QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

LARGE SCALE BIOLOGY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

LARGE SCALE BIOLOGY CORPORATION

3333 Vaca Valley Parkway

Vacaville, California 95688

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 24, 2005

To the Stockholders of Large Scale Biology Corporation:

Please take notice that the Annual Meeting of Stockholders of Large Scale Biology Corporation, a Delaware corporation (the "Company"), will be held on Friday, June 24, 2005 at 10:30 a.m. local time, at Travis Credit Union, Room B, One Travis Way, Vacaville, CA, for the following purposes:

1. To elect a board of five (5) directors of the Company, to serve until the 2006 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

2. To ratify the appointment of Macias Gini & Company LLP, as the Company's independent registered public accounting firm for the year ending December 31, 2005; and

3. To transact such other business as may properly come before the Annual Meeting or at any adjournments or postponements thereof.

A proxy statement attached to this notice describes these matters in more detail as well as additional information about the Company and its officers and directors. The board of directors has fixed the close of business on April 29, 2005 as the record date and only holders of record of the Company's common stock as of the close of business on April 29, 2005 are entitled to receive this notice and to vote at this Annual Meeting and at any adjournments or postponements thereof.

Vacaville, California

Date: May 23, 2005

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

LARGE SCALE BIOLOGY CORPORATION

3333 Vaca Valley Parkway

Vacaville, California 95688

PROXY STATEMENT

Date, Time and Place of Meeting

The enclosed proxy is solicited on behalf of the board of directors of Large Scale Biology Corporation for the Annual Meeting of Stockholders to be held on Friday, June 24, 2005 at 10:30 a.m. local time, at Travis Credit Union, Room B, One Travis Way, Vacaville, CA (the "Meeting") or at any adjournments or postponements of the Meeting, for the purposes set forth in the notice attached to this proxy statement. This proxy statement and accompanying proxy card are first being mailed to you on or about May 26, 2005.

GENERAL INFORMATION ABOUT VOTING

Record Date, Outstanding Shares, Quorum and Voting

You can vote your shares of common stock if our records show that you owned your shares on April 29, 2005, the record date. As of the record date, there were a total of 31,486,299 shares of common stock outstanding and entitled to vote at the Meeting. You are entitled to one vote for each share of common stock you hold as of the record date. It is important that the proxies be returned promptly and that your shares be represented. You are urged to sign, date and promptly return the enclosed proxy card in the enclosed envelope.

Business may be transacted at the Meeting if a quorum is present. A quorum is present at the Meeting if holders of a majority of the shares of common stock entitled to vote are present in person or by proxy at the Meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (a "broker nonvote"), the nominee can vote them as it sees fit only on matters that are determined to be routine, and not on any other proposal. Broker nonvotes will be counted as present to determine if a quorum exists but will not be counted as present and entitled to vote on any nonroutine proposal.

Directors will be elected by a plurality of the votes cast by the shares of common stock present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. Proposal No. 2 will be approved by the affirmative vote of the majority of the shares of common stock present at the Meeting (in person or by proxy) that are voted for or against the proposal. Abstentions will have the effect of a vote against, and broker nonvotes will not affect the outcome of the vote on a proposal. All votes will be tabulated by the inspector of elections appointed for the Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker nonvotes on each proposal.

Solicitations and Voting of Proxies

When proxies are properly dated, executed, and returned, the shares they represent will be voted at the Annual Meeting in accordance with the instructions of the stockholders. If not otherwise instructed, the shares represented by each valid returned Proxy in the form accompanying this Proxy will be voted "FOR" the ratification of the appointment of Macias Gini & Company LLP, as the Company's independent registered public accounting firm for the year ending December 31, 2005, and at the discretion of the proxy holders, upon such other business as may properly come before the Annual Meeting (including any proposal to adjourn the Annual Meeting) and any adjournment thereof. The matters described in this proxy statement are the only matters we know will be voted on at the Meeting. If other matters are properly presented at the Meeting, the proxyholders will vote your shares in accordance with the recommendations of management.

Please follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the Meeting. If you sign and date the proxy card and mail it back to us in the enclosed envelope, the proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote your shares "for" such proposal or, in the case of the election of directors, vote "for" election to the board of directors of all the nominees presented by the board of directors.

Revocability of Proxies

Any person signing a Proxy in the form accompanying this Proxy Statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote pursuant to the Proxy. A Proxy may be revoked (i) by a writing delivered to the Secretary of the Company stating that the Proxy is revoked, (ii) by a subsequent Proxy that is signed by the person who signed the earlier Proxy and is presented at the Annual Meeting, or (iii) by attendance at the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a Proxy). Please note, however, that if a stockholder's shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming that stockholder's beneficial ownership of the shares. Any written notice of revocation or subsequent Proxy should be delivered to Large Scale Biology Corporation, 3333 Vaca Valley Parkway Vacaville, California 95688, Attention: Secretary, or hand-delivered to the Secretary of Large Scale Biology Corporation at or before the taking of the vote at the Annual Meeting.

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional solicitation materials furnished to you. We will reimburse our transfer agent for its out-of-pocket expenses. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding voting information to the beneficial owners. We estimate that all of the foregoing costs will approximate $50,000. In addition to sending you these materials, some of our employees may contact you by telephone, by mail, or in person. We will not pay our employees additional compensation for contacting you.

2

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Company's board of directors presently has five members: Robert L. Erwin, Ulrich M. Grau, Ph.D., Bernard I. Grosser, M.D., Sol Levine and Kevin J. Ryan. The board of directors appointed Dr. Grau as a member of the Company's board of directors effective as of May 29, 2005. Dr. Grau was nominated by a non-management director. The independent members of our board of directors recommended, and our board of directors approved a slate of five (5) director nominees, all of whom are incumbent directors. Each nominee is to serve until the Company's next annual meeting of stockholders or until each such director's successor shall have been duly qualified and elected. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holders might determine. Each nominee has consented to being named in this proxy statement and to serve if elected.

Nominees to the Board

The director nominees, and their ages as of the date of the Meeting, their principal occupation, and the period during which they have served as a director of the Company are set forth in the following table and paragraphs:

Name

| | Age

| | Principal Occupation

| | Served as

Director Since

|

|---|

| Robert L. Erwin | | 51 | | Chairman of the Board of the Company and Managing Director of Bio-Strategic Directors, LLC | | 1987 |

| Kevin J. Ryan | | 64 | | President and Chief Executive Officer | | 1992–1996; 2001 |

| Ulrich M. Grau, Ph.D. | | 56 | | Chief Executive Officer of Lux Biosciences, Inc. | | May 2005 |

| Bernard I. Grosser, M.D. | | 76 | | Professor and Chairman, Department of Psychiatry, University of Utah School of Medicine | | 1996 |

| Sol Levine | | 76 | | Former President of Revlon, Inc. | | 1992 |

Robert L. Erwin co-founded the Company in 1987 and has been Chairman of the Board since 1992. From 1988 to 1992, he served as President. Mr. Erwin also served as our Chief Executive Officer from 1992 to April 2003. Prior to joining the Company, he co-founded Sungene Technologies Corporation, a biotechnology company, and served as its Vice President of Research and Product Development from 1981 through 1986. Since January 2004, Mr. Erwin has served as Managing Director of Bio-Strategic Directors, LLC, a business and technology consulting company. Mr. Erwin received his M.S. in genetics from Louisiana State University.

