UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-33312

SALARY.COM, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

| Delaware | | 04-3465241 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| |

195 West Street Waltham, Massachusetts | | 02451 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(781) 464-7300

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Exchange on Which Registered |

| Common Stock, $0.0001 par value | | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

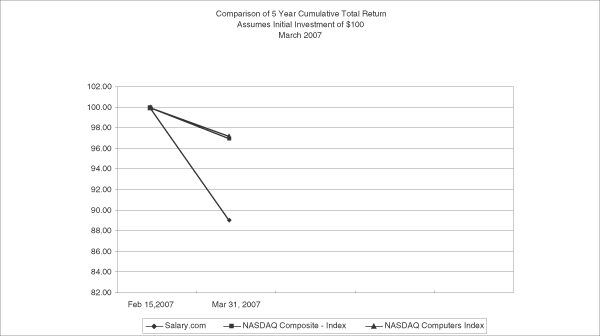

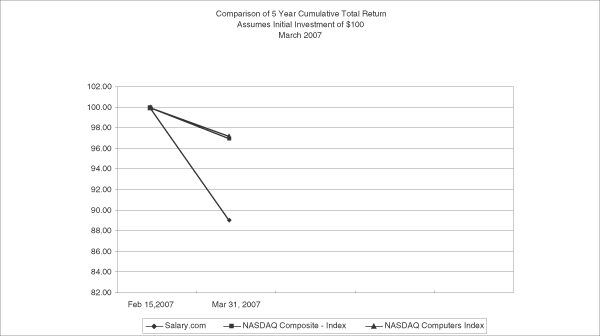

As of March 31, 2007, there were outstanding 15,307,165 shares of common stock, $.0001 par value per share. The aggregate market value of shares of common stock held by non-affiliates of the registrant, based upon the last sale price for such stock on that date as reported by the Nasdaq Global Market, was approximately $89,607,000. The registrant has provided this information as of March 31, 2007 because its common equity was not publicly traded as of the last business day of its most recently completed second fiscal quarter. The number of the registrant’s shares of common stock, $.0001 par value per share, outstanding as of June 21, 2007 was 15,272,540.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for the 2007 Annual Meeting of Stockholders, to be filed within 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

1

PART I

Overview

Salary.com is a leading provider of on-demand compensation and performance management solutions. Our comprehensive on-demand software applications are integrated with our proprietary data sets to automate the essential elements of our customers’ compensation management processes, link pay to performance and help drive business results. As a result, our solutions can significantly improve the effectiveness of our customers’ compensation spending and help them become more productive in managing their employees. We enable employers of all sizes to replace or supplement inefficient and expensive traditional approaches to compensation management, including paper-based surveys, consultants, internally developed software applications and spreadsheets.

Our on-demand solutions, which incorporate market compensation intelligence from our proprietary data sets, enable companies to determine how much to pay new and existing employees, research executive pay and manage overall compensation programs. Our data sets contain base, bonus and incentive pay data for positions held by more than 74% of U.S. employees and similar data for the top executives in over 10,000 U.S. public companies. Our flagship offering is CompAnalyst, a suite of on-demand compensation management applications that integrates our data, third-party survey data and a customer’s own pay data with a complete analytics offering. In addition, we provide a salary qualification service called PayScore to help mortgage professionals gain efficiencies in the application process. PayScore combines data and software to enable lenders to better qualify applicants’ salary claims, improve credit decision making and provide an audit trail for compliance purposes. In May 2007, we acquired ICR Limited, L.C. and ICR International Limited (ICR) and expanded our compensation data services for the specialty consumer goods industry across four key retail sectors (apparel, footwear, luxury goods and specialty retail) and the global technology industry covering technology jobs in over 70 countries.

Our expertise in compensation and technology provides additional opportunities to help our customers become more productive in managing their most critical asset – their people. Our on-demand talent management solutions offer customers effective and measurable ways to attract and inspire outstanding employee performance. We launched TalentManager, our employee life-cycle performance management application, to help businesses automate performance reviews, streamline compensation planning and link employee pay to performance. In addition to our on-demand enterprise software offerings, we also provide a series of applications through our website, which allows us to deliver salary management comparison and analysis tools to individuals and small businesses on a cost effective, real-time basis.

We offer our solutions principally on an annual or multi-year subscription basis. Our direct sales group markets and sells our solutions primarily using the telephone and web-based demonstrations. From the introduction of our solutions in 2000 through March 31, 2007, our enterprise subscriber base has grown to more than 1,850 companies who spend from $2,000 to more than $100,000 annually, including companies such as Wal-Mart, Home Depot, Procter & Gamble, Merrill Lynch, UPS and Cisco Systems. We also sell to both individual consumers and smaller businesses through our Salary.com website. According to comScore Networks, the amount of website traffic received by Salary.com over the twelve months ended March 31, 2007 places our website in the top 10 for Career Services and Development websites and in the top 10 for Financial Information and Advice websites during the twelve months ended September 30, 2006. Salary.com’s network of sites generated an average of more than three million unique visitors in the three months ended March 31, 2007.

From April 2001 through March 31, 2007, we achieved 24 consecutive quarters of revenue growth. During the years ended March 31, 2007, 2006 and 2005, we achieved positive operating cash flows of $3.1 million, $1.8 million and $0.9 million, respectively. During these periods, we have consistently incurred operating losses, including $8.3 million for 2007, $3.0 million for 2006 and $1.9 million for 2005. As of March 31, 2007, we had an accumulated deficit of $29.4 million.

2

Initial Public Offering

On February 14, 2007, we completed our initial public offering in which we sold an aggregate of 5,248,200 shares of our common stock, including 349,757 shares sold pursuant to the underwriters’ exercise of their over-allotment option on February 27, 2007, at a price of $10.50 per share. The net proceeds to us from our initial public offering aggregated approximately $48.0 million after deducting underwriting commissions and offering expenses. We used approximately $2.5 million of the net proceeds of our initial public offering to repay all outstanding borrowings under the Company’s revolving line of credit and term loan. We used approximately $10.3 million of the net proceeds of our initial public offering for our acquisition of ICR Limited. L.C. in May 2007. We intend to use the balance of the net proceeds from our initial public offering for general corporate purposes.

Industry Background

Compensation Management

For most organizations, the primary goal of compensation management is to design a compensation program that allows the employer to effectively and efficiently attract, motivate and retain employees. According to a February 2006 survey by CFO Magazine, 91% of companies ranked the management of “human capital” as one of the most important factors in the success of their business. Optimizing pay is a priority as compensation remains one of the largest expense categories for most companies. Also, it is widely believed that compensation is one of the most important factors influencing employee performance. The best managed companies typically are analytical and deliberate in establishing and monitoring their compensation programs and seek to understand compensation practices and levels at the organizations that compete with them for talent.

To execute their pay strategies, most large organizations rely on their internal compensation functions. Whether formal or informal, the compensation group’s role is to manage the organization’s full breadth of pay practices. Analytical professionals develop the overall compensation philosophy and specific pay programs; build the organization’s salary structures and manage the overall compensation budget; typically define how to link pay to performance and often work with line managers to cascade that linkage to each individual employee. They also report and make recommendations to senior management and the board of directors. The foundation for all this work is a true understanding of the appropriate compensation practices for specific jobs, departments, groups, and entire organizations.

