SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ Confidential,for Use of the Commission Only |

| | | | (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

SIRENZA MICRODEVICES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ Fee | | paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

SIRENZA MICRODEVICES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 30, 2002

TO THE STOCKHOLDERS OF SIRENZA MICRODEVICES, INC.:

NOTICE IS HEREBY GIVEN that the 2002 Annual Meeting of Stockholders of Sirenza Microdevices, Inc., a Delaware corporation (the Company or Sirenza Microdevices), will be held on Tuesday, May 30, 2002 at 2:00 p.m., local time, at the Company’s principal executive offices, located at 522 Almanor Avenue, Sunnyvale, California 94085, for the following purposes:

| | 1. | | To elect two Class II directors for a term of three years and until their successors are duly elected and qualified; |

| | 2. | | To ratify the appointment by the Board of Directors of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending December 31, 2002; and |

| | 3. | | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders.

Only stockholders of record at the close of business on April 1, 2002 are entitled to notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the Annual Meeting, you are urged to vote, sign, date and return the enclosed Proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she previously returned a Proxy.

By order of the Board of Directors |

|

/s/ THOMAS SCANNELL

|

Thomas Scannell Vice President, Finance and Administration, Chief Financial Officer, Secretary and Assistant Treasurer |

Sunnyvale, California

April 1, 2001

SIRENZA MICRODEVICES, INC.

522 ALMANOR AVENUE

SUNNYVALE, CA 94085

PROXY STATEMENT

FOR 2002 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of Sirenza Microdevices, Inc. (the Company or Sirenza Microdevices) for use at the Annual Meeting of Stockholders to be held on Tuesday, May 30, 2002 at 2:00 p.m., or at any adjournment or postponement thereof (the Annual Meeting), at the Company’s principal executive offices, located at 522 Almanor Avenue, Sunnyvale, California 94085, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Company’s telephone number at its principal executive offices is (408) 616-5400. The Company’s fiscal year ends on December 31st of each year. The Company’s last fiscal year ended on December 31, 2001 (the Last Fiscal Year).

RECORD DATE AND MAIL DATE; OUTSTANDING SHARES

Stockholders of record at the close of business on April 1, 2002 (the Record Date) are entitled to notice of and to vote at the Annual Meeting. This proxy statement, the form of proxy and the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2001 will be mailed on or about April 15, 2002 to all stockholders entitled to vote at the Annual Meeting. As of the close of business on February 15, 2002, 29,802,316 shares of the Company’s Common Stock, $0.001 par value (the Common Stock), were issued and outstanding.

VOTING AND REVOCABILITY OF PROXIES

When proxies are properly dated, executed and returned, the shares they represent will be voted at the Annual Meeting in accordance with the instructions of the stockholder as marked on such proxies. If no specific instructions are given, the shares represented by proxies will be voted as follows:

| | • | | FOR the election of the nominees for Class II directors set forth herein, and |

| | • | | FOR ratification of the appointment of independent auditors described herein. |

In addition, if any other matters properly come before the annual meeting, the persons named in the accompanying form of proxy will have discretion to vote the shares represented by proxies, or otherwise act with respect to such matters, in accordance with their best judgement.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by filing a written instrument revoking the proxy with the Secretary of the Company, by executing and delivering to the Company a subsequent proxy prior to the Annual Meeting, or by attending the Annual Meeting and voting in person.

VOTES PER SHARE; VOTES REQUIRED FOR APPROVAL

Each share of Common Stock outstanding as of the close of business on the Record Date shall be entitled to one vote on each matter properly brought before the stockholders at the Annual Meeting. The stockholders shall not be entitled to cumulate their votes on any matter brought before them at the Annual Meeting.

1

The affirmative vote of a plurality of the votes cast by the stockholders entitled to vote at the Annual Meeting is required for the election of the nominees for director contemplated in Proposal 1, meaning that the two properly nominated persons receiving the highest number of affirmative votes cast by stockholders entitled to vote at the Annual Meeting will be elected.

The affirmative vote of a majority of the shares of Common Stock present or represented by proxy and entitled to vote at the Annual Meeting is required for the ratification of the independent auditors for the Company contemplated in Proposal 2.

QUORUM; ABSTENTIONS; BROKER NON-VOTES

The quorum required for the transaction of business at the Annual Meeting shall be the presence at the Annual Meeting of a majority of the shares of Common Stock issued and outstanding at the close of business on the Record Date. Shares of Common Stock present at the Annual Meeting in person or represented by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

Because abstentions with respect to any matter are treated as shares present or represented by proxy and entitled to vote for the purpose of determining whether that matter has been approved by the stockholders, such abstentions have the same effect as negative votes for each proposal other than the election of directors. Shares present or represented by proxy and entitled to vote are counted toward a quorum, even if they abstain from voting on any matter.

Broker non-votes occur where a nominee such as a financial institution holds in its name shares beneficially owned by another person, and returns a proxy to the Company with respect to such shares, but indicates that it does not have the authorization of the beneficial owner to vote the owner’s shares on one or more proposals. Broker non-votes are counted as present or represented for purposes of determining the existence or absence of a quorum at a meeting. Broker non-votes are not, however, counted or deemed to be present or represented for purposes of determining whether stockholder approval of any particular matter has been obtained, and hence will not have the effect of negative votes on a matter unless the vote required for approval of such matter is the affirmative vote of some percentage of the outstanding shares entitled to vote, without regard to whether such shares are present or represented by proxy at the meeting.

DISSENTERS’ RIGHTS

There are no dissenters’ rights of appraisal associated with the matters to be acted upon in Proposals 1 and 2.

2

PROPOSAL 1

ELECTION OF DIRECTORS

GENERAL

The Company’s Board of Directors (the Board of Directors) is currently comprised of five directors who are divided into three classes with terms expiring in 2002, 2003 and 2004, respectively. A director serves in office until his or her term expires and his or her respective successor is duly elected and qualified, or until his or her earlier death, removal for cause or resignation. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors.

NOMINEES FOR CLASS II DIRECTOR

Only two of the current five seats on the Board of Directors are to be filled by the vote of the outstanding shares entitled to vote at the Annual Meeting. These two seats are the Class II directorships, the current term of which expires on the date of the Annual Meeting. These two seats are currently held by directors John Bumgarner, Jr. and Casimir Skrzypczak, both of whom have been nominated by the Board of Directors for re-election for a three-year term, to expire on the date of the Company’s 2005 Annual Meeting of Stockholders and the due election and qualification of their respective successors, or their earlier death, removal for cause or resignation.

Unless otherwise instructed, the persons named in the enclosed proxy intend to vote proxies received by them for the re-election of Mr. Bumgarner and Mr. Skrzypczak. The Company expects that each of Mr. Bumgarner and Mr. Skrzypczak will accept such nomination; however, in the event that any nominee is unable to or declines to serve as a director at the time of the Annual Meeting, proxies will be voted for a substitute nominee or nominees designated by the present Board of Directors.

