audit-Related Fees | | 72 |

| | Tax Fees | | 72 |

| | All Other Fees | | 72 |

| | Audit Committee Pre-Approval Requirements | | 73 |

| | Required Vote and Board of Directors Recommendation | | 73 |

OTHER MATTERS | |

73 |

ANNUAL REPORT AND OTHER SEC FILINGS | |

73 |

HOUSEHOLDING OF PROXY MATERIALS | |

73 |

STOCKHOLDER PROPOSALS FOR 2011 ANNUAL MEETING | |

74 |

APPENDIX A—2010 STOCK INCENTIVE PLAN | |

A-1 |

APPENDIX B—AMENDMENT TO SIXTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | |

B-1 |

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

| | | | |

| | | This Proxy Statement may include statements that are not historical facts and are considered "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Beacon Power Corporation's current views about future events and financial performances. These "forward-looking" statements are identified by the use of terms and phrases such as "believe," "expect," "plan," "anticipate," and similar expressions identifying forward-looking statements. Investors should not rely on forward-looking statements because they are subject to a variety of risks, uncertainties, and other factors that could cause actual results to differ materially from Beacon Power Corporation's expectation. These factors include, for example: a limited commercial operating history; the need to raise additional funding to build frequency regulation power plants and support our operations; success in closing the DOE loan and the ability to meet DOE loan and grant covenants; volatility in the pricing for frequency regulation and the effects of changes in electricity demand and natural gas prices on the frequency regulation market; our ability to obtain site interconnection approvals or other zoning and construction approvals in a timely manner; limited experience manufacturing flywheels in volume production or supplying frequency regulation services on a commercial basis; our ability to integrate 200 flywheels into a 20 MW facility; our ability to construct and operate plants in a variety of locations; our ability to make our technology fully compatible with 50 Hz. electrical design requirements for use in overseas markets; our ability to sell regulation services and plants at attractive margins; the uncertainty of the global economy; meeting the technical requirements of foreign markets based upon their specific grid and market characteristics; dependence on third-party suppliers; competition from companies with greater financial resources, especially from companies that are already in the frequency regulation market; possible government regulation that may impede the ability to market products or services or impact market size; possible product liability claims and the negative publicity which could result; any failure to protect intellectual property, or any possible infringement of third party patents; our ability to retain key executives and continue to attract additional talented human resources; and the historical volatility of our stock price. Such statements made by us fall within the safe harbors provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These factors are elaborated upon and other factors are described in the section of our Annual Report on Form 10-K titled "Risk Factors Relating to Our Business." We disclaim any obligation to update any forward-looking statements contained herein after the date of this Proxy Statement. | | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on July 21, 2010. Our proxy statement and annual report to security holders for the fiscal year ended December 31, 2009 are available atwww.beaconpower.com, under the "Investor" tab.

4

BEACON POWER CORPORATION

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

On July 21, 2010

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Beacon Power Corporation ("we", "us", "Beacon", "our", or the "Company") for use at the Annual Meeting of Stockholders to be held on July 21, 2010 beginning at 1:00 p.m. at our corporate headquarters located at 65 Middlesex Road, Tyngsboro, Massachusetts 01879, and at any adjournment or postponement of that meeting.

Introduction

We are furnishing you with this Proxy Statement in connection with the solicitation of proxies to be used at the Annual Meeting of Beacon to be held on July 21, 2010 and at any adjournment of the Annual Meeting, for the purposes set forth in the accompanying notice of the meeting. All holders of record of our Common Stock at the close of business on May 24, 2010 will be entitled to vote at this meeting and any adjournments thereof. The stock transfer books have not been closed.

We expect to mail this Proxy Statement, our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and the accompanying proxy card to our stockholders on or about June , 2010.

Methods of Voting

You may vote by mail, by telephone, over the Internet or in person at the Annual Meeting.

Voting by Mail. By signing and returning the proxy card in the enclosed prepaid and addressed envelope, you are authorizing the individuals named on the proxy card to vote your shares at the Annual Meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. Please sign and return your proxy card to ensure that all of your shares are voted.

Voting by Telephone. To vote by telephone, please follow the instructions included on your proxy card. If you vote by telephone, you do not need to complete and mail your proxy card.

Voting over the Internet. To vote over the Internet, please follow the instructions included on your proxy card. If you vote over the Internet, you do not need to complete and mail your proxy card.

Voting in Person at the Annual Meeting. If you plan to attend the Annual Meeting and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the meeting, you will need to bring to the meeting a legal proxy from your broker or other nominee authorizing you to vote such shares.

Solicitation of Proxies

We are soliciting proxies in the form enclosed on behalf of the Board of Directors. We will vote any such signed proxy, if received in time for the voting and not revoked, at the Annual Meeting according to your directions. We will vote any proxy that fails to specify a choice on any matter to be acted upon FOR the election of each nominee for director and FOR each other proposal to be acted upon. If you submit a signed proxy in the form enclosed, you will have the power to revoke it at any time before we use it by filing a later proxy with us, by attending the Annual Meeting and voting in

5

person, or by notifying us of the revocation in writing addressed to the Secretary of Beacon Power Corporation at 65 Middlesex Road, Tyngsboro, MA 01879.

We will pay for all expenses of preparing, assembling, printing and mailing the material used in the solicitation of proxies by the Board. Officers and regular Beacon employees may solicit proxies on behalf of the Board by telephone, telegram or personal interview, and we will bear the expenses of such efforts. We also may make arrangements with brokerage houses and other custodians, nominees and fiduciaries to forward soliciting materials to the beneficial owners of stock held of record by such persons at our expense. We have retained Georgeson Shareholder Communications, Inc. to assist in the solicitation of proxies for a fee of $8,500 plus reasonable out-of—pocket expenses.

Voting Rights

As of , 2010, we had shares of our common stock, $0.01 par value ("Common Stock"), issued and outstanding. You may vote your shares of Common Stock at the Annual Meeting if you were a stockholder of record as the close of business on May 24, 2010. Each share of Common Stock that you held as of the record date entitles you to one vote on each matter to be voted upon at the Annual Meeting. All holders of Common Stock vote together as one class.

The presence at the Annual Meeting, either in person or by proxy, of the holders of a majority of the issued and outstanding shares of Common Stock on the record date is necessary to constitute a quorum to transact business at the Annual Meeting. If a quorum is not present, we expect that the Annual Meeting will be adjourned or postponed in order to solicit additional proxies. Shares of Common Stock represented at the Annual Meeting but not voted, including shares of Common Stock for which proxies have been received but for which the holders have abstained, will be treated as present at the Annual Meeting for purposes of determining the presence or absence of a quorum for the transaction of all business.

Assuming a quorum is established, directors will be elected (under Proposal 1) by a plurality of votes cast. If a vote is withheld regarding the election of directors, such vote will have no effect.

Proposal 2, the approval of our 2010 Stock Incentive Plan, constituting an amendment, restatement and renaming of our 1998 Stock Incentive Plan, requires the affirmative vote of a majority of the total votes cast on the matter.

