SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

SIRENZA MICRODEVICES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

To our Stockholders:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of Sirenza Microdevices, Inc. to be held on Tuesday, May 24, 2005 at 2:00 p.m., local time, at 303 S. Technology Court, Broomfield, CO 80021.

The matters expected to be acted upon are described in detail in the following Notice of Annual Meeting and Proxy Statement.

Your vote is important.IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING, REGARDLESS OF THE NUMBER OF SHARES WHICH YOU HOLD. YOU ARE, THEREFORE, URGED TO EXECUTE AND RETURN, AT YOUR EARLIEST CONVENIENCE, THE ACCOMPANYING PROXY IN THE ENVELOPE WHICH HAS BEEN ENCLOSED. Returning the Proxy does not deprive you of your right to attend the meeting and vote your shares in person.

Thank you for your ongoing support of and continued interest in Sirenza Microdevices, Inc. We look forward to seeing you at the meeting.

Sincerely,

Robert Van Buskirk

President and Chief Executive Officer

SIRENZA MICRODEVICES, INC.

303 S. Technology Court

Broomfield, CO 80021

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of Stockholders of Sirenza Microdevices, Inc., a Delaware corporation (the Company or Sirenza), will be held on Tuesday, May 24, 2005 at 2:00 p.m., local time, at the Company’s principal executive offices located at 303 S. Technology Court, Broomfield, CO 80021, for the following purposes:

| | 1. | | To elect two Class II directors, each to serve for a term of three years until the 2008 Annual Meeting of Stockholders and until his successor has been elected and qualified or until his earlier resignation or removal. |

| | 2. | | To ratify the appointment of the Company’s independent auditors for the fiscal year ending December 31, 2005. |

| | 3. | | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders.

Only stockholders of record at the close of business on April 1, 2005 are entitled to notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person.However, to ensure your representation at the Annual Meeting, you are urged to vote, sign, date and return the enclosed Proxy as promptly as possible in the envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she previously returned a Proxy.

| | |

| | | BY ORDER OF THE BOARD OF DIRECTORS |

| |

| | |  |

| | | Clay Simpson Vice President, General Counsel and Secretary |

Broomfield, Colorado

April 14, 2005

April 14, 2005

SIRENZA MICRODEVICES, INC.

303 S. Technology Court

Broomfield, CO 80021

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of Sirenza Microdevices, Inc. (the Company or Sirenza) for use at the Annual Meeting of Stockholders to be held on Tuesday, May 24, 2005 at 2:00 p.m., local time, or at any adjournment or postponement thereof (the Annual Meeting), at the Company’s principal executive offices, located at 303 S. Technology Court, Broomfield, CO 80021, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Company’s telephone number at its principal executive offices is (303) 327-3030. The Company’s fiscal year ends on December 31st of each year.

Record Date and Mail Date; Outstanding Shares

Stockholders of record at the close of business on April 1, 2005 (the Record Date) are entitled to notice of and to vote at the Annual Meeting. This proxy statement, the form of proxy and the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2004 will be mailed on or about April 20, 2005 to all stockholders entitled to vote at the Annual Meeting. As of the close of business on April 1, 2005, 35,582,315 shares of the Company’s common stock, $0.001 par value (the common stock), were issued and outstanding.

Voting and Revocability of Proxies

When proxies are properly dated, executed and returned, the shares they represent will be voted at the Annual Meeting in accordance with the instructions of the stockholder as marked on such proxies. If no specific instructions are given, the shares represented by proxies will be voted as follows:

| | • | | “FOR” the re-election of John Bumgarner, Jr. and Casimir Skrzypczak (or such substitute nominees as set forth herein) to the Board of Directors as Class II directors, and |

| | • | | “FOR” ratification of the appointment of Ernst & Young, LLP as independent auditors of the Company for the fiscal year ending December 31, 2005. |

In addition, if any other matters properly come before the Annual Meeting, the persons named in the accompanying form of proxy will have discretion to vote the shares represented by proxies, or otherwise act with respect to such matters, in accordance with their best judgment.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by filing a written instrument revoking the proxy with the Secretary of the Company, by executing and

1

delivering to the Company a subsequent proxy prior to the Annual Meeting, or by attending the Annual Meeting and voting in person.

Votes Per Share

Each share of common stock outstanding as of the close of business on the Record Date shall be entitled to one vote on each matter properly brought before the stockholders at the Annual Meeting. Stockholders shall not be entitled to cumulate their votes on any matter brought before them at the Annual Meeting.

Solicitation of Proxies

The Company will bear the cost of soliciting proxies. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone, telegram, telefax or otherwise.

List of Stockholders Entitled to Vote

A list of the stockholders entitled to vote at the meeting, in alphabetical order, including the address and number of shares registered in the name of each such stockholder, shall be maintained at the Company’s principal executive office, located at 303 S. Technology Court, Broomfield, CO 80021, during the 10-day period immediately preceding the meeting date, and during such time shall be available during normal business hours for examination by any stockholder for any purpose germane to the meeting. A copy of such list shall also be present at the meeting and shall be available for inspection during the meeting by any stockholder present at the meeting.

Quorum; Abstentions; Broker Non-Votes

The quorum required for the transaction of business at the Annual Meeting shall be the presence at the Annual Meeting of a majority of the shares of common stock issued and outstanding at the close of business on the Record Date. Shares present at the Annual Meeting in person or represented by proxy and entitled to vote (including shares which abstain or do not vote) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

Because abstentions with respect to any matter are treated as shares present or represented by proxy and entitled to vote for the purpose of determining whether that matter has been approved by the stockholders, such abstentions have the same effect as negative votes for each proposal other than the election of directors.

Broker non-votes occur where a nominee such as a financial institution holds in its name shares beneficially owned by another person and returns a proxy to the Company with respect to such shares, but indicates that it does not have the authorization of the beneficial owner to vote the owner’s shares on one or more proposals. Broker non-votes are counted as present or represented for purposes of determining the existence or absence of a quorum at a meeting. Broker non-votes are not, however, counted or deemed to be present or represented for purposes of determining whether stockholder approval of any particular matter has been obtained, and hence will not have the effect of negative votes on a matter unless the vote required for approval of such matter is the affirmative vote of some percentage of the outstanding shares entitled to vote, without regard to whether such shares are present or represented by proxy at the meeting.

Dissenters’ Rights

There are no dissenters’ rights of appraisal associated with the matters to be acted upon in Proposals 1 and 2.

2

PROPOSAL 1

ELECTION OF DIRECTORS

General

The Company’s Board of Directors (the Board of Directors or Board) is currently comprised of six directors who are divided into three classes with terms expiring in 2005, 2006 and 2007, respectively. A director serves in office until his or her term expires and his or her respective successor is duly elected and qualified, or until his or her earlier death, removal for cause or resignation. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors.

Only two of the current six seats on the Board of Directors are to be filled by the vote of the outstanding shares entitled to vote at the Annual Meeting. These seats are the Class II directorships, the current term of which expires on the date of the Annual Meeting. These seats are currently held by John Bumgarner, Jr. and Casimir Skrzypczak, outside directors, each of whom has been nominated by the Nominating Committee and Board of Directors for re-election for a three-year term, to expire on the date of the Company’s 2008 annual meeting of stockholders and the due election and qualification of his successor, or his earlier death, removal for cause or resignation.

Unless otherwise instructed, the persons named in the enclosed proxy intend to vote proxies received by them for the re-election of Messrs. Bumgarner and Skrzypczak. The Company expects that Messrs. Bumgarner and Skrzypczak will accept such nominations; however, in the event either Mr. Bumgarner or Mr. Skrzypczak is unable to or declines to serve as a director at the time of the Annual Meeting, proxies will be voted for a substitute nominee designated by the present Board of Directors, unless the Board chooses to reduce the number of directors serving on the Board.

