Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-33312

SALARY.COM, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 04-3465241 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |

| 195 West Street Waltham, Massachusetts | 02451 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(781) 464-7300

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Exchange on Which Registered | |

| Common Stock, $0.0001 par value | The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x

Non-Accelerated Filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of September 30, 2007, there were outstanding 15,533,948 shares of common stock, $.0001 par value per share. The aggregate market value of shares of common stock held by non-affiliates of the registrant, based upon the last sale price for such stock on that date as reported by the Nasdaq Global Market, was approximately $108,786,000. For purposes of determining this amount only, Registrant has defined affiliates of the Registrant to include the executive officers and directors of Registrant and holders of more than 10% of the Registrant’s common stock on September 30, 2007. The number of the registrant’s shares of common stock, $.0001 par value per share, outstanding as of June 9, 2008 was 15,799,010.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for the 2008 Annual Meeting of Stockholders, to be filed within 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

| Page | ||||

| PART I | ||||

Item 1. | 2 | |||

Item 1A. | 28 | |||

Item 1B. | 46 | |||

Item 2. | 46 | |||

Item 3. | 46 | |||

Item 4. | 46 | |||

| PART II | ||||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 47 | ||

Item 6. | 51 | |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 53 | ||

Item 7A. | 67 | |||

Item 8. | 67 | |||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 67 | ||

Item 9A. | 67 | |||

Item 9B. | 70 | |||

| PART III | ||||

Item 10. | 70 | |||

Item 11. | 70 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 70 | ||

Item 13. | Certain Relationships and Related Transactions and Director Independence | 70 | ||

Item 14. | 70 | |||

| PART IV | ||||

Item 15. | 71 | |||

1

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Overview

We are a leading provider of on-demand compensation, performance management and competency management solutions in the human capital software-as-a-service (SaaS) market. Incorporated in 1999 as a Delaware corporation, we offer content-rich software and services to help businesses and individuals manage pay and performance. Companies of all sizes turn to us to effectively and efficiently compensate, promote and manage their employees. With our help, companies can put the right talent in the right roles to deliver business objectives and individuals at all levels can determine their worth.

Our highly configurable software applications and proprietary content and our consulting services help executives, line managers and compensation professionals automate, streamline and optimize critical talent management processes, such as market pricing, compensation planning, performance management, competency management (a competency is a set of demonstrated behaviors, skills and proficiencies that determine performance in a given role) and succession planning. Compensation and competency content are at the core of our solutions, which deliver productive and cost-effective ways for employers to manage and inspire their most important asset—their people.

We integrate our comprehensive SaaS applications with our proprietary content to automate the essential elements of our customers’ compensation and performance management processes. Our approach links pay to performance and aligns employees with corporate goals to drive business results. As a result, our solutions can significantly improve the effectiveness of our customers’ compensation spending and help them become more productive in managing their employees. We enable employers of all sizes to replace or supplement inefficient and expensive traditional approaches to compensation management, including paper-based surveys, consultants, internally developed software applications and spreadsheets. Our customers report gains in productivity, reduction in personnel hours to administer pay and performance programs and improvements in employee retention.

Our data sets contain base, bonus and incentive pay data for positions held by more than80% of U.S. employees and similar data for the top executives in more than 12,000 U.S. public companies. Our flagship offering is CompAnalyst, a suite of on-demand compensation management applications that integrates our data, third-party survey data and a customer’s own pay data with a complete analytics offering. In 2008, we expanded our CompAnalyst market data and added new geographic coverage in the Canadian market with more than 650 benchmark jobs. Our Canadian content has already attracted a diverse set of customers across multiple industries. We continue to build our IPAS global compensation technology survey with coverage of technology jobs from clerk to chief executive officer in more than 70 countries. In addition, we are expanding our compensation data services for the consumer goods retail sectors (i.e., apparel, footwear, luxury goods and specialty retail).

Our on-demand performance management solutions offer customers effective and measurable ways to attract and inspire outstanding employee performance. TalentManager, our employee lifecycle performance management software suite, helps businesses automate performance reviews, streamline compensation planning and link employee pay to performance. TalentManager helps employers gain visibility into their performance cycle and drive employee engagement in the process through a configurable, easy to use interface that can be personalized by users. Using TalentManager, employers can improve their performance management systems and model the critical jobs skills they need to achieve their business goals.

In fiscal year 2008, we acquired the assets of ITG Competency Group and Schoonover & Associates. We now offer one of the largest libraries of leadership and job-specific competencies and a leading job-competency model to manage competencies by position. During 2008, we launched our full employee performance suite that integrated compensation, performance and succession functions around job-based competency content. Our

2

Table of Contents

on-demand system helps line managers improve their ability to engage, develop and deploy their talent with learning references, coaching tips and progress journals. The integrated suite offers a cost effective way to automate performance and develop a strong internal pipeline of leaders.

In addition to our on-demand enterprise software offerings, we also provide a selection of applications on the Salary.com website. The applications deliver salary management comparison and analysis tools to individuals and small businesses on a cost effective, real-time basis. For example, in 2008, we launched TalentManager Professional, which offers enterprise-quality performance management at a price that smaller companies can afford. We also offer a professional edition of our CompAnalyst product suite for smaller companies with less than 500 full-time employees in either report format or through subscription services. We market to individual consumers providing career services, financial information and premium compensation reports personalized to a consumer’s unique background. Our network of sites generated an average of more than three million unique visitors during the fiscal year ended March 31, 2008.

We sell our enterprise solutions through our direct sales group, primarily using the telephone and web-based demonstrations, in annual or multi-year subscriptions. Over the past fiscal year, our enterprise subscriber base, companies that spend from $2,000 to more than $100,000 annually, has grown from 1,850 to nearly 2,800 customers. We draw our customers from all industries, including such companies as Singapore Airlines, Heineken USA, Comcast Corporation, E*Trade Financial Products, Sony Ericsson Mobile Communications, Yale New Haven Health System, Scotts Miracle-Gro and Rolex Watch USA.

From April 2001 through March 31, 2008, we achieved 28 consecutive quarters of revenue growth. During the years ended March 31, 2008, 2007 and 2006 we achieved positive operating cash flows of $8.4 million, $3.1 million and $1.8 million, respectively. During these periods, we have consistently incurred operating losses, including $12.3 million for 2008, $8.3 million for 2007 and $3.0 million for 2006. As of March 31, 2008, we had an accumulated deficit of $40.0 million.

Industry Background

Compensation and Performance Management

According to IDC’s Talent Pulse Survey (May 2007), more than two thirds of employers rank retaining top talent as their top future talent challenge, followed by the impending labor shortage and lack of leadership succession plan for their organizations. To respond to these challenges, employers are planning talent initiatives to develop their staff, reduce turnover, align goals, identify top performers and implement pay for performance.

