Exhibit 99.4

KRAFT FOODS PROPOSES COMBINATION WITH CADBURY PLC; BUILDING ON A

GLOBAL POWERHOUSE IN SNACKS, CONFECTIONERY AND QUICK MEALS

| | | | |

Companies | | Kraft Foods | | Cadbury plc |

| Ticker | | NYSE: KFT | | LSE: CBRY |

| | |

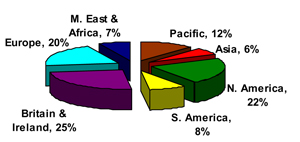

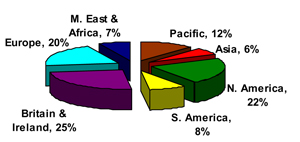

| Description | | Kraft Foods is the world’s second largest food company with annual revenues of $42 billion. The company’s portfolio of brands is available in 150 countries around the globe. Of its brands, more than 40 are at least 100 years old, nine brands have revenue exceeding $1 billion and more than 50 additional brands have revenues greater than $100 million. Headquartered near Chicago, Illinois, the company has approximately 100,000 employees, with products manufactured at 168 facilities worldwide. | | With an almost 200 year history, Cadbury plc is one of the world’s largest confectionery companies with No. 1 or No. 2 positions in more than 20 of the world’s 50 biggest confectionery markets. It also has the largest and most broadly spread emerging markets business of any confectionery company. Cadbury plc employs approximately 45,000 people around the world with direct operations in more than 60 countries. The company’s business is split into seven international units: Britain and Ireland, Europe, Middle East and Africa (MEA), North America, South America, Asia and Pacific. |

| | |

| | http://www.kraftfoodscompany.com | | http://www.cadbury.com |

| | |

| Key Brands | |  | |  |

| | |

| Employees | | Approximately 100,000 | | Approximately 45,000 |

| | |

| 2008 Revenues | | $42 Billion | | $9 Billion |

| |

| Combined Company | | Revenues: Approximately $50 Billion |

1

KRAFT FOODS PROPOSES COMBINATION WITH CADBURY PLC; BUILDING ON A

GLOBAL POWERHOUSE IN SNACKS, CONFECTIONERY AND QUICK MEALS

| | | | |

Companies | | Kraft Foods | | Cadbury plc |

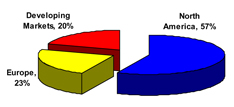

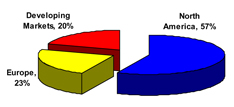

| Geographic Breakdown by 2008 Revenues | |  | |  |

| | | | |

| |

Strategic Rationale | | The transaction would create: • a company with approximately $50 billion in revenues; • a global powerhouse in snacks, confectionery and quick meals; • a geographically diversified combined business, with leading positions and significant scale in key developing markets including India, Mexico, Brazil, China and Russia; • a strong presence in instant consumption channels in both developed and developing markets, expanding the reach and margin potential of the combined business*; and • the potential for meaningful revenue synergies over time from investments in distribution, marketing and product development. In addition, there is a significant opportunity to realize pre-tax cost savings |

| | |

| Proposal Terms | | Proposal | | • 300 pence in cash and 0.2589 new Kraft Foods shares per Cadbury plc share** • Values each Cadbury plc share at 745 pence and values the entire issued share capital of Cadbury plc at £10.2 billion (based on share prices and exchange rates on September 4, 2009)** • Kraft Foods would also offer a mix and match facility under which Cadbury plc shareholders could elect, subject to availability, to vary the proportions in which they would receive cash and new Kraft Foods shares** |

| | |

| | Premium | | • Premiums to Cadbury plc’s share price: • 42% over Cadbury plc’s share price of 524 pence on July 3, 2009, prior to recent analyst suggestions regarding potential sector consolidation • 34% over Cadbury plc’s 90-day average share price of 555 pence in the period up to September 4, 2009, the last business day preceding the possible offer announcement • 31% over Cadbury plc’s closing share price of 568 pence on September 4, 2009, the last business day preceding the possible offer announcement |

2

KRAFT FOODS PROPOSES COMBINATION WITH CADBURY PLC; BUILDING ON A

GLOBAL POWERHOUSE IN SNACKS, CONFECTIONERY AND QUICK MEALS

WHERE TO FIND ADDITIONAL INFORMATION

Information for Media, Investors and Communities is available at www.transactioninfo.com/kraftfoods.

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements regarding our possible offer to combine with Cadbury plc. Such statements include statements about the benefits of the proposed combination, expected future earnings, revenues and cost savings and other such items, based on our plans, estimates and projections. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those predicted in any such forward-looking statements. Such factors include, but are not limited to, the possibility that the possible offer will not be pursued and the risk factors set forth in our filings with the US Securities and Exchange Commission (“SEC”), including our most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this document except as required by applicable law or regulation.

ADDITIONAL US-RELATED INFORMATION

This document is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Cadbury plc or Kraft Foods. Subject to future developments, Kraft Foods may file a registration statement and/or tender offer documents with the SEC in connection with the proposed combination.Cadbury plc shareholders should read those filings, and any other filings made by Kraft Foods with the SEC in connection with the proposed combination, as they will contain important information.Those documents, if and when filed, as well as Kraft Foods’ other public filings with the SEC may be obtained without charge at the SEC’s website at www.sec.gov and at Kraft Foods’ website at www.kraftfoodscompany.com.

RESPONSIBILITY STATEMENT

The directors of Kraft Foods each accept responsibility for the information contained in this document, save that the only responsibility accepted by them in respect of information in this document relating to Cadbury plc or the Cadbury Group (which has been compiled from public sources) is to ensure that such information has been correctly and fairly reproduced and presented. Subject as aforesaid, to the best of the knowledge and belief of the directors of Kraft Foods (who have taken all reasonable care to ensure that such is the case), the information contained in this document is in accordance with the facts and does not omit anything likely to affect the import of that information.

| * | Nothing in this document is intended to be a profit forecast and the statements in this document should not be interpreted to mean that the earnings per Kraft Foods share for the current or future financial periods will necessarily be greater than those for the relevant preceding financial period. |

| ** | Kraft Foods reserves the right to: |

(i) make an offer at any time at a value below the equivalent of 300 pence in cash and 0.2589 of new Kraft Foods shares per Cadbury plc share (taking the value of a Kraft Foods share and the exchange rate at the date of announcement of a firm intention to make an offer) with the agreement and recommendation of the Board of Cadbury plc or in the event that any Cadbury plc dividend is declared, made or paid (other than the announced interim dividend of 5.7 pence due to be paid by Cadbury plc on 16 October 2009); and/or

(ii) vary the form and/or mix of consideration of the possible offer.

3