Information Regarding Nominees and Other Directors

Certain background information regarding the nominees for director and the other current directors of the Company has been set forth below for your reference. There are no family relationships among any directors or executive officers of the Company, other than that between John Ocampo, the Chairman of the Board of Directors of the Company, and his spouse Susan M. Ocampo, the Treasurer of the Company. Stock ownership information for these persons is shown below under the heading “Security Ownership of Certain Beneficial Owners and Management” and is based upon information furnished by the respective individuals named therein. All ages are as of the Record Date.

| | | | | | | | |

Name

| | Age

| | Principal Occupation

| | Director

Since

| | Director

Class

|

Robert Van Buskirk | | 56 | | Chief Executive Officer of Sirenza | | 1999 | | I |

Peter Chung | | 37 | | Venture Capitalist | | 1999 | | I |

John Bumgarner, Jr. | | 62 | | Private Investor | | 1999 | | II |

Casimir Skrzypczak | | 63 | | Private Equity Investor | | 2000 | | II |

John Ocampo | | 45 | | Chairman of the Board of Sirenza | | 1985 | | III |

Gil Van Lunsen | | 62 | | Retired Audit Partner | | 2003 | | III |

3

Nominees for Class II Directors

John Bumgarner, Jr. has served as the Company’s director since December 1999. Mr. Bumgarner previously served as Chief Operating Officer and President of Strategic Investments for Williams Communications Group, Inc., a high technology company, from May 2001 to November 2002. Williams Communications Group, Inc., filed a Plan of Reorganization with the U.S. Bankruptcy Court for the Southern District of New York in August 2002. Mr. Bumgarner joined The Williams Companies, Inc., in 1977 and served as Senior Vice President of Williams Corporate Development and Planning and then served as President of Williams International Company as well as President of Williams Real Estate Company prior to joining Williams Communications Group, Inc. Mr. Bumgarner also serves as a director of MPSI, a global software and database company, Energy Partners, Ltd., an oil and natural gas exploration and production company, and one or more privately held companies. Mr. Bumgarner holds a B.S. from the University of Kansas and an M.B.A. from Stanford University.

Casimir Skrzypczak has served as the Company’s director since January 2000. Since July 2001, Mr. Skrzypczak has been a General Partner of Global Asset Capital, a private equity investor. From November 1999 to July 2001, Mr. Skrzypczak served as a Senior Vice President at Cisco Systems, a networking systems company. Prior to joining Cisco, Mr. Skrzypczak served as a Group President at Telcordia Technologies, a telecommunications company, from March 1997 to October 1999. From 1985 to March 1997, Mr. Skrzypczak served as President of NYNEX Science & Technology, Inc., a subsidiary of NYNEX Corporation, a telecommunications company. Mr. Skrzypczak also serves as a director of JDS Uniphase, a fiber-optic products manufacturer, ECI Telecom Ltd., a supplier of telecommunications networking solutions, WebEx Communications, a provider of web communications services, Somera Communications, Inc., a supplier of telecommunications infrastructure equipment and services, and a number of privately held companies. Mr. Skrzypczak holds a B.E. from Villanova University and an M.B.A. from Hofstra University.

Incumbent Class III Directors Whose Term Expires in 2006

John Ocampo, a co-founder of Sirenza, has served as the Company’s Chairman of the Board since December 1998 and has served as a director since the Company’s inception. From May 1999 to September 2002, Mr. Ocampo also served as the Company’s Chief Technology Officer, and from 1984 to May 1999 as the Company’s President and Chief Executive Officer. From 1982 to 1984, Mr. Ocampo served as General Manager at Magnum Microwave, an RF component manufacturer. From 1980 to 1982, he served as Engineering Manager at Avantek, a telecommunications engineering company, now Hewlett-Packard/Avantek. Mr. Ocampo holds a B.S.E.E. from Santa Clara University.

Gil Van Lunsen has served as a director of the Company and Chair of the Board’s Audit Committee since October 2003. Prior to his retirement in June 2000, Mr. Van Lunsen was a Managing Partner of KPMG LLP and led the firm’s Tulsa, Oklahoma office. During his 33-year career, Mr. Van Lunsen held various positions of increasing responsibility with KPMG. He was elected to the partnership in 1977. Mr. Van Lunsen is currently a member of the Board of Directors and the Audit Committee Chairman at Array Biopharma in Boulder, Colorado and a member of the Audit Committee of Northern Border Partners L.P. Additionally, Mr. Van Lunsen was a member of the Ethics Compliance Committee of Tyson Foods, Inc. from January 1997 to December 2002 and a member of the Board of Directors and the Audit Committee Chairman of Hillcrest Healthcare System from July 2000 to March 2005. Mr. Van Lunsen received a B.S./B.A. in accounting from the University of Denver and is a Certified Public Accountant.

4

Incumbent Class I Directors Whose Term Expires in 2007

Robert Van Buskirk has served as the Company’s President and Chief Executive Officer and as a director since June 1999. Before joining the Company, Mr. Van Buskirk held the position of Executive Vice President of Business Development and Operations from August 1998 to May 1999 at Multilink Technology Corporation, a company specializing in the design, development, and marketing of high bit-rate electronic products for advanced fiber optic transmission systems. Prior to his position at Multilink, Mr. Van Buskirk held various management positions at TRW (now Northrop Grumman), a semiconductor wafer manufacturer, including Executive Director of the TRW GaAs telecom products business from 1993 to August 1998. Mr. Van Buskirk holds a B.A. from California State University at Long Beach.

Peter Chung has served as a director of the Company since October 1999. Mr. Chung is a General Partner and Member of various entities affiliated with Summit Partners, L.P., a venture capital and private equity firm, where he has been employed since August 1994. Prior to attending Stanford Business School, Mr. Chung was a Financial Analyst with the Mergers and Acquisitions department at Goldman, Sachs & Co. from 1989 to 1992. Mr. Chung also serves as a director of iPayment, Inc., a provider of credit and debit card-based payment processing services to small merchants, SeaBright Insurance Holdings, Inc., a specialty provider of workers’ compensation insurance, and a number of privately held companies. Mr. Chung holds an A.B. from Harvard University and an M.B.A. from Stanford University.

Board Composition

The Company currently has six directors. In accordance with the terms of the Company’s certificate of incorporation, the terms of office of our Board of Directors are divided into three classes: Class II, whose term will expire at this Annual Meeting, Class III, whose term will expire at the annual meeting of stockholders to be held in 2006, and Class I, whose term will expire at the annual meeting of stockholders to be held in 2007. The Class II Directors are Mr. Bumgarner and Mr. Skrzypczak. The Class III Directors are Mr. Ocampo and Mr. Van Lunsen. The Class I Directors are Mr. Van Buskirk and Mr. Chung. At each future annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting of stockholders following their election and the due election and qualification of their successors, or until their earlier death, resignation or removal for cause. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of the Board of Directors may have the effect of delaying or preventing changes in control of the company. The Company’s directors may be removed for cause by the affirmative vote of the holders of a majority of the Company’s outstanding common stock.

Each member of the Board of Directors other than Messrs. Ocampo and Van Buskirk qualifies as an “independent director” in accordance with the published listing requirements of The Nasdaq National Market. The Nasdaq independence definition includes a series of objective tests, such as that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. In addition, as further required by the Nasdaq rules, the Board of Directors has made a subjective determination as to each independent director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and the company with regard to each director’s business and personal activities as they may relate to Sirenza and Sirenza’s management.