For most organizations, the primary goal of compensation planning and performance management is to design programs that attract, engage and retain key employees. Optimizing pay is a priority because compensation remains one of the largest expense categories for most companies. In addition, it is widely believed that compensation is one of the most important factors to recognize and enhance employee performance. Integrating pay with performance is a critical way to motivate employees to meet and exceed business goals and develop the workforce to adapt and respond to changing market conditions and business requirements. The best managed companies typically are analytical and deliberate in establishing and monitoring their compensation programs and successfully link pay and performance to reward achievement. They leverage technology to gain visibility into employee population, identify key talent, develop workforce skills and build a pipeline of internal leaders.

To execute their pay strategies, most large organizations rely on their internal compensation functions. Whether formal or informal, the compensation group’s role is to manage the organization’s full breadth of pay practices. Analytical professionals develop the overall compensation philosophy and specific pay programs. They build the organization’s salary structures, manage the overall compensation budget and typically define how to

3

Table of Contents

link pay to performance. They also often work with line managers to cascade that linkage to each individual employee. These professionals also report and make recommendations to senior management and the board of directors. The foundation for all this work is a true understanding of the appropriate compensation practices for specific jobs, departments, groups, and entire organizations.

Market pricing (the process of comparing positions and pay in a company against aggregated, statistically significant compensation data from companies of comparable size, industry and location) is the predominant approach companies use to determine appropriate compensation. To conduct a market pricing analysis for a particular position at a particular company, an internal compensation specialist or an outside consultant compares the job at that company with the closest matching benchmark jobs found in compensation surveys. When ample market data has been identified (generally from three or more third-party sources), the compensation specialist or consultant weights, adjusts and averages the data to form an opinion of the market price for the job. Through the use of market pricing, the development of salary structures, and execution of pay programs (e.g., base pay, commissions and incentives), organizations can effectively manage their compensation costs and link pay to performance.

Although most organizations agree that market pricing is important to compensation management, the processes and tools employed to make compensation decisions vary widely. Some organizations employ in-house compensation professionals who purchase surveys and use them to price the positions themselves, whereas others hire compensation consultants to market price their positions and recommend appropriate salary ranges. Many large companies will combine in-house resources for a majority of positions with the services of a consulting firm to market price the jobs that are most critical to the success of the organization or for which data is more difficult to obtain. It is also common for large organizations to purchase data from more than one source and use one or more software packages to manage different parts of the process. Smaller organizations do not typically have dedicated compensation specialists; they often rely on a human resource (HR) generalist to manage the compensation analysis duties for the organization as one component of a larger job.

Traditional Approaches to Compensation Management

Companies have traditionally used a variety of approaches for managing the compensation function. Many continue to use relatively simplistic internally developed software tools, often based on generic desktop programs such as Microsoft Excel. Some companies utilize broad HR and/or enterprise resource planning (ERP) software offerings, which include some compensation management capabilities but typically lack the specialized functionality to adequately address compensation management. Many of these solutions must be installed on clients’ servers and maintained by their information technology (IT) departments and do not seamlessly incorporate compensation data. Larger organizations also engage outside third parties to assist them in managing their compensation processes. Traditional third-party solution providers include HR business process outsourcers (HR BPOs) such as Hewitt Associates, Affiliated Computer Services, and HR consultants such as Mercer, Watson Wyatt Worldwide, Towers Perrin and Hay Group. HR consultants provide full-service market pricing, comparison analysis and compensation management process assistance, but at a high cost—up to $200,000 annually for a typical company with 500 positions.

Larger organizations face the challenges of compiling and managing large amounts of information, analyzing and reporting on actual and proposed compensation programs, collaborating among large or geographically dispersed teams and increasing the organizational effectiveness of their compensation plans. Although larger organizations typically have well-staffed HR departments and dedicated budgets and resources for compensation management, the need to manage information and data from multiple internal and external constituencies and integrate those inputs within a single system creates significant difficulties.

For small and mid-sized organizations, professional compensation management is often prohibitively expensive and time-consuming. These organizations are typically faced with a decision either to use external consulting firms, the cost of which often exceeds available budgets, or to commit scarce internal resources. In

4

Table of Contents

addition, HR responsibilities for these organizations are often assigned to only one or two dedicated staff or, in many cases, shared across non-dedicated staff that have other full-time responsibilities and may lack compensation expertise. Furthermore, these companies do not possess sophisticated interactive tools and information for making compensation decisions or administering compensation programs.

On-Demand Software and Compensation Management

Recent innovations in information technology have created opportunities to deliver software applications directly to users over the Internet in a subscription-based, on-demand business model. This model is made possible by the proliferation of high-speed, broadband Internet connectivity, open standards for application integration and advances in network availability and security. For the user, on-demand software eliminates the need for expensive hardware, software and internal IT support.

For HR personnel, who may not have large capital spending budgets, the often minimal (if any) upfront expenditure required to implement on-demand solutions and the minimal need for IT department involvement is particularly attractive. In addition, the hosted architecture helps ensure that the software and vendor-supplied content is kept current and secure, without requiring any user involvement. On-demand solutions also permit rapid deployment of and training for new applications, resulting in faster product adoption and increased productivity, especially for users who may have little or no technological background. These benefits typically result in a lower total cost of ownership and, in our belief, an increased return on investment. Finally, the on-demand model enables multiple users, including geographically dispersed executives, HR departments, departmental managers and employees, to easily coordinate and collaborate within a single application. These factors make the compensation management market well-suited for the on-demand software business model.

Traditional Approaches to Employee Performance Management

Typically, performance management has been treated as an annual, point-in-time conversation between line manager and employee that ends in a discussion of merit and bonus pay. The process has been a one-way dialogue from manager to employee; the styles of communication, content and process vary radically from manager to manager. Most organizations rely on manual, disparate systems to set goals, review employee performance, backfill employee vacancies and develop workforce to deliver business objectives. Nearly 50% of companies have not developed consistent, enterprise-wide standards and processes largely because of the lack of technology to automate their strategic HR processes. According to Bersin & Associates, the majority of companies cite that their systems are in various stages of maturity and implementation. The overwhelming majority of companies (80%) still use manual or spreadsheet systems to conduct and manage employee performance; more than 50% still rely on paper-based forms while 30% use limited spreadsheet form-based systems. According to IDC, only 30% of the market has implemented workforce performance management software. As a result, many lack visibility into their organization and find it difficult to ensure that individual goals and business unit goals are aligned with company objectives. As the workforce shortage increases and new generation of workers enters workforce, it becomes increasingly critical for employers to develop existing talent and address needs of the millennial workforce (i.e., those just entering the workforce) for two-way dialogue and ongoing feedback on performance and advancement. As a result, organizations rate their top talent management challenges to be addressing gaps in the leadership pipeline, creating performance-driven culture and filling key positions, according to Bersin & Associates. The lack of technology to automate and integrate the different HR systems to address these issues has become the largest challenge to companies that want to move to pay-for-performance and integrated performance management philosophies.

Integrated Employee Performance Management via SaaS

In response to these challenges, vendors have developed talent management software to help customers automate performance processes, provide visibility into an organization’s talent pool and improve accountability.

