UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| Investment Company Act file number: | | 811-09805 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 3 |

|

| (This Form N-CSR relates solely to the Registrant’s PGIM Jennison Focused Growth Fund, PGIM Quant Solutions Large-Cap Value Fund and PGIM Strategic Bond Fund) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 2/28/2022 |

| |

| Date of reporting period: | | 2/28/2022 |

Item 1 – Reports to Stockholders

PGIM JENNISON FOCUSED GROWTH FUND

ANNUAL REPORT

FEBRUARY 28, 2022

|

|

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery |

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, member SIPC. Jennison Associates LLC is a registered investment adviser. Both are Prudential Financial companies. © 2022 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgim.com/investments |

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Jennison Focused Growth Fund informative and useful. The report covers performance for the 12-month period that ended February 28, 2022. The global economy and markets continued to recover throughout the period from the ongoing impact of the COVID-19 pandemic. The Federal Reserve (the Fed) kept interest rates near zero to promote borrowing, while the approval of effective vaccines encouraged states to reopen their economies. Yet inflation surged to a 40-year high near the end of the period, prompting the Fed to signal it would begin raising rates to combat rising consumer prices. |

Stocks rallied for much of the period, with ongoing stimulus programs helping boost the job market and corporate profits. Equity markets rose to record levels but became much more volatile later on as investors worried that supply-chain challenges, the emergence of more contagious variants, and geopolitical uncertainty in Europe relating to Russia’s invasion of Ukraine might stall the recovery. For the period, large-cap US equities and stocks in developed foreign markets rose. Emerging market and small-cap US stocks fell.

Fixed income investors turned cautious during the period. Investment-grade bonds in the US and the overall global bond market, along with emerging market debt, posted negative returns for the period. US high yield corporate bonds posted a small gain.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is a top-10 investment manager globally with more than $1.5 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Jennison Focused Growth Fund

April 15, 2022

PGIM Jennison Focused Growth Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 2/28/22 | |

| | | One Year (%) | | Five Years (%) | | | Ten Years (%) | | | Since Inception (%) | |

| Class A | | | | | | | | | | | | | | |

| (with sales charges) | | -17.32 | | | 18.44 | | | | 14.99 | | | | — | |

| (without sales charges) | | -12.51 | | | 19.79 | | | | 15.64 | | | | — | |

| Class C | | | | | | | | | | | | | | |

| (with sales charges) | | -13.98 | | | 18.89 | | | | 14.77 | | | | — | |

| (without sales charges) | | -13.27 | | | 18.89 | | | | 14.77 | | | | — | |

| Class Z | | | | | | | | | | | | | | |

| (without sales charges) | | -12.27 | | | 20.16 | | | | 15.96 | | | | — | |

| Class R6 | | | | | | | | | | | | | | |

| (without sales charges) | | -12.19 | | | 20.23 | | | | N/A | | | | 15.89 (05/03/2012) | |

| Russell 1000® Growth Index | | | | | | | | | | | | | | |

| | 12.55 | | | 20.24 | | | | 16.97 | | | | — | |

| S&P 500 Index | |

| | | 16.38 | | | 15.17 | | | | 14.58 | | | | — | |

| | | | | | | | | | | | | | |

|

| Average Annual Total Returns as of 2/28/22 Since Inception (%) | |

| | | | | | | | | | | Class R6

(05/03/2012) | |

| Russell 1000® Growth Index | | | | | | | | 16.92 | |

| S&P 500 Index | | | | | | | | 14.54 | |

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’ inception date.

| | |

| 4 | | Visit our website at pgim.com/investments |

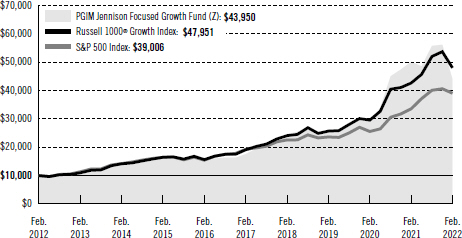

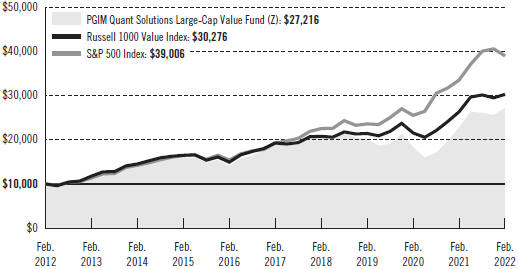

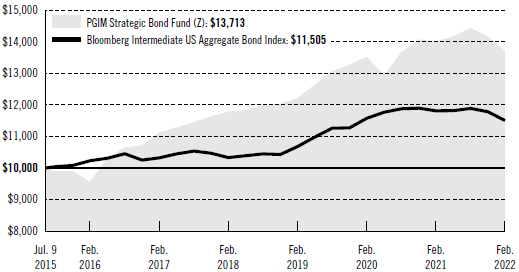

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Russell 1000 Growth Index and the S&P 500 Index by portraying the initial account values at the beginning of the 10-year period for Class Z shares (February 29, 2012) and the account values at the end of the current fiscal year (February 28, 2022), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| | | | |

PGIM Jennison Focused Growth Fund | | | 5 | |

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | | | |

| | | Class A | | Class C | | Class Z | | Class R6 |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | 1.00% on sales of $1 million or more made within 12 months of purchase | | 1.00% on sales made within 12 months of purchase | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | 0.30% (0.25% currently) | | 1.00% | | None | | None |

Benchmark Definitions

Russell 1000 Growth Index—The Russell 1000 Growth Index is an unmanaged index which contains those securities in the Russell 1000 Index with an above-average growth orientation. Companies in this Index tend to exhibit higher price-to-book ratios and price-to-earnings ratios, lower dividend yields, and higher forecasted growth rates.

S&P 500 Index*—The S&P 500 Index is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed.