INFORMATION REGARDING NOMINEES AND OTHER DIRECTORS

Certain background information regarding the nominees for director and the other current directors of the Company has been set forth below for your reference. There are no family relationships among any directors or executive officers of the Company, other than that between John Ocampo, the Chairman of the Board of Directors and Chief Technology Officer of the Company, and his spouse Susan Ocampo, the Treasurer of the Company. Stock ownership information for these persons is shown below under the heading Security Ownership of Certain Beneficial Owners and Management, and is based upon information furnished by the respective individuals named therein.

NOMINEES FOR CLASS II DIRECTOR

John Bumgarner, Jr. has served as the Company’s director since December 1999. Mr. Bumgarner has been the Chief Operating Officer of Williams Communications Group, a communications infrastructure company, since May 2001, and its President of Strategic Investments since 1999. From 1979 to May 2001, Mr. Bumgarner served in a number of capacities at Williams Companies, a communications and natural gas pipeline infrastructure company, most recently as a Senior Vice President of Corporate Development and Planning. From 1996 through May 2001, Mr. Bumgarner also served as President of Williams International, a pipeline infrastructure company. From 1995 to May 2001, Mr. Bumgarner served as President of Williams Headquarters Building Group as well. Mr. Bumgarner also serves as a director of MPSI, a global software and database company, PowerTel, a telecommunications service provider in Australia, Energy Partners, Ltd., an oil and natural gas exploration and production company, and one or more privately held companies. Mr. Bumgarner holds a B.S. from the University of Kansas, and an M.B.A. from Stanford University. Age 59.

3

Casimir Skrzypczak has served as the Company’s director since January 2000. Since July 2001, Mr. Skrzypczak has been a General Partner of Global Asset Capital, a venture capital fund. From November 1999 to July 2001, Mr. Skrzypczak served as a Senior Vice President at Cisco Systems, a networking systems company. Prior to joining Cisco, Mr. Skrzypczak served as a Group President at Telcordia Technologies, a telecommunications company, from March 1997 to October 1999. From 1985 to March 1997, Mr. Skrzypczak served as President of NYNEX Corporation, a telecommunications company. Mr. Skrzypczak also serves as a director of JDS Uniphase, a fiber-optic products manufacturer, and a number of privately held companies. Mr. Skrzypczak holds a B.E. from Villanova University and an M.B.A. from Hofstra University. Age 60.

INCUMBENT CLASS I DIRECTORS WHOSE TERMS EXPIRE IN 2004

Robert Van Buskirk has served as the Company’s President and Chief Executive Officer and as a director since May 1999. Before joining the Company, Mr. Van Buskirk held the position of Executive Vice President of Business Development and Operations from August 1998 to May 1999 at Multilink Technology Corporation, a company specializing in the design, development, and marketing of high bit-rate electronic products for advanced fiber optic transmission systems. Prior to his position at Multilink, Mr. Van Buskirk held various management positions at TRW, a semiconductor wafer manufacturer, including Executive Director of the TRW GaAs telecom products business from 1993 to August 1998. Mr. Van Buskirk holds a B.A. from California State University at Long Beach. Age 52.

Peter Chung has served as the Company’s director since October 1999. Mr. Chung is a General Partner and Member of various entities affiliated with Summit Partners, L.P., a venture capital and private equity firm, where he has been employed since August 1994. Summit Partners, L.P. and its affiliates manage a number of private equity funds, including Summit Ventures V, L.P., Summit V Companion Fund, L.P., Summit V Advisors (QP) Fund, L.P., Summit V Advisors Fund, L.P. and Summit Investors III, L.P. Prior to attending Stanford Business School, Mr. Chung was a Financial Analyst with the Mergers and Acquisitions department at Goldman, Sachs & Co. from 1989 to 1992. Mr. Chung also serves as a director of ADVA AG Optical Networking, an optical networking systems company, Ditech Communications Corporation, a developer of echo cancellation and optical networking equipment, Somera Communications, Inc., a supplier of telecommunications infrastructure equipment and services, and a number of privately held companies. Mr. Chung holds an A.B. from Harvard University and an M.B.A. from Stanford University. Age 34.

INCUMBENT CLASS III DIRECTOR WHOSE TERM EXPIRES IN 2003

John Ocampo, a co-founder of the Company, has served as the Company’s Chairman of the board since December 1998 and Chief Technology Officer since May 1999. From 1984 to May 1999, Mr. Ocampo also served as the Company’s President and Chief Executive Officer. From 1982 to 1984, Mr. Ocampo served as General Manager at Magnum Microwave, an RF component manufacturer. From 1980 to 1982, he served as Engineering Manager at Avantek, a telecommunications engineering company, now Hewlett-Packard/Avantek. Mr. Ocampo holds a B.S.E.E. degree from Santa Clara University. Age 42.

BOARD COMPOSITION

The Company currently has five directors. In accordance with the terms of the Company’s certificate of incorporation, the terms of office of our Board of Directors are divided into three classes: Class I, whose term will expire at the annual meeting of stockholders to be held in 2004, Class II, whose term will expire at the Annual Meeting, and Class III, whose term will expire at the annual meeting of stockholders to be held in 2003. The Class I Directors are Mr. Chung and Mr. Van Buskirk. The Class II Directors are Mr. Bumgarner and Mr. Skrzypczak. The Class III Director is Mr. Ocampo. At each future annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and

4

qualification until the third annual meeting of stockholders following their election and the due election and qualification of their successors, or until their earlier death, resignation or removal for cause. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of the Board of Directors may have the effect of delaying or preventing changes in control of the company. The Company’s directors may be removed for cause by the affirmative vote of the holders of a majority of the Company’s outstanding common stock.

BOARD AND COMMITTEE MEETINGS

The Board of Directors held a total of eleven meetings during the Last Fiscal Year. During the Last Fiscal Year, no director attended fewer than 75% of the aggregate of the number of meetings held by the Board of Directors and the number of meetings of committees, if any, upon which such director served.

The Company does not presently have a nominating committee. The audit committee, which was established in November 1999, consists of Mr. Bumgarner, Mr. Chung and Mr. Skrzypczak. Each member of the audit committee is an independent director as defined in Rule 4200 of the National Association of Securities Dealers’ listing standards, as applicable and as may be modified or supplemented to date. The audit committee held a total of six meetings during the Last Fiscal Year. The Board of Directors has adopted a written charter for the audit committee, which sets forth in detail the duties of and functions performed by the audit committee. Major functions of the audit committee include, without limitation: (i) continuous review of the adequacy of the Company’s system of internal controls; (ii) review of the independence, fee arrangements, audit scope, performance and audit findings of the Company’s independent auditors, and recommendation of the appointment of independent auditors to the Board of Directors; (iii) review prior to release of the audited financial statements and Management’s Discussion and Analysis contained in the Company’s Annual Report on Form 10-K, and the unaudited quarterly operating results contained in the Company’s quarterly earnings release; and (iv) preparation of reports to be included in Company proxy statements in compliance with Item 7(e)(3) of Schedule 14A. The audit committee report for the Last Fiscal Year is included in this Proxy Statement, beginning on page 18 hereof.

