UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

DENDREON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

DENDREON CORPORATION

1301 2nd Ave., Suite 3200

Seattle, Washington 98101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

JUNE 13, 2012

The Annual Meeting of Stockholders (the “Annual Meeting”) of Dendreon Corporation, a Delaware corporation (the “Company”), will be held on Wednesday, June 13, 2012, at 9:00 a.m., Pacific time, at the Seattle Art Museum, 1300 First Avenue, Seattle, Washington 98101, for the following purposes:

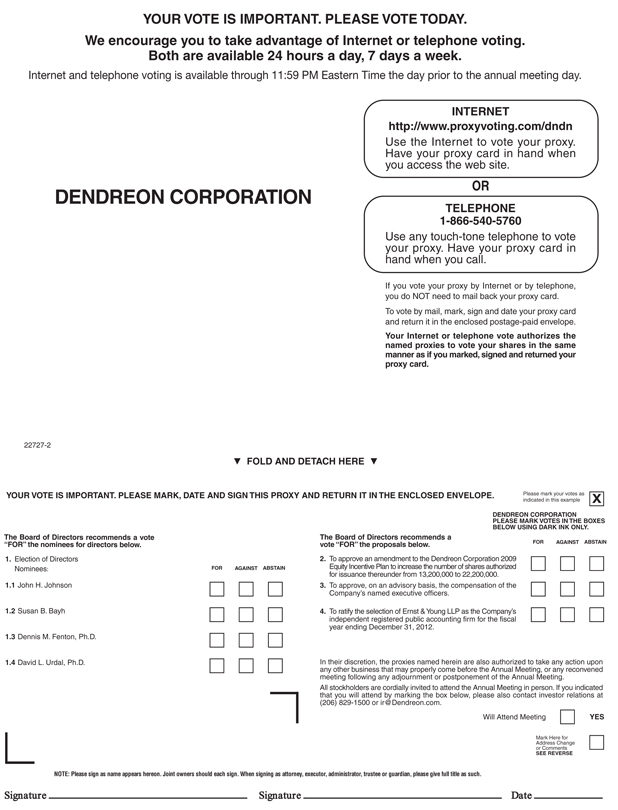

(1) To elect the four nominees named in the attached proxy statement as members of the Company’s Board of Directors to serve as Class III directors until the 2015 Annual Meeting of Stockholders;

(2) To approve an amendment to the Dendreon Corporation 2009 Equity Incentive Plan to increase the number of shares authorized for issuance thereunder from 13,200,000 to 22,200,000;

(3) To approve, on an advisory basis, the compensation of the Company’s named executive officers;

(4) To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; and

(5) To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on April 18, 2012 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether you expect to attend the Annual Meeting or not, please vote as soon as possible using one of the following methods: (1) by using the Internet as instructed on the proxy card; (2) by telephone by calling the toll-free number as instructed on the proxy card; or (3) if you receive a paper proxy card in the mail, by completing, signing, dating and returning the proxy card in accordance with its instructions. Your prompt response is necessary to ensure that your shares are represented at the Annual Meeting. If you vote in advance of the Annual Meeting using the Internet, telephone or proxy card, you can change your vote and revoke your proxy at any time before the polls close at the Annual Meeting by following the procedures described in the accompanying proxy statement.

By Order of the Board of Directors,

Christine Mikail

Executive Vice President, Corporate Development,

General Counsel and Secretary

April 27, 2012

TABLE OF CONTENTS

DENDREON CORPORATION

1301 2nd Ave., Suite 3200

Seattle, Washington 98101

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

JUNE 13, 2012

INFORMATION CONCERNING SOLICITATION AND VOTING

General

Your proxy is solicited on behalf of the Board of Directors of Dendreon Corporation, a Delaware corporation (“Dendreon”, the “Company”, “we”, “us”, or “our”), for use at the Annual Meeting of Stockholders (the “Annual Meeting”), to be held on June 13, 2012, at 9:00 a.m., Pacific time, and at any adjournments or postponements thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Seattle Art Museum, 1300 First Avenue, Seattle, Washington 98101. You may obtain directions to the location of the Annual Meeting by contacting Investor Relations, Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101; telephone: (206) 455-2220.

On or about April 30, 2012, we are either mailing or providing notice and electronic delivery of these proxy materials together with our Annual Report on Form 10-K (excluding exhibits) for the fiscal year ended December 31, 2011, and other information required by the rules of the Securities and Exchange Commission.

Important Notice Regarding the Availability of Proxy Materials for the

2012 Annual Meeting of Stockholders to be Held on June 13, 2012:

This proxy statement and the 2011 Annual Report to Stockholders are available for viewing, printing and downloading at http://bnymellon.mobular.net/bnymellon/dndn.

You may obtain a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as filed with the Securities and Exchange Commission (the “SEC”), except for exhibits thereto, without charge upon written request to Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, Attn: Investor Relations. Exhibits will be provided upon written request and payment of an appropriate processing fee.

Voting Rights and Outstanding Shares

Only holders of record of our Common Stock, par value $0.001 per share (“Common Stock”), at the close of business on April 18, 2012 (the “Record Date”) will be eligible to vote at the Annual Meeting. As of the Record Date, there were 154,001,053 shares of Common Stock outstanding. Each stockholder will be entitled to one vote for each share owned. Stockholders have no right to cumulative voting as to any matter to be voted on at the Annual Meeting. A list of stockholders of record will be open to the examination of any stockholder for any purpose germane to the meeting at Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, for a period of ten days prior to the Annual Meeting.

Matters to be Voted On; Votes Required

In accordance with our Amended and Restated Bylaws, the affirmative vote of a majority of the votes duly cast at the Annual Meeting is required for the election of the four director nominees. In the event that any of the director nominees fails to receive the required vote, the subject director is required to tender his or her resignation to the Board of Directors in accordance with our Amended and Restated Bylaws and our Policy Statement on Majority Voting, as adopted by the Board of Directors on December 1, 2011 and available athttp://investor.dendreon.com/governance.cfm.

Approval of the amendment to our 2009 Equity Incentive Plan (Proposal 2), approval of the advisory vote on the compensation of the Company’s named executive officers (Proposal 3) and approval of the ratification of

1

the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012 (Proposal 4) each requires the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter.

Although the advisory vote on compensation of the Company’s named executive officers is non-binding, as provided by law, our Board of Directors values stockholders’ opinions and will take the results of the vote into account when considering any changes to our executive compensation program.

Quorum, Abstention and Broker Non-Votes

The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person or by proxy to constitute a quorum for any business to be transacted at the Annual Meeting. Properly executed proxies marked “abstain” and “broker non-votes” will be considered “present” for purposes of determining whether a quorum is present at the Annual Meeting.

If the shares you own are held in “street name” by a broker, bank or other nominee, then your broker, bank or other nominee, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the instructions your broker, bank or other nominee provides you. If you do not give instructions to your broker, bank or other nominee, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to certain “non-discretionary” items. Of the proposals to be considered at the meeting, only the ratification of the selection of our independent registered public accounting firm is a discretionary item. Accordingly, your broker, bank or other nominee may exercise its discretionary authority with respect to the ratification of the selection of our independent registered public accounting firm if you do not provide voting instructions. “Broker non-votes” occur when certain nominees holding shares for beneficial owners do not vote those shares on a particular proposal because the nominees do not have discretionary authority to do so and have not received voting instructions with respect to the proposal from the beneficial owners.

