Filed Pursuant to Rule 424(b)(5)

Registration No. 333-177793

Prospectus supplement

(to prospectus dated November 16, 2011)

14,300,000 shares

Common stock

We are offering 14,300,000 shares of our common stock.

Shares of our common stock trade on the NASDAQ Capital Market under the symbol “ZIOP.” The last reported sale price on October 23, 2013 was $4.03 per share.

| | | | | | | | |

| | | Per Share | | | Total | |

| | |

Public offering price | | $ | 3.50 | | | $ | 50,050,000 | |

| | |

Underwriting discounts and commissions | | $ | 0.21 | | | $ | 3,003,000 | |

| | |

Proceeds, before expenses, to us | | $ | 3.29 | | | $ | 47,047,000 | |

We have granted the underwriters an option for a period of up to 30 days from the date of this prospectus supplement to purchase up to 2,145,000 of additional shares of common stock at the public offering price less the underwriting discounts and commissions.

INVESTING IN OUR COMMON STOCK INVOLVES RISK. SEE “RISK FACTORS” BEGINNING ON PAGE S-11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Intrexon Corporation, or Intrexon, which is affiliated with Randal J. Kirk, who serves as one of our directors, has agreed to purchase 2,857,143 shares of our common stock in this offering at the public offering price. The underwriters will receive the same discount from such shares of our common stock as they will from any other shares of our common stock sold to the public in this offering.

The underwriters expect to deliver the shares on or about October 29, 2013.

Sole book-running manager

J.P. Morgan

Co-managers

| | |

| JMP Securities | | Griffin Securities, Inc. |

October 23, 2013

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Table of contents

S-i

About this prospectus supplement

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this common stock offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date specified in the relevant agreement. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained in this prospectus supplement, the accompanying prospectus, or any free writing prospectus authorized by us, or incorporated by reference herein. We have not authorized, and the underwriters have not authorized, anyone to provide you with information that is different. The information contained in this prospectus supplement, the accompanying prospectus, or any free writing prospectus authorized by us, or incorporated by reference herein is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus, and any free writing prospectus authorized by us or of any sale of our common stock. It is important for you to read and consider all information contained in this prospectus supplement, the accompanying prospectus, and any free writing prospectus authorized by us, including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where you can find more information” and “Incorporation of information by reference” in this prospectus supplement and in the accompanying prospectus.

We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless otherwise stated, all references in this prospectus to “we,” “us,” “our,” “ZIOPHARM,” the “Company” and similar designations refer to ZIOPHARM Oncology, Inc.

S-ii

Prospectus supplement summary

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference in this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying prospectus, including the information referred to under the heading “Risk factors” in this prospectus supplement beginning on page S-11, the information incorporated by reference in this prospectus supplement and the accompanying prospectus, and the information included in any free writing prospectus that we have authorized for use in connection with this offering.

Company overview

ZIOPHARM Oncology, Inc. is a biopharmaceutical company that seeks to acquire, develop and commercialize, on its own or with commercial partners, a diverse portfolio of cancer therapies that can address unmet medical needs through synthetic biology. Pursuant to an exclusive channel agreement with Intrexon Corporation, or Intrexon, we obtained rights to Intrexon’s synthetic biology platform for use in the field of oncology, which included two existing clinical stage product candidates, Ad-RTS-IL-12 + Activator Ligand and DC-RTS-IL-12 + Activator Ligand. The synthetic biology platform employs an inducible gene-delivery system that enables controlled delivery of genes that produce therapeutic proteins to treat cancer. Ad-RTS-IL-12 is our lead drug candidate, which uses this gene delivery system to produce Interleukin-12, or IL-12, a potent, naturally occurring anti-cancer protein. We are currently studying Ad-RTS-IL-12 in two Phase 2 studies, the first for the treatment of metastatic melanoma, and the second for the treatment of metastatic breast cancer, and expect to announce early, preliminary data from these Phase 2 studies in the fourth quarter of 2013 and final data in 2014. We plan to continue to combine Intrexon’s synthetic biology platform with our capabilities to translate science to the patient setting to develop additional products to stimulate key pathways, including those used by the body’s immune system to inhibit the growth and metastasis of cancers. We have multiple programs under development and expect to file at least eight investigational new drug, or IND, applications through 2015. We also have a portfolio of small molecule drug candidates in early stages of development, which we are not actively developing ourselves but are seeking partners to pursue further development and potential commercialization.

Enabling technology

Synthetic biology entails the application of engineering principles to biological systems for the purpose of designing and constructing new biological systems or redesigning/modifying existing biological systems. Biological systems are governed by DNA, the building blocks of gene programs, which control cellular processes by coding for the production of proteins and other molecules that have a functional purpose and by regulating the activities of these molecules. This regulation occurs via complex biochemical and cellular reactions working through intricate cell signaling pathways, and control over these molecules modifies the output of biological systems. Synthetic biology has been enabled by the application of information technology and advanced statistical analysis, also known as bioinformatics, to genetic engineering, as well as by improvements in DNA synthesis. Synthetic biology aims to engineer gene-based programs or

S-1

codes to modify cellular function to achieve a desired biological outcome. Its application is intended to allow more precise control of drug concentration and dose, thereby improving the therapeutic index associated with the resulting drug.

On January 6, 2011, we entered into an Exclusive Channel Partner Agreement with Intrexon, which we refer to as the Channel Agreement, to develop and commercialize novel DNA-based therapeutics in the field of cancer treatment by combining Intrexon’s synthetic biology platform with our capabilities to translate science to the patient setting. As a result, our DNA synthetic biology platform employs an inducible gene-delivery system that enables controlled delivery of genes that produce therapeutic proteins to treat cancer. The first example of this regulated controlled delivery is achieved by producing IL-12, a potent, naturally occurring anti-cancer protein, under the control of Intrexon’s proprietary biological “switch” to turn on/off the therapeutic protein expression at the tumor site. We and Intrexon refer to this “switch” as the RheoSwitch Therapeutic System® or RTS® platform. Our initial drug candidates being developed using the synthetic biology platform are Ad-RTS-IL-12 and DC-RTS-IL-12, with a current focus on Ad-RTS-IL-12.

We have demonstrated that we are able to simultaneously express multiple effectors under control of the RTS® platform from the same construct. In the mouse, we have also shown that we are able to express multigenic DNA constructs in an embedded, controlled bioreactor, by injecting into skeletal muscle and measuring the DNA-coded proteins in the blood. Furthermore, we have also demonstrated the ability to express these same three genes under RTS® platform control in mesenchymal stem cells, or MSCs.