The compensation committee, which was established in November 1999, consists of Mr. Chung and Mr. Bumgarner. The compensation committee makes recommendations regarding our stock option plans and all matters concerning executive compensation. The compensation committee held a total of seven meetings during the Last Fiscal Year. The compensation committee report for the Last Fiscal Year is included in this Proxy Statement, beginning on page 15 hereof.

REQUIRED VOTE

The affirmative vote of a plurality of the votes cast by the stockholders entitled to vote at the Annual Meeting is required for the election of the nominees for director contemplated in Proposal 1, meaning that the two properly nominated persons receiving the highest number of affirmative votes cast by stockholders entitled to vote at the Annual Meeting will be elected.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

EACH OF THE NOMINEES LISTED ABOVE.

5

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Ernst & Young LLP has audited the Company’s financial statements since 1996, and the Board of Directors of the Company adopted a resolution selecting Ernst & Young LLP as the Company’s independent auditors to audit the financial statements of the Company for the fiscal year ending December 31, 2002. The Board of Directors recommends that stockholders vote for ratification of such appointment. In the event of a negative vote or lack of ratification, the Board of Directors will reconsider its selection. A representative of Ernst & Young LLP is expected to be available at the Annual Meeting with the opportunity to make a statement if such representative desires to do so, and is expected to be available to respond to appropriate questions.

FEES PAID TO ACCOUNTANTS FOR SERVICES RENDERED DURING FISCAL YEAR 2001

Audit Fees:

The fees of Ernst & Young LLP for review of the Company’s annual financial statements for the Last Fiscal Year and those financial statements included in the Company’s quarterly reports on Form 10-Q for the Last Fiscal Year totaled $221,500.

Financial Information Systems Design and Implementation Fees:

The Company did not engage Ernst & Young LLP to provide advice to the Company regarding financial information systems design and implementation during the Last Fiscal Year.

All Other Fees:

The fees of Ernst & Young LLP for all other services rendered to the Company during the Last Fiscal Year totaled $139,100. Of this amount, $9,800 was for audit related services (i.e., registration statements and accounting consultations) and $129,300 was for non-audit related services (i.e., tax filings and tax-related consultations).

The audit committee has considered whether Ernst & Young LLP’s provision of such non-audit services is compatible with maintaining Ernst & Young LLP’s independence.

REQUIRED VOTE

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent public accountants is not required by the Company’s bylaws or other applicable legal requirement. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board of Directors at its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares represented and entitled to vote at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP as the Company’s independent public accountants for the fiscal year ending December 31, 2002.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION

OF THE APPOINTMENT OF ERNST & YOUNG LLP

AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE 2002 FISCAL YEAR.

6

OTHER INFORMATION

EXECUTIVE OFFICERS

In addition to Mr. Ocampo and Mr. Van Buskirk, as of February 15, 2002, the following persons are executive officers of the Company:

Name

| | Age

| | Position

|

| Walter Baker | | 35 | | Vice President Engineering |

| Norman Hilgendorf | | 41 | | Vice President, Sales & Marketing |

| Rodney Hsing | | 39 | | Vice President of Strategic Accounts |

| Guy Krevet | | 55 | | Vice President, Operations |

| Susan Ocampo | | 44 | | Treasurer |

| John Pelose(1) | | 46 | | Vice President, Wireless Products |

| Robert Pinato | | 47 | | Vice President, Terminal Products |

| Gerald Quinnell | | 44 | | Executive Vice President, Business Development |

| Thomas Scannell | | 51 | | Vice President, Finance and Administration, Chief Financial Officer, Secretary and Assistant Treasurer |

| (1) | | Mr. Pelose began serving in this capacity in February 2002. |

Walter Baker has served as the Company’s Vice President of Engineering since December 2001. Mr. Baker served as the Company’s Vice President and General Manager of the Standard Products Unit from November 1999 to December 2001. Mr. Baker served as the Company’s Vice President of Engineering from September 1998 to November 1999, and as Engineering Manager of the Company’s design center in Richardson, Texas from September 1997 to September 1998. From June 1996 to September 1997, he was a Senior RFIC Design Engineer at Fujitsu Electronics, a manufacturer of electronic components. From 1993 to June 1996, Mr. Baker held the position of Design Manager at ITT General Transistor Corporation (GTC), a manufacturer of transistors. Mr. Baker received his B.S.E.E from Texas A&M University, an M.S.E.E. from Georgia Tech, and an M.B.A. from the University of Phoenix. Mr. Baker is a member of the Institute of Electrical and Electronic Engineers.

Norman Hilgendorf has served as the Company’s Vice President, Sales & Marketing since December 2001. Mr. Hilgendorf served as the Company’s Marketing Director, Standard Products from May 2000 to December 2001, and as the Company’s Central U.S. Sales Director from January 2000 to May 2000. From January 1998 to December 1999, he was Vice President and General Manager at Richardson Electronics, a manufacturer of electronics components. He was also the Business Unit Manager and Product Manager for Richardson Electronics from 1994 to January 1998. Mr. Hilgendorf received his B.S.E.E. from the University of Illinois and an M.B.A. from the University of Chicago.

Rodney Hsing has served as the Company’s Vice President of Strategic Accounts since December 2001. Mr. Hsing served as the Company’s Vice President of Sales for the Americas from December 2000 to December 2001. From December 1999 to December 2000, Mr. Hsing served as the Company’s Eastern Regional Sales Director. From March 1998 to December 1999, Mr. Hsing held the position of Marketing Manager at Atmel, Temic Semiconductors Communications Division. From November 1996 to March 1998, Mr. Hsing held the position of Supplier Business Manager at Avnet, Penstock Division. From 1994 to November 1996, Mr. Hsing held the position of Field Sales Engineer at Avnet Penstock Division. Mr. Hsing holds a B.S. from the University of Maryland.

Guy Krevet has served as the Company’s Vice President, Operations since November 1998. From June 1995 to November 1998, Mr. Krevet served as Vice President and General Manager of Operations,

7

Engineering, and Manufacturing for Avnet, Inc., a distributor of electronic components and computer products. From 1971 to 1995, Mr. Krevet served in various positions at Hewlett-Packard/Avantek, most recently as Manufacturing Manager.

Susan Ocampo is co-founder of the Company and has served as the Company’s Treasurer since November 1999. From 1988 to November 1999, Mrs. Ocampo also served as the Company’s Chief Financial Officer and Secretary and as one of our directors. Mrs. Ocampo holds a B.A. from Maryknoll College, in Manila, Philippines.