For purposes of calculating votes in the election of directors, broker non-votes and abstentions will not be counted as votes and will not affect the results of the vote. For purposes of calculating votes for the advisory vote on the compensation of the Company’s named executive officers and approval of the amendment to our 2009 Equity Incentive Plan, broker non-votes will not be counted as votes and will not affect the outcome of the votes for these matters. Because abstentions are considered present and entitled to vote on the matters, abstentions will have the same effect as a vote against the approval of the amendment to our 2009 Equity Incentive Plan, the approval of the advisory vote on compensation of the Company’s named executive officers and the ratification of our independent registered public accounting firm. For purposes of ratifying our independent registered public accounting firm, brokers have discretionary authority to vote and a broker non-vote on this proposal will have the same effect as a vote against the ratification of our independent registered public accounting firm.

Methods of Voting; Changing Votes

Stockholder of record; Shares registered in your name. If you are a stockholder of record, that is, your shares are registered in your own name, not in “street name” by a broker, bank or other nominee, and you received a Notice of Internet Availability of Proxy Materials, the Notice of Internet Availability of Proxy Materials will contain instructions on how to access and review the proxy materials online and how to obtain a paper or electronic copy of the proxy materials, which will include the proxy statement, a proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as well as instructions on how to vote either in person at the meeting, via the Internet, by telephone or by mail. If you are a stockholder of record and you received a paper copy of these proxy materials, you can vote your shares of our Common Stock using any of the following means:

| | • | | Voting by Proxy Cards. A stockholder may vote shares by returning a duly completed and executed proxy card to Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, Attention: Corporate Secretary. All proxy cards received by us that have been properly signed and have not been revoked will be voted in accordance with the instructions contained in the proxy cards. If a signed proxy card is received which does not specify a vote or an abstention, the shares represented by that proxy card will be voted “For” the director nominees to our Board of Directors listed on the proxy card, “For” the |

2

| | ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012, “For” the approval, on an advisory basis, of the compensation of the Company’s named executive officers, and “For” the approval of the amendment to the Dendreon Corporation 2009 Equity Incentive Plan. |

| | • | | Voting by Telephone or Internet. A stockholder may vote shares until 11:59 p.m. Pacific Time on June 12, 2012 by calling the toll-free number indicated on the proxy card and following the recorded instructions or by accessing the website indicated on the proxy card and following the instructions provided. When a stockholder votes by telephone or Internet, his, her or its vote is recorded immediately. |

| | • | | Voting by Attending the Annual Meeting. A stockholder may vote shares in person at the Annual Meeting. A stockholder planning to attend the Annual Meeting should bring proof of identification. Prior notice of a stockholder’s intention to attend is appreciated and may be provided by contacting Investor Relations at (206) 829-1500 or IR@Dendreon.com. If a stockholder attends the Annual Meeting, he, she or it may also submit his, her or its vote in person, and any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the Annual Meeting. Further, if the shares are held of record by a broker, bank or other nominee and a stockholder wishes to vote at the Annual Meeting, he, she or it must obtain a proxy issued in his, her or its name from the record holder in accordance with the materials and instructions for voting provided by his, her or its broker, bank or other nominee. |

Beneficial owner: Shares held in “street name.” If the shares you own are held in “street name”, then you may vote in accordance with the materials and instructions for voting the shares provided by your broker, bank or other nominee. If you wish to vote shares held in “street name” at the Annual Meeting, then you must obtain a proxy from your broker, bank or other nominee in order to vote your shares at the Annual Meeting in accordance with the materials and instructions for voting provided by your broker, bank or other nominee. If you do not vote by proxy or otherwise give voting instructions to your broker, bank or other nominee, such shares willnot be voted by the broker, bank or other nominee for the election of directors, the advisory vote on the compensation of the Company’s named executive officers or the proposal to approve the amendment to the Dendreon Corporation 2009 Equity Incentive Plan at the Annual Meeting.

Changing Votes. You may change your vote and revoke your earlier proxy at any time before it is exercised at the Annual Meeting by (1) delivering a proxy revocation or another duly executed proxy bearing a later date to Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, Attention: Corporate Secretary; (2) voting again by telephone or Internet in the manner described above; or (3) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not revoke a proxy unless you actually vote in person at the meeting. If you own shares in “street name” and want to revoke or change your vote after returning voting instructions to your broker, bank or other nominee, you may do so in accordance with the materials and instructions provided by your broker, bank or other nominee or by contacting such broker, bank or other nominee to effect the revocation or change of vote.

Counting of Votes

Computershare Shareowner Services LLC, the transfer agent and registrar for our Common Stock, will count, tabulate and certify the votes. A representative of Computershare Shareowner Services LLC will serve as inspector of elections at the Annual Meeting.

Stockholder Proposals

Each stockholder’s notice must contain certain prescribed information required by our Amended and Restated Bylaws as to each matter the stockholder proposes to bring before any annual meeting, as well as a representation whether the stockholder intends to deliver a proxy statement and/or form of proxy to holders of at least the percentage of our outstanding capital stock required to approve the nomination or proposal and/or otherwise to solicit proxies from stockholders in support of the nomination or proposal. The full text of the provisions of our Amended and Restated Bylaws dealing with stockholder nominations and proposals is available on our website and the SEC’s website, free of charge, athttp://www.sec.gov. In addition, a copy of the full text of our Amended and Restated Bylaws may be obtained from our Corporate Secretary upon written request.

3

Under the SEC’s rules, stockholders who wish to submit proposals for inclusion in our proxy statement for the 2013 Annual Meeting of Stockholders must submit such proposals so that they are received by us at 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, on or before December 28, 2012. If the date of next year’s annual meeting is changed by more than 30 days from the anniversary date of this year’s annual meeting on June 13, then the deadline is a reasonable time before we begin to print and send proxy materials.

In addition our Amended and Restated Bylaws require that stockholders must notify us in writing of the proposals or nominations for election to our Board of Directors other than those to be included in our proxy statement under the SEC’s rules. Pursuant to the advance notice provision of our Amended and Restated Bylaws, the notice must be submitted in writing to us not less than 90 days nor more than 120 days before the first anniversary of the previous year’s annual meeting. However, if the date of the annual meeting is advanced by more than 30 days, or delayed by more than 30 days, from the anniversary date, then we must receive such notice at the address noted above not earlier than the close of business on the 120th day before such annual meeting and not later than the close of business on the later of (1) the 90th day before such annual meeting or (2) the tenth day after the date on which public announcement of the date of such annual meeting is made. Assuming that our 2013 Annual Meeting of Stockholders is not advanced by more than 30 days nor delayed by more than 30 days from the anniversary date of the Annual Meeting, any nomination or stockholder proposal for next year’s annual meeting submitted to us on or between February 13, 2013 and March 15, 2013 will be considered filed on a timely basis.

Solicitation

We will bear the cost of the solicitation of proxies for the Annual Meeting, including preparation of this proxy statement, the proxy card and any additional information furnished to stockholders, including any mailing charges. We have retained the services of Georgeson Inc. to assist in the solicitation of proxies. We expect to pay approximately $7,500 for these services, plus out-of-pocket expenses. We will, upon request, furnish hard copies of the solicitation materials to record holders of our Common Stock as well as forward materials to beneficial holders upon instruction by banks, brokerage houses, fiduciaries and custodians who are record holders of our Common Stock. We may, on request, reimburse persons representing beneficial owners of our Common Stock for their costs of forwarding solicitation materials to beneficial owners. Proxies may be solicited by telephone, facsimile or personal solicitation. No additional compensation will be paid to our directors, officers or other employees for such services.