5

Meetings and Committee Composition

The Board of Directors and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. Quarterly Board meeting agendas include regularly scheduled sessions for the independent directors to meet without management present. Board members have access to all Sirenza employees outside of Board meetings.

The Board of Directors has delegated various responsibilities and authority to different Board committees as described in this section of the proxy statement. The Board of Directors currently has, and appoints the members of, standing Audit, Compensation and Nominating Committees. Each of these committees has a written charter approved by the Board of Directors. The members of the committees are all independent directors in accordance with the Nasdaq standards described above and are identified in the following table.

| | | | | | |

| | | Committee Membership

|

Director

| | Audit

| | Compensation

| | Nominating

|

John Bumgarner, Jr. | | | | Chair | | X |

Peter Chung | | X | | | | Chair |

Casimir Skrzypczak | | X | | X | | |

Gil Van Lunsen | | Chair | | | | X |

The Audit Committee assists the Board of Directors in its general oversight of Sirenza’s financial reporting, internal controls and audit functions, and is directly responsible for the appointment, retention, compensation and oversight of the work of Sirenza’s independent auditors. Each member of the Audit Committee is an independent director as defined in The Nasdaq National Market listing standards. In addition, each member of the Audit Committee meets the specific criteria for members of Audit Committees established by the SEC and The Nasdaq National Market. The Audit Committee includes at least one member who is determined by the Board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules, including that the person meets the relevant definition of an “independent director”. Gil Van Lunsen is the independent director who has been determined to be an audit committee financial expert. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Van Lunsen’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose on Mr. Van Lunsen any duties, obligations or liability that are greater than are generally imposed on him as a member of the Audit Committee and Board of Directors, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board of Directors.

The Board of Directors has adopted a written charter for the Audit Committee which sets forth in detail the duties of and functions performed by the Audit Committee. A copy of such charter is attached to this proxy statement asAppendix A. The Audit Committee reviews and reassesses the adequacy of its charter on an annual basis. Major functions of the Audit Committee include, without limitation: (i) review of the effectiveness of the Company’s internal control over financial reporting; (ii) review of the independence, fee arrangements, audit scope, performance and audit findings of the Company’s independent auditors; (iii) review prior to release of the audited financial statements and Management’s Discussion and Analysis contained in the Company’s Annual Report on Form 10-K; and (iv) preparation of reports to be included in Company proxy statements in compliance with SEC requirements. The Audit Committee held a total of six meetings in 2004.

6

The Compensation Committee reviews and approves salaries, equity incentives and other matters relating to executive compensation, and administers Sirenza’s equity plans. The Compensation Committee also reviews and approves various other company compensation policies and matters. The Compensation Committee held a total of 15 meetings in 2004.

The Nominating Committee makes recommendations to the Board of Directors regarding the size and composition of the Board. The Board of Directors has adopted a written charter for the Nominating Committee which sets forth in detail the duties of and functions performed by the Nominating Committee. A copy of such charter is available for review by stockholders on the Company’s website, located at www.sirenza.com/ir_governance.asp. No information from the Company’s website is meant to be incorporated herein by this reference. The Nominating Committee held one meeting in 2004. The Nominating Committee establishes procedures for the nomination process and nominates candidates for election to the Board. The Nominating Committee is responsible for reviewing with the Board, from time to time, the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board of Directors.

Identifying and Evaluating Nominees for Director

The Company’s Nominating Committee has adopted Board membership criteria that apply to recommended nominees for a position on the Company’s Board. Under these criteria, members of the Board should have the highest personal and professional ethics, integrity and values. They should have key personal characteristics such as strategic thinking, objectivity, independent judgment, intellect and the courage to speak out and actively participate in meetings, as well as possess demonstrated sound business judgment gained through broad experience in significant positions where the candidate has dealt with management, technical, financial or regulatory issues. A candidate should have the disposition to act independently in respect of the Company and others in order to protect the long-term interests of the Company and all stockholders. A candidate needs to be able to devote sufficient time to carry out his or her duties and responsibilities effectively and should be committed to serve on the Board for an extended period of time. A candidate should have sufficient financial or accounting knowledge to add value in the financial oversight role of the Board of Directors. Finally, a candidate should have no material relationship that could create an appearance of lack of independence with respect to the Company and should have no conflict of interest with the Company’s business. These factors, and others as considered useful by the Committee, are reviewed in the context of an assessment of the perceived needs of the Board at a particular point in time.

Consideration of new Board nominee candidates typically involves a series of internal discussions, review of information concerning candidates and interviews with selected candidates. The committee may also employ a search firm or pay fees to other third parties in connection with seeking or evaluating Board nominee candidates. Candidates for nomination to the Board typically are suggested by Board members or by employees. The Nominating Committee considers properly submitted nominees proposed by stockholders. Candidates proposed by stockholders are evaluated by the Nominating Committee using the same criteria as for other candidates. To recommend a prospective nominee for the Nominating Committee’s consideration, you may submit the candidate’s name and qualifications in writing to the Company’s Corporate Secretary at the address of our principal executive offices set forth above. In addition, the bylaws of the Company permit stockholders to nominate directors for election at an annual stockholder meeting. To nominate a director, the stockholder must deliver a proxy statement and form of proxy to holders of a sufficient number of shares to elect such nominee and provide the information required by the bylaws of the Company, as well as a statement by the nominee acknowledging that he or she will owe a fiduciary obligation to the Company and its stockholders. In addition, the stockholder must give timely notice to the Corporate Secretary of the Company in accordance with the bylaws of the Company, which, in general, require that the notice be received by the Corporate Secretary of the Company within the time period described below under “Stockholder Proposals”.

7

The Board of Directors held a total of ten meetings during 2004. During 2004, no director attended fewer than 75% of the aggregate of the number of meetings held by the Board of Directors and the number of meetings of committees, if any, upon which such director served.

Policy Regarding Director Attendance at Annual Stockholders Meeting

The Company’s policy with respect to director attendance at annual meetings of stockholders is that members of the Board of Directors are encouraged to attend the annual meeting of stockholders in person or via teleconference. Three members of the Board of Directors attended the 2004 annual meeting of stockholders.

Communications with the Board

Stockholders may communicate with the Board by writing to them by mail c/o Sirenza Microdevices, Inc., 303 S. Technology Court, Broomfield, Colorado, 80021. Any stockholder communications directed to the Board of Directors or a member of the Board will first be delivered to Sirenza’s Corporate Secretary who will forward all communications to the Board of Directors for review.

Director Compensation

Independent directors are paid a cash retainer of $4,000 per year for attendance at regularly scheduled Board meetings and an additional cash retainer of $1,000 per year for attendance at special Board meetings; the chairmen of each board committee receive an additional cash retainer of $7,000 per year; and other committee members each receive an additional cash retainer of $2,000 per year. In addition, independent directors receive a fee of $500 for each regularly scheduled Board meeting attended (typically six per year). All cash payments are calculated and paid in quarterly installments. Directors are also reimbursed for expenses in connection with attendance at Board of Directors and committee meetings. Independent directors may not receive consulting, advisory or other compensatory fees from Sirenza in addition to their Board compensation. Employee directors are not paid for Board service in addition to their regular employee compensation. The following table shows the aggregate cash compensation paid to each independent director in 2004:

| | | |

Director

| | Compensation in 2004

|

John Bumgarner, Jr. | | $ | 16,500 |

Peter Chung | | $ | 15,250 |

Casimir Skrzypczak | | $ | 12,000 |

Gil Van Lunsen | | $ | 16,500 |

Directors are also eligible to participate in the Company’s Amended and Restated 1998 Stock Plan. Pursuant to the Company’s Amended and Restated 1998 Stock Plan, non-employee directors are automatically granted an option to purchase 40,000 shares of common stock upon their initial election to the Board of Directors and an option to purchase an additional 10,000 shares of common stock each year following our annual stockholders meeting, so long as on such date, he or she has served on the Board of Directors for at least the previous six months. In 2004, each of Mr. Bumgarner, Mr. Chung, Mr. Skrzypczak and Mr. Van Lunsen were granted an option to purchase 10,000 shares of common stock at an exercise price of $3.96 per share. In the past, Mr. Chung did not receive any automatic option grants due to his affiliation with a former stockholder of the Company.