5

Table of Contents

The software options have increased with the advent of SaaS. This model makes it possible for companies to implement best practices as well as automate their systems without heavy investment in IT, large hosting fees or custom consulting services. IDC reports that, on average, 82% of surveyed performance vendors’ performance management implementations were delivered via the SaaS model, up from 62% a year ago. This 20-point increase in a single year demonstrates the adoption and acceptance of SaaS by the market. According to Salary.com research and IDC market analysis, buyer interest remains high in performance management, succession planning and compensation planning. According to Bersin & Associations, the integration of performance management functions is gaining momentum; although only 13% of companies have implemented an integrated performance management system, nearly 62% are in the process of linking these important systems to improve their ability to connect pay and performance, develop talent and model succession. The top three priority areas for integrated performance center on performance and development plans, performance and succession plans and pay-for-performance implementations.

Market Opportunity

Employee compensation is one of the largest expense categories for corporations in the U.S., with total compensation expense in 2007 approximating $7.51 trillion, according to the U.S. Bureau of Labor Statistics. As a result, managing compensation expense is critically important to organizations of all sizes. Estimates show the compensation management technology market, which includes software and online compensation data offerings, will grow from approximately $320 million in 2006 to approximately $460 million in 2008, according to an April 2006 study by independent market research firm Yankee Group. This projection from Yankee Group is focused on the market for software and related data offerings. However, we believe our total addressable market is larger because our products provide a solution that replaces, in part or in full, not only software and data offerings, but also service offerings addressing the compensation management market such as those provided by compensation consulting firms and HR BPOs. Yankee Group has estimated the market for service offerings to be approximately $960 million in 2006. In sum, the markets for software, data and service offerings totaled approximately $1.28 billion for 2006, which we believe provides a better estimate of our total addressable market.

Integrated Employee Performance Management

The market for employee performance management software and maintenance reached $529 million in 2007 and estimates show it will reach $885 million by 2012, increasing at a compound annual growth rate (CAGR) of nearly 11% according to IDC. IDC forecasts that spending on performance-management related services reached $1.1 billion in 2007 and will grow to $1.7 billion by 2012, increasing at a CAGR of nearly 10%. IDC estimates that the global market reached $1.6 billion and will increase at CAGR of 10% to $2.6 billion in 2012. IDC cites lower forecasts than previous years due to economic slowdown and its potential impact on talent management software and services.

Competency Management

Competency management consists of the competency content, the framework that combines the list of competencies per job, the behavior indicators of success by each competency, the proficiency levels and the learning references into a system that can be deployed enterprise wide to help organizations evaluate, assess and develop talent consistently and effectively. Competency management systems are recognized as the foundation content of strategic HR management providing a common currency to benchmark performance, identify high potential leaders, provide equitable compensation and engage employees in career planning. However, the majority of competency content is focused on leadership competencies only and tends to skew to the senior management levels of an organization; most organizations have not deployed competencies across all levels of the organization.

According to Bersin & Associates, although more than 86% of companies surveyed believe that skills and competency management are important or critical to succeed in employee performance management, more than

6

Table of Contents

60% do not have well-defined competencies and only 31% of organizations with performance management processes report well-implemented deployment of competencies in the performance assessment and review. The challenge for many HR professionals is to create an ongoing system to centralize the content, manage the multiple changes to models and then integrate them into disparate talent management systems such as recruiting, performance and learning systems in real-time.

Although the competency market today is relatively small—we estimate it to be under $500 million—it is rapidly becoming the next hot topic in HR circles. We estimate that software represents only 5% of the market spend today and we believe that there is an opportunity to redefine and expand the acceptance of competency content by building and deploying software that is tightly integrated with the competency content.

Our Solutions

Our integrated software applications provide extensive features and broad functionality that address the critical functions of compensation analysis and planning, goal setting, performance management and succession planning. By automating and integrating essential elements of compensation and performance management, our solutions enable our customers to increase productivity, promote employee retention, and ensure the right talent for the right roles to meet the business strategies of the future.

We combine content with on-demand software to manage both the compensation management lifecycle and the employee performance management suite.

Our content-rich compensation management suite addresses the various stages of the compensation management lifecycle—ranging from benchmarking jobs for establishing the market price of equivalent jobs, to managing the compensation review and goal setting process between operating managers and front-line employees. We deliver our compensation management solutions to customers through our CompAnalyst suite of on-demand software applications. Customers can subscribe to our software complete with market data for U.S. and Canada as well as import their own compensation surveys with our survey management module.

In addition to our compensation management solutions, we offer our TalentManager suite to deliver employee lifecycle performance management solutions, which help organizations establish and align goals throughout the organization, link employee pay to performance, and plan the succession for key positions. The enterprise version of TalentManager includes multi-language and currency support for global organizations.A small business version of TalentManager provides best practices and economical implementation for small and emerging companies or workgroups.

Our acquisition of ICR Limited, L.C. and ICR International Ltd. (ICR) in May 2007 expanded our compensation product offering with the addition of two new services: IPAS, the largest single source of international technology compensation data and software, including all relevant job titles in over 70 countries, and ICR Specialty Consumer Goods, a leading source of U.S. compensation data for apparel, footwear, luxury goods and specialty retail jobs.

Our comprehensive suite of integrated software applications provides the following key benefits:

Facilitates more effective compensation spending. Our solutions enable companies to deliver more effective and consistent compensation programs by reducing the risk of high turnover caused by underpaying employees and the risk of reduced profitability caused by overpaying employees. By making better compensation decisions, our customers are able to better attract, motivate and retain their employees, which we believe can lead to improved business execution and financial performance.

Enables Human Resource professionals to be more strategic. Our solutions incorporate features and best practices that automate compensation management to reduce or eliminate manual, paper-based and discrete

7

Table of Contents

business activities. As a result, our solutions help maximize the effectiveness of HR departments by enabling compensation professionals to focus on more strategic, high-value corporate-wide initiatives.

Provides access to proprietary market-driven compensation intelligence. Companies have traditionally made compensation decisions based on a limited number of surveys that are updated only once a year. By contrast, our proprietary data sets provide market-driven compensation information derived from numerous sources which are updated monthly. We believe that the current nature, as well as the breadth and depth, of our data sets provide our customers with significant advantages as they set their compensation levels. To build and update our data sets, our compensation professionals apply proprietary comparative algorithms and sophisticated statistical analysis to the data to provide the most up-to-date, comprehensive and useful information to our customers.

Provides ability to price technology jobs around the world using the same methodology and participants. Market pricing technology jobs across countries has traditionally been a challenging process complicated by multiple surveys, different job titles, inconsistent job matching, different participants per country and no centralized source to compare across countries. Through our IPAS product, we offer a uniform set of job benchmarks in a single source of comprehensive data that enables consistent benchmarking capabilities across all countries in the survey. Customers participate in a single, web-based survey and receive access to every job from clerk to chief executive officer for over 70 countries. For example, a customer can determine what an accountant makes across all countries in the survey, with the same source, same methodology, same participants, and same currency.