Householding of Annual Meeting Materials

Some brokers, banks and other nominee record holders may be participating in the practice of “householding” proxy statements, annual reports and Notices of Internet Availability of Proxy Materials. This means that only one copy of our proxy statement, annual report or Notice of Internet Availability of Proxy Materials may be sent to multiple stockholders in a household, which helps us reduce our printing costs and postage fees and helps the environment by using less paper. However, we will promptly deliver a separate copy of these documents to you if you write, email or call our Investor Relations department at 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, email: ir@dendreon.com, or telephone: (206) 455-2220. If you want to receive separate copies of the proxy statement, annual report or Notice of Internet Availability of Proxy Materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your broker, bank, or other nominee record holder, or you may contact us at the above address, email or phone number.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is currently composed of eleven members. Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide for the division of our Board of Directors into three classes, with each class consisting, as nearly as possible, of one-third of the total number of directors, and with each class having a three-year term. Our Board of Directors currently consists of three Class I directors, four Class II directors and four Class III directors. The Class I, Class II and Class III directors were elected to serve until the annual meeting of stockholders to be held in 2013, 2014 and 2012, respectively, and until their respective successors are elected and qualified or until his or her earlier death, resignation or removal.

At the Annual Meeting, our stockholders will have an opportunity to vote for four nominees for Class III directors: Susan B. Bayh, Dennis M. Fenton, M.D., John H. Johnson, and David L. Urdal, Ph.D. Each of the four nominees is currently a director of the Company. Ms. Bayh and Dr. Urdal were previously elected as directors by stockholders of the Company, while this is the first time Dr. Fenton and Mr. Johnson will be submitted to a vote by our stockholders. If elected at the Annual Meeting, Ms. Bayh, Dr. Fenton, Mr. Johnson and Dr. Urdal would serve until the 2015 Annual Meeting and until his/her successor is elected and has been duly qualified, or until such director’s earlier death, resignation or removal.

Directors are elected by the affirmative vote of a majority of the votes cast, present in person or represented by proxy and entitled to vote at the Annual Meeting. In the event that any of the director nominees fails to receive the required vote, the subject director is required to tender his or her resignation to the Board in accordance with our Amended and Restated Bylaws and our Policy Statement on Majority Voting, as adopted by the Board of Directors on December 1, 2011 and available athttp://investor.dendreon.com/governance.cfm. In the event that any nominee should become unable to serve as a director, such shares will be voted for the election of such substitute nominee, if any, as the Board of Directors may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Set forth below is biographical information for each person nominated for election at the Annual Meeting for a term expiring at the 2015 Annual Meeting and each person whose term of office as a director will continue after the Annual Meeting. The information presented includes information each director has given us about their ages, all positions they hold, their principal occupation and business experience for the past five years, and the names of other publicly-held companies of which they currently serve as a director or have served as a director during the past five years. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Corporate Governance Committee and our Board of Directors to conclude that he or she should serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our company and our Board of Directors. No corporation or organization referred to below is a subsidiary or other affiliate of ours. All our directors bring to our board a wealth of executive leadership experience derived from their diverse backgrounds.

5

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR”

THE ELECTION OF EACH OF THE NOMINEES FOR CLASS III DIRECTORS.

Nominees for Election for a Three-Year Term Expiring at the 2015 Annual Meeting (Class III Directors)

John H. Johnson,age 54, has served as a member of our Board of Directors since August 2011 and as our President and Chief Executive Officer since January 2012. Mr. Johnson previously served as the Chief Executive Officer and a director of Savient Pharmaceuticals, Inc., a pharmaceutical company, from January 2011 until January 2012, and prior to that time, served as Senior Vice President and President of Eli Lilly & Company’s Oncology unit from November 2009 until January 2011. He was also Chief Executive Officer of ImClone Systems, which develops targeted biologic cancer treatments, from August 2007 until November 2009, and served on ImClone’s board of directors until it was acquired by Eli Lilly in November 2008. Prior to joining ImClone, Mr. Johnson served as Company Group Chairman of Johnson & Johnson’s Worldwide Biopharmaceuticals unit from 2005 until August 2007, President of its Ortho Biotech Products LP and Ortho Biotech Canada unit from 2003 until 2005, and Worldwide Vice President of its CNS, Pharmaceuticals Group Strategic unit from 2001 until 2003. Prior to joining Johnson & Johnson, he also held several executive positions at Parkstone Medical Information Systems, Inc., Ortho-McNeil Pharmaceutical Corporation and Pfizer, Inc. Mr. Johnson currently serves as Chairman of the Board of Directors of Tranzyme, Inc., a clinical stage biopharmaceutical company, and as a member of its audit and nominating and corporate governance committees. He earned his bachelor’s degree from the East Stroudsburg University of Pennsylvania. Mr. Johnson’s dual role as an executive officer and director of Dendreon gives him unique insights into the day-to-day operations of our Company, a practical understanding of the issues and opportunities that face the Company, and its strategic planning, commercial growth, and strategic transactions, giving him the appropriate and valuable qualifications to serve as a member of our Board.

Susan B. Bayh, age 52, has served as a member of our Board of Directors since our acquisition of Corvas International, Inc. (“Corvas”), a biotechnology company, in July 2003. Prior to that, she served as a director of Corvas from June 2000 to July 2003. Ms. Bayh, retired since 2004, was a Distinguished Visiting Professor at the College of Business Administration at Butler University in Indianapolis, Indiana from 1994 to 2004. From 1994 to 2001, she was a Commissioner for the International Commission between the United States and Canada, overseeing compliance with environmental and water level treaties for the United States-Canada border. From 1989 to 1994, Ms. Bayh served as an attorney in the Pharmaceutical Division of Eli Lilly and Company, a pharmaceutical company. She currently serves on the Boards of Directors of Wellpoint, Inc., a health benefits company, Curis, Inc., a therapeutic drug development company, and Emmis Communications, a diversified media company, and previously served on the Board of Directors of Dyax Corp., a biotechnology company, from 2003 to March 2012 and MDRNA, Inc. (formerly Nastech Pharmaceutical Company Inc.), a biotechnology company, from 2006 to 2009. Ms. Bayh received a B.S. from the University of California, Berkeley and her J.D. from the University of Southern California Law School. Ms. Bayh’s service on multiple healthcare, pharmaceutical and biotechnology company boards, as well as her academic, international and regulatory experience, give her the skills and appropriate qualifications to serve as a member of our Board.

Dennis M. Fenton, Ph.D.,age 60, has served as a member of our Board of Directors since November 2011. Dr. Fenton, who retired in 2008, previously held numerous positions from 1982 to 2008 at Amgen, Inc., a biotechnology company, including executive roles in process development, manufacturing, sales and marketing and research and development. From 2000 until 2008, Dr. Fenton was Executive Vice President responsible for worldwide operations, manufacturing, process development and quality. From 1995 until 2000, Dr. Fenton was Senior Vice President of Operations, and from 1992 until 1995, he was Senior Vice President of Sales, Marketing and Process Development. Prior to his time at Amgen, Inc., Dr. Fenton served as Senior Research Scientist at Pfizer, Inc., and previously was a research associate and graduate student at Rutgers University. Dr. Fenton currently serves as a member of the board of directors at XenoPort, Inc., a publicly traded biopharmaceutical company, and also at Genelux Corporation, a biomedical company, Napo Pharmaceuticals, Inc., a pharmaceutical company, and Kythera Biopharmaceuticals, Inc., a biopharmaceutical company. He received his B.S. in Biology from Manhattan College and his Ph.D. in Microbiology from Rutgers University. Dr. Fenton’s extensive experience in development, operations and sales and marketing gives him the appropriate and valuable qualifications to serve as a member of our Board.