8

Beginning in 2004, Mr. Chung was able to accept the automatic grants under the Amended and Restated 1998 Stock Plan and he was granted an option to purchase 10,000 shares at an exercise price of $3.96 in 2004. In addition, Mr. Chung was granted an option to purchase 40,000 shares of common stock at an exercise price of $4.23 per share in replacement of previously declined options.

Code of Ethics

The Company has adopted a code of business conduct and ethics for directors, officers (including the Company’s principal executive officer, principal financial officer and controller) and employees, known as the Code of Business Ethics and Conduct. The Code of Business Ethics and Conduct is available for review by stockholders on the Company’s website at www.sirenza.com/ir_governance.asp. No information from the Company’s website is meant to be incorporated herein by this reference. The Company intends to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of our code of ethics by filing a current report on Form 8-K with the Securities and Exchange Commission disclosing such information, or by posting such information on our website, at the address specified above, within the period required by Item 5.05 of Form 8-K and, as applicable, the listing standards of the Nasdaq National Market.

Required Vote

The affirmative vote of a plurality of the votes cast by the stockholders entitled to vote at the Annual Meeting is required for the election of the nominees for director contemplated in Proposal 1, meaning that the two properly nominated persons receiving the highest number of affirmative votes cast by stockholders entitled to vote at the Annual Meeting will be elected.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” THE NOMINEES LISTED ABOVE.

9

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Ernst & Young LLP has audited the Company’s financial statements since 1996, and the Audit Committee of the Board of Directors of the Company has selected Ernst & Young LLP as the Company’s independent auditors to audit the financial statements of the Company for the fiscal year ending December 31, 2005. The Board of Directors recommends that stockholders vote for ratification of such appointment. A representative of Ernst & Young LLP is expected to be available at the Annual Meeting with the opportunity to make a statement if such representative desires to do so, and is expected to be available to respond to appropriate questions.

Fees Paid to Ernst & Young LLP

Audit Fees

In 2004, Ernst & Young LLP billed the Company an aggregate of $482,000 for the audit of the Company’s annual financial statements, the review of financial statements included in the Company’s quarterly reports on Form 10-Q, assistance with registration statements, and fees associated with our compliance with Section 404 of the Sarbanes-Oxley Act. During 2003, audit fees billed to the Company by Ernst & Young LLP totaled $302,000.

Audit-Related Fees

In 2004, Ernst & Young LLP billed the Company an aggregate of $9,000 for additional assurance and related services that were related to the audit of our annual financial statements or review of the Company’s quarterly financial statements. These services consisted of accounting consultations. During 2003, audit-related fees billed to the Company by Ernst & Young LLP totaled $125,000 and consisted of accounting consultations and assistance with an acquisition.

Tax Fees

In 2004, Ernst & Young LLP billed the Company an aggregate of $3,000 for professional services relating to tax compliance. This service consisted of preparation of tax returns for one of Sirenza’s foreign subsidiaries. During 2003, tax fees billed to the Company by Ernst & Young LLP totaled $80,000 and consisted of preparation of tax returns for Sirenza and its subsidiaries and tax consultations.

All Other Fees

In 2004 and 2003, Ernst & Young LLP did not bill the Company for any amounts for professional services other than the audit services, audit-related services and tax services described above.

The Audit Committee has determined that the provision of non-audit services by Ernst & Young LLP is compatible with maintaining auditor independence.

Audit Committee Pre-Approval Policies

All services performed by the independent auditors must be pre-approved by the Audit Committee. Such pre-approval may be granted at any time up to one year in advance of commencement of the specified services.

10

The Audit Committee may, in its discretion, establish fee thresholds for pre-approved categories of services which do not require specific approval by the Audit Committee for a particular service. Such pre-approved categories are detailed as to the service covered and the Audit Committee is periodically informed of the provision of each service. In addition, the Audit Committee has delegated to the Chair of the Audit Committee the authority to pre-approve audit-related and non-audit services not prohibited by law to be performed by the Company’s independent auditors and associated fees, provided that the Chair shall report any decisions to pre- approve such audit-related or non-audit services and fees to the full Audit Committee at its next regular meeting. The Audit Committee will not approve the provision of any prohibited service as set forth in the applicable regulations of the SEC and the Public Company Accounting Oversight Board. During 2004, no services were provided by the independent auditors under thede minimis rules set forth in Rule 2-01 of Regulation S-X promulgated by the SEC.

Required Vote

Stockholder ratification of the selection of Ernst & Young LLP as the Company’s independent auditors is not required by the Company’s bylaws or otherwise. However, the Board of Directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee at its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE 2005 FISCAL YEAR.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to the Company with respect to the beneficial ownership of the Company’s common stock as of April 1, 2005 by (i) each person known by the Company to own beneficially more than 5% of the outstanding shares of the Company’s common stock, (ii) each of the Named Executive Officers (as defined under “Executive Compensation” below), (iii) each of the Company’s directors and nominees for director, and (iv) all of the Company’s directors and executive officers as a group.

Except as otherwise indicated, and subject to applicable community property laws, to the Company’s knowledge the persons named below have sole voting and investment power with respect to all shares of common stock held by them. For the purposes of calculating percentage ownership, as of April 1, 2005, 35,582,315 shares of common stock were issued and outstanding.

Unless otherwise indicated below, each person has an address in care of Sirenza’s principal executive offices at 303 S. Technology Court, Broomfield, CO 80021.

| | | | | |

| | | Shares of Common

Stock Beneficially

Owned(1)

| |

Name and Address of Beneficial Owner

| | Number

| | Percent

| |

John Ocampo and Susan Ocampo(2) | | 12,973,531 | | 36.5 | % |

Kern Capital Management, LLC(3) | | 1,928,700 | | 5.4 | % |

Robert Van Buskirk(4) | | 667,289 | | 1.8 | % |

Charles Bland(5) | | 120,029 | | * | |

Thomas Scannell(6) | | 213,560 | | * | |

Gerald Quinnell(7) | | 234,194 | | * | |

John Bumgarner, Jr.(8) | | 44,123 | | * | |

Peter Chung | | — | | * | |

Casimir Skrzypczak(9) | | 52,971 | | * | |

Gil Van Lunsen(10) | | 16,191 | | * | |

All directors and executive officers as a group (19 persons)(11) | | 14,925,071 | | 40.2 | % |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to the securities. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of Sirenza Microdevices common stock subject to options held by that person that will be exercisable within sixty days of April 1, 2005, are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) | | Consists of 1,050,000 shares held by John Ocampo, 1,050,000 shares held by Susan Ocampo, 8,197,831 shares held by John Ocampo and Susan Ocampo, Trustees, Ocampo Family Trust UA 5-31-01, 221,604 shares held by Susan Ocampo and John Ocampo, Trustees, 2001 Ocampo Charitable Trust, 900,000 shares held by Samat Partners, a California limited partnership and an aggregate of 1,554,096 shares held by a custodian and various trusts for the benefit of the Ocampos’ children. Mrs. Ocampo is the custodian and Mr. and Mrs. Ocampo are co-trustees with a third person of each the trusts for the benefit of their children and share voting and dispositive authority over these shares. Mr. and Mrs. Ocampo disclaim beneficial ownership of the shares held by each of the foregoing trusts and partnerships except to the extent of their pecuniary interest in these shares. |

