CLICKSOFTWARE TECHNOLOGIES LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on June 28, 2012

Notice is hereby given that the Annual General Meeting of Shareholders of ClickSoftware Technologies Ltd. (the "Company") will be held at the offices of the Company, at Azorim Park, Oren Building, 94 Em Hamoshavot Road, Petach Tikva 49527 Israel, on June 28, 2012 at 4:00 p.m. local time (the "Meeting"). The agenda for the Meeting is as follows:

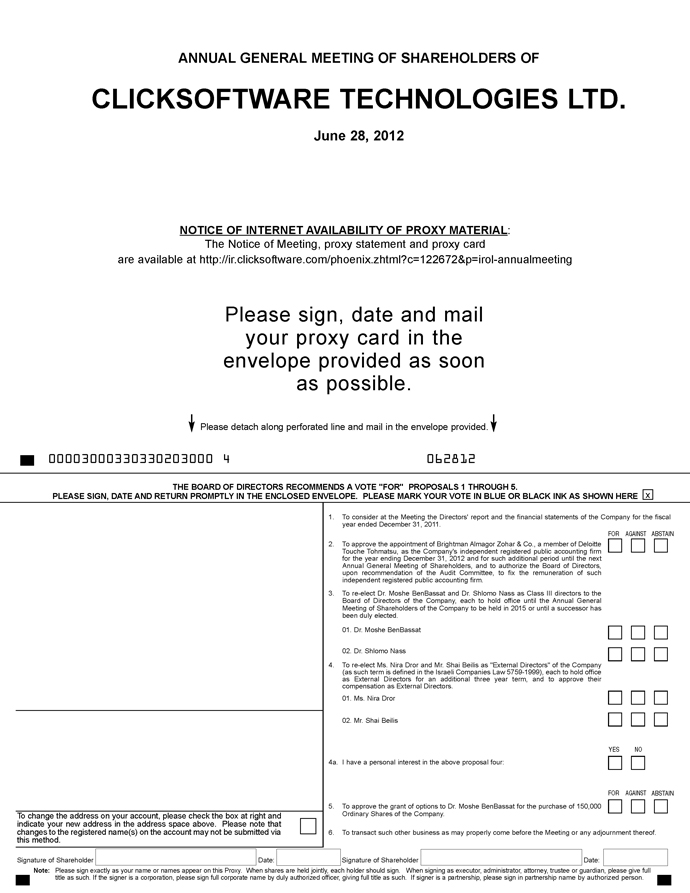

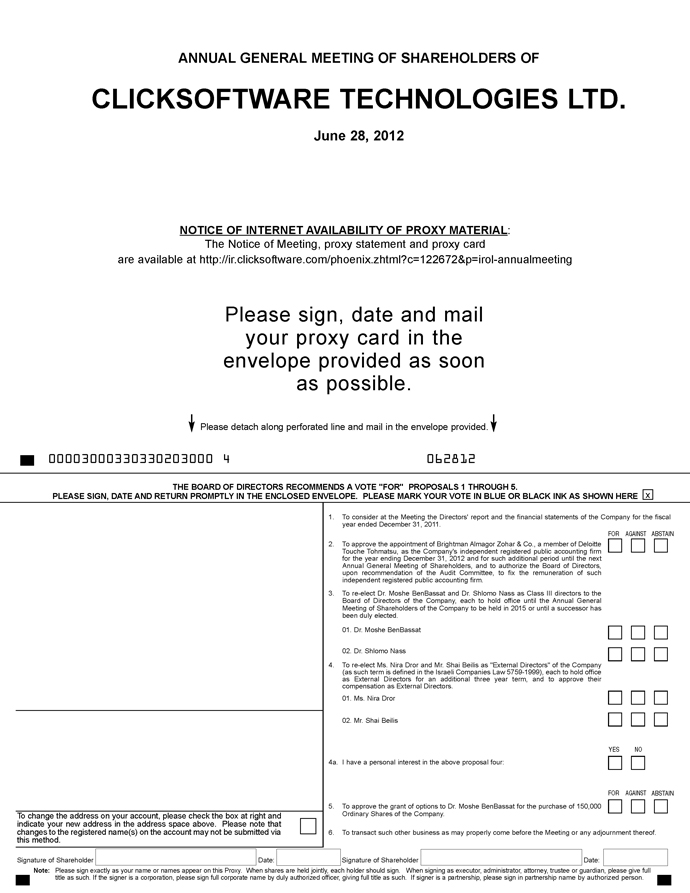

| 1. | To consider at the Meeting the Directors’ report and the financial statements of the Company for the fiscal year ended December 31, 2011. |