Recent developments

On October 21 and 22, 2013, we presented preclinical data from four studies at the 2013 joint meeting of the American Association for Cancer Research, the National Cancer Institute and the European Organization for Research and Treatment of Cancer, which we refer to as the 2013 AARC-NCI-EORTC. The reported data further supports the breadth of the Intrexon synthetic biology platform technology and the ability to express immunotherapies, and other therapies, in bothin vitro andin vivo models. The following summarizes the reported results:

The Controlled Local Expression of IL-12 as an Immunotherapeutic Treatment of Glioma study was designed to evaluate the viability of IL-12 expression-based therapeutic candidates in the treatment of glioma, or brain cancer. Two different RTS® controlled IL-12 expression-based therapeutic candidates were explored for the study, Ad-RTS-IL-12 (AD) and DC-RTS-IL-12 (DC), along with the orally-available small molecule activator ligand veledimex. Results demonstrated that the activator ligand achieved brain penetration in normal mouse and monkey models. Further, treatment with both AD and DC demonstrated dose-related increase in survival in a mouse model with no adverse clinical signs. Animals treated with DC > 5000 MOI (multiplicity of infection) or AD 5 x 109 viral particles survived throughout the duration of the study (100% survival at 75 days) with no adverse clinical signs observed. In contrast, the mean survival in the control groups was 22 (±3) days. We believe these findings support the utility of localized regulated IL-12 production as an approach for the treatment of malignant glioma.

The three additional abstracts presented at the 2013 AARC-NCI-EORTC meeting demonstrated (i) systemic expression of three distinct immune effectors from a single RTS® regulated multigenic

S-2

construct in mice; (ii) in vitro data supporting the potential use of MSCs for tumor-targeted delivery of single or multiple RTS® regulated cancer immunotherapies; and (iii) data supporting functional single chain variable fragment-Fc fusion proteins as an alternate approach to monoclonal antibodies which are more amenable for multi-genic therapies. These results highlight the potential use of skeletal muscle as an embedded controllable bioreactor to generate therapeutics for tumor-targeted delivery of single or multiple RTS® regulated cancer immunotherapies which could potentially be translated into an effective clinical regimen in the treatment of cancer. Furthermore, the potential use of MSCs for tumor-targeted delivery of single or multiple RTS® regulated cancer immunotherapies could potentially be translated into an effective clinical regimen for a variety of cancers. Furthermore, RTS® driven expression of trastuzumab- and cetuximab-based scFv-Fc constructs from an embedded controllable bioreactor have potential utility as DNA-based anticancer therapeutics.

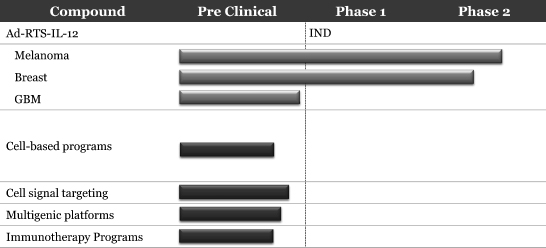

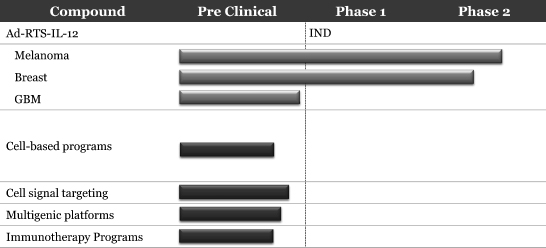

Product candidates

The following chart identifies our current synthetic biology product candidates and their stage of development, each of which are described in more detail below.

Synthetic biology programs:

Ad-RTS-IL-12 + Activator Ligand. Ad-RTS-IL-12 is currently being tested in two Phase 2 studies, the first for the treatment of metastatic melanoma, and the second for the treatment of non-resectable recurrent or metastatic breast cancer. Ad-RTS IL-12 is our lead drug candidate, which uses our gene delivery system to produce IL-12.

In March 2013, we announced the initiation of a randomized, open label Phase 2 clinical study of Ad-RTS-IL-12 to treat metastatic breast cancer. The two-part, multi-center U.S. study is enrolling patients with non-resectable, recurrent or metastatic breast cancer who have visible lesions or lesions accessible by injection. The primary endpoint of the study is rate of progression-free survival at 16 weeks. Secondary endpoints include objective response rate and duration of response. Initiation of the clinical study was followed by the presentation of results, from a study

S-3

in a breast cancer murine preclinical model, demonstrating the anti-tumor effects and tolerability of Ad-RTS-IL-12. The data were presented at the American Association for Cancer Research 2013 Annual Meeting in April.

In May 2013, we announced promising results from nonclinical studies and a Phase 1/2 study in metastatic melanoma using Ad-RTS-IL-12. In these studies, the controlled expression of IL-12, through a regulatable gene therapy strategy, was found to limit systemic toxicity while inducing biological and clinical activity in a dose-dependent fashion. The findings were presented in an oral session at the 16th Annual Meeting of the American Society of Gene and Cell Therapy, or ASGCT. In June, updated results were presented at the 2013 American Society for Clinical Oncology, or ASCO. Ad-RTS-IL-12 + Activator Ligand induce production of IL-12 mRNA in the tumor microenvironment (switch on). Upon removal of the oral activator ligand, IL-12 mRNA levels return to baseline (switch off). Following treatment with Ad-RTS-IL-12 + Activator Ligand, increases in TILs (CD8+, CD45RO+) were observed in the tumor microenvironment. Clinical activity was observed in injected and non-injected lesions primarily at the higher doses of the activator ligand. Inflammation, shrinkage, flattening, and depigmentation of lesions correlated with the highest serum levels of IFN-g. Ad-RTS-IL-12 + Activator Ligand therapy was generally well-tolerated and its safety profile is consistent with other immunotherapies.

The Phase 1 portion of the Phase 1/2 is study is complete, and the Phase 2 portion is on-going. This Phase 2 study, a multi-center, single-arm, open-label study, is enrolling patients with unresectable Stage III or IV melanoma and further evaluating the safety and efficacy of intratumoral injections of Ad-RTS-IL-12 in combination with an oral activator ligand. Data from this Phase 2 study is expected in the fourth quarter of 2013.

We are in the process of finalizing clinical protocol designs that will lead to the initiation of Phase 2 studies in the combination with standard of care, or SOC, in first quarter 2014 for the treatment of metastatic melanoma and metastatic breast cancer. Specifically, we expect to commence enrollment in a glioblastoma mulitforme Phase 1 dose-escalation study in the first quarter of 2014, with preliminary data expected near the end of 2014; in a melanoma Phase 2 combination study with SOC study in the first quarter of 2014, with preliminary data expected near the end of 2014; and in a breast cancer Phase 2 combination study with SOC in the first quarter of 2014, with preliminary data expected in the first quarter of 2015. Melanoma, breast cancer, and glioma (detailed below) represent significant market potentials with high unmet medical needs. The annual incidence in the United States of melanoma, breast cancer and glioblastoma is 76,690 patients, 234,580 patients and 18,000 patients, respectively, with the majority of those representing a high unmet medical need.

