UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33775

Nanosphere, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 36-4339870 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 4088 Commercial Avenue Northbrook, Illinois | | 60062 |

| (Address of principal executive offices) | | (Zip Code) |

(847) 400-9000

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| | |

(Title of Each Class) | | (Name of Each Exchange on Which Registered) |

| Common Stock, par value $0.01 | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $131.7 million based on the closing sale price for the registrant’s common stock on the NASDAQ Global Market on that date of $3.07 per share. This number is provided only for the purpose of this report on Form 10-K and does not represent an admission by either the registrant or any such person as to the status of such person.

As of February 11, 2014, there were 76,880,106 outstanding shares of common stock. The common stock is listed on the NASDAQ Global Market (trading symbol “NSPH”).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for fiscal year ended December 31, 2013 to be issued in conjunction with the registrant’s annual meeting of shareholders expected to be held on May 28, 2014 are incorporated by reference in Part III of this Form 10-K. The definitive proxy statement will be filed by the registrant with the SEC not later than 120 days from the end of the registrant’s fiscal year ended December 31, 2013. Except as specifically incorporated herein by reference, the above mentioned Proxy Statement is not deemed filed as part of this report.

NANOSPHERE, INC.

INDEX

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this Annual Report on Form 10-K regarding our strategy, future operations, future financial position, future net sales, projected expenses, products’ placements, performance and acceptance, prospects and plans and management’s objectives, as well as the growth of the overall market for our products in general and certain products in particular and the relative performance of other market participants are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievement to be materially different from those expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements reflect our current views about future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including but not limited to:

| | • | | inaccurate estimates of the potential market size for our products (including the hospital lab market in general and the blood stream infection (BSI) market in particular) or failure of the market for these products to grow as anticipated; |

| | • | | the past performance of other companies which we believe to have been in a market position analogous to where we believe we are now may not be predictive of our future results in the manner we believe them to be; |

| | • | | our analysis of who our competitors have been, who they are now and who they will be in the future (particularly in the infectious disease product markets) and our predictions of relevant future performance may be inaccurate; |

| | • | | comparisons of actual financial results for another company to what we predict will be our future financial results may be inapposite; |

| | • | | predictions of customer metrics needed to achieve profitability and their relationship to our cash flow position, needs and expenses may prove to be inaccurate; |

| | • | | entrance of other competitors or other factors causing us to lose competitive advantage in the sample-to-result MDx market; |

| | • | | a lack of commercial acceptance of the Verigene System, its array of tests, and the development of additional tests, which could negatively affect our financial results; |

| | • | | failure of third-party payors to reimburse our customers for the use of our clinical diagnostic products or reduction of reimbursement levels, which could harm our ability to sell our products; |

| | • | | failure of our products to perform as expected or to obtain certain approvals or the questioning of the reliability of the technology on which our products are based, which could cause lost revenue, delayed or reduced market acceptance of our products, increased costs and damage to our reputation; |

| | • | | our inability to manage our anticipated growth, constraints or inefficiencies caused by unanticipated acceleration and deceleration of customer demand; and |

| | • | | those set forth under “Risk Factors” in this Annual Report on Form 10-K. |

These forward-looking statements represent our estimates and assumptions only as of the date of this Annual Report on Form 10-K. Unless required by U.S. federal securities laws, we do not intend to update any of these forward-looking statements to reflect circumstances or events that occur after the statement is made or to conform these statements to actual results. The following discussion should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere in this Annual Report on Form 10-K. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Item 1A — Risk Factors” and elsewhere in this Annual Report on Form 10-K.

PART I.

Item 1. Business.

References herein to “we,” “us,” “our” or “the Company” refer to Nanosphere, Inc. unless the context specifically requires otherwise.

Overview

We are dedicated to enhancing medicine by providing targeted molecular diagnostic tests that can lead to earlier disease detection, optimal patient treatment and improved healthcare economics. Our platform, the Verigene® System, enables clinicians to rapidly identify and treat the bacteria and viruses responsible for some of the most complex, costly and deadly infectious diseases. The Verigene System includes a bench-top molecular diagnostics workstation that is an advanced platform for genomic and protein testing.

The Verigene System is differentiated by its ease of use, superior analytical performance and ability to detect many targets on a single test, referred to as “multiplexing.” It provides faster results, lower cost and less labor for hospital-based laboratories. Our ability to detect proteins, which can be as much as 100 times more sensitive than current technologies for certain targets, may enable earlier detection of and intervention in diseases associated with known biomarkers as well as the introduction of tests for new biomarkers that exist in concentrations too low to be detected by current technologies. We are focused on the infectious disease diagnostics market.

Our test menu is designed to provide hospitals with the following benefits:

| | 1) | save lives by identifying pathogens and appropriate treatment faster; |

| | 2) | reduce medical spending by accelerating appropriate treatment; and |

| | 3) | reduce antibiotic resistance growth by avoiding unnecessary treatments. |

The Verigene System is comprised of a microfluidics processor, a touchscreen reader and disposable test cartridges. Certain assays, such as the Warfarin metabolism and hyper-coagulation tests, were cleared by the U.S. Food and Drug Administration (“FDA”) for use with the original Verigene System processor (the “Original Processor”). Subsequently, we developed and launched a second generation Verigene System processor (the “ProcessorSP”) that handles the same processing steps as the Original Processor and incorporates sample preparation. Some of our current customers continue to use the Original Processor for hyper-coagulation testing and Warfarin metabolism testing. Our development plans are focused on expanding the menu of tests that will run on the ProcessorSP,and we plan to develop and seek regulatory approval of all future assays on the ProcessorSP.

Our Applications

The following table summarizes the FDA and CE In-Vitro Diagnostic Mark (“CE IVD Mark”) regulatory status of our near-term genomic and protein assays on the Verigene System:

| | | | |

Assay | | FDA Status(1) | | CE IVD Mark Status(2) |

Infectious Disease Assays | | | | |

| | |

| Respiratory Virus with Sub-Typing (RV+) | | 510(k) cleared | | CE IVD Marked |

| | |

| Respiratory Pathogens/Expanded Panel (RP) | | In development | | In development |

| | |

| Blood Stream Infection (BSI) Panels | | | | |

| | |

• Blood Culture – Gram Positive (BC-GP) • Blood Culture – Gram Negative (BC-GN) • Blood Culture – Yeast (BC-Y) | | 510(k) cleared 510(k) cleared(4) In development | | CE IVD Marked CE IVD Marked In development |

| | |

| C. difficile (CDF) | | 510(k) cleared | | CE IVD Marked |

| | |

| Enteric Panel (EP) | | Pending FDA clearance(5) | | Pending CE IVD Mark |

4

| | | | |

| | |

Human Pharmacogenetic Assays | | | | |

| | |

| Warfarin Metabolism (CYP2C9) | | 510(k) cleared(3) | | CE IVD Marked |

| | |

| Hyper-Coagulation (FV, FII, MTHFR Panel) | | 510(k) cleared(3) | | CE IVD Marked |