The predominant approach used by companies to determine appropriate compensation is “market pricing.” Market pricing is the process of comparing positions and pay in a company against aggregated, statistically significant compensation data from companies of comparable size, industry and location. To conduct a market pricing analysis for a particular position at a particular company, an internal compensation specialist or an outside consultant compares the job at that company with the closest matching “benchmark” jobs found in compensation surveys. When ample market data has been identified (generally from three or more third party sources), the compensation specialist or consultant weights, adjusts and averages the data to form an opinion of the market price for the job. Through the use of market pricing, the development of salary structures, and execution of pay programs (for example, base pay, commissions and incentives), organizations can effectively manage their compensation costs and link pay to performance.

Although most organizations are in agreement regarding the importance of market pricing in compensation management, there is wide variation regarding the processes and tools employed to make compensation decisions. Some organizations employ in-house compensation professionals who purchase surveys and use them to price the positions themselves, whereas others hire compensation consultants to market price their positions and recommend appropriate salary ranges. Many large companies will take a combination approach, using in-house resources for a majority of positions and engaging consulting firms to market price the jobs that are most critical to the success of the organization or for which data is more difficult to obtain. It is also common for large organizations to purchase data from more than one source and use one or more software packages to

3

manage different parts of the process. Smaller organizations do not typically have dedicated compensation specialists and therefore often rely on a human resource, or HR, generalist to manage the compensation analysis duties for the organization as part of a larger job.

Traditional Approaches to Compensation Management

Companies have traditionally used a variety of approaches for managing the compensation function. Many continue to use relatively simplistic internally developed software tools, often based on generic desktop programs such as Microsoft Excel. Some companies utilize broad HR and/or enterprise resource planning, or ERP, software offerings, which include some compensation management capability but typically lack the specialized functionality to adequately address compensation management. Many of these solutions must be installed on clients’ servers and maintained by their information technology, or IT, departments and do not seamlessly incorporate compensation data. Larger organizations also engage outside third parties to assist them in managing their compensation processes. Traditional third-party solution providers include HR business process outsourcers, or HR BPOs, such as Hewitt Associates, Affiliated Computer Services, and HR consultants, such as Mercer, Watson Wyatt Worldwide, Towers Perrin and Hay Group. HR consultants provide full service market pricing, comparison analysis and compensation management process assistance, but at a high cost—up to $200,000 annually for a typical company with 500 positions.

Larger organizations are faced with the challenges of compiling and managing large amounts of information, analyzing and reporting on actual and proposed compensation programs, collaborating among large or geographically dispersed teams and increasing the organizational effectiveness of their compensation plans. Although larger organizations typically have well-staffed HR departments and dedicated budgets and resources for compensation management, the need to manage information and data from multiple internal and external constituencies and integrate those inputs within a single system creates significant difficulties.

For small and mid-sized organizations, professional compensation management is often prohibitively expensive and time-consuming. These organizations are typically faced with a decision either to use external consulting firms, the cost of which often exceeds available budgets, or to commit scarce internal resources. In addition, HR responsibilities for these organizations are often assigned to only one or two dedicated staff or, in many cases, shared across non-dedicated staff who have other full-time responsibilities and may lack compensation expertise. Furthermore, these companies do not possess sophisticated interactive tools and information for making compensation decisions or administering compensation programs.

On-Demand Software and Compensation Management

Recent innovations in information technology have created opportunities to deliver software applications directly to users over the Internet in a subscription-based, on-demand business model. This model is made possible by the proliferation of high-speed, broadband Internet connectivity, open standards for application integration and advances in network availability and security. For the user, on-demand software eliminates the need for expensive hardware, software and internal IT support.

For HR personnel, who may not have large capital spending budgets, the often minimal (if any) upfront expenditure required to implement on-demand solutions and the minimal need for IT department involvement is particularly attractive. In addition, the hosted architecture helps ensure that the software and vendor-supplied content is kept current and secure, without requiring any user involvement. On-demand solutions also permit rapid deployment of and training for new applications, resulting in faster product adoption and increased productivity, especially for users who may have little or no technological background. These benefits typically result in a lower total cost of ownership and, in our belief, an increased return on investment. Finally, the on-demand model enables multiple users, including geographically dispersed executives, HR departments, departmental managers and employees, to easily coordinate and collaborate within a single application. These factors make the compensation management market well-suited for the on-demand software business model.

4

Market Opportunity

Employee compensation is one of the largest expense categories for corporations in the U.S., with total compensation expense in 2006 approximating $7.26 trillion, according to the U.S. Bureau of Labor Statistics. As a result, managing compensation expense is critically important to organizations of all sizes. The compensation management technology market, which includes software and online compensation data offerings, is estimated to grow from approximately $320 million for 2006 to approximately $460 million for 2008, according to an April 2006 study by independent market research firm Yankee Group. This projection from Yankee Group is focused on the market for software and related data offerings. However, we believe our total addressable market is larger, as our products provide a solution which replaces, in part or in full, not only software and data offerings, but also service offerings addressing the compensation management market such as those provided by compensation consulting firms and HR BPOs. Yankee Group has estimated the market for service offerings to be approximately $960 million for 2006. In sum, the markets for software, data and service offerings totaled approximately $1.28 billion for 2006, which we believe provides a better estimate of our total addressable market.

Our Solutions

Salary.com is a leading provider of on-demand compensation management solutions. Our web-based software suites help organizations of all sizes optimize compensation, manage employee performance and qualify salaries. Our integrated software applications provide extensive features and broad functionality that address the critical functions of compensation analysis and planning, goal setting and performance management. By automating and integrating essential elements of compensation management, our solutions allow our customers to reduce costs, save time and increase the effectiveness of their compensation spending.

Our unique combination of software and data addresses the various stages of the compensation management lifecycle—ranging from benchmarking positions to establish the market price of equivalent positions to managing the compensation review and goal setting process between operating managers and front-line employees. We deliver our compensation management solutions to customers through our CompAnalyst suite of on-demand software applications, which are tightly integrated with our proprietary data sets. Our PayScore product provides salary qualification services targeted to the specific needs of the mortgage lending industry. In addition to our compensation management solutions, we offer our TalentManager suite to deliver employee lifecycle performance management solutions, which help organizations establish goals throughout the organization and link employee pay to performance of those goals.

Our acquisition of ICR in May 2007 expanded our compensation product offering with the addition of two new services: IPAS®, the largest single source of international technology compensation data and software, including all relevant job titles in over 70 countries, and ICR Specialty Consumer Goods, a leading source of U.S. compensation data for apparel, footwear, luxury goods and specialty retail jobs.

Our comprehensive suite of integrated software applications provides the following key benefits:

Facilitates more effective compensation spending. Our solutions enable companies to deliver more effective and consistent compensation programs by reducing the risk of high turnover caused by underpaying employees and the risk of reduced profitability caused by overpaying employees. By making better compensation decisions, our customers are able to better attract, motivate and retain their employees, which we believe can lead to improved business execution and financial performance.

Enables Human Resource professionals to be more strategic. Our solutions incorporate features and best practices that automate compensation management to reduce or eliminate manual, paper-based and discrete business activities. As a result, our solutions help maximize the effectiveness of HR departments by enabling compensation professionals to focus on more strategic, high-value corporate-wide initiatives.

