UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

|

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x | | Definitive Proxy Statement |

|

¨ | | Definitive Additional Materials |

|

¨ | | Soliciting Material Pursuant to §240.14a-12 |

LARGE SCALE BIOLOGY CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

LARGE SCALE BIOLOGY CORPORATION

3333 Vaca Valley Parkway

Vacaville, California 95688

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 29, 2003

| To | | the Stockholders of Large Scale Biology Corporation: |

Please take notice that the Annual Meeting of Stockholders of Large Scale Biology Corporation, a Delaware corporation (the “Company”), will be held on Thursday, May 29, 2003 at 10:00 a.m. local time, at the Embassy Suites Hotel, Chicago-O’Hare, 5500 North River Road, Rosemont, Illinois, for the following purposes:

1. To elect a board of five (5) directors of the Company, to hold office until the 2004 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent auditors for the year ending December 31, 2003; and

3. To transact such other business as may properly come before the Annual Meeting or at any adjournments or postponements thereof.

A proxy statement attached to this notice describes these matters in more detail as well as additional information about the Company and its officers and directors. The board of directors has fixed the close of business on April 2, 2003 as the record date and only holders of record of the Company’s common stock as of the close of business on April 2, 2003 are entitled to receive this notice and to vote at this Annual Meeting and at any adjournments or postponements thereof.

By Order of the Board of Directors

John S. Rakitan

Secretary

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

LARGE SCALE BIOLOGY CORPORATION

3333 Vaca Valley Parkway

Vacaville, California 95688

PROXY STATEMENT

The enclosed proxy is solicited on behalf of the board of directors of Large Scale Biology Corporation (the “Company”, “we”, “us” or “our”) for the Annual Meeting of Stockholders to be held on Thursday, May 29, 2003 (the “Meeting”) or at any adjournments or postponements of the Meeting, for the purposes set forth in the notice attached to this proxy statement. This proxy statement and accompanying proxy card are first being mailed to you on or about May 2, 2003.

GENERAL INFORMATION ABOUT VOTING

You can vote your shares of common stock if our records show that you owned your shares on April 2, 2003, the record date. As of the record date, there were a total of 25,564,092 shares of common stock outstanding and entitled to vote at the Meeting. You are entitled to one vote for each share of common stock you hold as of the record date. It is important that the proxies be returned promptly and that your shares be represented. You are urged to sign, date and promptly return the enclosed proxy card in the enclosed envelope.

Business may be transacted at the Meeting if a quorum is present. A quorum is present at the Meeting if holders of a majority of the shares of common stock entitled to vote are present in person or by proxy at the Meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (a “broker nonvote”), the nominee can vote them as it sees fit only on matters that are determined to be routine, and not on any other proposal. Broker nonvotes will be counted as present to determine if a quorum exists but will not be counted as present and entitled to vote on any nonroutine proposal.

Directors will be elected by a plurality of the votes cast by the shares of common stock present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. Proposal No. 2 will be approved by the affirmative vote of the majority of the shares of common stock present at the Meeting (in person or by proxy) that are voted for or against the proposal. Abstentions will have the effect of a vote against, and broker nonvotes will not affect the outcome of the vote on a proposal. All votes will be tabulated by the inspector of elections appointed for the Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker nonvotes on each proposal.

Please follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the Meeting. If you sign and date the proxy card and mail it back to us in the enclosed envelope, the proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote your shares “for” such proposal or, in the case of the election of directors, vote “for” election to the board of directors of all the nominees presented by the board of directors.

The matters described in this proxy statement are the only matters we know will be voted on at the Meeting. If other matters are properly presented at the Meeting, the proxyholders will vote your shares in accordance with the recommendations of management.

1

At any time before the vote on a proposal, you can change your vote either by giving our Secretary, John S. Rakitan, at the Company address set forth above, written notice revoking your proxy card, or by signing, dating and returning to us a new proxy card at the Company address set forth above, or by attending the Meeting and voting in person. We will honor the proxy card with the latest date. Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you can attend the Meeting and vote your shares in person. If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares by proxy or in person at the Meeting.

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional solicitation materials furnished to you. We will reimburse our transfer agent for its out-of-pocket expenses. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding voting information to the beneficial owners. We estimate that all of the foregoing costs will approximate $50,000. In addition to sending you these materials, some of our employees may contact you by telephone, by mail, or in person. We will not pay our employees additional compensation for contacting you.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Company’s board of directors presently has six members: Marvyn Carton, Robert L. Erwin, John D. Fowler, Jr., Bernard I. Grosser, M.D., Sol Levine and Kevin J. Ryan. Mr. Fowler will not stand for re-election at the Meeting. Accordingly, the board of directors approved a slate of five (5) director nominees, all of whom are incumbent directors, and a reduction of the size of the board to five members following the Meeting. Each nominee is to serve until the Company’s next annual meeting of stockholders or until each such director’s successor shall have been duly qualified and elected. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxyholders might determine. Each nominee has consented to being named in this proxy statement and to serve if elected.

Nominees to the Board

The director nominees, and their ages as of the date of the Meeting, their principal occupation, and the period during which they have served as a director of the Company are set forth in the following table and paragraphs:

Name

| | Age

| | Principal Occupation

| | Served as Director Since

|

Robert L. Erwin | | 49 | | Chairman of the Board | | 1987 |

Kevin J. Ryan | | 63 | | President and Chief Executive Officer | | 1992 – 1996; 2001 |

Marvyn Carton | | 85 | | Former Principal of Allen & Company | | 1988 – 1990; 1998 |

Bernard I. Grosser, M.D. | | 74 | | Professor and Chairman, Department of Psychiatry, University of Utah School of Medicine | | 1996 |

Sol Levine | | 74 | | Former President of Revlon, Inc. | | 1992 |

Robert L. Erwinco-founded the Company in 1987 and has been Chairman of the Board since 1992. From 1988 to 1992, he served as President. Mr. Erwin served as our Chief Executive Officer from 1992 to April 2003. Prior to joining the Company, he co-founded Sungene Technologies Corporation, a biotechnology company, and served as its Vice President of Research and Product Development from 1981 through 1986. Mr. Erwin received his M.S. in genetics from Louisiana State University.