John Pelose has served as the Company’s Vice President, Wireless Products since February 2002. From December 2001 to February 2002, he served as the Company’s Director of Wireline Products. He also served as the Company’s Director of Marketing of Wireless Products from January 2000 to December 2001. Mr. Pelose held the position of Vice President and General Manager of Multicarrier Products for Spectrian, Inc., a manufacturer of radio frequency amplifiers, from November 1998 to January 2000. From March 1998 to November 1998, he served as Spectrian’s Vice President of Technical Business Development, and from 1995 to October 1998, he served as its Vice President of Manufacturing and Engineering. Mr. Pelose received his M.S.E.E. from University of Santa Clara and his B.S.E.E. from University of California at Davis.

Robert Pinato has served as the Company’s Vice President, Terminal Products since December 2001. Mr. Pinato served as the Company’s Vice President of International Sales from December 2000 to December 2001. From March 1999 to December 2000, Mr. Pinato served as the Company’s Asian Sales Director. Mr. Pinato held the position of Director at TRW Telecommunications Products from October 1998 to March 1999, and from 1995 to October 1998, served as its Manager, Marketing and Business Development. Mr. Pinato holds a B.S. from Pepperdine University and an M.B.A. from Loyola Marymount University.

Gerald Quinnell has served as the Company’s Executive Vice President, Business Development since February 2001. From November 1998 to December 2001, Mr. Quinnell also served as the Company’s Vice President, Sales and Marketing. From November 1998 to February 2001, Mr. Quinnell also served as the Company’s Chief Operating Officer. Mr. Quinnell served as President and Chief Operating Officer of the RF and Microwave business unit of Avnet, Inc. from June 1997 to September 1998, and as Corporate Vice President of Avnet, Inc., during the same period. From 1988 to June 1997, Mr. Quinnell served as Chief Operating Officer of Penstock, Inc., an RF and microwave distribution company subsequently sold to Avnet, Inc. Mr. Quinnell holds a B.S. from the University of Phoenix.

Thomas Scannell has served as the Company’s Vice President, Finance and Administration, Chief Financial Officer, Secretary and Assistant Treasurer since November 1999. From November 1996 to May 1999 Mr. Scannell served as the Vice President, Finance of Spectra-Physics Lasers, a laser manufacturer. From 1990 to November 1996, Mr. Scannell held the positions of Division Controller and Assistant Corporate Controller at Raychem Corporation, a materials science company. Mr. Scannell holds a B.A. and an M.B.A. from Stanford University.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information known to the Company with respect to the beneficial ownership of the Company’s common stock as of February 15, 2002 by (i) each person known by the Company to own beneficially more than 5% of the outstanding shares of the Company’s common stock, (ii) each of the Named Executive Officers (as defined below), (iii) each of the Company’s directors and nominees for director, and (iv) all of the Company’s directors and executive officers as a group.

Except as otherwise indicated, and subject to applicable community property laws, to the Company’s knowledge the persons named below have sole voting and investment power with respect to all shares of common stock held by them.

For the purposes of calculating percentage ownership, as of February 15, 2002, 29,802,316 shares of our common stock were issued and outstanding.

Unless otherwise indicated below, each person has an address in care of Sirenza Microdevices’ principal executive offices at 522 Almanor Avenue, Sunnyvale, California 94085.

| | | Shares of common stock beneficially owned(1)

| |

Name and address of beneficial owner

| | Number

| | Percent

| |

| 5% STOCKHOLDERS DIRECTORS AND NAMED EXECUTIVE OFFICERS: | | | | | |

| John and Susan Ocampo(2) | | 13,699,931 | | 46.0 | % |

| Entities affiliated with RS Investment Management Co. LLC(3) | | 2,724,200 | | 9.1 | % |

| Entities affiliated with Summit Partners L.P.(4) | | 1,605,897 | | 5.4 | % |

| Robert Van Buskirk(5) | | 194,888 | | * | |

| Guy Krevet(6) | | 88,442 | | * | |

| Gerald Quinnell(7) | | 176,123 | | * | |

| Thomas Scannell(8) | | 117,194 | | * | |

| John Bumgarner Jr.(9) | | 8,500 | | * | |

| Peter Chung(10) | | 1,605,897 | | 5.4 | % |

| Casimir Skrzypczak(11) | | 40,682 | | * | |

| All directors and executive officers as a group (14 persons)(12) | | 16,187,096 | | 53.1 | % |

| * | | Less than one percent (1%) |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to the securities. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Sirenza Microdevices Common Stock subject to options held by that person that will be exercisable within sixty days of February 15, 2002, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) | | Consists of 1,500,000 shares held by John Ocampo, 1,500,000 shares held by Susan Ocampo, 7,391,752 shares held jointly by John and Susan Ocampo, as community property, 1,050,000 shares held by John Ocampo and Susan Ocampo, Trustees of Susan Ocampo Annuity Trust U/I Dtd. September 27, 1999, 1,050,000 shares held by John Ocampo and Susan Ocampo, Trustees of John Ocampo Annuity Trust U/I Dtd. September 27, 1999, 250,000 shares held by Susan Ocampo and John Ocampo, Trustees, 2001 Ocampo Charitable Trust, 900,000 shares held by Samat Partners, a California limited partnership and an aggregate of 58,179 shares held by a custodian and various trusts for the benefit of the Ocampos’ minor children. Mrs. Ocampo is the custodian and Mr. and Mrs. Ocampo are co-trustees with a third person of each these trusts and share voting and dispositive authority over these shares. Mr. and Mrs. Ocampo disclaim beneficial ownership of the shares held by these trusts except to the extent of their pecuniary interest in these shares. |

9

| (3) | | Included in reliance on information contained in a Schedule 13G dated February 8, 2002, jointly filed by RS Investment Management Co. LLC, RS Investment Management, Inc. and RS Emerging Growth Fund. As to the indicated number of shares, RS Investment Management Co. LLC reported shared voting and dispositive power. RS Investment Management, Inc. reported shared voting and dispositive power as to 1,570,700 shares, or 5.3% of the outstanding Common Stock. RS Emerging Growth Fund reported shared voting and dispositive power over 1,515,900 shares, or 5.1% of the outstanding Common Stock. The address of record for entities affiliated with RS Investment Management Co. LLC is 388 Market Street, Ste. 200, San Francisco, California 94111. |

| (4) | | Includes 1,189,549 shares held by Summit Ventures V, L.P., 24,427 shares held by Summit Investors III, L.P., 25,766 shares held by Summit V Advisors, L.P., 281,839 shares held by Summit Ventures V Companion Fund, L.P., and 84,316 shares held by Summit V Advisors (QP), L.P. Summit Partners, LLC is the general partner of Summit Partners V, L.P., which is the general partner of each of Summit Ventures V, L.P., Summit V Advisors, L.P., Summit V Advisors (QP), L.P. and Summit Ventures V Companion Fund, L.P. Summit Partners, LLC, through an investment committee, has voting and dispositive authority over the shares held by each of these entities and Summit Investors III. The address of record for entities affiliated with Summit Partners, L.P. is 499 Hamilton Avenue, Suite 200, Palo Alto, CA 94301. |