| 2. | To approve the appointment of Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu, as the Company’s independent registered public accounting firm for the year ending December 31, 2012 and for such additional period until the next Annual General Meeting of Shareholders, and to authorize the Board of Directors, upon recommendation of the Audit Committee, to fix the remuneration of such independent registered public accounting firm. |

| 3. | To re-elect Dr. Moshe BenBassat and Dr. Shlomo Nass as Class III directors to the Board of Directors of the Company, each to hold office until the Annual General Meeting of Shareholders of the Company to be held in 2015 or until a successor has been duly elected. |

| 4. | To re-elect Ms. Nira Dror and Mr. Shai Beilis as “External Directors” of the Company (as such term is defined in the Israeli Companies Law 5759-1999), each to hold office as External Directors for an additional three year term, and to approve their compensation as External Directors. |

| 5. | To approve the grant of options to Dr. Moshe BenBassat for the purchase of 150,000 Ordinary Shares of the Company. |

| 6. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

Shareholders of record at the close of business on May 21, 2012 will be entitled to notice of and to vote at the Meeting. Shareholders who do not expect to attend the Meeting in person are requested to mark, date, sign and mail to the Company the enclosed proxy as promptly as possible in the enclosed pre-addressed envelope.

| By Order of the Board of Directors, | CLICKSOFTWARE TECHNOLOGIES LTD. |

| | |

| | Dr. Moshe BenBassat |

| | Chairman of the Board of Directors and |

| May 16, 2012 | Chief Executive Officer |

| YOUR VOTE IS IMPORTANT. IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENVELOPE PROVIDED. |

CLICKSOFTWARE TECHNOLOGIES LTD.

(the "Company")

94 Em Hamoshavot Road,

Petach Tikva 49527 Israel

_____________________

PROXY STATEMENT

____________________

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To be held on June 28, 2012

This Proxy Statement is furnished to the holders of Ordinary Shares, par value NIS 0.02 per share (the "Ordinary Shares"), of the Company, in connection with the solicitation by the Board of Directors of proxies for use at the Company's Annual General Meeting of Shareholders (the "Meeting") to be held on June 28, 2012 at 4:00 p.m. local time at the offices of the Company, 94 Em Hamoshavot Road, Petach Tikva 49527 Israel, or at any adjournment thereof. This Proxy Statement and the proxies solicited hereby are first being sent or delivered to the shareholders on or about May 24, 2012.

Proxies; Counting of Votes

A form of proxy for use at the Meeting is attached. The completed proxy should be mailed in the pre-addressed envelope provided and received by the Company or its transfer agent, American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, NY 11219 USA, Tel. 718-921-8275 (attention: Christine Pino), at least forty eight (48) hours before the Meeting. Upon the receipt of a properly executed proxy in the form enclosed herewith, the persons named as proxies therein will vote the Ordinary Shares, covered thereby in accordance with the directions of the shareholder executing such proxy.

Shareholders may revoke the authority granted by their execution of proxies at any time before the exercise thereof by filing with the Company a written notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Shareholders may vote shares directly held in their name in person at the Meeting. If a shareholder holds the shares in street name, such shareholder must request a legal proxy from the broker, bank or other nominee that holds the shares, and must present such legal proxy at the Meeting, in order to vote in person at the Meeting. Attendance at the Meeting will not, by itself, revoke a proxy. A shareholder who holds the Company’s shares under his, her or its name, and who attends the Meeting in person, shall be identified by a copy of an identity card, passport or a certificate of incorporation.