| | |

| CYP2C19 Genetic Variance | | 510(k) cleared | | CE IVD Marked |

| | |

Ultra-Sensitive Protein Assays | | | | |

| | |

| Cardiac Troponin I | | In development | | In development |

| | |

| Prostate-Specific Antigen (PSA) | | Research use only | | |

| (1) | For further description of our FDA regulatory requirements, please refer to the section “Regulation by the United States Food and Drug Administration” beginning on page 10 of this Annual Report on Form 10-K for the year ended December 31, 2013. |

| (2) | For further description of our CE IVD Mark regulatory requirements, please refer to the section “Foreign Government Regulation” beginning on page 13 of this Annual Report on Form 10-K for the year ended December 31, 2013 |

| (3) | Currently cleared only for use with the Original Processor. |

| (4) | 510(k) cleared January 2014. |

| (5) | 510(k) submitted January 2014. |

Infectious Disease Assays

Infectious disease testing is converting to molecular diagnostic methods driven to the need to improve clinical outcomes and reduce medical spending by identifying pathogens and drug resistance markers faster. Microbiology labs need tests that can rapidly detect a wide range of potential infectious agents in an automated system. The Verigene System provides the multiplexing, rapid turnaround and ease-of-use needed by these labs. Our infectious disease menu and the ProcessorSPprovide microbiology labs with the ability to identify infectious pathogens and antibiotic resistance in hours as compared to days using traditional methods.

We have received 510(k) clearance from the FDA for our respiratory panel that detects the presence of influenza A and B as well as respiratory syncytial virus (“RSV”) A and B. Influenza is commonly known as the seasonal flu and RSV is a respiratory virus that infects the lungs and breathing passages. RSV is the most common cause of bronchitis and pneumonia in children under the age of one year and has become a significant concern for older adults. Our respiratory panel provides physicians with a highly accurate and fast determination of which virus is present. This test result guides the most appropriate treatment therapy.

In the first quarter of 2011, we received 510(k) clearance from the FDA and obtained CE IVD Mark for our respiratory assay that includes subtyping for seasonal H1 virus, seasonal H3 virus, and the 2009 novel H1N1 virus, commonly known as swine flu, as well as the targets on our previously cleared respiratory assay. We believe this is the first sample-to-result molecular respiratory test to include all of these viruses, thus lowering the cost of molecular respiratory testing for hospitals while demonstrating the multiplexing capability of the Verigene System. The demand for this test will be highly dependent upon the seasonality and prevalence of respiratory viruses. We are developing an expanded respiratory panel that includes additional viral and bacterial respiratory pathogens. This expanded panel enables hospital-based laboratories to identify complex infections for the sickest patients as well as offer low cost influenza tests for healthier patients.

We developed a test to detect C. difficile,a bacterium that can cause symptoms ranging from diarrhea to life-threatening inflammation of the colon. For ourC. difficile test, we received 510(k) clearance from the FDA in the fourth quarter of 2012 and obtained CE IVD Mark in the first quarter of 2013.

We have developed and are continuing to develop blood stream infection panels for the earlier detection of specific bacteria and resistance markers present in patients with blood stream infections. These panels include gram-positive, gram-negative and yeast pathogens as well as resistance markers. These assays are designed to enable physicians to detect bacterial strains infecting patients and thus prescribe the most appropriate antibiotic regimen within 24 hours rather than after several days, which is typical for current traditional culture assays. The sensitivity and specificity of blood stream infection tests enable clinicians to make better therapeutic decisions sooner, thus improving patient outcomes and reducing costs. Treatment is typically initiated before these current traditional assays are complete. This early detection capability allows patients to avoid unnecessary treatments that may expose them to serious side effects. The first blood stream infection panel developed was for the detection of gram-positive organisms (BC-GP) that represent approximately 65% of blood stream infections. In June 2012, we received ade novo510(k) clearance, representing the first ever molecular bloodstream infection test, to market the full BC-GP panel. In January 2014, we received 510(k) clearance for our BC-GN assay representing approximately 35% of bloodstream infections. The BC-Y panel is in development.

5

Our development efforts also include an enteric pathogens (EP) test. Our enteric pathogens assay identifies theEnterobacteriaceae species that are often due to food poisoning. The enteric assay tests for a wide spectrum of organisms that are treated with various antibiotics and other drug therapies. This assay was submitted to the FDA for 510(k) clearance in January 2014.

Human Genetic Assays

We have received 510(k) clearance from the FDA for a warfarin metabolism assay performed on our Original Processor. This is a pharmacogenetic test to determine the existence of certain genetic mutations that affect the metabolism of warfarin-based drugs, including Coumadin®, the most-prescribed oral anticoagulant. CE IVD Mark was obtained for this assay during the first quarter of 2011, and we may submit an FDA application for this assay to allow its use on the Processor SP, although we have no immediate plans to do so.

We have also received 510(k) clearance from the FDA for a hypercoagulation assay performed on our Original Processor. This is a human genetic test to determine the existence of certain genetic mutations that are hereditary contributory factors in forming blood clots. This Verigene test detects the F5, F2, and MTHFR genes that are associated with hypercoagulation (i.e., thrombophilia). CE IVD Mark was obtained for this assay on the ProcessorSPduring the fourth quarter of 2011.

In the fourth quarter of 2012 we received 510(k) clearance from the FDA for a CYP2C19 genetic variance test. This assay was CE IVD Marked during the first quarter of 2011. This test detects variances in the cytochrome P-450 2C19 gene. These genetic variances are associated with deficient metabolism of CYP2C19-metabolized therapeutic agents including clopidogrel, more commonly known by the trade name PlavixTM.

We have a small customer base that uses our human genetic tests, however, our current product development and marketing efforts are focused on our infectious disease menu.

Ultra-Sensitive Protein Assays

Our ability to detect proteins at sensitivity levels that can be 100 times greater than current technologies may enable earlier detection of and intervention in diseases as well as enable the introduction of tests for new biomarkers that exist in concentrations too low to be detected by current technologies. We have developed, are currently developing or plan to develop diagnostic tests for markers that can be used to diagnose a variety of medical conditions including cardiovascular, respiratory, cancer, autoimmune, neurodegenerative and other diseases.

Cardiac troponin I (“cTnI”), is the gold standard biomarker for diagnosis of myocardial infarction, or heart attack, and identification of patients with acute coronary syndromes at risk for cardiovascular events. We have developed an assay to detect this protein. We are focused on investigating the potential to sell primary functional components of this assay to commercial labs as a marker for cardiac risk. Early studies suggest that our ultra-sensitive cTnI test may also be a useful monitoring tool for chronic heart failure (“CHF”) patients. Larger studies and regulatory hurdles will need to be cleared before we market the assay for CHF monitoring purposes.

In addition to the cardiac troponin I assay, we have developed an ultra-sensitive prostate-specific antigen (“PSA”) test for early diagnosis of recurrent prostate cancer. We also may develop ultra-sensitive protein assays in the areas of immunology, allergy and cancer.