Proposal 3, to authorize our Board of Directors to implement a reverse stock split and to file an amendment to our Sixth Amended and Restated Certificate of Incorporation to effect the reverse split and to reduce the number of shares of Common Stock authorized for issuance under the certificate, requires the affirmative vote of a majority of our shares issued and outstanding.

Proposal 4, the ratification of auditors, requires the affirmative vote of a majority of shares represented at the meeting.

If you return your proxy with instructions to abstain from voting on any of the proposals, your shares will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Other than with respect to the election of directors proposal (Proposal 1) and the proposal to approve our 2010 Stock Incentive Plan (Proposal 2), an abstention with respect to the other proposals has the legal effect of a vote "AGAINST" the proposal. Abstaining from voting on the election of directors proposal will have no effect because the directors who receive a plurality of votes are elected. Abstaining from voting on the approval of our 2010 Stock Incentive Plan will have no effect because abstentions are not considered votes cast under Delaware law. If your shares are held by your broker in "street name" and you do not vote your shares, your brokerage firm may not have the authority to vote your unvoted shares held by the firm on certain proposals, including on the election of directors. Since such "broker non-votes" are not considered cast on the Proposals, they will not have any effect on the outcome of Proposal 2. However, under Delaware law, to determine whether Proposal 3 and 4 have received the necessary number of affirmative votes, broker non-votes, like abstentions, will have the same effect as a vote AGAINST Proposals 3 and 4.

6

No Appraisal Rights

There are no appraisal rights associated with any of the proposals being considered at the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 26, 2010, certain information concerning the ownership of shares of our Common Stock by:

- •

- Each person or group that we know beneficially owns more than five percent of the issued and outstanding shares of common stock

- •

- Each director

- •

- Each executive officer for whom we are required to present compensation information in this proxy statement; and

- •

- All of our directors and executive officers as a group. Except as otherwise indicated, each person named has sole investment and voting power with respect to his, her or its shares of common stock shown.

Each beneficial owner other than Capital Ventures International, Enable Growth Partners, LP, Goldman Sachs Asset Management LP and Ramius LLC has an address c/o Beacon Power Corporation, 65 Middlesex Road, Tyngsboro, Massachusetts 01879.

| | | | | | | |

| | Shares beneficially owned | |

|---|

Name and Address of Beneficial Owner(2) | | Number(1) | | Percent

of Class | |

|---|

| Stephen P. Adik | | | 349,767 | | | * | |

| F. William Capp | | | 3,065,031 | | | 1.7 | % |

| Judith Judson | | | 109,304 | | | * | |

| Daniel Kletter | | | 258,020 | | | * | |

| Matthew L. Lazarewicz | | | 1,192,257 | | | * | |

| Virgil Rose | | | 256,528 | | | * | |

| Jack P. Smith | | | 411,073 | | | * | |

| James M. Spiezio | | | 1,210,333 | | | * | |

| Edward Weihman | | | 205,242 | | | * | |

5% Shareholders |

|

|

|

|

|

|

|

Capital Ventures International(3)

Heights Capital Management, Inc.

One Capitol Place

Grand Cayman, Cayman Islands

British West Indies | | | 17,033,632 | | | 8.6 | % |

Enable Capital Management(4)

One Ferry Building, Suite 255

San Francisco, CA 94111 |

|

|

16,896,877 |

|

|

8.5 |

% |

Goldman Sachs Asset Management, L.P.(5)

32 Old Slip

New York, NY 10005 |

|

|

12,253,630 |

|

|

6.5 |

% |

Ramius LLC(6)

599 Lexington Avenue, 20th Floor

New York, NY 10022 |

|

|

14,677,781 |

|

|

7.6 |

% |

All directors and executive officers as a group (9 persons) |

|

|

7,057,555 |

|

|

3.8 |

% |

7

- (1)

- The number of shares beneficially owned by each stockholder is determined under rules issued by the Securities and Exchange Commission and includes voting or investment power with respect to those securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and includes any shares as to which the individual or entity has the right to acquire beneficial ownership within 60 days after April 26, 2010 through the exercise of any warrant, stock option or other right. The inclusion in this joint proxy statement of these shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of those shares. The number of shares of Beacon common stock outstanding used in calculating the percentage for each listed person includes the shares of Beacon common stock underlying options or restricted stock units held by that person that are exercisable or convertible within 60 days of April 26, 2010, but excludes shares of Beacon common stock underlying options or restricted stock units held by any other person.

- (2)

- Includes the following shares of the Company's Common Stock which the indicated executive officer or director had the right to acquire within 60 days after April 23, 2010, through the exercise of stock options or restricted stock units: Mr. Adik, 349,767; Mr. Capp, 2,515,520; Ms. Judson, 109,304; Mr. Kletter, 208,020; Mr. Lazarewicz, 807,182; Mr. Rose, 231,528; Mr. Smith, 383,073; Mr. Spiezio, 948,386; and Mr. Weihman 205,242.

- (3)

- Heights Capital Management, Inc., the investment advisor of Capital Ventures International, has discretionary authority to vote and dispose of the shares held by Capital Ventures International and may be deemed to be the beneficial owner of these shares. The address for Heights Capital Management, Inc. is 101 California Street, Suite 3250, San Francisco, CA 94111. According to the Schedule 13G filing referenced below, this amount includes 15,248,953 shares underlying warrants to purchase Common Stock, which warrants are not exercisable to the extent that the shares then beneficially owned by the reporting persons would exceed 9.99% of our outstanding Common Stock. This amount does not include 567,636 shares underlying warrants to purchase Common Stock, which warrants are not exercisable to the extent that the shares then beneficially owned by the reporting persons would exceed 4.99% of our outstanding Common Stock. Information regarding the number of shares of Common Stock held by Capital Ventures International is based on information contained in a Schedule 13G filed with the SEC jointly with Heights Capital Management, Inc. on February 12, 2010.

- (4)

- Enable Capital Management, LLC ("ECM") is the general partner and/or investment manager of Enable Growth Partners, L.P. ("EGP") and Mitchell S. Levine ("Levine"), is managing member and majority owner of Enable Capital Management, LLC. ECM and Levine may, therefore, be deemed to beneficially own the Securities owned by EGP and such other investment limited partnerships for the purposes of Rule 13d-3 of the Securities Exchange Act of 1934, as amended, insofar as they may be deemed to have the power to direct the voting or disposition of those securities. Each of ECM and Levine disclaims beneficial ownership as to the securities, except to the extent of his or its pecuniary interests therein. Shares beneficially owned by ECM includes 16,896,877 shares underlying warrants to purchase Common Stock.

- (5)

- Information regarding ownership of Common Stock by Goldman Sachs Asset Management, L.P., ("GSAM") and GS Investments Strategies, LLC ("GSIS"), each a wholly-owned subsidiary of The Goldman Sachs Group, Inc., is included herein in reliance on information set forth in the Schedule 13G filed jointly by GSAM and GSIS with the SEC on February 16, 2010, reflecting ownership as of December 31, 2009. GSAM and GSIS are both classified as investment advisors in accordance with Rule 13d-1(b)(1)(ii)(E) under the Securities Exchange Act of 1934.

