UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to§240.14a-12 |

DENDREON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

DENDREON CORPORATION

1301 2nd Ave.

Seattle, Washington 98101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 15, 2014

The Annual Meeting of Stockholders (the “Annual Meeting”) of Dendreon Corporation, a Delaware corporation (“Dendreon” or the “Company”), will be held on Thursday, May 15, 2014, at 9:00 a.m., Eastern Time, at the Bridgewater Marriott, 700 Commons Way, Bridgewater, New Jersey 08807, for the following purposes:

(1) To elect the nominee named in the attached proxy statement as a member of the Company’s Board of Directors to serve as a Class II director until the 2017 Annual Meeting of Stockholders;

(2) To approve an amendment to the Dendreon Corporation 2009 Equity Incentive Plan to increase the individual limits and the number of shares authorized for issuance thereunder from 22,200,000 to 32,000,000;

(3) To approve, on an advisory basis, the compensation of the Company’s named executive officers;

(4) To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014;

(5) To consider the stockholder proposal described in the attached proxy statement, if properly presented at the meeting; and

(6) To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on April 2, 2014 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether you expect to attend the Annual Meeting or not, please vote as soon as possible using one of the following methods: (1) by using the Internet as instructed on the proxy card; (2) by telephone by calling the toll-free number as instructed on the proxy card; or (3) if you receive a paper proxy card in the mail, by completing, signing, dating and returning the proxy card in accordance with its instructions. Your prompt response is necessary to ensure that your shares are represented at the Annual Meeting. If you vote in advance of the Annual Meeting using the Internet, telephone or proxy card, you can change your vote and revoke your proxy at any time before the polls close at the Annual Meeting by following the procedures described in the accompanying proxy statement.

By Order of the Board of Directors,

John Johnson

Chairman, Presidentand Chief Executive Officer

April 18, 2014

TABLE OF CONTENTS

i

Proxy Statement Summary

This summary highlights the information in the attached proxy statement, including information regarding the Company’s business performance, executive compensation decisions, governance highlights and voting matters. For more information and before you vote, please review the entire proxy statement.

This past year, Dendreon achieved several operational successes but also encountered many challenges, including difficulties in commercializing PROVENGE®, our personalized immunotherapy to treat prostate cancer. However, Dendreon sustained significant revenue levels from the sale of PROVENGE, with $283.7 million in net revenue in 2013. In addition, the European Commission authorized its marketing in all 28 countries of the E.U., as well as Norway, Iceland and Liechtenstein.

In 2012, we recruited John Johnson as Chief Executive Officer to bolster the commercialization of PROVENGE. Over the past year, Mr. Johnson has been applying his commercial experience to strengthen sales of PROVENGE by aligning our cost structure and internal infrastructure, improving operating efficiencies and cost of goods sold and identifying strategic business development opportunities to provide a stable foundation for future stockholder value enhancement.

| | Executive | Compensation Changes |

Because all of our 2013 business development changes are directly or indirectly aimed at enhancing stockholder value, we have tied executive annual bonus awards to the achievement of corporate objectives and added performance-based equity to further align management and stockholder interests. In 2013, annual bonuses and performance-based equity were awarded at 57% of target given partial achievement of our corporate goals.

In 2013, we also made several changes to our executive pay program to respond to stockholder feedback we received after our 2013 say on pay vote. Because only 31% of stockholders supported our executives’ 2012 compensation, the Board of Directors and Compensation Committee reached out to our top stockholders to understand their concerns. The principal changes to our pay program and governance policies include the following:

| | | | | | |

| Significant Actions Taken in Response to 2013 Say on Pay Vote |

| Changes Going Forward | | Effective | | | Referenced on Page |

| | |

Altered long-term incentive mix to include 50% performance-based equity | | | 2013 | | | 33 |

| | | | | | |

| | |

Added a 3-year modifier to decrease equity grants up to 25% if performance goals are not met | | | 2014 | | | 34 |

| | | | | | |

| | |

Enhanced disclosure of short- and long-term performance targets | | | 2014 | | | 31-32 |

| | | | | | |

| | |

Adopted a clawback policy | | | 2014 | | | 35 |

| | | | | | |

| | |

Adopted an anti-hedging policy/disclosed anti-pledging policy | | | 2014 | | | 35 |

| | | | | | |

| | |

Adopted executive stock ownership guidelines | | | 2014 | | | 34 |

| | | | | | |

| | |

Enhanced disclosure to better explain our compensation programs | | | 2014 | | | 20-34 |

1

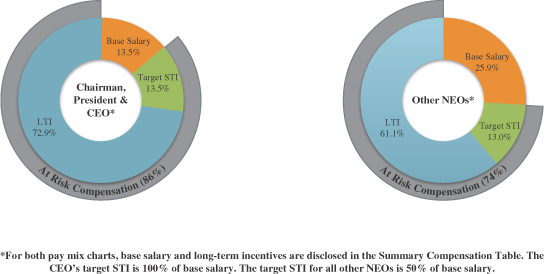

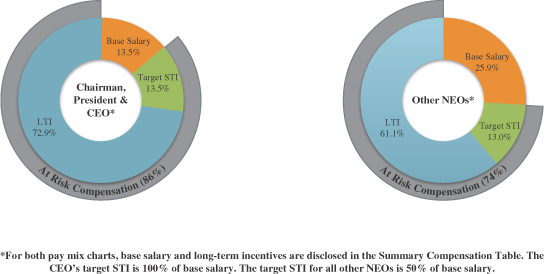

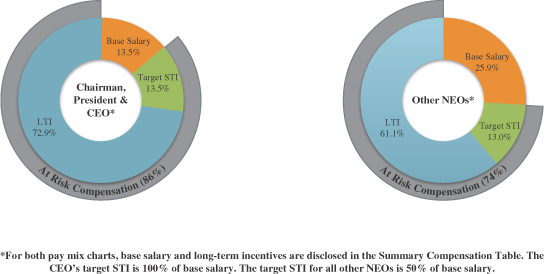

Our executive compensation philosophy is to pay for performance. We designed our executive compensation program to attract and retain the most talented executive officers and motivate them to enhance long-term stockholder value by achieving our financial, product commercialization, research and development and other corporate goals. Accordingly, while we pay competitive base salaries and provide other benefits, the majority of our named executive officers’ compensation opportunity is based on variable pay, thereby aligning their interests with those of our stockholders as set forth in the following charts.