*The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

| | |

| 6 | | Visit our website at pgim.com/investments |

Presentation of Fund Holdings as of 2/28/22

| | | | |

| | |

| Ten Largest Holdings | | Line of Business | | % of Net Assets |

| Amazon.com, Inc. | | Internet & Direct Marketing Retail | | 9.3% |

| Microsoft Corp. | | Software | | 9.0% |

| Tesla, Inc. | | Automobiles | | 7.3% |

| Apple, Inc. | | Technology Hardware, Storage & Peripherals | | 6.2% |

| NVIDIA Corp. | | Semiconductors & Semiconductor Equipment | | 5.3% |

| LVMH Moet Hennessy Louis Vuitton SE (France) | | Textiles, Apparel & Luxury Goods | | 5.0% |

| Alphabet, Inc. (Class A Stock) | | Interactive Media & Services | | 4.0% |

| Alphabet, Inc. (Class C Stock) | | Interactive Media & Services | | 4.0% |

| Costco Wholesale Corp. | | Food & Staples Retailing | | 3.9% |

| MercadoLibre, Inc. (Brazil) | | Internet & Direct Marketing Retail | | 3.5% |

Holdings reflect only long-term investments and are subject to change.

| | | | |

PGIM Jennison Focused Growth Fund | | | 7 | |

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Jennison Focused Growth Fund’s Class Z shares returned -12.27% in the 12-month reporting period that ended February 28, 2022, underperforming the 12.55% return of the Russell 1000 Growth Index (the Index).

What were the market conditions?

| • | | The US economy exhibited robust growth in 2021, as policymakers continued to support growth through monetary and fiscal stimulus to combat the effects of the COVID-19 pandemic. Corporate earnings remained strong, continuing their recovery from pandemic lows in 2020. |

| • | | Against this backdrop, US equity markets closed out 2021 at all-time highs. However, persistently high inflation spurred the Federal Reserve to pivot to a tightening stance late in the year, leading to a spike in Treasury yields and a general repricing of risk. These developments weighed heavily on high-valuation, high-growth stocks. |

| • | | The weakness in growth stocks spilled into the overall market in the first two months of 2022, accelerating toward the end of February, as Russia’s invasion of Ukraine led to a spike in energy and other commodity prices and introduced new risks for the global economy. |

What worked?

| • | | A number of the Fund’s top holdings in the information technology and communications services sectors provided significant positive contributions to the Fund’s returns over the reporting period. Digitization of the economy accelerated, with consumers continuing to shift toward e-commerce and streaming entertainment. Enterprises also migrated a growing share of their business functions to the cloud. Leading beneficiaries of these trends were well represented in Jennison’s portfolios, and Jennison expects them to continue to be a source of strong performance in the future. Strong performers during the period included: |

| • | | Nvidia Corp., the industry leader in advanced graphics chips, was the top contributor to the Fund’s returns. The company benefited from strong secular growth across a number of its business lines, including datacenter, automotive, and gaming. The company’s results repeatedly exceeded consensus estimates during the period. |

| • | | Microsoft Corp. and Alphabet Inc. were the strongest performers among the Fund’s mega-cap technology holdings, gaining ground on impressive growth and profitability from their diversified portfolios of consumer and enterprise businesses. |

| • | | In the consumer space, luxury goods giant LVMH Moet Hennessy Louis Vuitton and wholesale retailer Costco Wholesale Corp. were also among the top contributors to performance as the strength of their respective franchises and loyal customer bases supported revenue and margin growth during a challenging period. |

| | |

| 8 | | Visit our website at pgim.com/investments |

What didn’t work?

| • | | A meaningful correction in the stock prices of many of the Fund’s high-growth holdings that had less-visible, short-term profitability drove most of the underperformance during the reporting period. Many of these companies made the strategic decision to reinvest cash flows into building their franchises rather than report current profits. While Jennison believes these companies will prove profitable over the long term, the uncertainty associated with those future profits led to significant valuation compression late in 2021 and early 2022 as interest rate expectations rose. |

| • | | The Fund’s performance also lagged due to holdings that reported results below expectations or struggled with executing their business plans in the difficult operating environment created by the pandemic. For some technology and e-commerce companies, this disappointment resulted partly from the complexity of comparing recent financial results to the elevated growth rates that they reported earlier in the pandemic. Jennison believes this comparison issue will become less material in the second half of 2022. |

| • | | It is worth noting that the Fund’s underperformance over the period was the largest in the strategy’s history. To put this period in context, the previous period provided the largest outperformance in the strategy’s history. These significant swings reflect, in large part, the effects of the pandemic. Jennison remains confident that strong secular growth patterns of the Fund’s holdings will drive share prices higher over time and lead to strong returns for long-term investors. |

Current outlook

The current economic and geopolitical backdrop is creating significant uncertainty with respect to the path of inflation and interest rates. Moreover, the ongoing crisis in Ukraine is contributing to elevated risk aversion and may have a dampening effect on global growth, raising the risk of recession in certain regions. Jennison would not be surprised to see continued pressure on high-valuation, high-growth stocks in the near term, as investors reprice risk and seek clarity regarding the post-pandemic growth rates of companies that have benefited disproportionately from recent consumer and technological trends. That said, Jennison believes the challenging comparisons in financial results that many growth stocks currently face will ease over the course of 2022, and that the market will once again assign an appropriate valuation premium to the durable, secular growth opportunities represented in the Fund.

* This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s assigned index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

| | | | |

PGIM Jennison Focused Growth Fund | | | 9 | |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended February 28, 2022. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

| | |

| 10 | | Visit our website at pgim.com/investments |

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | | |

PGIM Jennison Focused Growth Fund | | Beginning

Account Value

September 1, 2021 | | Ending

Account Value

February 28, 2022 | | Annualized

Expense

Ratio Based on

the

Six-Month Period | | Expenses Paid

During the

Six-Month

Period* |

| Class A | | Actual | | $1,000.00 | | $ 788.20 | | 1.06% | | $4.70 |

| | Hypothetical | | $1,000.00 | | $1,019.54 | | 1.06% | | $5.31 |

| Class C | | Actual | | $1,000.00 | | $ 784.40 | | 1.80% | | $7.96 |

| | Hypothetical | | $1,000.00 | | $1,015.87 | | 1.80% | | $9.00 |

| Class Z | | Actual | | $1,000.00 | | $ 789.10 | | 0.75% | | $3.33 |

| | Hypothetical | | $1,000.00 | | $1,021.08 | | 0.75% | | $3.76 |

| Class R6 | | Actual | | $1,000.00 | | $ 789.60 | | 0.67% | | $2.97 |

| | | Hypothetical | | $1,000.00 | | $1,021.47 | | 0.67% | | $3.36 |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 181 days in the six-month period ended February 28, 2022, and divided by the 365 days in the Fund’s fiscal year ended February 28, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