6

David L. Urdal, Ph.D., age 62, has served as a member of our Board of Directors since 1995. Until his retirement in December 2011, he served as our Executive Vice President and Chief Scientific Officer since December 2010, and previously served as our Chief Scientific Officer and director since joining the Company in July 1995. He also served as Vice Chair of the Company’s Board of Directors from 1995 to June 2004, as Executive Vice President from January 1999 through December 2000, as the Company’s President from January 2001 to December 2003, and as Senior Vice President since June 2004. From 1982 until July 1995, Dr. Urdal held various positions with Immunex Corporation, a biotechnology company, including President of Immunex Manufacturing Corporation, Vice President and Director of Development, and head of the departments of biochemistry and membrane biochemistry. Dr. Urdal serves as a director of VLST, a biotechnology company and previously served as a director of ORE Pharmaceuticals, Inc., a pharmaceutical drug repositioning and development company, from 2007 until 2010. Dr. Urdal received a B.S. in zoology, a M.S. in Public Health and a Ph.D. in Biochemical Oncology from the University of Washington. Dr. Urdal’s biotechnology and pharmaceutical industry board and senior management experience, including his long-term senior management role with the Company, together with his scientific expertise and background give him the valuable and appropriate qualifications to serve as a member of our Board.

Directors Continuing in Office until the 2013 Annual Meeting (Class I Directors)

Gerardo Canet,age 66, has served as a member of our Board of Directors since December 1996. Mr. Canet is currently a member of the Board of Directors of IntegraMed America, Inc., and from 1994 to 2005, served as its Chief Executive Officer. IntegraMed provides services to patients and medical practices that specialize in the diagnosis and treatment of infertility and vein care. Mr. Canet received a B.A. in Economics from Tufts University and an M.B.A. from Suffolk University. Mr. Canet’s extensive experience in senior management and board service in the healthcare services industry gives him the appropriate and desired qualifications to serve as a member of our Board.

Bogdan Dziurzynski, D.P.A., age 63, has served a member of our Board of Directors since May 2001. Since 2001, Dr. Dziurzynski has been a consultant in strategic regulatory management to the biotechnology industry. Dr. Dziurzynski currently serves on the Board of the Biologics Consulting Group and previously served on the Board of Directors of Allostera Pharma Inc. Dr. Dziurzynski is a fellow and past Chairman of the Board of the Regulatory Affairs Professional Society. He also serves as an advisory board member of Integrated Biotherapeutics, Inc. From 1994 to 2001, Dr. Dziurzynski was the Senior Vice President of Regulatory Affairs and Quality Assurance for MedImmune, Inc., a biotechnology company. From 1988 to 1994, Dr. Dziurzynski was Vice President of Regulatory Affairs and Quality Assurance for Immunex Corporation, a biotechnology company. Dr. Dziurzynski has a B.A. in Psychology from Rutgers University, an M.B.A. from Seattle University and a Doctorate in Public Administration from the University of Southern California. Dr. Dziurzynski’s background and experience in biotechnology regulatory matters including the drug and device products approval process, product lifecycle management, product development and manufacturing, and all aspects of commercial product marketing, as well as his extensive period of board service and management roles within the industry give him the appropriate and pertinent qualifications to serve as a member of our Board.

Douglas G. Watson, age 67, has served as a member of our Board of Directors since February 2000 and was named Lead Independent Director in January 2012. Mr. Watson is Chief Executive Officer of Pittencrieff Glen Associates, a consulting firm that he founded in July 1999. From January 1997 to May 1999, Mr. Watson served as President and Chief Executive Officer of Novartis Corporation, the U.S. subsidiary of Novartis AG. From April 1996 to December 1996, Mr. Watson served as President and Chief Executive Officer of Ciba-Geigy Corporation, which merged into Novartis Corporation in December 1996. Mr. Watson’s career spanned 33 years with Novartis, having joined Geigy (UK) Ltd. in 1966. Mr. Watson also currently serves as Chairman of OraSure Technologies, Inc., a medical diagnostics company, and as a director of Delcath Systems, Inc., a specialty pharmaceutical and medical device company, and BioMimetic Therapeutics, Inc., a biotechnology company. Mr. Watson previously served on the Board of Directors of Genta Incorporated, a biopharmaceutical company, from 2002 to January 2011, Javelin Pharmaceuticals, Inc., a pharmaceutical company, from 2004 to 2010, and Engelhard Corporation, a surface and materials science company, from 1991 to 2006. Mr. Watson received an M.A. in Pure Mathematics from Churchill College, Cambridge University and holds an ACMA qualification as an Associate of the Chartered Institute of Management Accountants. Mr. Watson’s long-time and diverse experi-

7

ence in executive roles in the pharmaceutical industry, and board service in the biopharmaceuticals industry, together with his accounting background and financial expertise, give him the appropriate and valuable qualifications to serve as a member of our Board.

Directors Continuing in Office until the 2014 Annual Meeting (Class II Directors)

Richard B. Brewer, age 61, has served as a member of our Board of Directors since February 2004 and was previously the Chair of our Board of Directors from June 2004 until January 2012. He has been the Executive Chairman of the Board at Nile Therapeutics, Inc., a biopharmaceutical company, since July 2010, and is a partner at Crest Asset Management, a management advisory and investment firm, which he founded in January 2003. Since 2009, Mr. Brewer has served as the Chairman of the Board of Directors of Arca Biopharma, Inc., a biopharmaceutical company focused on genetically-targeted therapies for heart failure, and served as its President and Chief Executive Officer from 2006 to 2009. From September 1998 until February 2004, Mr. Brewer served as Chief Executive Officer and President of Scios Inc., a biopharmaceutical company. From 1996 until 1998, Mr. Brewer served as the Chief Operating Officer at Heartport, a cardiovascular device company. From 1984 until 1995, Mr. Brewer was employed by Genentech, Inc., a biotechnology company, and served as its Senior Vice President of Sales and Marketing, and Senior Vice President of Genentech Europe and Canada. Mr. Brewer serves as a director of SRI International, an independent, non-profit research group. He is an advisory board member at the Kellogg Graduate School of Management Center for Biotechnology at Northwestern University. Mr. Brewer holds a B.S. from Virginia Polytechnic Institute and an M.B.A. from Northwestern University. Mr. Brewer’s extensive biotechnology industry experience, both as an outside advisor and in various operating and management roles, including as the chief executive officer of two biotechnology companies, as well as his background and experience in investment management and corporate finance both in the U.S. and the EU, give him the appropriate qualifications to serve as a member of our Board.

Mitchell H. Gold, M.D., age 45, has served as a member of our Board of Directors since May 2002, and was appointed as the Executive Chair of our Board of Directors in January 2012. Dr. Gold previously served as our President and Chief Executive Officer from January 2003 until January 2012, served as our Vice President of Business Development from June 2001 to May 2002, and also as our Chief Business Officer from May 2002 through December 2002. From April 2000 to May 2001, Dr. Gold served as Vice President of Business Development and Vice President of Sales and Marketing for Data Critical Corporation, a company engaged in wireless transmission of critical healthcare data, now a division of GE Medical. From 1995 to April 2000, Dr. Gold was the President and Chief Executive Officer, and a co-founder of Elixis Corporation, a medical information systems company. From 1993 to 1998, Dr. Gold was a resident physician in the Department of Urology at the University of Washington. Dr. Gold currently serves on the Board of Directors of Jennerex, Inc., a private clinical-stage biotherapeutics company, and on the board of the University of Washington/Fred Hutchinson Cancer Research Center Prostate Cancer Institute. Dr. Gold received a B.S. from the University of Wisconsin-Madison and an M.D. from Rush Medical College. Dr. Gold’s prior experience as the President and Chief Executive Officer of our Company, his operational knowledge of our Company, and his scientific understanding give him the appropriate and valuable qualifications to serve as a member and Chair of our Board.