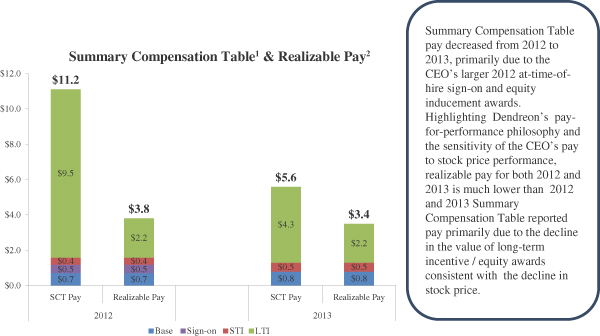

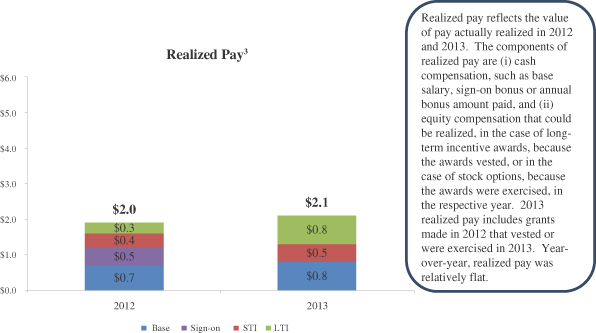

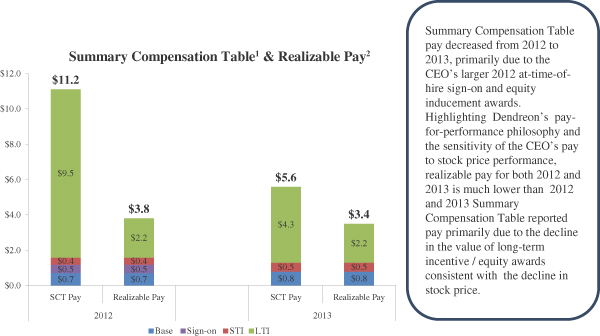

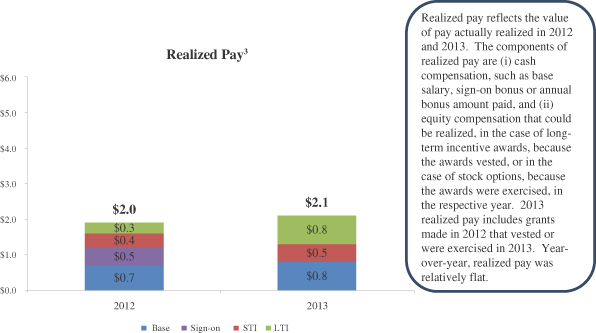

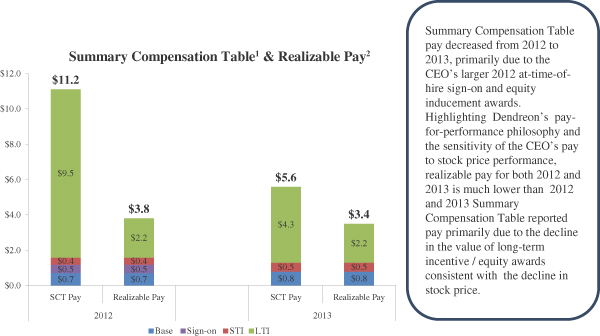

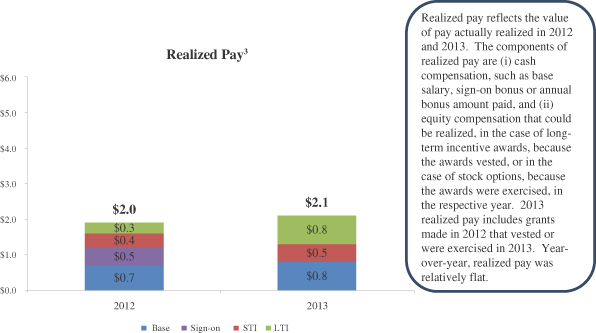

Consistent with our pay for performance philosophy, compensation amounts granted and disclosed in the Summary Compensation Table will not be realized by executives if performance goals are not met. To assess our pay for performance alignment, we look at realizable and realized compensation. Realizable pay reflects the actual current value of outstanding long-term incentive awards. Realized pay reflects the actual value of awards that actually vested, or in the case of options, were exercised, during the year. The graph below shows the difference between the compensation reported in the Summary Compensation Table, realizable pay, and realized pay for 2012 and 2013 for the CEO. For more information, see pages 21 and 22.

2

(1) Summary Compensation Table pay includes; (i) base salary, (ii) sign-on bonus, (iii) actual annual incentive earned (or “STI” in the chart), and (iv) the grant date fair value of long-term equity compensation (or “LTI” in the chart), each as reported in the Summary Compensation Table for the applicable year.

(2) Realizable pay includes; (i) base salary and (ii) sign-on bonus, (iii) actual annual incentive earned (or “STI” in the chart), each as reported in the Summary Compensation Table for the applicable year, and (iv) long-term equity (or “LTI” in the chart) value reflecting the Black-Scholes value of outstanding (vested and unvested) option awards, calculated based on the stock price at the end of 2013 ($2.99) plus the value of vested and unvested restricted stock awards (time-based and performance-based) less forfeited shares , calculated based on the stock price at the end of 2013.

(3) Realized pay includes; (i) base salary and (ii) sign-on bonus, (iii) actual annual incentive earned (or “STI” in the chart), each as reported in the Summary Compensation Table for the applicable year, and (iv) the in-the-money value of any option awards exercised in the applicable year plus the value of any restricted stock awards (time-based and performance-based), that vested in the applicable year (both options and restricted stock are included in “LTI” in the chart), calculated based on the stock price as of the vesting date.

3

Pay Policies and Practices

|

| |

Continuing Pay and Governance Practices |

|

“Double trigger” provisions for the acceleration of vesting of outstanding equity following a change in control and qualifying termination |

|

|

|

No golden parachute excise tax gross-ups provided to any employee |

|

|

|

| Compensation plans that strive to pay out at median for target performance achievement with total compensation above the median for superior or extraordinary performance and below the median for below target performance |

|

|

|

| Limited perquisites for our named executive officers, comprised of payment for executive disability insurance premiums and matching on our 401(k) plan |

|

|

|

| Consideration of risk when designing our compensation plans |

|

|

|

An independent compensation committee |

Governance Highlights

| | |

| |

Governance Element | | Explanation |

| |

Board independence | | Majority of independent directors |

| |

Independent committees | | Audit, Compensation and Corporate Governance |

| |

Board leadership structure | | Combined chair/CEO and lead independent director |

| |

Risk oversight | | Board and board committee oversight and management of risk by Audit, Compensation and Corporate Governance Committees |

| |

Voting standard for board elections | | Majority of votes cast |

| |

Board structure | | Classified with three classes of directors |

| |

Independent board and committee meetings | | Board and committee members meet in executive session at the majority of their meetings |

4

Meeting Agenda and Voting Recommendations

| | | | | | | | | | |

| | |

Voting Matters | | Board Recommendation | | | Page

Reference | |

| 1. | | To elect the nominee named in the attached proxy statement as a member of the Company’s Board of Directors to serve as a Class II director until the 2017 Annual Meeting of Stockholders | | | FOR | | | | 10 | |

| 2. | | To approve an amendment to the Dendreon Corporation 2009 Equity Incentive Plan to increase the individual limits and the number of shares authorized for issuance thereunder from 22,200,000 to 32,000,000 | | | FOR | | | | 52-61 | |

| 3. | | To approve, on an advisory basis, the compensation of the Company’s named executive officers | | | FOR | | | | 63 | |

| 4. | | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014 | | | FOR | | | | 64 | |

| 5. | | To consider the stockholder proposal described in the attached proxy statement, if properly presented at the meeting | | | VOTE | (1) | | | 66-67 | |

| 6. | | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof | | | | | | | | |

| | (1) | We received this stockholder proposal from UAW Retiree Medical Benefits Trust, and if it is properly presented at the meeting, the proposal will be voted upon by stockholders. The Board of Directors is interested in your views regarding the proposal. The Board of Directors has considered this proposal and has determined not to make a recommendation either in favor of or opposed to the proposal. The proposal, which is advisory in nature, would constitute a recommendation to the Board of Directors, if approved by stockholders, for the annual election of directors. The Board of Directors intends to follow the determination of its stockholders with respect to this proposal. |

5

DENDREON CORPORATION

1301 2nd Ave.

Seattle, Washington 98101

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 15, 2014

INFORMATION CONCERNING SOLICITATION AND VOTING

General

Your proxy is solicited on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Dendreon Corporation, a Delaware corporation (“Dendreon”, the “Company”, “we”, “us”, or “our”), for use at the Annual Meeting of Stockholders (the “Annual Meeting”), to be held on May 15, 2014, at 9:00 a.m., Eastern Time, and at any adjournments or postponements thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at the Bridgewater Marriott, 700 Commons Way, Bridgewater, New Jersey 08807. You may obtain directions to the location of the Annual Meeting by contacting Investor Relations, Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101; telephone: (206) 455-2220.

On or about April 21, 2014, we are either mailing or providing notice and electronic delivery of these proxy materials together with our Annual Report on Form 10-K (excluding exhibits) for the fiscal year ended December 31, 2013, and other information required by the rules of the Securities and Exchange Commission (the “SEC”).