DC-RTS-IL-12 + Activator Ligand. We completed enrollment in a Phase 1 dose escalation study of DC-RTS-IL-12 in the second quarter of 2012 in the United States. DC-RTS-IL-12 employs intratumoral injection of modified dendritic cells from each patient and oral dosing of an activator ligand to turn on in vivo expression of IL-12. DC-RTS-IL-12, through the RTS® platform, controls the timing and level of transgene expression. The RTS® technology functions as a “gene switch” for the regulated expression of human IL-12 in the patients’ dendritic cells which are transduced with a replication incompetent adenoviral vector carrying the IL-12 gene under the control of the RTS® platform. Currently, there are no actively enrolling studies using DC-RTS-IL-12, as we have prioritized our clinical development efforts on Ad-RTS-IL-12.

S-4

Earlier stage programs. Preclinical mouse glioma studies evaluating either Ad-RTS-IL-12 orDC-RTS-IL-12 therapy demonstrated a survival benefit in all animals treated at higher doses with no adverse clinical signs and symptoms. Additional preclinical studies are currently ongoing with Ad-RTS-IL-12 to enable initiation of a Phase 1 clinical study in the first half of 2014. This Phase 1 clinical study will evaluate the safety and tolerability of the Ad-RTS-IL-12 therapy in patients with recurrent or progressive glioblastoma. Glioblastoma is by far the most frequent malignant glioma and is associated with a particularly aggressive course and dismal prognosis. The current standard of care is based on surgical resection to the maximum extent, followed by radiotherapy and concomitant adjuvant temozolomide. Such aggressive treatment is associated with only modest improvements in survival. Newly diagnosed glioblastoma patients have a median overall survival, or OS, of 11-17 month, 2 year OS rate, between 15-17%.

We are actively pursuing several synthetic biology approaches, including gene delivery with human MSCs, functional single chain variable fragment-Fc fusion proteins and multigenic approaches in our discovery pipeline to address unmet medical needs in cancer that are expected to result in multiple INDs in 2014 and beyond. Each of the candidates has been designed, built, and tested in our discovery and preclinical program, including significant progress made to date with multigenic approaches to cancer treatment that will target more than one biologic pathway. It is currently well accepted that combining multiple immunomodulatory therapeutic modalities should have a more profound impact promoting cancer remission than monotherapies.

Small molecule programs

Palifosfamide, ZIO-201. The small molecule palifosfamide, or isophosphoramide mustard, is a proprietary active metabolite of the pro-drug ifosfamide. Because palifosfamide is the stabilized active metabolite of ifosfamide and a distinct pharmaceutical composition without the acrolein or chloroacetaldehyde metabolites we believe that the administration of palifosfamide may be an effective and well-tolerated agent to treat cancer. In addition to anticipated lower toxicity, palifosfamide may have other advantages over ifosfamide and cyclophosphamide. Palifosfamide cross-links DNA differently than the active metabolite of cyclophosphamide, resulting in a different activity profile. We are seeking to out-license or otherwise monetize palifosfamide.

Soft Tissue Sarcoma. Previously we have studied palifosfamide in combination with doxorubicin in patients with soft tissue sarcoma. In March 2013, we announced that the Phase 3 study, PICASSO 3, did not meet its primary endpoint of progression-free survival, and that we would terminate our development program in metastatic soft tissue sarcoma. PICASSO 3 study data was presented at the 2013 European Cancer Congress.

Small-Cell Lung Cancer. Small-Cell Lung Cancer, or SCLC, is almost exclusively associated with smoking. Standard of care for SCLC, which is etoposide and platinum therapy, has changed little in decades. Published studies of ifosfamide in combination with standard of care have evidenced enhanced efficacy but also with enhanced side effects, providing for an unfavorable benefit to risk association. We believe that combining palifosfamide with standard of care could offer a separation of enhanced efficacy with reduced toxicity.

S-5

Data from a Phase 1 trial of palifosfamide in combination with etoposide and carboplatin informed appropriate dosing for initiating an adaptive Phase 3 trial in first-line, metastatic SCLC. In June 2012, the Company initiated an international, multi-center, open-label, adaptive, randomized study of palifosfamide in combination with carboplatin and etoposide, or PaCE, chemotherapy versus carboplatin and etoposide, or CE, alone in chemotherapy naïve patients with metastatic small cell lung cancer, which we refer to as MATISSE. The trial’s primary endpoint is overall survival.

Based on the outcome of PICASSO 3 in soft tissue sarcoma and the resulting revision in the company’s development plans for palifosfamide, enrollment in this study was suspended with 188 patients enrolled. The interim analysis of overall survival events in MATISSE is forecasted to be reached in the first half of 2014.

Darinaparsin, ZIO-101. Darinaparsin is an anti-mitochondrial (organic arsenic) compound (covered by issued patents and pending patent applications in the United States and in foreign countries). Phase 1 testing of the intravenous, or IV, form of darinaparsin in solid tumors and hematological cancers was completed. We reported clinical activity and a safety profile from these studies as predicted by preclinical results. We subsequently completed Phase 2 studies in advanced myeloma, primary liver cancer and in certain other hematological cancers. At the May 2009 annual meeting of ASCO, we reported favorable results from the IV trial in lymphoma, particularly peripheral T-cell lymphoma, or PTCL. A Phase 1 trial in solid tumors with an oral form of darinaparsin has completed enrollment. We have obtained Orphan Drug Designation for darinaparsin in the United States and Europe for the treatment of PTCL and have entered into a licensing agreement with Solasia Pharma K.K., or Solasia, for the Asia/Pacific territory with a focus on IV-administered darinaparsin in PTCL. Clinical studies are currently ongoing with Solasia. We are seeking to out-license or otherwise monetize darinaparsin for territories not covered by our agreement with Solasia.

Indibulin, ZIO-301. Indibulin is a novel, small molecule inhibitor of tubulin polymerization and is potentially safer than other tubulin inhibitors as no neurotoxicity has been observed in preclinical studies or in Phase 1 clinical trials. Indibulin has a different pharmacological profile from other tubulin inhibitors currently on the market as it binds to a unique site on tubulin and is active in multi-drug-resistant (MDR-1, MRP-1) and taxane-resistant tumors. A Phase 1 study was conducted in late stage metastatic breast cancer and was found to be safe and tolerable. We are seeking to out-license or otherwise monetize indibulin.

Development plans

We are currently pursuing several clinical development opportunities, principally in our synthetic biology programs. We are also evaluating additional potential preclinical candidates and continuing discovery efforts aimed at identifying other potential product candidates under our Channel Agreement with Intrexon. In addition, we may seek to enhance our pipeline in synthetic biology through highly focused strategic transactions, which may include acquisitions, partnerships and in-licensing activities. We are actively seeking to out-license some or all of our small molecule programs to further support our synthetic biology efforts.

Our current plans involve using our principal internal financial resources to develop the synthetic biology program, with the intention of ultimately partnering or otherwise raising additional

S-6

capital to support further development activities for our strategic product candidates. As of September 30, 2013, we had approximately $23.6 million of cash and cash equivalents. Based upon our current plans and without taking into account the net proceeds of this offering, we anticipate that our cash resources will be sufficient to fund our operations into the first quarter of 2014. This forecast of cash resources is forward-looking information that involves risks and uncertainties, and the actual amount of our expenses over the next six months could vary materially and adversely as a result of a number of factors, including the factors discussed in the “Risk Factors” section of this prospectus supplement and the uncertainties applicable to our forecast for the overall sufficiency of our capital resources. We have based our estimates on assumptions that may prove to be wrong, and our expenses could prove to be significantly higher than we currently anticipate.