5

Provides access to proprietary market-driven compensation intelligence. Companies have traditionally made compensation decisions based on a limited number of surveys that are updated only once a year. By contrast, our proprietary data sets provide market-driven compensation information that is derived from numerous sources and which is updated monthly. We believe that the current nature, as well as the breadth and depth, of our data sets provide our customers with significant advantages as they set their compensation levels. To build and update our data sets, our compensation professionals apply proprietary comparative algorithms and sophisticated statistical analysis to the data to provide the most up-to-date, comprehensive and useful information to our customers.

Provides ability to price technology jobs around the world using the same methodology and participants. Market pricing technology jobs across countries has traditionally been a challenging process complicated by multiple surveys, different job titles, inconsistent job matching, different participants per country and no centralized source to compare across countries. Through our IPAS product, we offer a uniform set of job benchmarks in a single source of comprehensive data that enables consistent benchmarking capabilities across all countries in the survey. Customers participate in a single, web-based survey and receive access to every job from clerk to executive for over 70 countries. For example, a customer can determine what an accountant makes across all countries in the survey, with the same source, same methodology, same participants, and same currency.

Reduces compensation management costs. We believe that our solutions are more cost-effective than other available offerings. Our on-demand model significantly reduces or eliminates the installation and maintenance costs associated with on-premise solutions. Our intuitive user interfaces allow our customers to find the right data, manage its application and configure overall compensation plans with little or no technical assistance. Furthermore, by integrating our software with our proprietary data sets, we provide our customers with a significantly less expensive compensation management solution than the traditional approach of separately purchasing combinations of consulting services, surveys and software applications.

Allows for rapid deployment and scalability. Our on-demand software can be deployed rapidly and provisioned easily, without our customers having to make a large and risky upfront investment in software, hardware, implementation services or dedicated IT staff. The delivery platform for our software allows the solution to scale to suit customers’ needs. Additional users with defined privileges can be granted access with minimal implementation time, and new applications, such as analytics, can be deployed quickly and transparently to existing customers.

6

Data

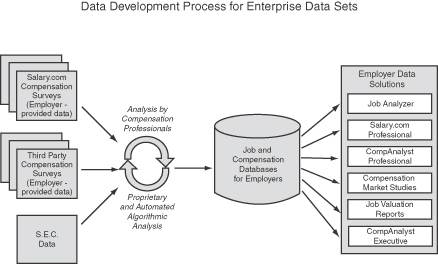

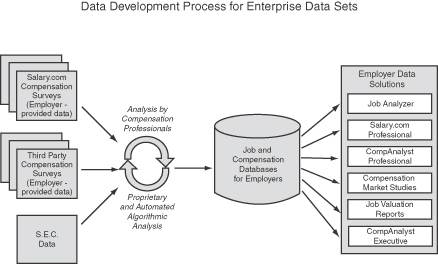

Our proprietary data sets are a core differentiator of our solutions. By providing comprehensive data within our applications, we are able to assist corporate customers in achieving their compensation management objectives faster and more efficiently. The following diagram illustrates how we gather and process data and make it available to our enterprise customers through our software applications:

To develop our data sets, we begin with raw data we obtain from numerous sources. We purchase data directly from industry associations, compensation consulting firms, economic analysis firms and other sources. We also collect data directly from employers, partners and government agencies (for example, the U.S. Bureau of Labor Statistics, Department of Labor and SEC). Our team of certified compensation professionals also conducts proprietary compensation surveys on emerging jobs such as Corporate Ethics Officers and Six Sigma jobs. Through our acquisition of ICR in May 2007, we expanded both our custom survey capabilities to include consumer goods surveys across four main sectors—luxury goods, apparel, footwear and specialty retail—and also our data-filled software capabilities into global technology jobs with the addition of the IPAS product. Our team of compensation professionals processes data from these sources to derive our own proprietary data sets of compensation and other job-related information.

Our Market Pricing Data Processes

For our proprietary market pricing data sets, we use both standard and proprietary algorithms, which provide our customers with complete and consistent data that is representative of nearly all relevant markets and reasonable combinations of jobs, industries, locations and organization sizes. The completeness and consistency of our data sets provides our enterprise and consumer customers with market-driven compensation intelligence that we believe they could not procure or easily derive from alternate sources. In addition, our market pricing data processes and data sets also reduce the problems corporate compensation departments face from their lack of standardized processes for analyzing and combining multiple survey sources and maintaining the consistency of those sources year-over-year.

Enterprise and Consumer Data Sets

We have one proprietary data set for our enterprise customers and one for consumer customers. Our enterprise data set contains base, bonus and incentive pay data for positions held by more than 74% of U.S. employees and our consumer data set currently addresses the jobs held by more than 80% of the U.S. workforce.

7

Our enterprise solutions report data based on the most reliable sources available. Our enterprise customers may also incorporate data sources that they have independently acquired, which are then available for their exclusive use. Our enterprise data set is also augmented by compensation data from our customers, which they provide to us through surveys we conduct and which we do not include in our consumer data set. In addition, we provide a module in which an enterprise customer can store its own employee records to match to its preferred market sources and compare actual compensation, target compensation and market compensation.

Our lower priced and free consumer products report data designed to provide a reasonably accurate estimate of the compensation pay levels for thousands of jobs in various types of organizations throughout the United States and Canada. The jobs reported in our consumer tools are primarily the major benchmark jobs available from numerous public data sources. The purpose of the consumer tools is to educate the individual employee regarding the compensation decision-making process and to provide a reasonable approximation of the market for that individual’s job. We believe the best way for an employee and employer to have a productive conversation regarding compensation and pay for performance is for both to be educated about the process and current market values.

SEC Data Set

In addition to our proprietary market pricing data sets described above, we also maintain a complete data set of executive compensation and related data for more than 10,000 U.S. publicly-traded companies. All compensation data included in this data set is obtained directly from filings made by these companies with the SEC. Our SEC data set also contains data on director compensation from approximately 3,000 of the largest publicly-traded companies. Our SEC data set is updated daily to reflect new public filings and we maintain the historical data in our SEC data set to facilitate comparisons.

We also include basic financial data on public companies in our SEC data set, which we purchase from Standard & Poors. This data is used to allow our customers to place compensation data in the context of a company’s financial performance.