Important Notice Regarding the Availability of Proxy Materials for the

2014 Annual Meeting of Stockholders to be Held on May 15, 2014:

This proxy statement and the 2013 Annual Report to Stockholders are available for viewing, printing and downloading atwww.edocumentview.com/dndn.

You may obtain a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as filed with the SEC, except for exhibits thereto, without charge upon written request to Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101, Attn: Investor Relations. Exhibits will be provided upon written request and payment of an appropriate processing fee.

Voting Rights and Outstanding Shares

Only holders of record of our common stock, par value $0.001 per share (“Common Stock”), at the close of business on April 2, 2014 (the “Record Date”) will be eligible to vote at the Annual Meeting. As of the Record Date, there were 160,055,271 shares of Common Stock outstanding. Each stockholder will be entitled to one vote for each share owned. Stockholders have no right to cumulative voting as to any matter to be voted on at the Annual Meeting. A list of stockholders of record will be open to the examination of any stockholder for any purpose germane to the Annual Meeting at Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101, for a period of ten days prior to the Annual Meeting.

Matters to be Voted On; Votes Required

In accordance with our Amended and Restated Bylaws, the affirmative vote of a majority of the votes duly cast at the Annual Meeting is required for the election of the director nominee (Proposal 1). In the event that any of the director nominees fails to receive the required vote, the subject director is required to tender his or her resignation to the Board of Directors in accordance with our Amended and Restated Bylaws and our Policy Statement on Majority Voting, as adopted by the Board of Directors on December 1, 2011 and available athttp://investor.dendreon.com/governance.cfm.

Approval of the amendment to our 2009 Equity Incentive Plan (Proposal 2), approval of the advisory vote on the compensation of the Company’s named executive officers (Proposal 3), the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 4), and approval of the advisory vote on the stockholder proposal to repeal the

6

classified board (Proposal 5) each requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter.

Although the advisory vote on the compensation of the Company’s named executive officers, the vote on the ratification of the Company’s independent registered public accounting firm, and the advisory vote on the stockholder proposal to repeal the classified board are non-binding, as provided by law, our Board of Directors values stockholders’ opinions and will take the results of the votes into account when considering any changes to our executive compensation program, the selection of the Company’s independent registered public accounting firm and the stockholder proposal to repeal the classified board, respectively.

Quorum, Abstention and Broker Non-Votes

The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person or by proxy to constitute a quorum for any business to be transacted at the Annual Meeting. Properly executed proxies marked “abstain” and “broker non-votes” will be considered “present” for purposes of determining whether a quorum is present at the Annual Meeting.

If the shares you own are held in “street name” by a broker, bank or other nominee, then your broker, bank or other nominee, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the instructions your broker, bank or other nominee provides you. If you do not give instructions to your broker, bank or other nominee, it will still be able to vote your shares with respect to “discretionary” items, but will not be allowed to vote your shares with respect to “non-discretionary” items. Of the proposals to be considered at the Annual Meeting, only the ratification of the selection of our independent registered public accounting firm (Proposal 4) is a discretionary item. Accordingly, your broker, bank or other nominee may exercise its discretionary authority with respect to the ratification of the selection of our independent registered public accounting firm if you do not provide voting instructions. “Broker non-votes” occur when certain nominees holding shares for beneficial owners do not vote those shares on a particular proposal because the nominees do not have discretionary authority to do so and have not received voting instructions with respect to the proposal from the beneficial owners.

For purposes of calculating votes in the election of the director nominee (Proposal 1), broker non-votes and abstentions will not be counted as votes and will not affect the results of the vote. For purposes of calculating votes for the approval of the amendment to our 2009 Equity Incentive Plan (Proposal 2), the advisory vote on the compensation of the Company’s named executive officers (Proposal 3), and the advisory vote on the stockholder proposal to repeal the classified board (Proposal 5), broker non-votes will not be counted as votes and will not affect the outcome of the votes for these matters. Because abstentions are considered present and entitled to vote on the matters, abstentions will have the same effect as a vote against the approval of the amendment to our 2009 Equity Incentive Plan, the approval of the advisory vote on compensation of the Company’s named executive officers, the ratification of our independent registered public accounting firm, and approval of the advisory vote on the stockholder proposal to repeal the classified board. For purposes of ratifying our independent registered public accounting firm, brokers have discretionary authority to vote and a broker non-vote on this proposal will have the same effect as a vote against the ratification of our independent registered public accounting firm.

Methods of Voting; Changing Votes

Stockholder of record; Shares registered in your name. If you are a stockholder of record, that is, your shares are registered in your own name, not in “street name” by a broker, bank or other nominee, and you received a Notice of Internet Availability of Proxy Materials, the Notice of Internet Availability of Proxy Materials will contain instructions on how to access and review the proxy materials online and how to obtain a paper or electronic copy of the proxy materials, which will include the proxy statement, a proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as well as instructions on how to vote either in person at the Annual Meeting, via the Internet, by telephone or by mail. If you are a stockholder of record and you received a paper copy of these proxy materials, you can vote your shares of our Common Stock using any of the following means:

| | • | | Voting by Proxy Cards. A stockholder may vote shares by returning a duly completed and executed proxy card to Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101, Attention: Corporate |

7

| | Secretary. All proxy cards received by us that have been properly signed and have not been revoked will be voted in accordance with the instructions contained in the proxy cards. If a signed proxy card is received which does not specify a vote or an abstention, the shares represented by that proxy card will be voted “For” the election of the director nominee listed on the proxy card to our Board of Directors (Proposal 1), “For” the approval of the amendment to our 2009 Equity Incentive Plan (Proposal 2), “For” the approval, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 3), “For” the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 4), and “Abstain” with respect to the stockholder proposal to repeal the classified board (Proposal 5). |

| | • | | Voting by Telephone or Internet. A stockholder may vote shares until 11:59 p.m. Eastern Time on May 14, 2014 by calling the toll-free number indicated on the proxy card and following the recorded instructions or by accessing the website indicated on the proxy card and following the instructions provided. When a stockholder votes by telephone or Internet, his, her or its vote is recorded immediately. |

| | • | | Voting by Attending the Annual Meeting. A stockholder may vote shares in person at the Annual Meeting. A stockholder planning to attend the Annual Meeting should bring proof of identification. Prior notice of a stockholder’s intention to attend is appreciated and may be provided by contacting Investor Relations at (206) 455-2220 or IR@Dendreon.com. If a stockholder attends the Annual Meeting, he, she or it may also submit his, her or its vote in person, and any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the Annual Meeting. Further, if the shares are held of record by a broker, bank or other nominee and a stockholder wishes to vote at the Annual Meeting, he, she or it must obtain a proxy issued in his, her or its name from the record holder in accordance with the materials and instructions for voting provided by his, her or its broker, bank or other nominee. |

Beneficial owner: Shares held in “street name.” If the shares you own are held in “street name”, then you may vote in accordance with the materials and instructions for voting the shares provided by your broker, bank or other nominee. If you wish to vote shares held in “street name” at the Annual Meeting, then you must obtain a proxy from your broker, bank or other nominee in order to vote your shares at the Annual Meeting in accordance with the materials and instructions for voting provided by your broker, bank or other nominee. If you do not vote by proxy or otherwise give voting instructions to your broker, bank or other nominee, such shares willnot be voted by the broker, bank or other nominee for the election of directors, the approval of the amendment to our 2009 Equity Incentive Plan, the approval of, on an advisory basis, of the compensation of the Company’s named executive officers, or approval of, on an advisory basis, the stockholder proposal to repeal the classified board.

Changing Votes. You may change your vote and revoke your earlier proxy at any time before it is exercised at the Annual Meeting by (1) delivering a proxy revocation or another duly executed proxy bearing a later date to Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101, Attention: Corporate Secretary; (2) voting again by telephone or Internet in the manner described above; or (3) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not revoke a proxy unless you actually vote in person at the Annual Meeting. If you own shares in “street name” and want to revoke or change your vote after returning voting instructions to your broker, bank or other nominee, you may do so in accordance with the materials and instructions provided by your broker, bank or other nominee or by contacting such broker, bank or other nominee to effect the revocation or change of vote.