2

Kevin J. Ryanhas been our President and Chief Executive Officer since April 2003. Mr. Ryan was our President from 1991 to 1995, served as a director of the Company from 1992 to 1996, and has been a member of the board of directors since May 2001 when he rejoined our board. Mr. Ryan served as President, Chief Executive Officer and a director of Wesley Jessen VisionCare, Inc., a contact lens company, from June 1995 through October 2000. Mr. Ryan has served as Chairman of the Board of CibaVision’s Advisory Committee. From 1987 to 1990, Mr. Ryan served as President of Barnes-Hind’s contact lens business; from 1983 to 1987, as President of Revlon VisionCare (a division of Revlon, Inc.); from 1978 to 1983, as President of Barnes-Hind (then a part of Revlon VisionCare); and from 1974 to 1978, as Vice President of Sales and Marketing at the Westwood Division of Bristol-Myers. Mr. Ryan is a managing member of Technology Directors II, LLC (which holds more than 14% of our outstanding common stock) and Technology Directors II BST, LLC, each of which is an investment limited liability company, and the Chairman of the Board of Directors of Sonic Innovations, Inc., a medical device company. Mr. Ryan received his bachelor’s degree in business and marketing from the University of Notre Dame.

Marvyn Cartonwas a director of the Company from 1988 to 1990 and has been a member of the board of directors since October 1998. Mr. Carton was an Executive Vice President and Director of Allen & Company, an investment banking firm, until his retirement in 1992. Mr. Carton received his B.A. from Brown University and his M.B.A. from New York University.

Bernard I. Grosser, M.D. has been a director of the Company since January 1996. Dr. Grosser has served as a Professor and as the Chairman of the Department of Psychiatry of the University of Utah School of Medicine since 1982. He also serves as a director of Human Pheromone Sciences, Inc., a biotechnology-based company in the field of human pheromone products. Dr. Grosser received his B.A. from the University of Massachusetts, his M.S. in zoology from the University of Michigan and his M.D. from Case Western Reserve University.

Sol Levinehas been a director of the Company since March 1992. Mr. Levine is a nonvoting member of Technology Directors II, LLC and Technology Directors II BST, LLC, each of which is an investment limited liability company. Mr. Levine was the President of Revlon, Inc. until his retirement in 1990.

Committees and Meetings

The board of directors held ten meetings in 2002. Mr. Carton attended seven of these meetings. During 2002, no other director attended fewer than 75% of the aggregate of (1) the total number of meetings of the board of directors held during the period they served on the board, and (2) the total number of meetings held by all committees of the board on which they served which were held during the periods they served on such committees.

The audit committee is composed of independent directors who, in accordance with the audit committee charter, assist the board of directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. The audit committee currently consists of Messrs. Carton and Levine and Dr. Grosser, and will consist of Messrs. Carton and Levine and Dr. Grosser following the Meeting. From January 2002 to May 2002, the audit committee consisted of Messrs. Carton, Levine and former director Mr. James P. TenBroek. From May 2002 to April 2003, Mr. Ryan served on the audit committee. The audit committee met four times in 2002.

The board of directors adopted and approved a charter for the audit committee in July 2000, and the charter was amended in April 2001. The board of directors has determined that all members of the audit committee are “independent” as that term is defined in Rule 4200 of the listing standards of the National Association of Securities Dealers.

3

The executive committee acts on an interim basis between meetings of the full board of directors with all of the authority and power of the full board of directors in the management of our business and affairs, except as otherwise limited by our bylaws. The executive committee currently consists of Messrs. Erwin, Fowler, Levine and Ryan, and will consist of Messrs. Erwin, Levine and Ryan following the Meeting. The executive committee met two times in 2002.

The compensation committee reviews and approves the compensation and benefits for our executive officers, administers our stock plans and performs other duties as may from time to time be determined by the board of directors. The compensation committee currently consists of Dr. Grosser and Messrs. Carton and Levine, each of whom will continue to serve on the compensation committee following the Meeting. The compensation committee met two times in 2002.

The board of directors does not have a nominating committee.

Director Compensation

We do not pay cash compensation to directors who are not our employees, but they do receive stock options and reimbursement of out-of-pocket travel expenses for attendance at meetings of the board of directors. Directors who are also our employees do not receive additional compensation for serving as directors. Under the Company’s 2000 Stock Incentive Plan, non-employee directors receive automatic option grants to purchase 30,000 shares of common stock upon becoming directors and automatic option grants to purchase 6,000 shares of common stock on the date of each annual meeting of stockholders with an exercise price equal to the fair market value of our stock on that date, if they continue to serve as directors. These automatic option grants are immediately exercisable. However, the shares issued upon exercise of these options remain subject to the Company’s right to repurchase the shares upon termination of board service. Initial automatic option grants vest, and the Company’s right of repurchase lapses, with respect to 1,500 shares every three months over a five-year period from the date of grant. Subsequent automatic option grants vest, and the Company’s right of repurchase lapses, with respect to 1,500 shares every three months over a one-year period from the date of grant.

Compensation Committee Interlocks and Insider Participation

From January 2002 to May 2002, the compensation committee consisted of Dr. Grosser and Mr. Carton and our former director Mr. James P. TenBroek. Mr. Levine was elected to the Compensation Committee on May 13, 2002 to replace Mr. TenBroek. During 2002, former director Charles D. Nash served on the compensation committee from December 18 through December 31, replacing Mr. Levine. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH

NAMED NOMINEE.

4

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF AUDITORS

Our audit committee has selected Deloitte & Touche LLP as the Company’s independent auditors to perform an audit of the Company’s consolidated financial statements for the year ending December 31, 2003. The stockholders are being asked to ratify this selection. Deloitte & Touche LLP has audited the Company’s consolidated financial statements since 1999.