8

Products

We offer a suite of compensation management applications for enterprise customers that helps companies determine how much to pay new and existing employees and manage overall compensation programs. We also offer a suite of performance management applications to assist customers to establish performance goals throughout their organizations and link each employee’s pay to performance against these goals (“pay-for-performance”). Along with our application suites, we provide our customers with implementation and data configuration services as well as assistance with the application of our compensation and performance management solutions to their organization. In addition to our enterprise offerings, we also provide a series of consumer and e-commerce solutions through our website to provide compensation information and tools designed for the consumer. We provide our solutions on a subscription, transaction or ad-sponsored basis. For the years ended March 31, 2007, 2006 and 2005, our subscription revenues derived from our TalentManager products comprised less than 15% of our total revenues, with the remainder of our subscription revenues being derived from our compensation management and data products. Our solutions consist of the following products:

| | | | |

Product Category | | Product Name | | Principal Revenue Type |

Enterprise Solutions—Compensation Management Products | | CompAnalyst Suite Job Analyzer Survey Center Salary Structures Reporting & Analysis | | Subscription Subscription Subscription Subscription Subscription |

| | |

| | CompAnalyst Executive | | Subscription |

| | |

| | CompAnalyst Professional Edition | | Subscription |

| | |

| | Salary.com Professional Edition | | Subscription |

| | |

| | PayScore | | Subscription |

| | |

| | Job Valuation Reports | | Subscription |

| | |

| | Compensation Market Studies | | Transaction |

| | |

| | Salary.com Survey | | Transaction |

| | |

Enterprise Solutions—Performance Management Products | | TalentManager Suite PerformanceManager CompPlanner IncentivesManager StockOptionManager | | Subscription Subscription Subscription Subscription |

| | |

Consumer & E-Commerce Solutions | | www.salary.com | | Subscription/Ad-sponsored |

| | |

| | Salary Wizard | | Subscription/Ad-sponsored |

| | |

| | Salary Center | | Subscription/Ad-sponsored |

| | |

| | Personal Salary Report Subscription | | Subscription |

Enterprise Solutions

Compensation Management Products

CompAnalyst is a suite of on-demand compensation management solutions for use by the compensation professional in an enterprise. CompAnalyst is built around a core data set of market pricing information and includes access to several analytics applications, including the following:

Job Analyzer: Allows large enterprise customers easy access to our U.S. benchmark data set of market pricing for approximately 3,300 positions in companies of all sizes, across 20 industries and all U.S. geographies

9

(including regions, states and major metropolitan areas). Customers can also quickly find the market price for any benchmark job or create and price a “hybrid job” by mixing multiple positions together.

Survey Center: Provides customers with a centralized, online repository for managing and performing market pricing with third-party surveys that they acquire and own themselves. Easy to use tools enable customers to age, weight, adjust and combine data from multiple sources to produce market rates for use in compensation program design and analysis. Customers can use this functionality when they have specific data sources and weightings they choose to employ in determining market pricing. The Survey Center module also simplifies and speeds up the customer’s survey participation process by leveraging data typically used within the module’s core functionality—including employee pay and demographic data and company job to survey job matches—and exporting survey participation files in the specific survey vendor’s preferred format.

Salary Structures: Provides tools for analyzing current pay structures and for modeling the cost of proposed changes. The Salary Structures module enables customers to assess the alignment of pay practices with the external market and internal targets, and to perform “what if” analysis to support recommendations for changes in compensation program design.

Reporting & Analysis: Enables organizations to assess external competitiveness against internal equity by comparing actual pay practices to market data developed in Job Analyzer or Survey Center. Customers may analyze trends by year, compare pay practices across groups of employees (for example, by region, business unit, Equal Employment Opportunity Commission protected class) and create custom queries to meet their analysis needs. Customers can also store data and use it to conduct historical comparisons.

CompAnalyst Executive: This application allows CEOs, CFOs, executive compensation specialists, board members and consultants to analyze and review compensation information disclosed in filings with the SEC for more than 10,000 public companies. The data available with this product, which is updated daily, includes pay, incentive compensation, Black-Scholes values, benefits, director compensation, financial and stock performance data and more. CompAnalyst Executive’s functionality includes the ability to build and analyze peer groups by industry, size and location, as well as company financial performance measures and executive and director pay measures.

CompAnalyst Professional Edition: This application is similar to Job Analyzer, except with less data and functionality. Our sales force sells this application to smaller businesses.

PayScore: This product is a salary qualification service which helps mortgage professionals gain efficiencies in the application process. PayScore combines data and software to enable lenders to better qualify applicants’ salary claims, improve credit decision making and provide an audit trail for compliance purposes.

Salary.com Professional Edition: This data product is similar to CompAnalyst Professional Edition, but contains data only on small companies. We sell this application online through our website and our partners’ websites directly to businesses that typically have fewer than 100 employees.

Job Valuation Reports: This report is designed for use by HR departments to price a single position. It allows users to view a report on the appropriate market compensation data for that job and, if they desire, recommend adjustments to reflect the particular experience, education and other factors specific to an employee currently in the job. The job valuation report also includes basic explanations of how to use the data and how to explain market pricing practices to an employee. We sell this application to employers through our website and our partners’ websites.

Compensation Market Studies: These survey-like reports aggregate the data, generally for 50 to 200 related job titles within an industry group, typically within the same job family (for example, finance and accounting) or the same level (for example, executives). Salary.com has more than 100,000 of these reports that we update each month and sell to employers through our website and our partners’ websites.

10

Salary.com Surveys: Salary.com runs and manages compensation and benefits surveys, some of which are sponsored directly by Salary.com and others of which are sponsored in partnership with industry associations or other external sponsors. To conduct a survey, Salary.com solicits companies to submit actual pay data for their employees to us. We analyze, aggregate and anonymize their data and report the results back to participating companies. Typically, we charge participants a fee and we also may sell final reports to non-participants for a higher fee.

Performance Management Products

TalentManager is a suite of on-demand solutions that provides the essential workflow to link pay to performance across the enterprise. TalentManager enables an organization to manage goal setting, performance reviews and incentive programs, and to link those elements to relevant compensation programs within a single integrated application. Our TalentManager suite includes the following:

Performance Manager: Enables the communication and setting of goals by employees and managers and tracks performance against those goals. The system uses the goals as the basis for managing the performance review process. Performance Manager is fully integrated with CompPlanner, IncentivesManager and StockOptionManager and can link a virtually unlimited number of pay plans to an individual or to a particular goal.

CompPlanner: Enables organizations to automate and control the process of allocating salary increases, budget pools, lump sum adjustments and basic bonus plans. Within CompPlanner, HR and finance departments can set rules or guidelines that dictate the limits and the approval process for any component of the compensation decision-making process. By setting all of the rules in one system, which programmatically enforces the process, the entire organization can easily and efficiently adhere to policies and control procedures.

IncentivesManager: A configurable and customizable application capable of managing incentive plans. Incentive plans vary significantly among and within organizations and can have very complex management and payout structures. Although CompPlanner includes features to address basic incentive plans, many organizations need the additional sophisticated performance measures and calculations available in IncentivesManager.

StockOptionManager: Provides an environment and business rules for managing the allocation of stock and stock options as part of the compensation cycle. The granting of equity incentives within a company can be a simple or complex process, depending on the company’s philosophy and internal rules. Like IncentivesManager, StockOptionManager addresses the complexity necessary to accommodate an organization’s equity allocation rules and processes. The StockOptionManager module accommodates both publicly-traded and private company equity.

Professional Services

Our CompAnalyst professional services teams handle new customer implementations, training and general help desk services for the CompAnalyst product line and all data products. The TalentManager professional services team handles all new customer implementations, configurations, training, and general help desk services for the TalentManager suite of applications. For implementations that are not strictly “plug and play,” our product-specific implementation teams provide initialization, configuration, training and general help-desk services. We also train our customers so that they can be more self-sufficient for future implementations. TalentManager customers generally require more professional services than do CompAnalyst customers. Professional services in most cases are included as part of our subscription agreements and, to a lesser extent, are offered on an as-needed basis.

11

Consumer and E-Commerce Solutions

Our consumer and e-commerce family of products consists of free-to-user applications that are ad-sponsored, as well as certain premium products that are sold directly to individuals visiting our website. We also generate indirect revenue from these products through advertisers that pay for space on our website and our partners’ websites.