- (6)

- Information taken solely from Amendment No. 1 to the Schedule 13G filed jointly with the SEC on February 10, 2010 by Ramius LLC, Ramius Advisors LLC, RCG PB, Ltd, Ramius Enterprise Master Fund Ltd, Ramius Navigation Master Fund Ltd, C4S & Co L.L.C., Peter A. Cohen, Morgan B. Stark, Jeffrey M. Solomon, Thomas W. Strauss, Cowen Group, Inc. and RCG Holdings LLC (collectively the "Reporting Persons"). Based on the matters reported in such filing, as of December 31, 2009: (i) Ramius Navigation Master Fund Ltd ("Navigation Master Fund") is the beneficial owner of 11,008,336 shares, including 8,272,500 shares exercisable upon the exercise

8

of warrants; (ii) Ramius Enterprise Master Fund Ltd ("Enterprise Master Fund") is the beneficial owner of 3,669,445 shares, including 2,757,500 shares issuable upon the exercise of warrants; (iii) RCG PB Ltd., as the sole shareholder of Navigation Master Fund, may be deemed to beneficially own the 11,008,336 shares beneficially owned by Navigation Master Fund; (iv) Ramius Advisors, LLC ("Ramius Advisors"), as the investment advisor of Enterprise Master Fund and Navigation Master Fund; Ramius LLC, as the sole member of Ramius Advisors; Cowen Group, Inc., as the sole member of Ramius LLC; RCG Holdings LLC, as a signficant sharheolder of Cower Group, Inc.; C4S & Co., L.L.C. ("C4S"), as the management member of RCG Holdings, LLC; and Messrs Coden, Stark, Strauss and Solomon, may each be deemed to beneficially own the 3,669,445 shares owned by Enterprise Master Fund and the 11,008,336 shares owned by Navigation Master Fund. Each Reporting Person (other than Navigation Master Fund and Enterprise Master Fund) disclaims beneficial ownership of the shares reported herein except to the extent of his or its pecuniary interest therein.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires our directors and officers, and persons who beneficially own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock. Directors, officers and greater than ten percent stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, during our fiscal year ended December 31, 2009, all Section 16(a) filing requirements applicable to our directors, officers and ten percent stockholders were satisfied.

9

CORPORATE GOVERNANCE

Executive Officers

The names, ages, current positions and principal occupations during the last five years of our current executive officers are described below:

| | | | | |

Name | | Age | | Position |

|---|

F. William Capp | | | 61 | | President and Chief Executive Officer |

Matthew L. Lazarewicz | | | 59 | | Vice President of Engineering and Chief Technical Officer |

James M. Spiezio | | | 62 | | Vice President of Finance, Chief Financial Officer, Treasurer and Secretary |

Judith Judson | | | 37 | | Vice President, Asset Management and Market Development |

F. William Capp

Mr. Capp has served as our President, Chief Executive Officer and a member of the Board of Directors since December 1, 2001 when he joined the Company. Mr. Capp received his Bachelor of Science in Aeronautical Engineering from Purdue University, a Master of Business Administration and a Master's Degree in Mechanical Engineering from the University of Michigan.

Matthew L. Lazarewicz

Mr. Lazarewicz has served as our Vice President of Engineering since February 1999, and was named our Chief Technical Officer in September of 2001. Mr. Lazarewicz is a Registered Professional Engineer in the Commonwealth of Massachusetts and received both Bachelor's and Master's Degrees in Mechanical Engineering from the Massachusetts Institute of Technology. Mr. Lazarewicz also completed his Master's Degree in Management at the Massachusetts Institute of Technology Sloan School of Management.

James M. Spiezio

Mr. Spiezio joined our Company in May 2000. He has served as Vice President of Finance, Chief Financial Officer and Treasurer since July 2000, Secretary since March 2001, and was our Corporate Controller from May 2000 to July 2000. He has over twenty-seven years of diversified manufacturing and financial management experience. Mr. Spiezio is a graduate of the Indiana University School of Business.

Judith Judson

Ms. Judson joined our Company in January 2008 as Director of Regulatory and Market Affairs. She was appointed as Vice President, Asset Management and Market Development in April 2010. Prior to joining Beacon Power, Ms. Judson worked as a consultant to businesses in the energy sector from April 2007 through January 2008, served as a Commissioner and Chairman of the Massachusetts Department of Telecommunications and Energy from 2005 through April 2007, and ran as a candidate for State Representative in the 13th Essex District of Massachusetts in 2004. Ms. Judson received her Bachelor of Science in Mechanical Engineering from Kettering University and a Master of Business Administration from Harvard Business School.

Board Leadership Structure

In August 2009, the Board of Directors formally appointed a Chairman of the Board, to recognize the differences between the roles of Chief Executive Officer and of Chairman of the Board. The CEO articulates management's view of the Company's strategic direction and provides day-to-day leadership,

10

while the Chairman of the Board provides guidance to the CEO, sets the agenda for Board meetings and presides over meetings of the full Board. Our Board is comprised of six directors, five of whom are independent directors. As discussed below, we have four standing Board committees, all of which are comprised entirely of, and are chaired by, independent directors. We believe that this leadership structure has been effective for the Company by providing a balance of power with strong independent leadership.

Board's Role in Risk Oversight

The Board's role in the Company's risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, and strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate "risk owner" within the organization to enable it to understand our risk identification, risk management and risk mitigation strategies. When a committee receives a report, the Chairman of the relevant committee reports on the discussion to the full Board during the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Board of Directors Meetings and Committees

Meetings. During the fiscal year ended December 31, 2009, our Board of Directors held 16 meetings. Each director attended more than 75% of the aggregate of (i) the total number of meetings of our Board of Directors held during the period for which he has been a director and (ii) the total number of meetings held by all committees of our Board of Directors on which he served during the period.

Committees. Our Board of Directors has established four standing committees: the Audit Committee, the Compensation Committee, Finance Committee and the Nominating and Governance Committee. No member of any of these committees is an employee of Beacon. Effective April 1, 2010, the membership of each committee is listed below.

| | | | | | |

| Audit | | Compensation | | Nominating and

Governance | | Finance Committee |

|---|

| Stephen P. Adik,Chair | | Jack P. Smith,Chair | | Virgil G. Rose,Chair | | Daniel E. Kletter,Chair |

| Edward A. Weihman | | Stephen P. Adik | | Daniel E. Kletter | | Stephen P. Adik |

| Daniel E. Kletter | | Virgil G. Rose | | Jack P. Smith | | Edward A. Weihman |

Audit Committee. Under the rules of the Nasdaq Stock Market, our Audit Committee must have at least three members, all of whom must be independent. All members of our Audit Committee qualify as independent as defined in the Nasdaq Stock Market and SEC rules. Mr. Adik and Mr. Kletter are each qualified as an Audit Committee Financial Expert, as defined by the SEC. The Audit Committee is appointed by and reports to our Board of Directors. Its responsibilities include, but are not limited to, the appointment, compensation and dismissal of our independent auditors, review of the scope and results of our independent auditors' audit activities, evaluation of the independence of our independent auditors and review of our accounting controls and policies, financial reporting practices and internal audit control procedures and related reports. During the last fiscal year, the Audit Committee held 8 meetings. The Audit Committee's charter can be found on our website atwww.beaconpower.com.