Representatives of Deloitte & Touche LLP are expected to be present at the Meeting. They will have an opportunity to make a statement if they so desire and they will be available to respond to appropriate questions.

Stockholder ratification of the selection of Deloitte & Touche LLP as the Company’s independent auditors is not required by the Company’s bylaws or otherwise. However, the Company has elected to seek such ratification as a matter of sound corporate practice. Should the Company’s stockholders fail to ratify the appointment of Deloitte & Touche LLP as independent auditors, the audit committee will investigate the reasons for stockholder rejection and the board of directors will reevaluate the audit committee’s selection.

The following table sets forth the aggregate fees billed to the Company by Deloitte & Touche LLP for 2002:

(1) | | Audit Fees—Fees for the audit of the Company’s consolidated financial statements for the year ended December 31, 2002 and reviews of the Company’s 2002 quarterly financial statements | | $ | 126,440 |

(2) | | Financial Information Systems Design and Implementation Fees | | | — |

(3) | | All Other Fees—Tax preparation and consultation services and a benefit plan audit | | | 42,510 |

The audit committee believes that the services described in items 2 and 3 above were compatible with maintaining auditor independence.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE

APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT AUDITORS.

OTHER MATTERS

Our board of directors knows of no other business which will be presented at the Meeting. If any other business is properly brought before the Meeting, proxies in the enclosed form will be voted in respect thereof in accordance with the recommendations of management.

A copy of our annual report for year ended December 31, 2002 has been mailed concurrently with this proxy statement to all stockholders entitled to notice of and to vote at the Meeting. The annual report is not incorporated into this proxy statement and is not considered proxy solicitation material.

5

EXECUTIVE OFFICERS

The names, ages and positions of our executive officers as of April 15, 2003 are as follows:

Name

| | Age

| | Position

|

Kevin J. Ryan | | 63 | | President and Chief Executive Officer |

Ronald J. Artale | | 53 | | Senior Vice President, Chief Operating Officer and Chief Financial Officer |

Michael D. Centron | | 47 | | Vice President and Treasurer |

Laurence K. Grill, Ph.D. | | 53 | | Senior Vice President, Research and Chief Scientific Officer |

R. Barry Holtz, Ph.D. | | 56 | | Senior Vice President, Biopharmaceutical Development |

David R. McGee, Ph.D. | | 53 | | Executive Vice President |

Daniel J. Moriarty | | 61 | | Vice President, Corporate Affairs |

John S. Rakitan | | 58 | | Senior Vice President, General Counsel and Secretary |

Daniel Tusé, Ph.D. | | 51 | | Vice President, Business Development |

Robert J. Walden | | 47 | | Senior Vice President |

Kevin J. Ryan, See “Proposal No. 1: Election of Directors” for Mr. Ryan’s biography.

Ronald J. Artale joined the Company as a Senior Vice President and our Chief Financial Officer in November 2001 and has served in those capacities since that time. Mr. Artale also has served as our Chief Operating Officer since April 2003. Since April 2001, Mr. Artale has been a Managing Member and Executive Vice President of the venture capital firms VMA, LLC and VMG, LLC, and has served as Vice President, Chief Financial Officer and Treasurer and a member of the board of directors of Addition Technology, Inc., a vision correction medical device company. From 1996 to March 2001, Mr. Artale served as Vice President, Finance and Corporate Controller of Wesley Jessen VisionCare, Inc., a contact lens company. Mr. Artale received his B.B.A. in accounting from Niagara University and his M.B.A. from St. John’s University.

Michael D. Centron has served as our Treasurer since 1991 and as a Vice President since March 2001. Mr. Centron joined the Company as the Controller in 1988. Mr. Centron is a certified public accountant and received his B.S. in economics from the Wharton School of the University of Pennsylvania and his M.B.A. from the University of California, Berkeley.

Laurence K. Grill, Ph.D. has served as our Chief Scientific Officer since June 2002. Dr. Grill co-founded the Company and served as our Vice President, Research from 1987 to 1999 and as Senior Vice President, Research since 1999. He received his Ph.D. in plant pathology from the University of California at Riverside.

R. Barry Holtz, Ph.D. has served as our Senior Vice President, Biopharmaceutical Development since September 2002. Dr. Holtz joined the Company in 1989 and served as Vice President of Bioprocess Development from 1989 to 1999, and as Senior Vice President, Bioprocess Development from 1999 to September 2002. Dr. Holtz received his Ph.D. in biochemistry from Pennsylvania State University.

David R. McGee, Ph.D. has served as an Executive Vice President since September 2002. Dr. McGee co-founded the Company and served as a Vice President of the Company from 1987 to 1997 and as a Senior Vice President and Chief Operating Officer from 1997 to September 2002. Dr. McGee has also served as our Assistant Secretary since 1991. Dr. McGee received his Ph.D. in genetics from Louisiana State University and served as a faculty instructor of zoology and genetics at Louisiana State University.

6

Daniel J. Moriarty joined the Company as Vice President, Corporate Affairs in May 2001 after advising the Company as a communications consultant for the previous year, when he also served Metro-Goldwyn-Mayer, Inc., Boucheron, Inc. (USA) and Gloss.com. He has been the senior corporate communications executive of Christian Dior Perfumes, Inc. (Vice President, Corporate Relations 1996- 1999) and Revlon, Inc. (Senior Vice President – Global Corporate Communications, 1978-1992). He was Vice President-Sales/West for the Aramis, Inc. division of the Estee Lauder Companies (1992-1996.) Mr. Moriarty serves on the boards of directors of Ritz Tower, Inc., New York, and Greater New York March of Dimes. He received a B.A. degree in English from Georgetown University.

John S. Rakitan is our General Counsel and Secretary and a Senior Vice President. Mr. Rakitan joined the Company in 1987 as the Controller. He served as Treasurer from 1988 to 1990. Mr. Rakitan was appointed Vice President, General Counsel and Assistant Secretary in 1988, Secretary in 1991 and Senior Vice President in 1999. Before joining the Company, Mr. Rakitan was an attorney in private practice. Mr. Rakitan received his J.D. from the University of Notre Dame.