The Verigene System

The Verigene System is comprised of a microfluidics processor, a touchscreen reader and disposable test cartridges. The microfluidics processor interacts with and manipulates various functional components of the test cartridge, accomplishing a number of necessary steps including target binding to the nucleic acid or protein array, nanoparticle probe hybridization, intermediate washes and signal amplification. The reader houses the optical detection module that illuminates the test slide and automated spot recognition software that analyzes the resulting signal intensities and provides the test results. The reader also serves as the control station for the Verigene System and features a simple and intuitive touchscreen interface that allows users to track samples and test cartridges, initiate and monitor test processing, analyze results and generate reports. The reader is web-enabled to allow remote access to results and reports.

6

To perform a test, the operator adds a prepared sample to a designated port in the test cartridge, enters sample identification and test cartridge information into the reader using the touchscreen keyboard or via the barcode wand, and inserts the test cartridge into the processor. The processor assimilates information received from the reader and matches it to the inserted test cartridge and initiates the specified test protocol. Once the assay process is complete the test array is introduced into the reader for image analysis and result reporting.

Our Technology

We believe our technology will drive broad usage of ultra-sensitive and multiplexed protein and genomic diagnostics in clinical laboratories, much as enzyme-linked immunosorbent assay, or ELISA, technology accelerated the use of protein testing in the 1970s and 1980s and polymerase chain, or PCR, catalyzed the emergence of nucleic acid diagnostics in the 1990s.

Our Gold Nanoparticle Molecular Probes

At the core of our technology is the use of gold nanoparticles which offer a unique set of physical properties that can be exploited in the detection of biological molecules. In 1998, Dr. Chad Mirkin, a former director of the Company, and Dr. Robert Letsinger at Northwestern University (“Northwestern”) developed a novel process to prepare stable probes by covalently attaching oligonucleotides to gold nanoparticles. This method, protected by patents, is exclusively assigned to or owned by us. We have refined the synthesis methods to enable highly reproducible production of nanoparticle probes with diameters in the 13-50 nanometer range required for highly sensitive biomedical analysis. Subsequently, we have also developed methods for attaching antibodies to gold nanoparticles, thereby producing highly stable probes for ultra-sensitive detection of proteins.

The properties of nanoparticle probes can be tailored by controlling the size of the particles, the density of recognition-oligomers or antibodies on the nanoparticles, the use of diluent oligonucleotides, the use of spacer oligonucleotides and the salt concentration. Combined, the optimization of these properties enables us to deliver superior analytical performance characteristics versus other methods, for example:

| | • | | High Signal-to-Noise Ratio. Our nanoparticle probes deliver significantly stronger signals than the fluorescent probes, or fluorophores, used in most diagnostic platforms today. Nanoparticles are typically 10-100 nm in diameter and therefore significantly larger than conventional fluorophores. This size difference enables nanoparticles to produce up to 10,000 times more signal via light scattering than a fluorophore. A single nanoparticle can be detected with simple optical instrumentation with very high sensitivity, thus eliminating the need to employ amplification techniques. |

| | • | | Orders of Magnitude Greater Sensitivity and Lower Detection Limits. The sensitivity and limits of detection of our technology are further enhanced by a silver-staining step, which effectively amplifies the signal from each nanoparticle bound to a target molecule. In this process, silver is coated onto the gold nanoparticle surface, producing larger particles with further enhanced optical properties. Whereas the leading technologies today can detect molecules at the picomolar range (10 -12 ), our technology is capable of up to a million times higher sensitivity at the attomolar (10 -18 ) range, enabling the unprecedented analysis of rarely expressed genes or low abundance proteins for early disease detection and diagnosis. |

| | • | | Unparalleled Specificity. A key property of the oligonucleotide-linked gold nanoparticle is an extremely sharp melting curve. The melting curve is the temperature range during which the capture oligonucleotide dissociates with the complementary target oligonucleotide in the sample. Our nanoparticles exhibit dissociation transitions of less than one degree in Celsius temperature, whereas most alternative products are based on polymerase chain reaction, or PCR, which exhibits melt transitions typically in the 15-30 degree Celsius range. The narrow band of temperature in which binding and dissociation occurs, creates a significantly higher signal to noise ratio resulting in greater specificity. These qualities eliminate errors caused by mismatched nucleotide pairs, thereby allowing genomic targets differing by a single nucleotide (base pair) to be distinguished with unprecedented selectivity. Sharp melting curves are a proprietary feature of our nanoparticles and our patent portfolio includes issued patents protecting the methods and product performance related to melt transition curves. |

| | • | | High Count Multiplexing. Our core technology enables high count multiplexing, or simultaneous multiple target identification in a single sample, using a simple low-density microarray. A sample and probe mixture is introduced simultaneously into a single self-contained reaction chamber pre-printed with multiple reaction spots, each containing capture strand oligonucleotides or proteins that are complementary to a specific target molecule of interest. By utilizing the sharp melt transition of the nanoparticle probes, multiple targets can be discretely identified in a single sample. This methodology eliminates the need for complex and costly means of physically isolating individual target molecules. |

| | • | | Detection of Genomic and Protein Molecules Simultaneously. We are able to synthesize our gold nanoparticle probes for the simultaneous multiplexed detection of both protein and genomic targets in the same assay. |

| | • | | Superior Reaction Kinetics. The sharp melt transition curves in our gold nanoparticles increase binding affinity thereby leading to improved assay kinetics and efficiency. |

7

| | • | | Long-Term Stability. The high density of oligonucleotides per nanoparticle, serves both as a protective and recognition layer on the nanoparticle surface and ensures the long-term stability of our nanoparticles. We have patented approaches using localized salt and buffer concentrations that deliver long-shelf life for our technology and reagent set. |

Assay Format

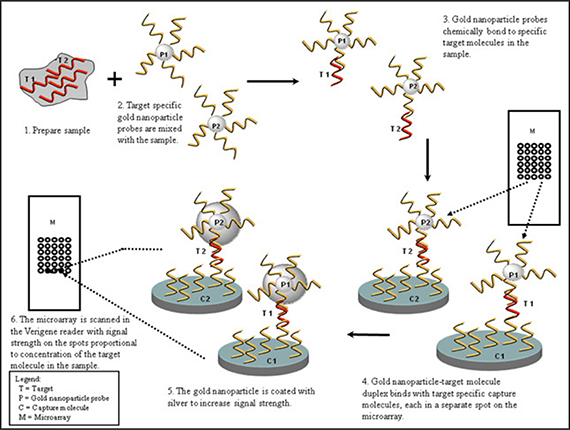

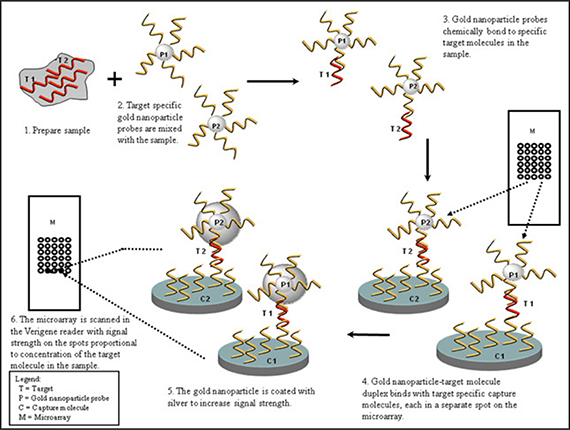

Our silver-enhanced gold nanoparticles and related optical detection technology are used for diagnostic assays which detect genomic and proteomic targets captured onto microarrays as shown in the “Schematic of Microarray Based Detection Using Nanoparticle Probes” below. The microarray format enables high count multiplexing of assay targets, facilitating the development of a broad menu of tests, including for complex diseases where multiple targets must be evaluated to provide a diagnosis, in a simple, scalable format.