Record Date; Solicitation of Proxies

Only shareholders of record at the close of business on May 21, 2012 will be entitled to receive notice of, and to vote at, the Meeting and any adjournment thereof. Proxies will be solicited chiefly by mail; however, certain officers, directors, employees and agents of the Company, none of whom will receive additional compensation therefore, may solicit proxies by telephone, fax or other personal contact. Copies of solicitation materials will be furnished to banks, brokerage firms, nominees, fiduciaries and other custodians holding Ordinary Shares in their names for others to send proxy materials to and obtain proxies from the beneficial owners of such Ordinary Shares. The Company will bear the cost of soliciting proxies, including postage, printing and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of Ordinary Shares. Copies of solicitation materials and the proposed forms of the resolutions to be adopted at the Meeting will be available for shareholders viewing at the Company’s offices during business hours.

To the extent you would like to state your position with respect to any of proposals described in this proxy statement, in addition to any right you may have under applicable law, pursuant to regulations under the Israeli Companies Law 5759 – 1999 (the “Companies Law”), you may do so by delivery of a notice to the Company’s offices located at 94 Em Hamoshavot Road, Petach Tikva 49527 Israel, not later than May 31, 2012. Our Board of Directors may respond to your notice.

Following the Meeting, one or more shareholders holding, at the Record Date, at least five percent (5%) of the total voting rights of the Company, which are not held by Controlling Shareholders (as defined hereunder) of the Company, may review the Proxy Cards submitted to the Company at the Company’s offices during business hours.

Pursuant to the Israeli Companies Law, a “Controlling Shareholder” is defined as any shareholder that has the ability to direct the company’s actions, other than such ability resulting only from serving as a director or other office holder of the Company. Any shareholder holding 25% or more of either the voting rights in the Company or the right to appoint directors or the Company's general manager is deemed to be a Controlling Shareholder.

Quorum and Voting Requirements

Two or more shareholders, present in person or by proxy and holding or representing shares conferring in the aggregate at least 33% of the voting power of the Company, will constitute a quorum at the Meeting. Shares that are voted in person or by proxy “FOR” or “AGAINST” are treated as being present at the Meeting for purposes of establishing a quorum and are also treated as voting at the Meeting with respect to such matters.

Under applicable regulations, a "broker non-vote" occurs on an item when a broker identified as the record holder of shares is not permitted by applicable rules, to vote on that item without instruction from the beneficial owner of the shares and no instruction has been received. For instance, the election of directors is not a "routine" matter for purposes of broker voting. If a shareholder does not instruct the broker how to vote with respect to such item, the broker may not vote with respect to this proposal and those votes will be counted as "broker non-votes." The matters described in Proposals 3 to 5 are not "routine" matters, and therefore, if a beneficial shareholder does not instruct the broker how to vote with respect to these items, the broker may not vote with respect to these proposals and those votes will be counted as "broker non-votes." It should be noted that it is the intention of the persons appointed as proxies in the accompanying proxy to vote “FOR” the other items on the agenda unless specifically instructed to the contrary, or unless they may be determined not to be “routine” matters, in which case, a broker may not vote on such matters without instructions from the shareholder. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but such abstentions and broker non-votes will not be counted for purposes of determining the number of votes cast with respect to the particular proposal.

If a quorum is not present within thirty minutes from the time appointed for the Meeting, the Meeting will be adjourned to the same day on the following week, at the same time and place, or to such day and at such time and place as the Chairman of the Meeting may determine. At such adjourned Meeting, any two shareholders, present in person or by proxy, will constitute a quorum.

The affirmative vote of at least a majority of the votes of shareholders present and voting at the Meeting in person or by proxy is required to constitute approval of each of Proposals 2, 3 and 5.

Proposal 4 is a special resolution which requires the affirmative vote of a majority of the shares present, in person or by proxy, and voting on the matter, provided that either (i) at least a majority of the voted shares of shareholders who are not Controlling Shareholders and who do not have a personal interest in the resolution are voted in favor of the election of the external director; or (ii) the total number of shares of shareholders, who are not Controlling Shareholders and who do not have a personal interest in the resolution, voted against the election of the external director does not exceed two percent (2%) of the outstanding voting power in the company. For a definition of “Personal Interest”, please see Proposal 4 below.