Furthermore, the successful development of our product candidates is highly uncertain. Product development costs and timelines can vary significantly for each product candidate, are difficult to accurately predict, and will require us to obtain additional funding, either alone or in connection with partnering arrangements. Various statutes and regulations also govern or influence the development, manufacturing, safety, labeling, storage, record keeping and marketing of each product. The lengthy process of seeking approval and the subsequent compliance with applicable statutes and regulations require the expenditure of substantial resources. Any failure by us to obtain, or any delay in obtaining, regulatory approvals could materially, adversely affect our business. To date, we have not received approval for the sale of any product candidates in any market and, therefore, have not generated any revenues from our product candidates.

Risk factors

An investment in our common stock is subject to a number of risks and uncertainties. Before investing in our common stock, you should carefully consider the following, as well as the more detailed discussion of risk factors and other information included in this prospectus supplement.

| • | | We will require additional financial resources in order to continue on-going development of our product candidates; if we are unable to obtain these additional resources, we may be forced to delay or discontinue clinical testing of our product candidates. |

| • | | We need to raise additional capital to fund our operations. The manner in which we raise any additional funds may affect the value of your investment in our common stock. |

| • | | Clinical trials are very expensive, time-consuming, and difficult to design and implement, and may not support our product candidate claims. |

| • | | We may not be able to commercialize any products, generate significant revenues, or attain profitability. |

| • | | The technology underlying our Channel Arrangement with Intrexon is based in part on early stage technology in the field of human oncologic therapeutics, which makes it difficult to predict the time and cost of product candidate development and subsequently obtaining regulatory approval. |

| • | | Currently, no gene therapy products have been approved in the United States and only one product has been approved in Europe. |

S-7

| • | | Our use of synthetic biology to develop product candidates may become subject to increasing regulation, or may be limited by ethical, legal and social concerns about synthetic biologically engineered products. |

| • | | We have a limited operating history upon which to base an investment decision. |

Corporate information

We originally incorporated in Colorado in September 1998 (under the name Net Escapes, Inc.) and later changed our name to “EasyWeb, Inc.” in February 1999. We re-incorporated in Delaware on May 16, 2005 under the same name. On September 13, 2005, we completed a “reverse” acquisition of privately held ZIOPHARM, Inc., a Delaware corporation. To effect this transaction, we caused ZIO Acquisition Corp., our wholly-owned subsidiary, to merge with and into ZIOPHARM, Inc., with ZIOPHARM, Inc. surviving as our wholly owned subsidiary. In accordance with the terms of the merger, the outstanding common stock of ZIOPHARM, Inc. automatically converted into the right to receive an aggregate of approximately 97.3% of our outstanding common stock (after giving effect to the transaction). Following the merger, we caused ZIOPHARM, Inc. to merge with and into us and we changed our name to “ZIOPHARM Oncology, Inc.” Although EasyWeb, Inc. was the legal acquirer in the transaction, we accounted for the transaction as a reverse acquisition under generally accepted accounting principles. As a result, ZIOPHARM, Inc. became the registrant with the Commission and the historical financial statements of ZIOPHARM, Inc. became our historical financial statements.

Our principal executive offices are located at One First Avenue, Parris Building 34, Navy Yard Plaza, Boston, Massachusetts 02129, and our telephone number is (617) 259-1970. Our Internet site iswww.ziopharm.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus supplement or the accompanying prospectus, and you should not consider it part of this prospectus supplement or part of the accompanying prospectus.

S-8

The offering

Common stock offered

by us in this offering | 14,300,000 shares |

Option to purchase additional shares | We have granted the underwriters an option for a period of up to 30 days from the date of this prospectus supplement to purchase up to 2,145,000 additional shares of common stock at the public offering price less the underwriting discounts and commissions. |

Common stock to be outstanding immediately after this offering | 97,981,580 shares (or 100,126,580 shares if the underwriters exercise in full their option to purchase additional shares) |

Use of proceeds | We intend to use the net proceeds from this offering for the overall development of our drug candidates, including our synthetic biology candidates and small molecule candidates, and for general corporate and working capital purposes. See “Use of Proceeds.” |

Risk factors | See “Risk factors” beginning on page S-11 for a discussion of some of the factors you should carefully consider before deciding to invest in shares of our common stock. |

NASDAQ Capital Market symbol | ZIOP |

The number of shares of common stock to be outstanding immediately after this offering is based on 83,681,580 shares of common stock outstanding as of September 30, 2013 and does not include:

| • | | 5,730,169 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2013, having a weighted average exercise price of $3.73 per share; |

| • | | 1,565,070 shares of our common stock available as of September 30, 2013 for future issuance pursuant to our 2003 Stock Option Plan and our 2012 Equity Incentive Plan; and |

| • | | 10,392,387 shares of our common stock issuable upon the exercise of outstanding warrants as of September 30, 2013 with a weighted-average exercise price of $3.57 per share. |

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriters of their option to purchase additional shares.

S-9

Indication of interest

Intrexon, which is affiliated with Randal J. Kirk, who serves as one of our directors, has agreed to purchase 2,857,143 shares of our common stock in this offering at the public offering price. The underwriters will receive the same discount from such shares of our common stock as they will from any other shares of our common stock sold to the public in this offering.

S-10

Risk factors

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks described below and discussed under the section captioned “Risk Factors” contained in our Quarterly Report on Form 10-Q for the period ended September 30, 2013, which is incorporated by reference in this prospectus supplement and the accompanying prospectus, in its entirety, together with other information in this prospectus supplement, the accompanying prospectus, the information and documents incorporated by reference, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. The risks described below and in the documents referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business.

Risks related to our business

We will require additional financial resources in order to continue ongoing development of our product candidates; if we are unable to obtain these additional resources, we may be forced to delay or discontinue clinical testing of our product candidates.

We have not generated significant revenue and have incurred significant net losses in each year since our inception. For the nine months ended September 30, 2013, we had a net loss of $48.2 million, and, as of September 30, 2013, we had incurred approximately $331.9 million of cumulative net losses since our inception in 2003. We expect to continue to incur significant operating expenditures and net losses. Further development of our product candidates, including product candidates that we may develop under our Channel Agreement with Intrexon, will likely require substantial increases in our expenses as we:

| • | | continue to undertake clinical trials for product candidates; |

| • | | scale-up the formulation and manufacturing of our product candidates; |

| • | | seek regulatory approvals for product candidates; |

| • | | implement additional internal systems and infrastructure; and |

| • | | hire additional personnel. |

We continue to seek additional financial resources to fund the further development of our product candidates. If we are unable to obtain sufficient additional capital, one or more of these programs could be placed on hold. Because we are currently devoting a significant portion of our resources to the development of synthetic biology and our adaptive Phase 3 trial for first-line SCLC for IV palifosfamide, MATISSE, further progress with the development of our other candidates may be significantly delayed and may depend on the licensing of those compounds to third parties.