Counting of Votes

Computershare Shareowner Services LLC, the transfer agent and registrar for our Common Stock, will count, tabulate and certify the votes cast at the Annual Meeting. A representative of Computershare Shareowner Services LLC will serve as inspector of elections at the Annual Meeting.

Stockholder Proposals

In order for stockholders to nominate an individual for election to the Board of Directors or propose other business to be taken at the Annual Meeting, each stockholder’s notice must contain certain prescribed information required by our Amended and Restated Bylaws as to each matter the stockholder proposes to bring

8

before any Annual Meeting, as well as a representation whether the stockholder intends to deliver a proxy statement and/or form of proxy to holders of at least the percentage of our outstanding capital stock required to approve the nomination or proposal and/or otherwise to solicit proxies from stockholders in support of the nomination or proposal. The full text of the provisions of our Amended and Restated Bylaws dealing with stockholder nominations and proposals is available on our website and the SEC’s website, free of charge, athttp://www.sec.gov. In addition, a copy of the full text of our Amended and Restated Bylaws may be obtained from our Corporate Secretary upon written request.

Under the SEC’s rules, stockholders who wish to submit proposals for inclusion in the proxy statement of our Board of Directors for the 2015 Annual Meeting of Stockholders must submit such proposals so that they are received by us at 1301 2nd Ave., Seattle, Washington 98101, on or before December 22, 2014. If the date of next year’s Annual Meeting is changed by more than 30 days from the anniversary date of this year’s Annual Meeting on May 15, then the deadline is a reasonable time before we begin to print and send proxy materials.

Stockholders who do not wish to use the mechanism provided by the rules of the SEC in proposing a matter for action at the next Annual Meeting must notify us in writing of the proposal or nomination for election to our Board of Directors and the information required by the provisions of our Amended and Restated Bylaws dealing with advance notice of stockholder proposals and director nominations. Pursuant to the advance notice provision of our Amended and Restated Bylaws, the notice must be submitted in writing to us not less than 90 days nor more than 120 days before the first anniversary of the previous year’s Annual Meeting. However, if the date of the Annual Meeting is advanced by more than 30 days, or delayed by more than 30 days, from the anniversary date, then we must receive such notice at the address noted above not earlier than the close of business on the 120th day before such Annual Meeting and not later than the close of business on the later of (1) the 90th day before such Annual Meeting or (2) the tenth day after the date on which public announcement of the date of such Annual Meeting is made. Assuming that our 2015 Annual Meeting of Stockholders is not advanced by more than 30 days nor delayed by more than 30 days from the anniversary date of the Annual Meeting, any nomination or stockholder proposal for next year’s Annual Meeting submitted to us on or between January 15, 2015 and February 14, 2015 will be considered filed on a timely basis.

Solicitation

We will bear the cost of the solicitation of proxies for the Annual Meeting, including preparation of this proxy statement, the proxy card and any additional information furnished to stockholders, including any mailing charges. We have retained the services of MacKenzie Partners Inc. to assist in the solicitation of proxies. We expect to pay approximately $15,000 for these services, plus out-of-pocket expenses. We will, upon request, furnish hard copies of the solicitation materials to record holders of our Common Stock as well as forward materials to beneficial holders upon instruction by banks, brokerage houses, fiduciaries and custodians who are record holders of our Common Stock. We may, on request, reimburse persons representing beneficial owners of our Common Stock for their costs of forwarding solicitation materials to beneficial owners. Proxies may be solicited by telephone, facsimile or personal solicitation. No additional compensation will be paid to our directors, officers or other employees for such services.

Householding of Annual Meeting Materials

Some brokers, banks and other nominee record holders may be participating in the practice of “householding” proxy statements, annual reports and Notices of Internet Availability of Proxy Materials. This means that only one copy of our proxy statement, annual report or Notice of Internet Availability of Proxy Materials may be sent to multiple stockholders in a household, which helps us reduce our printing costs and postage fees and helps the environment by using less paper. However, we will promptly deliver a separate copy of these documents to you if you write, email or call our Investor Relations department at 1301 2nd Ave., Seattle, Washington 98101, email: ir@dendreon.com, or telephone: (206) 455-2220. If you want to receive separate copies of the proxy statement, annual report or Notice of Internet Availability of Proxy Materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your broker, bank, or other nominee record holder, or you may contact us at the above address, email or phone number.

9

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is currently composed of seven members. Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide for the division of our Board of Directors into three classes, with each class consisting, as nearly as possible, of one-third of the total number of directors, and with each class having a three-year term. Our Board of Directors currently consists of two Class I directors, one Class II director and four Class III directors. The Class I, Class II and Class III directors were elected to serve until the Company’s annual meeting of stockholders to be held in 2016, 2014 and 2015, respectively, and until their respective successors are elected and qualified or until his or her earlier death, resignation or removal.

At the Annual Meeting, our stockholders will have an opportunity to vote for David C. Stump, M.D. as a nominee for Class II director. Pedro Granadillo, a Class II director, resigned from the Board of Directors on March 4, 2014. Proxies cannot be voted for a greater number of persons than the number of nominees named. Dr. Stump is currently a director of the Company and was previously elected as a director by stockholders of the Company. If elected at the Annual Meeting, Dr. Stump would each serve until the 2017 Annual Meeting and until his successor is elected and has been duly qualified, or until his earlier death, resignation or removal.

Directors are elected by the affirmative vote of a majority of the votes cast, present in person or represented by proxy and entitled to vote at the Annual Meeting. In the event that any of the director nominees fails to receive the required vote, the subject director is required to tender his resignation to the Board in accordance with our Amended and Restated Bylaws and our Policy Statement on Majority Voting, as adopted by the Board of Directors on December 1, 2011 athttp://investor.dendreon.com/governance.cfm. In the event that any nominee should become unable to serve as a director, such shares will be voted for the election of such substitute nominee, if any, as the Board of Directors may propose. Each person nominated for election has agreed to serve if elected, and our Board of Directors has no reason to believe that any nominee will be unable to serve.

Set forth below is biographical information for Dr. Stump and each person whose term of office as a director will continue after the Annual Meeting. The information presented includes information each director has given us about their ages, all positions they hold, their principal occupation and business experience for the past five years, and the names of other publicly-held companies of which they currently serve as a director or have served as a director during the past five years. In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Corporate Governance Committee and our Board of Directors to conclude that he or she should serve as a director, we also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our Company and our Board of Directors. No corporation or organization referred to below is a subsidiary or other affiliate of ours. All our directors bring to our Board a wealth of executive leadership experience derived from their diverse backgrounds.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR”

THE ELECTION OF THE NOMINEE FOR CLASS II DIRECTOR.

10

Nominee for Election for a Three-Year Term Expiring at the 2017 Annual Meeting (Class II Director)

David C. Stump, M.D.,age 64, has served as a member of our Board of Directors since June 2010. Dr. Stump was most recently at Human Genome Sciences, Inc. from November 1999 until December 2012. He served as Executive Vice President of Research and Development at Human Genome Sciences, Inc., a biopharmaceutical company, from May 2007 to December 2012, Executive Vice President of Drug Development from December 2003 to May 2007, and Senior Vice President, Drug Development from November 1999 to December 2003. Prior to joining Human Genome Sciences, Inc., Dr. Stump held several positions at Genentech, Inc., including Vice President of Clinical Research, and was named a Genentech Fellow in 1996 for leadership of its cardiovascular drug development activities. Prior to Genentech, Dr. Stump served as Associate Professor of Medicine and Biochemistry at the University of Vermont. He is currently a member of the Board of Directors for Sunesis Pharmaceuticals, Inc., a publicly traded pharmaceutical company, and MacroGenics, Inc., a publicly traded biopharmaceutical company. Dr. Stump also serves on the Board of Trustees for Earlham College. He received his M.D. from Indiana University and his bachelor’s degree from Earlham College. Dr. Stump completed his residency and fellowship training in internal medicine, hematology, and oncology at the University of Iowa and is board certified in all three areas. Dr. Stump’s medical and scientific background, as well as his leadership roles at leading biotech and pharmaceutical companies, provide him with expertise and qualifications to serve as a member of our Board.