| (3) | | Included in reliance on information contained in a Schedule 13G filed on February 14, 2005 by Kern Capital Management, LLC (“KCM”). As to the indicated number of shares, KCM reported sole voting and dispositive power. The same filing notes that Robert E. Kern and David G. Kern, as controlling members of KCM, may be deemed to beneficially own the indicated number of shares (although both parties expressly disclaim such beneficial ownership), and to share voting and dispositive power over such shares. The address of record for KCM is 114 W. 47th Street, Suite 1926, New York, NY 10036. |

| (4) | | Includes 534,780 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

| (5) | | Includes 94,999 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

| (6) | | Includes 205,493 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

| (7) | | Includes 143,615 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

12

| (8) | | Consists of 1,000 shares held by 21stCentury LLC, of which Mr. Bumgarner is a managing member, and 43,123 shares subject to outstanding options exercisable within sixty days of April 1, 2005. Mr. Bumgarner disclaims beneficial ownership of the shares held by 21stCentury LLC except to the extent of his pecuniary interest in these shares. |

| (9) | | Includes 34,789 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

| (10) | | Includes 15,833 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

| (11) | | Includes an aggregate of 1,528,725 shares subject to outstanding options exercisable within sixty days of April 1, 2005. |

EQUITY COMPENSATION PLAN INFORMATION

The table below sets forth certain information regarding the Company’s equity compensation plans as of the end of 2004.

| | | | | | |

Plan Category

| | Number of Securities To Be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted-Average Exercise

Price of Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (excluding

securities reflected in

column (a))

|

| | | (a)

| | (b)

| | (c)

|

Equity Compensation Plans Approved By Security Holders | | 5,571,569 | | $2.61 | | 454,620(1) |

Equity Compensation Plans Not Approved By Security Holders | | None | | Not applicable | | None |

| (1) | | Consists of 440,174 shares available for future issuance under the Amended and Restated 1998 Stock Plan, and 14,446 shares available for future issuance under the 2000 Employee Stock Purchase Plan as of the end of the last fiscal year. The number of shares available for future issuance under the Amended and Restated 1998 Plan is increased on January 1 of each year by a number of shares equal to the lesser of (i) 1,500,000 shares, (ii) 3% of our outstanding shares as of such date, or (iii) such lesser amount as is determined by the Board of Directors. The number of shares available for future issuance under the 2000 Employee Stock Purchase Plan is increased on January 1 of each year by a number of shares equal to the lesser of (i) 350,000 shares, (ii) 1% of our outstanding shares as of such date, or (iii) such lesser amount as is determined by the Board of Directors. As a result of these provisions, the number of shares available for future issuance under the Amended and Restated 1998 Plan was increased by 1,062,013 shares in 2005, and the number of shares available for future issuance under the 2000 Plan was increased by 350,000 shares in 2005. |

13

EXECUTIVE OFFICERS

The names of the Company’s executive officers, and certain information about them as of April 1, 2005, are set forth below:

| | | | |

Name

| | Age

| | Position

|

John Ocampo | | 45 | | Chairman of the Board |

Robert Van Buskirk | | 56 | | President and Chief Executive Officer |

Charles Bland | | 56 | | Chief Operating Officer |

Joseph Johnson | | 64 | | Chief Technology Officer and Vice President, Advanced Products |

Gerald Quinnell | | 47 | | Chief Strategy Officer |

Gerald Hatley | | 35 | | Vice President, Controller and Chief Accounting Officer |

Norman Hilgendorf | | 44 | | Vice President, Business Development & Strategic Marketing |

Ralph “Skip” Hoover | | 53 | | Vice President, Sales |

Jacquie Maidel | | 60 | | Vice President, Human Resources |

Christopher Menicou | | 46 | | Vice President, Quality/Reliability |

Susan Ocampo | | 47 | | Treasurer |

John Pelose | | 50 | | Vice President and General Manager, Amplifier Division |

Thomas Scannell | | 54 | | Vice President, Finance, Chief Financial Officer, Assistant Secretary and Assistant Treasurer |

Timothy Schamberger | | 43 | | Vice President and General Manager, Signal Source Division |

Clay Simpson | | 33 | | Vice President and General Counsel |

Additional information regarding Messrs. Ocampo and Van Buskirk may be found above under “Proposal 1—Election of Directors—Information Regarding Nominees and Other Directors.”

Charles Bland has served as the Company’s Chief Operating Officer since May 2003. Prior to joining the Company, Mr. Bland served as the President and Chief Executive Officer of Vari-L Company, Inc. since May 2001. From June 2000 until he joined Vari-L, he served as the President of Growzone, Inc., a software company focused on the horticultural industry, and from June 1999 until June 2000, he was the President of AmericasDoctors.com, an Internet health care content site. From 1998 to 1999, Mr. Bland was the Chief Operating Officer at Quark Incorporated, provider of shrink wrap and client server software for the publishing industry. For the previous 24 years, Mr. Bland worked in positions of increasing responsibility with Owens Corning Fiberglass, a high performance glass composites and building materials company, with his final assignment being President, Africa/Latin American Operations. Mr. Bland received his B.S., Accounting and Finance, degree from Ohio State University and his M.B.A. from the Sloan School, Massachusetts Institute of Technology.

Joseph Johnson has served as the Company’s Vice President, Advanced Products and Chief Technology Officer since September 2002. From 1994 until September 2002, he was President, Chief Executive Officer and Founder of Xemod, Inc., a fabless manufacturer of RF components. Mr. Johnson holds a B.S.E.E degree from North Carolina State University and an M.S. in Physics from Lynchburg College.

Gerald Quinnell has served as the Company’s Chief Strategy Officer since October 2004. From February 2001 to October 2004, Mr. Quinnell served as the Company’s Executive Vice President, Business Development. From November 1998 to December 2001, Mr. Quinnell served as the Company’s Vice President, Sales and Marketing. From November 1998 to February 2001, Mr. Quinnell also served as the Company’s Chief Operating Officer. Mr. Quinnell served as President and Chief Operating Officer of the RF and Microwave business unit of

14

Avnet, Inc. from June 1997 to September 1998, and as Corporate Vice President of Avnet, Inc., during the same period. From 1988 to June 1997, Mr. Quinnell served as Chief Operating Officer of Penstock, Inc., an RF and microwave distribution company subsequently sold to Avnet, Inc. Mr. Quinnell holds a B.S. from the University of Phoenix.

Gerald Hatley has served as the Company’s Vice President, Controller and Chief Accounting Officer since April 2002. Mr. Hatley served as the Company’s Controller from December 1999 to April 2002. From October 1994 to December 1999, he served as an auditor for Ernst & Young LLP, most recently as an audit manager. Mr. Hatley holds a B.S. from California Polytechnic State University, San Luis Obispo and is a certified public accountant.