We anticipate that our cash resources without giving effect to the proceeds of this offering will be sufficient to fund our operations into the first quarter of 2014, and we have no current committed sources of additional capital. As a result, our independent registered public accounting firm has expressed a substantial doubt about our ability to continue as a going concern in their report on our financial statements. We do not know whether additional financing will be available on terms favorable or acceptable to us when needed, if at all. Our

S-11

business is highly cash-intensive and our ability to continue operations after our current cash resources are exhausted depends on our ability to obtain additional financing and/or achieve profitable operations, as to which no assurances can be given. If adequate additional funds are not available when required, or if we are unsuccessful in entering into partnership agreements for the further development of our products, we will be required to delay, reduce or eliminate planned preclinical and clinical trials and may be forced to terminate the approval process for our product candidates from the FDA or other regulatory authorities. In addition, we could be forced to discontinue product development, forego attractive business opportunities or pursue merger or divestiture strategies. In the event we are unable to obtain additional financing, we may be forced to cease operations altogether.

We need to raise additional capital to fund our operations. The manner in which we raise any additional funds may affect the value of your investment in our common stock.

As of September 30, 2013, we had incurred approximately $331.9 million of cumulative net losses and had approximately $23.6 million of cash and cash equivalents. We anticipate that our cash resources without giving effect to the proceeds of this offering will be sufficient to fund our operations into the first quarter of 2014. Following negative results in our PICASSO 3 pivotal trial in first-line metastatic soft tissue sarcoma, or STS, in March 2013, we implemented a workforce reduction plan and other cost-cutting measures in an attempt to extend our cash resources as long as possible, though there are no assurances that such efforts will be effective. In addition, changes may occur that would consume our existing capital prior to the first quarter of 2014, including expansion of the scope of, and/or slower than expected progress of, our research and development efforts and changes in governmental regulation. As a result, our independent registered public accounting firm has expressed a substantial doubt about our ability to continue as a going concern in their report on our financial statements. Actual costs may ultimately vary from our current expectations, which could materially impact our use of capital and our forecast of the period of time through which our financial resources will be adequate to support our operations. We have estimated the sufficiency of our cash resources based in part on the discontinuation of the PICASSO 3 pivotal trial for first-line metastatic STS and our adaptive Phase 3 trial for first-line SCLC for IV palifosfamide and our current timing expectations for the interim analysis of data in the MATISSE trial. Also our estimates include the advancement of our synthetic biology product candidates in the clinic under our Channel Agreement with Intrexon, and we expect that the costs associated with these and additional product candidates will increase the level of our overall research and development expenses significantly going forward.

In addition to above factors, our actual cash requirements may vary materially from our current expectations for a number of other factors that may include, but are not limited to, changes in the focus and direction of our development programs, competitive and technical advances, costs associated with the development of our product candidates, our ability to secure partnering arrangements, and costs of filing, prosecuting, defending and enforcing our intellectual property rights. If we exhaust our capital reserves more quickly than anticipated, regardless of the reason, and we are unable to obtain additional financing on terms acceptable to us or at all, we will be unable to proceed with development of some or all of our product candidates on expected timelines and will be forced to prioritize among them.

The unpredictability of the capital markets may severely hinder our ability to raise capital within the time periods needed or on terms we consider acceptable, if at all. Moreover, if we fail to advance one or more of our current product candidates to later-stage clinical trials, successfully

S-12

commercialize one or more of our product candidates, or acquire new product candidates for development, we may have difficulty attracting investors that might otherwise be a source of additional financing.

Our need for additional capital and limited capital resources may force us to accept financing terms that could be significantly dilutive to existing stockholders. To the extent that we raise additional capital by issuing equity securities, our stockholders may experience dilution. In addition, we may grant future investors rights superior to those of our existing stockholders. If we raise additional funds through collaborations and licensing arrangements, it may be necessary to relinquish some rights to our technologies, product candidates or products, or grant licenses on terms that are not favorable to us. If we raise additional funds by incurring debt, we could incur significant interest expense and become subject to covenants in the related transaction documentation that could affect the manner in which we conduct our business.

Clinical trials are very expensive, time-consuming, and difficult to design and implement.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial process itself is also time-consuming and results are inherently uncertain. We estimate that clinical trials of our product candidates will take at least several years to complete. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

| • | | unforeseen safety issues; |

| • | | determination of dosing issues; |

| • | | lack of effectiveness during clinical trials; |

| • | | slower than expected rates of patient recruitment and enrollment; |

| • | | inability to monitor patients adequately during or after treatment; |

| • | | inability or unwillingness of medical investigators to follow our clinical protocols; and |

| • | | regulatory determinations to temporarily or permanently cease enrollment for other reasons not related to patient safety. |

Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful. For example, despite positive findings in earlier clinical trials, our product candidate palifosfamide failed to meet the primary endpoint of the Phase 3 PICASSO 3 trail. In addition, we or the FDA may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the FDA finds deficiencies in our Investigational New Drug, or IND, submission or in the conduct of these trials.

See also “—Our product candidates are in various stages of clinical trials, which are very expensive and time-consuming. We cannot be certain when we will be able to file an NDA or BLA, with the FDA and any failure or delay in completing clinical trials for our product candidates could harm our business.”

We may not be able to obtain or maintain orphan drug exclusivity for our product candidates.

We have received Orphan Drug designations for darinaparsin for the treatment of peripheralT-cell lymphoma in both the United States and Europe, and we may be able to receive additional

S-13

Orphan Drug designation from the FDA and the European Medicines Agency, or EMA, for other product candidates. In the United States, orphan designation is available to drugs intended to treat, diagnose or prevent a rare disease or condition that affects fewer than 200,000 people in the United States at the time of application for orphan designation. Orphan designation qualifies the sponsor of the product for a tax credit and marketing incentives. The first sponsor to receive FDA marketing approval for a drug with an orphan designation is entitled to a seven-year exclusive marketing period in the United States for that product for that indication and, typically, a waiver of the prescription drug user fee for its marketing application. However, a drug that the FDA considers to be clinically superior to, or different from, the approved orphan drug, even though for the same indication, may also obtain approval in the United States during the seven-year exclusive marketing period. Orphan drug exclusive marketing rights may also be lost if the FDA later determines that the request for designation was materially defective or if the manufacturer is unable to assure sufficient quantity of the drug. There is no guarantee that any of our other product candidates will receive Orphan Drug designation or that, even if such product candidate is granted such status, the product candidate’s clinical development and regulatory approval process will not be delayed or will be successful.

We may not be able to commercialize any products, generate significant revenues, or attain profitability.

To date, none of our product candidates have been approved for commercial sale in any country. The process to develop, obtain regulatory approval for, and commercialize potential drug candidates is long, complex, and costly. Unless and until we receive approval from the FDA and/or other regulatory authorities for our product candidates, we cannot sell our drugs and will not have product revenues. Even if we obtain regulatory approval for one or more of our product candidates, if we are unable to successfully commercialize our products, we may not be able to generate sufficient revenues to achieve or maintain profitability, or to continue our business without raising significant additional capital, which may not be available. Our failure to achieve or maintain profitability could negatively impact the trading price of our common stock.