Daniel Tusé, Ph.D. has served as Vice President, Business Development since January 2002 and has served as the head of our business development group since October 2002. Dr. Tusé joined the Company as Vice President, Pharmaceutical Development in 1995 and served in that position until January 2002. Before joining the Company, Dr. Tusé was Assistant Director of the Life Sciences Division of SRI International, a business consulting firm. Dr. Tusé received his Ph.D. in microbiology from the University of California, Davis.

Robert J. Walden is a Senior Vice President of the Company and has served as President of LSBC/Proteomics, the Company’s division in Germantown, Maryland since September 2002. Mr. Walden was a director of the Company from May 1999 to May 2001. Mr. Walden served as Vice President, Finance, at the business that is now our proteomics division from 1997 to September 2001. In March 2001, Mr. Walden was appointed Vice President, General Manager of our proteomics division. In January 2002, Mr. Walden was appointed Senior Vice President of the Company and General Manager of our proteomics division. Mr. Walden received his B.S. in finance from the University of Maryland.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known by us with respect to the beneficial ownership of the Company’s common stock as of April 15, 2003 by:

| | • | | Each person or entity who is known by us to beneficially own greater than 5% of our outstanding common stock; |

| | • | | Each of the Named Executive Officers (see “Executive Compensation and Related Information” below); |

| | • | | Each of our directors and director nominees; |

| | • | | All current directors and executive officers as a group. |

The percentage of shares beneficially owned is based on 25,526,842 shares of common stock outstanding as of April 15, 2003. Shares of common stock subject to stock options and warrants that are currently exercisable or exercisable within 60 days of April 15, 2003 are deemed to be outstanding for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless indicated below, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

7

Unless otherwise indicated, the principal address of each of the stockholders below is c/o Large Scale Biology Corporation, 3333 Vaca Valley Parkway, Suite 1000, Vacaville, CA 95688.

Beneficial Owner

| | Number of Shares Beneficially Owned

| | Percentage of Shares Beneficially Owned

| |

Kevin J. Ryan (1) | | 4,490,461 | | 17.6 | % |

John W. Maki (2) | | 3,704,391 | | 14.5 | |

John J. O’Malley (3) | | 3,704,391 | | 14.5 | |

Technology Directors II, LLC (4) 460 Bloomfield Ave., Suite 200 Montclair, NJ 07042 | | 3,667,453 | | 14.4 | |

William Blair & Company, LLC (5) 222 West Adams Chicago, IL 60606 | | 1,956,600 | | 7.7 | |

The Dow Chemical Company (6) 2030 Dow Center Midland, MI 48674 | | 1,848,091 | | 6.8 | |

John D. Fowler, Jr. (7) | | 1,378,575 | | 5.2 | |

Robert L. Erwin (8) | | 930,822 | | 3.6 | |

David R. McGee, Ph.D. (9) | | 455,694 | | 1.8 | |

Sol Levine (10) | | 420,358 | | 1.6 | |

John S. Rakitan (11) | | 393,731 | | 1.5 | |

Ronald J. Artale (12) | | 287,774 | | 1.1 | |

Bernard I. Grosser, M.D. (13) | | 159,483 | | * | |

Marvyn Carton (14) | | 120,449 | | * | |

Directors and officers as a group (15 persons) (15) | | 10,018,987 | | 35.4 | |

| (1) | | Includes 3,667,453 shares held by Technology Directors II, LLC and 12,000 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. Mr. Ryan is a managing member of Technology Directors II, LLC. Mr. Ryan disclaims beneficial ownership of the shares held by Technology Directors II, LLC except to the extent of his pecuniary interest in this entity. |

| (2) | | Represents 3,667,453 shares held by Technology Directors II, LLC and 36,938 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. Mr. Maki is a managing member of Technology Directors II, LLC. Mr. Maki disclaims beneficial ownership of the shares held by Technology Directors II, LLC except to the extent of his pecuniary interest in this entity. |

| (3) | | Represents 3,667,453 shares held by Technology Directors II, LLC and 36,938 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. Mr. O’Malley is a managing member of Technology Directors II, LLC. Mr. O’Malley disclaims beneficial ownership of the shares held by Technology Directors II, LLC except to the extent of his pecuniary interest in this entity. |

| (4) | | Messrs. Maki, O’Malley and Ryan share voting and dispositive power with respect to Technology Directors II, LLC. |

| (5) | | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 13, 2003. |

| (6) | | Represents shares issuable upon exercise of a warrant that is exercisable currently and within 60 days of April 15, 2003. |

| (7) | | Includes 850,000 and 250,000 shares issuable upon exercise of options and a warrant, respectively, that are exercisable currently or within 60 days of April 15, 2003. |

8

| (8) | | Includes 30,000 shares held by the Marti Nelson Medical Foundation and 233,854 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. Mr. Erwin is a director and co-founder of the Marti Nelson Medical Foundation and disclaims beneficial ownership of the shares held by the Foundation. |

| (9) | | Includes 119,791 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. |

| (10) | | Includes 80,438 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. Mr. Levine is a nonvoting member of Technology Directors II, LLC. Accordingly, his holdings do not include shares held by this entity. |

| (11) | | Includes 119,791 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. |

| (12) | | Includes 216,666 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. |

| (13) | | Includes 42,938 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. |

| (14) | | Includes 42,938 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. |

| (15) | | Includes an aggregate of 2,749,624 shares issuable upon exercise of options that are exercisable currently or within 60 days of April 15, 2003. |

9

EXECUTIVE COMPENSATION AND RELATED INFORMATION

The following table summarizes the compensation earned by our Chief Executive Officer and the four other most highly compensated executive officers, all acting in such capacities as of December 31, 2002 (collectively, the “Named Executive Officers”).