Compensation Committee. Our Compensation Committee has the authority to set the compensation of our Chief Executive Officer and all other executive officers and has the responsibility to review the design, administration and effectiveness of all programs and policies concerning executive

11

compensation and establishing and reviewing general policies relating to compensation and benefits of employees. The Compensation Committee administers our Third Amended and Restated 1998 Stock Incentive Plan and Employee Stock Purchase Plan. Messrs. Adik, Smith and Rose are non-employee directors who have no interlocking relationships as defined by the SEC, and are all independent pursuant to the rules of the Nasdaq Stock Exchange applicable to members of this committee. The Compensation Committee held 12 meetings during the last fiscal year. The Compensation Committee's charter can be found on our website atwww.beaconpower.com.

Nominating and Governance Committee. The Nominating and Governance Committee recommends to the Board corporate governance guidelines applicable to the Board and to the Company and oversees the effectiveness of our corporate governance in accordance with those guidelines. The committee also identifies individuals qualified to become Board members, reviews the qualifications of nominee directors and recommends to the Board the director nominees for annual meetings of stockholders and candidates to fill vacancies on the Board. Additionally, the committee recommends to the Board the directors to be appointed to Board committees. While the committee does not have a formal diversity policy for Board membership, the Board seeks directors who represent a mix of backgrounds, perspective and experiences that will enhance the quality of the Board's deliberations and decisions.

A stockholder may nominate a person for election as a director by complying with Section 2.2 of our By-Laws, which provides that advance notice of a nomination must be delivered to us and must contain the name and certain information concerning the nominee and the stockholders who support the nominee's election. A copy of this By-Law provision may be obtained by writing to Beacon Power Corporation, Attn: James M. Spiezio, Secretary, 65 Middlesex Road, Tyngsboro, Massachusetts 01879. Director nominees recommended by our stockholders will be considered on the same terms as other nominees. All members of our Nominating and Governance Committee qualify as independent pursuant to the rules of the Nasdaq Stock Market. The Nominating and Governance Committee held 5 meetings during the last fiscal year. The charter for our Nominating and Governance Committee can be found on our web site atwww.beaconpower.com.

Finance Committee. The Finance Committee is appointed by the Board of Directors to assist the Board in monitoring material financial matters involving: (1) debt undertaken by the Company; (2) equity raised by the Company; (3) share splits or retirement of shares by the Company; (4) cash dividends or share dividends paid by the Company; (5) acquisitions and divestures; (6) significant changes in Company ownership; (7) project finance for the Company and/or for affiliates that it may sponsor; and (8) such other matters as are similar or related to these matters, or which the Board considers to be necessary or advisable. While the Committee has the responsibilities and powers set forth in its Charter, it is not the duty of the Committee to plan or conduct financial transactions nor does the Committee have any oversight responsibility with respect to the Company's financial reporting. The Finance Committee held 7 meetings during the last fiscal year. The Finance Committee's Charter can be found on our website atwww.beaconpower.com.

Director Independence

There are no family relationships among any of our directors or executive officers. Messrs. Adik, Smith, Kletter, Weihman and Rose, representing a majority of our directors, are independent under the rules of the Nasdaq Stock Market. Our board holds regularly scheduled meetings at which only these independent directors are present.

Limitation of Liability and Indemnification

Our Certificate of Incorporation limits the liability of our directors, officers and various other parties whom we have requested to serve as directors, officers, trustees or in similar capacities with

12

other entities to us or our stockholders for any liability arising from an action to which such persons are a party by reason of the fact that they were serving Beacon or at our request to the fullest extent permitted by the Delaware General Corporation Law.

We have entered into indemnification agreements with our directors and executive officers. Subject to certain limited exceptions, under these agreements, we will be obligated, to the fullest extent not prohibited by the Delaware General Corporation Law, to indemnify such directors and officers against all expenses, judgments, fines and penalties incurred in connection with the defense or settlement of any actions brought against them by reason of the fact that they were Beacon directors or executive officers. We also maintain liability insurance for our directors and executive officers in order to limit our exposure to liability for indemnification of our directors and executive officers.

Communication with Our Board of Directors

Our Board of Directors provides a process for our stockholders and other interested parties to send communications directly to our non-employee directors. Any person who desires to contact the non-employee directors may do so by writing to: Board of Directors, c/o Beacon Power Corporation, 65 Middlesex Road, Tyngsboro, Massachusetts 01879.

Communications received will be forwarded directly to the Chair of the Nominating and Governance Committee. The Chair of the Nominating and Governance Committee will, in his discretion, forward such communications to other directors, members of our management or such other persons as he deems appropriate. The Chair of the Nominating and Governance Committee, or, if appropriate, our management, will respond in a timely manner to any substantive communications from a stockholder or interested party.

Our Audit Committee also provides a process to send communications directly to the committee about our accounting, internal accounting controls or auditing matters. Any person who desires to contact the Audit Committee regarding such matters may do so by writing to Audit Committee of the Board of Directors, c/o Beacon Power Corporation, 65 Middlesex Road, Tyngsboro, Massachusetts 01879.

Communications received by mail will be forwarded directly to the Chair of the Audit Committee. The Chair of the Audit Committee, in his discretion, will forward such communications to other directors, members of our management or such other persons as he deems appropriate. The Chair of the Audit Committee, or, if appropriate, our management, will respond in a timely manner to any substantive communications from a stockholder or an interested party.

13

AUDIT COMMITTEE REPORT

The Audit Committee of our Board of Directors is composed of three members and acts under a written charter. All members of the Audit Committee are independent directors, as defined by its charter and the rules of the Securities and Exchange Commission and Nasdaq Stock Market.

In connection with the preparation and filing of our Annual Report on Form 10-K for the year ended December 31, 2009, the Audit Committee (i) reviewed and discussed the audited financial statements with management, (ii) discussed with Miller Wachman LLP, our independent auditors for the fiscal year ending December 31, 2009, the matters required to be discussed by Statement of Auditing Standards 61, as amended, as adopted by the Public Company Accounting Oversight Board and (iii) received the written disclosures and the letter from Miller Wachman LLP required by applicable requirements of the Public Company Accounting Oversight board regarding Miller Wachman LLP's communications with the audit committee concerning independence, and has discussed the independence of Miller Wachman LLP with such firm. Based on the review and discussions referred to above, among other things, the Audit Committee recommended to our Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2009.