Kevin J. Ryan has been our President and Chief Executive Officer since April 2003. Mr. Ryan was our President from 1991 to 1995, served as a director of the Company from 1992 to 1996, and has been a member of the board of directors since May 2001 when he rejoined our board. From 2000 through 2003, Mr. Ryan served in an active capacity with Sonic Innovations, Inc. and managed a number of private investments. Mr. Ryan served as President, Chief Executive Officer and a director of Wesley Jessen VisionCare, Inc., a contact lens company, from June 1995 through October 2000. Mr. Ryan has served as Chairman of the Board of CibaVision's Advisory Committee. From 1987 to 1990, Mr. Ryan served as President of Barnes-Hind's contact lens business; from 1983 to 1987, as President of Revlon VisionCare (a division of Revlon, Inc.); from 1978 to 1983, as President of Barnes-Hind (then a part of Revlon VisionCare); and from 1974 to 1978, as Vice President of Sales and Marketing at the Westwood Division of Bristol-Myers. Mr. Ryan is a managing member of Technology Directors II, LLC (which holds 11.8% of our outstanding common stock) and Technology Directors II BST, LLC, each of which is an investment limited liability company, and the Chairman of the Board of Directors of Sonic Innovations, Inc., a medical device company. Mr. Ryan received his bachelor's degree in business and marketing from the University of Notre Dame.

3

Ulrich M. Grau, Ph.D. founded and currently serves as Chief Executive Officer of Lux Biosciences, Inc., an ophthalmic diseases treatment company. Prior to founding Lux Biosciences, from 2002 to 2005, Dr. Grau was Chief Scientific Officer of Enzon Pharmaceuticals, Inc. From January 2000 to March 2001 Dr. Grau served as President of Research and Development at BASF Pharma/Knoll. From January 1999 to July 1999 Dr. Grau served as Senior Vice President and R&D integration officer at Aventis Pharmaceuticals. Dr. Grau earned his Ph.D. degree in Chemistry and Biochemistry from the University of Stuttgart and spent three years as a Postdoctoral Fellow at the Department of Biological Sciences at Purdue University, Indiana.

Bernard I. Grosser, M.D. has been a director of the Company since January 1996. Dr. Grosser has served as a Professor and as the Chairman of the Department of Psychiatry of the University of Utah School of Medicine since 1982. He has also served as a director of Human Pheromone Sciences, Inc., a biotechnology-based company in the field of human pheromone products, since 1990. Dr. Grosser received his B.A. from the University of Massachusetts, his M.S. in zoology from the University of Michigan and his M.D. from Case Western Reserve University.

Sol Levine has been a director of the Company since March 1992. Mr. Levine is a nonvoting member of Technology Directors II, LLC and Technology Directors II BST, LLC, each of which is an investment limited liability company. Mr. Levine was the President of Revlon, Inc. until his retirement in 1990.

There are no family relationships among any of the directors or officers of the Company.

Independence of Directors

The board of directors has determined that a majority of its members are "independent directors" as that term is defined in Rule 4200(a)(15) of the Marketplace Rules of the National Association of Securities Dealers. Our independent directors include: Mr. Levine and Drs. Grau and Grosser. In addition, these members of the board of directors meet the "outside director" requirements of the regulations under Section 162(m) of the Internal Revenue Code, and the "non-employee director" requirements under Rule 16b-3 of the Securities Exchange Act of 1934, as amended

Committees and Meetings

The board of directors held fifteen meetings in 2004. During 2004 no director attended fewer than 75% of the aggregate of (1) the total number of meetings of the board of directors held during the period they served on the board, and (2) the total number of meetings held by all committees of the board on which they served which were held during the periods they served on such committees. We encourage members of the board of directors to attend our annual meetings of stockholders. All of our board members attended last year's meeting.

The audit committee of the Company's board of directors is composed of independent directors who, in accordance with the audit committee charter, assist the board of directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. Currently, three directors comprise the audit committee: Mr. Levine and Drs. Grau and Grosser. Mr. Levine serves as Chairman of the audit committee. Dr. Grau was appointed to the audit committee effective May 29, 2005. The audit committee met five times in 2004.

The audit committee assists the board in fulfilling its statutory and fiduciary oversight responsibilities relating to the Company's financial accounting, reporting and controls including:

- •

- Appoint and set the compensation of independent auditors to audit the Company's financial statements, review and evaluate the qualifications, independence and performance of the independent auditors and otherwise oversee the independent auditors;

4

- •

- Assist board oversight of the integrity of the Company's financial statements, monitor the periodic reviews of the adequacy of the accounting and financial reporting processes and systems of internal control that are conducted by the independent auditors, the Company's financial and senior management and provide the board with the results of its monitoring and recommendations derived therefrom;

- •

- Monitor the Company's compliance with legal and regulatory requirements;

- •

- Facilitate communication among the independent auditors, the Company's financial and senior management, and the board;

- •

- Annually prepare a report to the Company's stockholders for inclusion in the Company's annual proxy statement as required by the rules and regulations of the Securities and Exchange Commission; and

- •

- Provide to the board such additional information and materials as it may deem necessary to make the board aware of significant financial matters that require the attention of the board.

The board of directors adopted and approved a charter for the audit committee in July 2000, and the charter was amended in April 2001 and again in April 2004. Each of the members of the audit committee is an "independent director" as that term is defined in Rule 4200(a)(15) of the Marketplace Rules of the National Association of Securities Dealers, Inc. The members of the audit committee also meet the independence requirements of Rule 10A-3(B)(i) of the Securities Exchange Act of 1934, and each of the criteria set forth in Rule 4350(d)(2)(A) of the NASD Marketplace Rules. The board of directors has determined that Mr. Levine qualifies as an "audit committee financial expert" as defined by the rules of the Securities and Exchange Commission.

The executive committee acts on an interim basis between meetings of the full board of directors with all of the authority and power of the full board of directors in the management of our business and affairs, except as otherwise limited by our bylaws. The executive committee currently consists of Messrs. Erwin, Levine and Ryan. The executive committee did not meet in 2004.

The compensation committee reviews and approves the compensation and benefits for our executive officers, administers our stock plans and performs other duties as may from time to time be determined by the board of directors. The compensation committee currently consists of Dr. Grosser and Mr. Levine, each of whom will continue to serve on the compensation committee following the Meeting. The compensation committee met one time in 2004 to approve the Compensation Committee Report on Executive Compensation contained in the 2004 Proxy. Because of the small size of the board of directors, with only five members during most of 2004 and four members after the passing away of Mr. Carton on September 7, 2004, executive compensation issues were discussed and approved during meetings of the Company's entire board of directors that included the presence of all compensation committee members. All executive compensation was approved by a majority of outside directors. The compensation of the chief executive officer was not discussed at such meetings and his compensation in 2004 remained the same as his compensation in 2003.

The board of directors does not have a nominating committee and there is no nominating committee charter. The board of directors believes that given the small size of the board of directors, with only five members, nominations by the full board of directors would provide a more diverse and larger number of prospective directors. While there is no nominating committee, a majority of independent directors recommended for the full board's selection of all director nominees.