Norman Hilgendorf has served as the Company’s Vice President, Business Development and Strategic Marketing since October 2004. From December 2001 to October 2004, Mr. Hilgendorf served as the Company’s Vice President, Sales & Marketing. Mr. Hilgendorf served as the Company’s Marketing Director, Standard Products from May 2000 to December 2001, and as the Company’s Central U.S. Sales Director from January 2000 to May 2000. From January 1998 to December 1999, he was Vice President and General Manager at Richardson Electronics, a distributor of electronics components. He was also the Wireless Business Unit Manager and Product Manager for Richardson Electronics from 1994 to January 1998. Mr. Hilgendorf received his B.S.E.E. from the University of Illinois and an M.B.A. from the University of Chicago.

R.E. “Skip” Hoover has served as the Company’s Vice President, Sales since October 2004. Mr. Hoover joined the Company in September 2003 as Executive Director, Aerospace & Defense Business Unit, a position he held until October 2004. Prior to joining the Company, Mr. Hoover served as President of Castlewood Consulting Group, a consulting services company in the electronics industry, from March 2003 to September 2003. From November 1992 to March 2003, Mr. Hoover was with WJ Communications, Inc., a designer of RF components, in various management roles, most recently serving as Executive Vice President from 2000 to March 2003. Mr. Hoover holds a B.S. in Business from the California State University, Long Beach.

Jacquie Maidel joined the Company in May 2003 as Director of Human Resources and was named Vice President, Human Resources in October 2003. Prior to joining the Company, Ms. Maidel served as Director of Human Resources at Vari-L Company, Inc. from May 2001 to May 2003. From June 1988 to the time she joined Vari-L, Ms. Maidel served initially as Director, and later as Corporate Vice President of Human Resources for the U.S. and U.K. operations of Arcadis NV, an international engineering consulting firm. Prior to that, Ms. Maidel was employed in Human Resources for 10 years at Cold Spring Harbor Laboratory, a major national cancer and genetic research laboratory. Ms. Maidel received a B.A. degree in Fine Arts from Cambridge PolyTechnical College.

Christopher Menicou has served as the Company’s Vice President, Quality and Reliability since September 2002. Mr. Menicou held the position of Vice President of Operations from October 2000 to November 2001 for Spectrian, Inc., a manufacturer of radio frequency amplifiers. From January 1998 to October 2000, he served as Spectrian’s Vice President of Quality and Reliability. He also held the position of Vice President of Quality at Credence Test Systems, a semiconductor equipment manufacturer, from March 1997 to January 1998. Prior to this he held various operations, customer support and quality management positions at Trillium, a private company, later acquired by LTX Corporation and Fairchild/Schlumberger. Mr. Menicou holds a B.S. from San Jose State University.

15

Susan Ocampo is co-founder of the Company and has served as the Company’s Treasurer since November 1999. From 1988 to November 1999, Mrs. Ocampo also served as the Company’s Chief Financial Officer and Secretary and as one of the Company’s directors. Mrs. Ocampo holds a B.A. from Maryknoll College, in Manila, Philippines.

John Pelose has served as the Company’s Vice President and General Manager, Amplifier division since May 2003. Prior to that time, Mr. Pelose served as the Company’s Vice President, Wireless Products from February 2002 to May 2003, and as the Company’s Director of Wireline Products from December 2001 to February 2002. He also served as the Company’s Director of Marketing of Wireless Products from January 2000 to December 2001. Mr. Pelose held the position of Vice President and General Manager of Multicarrier Products for Spectrian, Inc., a manufacturer of radio frequency amplifiers, from November 1998 to January 2000. From March 1998 to November 1998, he served as Spectrian’s Vice President of Technical Business Development, and from 1995 to October 1998, he served as its Vice President of Manufacturing Engineering. Mr. Pelose received his M.S.E.E. from University of Santa Clara and his B.S.E.E. from University of California at Davis.

Thomas Scannell has served as the Company’s Vice President, Finance and Chief Financial Officer and Assistant Treasurer since November 1999 and has served as Assistant Secretary since January 2003. From November 1999 to January 2003, Mr. Scannell also served as the Company’s Secretary and Vice President, Administration. From November 1996 to May 1999, Mr. Scannell served as the Vice President, Finance of Spectra-Physics Lasers, a laser manufacturer. From 1990 to November 1996, Mr. Scannell held the positions of Division Controller and Assistant Corporate Controller at Raychem Corporation, a materials science company. Mr. Scannell holds a B.A. and an M.B.A. from Stanford University.

Timothy Schamberger joined the Company as Vice President and General Manager of Signal Source division in May 2003. Prior to joining the Company, Mr. Schamberger served as the Vice President, Sales and Marketing of Vari-L Company, Inc. from May 2002 to May 2003. From March 1993 to May 2002, Mr. Schamberger served in various sales & marketing roles for M/A-Com, a wireless RF components manufacturer, including Strategic Account Manager, Regional Sales Manager and District Sales Manager. Mr. Schamberger’s previous experience also includes program management and engineering positions with Allied Signal Aerospace Corp., a manufacturer of non-nuclear systems for nuclear weapons, and Wilcox Electric, a manufacturer of ground-based navigation aid equipment. Mr. Schamberger received his B.S.E.E. from Kansas State University.

Clay Simpson joined the Company as Vice President and General Counsel in March 2005 and was appointed as its Secretary in April 2005. Prior to joining the Company, from October 1997 through February 2005, Mr. Simpson served as an Associate Attorney with the law firm of Wilson Sonsini Goodrich & Rosati, P.C. Mr. Simpson holds a B.A from the University of California, Los Angeles, and a J.D. from Columbia University.

16

EXECUTIVE COMPENSATION

The following table shows, as to any person serving as Chief Executive Officer during 2004 and each of the four other most highly compensated executive officers of the Company during 2004 whose salary plus bonus exceeded $100,000 (together, the Named Executive Officers), information concerning compensation paid for services rendered to the Company during the last three fiscal years.

Summary Compensation Table

| | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | | Long-Term Compensation

|

Name and Principal Position

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation ($)

| | | Restricted

Stock

Awards (1)($)

| | Securities

Underlying

Options/SARs

(2)(#)

| | | All Other

Compensation

(3)($)

|

Robert Van Buskirk President and Chief Executive Officer | | 2004

2003

2002 | | 300,000

275,000

262,337 | | —

—

— | | —

234,230

— |

(4)

| | $

| 382,000

—

— | | —

480,000

300,000 |

(5)

(6) | | 3,337

3,472

3,472 |

| | | | | | | |

John Ocampo Chairman of the Board | | 2004

2003

2002 | | 250,000

250,000

250,000 | | —

—

— | | —

—

— |

| |

| —

—

— | | —

—

— |

| | 3,337

3,472

3,472 |

| | | | | | | |

Charles Bland(9) Chief Operating Officer | | 2004

2003 | | 250,000

163,014 | | 25,000

— | | —

— |

| |

| —

— | | 30,000

250,000 |

| | 3,337

3,058 |

| | | | | | | |

Thomas Scannell Vice President, Finance and Chief Financial Officer | | 2004

2003

2002 | | 215,000

205,000

196,510 | | —

10,000

5,000 | | —

114,062

2,628 |

(7)

(8) | |

| —

—

— | | 30,000

145,000

75,000 |

(5)

