Exhibit 99.10

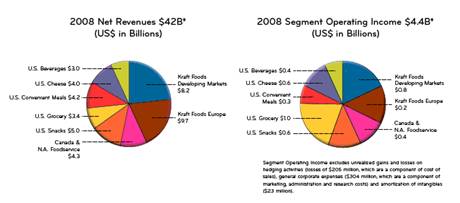

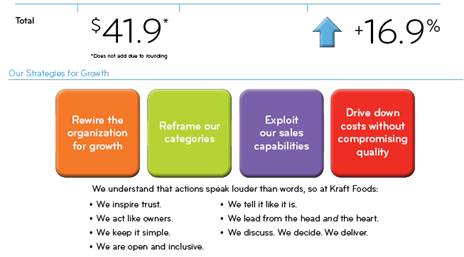

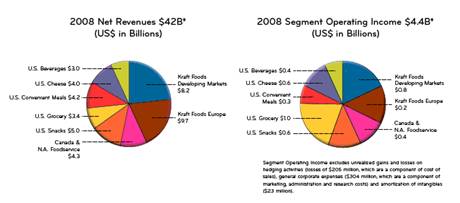

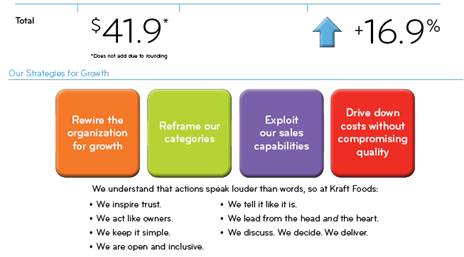

We are the world’s second largest food company with annual revenues of $42 billion

| | • | | Millions of times a day, in about 150 countries, consumers reach for their favorite Kraft Foods brands. And, in the U.S., our products are present in more than 99 percent of households. |

| | • | | We proudly market nine brands with revenues exceeding $1 billion, includingKraft,Jacobs, LU,Maxwell House,Milka,Nabiscoand itsOreobrand, Philadelphia, and Oscar Mayer.More than 50 additional brands have revenues greater than $100 million. More than 40 of our brands are at least 100 years old. |

| | • | | More than 80 percent of our revenues come from products that hold the No. 1 share position in their respective categories. |

| | • | | Our approximately 100,000 employees work tirelessly to make delicious foods consumers can feel great about. We make our products at 168 company-owned manufacturing and processing facilities worldwide and with selected co-manufacturers. |

| | • | | Kraft Foods has had a presence in the UK for 85 years having opened its first European sales office in London in 1924. But in terms of brand history, it can trace its UK roots back to 1767, which is whenTerry’s began as a business (Kraft Foods acquired this brand nearly 20 years ago). |

| | • | | Our key brands in the UK areKenco, Carte Noire, Dairylea, Philadelphia, Terry’s, Toblerone, Oreo and Ritz. |

| | • | | For 25 years, Cheltenham has been the UK headquarters of Kraft Foods. The Banbury site boasts one of the world’s largest soluble coffee facilities manufacturingKenco,Maxwell House andMellow Bird’s soluble coffees, yielding some 11 billion cups of coffee a year. Kraft Foods employs around 1,500 people in the UK. |

| | • | | Since 1997, we have provided more than 1 billion servings of food as part of our program to fight hunger and support healthy lifestyles worldwide. |

| | • | | Our company is a member of the Dow Jones Industrial Average, Standard & Poor’s 500, the Dow Jones Sustainability Index and Ethibel Sustainability Index. |

| | • | | To learn more about the company’s sustainability initiatives, visithttp://kraftfoodscompany.com/About/sustainability. |

| | • | | To learn more about Kraft Foods, please visithttp://www.kraftfoodscompany.com. |

Top Institutional Holders*

(Shares in Millions)

| | | | | |

Name | | Shares | | % of KFT | |

Berkshire Hathaway, Inc. | | 138.3 | | 9.4 | % |

State Street Global Advisors | | 77.0 | | 5.2 | % |

Barclays Global Investors NA | | 56.8 | | 3.9 | % |

Vanguard Group, Inc. | | 47.1 | | 3.2 | % |

Capital World Investors | | 46.4 | | 3.2 | % |

Trian Fund Management L.P. | | 34.4 | | 2.3 | % |

Morgan Stanley & Co., Inc. | | 27.9 | | 1.9 | % |

Barrow, Hanley, Mewhinney & Strauss, Inc. | | 24.9 | | 1.7 | % |

Bank of New York Mellon | | 20.9 | | 1.4 | % |

Fidelity Management & Research | | 17.9 | | 1.2 | % |

| * | As of December 31, 2008 per 13F filings |

1

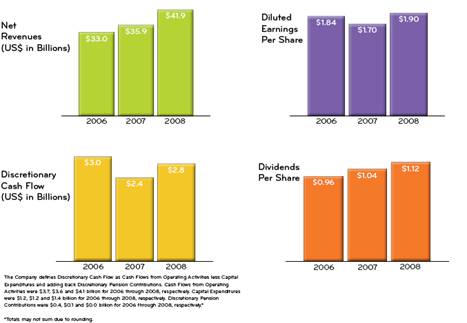

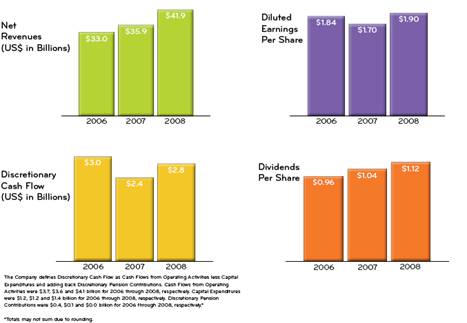

Financial Trends

Kraft Foods at a Glance — 2008 Consumer Sector Data

2

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements regarding expected future earnings, revenues and cost savings and other such items, based on our plans, estimates and projections. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those predicted in any such forward-looking statements. Such factors include but are not limited to, continued volatility of input costs, pricing actions, increased competition, our ability to differentiate our products from private label products, unanticipated expenses such as litigation or legal settlement expenses, our indebtedness and ability to pay our indebtedness, the shift in our product mix to lower margin offerings, risks from operating internationally, tax law changes, the possibility that our proposed combination with Cadbury plc will not be pursued, failure to obtain necessary regulatory approvals or required financing or to satisfy any of the other conditions to the combination, adverse effects on the market price of our common stock and on our operating results because of a failure to complete the combination, failure to realize the expected benefits of the combination, negative effects of announcement or consummation of the combination on the market price of our common stock, significant transaction costs and/or unknown liabilities and general economic and business conditions that affect the combined companies following the combination and the risk factors set forth in our filings with the US Securities and Exchange Commission (“SEC”), including our most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this document except as required by applicable law or regulation.

ADDITIONAL U.S.-RELATED INFORMATION

This document is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Cadbury plc or Kraft Foods. Subject to future developments, we may file a registration statement and/or tender offer documents with the SEC in connection with the proposed combination.Cadbury plc shareholders should read those filings, and any other filings made by us with the SEC in connection with the proposed combination, as they will contain important information.Those documents, if and when filed, as well as our other public filings with the SEC may be obtained without charge at the SEC’s website atwww.sec.gov and at our web site atwww.kraftfoodscompany.com.

3