Summary Compensation Table

| | | | | | | | | | | Long-Term Compensation Awards

| |

| | | | | Annual Compensation

| | | Restricted Stock Award

| | | Securities Underlying Options

| |

Name and Principal Position

| | Year

| | Salary

| | | Other

| | | |

Robert L. Erwin | | 2002 | | $ | 297,504 | (2) | | $ | — | | | $ | — | | | 125,000 | |

Chairman of the Board and former Chief Executive Officer (1) | | 2001 2000 | |

| 293,000

184,000 |

| | | — — | | | | — — | | | 75,000 — | |

|

John D. Fowler, Jr. | | 2002 | | | 287,500 | (4) | | | — | | | | — | | | 250,000 | |

Director and former President (3) | | 2001 2000 | | | 33,125 — | | | | — — | | | | 690,000 — | (5) | | 850,000 — | (6) |

|

David R. McGee, Ph.D. | | 2002 | | | 241,671 | (7) | | | — | | | | — | | | 50,000 | |

Executive Vice President | | 2001 | | | 238,000 | | | | — | | | | — | | | 50,000 | |

| | | 2000 | | | 165,000 | | | | — | | | | — | | | — | |

|

Ronald J. Artale | | 2002 | | | 220,004 | (8) | | | 32,985 | (9) | | | — | | | 50,000 | |

Senior Vice President, Chief Operating Officer and Chief Financial Officer | | 2001 2000 | | | 36,668 — | | | | — — | | | | — — | | | 400,000 — | |

|

John S. Rakitan | | 2002 | | | 190,004 | (10) | | | — | | | | — | | | 50,000 | |

Senior Vice President and General Counsel | | 2001 2000 | |

| 190,000

152,000 |

| | | — — | | | | — — | | | 50,000 — | |

| (1) | | Mr. Erwin was our Chief Executive Officer for the period covered by this table. Mr. Kevin Ryan is our current Chief Executive Officer. Mr. Ryan has agreed and the board of directors has approved an annual salary for Mr. Ryan in the amount of $30,000. |

| (2) | | Includes $17,500 of cash compensation forgone at the election of Mr. Erwin and $28,250 of salary forgone pursuant to a mandatory reduction applicable to most of the Company’s highly compensated employees. In lieu of these reductions, the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture and Mr. Erwin may not be entitled to the stock issued to him. |

| (3) | | Mr. Fowler was our President for the period covered by this table. Mr. Kevin Ryan is our current President. Mr. Fowler is not standing for reelection as a director at the Meeting. |

| (4) | | Includes $17,500 of cash compensation forgone at the election of Mr. Fowler and $27,750 of salary forgone pursuant to a mandatory reduction applicable to most of the Company’s highly compensated employees. In lieu of these reductions, the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture. However, in connection with Mr. Fowler’s separation from the Company in April 2003, the Company waived the forfeiture provision for stock issued to him. |

| (5) | | On November 1, 2001, Mr. Fowler was issued, subject to the Company’s right of reversion, 200,000 shares of common stock. The fair market value of the Company’s common stock on the grant date was $3.45. The Company’s reversion right was originally scheduled to expire |

10

| | on a quarterly basis over a three-year period. However, pursuant to Mr. Fowler’s employment agreement, the Company’s reversion right expired as to all shares when our former chief executive officer, Mr. Erwin, was replaced by someone other than Mr. Fowler in April 2003. As provided by the terms of the stock issuance, at each vesting date in 2002, Mr. Fowler elected to revert a portion of his vested shares to the Company to settle minimum statutory payroll taxes realized by Mr. Fowler but paid by the Company. On December 31, 2002, Mr. Fowler held 57,874 vested shares and 100,000 unvested shares that remained subject to the Company’s right of reversion. If declared by the Company’s board of directors, dividends will be paid on this stock award. At December 31, 2002, the value of this stock award was $126,299, based on Mr. Fowler’s aggregate vested and unvested shares and the fair market value of our common stock on that date. |

| (6) | | Includes a warrant to purchase 250,000 shares of common stock. |

| (7) | | Includes $11,667 of cash compensation forgone at the election of Dr. McGee and $21,000 of salary forgone pursuant to a mandatory reduction applicable to most of the Company’s highly compensated employees. In lieu of these reductions, the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture and Dr. McGee may not be entitled to the stock issued to him. |

| (8) | | Includes $11,000 of salary forgone pursuant to a mandatory reduction applicable to most of the Company’s highly compensated employees. In lieu thereof the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture and Mr. Artale may not be entitled to the stock issued to him. |

| (9) | | The Company provided temporary housing, including basic furnishings, for Mr. Artale near the Company’s corporate office. In addition, the Company reimbursed Mr. Artale for air travel expenses incurred between his personal residence outside of California and the Company’s corporate office. |

| (10) | | Includes $9,500 of salary forgone pursuant to a mandatory reduction applicable to most of the Company’s highly compensated employees. In lieu thereof the Company issued shares of its common stock under the 2000 Stock Incentive Plan at an equivalent fair market value. Stock issued in lieu of the mandatory reduction is subject to a risk of forfeiture and Mr. Rakitan may not be entitled to the stock issued to him. |

11

Stock Option Grants in 2002

The following table summarizes information regarding stock options granted under the 2000 Stock Incentive Plan to the Named Executive Officers in 2002. Unless otherwise indicated below, options generally become exercisable and vest ratably over a period of 12 to 16 quarters.

| | | Individual Grants

| | | | |

| | | Number of Securities Underlying Options Granted

| | Percent of Total Options Granted to Employees in 2002 (1)

| | | Exercise Price (2)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3)

|

Name

| | | | | | 5%

| | 10%

|

Robert L. Erwin | | 125,000 | | 7.2 | % | | $ | 1.23 | | 6/2/2012 | | $ | 96,250 | | $ | 245,000 |

John D. Fowler, Jr. | | 250,000 | | 14.3 | | | | 1.35 | | 10/31/2012 | | | 212,500 | | | 537,500 |

David R. McGee, Ph.D. | | 50,000 | | 2.9 | | | | 1.23 | | 6/2/2012 | | | 38,500 | | | 98,000 |