5

Director Qualifications and Nominations

A majority of the independent directors of the board of directors recommends for the full board's selection all director nominees. These directors identify, consider and recommend candidates for membership on the board and will consider suggestions from stockholders for nominees for election as directors at the 2006 Annual Meeting, provided that the recommendations are received on a timely basis and meet the criteria set forth below. The independent directors of the board of directors and the full board do not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our stockholders. While the independent directors of the board of directors and the full board have not determined minimum criteria for director nominees, they seek to achieve a balance of knowledge, experience and capability on our board. To this end, the independent directors and the full board seek nominees with high professional and personal ethics and values, an understanding of our business lines and industry, diversity of business experience and expertise, broad-based business acumen, and the ability to think strategically. In addition, the independent directors and the full board consider the level of the candidate's commitment to active participation as a director, both at board and committee meetings and otherwise.

Any stockholder of the Company may nominate one or more persons for election as a director of the Company at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our Amended and Restated Bylaws. In addition, the notice must include any other information required pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended. Our Amended and Restated Bylaws specify additional nomination requirements. In order to include a proposal for such nomination of a director in our proxy statement for next year's annual meeting, the written proposal will be subject to the deadlines and procedures described under "Stockholder Proposals" and in the bullet points below. The independent directors of the board have established the following procedure for stockholders to submit director nominee recommendations:

- •

- If you would like to recommend a director candidate for the next annual meeting, you must submit the recommendations by mail to our Secretary at our principal executive offices, no later than the 120th calendar day before the date that we last mailed our proxy statement to stockholders in connection with the previous year's annual meeting.

- •

- Recommendations for candidates must be accompanied by personal information of the candidate, including a list of the candidate's references, the candidate's resume or curriculum vitae and such other information as determined by our Secretary and as necessary to satisfy rules and regulations of the Securities and Exchange Commission and our bylaws, together with a letter signed by the proposed candidate consenting to serve on the board if nominated and elected.

The independent directors of the board of directors consider nominees based on the Company's need to fill vacancies or to expand the board, and also considers the Company's need to fill particular roles on the board or committees thereof (e.g. independent director, audit committee financial expert, etc.) and evaluate candidates in accordance with its policies regarding director qualifications, qualities and skills. The independent directors of the board of directors and the full board will consider all candidates identified through the processes described above, and will evaluate each of them, including incumbents, based on the same criteria.

6

Director Compensation

During 2004 we did not pay cash compensation to directors who are not our employees, but they did receive stock options and reimbursement of out-of-pocket travel expenses for attendance at meetings of the board of directors. Beginning in 2005 any new directors who are not our employees will receive $2,500 for in-person attendance and $500 for attendance by phone at regularly scheduled board meetings. Directors who are also our employees do not receive additional compensation for serving as directors. Any new non-employee directors will receive automatic option grants to purchase 50,000 shares of common stock upon becoming directors with an exercise price equal to the fair market value of our stock on that date. Current non-employee directors receive automatic option grants to purchase 6,000 shares of common stock on the date of each annual meeting of stockholders with an exercise price equal to the fair market value of our stock on that date, if they continue to serve as directors. Any new non-employee directors will receive automatic option grants to purchase 10,000 shares of common stock on the date of each annual meeting of stockholders with an exercise price equal to the fair market value of our stock on that date, if they continue to serve as directors. These automatic option grants are immediately exercisable. However, the shares issued upon exercise of these options remain subject to the Company's right to repurchase the shares upon termination of board service. Initial automatic option grants vest, and the Company's right of repurchase lapses, ratably over twenty quarterly periods from the date of grant. Subsequent automatic option grants vest, and the Company's right of repurchase lapses, ratably over four quarterly periods from the date of grant.

Corporate Governance

The Company has adopted a Code of Conduct and Ethics, which is posted on and can be accessed at the Company's website at http://www.lsbc.com/policies. All financial and senior managers and directors of the Company including the Chief Executive Officer and our senior financial officers, are required to adhere to the code of conduct and ethics in discharging their work-related responsibilities. Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the code of conduct and ethics.

We have also established a procedure through which employees may report concerns about the Company's business practices. In keeping with the Sarbanes-Oxley Act of 2002, the Audit Committee has established procedures for receipt and handling of complaints received by the Company regarding accounting or auditing matters, and to allow for the confidential anonymous submission by our employees of concerns regarding accounting or auditing matters.

Communications with the Board of Directors

Any stockholder who desires to contact the Board or specific members of the Board may do so by writing to: The Board of Directors, Large Scale Biology Corporation, 3333 Vaca Valley Parkway, Suite 1000, Vacaville, California 95688.

Compensation Committee Interlocks and Insider Participation

During 2004 the compensation committee consisted of Dr. Grosser, Mr. Carton and Mr. Levine. Mr. Carton served on the committee until he passed away on September 7, 2004. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH

NAMED NOMINEE.

7

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Our audit committee has appointed Macias Gini & Company LLP, as the Company's independent registered public accounting firm effective May 3, 2005 to audit the Company's financial statements for the year ending December 31, 2005. The stockholders are being asked to ratify this selection.

Representatives of Macias Gini & Company LLP, are expected to be present at the Meeting. They will have an opportunity to make a statement if they so desire and they will be available to respond to appropriate questions.

Stockholder ratification of the selection of Macias Gini & Company LLP, as the Company's independent registered public accounting firm is not required by the Company's bylaws or otherwise. However, the Company has elected to seek such ratification as a matter of sound corporate practice. Should the Company's stockholders fail to ratify the appointment of Macias Gini & Company LLP, as independent registered public accounting firm, the audit committee will investigate the reasons for stockholder rejection and the board of directors will reevaluate the audit committee's selection.

Change in Auditors

On April 8, 2005, Deloitte & Touche, LLP ("Deloitte") notified the Company that it would decline to stand for re-election as the Company's independent registered public accounting firm after completion of the audit of the Company's consolidated financial statements included in the Company's Form 10-K for the year ended December 31, 2004. The client-auditor relationship between the Company and Deloitte & Touche, LLP ceased on April 15, 2005. Deloitte & Touche, LLP, has audited the Company's consolidated financial statements since 1999.

Deloitte's reports on our consolidated financial statements for the years ended December 31, 2004 and 2003 do not contain an adverse opinion or a disclaimer of opinion, and are not qualified or modified as to uncertainty, audit scope, or accounting principles, except that Deloitte's report, dated April 15, 2005, on the consolidated financial statements for the year ended December 31, 2004 expresses an unqualified opinion and includes an explanatory paragraph relating to the uncertainty of the Company's ability to continue as a going concern.

In addition, no reportable events, as defined in Item 304(a)(1)(v) of Regulation S-K, occurred during the Company's two most recent fiscal years and through April 15, 2005.

During 2004 and 2003 and through April 15, 2005, there were no disagreements with Deloitte on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Deloitte, would have caused it to make reference to the subject matter of the disagreements in connection with its reports.