Two probe types can be used in a single assay. Oligonucleotide probes are used for genomic assays and antibodies for protein assays. One probe, complementary to a specific site on the target molecule, is attached to a surface such as a glass slide and the other probe, complementary to a different site on the target molecule, is attached to the surface of gold nanoparticles. In the presence of the target molecule of interest, the probes and target form a three dimensional, cross-linked aggregate. After silver coating the gold nanoparticles, light scatter is measured on the surface of the microarray slide. The silver-enhanced gold nanoparticle probes located on the slide surface scatter light in proportion to the concentration of the target in the sample. This light is detected through optical imaging and translated into clinical results via our proprietary software algorithms.

Schematic of Microarray Based Detection Using Nanoparticle Probes

The above graphic depicts a genomic or proteomic assay utilizing a molecule attached to a gold nanoparticle. In the case of a genomic assay, the molecule represents an oligonucleotide. In the case of a proteomic assay, the molecule represents an antibody.

8

Intellectual Property

As of December 31, 2013, our patent portfolio is comprised, on a worldwide basis, of 187 issued patents and 11 pending patent applications which we own directly or for which we are the exclusive licensee. Some of these patents and patent applications derive from a common parent patent application or are foreign counterpart patent applications and relate to similar or identical technological claims. The issued patents cover approximately 11 different technological claims and the pending patent applications cover approximately three additional technological claims.

Many of our issued and pending patents were exclusively licensed from the International Institute for Nanotechnology at Northwestern in May 2000, and they generally cover our core technology, including nanotechnology-based biodiagnostics and biobarcode technology. Our issued patents expire between 2017 and 2025. We believe our patent portfolio provides protection against other companies offering products employing the same technologies and methods as we have patented. While we believe our patent portfolio establishes a proprietary position, there are many competitive products utilizing other technologies that do not infringe on our patents.

In addition, as of December 31, 2013, we have non-exclusive licenses for at least 43 U.S. patents that cover 11 different technological claims from various third parties. Most of these license agreements require us to pay the licensor royalty fees that typically expire upon the patent expiration dates, which range from 2014 to 2027. These license agreements are non-exclusive and do not create a proprietary position. The expiration of these non-exclusive licenses will result in the termination of certain royalty payments by us to the licensors.

Research and Development

Our research and development efforts are focused on:

| | • | | Expanding and Enhancing the Capabilities of Our Instrument Platform. Design elements and components of our current instrument platform will serve as the foundation for future generation development. The Processor SP incorporates sample preparation into our system. By adding this step, labs can now process a raw sample material, in most cases whole blood, in a single step. This feature is critical for analyzing infectious diseases and will further simplify the processing of clinical samples from swab, cerebrospinal fluid and serum. |

| | • | | Developing Increased Throughput Instruments.We have plans to develop a fully automated instrument with increased throughput and sample preparation for both infectious disease and human genetic tests for use in larger hospital-based laboratories. By basing future generations of our instrument platform on existing design elements, each new generation of development will process assays developed for previous generations. |

| | • | | Developing Additional Genomic and Protein Assays. We are in various phases of developing and commercializing new assays for detecting protein biomarkers, infectious diseases and human genetic markers. Currently, we are researching additional human genetic, infectious disease and ultra-sensitive protein assays. |

| | • | | Validating and Commercializing New Biomarkers. We have a dedicated team of protein scientists and assay developers who conduct assay development to support feasibility testing and new protein biomarker validation. This team is collaborating with clinical researchers in academic and private settings to apply our ultra-sensitive protein detection technology to the researchers’ efforts to create diagnostic methods with greater clinical sensitivity and specificity. We are also applying our ultra-sensitivity methods to the development of established protein biomarkers that may lead to earlier detection of medical conditions including cancer, neurodegenerative disorders including Alzheimer’s disease, sepsis and mad cow disease, as well as for blood screening and veterinary applications. |

| | • | | Enhancing Performance of Established Product Systems and Developing New Applications. Our license agreement with Northwestern provided us with an exclusive license to certain patents and patent applications related to the application of nanotechnology to biodiagnostics and to biobarcode technology. This license covers all discoveries from the International Institute for Nanotechnology at Northwestern in the field of biodiagnostics through January 1, 2013. Thereafter, the license provides that we continue to have the first right to an exclusive license for all discoveries the International Institute for Nanotechnology at Northwestern develops in the field of biodiagnostics, however, the economic terms are to be negotiated in good faith by both parties. Our research team utilizes the research and patents developed at Northwestern to develop diagnostic applications including additional genomic and protein testing assays for use in the Verigene System. |

9

Employees

As of December 31, 2013, we had 165 full-time employees. Of these employees, 56 were in research and development, 42 were in manufacturing (in support of both product sales and the research and development function), 50 were in sales and marketing and 17 were in general and administrative functions. We have never had a work stoppage and none of our employees are covered by collective bargaining agreements or represented by a labor union. We believe our employee relations are good.

Government Grants and Contracts

Since our inception, we have received government grants that had allowed for the evaluation and development of new technologies and also allowed for development of market specific diagnostic products.

We have benefited from Small Business Innovation Research grants to prove feasibility of gold nanoparticle based detection technology as well as evaluate potential new technologies and medical diagnostic applications.

We have received government contracts for the development of automated biological agent detection systems using nanoparticle probes that are capable of rapidly detecting biological warfare agents and biological toxins. These products have potential applications for both government contractors and civilian first responders. Since inception, we have recorded revenue of approximately $10.3 million under these grants and contracts.

Manufacturing

We assemble and package all our finished products at our corporate headquarters in Northbrook, Illinois. Our manufacturing facility occupies approximately 13,797 square feet of the 42,742 square feet, which we lease at our Northbrook facility. There, we manufacture our proprietary nanoparticle probes, assay reagents, test cartridges and instrumentation. We outsource much of the disposable component molding. Reagent manufacturing and cartridge filling is performed under the current Good Manufacturing Practices — Quality System Regulation as required by the FDA for the manufacture of in vitro diagnostic products. These regulations carefully control the manufacture, testing and release of diagnostics products as well as raw material receipt and control.

We have controlled methods for the consistent manufacturing of our proprietary nanoparticles and production oligonucleotides at very high purity (greater than 95%). We also manufacture at our Northbrook facility a proprietary linker to ensure stable bonding of the oligonucleotide to the gold nanoparticle.