Reduces compensation management costs. We believe that our solutions are more cost-effective than other available offerings. Our on-demand model significantly reduces or eliminates the installation and maintenance costs associated with on-premises solutions. Our intuitive user interfaces enable our customers to find the right data, manage its application and configure overall compensation plans with little or no technical assistance. Furthermore, by integrating our software with our proprietary data sets, we provide our customers with a significantly less expensive compensation management solution than the traditional approach of separately purchasing combinations of consulting services, surveys and software applications.

Enables rapid deployment and scalability. Our on-demand software can be deployed rapidly and provisioned easily, without our customers having to make a large and risky upfront investment in software, hardware, implementation services or dedicated IT staff. The delivery platform for our software enables the solution to scale to suit customers’ needs. Additional users with defined privileges can be granted access with minimal implementation time, and new applications, such as analytics, can be deployed quickly and transparently to existing customers.

Reduces turnover and improves identification and development of top performers. Our on-demand software can be configured to an organization’s performance philosophies to uniformly identify top talent across the organization.

Aligns everyone with organizational goals.Our goal management module enables management to ensure that individual and group goals are aligned with organizational goals to keep employees focused on priorities and to monitor the execution of the business strategy.

Aligns pay with performance. The integrated pay and performance modules enable management to ensure that top performers are rewarded for their contribution as well as to ensure that all employees are paid equitably according to the organization’s pay-for-performance philosophy. This is critical for retention of top performers while also maintaining compliance and budget control. By integrating goal setting and performance reviews, the performance suite helps employees track their accomplishments throughout the year and compare capabilities with current or future job requirements. Employees can see which of their activities align with organizational goals and how they are adding value. This motivates employees to focus on their performance and development as a vital part of building their career.

8

Table of Contents

Streamlines annual and date-scheduled performance review cycle.The performance management suite takes the drudgery out of the annual performance review process by automatically generating review forms with appropriate competencies for every job. Employee goal achievement is automatically added to the review form so that managers can accurately rate performance. Reviews also can be performed by multiple raters or may be scheduled based on anniversaries or any other date trigger to remind managers and employees to communicate more frequently about performance.

Improves visibility and management of high-potential talent.The succession planning module also improves the visibility of key talent or high-potential employees across the organization through performance reviews, detailed employee profile tracking, and comparison of talented employees to the requirements of positions before they become vacant. By comparing all employees against job requirements and highlighting their achievements, talented employees—who might otherwise go unnoticed or leave the company—may be surfaced.

Buildsstrong pipeline of future leaders.The succession planning module also enables organizations to plan their resources by positions or jobs, and to compare current employee competencies to those needed by the organization in the future. Specific successors may be identified for any number of positions based on their criticality, so candidates may undertake development to ensure a ready pipeline of future leaders.

Increases effectiveness of learning and development.Our proprietary job-competency models help employees and managers understand the competencies needed to perform their jobs, and to create learning and development goals appropriate for their gaps or career directions. This ensures learning and development activities that will directly impact employee performance and profitability. Customers can utilize their own competency or learning content as well to facilitate development.

Enables global rollout of performance management.The enterprise TalentManager suite facilitates efficient global rollout by enabling common standards and best practices for performance programs in any geography with language support for local cultures. Organizations have the ability to localize the terminology or practices to meet their business needs, and yet take advantage of a common platform that keeps implementation simple and cost-efficient.

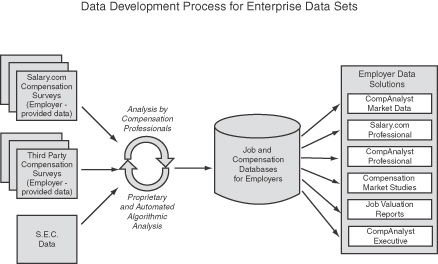

Content

Our proprietary content is a core differentiator of our solutions. By providing comprehensive content embedded within our applications, we are able to assist corporate customers in achieving their compensation management and performance management objectives faster and more efficiently. The following diagram illustrates how we gather and process data and make it available to our enterprise customers through our software applications:

9

Table of Contents

To develop our data sets, we begin with raw data we obtain from numerous sources. We purchase data directly from industry associations, compensation consulting firms, economic analysis firms and other sources. We also collect data directly from employers, partners and government agencies (for example, the U.S. Bureau of Labor Statistics, Department of Labor and SEC). Our team of certified compensation professionals also conducts proprietary compensation surveys on emerging jobs such as Corporate Ethics Officers and Six Sigma jobs. Through our acquisition of ICR in May 2007, we expanded both our custom survey capabilities to include consumer goods surveys across four main sectors—luxury goods, apparel, footwear and specialty retail—and also our data-filled software capabilities into global technology jobs with the addition of the IPAS product. Our team of compensation professionals processes data from these sources to derive our own proprietary data sets of compensation and other job-related information.

Our Market Pricing Data Processes

For our proprietary market pricing data sets, we use both standard and proprietary algorithms, which provide our customers with complete and consistent data that is representative of nearly all relevant markets and reasonable combinations of jobs, industries, locations and organization sizes. The completeness and consistency of our data sets provides our enterprise and consumer customers with market-driven compensation intelligence that we believe they could not procure or easily derive from alternate sources. In addition, our market pricing data processes and data sets also reduce the problems corporate compensation departments face from their lack of standardized processes for analyzing and combining multiple survey sources and maintaining the consistency of those sources year-over-year.

Enterprise and Consumer Data Sets

We have two proprietary data sets: one for our enterprise customers and one for consumer customers. Our enterprise data set contains base, bonus and incentive pay data for more than 3,600 positions held by more than80% of U.S. employees and our consumer data set currently addresses more than 3,700 jobs held by more than86% of the U.S. workforce.

Our enterprise solutions report data based on the most reliable sources available. Our enterprise customers may also incorporate data sources that they have independently acquired, which are then available for their exclusive use. Our enterprise data set also is augmented by compensation data from our customers, which they provide to us through surveys we conduct and which we do not include in our consumer data set. In addition, we provide a module in which an enterprise customer can store its own employee records to match to its preferred market sources and compare actual compensation, target compensation and market compensation.

Our lower-priced and free consumer products report data designed to provide a reasonably accurate estimate of the compensation pay levels for thousands of jobs in various types of organizations throughout the United States and Canada. The jobs reported in our consumer tools are primarily the major benchmark jobs available from numerous publicly available data sources. The purpose of the consumer tools is to educate the individual employee regarding the compensation decision-making process and to provide a reasonable approximation of the market for that individual’s job. We believe the best way for an employee and employer to have a productive conversation regarding compensation and pay for performance is for both to be educated about the process and current market values.