8

Principal Auditor Fees and Services

The following table sets forth the aggregate fees billed by Deloitte & Touche, LLP, for audit services rendered in connection with the consolidated financial statements and reports for 2004 and 2003, and for other services rendered during 2004 and 2003 on behalf of the Company and its subsidiaries, as well as all out-of-pocket costs incurred in connection with these services, which have been billed to the Company:

| | 2003

| | 2004

| |

|---|

| | Amount

| | % of

Total

| | Amount

| | % of

Total

| |

|---|

| Audit fees | | $ | 143,000 | | 76 | % | $ | 155,000 | | 78 | % |

| Audit-related fees | | | 25,000 | | 13 | % | | 25,000 | | 13 | % |

| Tax fees | | | 21,000 | | 11 | % | | 18,000 | | 9 | % |

| All other fees: | | | — | | — | | | — | | — | |

| | |

| | | |

| | | |

| Total fees | | $ | 189,000 | | | | $ | 198,000 | | | |

| | |

| | | |

| | | |

Audit fees consists of fees billed for professional services rendered for the audit of the Company's consolidated financial statements and review of the interim condensed consolidated financial statements included in quarterly reports and services that are normally provided by Deloitte & Touche, LLP, in connection with statutory and regulatory filings or engagements, and attest services, except those not required by statute or regulation.

Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company's financial statements (described above). These services include accounting consultations in connection with SEC filings other than quarterly and annual regulatory filings.

Tax fees consist of fees for professional services for tax compliance, tax advice and tax planning. These fees related to the preparation and review of federal, state and municipality tax returns and tax consultations regarding taxability of stock options, employee benefits and the stock awards plan.

All other fees consist of fees for all other services.

Policy on Pre-Approval by Audit Committee of Services Performed by Independent Registered Public Accounting Firm

The policy of the audit committee is to pre-approve all audit and permissible non-audit services to be performed by the Company's independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" RATIFICATION OF THE

APPOINTMENT OF MACIAS GINI & COMPANY LLP, AS OUR INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM.

OTHER MATTERS

Our board of directors knows of no other business, which will be presented at the Meeting. If any other business is properly brought before the Meeting, proxies in the enclosed form will be voted in respect thereof in accordance with the recommendations of management.

A copy of our annual report for year ended December 31, 2004, has been mailed concurrently with this proxy statement to all stockholders entitled to notice of and to vote at the Meeting. The annual report is not incorporated into this proxy statement and is not considered proxy solicitation material.

9

EXECUTIVE OFFICERS

The names of the Company's executive officers, their ages and positions as of April 29, 2005 are set forth in the following table and paragraphs:

Name

| | Age

| | Position

|

|---|

| Kevin J. Ryan | | 64 | | President and Chief Executive Officer |

| Ronald J. Artale | | 55 | | Senior Vice President, Chief Operating Officer and Chief Financial Officer |

| Michael D. Centron | | 49 | | Vice President, Finance and Administration, and Treasurer |

| Laurence K. Grill, Ph.D. | | 55 | | Senior Vice President, Research and Chief Scientific Officer |

| John S. Rakitan | | 60 | | Senior Vice President, General Counsel and Secretary |

| Daniel Tusé, Ph.D. | | 53 | | Vice President, Business Development |

Kevin J. Ryan, See "Directors" for Mr. Ryan's biography.

Ronald J. Artale joined the Company as a Senior Vice President and our Chief Financial Officer in November 2001 and has served in those capacities since that time. Mr. Artale has also served as our Chief Operating Officer since April 2003. Mr. Artale served as Vice President, Chief Financial Officer and Treasurer from April 2001 to February 2002 and a member of the board of directors since June 2003 of Addition Technology, Inc., a privately-held vision correction medical device company. Since April 2001, Mr. Artale served as a Managing Member and Executive Vice President of the venture capital firms VMA, LLC and VMG, LLC. From 1996 to March 2001, Mr. Artale served as Vice President, Finance and Corporate Controller of Wesley Jessen VisionCare, Inc., a contact lens company. Mr. Artale received his B.B.A. in accounting from Niagara University and his M.B.A. from St. John's University.

Michael D. Centron has served as our Treasurer since 1991 and as a Vice President since March 2001. In June 2003 he was appointed Vice President of Finance and Administration. Mr. Centron joined the Company as the Controller in 1988. Mr. Centron is a certified public accountant and received his B.S. in economics from the Wharton School of the University of Pennsylvania and his M.B.A. from the Haas School of the University of California, Berkeley.

Laurence K. Grill, Ph.D. has served as our Chief Scientific Officer since June 2002. Dr. Grill co-founded the Company and served as our Vice President, Research from 1987 to 1999 and as Senior Vice President, Research since 1999. He received his Ph.D. in plant pathology from the University of California at Riverside.

John S. Rakitan is our General Counsel and Secretary and a Senior Vice President. Mr. Rakitan joined the Company in 1987 as the Controller. He served as Treasurer from 1988 to 1990. Mr. Rakitan was appointed Vice President, General Counsel and Assistant Secretary in 1988, Secretary in 1991 and Senior Vice President in 1999. Before joining the Company, Mr. Rakitan was an attorney in private practice. Mr. Rakitan received his J.D. from the University of Notre Dame.

Daniel Tusé, Ph.D. has served as Vice President, Business Development since January 2002 and has served as the head of our business development group since October 2002. Dr. Tusé joined the Company as Vice President, Pharmaceutical Development in 1995 and served in that position until January 2002. Before joining the Company, Dr. Tusé was Assistant Director of the Life Sciences Division of SRI International, a business consulting firm. Dr. Tusé received his Ph.D. in microbiology from the University of California, Davis.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known by us with respect to the beneficial ownership of the Company's common stock as of April 29, 2005 by:

- •

- Each person or entity who is known by us to beneficially own greater than 5% of our outstanding common stock;

- •

- Each of the Named Executive Officers (see "Executive Compensation and Related Information" below);

- •

- Each of our directors and director nominees;

- •

- All current directors and executive officers as a group.

The percentage of shares beneficially owned is based on 31,486,299 shares of common stock outstanding as of April 29, 2005. Shares of common stock subject to stock options and warrants that are currently exercisable or exercisable within 60 days of April 29, 2005 are deemed to be outstanding for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless indicated below, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

Unless otherwise indicated, the principal address of each of the stockholders below is c/o Large Scale Biology Corporation, 3333 Vaca Valley Parkway, Suite 1000, Vacaville, CA 95688.

Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percentage of Shares

Beneficially Owned

| |

|---|

| Kevin J. Ryan (1) | | 6,115,654 | | 18.5 | % |

| John W. Maki (2) | | 3,710,953 | | 11.8 | |

| John J. O'Malley (3) | | 3,710,953 | | 11.8 | |

Technology Directors II, LLC (4)

460 Bloomfield Ave., Suite 200

Montclair, NJ 07042 | | 3,667,453 | | 11.6 | |

| Robert L. Erwin (5) | | 969,217 | | 3.0 | |

| Ronald J. Artale (6) | | 782,980 | | 2.4 | |

| John S. Rakitan (7) | | 557,496 | | 1.8 | |

| Laurence K. Grill, Ph.D. (8) | | 529,771 | | 1.7 | |

| Sol Levine (9) | | 401,420 | | 1.3 | |

| Daniel Tusé, Ph.D. (10) | | 354,333 | | 1.1 | |

| Bernard I. Grosser, M.D. (11) | | 188,045 | | * | |

| Directors and officers as a group (9 persons)(12) | | 10,169,441 | | 28.9 | |

- *

- Less than one percent.