Our consumer and e-commerce products include:

www.salary.com: Our destination website and marketing face of the company is an advertising and online subscription sales channel. Our internet media traffic has grown to an average of more than three million unique monthly visitors over the three months ended March 31, 2007. According to comScore Networks, the amount of website traffic received by Salary.com over the twelve months ended March 31, 2007 places it in the top 10 most visited for Career Services and Development websites and in the top 10 most visited for Financial Information and Advice websites during the twelve months ended September 30, 2006. According to a search we performed using Google, more than 9,000 websites currently link directly to www.salary.com. The site includes calculators, memberships, newsletters and content around the topic of career and pay management for individuals, as well as related business content for small business and enterprise audiences. We believe that more than 90% of Salary.com’s traffic is organically generated and is not the result of substantial direct advertising and marketing on our part.

Salary Wizard: Salary Wizard is an ad-sponsored salary calculator designed to provide non-scoped, national average base pay and total annual cash compensation ranges for the positions we track. Users may adjust the national average information to their desired location by selecting a metropolitan area or zip code, and the results will be adjusted using a geographic adjustment factor to estimate the pay level for that location. Salary Wizard also attracts visitors to our website and our syndicated partner network of sites and serves as an entry point for consumers and employers to purchase a report or subscription product from us. The product is used more than 3 million times per month by both individuals and businesses.

Salary Center: Our syndicated product is a fully functional set of applications that deploy onto our partners’ websites to power the compensation section of their websites in a co-branded manner. For example, AOL Career Channel’s salary area is populated with Salary.com tools and the content is hosted and managed by Salary.com. The syndicated Salary Center product typically includes advertising inventory and e-commerce reports for which partners share revenue with Salary.com. Salary.com partners include AOL, Monster, CNN Money, Yahoo! Hotjobs, Dice, Business Week, the New York Times, ADP and 500 other companies representing more than 2,500 discrete websites.

Personal Salary Report Subscription: This application is a premium 14-page report providing individuals with an HR-quality assessment of their worth in the job market. The report also educates the subscriber about how employers determine compensation and also advises the subscriber on how to negotiate salary for a win-win outcome.

In addition to these online offerings, we also sell space for third party advertisers to deliver their messages to users of Salary.com’s website. Advertisers will pay for targeted inventory space adjacent to content that will be viewed by certain types of consumers. We believe our advertising inventory is attractive to advertisers because we provide a large volume of exposure opportunities and we can link those opportunities to a variety of consumer demographic factors, such as job title, location and income. Advertisers that purchase this inventory include job boards, recruiters, colleges and universities and financial services firms.

Compensation Team

We believe that one of the most significant differentiators between us and our software competitors is our compensation team. In addition to hiring experienced compensation professionals from industry, most of whom

12

are certified compensation professionals, we train our technology personnel about compensation and our compensation personnel about technology, so that each group possesses both the HR and the technological expertise essential to our products. We believe that this combined expertise allows us to design our software and data sets in a sophisticated and useful manner for our customers. We also try to ensure that employees with compensation experience are deployed throughout our organization. Historically, we have moved compensation professionals into roles within sales, product management, and professional services. In this way we are able to embed compensation knowledge, skills and abilities in all aspects of what we do, and we believe this allows us to position our domain expertise as a true competitive advantage.

Research & Development

Our research and development efforts are focused on improving and enhancing our existing on-demand service offerings as well as developing new products, features and functionality. Expansion of our solutions into new areas often involves a multiple year commitment to enter a new business, and we seek new product opportunities related to compensation, performance and talent management. When we extend an existing application or data set, our development costs are relatively low. When we innovate in an area requiring the development of a new data set, our development costs increase due to the high initial fixed costs of entering the new area and also building original software functionality. Once the initial investment in a new area has been made, however, the ongoing costs to maintain a data set and extend a product are often significantly less than the costs of maintaining the typical installed software product. Research and development expense for the fiscal years ended March 31, 2007, 2006 and 2005 was $4.1 million, $2.2 million and $1.4 million, respectively.

Technology

We were a pioneer in hosted, multi-tenant, on-demand software, launching our first product in 2000. Our on-demand software is a highly scalable, multi-tenant application platform written in CSS, XML, DHTML, Visual Basic, C++, Java and C# for the .NET framework and COM+ and MSMQ for the Windows operating systems. We use commercially available hardware and a combination of proprietary and commercially available software, including Microsoft SQL Server, Microsoft IIS Server and Microsoft Windows.

Our on-demand software treats our customers as separate tenants in central applications and data sets. As a result, we are able to spread the cost of delivering our service across our user base. In addition, because we do not have to manage thousands of distinct applications with their own business logic and database schemas, we believe that we can scale our business faster than traditional software vendors, even those that have modified their products to be accessible over the Internet.

Our TalentManager products are built on our proprietary, highly scalable Salary.com FlexTenant platform, which enables us to customize the business logic, data flow, workflow and user interfaces of our enterprise applications for clients and yet continue to operate in the same multi-tenant application shared by our other customers.

Operations

We serve all of our customers from a third-party network operations facility located in Watertown, Massachusetts, operated by AT&T. This facility provides around-the-clock security personnel, photo ID/access cards, biometric hand scanners and sophisticated fire systems. The overall security of each data center (inside and outside) and network operations center are monitored by digital video surveillance cameras 24 hours a day, seven days a week. Additionally, redundant bandwidth, on-site electrical generators and environmental control devices are used to keep servers up and running. We continuously monitor the performance of our service. We have a comprehensive security infrastructure, including firewalls, intrusion detection systems and encryption for transmissions over the Internet. We monitor and test this security infrastructure on a regular basis. Our site operations team provides system management, maintenance, monitoring and back-up. We run tests regularly to

13

ensure adequate response from our sites and conduct production environment reviews for hosting capacity, expansion and upgrade planning. We also monitor site availability and latency. We own or lease and operate all of the hardware on which our applications run in the network operations facility.

To facilitate high availability of our solutions and loss recovery, we operate a multi-tiered system configuration with redundant bandwidth, load balanced web server pools, replicated and clustered database servers and fault tolerant storage devices. Data sets are restored to hot standby database servers using transaction logs shipped from primary production database servers. This solution is designed to provide near real-time fail-over service in the event of a malfunction with a primary clustered database or server. Full backups of all data sets take place nightly and are archived to tapes. These tapes are rotated offsite to a separate facility managed by Iron Mountain. We also maintain a fully redundant site, located within our headquarters, which would serve as our primary site in the event that a disaster was to render the network operations facility inoperable. Our real-time backups are stored on servers in our corporate headquarters. Although we have not experienced a failure of our third-party network operations facility, we believe that if such facility became inoperable, most of our products would be available to our customers with minimal interruption in service.

Sales and Marketing

We sell our enterprise solutions primarily through our direct sales organization and to a lesser extent through indirect channels. As of March 31, 2007, our direct sales force consisted of 68 employees, including 38 account executives. We employ business development representatives to call potential enterprise customers to book initial demonstrations and to qualify customer leads. Once a lead is qualified, our account executives assess customer needs, complete demonstrations and close sales, primarily by telephone and via web-based product demonstrations. We also employ account managers who maintain on-going or post-sale relationships with subscribers, manage renewals and generate interest from existing customers to purchase additional products. Additionally, our sales engineers and compensation professionals assist with sales to customers with particularly complex needs and provide post-sales customer support. Most of our sales personnel are located in our headquarters in Waltham, Massachusetts. We also have an advertising and syndication sales team, which works much in the same way as our enterprise product sales team, but focuses its efforts on selling and marketing advertising on our website and syndication of our consumer offerings to other websites. Although we have relationships with many partners, including websites and consulting firms, these partners accounted for less than 10% in the aggregate of our total revenue in the fiscal years ended March 31, 2007 and 2006.