Ethical, legal and social concerns about synthetic biologically engineered products could limit or prevent the use of our product candidates.

Our products candidates use a synthetic biology platform. Public perception about the safety and environmental hazards of, and ethical concerns over, genetically engineered products could influence public acceptance of our product candidates. If we are not able to overcome the ethical, legal and social concerns relating to synthetic biological engineering, our product candidates may not be accepted. These concerns could result in increased expenses, regulatory scrutiny, delays or other impediments to the public acceptance and commercialization of our product candidates. Our ability to develop and commercialize products could be limited by public attitudes and governmental regulation.

The subject of genetically modified organisms has received negative publicity, which has aroused public debate. This adverse publicity could lead to greater regulation and trade restrictions on imports of genetically altered products. Further, there is a risk that our product candidates could cause adverse health effects or other adverse events, which could also lead to negative publicity.

The synthetic biological platform that we use may have significantly enhanced characteristics compared to those found in naturally occurring organisms, enzymes or microbes. While we

S-14

believe we produce synthetic biological technologies only for use in a controlled laboratory and industrial environment, the release of such synthetic biological technologies into uncontrolled environments could have unintended consequences. Any adverse effect resulting from such a release could have a material adverse effect on our business and financial condition, and we may have exposure to liability for any resulting harm.

Our use of synthetic biology to develop product candidates may become subject to increasing regulation in the future.

Most of the laws and regulations concerning synthetic biology relate to the end products produced using synthetic biology, but that may change. For example, the Presidential Commission for the Study of Bioethical Issues in December 2010 recommended that the federal government oversee, but not regulate, synthetic biology research. The Presidential Commission also recommended that the government lead an ongoing review of developments in the synthetic biology field. Synthetic biology may become subject to additional government regulations as a result of the recommendations, which could require us to incur significant additional capital and operating expenditures and other costs in complying with these laws and regulations.

The technology on which our Channel Agreement with Intrexon Corporation is based in part on early stage technology in the field of human oncologic therapeutics.

Our Channel Agreement with Intrexon contemplates our using Intrexon’s advanced transgene engineering platform for the controlled and precise cellular production of anti-cancer effectors. The synthetic biology effector platform in which we have acquired rights represents early-stage technology in the field of human oncologic biotherapeutics, with DC-RTS-IL-12 having completed a Phase 1 study in melanoma and Ad-RTS-IL-12 currently in two Phase 2 studies, in melanoma and breast cancer. Although we plan to leverage Intrexon’s synthetic biology platform for additional products targeting key pathways used by cancers to grow and metastasize, we may not be successful in developing and commercializing these products for a variety of reasons. The risk factors set forth herein that apply to our small molecule drug candidates, which are in various stages of development, also apply to product candidates that we seek to develop under our Channel Agreement with Intrexon.

We will incur additional expenses in connection with our Channel Agreement with Intrexon Corporation.

The synthetic biology platform, in which we have acquired rights for cancer from Intrexon, includes two existing product candidates, DC-RTS-IL-12 and Ad-RTS-IL-12. Upon entry into the Channel Agreement with Intrexon, we assumed responsibility for the clinical development of these product candidates, which we expect will increase the level of our overall research and development expenses significantly going forward. Although all human clinical trials are expensive and difficult to design and implement, we believe that due to complexity, costs associated with clinical trials for synthetic biology products are greater than the corresponding costs associated with clinical trials for small molecule candidates. In addition to increased research and development costs, prior to the adoption of our March 2013 workforce reduction plan, we added headcount in part to support our Channel Agreement endeavors, and we may need to do so again in the future which would add to our general and administrative expenses going forward.

S-15

Although our forecasts for expenses and the sufficiency of our capital resources takes into account our plans to develop the Intrexon products, we assumed development responsibility for these products on January 6, 2011, and the actual costs associated therewith may be significantly in excess of forecasted amounts. In addition to the amount and timing of expenses related to the clinical trials, our actual cash requirements may vary materially from our current expectations for a number of other factors that may include, but are not limited to, changes in the focus and direction of our development programs, competitive and technical advances, costs associated with the development of our product candidates and costs of filing, prosecuting, defending and enforcing our intellectual property rights. If we exhaust our capital reserves more quickly than anticipated, regardless of the reason, and we are unable to obtain additional financing on terms acceptable to us or at all, we will be unable to proceed with development of some or all of our product candidates on expected timelines and will be forced to prioritize among them.

We may not be able to retain the exclusive rights licensed to us by Intrexon Corporation to develop and commercialize products involving DNA administered to humans for expression of anti-cancer effectors for the purpose of treatment or prophylaxis of cancer.

Under the Channel Agreement, we use Intrexon’s technology directed towards in vivo expression of effectors in connection with the development of DC-RTS-IL-12 and Ad-RTS-IL-12 and generally to research, develop and commercialize products, in each case in which DNA is administered to humans for expression of anti-cancer effectors for the purpose of treatment or prophylaxis of cancer, which we collectively refer to as the Cancer Program. The Channel Agreement grants us a worldwide license to use patents and other intellectual property of Intrexon in connection with the research, development, use, importing, manufacture, sale, and offer for sale of products involving DNA administered to humans for expression of anti-cancer effectors for the purpose of treatment or prophylaxis of cancer, which we refer to collectively as the ZIOPHARM Products. Such license is exclusive with respect to any clinical development, selling, offering for sale or other commercialization of ZIOPHARM Products, and otherwise is non-exclusive. Subject to limited exceptions, we may not sublicense the rights described without Intrexon’s written consent. Under the Channel Agreement, and subject to certain exceptions, we are responsible for, among other things, the performance of the Cancer Program, including development, commercialization and certain aspects of manufacturing of ZIOPHARM Products.

Intrexon may terminate the Channel Agreement if we fail to use diligent efforts to develop and commercialize ZIOPHARM Products or if we elect not to pursue the development of a Cancer Program identified by Intrexon that is a “Superior Therapy” as defined in the Channel Agreement. We may voluntarily terminate the Channel Agreement upon 90 days written notice to Intrexon. Upon termination of the Channel Agreement, we may continue to develop and commercialize any ZIOPHARM Product that, at the time of termination:

| • | | is being commercialized by us; |

| • | | has received regulatory approval; |

| • | | is a subject of an application for regulatory approval that is pending before the applicable regulatory authority; or |

| • | | is the subject of at least an ongoing Phase 2 clinical trial (in the case of a termination by Intrexon due to an uncured breach or a voluntary termination by us), or an ongoing Phase 1 clinical trial in the field (in the case of a termination by us due to an uncured breach or a |

S-16

| | termination by Intrexon following an unconsented assignment by us or our election not to pursue development of a Superior Therapy). |

Our obligation to pay 50% of net profits or revenue as described further in our Annual Report on Form 10-K under the heading “Business—License Agreements, Intellectual Property and Other Agreements—Exclusive Channel Partner Agreement with Intrexon Corporation” with respect to these “retained” products will survive termination of the Channel Agreement.