SEC Data Set

In addition to our proprietary market pricing data sets described above, we also maintain a complete data set of executive compensation and related data for more than 12,000 U.S. publicly traded companies. All compensation data included in this data set is obtained directly from filings made by these companies with the SEC. Our SEC data set also contains data on the compensation of directors from approximately 3,000 of the largest publicly traded companies. Our SEC data set is updated daily to reflect new public filings and we maintain the historical data in our SEC data set to facilitate comparisons.

10

Table of Contents

We also include basic financial data on public companies in our SEC data set, which we purchase from Standard & Poor’s. This data is used to enable our customers to place compensation data in the context of a company’s financial performance.

Competency Content and Job Competency Models

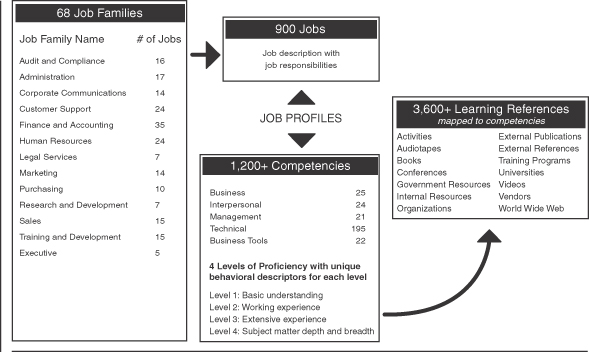

In fiscal year 2008, we acquired the Schoonover competency content library with more than 1,800 leadership competencies and the ITG Competency Group with more than 1,200 job-specific competencies. The combined content library houses more than 3,000 competencies. We help customers build competency libraries as well as help them design competency models that can be deployed across the organization. Customers can purchase our competency content to build or augment their competency content. We offer customers six different types of competency content: business (general business knowledge and skills), individual, (knowledge, abilities and behaviors that drive personal effectiveness), functional, (technical skills and abilities associated with specific jobs), core (general competencies defined for all employees), management (competencies specific to managers and supervisors’ job tasks), and leadership (competencies specific to executive and leadership roles). Our off-the-shelf competency content and models by industry and job family including corporate enterprise, insurance enterprise, banking enterprise, retail enterprise, manufacturing enterprise, information technology, general leadership, healthcare administration as well as assessment tools, implementation guides and customization tools to tailor competencies to a customer’s organization. Each model contains competencies for 68 job families, 900 job profiles, more than 1,200 competencies, 3,600 learning references and 25,500 behavior indicators which include four proficiency level recommendations to measure success in a given job.

Products

We offer a suite of enterprise compensation management applications for enterprise customers that helps companies determine how much to pay new and existing employees and manage overall compensation programs. We also offer a suite of performance management applications to assist customers in establishing and tracking performance goals throughout their organizations, linking each employee’s pay to performance against these goals, and planning for talent needs and future succession. Along with our application suites, we provide our

11

Table of Contents

customers with implementation and data configuration services as well as assistance with the configuration of our compensation and performance management solutions to their organization’s unique business needs. In addition to our enterprise offerings, we also provide a series of consumer and e-commerce solutions through our website to provide compensation information and tools designed for the consumer. We provide these solutions on a subscription, transaction or ad-sponsored basis.

For the years ended March 31, 2008, 2007, 2006 and 2005, our subscription revenues derived from our TalentManager products comprised less than 10% of our total revenues, with the remainder of our subscription revenues being derived from our compensation management and data products. Our solutions consist of the following products:

Product Category | Product Name | Principal Revenue Type | ||

Enterprise Solutions—Compensation Management Solutions | CompAnalyst (CA) Suite CA | U.S. Market Data CA | Canadian Market Data CA | Survey Center CA | Reporting & Analytics CA | Salary Structures CA | Merit Modeling CA | Executive | Subscription Subscription Subscription Subscription Subscription Subscription Subscription Subscription | ||

Compensation Consulting Services | Transaction | |||

Small Business—Compensation Solutions | CompAnalyst Professional Edition | Subscription | ||

| Salary.com | Professional Edition | Subscription | |||

Compensation Surveys—All Sizes | Salary.com Compensation Market Studies | Transaction | ||

| Salary.com Industry Surveys | Transaction | |||

Salary.com Consumer Goods Surveys | Transaction | |||

| Salary.com IPAS Survey | Transaction | |||

Enterprise Solutions—Performance Management Services | TalentManager (TM) Suite TM | Performance Management TM | Compensation Planning TM | Incentive Management TM | Succession Planning TalentManager Professional Edition ITG Job Competence Model Schoonover Leadership Library | Subscription Subscription Subscription Subscription Subscription Transaction

Transaction Transaction | ||

Salary.com Competency & HCM Consulting | Transaction | |||

Consumer & E-Commerce Services | www.salary.com | Subscription/Ad-sponsored | ||

| Salary Wizard | Subscription/Ad-sponsored | |||

| Salary Center | Subscription/Ad-sponsored | |||

| Personal Salary Report Subscription | Subscription | |||

12

Table of Contents

Enterprise Solutions

Compensation Management Products

CompAnalyst (CA) is a suite of on-demand compensation management solutions for use by compensation professionals in large and small organizations. CompAnalyst is built around a core data set of accurate, employer-reported market data that is benchmarked and mapped for jobs held by more than 80% of U.S. employees. Customers get immediate access to a complete source of data to value jobs, participate in surveys and analyze pay competitiveness including the following applications:

CA | Market Data: Provides customers of all sizes easy access to a single source of accurate and trusted compensation data for over 3,700 benchmark jobsin companies of all sizes, across 21 industries, 29 company size categories and across all U.S. geographies (243 geographic listings including regions, states and major metropolitan areas) as well as more than 650 benchmark jobs in Canada. Customers can also quickly find the market price for any benchmark job or create and price a “hybrid job” by mixing multiple jobs together.

CA | Survey Center: Provides customers with a centralized, online repository for managing and performing market pricing with third-party surveys that they acquire and own themselves. The solution also simplifies the customers’ participation in multiple surveys. Our easy-to-use tools enable customers to age, weight, adjust and combine data from multiple sources to produce market rates for use in compensation program design and analysis activities. Customers can use this functionality when they have specific data sources and weightings they choose to employ in determining market pricing. The Survey Center module also simplifies and speeds up the customer’s survey participation process by leveraging data already stored within the module—including employee pay and demographic data as well as the company’s job matches to survey vendor jobs—and exporting survey participation files in the specific survey vendor’s preferred format.

CA | Reporting & Analysis: Enables organizations to assess external competitiveness against internal equity by comparing actual pay practices to market data developed in CA Market Data or Survey Center. Customers may analyze trends by year, compare pay practices across groups of employees (e.g., by region, business unit, Equal Employment Opportunity Commission protected class) and create custom queries to meet their analysis needs. Customers can also store data and use it to conduct historical comparisons.

CA | Salary Structures: Facilitates streamlined analysis of cost scenarios related to internal salary structures and distribution of merit budgets. Provides customers visibility into internal equity and helps customers assess salary structures against market rates. Customers can analyze current pay structures and model the budget impact and cost of new structures and proposed changes. The Salary Structures module enables customers to assess the alignment of pay practices with the external market and internal targets, and to perform “what if” analysis to support recommendations for changes in compensation program design. Customers can seamlessly integrate with the merit modeling module and link to the performance module to verify where an employee fits within the salary structure when determining appropriate pay for performance.