Our marketing program is anchored by an integrated communications strategy that supports the core of our brand and value proposition. Our marketing programs include direct mail and email campaigns, using our website to provide product and company information, advertising in both print and online media, search engine marketing, issuing press releases on a regular basis and launching events to publicize our service to existing customers and prospects. We build our brand through our website, syndication and public relations, all of which are intended to increase market awareness of Salary.com as a top-tier provider of on-demand compensation management solutions, as well as a leading website for free information about compensation. Furthermore, our spokespersons are frequently sought as expert commentators by major media, including television, radio, newspapers and mainstream and trade magazines. We believe that this is a critical component of our branding program and positions Salary.com as an expert in the compensation field. In the fiscal year ended March 31, 2007, our television and radio appearances were viewed more than 50 million times and our print appearances were viewed more than 140 million times. We also conduct seminars, participate in trade shows and industry conferences, publish white papers on HR issues and develop customer reference programs.

14

Customers

As of March 31, 2007, we had more than 1,850 enterprise subscribers, in various industries, who spend from $2,000 to more than $100,000 annually. No single customer accounted for more than 3% of our revenue in the fiscal years ended March 31, 2006 or 2007. Below is a representative list of companies who were customers as of March 31, 2007, grouped by industry category and number of employees in the business unit we serve.

| | | | |

Industry | | More than 500 Full-Time Employees | | 500 or Fewer Full-Time Employees |

Retail | | Toys R’ Us | | Dial-a-Mattress |

| | Home Depot | | Hickory Farms |

| | Abercrombie & Fitch | | Honey Baked Ham |

| | Linens ‘N Things | | Red Envelope |

| | Hallmark | | Zappos.com |

| | |

Consumer Products | | Campbell Soup | | LaCrosse Footwear |

| | Procter & Gamble | | Premier Agenda |

| | Kohler | | Birds Eye |

| | Royal Caribbean | | Waterford Wedgwood USA |

| | Avon | | Bunn-O-Matic |

| | |

Financial Products and Services | | Equifax | | American Capital Strategies |

| | Merrill Lynch | | Cole Taylor Bank |

| | PricewaterhouseCoopers | | Cascade Bancorp |

| | M&T Bank | | Ocean First Financial |

| | MasterCard | | Juniper Bank |

| | |

Manufacturing | | Raytheon | | Wagner Spray Technology |

| | Bosch | | Royal Appliance |

| | Honeywell | | Rockford Corporation |

| | BASF | | Troy Corporation |

| | Goodrich | | JSP International |

| | |

Technology | | Cisco Systems | | Sycamore Networks |

| | Thermo Fisher Scientific | | Powerwave Technologies |

| | Trimble Navigation | | DigitalGlobe |

| | Mitsubishi Electronics USA | | SiRF Technologies |

| | SRA International | | Omron Components |

Competition

The market for on-demand compensation management and performance management solutions is fragmented, competitive and rapidly evolving, and there are low barriers to entry to some segments of this market. Within our markets, the most common applications in use today are generic desktop software tools and solutions that are not specifically designed for compensation management or performance management. We also compete with software vendors that offer solutions through either traditional on-premise delivery methods or to a lesser extent, on-demand solutions, and established consulting firms that continue to offer a diversity of services and software products. We also expect to encounter new and evolving competition as the market for on-demand compensation management software and services consolidates and matures and as organizations become increasingly aware of the advantages and efficiencies that can be attained from the use of compensation management software and data solutions.

15

We believe the principal factors that generally determine a company’s competitive advantage in the compensation management and performance management markets include the following:

| | • | | a large installed customer base; |

| | • | | a well-known and respected brand; |

| | • | | breadth and depth of proprietary content; |

| | • | | the ability to offer both powerful software and technology and accurate compensation data in a single offering; |

| | • | | a suite of products (rather than individual point solutions); and |

| | • | | an integrated platform (e.g., in which pay and performance software and data are linked). |

We face competition primarily from five sources:

| | • | | generic desktop software and in-house or custom-developed solutions; |

| | • | | established software vendors offering products specifically designed for compensation management, performance management and/or talent management; |

| | • | | established compensation and HR consulting firms; |

| | • | | other websites and advertising venues; and |

| | • | | existing and future start-up companies offering software, data, and e-commerce compensation solutions. |

Generic desktop software and in-house or custom- developed solutions. Perhaps the most common applications in use today are generic desktop software tools such as Microsoft Excel and Microsoft Access, as well as other commercially available software solutions not specifically designed for compensation or performance management. Compensation professionals at organizations of all sizes routinely use these generic software tools to develop in-house or home-grown solutions. Although we believe our CompAnalyst and TalentManager offerings are superior to these home-grown, partially-automated solutions, some potential customers may be reluctant to switch both because of the cost of our solution and because of the perceived risk they face in giving up direct control over their sources of data.

Established software vendors. Established HR software vendors compete with both our CompAnalyst and TalentManager solutions. In addition, the market for our TalentManager solution is extremely competitive and includes several companies that are more established and have greater financial, technological and marketing resources than we do. As a result, we expect to face intense ongoing competition in this segment of our business, which could affect our ability to increase or maintain market share in the performance management arena.

We also expect that new competitors, such as enterprise software vendors that have traditionally focused on enterprise resource planning, or ERP, or back office applications, will enter, or greatly expand their offerings in, the on-demand compensation and performance management software market as it develops and matures. In addition, there are a number of companies that have products in the broader talent management market, which includes not only compensation and performance management, but also learning and recruitment management. We expect over time that certain of these companies may also seek to offer compensation and performance management products in competition with us. These large, traditional players in the HR space could focus their considerable financial, technical, marketing and sales resources on various segments of our business, either by developing their own products in-house or purchasing a smaller company. To the extent such efforts are successful, it is possible that these new competitors could rapidly acquire significant market share.

16

Established compensation and HR consulting firms. The market for compensation management data and services has traditionally been dominated by large consulting firms, all of which have greater financial, sales and marketing, management, service, support and other resources than we have. Such firms have traditionally offered an expensive but fully customized compensation management solution to the nation’s largest enterprises. Additionally, in recent years such firms have begun to reinvest in their software-based compensation management tools. We thus face two types of competition from established consulting firms:

| | • | | First, their customized consulting services represent a challenge to our CompAnalyst suite, particularly in larger organizations, which frequently have long-standing and well-entrenched relationships with compensation and HR consulting firms. This challenge is particularly acute for our CompAnalyst Executive product line, as HR and compensation executives are often reluctant to change the processes used to determine their bosses’ pay. |

| | • | | Second, some established HR consulting firms offer software that competes directly with certain modules of both our CompAnalyst and TalentManager product lines. While we believe that our software products compete favorably with those offered by consulting firms, these firms have far greater resources than we do and as a result may compete successfully with our CompAnalyst and TalentManager solutions. |

Other websites and advertising venues. Our advertising-sponsored offerings (Salary Wizard, www.salary.com, and Salary Center) compete with a wide variety of other websites and online media for advertising dollars. To the extent these competitors are able to offer advertisers more effective or cost-efficient means of marketing their product and services, we may be unable to grow, or face reduced revenues from some or all of our advertising-based products.