| | |

| | | Submitted by the Audit Committee: |

|

|

Stephen P. Adik,Chair

Daniel E. Kletter

Edward A. Weihman

|

14

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Executive Summary

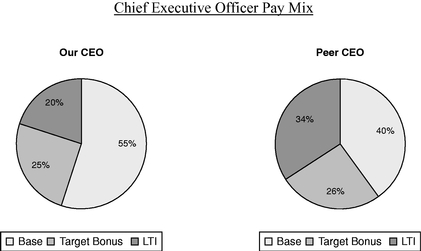

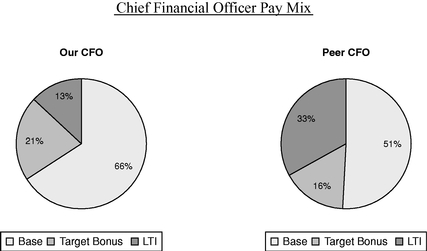

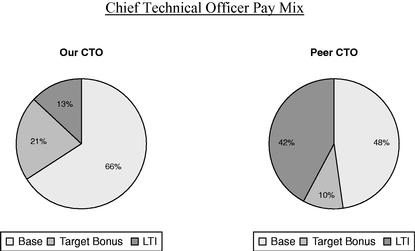

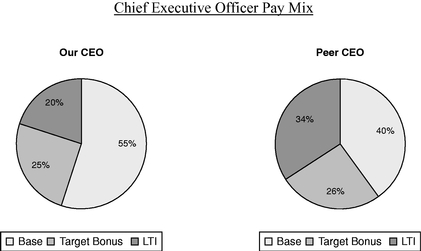

Our executive compensation and benefit program has been designed to encourage our named executive officers (our chief executive officer, or CEO; our chief financial officer, or CFO; and our chief technology officer, or CTO) to pursue our strategic objectives while effectively managing the risks and challenges inherent in a development stage company transitioning into a commercial company. We created a compensation package that combines short and long-term components through a mix of base salary, bonus and equity compensation, in the proportions we believe are most appropriate to incentivize and reward our executive officers for achieving our strategic objectives. Moreover, the program is designed to be competitive with comparable employers and to align management's incentives with the long-term interests of our stockholders. Our compensation-setting process consists of establishing targeted overall compensation for each executive officer and then allocating that compensation among fixed and variable elements. At the executive level, we design the incentive compensation to reward company-wide performance, shareholder value creation, and the achievement of specific financial, operational and strategic objectives.

The Compensation Committee, after considering the Company's cash position as of the end of 2008, cash requirements for 2009, and the Company's business plan for 2009, decided to hold the executive officers' salaries at the 2008 level for 2009. Given market conditions and our stock price as of the beginning of 2009, the Compensation Committee also decided to recalibrate the 2009 executive equity award structure. During recent years, the Compensation Committee had targeted the long-term equity incentive grants to the executive officers at 100% of base salary for our CEO and at 55% of base salary for our CFO and CTO, with the grant size calculated using the Black-Scholes fair value. When evaluating the incentive structure for 2009, the Compensation Committee determined that the use of the Black-Scholes formula when the market price for our stock was lower than in prior years would have resulted in granting a significantly larger number of options and Restricted Stock Units (RSUs) than in prior years. The Compensation Committee believed that this was not appropriate and after receiving guidance from its compensation consultants, an alternative methodology was used to set long-term incentives. The revised method used to calculate the 2009 grants was to simply apply a factor of 120% as a function of the number of options and RSUs granted for 2008. As a result of this change in methodology, the percentage of total compensation that was variable and based on the performance of the Company dropped from 58% to 47% for our CEO, and from 46% to 36% for our CFO and CTO. However, our Compensation Committee believes that our compensation program remains a performance-oriented structure, with an appropriate portion of compensation at risk for our executive officers.

In 2009 our executive officers' performance relative to strategic objectives resulted in a 90% payout of the targeted bonus amount. The objectives for 2009 had five primary components: (1) funding, (2) reliable operation of our flywheel systems and cost reductions on both flywheel systems and balance of plant, (3) breaking ground at our Stephentown site, (4) improvement of our economics through favorable tariff improvements, and (5) work on alternative applications. In addition, there were stretch objectives for a "take or pay" agreement, agreements for sales outside the United States or funding from the stimulus legislation. In summary, the key targeted objectives and results were as follows:

- •

- On funding, the targets for the year were exceeded in a very challenging economic environment

- •

- On reliable operations of our flywheel systems and cost reductions on both flywheel systems and the balance of plant, the targets for the year were exceeded

- •

- On breaking ground at our Stephentown site, the target was met

15

- •

- On improving the economics through favorable tariff improvements and work on alternative applications, the targets were met.

On the stretch objectives, the target for funding from stimulus legislation was exceeded. The overall evaluation of performance to targets for 2009 was that as a percentage of targeted objectives, an appropriate rating would be approximately 120%. However, the Compensation Committee, upon reviewing the results of executive performance for 2009 determined that an award of 90% was appropriate. The Compensation Committee took this discretionary position that while management had performed well on its targets, the reduction in stock price during 2009 warranted a lower than target payout. The Compensation Committee determined that 90% was a fair payout.

Role of Our Compensation Committee

Our Compensation Committee approves, administers and interprets our executive compensation policies. Our Compensation Committee is appointed by our Board of Directors, and consists entirely of directors who are "outside directors" for purposes of Section 162(m) of the Internal Revenue Code, "non-employee directors" for purposes of Rule 16b-3 under the Exchange Act and "independent directors" for purposes of the rules of the Nasdaq Stock Market. Our Compensation Committee has three members: Mr. Stephen P. Adik, Mr. Virgil G. Rose and Mr. Jack P. Smith, who chairs the committee.

Our Compensation Committee reviews and makes recommendations to our Board of Directors to ensure that our compensation program is consistent with our compensation philosophy and corporate governance guidelines and, subject to the approval of our Board (without the participation of the CEO), establishes the compensation paid or granted to our executive officers, which include our CEO, CFO and CTO. The Compensation Committee also establishes an overall pool of compensation for Senior Management and other employees.

Messrs. Adik, Smith and Rose are non-employee directors who have no interlocking relationships as defined by the SEC, and are all independent pursuant to the rules of the Nasdaq Stock Market applicable to members of this committee.

Role of Compensation Consultant

The Compensation Committee generally engages an independent compensation consultant to provide a market perspective on executive compensation matters. Towers Watson (formerly known as Watson Wyatt) has served as the Compensation Committee's consultant since 2005. During that time, the Compensation Committee has utilized Towers Watson for various activities, including but not limited to peer group development, competitive market analysis, incentive plan design and assistance in pay determination. During 2009, we paid Towers Watson approximately $41,000 for all services provided. None of these services related to matters outside of our executive compensation program. The Compensation Committee expects to continue to engage an outside advisor in the development of programs and pay setting activities.

Role of our Executive Officers

The role of our CEO and CFO is to allocate the compensation pool approved by the Compensation Committee among all our other employees and to provide recommendations to the Compensation Committee in regard to any equity compensation to be granted to other employees.

During the transition from development stage to commercial production, we have aligned the compensation structure of all other employees to the same company-wide strategic objectives and performance as the executive officers' compensation. As we move into volume production of commercial products, we will continue to evaluate the effectiveness of company-wide strategic

16

objectives. If we determine that company performance would be improved by combining these objectives with specific operational goals within areas we will modify our programs.

Program Participants

Our executive officers in 2009 were:

- •

- F. William Capp, Chief Executive Officer (CEO)

- •

- James M. Spiezio, Chief Financial Officer (CFO)

- •

- Matthew L. Lazarewicz, Chief Technical Officer (CTO)

On April 26, 2010, our Board of Directors named Judith Judson, from Director of Regulatory and Market Affairs, to Vice President, Asset Management and Market Development. As an executive officer of the Company, she is eligible to participate in our 2010 executive officer compensation programs. Because she was not an executive officer during fiscal year 2009, her compensation is not presented for such year in this proxy statement.