Directors Continuing in Office until the 2015 Annual Meeting (Class III Directors)

John H. Johnson,age 56, has served as a member of our Board of Directors since August 2011, and was named Chair in July 2012. He has also served as our President and Chief Executive Officer since January 2012. Mr. Johnson previously served as the Chief Executive Officer and a director of Savient Pharmaceuticals, Inc., a pharmaceutical company, from January 2011 until January 2012, and prior to that time, served as Senior Vice President and President of Eli Lilly and Company’s Oncology unit from November 2009 until January 2011. He was also Chief Executive Officer of ImClone Systems Incorporated (“ImClone”), which develops targeted biologic cancer treatments, from August 2007 until November 2009, and served on ImClone’s Board of Directors until it was acquired by Eli Lilly in November 2008. Prior to joining ImClone, Mr. Johnson served as Company Group Chairman of Johnson & Johnson’s Worldwide Biopharmaceuticals unit from 2005 until August 2007, President of its Ortho Biotech Products LP and Ortho Biotech Canada unit from 2003 until 2005, and Worldwide Vice President of its CNS, Pharmaceuticals Group Strategic unit from 2001 until 2003. Prior to joining Johnson & Johnson, he also held several executive positions at Parkstone Medical Information Systems, Inc., Ortho-McNeil Pharmaceutical Corporation and Pfizer, Inc. Mr. Johnson currently serves on the Board of Directors of Cempra, Inc., a publicly traded clinical stage pharmaceutical company, and the Board of Directors of Portola Pharmaceuticals, Inc., a publicly traded pharmaceutical company. Mr. Johnson served as the Chairman of the Board of Directors of Tranzyme, Inc., a clinical stage biopharmaceutical company, from 2010 to 2013. He earned his bachelor’s degree from the East Stroudsburg University of Pennsylvania. Mr. Johnson’s dual role as an executive officer and director of Dendreon Corporation gives him unique insights into the day-to-day operations of our Company, a practical understanding of the issues and opportunities that face the Company, and its strategic planning, commercial growth, and strategic transactions, giving him the appropriate and valuable qualifications to serve as a member of our Board.

Susan B. Bayh, age 54, has served as a member of our Board of Directors since our acquisition of Corvas International, Inc. (“Corvas”), a biotechnology company, in July 2003. Prior to that, she served as a director of Corvas from June 2000 to July 2003. Ms. Bayh, retired since 2004, was a Distinguished Visiting Professor at the College of Business Administration at Butler University in Indianapolis, Indiana from 1994 to 2004. From 1994 to 2001, she was a Commissioner for the International Commission between the United States and Canada, overseeing compliance with environmental and water level treaties for the United States-Canada border. From 1989 to 1994, Ms. Bayh served as an attorney in the Pharmaceutical Division of Eli Lilly and Company. She currently serves on the Board of Directors of Emmis Communications, a diversified media company, and previously served on the Board of Directors of Dyax Corp., a biotechnology company, from 2003 to March 2012, MDRNA,Inc. (formerly Nastech Pharmaceutical Company Inc.), a biotechnology company, from 2006 to 2009, Wellpoint, Inc., a health benefits company, from 2001 to 2013, and Curis, Inc., a therapeutic drug development company, from 2000 to 2013. Ms. Bayh received a B.S. from the University of California, Berkeley and her J.D. from the

11

University of Southern California Law School. Ms. Bayh’s service on multiple healthcare, pharmaceutical and biotechnology company boards, as well as her academic, international and regulatory experience, give her the skills and appropriate qualifications to serve as a member of our Board.

Dennis M. Fenton, Ph.D.,age 62, has served as a member of our Board of Directors since November 2011. Dr. Fenton, who retired in 2008, previously held numerous positions from 1982 to 2008 at Amgen, Inc., a biotechnology company, including executive roles in process development, manufacturing, sales and marketing and research and development. From 2000 until 2008, Dr. Fenton was Executive Vice President responsible for worldwide operations, manufacturing, process development and quality. From 1995 until 2000, Dr. Fenton was Senior Vice President of Operations, and from 1992 until 1995, he was Senior Vice President of Sales, Marketing and Process Development. Prior to his time at Amgen, Inc., Dr. Fenton served as Senior Research Scientist at Pfizer, Inc., and previously was a research associate and graduate student at Rutgers University. Dr. Fenton currently serves as a member of the Board of Directors at Hospira Inc., a publicly traded biopharmaceutical company, XenoPort, Inc., a publicly traded biopharmaceutical company, Kythera Biopharmaceuticals, Inc., a publicly traded biopharmaceutical company, and Nora Therapeutics, a biopharmaceutical company. He previously served on the Board of Directors of Genelux Corporation, a biomedical company, from 2011 to 2013, and Napo Pharmaceuticals, Inc., a pharmaceutical company, from 2010 to 2014. Dr. Fenton received his B.S. in Biology from Manhattan College and his Ph.D. in Microbiology from Rutgers University. Dr. Fenton’s extensive experience in development, operations and sales and marketing gives him the appropriate and valuable qualifications to serve as a member of our Board.

David L. Urdal, Ph.D., age 64, has served as a member of our Board of Directors since 1995. Until his retirement in December 2011, he served as our Executive Vice President and Chief Scientific Officer since December 2010, and previously served as our Chief Scientific Officer and director since joining the Company in July 1995. He also served as Vice Chair of the Company’s Board of Directors from 1995 to June 2004, as Executive Vice President from January 1999 through December 2000, as the Company’s President from January 2001 to December 2003, and as Senior Vice President from June 2004 until December 2010. From 1982 until July 1995, Dr. Urdal held various positions with Immunex Corporation, a biotechnology company, including President of Immunex Manufacturing Corporation, Vice President and Director of Development, and head of the departments of biochemistry and membrane biochemistry. Dr. Urdal previously served as a director of VLST, a biotechnology company, from 2008 to 2013, and ORE Pharmaceuticals, Inc., a pharmaceutical drug repositioning and development company, from 2007 until 2010. Dr. Urdal received a B.S. in zoology, a M.S. in Public Health and a Ph.D. in Biochemical Oncology from the University of Washington. Dr. Urdal’s biotechnology and pharmaceutical industry board and senior management experience, including his long-term senior management role with the Company, together with his scientific expertise and background give him the valuable and appropriate qualifications to serve as a member of our Board.

Directors Continuing in Office until the 2016 Annual Meeting (Class I Directors)

Bogdan Dziurzynski, D.P.A., age 65, has served as a member of our Board of Directors since May 2001. Since 2001, Dr. Dziurzynski has been a consultant in strategic regulatory management to the biotechnology industry. Dr. Dziurzynski currently serves on the Board of Directors of Anthera Pharmaceuticals Inc. and previously served on the Board of Directors of the Biologics Consulting Group and Allostera Pharma Inc. Dr. Dziurzynski is a fellow and past Chairman of the Board of the Regulatory Affairs Professional Society. From 1994 to 2001, Dr. Dziurzynski was the Senior Vice President of Regulatory Affairs and Quality Assurance for MedImmune, Inc., a biotechnology company. From 1988 to 1994, Dr. Dziurzynski was Vice President of Regulatory Affairs and Quality Assurance for Immunex Corporation, a biotechnology company. Dr. Dziurzynski has a B.A. in Psychology from Rutgers University, an M.B.A. from Seattle University and a Doctorate in Public Administration from the University of Southern California. Dr. Dziurzynski’s background and experience in biotechnology regulatory matters including the drug and device products approval process, product lifecycle management, product development and manufacturing, and all aspects of commercial product marketing, as well as his extensive period of board service and management roles within the industry give him the appropriate and pertinent qualifications to serve as a member of our Board.