All quality control tests are validated to ensure product quality measurements are accurate. Manufacturing of the Verigene System, including test cartridges, is tightly controlled with the use of manufacturing batch records. These records control which product is produced and ensure that each batch of product is manufactured consistently and according to the intended design.

We plan to continue to manufacture components that we determine are highly proprietary or difficult to produce consistently while outsourcing commodity components. As we continue to execute on our sales and marketing plans, we have ramped-up our manufacturing operations to meet demand. We are likely to establish additional outsourcing partnerships as we manufacture additional products. While we believe our current facilities and expansion rights are adequate to meet our manufacturing needs for at least the next three years, we may need to lease additional space. On February 13, 2014, we exercised a right of first refusal under our recently revised facilities lease to acquire an additional 8,535 square feet of space in our building as soon as such space becomes available. The current tenant occupying this additional space is expected to vacate the space on or about August 31, 2014.

Sales and Marketing

As a part of our business strategy, we have a direct sales and marketing organization to support the sales of the Verigene System and its initial menu of tests in the United States. This organization comprises geographically dispersed sales representatives and clinical support specialists as well as a centralized staff of market and product managers. We believe that the primary market for our diagnostic applications will be hospital-based laboratories and academic research institutions in the United States. A customer may purchase the Verigene System instruments, lease them from a third party or enter into a reagent rental agreement. Our reagent rental agreements include customer commitments to purchase a certain minimum volume of cartridges over the term of the agreement. As part of these agreements, a portion of the charge for each cartridge is a rental fee for use of the equipment.

Our sales and marketing organization provides customer service related to order fulfillment, technical service, training, product support and distribution logistics.

10

We believe that the primary international customers for our diagnostic applications will be hospital-based laboratories and academic research institutions. We have obtained CE IVD Mark certification for sale of the Verigene System in European Union countries and will do so for each assay we plan to market in Europe. Outside the United States, we initiate sales through marketing partners and distributors. As of the end of 2013 we have entered into 15 international distribution partnerships. A distribution strategy is being developed for each relevant international market. We support our distribution partners with specialists who train our partners’ sales forces and provide technical support.

Competition

We primarily face competition in the nucleic acid based testing market from companies that provide PCR-based technologies. We believe that, over time, the Verigene System will compete with these companies primarily on the following factors: (1) cost effectiveness; (2) ease of use; (3) multiplexing capability; (4) range of tests offered; (5) immediacy of results; (6) sensitivity and specificity of tests and (7) reliability.

The Company is now focused primarily on molecular based infectious disease markets and therefore has identified Beckton, Dickinson and Company, Bio Mérieux, Cepheid, GenMark Diagnostics and Luminex as potential competitors.

We could also face competition in the protein detection market from companies that provide mass spectrometry systems. Although mass spectrometry systems offer high sensitivity, they are extremely costly, require significant time and effort by sophisticated staff and cannot detect many complex, disease-causing proteins. Due to these significant limitations we consider mass spectrometry systems to be a lower competitive threat within commercial protein diagnostics laboratories.

The protein detection market also includes companies that provide ELISA-based testing systems. We believe that our technology, which is at least 100 times more sensitive than ELISA-based technologies provides a significant advantage because it can detect proteins at lower concentrations equating to earlier detection of disease. This sensitivity will create new value for existing biomarkers and allow the discovery of novel biomarkers for the treatment and monitoring of disease where none exist today.

Regulation by the United States Food and Drug Administration

In the United States, the FDA regulates the sale and distribution, in interstate commerce, of medical devices, includingin vitro diagnostic test kits. Pursuant to the federal Food, Drug, and Cosmetic Act, the FDA regulates the preclinical and clinical design and development, testing, manufacture, labeling, distribution and promotion of medical devices. We will not be able to commence marketing or commercial sales in the United States of new medical devices under development that fall within the FDA’s jurisdiction until we receive 510(k) clearance or approval from the FDA.

In the United States, medical devices are classified into one of three classes (i.e., Class I, II or III) on the basis of the controls deemed necessary by the FDA to reasonably ensure their safety and effectiveness. Class I devices are subject to general controls (e.g., establishment registration, medical device listing, labeling regulations, possible premarket notification and adherence to current Good Manufacturing Practice/Quality System Regulations (“QSR”)). However, most Class I devices are exempt from premarket notification (510(k) clearance). Class II devices are subject to general and special controls (e.g., special labeling requirements, mandatory performance standards, premarket notification (510(k) clearance) often with guidance from an FDA special control guideline, adherence to current Good Manufacturing Practice/QSR, possible post-market surveillance). Generally, Class III devices are subject to general and special controls and must receive premarket approval, or PMA, by the FDA to ensure their safety and effectiveness (e.g., new devices for which insufficient information exists to assure safety and effectiveness through general and special controls; often such devices are life-sustaining, life-supporting and implantable). Many devices that have been approved by way of premarket approval are required to perform post-market surveillance.

11

510(k) Clearance

The FDA will grant 510(k) clearance if the submitted information establishes that the proposed device is “substantially equivalent” to a legally marketed Class I or Class II medical device or a pre-amendment Class III medical device for which the FDA has not sought PMA. The FDA has recently been requiring more rigorous demonstration of substantial equivalence than in the past. The FDA may determine that a proposed device is not substantially equivalent (“NSE”) to a legally marketed device or that additional information is needed before a substantial equivalence determination can be made. In the former case and when there exists no current legally marketed device to which substantial equivalence can be claimed, theDe Novo Classification Process (Evaluation of Automatic Class III Designation) regulatory process may be utilized. Under thisde Novoprocess, a device manufacturer can avoid having to seek PMA approval following an NSE determination,provided the device is considered by FDA to be a moderate to low risk device whose risks could be mitigated through the use of Special Controls. This enables the device to be “automatically” down-classified from Class III to Class II and marketing authorization sought essentially through the less burdensome 510(k) process. This process may be particularly applicable to many of our future products, in that they may utilize new or existing molecular markers and significantly different technology as compared to current marketed products or for which there is no existing like product on the market. Nonetheless, a “not substantially equivalent” determination, or a request for additional information, could prevent or delay the market introduction of new products that fall into this category. For any devices that are cleared through the 510(k) process, modifications or enhancements that could significantly affect safety or effectiveness, or constitute a major change in the intended use and/or performance of the device, require new 510(k) submissions and clearances.

Premarket Approval

A PMA application must be filed if a proposed device is a new device not substantially equivalent to a legally marketed Class I or Class II device, or if it is a pre-amendment Class III device for which the FDA has sought PMA. A PMA application must be supported by valid scientific evidence to demonstrate the safety and effectiveness of the device, typically including the results of clinical investigations, bench tests, and laboratory and animal studies. The PMA application must also contain a complete description of the device and its components and a detailed description of the method, facilities and controls used to manufacture the device. In addition, the submission must include the proposed labeling, advertising literature and any training materials. The PMA process can be expensive, uncertain and lengthy, and a number of devices for which FDA approval has been sought by other companies have never been approved for marketing.