Development of a Formal Compensation Program

Our Compensation Committee has taken the following steps to ensure that our compensation and benefit programs for executive officers are consistent with our compensation philosophy and our corporate governance guidelines:

- •

- Beginning in 2005, the committee engaged and directed Towers Watson, as our independent executive compensation and benefits consultant, to assess the competitiveness of our compensation program, and provide a high-level review of our long-term incentive plan

- •

- With the assistance of ongoing input from Towers Watson, we have developed appropriate compensation packages by targeting a competitive level of pay as measured against our peer group described below

- •

- We have maintained a practice of reviewing the performance and determining the total compensation earned, paid or awarded to our Chief Executive Officer independent of input from him

- •

- We have developed compensation guidelines for our Chief Financial Officer and Chief Technical Officer with assistance from our Chief Executive Officer, and determined what we believe to be appropriate total compensation based on competitive levels as measured against our peer group

- •

- We have maintained the practice of holding executive sessions, without executive officers present, at every Compensation Committee meeting

- •

- For the remainder of the management team the Compensation Committee and executive officers review the compensation program to insure consistency with our compensation philosophy and governance guidelines.

Based on these efforts and examinations, the Compensation Committee developed a compensation program intended to be in place for the next several years and continues to monitor this program to insure its effectiveness.

Market Referencing

To test the competitiveness of our compensation program, Towers Watson was engaged to compare our compensation practices and levels to a group of specific peer companies, representative of companies of similar size and industry. As our company continues to grow, Towers Watson analyzes and updates the compensation benchmarking peer group where appropriate. The recommended changes, if

17

any, in the peer group is then presented to the Compensation Committee for approval. In 2007, Towers Watson helped us to select a comparison group using the following criteria:

- •

- Publicly-traded companies subject to disclosure requirements governed by the SEC

- •

- Companies that operate in the capital goods sectors or select companies in the clean technology industry

- •

- Companies that are similar in size to the company:

- •

- Market capitalization—generally within a range of .5X - 2.5X of our own

- •

- Revenue—generally within a range of $0 to $50 million

- •

- Companies that are generally in a similar business stage.

In 2009, Towers Watson and the Compensation Committee reviewed the peer group previously selected and determined that the following peer group of 11 companies continues to be appropriate and no changes were recommended:

- •

- Active Power Inc.

- •

- Akeena Solar Inc.

- •

- Ascent Solar Technologies

- •

- Capstone Turbine Corporation

- •

- Daystar Technologies Inc.

- •

- Evergreen Energy Inc.

- •

- Hoku Scientific Inc.

- •

- Ocean Power Technologies Inc.

- •

- Satcon Technology Corporation

- •

- Spire Corporation

- •

- UQM Technologies, Inc.

The Compensation Committee engaged Towers Watson in December 2009 to update its 2007 benchmarking analysis. The analysis consisted of assessing our named executive officer compensation against that of the peer group. The analysis specifically reviewed base salaries, annual incentive targets, long-term incentive levels and overall total direct compensation. As a group, our named executive officers' base salaries in 2009 were between the 25th and 50th percentile of the peer group, while target total direct compensation (TDC) was closer to the market 50th percentile (CEO TDC approximated the market 30th percentile). The Committee also reviewed annual and three year Total Shareholder Return (TSR) performance of the company versus its peer group and the Russell 2000 (small cap index). It was determined that the Company underperformed the peer group and index with regards to shareholder return.

We intend to continue our strategy of providing competitive compensation opportunity to our executive officers, through programs that emphasize performance-based incentive compensation in the form of cash and equity. To that end, total executive compensation is structured to ensure that, due to the nature of our business, there is an equal focus on our operational and financial performance and stockholder return. We believe that the positioning of our executive officer compensation was consistent with our financial performance, the individual performance of each of our executives and the interests of our stockholders. We also believe that the total compensation was reasonable in the aggregate. Further, in light of our compensation philosophy, we believe that the total compensation package for

18

our executive officers should continue to consist of base salary, annual cash incentive awards (bonuses), long-term equity-based incentive compensation, and certain other benefits.

The competitive posture of our total annual direct compensation will vary from year to year based on our results and individual performance. as compared to the performance of the peer group companies and the respective level of annual performance bonus awards made to their executives.

Components of Compensation Program

Our performance-driven compensation program has both short-term and long-term components. Our executive officers' compensation is defined in the Executive Agreements (which are further detailed in the section titled "Executive Officer Employment Agreements" below). All of our other employees are employees at will. However, all of our employees participate in the compensation programs as noted below.

Current Compensation Components

We utilize current compensation components that include base salary and cash bonuses to motivate and reward our employees, including our executive officers, in accordance with our defined objectives. Our Compensation Committee has established this program to set and refine management objectives and to measure performance against those objectives. The Compensation Committee reviews its conclusions on short term compensation with the Board (without the participation of the CEO), and once a consensus is reached, the short term compensation decisions are presented to the executive officers.

Base Salary

Base salary rewards the experience, skills, knowledge and responsibilities required of each of our executive officers and reflects competitive market conditions. The factors considered in determining salary and annual increases to salary, which are typically adjusted effective January 1 of each year, are:

- •

- Experience

- •

- Functional role

- •

- Level of responsibility

- •

- Performance and accomplishments

- •

- Comparisons against market benchmarks described earlier in this discussion

- •

- Trends in compensation for the geographic region

- •

- Professional effectiveness including leadership, commitment, creativity and team building

- •

- Knowledge, skills, attitude and focus

- •

- Competitive market for corresponding positions within comparable geographic areas and industries

Using the criteria outlined above, our Compensation Committee works directly with its independent compensation consultant to determine the compensation recommendations that our Compensation Committee makes to our Board of Directors regarding specific compensation actions for the executive officers. The Compensation Committee evaluates each executive officer's base salary in terms of his individual performance and his relative percentile performance to the peer group. However, after considering the Company's cash position as of the end of 2008, cash requirements for 2009, and the Company's business plan for 2009, the Compensation Committee decided to hold the

19

executive officers' salaries at the 2008 level for 2009. The executive officers' base salaries were as follows:

| | | | | | | | | | | | | | | | | | | |

|

|---|

| | Executive Officer

| |

| | 2008 Base Salary

| |

| | 2009 Base Salary

| |

| | % Increase

| |

|

|---|

| | F. William Capp | | | | $ | 296,125 | | | | $ | 296,125 | | | | | 0.0 | % | |

| | James M. Spiezio | | | | | 210,813 | | | | | 210,813 | | | | | 0.0 | % | |

| | Matthew L. Lazarewicz | | | | | 189,280 | | | | | 189,280 | | | | | 0.0 | % | |

Performance Bonus

Overview of Performance Bonus Program

Awards under the performance bonus program are based on a quantitative and qualitative review of all of the facts and circumstances related to the Company and each executive's or employee's performance. An executive officer may receive awards from zero to 100% of his target bonus based on the review of results. Additional awards of up to 70% of the target bonus may be awarded for performance at levels above targeted goals and objectives or improvement in the timing of achieving certain results. The criteria for these potential additions to the bonus are clearly defined as part of establishing the potential bonus structure each year.