CA | Merit Modeling: Models the cost of performance-based merit increase programs. Customers can build merit matrices to meet budgets based on parameters for performance and range placement or market index. Customers can model with historical data or expected performance distributions and compare the cost of multiple scenarios for the determination of appropriate merit budgets. This module provides quick and easy tools to measure the impact of merit increases for financial and strategic planning purposes, and integrates with compensation planning and performance management.

CA | Executive: Allows CEOs, CFOs, executive compensation specialists, board members and consultants to instantly analyze and review compensation information disclosed in filings with the SEC for more than 12,000 public companies. The data available with this product, which is updated daily, includes pay, incentive compensation, Black-Scholes values, benefits, director compensation, financial and stock performance data and more. CompAnalyst Executive’s functionality includes the ability to build and analyze peer groups by industry, size and location, as well as company financial performance measures and executive and director pay measures.

13

Table of Contents

CompAnalyst | Professional Edition: Targeted to businesses with under 350 full-time equivalents, or FTE’s; provides market content and software, similar to CompAnalyst market content, except with less data and functionality. Our sales force sells this application to smaller businesses.

Salary.com Professional Edition: Targeted to businesses with less than 100 FTE’s and offered via the web in a self-service subscription model. This data product is similar to CompAnalyst Professional Edition, but contains data only on small companies.

Salary.com Job Valuation Reports: This report is designed for use by HR departments to price a single job. It allows users to view a report on the appropriate market compensation data for that job and, if they desire, recommend adjustments to reflect the particular experience, education and other factors specific to an employee currently in the job. The job valuation report also includes basic explanations of how to use the data and how to explain market pricing practices to an employee. We sell this application to employers through our website and our partners’ websites.

Salary.com Compensation Market Studies: These survey-like reports aggregate the data, generally for 50 to 200 related job titles within an industry group, typically within the same job family (for example, finance and accounting) or the same level (for example, executives). We have more than 100,000 of these reports that we sell to employers through our website and our partners’ websites.

Salary.com Industry Surveys: We run compensation and benefits surveys, some of which are sponsored directly by us and others of which are sponsored in partnership with industry associations or other external sponsors. To conduct a survey, we solicit companies to submit actual pay data for their employees to us. We analyze, aggregate and anonymize their data and report the results back to participating companies. Typically, we charge participants a fee and we also may sell final reports to non-participants for a higher fee.

Salary.com | IPAS Global Survey: Provides global compensation content-rich software to value jobs and total compensation factors for companies in the high technology industry through our IPAS survey software. Customers must participate in compensation surveys and subscribe to the on-demand software to access compensation information. Customers can access a single source of compensation content from clerk to chief executive officer in over 70 countries.

Salary.com | Consumer Surveys: Provides industry-specific compensation content and reports to value jobs in the consumer retail industry. Customers must participate in the compensation surveys and purchase the reports to access the compensation data for the four consumer goods markets including: Specialty Retail, Luxury Goods, Footwear and Apparel.

PayScore: This product is a salary qualification service which helps mortgage professionals gain efficiencies in the application process. PayScore combines data and software to enable lenders to better qualify applicants’ salary claims, improve credit decision making and provide an audit trail for compliance purposes.

Performance Management Products

TalentManager is a suite of on-demand performance management solutions that provides the essential workflow to link pay to performance, improve performance management interactions, and develop a strong pipeline of future leaders across the enterprise. TalentManager enables an organization to manage goal setting, performance reviews and incentive plans, and to link these critical activities to the relevant compensation programs to administer the organization’s pay-for-performance program—all within a single integrated application. Our TalentManager suite includes the following modules:

Performance Management:Enables the communication and setting of goals and targets by employees and managers as well as the tracking of performance against those goals. The system enables organizations to

14

Table of Contents

establish corporate level goals and to cascade those goals throughout the organization to ensure alignment and results. The system automatically brings employee goals to the employee’s performance review along with their accomplishments to date to streamline the review process and facilitate better employee-manager interactions. Performance Management is fully integrated with compensation planning, succession planning and incentives. We can link any goal or other component of performance to a virtually unlimited number of pay programs to reflect the organization’s pay-for-performance philosophy.

Compensation Planning: Enables organizations to automate and control the process of allocating salary increases, budget pools, lump sum adjustments and basic bonus plans. Within TalentManager, HR and finance departments can set rules or guidelines that dictate the limits and the approval process for any component of the compensation decision-making process. By setting all of the rules in one system, which programmatically enforces the process, the entire organization can easily and efficiently adhere to policies and control procedures while ensuring equitable pay-for-performance.

Incentive Management: A configurable and customizable application capable of managing complex formulaic incentive plans. Incentive plans vary significantly among and within organizations and can have complex rules and payout structures. This module is used when organizations have multiple incentive plans with similar structures typically based on corporate key performance indicators (KPIs), as well as individual goals and targets that tailor the incentive compensation for the individual. Although the standard Compensation Planning module includes features to address basic variable compensation, many organizations need the additional sophisticated algorithm and payout administration available in the Incentive Management module.

Succession Planning:Enables companies to plan resources, create succession plans and easily identify backup candidates with the necessary skills, competency ratings and performance history. The system also allows resource planners to determine and manage gaps in skills or competencies needed for jobs or position that will be required to execute the business strategy. Customers can assess candidates, recognize skill gaps and create appropriate development plans to build sufficient bench strength and ensure a consistent pool of high potential employees for critical roles across the organization. Managers and executives can streamline planning for vacancies to minimize risk and quickly fill key leadership roles to manage transitions to minimize impact on the business. Identifying succession candidates early enables organizations to implement employee development plans, close skills gaps, and ensure that effective leaders are fully ready to assume critical roles when the time comes.

TalentManager Professional Edition: Provides a configurable, scaled down version of the enterprise TalentManager performance and compensation management software targeted to companies with less than 500 FTE’s.The professional edition enables smaller employers to deploy the best practices of larger organizations to motivate and reward teams through appropriate pay-for-performance programs—all without extensive HR oversight, heavy IT investment, or long implementation timeframes. The professional edition offers a menu of configurable components for performance, compensation planning and variable incentive programs in an easy to use and easy to maintain user experience.

Professional Services

Our CompAnalyst professional services teams handle new customer implementations, training and general help desk services for the CompAnalyst product line and all data products. The TalentManager professional services team handles all new customer implementations, configurations, training, and general help desk services for the TalentManager suite of applications. For implementations that are not strictly “plug and play,” our product-specific implementation teams provide initialization, configuration, training and general help-desk services. We also train our customers so that they can be more self-sufficient for future implementations. TalentManager customers generally require more professional services than CompAnalyst customers. Professional services in most cases are included as part of our subscription agreements and, to a lesser extent, are offered on an as-needed basis.