Upon receipt of a PMA application, the FDA makes a threshold determination as to whether the application is sufficiently complete to permit a substantive review. If the FDA determines that the PMA application is complete, the FDA will accept the application for filing. Once the submission is accepted, the FDA begins an in-depth review of the PMA. The FDA’s review of a PMA application generally takes one to three years from the date the application is accepted, but may take significantly longer. The review time is often extended by the FDA asking for more information or clarification of information already provided in the submission. During the review period, an advisory committee, typically a panel of clinicians and subject matter experts, will likely be convened to review and evaluate the application and provide recommendations to the FDA as to whether the device should be approved. The FDA is not bound by the recommendation of the advisory panel, however often abides by it. Toward the end of the PMA review process, the FDA generally will conduct an inspection of the manufacturer’s facilities to ensure that the facilities are in compliance with applicable current Good Manufacturing Practices/QSR requirements.

If FDA evaluations of both the PMA application and the manufacturing facilities are favorable, the FDA may issue either an approval letter or an approvable letter, the latter of which contains a number of conditions that must be met in order to secure final approval of the PMA. When and if those conditions have been fulfilled to the satisfaction of the FDA, the Agency will issue an Approval Order, authorizing commercial marketing of the device for certain indications. If the FDA’s evaluation of the PMA application or manufacturing facilities is not favorable, the FDA will deny approval of the PMA application and issue a Not Approvable letter. The FDA may determine that additional clinical investigations are necessary, in which case the PMA may be delayed for one or more years while additional clinical investigations are conducted and submitted in an amendment to the PMA.

Modifications to a device that is the subject of an approved PMA, including its labeling or manufacturing process, most often require approval by the FDA of PMA supplements. Supplements to an approved PMA often require the submission of the same type of information required for an original PMA, except that the supplement is generally limited to that information needed to support the proposed change from the product covered by the original PMA. The FDA also has the authority to withdraw or temporarily suspend PMA approvals under specific circumstances.

12

Clinical Investigations

Before we can submit a medical device for 510(k) clearance, we may have to perform a relatively short (i.e., months) method comparison study at external clinical sites to ensure that the test performs appropriately when conducted by end users. This is a study in a clinical environment and is considered a clinical trial. However, patient-specific clinical outcome information is most often not required. Alternatively, when we submit a PMA, we generally must conduct a longer (i.e., years) clinical trial of the device which supports the clinical utility of the device, demonstrating how the device will perform when used with patients in the test’s intended use population, establish the safety and effectiveness of the device.

Although clinical investigations of most devices are subject to the investigational device exemption, or IDE requirements, clinical investigations ofin vitro diagnostic tests, including our products and products under development, are exempt from approval of an IDE application prior to initiation of the clinical study, provided the testing is non-invasive, does not require an invasive sampling procedure that presents a significant risk, does not intentionally introduce energy into the subject, and is not used as a diagnostic procedure without confirmation by another medically established test or procedure. In addition, our tests must be labeled “for research use only” or “for investigational use only,” and distribution controls must be established to assure that our tests distributed for research, method comparisons or clinical trials are used only for those purposes.

Regulation After FDA Approval or Clearance

Any devices we manufacture or distribute pursuant to 510(k) clearance or approval by the FDA are subject to pervasive and continuing regulation by the FDA and certain state agencies. We are required to adhere to applicable regulations setting forth detailed current Good Manufacturing Practices/QSR requirements, which include testing, control, design and documentation requirements. Non-compliance with these standards can result in, among other things, fines, injunctions, civil penalties, recalls or seizures of products, total or partial suspension of production, failure of the government to grant 510(k) clearance or PMA approval for devices, withdrawal of marketing approvals and criminal prosecutions. We have designed and implemented our manufacturing facilities under the current Good Manufacturing Practices/QSR requirements. Our manufacturing facility has been inspected by the FDA and will continue to be periodically inspected by the FDA.

Because we are a manufacturer of medical devices, we must also comply with medical device reporting (MDR) requirements by reporting to the FDA any incident in which our product may have caused or contributed to a death or serious injury. We must also report any incident in which our product malfunctioned if that malfunction would likely cause or contribute to a death or serious injury if it were to recur. Labeling and promotional activities are subject to scrutiny by the FDA and, in certain circumstances, by the Federal Trade Commission. Current FDA enforcement policy prohibits the marketing of approved medical devices for unapproved uses.

We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control and disposal of hazardous or potentially hazardous substances. We have numerous policies and procedures in place to ensure compliance with these laws and to minimize the risk of occupational exposure to hazardous materials. In addition, we do not expect the operations of our products to produce significant quantities of hazardous or toxic waste that would require extraordinary disposal practices. Although the costs to comply with these applicable laws and regulations have not been material, we cannot predict the impact on our business of new or amended laws or regulations, or any changes in the way existing and future laws and regulations are interpreted or enforced. Moreover, as we develop toxin and pathogen detection products for the food and agriculture markets, we may be subject to the regulations of various food safety organizations, including the United States Department of Agriculture.

Export of Our Products

Export of products subject to the 510(k) notification requirements, but not yet cleared to market, are permitted with FDA authorization provided certain requirements are met. Unapproved products subject to the PMA requirements must be approved by the FDA for export. To obtain FDA export approval, we must meet certain requirements, including, with some exceptions, documentation demonstrating that the product is approved for import into the country to which it is to be imported and, in some instances, safety data for the devices.

13

Clinical Laboratory Improvement Amendments of 1988

The use of our products is also affected by the Clinical Laboratory Improvement Amendments of 1988, or CLIA, and related federal and state regulations, which provide for regulation of laboratory testing. These regulations mandate that clinical laboratories must be certified by the federal government, by a federally-approved accreditation agency or by a state that has been deemed exempt from the regulation’s requirements. Moreover, these laboratories must meet quality assurance, quality control and personnel standards, and they must undergo proficiency testing and inspections. The CLIA standards applicable to clinical laboratories are based on the complexity of the method of testing performed by the laboratory, which range from “waived” to “moderate complexity” to “high complexity.” Generally, the more complex the method of testing is, the higher the cost to perform the testing. We expect that most of our products will be categorized as either “moderate complexity” or “high complexity.” All tests cleared by the FDA on the ProcessorSP have been categorized as “moderate complexity” by the FDA due to the ease in which to operate our Verigene system.

Foreign Government Regulation

We are marketing our products in certain foreign markets. Obtaining a CE IVD Mark is a mandatory requirement under the In-Vitro Diagnostic Directive 98/79/EC that addresses the essential requirements that anin-vitro diagnostic device must meet before being marketed within the European Union. We have obtained CE IVD Mark approval for sale of the Verigene System in European Union countries and will do so for any assay we plan to launch in Europe. Additional regulatory requirements exist in most foreign countries including, but not limited to, product standards, packaging requirements, labeling requirements and import restrictions on devices. Each country has its own tariff regulations, duties and tax requirements.