Pedro Granadillo, age 64, has served as a member of our Board of Directors since October 2009. Mr. Granadillo, now retired since 2004, was most recently Senior Vice President of Global Manufacturing, Quality and Human Resources until 2004 as well as a member of the executive committee at Eli Lilly & Company. Mr. Granadillo worked at Eli Lilly & Company for over thirty years from 1970 to 2004, serving in roles such as Vice President of Human Resources, Vice President of Pharmaceutical Manufacturing, Executive Director, Production Operations and Director of Manufacturing Strategy Development. As the company’s top executive for both manufacturing and human resources, Mr. Granadillo was responsible for the overall management of an extensive network of pharmaceutical manufacturing facilities and for policies affecting the company’s global workforce of more than 43,000 employees. He currently serves on the Board of Directors of Haemonetics Corporation, a blood processing company, NPS Pharmaceuticals, Inc, a biopharmaceutical company and Nile Therapeutics, Inc., a biopharmaceutical company and served on the Board of Directors of Noven Pharmaceuticals, Inc., a pharmaceutical company, from 2004 to 2009, and First Indiana Bank, a banking company, from 2002 to 2007. Mr. Granadillo received a B.S. in industrial engineering from Purdue University. Mr. Granadillo’s lengthy management experience at a leading pharmaceutical manufacturer, and broad pharmaceutical and biotechnology

8

industry board service give him the appropriate qualifications to serve as a member of our Board. In addition, Mr. Granadillo has extensive experience in multiple areas, including corporate management, human resources, manufacturing and quality including designing and operating complex global manufacturing networks, senior leadership development and succession planning, executive compensation, organizational transformation and portfolio management, which gives him the appropriate qualifications to serve as a member of our Board.

David C. Stump, M.D.,age 62, has served as a member of our Board of Directors since June 2010. Dr. Stump is currently Executive Vice President of Research and Development for Human Genome Sciences, Inc. and has served at that company since November 1999. From December 2003 to May 2007, Dr. Stump served as Executive Vice President of Drug Development at Human Genome Sciences and, from November 1999 to December 2003, as its Senior Vice President, Drug Development. Prior to joining Human Genome Sciences, Inc., Dr. Stump held several positions at Genentech, Inc., including Vice President of Clinical Research, and was named a Genentech Fellow in 1996 for leadership of its cardiovascular drug development activities. Prior to Genentech, Dr. Stump served as Associate Professor of Medicine and Biochemistry at the University of Vermont. He is currently a member of the Board of Directors for Sunesis Pharmaceuticals, Inc., a pharmaceutical company, as well as of the Board of Trustees for Earlham College. Dr. Stump received his M.D. from Indiana University and his bachelor’s degree from Earlham College. Dr. Stump completed his residency and fellowship training in internal medicine, hematology, and oncology at the University of Iowa and is board certified in all three areas. Dr. Stump’s medical and scientific background, as well as his leadership roles at leading biotech and pharmaceutical companies, provide him with expertise and qualifications to serve as a member of our Board.

BOARD OF DIRECTORS

Director Independence

Under applicable NASDAQ rules, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors and Corporate Governance Committee has determined that none of Ms. Bayh, Mr. Brewer, Mr. Canet, Dr. Dziurzynski, Dr. Fenton, Mr. Granadillo, Dr. Stump, and Mr. Watson has a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 5605(a)(2) of the NASDAQ Stock Market, Inc. Marketplace Rules.

In making its independence determinations, the Corporate Governance Committee each year reviews any transactions and relationships between the director, or any member of his or her immediate family, and the Company, and bases the determination on information provided by the director, Company records and publicly available information during the year. Specifically, the Corporate Governance Committee will consider the following types of relationships and transactions: (1) principal employment of and other public company directorships held by each non-employee director; (2) contracts or arrangements that are ongoing or which existed during any of the past three fiscal years between our Company and any entity for which the non-employee director, or his or her immediate family member, is an executive officer or greater-than-10% stockholder; and (3) contracts or arrangements that are ongoing or which existed during any of the past three fiscal years between our Company and any other public company for which the non-employee director serves as a director. During 2011, there were no material relationships or transactions in these categories reviewed by the Corporate Governance Committee, nor were there any other similar relationships or transactions the Corporate Governance Committee considered.

Board of Directors Meetings

The Board of Directors held seventeen meetings in fiscal 2011. In fiscal 2011, each director attended at least 75% of the aggregate number of meetings of the Board and the number of meetings held by all committees on which he or she then served. We encourage but do not require the directors to attend the annual meeting of stockholders. We schedule a regular meeting of the Board of Directors immediately following each annual meeting of stockholders. All of our directors attended the 2011 Annual Meeting of Stockholders.

9

Committees of the Board of Directors

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance Committee, each of which has a written charter that is available on the Investors section of our website athttp://investor.dendreon.com/governance.cfm.

Audit Committee

The primary responsibility of the Audit Committee is to oversee our financial reporting process on behalf of the Board of Directors. Among other things, the Audit Committee is responsible for overseeing our accounting and financial reporting processes and audits of our financial statements, reviewing and discussing with our independent auditors critical accounting policies and practices for our Company, engaging in discussions with management and the independent auditors to assess risk for the Company and management thereof, and reviewing with management and the independent auditors the effectiveness of our internal controls and disclosure controls and procedures. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of our independent auditors, including the resolution of disagreements, if any, between management and the auditors regarding financial reporting. In addition, the Audit Committee is responsible for reviewing and approving any related party transaction that is required to be disclosed pursuant to Item 404 of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The current members of the Audit Committee are Messrs. Watson (Chair), Canet, Granadillo, and Dr. Fenton (since November 2011), each of whom the Board of Directors has determined is independent under the rules of the NASDAQ Stock Market and the independent requirements contemplated by Rule 10A-3 under the Exchange Act. The Audit Committee met eight times during 2011. The Board of Directors determined that each of Messrs. Watson, Canet and Granadillo, and Dr. Fenton is an “audit committee financial expert,” as that term is defined in Item 407(d)(5) of Regulation S-K.

Compensation Committee

The Compensation Committee develops compensation policies and implements compensation programs, makes recommendations annually concerning salaries and incentive compensation, awards stock options and restricted stock to officers and employees under our stock incentive plans and otherwise determines compensation levels and performs such other functions regarding compensation for officers and employees as the Board of Directors may delegate in accordance with the Compensation Committee Charter. While the Corporate Governance Committee reviews and approves changes to non-employee director compensation pursuant to its charter, the Compensation Committee works in conjunction with the Corporate Governance Committee on such matters.

Compensation for our named executive officers each year is usually determined by the Board of Directors prior to the first quarter of the relevant year. When determining annual compensation levels and targets for our executives, the Compensation Committee reviews corporate goals, evaluates individual performance, considers competitive market data and establishes compensation based on these factors, or in the case of our named executive officers, makes recommendations to our Board of Directors, who then act as a whole to set compensation based on these factors. The values of each component of total direct compensation (base salary, target annual cash incentive and equity awards) for the current year, as well as total annual compensation for the prior year are all considered collectively by our Compensation Committee as part of this process.