Existing and future start-up software, data, and e-commerce companies. A number of smaller, early-stage companies offer products that compete directly with one or more of our product lines. Although many of these young companies may have fewer resources than we do, to the extent they are successful in their efforts, we expect to face more effective competition from them in the future, and our financial performance may suffer as a result. In addition, because the market for compensation and performance management software and services, as well as e-commerce compensation products, is nascent and rapidly evolving, we expect additional, as yet unformed, companies to enter our markets in the future. To the extent this occurs, some or all of our product lines will face greater competition in the future, which may materially adversely affect our financial performance.

Intellectual Property and Proprietary Content

We rely on a combination of patent, trademark, copyright and trade secret laws in the United States and other jurisdictions as well as confidentiality procedures and contractual provisions to protect our proprietary technology and our brand. We have one U.S. issued patent (for our proprietary methods for calculating market pricing across our data sets) which expires in 2022 and three pending U.S. patent applications, as well as related patents and patent applications in other jurisdictions. We also enter into confidentiality and proprietary rights agreements with our employees, consultants and other third parties and control access to software, documentation, data and other proprietary information.

We pursue the registration of our trademarks in the United States. Currently, our CompPlanner and Salary Wizard marks are federally registered in the U.S. In addition, we have applied for registration of the following trademarks: Salary.com, CompAnalyst, CompAnalyst Executive, Survey Center, PayScore, TalentManager and FlexTenant.

We currently license some of the content used to build our compensation data sets from numerous providers pursuant to data reseller, data distribution, and license agreements with these providers. Our data sets are generally derived from market data as collected in salary surveys. This information is used as one of several inputs to our data set calculation methodology. Most of the licenses for this content are non-exclusive. We cannot

17

assure you that the data we require for our data sets will be available from such sources in the future or that the cost of such data will not increase. Because we have content from numerous providers, we do not believe that the loss of any one license would materially affect the quality of our data sets, however, we cannot assure you that any single data set will not be substantially reliant on a single source in the future. Additionally, if a third party successfully asserted a claim that our use of data has violated our agreement with them or infringed upon their copyright, we may be required to remove the applicable data from our data sets and regenerate our data sets without such data.

Although the protection afforded by patent, trademark, copyright and trade secret laws may provide some advantages, we believe that our ability to maintain our competitive position is largely determined by such factors as the technical skills of our personnel, the breadth and depth of our proprietary data sets, new product developments and product enhancements.

Substantial litigation regarding intellectual property rights exists in the software industry. From time to time, in the ordinary course of business, we may be subject to claims relating to our intellectual property rights or those of others, and we expect that third parties may commence legal proceedings or otherwise assert intellectual property claims against us in the future, particularly as we expand the complexity and scope of our business, the number of similar products increases and the functionality of these products further overlap. If a claim is asserted that we have infringed the intellectual property of a third party, we may be required to seek licenses to that technology. In addition, we license third party technologies, primarily from Microsoft, that are incorporated into some elements of our services. Although we do not believe that any one license is material to our operations, licenses from third parties may not continue to be available to us at a reasonable cost, or at all. Additionally, the steps we have taken to protect our intellectual property rights may not be adequate. Third parties may infringe or misappropriate our proprietary rights. Competitors may also independently develop technologies that are substantially equivalent or superior to the technologies we employ in our services.

Employees

At March 31, 2007, we had 255 full-time and part-time employees. Our employees are not represented by any collective bargaining agreement, and we have never experienced a work stoppage. We believe we have good relations with our employees.

Officers

Kent Plunkett founded Salary.com and has served as our Chairman, President and Chief Executive Officer since 1999. Prior to founding Salary.com, Mr. Plunkett was CEO of Bumblebee Technologies Inc., a career software publisher, from 1996 through 1999, held a leadership role at InfoSpace, Inc., an online content syndication company, including online white and yellow pages, private-label search and mobile entertainment, in 1996 and Director of Business Development for Pro CD, Inc., a CD-ROM electronic directory publisher of white pages, yellow pages and mapping content, from 1995 through 1996. Mr. Plunkett holds an A.B. degree from Georgetown University and an M.B.A. from the Harvard Business School and is a Certified Compensation Professional.

Yong Zhang has served as our Chief Technology Officer since April 2000 and as our Executive Vice President and Chief Operating Officer since June 2006. Mr. Zhang has been a member of our board of directors since December 2004. Prior to joining Salary.com, Mr. Zhang held various technical leadership and project management positions at privately held software and healthcare companies, including Iconomy.com, a pioneer of private-label e-commerce solutions, Smart Route System, a traveler information company, and Center for Health and Human Services, Inc., and served as consultant for Aerovox, Inc., a publicly-held capacitor manufacturer. Mr. Zhang holds a B.S. in Physics from Shanghai University of Science and Technology, an M.B.A. from Cornell University and an M.S. in Electrical Engineering as well as an M.S. in Physics from University of Massachusetts at Dartmouth. Mr. Zhang is a Certified Compensation Professional and a Global Remuneration Professional.

18

William H. Coleman has served as our Senior Vice President and Chief Compensation Officer since November 2006 and served as our Senior Vice President, Compensation from November 2002 until November 2006 and as our Vice President, Compensation from May 2000 until November 2002. Prior to joining us, Mr. Coleman held senior compensation positions with Watson Wyatt Worldwide, a global consulting company, and PricewaterhouseCoopers LLP. Mr. Coleman holds a B.S. in Mathematics from the Massachusetts Institute of Technology and is a Certified Compensation Professional.

Kenneth S. Goldman has served as our Senior Vice President, Chief Financial Officer and Treasurer since March 2006. Mr. Goldman has been a member of our board of directors since November 2006. From April 2004 to March 2006, Mr. Goldman was a Principal with Mirus Capital Advisors, an investment banking firm. From March 2002 to March 2004, Mr. Goldman was Senior Vice President and Chief Financial Officer of Lodestar Corporation, an enterprise software company. From March 2000 through March 2002, Mr. Goldman was Executive Vice President and Chief Financial Officer of Student Advantage, a NASDAQ-traded marketing services company. Prior to 2000, Mr. Goldman served as the chief financial officer of several companies, including MediaMap, a provider of software and content data, ShopLink.com, an online provider of grocery shopping and household consumables, the international division of Liberty Mutual Group, and Goldweitz & Company, a real estate investment and development firm. Mr. Goldman started his career with KPMG and has been a Certified Public Accountant since 1984. Mr. Goldman holds a B.S. in Business Administration from the Whitman School of Management at Syracuse University.