Corporate Information

We were incorporated in Delaware in 1999 under the name Nanosphere, Inc. Our principal executive offices are located at 4088 Commercial Avenue, Northbrook, Illinois 60062, and our main telephone number is (847) 400-9000. Our website is located on the world wide web at http://www.nanosphere.us.

Other Information

Copies of the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through the investor relations section of the Company’s website (www.nanosphere.us) as soon as reasonably practicable after the Company electronically files the material with, or furnishes it to, the Securities and Exchange Commission.

Item 1A. Risk Factors.

Our results from operations may be affected by the risk factors set forth below. All investors should consider the following risk factors before deciding to purchase securities of the Company. If any of the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our common stock to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business operations and could result in a complete loss of your investment.

Risks Related to Our Business

We have a history of losses and we may never achieve or maintain profitability.

We have a limited operating history and have incurred significant losses in each fiscal year since our inception, including net losses of $34.6 million, $32.9 million and $35.4 million in the years ended December 31, 2013, 2012 and 2011, respectively. As of December 31, 2013, we had an accumulated deficit of approximately $382.8 million. Our losses resulted principally from costs incurred in our research and development programs and from our general and administrative expenses. In recent years, we have incurred significant costs in connection with the development of the Verigene System and its test menu. We expect our research and development expense levels to remain high for the foreseeable future as we seek to enhance our existing product and develop new products. These losses, among other things, have had and will continue to have an adverse effect on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. If we fail to achieve profitability in the future, the market price of our common stock could decline.

14

Our financial results depend on commercial acceptance of the Verigene System, its array of tests, and the development of additional tests.

Our future depends on the success of the Verigene System, which depends primarily on its acceptance by hospitals, research institutions, and independent diagnostic laboratories as a reliable, accurate and cost-effective replacement for traditional molecular diagnostic measurement methods. Many hospitals and laboratories already use expensive molecular diagnostic testing instruments in their laboratories and may be reluctant to change their current procedures for performing such analyses.

The Verigene System currently does not process a sufficiently broad menu of tests nor volume of samples for some hospitals and laboratories to consider adopting it. Although we continue to develop additional tests to respond to hospitals’ and laboratories’ needs, we cannot guarantee that we will be able to develop enough additional tests quickly enough or in a manner that is cost-effective or at all. The development of new or enhanced products is a complex and uncertain process requiring the accurate anticipation of technological and market trends, as well as precise technological execution. We are currently not able to estimate when or if we will be able to develop, commercialize or sell additional tests or enhance existing products. If we are unable to increase sales of the Verigene System and its tests or to successfully develop and commercialize additional products or tests, our revenues and our ability to achieve profitability would be impaired.

The regulatory approval process is expensive, time consuming and uncertain and the failure to obtain such approvals will prevent us from commercializing our future products.

Our products are subject to approval or clearance by the FDA or foreign governmental entities prior to their marketing for commercial use. The 510(k) clearance and premarket approval processes as well as the foreign approvals required to initiate sales outside the United States can be expensive, time consuming and uncertain. It may take as long as eighteen months or longer from submission to obtain 510(k) clearance, and from one to three years from submission to obtain premarket approval; however, it may take longer, and 510(k) clearance or premarket approval may never be obtained. Delays in receipt of, or failure to obtain, clearances or approvals for future products, including tests that are currently in development, would result in delayed, or no, realization of revenues from such products and in substantial additional costs which could decrease our profitability. Relative to larger organizations, we have limited experience in filing FDA applications for 510(k) clearance and premarket approval. There are no assurances that we will obtain any required clearance or approval. Any such failure, or any material delay in obtaining the clearance or approval, could harm our business, financial condition and results of operations.

We and our customers are subject to various governmental regulations, and we may incur significant expenses to comply with, and experience delays in our product commercialization as a result of, these regulations.

The products we develop, manufacture and market are subject to regulation by the FDA and numerous other federal, state and foreign governmental authorities. We generally are prohibited from marketing our products in the United States unless we obtain either 510(k) clearance or premarket approval from the FDA.

In addition, we are required to continue to comply with applicable FDA and other regulatory requirements once we have obtained 510(k) clearance or PMA approval for a product. These requirements include the Quality System Regulation, labeling requirements, the FDA’s general prohibition against promoting products for unapproved or “off-label” uses and adverse event reporting regulations. Failure to comply with applicable FDA product regulatory requirements could result in warning letters, fines, injunctions, civil penalties, repairs, replacements, refunds, recalls or seizures of products, total or partial suspension of production, the FDA’s refusal to grant future pre-market clearances or approvals, withdrawals or suspensions of current product applications and criminal prosecution. Any of these actions, in combination or alone, could prevent us from selling our products and would likely harm our business.

Our manufacturing facilities are subject to periodic regulatory inspections by the FDA and other federal and state regulatory agencies. The use of our diagnostic products by our customers is also affected by the Clinical Laboratory Improvement Amendments of 1988, or “CLIA”, and related federal and state regulations that provide for regulation of laboratory testing. CLIA is intended to ensure the quality and reliability of clinical laboratories in the United States by mandating specific standards in the areas of personnel qualifications, administration, participation in proficiency testing, patient test management, quality and inspections. Current or future CLIA requirements or the promulgation of additional regulations affecting laboratory testing may prevent some laboratories from using some or all of our diagnostic products.

The FDA and foreign governmental regulators have made, and may continue to make, changes in approval requirements and processes. We cannot predict what these changes will be, how or when they will occur or what effect they will have on the regulation of our products. Any new regulations, including regulations specifically related to nanotechnology, may impose additional costs or lengthen review times of our products. Delays in receipt of or failure to receive regulatory approvals or clearances for our new products would have a material adverse effect on our business, financial condition and results of operations.

15

If third-party payors do not reimburse our customers for the use of our clinical diagnostic products or if they reduce reimbursement levels, our ability to sell our products will be harmed.

We intend to sell our products primarily to hospital-based laboratories and academic research institutions, substantially all of which receive reimbursement for the health care services they provide to their patients from third-party payors, such as Medicare, Medicaid and other domestic and international government programs, private insurance plans and managed care programs. Most of these third-party payors may deny reimbursement if they determine that a medical product was not used in accordance with cost-effective treatment methods, as determined by the third-party payor, or was used for an unapproved indication. Third-party payors also may refuse to reimburse for procedures and devices deemed to be experimental.

In the United States, the American Medical Association assigns specific Current Procedural Terminology, or CPT, codes, which are necessary for reimbursement of diagnostic tests. Once the CPT code is established, the Centers for Medicare and Medicaid Services establish reimbursement payment levels and coverage rules under Medicaid and Medicare, and private payors establish rates and coverage rules independently. Although the tests performed by our assays in development have previously assigned CPT Codes, we cannot guarantee that our assays are covered by such CPT codes and are therefore approved for reimbursement by Medicare and Medicaid as well as most third-party payors. Additionally, certain of our future products may not be approved for reimbursement. Third-party payors may choose to reimburse our customers on a per test basis, rather than on the basis of the number of results given by the test. This may result in reference laboratories, public health institutions and hospitals electing to use separate tests to screen for each disease so that they can receive reimbursement for each test they conduct. In that event, these entities likely would purchase separate tests for each disease, rather than products that multiplex. Third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement for medical products and services. Increasingly, Medicare, Medicaid and other third-party payors are challenging the prices charged for medical services, including clinical diagnostic tests. Levels of reimbursement may decrease in the future, and future legislation, regulation or reimbursement policies of third-party payors may adversely affect the demand for and price levels of our products. If our customers are not reimbursed for our products, they may reduce or discontinue purchases of our products, which would cause our revenues to decline.