(6) | | 3,294

3,386

3,256 |

| | | | | | | |

Gerald Quinnell Chief Strategy Officer | | 2004

2003

2002 | | 207,500

200,000

190,000 | | —

—

5,000 | | —

—

2,628 |

(8) | |

| —

—

— | | 30,000

140,000

— |

(5)

| | 3,267

3,364

3,364 |

| (1) | | As of December 31, 2004, there were an aggregate of 100,000 shares of restricted stock issued to Named Executive Officers that remained outstanding, having an aggregate value of $656,000 based on the closing common stock per share price of $6.56 as reported on the Nasdaq National Market as of that date. The 100,000 shares of restricted stock granted to Mr. Van Buskirk vest as follows: 100% on the date that is three years following the date of grant, provided, however, that 50% of the shares immediately vest in the event that the closing trading price of the Company’s Common Stock on The Nasdaq National Market is greater than or equal to $6.396 for five consecutive trading days. In the fourth quarter of 2004, the Company’s stock price exceeded $6.396 for five consecutive trading days, resulting in vesting of 50% of such shares. In the event that any dividends are declared and paid on the common stock during the period during which any such restricted stock remains subject to vesting restrictions, such dividends shall be paid with respect to the restricted shares. |

| (2) | | No stock appreciation rights have been granted by the Company. |

| (3) | | Consist of matching contributions of $2,500 paid annually to each Named Executive Officer’s 401(k) plan account and term life insurance premiums paid by the Company. In 2004, term life insurance premiums in the following amounts were paid: $837 for each of Messrs. Bland, Van Buskirk and Ocampo, $794 for Mr. Scannell and $767 for Mr. Quinnell. |

| (4) | | Consists of $139,589 paid to Mr. Van Buskirk in 2003 as a relocation allowance in connection with Mr. Van Buskirk’s move, at the Company’s request, from California to the area of the Company’s new corporate headquarters located in Broomfield, Colorado, and $94,641 paid to Mr. Van Buskirk as reimbursement for taxes due on such relocation allowance. |

| (5) | | In the third quarter of 2002, Sirenza’s board of directors approved a voluntary stock option exchange program for employees and directors. Under the program, eligible employees and directors were given the opportunity to exchange certain unexercised stock options for new options to be granted at least six months and one day following the cancellation of the exchanged options. Each officer was granted new options in the first quarter of 2003 exercisable for an equal number of shares as the exchanged options. No additional options were granted in 2003 to the Named Executive Officers. |

| (6) | | These options were tendered and cancelled pursuant to the Company’s voluntary stock option program described above. |

| (7) | | Consists of $65,372 paid to Mr. Scannell in 2003 as a relocation allowance in connection with Mr. Scannell’s move, at the Company’s request, from California to the area of the Company’s new corporate headquarters located in Broomfield, Colorado, $44,180 paid to Mr. Scannell as reimbursement for taxes due |

17

| | on such relocation allowance, and $4,510 paid to Mr. Scannell as reimbursement for taxes due on the bonus paid during 2003. |

| (8) | | Represents reimbursement for taxes due on bonus. |

| (9) | | Mr. Bland joined the Company in May 2003. |

Option/SAR Grants During Last Fiscal Year

The following table shows, as for each Named Executive Officer, information concerning stock options granted during 2004.

| | | | | | | | | | | | | |

| | | Individual Grants

| | |

Name

| | Number of

Securities

Underlying

Options/SARs

Granted(#)

| | Percent of Total

Options/SARs

Granted To

Employees in

Fiscal Year

| | | Exercise

or Base

Price

($/Sh)(1)

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(2)

|

| | | | | | 5% ($)

| | 10% ($)

|

Robert Van Buskirk | | — | | — | | | — | | — | | — | | — |

John Ocampo | | — | | — | | | — | | — | | — | | — |

Charles Bland | | 30,000 | | 2.6 | % | | 4.58 | | 10/22/2014 | | 86,410 | | 218,980 |

Thomas Scannell | | 30,000 | | 2.6 | % | | 4.58 | | 10/22/2014 | | 86,410 | | 218,980 |

Gerald Quinnell | | 30,000 | | 2.6 | % | | 4.58 | | 10/22/2014 | | 86,410 | | 218,980 |

| (1) | | Represents the fair market value of the underlying common stock on the date of grant. |

| (2) | | Potential realizable value is based on an assumption that the stock price of the common stock appreciates at the annual rate shown (compounded annually) from the date of grant until the end of the ten year option term. Potential realizable value is shown net of exercise price. These amounts are calculated based on the regulations promulgated by the SEC and do not reflect the Company’s estimate of future stock price growth. |

Aggregated Option/SAR Exercises in Last Fiscal Year and

Year-End Option/SAR Values

The following table sets forth, as to the Named Executive Officers, certain information concerning stock options exercised during 2004 and the number of shares subject to exercisable and unexercisable stock options as of the end of 2004. The table also sets forth certain information with respect to the value of stock options held by such individuals as of the end of 2004.

| | | | | | | | | | | | |

Name

| | Shares

Acquired on Exercise (#)

| | Value

Received ($)

| | Number of Securities

Underlying Unexercised

Options/SARs at Last Fiscal

Year End (#)

| | Value of Unexercised In-

The-Money Options/SARs

at Last Fiscal Year End

($)(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Robert Van Buskirk | | 17,400 | | 69,859 | | 494,780 | | 210,000 | | 2,546,787 | | 1,096,200 |

John Ocampo | | — | | — | | — | | — | | — | | — |

Charles Bland | | — | | — | | 98,958 | | 181,042 | | 492,811 | | 811,589 |

Thomas Scannell | | 33,169 | | 110,142 | | 210,627 | | 105,104 | | 780,458 | | 390,541 |

Gerald Quinnell | | 30,540 | | 169,214 | | 129,033 | | 91,250 | | 665,457 | | 379,125 |

| (1) | | The amount set forth represents the difference between the closing common stock share price of $6.56 on December 31, 2004, as reported by the Nasdaq National Market, and the applicable exercise price, multiplied by the applicable number of shares subject to the option. |

Employment Agreements and Termination of Employment and Change of Control Arrangements

Sirenza has entered into employment-related agreements with seven of its executive officers: Charles Bland, the Company’s Chief Operating Officer, Gerald Hatley, the Company’s Vice President, Controller and Chief

18

Accounting Officer, Gerald Quinnell, the Company’s Chief Strategy Officer, Thomas Scannell, the Company’s Vice President, Finance and Chief Financial Officer, Timothy Schamberger, the Company’s Vice President and General Manager, Signal Source division, and Robert Van Buskirk, the Company’s President and Chief Executive Officer and Clay Simpson, the Company’s Vice President and General Counsel. Any employment agreements disclosed in the Company’s prior periodic filings that are not listed here have expired by their terms or been cancelled. The following summarizes the material terms of each of the agreements listed above.

Relocation of Officers (Robert Van Buskirk, Thomas Scannell, Gerald Hatley and Clay Simpson)

In connection with the Company’s relocation of its corporate headquarters from Sunnyvale, California to Broomfield, Colorado, in September 2003 Sirenza entered into employment agreements with each of Mr. Hatley, Mr. Scannell and Mr. Van Buskirk that provided certain incentives to each officer to relocate their home and continue employment with Sirenza following the move. In connection with its hiring of Mr. Simpson in March 2005, Sirenza entered into an employment agreement with Mr. Simpson providing similar incentives.

The agreement with Mr. Van Buskirk provides for a two-year employment relationship commencing on August 1, 2003 and sets forth the base salary, bonus opportunity, options, benefits and the responsibilities of Mr. Van Buskirk’s position in effect at the time of execution of the agreement. The agreement will be automatically renewed for successive one-year terms unless either party provides notice of termination 60 days prior to the end of the existing term. Either the Company or Mr. Van Buskirk may terminate the employment relationship for any or no reason upon at least 30 days’ prior notice to the other party. However, if during the term of the agreement, Mr. Van Buskirk is terminated other than for “cause” or he resigns his employment with “good reason” (as such terms are defined in his agreement), Mr. Van Buskirk is entitled to continue to receive severance benefits equal to his base salary then in effect for a period of thirty months, and 50% of all unvested options will immediately accelerate and vest. In addition, if the involuntary termination occurs within 24 months of Mr. Van Buskirk’s move to Colorado, Mr. Van Buskirk is entitled to receive a payment in the amount of $22,500 as a moving allowance to return to California. Mr. Van Buskirk is also entitled to similar cash severance and acceleration of options if his employment is terminated due to his death. Pursuant to his employment agreement, Mr. Van Buskirk has also agreed not to engage in competitive activities with Sirenza for the lesser of (i) one year following termination of employment and (ii) such period of time during which he is entitled to severance benefits under the agreement.