PGIM Jennison Focused Growth Fund | | | 11 | |

Schedule of Investments

as of February 28, 2022

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

LONG-TERM INVESTMENTS 97.9% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Automobiles 7.3% | | | | | | | | |

Tesla, Inc.* | | | 153,655 | | | $ | 133,745,922 | |

| | |

Entertainment 2.5% | | | | | | | | |

Netflix, Inc.* | | | 71,322 | | | | 28,137,955 | |

ROBLOX Corp. (Class A Stock)*(a) | | | 190,220 | | | | 9,809,645 | |

Sea Ltd. (Taiwan), ADR* | | | 53,511 | | | | 7,791,202 | |

| | | | | | | | |

| | |

| | | | | | | 45,738,802 | |

| | |

Food & Staples Retailing 3.9% | | | | | | | | |

Costco Wholesale Corp. | | | 136,846 | | | | 71,057,285 | |

| | |

Health Care Equipment & Supplies 2.1% | | | | | | | | |

Align Technology, Inc.* | | | 76,922 | | | | 39,342,526 | |

| | |

Health Care Providers & Services 2.0% | | | | | | | | |

UnitedHealth Group, Inc. | | | 77,877 | | | | 37,059,328 | |

| | |

Hotels, Restaurants & Leisure 2.8% | | | | | | | | |

Airbnb, Inc. (Class A Stock)* | | | 341,525 | | | | 51,737,622 | |

| | |

Interactive Media & Services 13.1% | | | | | | | | |

Alphabet, Inc. (Class A Stock)* | | | 27,217 | | | | 73,516,928 | |

Alphabet, Inc. (Class C Stock)* | | | 27,248 | | | | 73,510,199 | |

Match Group, Inc.*(a) | | | 325,106 | | | | 36,246,068 | |

Snap, Inc. (Class A Stock)*(a) | | | 715,717 | | | | 28,585,737 | |

ZoomInfo Technologies, Inc.* | | | 523,910 | | | | 28,652,638 | |

| | | | | | | | |

| | |

| | | | | | | 240,511,570 | |

| | |

Internet & Direct Marketing Retail 12.8% | | | | | | | | |

Amazon.com, Inc.* | | | 55,259 | | | | 169,714,756 | |

MercadoLibre, Inc. (Brazil)* | | | 57,384 | | | | 64,651,684 | |

| | | | | | | | |

| | |

| | | | | | | 234,366,440 | |

| | |

IT Services 8.8% | | | | | | | | |

Adyen NV (Netherlands), 144A* | | | 27,773 | | | | 57,016,948 | |

Mastercard, Inc. (Class A Stock) | | | 143,179 | | | | 51,661,847 | |

Shopify, Inc. (Canada) (Class A Stock)* | | | 47,176 | | | | 32,752,410 | |

Snowflake, Inc. (Class A Stock)* | | | 77,989 | | | | 20,718,558 | |

| | | | | | | | |

| | |

| | | | | | | 162,149,763 | |

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 13

Schedule of Investments (continued)

as of February 28, 2022

| | | | | | | | |

| | |

Description | | Shares | | | Value | |

| | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Personal Products 3.0% | | | | | | | | |

Estee Lauder Cos., Inc. (The) (Class A Stock) | | | 185,876 | | | $ | 55,080,635 | |

| | |

Pharmaceuticals 2.1% | | | | | | | | |

Eli Lilly & Co. | | | 157,211 | | | | 39,294,889 | |

| | |

Semiconductors & Semiconductor Equipment 5.3% | | | | | | | | |

NVIDIA Corp. | | | 401,739 | | | | 97,964,055 | |

| | |

Software 15.0% | | | | | | | | |

Atlassian Corp. PLC (Class A Stock)* | | | 110,822 | | | | 33,880,502 | |

HubSpot, Inc.* | | | 53,648 | | | | 28,165,200 | |

Microsoft Corp. | | | 554,409 | | | | 165,651,865 | |

salesforce.com, Inc.* | | | 223,054 | | | | 46,959,559 | |

| | | | | | | | |

| | |

| | | | | | | 274,657,126 | |

| | |

Technology Hardware, Storage & Peripherals 6.2% | | | | | | | | |

Apple, Inc. | | | 689,109 | | | | 113,785,678 | |

| | |

Textiles, Apparel & Luxury Goods 11.0% | | | | | | | | |

Lululemon Athletica, Inc.* | | | 173,736 | | | | 55,585,096 | |

LVMH Moet Hennessy Louis Vuitton SE (France) | | | 123,847 | | | | 91,107,011 | |

NIKE, Inc. (Class B Stock) | | | 402,249 | | | | 54,927,101 | |

| | | | | | | | |

| | |

| | | | | | | 201,619,208 | |

| | | | | | | | |

| | |

TOTAL LONG-TERM INVESTMENTS

(cost $1,348,921,392) | | | | | | | 1,798,110,849 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENTS 2.4% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUND 0.7% | | | | | | | | |

PGIM Institutional Money Market Fund

(cost $13,334,208; includes $13,333,598 of cash collateral for securities on loan)(b)(wa) | | | 13,344,100 | | | | 13,333,425 | |

| | | | | | | | |

See Notes to Financial Statements.