- (1)

- Includes 3,667,453 shares held by Technology Directors II, LLC, 68,196 shares held by the Ryan Family Trust, of which Mr. Ryan is Trustee, 12,000 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005, 631,579 maximum shares issuable if Mr. Ryan elects to convert his $600,000 convertible note payable to him calculated by dividing $600,000 by the greater of $.95 or 90% of the average closing price the 22 trading days prior to conversion and 903,614 shares issuable if Mr. Ryan elects to exercise his warrant to purchase shares of the Company's common stock. Mr. Ryan is a managing member of Technology Directors II, LLC. Mr. Ryan disclaims beneficial ownership of the shares held by Technology Directors II, LLC except to the extent of his pecuniary interest in this entity.

11

- (2)

- Represents 3,667,453 shares held by Technology Directors II, LLC and 43,500 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005. Mr. Maki is a managing member of Technology Directors II, LLC. Mr. Maki disclaims beneficial ownership of the shares held by Technology Directors II, LLC except to the extent of his pecuniary interest in this entity.

- (3)

- Represents 3,667,453 shares held by Technology Directors II, LLC and 43,500 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005. Mr. O'Malley is a managing member of Technology Directors II, LLC. Mr. O'Malley disclaims beneficial ownership of the shares held by Technology Directors II, LLC except to the extent of his pecuniary interest in this entity.

- (4)

- Messrs. Maki, O'Malley and Ryan share voting and dispositive power with respect to Technology Directors II, LLC.

- (5)

- Includes 25,000 shares held by the Marti Nelson Medical Foundation; 13,500 shares held by the Erwin and Nelson Exemption Trust, of which Mr. Erwin is Trustee; 434,675 shares held by the Erwin and Nelson Living Trust, of which Mr. Erwin is Trustee; and 356,000 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005. Mr. Erwin is a director and co-founder of the Marti Nelson Medical Foundation and disclaims beneficial ownership of the shares held by the Foundation.

- (6)

- Includes 658,332 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005.

- (7)

- Includes 21,000 shares held by Timothy J. Rakitan Trust, of which Mr. John S. Rakitan is Trustee, 21,000 shares held by John T. Rakitan Trust, of which Mr. John S. Rakitan is Trustee, and 249,999 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005.

- (8)

- Includes 218,500 shares held by the Grill Family Trust, of which Dr. Grill is Trustee, and 201,666 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005.

- (9)

- Includes 61,500 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005. Mr. Levine is a nonvoting member of Technology Directors II, LLC. Accordingly, his holdings do not include shares held by this entity.

- (10)

- Includes 344,333 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005.

- (11)

- Includes 61,500 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005.

- (12)

- Includes an aggregate of 2,143,663 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 29, 2005, 631,579 maximum shares issuable if Mr. Ryan elects to convert his $600,000 convertible note payable to him calculated by dividing $600,000 by the greater of $.95 or 90% of the average closing price the 22 trading days prior to conversion and 903,614 shares issuable if Mr. Ryan elects to exercise his warrant to purchase shares of the Company's common stock.

12

EXECUTIVE COMPENSATION AND RELATED INFORMATION

The following table summarizes the compensation earned by our Chief Executive Officer and the four other most highly compensated executive officers, all acting in such capacities as of December 31, 2004, (collectively referred to as the "Named Executive Officers"). The aggregate amount of perquisites and other personal benefits, securities or properties received by each Named Executive Officer was less than either $50,000 or 10% of the total annual salary and bonus reported for each respective Named Executive Officer in each year reported below.

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation Awards

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| |

| | Restricted

Stock

Award

| | Securities

Underlying

Options

| | All Other

Compensation(4)

|

|---|

| | Year

| | Salary

| | Other

|

|---|

Kevin J. Ryan

President and

Chief Executive Officer | | 2004

2003

2002 | | $

| 30,000

21,500

— | | $

| —

—

— | | —

—

— | | —

—

— | | $

| —

—

— |

Ronald J. Artale

Senior Vice President,

Chief Operating Officer and

Chief Financial Officer |

|

2004

2003

2002 |

|

|

242,500

220,000

220,000 |

(1)

(1)

(1) |

|

24,000

27,700

33,000 |

(2)

(2)

(2) |

—

—

— |

|

100,000

250,000

50,000 |

|

|

2,000

2,000

2,200 |

Lawrence K. Grill, Ph.D.

Senior Vice President, Research and Chief Scientific Officer |

|

2004

2003

2002 |

|

|

190,000

190,000

184,250 |

(3)

(3)

(3) |

|

—

—

— |

|

—

—

— |

|

—

40,000

50,000 |

|

|

3,100

3,200

4,700 |

John S. Rakitan

Senior Vice President and General Counsel and Secretary |

|

2004

2003

2002 |

|

|

214,200

190,000

190,000 |

(3)

(3)

(3) |

|

—

—

— |

|

—

—

— |

|

100,000

50,000

50,000 |

|

|

3,600

3,300

4,900 |

Daniel Tusé, Ph.D.

Senior Vice President,

Biopharmaceutical Development |

|

2004

2003

2002 |

|

|

167,200

153,000

151,700 |

|

|

—

—

— |

|

—

—

— |

|

—

50,000

50,000 |

|

|

3,100

3,000

4,200 |

- (1)

- Includes salary forgone pursuant to a mandatory reduction of $22,000 in 2004, $22,000 in 2003 and $11,000 in 2002. In lieu thereof the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture and Mr. Artale may not be entitled to the stock issued to him.

- (2)

- The Company provided housing, including basic furnishings, for Mr. Artale near the Company's corporate office. In addition, the Company reimbursed Mr. Artale for air travel expenses incurred between his personal residence outside of California and the Company's corporate office.

- (3)

- Includes salary forgone pursuant to a mandatory reduction of $19,000 in 2004, $19,000 in 2003 and $9,500 in 2002. In lieu thereof the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture and Mr. Rakitan and Dr. Grill may not be entitled to the stock issued to them.

- (4)

- Comprised of term life insurance premium of less than $1,000 and 401(k) matching contributions.

13

Stock Option Grants in 2004

The following table summarizes information regarding stock options granted under the 2000 Stock Incentive Plan to the Named Executive Officers in 2004. Unless otherwise indicated below, options generally become exercisable and vest ratably over a period of 12 quarters.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term(3)

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total Options

Granted to

Employees in

2004(1)

| |

| |

|

|---|

Name

| | Exercise

Price(2)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Kevin J. Ryan | | — | | — | | | — | | — | | | — | | | — |

| Ronald J. Artale | | 100,000 | | 18.6 | % | $ | 1.92 | | 3/01/2014 | | $ | 120,750 | | $ | 306,000 |

| John S. Rakitan | | 100,000 | | 18.6 | % | | 1.92 | | 3/01/2014 | | | 120,750 | | | 306,000 |

| Lawrence K. Grill, Ph.D. | | — | | — | | | — | | — | | | — | | | — |

| Daniel Tusé, Ph.D. | | — | | — | | | — | | — | | | — | | | — |

- (1)

- Based upon a total of 539,000 stock options granted to all employees in 2004.

- (2)

- Exercise prices of granted stock options are equal to the closing price of the Company's common stock as reported on the NASDAQ National Market on the date of grant.

- (3)

- In accordance with Securities and Exchange Commission rules, these columns quantify the hypothetical gains that could be achieved by the respective options assuming the options are exercised at the end of the option terms and the Company's stock price appreciates from the date of grant at compounded annual rates of 5% and 10%. Actual gains, if any, on stock option exercises will depend on the future performance of our common stock and overall stock market conditions. If our stock price does not exceed the exercise price at the time of exercise, the realized value to the option holder will be zero.