There can be no assurance that we will be able to successfully perform under the Channel Agreement and if the Channel Agreement is terminated it may prevent us from achieving our business objectives.

We have a limited operating history upon which to base an investment decision.

We are a development-stage company that was incorporated in September 2003. To date, we have not demonstrated an ability to perform the functions necessary for the successful commercialization of any product candidates. The successful commercialization of any product candidates will require us to perform a variety of functions, including:

| • | | continuing to undertake preclinical development and clinical trials; |

| • | | participating in regulatory approval processes; |

| • | | formulating and manufacturing products; and |

| • | | conducting sales and marketing activities. |

Our operations have been limited to organizing and staffing our company, acquiring, developing and securing our proprietary product candidates, and undertaking preclinical and clinical trials of our product candidates. These operations provide a limited basis for you to assess our ability to commercialize our product candidates and the advisability of investing in our securities.

Because we currently neither have nor intend to establish internal research capabilities, we are dependent upon pharmaceutical and biotechnology companies and academic and other researchers to sell or license us their product candidates and technology.

Proposing, negotiating, and implementing an economically viable product acquisition or license is a lengthy and complex process. We compete for partnering arrangements and license agreements with pharmaceutical, biopharmaceutical, and biotechnology companies, many of which have significantly more experience than we do, and have significantly more financial resources. Our competitors may have stronger relationships with certain third parties including academic research institutions, with whom we are interested in collaborating and may have, therefore, a competitive advantage in entering into partnering arrangements with those third parties. We may not be able to acquire rights to additional product candidates on terms that we find acceptable, or at all.

We expect that any product candidate to which we acquire rights will require significant additional development and other efforts prior to commercial sale, including extensive clinical testing and approval by the FDA and applicable foreign regulatory authorities. All drug product candidates are subject to the risks of failure inherent in pharmaceutical product development, including the possibility that the product candidate will not be shown to be sufficiently safe or effective for approval by regulatory authorities. Even if our product candidates are approved, they may not be economically manufactured or produced, or be successfully commercialized.

S-17

We actively evaluate additional product candidates to acquire for development. Such additional product candidates, if any, could significantly increase our capital requirements and place further strain on the time of our existing personnel, which may delay or otherwise adversely affect the development of our existing product candidates. We must manage our development efforts and clinical trials effectively, and hire, train and integrate additional management, administrative, and sales and marketing personnel. We may not be able to accomplish these tasks, and our failure to accomplish any of them could prevent us from successfully growing.

We may not be able to successfully manage our growth.

In the future, if we are able to advance our product candidates to the point of, and thereafter through, clinical trials, we will need to expand our development, regulatory, manufacturing, marketing and sales capabilities or contract with third parties to provide for these capabilities. Any future growth will place a significant strain on our management and on our administrative, operational, and financial resources. Therefore, our future financial performance and our ability to commercialize our product candidates and to compete effectively will depend, in part, on our ability to manage any future growth effectively. To manage this growth, we must expand our facilities, augment our operational, financial and management systems, and hire and train additional qualified personnel. If we are unable to manage our growth effectively, our business may be harmed.

Our business will subject us to the risk of liability claims associated with the use of hazardous materials and chemicals.

Our contract research and development activities may involve the controlled use of hazardous materials and chemicals. Although we believe that our safety procedures for using, storing, handling and disposing of these materials comply with federal, state and local laws and regulations, we cannot completely eliminate the risk of accidental injury or contamination from these materials. In the event of such an accident, we could be held liable for any resulting damages and any liability could have a materially adverse effect on our business, financial condition, and results of operations. In addition, the federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous or radioactive materials and waste products may require our contractors to incur substantial compliance costs that could materially adversely affect our business, financial condition, and results of operations.

We rely on key executive officers and scientific and medical advisors, and their knowledge of our business and technical expertise would be difficult to replace.

We are highly dependent on Dr. Jonathan Lewis, our Chief Executive Officer, Caesar J. Belbel, our Executive Vice President and Chief Legal Officer and our principal scientific, regulatory, and medical advisors. Dr. Lewis’ and Mr. Belbel’s employment are governed by written employment agreements. The employment agreement with Dr. Lewis provides for a term that expires in January 2014. Dr. Lewis and Mr. Belbel may terminate their employment with us at any time, subject, however, to certain non-compete and non-solicitation covenants. The loss of the technical knowledge and management and industry expertise of Dr. Lewis and Mr. Belbel, or any of our other key personnel, could result in delays in product development, loss of customers and sales, and diversion of management resources, which could adversely affect our operating results. We do not carry “key person” life insurance policies on any of our officers or key employees.

S-18

If we are unable to hire additional qualified personnel, our ability to grow our business may be harmed.

We will need to hire additional qualified personnel with expertise in preclinical and clinical research and testing, government regulation, formulation and manufacturing, and eventually, sales and marketing. We compete for qualified individuals with numerous biopharmaceutical companies, universities, and other research institutions. Competition for such individuals is intense and we cannot be certain that our search for such personnel will be successful. Attracting and retaining qualified personnel will be critical to our success. If we are unable to hire additional qualified personnel, our ability to grow our business may be harmed.

We may incur substantial liabilities and may be required to limit commercialization of our products in response to product liability lawsuits.

The testing and marketing of medical products entail an inherent risk of product liability. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our products, if approved. Even a successful defense would require significant financial and management resources. Regardless of the merit or eventual outcome, liability claims may result in:

| • | | decreased demand for our product candidates; |

| • | | injury to our reputation; |

| • | | withdrawal of clinical trial participants; |

| • | | withdrawal of prior governmental approvals; |

| • | | costs of related litigation; |

| • | | substantial monetary awards to patients; |

| • | | the inability to commercialize our product candidates. |

We currently carry clinical trial insurance and product liability insurance. However, an inability to renew our policies or to obtain sufficient insurance at an acceptable cost could prevent or inhibit the commercialization of pharmaceutical products that we develop, alone or with collaborators.

Our business and operations would suffer in the event of system failures.

Despite the implementation of security measures, our internal computer systems and those of our current and future contractors and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. While we are not aware of any such material system failure, accident or security breach to date, if such an event were to occur and cause interruptions in our operations, it could result in a material disruption of our development programs and our business operations. For example, the loss of clinical trial data from completed or future clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data. Likewise, we rely on third parties to manufacture our drug candidates and conduct clinical trials, and similar events relating to their computer systems could also have a material adverse effect on our business. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the further development and commercialization of our drug candidates could be delayed.

S-19

Risks related to the clinical testing, regulatory approval and manufacturing of our product candidates

If we are unable to obtain the necessary U.S. or worldwide regulatory approvals to commercialize any product candidate, our business will suffer.