12

Douglas G. Watson, age 69, has served as a member of our Board of Directors since February 2000 and was named Lead Independent Director in January 2012. Mr. Watson is Chief Executive Officer of Pittencrieff Glen Associates, a consulting firm that he founded in July 1999. From January 1997 to May 1999, Mr. Watson served as President and Chief Executive Officer of Novartis Corporation, the U.S. subsidiary of Novartis AG. From April 1996 to December 1996, Mr. Watson served as President and Chief Executive Officer of Ciba-Geigy Corporation, which merged into Novartis Corporation in December 1996. Mr. Watson’s career spanned 33 years with Novartis, having joined Geigy (UK) Ltd. in 1966. Mr. Watson also currently serves as Chairman of OraSure Technologies, Inc., a medical diagnostics company, and as a director of Delcath Systems, Inc., a specialty pharmaceutical and medical device company, and Wright Medical Group Inc., a specialty orthopedic company. Mr. Watson previously served on the Board of Directors of BioMimetic Therapeutics, Inc., a biotechnology company, from 1999 to March 2013, Genta Incorporated, a biopharmaceutical company, from 2002 to January 2011, Javelin Pharmaceuticals, Inc., a pharmaceutical company, from 2004 to 2010, and Engelhard Corporation, a surface and materials science company, from 1991 to 2006. Mr. Watson received an M.A. in Pure Mathematics from Churchill College, Cambridge University and holds an ACMA qualification as an Associate of the Chartered Institute of Management Accountants. Mr. Watson’s long-time and diverse experience in executive roles in the pharmaceutical industry, and board service in the biopharmaceuticals industry, together with his accounting background and financial expertise, give him the appropriate and valuable qualifications to serve as a member of our Board.

BOARD OF DIRECTORS

Director Independence

Under applicable NASDAQ rules, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors and Corporate Governance Committee has determined that none of Ms. Bayh, Dr. Dziurzynski, Dr. Fenton, Dr. Stump, and Mr. Watson has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 5605(a)(2) of the NASDAQ Stock Market listing rules. Mr. Gerardo Canet and Mr. Granadillo also served on the Board of Directors in 2013 and each was determined to be an “independent director” as defined under Rule 5605(a)(2) of the NASDAQ Stock Market listing rules.

In making its independence determinations, the Corporate Governance Committee each year reviews any transactions and relationships between the director, or any member of his or her immediate family, and the Company, and bases the determination on information provided by the director, Company records and publicly available information during the year. Specifically, the Corporate Governance Committee will consider the following types of relationships and transactions: (1) principal employment of and other public company directorships held by each non-employee director; (2) contracts or arrangements that are ongoing or that existed during any of the past three fiscal years between our Company and any entity for which the non-employee director, or his or her immediate family member, is an executive officer or greater-than-10% stockholder; and (3) contracts or arrangements that are ongoing or that existed during any of the past three fiscal years between our Company and any other public company for which the non-employee director serves as a director. During 2013, there were no material relationships or transactions in these categories reviewed by the Corporate Governance Committee, nor were there any other similar relationships or transactions that the Corporate Governance Committee considered.

Board of Directors Meetings

Our Board of Directors held thirteen meetings in fiscal 2013. In fiscal 2013, each of our current directors attended at least 75% of the aggregate number of meetings of the Board and the number of meetings held by all committees on which he or she then served. We encourage but do not require the directors to attend the Company’s Annual Meeting. We schedule a regular meeting of the Board of Directors immediately following each

13

annual meeting of stockholders. Six of our seven current directors attended the Company’s 2013 annual meeting of stockholders.

Committees of the Board of Directors

Our Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance Committee, each of which has a written charter that is available on the Investors section of our website athttp://investor.dendreon.com/governance.cfm.

Audit Committee

The primary responsibility of the Audit Committee is to oversee our financial reporting process on behalf of the Board of Directors. Among other things, the Audit Committee is responsible for overseeing our accounting and financial reporting processes and audits of our financial statements, reviewing and discussing with our independent auditors critical accounting policies and practices for our Company, engaging in discussions with management and the independent auditors to assess risk for the Company and management thereof, and reviewing with management and the independent auditors the effectiveness of our internal controls and disclosure controls and procedures. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of our independent auditors, including the resolution of disagreements, if any, between management and the auditors regarding financial reporting. In addition, the Audit Committee is responsible for reviewing and approving any related party transaction that is required to be disclosed pursuant to Item 404 of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The current members of the Audit Committee are Mr. Watson (Chair) and Drs. Fenton and Stump, each of whom the Board of Directors has determined is independent under the rules of the NASDAQ Stock Market and the independent requirements contemplated by Rule 10A-3 under the Exchange Act. The Audit Committee met eight times during 2013. The Board of Directors determined that each of Mr. Watson and Dr. Fenton is an “audit committee financial expert,” pursuant to the rules of the NASDAQ Stock Market and Item 407(d)(5) of Regulation S-K. Messrs. Canet and Granadillo also served on the Audit Committee in 2013 and were determined to be independent under the rules of the NASDAQ Stock Market and the independent requirements contemplated by Rule 10A-3 under the Exchange Act.

Compensation Committee

The Compensation Committee develops compensation policies and implements compensation programs, makes recommendations annually concerning salaries and incentive compensation, awards stock options and restricted stock to officers and employees under our stock incentive plans and otherwise determines compensation levels and performs such other functions regarding compensation for officers and employees as the Board of Directors may delegate in accordance with the Compensation Committee charter. While the Corporate Governance Committee reviews and approves changes to non-employee director compensation pursuant to its charter, the Compensation Committee works in conjunction with the Corporate Governance Committee on such matters.

Compensation for our named executive officers each year is usually determined by the Board of Directors prior to or during the first quarter of the relevant year. When determining annual compensation levels and targets for our executives, the Compensation Committee reviews corporate goals, evaluates individual performance, considers competitive market data and establishes compensation based on these factors, or in the case of our named executive officers, makes recommendations to our Board of Directors, who then act as a whole to set compensation based on these factors. The values of each component of total direct compensation (base salary, target annual cash bonus and equity awards) for the current year, as well as total annual compensation for the prior year are all considered collectively by our Compensation Committee as part of this process.

Our Compensation Committee has the authority to engage the services of outside advisors, experts and others to assist our Compensation Committee in determining the compensation of our named executive officers. Our Compensation Committee may, from time to time, delegate certain authority to authorized persons internally, including our human resources department, to carry out certain administrative duties. The Compensation Committee holds executive sessions (with no members of management present) at the majority of its meetings.

14

The current members of the Compensation Committee are Drs. Fenton (Chair) and Dziurzynski, Ms. Bayh and Mr. Watson, each of whom the Board of Directors has determined is independent under the rules of the NASDAQ Stock Market. Messrs. Canet and Granadillo also served on the Compensation Committee in 2013 and were determined to be independent under the rules of the NASDAQ Stock Market. The Compensation Committee met nine times during 2013.

Corporate Governance Committee

The Corporate Governance Committee considers and makes recommendations regarding corporate governance requirements and principles, periodically reviews the performance and operations of the standing committees of the Board of Directors and evaluates and recommends individuals for membership on the Company’s Board of Directors and committees. The processes and procedures followed by the Corporate Governance Committee are described below under the heading “Director Nomination Process”. The Corporate Governance Committee also reviews and approves changes to non-employee director compensation pursuant to its charter.

The current members of the Corporate Governance Committee are Dr. Dziurzynski (Chair), Ms. Bayh and Dr. Stump, each of whom the Board of Directors has determined is independent under the rules of the NASDAQ Stock Market. Mr. Fenton also served on the Corporate Governance Committee in 2013 and was determined to be independent under the rules of the NASDAQ Stock Market. The Corporate Governance Committee met nine times during 2013.

Director Nomination Process

Potential nominees for director are referred to the Corporate Governance Committee for consideration and evaluation. If the Corporate Governance Committee identifies a need to replace a current member of the Board of Directors, to fill a vacancy in or to expand the size of the Board of Directors, the Corporate Governance Committee will consider those individuals recommended as candidates for Board membership, including those recommended by stockholders, and hold meetings to evaluate biographical information and background material relating to candidates, and interview any selected candidates.