Aggregated Option Exercises in Last Year and Year-End Option Values

The following table summarizes information regarding stock options exercised by the Named Executive Officers in 2004 and the value of unexercised "in-the-money" options they held at December 31, 2004.

| |

| |

| | Number of Securities

Underlying Unexercised

Options at

December 31, 2004(1)

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money Options at December 31, 2004(2)

|

|---|

| | Common

Shares

Acquired

on Exercise

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Kevin J. Ryan | | — | | — | | — | | — | | $ | — | | $ | — |

| Ronald J. Artale | | — | | — | | 166,667 | | 133,333 | | | 20,000 | | | 19,000 |

| John S. Rakitan | | — | | — | | 61,667 | | 28,333 | | | 4,250 | | | 3,250 |

| Lawrence K. Grill, Ph.D. | | — | | — | | 66,667 | | 33,333 | | | 5,000 | | | 4,000 |

| Daniel Tusé, Ph.D. | | — | | — | | 66,667 | | 33,333 | | | 5,000 | | | 4,000 |

- (1)

- Options generally become exercisable and vest ratably over a period of 12 quarters.

- (2)

- In-the-money options represents unexercised options having a per share exercise price below $1.26, the closing price of the Company's common stock at December 31, 2004, as reported on the NASDAQ National Market. The value of unexercised in-the-money options equals the number of in-the-money options multiplied by the excess of $1.26 over the per-share exercise prices of the options. The value of unexercised in-the-money options at December 31, 2004, may never be realized by the option holders.

14

Employment Contracts, Termination of Employment Arrangements and Change of Control Agreements

In November 2001, Ronald J. Artale joined the Company as Senior Vice President and Chief Financial Officer. Mr. Artale's offer letter provided for an initial salary of $220,000 commencing on November 1, 2001. As a result of mandatory reductions in cash compensation, Mr. Artale's annual salary was reduced to $198,000. Mr. Artale's annual salary was subsequently increased to $225,000 during 2004. Mr. Artale received 17,354, 26,171 and 10,112 shares of common stock under the Company's 2000 Stock Incentive Plan with an aggregate value equivalent to the amount of the mandatory reduction of his cash compensation in 2004, 2003 and 2002, respectively. These shares are subject to a risk of forfeiture and Mr. Artale may not be entitled to the stock issued to him. If he is terminated without cause, he will receive severance equivalent to twelve months salary. Mr. Artale also received options to purchase 400,000 shares of common stock at an exercise price of $3.45 per share under the 2000 Stock Incentive Plan. These options vest in equal quarterly installments over a period of three years. All unvested options will immediately vest if the Company is acquired. Pursuant to the offer letter and an extension thereof, Mr. Artale received payments for various relocation, housing and travel expenses in 2004. Mr. Artale's employment is at will and may be terminated at any time, with or without formal cause.

Mr. Ryan's current annual salary is $30,000. Mr. Ryan's employment is at will and may be terminated at any time, with or without formal cause.

Dr. Grill's current annual salary is $171,000. Dr. Grill's employment is at will and may be terminated at any time, with or without formal cause.

Mr. Rakitan's current annual salary is $200,000. Mr. Rakitan's employment is at will and may be terminated at any time, with or without formal cause.

Dr. Tusé's current annual salary is $170,000. Dr. Tusé's employment is at will and may be terminated at any time, with or without formal cause.

There currently is no bonus plan in effect applicable to the Named Executive Officers.

15

Equity Compensation Plans Information

The Company's equity compensation plans are fully described in our annual report for the year ended December 31, 2004. The Company maintains the 2000 Stock Incentive Plan (the "Plan") and the 2000 Employee Stock Purchase Plan (the "ESPP"), each of which has been approved by the Company's stockholders. Information related to our equity compensation plans as of December 31, 2004, is set forth below.

| | (a)

| |

| | (c)

| |

|---|

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | (b)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column(a))

| |

|---|

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| |

|---|

| Equity compensation plans approved by security holders | | 7,106,571 | (1)(2) | $ | 4.20 | | 4,077,001 | (3)(4) |

| Equity compensation plans not approved by security holders | | 250,000 | (5) | | 5.13 | | — | |

| | |

| | | | |

| |

| Total | | 7,356,571 | | | 4.23 | | 4,077,001 | |

| | |

| | | | |

| |

- (1)

- Excludes 979,913 shares of restricted common stock issued by the Plan under the terms of the Company's Stock Issuance Program. These shares are subject to a risk of forfeiture or may be subject to repurchase by the Company at a weighted average exercise price of $0.93.

- (2)

- Excludes purchase rights accruing under the ESPP.

- (3)

- Includes 2,939,823 and 1,137,178 shares available for issuance under the Plan and the ESPP, respectively.

- (4)

- Pursuant to the Plan and the ESPP, on each January 1, the number of shares of common stock reserved for issuance under the Plan and the ESPP shall be increased automatically by a number of shares equal to 4% and 1%, respectively, of the total number of outstanding shares of common stock on the last trading day of the immediately preceding month, provided that no such increase under the Plan and the ESPP may exceed 2,000,000 and 350,000 shares, respectively, in any calendar year.

- (5)

- On November 1, 2001, John D. Fowler, Jr. was issued a warrant to purchase 250,000 shares of common stock as additional compensation to him upon entering into his employment with the Company.

16

The following pages contain a report relating to executive compensation for 2004, a chart titled "Stock Performance Graph" and a report issued by our Audit Committee relating to its review of the accounting, auditing and financial reporting practices of the Company. Stockholders should be aware that under SEC rules, the Report On Executive Compensation, the Stock Performance Graph and the Audit Committee Report are not deemed to be "soliciting material" or "filed" with the SEC under the Securities Exchange Act of 1934, and are not incorporated by reference in any past or future filing by the Company under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, unless these sections are specifically referenced.

REPORT ON EXECUTIVE COMPENSATION

Compensation Committee

Generally, the Compensation Committee sets the compensation of the Chief Executive Officer and other officers of the Company, reviews the design, administration and effectiveness of compensation programs for other key executives and approves stock option grants for all executive officers. The Committee is composed entirely of outside directors. Because of the small size of the board of directors, with only five members during most of 2004 and four members after the passing away of Mr. Carton on September 7, 2004, executive compensation issues were discussed and approved during meetings of the Company's entire board of directors that included the presence of all outside directors. All executive compensation was approved by a majority of outside directors. The compensation of the chief executive officer was not discussed at such meetings and his compensation in 2004 remained the same as his compensation in 2003.

Compensation Philosophy and Objectives

We believe that the compensation programs for the executive officers should be designed to motivate and retain talented executives responsible for the success of the Company and should be determined within a competitive framework and individual contribution. Within this overall philosophy, our objectives are to align the financial interests of executive officers with those of stockholders by providing equity-based, long-term incentives.

Compensation Components and Policy

The major components of the Company's executive officer total compensation package are base salary and long-term, equity-based incentive awards.

Base Compensation. Effective July 1, 2002, the Company mandated a broad-based salary reduction program that was effective for 13 of the Company's most highly paid employees during 2004, including most executive officers. Under this broad-based program, certain officers realized reductions of approximately 10% of their annual cash compensation. Executive officers whose salaries were reduced are receiving stock compensation under the Company's 2000 Stock Incentive Plan with values equivalent to the reduction in their cash compensation. Executive officers were issued a total of 65,029 shares of the Company's common stock under the 2000 Stock Incentive Plan in connection with such continued cash compensation reductions in 2004.