No vote is required for Proposal 1.

| THE PROXY CARD ENCLOSED WITH THIS PROXY STATEMENT SHALL ALSO SERVE AS A VOTING INSTRUMENT AS SUCH TERM IS DEFINED UNDER THE ISRAELI COMPANIES LAW. |

| |

| THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" ALL THE PROPOSALS LISTED IN THIS PROXY STATEMENT. |

PROPOSAL 1 - RECEIPT AND CONSIDERATION OF THE

DIRECTOR’S REPORT AND THE CONSOLIDATED FINANCIAL STATEMENTS

OF THE COMPANY FOR THE YEAR ENDED DECEMBER 31, 2011

The Company's Annual Report for the year ended December 31, 2011 is available on its website at the address www.clicksoftware.com. The contents of the Company’s website are not part of this proxy statement. The Company's Consolidated Financial Statements for the year ended December 31, 2011 are included in such report. At the Meeting, the Company will review the audited financial statements for the year ended December 31, 2011, as presented in the Company's Annual Report for the year ended December 31, 2011 and will answer appropriate questions relating thereto.

No vote will be required regarding this item.

PROPOSAL 2 - APPOINTMENT AND RENUMERATION

OF THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has recommended the appointment of Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu (“Brightman Almagor”), as the Company’s independent registered public accounting firm for the year ending December 31, 2012. Brightman Almagor has been the Company’s independent registered public accounting firm since December 31, 2002 and audited the Company's books and accounts for the year ended December 31, 2011.

The following table provides information regarding fees paid by us to Brightman Almagor for all services, including audit services, for the years ended December 31, 2011 and 2010:

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | |

| | | | | | | |

| Audit fees(1) | | $ | 175,000 | | | $ | 177,000 | |

| Audit-related fees | | | - | | | | - | |

| Tax fees(2) | | | 37,000 | | | | 31,000 | |

| All other fees | | | - | | | | - | |

| | | | | | | | | |

| Total | | $ | 212,000 | | | $ | 208,000 | |

| (1) | Includes professional services rendered in connection with the audit of our annual financial statements and internal control over financial reporting and the review of our interim financial statements. |

| (2) | Includes professional fees related to tax returns, transfer pricing and consulting on state and sales tax in the United States. |

It is proposed that the following resolution be adopted at the Meeting:

“RESOLVED, that the appointment of Brightman Almagor as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2012 and for such additional period until the next Annual General Meeting of Shareholders, and that the Board of Directors be, and it hereby is, authorized, upon recommendation of the Audit Committee, to fix the remuneration of such independent registered public accounting firm.”

The affirmative vote of at least a majority of the votes of shareholders present and voting at the Meeting in person or by proxy is required for the approval of the resolution to appoint the Company's independent auditors.

PROPOSAL 3 - RE-ELECTION OF CLASS III DIRECTORS

The Company's Articles of Association provide that the number of Directors shall be not less than 2 and not more than 11. There are currently seven members on the Company’s Board. The Company’s Board of Directors is classified into classes of directors as follows:

| Name of Director and Class | | Age | | | Term Expires | |

| Israel Borovich, Class II | | | 70 | | | | 2014 | |

| Gil Weiser, Class II | | | 70 | | | | 2014 | |

| Moshe BenBassat, Class III | | | 64 | | | | 2012 | |

| Shlomo Nass, Class III | | | 51 | | | | 2012 | |

| Nira Dror, External Director | | | 57 | | | | 2012 | |

| Shai Beilis, External Director | | | 63 | | | | 2012 | |

| Menahem Shalgi, External Director | | | 62 | | | | 2013 | |

The term of the Class III Directors will expire at the Meeting and successor Class III Directors shall be elected at the Meeting. In accordance with Israeli law and practice, our Board of Directors is authorized to recommend to our shareholders director nominees for election. Accordingly, our Board (with the recommendation of the Nominating Committee of the Board), has nominated such directors for re-election to our Board of Directors. We are unaware of any reason why any of the nominees, if re-elected, should be unable to serve as a director. All nominees listed below have advised the Board of Directors of the Company that they intend to serve as director if re-elected.