We may fail to receive positive clinical results from the diagnostic tests currently in development that require clinical trials, and even if we receive positive clinical results, we may still fail to receive the necessary clearances or approvals to market our products.

We are investing in the research and development of new products to expand the menu of testing options for the Verigene System. In order to commercialize our products, we are required to undertake time consuming and costly development activities, sometimes including clinical trials for which the outcome is uncertain. Products that appear promising during early development and preclinical studies may, nonetheless, fail to demonstrate the results needed to support regulatory approval. Even if we receive positive clinical results, we may still fail to obtain the necessary FDA 510(k) clearance and approvals.

Our operating results may be variable and unpredictable.

The sales cycles for our products may be lengthy, which will make it difficult for us to accurately forecast revenues in a given period, and may cause revenues and operating results to vary significantly from period to period. In addition to its length, the sales cycle associated with our products is subject to a number of significant risks, including the budgetary constraints of our customers, their inventory management practices and possibly internal acceptance reviews, all of which are beyond our control. Sales of our products will also involve the purchasing decisions of large, medium and small hospitals and laboratories which can require many levels of pre-approvals, further lengthening sales time. As a result, we may expend considerable resources on unsuccessful sales efforts or we may not be able to complete transactions on the scheduled anticipated.

If we do not achieve our projected development goals in the quantities or time frames we estimate, the commercialization of our products may be delayed and our business prospects may suffer. The assumptions underlying our product placement and development goals also may prove to be materially inaccurate.

From time to time, we estimate the timing of the accomplishment of various scientific, clinical, regulatory and other product development goals. These goals may include the commencement or completion of scientific studies and clinical trials, the timing and number of product placements and the submission of regulatory filings. We also may disclose projected expenditures or other forecasts for future periods in information that we furnish to the SEC from time to time. These and other projections are based on management’s current expectations and may not contain sufficient margin of error or cushion for any specific uncertainties, or for the uncertainties inherent in all forecasting. The actual timing of our product placement and development goals and actual expenditures or other financial results can vary dramatically compared to our estimates, in some cases for reasons beyond our control. If we do not meet projections as announced from time to time, the development, placement and commercialization of our products may be delayed and our business prospects may suffer. The assumptions management has used to produce these projections may significantly change or prove to be inaccurate. Accordingly, you should not unduly rely on any of these forward-looking statements.

16

If we do not achieve significant product revenue, we may not be able to meet our cash requirements without obtaining additional capital from external sources, and if we are unable to do so, we may have to curtail or cease operations.

We expect capital outlays and operating expenditures to increase over the next few years as we expand our infrastructure, commercialization, manufacturing, and research and development activities. We anticipate that our current cash and cash equivalents, which include the net proceeds of our initial and secondary public offerings, will be sufficient to meet our estimated needs for at least twelve months. However, we operate in a market that makes our prospects difficult to evaluate, and we will need additional financing to execute on our current or future business strategies. The amount and the timing of the additional capital we will need to raise depends on many factors, including:

| | • | | the level of research and development investment required to maintain and improve our technology; |

| | • | | the amount and growth rate, if any, of our revenues; |

| | • | | changes in product development plans needed to address any difficulties in manufacturing or commercializing the Verigene System and enhancements to our system; |

| | • | | the costs of filing, prosecuting, defending and enforcing patent claims and other intellectual property rights; |

| | • | | competing technological and market developments; |

| | • | | our need or decision to acquire or license complementary technologies or acquire complementary businesses; |

| | • | | the expansion of our sales force; and |

| | • | | changes in regulatory policies, practices or laws that affect our operations, including clearance to market our products. |

We cannot be certain that additional capital will be available when and as needed or that our actual cash requirements will not be greater than anticipated. If we require additional capital at a time when investment in diagnostics companies or in the marketplace in general is limited due to the then prevailing market or other conditions, we may not be able to raise such funds at the time that we desire or any time thereafter. In addition, if we raise additional funds through the issuance of common stock or convertible securities, the percentage ownership of our stockholders could be significantly diluted, and these newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. If we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we raise additional funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our technologies or products, or grant licenses on terms that are not favorable to us.

Our ability to use net operating losses to offset future taxable income may be subject to certain limitations.

We currently have significant net operating losses (NOLs) that may be used to offset future taxable income. In general, under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), a corporation that undergoes an “ownership change” is subject to limitations on its ability to utilize its pre-change NOLs to offset future taxable income. Our recently completed underwritten public offering of common stock or future changes in our stock ownership, some of which are outside of our control, could result in an ownership change under Section 382 of the Code, which would significantly limit our ability to utilize NOLs to offset future taxable income.

The adverse capital and credit market conditions could affect our liquidity.

Adverse capital and credit market conditions could affect our ability to meet liquidity needs, as well as our access to capital and cost of capital. The capital and credit markets have been experiencing extreme volatility and disruption for more than 12 months. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by continued disruptions in the capital and credit markets.

If our products do not perform as expected or the reliability of the technology on which our products are based is questioned, we could experience lost revenue, delayed or reduced market acceptance of our products, increased costs and damage to our reputation.

Our success depends on the market’s confidence that we can provide reliable, high-quality diagnostics systems. We believe that customers in our target markets are likely to be particularly sensitive to product defects and errors.

17

Our reputation and the public image of our products or technologies may be impaired if our products fail to perform as expected or our products are perceived as difficult to use. Our products are complex and may develop or contain undetected defects or errors. Any defects or errors could lead to the filing of product liability claims, which could be costly and time-consuming to defend and result in substantial damages. If we experience a sustained material defect or error, this could result in loss or delay of revenues, delayed market acceptance, damaged reputation, diversion of development resources, legal claims, increased insurance costs or increased service and warranty costs, any of which could materially harm our business. We cannot assure you that our product liability insurance would protect our assets from the financial impact of defending a product liability claim. A product liability claim could have a serious adverse effect on our business, financial condition and results of operations.

We rely on third-party license agreements for patents and other technology related to our products, and the termination of these agreements could delay or prevent us from being able to commercialize our products.

As of December 31, 2013, our patent portfolio is comprised, on a worldwide basis, of 187 issued patents and 11 pending patent applications which we own directly or for which we are the exclusive licensee. Some of these patents and patent applications derive from a common parent patent application or are foreign counterpart patent applications and relate to similar or identical technological claims. The issued patents cover approximately 11 different technological claims and the pending patent applications cover approximately three additional technological claims.