We may not be able to obtain the approvals necessary to commercialize our product candidates, or any product candidate that we may acquire or develop in the future for commercial sale. We will need FDA approval to commercialize our product candidates in the United States and approvals from regulatory authorities in foreign jurisdictions equivalent to the FDA to commercialize our product candidates in those jurisdictions. In order to obtain FDA approval of any product candidate, we must submit to the FDA a New Drug Application, or NDA, or Biologics License Application, or BLA, demonstrating that the product candidate is safe for humans and effective for its intended use. This demonstration requires significant research and animal tests, which are referred to as preclinical studies, as well as human tests, which are referred to as clinical trials. Satisfaction of the FDA’s regulatory requirements typically takes many years, depending upon the type, complexity, and novelty of the product candidate, and will require substantial resources for research, development, and testing. We cannot predict whether our research, development, and clinical approaches will result in drugs that the FDA will consider safe for humans and effective for their intended uses. The FDA has substantial discretion in the drug approval process and may require us to conduct additional preclinical and clinical testing or to perform post-marketing studies. The approval process may also be delayed by changes in government regulation, future legislation, or administrative action or changes in FDA policy that occur prior to or during our regulatory review. Delays in obtaining regulatory approvals may:

| • | | delay commercialization of, and our ability to derive product revenues from, our product candidates; |

| • | | impose costly procedures on us; and |

| • | | diminish any competitive advantages that we may otherwise enjoy. |

Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our NDAs or BLAs. We cannot be sure that we will ever obtain regulatory approval for any of our product candidates. Failure to obtain FDA approval for our product candidates will severely undermine our business by leaving us without a saleable product, and therefore without any potential revenue source, until another product candidate can be developed. There is no guarantee that we will ever be able to develop or acquire another product candidate or that we will obtain FDA approval if we are able to do so.

In foreign jurisdictions, we similarly must receive approval from applicable regulatory authorities before we can commercialize any drugs. Foreign regulatory approval processes generally include all of the risks associated with the FDA approval procedures described above.

Our product candidates are in various stages of clinical trials, which are very expensive and time-consuming. We cannot be certain when we will be able to submit an NDA or BLA to the FDA and any failure or delay in completing clinical trials for our product candidates could harm our business.

Our product candidates are in various stages of development and require extensive clinical testing. Notwithstanding our current clinical trial plans for each of our existing product

S-20

candidates, we may not be able to commence additional trials or see results from these trials within our anticipated timelines. As such, we cannot predict with any certainty if or when we might submit an NDA or BLA for regulatory approval of our product candidates or whether such an NDA or BLA will be accepted. Because we do not anticipate generating revenues unless and until we submit one or more NDAs or BLAs and thereafter obtain requisite FDA approvals, the timing of our NDA or BLA submissions and FDA determinations regarding approval thereof, will directly affect if and when we are able to generate revenues.

The results of our clinical trials may not support our product candidate claims.

Even if our clinical trials are completed as planned, we cannot be certain that their results will support approval of our product candidates. The FDA normally expects two randomized, well-controlled Phase 3 pivotal studies in support of approval of an NDA or BLA. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be certain that the results of later clinical trials will replicate the results of prior clinical trials and preclinical testing. For example, despite positive findings in earlier clinical trials, our product candidate palifosfamide failed to meet the primary endpoints of the Phase 3 PICASSO 3 trial, causing us to suspend clinical development of palifosfamide in soft tissue sarcoma. The clinical trial process may fail to demonstrate that our product candidates are safe for humans and effective for the indicated uses. This failure would cause us to abandon a product candidate and may delay development of other product candidates. Any delay in, or termination of, our clinical trials will delay the submission of our NDAs or BLAs with the FDA and, ultimately, our ability to commercialize our product candidates and generate product revenues. In addition, our clinical trials involve small patient populations. Because of the small sample size, the results of these clinical trials may not be indicative of future results.

Our synthetic biology product candidates are based on a novel technology, which makes it difficult to predict the time and cost of product candidate development and subsequently obtaining regulatory approval. Currently, no gene therapy products have been approved in the United States and only one product has been approved in Europe.

We have recently focused our product research and development efforts on our synthetic biology product candidates under our Channel Agreement with Intrexon. These products, including DC-RTS-IL-12 and Ad-RTS-IL-12, are based on gene therapy technology. Due to the novelty of this medical technology, there can be no assurance that any development problems we experience in the future related to our synthetic biology platform will not cause significant delays or unanticipated costs, or that such development problems can be solved. We may also experience unanticipated problems or delays in expanding our manufacturing capacity or transferring our manufacturing process to commercial partners, which may prevent us from completing our clinical studies or commercializing our synthetic biology product candidates on a timely or profitable basis, if at all.

In addition, the clinical study requirements of the FDA, the EMA and other regulatory agencies and the criteria these regulators use to determine the safety and efficacy of a product candidate vary substantially according to the type, complexity, novelty and intended use and market of the potential products. The regulatory approval process for novel product candidates such as ours can be more expensive and take longer than for other, better known or extensively studied pharmaceutical or other product candidates. Currently, only one gene therapy product, UniQure’s Glybera, which received marketing authorization from the EMA in 2012, has been

S-21

approved in Europe but has not yet been launched for commercial sale, which makes it difficult to determine how long it will take or how much it will cost to obtain regulatory approvals for our product candidates in either the United States or Europe. Approvals by the EMA may not be indicative of what the FDA may require for approval.

Regulatory requirements governing gene and cell therapy products have changed frequently and may continue to change in the future. For example, the FDA has established the Office of Cellular, Tissue and Gene Therapies within its Center for Biologics Evaluation and Research, or CBER, to consolidate the review of gene therapy and related products, and the Cellular, Tissue and Gene Therapies Advisory Committee to advise CBER on its review. Gene therapy clinical studies conducted at institutions that receive funding for recombinant DNA research from the U.S. National Institutes of Health, or the NIH, are also subject to review by the NIH Office of Biotechnology Activities’ Recombinant DNA Advisory Committee, or the RAC. Although the FDA decides whether individual gene therapy protocols may proceed, the RAC review process can impede the initiation of a clinical trial, even if the FDA has reviewed the trial and approved its initiation. Conversely, the FDA can put an IND on clinical hold even if the RAC has provided a favorable review. Also, before a clinical trial can begin at an NIH-funded institution, that institution’s institutional review board, or IRB, and its Institutional Biosafety Committee will have to review the proposed clinical trial to assess the safety of the trial. In addition, adverse developments in clinical trials of gene therapy products conducted by others may cause the FDA or other regulatory bodies to change the requirements for approval of any of our product candidates.

These regulatory review committees and advisory groups and the new guidelines they promulgate may lengthen the regulatory review process, require us to perform additional studies, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization of these treatment candidates or lead to significant post-approval limitations or restrictions. As we advance our synthetic biology product candidates, we will be required to consult with these regulatory and advisory groups, and comply with applicable guidelines. If we fail to do so, we may be required to delay or discontinue development of our product candidates. These additional processes may result in a review and approval process that is longer than we otherwise would have expected for oncology product candidates. Delay or failure to obtain, or unexpected costs in obtaining, the regulatory approval necessary to bring a potential product to market could decrease our ability to generate sufficient product revenue to maintain our business.