The Board of Directors recommends that at the Meeting, Dr. Moshe BenBassat and Dr. Shlomo Nass be re-elected to serve as Class III Directors, for a term expiring at the annual meeting to be held in the third year following their re-election and until their successors have been duly elected and qualified.

The following information concerning the nominees is based on the records of the Company and information furnished to it by the nominees:

DR. MOSHE BENBASSAT co-founded ClickSoftware in 1979 and has served as our Chairman and Chief Executive Officer since our inception. From 1987 to 1999, Dr. BenBassat served as a Professor of Information Systems at the Faculty of Management at Tel-Aviv University. Dr. BenBassat has also held academic positions at the University of Southern California and the University of California in Los Angeles. Dr. BenBassat holds B.S., M.S. and Ph.D. degrees in Mathematics and Statistics from Tel-Aviv University. Dr. BenBassat pioneered the field of 'service chain optimization', a term he coined in the 1990s and is considered to be one of the world's leading experts in the field.

DR. SHLOMO NASShas served as a director since July 2009. Dr. Nass currently serves as Senior Partner in Dr. Shlomo Nass & Co., an Israeli law firm that he founded in December 2002, specializing in real estate, liquidations, receiverships and corporate rehabilitation, arbitration, corporate and commercial law. Since 2001 he has served as President, Partner and Director of the group of investment companies within Israel Global Business. From 2001 until November 2010, he served as Chairman of the Financial Statement Committee and as Vice Chairman of the Board of Directors of Tao T'suot Ltd., and from November 2010 he has served as its Chairman of the Board of Directors. From 2006 until 2011, he served on the Board of Directors of NMC United Entertainment Ltd. From November 2009 until 2011, he served as a director, as a member of the Investment Committee and as a member of the Auditing Committee of Partner Communications Company Ltd. Since January 2010, he has served as a director and as Chairman of the Financial Statement Committee of Aviv Arlon Ltd. Since 2011, he served as a director of City Group Financial Products Ltd. Since 2011 he has served as a director and a member of the Auditing Committee of Tempo Beer Industries Ltd. Since August 2008 he has served on the Board of Directors of The Blue Shore Development Company (Tel–Aviv – Herzelia) Ltd. Since 1991, he has served as Vice Chairman of The Public Advisory Committee on Trade Levies. From 2003 until the end of 2009, Dr. Nass served as Chairman of the Financial Statement Committee and as a member of the Board of Directors of IBC-Industrial Buildings Corporation Ltd. (Mivnei Ta'asiya), an Israeli real estate and infrastructure development company. From 2003 until 2010, he served as Chairman of the Financial Statement and Auditing Committee of Formula Systems (1985) Ltd. From 2005 to the end of 2008, he also served as the Chairman of the Board of Directors of Ayalon Insurance Co. Ltd. and Ayalon Financial Solutions Ltd. Dr. Nass also served on the Board of Directors of the following companies in his role as Chairman: since 2011 of Hevruta Shivuk Ltd. and Hevruta Tzarhanut Ltd., since 2008 of Chaniman Entrepreneurship Ltd., since 2005 of M.D.K Touch Ltd. and since 2004 of Shir-Lak Ltd. Dr. Nass received his Ph.D. and LL.B. in Law and B.Sc., Economics and Accounting from Bar-Ilan University, and completed a Mediators Course of the Ministry of Justice. He is a member of the Israeli Bar Association and is a Certified Public Accountant in Israel. Dr. Nass is also a Certified Information System Auditor, C.I.S.A. (USA). In his military service, Dr. Nass served as an officer in the Israeli Defense Forces, or IDF, on the Information Systems Auditing Team for the Paymaster General Administration.

The Board of Directors determined that Dr. Nass is qualified to serve as an independent director and audit committee financial expert for the purposes of the rules of the NASDAQ Stock Market and the rules of the U.S. Securities and Exchange Commission.