15

Table of Contents

Compensation Consulting

Our team of certified compensation professionals helps customers analyze and deliver compensation best practices including assessment, design and implementation of new processes. Our compensation assessment service provides system diagnostic report to benchmark a company’s compensation system vs. industry best practices. In the design phase, our compensation consultants provide services to define, communicate and implement the organization’s compensation philosophy including the development of compensation policies and procedures, the design of market-based compensation, internal equity-based compensation programs and short- term incentive programs. In the implementation phase, our team aligns the scoped programs and handles all the necessary rollout and communication such as pay delivery policies regarding grade movement, promotions and out-of-range employees.

Competency-Driven HCM Management Consulting

Our human capital consulting practice helps organizations deploy competency-driven talent management systems to drive performance management and leadership development. We help organization design their talent systems around job-based competency content that they can deploy rapidly, manage internally and deliver consistently across the entire organization. Our team of industry experts, including competency and leadership development pioneer Dr. Stephen Schoonover, help senior executives identify the key competencies that reinforce a companies goals and culture; author and map competencies to jobs and job profiles, build competency models to drive identification and development of key internal leaders and build a curriculum to develop future leaders to drive business growth and results.

Consumer and E-Commerce Solutions

Our consumer and e-commerce family of products consists of free-to-user applications that are ad-sponsored, as well as certain premium products that are sold directly to individuals visiting our website. We also generate indirect revenue from these products through advertisers that pay for space on our website and our partners’ websites.

Our consumer and e-commerce products include:

www.salary.com: Our destination website and marketing face of the company is an advertising and online subscription sales channel. Our internet media traffic averaged three million unique monthly visitors during the fiscal year ended March 31, 2008. According toa search we performed using Google, more than50,000 external links direct consumers to our website for career information, salary negotiation and ways to determine their worth. The site includes calculators, memberships, newsletters and content around the topic of career and pay management for individuals, as well as related business content for small business and enterprise audiences. We believe that more than 90% of Salary.com’s traffic is organically generated and is not the result of substantial direct advertising and marketing on our part.

Salary Wizard: Salary Wizard is an ad-sponsored salary calculator designed to provide non-scoped, national average base pay and total annual cash compensation ranges for the positions we track. Users may adjust the national average information to their desired location by selecting a metropolitan area or zip code, and the results will be adjusted using a geographic adjustment factor to estimate the pay level for that location. In 2008, we introduced new features to help users personalize their answers and see how they compare not only to what employers pay in their area but how their background compares to their peers in their local area. Salary Wizard also attracts visitors to our website and our syndicated partner network of sites and serves as an entry point for consumers and employers to purchase a report or subscription product from us. The product is used more than 3 million times per month by both individuals and businesses.

Salary Center: Our syndicated product is a fully functional set of applications that deploy onto our partners’ websites to power the compensation section of their websites in a co-branded manner. For example,

16

Table of Contents

Monster’s Salary & Benefits area is populated with Salary.com tools and the content is hosted and managed by Salary.com. The syndicated Salary Center product typically includes advertising inventory and e-commerce reports for which partners share revenue with us. Our partners include Monster, CNN Money, Yahoo! Hotjobs, Dice, Business Week, the New York Times, ADP and over 575 other companies representing more than 2,500 discrete websites.

Personal Salary Report Subscription: This application is a premium 14-page report providing individuals with an HR-quality assessment of their worth in the job market. The report also educates the subscriber about how employers determine compensation and advises the subscriber on how to negotiate salary for a win-win outcome.

In addition to these online offerings, we also sell space for third-party advertisers to deliver their messages to users of our website. Advertisers will pay for targeted inventory space adjacent to content that will be viewed by certain types of consumers. We believe our advertising inventory is attractive to advertisers because we provide a large volume of exposure opportunities and we can link those opportunities to a variety of consumer demographic factors, such as job title, location and income. Advertisers that purchase this inventory include job boards, recruiters, colleges and universities and financial services firms.

Compensation Team

We believe that one of the most significant differentiators between us and our software competitors is our compensation team. In addition to hiring experienced compensation professionals from industry, many of whom are certified compensation professionals, we train our technology personnel about compensation and our compensation personnel about technology, so that each group possesses both the HR and the technological expertise essential to our products. We believe that this combined expertise enables us to design our software and data sets in a sophisticated and useful manner for our customers. We also try to ensure that employees with compensation experience are deployed throughout our organization. Historically, we have moved compensation professionals into roles within sales, product management, and professional services. In this way we are able to embed compensation knowledge, skills and abilities in all aspects of what we do, and we believe this enables us to position our domain expertise as a true competitive advantage.

Research & Development

Our research and development efforts are focused on improving and enhancing our existing on-demand service offerings as well as developing new products, features and functionality. Expansion of our solutions into new areas often involves a multiple-year commitment to enter a new business, and we seek new product opportunities related to compensation, performance and talent management. When we extend an existing application or data set, our development costs are relatively low. When we innovate in an area requiring the development of a new data set, our development costs increase due to the high initial fixed costs of entering the new area and also building original software functionality. Once the initial investment in a new area has been made, however, the ongoing costs to maintain a data set and extend a product are often significantly less than the costs of maintaining the typical installed software product. Research and development expense for the fiscal years ended March 31, 2008, 2007 and 2006 was $4.9 million, $4.1 million and $2.2 million, respectively.

Technology

We pioneered hosted, multi-tenant, on-demand software when we launched our first product in 2000. Our on-demand software is a highly scalable, multi-tenant application platform written in CSS, XML, DHTML, Visual Basic, C++, Java and C# for the .NET framework and COM+ and MSMQ for the Windows operating systems. We use commercially available hardware and a combination of proprietary and commercially available software, including Microsoft SQL Server, Microsoft IIS Server and Microsoft Windows.

17

Table of Contents

Our on-demand software treats our customers as separate tenants in central applications and data sets. As a result, we are able to spread the cost of delivering our service across our user base. In addition, because we do not have to manage thousands of distinct applications with their own business logic and database schemas, we believe that we can scale our business faster than traditional software vendors, even those that have modified their products to be accessible over the Internet.

Our TalentManager products are built on our proprietary, highly scalable Salary.com FlexTenant platform, which enables us to customize the business logic, data flow, workflow and user interfaces of our enterprise applications for clients and yet continue to operate in the same multi-tenant application shared by our other customers.

Operations

We serve all of our customers from a third-party network operations facility located in Watertown, Massachusetts. This facility — operated by AT&T — provides around-the-clock security personnel, photo ID/access cards, biometric hand scanners and sophisticated fire systems. The overall security of each data center (inside and outside) and network operations center are monitored by digital video surveillance cameras 24 hours a day, seven days a week. In addition, redundant bandwidth, on-site electrical generators and environmental control devices are used to keep servers up and running. We continuously monitor the performance of our service. We have a comprehensive security infrastructure, including firewalls, intrusion detection systems and encryption for transmissions over the Internet. We monitor and test this security infrastructure on a regular basis. Our site operations team provides system management, maintenance, monitoring and back-up. We run tests regularly to ensure adequate response from our sites and conduct production environment reviews for hosting capacity, expansion and upgrade planning. We also monitor site availability and latency. We own or lease and operate all of the hardware on which our applications run in the network operations facility.

To facilitate high availability of our solutions and loss recovery, we operate a multi-tiered system configuration with redundant bandwidth, load balanced web server pools, replicated and clustered database servers and fault tolerant storage devices. Data sets are restored to hot standby database servers using transaction logs shipped from primary production database servers. This solution is designed to provide near real-time failover service in the event of a malfunction with a primary clustered database or server. Full backups of all data sets take place nightly and are archived to tapes. These tapes are rotated offsite to a separate facility managed by Iron Mountain. We also maintain a fully redundant site, located within our headquarters, which would serve as our primary site in the event that a disaster was to render the network operations facility inoperable. Our real-time backups are stored on servers in our corporate headquarters. Although we have not experienced a failure of our third-party network operations facility, we believe that if such facility became inoperable, most of our products would be available to our customers with minimal interruption in service.

In 2008, we successfully completed the Statement on Auditing Standards No. 70 (SAS 70) Type II audit and received our SAS 70 Type II Certification. The SAS 70 is an internationally recognized auditing standard developed by the American Institute of Certified Public Accountants (AICPA). It defines the professional standards used by auditors to assess the internal controls of a service organization. The SAS 70 audit reports on the internal controls and safeguards service organizations have in place to process data belonging to its customers. The audit, conducted by an independent service auditor, focused on six key areas: information technology organization and access security, applications system development, implementation and maintenance and computer operations.

Sales and Marketing

We sell our enterprise solutions primarily through our direct sales organization and to a lesser extent through indirect channels. As of March 31, 2008, our direct sales force consisted of 96 employees. We employ business development representatives to call potential enterprise customers to book initial demonstrations and to

18

Table of Contents

qualify customer leads. Once a lead is qualified, our account executives assess customer needs, complete demonstrations and close sales, primarily by telephone and via web-based product demonstrations. We also employ account managers who maintain on-going or post-sale relationships with subscribers, manage renewals and generate interest from existing customers to purchase additional products. In addition, our sales engineers and compensation professionals assist with sales to customers with particularly complex needs and provide post-sales customer support. Most of our sales personnel are located in our headquarters in Waltham, Massachusetts. We also have an advertising and syndication sales team, which works in much the same way as our enterprise product sales team, but focuses its efforts on selling and marketing advertising on our website and syndication of our consumer offerings to other websites. Although we have relationships with many partners, including websites and consulting firms, these partners accounted for less than 10% in the aggregate of our total revenue in the fiscal years ended March 31, 2008 and 2007.

Our marketing program is anchored by an integrated communications strategy that supports the core of our brand and value proposition. Our marketing programs include direct mail and email campaigns, using our website to provide product and company information, advertising in both print and online media, search engine marketing, issuing press releases on a regular basis and launching events to publicize our service to existing customers and prospects. We build our brand through our website, syndication and public relations, all of which are intended to increase market awareness of us as a top-tier provider of on-demand compensation management solutions, as well as a leading website for free information about compensation. Furthermore, our thought leaders are frequently sought as expert commentators by major media, including television, radio, newspapers and mainstream and trade magazines. We believe that this is a critical component of our branding program and positions us as an expert in the compensation field. In the fiscal year ended March 31, 2008, our television and radio appearances were viewed more than 50 million times and our print appearances were viewed more than 200 million times. We also conduct seminars, participate in trade shows and industry conferences, publish white papers on HR issues and develop customer reference programs.

In May 2008, we announced new marketing and sales initiatives designed to accelerate growth and expand our leadership position in the compensation and employee performance management markets. Over the next two years, we plan to re-invest up to $10 million in marketing and hire up to 100 sales people to support new product offerings. The marketing investments are expected to extend our compensation brand globally and build awareness among a new set of buyers in organizational and leadership development. We plan to incrementally hire up to 100 sales people to build out our competency, international, small business and strategic sales teams to penetrate new buying groups and new geographic markets over the next two years.

Customers

As of March 31, 2008, we had nearly 2,800 enterprise subscribers, in various industries, who spend from $2,000 to more than $100,000 annually. No single customer accounted for more than 3% of our revenue in the fiscal years ended March 31, 2008 or 2007. Below is a representative list of companies who were customers as of March 31, 2008, grouped by industry category and number of employees in the business unit we serve.

Industry | 10,000+Full-Time Employees | 1,000 to 9,999 Full-Time Employees | Less than 1,000 | |||

Transportation | Southwest Airlines | CHEP | Air France USA | |||

Greyhound Lines, Inc. | Covenant Transportation | Mexicana Airlines | ||||

Old Dominion Freight Line, Inc. | Saia Motor Freight Line | Singapore Airlines | ||||

Amtrak Passenger Railroad | Expedia, Inc. | Virgin Atlantic | ||||

Swift Transportation Co., Inc. | Norwegian Cruise Lines | Alaska Railroad | ||||

Retail | Amazon.com, Inc. | Lifetime Fitness | Guess?, Inc. | |||

Wal-Mart Stores, Inc. | Lord & Taylor LLC | Harry Winston | ||||

Hallmark Cards, Inc. | eBay, Inc. | Rolex Watch USA | ||||

Steve and Barry’s LLC | Tiffany & Co. | Eastern Mountain Sports | ||||

Target Corporation | Chanel USA, Inc. | Quiksilver, Inc. | ||||

Williams-Sonoma, Inc. | J. Crew Group, Inc. | Ikea North America, Inc. | ||||

19

Table of Contents

Industry | 10,000+Full-Time Employees | 1,000 to 9,999 Full-Time Employees | Less than 1,000 | |||

Publishing | Bertelsmann, Inc. | BBC Worldwide Americas | The Motley Fool, Inc. | |||

ESPN, Inc. | XM Satellite Radio | |||||

Jostens | VistaPrint USA, Inc. | National Public Radio | ||||

Thomson Reuters | John Wiley & Sons The New York Times Company | Harvard Business School Publishing Corporation | ||||

Consumer Products | Yahoo! Inc. | Ticketmaster | Comcast Corporation | |||

Sony Corporation of America | Nu Skin Enterprises | FUJIFILM Dimatix, Inc. | ||||

AMF Bowling | Deluxe Corporation | Heineken USA | ||||

Stanley Works | Dreyer’s Grand Ice Cream | Zipcar, Inc. | ||||

La-Z-Boy Incorporate | Electronic Arts | Duraflame Inc. | ||||

National Football League | Birkenstock, USA LP | |||||

Financial Products and Services | Alfa Corporation | First Capital Corporation | ||||

Commerce Bank | Imperial Capital Bank | Chicago Board Options Exchange, Inc. | ||||