14

| | | | | | | | |

| | |

| Description | | Shares | | | Value | |

| | |

UNAFFILIATED FUND 1.7% | | | | | | | | |

Dreyfus Government Cash Management (Institutional Shares)

(cost $30,066,674) | | | 30,066,674 | | | $ | 30,066,674 | |

| | | | | | | | |

| | |

TOTAL SHORT-TERM INVESTMENTS

(cost $43,400,882) | | | | | | | 43,400,099 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS 100.3%

(cost $1,392,322,274) | | | | | | | 1,841,510,948 | |

Liabilities in excess of other assets (0.3)% | | | | | | | (5,723,696 | ) |

| | | | | | | | |

| | |

NET ASSETS 100.0% | | | | | | $ | 1,835,787,252 | |

| | | | | | | | |

Below is a list of the abbreviation(s) used in the annual report:

| | 144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers. |

ADR—American Depositary Receipt

LIBOR—London Interbank Offered Rate

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $13,335,118; cash collateral of $13,333,598 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (wa) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the PGIM Core Ultra Short Bond Fund and PGIM Institutional Money Market Fund, if applicable. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of February 28, 2022 in valuing such portfolio securities:

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 15

Schedule of Investments (continued)

as of February 28, 2022

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Assets | | | | | | | | | | | | |

Long-Term Investments | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Automobiles | | $ | 133,745,922 | | | $ | — | | | $ | — | |

Entertainment | | | 45,738,802 | | | | — | | | | — | |

Food & Staples Retailing | | | 71,057,285 | | | | — | | | | — | |

Health Care Equipment & Supplies | | | 39,342,526 | | | | — | | | | — | |

Health Care Providers & Services | | | 37,059,328 | | | | — | | | | — | |

Hotels, Restaurants & Leisure | | | 51,737,622 | | | | — | | | | — | |

Interactive Media & Services | | | 240,511,570 | | | | — | | | | — | |

Internet & Direct Marketing Retail | | | 234,366,440 | | | | — | | | | — | |

IT Services | | | 105,132,815 | | | | 57,016,948 | | | | — | |

Personal Products | | | 55,080,635 | | | | — | | | | — | |

Pharmaceuticals | | | 39,294,889 | | | | — | | | | — | |

Semiconductors & Semiconductor Equipment | | | 97,964,055 | | | | — | | | | — | |

Software | | | 274,657,126 | | | | — | | | | — | |

Technology Hardware, Storage & Peripherals | | | 113,785,678 | | | | — | | | | — | |

Textiles, Apparel & Luxury Goods | | | 110,512,197 | | | | 91,107,011 | | | | — | |

Short-Term Investments | | | | | | | | | | | | |

Affiliated Mutual Fund | | | 13,333,425 | | | | — | | | | — | |

Unaffiliated Fund | | | 30,066,674 | | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total | | $ | 1,693,386,989 | | | $ | 148,123,959 | | | $ | — | |

| | | | | | | | | | | | |

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of February 28, 2022 were as follows (unaudited):

| | | | |

Software | | | 15.0 | % |

Interactive Media & Services | | | 13.1 | |

Internet & Direct Marketing Retail | | | 12.8 | |

Textiles, Apparel & Luxury Goods | | | 11.0 | |

IT Services | | | 8.8 | |

Automobiles | | | 7.3 | |

Technology Hardware, Storage & Peripherals | | | 6.2 | |

Semiconductors & Semiconductor Equipment | | | 5.3 | |

Food & Staples Retailing | | | 3.9 | |

Personal Products | | | 3.0 | |

Hotels, Restaurants & Leisure | | | 2.8 | |

Entertainment | | | 2.5 | |

| | | | |

Health Care Equipment & Supplies | | | 2.1 | % |

Pharmaceuticals | | | 2.1 | |

Health Care Providers & Services | | | 2.0 | |

Unaffiliated Fund | | | 1.7 | |

Affiliated Mutual Fund (0.7% represents investments purchased with collateral from securities on loan) | | | 0.7 | |

| | | | |

| | | 100.3 | |

Liabilities in excess of other assets | | | (0.3 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit

See Notes to Financial Statements.

16

offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| | | | | | |

| Description | | Gross Market

Value of

Recognized

Assets/(Liabilities) | | Collateral Pledged/(Received)(1) | | Net

Amount |

Securities on Loan | | $13,335,118 | | $(13,333,598) | | $1,520 |

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 17

Statement of Assets and Liabilities

as of February 28, 2022

| | | | |

| |

Assets | | | | |

| |

Investments at value, including securities on loan of $13,335,118: | | | | |

Unaffiliated investments (cost $1,378,988,066) | | $ | 1,828,177,523 | |

Affiliated investments (cost $13,334,208) | | | 13,333,425 | |

Receivable for investments sold | | | 10,625,052 | |

Receivable for Fund shares sold | | | 2,777,234 | |

Dividends receivable | | | 610,278 | |

Tax reclaim receivable | | | 173,213 | |

Prepaid expenses and other assets | | | 56,855 | |

| | | | |

| |

Total Assets | | | 1,855,753,580 | |

| | | | |

| |

Liabilities | | | | |

| |

Payable to broker for collateral for securities on loan | | | 13,333,598 | |

Payable for Fund shares purchased | | | 5,038,215 | |

Management fee payable | | | 638,639 | |

Accrued expenses and other liabilities | | | 596,805 | |

Distribution fee payable | | | 257,188 | |

Affiliated transfer agent fee payable | | | 93,679 | |

Trustees’ fees payable | | | 8,204 | |

| | | | |

| |

Total Liabilities | | | 19,966,328 | |

| | | | |

| |

Net Assets | | $ | 1,835,787,252 | |

| | | | |

| |

| | | | | |

| |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 96,838 | |

Paid-in capital in excess of par | | | 1,508,692,074 | |

Total distributable earnings (loss) | | | 326,998,340 | |

| | | | |

| |

Net assets, February 28, 2022 | | $ | 1,835,787,252 | |

| | | | |

See Notes to Financial Statements.