It is proposed that the following resolutions be adopted at the Meeting:

“RESOLVED,thatDr. Moshe BenBassat be re-elected to the Board of Directors and be classified as a Class III Director who shall serve until the Annual General Meeting of the Shareholders to be held in 2015 and until a respective successor is duly elected and qualified; and

“RESOLVED,that Dr. Shlomo Nass, be re-elected to the Board of Directors and be classified as a Class III Director who shall serve until the Annual General Meeting of the Shareholders to be held in 2015 and until a respective successor is duly elected and qualified to serve”.

The affirmative vote of the holders of a majority of the voting power present and voting at the Meeting in person or by proxy is necessary for the approval of the resolution to elect each of the foregoing nominees as Director.

PROPOSAL 4 – RE-ELECTION OF EXTERNAL DIRECTORS AND APPROVAL OF THEIR COMPENSATION

Under the Companies Law, public companies are required to elect at least two external directors who must meet specified standards of independence. The Companies Law provides that a person may not be appointed as an external director if (i) the person is a relative of a Controlling Shareholder; (ii) the person, or the person’s relative, partner, employer or an entity under that person’s control, has or had during the two years preceding the date of appointment any affiliation with the company, or the Controlling Shareholder or its relative; (iii) in a company that does not have a Controlling Shareholder, such person has an affiliation (as such term is defined in the Companies Law), at the time of his appointment, to the chairman, chief executive officer, a shareholder holding at least five percent (5%) of the share capital of the company or the chief financial officer; and (iv) if such person’s relative, partner, employer, supervisor, or an entity he controls, has other than negligible business or professional relations with any of the persons with whom the external director himself may not be affiliated. The term “relative” means a spouse, sibling, parent, grandparent and child, and child, sibling or parent of a spouse or the spouse of any of the foregoing. The term “affiliation” includes an employment relationship, a business or professional relationship maintained on a regular basis, control and service as an office holder (excluding service as an external director of a company that is offering its shares to the public for the first time). In addition, no person may serve as an external director if the person’s position or other activities create or may create a conflict of interest with the person’s responsibilities as director or may otherwise interfere with the person’s ability to serve as director. If, at the time an external director is appointed, all members of the Board of Directors who are not Controlling Shareholders or their relatives, are of the same gender, then that external director must be of the other gender. A director of one company may not be appointed as an external director of another company if a director of the other company is acting as an external director of the first company at such time. External directors may not have during the two years preceding their appointment, directly or indirectly through a relative, partner, employer or controlled entity, any affiliation with (i) the public company, (ii) those of its shareholders who are Controlling Shareholders at the time of appointment, or (iii) any entity controlled by the company or by its Controlling Shareholder.

At least one external director elected must have “accounting and financial expertise” and any other external director must have either ‘‘accounting and financial expertise’’ or “professional qualification,” as such terms are defined by regulations promulgated under the Israeli Companies Law.

The term of office of each of Ms. Nira Dror and Mr. Shai Beilis as external directors of the Company expires at the Meeting. Our Nominating Committee and the Board of Directors recommend that our shareholders approve the re-election of:

| (a) | Ms. Nira Dror, to serve as an external director for a second term ending at the Company's annual general meeting of shareholders in 2015. Our Nominating Committee, Audit Committee and Board of Directors recognize the accounting and financial expertise and unique contribution of Ms. Dror as an external director to the board and various committees and believe it is in the best interests of the Company to re-elect her to serve on the Board. Ms. Dror has submitted to us a declaration stating that she complies with the requirements imposed by the Companies Law for the office of external director. |

NIRA DRORhas served as an External Director of the Company since July 2009. Ms. Dror is the owner and the General Manager of Nira Dror Ltd., a company which she founded in 2006 that provides consulting and representation services for companies in the aviation and tourism industries. From 2003 to 2005, Ms. Dror served as Deputy General Manager and as General Manager of North America at El Al. From 1999 to 2003, she served as General Manager of Eastern Europe and East Mediterranean at British Airways, and from 1989 to 1999, as General Manager for Israel. From 1984 to 1985, Ms. Dror served as the Chief Economist for Teus Azorei Pituach Ltd. and from 1985 to 1989, she served as the General Manager of Histour Ltd., a tourism company. Ms. Dror currently serves on the Board of Directors and as Chairperson of the Audit Committee of Bank Hapoalim Ltd. and Shemen Oil and Gas Resources Limited. Ms. Dror currently serves on the Board of Directors and as a member of the Audit Committee of the following companies: Dikla Insurance Company Ltd., Tzur Shamir Holdings Ltd., S. Shlomo Holding Ltd. and Sharonim Ltd. She was a member of the board of directors of H&O Ltd. from 2005 to 2008, and of Chamei Yoav Tourism from 2005 to 2008. Ms. Dror was also a member of the Executive Committee of the panel of airlines in Israel from 1990 to 1999. Ms. Dror holds a B.A. in Economics and Business Administration and an M.B.A. from Tel Aviv University.