Our Compensation Committee has the authority to engage the services of outside advisors, experts and others to assist our Compensation Committee in determining the compensation of our executive officers. Our Compensation Committee may, from time to time, delegate certain authority to authorized persons internally, including our human resources department, to carry out certain administrative duties. The Compensation Committee holds executive sessions (with no members of management present) at the majority of its meetings.

The current members of the Compensation Committee are Mr. Granadillo (Chair since December 2011), Mr. Canet (Chair until December 2011), Ms. Bayh, and Dr. Dziurzynski, each of whom the Board of Directors has determined is independent under the rules of the NASDAQ Stock Market. The Compensation Committee met nine times during 2011.

10

Corporate Governance Committee

The Corporate Governance Committee considers and makes recommendations regarding corporate governance requirements and principles, periodically reviews the performance and operations of the standing committees of the Board of Directors and evaluates and recommends individuals for membership on the Company’s Board of Directors and committees. The processes and procedures followed by the Corporate Governance Committee are described below under the heading “Director Nomination Process”. The Corporate Governance Committee also reviews and approves changes to non-employee director compensation pursuant to its charter.

The current members of the Corporate Governance Committee are Dr. Dziurzynski (Chair), Ms. Bayh, Mr. Brewer (since January 30, 2012) and Dr. Stump, each of whom the Board of Directors has determined is independent under the rules of the NASDAQ Stock Market. The Corporate Governance Committee met eight times during 2011.

Director Nomination Process

Potential nominees for director are referred to the Corporate Governance Committee for consideration and evaluation. If the Committee identifies a need to replace a current member of the Board of Directors, to fill a vacancy in or to expand the size of the Board of Directors, the Corporate Governance Committee will consider those individuals recommended as candidates for Board membership, including those recommended by stockholders, and hold meetings to evaluate biographical information and background material relating to candidates, and interview any selected candidates.

According to its adopted policy, the Corporate Governance Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, our advisors and executive search firms. The Board of Directors does not currently prescribe any minimum qualifications for director candidates. The Corporate Governance Committee will consider the Company’s current needs and the qualities needed for Board service, including experience and achievement in business, finance, biotechnology, health sciences or other areas relevant to the Company’s activities; reputation, ethical character and maturity of judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of the responsibilities of a director; independence under SEC rules and the NASDAQ listing standards; service on other boards of directors; sufficient time to devote to Board matters; and the ability to work effectively and collegially with other Board members. Although the Board of Directors does not have a formal diversity policy for director candidates, the Corporate Governance Committee will consider such factors as it deems appropriate to assist in developing a Board of Directors and committees that are diverse in nature and comprised of experienced and seasoned advisors. In 2011, the Company engaged Spencer Stuart, an executive search firm, to assist in identifying and evaluating potential board nominees. The Corporate Governance Committee will consider director candidates recommended by stockholders and will evaluate those candidates in the same manner as candidates recommended by other sources if stockholders submitting recommendations follow the procedures established by the Corporate Governance Committee. Stockholders also have the right under our Amended and Restated Bylaws to directly nominate director candidates without any action or recommendation on the part of the Corporate Governance Committee or our Board of Directors by following the relevant procedures summarized in this proxy statement under the caption “Stockholder Proposals.” We did not implement any changes to our process for stockholder recommendations of director nominees during 2011.

In making recommendations for director nominees for an annual meeting of stockholders, the Corporate Governance Committee will consider any written recommendations of director candidates by stockholders received by our Corporate Secretary not later than the close of business on the 90th day nor earlier than the 120th day prior to the first anniversary of the previous year’s annual meeting of stockholders. Recommendations must include the candidate’s name and contact information and a statement of the candidate’s background and qualifications, as well as the name and contact information of the stockholder or stockholders making the recommendation, and such other information as may be required under our Amended and Restated Bylaws. Recommendations for director nominees for the 2013 Annual Meeting of Stockholders must be mailed to Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, Attention: Corporate Secretary, faxed to our Corporate Secretary at (206) 219-7211 or e-mailed to secretary@dendreon.com by March 15, 2013. No stockholder recommendations for director nominees were received for consideration in advance of the Annual Meeting pursuant to the procedures established by our Amended and Restated Bylaws.

At the Annual Meeting, stockholders will be asked to consider the election of Dr. Fenton and Mr. Johnson, who have been nominated for election as directors for the first time. During 2011, Dr. Fenton and Mr. Johnson

11

were each appointed by our Board as a new director. Spencer Stuart recommended Mr. Johnson and Dr. Fenton each as a nominee for director to the Corporate Governance Committee, which in turn recommended to the Board that Mr. Johnson and Dr. Fenton each be elected as a director.

Board Leadership Structure

In January 2012, the Board of Directors appointed Dr. Gold, our former Chief Executive Officer, to serve as the Executive Chair of the Board of Directors until June 30, 2012, after which Mr. Johnson will then become Chair of the Board of Directors. The Board of Directors has not historically had a formal policy regarding the separation of the roles of Chief Executive Officer and Chair of the Board, as the Board believes it is in the best interests of the Company to make the determination regarding how to fulfill these functions based on the position and direction of the Company, and the membership of the Board of Directors at the pertinent time.

At present, the Board of Directors believes the transition of the Chair of the Board from our former Chief Executive Officer to the present Chief Executive Officer facilitates the chief executive officer transition and provides enhanced efficiency, effective decision-making and clear accountability. The Board of Directors believes that the combined position of Chief Executive Officer and Chair will be effective for the Company by maximizing strategic advantages, company expertise and industry expertise. Mr. Johnson is the director most familiar with the Company’s business and industry and best positioned to set and execute strategic priorities. Mr. Johnson’s leadership, driven by his deep business and industry expertise, enhances the Board of Director’s exercise of its responsibilities. As Mr. Johnson will serve as both the Chief Executive Officer and the Chair of the Board of Directors following June 30, 2012, the Board also determined as of January 31, 2012 to appoint a Lead Independent Director, Mr. Watson. The position of lead independent director has been structured to serve as an effective balance to a combined role of Chief Executive Officer and Chair of the Board. Since January 31, 2012, Mr. Watson has served as the lead independent director of the Board. His duties include, among others:

| | • | | providing leadership to the Board complementary to the Board chairman; |

| | • | | working with the Chair of the Board and Corporate Secretary to set the agenda for Board meetings; |

| | • | | leading sessions of independent directors without management present; and |

| | • | | chairing Board meetings if the Chair of the Board is not in attendance. |

The Lead Independent Director further strengthens the Board of Director’s independence and autonomous oversight of our business as well as Board communication and effectiveness. The Board will evaluate this structure periodically, including the appointment of the Lead Independent Director.

Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board of Directors’ attention the most material risks to the Company. The Board of Directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company and oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board of Directors. The Corporate Governance Committee regularly reviews enterprise-wide risk management. The Audit Committee focuses primarily on financial and accounting, legal and compliance, and IT systems risks. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from the Company’s compensation policies and programs. The Compensation Committee also reviews compensation and benefits plans affecting employees as well as those applicable to executive officers. The full Board of Directors considers strategic risks and opportunities and regularly receives reports from the committees regarding risk oversight in their areas of responsibility.