Ronald J. Artale | | 50,000 | | 2.9 | | | | 1.23 | | 6/2/2012 | | | 38,500 | | | 98,000 |

John S. Rakitan | | 50,000 | | 2.9 | | | | 1.23 | | 6/2/2012 | | | 38,500 | | | 98,000 |

| (1) | | Based upon a total of 1,742,250 stock options granted to all employees in 2002. |

| (2) | | Exercise prices of granted stock options are equal to the closing price of the Company’s common stock as reported on the NASDAQ National Market on the date of grant. |

| (3) | | In accordance with Securities and Exchange Commission rules, these columns quantify the hypothetical gains that could be achieved by the respective options assuming the options are exercised at the end of the option terms and the Company’s stock price appreciates from the date of grant at compounded annual rates of 5% and 10%. Actual gains, if any, on stock option exercises will depend on the future performance of our common stock and overall stock market conditions. If our stock price does not exceed the exercise price at the time of exercise, the realized value to the option holder will be zero. |

Aggregated Option Exercises in Last Year and Year-End Option Values

The following table summarizes information regarding stock options exercised by the Named Executive Officers in 2002 and the value of unexercised “in-the-money” options they held at December 31, 2002.

| | | Common Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at December 31, 2002 (1)

| | | Value of Unexercised In-the-Money Options at December 31, 2002 (2)

|

Name

| | | | Exercisable

| | Unexercisable

| | | Exercisable

| | Unexercisable

|

Robert L. Erwin | | — | | $ | — | | 203,646 | | 146,354 | | | $ | — | | $ | — |

John D. Fowler, Jr. | | — | | | — | | 200,000 | | 650,000 | (3) | | | — | | | — |

David R. McGee, Ph.D. | | 22,500 | | | 35,550 | | 105,208 | | 69,792 | | | | — | | | — |

Ronald J. Artale | | — | | | — | | 141,666 | | 308,334 | | | | — | | | — |

John S. Rakitan | | 22,500 | | | 35,550 | | 105,208 | | 69,792 | | | | — | | | — |

| (1) | | Options generally become exercisable and vest ratably over a period of 12 to 16 quarters. |

| (2) | | In-the-money options represents unexercised options having a per share exercise price below $0.80, the closing price of the Company’s common stock at December 31, 2002, as reported on the NASDAQ National Market. |

| (3) | | Pursuant to Mr. Fowler’s employment agreement, the unvested portion of his outstanding stock options vested immediately when our former chief executive officer, Mr. Erwin, was replaced by someone other than Mr. Fowler in April 2003. |

12

Employment Contracts, Termination of Employment Arrangements and Change of Control Agreements

In connection with our acquisition of Large Scale Proteomics Corporation (“Proteomics”) in 1999, the Company entered into employment agreements with two of the founders of Proteomics: Dr. N. Leigh Anderson, who served as a director of the Company from May 1999 to June 2002 and our Chief Scientific Officer from January 2001 to June 2002, and Dr. Norman Anderson, who served as the Chief Scientist at the business that is now our proteomics division from November 1985 to June 2002, and the father of Dr. N. Leigh Anderson. They each left the Company in June 2002. Their employment agreements each had five-year terms beginning January 25, 1999 and provided for minimum annual salaries of $185,000. Each agreement also restricted each employee from competing commercially with the Company or our proteomics division over the five-year term of the agreements. In addition, the Company paid Dr. Norman Anderson $500,000 over two years as compensation for his non-competition agreement. In June 2002 the Company entered into separation agreements with these former employees, pursuant to which Dr. N. Leigh Anderson’s and Dr. Norman Anderson’s employment agreements were terminated and the Company paid them gross severance in the amounts of $200,000 and $166,667, respectively.

In 1999, the Company also entered into a license and consulting agreement with Dr. Norman Anderson covering certain biochip technology developed by him. The license is a worldwide, exclusive, non-royalty bearing license to the biochip technology. This agreement required monthly payments of $4,000 and $6,667 for consulting services over two years and for license fees over five years, respectively. In connection with Dr. Norman Anderson’s separation agreement with the Company in June 2002, the Company paid him the balance of license fees payable under the license agreement in a lump sum of $133,320, bringing the total license fee payments in 2002 to $166,655. No further payments will be made under the license agreement.

John D. Fowler, Jr. joined the Company as President in November 2001 and served in that capacity until his separation from the Company in April 2003. Mr. Fowler’s offer letter, dated November 1, 2001, set forth a compensation arrangement for him, which is summarized below:

| | • | | Mr. Fowler’s initial salary was $285,000 commencing on November 1, 2001. (Through a combination of voluntary and mandatory reductions of cash compensation in 2002, Mr. Fowler’s annual salary had been reduced to $229,500.) In 2002, Mr. Fowler received 30,346 shares of common stock under the Company’s 2000 Stock Incentive Plan with a value equivalent to the aggregate amount of voluntary and mandatory reductions of his cash compensation. The stock issued to Mr. Fowler in lieu of the mandatory reduction of his cash compensation was originally subject to a risk of forfeiture. However, in connection with Mr. Fowler’s separation from the Company, the Company waived the forfeiture provisions. If terminated without cause, he would receive severance equivalent to twelve months salary. Under this provision of his offer letter, Mr. Fowler will receive severance equivalent to his initial salary of $285,000 in the form of a cash payment of $229,500, and shares of the Company’s common stock equal in value to $55,500. |

| | • | | Mr. Fowler received options to purchase 600,000 shares of common stock at an exercise price of $3.45 per share under the Company’s 2000 Stock Incentive Plan. Also, in each of the first two years of Mr. Fowler’s employment, the Company agreed that he would be granted options to purchase common stock equal in number to the higher of 250,000 or the greatest number of options granted to any employee other than Robert L. Erwin, the Company’s former chief executive officer. Under this provision of the offer letter, the first such grant was made effective November 1, 2002 with an agreed exercise price equal to the fair market value of the Company’s stock as of that date. These stock options were to vest in equal quarterly installments over a period of three years. The offer letter further provided that all options would immediately vest if the Company was acquired, our |