18

| | | | |

Class A | | | | |

| |

Net asset value and redemption price per share, ($1,078,255,962 ÷ 58,421,480 shares of beneficial interest issued and outstanding) | | | $18.46 | |

Maximum sales charge (5.50% of offering price) | | | 1.07 | |

| |

Maximum offering price to public | | | $19.53 | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share, | | | | |

($60,204,535 ÷ 4,632,419 shares of beneficial interest issued and outstanding) | | | $13.00 | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share, ($538,779,898 ÷ 26,108,942 shares of beneficial interest issued and outstanding) | | | $20.64 | |

| |

Class R6 | | | | |

| |

Net asset value, offering price and redemption price per share, ($158,546,857 ÷ 7,674,906 shares of beneficial interest issued and outstanding) | | | $20.66 | |

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 19

Statement of Operations

Year Ended February 28, 2022

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income (net of $100,475 foreign withholding tax) | | $ | 2,731,041 | |

Income from securities lending, net (including affiliated income of $14,729) | | | 75,666 | |

Affiliated dividend income | | | 9,242 | |

| | | | |

| |

Total income | | | 2,815,949 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 9,836,659 | |

Distribution fee(a) | | | 2,567,385 | |

Transfer agent’s fees and expenses (including affiliated expense of $389,243)(a) | | | 1,624,906 | |

Shareholders’ reports | | | 168,077 | |

Custodian and accounting fees | | | 125,105 | |

Registration fees(a) | | | 97,590 | |

SEC registration fees | | | 76,873 | |

Legal fees and expenses | | | 34,252 | |

Audit fee | | | 28,907 | |

Trustees’ fees | | | 26,113 | |

Miscellaneous | | | 41,610 | |

| | | | |

Total expenses | | | 14,627,477 | |

Less: Fee waiver and/or expense reimbursement(a) | | | (707,440 | ) |

Distribution fee waiver(a) | | | (326,787 | ) |

| | | | |

| |

Net expenses | | | 13,593,250 | |

| | | | |

| |

Net investment income (loss) | | | (10,777,301 | ) |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $18,000) | | | (23,234,279 | ) |

Foreign currency transactions | | | 2,197 | |

| | | | |

| |

| | | (23,232,082 | ) |

| | | | |

| |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (including affiliated of $(20,311)) | | | (314,682,667 | ) |

Foreign currencies | | | (6,973 | ) |

| | | | |

| |

| | | (314,689,640 | ) |

| | | | |

| |

Net gain (loss) on investment and foreign currency transactions | | | (337,921,722 | ) |

| | | | |

| |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | (348,699,023 | ) |

| | | | |

(a) Class specific expenses and waivers were as follows:

| | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class Z | | | Class R6 | |

Distribution fee | | | 1,960,721 | | | | 606,664 | | | | — | | | | — | |

Transfer agent’s fees and expenses | | | 923,679 | | | | 62,175 | | | | 637,345 | | | | 1,707 | |

Registration fees | | | 31,630 | | | | 15,559 | | | | 26,983 | | | | 23,418 | |

Fee waiver and/or expense reimbursement | | | (273,658 | ) | | | (17,756 | ) | | | (343,974 | ) | | | (72,052 | ) |

Distribution fee waiver | | | (326,787 | ) | | | — | | | | — | | | | — | |

See Notes to Financial Statements.

20

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | Year Ended

February 28, | | | |

| | | |

| | | 2022 | | | 2021 | | | |

| | | |

Increase (Decrease) in Net Assets | | | | | | | | | | |

| | | |

Operations | | | | | | | | | | |

Net investment income (loss) | | $ | (10,777,301 | ) | | $ | (6,768,666 | ) | | |

Net realized gain (loss) on investment and foreign currency transactions | | | (23,232,082 | ) | | | 156,829,165 | | | |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | (314,689,640 | ) | | | 314,825,601 | | | |

| | | | | | | | | | |

| | | |

Net increase (decrease) in net assets resulting from operations | | | (348,699,023 | ) | | | 464,886,100 | | | |

| | | | | | | | | | |

| | | |

Dividends and Distributions | | | | | | | | | | |

Distributions from distributable earnings | | | | | | | | | | |

Class A | | | (69,905,533 | ) | | | (39,594,520 | ) | | |

Class C | | | (10,492,498 | ) | | | (6,725,448 | ) | | |

Class Z | | | (69,936,125 | ) | | | (44,456,131 | ) | | |

Class R6 | | | (24,598,404 | ) | | | (6,765,090 | ) | | |

| | | | | | | | | | |

| | | |

| | | (174,932,560 | ) | | | (97,541,189 | ) | | |

| | | | | | | | | | |

Fund share transactions (Net of share conversions) | | | | | | | | | | |

Net proceeds from shares sold | | | 315,674,446 | | | | 434,815,164 | | | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 165,611,664 | | | | 91,578,722 | | | |

Net asset value of shares issued in merger | | | 1,090,237,618 | | | | — | | | |

Cost of shares purchased | | | (488,250,524 | ) | | | (291,946,361 | ) | | |

| | | | | | | | | | |

| | | |

Net increase (decrease) in net assets from Fund share transactions | | | 1,083,273,204 | | | | 234,447,525 | | | |

| | | | | | | | | | |

Total increase (decrease) | | | 559,641,621 | | | | 601,792,436 | | | |

| | | |

Net Assets: | | | | | | | | | | |

| | | |

Beginning of year | | | 1,276,145,631 | | | | 674,353,195 | | | |

| | | | | | | | | | |

| | | |

End of year | | $ | 1,835,787,252 | | | $ | 1,276,145,631 | | | |

| | | | | | | | | | |

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 21

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Class A Shares | | | | | | | | | | | | | | | |

| | | | | | Year Ended February 28/29, | | | | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Year | | | $24.34 | | | | $15.84 | | | | $14.91 | | | | $15.46 | | | | $12.42 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.20 | ) | | | (0.18 | ) | | | (0.11 | ) | | | (0.08 | ) | | | (0.09 | ) |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | (2.10 | ) | | | 10.85 | | | | 1.97 | | | | 1.01 | | | | 4.75 | |

Total from investment operations | | | (2.30 | ) | | | 10.67 | | | | 1.86 | | | | 0.93 | | | | 4.66 | |

Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | (3.58 | ) | | | (2.17 | ) | | | (0.93 | ) | | | (1.48 | ) | | | (1.62 | ) |

Net asset value, end of year | | | $18.46 | | | | $24.34 | | | | $15.84 | | | | $14.91 | | | | $15.46 | |