| (5) | | Includes 159,876 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

| (6) | | Includes 57,265 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

| (7) | | Includes 82,493 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

| (8) | | Includes 114,166 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

| (9) | | Includes 1,000 shares held by 21st Century LLC, of which Mr. Bumgarner is a managing member, and 7,500 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

| (10) | | Mr. Chung, one of our directors, is a member of Summit Partners, LLC, the general partner of Summit Partners V, L.P., which is the general partner of each of Summit Ventures V, L.P., Summit V Advisors, L.P., Summit Ventures V Companion Fund, L.P. and Summit V Advisors Fund (QP), L.P. Summit Partners, LLC, through an investment committee, has voting and dispositive authority over the shares held by these entities and Summit Investors III, L.P. Mr. Chung does not have voting or dispositive authority over these shares and disclaims beneficial ownership except to the extent of his pecuniary interest in these shares. |

| (11) | | Includes 22,500 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

| (12) | | Includes an aggregate of 659,111 shares subject to outstanding options exercisable within sixty days of February 15, 2002. |

EQUITY COMPENSATION PLAN INFORMATION

The table below sets forth certain information regarding our equity compensation plans as of the end of the Last Fiscal Year.

Plan Category

| | (A) Number Of Securities To Be Issued Upon Exercise Of Outstanding Options, Warrants And Rights

| | (B) Weighted-Average Exercise Price Of Outstanding Options, Warrants And Rights

| | (C) Number Of Securities Remaining Available For Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected In Column (A)

|

| Equity Compensation Plans Approved By Security Holders | | 3,751,604 | | $9.58 | | 1,039,165(1) |

| Equity Compensation Plans Not Approved By Security Holders | | None | | Not applicable | | None |

| (1) | | Consists of 620,534 shares available for issuance under our Amended and Restated 1998 Stock Plan, and 418,631 shares available for issuance under our 2000 Employee Stock Purchase Plan. The number of shares available for future issuance under the 1998 Plan is increased each year by a number of shares equal to the lesser of (i) 1,500,000 shares, (ii) 3% of our outstanding shares as of such date, or (iii) such other amount as is determined by our Board of Directors. The number of shares available for future issuance under the 2000 Plan is increased each year by a number of shares equal to the lesser of (i) 350,000 shares, (ii) 1% of our outstanding shares as of such date, or (iii) such other amount as is determined by our Board of Directors. |

10

EXECUTIVE OFFICER COMPENSATION

SUMMARY COMPENSATION

The following table shows, as to any person serving as Chief Executive Officer during the Last Fiscal Year and each of the four other most highly compensated executive officers of the Company during the Last Fiscal Year whose salary plus bonus exceeded $100,000 (the Named Executive Officers), information concerning compensation paid for services rendered to the Company during the last three fiscal years.

SUMMARY COMPENSATION TABLE

Name and Principal Position

| | Year

| | Salary

| | | Bonus($)

| | Other Annual Compensation

| | | Long-Term Compensation Options/SARS

| | All Other Compensation(2)

|

| Robert Van Buskirk | | 2001 | | $ | 212,279 | | | $ | — | | $ | — | | | 90,000 | | $ | 3,400 |

| President and Chief | | 2000 | | $ | 225,000 | | | $ | 130,000 | | $ | — | | | 90,000 | | $ | 3,070 |

| Executive Officer | | 1999 | | $ | 93,461 | (3) | | $ | 50,000 | | $ | — | | | 342,180 | | $ | 2,897 |

|

| John Ocampo | | 2001 | | $ | 235,000 | | | $ | — | | $ | — | | | — | | $ | 3,382 |

| Chairman of the Board and | | 2000 | | $ | 250,000 | | | $ | — | | $ | — | | | — | | $ | 3,070 |

| Chief Technology Officer | | 1999 | | $ | 241,799 | | | $ | 100,000 | | $ | 2,989,958 | (1) | | — | | $ | 17,932 |

|

| Gerald Quinnell | | 2001 | | $ | 188,692 | | | $ | — | | $ | — | | | 70,000 | | $ | 3,319 |

| Executive Vice President, | | 2000 | | $ | 200,000 | | | $ | 59,000 | | $ | — | | | 70,000 | | $ | 2,968 |

| Business Development | | 1999 | | $ | 200,000 | | | $ | 100,000 | | $ | — | | | 119,924 | | $ | 3,293 |

|

| Guy Krevet | | 2001 | | $ | 174,540 | | | $ | — | | $ | — | | | 60,000 | | $ | 3,285 |

| Vice President, Operations | | 2000 | | $ | 185,000 | | | $ | 55,000 | | $ | — | | | 60,000 | | $ | 2,968 |

| | | 1999 | | $ | 154,038 | | | $ | 75,000 | | $ | — | | | 111,090 | | $ | 3,293 |

|

| Thomas Scannell | | 2001 | | $ | 165,106 | | | $ | — | | $ | — | | | 70,000 | | $ | 3,256 |

| Vice President, Finance and | | 2000 | | $ | 175,000 | | | $ | 103,000 | | $ | — | | | 70,000 | | $ | 2,968 |

| Administration, Chief Financial Officer, Secretary and Assistant Treasurer | | 1999 | | $ | 24,904 | (4) | | $ | — | | $ | — | | | 200,000 | | $ | 66 |

| (1) | | The amount in the column entitled Other Annual Compensation for Mr. Ocampo consists of amounts paid to him as a special bonus to assist Mr. and Mrs. Ocampo with federal and state tax liabilities of Sirenza Microdevices paid by Mr. and Mrs. Ocampo while we were an S corporation and to assist Mr. and Mrs. Ocampo in paying taxes they incurred as a result of the receipt of these amounts and taxes associated with receipt of a dividend paid in 1999. |

| (2) | | The amounts in the column entitled All Other Compensation consist of term life and health insurance premiums paid by us and contributions by us of $2,500 annually to each named executive officer’s 401(k) plan account. We also paid Mr. Ocampo $14,841 pursuant to our profit sharing plan in 1999. |

| (3) | | Mr. Van Buskirk joined the Company as our President and Chief Executive Officer in May 1999. Mr. Van Buskirk’s salary on an annualized basis in 1999 was $225,000. Mr. Ocampo served as our President and Chief Executive Officer until May 1999. |

| (4) | | Mr. Scannell joined the Company as our Vice President, Finance and Administration, Chief Financial Officer, Secretary and Assistant Treasurer in November 1999. Mr. Scannell’s salary on an annualized basis in 1999 was $175,000. |

11

STOCK OPTION GRANTS AND EXERCISES

The following table shows, as for each Named Executive Officer, information concerning stock options granted during the Last Fiscal Year.