13

| | current chief executive officer was replaced by someone other than Mr. Fowler, or Mr. Fowler was terminated without cause or as a result of his death or disability. Under this provision of his offer letter, the unvested portion of his 850,000 options vested immediately when our former chief executive officer, Robert L. Erwin, was replaced by Mr. Kevin Ryan in April 2003. |

| | • | | Pursuant to the offer letter, Mr. Fowler purchased 100,000 shares of common stock from the Company at a purchase price of $3.45 per share, the closing price of the Company’s common stock on November 1, 2001. |

| | • | | Mr. Fowler was issued 200,000 shares of the Company’s common stock as additional compensation to him upon entering into his employment with the Company. These shares were subject to the Company’s right of reversion upon termination of his employment by the Company for cause. These shares were to vest and the Company’s right of reversion was to lapse according to the following schedule: 50,000 shares on January 1, 2002, and thereafter in twelve quarterly installments of 12,500 shares beginning February 1, 2002. However, the Company’s reversion right expired as to all of the shares of common stock when our former chief executive officer, Robert L. Erwin, was replaced by Mr. Kevin Ryan in April 2003. |

| | • | | On November 1, 2001, Mr. Fowler was issued a warrant to purchase 250,000 shares of common stock as additional compensation to him upon entering into his employment with the Company. Pursuant to the offer letter, the warrant became immediately exercisable in full when our former chief executive officer, Robert L. Erwin, was replaced by Mr. Kevin Ryan in April 2003. This warrant has an exercise price of $5.13 and expires in February 2012. |

| | • | | Mr. Fowler’s employment was at will. Mr. Fowler resigned in April 2003. |

In November 2001, Ronald J. Artale joined the Company as Senior Vice President and Chief Financial Officer. Mr. Artale’s offer letter provided for an initial salary of $220,000 commencing on November 1, 2001. As a result of mandatory reductions in cash compensation, Mr. Artale’s annual salary is now $198,000. In 2002, Mr. Artale received 10,112 shares of common stock under the Company’s 2000 Stock Incentive Plan with an aggregate value equivalent to the amount of the mandatory reduction of his cash compensation. These shares are subject to a risk of forfeiture and Mr. Artale may not be entitled to the stock issued to him. Mr. Artale is eligible for undetermined bonus and stock option grants. If he is terminated without cause, he will receive severance equivalent to twelve months salary. Mr. Artale also received options to purchase 400,000 shares of common stock at an exercise price of $3.45 per share under the 2000 Stock Incentive Plan. These options vest in equal quarterly installments over a period of three years. All unvested options will immediately vest if the Company is acquired. Pursuant to the offer letter and an extension thereof, Mr. Artale received payments for various relocation, housing and travel expenses in 2002. Mr. Artale’s employment is at will and may be terminated at any time, with or without formal cause.

14

Equity Compensation Plan Information

The Company’s equity compensation plans are fully described in our annual report for the year ended December 31, 2002. The Company maintains the 2000 Stock Incentive Plan (the “Plan”) and the 2000 Employee Stock Purchase Plan (the “ESPP”), each of which has been approved by the Company’s stockholders. Information related to our equity compensation plans as of December 31, 2002 is set forth below.

| | | (a)

| | | (b)

| | (c)

| |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

| |

Equity compensation plans approved by security holders | | 6,845,654 | (1)(2) | | $ | 4.96 | | 2,916,200 | (3)(4) |

Equity compensation plans not approved by security holders | | 250,000 | (5) | | | 5.13 | | — | |

| | |

|

| | | | |

|

|

Total | | 7,095,654 | | | | 4.97 | | 2,916,200 | |

| | |

|

| | | | |

|

|

| (1) | | Excludes 226,003 shares of restricted common stock issued by the Plan under the terms of the Company’s Stock Issuance Program. These shares are subject to a risk of forfeiture or may be subject to repurchase by the Company at a weighted average exercise price of $1.09. |

| (2) | | Excludes purchase rights accruing under the ESPP. |

| (3) | | Includes 2,182,997 and 733,203 shares available for issuance under the Plan and the ESPP, respectively. |

| (4) | | Pursuant to the Plan and the ESPP, on each January 1, the number of shares of common stock reserved for issuance under the Plan and the ESPP shall be increased automatically by a number of shares equal to 4% and 1%, respectively, of the total number of outstanding shares of common stock on the last trading day of the immediately preceding month, provided that no such increase under the Plan and the ESPP may exceed 2,000,000 and 350,000 shares, respectively, in any calendar year. |

| (5) | | On November 1, 2001, John D. Fowler, Jr. was issued a warrant to purchase 250,000 shares of common stock as additional compensation to him upon entering into his employment with the Company. |

The following pages contain a report issued by our Compensation Committee relating to executive compensation for 2002, a chart titled “Stock Performance Graph” and a report issued by our Audit Committee relating to its review of the accounting, auditing and financial reporting practices of the Company. Stockholders should be aware that under SEC rules, the Compensation Committee Report On Executive Compensation, the Stock Performance Graph and the Audit Committee Report are not deemed to be “soliciting material” or “filed” with the SEC under the Securities Exchange Act of 1934, and are not incorporated by reference in any past or future filing by the Company under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, unless these sections are specifically referenced.

15

COMPENSATION COMMITTEE REPORT ON

EXECUTIVE COMPENSATION

Compensation Committee

The Compensation Committee in conjunction with the board of directors sets the compensation of the Chief Executive Officer and other officers of the Company, reviews the design, administration and effectiveness of compensation programs for other key executives and approves stock option grants for all executive officers. The Committee is composed entirely of outside directors.

Compensation Philosophy and Objectives

The Committee believes that the compensation programs for the executive officers should be designed to attract, motivate and retain talented executives responsible for the success of the Company and should be determined within a competitive framework and based on the achievement of designated financial targets, individual contribution, customer satisfaction and financial performance relative to that of the Company’s competitors.