Total Return(b): | | | (12.51 | )% | | | 67.82 | % | | | 12.47 | % | | | 6.66 | % | | | 40.04 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 1,078,256 | | | $ | 485,590 | | | $ | 292,554 | | | $ | 245,528 | | | $ | 226,316 | |

Average net assets (000) | | | $653,573 | | | $ | 393,844 | | | $ | 283,060 | | | $ | 234,841 | | | $ | 195,791 | |

Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

Expenses after waivers and/or expense reimbursement | | | 1.05 | % | | | 1.07 | % | | | 1.10 | % | | | 1.15 | % | | | 1.24 | % |

Expenses before waivers and/or expense reimbursement | | | 1.14 | % | | | 1.15 | % | | | 1.19 | % | | | 1.27 | % | | | 1.43 | % |

Net investment income (loss) | | | (0.86 | )% | | | (0.84 | )% | | | (0.66 | )% | | | (0.52 | )% | | | (0.62 | )% |

Portfolio turnover rate(e) | | | 67 | % | | | 74 | % | | | 72 | % | | | 52 | % | | | 87 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Effective October 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

22

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Class C Shares | | | | | | | | | | | | | | | |

| | | | | | Year Ended February 28/29, | | | | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Year | | | $18.25 | | | | $12.29 | | | | $11.84 | | | | $12.67 | | | | $10.50 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.28 | ) | | | (0.25 | ) | | | (0.17 | ) | | | (0.15 | ) | | | (0.16 | ) |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | (1.39 | ) | | | 8.38 | | | | 1.55 | | | | 0.80 | | | | 3.95 | |

Total from investment operations | | | (1.67 | ) | | | 8.13 | | | | 1.38 | | | | 0.65 | | | | 3.79 | |

Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | (3.58 | ) | | | (2.17 | ) | | | (0.93 | ) | | | (1.48 | ) | | | (1.62 | ) |

Net asset value, end of year | | | $13.00 | | | | $18.25 | | | | $12.29 | | | | $11.84 | | | | $12.67 | |

Total Return(b): | | | (13.27 | )% | | | 66.59 | % | | | 11.73 | % | | | 5.86 | % | | | 39.02 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 60,205 | | | $ | 59,185 | | | $ | 39,542 | | | $ | 66,687 | | | $ | 56,630 | |

Average net assets (000) | | $ | 60,666 | | | $ | 51,793 | | | $ | 44,576 | | | $ | 60,750 | | | $ | 49,905 | |

Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

Expenses after waivers and/or expense reimbursement | | | 1.79 | % | | | 1.79 | % | | | 1.82 | % | | | 1.89 | % | | | 1.99 | % |

Expenses before waivers and/or expense reimbursement | | | 1.82 | % | | | 1.82 | % | | | 1.86 | % | | | 1.95 | % | | | 2.14 | % |

Net investment income (loss) | | | (1.61 | )% | | | (1.56 | )% | | | (1.39 | )% | | | (1.26 | )% | | | (1.37 | )% |

Portfolio turnover rate(e) | | | 67 | % | | | 74 | % | | | 72 | % | | | 52 | % | | | 87 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Effective October 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 23

Financial Highlights (continued)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Class Z Shares | | | | | | | | | | | | | | | |

| | | | | | Year Ended February 28/29, | | | | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Year | | | $26.76 | | | | $17.23 | | | | $16.09 | | | | $16.52 | | | | $13.14 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.15 | ) | | | (0.12 | ) | | | (0.05 | ) | | | (0.03 | ) | | | (0.05 | ) |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | (2.39 | ) | | | 11.82 | | | | 2.12 | | | | 1.08 | | | | 5.05 | |

Total from investment operations | | | (2.54 | ) | | | 11.70 | | | | 2.07 | | | | 1.05 | | | | 5.00 | |

Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | (3.58 | ) | | | (2.17 | ) | | | (0.93 | ) | | | (1.48 | ) | | | (1.62 | ) |

Net asset value, end of year | | | $20.64 | | | | $26.76 | | | | $17.23 | | | | $16.09 | | | | $16.52 | |

Total Return(b): | | | (12.27 | )% | | | 68.34 | % | | | 12.87 | % | | | 6.98 | % | | | 40.46 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 538,780 | | | $ | 593,796 | | | $ | 316,686 | | | $ | 278,810 | | | $ | 162,297 | |

Average net assets (000) | | $ | 587,500 | | | $ | 453,422 | | | $ | 311,632 | | | $ | 227,690 | | | $ | 116,296 | |

Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

Expenses after waivers and/or expense reimbursement | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.82 | % | | | 0.99 | % |

Expenses before waivers and/or expense reimbursement | | | 0.81 | % | | | 0.81 | % | | | 0.83 | % | | | 0.90 | % | | | 1.12 | % |

Net investment income (loss) | | | (0.56 | )% | | | (0.52 | )% | | | (0.31 | )% | | | (0.21 | )% | | | (0.37 | )% |

Portfolio turnover rate(e) | | | 67 | % | | | 74 | % | | | 72 | % | | | 52 | % | | | 87 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Effective October 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

24

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Class R6 Shares | | | | | | | | | | | | | | | |

| | | | | | Year Ended February 28/29, | | | | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

Per Share Operating Performance(a): | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Year | | | $26.76 | | | | $17.21 | | | | $16.07 | | | | $16.49 | | | | $13.12 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.13 | ) | | | (0.11 | ) | | | (0.04 | ) | | | (0.02 | ) | | | (0.06 | ) |

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | (2.39 | ) | | | 11.83 | | | | 2.11 | | | | 1.08 | | | | 5.05 | |

Total from investment operations | | | (2.52 | ) | | | 11.72 | | | | 2.07 | | | | 1.06 | | | | 4.99 | |

Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | (3.58 | ) | | | (2.17 | ) | | | (0.93 | ) | | | (1.48 | ) | | | (1.62 | ) |

Net asset value, end of year | | | $20.66 | | | | $26.76 | | | | $17.21 | | | | $16.07 | | | | $16.49 | |