The base salaries for executive officers other than our Chief Executive Officer were reviewed, and in some cases increased during 2004 based upon each individual's current salary and responsibilities, recognition of personal performance and length of time since prior salary increases that were in 2001 and 2002. The purpose of such salary increases was for merit and the retention of executive officers. The basis of stock compensation for the compensation reductions mentioned above were not adjusted at that time.

17

Long-Term, Equity-Based Incentive Awards. The goal of the Company's long-term, equity-based incentive awards is to align the interests of executive officers with stockholders and to provide each executive officer with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Option grants to acquire shares of the Company's common stock are at a fixed price per share (generally, the market price on the grant date) over a specified period of time. Options granted vest in quarterly installments generally over a three-year period, contingent upon the optionee's continued employment with the Company. Accordingly, the option grants generally will provide a return only if the optionee remains with the Company, and in any event only if the market price of the Company's common stock appreciates over the option term. In 2004 the full board of directors granted options to purchase an aggregate of 200,000 shares of common stock to two of the Company's executive officers.

CEO Compensation. Mr. Ryan served as the Company's CEO during 2004. In 2003, in connection with his appointment as our CEO and in consideration of Mr. Ryan's wishes and the Company's limited cash resources at that time, we established a $30,000 base salary for Mr. Ryan. Mr. Ryan's salary was not changed in 2004 and, accordingly, he earned $30,000 in base salary during 2004. Mr. Ryan's compensation arrangement contains neither a variable incentive award nor a specific plan of incentive stock options. Mr. Ryan received no options in 2004 for his performance as CEO.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of their executive officers, to the extent that compensation exceeds $1 million per covered officer in any fiscal year. The limitation applies only to compensation that is not considered to be performance-based. Non-performance based compensation paid to the Company's executive officers for the 2004 fiscal year did not exceed the $1 million limit for any officer, and we do not anticipate that the non-performance based compensation to be paid to the Company's executive officers for fiscal 2004 will exceed that limit. The Company's 2000 Stock Incentive Plan has been structured so that any compensation deemed paid in connection with the exercise of option grants made under that plan with an exercise price equal to the fair market value of the option shares on the grant date will qualify as performance-based compensation that will not be subject to the $1 million limitation.

Other Elements of Executive Compensation

Executives are eligible for corporation-wide medical and dental benefits, participation in a 401(k) plan under which the Company currently provides matching contributions up to $3,075 per year and participation in the Company Employee Stock Purchase Plan. In addition, executives participate in a corporation-wide group term life insurance program, and short- and long-term disability insurance programs.

18

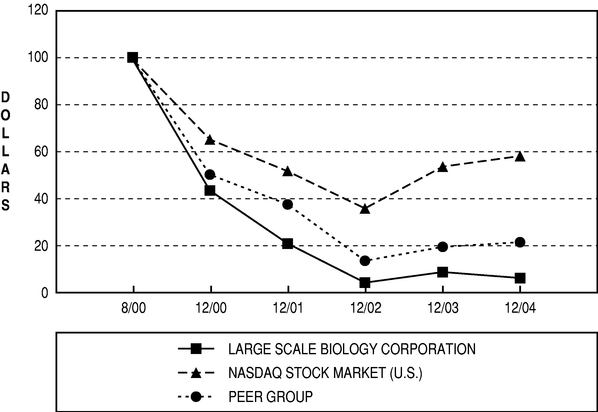

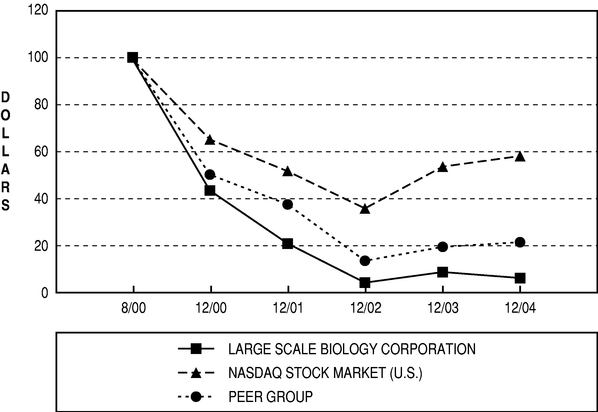

STOCK PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return of the Company's common stock with the cumulative total return of the NASDAQ Stock Market-U.S. Index and of a peer group of companies for the period beginning August 10, 2000 (the first NASDAQ trading day of the Company's common stock) through December 31, 2004. This graph assumes the investment of $100 on August 10, 2000 in each of the common stock of the Company, the NASDAQ Stock Market-U.S. Index, and our peer group, and that all dividends were reinvested. Our peer companies are: Applera Corporation, Ciphergen Biosystems, Inc., Diversa Corporation, Dyax Corporation, Exelixis, Inc., Icoria Inc., Illumina, Inc., Incyte Corporation, Lexicon Genetics Inc., and Rigel Pharmaceuticals, Inc.

The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of the Company's common stock.

- *

- $100 invested on 8/10/00 in stock and index, including reinvestment of dividends.

Cumulative Total Return

| | 8/10/00

| | 12/00

| | 12/01

| | 12/02

| | 12/03

| | 12/04

|

|---|

| Large Scale Biology Corporation | | 100.00 | | 43.44 | | 20.58 | | 3.66 | | 8.42 | | 5.76 |

| NASDAQ Stock Market-U.S. Index | | 100.00 | | 65.27 | | 51.78 | | 35.80 | | 53.55 | | 58.23 |

| Peer Group | | 100.00 | | 50.34 | | 37.44 | | 13.32 | | 19.20 | | 21.12 |

19

AUDIT COMMITTEE REPORT

In accordance with its written charter adopted by the board of directors, the Audit Committee oversees the quality and integrity of the Company's accounting and financial reporting practices and the audit of the Company's consolidated financial statements by its independent registered public accounting firm.

The Audit Committee has reviewed and discussed the Company's audited consolidated financial statements for the year ended December 31, 2004, with the Company's management and its independent registered public accounting firm, Deloitte & Touche, LLP, prior to public release. The Audit Committee has discussed with Deloitte & Touche, LLP, the matters required to be discussed by Statement on Auditing Standards No. 61, "Communication with Audit Committees," as amended, which includes, among other items, matters related to the conduct of the audit of the Company's consolidated financial statements.

The Audit Committee has received the written disclosures and the letter from Deloitte & Touche, LLP, required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," and the Audit Committee discussed with Deloitte & Touche, LLP, their independence from the Company.

Based on the review and discussions referred to above, the Audit Committee recommended to the Company's board of directors and the board of directors has approved that the audited consolidated financial statements for the year ended December 31, 2004, be included in the Company's Annual Report on Form 10-K.

20

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

From January 1, 2004, to the present, there are no transactions in which the amount involved exceeds $60,000 to which we or any of our subsidiaries is a party and in which any executive officer, director, 5% beneficial owner of our common stock or member of the immediate family of any of the foregoing persons has a direct or indirect material interest, except for payments set forth under "Executive Compensation and Related Information" and those described below.