Compensation Committee Interlocks and Insider Participation

During 2011, the members of our Compensation Committee were Mr. Granadillo (Chair since December 2011), Mr. Canet (Chair until December 2011), Ms. Bayh, and Dr. Dziurzynski. No member of our Compensation Committee has been an officer or employee of our Company at any time. None of our executive officers during 2011 served as a director or as a member of the compensation committee of another entity that has an executive officer who served as a director of the Company or on our Compensation Committee during 2011.

12

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

We have established a procedure for stockholders to communicate with the Board of Directors or a particular Board committee. Communications should be in writing, addressed to: Dendreon Corporation, 1301 2nd Ave., Suite 3200, Seattle, Washington 98101, and marked to the attention of the Board of Directors or any of its individual committees. Copies of all communications so addressed will be promptly forwarded to the chair of the committee involved, or in the case of communications addressed to the Board of Directors as a whole, to the Corporate Governance Committee.

DIRECTOR COMPENSATION

In 2011, we compensated only non-employee directors for serving on our Board of Directors in accordance with previously approved guidelines. Dr. Gold, who was our President and Chief Executive Officer from January 2003 until January 2012, did not receive any compensation in connection with his service as a director. The compensation that we paid to him in 2011 as President and Chief Executive Officer is discussed in “Executive Compensation” below.

During 2011, each non-employee director received an annual retainer of $60,000. In addition, the Chair of the Board received an additional $75,000 retainer per year, and the chairs of each of our Audit, Compensation and Corporate Governance Committees received an additional retainer per year of $25,000, $20,000 and $10,000, respectively. We also paid annual retainers to the members of the Audit Committee, Compensation Committee, and Corporate Governance Committee who are not committee chairs of $12,000, $10,000, and $5,000, respectively. All amounts were paid proportionately. For 2011, the total aggregate cash compensation earned by our non-employee directors for their periods of service was $667,000. The Board of Directors decided not to review or change these guidelines for 2012. We also continue to reimburse each of our directors for expenses incurred in connection with attending Board of Directors’ meetings and for their service as directors in accordance with Company policy.

Our policy is to grant our new non-employee directors an initial equity award, which policy is updated from time to time at the discretion of the Board of Directors. In August 2011, upon joining the Board, Mr. Johnson was granted 10,443 shares of restricted stock that will fully vest upon the first anniversary of the date of grant and a stock option to purchase 20,886 shares of Common Stock that will also fully vest upon the first anniversary of the date of grant. In January 2012, the Board reviewed and maintained this policy, as previously determined in December 2010, to provide for an initial equity award for new non-employee directors elected prior to October 1st of any year equal to the prior year’s grant for the other non-employee directors, with 100% of such award to vest on the first anniversary of the date of grant. As a new director appointed during November 2011, Dr. Fenton did not receive an initial equity award in 2011. Instead, Dr. Fenton received a grant of 25,000 shares of restricted stock on January 3, 2012, which will fully vest upon the first anniversary of the date of grant. In January 2012, the Board of Directors also approved an annual equity award for each non-employee director (other than Dr. Fenton) of 25,000 shares of restricted stock that fully vested upon grant on January 3, 2012.

We determine the value of the grant to our non-employee directors under the 2009 Equity Incentive Plan of an option to purchase one share of Common Stock using the Black-Scholes-Merton valuation methodology and assumptions described in our financial statements to estimate the value of compensatory stock options and awards. All options granted to our non-employee directors are granted with an exercise price equal to the closing price of our Common Stock on the NASDAQ Global Market on the grant date.

13

The table below sets forth, for each non-employee director, the amount of cash compensation paid by us and the value of stock awards received from us for his or her service during 2011:

2011 Director Compensation Table

| | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in Cash | | | Stock Awards

($) | | | Option

Awards

($)(1) | | | Total

($) | |

Susan B. Bayh | | $ | 75,000 | | | $ | 189,000 | (2) | | | | (3) | | $ | 264,000 | |

Richard B. Brewer | | | 140,000 | (4) | | | 189,000 | (2) | | | | (3) | | | 329,000 | |

Gerardo Canet | | | 92,000 | (5) | | | 189,000 | (2) | | | | (3) | | | 281,000 | |

Bogdan Dziurzynski, D.P.A | | | 80,000 | (6) | | | 189,000 | (2) | | | | (3) | | | 269,000 | |

Dennis M. Fenton, Ph.D(7). | | | 18,000 | | | | 189,000 | (2) | | | | (3) | | | 207,000 | |

Pedro Granadillo | | | 82,000 | | | | 189,000 | (2) | | | | (3) | | | 271,000 | |

John H. Johnson(8) | | | 30,000 | | | | 314,003 | (2) | | $ | 161,177 | (9) | | | 505,180 | |

David C. Stump, M.D. | | | 65,000 | | | | 189,000 | (2) | | | | (3) | | | 254,000 | |

Douglas G. Watson | | | 85,000 | (10) | | | 189,000 | (2) | | | | (3) | | | 274,000 | |

| (1) | The compensation cost represents the aggregate fair value on the grant date as determined in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718 (“ASC 718”) using the Black-Scholes-Merton (“BSM”) option pricing model. For more information about the assumptions we made in determining the grant date fair value, see Note 12 of the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. As of December 31, 2011, our non-employee directors held options to purchase the following number of shares of Common Stock: Ms. Bayh, 59,363; Mr. Brewer, 14,192; Mr. Canet, 14,192; Dr. Dziurzynski, 42,863; Dr. Fenton, none; Mr. Granadillo, 14,192; Mr. Johnson, 20,886; Dr. Stump, 13,772; and Mr. Watson, 6,692. |

| (2) | Includes shares granted on January 3, 2012 for 2011 services. A grant of 25,000 shares to Dr. Fenton will vest on January 3, 2013. A grant of 10,443 shares to Mr. Johnson in his role as a non-employee director will vest on August 18, 2012. The remaining shares granted were fully vested on the grant date. The compensation cost represents the aggregate fair value on the grant date as determined in accordance with ASC 718. For more information about the assumptions we made in determining the grant date fair value, see Note 12 of the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. Aside from the shares owned by Dr. Fenton and Mr. Johnson as described above, our non-employee directors did not hold any unvested stock awards as of December 31, 2011. |

| (3) | No stock options were granted for services rendered during the fiscal year ended December 31, 2011. |

| (4) | Amounts shown include retainer and Chair of the Board fee earned during 2011. |

| (5) | Amounts shown include retainer and Compensation Committee chair fee earned during 2011. |

| (6) | Amounts shown include retainer and Corporate Governance Committee chair fee earned during 2011. |

| (7) | Dr. Fenton joined the Board of Directors in November 2011. |

| (8) | Mr. Johnson joined the Board of Directors in August 2011 and served as an independent director until January 31, 2012, at which time he was appointed President and Chief Executive Officer. He received a grant of shares and options in August 2011 upon joining the Board of Directors and a grant of shares in January 2012 for 2011 services. |

| (9) | Stock options with a value of $161,177 were granted on August 18, 2011 and will vest on August 18, 2012. The compensation cost represents the aggregate fair value on the grant date as determined in accordance with ASC 718 using the BSM option pricing model. For more information about the assumptions we made in determining the grant date fair value, see Note 12 of the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. |

| (10) | Amounts shown include retainer and Audit Committee chair fee earned during 2011. |

14

Under corporate governance principles adopted by our Board of Directors in 2005, our non-employee directors are encouraged to own stock in our Company as a long-term investment. In January 2012, the ownership target was reviewed and maintained. Our non-employee directors are encouraged to own stock in our Company in an amount equal to three times the annual general Board of Directors’ retainer, with five years to achieve such target after a director has joined our Board of Directors. As of December 31, 2011, each of our non-employee directors met their applicable ownership guideline, with the exception of Drs. Fenton and Stump, who are not yet subject to the guideline requirement as they have not yet met the length of service requirement.