According to its adopted policy, the Corporate Governance Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, our advisors and executive search firms. The Board of Directors does not currently prescribe any minimum qualifications for director candidates. The Corporate Governance Committee will consider the Company’s current needs and the qualities needed for Board service, including experience and achievement in business, finance, biotechnology, health sciences or other areas relevant to the Company’s activities; reputation, ethical character and maturity of judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of the responsibilities of a director; independence under SEC rules and the NASDAQ listing standards; service on other boards of directors; sufficient time to devote to Board matters; and the ability to work effectively and collegially with other Board members. Although the Board of Directors does not have a formal diversity policy for director candidates, the Corporate Governance Committee will consider such factors as it deems appropriate to assist in developing a Board of Directors and committees that are diverse in nature and comprised of experienced and seasoned advisors. The Corporate Governance Committee will consider director candidates recommended by stockholders and will evaluate those candidates in the same manner as candidates recommended by other sources if stockholders submitting recommendations follow the procedures established by the Corporate Governance Committee. We did not implement any changes to our process for stockholder recommendations of director nominees during 2013.

In making recommendations for director nominees for an annual meeting of stockholders of the Company, the Corporate Governance Committee will consider any written recommendations of director candidates by stockholders received by our Corporate Secretary not later than the close of business on the 90th day nor earlier than the 120th day prior to the first anniversary of the previous year’s annual meeting of stockholders. Recommendations must include the candidate’s name and contact information and a statement of the candidate’s background and qualifications, as well as the name and contact information of the stockholder or stockholders making the recommendation, and such other information as may be required under our Amended and Restated Bylaws. Recommendations for director nominees for the 2015 Annual Meeting of Stockholders must be mailed

15

to Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101, Attention: Corporate Secretary, faxed to our Corporate Secretary at (206) 219-7211 or e-mailed to secretary@dendreon.com on or between January 15, 2015 and February 14, 2015. No stockholder recommendations for director nominees were received for consideration in advance of the Annual Meeting pursuant to the procedures established by our Amended and Restated Bylaws.

Board Leadership Structure

Mr. Johnson has been Chair of the Board of Directors since July 2012. The Board of Directors has not historically had a formal policy regarding the separation of the roles of Chief Executive Officer and Chair of the Board, as the Board believes it is in the best interests of the Company to make the determination regarding how to fulfill these functions based on the position and direction of the Company, and the membership of the Board of Directors at the pertinent time. The Board of Directors believes that the combined position of Chief Executive Officer and Chair is effective for the Company by maximizing strategic advantages, company expertise and industry expertise. Mr. Johnson is the director most familiar with the Company’s business and industry and best positioned to set and execute strategic priorities. The Board of Directors determined that Mr. Johnson’s leadership, driven by his deep business and industry expertise, enhances the Board’s exercise of its responsibilities.

As Mr. Johnson serves as both the Chief Executive Officer and the Chair of the Board of Directors, the Board also determined as of January 31, 2012 to appoint a Lead Independent Director, Mr. Watson. The position of Lead Independent Director has been structured to serve as an effective balance to the combined role of Chief Executive Officer and Chair of the Board. Since January 31, 2012, Mr. Watson has served as the Lead Independent Director of the Board. His duties include, among others:

| | • | | providing leadership to the Board complementary to the Board Chair; |

| | • | | working with the Chair of the Board and Corporate Secretary to set the agenda for Board meetings; |

| | • | | leading sessions of independent directors without management present; and |

| | • | | chairing Board meetings if the Chair of the Board is not in attendance. |

The Lead Independent Director further strengthens the Board of Director’s independence and autonomous oversight of our business as well as Board communication and effectiveness. The Board will evaluate this structure periodically, including the appointment of the Lead Independent Director.

Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board of Directors’ attention the most material risks to the Company. The Board of Directors has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company and oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board of Directors. The Corporate Governance Committee reviews enterprise-wide risk management. The Audit Committee focuses primarily on financial and accounting, legal and compliance, and IT systems risks. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from the Company’s compensation policies and programs. The Compensation Committee also reviews compensation and benefits plans affecting employees as well as those applicable to executive officers. The Board of Directors considers strategic risks and opportunities and regularly receives reports from the committees regarding risk oversight in their areas of responsibility.

Compensation-Related Risks

The Company reviewed compensation-related risks with its compensation consultant. The review focused on the primary components of compensation, which are base salary, annual cash bonus and long-term equity incentive compensation. As described below, the Board believes that the Company has a well-balanced and diverse compensation structure in which risk has been mitigated through the use of benchmarking and by linking an appropriate portion of compensation to the Company’s long-term performance.

| | • | | Base salary compensation is reviewed by the Compensation Committee and approved by the Board for each executive based on individual performance during the prior year, as well as the base salary compensation paid to similarly situated officers in peer group companies and the recommendation of its |

16

| | compensation consultant. Because base salaries are periodically benchmarked to ensure consistency with industry practices, the impact of individual performance on base salary levels is limited. As a result, the Company believes that its policies and practices relating to base salary reduce the likelihood of excessive risk taking. |

| | • | | Annual cash bonus compensation is reviewed by the Compensation Committee and approved by the Board for each executive based on the extent to which the Company’s corporate goals have been achieved for the prior year. For each executive, all of bonus compensation is tied to achievement of the corporate goals. Notably, the corporate goals are not tied to short-term improvements in earnings or stock value. Rather, the specific corporate goals established by the Board were selected because the Board believed them to be the key metrics used by management to achieve long-term business objectives and ensure the Company’s future success. As a result, the Company believes that the corporate goal component of bonus compensation has a focus on the Company’s long-term success. Because bonus compensation is tied to achievement of corporate goals that are linked to the long-term success of the Company, the Company does not believe that it encourages excessive risk-taking. |

| | • | | Long-term incentive compensation is granted to executives based on a philosophy that equity grants with service- or performance-based vesting requirements tie a portion of the executives’ compensation to the Company’s long-term performance and thereby align the interests of executives with the interests of the Company’s stockholders. The Company provides long-term incentive awards primarily through the issuance of stock options and restricted stock awards, including stock options and restricted stock awards subject to performance requirements. Executives realize value on stock options only if the price of the Company’s Common Stock increases (which benefits all stockholders) and only if the executives remain employed by the Company beyond the date that their options vest. Grants of restricted stock awards encourage executive ownership of Company shares and align the incentives of our executives with the interests of the Company’s stockholders. In addition, the performance conditions established by the Board for performance-based stock options or restricted stock awards are also linked to the key metrics used by management to achieve long-term business objectives and the Company’s future success. Overall, the Company believes that its approach of tying a meaningful portion of executive compensation to the long-term value of the Company’s equity discourages inappropriate risk-taking and is a valuable tool in managing and mitigating any risks associated with its compensation policies and practices. |

Based on its determination that the individual components of the Company’s compensation program do not individually or in the aggregate encourage excessive or inappropriate risk-taking, the Company has concluded that the risks associated with its compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Compensation Committee Interlocks and Insider Participation

During 2013, the members of our Compensation Committee were Messrs. Canet, Granadillo and Watson, Ms. Bayh and Dr. Dziurzynski. No member of our Compensation Committee has been an officer or employee of our Company at any time. None of our executive officers during 2013 served as a director or as a member of the compensation committee of another entity that has an executive officer who served as a director of the Company or on our Compensation Committee during 2013.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

We have established a procedure for stockholders to communicate with the Board of Directors or a particular Board committee. Communications should be in writing, addressed to: Dendreon Corporation, 1301 2nd Ave., Seattle, Washington 98101, and marked to the attention of the Board of Directors or any of its individual committees. Copies of all communications so addressed will be promptly forwarded to the chair of the committee involved, or in the case of communications addressed to the Board of Directors as a whole, to the Corporate Governance Committee.