Our Nominating Committee and the Board of Directors further recommend that our shareholders approve the re-election of:

| (b) | Mr. Shai Beilis, to serve as an external director for a second term ending at the Company's annual general meeting of shareholders in 2015. Our Nominating Committee and Board of Directors believe it is in the best interests of the Company to re-elect him to serve on the Board. Mr. Beilis has submitted to us a declaration stating that he complies with the requirements imposed by the Companies Law for the office of external director. |

SHAI BEILIShas served as an External Director of the Company since July, 2009. Mr. Beilisfounded Formula Ventures (within the Formula Group) in 1998 and was the Chairman of the Board since its inception. Formula Ventures Ltd. is the advisor and General Partner of two venture capital funds: Formula Ventures I and Formula Ventures II. Mr. Beilis is also the Chairman of Formula Vertex UK Ltd., which was the advisor for the European Technology Venture Portfolio of UBS Capital. Mr. Beilis joined the Formula Group in 1994 as Chief Executive Officer of Argotec. Mr. Beilis was CEO of Clal Computers and Technology Ltd. from 1993 to 1995, an Israeli IT holding company traded in the Tel-Aviv Stock Exchange. From 1987 to 1993 Mr. Beilis was Vice President at Digital Equipment Corporation Israel. From 1978 to 1986, he was Chief Executive Officer of Yael Software and Services. Mr. Beilis has served as director or chairman of over sixty Israeli high tech companies (including the following Nasdaq listed companies: Wiztec Solutions Ltd. (1996 to 1999), BluePhoenix Solutions Ltd. (1995 to 2008), RadView Software Ltd. (1998 to 2010), and Formula Systems (1985) Ltd. (1997 to 2005)). Mr. Beilis holds an M.Sc. in Computer Science from the Weizmann Institute of Science in Rehovot, Israel, and a B.Sc., cum laude, in Mathematics and Economics from the Hebrew University in Jerusalem, Israel.

The compensation of external directors of an Israeli company is regulated by the Israeli Companies Regulations (Rules Regarding Compensation and Expenses to External Directors), 2000, as amended, or the Regulations, and the Companies Regulations (Alleviation for Public Companies whose Shares are Traded on a Stock Exchange Outside of Israel), 2000, as amended.

Compensation of an External Director must be determined prior to the person’s consent to serve as an External Director, although the compensation of an External Director may be increased to the same level as that of newly appointed External Directors. Compensation may be decreased once the incumbent External Directors’ terms expire, and subject to such decreases being presented to the nominees prior to their consents to serve as External Directors.

Compensation of all Directors requires the approval of our Audit Committee, Board of Directors and shareholders, in that order. In connection with the re-election of Nira Dror and Shai Beilis, our Compensation Committee, Audit Committee and Board of Directors have approved the compensation package set forth below.

It is proposed that the following resolutions be adopted at the Meeting:

“RESOLVED, that Nira Dror and Shai Beilis be re-elected to the Board of Directors to serve as External Directors for an additional term of three (3) years in accordance with the Israeli Companies Law which will end at the Annual General Meeting of the Shareholders to be held in 2015”; and

“FURTHER RESOLVED, to approve a compensation package for Nira Dror and Shai Beilis, effective as of the date of the Meeting, equal to the compensation package for External Directors approved at the 2010 Annual Meeting of the Shareholders which shall consist of: (i) an annual cash compensation of US $22,000, plus VAT, if applicable against a valid invoice, which shall be the full cash compensation due for all of his activities and tasks as a member of the Board of Directors and as member of committees thereof, to be paid in four quarterly equal installments payable in advance; (ii) reimbursement of expenses incurred by such director or External Director in connection with participation in meetings of the Board of Directors and committees thereof, subject to the limitations of Israeli law and in accordance with the Company’s expense reimbursement policy; and (iii) annual grants of 8,000 Restricted Stock Units (RSUs) which shall vest in twelve (12) equal monthly installments as of its date of grant, provided that the grantee continues to serve as a director on such date”.