On an individual level, the Compensation Committee attempts to set clearly defined goals for each executive officer, focusing on the categories mentioned below, with an emphasis on quantifiable and achievable goals. Once the defined goals have been identified, the Compensation Committee engages in a collaborative process with the executive officers to reach agreement on the following aspects of the short term goals:

- •

- Agreement that the goals formulated are viewed by the executive officers as the correct drivers for the business from their perspectives

- •

- Consistency of these goals with our short and long term strategies

- •

- Timing, measurability and relative values that should be ascribed to each goal; and

- •

- Agreement that the goals are difficult yet realistically attainable.

The Compensation Committee sees this process both as the optimal means of assembling accurate information regarding the expectation and realization of performance, as well as an integral part of our culture of collaborative, team-oriented management.

The Compensation Committee evaluates each executive officer as well as our other key employees once each year based on the achievement of set goals. This review is typically done during the first quarter of the year. We review final results for the year versus pre-determined objectives and begin discussions regarding performance objectives for the current fiscal year. Performance bonuses, at the discretion of the Compensation Committee, may be awarded in the form of cash or RSUs and equity-based awards. During recent years, the performance bonuses have been paid in cash.

Total compensation for our executive officers may vary significantly from year to year, based on the percentage of achievement of goals. In addition, the value of equity awards in either RSUs or stock options may vary significantly in value based on the performance of our stock price.

20

Discretionary Bonus

Additional discretionary awards of the target bonus may be awarded for performance to targets that emerge subsequent to the establishment of the year's bonus program or other achievements not previously identified, or performance to existing targets that is greater or timelier than the target.

2009 Performance Bonus and Resulting Bonus Payout

Our business strategy is to become a leader in providing frequency regulation services to the electrical grid. We intend to build our service business through our internal research efforts, our use of proprietary technologies, expansion of manufacturing capabilities and our deployment of facilities dedicated to providing economically-viable frequency regulation services to the electrical grid. In order to accomplish these goals, we will need to expand manufacturing capabilities, acquire appropriate locations for installation of our flywheel systems and raise additional financing. We must also focus on continually strengthening our management and technical teams, in order to provide the human resources necessary to carry out our business objectives.

In 2009, we made progress in executing our strategic plan. For 2009, the target performance goals and results were as follows:

| | | | | | | | | | | | | | | | | | |

| |

|---|

| | Metrics

| |

| | Comments on results

| |

| | Potential

Value (%

of Bonus

Award)

| |

| | Value

Awarded

Based on

Achievement

(% of Bonus

Award)

| |

|

|---|

| |

|---|

| | | Funding: Goals related to continued funding of basic cash burn; progress on DOE loan application; and debt or equity funding to support DOE-required equity contribution and beyond. | | | | Seaside funding was completed on schedule in March 2010. The DOE loan application was approved by the credit review board, making us the first public company and the second of 16 applicants to receive the commitment. We raised over $20 million in a December 2009 financing, providing funding for the remaining equity commitment for Stephentown and a portion of our goals outside of the DOE requirements. | | | | | 25 | | | | | 25 | | |

| | | 25kWh flywheel development: Goals related to achieving and maintaining reliable operation on flywheels and the Smart Energy Matrix System connected to grid operators; significant progress on cost reductions for both flywheel and balance of plant | | | | We made continuous improvement, redesigning motor generators to address an overheating issue, and achieved 3MW capacity in service. We met our goals on both flywheel and other cost reductions on an accelerated timeframe that earned a bonus under the plan metrics. | | | | | 20 | | | | | 26 | | |

| | | Financial reporting: Institute monthly reporting of financial results from regulation operations to the Board of Directors; develop an investor relations package; update and validate internal financial forecasting model. | | | | We met each of our goals in this area. | | | | | 15 | | | | | 15 | | |

21

| | | | | | | | | | | | | | | | | | |

| |

|---|

| | Metrics

| |

| | Comments on results

| |

| | Potential

Value (%

of Bonus

Award)

| |

| | Value

Awarded

Based on

Achievement

(% of Bonus

Award)

| |

|

|---|

| |

|---|

| | | Deployment: Goals related to maintaining high operational availability in Tyngsboro, groundbreaking in Stephentown, and adding 1MW of revenue service at AEP site in PJM Interconnection and 5MW of revenue service in New York. | | | | We achieved about one-half of the goals relating to operational availability by solving motor issues, making progress on balance issues and achieving cost reductions. We broke ground in Stephentown in November, behind schedule. The goals relating to adding 1 MW at AEP and 5 MW in New York were not met. | | | | | 15 | | | | | 7 | | |

| | | Market Access: Work with ISOs on market changes and related developments that will support non-discriminatory treatment of alternative energy storage technologies. | | | | We met or exceeded our goals in this area. In NYISO, favorable market tariff and associated software changes were approved by FERC in May 2009, earlier than our target. ISONE is now running a NYISO-style regulation dispatch signal and is creating a working group to develop signal changes. An improved dispatch signal for storage is in place in PJM. MISO favorable market tariff and software modifications are effective January 2010. Progress made with CAISO and we are exploring markets in Canada, ERCOT, Europe and elsewhere. | | | | | 15 | | | | | 18 | | |

| | | R&D contracts, government and other goals: Meet deliverables under Tehachapi contract; update corporate web site; refine IR strategy and communications; expand favorable MA carbon credit treatment to other states; safety goals; and convert Green Box into "Smart Grid Laboratory". | | | | We have met deliverables for Tehachapi but the prime contractor has delayed the schedule. We met goals relating to investor relations and safety. Our new corporate web site was completed behind schedule. We did not meet goals relating to expanding the MA carbon credits to other states or creating our "Smart Grid Laboratory". | | | | | 5 | | | | | 4 | | |

22

| | | | | | | | | | | | | | | | | | |

| |

|---|

| | Metrics

| |

| | Comments on results

| |

| | Potential

Value (%

of Bonus

Award)

| |

| | Value

Awarded

Based on

Achievement

(% of Bonus

Award)

| |

|

|---|

| |

|---|

| | | Additional revenue sources: Obtain a contract from state or federal agency or strategic partner to provide additional funding, e.g., Navy project or NYSERDA. | | | | We announced a $2 million NY State Energy Research and Development Authority (NYSERDA) contract, which is being finalized in conjunction with the DOE loan. | | | | | 5 | | | | | 5 | | |

| | | Stretch goals: Stretch goals would permit bonus amounts above the targets, for (a) signing a "take or pay" agreement with a third party for frequency regulation services (up to additional 15% of bonus award), (b) selling services or a system outside of the US (up to 15%), (c) receiving funding from the federal stimulus legislation (up to 20%), or (d) success in promoting regulatory or legislative energy storage incentives (up to 20%). | | | | We were awarded a $24 million grant from the DOE for our second 20MW plant, to be located in Illinois. We did not meet our other stretch goals. | | | | | 70 | | | | | 20 | | |