OPTION GRANTS DURING LAST FISCAL YEAR

| | | Options Granted (#)(1)

| | Percent of Total Options Granted To Employees in Fiscal Year

| | | Exercise or Base Price ($/share)(2)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3)

|

Name

| | | | | | 5% ($)

| | 10% ($)

|

| Robert Van Buskirk | | 90,000 | | 7.6 | % | | $ | 7.75 | | 08/27/11 | | $ | 438,654 | | $ | 1,111,635 |

| John Ocampo | | — | | — | | | | — | | — | | | — | | | — |

| Gerald Quinnell | | 70,000 | | 5.9 | % | | $ | 7.75 | | 08/27/11 | | $ | 341,175 | | $ | 864,605 |

| Guy Krevet | | 60,000 | | 5.1 | % | | $ | 7.75 | | 08/27/11 | | $ | 292,436 | | $ | 741,090 |

| Thomas Scannell | | 70,000 | | 5.9 | % | | $ | 7.75 | | 08/27/11 | | $ | 341,175 | | $ | 864,605 |

| (1) | | These options become exercisable as to 25% of the shares one year from the date of grant and as to one forty-eighth of the shares after each month thereafter. |

| (2) | | Represents the fair market value of the underlying Common Stock as determined by the Board of Directors on the date of grant. |

| (3) | | Potential realizable value is based on an assumption that the stock price of the Common Stock appreciates at the annual rate shown (compounded annually) from the date of grant until the end of the ten year option term. Potential realizable value is shown net of exercise price. These amounts are calculated based on the regulations promulgated by the SEC and do not reflect the Company’s estimate of future stock price growth. |

12

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR AND YEAR-END OPTION VALUES

The following table sets forth, as to the Named Executive Officers, certain information concerning stock options exercised during the Last Fiscal Year and the number of shares subject to exercisable and unexercisable stock options as of the end of the Last Fiscal Year. The table also sets forth certain information with respect to the value of stock options held by such individuals as of the end of the Last Fiscal Year.

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options at Last Fiscal Year End

| | Value of Unexercised In-The-Money Options at Last Fiscal Year End(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Robert Van Buskirk | | 70,000 | | $ | 1,571,401 | | 155,737 | | 296,443 | | $ | 602,952 | | $ | 646,355 |

| President, Chief Executive Officer and Director | | | | | | | | | | | | | | | |

|

| John Ocampo | | — | | | — | | — | | — | | | — | | | — |

| Chief Technology Officer and Chairman of the Board | | | | | | | | | | | | | | | |

|

| Gerald Quinnell | | 88,449 | | $ | 1,465,638 | | 68,949 | | 251,026 | | $ | 251,209 | | $ | 644,477 |

| Executive Vice President, Sales and Marketing and Business Development | | | | | | | | | | | | | | | |

|

| Guy Krevet | | 38,725 | | $ | 542,912 | | 38,239 | | 177,126 | | $ | 106,971 | | $ | 350,088 |

| Vice President, Operations | | | | | | | | | | | | | | | |

|

| Thomas Scannell | | 30,000 | | $ | 417,700 | | 93,124 | | 216,876 | | $ | 340,422 | | $ | 439,878 |

| Vice President, Finance and Administration, Chief Financial Officer, Secretary and Assistant Treasurer | | | | | | | | | | | | | | | |

| (1) | | The amount set forth represents the difference between the closing Common Stock share price of $6.09 on December 31, 2001, as reported by the Nasdaq National Market, and the applicable exercise price, multiplied by the applicable number of options. |

DIRECTOR COMPENSATION

Directors currently receive no cash compensation for serving on the Board of Directors. However, directors are reimbursed for expenses in connection with attendance at Board of Directors and committee meetings.

Directors are eligible to participate in the Company’s Amended and Restated 1998 Stock Plan. Pursuant to the Company’s Amended and Restated 1998 Stock Plan, non-employee directors are automatically granted an option to purchase 40,000 shares of common stock upon their election to the Board of Directors and an option to purchase an additional 10,000 shares of common stock each year following the date of our annual stockholders meeting, so long as on such date, he or she has served on the Board of Directors for at least the previous six months. On May 30, 2001, the Company granted each of Mr. Bumgarner and Mr. Skrzypczak an option to purchase 10,000 shares of common stock at an exercise price of $12.45 per share.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company’s Compensation Committee consists of Mr. Bumgarner and Mr. Chung. None of the Company’s executive officers serves as a director or member of the compensation committee or other board committee performing equivalent functions of another entity that has one or more executive officers serving on

13

the Company’s Board of Directors or compensation committee. Prior to the formation of the compensation committee, compensation decisions were made by the Board of Directors beginning in May 1999 and prior to that by the Company’s President.

EMPLOYMENT AGREEMENTS AND CHANGE OF CONTROL ARRANGEMENTS

We have entered into change of control agreements with Guy Krevet and Mr. Quinnell which provide that these executive officers are entitled to a maximum of six months of severance pay and acceleration of options in the event of the termination of employment of such individual within twelve months of a change of control of the Company. In addition, we have signed an offer letter with Mr. Scannell that provides for six months of severance pay in the event Mr. Scannell is terminated without cause and acceleration of all outstanding options in the event of a change of control of the Company.

14

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board of Directors establishes the general compensation policies of the Company as well as the compensation plans and specific compensation levels for executive officers. The Compensation Committee is currently composed of non-employee directors who have no interlocking relationships as defined by the Securities and Exchange Commission.

The objectives of the Compensation Committee are to enhance the Company’s ability to recruit and retain qualified management, to motivate executives to achieve established performance goals and to maximize long-term shareholder value.

The Chief Executive Officer’s salary, bonus and equity incentive awards are established by the Compensation Committee. Recommendations regarding the base salary, bonuses and stock option or other awards of the Company’s executive officers other than Mr. Van Buskirk are made to the Compensation Committee by Mr. Van Buskirk and are subject to its approval. The Compensation Committee believes that the compensation of the executive officers, including that of the Chief Executive Officer (each an Executive Officer and collectively the Executive Officers), should be influenced by the Company’s performance. The Committee establishes the salaries and bonuses of all of the Executive Officers by considering (i) the Company’s financial performance for the past year, (ii) the achievement of certain objectives related to the particular Executive Officer’s area of responsibility, (iii) the salaries and bonuses of executive officers in similar positions of comparably-sized companies and (iv) the relationship between revenue and profits and executive officer compensation. The Committee believes that the compensation paid to the Company’s Executive Officers in the Last Fiscal Year was comparable to similarly-sized businesses in the industry.