Under the Israeli Companies Law, the election of the nominee for external director requires the affirmative vote of a majority of ordinary shares present and voting at the Meeting, in person or by proxy, entitled to vote and voting on the matter, provided that either: (i) at least a majority of the shares of shareholders who are not Controlling Shareholders and who do not have a personal interest in the resolution are voted in favor of the election of the external director; or (ii) the total number of the shares of shareholders who are not Controlling Shareholders and who do not have a personal interest in the resolution voted against the election of the external director does not exceed two percent (2%) of the outstanding voting power in the company.

A “personal interest” for this purpose is defined as: (1) a shareholder’s personal interest in the approval of an act or a transaction of the Company, including (i) the personal interest of his or her relative (which includes for these purposes any members of his/her (or his/her spouse's) immediate family or the spouses of any such members of his or her (or his/her spouse's) immediate family); and (ii) a personal interest of a body corporate in which a shareholder or any of his/her aforementioned relatives serves as a director or the chief executive officer, owns at least five percent (5%) of its issued share capital or its voting rights or has the right to appoint a director or chief executive officer, but excluding: (a) a personal interest arising solely from the fact of holding shares in the Company or in a body corporate; and (b) a personal interest that is not a result of connections with a Controlling Shareholder. “Controlling” for the purpose of the preceding paragraph means the ability to direct the acts of the Company. Any person holding twenty five percent (25%) or more of the voting power of the Company or the right to appoint directors or the Chief Executive Officer is presumed to have control of the Company.

For this purpose, all shareholders are asked to indicate on the enclosed proxy card whether or not they have a personal interest by marking their vote in the appropriate line.

PROPOSAL 5 - GRANT OF OPTIONS TO DR. MOSHE BENBASSAT

Subject to shareholder approval, the Board of Directors and the Audit and Compensation Committees approved the issuance of additional options to Dr. Moshe BenBassat.

The Audit and Compensation Committees and the Board of Directors believe it to be in the best interests of the Company to grant to Dr. BenBassat options to purchase 150,000 ordinary shares of the Company.

Additional information about the Company’s stock option plans and grants is available in the Company’s Annual Report on Form 20-F for the year ended December 31, 2011.

The Audit and Compensation Committees and the Board of Directors believe the proposed grant of options to be fair and reasonable and in the best interests of the Company.

It is therefore proposed that at the Meeting, the following resolution be adopted:

“RESOLVED, to approve the grant of options, according to the Company's 2003 Israeli Option Plan (the “Plan”), to Dr. Moshe BenBassat or to an entity designated by Dr. BenBassat through which he provides services to the Company, to purchase 150,000 Ordinary Shares at an exercise price equal to the closing sale price of the Company’s Ordinary Shares on the trading day immediately preceding the Meeting (the “Options”). The Options will vest as follows: 25% on the first anniversary date of the Options grant and 1/48 at the end of each month thereafter. The Options will expire seven years from the date of grant, subject to earlier termination of the Options in accordance with the Plan. The shareholders confirm that this resolution is not detrimental to the Company’s interests��.

The affirmative vote of the holders of a majority of the voting power present and voting at the Meeting in person or by proxy is necessary for the approval of the resolution to grant toDr. Moshe BenBassat 150,000 options.

OTHER BUSINESS

Management knows of no other business to be transacted at the Meeting. However, if any other matters are properly presented to the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

| | By order of the Board of Directors, |

| | |

| | Dr. Moshe BenBassat |

| | Chairman of the Board of Directors and |

| | Chief Executive Officer |

Petach Tikva, Israel

May 16, 2012