Meredith A. Hanrahan has served as our Senior Vice President and Chief Marketing Officer since September 2005. From January 2005 to September 2005, Ms. Hanrahan was a marketing consultant for Yankee Group, a technology research and consulting firm, and also for Boston Beer Company, a publicly-traded beverage company. From November 2003 until November 2004, Ms. Hanrahan was General Manager and Chief Marketing Officer for AG Interactive (the interactive division of American Greetings) and from May 2000 through November 2003, Ms. Hanrahan was Vice President and General Manager for Terra Lycos, a Spanish provider of Internet access. Prior to that, Ms. Hanrahan worked for five years as a strategy consultant for KPMG and McKinsey & Company in New York, and for ten years in senior and management positions at General Mills, Inc., Miller Brewing Company, and Lindt Chocolate USA. Ms. Hanrahan holds a B.A. from the University of New Hampshire and an M.B.A. from the Harvard Business School.

Teresa A. Shipp has served as our Senior Vice President of Sales since May 2003 and served as our Corporate Controller from November 2002 until August 2004. From November 2001 until September 2002, Ms. Shipp was International Finance Manager for LoJack Corporation, a publicly-held provider of vehicle recovery systems. Ms. Shipp holds a B.S. in Electrical Engineering from the University of Notre Dame and an M.B.A. from the Harvard Business School and is a Certified Public Accountant, a Certified Compensation Professional and a Global Remuneration Professional.

Christopher J. Fusco has served as our Vice President of Compensation and Data Operations since July 2006 and served as our Vice President, Business Analysis, from July 2005 to July 2006, our Professional Services Director from March 2004 to July 2005 and our Senior Compensation Consultant from February 2002 to March 2004. From July 1998 through May 2001, Mr. Fusco was a Senior Consultant with William M. Mercer, Inc., a global consulting company. Prior to 1998, Mr. Fusco served in various compensation management positions with companies such as KPMG, an audit, tax and advisory firm, W.R. Grace & Co., a global specialty chemicals and materials company, Towers Perrin, a professional services firm, and Interleaf, a provider of software products used for business documents. Mr. Fusco holds a B.S. from the University of Connecticut and an M.B.A. from Northeastern University. Mr. Fusco is a Certified Compensation Professional and Global Remuneration Professional and has earned lifetime achievement as a Senior Professional in Human Resources (SPHR) by the Society of Human Resource Management.

Andrew Linn has served as our Senior Vice President of Global Data Products since July 2005 and served as our Senior Vice President of Product Management from 2000 to July 2005. Prior to 2000, Mr. Linn served in

19

various capacities with One Source Information Services (and its predecessor, Lotus Development Corporation), including Group Product Manager and Product Manager from November 1988 through January 2000, an aggregator of business and company information. Mr. Linn holds a B.S. from the Wharton School at the University of Pennsylvania and is a Chartered Financial Analyst and a Certified Compensation Professional.

Elliot J. Mark has served as our Senior Vice President, General Counsel and Secretary since October 2006. From August 2003 until September 2006, Mr. Mark was Senior Vice President and General Counsel of Viisage Technology, Inc., a NASDAQ-traded identity technology company. During the period from January 2001 to March 2003, Mr. Mark was the General Counsel of eRoom Technology, Inc., an enterprise software company. Prior to that, Mr. Mark held senior legal positions at SimPlayer Sports, Inc., a developer of interactive applications for the sports market, Arthur D. Little, Inc., a global consulting firm, and Molten Metal Technology, Inc., an environmental technology company. Mr. Mark started his career with Goodwin Procter LLP. Mr. Mark holds a B.A. from Wesleyan University and a J.D. from The Georgetown University Law Center.

Mark Albrecht has served as our Vice President of Product Marketing for Talent Management Solutions since March 2006 and from February 2004 to March 2006, he served as our Vice President of Professional Services. From 2002 through 2004, Mr. Albrecht served as Managing Partner of Business Performance Partners, a performance management consulting firm. During the period from 2000 through 2002, Mr. Albrecht was Vice President of Professional Services at Commerce One, a supplier of on demand supply chain management solutions. Mr. Albrecht holds a B.S. from Florida State University, an M.B.A. in Operations Management from Boston University and an M.A. in Psychology from Montclair State College and is a Certified Compensation Professional.

Nicholas Camelio has served as our Vice President of Human Resources since June 2007. From January 2006 to March 2007, Mr. Camelio was the Vice President of Human Resources for BrassRing Inc., an enterprise application talent management solution provider. From February 2001 through January 2006, Mr. Camelio served as Senior Director of Human Resources at BrassRing Inc., and prior to that was a Regional Human Resources Director for Vignette Corporation, an enterprise software company. From 1992 through February, 2000, Mr. Camelio held a variety of positions at Lotus Development Corporation and International Business Machines (IBM), including Human Resources Director for the North American Sales and Services organization. Mr. Camelio holds a B.S. from Bentley College and is a member of the Society of Human Resource Management and a certified MBTI professional trainer.

Joseph E. Duggan joined us in May 2007 as part of the ICR acquisition, and serves as the Vice President and co-General Manager of our ICR division. Mr. Duggan was a founding partner of ICR in 1995, and served in an executive role at that firm since its founding. Prior to that, Mr. Duggan held senior management positions with Stride Rite Corporation, a publicly traded footwear company, and Data General Corporation, a computer systems manufacturer. He has a B.S. from Suffolk University and an M.B.A. from Babson College.

Dana Freeman has served as our Vice President of Product Management since March 2006. From 2003 through 2006, Mr. Freeman was Vice President of Product Management at Deploy Solutions, a human resources management software company. From 1999 through 2003, Mr. Freeman was President and CEO of HRchitect, a human capital management consulting company. Mr. Freeman holds a B.S. in Business Administration from the University of Maine.

John McCammond has served as our Vice President of Business Development since May 2005. From 2001 to 2005, Mr. McCammond was Vice President of Channel Sales at Avaki, a provider of enterprise information integration software systems. Mr. McCammond holds a B.A. from Williams College and an M.B.A. from the Harvard Business School.

Thomas A. Samalis has served as our Vice President and Corporate Controller since August 2004. From 1994 to July 2004, Mr. Samalis was Vice President and Corporate Controller for OneSource Information

20

Services, Inc., a publicly-held company and provider of business information. Prior to that, he was employed for twenty-three years by Interactive Data Corporation, a provider of business and financial data, where he served as Vice President and Corporate Controller for six years, and in various finance and accounting capacities, including Director of Accounting and Accounting Manager throughout the preceding seventeen years. Mr. Samalis holds a B.S. in Accounting from Suffolk University and an M.B.A. from Bentley College.

Roger C. Sturtevant, Jr. joined us in May 2007 as part of the ICR acquisition, and serves as the Vice President and co-General Manager of our ICR division. Mr. Sturtevant was a founding partner of ICR in 1995. Prior to that, he was the Manager of Compensation, HRIS and Staffing at Kendall Healthcare Products, a healthcare products company. Mr. Sturtevant holds a B.S. in Organizational Psychology and an M.S. in Human Resources Management from Purdue University.

Dean Vassiliou has served as our Vice President of Professional Services since October 2006. From November 2005 to October 2006, Mr. Vassiliou was the Vice President of Professional Services at 4DataLink Inc., an enterprise application integration solution provider. From June 2004 to November 2005, he was the Vice President of Product Management and Marketing at Valaran Corporation, an enterprise software company. Prior to that, Mr. Vassiliou held a variety of positions at Lodestar Corporation, an enterprise software company, from 1998 to February 2004, including Senior Vice President of Products, Services and Support from November 2001 to February 2004. Mr. Vassiliou holds a B.S. in Mechanical Engineering from the University of Hartford.

Facilities