In addition to salary and bonus, the Committee, from time to time, grants options to Executive Officers. The Committee thus views option grants as an important component of its long-term, performance-based compensation philosophy. Since the value of an option bears a direct relationship to the Company’s stock price, the Committee believes that options motivate Executive Officers to manage the Company in a manner which will also benefit shareholders. As such, options are granted at the current market price. One of the principal factors considered in granting options to an Executive Officer is the Executive Officers ability to influence the Company’s long-term growth and profitability.

| | Re | spectfully Submitted By the Compensation Committee: |

15

CERTAIN TRANSACTIONS

The following is a description of transactions since the beginning of the Last Fiscal Year to which the Company has been a party, in which the amount involved in the transaction exceeds $60,000 and in which any director, executive officer, or holder of more than 5% of the Company’s capital stock had or will have a direct or indirect material interest other than compensation arrangements which are otherwise described under Executive Officer Compensation.

We have used the services of MPI Corporation of Manila, Philippines, for the packaging of a significant amount of our radio frequency components. MPI is owned by Jose Ocampo, a cousin of John Ocampo, our co-founder, Chairman of the Board and Chief Technology Officer, and a principal stockholder of Sirenza Microdevices. We paid MPI an aggregate of $297,000 in 2001 for these services. In addition, amounts owed by us to MPI for such services at December 31, 2001 totaled $277,000. In 1998 and 1999 we granted Jose Ocampo options to purchase 333,270 shares of common stock at exercise prices ranging from $0.92 to $1.50. In 2001, Jose Ocampo exercised 247,270 of those stock options and none remained outstanding and exercisable at December 31, 2001.

During the Last Fiscal Year, the Company granted options to its executive officers and directors. The Company intends to grant options to its executive officers and directors in the future. The Company has also entered into indemnification agreements with its executive officers and directors.

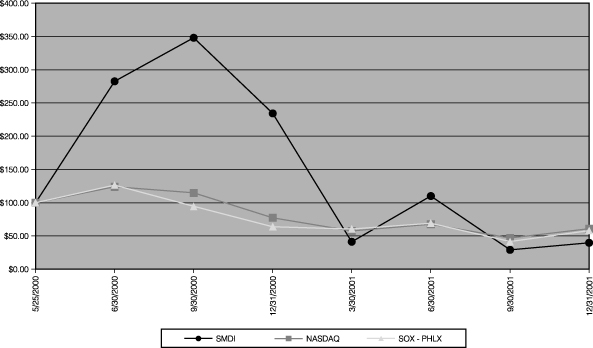

PERFORMANCE GRAPH

Set forth below is a line graph comparing the percentage change in the cumulative return to the stockholders of the Company’s Common Stock with the cumulative return of the Nasdaq Composite Index and the SOX - PHLX Semiconductor Index for the period commencing May 25, 2000 (the date the Company’s Common Stock commenced trading on the Nasdaq National Market) and ending on December 31, 2001.

16

The graph assumes that $100 was invested on May 25, 2000 in the Company’s Common Stock, in the Nasdaq Composite Index and in the SOX - PHLX Semiconductor Index and that all dividends were reinvested. No dividends have been declared or paid in the Company’s Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

17

AUDIT COMMITTEE REPORT

In connection with the audit by Ernst & Young LLP, the Company’s independent auditors, of the Company’s financial statements as of and for the fiscal year ended December 31, 2001, the Audit Committee of the Board of Directors of the Company has performed the following functions, among others:

| | • | | The Audit Committee has reviewed and discussed the audited financial statements with management. |

| | • | | The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as modified or supplemented. This discussion included, among other topics, the quality, not just the acceptability, of the Company’s accounting principles, the clarity of disclosures in the financial statements, the consistency of the Company’s application of accounting policies, and the auditors’ responsibility under Generally Accepted Auditing Standards to provide the Audit Committee with information regarding the Company’s internal control structure and financial statements, changes to significant accounting policies, management’s judgments and accounting estimates and significant audit adjustments. |

| | • | | The Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, as modified or supplemented, and has discussed with the independent auditors their independence. In considering the auditors’ independence, the Audit Committee has considered the amount and nature of any fees paid by the Company to the independent auditors for non-audit services. |

| | • | | Based on the above-mentioned review and discussions with management and the independent auditors, the Audit Committee has recommended to the Board of Directors that the Company’s audited financial statements as of and for the fiscal year ended December 31, 2001 be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission. |

While the Audit Committee has performed the above functions, management, and not the Audit Committee, has the primary responsibility for the financial statements and the reporting process, including the system of internal accounting controls. Similarly, it is the responsibility of the independent auditors, and not the Audit Committee, to conduct the audit and express an opinion as to the conformity of the financial statements with accounting principles generally accepted in the United States.

| | Re | spectfully Submitted By The Audit Committee: |

18

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s executive officers, directors and persons who own more than 10% of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). Such executive officers, directors and 10% stockholders are also required by SEC rules to furnish the Company with copies of all forms that they file pursuant to Section 16(a). Based solely on its review of copies of Forms 3 and 4 and amendments thereto furnished to the Company pursuant to Rule 16a-3 and Forms 5 and amendments thereto furnished to the Company with respect to the Last Fiscal Year, and any written representations referred to in Item 405(b)(2)(i) of Regulation S-K stating that no Forms 5 were required, the Company believes that, during the Last Fiscal Year, all Section 16(a) filing requirements applicable to the Company’s officers and directors were complied with, except as follows: (i) a Form 5 was not timely filed by Casimir Skrzypczak, a member of the Company’s Board of Directors; (ii) a Form 4 for July 2001 and a Form 5 were not timely filed by John C. Bumgarner, Jr., a member of the Company’s Board of Directors; (iii) a Form 4 for November 2001 was not timely filed by Walter Baker, the Company’s Vice President, Engineering; (iv) a Form 4 for November 2001 and a Form 5 were not timely filed by Norm Hilgendorf, the Company’s Vice President, Sales and Marketing; (v) a Form 4 for November 2001 was not timely filed by Rodney Hsing, the Company’s Vice President, Strategic Accounts; (vi) a Form 5 was not timely filed by Robert Pinato, the Company’s Vice President, Terminal Products; and (vii) a Form 4 for January 2001 was not timely filed by Gerald Quinnell, the Company’s Executive Vice President of Business Development. A corrective filing has been made for each of the above-described incidences of noncompliance.

SOLICITATION OF PROXIES

The Company will bear the cost of soliciting proxies. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone, telegram, telefax or otherwise.

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS

Proposals of stockholders of the Company which are intended to be presented by such stockholders next year at the Company’s 2003 annual meeting of stockholders must be received by the Company no later than December 17, 2002 in order to be considered for possible inclusion in the proxy statement and form of proxy relating to that annual meeting.

In addition, the Company’s bylaws establish an advance notice procedure with regard to certain matters, including stockholder proposals and director nominations not included in the Company’s proxy statement which are proposed to be properly brought before an annual meeting of stockholders. Such stockholder must deliver written notice to the Secretary of the Company not less than 120 days in advance of the one-year anniversary of the date at which the notice of the previous year’s annual meeting was mailed to the stockholders by the Company (in the case of the 2003 annual meeting this date is December 17, 2002). This notice must contain specified information concerning the matters proposed to be brought before such annual meeting and concerning the stockholder proposing such matters.