15

COMPENSATION DISCUSSION AND ANALYSIS

Executive Compensation Summary

Pay for Performance

The cornerstone of our executive compensation program is pay for performance. Accordingly, while we pay competitive base salaries and provide other benefits, the majority of our named executive officers’ compensation opportunity is based on variable pay.

Our Company failed to meet its forecasted 2011 revenue guidance, which resulted in a significant decline in the value of our Common Stock in 2011 and a corresponding decline in market capitalization. As a result, and consistent with our pay-for-performance philosophy, the Board of Directors (the “Board”) took the following actions:

| | • | | Our named executive officers received no annual base salary increases for 2012 after moderate increases for 2011. |

| | • | | Except for Dr. Gold, who received none of his target annual cash bonus for 2011, our continuing named executive officers received only 50% of their target annual cash bonuses for 2011 because the Company failed to achieve the 2011 revenue goal, which counted for 50% of the 2011 performance goals. |

In addition, our named executive officers who left their positions after the 2011 year-end forfeited 100% of their performance-based restricted stock awards granted in December 2010.

Corporate Governance and Pay Best Practices

The Compensation Committee of our Board and the Board’s independent members, assisted by the Compensation Committee’s independent compensation consultant, Mercer (US) Inc. (“Mercer”), stay informed of developing corporate governance and executive compensation best practices and strive to implement them. Our best practices include:

| | • | | Adopting an annual Say on Pay advisory vote, commencing in 2011 and continuing at the Annual Meeting, consistent with the preference of the majority of stockholders who cast votes at the 2011 Annual Meeting of Stockholders and with management’s recommendation to our stockholders. |

| | • | | Providing no golden parachute excise tax gross-ups for any of our employees. |

2011 Advisory Say on Pay Vote and Say on Pay Frequency Vote

At our 2011 Annual Meeting of Stockholders, we held a stockholder advisory vote on the compensation of our named executive officers, commonly referred to as a “Say on Pay” vote. Approximately 97% of our stockholders approved the compensation of our named executive officers by casting a vote in favor of our 2011 Say on Pay resolution. Considering this vote and following the annual review of our executive compensation philosophy, the Compensation Committee decided to retain our overall approach to executive compensation. Moreover, in determining how often to hold a stockholder advisory vote on named executive officer compensation, the Board took into account our stockholders’ preference (approximately 86% of votes cast) for an annual vote at the 2011 Annual Meeting of Stockholders. Specifically, the Board determined that we will hold an annual advisory stockholder vote on our named executive officer compensation until considering the results of our next Say on Pay frequency vote.

Objectives of our Executive Compensation Program

Our Company’s mission is to discover, develop and commercialize novel therapeutics that may significantly improve cancer treatment options for patients. To achieve this mission, we seek to attract and retain the most talented executive officers and employees, reward them for helping achieve our business objectives and motivate them to enhance long-term stockholder value by achieving our financial, product commercialization, research and development and other corporate goals.

The goals of our executive compensation program closely align executive pay with achieving our Company’s business objectives and corporate performance. Each year, if we achieve our corporate objectives, our executive compensation program will reward our named executive officers for their role in helping us succeed in reaching our goals through successful completion of their responsibilities. We also expect that compensation for

16

our executive officers will be less in years in which we do not achieve all of our corporate objectives. The Company’s focus during 2011 continued to heavily emphasize the successful commercialization of PROVENGE and revenue growth related targets, as well as market expansion and new product development. Our executive compensation performance objectives for 2011 were based solely on corporate goals, which we believe most directly aligns the interests of our executive officers with the interests of our stockholders.

This Compensation Discussion and Analysis explains our executive pay program as it relates to the following executive officers, including all individuals who served as Chief Executive Officer or Chief Financial Officer during the last fiscal year, the three other most highly compensated executive officers who were serving as executive officers at the end of the last fiscal year and two additional individuals who were no longer serving as executive officers as of the end of the last fiscal year (named executive officers). Compensation information for the named executive officers is presented in the tables following this discussion in accordance with SEC rules, and stockholders are being asked to approve their compensation in an advisory (non-binding) vote discussed in Proposal 3 below:

| | |

Mitchell H. Gold, M.D.(1) | | (Former) President and Chief Executive Officer |

| |

Gregory T. Schiffman | | Executive Vice President, Chief Financial Officer and Treasurer |

| |

Hans E. Bishop(2) | | (Former) Executive Vice President and Chief Operating Officer |

| |

Mark W. Frohlich, M.D. | | Executive Vice President, Research and Development and Chief Medical Officer |

| |

Richard F. Hamm, Jr.(3) | | (Former) Executive Vice President, General Counsel and Secretary |

| |

John E. Osborn(4) | | (Former) Executive Vice President, General Counsel and Secretary |

Richard J. Ranieri | | Executive Vice President, Human Resources |

| (1) | Dr. Gold resigned from his position as President and Chief Executive Officer in January 2012, at which time Mr. John Johnson joined the Company as President and Chief Executive Officer. Dr. Gold will continue with the Company as Executive Chairman until June 30, 2012. |

| (2) | Mr. Bishop left his position as Executive Vice President and Chief Operating Officer in September 2011. |

| (3) | Mr. Hamm left his position as Executive Vice President and General Counsel in June 2011. |

| (4) | Mr. Osborn left his position as Executive Vice President and General Counsel in February 2012, but will continue to be employed in an executive advisory role until June 30, 2012. |

Role of Our Compensation Committee

Our Company’s compensation policies and practices are developed by the Compensation Committee and implemented by our Board of Directors upon the recommendation of the Compensation Committee. The Compensation Committee’s responsibility is to review and consider management performance in achieving our corporate goals and to ensure that our Company’s compensation policies and practices are competitive and effective to motivate management, while avoiding inappropriate compensation-based risk. The authority and responsibilities of the Compensation Committee are set forth in its charter and include:

| | • | | taking any and all actions that have been delegated by our Board of Directors with respect to determining the compensation of officers and employees of our Company; |

| | • | | proposing the adoption, amendment and termination of equity incentive plans, stock purchase plans, and tax-qualified profit sharing plans, and other similar programs, which we refer to as our compensation plans; |

| | • | | determining participation in and granting awards under our compensation plans; and |

| | • | | reviewing, advising and approving such other compensation matters as our Board of Directors may wish. |

17

Our Compensation Committee also considers the results of any stockholder advisory votes to approve the compensation of our named executive officers. Our Compensation Committee met nine times in 2011. The Compensation Committee held discussions with senior management, approved compensation plan awards, reviewed and established our corporate objectives, which are also approved by the Board of Directors, and reviewed the elements and structure of the total compensation packages for our executive officers for 2011.

Role of our Compensation Consultant and Benchmarking Practices for 2011 Compensation Decisions

Independent Compensation Consultant

In 2011, the Compensation Committee retained the services of an external compensation consultant, Mercer. The mandate of the consultant was to assist the Compensation Committee in its review of executive compensation practices, including the competitiveness of pay levels, retention programs, executive compensation design issues, market trends, and technical considerations. The Compensation Committee regularly evaluated Mercer’s performance and has the final authority to engage and terminate Mercer.