On March 3, 2005, we issued a $600,000 convertible promissory note, or Note, to Kevin J. Ryan, our President and Chief Executive Officer and a member of our board of directors. The Note bears interest at 8% and is due on July 1, 2005. The Note is convertible into our Common Stock, at the option of the holder, on or before the due date, at a conversion price equal to the greater of the closing price of our Common Stock on March 3, 2005, or 90% of the average of the closing prices of our common stock on the 22 trading days ending the day before the conversion of the Note. The Note may be prepaid by us without penalty at any time. We granted piggyback registration rights with respect to the shares issuable upon exercise of the Note, with respect to any registration filing by us, other than a filing pursuant to Form S-4 or Form S-8.

On April 15, 2005, we received $3,000,000 in cash in exchange for a promissory note, or Promissory Note, issued to Kevin J. Ryan, our President and Chief Executive Officer and a member of our board of directors. The Promissory Note bears interest at the prime rate plus two percent per annum initially at 7.75% due monthly starting May 15, 2005 with a rate not less than 7.25%. The Promissory Note is due on April 17, 2006. Borrowings under the loan are secured by certain patented intellectual property. The Promissory Note may be prepaid by us without penalty at any time. The holder of the Promissory Note may elect to be repaid up to $1,500,000 as a result of any Company financing event with net proceeds of $4,000,000 or more.

In connection with the Promissory Note, we issued a common stock purchase warrant that expires on April 15, 2011. The holder of the warrant has the option either to purchase 903,614 shares of our common stock at $0.83 per share or common stock of our subsidiary, Predictive Diagnostic, Inc, or PDI. The PDI exercise price would be the lowest price per share of the PDI stock in any PDI financing event of no less than $1,500,000. The number of warrant shares would be determined by dividing $3,000,000 by the PDI exercise price. PDI common stock issuable pursuant to the warrant would be subject to exchange and underwriter's holding period restrictions, or "lock-ups." We granted piggyback registration rights with respect to the shares issuable upon exercise of the warrant, with respect to any registration filing by us, other than a filing pursuant to Form S-4 or Form S-8.

COMPLIANCE UNDER SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

The members of the board of directors, our executive officers and persons who hold more than 10% of our outstanding common stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, which require them to file reports with respect to their ownership of our common stock and their transactions in such common stock. Based solely upon the review of the Forms 3, 4 and 5 furnished to the Company and certain representations made to the Company, the Company believes that during 2004, all members of the board of directors, our executive officers and person(s) who hold more than 10% of our outstanding common stock timely filed all reports required to be filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 with respect to transactions in equity securities of the Company.

21

STOCKHOLDER PROPOSALS

Deadline for receipt of stockholder proposals for the 2006 Annual Meeting of Stockholders

Proposals of our stockholders that are intended to be included in our proxy statement and presented by such stockholders at our 2006 Annual Meeting of Stockholders must be received no later than January 26, 2006. Stockholders wishing to nominate directors or propose other business at the 2006 Annual Meeting of Stockholders, but not intending to include such nomination or proposal in the Company's proxy statement for such meeting, must give advance written notice to the Company pursuant to our bylaws. Our bylaws provide that notice of any such nomination or proposal must be received at our principal executive offices not less than 120 days prior to the date of the 2006 Annual Meeting of Stockholders and must contain the information specified by our bylaws. If this notice is not timely, then the nomination or proposal will not be brought before the 2006 Annual Meeting of Stockholders.

22

PROXY

LARGE SCALE BIOLOGY CORPORATION

Annual Meeting of Stockholders—June 24, 2005

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Kevin J. Ryan, Ronald J. Artale and John S. Rakitan, and each of them, as proxies of the undersigned, with full power to appoint substitutes, and hereby authorizes them to represent and to vote all shares of stock of Large Scale Biology Corporation which the undersigned is entitled to vote, as specified on the reverse side of this card at the Annual Meeting of Stockholders of Large Scale Biology Corporation (the "Meeting") to be held on June 24, 2005, at 10:30 a.m. local time, at the Travis Credit Union, Room B, One Travis Way, Vacaville, California and at any adjournment or postponement thereof.

WHEN THIS PROXY IS PROPERLY EXECUTED, THE SHARES TO WHICH THIS PROXY RELATES WILL BE VOTED AS SPECIFIED AND, IF NO SPECIFICATION IS MADE, WILL BE VOTED FOR ALL NOMINEES FOR DIRECTORS IN PROPOSAL 1 AND FOR PROPOSAL 2, AND THIS PROXY AUTHORIZES THE ABOVE DESIGNATED PROXIES TO VOTE IN THEIR DISCRETION ON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF TO THE EXTENT AUTHORIZED BY RULE 14a-4(c) PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

| SEE REVERSE SIDE | | (CONTINUED AND TO BE SIGNED ON

REVERSE SIDE) | | SEE REVERSE SIDE |

DETACH HERE

X Please mark votes as in this example.

The Board of Directors recommends a vote FOR proposals 1 and 2.

| 1. | | Election of Directors

Nominees: (01) Robert L. Erwin, (02) Ulrich M. Grau, Ph.D., (03) Bernard I. Grosser, M.D., (04) Sol Levine, and (05) Kevin J. Ryan. | | 2. | | To ratify the selection of Macias Gini & Company LLP as Large Scale Biology Corporation's independent registered public accounting firm for the year ending December 31, 2005. | | FOR

o | | AGAINST

o | | ABSTAIN

o |

| | | o | | FOR ALL

NOMINEES | | o | | WITHHELD

FROM ALL

NOMINEES | | | | | | | | | | |

| | | | | | | | | | | 3. | | To transact such other business as may properly come before the Meeting and any adjournment or postponement thereof. | | | | | | |

| o | | | | | | | | | | |

| (Instruction: to withhold authority to vote for any individual nominee, write that nominee's name on the space provided above.) | | | | | | | | | | |

| | | | | | | | | | | | | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT o | | MARK HERE IF YOU PLAN TO ATTEND THE MEETING o |

| | | | | | | | | | |

Please sign exactly as your name(s) appear(s) on this Proxy. If shares of stock stand of record in the names of two or more persons or in the name of husband and wife, whether as joint tenants or otherwise, both or all of such persons should sign this Proxy. If shares of stock are held of record by a corporation, this Proxy should be executed by the president or vice president and the secretary or assistant secretary. Executors, administrators or other fiduciaries who execute this Proxy for a deceased stockholder should give their full title. Please date this Proxy. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | |

| Signature: | | | | Date: | | | | Signature: | | | | Date: | | |

| | |

| | | |

| | | |

| | | |

|

QuickLinks

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held on June 24, 2005PROXY STATEMENTGENERAL INFORMATION ABOUT VOTINGPROPOSAL NO. 1: ELECTION OF DIRECTORSOUR BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF MACIAS GINI & COMPANY LLP, AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.OTHER MATTERSEXECUTIVE OFFICERSSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTEXECUTIVE COMPENSATION AND RELATED INFORMATIONEquity Compensation Plans InformationREPORT ON EXECUTIVE COMPENSATIONSTOCK PERFORMANCE GRAPHAUDIT COMMITTEE REPORTCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSCOMPLIANCE UNDER SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934STOCKHOLDER PROPOSALSPROXY LARGE SCALE BIOLOGY CORPORATION Annual Meeting of Stockholders—June 24, 2005THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORSThe Board of Directors recommends a vote FOR proposals 1 and 2.