In the event that either (i) the Company did not have an annual meeting during the immediately previous year, or (ii) the date of the current year annual meeting is more than 30 days from the one year anniversary of the immediately prior annual meeting, then the deadline for the Company’s receipt of the notice required by the bylaws shall instead be the later of (a) the date that is 120 days prior to the current year annual meeting, and (b) the date that is 10 days following the first public notice of the date of such annual meeting. A copy of the full text of the bylaw provision discussed above may be obtained by writing to the Secretary of the Company at the address below. All notices of proposals by stockholders, whether or not included in the Company’s proxy

19

materials, should be sent to Sirenza Microdevices, Inc., 522 Almanor Avenue, Sunnyvale, California 94085, Attention: Corporate Secretary.

LIST OF STOCKHOLDERS ENTITLED TO VOTE

A list of the stockholders entitled to vote at the meeting, in alphabetical order, including the address and number of shares registered in the name of each such stockholder, shall be maintained at the Company’s principal executive office, located at 522 Almanor Avenue, Sunnyvale, CA 94085, during the 10-day period immediately preceding the meeting date, and during such time shall available during normal business hours for examination by any stockholder for any purpose germane to the meeting. A copy of such list shall also be present at the meeting, and shall be available for inspection during the meeting by any stockholder present at the meeting.

DISCLAIMER REGARDING COMMITTEE REPORTS

Neither (i) the compensation committee report contained herein, (ii) the audit committee report contained herein, or (iii) any other information required to be disclosed herein by Item 306(a) or (b) of Regulation S-K or Item 7(e)(3) of Schedule 14A shall be deemed to be soliciting material or to be filed with the SEC, nor shall such information be incorporated by reference into any past or future filing under the Securities Act or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such filing.

UNDERTAKING TO FURNISH FORM 10-K

UPON THE WRITTEN REQUEST OF ANY PERSON WHOSE PROXY IS SOLICITED HEREBY, THE COMPANY SHALL PROVIDE TO SUCH PERSON, FREE OF CHARGE, A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE LAST FISCAL YEAR, AS FILED WITH THE SECURITIES EXCHANGE COMMISSION, CONTAINING A LIST BRIEFLY DESCRIBING THE EXHIBITS THERETO, BUT NOT THE EXHIBITS THEMSELVES. AMONG THE PROXY SOLICITATION MATERIALS MAILED TO YOU WITH THIS PROXY STATEMENT IS A COPY OF THE COMPANY’S ANNUAL REPORT TO STOCKHOLDERS FOR THE LAST FISCAL YEAR, WHICH INCLUDES A COPY OF THE ABOVE-REFERENCED ANNUAL REPORT ON FORM 10-K. IF FOR SOME REASON YOU HAVE NOT RECEIVED IT, PLEASE NOTIFY THE COMPANY AT THE ADDRESS BELOW. UPON WRITTEN REQUEST FROM ANY BENEFICIAL OWNER OF SECURITIES ENTITLED TO VOTE AT THE ANNUAL MEETING, AND PAYMENT TO THE COMPANY OF A FEE IN THE AMOUNT OF THE COMPANY’S REASONABLE EXPENSES OF FURNISHING SUCH COPY, THE COMPANY WILL ALSO FURNISH SUCH BENEFICIAL OWNER WITH A COPY OF ANY REQUESTED EXHIBIT TO THE ANNUAL REPORT ON FORM 10-K FOR THE LAST FISCAL YEAR. PLEASE ADDRESS ANY SUCH REQUESTS TO SIRENZA MICRODEVICES, INC., 522 ALMANOR AVENUE, SUNNYVALE, CALIFORNIA 94085, ATTENTION: THOMAS SCANNELL.

OTHER MATTERS

The Board of Directors does not know of any other matters to be presented at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend.

20

YOUR VOTE IS IMPORTANT

It is important that your shares be represented at the Annual Meeting, regardless of the number of shares which you hold. You are, therefore, urged to execute and return, at your earliest convenience, the accompanying proxy in the envelope which has been enclosed.

By order of the Board of Directors |

|

| | | /s/ THOMAS SCANNELL

|

| | | Thomas Scannell Vice President, Finance and Administration, Chief Financial Officer, Secretary and Assistant Treasurer |

April 1, 2002

21

SIRENZA MICRODEVICES, INC.

ANNUAL MEETING OF STOCKHOLDERS

May 30, 2002

This proxy is solicited on behalf of the Board of Directors of the Company

The undersigned stockholder of Sirenza Microdevices, Inc., a Delaware corporation (the Company), hereby acknowledges receipt of the Notice of Annual Meeting of Stockholders and Proxy Statement, each dated April 1, 2002, and the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2001, and hereby appoints Robert Van Buskirk and Thomas Scannell, or either of them, as proxies and attorneys-in-fact, with full power to each of substitution on behalf and in the name of the undersigned, to vote and otherwise represent all of the shares of Common Stock of the Company registered in the name of the undersigned at the 2002 Annual Meeting of Stockholders of the Company, to be held on May 30, 2002 at 2:00 p.m. (local time) at the Company’s principal executive offices, located at 522 Almanor Avenue, Sunnyvale, California 94085, and any adjournment or postponement thereof, with the same effect as if the undersigned were present and voting such shares, on the following matters and in the following manner:

TO ASSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, PLEASE MARK, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

(See reverse.)

PLEASE MARK YOUR VOTES AS INDICATED IN THE FOLLOWING EXAMPLE. x

1. | | THE ELECTION OF JOHN BUMGARNER, JR. AND CASIMIR SKRZYPCZAK AS CLASS II DIRECTORS OF THE COMPANY TO SERVE FOR A TERM OF THREE YEARS AND UNTIL SUCH TIME AS THEIR RESPECTIVE SUCCESSORS SHALL BE DULY ELECTED AND QUALIFIED. |

¨ FOR ALL (Except withhold | | ¨ WITHHOLD ALL | | |

| as to Nominee(s) written | | | | |

| below, if any | | | | |

Excepted:

2. | | TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2002. |

¨ FOR | | ¨ AGAINST | | ¨ ABSTAIN |

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATION MADE. IF NO SPECIFICATION IS MADE, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED FOR EACH OF THE ABOVE PERSONS AND PROPOSALS. THE PROXYHOLDERS MAY VOTE THE SHARES REPRESENTED BY THIS PROXY FOR OR AGAINST SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING, OR MAY OTHERWISE REPRESENT SUCH SHARES WITH RESPECT TO SUCH MATTERS, IN EACH CASE IN THEIR DISCRETION.

Sign exactly as your name(s) appear on the stock certificate. A corporation or partnership is requested to sign its name by its President or other authorized officer, with the office held designated. Executors, administrators, trustees, etc., are requested to so indicate when signing. If stock is registered in two names, both should sign.

I plan to attend the Annual Meeting: Yes ¨ No ¨