17

DIRECTOR COMPENSATION

We compensate only our non-employee directors for serving on our Board of Directors. Our Board of Directors has adopted guidelines for the compensation of our non-employee directors. During 2013, each non-employee director received an annual retainer of $60,000. In addition, the Lead Independent Director received an additional $30,000 retainer per year, and the chairs of each of our Audit, Compensation and Corporate Governance Committees received an additional retainer per year of $25,000, $20,000 and $10,000, respectively. We also paid annual retainers to the members of the Audit Committee, Compensation Committee, and Corporate Governance Committee who are not committee chairs of $12,000, $10,000, and $5,000, respectively. All amounts were paid proportionately. For 2013, the total aggregate cash compensation earned by our non-employee directors for their periods of service was $618,712. In January 2014, the Board reviewed and maintained these guidelines for 2014. We also continue to reimburse each of our directors for expenses incurred in connection with attending Board of Directors’ meetings and for their service as directors in accordance with Company policy.

Our policy is to grant our new non-employee directors an initial equity award, which policy is updated from time to time at the discretion of the Board of Directors. In January 2014, the Board reviewed and maintained this policy to provide for an initial equity award for new non-employee directors elected prior to October 1st of any year equal to the prior year’s grant for the other non-employee directors, with 100% of such award to vest on the first anniversary of the date of grant. In January 2014, the Board of Directors also approved an annual equity award for each non-employee director of 25,000 shares of restricted stock that will vest over a year in equal quarterly installments.

The table below sets forth, for each non-employee director, the amount of cash compensation paid by us and the value of stock awards received from us for his or her service during 2013:

2013 Director Compensation Table

| | | | | | | | | | | | |

Name | | Fees Earned

or Paid in Cash | | | Stock Awards

($) (1) | | | Total

($) | |

Susan B. Bayh | | $ | 75,000 | (2) | | $ | 77,000 | | | $ | 152,000 | |

Gerardo Canet(3) | | | 41,000 | | | | — | | | | 41,000 | |

Bogdan Dziurzynski, D.P.A | | | 80,000 | (4) | | | 77,000 | | | | 157,000 | |

Dennis M. Fenton, Ph.D. | | | 77,000 | (5) | | | 77,000 | | | | 154,000 | |

Mitchell H. Gold(6) | | | 8,712 | | | | — | | | | 8,712 | |

Pedro Granadillo(7) | | | 92,000 | (8) | | | 77,000 | | | | 169,000 | |

John H. Johnson(9) | | | — | | | | — | | | | — | |

David C. Stump, M.D. | | | 65,000 | (10) | | | 77,000 | | | | 142,000 | |

David L. Urdal, Ph.D. | | | 60,000 | | | | 77,000 | | | | 137,000 | |

Douglas G. Watson | | | 120,000 | (11) | | | 77,000 | | | | 197,000 | |

| (1) | Includes shares granted on January 3, 2014 for 2013 services, which vest in equal quarterly installments over one year from the date of grant. The compensation cost represents the aggregate fair value on the grant date as determined in accordance with ASC 718. For more information about the assumptions we made in determining the grant date fair value, see Note 12 of the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Our non-employee directors did not hold any unvested stock awards as of December 31, 2013. As of December 31, 2013, our non-employee directors held options to purchase the following number of shares of Common Stock: Ms. Bayh, 59,363; Dr. Dziurzynski, 42,863; Dr. Fenton, none; Mr. Granadillo, 14,192; Dr. Stump, 13,772; Dr. Urdal, 86,348; and Mr. Watson, 6,692. |

| (2) | Amounts shown include retainer, Compensation Committee member fee and Corporate Governance Committee member fee earned during 2013. |

| (3) | Mr. Canet resigned from the Board effective April 22, 2013. |

18

| (4) | Amounts shown include retainer, Corporate Governance Committee chair fee and Compensation Committee member fee earned during 2013. |

| (5) | Amounts shown include retainer, Audit Committee member fee and Corporate Governance Committee member fee earned during 2013. |

| (6) | Dr. Gold resigned from the Board effective February 22, 2013. |

| (7) | Mr. Granadillo resigned from the Board effective March 4, 2014. |

| (8) | Amounts shown include retainer, Compensation Committee chair fee and Audit Committee member fee earned during 2013. |

| (9) | Mr. Johnson received no compensation for 2013 services on the Board. |

| (10) | Amounts shown include retainer and Corporate Governance Committee member fee earned during 2013. |

| (11) | Amounts shown include retainer, Lead Independent Director fee, Audit Committee chair fee and Compensation Committee member fee earned during 2013. |

Under corporate governance principles adopted by our Board of Directors in 2005, our non-employee directors are encouraged to own stock in our Company as a long-term investment. In January 2013, the ownership target was reviewed and maintained. Our non-employee directors are encouraged to own stock in our Company in an amount equal to three times the annual general Board of Directors’ retainer, with five years to achieve such target after a director has joined our Board of Directors. As of December 31, 2013, all of our non-employee directors who have met the length of service requirement are in compliance with the ownership guidelines. Drs. Fenton and Stump are not yet subject to the ownership guidelines as they have not yet met the length of service requirement.

19

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Executive Summary to the Compensation Discussion and Analysis highlights how the Company’s significant corporate events and performance results for 2013 shaped the Compensation Committee’s subsequent executive compensation decisions. Dendreon achieved several operational successes in 2013, including restructuring the Company and lowering the costs of goods sold (COGS) for PROVENGE®, our first-in-class personalized immunotherapy for the treatment of prostate cancer. Dendreon also encountered challenges in commercializing PROVENGE in a highly competitive atmosphere. However, we believe PROVENGE addresses a significant unmet medical need as the only personalized treatment clinically proven to help extend the life of prostate cancer patients.

Dendreon sustained significant revenue levels from the sale of PROVENGE, with $283.7 million in net revenue in 2013, compared to $325.3 million in 2012 and $213.5 million in 2011. In addition, the European Commission authorized marketing in all 28 countries of the E.U. in 2013 as well as Norway, Iceland and Liechtenstein. Although the Company saw a decline in revenue in 2013, the Company made changes to improve the commercialization of PROVENGE over the long term.

As a first step toward bolstering the commercialization of PROVENGE, we recruited a talented Chief Executive Officer, Mr. John Johnson, in 2012. Mr. Johnson has over 30 years of significant management and commercial experience at publicly traded global pharmaceutical companies and biotechnology companies. In addition to hiring a strong chief executive with key commercial experience and a new management team, the Company has taken decisive, and sometimes difficult, action to:

| | • | | Align our cost structure and internal infrastructure to meet our current demand; |

| | • | | Improve our operating efficiencies and decreasing our COGS for PROVENGE; |

| | • | | Invest in the commercialization of PROVENGE to drive revenue growth; and |

| | • | | Identify and implement strategic business development opportunities to strengthen our business model and provide a stable foundation for future stockholder value enhancement. |

We added performance-based equity to our executive pay program to further align management and stockholder interests. To enhance stockholder value, we tied the executive annual bonus awards to the achievement of objectives that advance our overall strategic plan, designed to maximize the value of the company, which would then directly align the interests of management with those of stockholders. For 2013, annual bonuses were awarded at 57% of target given the achievement of our COGS target, the strategic objectives and the quality and compliance milestones as set forth in this table with details under “Annual Cash Bonus” below:

2013 Annual Cash Bonus Targets and Actual Performance*

| | | | | | | | |

Goal | | Weighting | | Target | | Actual Achievement | | Overall

Achievement |

| Annual product revenue or product revenue of $100 million in any quarter | | 40% | | $371-375 million | | 0% at less than

$330 million | | 0% |

| Second half cost of goods sold (COGS) as a percent of second half revenue | | 25% | | A reduction of our COGS as a percent of revenue as more fully detailed on pages 31 and 32 | | 106% at 56.2% COGS

at $143 million revenue | | 27% |

Strategic objectives | | 25% | | Achieve the objectives detailed below on page 31 | | 100% | | 25% |

Improved manufacturing