The agreement with Mr. Scannell provides for a two-year employment relationship commencing on August 1, 2003 and sets forth the base salary, bonus opportunity, options, benefits and the responsibilities of Mr. Scannell’s position in effect at the time of execution of the agreement. The agreement will be automatically renewed for successive one-year terms unless either party provides notice of termination 60 days prior to the end of the existing term. Either the Company or Mr. Scannell may terminate the employment relationship for any or no reason upon at least 30 days’ prior notice to the other party. However, if during the term of the agreement, Mr. Scannell is terminated other than for “cause” or he resigns his employment with “good reason” (as such terms are defined in his agreement), Mr. Scannell is entitled to continue to receive severance benefits equal to his base salary then in effect for a period of eighteen months, and 50% of all unvested options will immediately accelerate and vest. In addition, if the involuntary termination occurs within 24 months of Mr. Scannell’s move to Colorado, Mr. Scannell is entitled to receive a payment in the amount of at least $13,900 but not to exceed $22,500 as a moving allowance for moving costs to return to California. Mr. Scannell is also entitled to similar cash severance and acceleration of options if his employment is terminated due to his death.

19

The agreement with Mr. Hatley provides for a two-year employment relationship commencing on September 1, 2003 and sets forth the base salary, bonus opportunity, options, benefits and the responsibilities of Mr. Hatley’s position in effect at the time of execution of the agreement. The agreement will be automatically renewed for successive one-year terms unless a party provides notice of termination 60 days prior to the end of the existing term. Either the Company or Mr. Hatley may terminate the employment relationship for any or no reason upon at least 30 days’ prior notice to the other party. However, if during the term of the agreement, Mr. Hatley is terminated other than for “cause” or he resigns his employment with “good reason” (as such terms are defined in his agreement), Mr. Hatley is entitled to continue to receive severance benefits equal to his base salary then in effect for a period of six months, and 50% of all unvested options will immediately accelerate and vest. In addition, if the involuntary termination occurs within 24 months of Mr. Hatley’s move to Colorado, Mr. Hatley is entitled to receive a payment in the amount of $3,600 as a moving allowance for moving costs to return to California. Mr. Hatley is also entitled to similar cash severance and acceleration of options if his employment is terminated due to his death.

The agreement with Mr. Simpson provides for a two-year employment relationship commencing on March 1, 2005 and sets forth the base salary, bonus opportunity, options, benefits and the responsibilities of Mr. Simpson’s position in effect at the time of execution of the agreement. The agreement will be automatically renewed for successive one-year terms unless a party provides notice of termination 60 days prior to the end of the existing term. Either the Company or Mr. Simpson may terminate the employment relationship for any or no reason upon at least 30 days’ prior notice to the other party. However, if during the term of the agreement, Mr. Simpson is terminated other than for “cause” or he resigns his employment with “good reason” (as such terms are defined in his agreement), Mr. Simpson is entitled to continue to receive severance benefits equal to his base salary then in effect for a period of six months, and 50% of all unvested options will immediately accelerate and vest. In addition, if the involuntary termination occurs within 24 months of Mr. Simpson’s move to Colorado, Mr. Simpson is entitled to receive a payment in the amount of $8,150 as a moving allowance for moving costs to return to California. Mr. Simpson is also entitled to similar cash severance and acceleration of options if his employment is terminated due to his death.

Vari-L Acquisition (Charles Bland and Timothy Schamberger)

In connection with the acquisition of Vari-L Company, Inc. in May 2003, the Company entered into employment agreements with each of Mr. Bland and Mr. Schamberger that provided certain incentives to each to begin and continue employment with Sirenza following the acquisition. These employment agreements superseded any previously existing employment agreements entered into by each of these individuals with Vari-L. The agreements with Messrs. Bland and Schamberger provide for an at-will employment relationship and established the initial base salary, bonus opportunity, options, benefits and the responsibilities of each position at the time of hire. Although the employment agreement is at-will, each agreement also provides that if, between the day following such officer’s one year anniversary of starting employment with Sirenza and his two year anniversary of starting employment with Sirenza, he is terminated other than for “cause” or he resigns his employment with “good reason” (as such terms are defined in his agreement), and signs and does not revoke a general release of claims in Sirenza’s favor, which release is reasonably acceptable to Sirenza, then such officer will be entitled to continue to receive his base salary then in effect for a period of six months. Mr. Bland and Mr. Schamberger have also agreed not to engage in competitive activities with Sirenza for one year following termination of employment.

Change of Control Arrangements (Gerald Quinnell)

Sirenza has entered into a change of control and severance agreement with Mr. Quinnell which provides that, in the event that Mr. Quinnell is involuntarily terminated by Sirenza without cause within twelve months

20

following a change of control of Sirenza (with “cause” and “change of control” defined in the agreement), Mr. Quinnell is entitled to receive continued payment of the officer’s base salary for a period of six months from the date of termination or until such earlier date when the officer obtains full-time employment in a senior management position with a subsequent employer. In addition, Sirenza must maintain group health, life and other insurance policies for the officer during this same six-month period. The agreements also provide that all unvested options held by Mr. Quinnell shall accelerate in full automatically upon a change of control of Sirenza. Except as described above, the agreements specify that the employment relationship is at-will, either party may terminate the employment relationship with no notice, and the officer is entitled to no severance for any termination other than in connection with a change of control.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

The Company’s Compensation Committee consists of Mr. Bumgarner and Mr. Skrzypczak. No member of the Compensation Committee was an employee of the Company or its subsidiaries during 2004 and no member was a former officer of the Company or its subsidiaries. None of the Company’s executive officers serves as a director or member of the Compensation Committee (or other board committee performing equivalent functions) of another entity that has one or more executive officers serving on the Company’s Board of Directors or Compensation Committee.

21

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board of Directors establishes the general compensation policies of the Company and the specific compensation levels for the Chief Executive Officer and other executive officers of the Company. Additionally, the Compensation Committee is routinely consulted to approve the compensation of a newly hired executive or of an executive whose scope of responsibility has changed significantly. The Compensation Committee is composed of two independent non-employee directors who have no interlocking relationships as defined by the Securities and Exchange Commission. Although Robert Van Buskirk, the Company’s President and Chief Executive Officer, is generally invited to attend the meetings of the Compensation Committee, he does not attend meetings or participate in deliberations that relate to his own compensation.

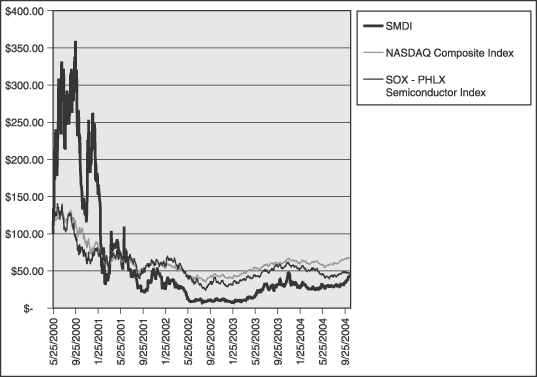

General Compensation Policy