Total Return(b): | | | (12.19 | )% | | | 68.44 | % | | | 13.01 | % | | | 7.06 | % | | | 40.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $158,547 | | | | $137,574 | | | | $22,843 | | | | $18,222 | | | | $4,688 | |

Average net assets (000) | | | $180,823 | | | | $58,252 | | | | $21,320 | | | | $11,478 | | | | $2,037 | |

Ratios to average net assets(c)(d): | | | | | | | | | | | | | | | | | | | | |

Expenses after waivers and/or expense reimbursement | | | 0.67 | % | | | 0.67 | % | | | 0.67 | % | | | 0.73 | % | | | 0.99 | % |

Expenses before waivers and/or expense reimbursement | | | 0.71 | % | | | 0.75 | % | | | 0.78 | % | | | 0.86 | % | | | 1.53 | % |

Net investment income (loss) | | | (0.48 | )% | | | (0.46 | )% | | | (0.23 | )% | | | (0.13 | )% | | | (0.37 | )% |

Portfolio turnover rate(e) | | | 67 | % | | | 74 | % | | | 72 | % | | | 52 | % | | | 87 | % |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (c) | Effective October 1, 2017, class specific expenses include transfer agent fees and expenses and registration fees, which are charged to their respective share class. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

PGIM Jennison Focused Growth Fund 25

Notes to Financial Statements

1. Organization

Prudential Investment Portfolios 3 (the “Registered Investment Company” or “RIC”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The RIC is organized as a Delaware Statutory Trust. These financial statements relate only to the PGIM Jennison Focused Growth Fund (the “Fund”), a series of the RIC. The Fund is classified as a non-diversified fund for purposes of the 1940 Act.

The investment objective of the Fund is to seek long-term growth of capital.

2. Accounting Policies

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services — Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform to U.S. generally accepted accounting principles (“GAAP”). The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Fund holds securities and other assets and liabilities that are fair valued as of the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. As described in further detail below, the Fund’s investments are valued daily based on a number of factors, including the type of investment and whether market quotations are readily available. The RIC’s Board of Trustees (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or the “Manager”). Pursuant to the Board’s delegation, the Manager has established a Valuation Committee responsible for supervising the fair valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. A record of the Valuation Committee’s actions is subject to the Board’s review at its first quarterly meeting following the quarter in which such actions take place.

For the fiscal reporting year-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities

26

trade in markets that are open on weekends and U.S. holidays, the values of some of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments and referred to herein as the “fair value hierarchy” in accordance with FASB ASC Topic 820—Fair Value Measurement.

Common or preferred stocks, exchange-traded funds and derivative instruments, if applicable, that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy. In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Foreign equities traded on foreign securities exchanges are generally valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements up to the time the Fund is valued. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stock valuation policies discussed above.

Investments in open-end funds (other than exchange-traded funds) are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy. Altering one or more unobservable inputs may result in a significant change to a Level 3 security’s fair value measurement.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of

PGIM Jennison Focused Growth Fund 27

Notes to Financial Statements (continued)

the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities — at the exchange rate as of the valuation date;

(ii) purchases and sales of investment securities, income and expenses — at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not generally isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period unrealized and realized foreign currency gains (losses) are included in the reported net change in unrealized appreciation (depreciation) on investments and net realized gains (losses) on investment transactions on the Statements of Operations.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from the disposition of holdings of foreign currencies, currency gains (losses) realized between the trade and settlement dates on investment transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) arise from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates.

Master Netting Arrangements: The RIC, on behalf of the Fund, is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a subadviser may have negotiated and entered into on behalf of all or a portion of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the

28

Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law.

Securities Lending: The Fund lends its portfolio securities to banks and broker-dealers. The loans are secured by collateral at least equal to the market value of the securities loaned. Collateral pledged by each borrower is invested in an affiliated money market fund and is marked to market daily, based on the previous day’s market value, such that the value of the collateral exceeds the value of the loaned securities. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the financial statements may reflect a collateral value that is less than the market value of the loaned securities. Such shortfall is remedied as described above. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the Fund securities identical to the loaned securities. The remaining maturities of the securities lending transactions are considered overnight and continuous. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities in the open market using the collateral.

The Fund recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The borrower receives all interest and dividends from the securities loaned and such payments are passed back to the lender in amounts equivalent thereto, which are reflected in interest income or unaffiliated dividend income based on the nature of the payment on the Statement of Operations. The Fund also continues to recognize any unrealized gain (loss) in the market price of the securities loaned and on the change in the value of the collateral invested that may occur during the term of the loan. In addition, realized gain (loss) is recognized on changes in the value of the collateral invested upon liquidation of the collateral. Net earnings from securities lending are disclosed in the Statement of Operations.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on the ex-date, or for certain foreign securities, when the Fund becomes aware of such dividends. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual. Net investment income or loss (other than class specific expenses and waivers, which are allocated as noted below) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day. Class specific expenses and waivers, where applicable, are charged to the respective share classes. Such class specific expenses and waivers include distribution fees and distribution fee waivers,

PGIM Jennison Focused Growth Fund 29

Notes to Financial Statements (continued)

shareholder servicing fees, transfer agent’s fees and expenses, registration fees and fee waivers and/or expense reimbursements, as applicable.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign dividends, interest and capital gains, if any, are recorded, net of reclaimable amounts, at the time the related income is earned.

Dividends and Distributions: Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from GAAP, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified between total distributable earnings (loss) and paid-in capital in excess of par, as appropriate. The chart below sets forth the expected frequency of dividend and capital gains distributions to shareholders. Various factors may impact the frequency of dividend distributions to shareholders, including but not limited to adverse market conditions or portfolio holding-specific events.

| | |

| | |

| Expected Distribution Schedule to Shareholders* | | Frequency |

| Net Investment Income | | Annually |

| Short-Term Capital Gains | | Annually |

| Long-Term Capital Gains | | Annually |

| * | Under certain circumstances, the Fund may make more than one distribution of short-term capital gains during a fiscal year. |

Estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

3. Agreements

The RIC, on behalf of the Fund, has a management agreement with the Manager. Pursuant to this agreement, the Manager has responsibility for all investment advisory services and supervises the subadviser’s performance of such services.