| | | | | | | Totals | | | | | 170 | | | | | 120 | | |

| | | | | | | Discretionary Adjustment | | | | | | | | | | (30 | ) | |

| | | | | | | Bonus % Awarded | | | | | | | | | | 90 | | |

| |

The overall evaluation of performance to targets for 2009 was that as a percentage of targeted objectives, an appropriate rating would be approximately 120%. However, the Compensation Committee, upon reviewing the results of executive performance for 2009 determined that an award of 90% was appropriate. The Compensation Committee took this discretionary position that while management had performed quite well on its targets, the reduction in stock price during 2009 warranted a lower than target payout. The Compensation Committee determined that 90% was a fair payout. Accordingly, for our executive officers, the targeted and actual bonuses paid in cash in March 2010 for our 2009 performance plan were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|---|

| | Name

| |

| | 2009 Base Salary

| |

| | Targeted Bonus Potential as a % of Salary

| |

| | 2009 Target Bonus Potential

| |

| | Bonus Percent Awarded (as a % of Target)

| |

| | Bonus Amount Earned

| |

|

|---|

| | | F. William Capp | | | | $ | 296,125 | | | | | 50.0 | % | | | $ | 148,063 | | | | | 90.0 | % | | | $ | 133,256 | | |

| | | James M. Spiezio | | | | | 210,813 | | | | | 35.0 | % | | | | 73,785 | | | | | 90.0 | % | | | | 66,406 | | |

| | | Matthew L. Lazarewicz | | | | | 189,280 | | | | | 35.0 | % | | | | 66,248 | | | | | 90.0 | % | | | | 59,623 | | |

The bonus potential as a percent of salary is defined in the executive officers' Employment Agreements with the Company. These agreements are further described below.

Long-term Compensation

At present, our long-term compensation for executive officers consists of a combination of common stock options and RSUs, all with a three year vesting period, and performance stock units

23

(PSUs) tied to achieving specific longer term objectives. We believe this strategy of utilizing a combination of options, RSUs and PSUs is appropriate for aligning the interests of our executive officers with those of our stockholders over the long-term, focuses on attaining key operational milestones, and provides an effective retention feature. All options, RSUs and PSUs are granted under our Third Amended and Restated 1998 Stock Incentive Plan. Our practice is to grant stock options and RSUs on an annual basis at the time of annual performance review. The typical target expected value of the annual long term incentive grant is 100% of base salary for our CEO and 55% of base salary for our CFO and CTO. Given market conditions and our stock price as of the beginning of 2009, the Compensation Committee decided to recalibrate the 2009 executive equity awards, because use of the Black-Scholes formula when the market price for our stock was lower than in prior years would have resulted in granting a significantly larger number of options and RSUs. After receiving guidance from its compensation consultants, the Board decided to calculate the 2009 executive officers' equity grants at 120% of the number of options and RSUs granted for 2008. As a result, the percentage of total compensation that was variable and based on the performance of the Company dropped from 58% to 47% for our CEO and from 46% to 36% for our CFO and CTO. In addition, PSUs were last granted in 2006 as a special grant to motivate the executives to achieve specific long-term financial objectives. These PSUs cliff vest in 2009 or 2010 based upon the achievement of the specified objectives. Management did not meet those objectives for 2009, and does not expect to meet them for 2010, so no PSUs will vest from the 2006 grant. Although no additional PSUs were granted in 2007, 2008 or 2009, the Compensation Committee continues to consider PSUs a key component of our long-term compensation strategy because of their multi-year performance approach. The 2006 PSUs have been terminated in 2010, and are being replaced in 2010 with an annual PSU plan that will cliff vest based upon achieving newly-specified objectives.

We analyze the following when we set the number of options or RSUs to be granted to each executive. On an individual basis, we compare:

- •

- The fair value of the grants using a Black-Scholes valuation for equity awards that is consistent with the Accounting Standards Codification Topic 718

- •

- The number of common stock options and RSUs granted by position

- •

- The competitive level of our equity-based compensation practices versus the market based upon our peer group, including levels, share usage levels, dilution and overall equity plan expense.

Each of the three elements of our LTI program—stock options, restricted stock units and performance stock units—is discussed in more detail below.

Common Stock Option Grants

Our common stock option grants are designed to align our executives' performance objectives with the interests of our stockholders. We believe that these options provide an important component of executive compensation which is fully aligned with our shareholders' interests whereby the impact of any business setbacks, whether Company-specific or industry based, achievement of objectives or other performance matters impacts the executive officers as well as shareholders directly. Our Compensation Committee also grants options to key employees based on this same rationale and enables these key employees to participate in the long term appreciation of our stockholder value. In addition, all new permanent, full-time employees are granted options when they join the Company. We further believe that our option grants provide a means to assist in the retention of key employees, inasmuch as they are in almost all cases subject to vesting over an extended period of time.

In 2009, we granted options vesting over three years to our executive officers pursuant to the Executive Agreements as follows: Mr. Capp, 349,535 options; Mr. Spiezio, 136,918 options; and

24

Mr. Lazarewicz, 122,911 options. These options had exercise prices based on the stock closing price on the date of grant, which was $0.49.

In the past, we have calculated the number of options or RSUs to be granted to our executive by dividing the targeted compensation dollar amount (based on the percentage of base salary, as described earlier) by the fair value of the option using a Black-Scholes valuation model. In light of our low stock price, the Compensation Committee determined the size of the 2009 grants by applying a factor of 1.2 to the 2008 grants. This resulted in a significantly lower grant size than would have been granted using the Black-Scholes valuation model.

Restricted Stock Unit Grants

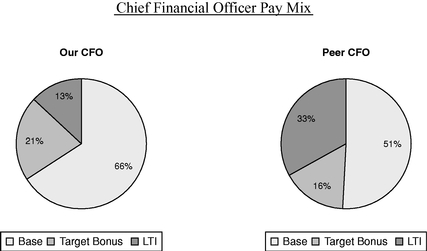

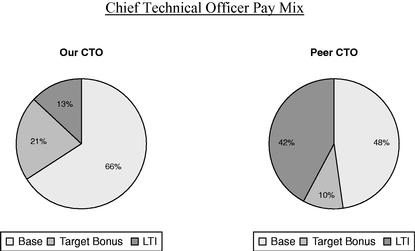

RSUs were granted to our executive officers pursuant to the Executive Agreements, which are renegotiated annually. Our issuance of RSUs is a further effort to align management's performance objectives with the interest of shareholders by having the same attributes as our vesting stock options with the additional alignment of each executive officer owning actual shares. These RSUs vest quarterly over a three year period, and are generally converted to common stock on the vesting dates. The numbers of RSUs issued to each of the executive officers based upon the 2009 Executive Agreements were as follows: Mr. Capp, 38,820 units; Mr. Spiezio, 15,214 units; and Mr. Lazarewicz, 13,639 units. The closing price on the date of grant was $0.49. The number of RSUs granted in 2009, as with the stock options, was calculated by applying a factor of 1.2 to the number of RSUs granted in 2008. The effect of the change in method of calculating the long-term incentive grants in 2009 was to significantly reduce the value of these incentives as a percentage of base salary as compared to the prior year. The charts below show long-term incentive (LTI) grants as a percentage of base salary for 2008 and 2009: