UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-09877

CALVERT RESPONSIBLE INDEX SERIES, INC.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2017

Date of Reporting Period

Item 1. Reports to Stockholders

Calvert US Large-Cap Core Responsible Index Fund (formerly, Calvert U.S. Large Cap Core Responsible Index Fund)

Calvert US Large-Cap Growth Responsible Index Fund (formerly, Calvert U.S. Large Cap Growth Responsible Index Fund)

Calvert US Large-Cap Value Responsible Index Fund (formerly, U.S. Large Cap Value Responsible Index Fund)

Calvert US Mid-Cap Core Responsible Index Fund (formerly, U.S. Mid Cap Core Responsible Index Fund)

Calvert International Responsible Index Fund (formerly, Calvert Developed Markets Ex-U.S. Responsible Index Fund)

|  | |

Calvert US Large-Cap Core Responsible Index Fund |  | |

|  | |

Annual Report September 30, 2017 E-Delivery Sign-Up — Details Inside |  |

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund and its adviser have claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser is subject to CFTC regulation. |

Choose Planet-friendly E-delivery! Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs. Just go to www.calvert.com. If you already have an online account with the Calvert funds, click on Login to access your Account and select the documents you would like to receive via e-mail. If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps. Note: If your shares are not held directly with the Calvert funds but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm. |

| TABLE OF CONTENTS | |||

| Management’s Discussion of Fund Performance | ||||

| Performance | ||||

| Fund Profile | ||||

| Endnotes and Additional Disclosures | ||||

| Understanding Your Fund’s Expenses | ||||

| Financial Statements | ||||

| Report of Independent Registered Public Accounting Firm | ||||

| Federal Tax | ||||

| Management and Organization | ||||

| Important Notices | ||||

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE1

Economic and Market Conditions U.S. stocks delivered strong returns in the 12-month period ended September 30, 2017 behind an extended rally that began with Donald Trump's victory in the U.S. presidential election. After lagging early in the period, U.S stocks moved sharply higher following President Trump's election on November 8, 2016. While its effect was broad-based, the rally particularly favored financial stocks, which received another boost in mid-December when the U.S. Federal Reserve (the Fed) raised its benchmark interest rate amid continued economic growth. After a brief pullback in the final weeks of 2016, U.S. equities resumed their advance in early 2017. U.S. stocks slipped in March 2017, as the failure of President Trump's health care bill in Congress raised concerns about prospects for the rest of his policy agenda including tax reform and infrastructure spending. However, stocks quickly regained their upward momentum, advancing steadily despite additional Fed rate hikes in March and June. Encouraged by a range of economic indicators, particularly U.S. job market gains, many investors viewed the rate hikes as a sign of a strengthening economy. U.S. equities retreated again in August amid rising geopolitical tensions over the North Korea stand-off and the devastation in Texas left by Hurricane Harvey. Stocks soon resumed their upward trend, with some U.S. indexes reaching record highs in the final month of the period. From a sector perspective, energy stocks delivered notable performance in the quarter as oil prices rose and refinery damage from Hurricane Harvey constricted supplies. The massive flood damage from the hurricane also helped boost auto sales, which rose in September after declining for much of 2017. Major stock indexes recorded double-digit gains for the period. The blue-chip Dow Jones Industrial Average2 advanced 25.45%, while the broader U.S. equity market, as represented by the S&P 500 Index, rose 18.61%. The technology-laden NASDAQ Composite Index delivered a 23.68% gain. Small-cap U.S. stocks, as measured by the Russell 2000® Index, generally outperformed their large-cap counterparts as measured by the S&P 500 Index during the period. Growth stocks, as a group, outpaced value stocks in both the large- and small-cap categories, as measured by the Russell growth and value indexes. | Investment Strategy The Calvert US Large-Cap Core Responsible Index Fund (the Fund) uses a passive investment strategy to seek to track the performance of the Calvert US Large-Cap Core Responsible Index (the Index). This is accomplished by investing in all, or virtually all, of the stocks in the Index in approximately the same proportion. The Index is comprised of the largest stocks of mid- and large-cap companies domiciled in the United States, excluding real estate investment trusts, master limited partnerships, and similar types of securities that are selected based on their environmental, social and governance (ESG) profile that meets the Calvert Principles of Responsible Investing. The Index reconstitutes semi-annually and is rebalanced quarterly. Fund Performance For the fiscal year ending September 30, 2017, the Fund’s Class A shares at net asset value (NAV) had a total return of 17.71%. By comparison, the Fund’s primary benchmark, the Index, returned 18.43% during the period. The Fund's underperformance versus its benchmark was due to Fund expenses and fees, which the Index does not incur. Ten of the Fund's 11 economic sectors delivered positive returns for the 12-month period. The one sector that delivered a negative return was energy. The other weak performing sectors were consumer staples and telecommunications services. The strongest performing sectors were financials, information technology and real estate. | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to www.calvert.com.

2 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT (Unaudited)

PERFORMANCE

Performance2,3 | ||||||||||||||

Portfolio Manager Thomas C. Seto of Calvert Research and Management | ||||||||||||||

| % Average Annual Total Returns | Class Inception Date | Performance Inception Date | One Year | Five Years | Ten Years | |||||||||

| Class A at NAV | 06/30/2000 | 06/30/2000 | 17.71 | % | 14.01 | % | 6.99 | % | ||||||

| Class A with 4.75% Maximum Sales Charge | — | — | 12.10 | 12.91 | 6.47 | |||||||||

| Class C at NAV | 06/30/2000 | 06/30/2000 | 16.85 | 13.10 | 6.04 | |||||||||

| Class C with 1% Maximum Sales Charge | — | — | 15.85 | 13.10 | 6.04 | |||||||||

| Class I at NAV | 06/30/2000 | 06/30/2000 | 18.17 | 14.53 | 7.53 | |||||||||

| Class Y at NAV | 07/13/2012 | 06/30/2000 | 18.04 | 14.17 | 7.06 | |||||||||

| Calvert US Large-Cap Core Responsible Index | — | — | 18.43 | % | 14.90 | % | 8.06 | % | ||||||

Russell 1000® Index | — | — | 18.54 | 14.26 | 7.54 | |||||||||

% Total Annual Operating Expense Ratios4 | Class A | Class C | Class I | Class Y | ||||||||||

| Gross | 0.70 | % | 1.52 | % | 0.37 | % | 0.48 | % | ||||||

| Net | 0.54 | 1.29 | 0.19 | 0.29 | ||||||||||

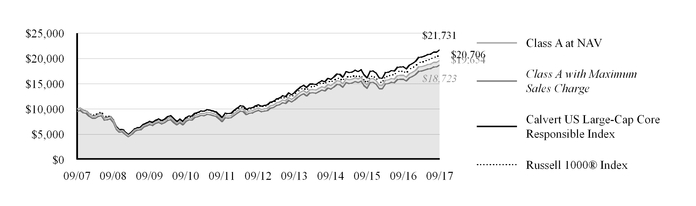

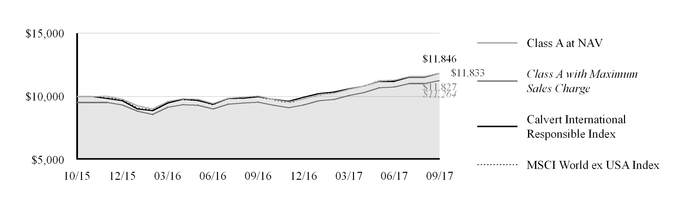

| Growth of $10,000 |

| This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index. |

Growth of Investment3 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge | ||||

| Class C | $10,000 | 9/30/2007 | $17,982 | N.A. | ||||

| Class I | $100,000 | 9/30/2007 | $206,734 | N.A. | ||||

| Class Y | $10,000 | 9/30/2007 | $19,791 | N.A. | ||||

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to www.calvert.com.

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT (Unaudited) 3

FUND PROFILE

SECTOR ALLOCATION (% of total investments)5 | TEN LARGEST STOCK HOLDINGS (% of net assets) | ||||||

| Information Technology | 25.4 | % | Apple, Inc. | 3.6 | % | ||

| Financials | 15.8 | % | Alphabet, Inc., Class A | 3.0 | % | ||

| Health Care | 15.0 | % | Microsoft Corp. | 2.6 | % | ||

| Consumer Discretionary | 13.3 | % | Facebook, Inc., Class A | 2.2 | % | ||

| Industrials | 11.4 | % | Amazon.com, Inc. | 2.0 | % | ||

| Consumer Staples | 8.4 | % | Johnson & Johnson | 1.9 | % | ||

| Materials | 3.5 | % | Bank of America Corp. | 1.5 | % | ||

| Utilities | 3.5 | % | Procter & Gamble Co. (The) | 1.5 | % | ||

| Telecommunication Services | 2.2 | % | General Electric Co. | 1.5 | % | ||

| Energy | 1.0 | % | Citigroup, Inc. | 1.2 | % | ||

| Time Deposit | 0.4 | % | Total | 21.0 | % | ||

| Real Estate | 0.1 | % | |||||

| Total | 100.0 | % | |||||

See Endnotes and Additional Disclosures in this report.

4 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT (Unaudited)

| Endnotes and Additional Disclosures | ||

1 The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission.2 Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. S&P 500 Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. NASDAQ Composite Index is a market capitalization-weighted index of all domestic and international securities listed on NASDAQ. Russell 2000® Index is an unmanaged index of 2,000 U.S. small-cap stocks. Calvert US Large-Cap Core Responsible Index is comprised of mid and large capitalization U.S. stocks with growth characteristics that operate their businesses in a manner that is consistent with the Calvert Principles for Responsible Investment. Russell 1000® Index is an unmanaged index of U.S. large-cap stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index.3 Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.4 Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/19. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report.5 Does not include Short Term Investment of Cash Collateral for Securities Loaned.Important Notice to Shareholders Effective November 6, 2017 the name of Calvert US Large-Cap Core Responsible Index Fund was changed from Calvert U.S. Large Cap Core Responsible Index Fund. | ||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT (Unaudited) 5

UNDERSTANDING YOUR FUND'S EXPENSES

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2017 to September 30, 2017).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| BEGINNING ACCOUNT VALUE (4/1/17) | ENDING ACCOUNT VALUE (9/30/17) | EXPENSES PAID DURING PERIOD* (4/1/17 - 9/30/17) | ANNUALIZED EXPENSE RATIO | |

| Actual | ||||

| Class A | $1,000.00 | $1,068.90 | $2.80** | 0.54% |

| Class C | $1,000.00 | $1,065.00 | $6.68** | 1.29% |

| Class I | $1,000.00 | $1,071.30 | $0.99** | 0.19% |

| Class Y | $1,000.00 | $1,070.40 | $1.51** | 0.29% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,022.36 | $2.74** | 0.54% |

| Class C | $1,000.00 | $1,018.60 | $6.53** | 1.29% |

| Class I | $1,000.00 | $1,024.12 | $0.96** | 0.19% |

| Class Y | $1,000.00 | $1,023.61 | $1.47** | 0.29% |

| * Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2017. | ||||

| ** Absent a waiver and/or reimbursement of expenses by affiliates, expenses would be higher. | ||||

6 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT (Unaudited)

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2017

| SHARES | VALUE ($) | |

| COMMON STOCKS - 99.3% | ||

| Aerospace & Defense - 0.2% | ||

| HEICO Corp. | 3,765 | 338,135 |

| Hexcel Corp. | 4,788 | 274,927 |

| Rockwell Collins, Inc. | 11,210 | 1,465,259 |

| 2,078,321 | ||

| Air Freight & Logistics - 0.9% | ||

| C.H. Robinson Worldwide, Inc. | 9,979 | 759,402 |

| Expeditors International of Washington, Inc. | 12,118 | 725,383 |

| United Parcel Service, Inc., Class B | 56,854 | 6,827,597 |

| 8,312,382 | ||

| Airlines - 0.8% | ||

| Alaska Air Group, Inc. | 7,761 | 591,931 |

| American Airlines Group, Inc. | 30,538 | 1,450,250 |

| Delta Air Lines, Inc. | 48,328 | 2,330,376 |

| JetBlue Airways Corp. * | 20,844 | 386,239 |

| Southwest Airlines Co. | 36,721 | 2,055,642 |

| Spirit Airlines, Inc. * | 3,515 | 117,436 |

| United Continental Holdings, Inc. * | 15,784 | 960,930 |

| 7,892,804 | ||

| Auto Components - 0.3% | ||

| BorgWarner, Inc. | 8,826 | 452,156 |

| Delphi Automotive plc | 13,354 | 1,314,034 |

| Gentex Corp. | 14,355 | 284,229 |

| Goodyear Tire & Rubber Co. (The) | 12,692 | 422,009 |

| Tenneco, Inc. | 2,636 | 159,926 |

| Visteon Corp. * | 1,681 | 208,057 |

| 2,840,411 | ||

| Automobiles - 0.6% | ||

| Ford Motor Co. | 195,097 | 2,335,311 |

| Harley-Davidson, Inc. | 8,308 | 400,528 |

| Tesla, Inc. * | 6,658 | 2,271,044 |

| Thor Industries, Inc. | 2,757 | 347,134 |

| 5,354,017 | ||

| Banks - 5.9% | ||

| Associated Banc-Corp. | 8,126 | 197,056 |

| Bank of America Corp. | 574,905 | 14,568,093 |

| Bank of Hawaii Corp. | 2,336 | 194,729 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 7

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Bank of the Ozarks, Inc. | 7,271 | 349,372 |

| BankUnited, Inc. | 7,529 | 267,807 |

| BB&T Corp. | 46,227 | 2,169,895 |

| BOK Financial Corp. | 1,110 | 98,879 |

| Chemical Financial Corp. | 4,623 | 241,598 |

| CIT Group, Inc. | 10,641 | 521,941 |

| Citigroup, Inc. | 159,908 | 11,631,708 |

| Citizens Financial Group, Inc. | 28,682 | 1,086,187 |

| Comerica, Inc. | 9,741 | 742,849 |

| Commerce Bancshares, Inc. | 7,377 | 426,169 |

| Cullen/Frost Bankers, Inc. | 3,329 | 315,989 |

| East West Bancorp, Inc. | 8,465 | 506,038 |

| Fifth Third Bancorp | 41,257 | 1,154,371 |

| First Citizens BancShares, Inc., Class A | 451 | 168,624 |

| First Hawaiian, Inc. | 6,742 | 204,215 |

| First Horizon National Corp. | 12,189 | 233,419 |

| First Republic Bank | 9,289 | 970,329 |

| FNB Corp. | 20,148 | 282,676 |

| Fulton Financial Corp. | 9,397 | 176,194 |

| Hancock Holding Co. | 4,887 | 236,775 |

| Home BancShares, Inc. | 6,923 | 174,598 |

| Huntington Bancshares, Inc. | 62,369 | 870,671 |

| IBERIABANK Corp. | 2,315 | 190,177 |

| Investors Bancorp, Inc. | 19,511 | 266,130 |

| KeyCorp | 64,345 | 1,210,973 |

| M&T Bank Corp. | 8,898 | 1,432,934 |

| MB Financial, Inc. | 3,577 | 161,037 |

| PacWest Bancorp | 7,891 | 398,574 |

| People's United Financial, Inc. | 20,715 | 375,770 |

| Pinnacle Financial Partners, Inc. | 3,433 | 229,839 |

| PNC Financial Services Group, Inc. (The) | 27,787 | 3,744,854 |

| Popular, Inc. | 5,710 | 205,217 |

| Prosperity Bancshares, Inc. | 3,886 | 255,427 |

| Regions Financial Corp. | 68,287 | 1,040,011 |

| Signature Bank * | 2,803 | 358,896 |

| Sterling Bancorp | 8,949 | 220,593 |

| SVB Financial Group * | 3,071 | 574,553 |

| Synovus Financial Corp. | 6,505 | 299,620 |

| Texas Capital Bancshares, Inc. * | 3,496 | 299,957 |

| UMB Financial Corp. | 2,437 | 181,532 |

| Umpqua Holdings Corp. | 15,457 | 301,566 |

| United Bankshares, Inc. | 4,146 | 154,024 |

| US Bancorp | 91,138 | 4,884,085 |

| Valley National Bancorp | 16,350 | 197,018 |

| Webster Financial Corp. | 5,017 | 263,643 |

8 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Western Alliance Bancorp * | 5,224 | 277,290 |

| Wintrust Financial Corp. | 4,286 | 335,637 |

| Zions Bancorporation | 12,098 | 570,784 |

| 56,220,323 | ||

| Beverages - 2.2% | ||

| Coca-Cola Co. (The) | 230,870 | 10,391,459 |

| Dr Pepper Snapple Group, Inc. | 10,672 | 944,152 |

| PepsiCo, Inc. | 84,352 | 9,399,343 |

| 20,734,954 | ||

| Biotechnology - 4.1% | ||

| AbbVie, Inc. | 81,368 | 7,230,360 |

| ACADIA Pharmaceuticals, Inc. *(a) | 5,094 | 191,891 |

| Alexion Pharmaceuticals, Inc. * | 11,514 | 1,615,299 |

| Alkermes plc * | 8,182 | 415,973 |

| Alnylam Pharmaceuticals, Inc. * | 4,914 | 577,346 |

| Amgen, Inc. | 37,219 | 6,939,483 |

| Biogen, Inc. * | 10,771 | 3,372,616 |

| BioMarin Pharmaceutical, Inc. * | 8,821 | 820,970 |

| Bioverativ, Inc. * | 6,364 | 363,193 |

| Bluebird Bio, Inc. * | 1,949 | 267,695 |

| Celgene Corp. * | 39,874 | 5,814,427 |

| Exelixis, Inc. * | 14,288 | 346,198 |

| Gilead Sciences, Inc. | 65,882 | 5,337,760 |

| Incyte Corp. * | 8,578 | 1,001,396 |

| Intercept Pharmaceuticals, Inc. *(a) | 1,291 | 74,930 |

| Ionis Pharmaceuticals, Inc. * | 5,418 | 274,693 |

| Kite Pharma, Inc. * | 2,426 | 436,219 |

| Regeneron Pharmaceuticals, Inc. * | 3,864 | 1,727,672 |

| Seattle Genetics, Inc. * | 4,952 | 269,438 |

| TESARO, Inc. * | 1,461 | 188,615 |

| United Therapeutics Corp. * | 2,286 | 267,896 |

| Vertex Pharmaceuticals, Inc. * | 12,400 | 1,885,296 |

| 39,419,366 | ||

| Building Products - 0.6% | ||

| Allegion plc | 6,094 | 526,948 |

| Fortune Brands Home & Security, Inc. | 10,666 | 717,075 |

| Johnson Controls International plc | 62,383 | 2,513,411 |

| Masco Corp. | 22,020 | 859,000 |

| Owens Corning | 7,564 | 585,076 |

| USG Corp. * | 5,785 | 188,880 |

| 5,390,390 | ||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 9

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Capital Markets - 4.6% | ||

| Affiliated Managers Group, Inc. | 3,442 | 653,395 |

| Ameriprise Financial, Inc. | 8,984 | 1,334,214 |

| Bank of New York Mellon Corp. (The) | 59,831 | 3,172,240 |

| BGC Partners, Inc., Class A | 11,269 | 163,062 |

| BlackRock, Inc. | 7,043 | 3,148,855 |

| CBOE Holdings, Inc. | 6,210 | 668,382 |

| Charles Schwab Corp. (The) | 69,411 | 3,036,037 |

| CME Group, Inc. | 19,944 | 2,706,002 |

| E*Trade Financial Corp. * | 18,599 | 811,102 |

| Evercore, Inc., Class A | 2,768 | 222,132 |

| Federated Investors, Inc., Class B | 8,889 | 264,003 |

| Franklin Resources, Inc. | 18,821 | 837,723 |

| Goldman Sachs Group, Inc. (The) | 21,202 | 5,028,902 |

| Interactive Brokers Group, Inc., Class A | 25,554 | 1,150,952 |

| Intercontinental Exchange, Inc. | 34,359 | 2,360,463 |

| Invesco Ltd. | 23,364 | 818,675 |

| Legg Mason, Inc. | 5,350 | 210,309 |

| LPL Financial Holdings, Inc. | 5,529 | 285,131 |

| MarketAxess Holdings, Inc. | 2,226 | 410,719 |

| Moody's Corp. | 10,113 | 1,407,831 |

| Morgan Stanley | 83,459 | 4,020,220 |

| Morningstar, Inc. | 1,011 | 85,925 |

| MSCI, Inc. | 5,534 | 646,925 |

| Nasdaq, Inc. | 7,521 | 583,404 |

| Northern Trust Corp. | 12,502 | 1,149,309 |

| Raymond James Financial, Inc. | 7,030 | 592,840 |

| S&P Global, Inc. | 14,640 | 2,288,378 |

| SEI Investments Co. | 8,571 | 523,345 |

| State Street Corp. | 21,471 | 2,051,339 |

| Stifel Financial Corp. | 3,687 | 197,107 |

| T. Rowe Price Group, Inc. | 13,753 | 1,246,709 |

| TD Ameritrade Holding Corp. | 14,310 | 698,328 |

| Thomson Reuters Corp. | 16,986 | 779,318 |

| 43,553,276 | ||

| Chemicals - 2.3% | ||

| Air Products & Chemicals, Inc. | 23,498 | 3,553,367 |

| Axalta Coating Systems Ltd. * | 24,242 | 701,079 |

| Eastman Chemical Co. | 14,396 | 1,302,694 |

| Ecolab, Inc. | 26,253 | 3,376,398 |

| International Flavors & Fragrances, Inc. | 8,377 | 1,197,157 |

| Mosaic Co. (The) | 38,061 | 821,737 |

| PolyOne Corp. | 7,985 | 319,639 |

| PPG Industries, Inc. | 26,913 | 2,924,367 |

10 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Praxair, Inc. | 29,746 | 4,156,706 |

| Sensient Technologies Corp. | 4,452 | 342,448 |

| Sherwin-Williams Co. (The) | 8,618 | 3,085,589 |

| 21,781,181 | ||

| Commercial Services & Supplies - 0.6% | ||

| Cintas Corp. | 5,724 | 825,859 |

| Clean Harbors, Inc. * | 3,326 | 188,584 |

| Copart, Inc. * | 11,386 | 391,337 |

| Deluxe Corp. | 3,061 | 223,331 |

| Healthcare Services Group, Inc. | 4,606 | 248,586 |

| KAR Auction Services, Inc. | 9,458 | 451,525 |

| MSA Safety, Inc. | 2,985 | 237,337 |

| Pitney Bowes, Inc. | 16,029 | 224,566 |

| Republic Services, Inc. | 14,685 | 970,091 |

| UniFirst Corp. | 952 | 144,228 |

| Waste Management, Inc. | 25,707 | 2,012,087 |

| 5,917,531 | ||

| Communications Equipment - 1.2% | ||

| Arista Networks, Inc. * | 1,788 | 339,023 |

| ARRIS International plc * | 8,066 | 229,800 |

| Brocade Communications Systems, Inc. | 18,304 | 218,733 |

| Ciena Corp. * | 5,637 | 123,845 |

| Cisco Systems, Inc. | 216,733 | 7,288,731 |

| CommScope Holding Co., Inc. * | 6,808 | 226,094 |

| EchoStar Corp., Class A * | 4,037 | 231,037 |

| F5 Networks, Inc. * | 2,499 | 301,279 |

| Finisar Corp. * | 4,579 | 101,516 |

| Harris Corp. | 5,507 | 725,162 |

| Juniper Networks, Inc. | 15,372 | 427,803 |

| Lumentum Holdings, Inc. * | 2,188 | 118,918 |

| Motorola Solutions, Inc. | 6,660 | 565,234 |

| NetScout Systems, Inc. * | 3,994 | 129,206 |

| Palo Alto Networks, Inc. * | 3,996 | 575,824 |

| Ubiquiti Networks, Inc. *(a) | 1,817 | 101,788 |

| 11,703,993 | ||

| Construction & Engineering - 0.1% | ||

| Dycom Industries, Inc. * | 2,016 | 173,134 |

| EMCOR Group, Inc. | 3,962 | 274,884 |

| Quanta Services, Inc. * | 9,843 | 367,833 |

| Valmont Industries, Inc. | 1,443 | 228,138 |

| 1,043,989 | ||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 11

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Consumer Finance - 1.1% | ||

| Ally Financial, Inc. | 25,803 | 625,981 |

| American Express Co. | 42,977 | 3,887,699 |

| Capital One Financial Corp. | 27,809 | 2,354,310 |

| Credit Acceptance Corp. * | 692 | 193,878 |

| Discover Financial Services | 21,523 | 1,387,803 |

| OneMain Holdings, Inc. * | 7,413 | 208,973 |

| SLM Corp. * | 23,908 | 274,225 |

| Synchrony Financial | 43,788 | 1,359,617 |

| 10,292,486 | ||

| Containers & Packaging - 0.9% | ||

| AptarGroup, Inc. | 6,373 | 550,054 |

| Avery Dennison Corp. | 9,562 | 940,327 |

| Ball Corp. | 36,071 | 1,489,732 |

| Berry Global Group, Inc. * | 12,948 | 733,504 |

| Crown Holdings, Inc. * | 13,538 | 808,489 |

| Greif, Inc., Class A | 5,962 | 349,016 |

| Owens-Illinois, Inc. * | 15,985 | 402,183 |

| Sealed Air Corp. | 20,563 | 878,451 |

| Sonoco Products Co. | 9,690 | 488,861 |

| WestRock Co. | 26,906 | 1,526,377 |

| 8,166,994 | ||

| Distributors - 0.2% | ||

| Genuine Parts Co. | 7,843 | 750,183 |

| LKQ Corp. * | 14,296 | 514,513 |

| Pool Corp. | 1,824 | 197,302 |

| 1,461,998 | ||

| Diversified Consumer Services - 0.1% | ||

| Bright Horizons Family Solutions, Inc. * | 2,219 | 191,300 |

| Graham Holdings Co., Class B | 191 | 111,754 |

| Grand Canyon Education, Inc. * | 2,982 | 270,825 |

| Service Corp. International | 10,014 | 345,483 |

| ServiceMaster Global Holdings, Inc. * | 6,779 | 316,783 |

| 1,236,145 | ||

| Diversified Financial Services - 0.0% (b) | ||

| Voya Financial, Inc. | 11,073 | 441,702 |

| Diversified Telecommunication Services - 2.1% | ||

| AT&T, Inc. | 255,775 | 10,018,707 |

| CenturyLink, Inc. (a) | 16,693 | 315,497 |

12 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Level 3 Communications, Inc. * | 11,348 | 604,735 |

| Verizon Communications, Inc. | 171,316 | 8,478,429 |

| Zayo Group Holdings, Inc. * | 7,547 | 259,768 |

| 19,677,136 | ||

| Electric Utilities - 1.0% | ||

| Alliant Energy Corp. | 40,897 | 1,700,088 |

| Eversource Energy | 52,415 | 3,167,963 |

| Portland General Electric Co. | 14,826 | 676,659 |

| Xcel Energy, Inc. | 83,155 | 3,934,894 |

| 9,479,604 | ||

| Electrical Equipment - 1.0% | ||

| Acuity Brands, Inc. | 3,186 | 545,698 |

| AMETEK, Inc. | 15,170 | 1,001,827 |

| Eaton Corp. plc | 29,259 | 2,246,799 |

| Emerson Electric Co. | 42,547 | 2,673,653 |

| EnerSys | 3,662 | 253,301 |

| Hubbell, Inc. | 3,549 | 411,755 |

| Regal-Beloit Corp. | 2,818 | 222,622 |

| Rockwell Automation, Inc. | 8,125 | 1,447,956 |

| Sensata Technologies Holding NV * | 10,855 | 521,800 |

| 9,325,411 | ||

| Electronic Equipment, Instruments & Components - 0.7% | ||

| Arrow Electronics, Inc. * | 4,356 | 350,266 |

| Avnet, Inc. | 4,325 | 169,972 |

| CDW Corp. | 5,986 | 395,076 |

| Coherent, Inc. * | 1,065 | 250,456 |

| Corning, Inc. | 40,234 | 1,203,801 |

| Dolby Laboratories, Inc., Class A | 4,313 | 248,084 |

| FLIR Systems, Inc. | 5,903 | 229,686 |

| IPG Photonics Corp. * | 1,577 | 291,840 |

| Jabil, Inc. | 8,312 | 237,308 |

| Keysight Technologies, Inc. * | 7,881 | 328,322 |

| National Instruments Corp. | 4,287 | 180,783 |

| SYNNEX Corp. | 1,489 | 188,373 |

| TE Connectivity Ltd. | 15,211 | 1,263,426 |

| Tech Data Corp. * | 1,374 | 122,080 |

| Trimble, Inc. * | 10,917 | 428,492 |

| Universal Display Corp. | 1,805 | 232,574 |

| Zebra Technologies Corp., Class A * | 2,084 | 226,281 |

| 6,346,820 | ||

| Energy Equipment & Services - 1.0% | ||

| Baker Hughes a GE Co. | 96,523 | 3,534,672 |

| Core Laboratories NV (a) | 10,914 | 1,077,212 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 13

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| National Oilwell Varco, Inc. | 85,314 | 3,048,269 |

| Oceaneering International, Inc. | 23,317 | 612,538 |

| US Silica Holdings, Inc. | 17,397 | 540,525 |

| Weatherford International plc * | 197,879 | 906,286 |

| 9,719,502 | ||

| Food & Staples Retailing - 1.8% | ||

| Casey's General Stores, Inc. | 2,327 | 254,690 |

| Costco Wholesale Corp. | 26,807 | 4,404,122 |

| CVS Health Corp. | 60,759 | 4,940,922 |

| Kroger Co. (The) | 48,625 | 975,417 |

| Performance Food Group Co. * | 4,785 | 135,176 |

| PriceSmart, Inc. | 1,950 | 174,038 |

| Rite Aid Corp. * | 47,735 | 93,561 |

| Sprouts Farmers Market, Inc. * | 9,622 | 180,605 |

| Sysco Corp. | 29,567 | 1,595,140 |

| US Foods Holding Corp. * | 8,862 | 236,615 |

| Walgreens Boots Alliance, Inc. | 53,923 | 4,163,934 |

| 17,154,220 | ||

| Food Products - 1.8% | ||

| B&G Foods, Inc. | 3,720 | 118,482 |

| Blue Buffalo Pet Products, Inc. * | 5,947 | 168,597 |

| Bunge Ltd. | 8,249 | 572,976 |

| Campbell Soup Co. | 10,434 | 488,520 |

| Conagra Brands, Inc. | 24,116 | 813,674 |

| Flowers Foods, Inc. | 11,379 | 214,039 |

| General Mills, Inc. | 35,395 | 1,832,045 |

| Hain Celestial Group, Inc. (The) * | 7,528 | 309,777 |

| Hershey Co. (The) | 11,716 | 1,279,036 |

| Hormel Foods Corp. | 15,528 | 499,070 |

| Ingredion, Inc. | 4,274 | 515,615 |

| J. M. Smucker Co. (The) | 6,810 | 714,573 |

| Kellogg Co. | 14,231 | 887,587 |

| Kraft Heinz Co. (The) | 35,183 | 2,728,442 |

| Lamb Weston Holdings, Inc. | 8,900 | 417,321 |

| Lancaster Colony Corp. | 1,222 | 146,787 |

| McCormick & Co., Inc. | 7,866 | 807,366 |

| Mondelez International, Inc., Class A | 89,608 | 3,643,461 |

| Pinnacle Foods, Inc. | 7,373 | 421,514 |

| Post Holdings, Inc. * | 3,769 | 332,690 |

| Snyder's-Lance, Inc. | 5,277 | 201,265 |

| TreeHouse Foods, Inc. * | 3,541 | 239,832 |

| 17,352,669 | ||

14 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Gas Utilities - 0.6% | ||

| Atmos Energy Corp. | 17,720 | 1,485,645 |

| New Jersey Resources Corp. | 15,234 | 642,113 |

| ONE Gas, Inc. | 9,309 | 685,515 |

| Southwest Gas Holdings, Inc. | 7,298 | 566,471 |

| Spire, Inc. | 8,313 | 620,565 |

| UGI Corp. | 28,550 | 1,337,853 |

| WGL Holdings, Inc. | 8,285 | 697,597 |

| 6,035,759 | ||

| Health Care Equipment & Supplies - 2.1% | ||

| Abbott Laboratories | 88,461 | 4,720,279 |

| ABIOMED, Inc. * | 2,156 | 363,502 |

| Alere, Inc. * | 4,339 | 221,246 |

| Align Technology, Inc. * | 3,852 | 717,512 |

| Becton Dickinson and Co. | 11,560 | 2,265,182 |

| Boston Scientific Corp. * | 67,868 | 1,979,709 |

| Cantel Medical Corp. | 1,174 | 110,556 |

| Cooper Cos., Inc. (The) | 2,497 | 592,064 |

| Danaher Corp. | 31,660 | 2,715,795 |

| DENTSPLY SIRONA, Inc. | 12,155 | 726,990 |

| DexCom, Inc. * | 4,395 | 215,025 |

| Edwards Lifesciences Corp. * | 10,854 | 1,186,451 |

| Globus Medical, Inc., Class A * | 5,233 | 155,525 |

| Hill-Rom Holdings, Inc. | 3,014 | 223,036 |

| Hologic, Inc. * | 13,636 | 500,305 |

| ICU Medical, Inc. * | 522 | 97,014 |

| IDEXX Laboratories, Inc. * | 4,364 | 678,558 |

| Masimo Corp. * | 2,151 | 186,190 |

| NuVasive, Inc. * | 2,566 | 142,310 |

| ResMed, Inc. | 7,849 | 604,059 |

| STERIS plc | 4,313 | 381,269 |

| Teleflex, Inc. | 2,070 | 500,878 |

| Varian Medical Systems, Inc. * | 5,322 | 532,519 |

| West Pharmaceutical Services, Inc. | 4,803 | 462,337 |

| 20,278,311 | ||

| Health Care Providers & Services - 1.7% | ||

| Acadia Healthcare Co., Inc. *(a) | 3,557 | 169,882 |

| AmerisourceBergen Corp. | 9,192 | 760,638 |

| Anthem, Inc. | 13,809 | 2,622,053 |

| Cardinal Health, Inc. | 15,348 | 1,027,088 |

| Centene Corp. * | 8,597 | 831,932 |

| Chemed Corp. | 853 | 172,349 |

| DaVita, Inc. * | 8,617 | 511,764 |

| Envision Healthcare Corp. * | 5,480 | 246,326 |

| Express Scripts Holding Co. * | 28,665 | 1,815,068 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 15

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| HCA Healthcare, Inc. * | 14,014 | 1,115,374 |

| HealthSouth Corp. | 4,461 | 206,767 |

| Henry Schein, Inc. * | 7,734 | 634,111 |

| Humana, Inc. | 7,311 | 1,781,179 |

| Laboratory Corp. of America Holdings * | 5,277 | 796,669 |

| McKesson Corp. | 11,075 | 1,701,231 |

| Mednax, Inc. * | 3,427 | 147,772 |

| Molina Healthcare, Inc. * | 1,719 | 118,198 |

| Patterson Cos., Inc. | 4,216 | 162,948 |

| Premier, Inc., Class A * | 6,888 | 224,342 |

| Quest Diagnostics, Inc. | 6,915 | 647,521 |

| WellCare Health Plans, Inc. * | 2,206 | 378,858 |

| 16,072,070 | ||

| Health Care Technology - 0.2% | ||

| athenahealth, Inc. * | 2,274 | 282,795 |

| Cerner Corp. * | 15,651 | 1,116,229 |

| Cotiviti Holdings, Inc. * | 2,345 | 84,373 |

| Medidata Solutions, Inc. * | 2,930 | 228,716 |

| Veeva Systems, Inc., Class A * | 7,335 | 413,767 |

| 2,125,880 | ||

| Hotels, Restaurants & Leisure - 1.5% | ||

| Aramark | 11,625 | 472,091 |

| Buffalo Wild Wings, Inc. * | 930 | 98,301 |

| Chipotle Mexican Grill, Inc. * | 1,283 | 394,946 |

| Choice Hotels International, Inc. | 1,826 | 116,681 |

| Cracker Barrel Old Country Store, Inc. | 1,217 | 184,522 |

| Darden Restaurants, Inc. | 5,760 | 453,773 |

| Domino's Pizza, Inc. | 2,624 | 520,995 |

| Dunkin' Brands Group, Inc. | 4,512 | 239,497 |

| Hilton Worldwide Holdings, Inc. | 9,632 | 668,942 |

| Hyatt Hotels Corp., Class A * | 5,755 | 355,601 |

| ILG, Inc. | 8,136 | 217,475 |

| Jack in the Box, Inc. | 1,661 | 169,289 |

| Marriott International, Inc., Class A | 15,492 | 1,708,148 |

| Marriott Vacations Worldwide Corp. | 1,092 | 135,987 |

| Papa John's International, Inc. | 1,124 | 82,131 |

| Royal Caribbean Cruises Ltd. | 8,499 | 1,007,471 |

| Six Flags Entertainment Corp. | 4,832 | 294,462 |

| Starbucks Corp. | 71,432 | 3,836,613 |

| Texas Roadhouse, Inc. | 4,128 | 202,850 |

| Vail Resorts, Inc. | 1,809 | 412,669 |

| Wendy's Co. (The) | 9,964 | 154,741 |

16 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Wyndham Worldwide Corp. | 4,999 | 526,945 |

| Yum China Holdings, Inc. * | 20,018 | 800,119 |

| Yum! Brands, Inc. | 17,532 | 1,290,531 |

| 14,344,780 | ||

| Household Durables - 0.5% | ||

| CalAtlantic Group, Inc. | 4,835 | 177,106 |

| Garmin Ltd. | 5,378 | 290,251 |

| Helen of Troy Ltd. * | 1,319 | 127,811 |

| Leggett & Platt, Inc. | 7,725 | 368,714 |

| Lennar Corp., Class A | 10,404 | 549,331 |

| Mohawk Industries, Inc. * | 3,061 | 757,628 |

| Newell Brands, Inc. | 25,862 | 1,103,532 |

| Tempur Sealy International, Inc. * | 2,289 | 147,686 |

| Toll Brothers, Inc. | 6,245 | 258,980 |

| Tupperware Brands Corp. | 2,531 | 156,467 |

| Whirlpool Corp. | 3,612 | 666,197 |

| 4,603,703 | ||

| Household Products - 2.3% | ||

| Church & Dwight Co., Inc. | 14,911 | 722,438 |

| Clorox Co. (The) | 7,936 | 1,046,838 |

| Colgate-Palmolive Co. | 52,139 | 3,798,326 |

| Kimberly-Clark Corp. | 20,126 | 2,368,427 |

| Procter & Gamble Co. (The) | 152,805 | 13,902,199 |

| 21,838,228 | ||

| Independent Power and Renewable Electricity Producers - 0.1% | ||

| NRG Yield, Inc., Class C | 33,530 | 647,129 |

| Ormat Technologies, Inc. | 5,470 | 333,944 |

| 981,073 | ||

| Industrial Conglomerates - 2.5% | ||

| 3M Co. | 38,561 | 8,093,954 |

| Carlisle Cos., Inc. | 5,000 | 501,450 |

| General Electric Co. | 571,193 | 13,811,447 |

| Roper Technologies, Inc. | 6,951 | 1,691,873 |

| 24,098,724 | ||

| Insurance - 4.1% | ||

| Aflac, Inc. | 23,204 | 1,888,574 |

| Alleghany Corp. * | 902 | 499,717 |

| Allstate Corp. (The) | 20,742 | 1,906,397 |

| American Financial Group, Inc. | 3,884 | 401,800 |

| American International Group, Inc. | 52,158 | 3,201,980 |

| American National Insurance Co. | 1,119 | 132,132 |

| Aon plc | 15,699 | 2,293,624 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 17

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Arch Capital Group Ltd. * | 7,133 | 702,600 |

| Arthur J. Gallagher & Co. | 10,395 | 639,812 |

| Aspen Insurance Holdings Ltd. | 4,181 | 168,912 |

| Assurant, Inc. | 3,367 | 321,616 |

| Assured Guaranty Ltd. | 7,299 | 275,537 |

| Axis Capital Holdings Ltd. | 5,009 | 287,066 |

| Brown & Brown, Inc. | 5,705 | 274,924 |

| Chubb Ltd. | 26,833 | 3,825,044 |

| Cincinnati Financial Corp. | 8,790 | 673,050 |

| CNO Financial Group, Inc. | 9,886 | 230,739 |

| Enstar Group Ltd. * | 907 | 201,671 |

| Everest Re Group Ltd. | 1,544 | 352,634 |

| First American Financial Corp. | 6,015 | 300,570 |

| Hanover Insurance Group, Inc. (The) | 2,959 | 286,816 |

| Hartford Financial Services Group, Inc. (The) | 21,181 | 1,174,063 |

| Lincoln National Corp. | 14,031 | 1,030,998 |

| Loews Corp. | 15,217 | 728,286 |

| Marsh & McLennan Cos., Inc. | 29,234 | 2,450,102 |

| MetLife, Inc. | 48,628 | 2,526,225 |

| Old Republic International Corp. | 13,335 | 262,566 |

| Primerica, Inc. | 2,599 | 211,948 |

| Principal Financial Group, Inc. | 15,860 | 1,020,432 |

| Progressive Corp. (The) | 34,561 | 1,673,444 |

| Prudential Financial, Inc. | 24,901 | 2,647,474 |

| Reinsurance Group of America, Inc. | 3,604 | 502,866 |

| RenaissanceRe Holdings Ltd. | 2,586 | 349,472 |

| RLI Corp. | 2,205 | 126,479 |

| Torchmark Corp. | 6,003 | 480,780 |

| Travelers Cos., Inc. (The) | 15,861 | 1,943,290 |

| Unum Group | 13,017 | 665,559 |

| Validus Holdings Ltd. | 3,296 | 162,196 |

| White Mountains Insurance Group Ltd. | 252 | 215,964 |

| Willis Towers Watson plc | 7,621 | 1,175,387 |

| XL Group Ltd. | 15,375 | 606,544 |

| 38,819,290 | ||

| Internet & Direct Marketing Retail - 3.0% | ||

| Amazon.com, Inc. * | 20,168 | 19,388,507 |

| Expedia, Inc. | 6,213 | 894,299 |

| Netflix, Inc. * | 21,777 | 3,949,259 |

| Priceline Group, Inc. (The) * | 2,440 | 4,467,201 |

| TripAdvisor, Inc. * | 5,656 | 229,238 |

| Wayfair, Inc., Class A * | 2,456 | 165,534 |

| 29,094,038 | ||

18 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Internet Software & Services - 5.7% | ||

| Akamai Technologies, Inc. * | 8,014 | 390,442 |

| Alphabet, Inc., Class A * | 29,554 | 28,777,321 |

| CoStar Group, Inc. * | 1,444 | 387,353 |

| eBay, Inc. * | 43,597 | 1,676,740 |

| Facebook, Inc., Class A * | 125,018 | 21,361,826 |

| GrubHub, Inc. * | 3,712 | 195,474 |

| IAC/InterActiveCorp * | 3,374 | 396,715 |

| j2 Global, Inc. | 1,495 | 110,450 |

| LogMeIn, Inc. | 2,037 | 224,172 |

| Twitter, Inc. * | 28,279 | 477,067 |

| VeriSign, Inc. * | 3,561 | 378,855 |

| Zillow Group, Inc., Class C * | 6,182 | 248,578 |

| 54,624,993 | ||

| IT Services - 4.7% | ||

| Accenture plc, Class A | 27,298 | 3,687,141 |

| Alliance Data Systems Corp. | 2,204 | 488,296 |

| Amdocs Ltd. | 5,720 | 367,910 |

| Automatic Data Processing, Inc. | 19,198 | 2,098,725 |

| Black Knight Financial Services, Inc., Class A * | 2,117 | 91,137 |

| Booz Allen Hamilton Holding Corp. | 5,160 | 192,932 |

| Broadridge Financial Solutions, Inc. | 4,418 | 357,063 |

| CACI International, Inc., Class A * | 1,057 | 147,293 |

| Cognizant Technology Solutions Corp., Class A | 24,905 | 1,806,609 |

| Conduent, Inc. * | 8,020 | 125,673 |

| CoreLogic, Inc. * | 6,414 | 296,455 |

| CSRA, Inc. | 6,321 | 203,979 |

| DST Systems, Inc. | 2,858 | 156,847 |

| DXC Technology Co. | 12,608 | 1,082,775 |

| EPAM Systems, Inc. * | 1,798 | 158,098 |

| Euronet Worldwide, Inc. * | 1,922 | 182,186 |

| Fidelity National Information Services, Inc. | 13,673 | 1,276,922 |

| First Data Corp., Class A * | 34,592 | 624,040 |

| Fiserv, Inc. * | 9,214 | 1,188,237 |

| FleetCor Technologies, Inc. * | 3,995 | 618,306 |

| Gartner, Inc. * | 3,608 | 448,871 |

| Genpact Ltd. | 6,201 | 178,279 |

| International Business Machines Corp. | 37,498 | 5,440,210 |

| Jack Henry & Associates, Inc. | 2,819 | 289,765 |

| Leidos Holdings, Inc. | 6,496 | 384,693 |

| MasterCard, Inc., Class A | 41,736 | 5,893,123 |

| MAXIMUS, Inc. | 2,843 | 183,374 |

| Paychex, Inc. | 14,490 | 868,820 |

| PayPal Holdings, Inc. * | 47,882 | 3,065,884 |

| Sabre Corp. | 7,738 | 140,058 |

| Science Applications International Corp. | 1,701 | 113,712 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 19

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Square, Inc., Class A * | 16,245 | 468,018 |

| Teradata Corp. * | 5,573 | 188,312 |

| Total System Services, Inc. | 7,668 | 502,254 |

| Vantiv, Inc., Class A * | 7,780 | 548,257 |

| Visa, Inc., Class A | 99,836 | 10,506,741 |

| Western Union Co. (The) | 21,143 | 405,946 |

| WEX, Inc. * | 1,937 | 217,370 |

| 44,994,311 | ||

| Leisure Products - 0.1% | ||

| Brunswick Corp. | 4,516 | 252,760 |

| Hasbro, Inc. | 5,165 | 504,466 |

| Mattel, Inc. | 16,419 | 254,166 |

| Polaris Industries, Inc. | 2,940 | 307,612 |

| 1,319,004 | ||

| Life Sciences Tools & Services - 1.1% | ||

| Agilent Technologies, Inc. | 16,833 | 1,080,679 |

| Bio-Rad Laboratories, Inc., Class A * | 1,094 | 243,109 |

| Bio-Techne Corp. | 1,816 | 219,536 |

| Bruker Corp. | 5,042 | 149,999 |

| Charles River Laboratories International, Inc. * | 2,344 | 253,199 |

| Illumina, Inc. * | 7,602 | 1,514,318 |

| INC Research Holdings, Inc., Class A * | 2,354 | 123,114 |

| Mettler-Toledo International, Inc. * | 1,293 | 809,625 |

| PAREXEL International Corp. * | 2,637 | 232,267 |

| PerkinElmer, Inc. | 5,903 | 407,130 |

| PRA Health Sciences, Inc. * | 2,083 | 158,662 |

| Quintiles IMS Holdings, Inc. * | 7,751 | 736,887 |

| Thermo Fisher Scientific, Inc. | 19,774 | 3,741,241 |

| VWR Corp. * | 4,633 | 153,399 |

| Waters Corp. * | 3,992 | 716,644 |

| 10,539,809 | ||

| Machinery - 2.7% | ||

| AGCO Corp. | 4,215 | 310,941 |

| Allison Transmission Holdings, Inc. | 10,692 | 401,271 |

| Barnes Group, Inc. | 3,021 | 212,799 |

| Colfax Corp. * | 7,886 | 328,373 |

| Crane Co. | 3,109 | 248,689 |

| Cummins, Inc. | 10,274 | 1,726,340 |

| Deere & Co. | 20,669 | 2,595,820 |

| Donaldson Co., Inc. | 8,477 | 389,433 |

| Dover Corp. | 10,229 | 934,828 |

| Flowserve Corp. | 10,839 | 461,633 |

| Fortive Corp. | 19,352 | 1,369,928 |

| Graco, Inc. | 3,571 | 441,697 |

20 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| IDEX Corp. | 5,017 | 609,415 |

| Illinois Tool Works, Inc. | 20,217 | 2,991,307 |

| Ingersoll-Rand plc | 16,131 | 1,438,401 |

| ITT, Inc. | 4,976 | 220,288 |

| Kennametal, Inc. | 5,049 | 203,677 |

| Lincoln Electric Holdings, Inc. | 3,957 | 362,778 |

| Middleby Corp. (The) * | 4,371 | 560,231 |

| Nordson Corp. | 3,381 | 400,648 |

| Oshkosh Corp. | 4,690 | 387,113 |

| PACCAR, Inc. | 22,156 | 1,602,765 |

| Parker-Hannifin Corp. | 8,568 | 1,499,571 |

| Pentair plc | 11,402 | 774,880 |

| Snap-on, Inc. | 3,484 | 519,151 |

| Stanley Black & Decker, Inc. | 10,298 | 1,554,689 |

| Terex Corp. | 6,602 | 297,222 |

| Timken Co. (The) | 4,905 | 238,138 |

| Toro Co. (The) | 6,841 | 424,552 |

| WABCO Holdings, Inc. * | 3,313 | 490,324 |

| Wabtec Corp. (a) | 6,063 | 459,272 |

| Woodward, Inc. | 3,228 | 250,525 |

| Xylem, Inc. | 12,331 | 772,291 |

| 25,478,990 | ||

| Media - 3.0% | ||

| AMC Entertainment Holdings, Inc., Class A | 7,590 | 111,573 |

| AMC Networks, Inc., Class A * | 2,657 | 155,355 |

| Cable One, Inc. | 241 | 174,031 |

| CBS Corp., Class B | 22,518 | 1,306,044 |

| Cinemark Holdings, Inc. | 4,148 | 150,199 |

| Comcast Corp., Class A | 233,091 | 8,969,342 |

| Discovery Communications, Inc., Class A * | 20,116 | 428,270 |

| DISH Network Corp., Class A * | 24,081 | 1,305,913 |

| Interpublic Group of Cos., Inc. (The) | 18,051 | 375,280 |

| John Wiley & Sons, Inc., Class A | 1,833 | 98,065 |

| Liberty Broadband Corp., Class C * | 8,516 | 811,575 |

| Lions Gate Entertainment Corp., Class A * | 10,398 | 347,813 |

| Live Nation Entertainment, Inc. * | 7,066 | 307,724 |

| Madison Square Garden Co. (The), Class A * | 1,136 | 243,217 |

| Omnicom Group, Inc. | 10,752 | 796,401 |

| Regal Entertainment Group, Class A | 9,821 | 157,136 |

| Scripps Networks Interactive, Inc., Class A | 6,779 | 582,248 |

| Sinclair Broadcast Group, Inc., Class A | 4,249 | 136,180 |

| Sirius XM Holdings, Inc. | 87,579 | 483,436 |

| TEGNA, Inc. | 12,266 | 163,506 |

| Time Warner, Inc. | 39,200 | 4,016,040 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 21

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Tribune Media Co., Class A | 3,927 | 160,457 |

| Viacom, Inc., Class B | 20,777 | 578,432 |

| Walt Disney Co. (The) | 72,668 | 7,162,885 |

| 29,021,122 | ||

| Metals & Mining - 0.4% | ||

| Nucor Corp. | 33,992 | 1,904,912 |

| Reliance Steel & Aluminum Co. | 7,680 | 584,986 |

| Steel Dynamics, Inc. | 24,820 | 855,545 |

| Worthington Industries, Inc. | 4,126 | 189,796 |

| 3,535,239 | ||

| Multi-Utilities - 1.4% | ||

| CenterPoint Energy, Inc. | 73,595 | 2,149,710 |

| CMS Energy Corp. | 45,289 | 2,097,787 |

| Consolidated Edison, Inc. | 50,202 | 4,050,297 |

| Sempra Energy | 40,914 | 4,669,515 |

| 12,967,309 | ||

| Multiline Retail - 0.4% | ||

| Dollar General Corp. | 13,083 | 1,060,377 |

| Kohl's Corp. | 8,583 | 391,814 |

| Macy's, Inc. | 17,574 | 383,465 |

| Nordstrom, Inc. | 5,619 | 264,936 |

| Target Corp. | 27,820 | 1,641,658 |

| 3,742,250 | ||

| Personal Products - 0.3% | ||

| Coty, Inc., Class A | 26,651 | 440,541 |

| Edgewell Personal Care Co. * | 3,572 | 259,934 |

| Estee Lauder Cos., Inc. (The), Class A | 22,622 | 2,439,557 |

| 3,140,032 | ||

| Pharmaceuticals - 5.7% | ||

| Akorn, Inc. * | 3,995 | 132,594 |

| Allergan plc | 16,894 | 3,462,425 |

| Bristol-Myers Squibb Co. | 83,183 | 5,302,084 |

| Catalent, Inc. * | 6,497 | 259,360 |

| Eli Lilly & Co. | 49,448 | 4,229,782 |

| Endo International plc * | 11,357 | 97,273 |

| Jazz Pharmaceuticals plc * | 3,031 | 443,284 |

| Johnson & Johnson | 137,153 | 17,831,262 |

| Medicines Co. (The) * | 3,788 | 140,307 |

| Merck & Co., Inc. | 138,301 | 8,855,413 |

| Nektar Therapeutics * | 7,376 | 177,024 |

| Perrigo Co. plc | 6,767 | 572,827 |

22 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Pfizer, Inc. | 301,645 | 10,768,726 |

| Prestige Brands Holdings, Inc. * | 2,852 | 142,857 |

| Zoetis, Inc. | 25,359 | 1,616,890 |

| 54,032,108 | ||

| Professional Services - 0.4% | ||

| Dun & Bradstreet Corp. (The) | 2,474 | 287,998 |

| Manpowergroup, Inc. | 4,645 | 547,274 |

| Nielsen Holdings plc | 21,721 | 900,336 |

| Robert Half International, Inc. | 8,862 | 446,113 |

| TransUnion * | 9,579 | 452,704 |

| Verisk Analytics, Inc. * | 10,517 | 874,909 |

| 3,509,334 | ||

| Real Estate Management & Development - 0.1% | ||

| CBRE Group, Inc., Class A * | 14,520 | 550,017 |

| Jones Lang LaSalle, Inc. | 2,050 | 253,175 |

| Realogy Holdings Corp. | 6,947 | 228,904 |

| 1,032,096 | ||

| Road & Rail - 1.1% | ||

| AMERCO | 548 | 205,445 |

| Genesee & Wyoming, Inc., Class A * | 4,779 | 353,694 |

| Kansas City Southern | 6,453 | 701,312 |

| Landstar System, Inc. | 3,238 | 322,667 |

| Norfolk Southern Corp. | 18,909 | 2,500,526 |

| Ryder System, Inc. | 3,681 | 311,228 |

| Union Pacific Corp. | 52,673 | 6,108,488 |

| 10,503,360 | ||

| Semiconductors & Semiconductor Equipment - 3.5% | ||

| Advanced Energy Industries, Inc. * | 1,217 | 98,285 |

| Advanced Micro Devices, Inc. * | 32,364 | 412,641 |

| Analog Devices, Inc. | 16,921 | 1,458,083 |

| Applied Materials, Inc. | 45,380 | 2,363,844 |

| Cavium, Inc. * | 2,926 | 192,940 |

| Cirrus Logic, Inc. * | 2,763 | 147,323 |

| Cree, Inc. * | 4,080 | 115,015 |

| Cypress Semiconductor Corp. | 13,659 | 205,158 |

| Entegris, Inc. * | 9,607 | 277,162 |

| First Solar, Inc. * | 2,870 | 131,676 |

| Integrated Device Technology, Inc. * | 5,776 | 153,526 |

| Intel Corp. | 202,079 | 7,695,168 |

| KLA-Tencor Corp. | 6,508 | 689,848 |

| Lam Research Corp. | 7,193 | 1,330,993 |

| Marvell Technology Group Ltd. | 18,448 | 330,219 |

| Maxim Integrated Products, Inc. | 13,553 | 646,614 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 23

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Microchip Technology, Inc. | 9,825 | 882,089 |

| Micron Technology, Inc. * | 48,541 | 1,909,118 |

| NVIDIA Corp. | 25,817 | 4,615,305 |

| ON Semiconductor Corp. * | 19,571 | 361,476 |

| QUALCOMM, Inc. | 64,089 | 3,322,374 |

| Silicon Laboratories, Inc. * | 1,510 | 120,649 |

| Skyworks Solutions, Inc. | 7,478 | 762,008 |

| Teradyne, Inc. | 8,676 | 323,528 |

| Texas Instruments, Inc. | 42,286 | 3,790,517 |

| Versum Materials, Inc. | 4,331 | 168,129 |

| Xilinx, Inc. | 10,196 | 722,183 |

| 33,225,871 | ||

| Software - 5.4% | ||

| Adobe Systems, Inc. * | 21,398 | 3,192,154 |

| ANSYS, Inc. * | 3,316 | 406,973 |

| Aspen Technology, Inc. * | 3,411 | 214,245 |

| Atlassian Corp. plc, Class A * | 9,398 | 330,340 |

| Autodesk, Inc. * | 9,418 | 1,057,265 |

| Blackbaud, Inc. | 1,922 | 168,752 |

| CA, Inc. | 12,896 | 430,468 |

| CDK Global, Inc. | 5,746 | 362,515 |

| Citrix Systems, Inc. * | 6,654 | 511,160 |

| Electronic Arts, Inc. * | 13,045 | 1,540,093 |

| Ellie Mae, Inc. * | 1,252 | 102,827 |

| Fair Isaac Corp. | 1,347 | 189,253 |

| Fortinet, Inc. * | 6,178 | 221,419 |

| Guidewire Software, Inc. * | 3,097 | 241,132 |

| Intuit, Inc. | 10,416 | 1,480,530 |

| Manhattan Associates, Inc. * | 3,106 | 129,116 |

| Microsoft Corp. | 332,047 | 24,734,181 |

| Oracle Corp. | 130,071 | 6,288,933 |

| Paycom Software, Inc. * | 1,290 | 96,698 |

| Proofpoint, Inc. * | 2,004 | 174,789 |

| PTC, Inc. * | 4,914 | 276,560 |

| Red Hat, Inc. * | 8,036 | 890,871 |

| Salesforce.com, Inc. * | 29,561 | 2,761,589 |

| ServiceNow, Inc. * | 7,323 | 860,672 |

| Splunk, Inc. * | 6,428 | 427,012 |

| Symantec Corp. | 24,502 | 803,911 |

| Synopsys, Inc. * | 5,866 | 472,389 |

| Tableau Software, Inc., Class A * | 3,318 | 248,485 |

| Take-Two Interactive Software, Inc. * | 4,862 | 497,042 |

| Ultimate Software Group, Inc. (The) * | 1,208 | 229,037 |

| VMware, Inc., Class A * | 12,038 | 1,314,429 |

| Workday, Inc., Class A * | 9,158 | 965,162 |

| 51,620,002 | ||

24 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| Specialty Retail - 2.6% | ||

| Advance Auto Parts, Inc. | 3,477 | 344,918 |

| AutoNation, Inc. * | 4,233 | 200,898 |

| AutoZone, Inc. * | 1,539 | 915,874 |

| Bed Bath & Beyond, Inc. | 6,976 | 163,727 |

| Best Buy Co., Inc. | 12,680 | 722,253 |

| Burlington Stores, Inc. * | 3,569 | 340,697 |

| CarMax, Inc. * | 8,829 | 669,327 |

| Dick's Sporting Goods, Inc. | 4,875 | 131,674 |

| Foot Locker, Inc. | 6,074 | 213,926 |

| Gap, Inc. (The) | 8,565 | 252,925 |

| Home Depot, Inc. (The) | 59,088 | 9,664,433 |

| L Brands, Inc. | 11,898 | 495,076 |

| Lowe's Cos., Inc. | 41,714 | 3,334,617 |

| Michaels Cos., Inc. (The) * | 7,503 | 161,089 |

| Murphy USA, Inc. * | 2,606 | 179,814 |

| O'Reilly Automotive, Inc. * | 4,292 | 924,368 |

| Penske Automotive Group, Inc. | 1,934 | 92,000 |

| Ross Stores, Inc. | 19,484 | 1,258,082 |

| Sally Beauty Holdings, Inc. * | 8,092 | 158,441 |

| Signet Jewelers Ltd. (a) | 2,924 | 194,592 |

| Tiffany & Co. | 4,866 | 446,602 |

| TJX Cos., Inc. (The) | 31,158 | 2,297,279 |

| Tractor Supply Co. | 6,176 | 390,879 |

| Ulta Salon, Cosmetics & Fragrance, Inc. * | 3,032 | 685,414 |

| Williams-Sonoma, Inc. | 3,966 | 197,745 |

| 24,436,650 | ||

| Technology Hardware, Storage & Peripherals - 4.1% | ||

| Apple, Inc. | 221,923 | 34,202,773 |

| Hewlett Packard Enterprise Co. | 90,135 | 1,325,886 |

| HP, Inc. | 73,020 | 1,457,479 |

| NCR Corp. * | 5,197 | 194,992 |

| NetApp, Inc. | 11,018 | 482,148 |

| Seagate Technology plc | 11,772 | 390,477 |

| Western Digital Corp. | 12,721 | 1,099,094 |

| Xerox Corp. | 8,803 | 293,052 |

| 39,445,901 | ||

| Textiles, Apparel & Luxury Goods - 0.9% | ||

| Carter's, Inc. | 3,075 | 303,656 |

| Coach, Inc. | 13,018 | 524,365 |

| Columbia Sportswear Co. | 2,163 | 133,197 |

| Hanesbrands, Inc. | 19,270 | 474,813 |

| lululemon athletica, Inc. * | 6,601 | 410,912 |

| Michael Kors Holdings Ltd. * | 7,562 | 361,842 |

| NIKE, Inc., Class B | 80,980 | 4,198,813 |

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 25

| SHARES | VALUE ($) | |

| COMMON STOCKS - CONT’D | ||

| PVH Corp. | 4,526 | 570,548 |

| Ralph Lauren Corp. | 4,220 | 372,584 |

| Skechers U.S.A., Inc., Class A * | 8,642 | 216,828 |

| Under Armour, Inc., Class A *(a) | 22,867 | 376,848 |

| VF Corp. | 15,294 | 972,240 |

| 8,916,646 | ||

| Thrifts & Mortgage Finance - 0.1% | ||

| Essent Group Ltd. * | 3,762 | 152,361 |

| MGIC Investment Corp. * | 18,700 | 234,311 |

| New York Community Bancorp, Inc. | 25,326 | 326,452 |

| Radian Group, Inc. | 11,843 | 221,346 |

| TFS Financial Corp. | 9,601 | 154,864 |

| Washington Federal, Inc. | 6,113 | 205,702 |

| 1,295,036 | ||

| Trading Companies & Distributors - 0.4% | ||

| Air Lease Corp. | 6,021 | 256,615 |

| Beacon Roofing Supply, Inc. * | 4,857 | 248,921 |

| Fastenal Co. | 19,074 | 869,393 |

| HD Supply Holdings, Inc. * | 13,891 | 501,049 |

| MSC Industrial Direct Co., Inc., Class A | 4,072 | 307,721 |

| United Rentals, Inc. * | 5,702 | 791,096 |

| Univar, Inc. * | 6,309 | 182,519 |

| W.W. Grainger, Inc. | 3,419 | 614,565 |

| WESCO International, Inc. * | 3,575 | 208,244 |

| 3,980,123 | ||

| Transportation Infrastructure - 0.0% (b) | ||

| Macquarie Infrastructure Corp. | 4,685 | 338,163 |

| Water Utilities - 0.4% | ||

| American Water Works Co., Inc. | 29,816 | 2,412,412 |

| Aqua America, Inc. | 29,330 | 973,463 |

| 3,385,875 | ||

| Wireless Telecommunication Services - 0.1% | ||

| Sprint Corp. * | 29,949 | 233,003 |

| T-Mobile US, Inc. * | 11,189 | 689,914 |

| Telephone & Data Systems, Inc. | 5,307 | 148,012 |

| United States Cellular Corp. * | 2,698 | 95,509 |

| 1,166,438 | ||

| Total Common Stocks (Cost $718,959,631) | 947,440,143 | |

26 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

| SHARES | VALUE ($) | |

| RIGHTS - 0.0% (b) | ||

| Biotechnology - 0.0% (b) | ||

| Dyax Corp. CVR, Exp. 12/31/19 *(c)(d) | 4,124 | 4,577 |

| Food & Staples Retailing - 0.0% (b) | ||

| Safeway Casa Ley CVR *(c) | 7,013 | 0 |

| Safeway PDC LLC CVR *(c) | 7,013 | 0 |

| 0 | ||

| Total Rights (Cost $11,892) | 4,577 | |

| PRINCIPAL AMOUNT ($) | VALUE ($) | |

| TIME DEPOSIT - 0.4% | ||

| State Street Bank and Trust Eurodollar Time Deposit, 0.12%, 10/2/17 | 3,723,931 | 3,723,931 |

| Total Time Deposit (Cost $3,723,931) | 3,723,931 | |

| SHARES | VALUE ($) | |

| SHORT TERM INVESTMENT OF CASH COLLATERAL FOR SECURITIES LOANED - 0.1% | ||

| State Street Institutional U.S. Government Money Market Fund - Premier Class, 0.92% | 1,350,597 | 1,350,597 |

| Total Short Term Investment of Cash Collateral for Securities Loaned (Cost $1,350,597) | 1,350,597 | |

| TOTAL INVESTMENTS (Cost $724,046,051) - 99.8% | 952,519,248 | |

| Other assets and liabilities, net - 0.2% | 1,967,637 | |

NET ASSETS - 100.0% | 954,486,885 | |

| NOTES TO SCHEDULE OF INVESTMENTS | ||||

| * Non-income producing security. | ||||

| (a) Security, or portion of security, is on loan. Total value of securities on loan is $1,309,145 as of September 30, 2017. | ||||

| (b) Amount is less than 0.05%. | ||||

| (c) For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note A). | ||||

| (d) Restricted security, acquired on January 25, 2016 with an acquisition cost of $4,577. Total market value of the restricted security amounts to $4,577, which represents less than 0.05% of the net assets of the Fund as of September 30, 2017. | ||||

| Abbreviations: | ||||

| CVR: | Contingent Value Rights | |||

| See notes to financial statements. | ||||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 27

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2017

| ASSETS | |||

Investments in securities of unaffiliated issuers, at value (identified cost $724,046,051) - including $1,309,145 of securities on loan | $952,519,248 | ||

| Receivable for capital shares sold | 3,052,405 | ||

| Dividends and interest receivable | 789,605 | ||

| Securities lending income receivable | 2,238 | ||

| Receivable from affiliates | 70,688 | ||

| Directors' deferred compensation plan | 419,452 | ||

| Total assets | 956,853,636 | ||

| LIABILITIES | |||

| Payable for capital shares redeemed | 95,957 | ||

| Deposits for securities loaned | 1,350,597 | ||

| Payable to affiliates: | |||

| Investment advisory fee | 115,142 | ||

| Administrative fee | 83,366 | ||

| Distribution and service fees | 95,121 | ||

| Sub-transfer agency fee | 4,686 | ||

| Directors' deferred compensation plan | 419,452 | ||

| Accrued expenses | 202,430 | ||

| Total liabilities | 2,366,751 | ||

| NET ASSETS | $954,486,885 | ||

| NET ASSETS CONSIST OF: | |||

| Paid-in capital applicable to common stock | |||

| (250,000,000 shares of $0.01 par value authorized) | $718,570,760 | ||

| Accumulated undistributed net investment income | 9,740,817 | ||

| Accumulated net realized loss | (2,297,889) | ||

| Net unrealized appreciation (depreciation) | 228,473,197 | ||

| Total | $954,486,885 | ||

| NET ASSET VALUE PER SHARE | |||

| Class A (based on net assets of $264,813,989 and 12,369,878 shares outstanding) | $21.41 | ||

| Class C (based on net assets of $51,301,075 and 2,545,123 shares outstanding) | $20.16 | ||

| Class I (based on net assets of $544,751,127 and 24,833,552 shares outstanding) | $21.94 | ||

| Class Y (based on net assets of $93,620,694 and 4,366,308 shares outstanding) | $21.44 | ||

| OFFERING PRICE PER SHARE* | |||

| Class A (100/95.25 of net asset value per share) | $22.48 | ||

| * On sales of $50,000 or more, the offering price of Class A shares is reduced. | |||

| See notes to financial statements. | |||

28 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2017

| INVESTMENT INCOME | |||

| Dividend income (net of foreign taxes withheld of $7,732) | $17,842,023 | ||

| Interest income | 8,769 | ||

| Securities lending income, net | 66,043 | ||

| Other income | 234 | ||

| Total investment income | 17,917,069 | ||

| EXPENSES | |||

| Investment advisory fee | 1,303,329 | ||

| Administrative fee | 1,042,663 | ||

| Distribution and service fees: | |||

| Class A | 724,808 | ||

| Class C | 482,605 | ||

| Directors' fees and expenses | 63,599 | ||

| Custodian fees | 103,440 | ||

| Transfer agency fees and expenses: | |||

| Class A | 282,490 | ||

| Class C | 62,255 | ||

| Class I | 16,458 | ||

| Class Y | 48,912 | ||

| Accounting fees | 202,862 | ||

| Professional fees | 62,172 | ||

| Registration fees: | |||

| Class A | 22,996 | ||

| Class C | 14,476 | ||

| Class I | 34,217 | ||

| Class Y | 19,142 | ||

| Reports to shareholders | 52,541 | ||

| Miscellaneous | 118,376 | ||

| Total expenses | 4,657,341 | ||

| Waiver and/or reimbursement of expenses by affiliates | (1,374,458) | ||

| Reimbursement of expenses-other | (10,429) | ||

| Net expenses | 3,272,454 | ||

| Net investment income (loss) | 14,644,615 | ||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 29

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2017 - CONT’D

| REALIZED AND UNREALIZED GAIN (LOSS) | |||

| Net realized gain (loss) on: | |||

| Investment securities - unaffiliated issuers | 3,559,344 | ||

| Foreign currency transactions | 90 | ||

| 3,559,434 | |||

| Net change in unrealized appreciation (depreciation) on investment securities - unaffiliated issuers | 125,206,981 | ||

| Net realized and unrealized gain (loss) | 128,766,415 | ||

| Net increase (decrease) in net assets resulting from operations | $143,411,030 | ||

| See notes to financial statements. | |||

30 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

STATEMENTS OF CHANGES IN NET ASSETS

| INCREASE (DECREASE) IN NET ASSETS | Year Ended September 30, 2017 | Year Ended September 30, 2016 | |||||

| Operations: | |||||||

| Net investment income (loss) | $14,644,615 | $10,655,857 | |||||

| Net realized gain (loss) | 3,559,434 | 16,747,930 | |||||

| Net change in unrealized appreciation (depreciation) | 125,206,981 | 52,217,493 | |||||

| Net increase (decrease) in net assets resulting from operations | 143,411,030 | 79,621,280 | |||||

| Distributions to shareholders from: | |||||||

| Net investment income: | |||||||

| Class A shares | (3,720,741) | (2,953,205) | |||||

| Class C shares | (144,890) | (194,986) | |||||

| Class I shares | (7,056,349) | (3,977,636) | |||||

| Class Y shares | (746,260) | (277,391) | |||||

| Net realized gain: | |||||||

| Class A shares | (7,031,592) | (17,083,274) | |||||

| Class C shares | (1,057,085) | (2,440,131) | |||||

| Class I shares | (9,076,731) | (16,343,727) | |||||

| Class Y shares | (1,017,673) | (1,224,825) | |||||

| Total distributions to shareholders | (29,851,321) | (44,495,175) | |||||

| Capital share transactions: | |||||||

| Class A shares | (92,117,279) | 35,380,845 | |||||

| Class C shares | 1,422,650 | 5,299,455 | |||||

| Class I shares | 96,441,971 | 184,973,555 | |||||

| Class Y shares | 38,918,371 | 26,723,562 | |||||

| Net increase (decrease) in net assets from capital share transactions | 44,665,713 | 252,377,417 | |||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | 158,225,422 | 287,503,522 | |||||

| NET ASSETS | |||||||

| Beginning of year | 796,261,463 | 508,757,941 | |||||

| End of year (including accumulated undistributed net investment income of $9,740,817 and $8,679,700, respectively) | $954,486,885 | $796,261,463 | |||||

| See notes to financial statements. | |||||||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 31

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | ||||||||||||||

| CLASS A SHARES | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||

| Net asset value, beginning | $18.80 | $17.90 | $18.30 | $15.90 | $13.27 | |||||||||

| Income from investment operations: | ||||||||||||||

Net investment income (a) | 0.30 | 0.26 | 0.23 | 0.18 | 0.17 | |||||||||

| Net realized and unrealized gain (loss) | 2.95 | 1.94 | (0.01) | 2.73 | 2.61 | |||||||||

| Total from investment operations | 3.25 | 2.20 | 0.22 | 2.91 | 2.78 | |||||||||

| Distributions from: | ||||||||||||||

| Net investment income | (0.22) | (0.18) | (0.13) | (0.14) | (0.15) | |||||||||

| Net realized gain | (0.42) | (1.12) | (0.49) | (0.37) | — | |||||||||

| Total distributions | (0.64) | (1.30) | (0.62) | (0.51) | (0.15) | |||||||||

| Total increase (decrease) in net asset value | 2.61 | 0.90 | (0.40) | 2.40 | 2.63 | |||||||||

| Net asset value, ending | $21.41 | $18.80 | $17.90 | $18.30 | $15.90 | |||||||||

Total return (b) | 17.71 | % | 12.68 | % | 1.06 | % | 18.65 | % | 21.16 | % | ||||

Ratios to average net assets: (c) | ||||||||||||||

| Total expenses | 0.70 | % | 0.71 | % | 0.77 | % | 0.87 | % | 1.02 | % | ||||

| Net expenses | 0.54 | % | 0.54 | % | 0.68 | % | 0.75 | % | 0.75 | % | ||||

| Net investment income | 1.51 | % | 1.46 | % | 1.21 | % | 1.02 | % | 1.15 | % | ||||

| Portfolio turnover | 31 | % | 27 | % | 33 | % | 8 | % | 14 | % | ||||

| Net assets, ending (in thousands) | $264,814 | $319,773 | $269,684 | $214,427 | $149,738 | |||||||||

(a) Computed using average shares outstanding. | ||||||||||||||

(b) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. | ||||||||||||||

(c) Total expenses do not reflect amounts reimbursed and/or waived by the Adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. | ||||||||||||||

| See notes to financial statements. | ||||||||||||||

32 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | ||||||||||||||

| CLASS C SHARES | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||

| Net asset value, beginning | $17.71 | $16.97 | $17.41 | $15.15 | $12.65 | |||||||||

| Income from investment operations: | ||||||||||||||

Net investment income (a) | 0.15 | 0.12 | 0.08 | 0.03 | 0.03 | |||||||||

| Net realized and unrealized gain (loss) | 2.78 | 1.82 | — | (b) | 2.62 | 2.50 | ||||||||

| Total from investment operations | 2.93 | 1.94 | 0.08 | 2.65 | 2.53 | |||||||||

| Distributions from: | ||||||||||||||

| Net investment income | (0.06) | (0.08) | (0.03) | (0.02) | (0.03) | |||||||||

| Net realized gain | (0.42) | (1.12) | (0.49) | (0.37) | — | |||||||||

| Total distributions | (0.48) | (1.20) | (0.52) | (0.39) | (0.03) | |||||||||

| Total increase (decrease) in net asset value | 2.45 | 0.74 | (0.44) | 2.26 | 2.50 | |||||||||

| Net asset value, ending | $20.16 | $17.71 | $16.97 | $17.41 | $15.15 | |||||||||

Total return (c) | 16.85 | % | 11.78 | % | 0.30 | % | 17.75 | % | 20.02 | % | ||||

Ratios to average net assets: (d) | ||||||||||||||

| Total expenses | 1.50 | % | 1.53 | % | 1.57 | % | 1.61 | % | 1.77 | % | ||||

| Net expenses | 1.29 | % | 1.29 | % | 1.44 | % | 1.57 | % | 1.65 | % | ||||

| Net investment income | 0.77 | % | 0.70 | % | 0.45 | % | 0.19 | % | 0.25 | % | ||||

| Portfolio turnover | 31 | % | 27 | % | 33 | % | 8 | % | 14 | % | ||||

| Net assets, ending (in thousands) | $51,301 | $43,579 | $36,398 | $25,864 | $15,259 | |||||||||

(a) Computed using average shares outstanding. | ||||||||||||||

(b) Amount is less than $0.005. | ||||||||||||||

(c) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. | ||||||||||||||

(d) Total expenses do not reflect amounts reimbursed and/or waived by the Adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. | ||||||||||||||

| See notes to financial statements. | ||||||||||||||

www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT 33

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | ||||||||||||||

| CLASS I SHARES | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||

| Net asset value, beginning | $19.26 | $18.33 | $18.69 | $16.20 | $13.48 | |||||||||

| Income from investment operations: | ||||||||||||||

Net investment income (a) | 0.38 | 0.33 | 0.33 | 0.27 | 0.25 | |||||||||

| Net realized and unrealized gain (loss) | 3.03 | 1.98 | (0.01) | 2.81 | 2.64 | |||||||||

| Total from investment operations | 3.41 | 2.31 | 0.32 | 3.08 | 2.89 | |||||||||

| Distributions from: | ||||||||||||||

| Net investment income | (0.31) | (0.26) | (0.19) | (0.22) | (0.17) | |||||||||

| Net realized gain | (0.42) | (1.12) | (0.49) | (0.37) | — | |||||||||

| Total distributions | (0.73) | (1.38) | (0.68) | (0.59) | (0.17) | |||||||||

| Total increase (decrease) in net asset value | 2.68 | 0.93 | (0.36) | 2.49 | 2.72 | |||||||||

| Net asset value, ending | $21.94 | $19.26 | $18.33 | $18.69 | $16.20 | |||||||||

Total return (b) | 18.17 | % | 13.00 | % | 1.54 | % | 19.39 | % | 21.76 | % | ||||

Ratios to average net assets: (c) | ||||||||||||||

| Total expenses | 0.35 | % | 0.36 | % | 0.36 | % | 0.37 | % | 0.46 | % | ||||

| Net expenses | 0.19 | % | 0.19 | % | 0.20 | % | 0.21 | % | 0.21 | % | ||||

| Net investment income | 1.87 | % | 1.80 | % | 1.69 | % | 1.56 | % | 1.70 | % | ||||

| Portfolio turnover | 31 | % | 27 | % | 33 | % | 8 | % | 14 | % | ||||

| Net assets, ending (in thousands) | $544,751 | $387,043 | $186,257 | $122,405 | $66,818 | |||||||||

(a) Computed using average shares outstanding. | ||||||||||||||

(b) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. | ||||||||||||||

(c) Total expenses do not reflect amounts reimbursed and/or waived by the Adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. | ||||||||||||||

| See notes to financial statements. | ||||||||||||||

34 www.calvert.com CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND ANNUAL REPORT

CALVERT US LARGE-CAP CORE RESPONSIBLE INDEX FUND

FINANCIAL HIGHLIGHTS

| Year Ended September 30, | ||||||||||||||

| CLASS Y SHARES | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||

| Net asset value, beginning | $18.84 | $17.95 | $18.40 | $16.01 | $13.27 | |||||||||