The Manager has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison” or the “subadviser”). The Manager pays for the services of Jennison.

30

Fees payable under the management agreement are computed daily and paid monthly. For the reporting period ended February 28, 2022, the contractual and effective management fee rates were as follows:

| | |

| | |

| Contractual Management Rate | | Effective Management Fee, before any waivers

and/or expense reimbursements |

0.67% up to $1 billion of average daily net assets; | | 0.66% |

0.65% from $1 billion to $3 billion of average daily net assets; | | |

0.63% from $3 billion to $5 billion of average daily net assets; | | |

0.62% from $5 billion to $10 billion of average daily assets; | | |

0.61% over $10 billion of average daily net assets | | |

The Manager has contractually agreed, through June 30, 2023, to limit total annual operating expenses after fee waivers and/or expense reimbursements.

This contractual waiver excludes interest, brokerage, taxes (such as income and foreign withholding taxes, stamp duty and deferred tax expenses), acquired fund fees and expenses, extraordinary expenses, and certain other Fund expenses such as dividend and interest expense and broker charges on short sales.

Where applicable, the Manager agrees to waive management fees or shared operating expenses on any share class to the same extent that it waives such expenses on any other share class. In addition, total annual operating expenses for Class R6 shares will not exceed total annual operating expenses for Class Z shares. Fees and/or expenses waived and/or reimbursed by the Manager may be recouped by the Manager within the same fiscal year during which such waiver and/or reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. Effective December 11, 2021, the expense limitations attributable to each class are as follows:

| | | | | | | | | | |

| | | |

| Class | | Expense

Limitations | | Prior Expense

Limitations* |

A | | | | 1.05 | % | | | | — | % |

C | | | | 1.78 | | | | | — | |

Z | | | | 0.75 | | | | | 0.75 | |

R6 | | | | 0.67 | | | | | 0.67 | |

*The expense limitations attributable to each share class prior to December 11, 2021.

The RIC, on behalf of the Fund, has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class C, Class Z and Class R6 shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A and Class C shares, pursuant to the plans of distribution (the “Distribution Plans”), regardless of expenses actually incurred by PIMS.

PGIM Jennison Focused Growth Fund 31

Notes to Financial Statements (continued)

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution related activities at an annual rate based on average daily net assets per class. PIMS has contractually agreed through June 30, 2023 to limit such fees on certain classes based on the average daily net assets.The distribution fees are accrued daily and payable monthly. The Fund’s annual distribution contractual rate and limit where applicable are as follows:

| | | | | | | | | | |

| Class | | Contractual Rate | | Limit |

A | | | | 0.30 | % | | 0.25% | |

C | | | | 1.00 | | | — | |

Z | | | | N/A | | | N/A | |

R6 | | | | N/A | | | N/A | |

For the reporting period ended February 28, 2022, PIMS received front-end sales charges (“FESL”) resulting from sales of certain class shares and contingent deferred sales charges (“CDSC”) imposed upon redemptions by certain shareholders. From these fees, PIMS paid such sales charges to broker-dealers, who in turn paid commissions to salespersons and incurred other distribution costs. The sales charges are as follows where applicable:

| | | | |

| FESL by Class | | Amount | |

A | | | $507,967 | |

C | | | — | |

| | | | |

| CDSC by Class | | Amount | |

A | | | $2,438 | |

C | | | 7,269 | |

PGIM Investments, PIMS and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

4. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PGIM Investments and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund may invest its overnight sweep cash in the PGIM Core Ultra Short Bond Fund (the “Core Fund”), and its securities lending cash collateral in the PGIM Institutional Money Market Fund (the “Money Market Fund”), each a fund of Prudential Investment Portfolios 2, registered under the 1940 Act and managed by PGIM Investments. PGIM Investments and/or its affiliates are paid fees or reimbursed for providing their services to the Core Fund and the Money Market Fund. In addition to the realized and unrealized gains on investments in the Core Fund and Money Market Fund, earnings from such investments are disclosed on

32

the Statement of Operations as “Affiliated dividend income” and “Income from securities lending, net”, respectively. Effective January 2022, the Fund changed its overnight cash sweep vehicle from the Core Fund to an unaffiliated money market fund.

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act, that subject to certain conditions, permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors/trustees, and/or common officers. For the year ended February 28, 2022, no 17a-7 transactions were entered into by the Fund.

5. Portfolio Securities

The aggregate cost of purchases and proceeds from sales of portfolio securities (excluding short-term investments and U.S. Government securities) for the reporting period ended February 28, 2022, were as follows:

| | | | | | |

| Cost of Purchases | | | | | | Proceeds from Sales |

| $930,600,732 | | | | | | $1,138,310,692 |

A summary of the cost of purchases and proceeds from sales of shares of affiliated mutual funds for the year ended February 28, 2022, is presented as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value,

Beginning

of Year | | | Cost of

Purchases | | | Proceeds

from Sales | | | Change in

Unrealized

Gain

(Loss) | | | Realized

Gain

(Loss) | | | Value,

End of Year | | | Shares,

End of

Year | | | Income | |

|

| | Short-Term Investments - Affiliated Mutual Funds: | |

|

| | PGIM Core Ultra Short Bond Fund(1)(wa) | |

| | $ 8,104,965 | | | | $313,514,605 | | | | $321,619,570 | | | | $ — | | | | $ — | | | | $ — | | | | — | | | | $ 9,242 | |

| | |

| | PGIM Institutional Money Market Fund(1)(b)(wa) | | | | | | | | | |

| | 39,067,234 | | | | 473,752,717 | | | | 499,484,215 | | | | (20,311) | | | | 18,000 | | | | 13,333,425 | | | | 13,344,100 | | | | 14,729 | (2) |

| | $47,172,199 | | | | $787,267,322 | | | | $821,103,785 | | | | $(20,311) | | | | $18,000 | | | | $13,333,425 | | | | | | | | $23,971 | |

| (1) | The Fund did not have any capital gain distributions during the reporting period. |

| (2) | The amount, or a portion thereof, represents the affiliated securities lending income shown on the Statement of Operations. |