Within this overall philosophy, the Committee’s objectives are to:

| | • | | Offer a total compensation program that takes into consideration the compensation practices of a group of selected companies in the biotechnology field. |

| | • | | Provide annual variable incentive awards that take into account the Company’s overall financial performance in terms of designated corporate objectives as well as individual contributions. |

| | • | | Align the financial interests of executive officers with those of stockholders by providing significant equity-based, long-term incentives. |

Compensation Components and Process

The three major components of the Company’s executive officer compensation are: (i) base salary, (ii) variable incentive awards and (iii) long-term, equity-based incentive awards. The Committee determined the compensation levels for the executive officers with the assistance of the Company’s Human Resources Department and an independent consulting firm that furnish the Committee with executive compensation data drawn from a survey of approximately 115 similarly sized companies in the biotechnology field, out of approximately 400 biotechnology companies nationwide. Our executive salaries were set in approximately the middle of the range of executive salaries for such similarly sized companies. The positions of the Company’s Chief Executive Officer and executive officers were compared with those of their counterparts and the market compensation levels for comparable positions were examined to determine base salary, target incentives and total cash compensation and stock option grants.

Base Compensation. The base salary for each executive officer is set on the basis of responsibilities, personal performance and a review of comparable positions at similarly sized companies in our industry. The level of base salary set for such executive officers to date has ranged from below the average range of salaries to above the average compared to the surveyed compensation.

Effective December 1, 2001, our Chief Executive Officer and three other executive officers elected to take a portion of their salary, normally paid in cash, in shares of common stock between the period of December 1, 2001 to June 30, 2002. The amount of stock compensation

16

that each individual elected to take in lieu of cash ranged from $11,667 to $17,500. The number of shares issued to each executive was determined by dividing the amount of such executive’s reduction by the per share closing price of the Company’s common stock as reported on the NASDAQ National Market on the last trading day of the period. This arrangement reduced the cash outlays for the Company while maintaining upside incentives through stock ownership for the executives. Under this voluntary arrangement, the Company issued the affected officers a total of 17,162 shares of our common stock.

Effective July 1, 2002, the salary reduction program for the four officers discussed above was superseded by a broad-based salary reduction program mandated by the Company for more than 25 of the Company’s most highly paid employees, including most executive officers. Under this broad-based program, those incumbent officers whose salaries were voluntarily reduced effective December 2001 now realize reductions of approximately 17%-20% of their annual cash compensation. Most other executive officers are realizing 10% reductions in the annual cash compensation under the broad-based program. Each current executive officer whose salaries were reduced is receiving stock compensation under the Company’s 2000 Stock Incentive Plan with a value equivalent to the reduction in their cash compensation. In 2002, executive officers were issued a total of 128,458 shares of the Company’s common stock under the 2000 Stock Incentive Plan in connection with such cash compensation reductions.

Variable Incentive Awards. To reinforce the attainment of Company goals, the Committee believes that a portion of the annual compensation of each executive officer should be in the form of variable incentive pay. On March 9, 2001, the board of directors adopted a plan to provide such incentive compensation to take effect in 2001. The annual incentive compensation for executive officers is determined on the basis of the Company’s achievement of the financial performance targets and also includes a component based on the executive’s individual performance. In view of the Company’s performance, no incentive payments were made to executive officers in 2002. To date, no incentive payments have been made under this incentive compensation plan.

Long-Term, Equity-Based Incentive Awards. The goal of the Company’s long-term, equity-based incentive awards is to align the interests of executive officers with stockholders and to provide each executive officer with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. The Committee determines the size of long-term, equity-based incentives according to each executive’s position within the Company and sets a level it considers appropriate to create a meaningful opportunity for stock ownership. In addition, the Committee takes into account an individual’s recent performance, his or her potential for future responsibility and promotion, comparable awards made to individuals in similar positions within the Company and at similarly sized companies in our industry and the number of unvested options held by each individual at the time of the new grant. The relative weight given to each of these factors varies among individuals at the Committee’s discretion. Option grants to acquire shares of the Company’s common stock are at a fixed price per share (generally, the market price on the grant date) over a specified period of time. Options granted vest in quarterly installments generally over a three- or four-year period, contingent upon the optionee’s continued employment with the Company. Accordingly, the option grants generally will provide a return only if the optionee remains with the Company, and in any event only if the market price of the Company’s common stock appreciates over the option term. In 2002, the Committee recommended, and the full board of directors granted, options to purchase an aggregate of 767,500 shares of common stock to the Company’s executive officers.

17

CEO Compensation. After the effect of the voluntary and mandatory reductions in cash compensation described above, Mr. Erwin’s base salary in 2002 was $251,754, as compared to $293,000 in 2001. With respect to Mr. Erwin’s base salary, the Committee took into account base salaries of chief executive officers at similarly sized companies in our industry, and his performance integrating the company’s technologies. In 2002, the Company granted options to purchase 125,000 shares of common stock to Mr. Erwin, with a value below the average of that for CEOs of similarly sized companies according to the survey data described above. Mr. Erwin did not receive a variable incentive award in 2002. In 2002, Mr. Erwin was issued a total of 4,840 shares of common stock in lieu of cash compensation foregone voluntarily, and a total of 25,966 shares of common stock under the 2000 Stock Incentive Plan as a result of the Company’s program of mandatory reductions of cash compensation for highly paid employees.

President’s Compensation. After the effect of the voluntary and mandatory reductions of cash compensation described above, Mr. Fowler’s base salary in 2002 was $242,250, as compared to $285,000, the amount specified in his employment agreement. Mr. Fowler did not receive any variable incentive award in 2002. Mr. Fowler was issued a total of 4,840 shares of common stock in lieu of cash compensation foregone voluntarily, and a total of 25,506 shares of common stock under the 2000 Stock Incentive Plan as a result of the Company’s program of mandatory reductions of cash compensation for highly paid employees.

Pursuant to the terms of his offer of employment, Mr. Fowler received stock options to purchase 250,000 shares of common stock with an exercise price equal to the price of the Company’s common stock on November 1, 2002.

In formulating the compensation package for Mr. Fowler initially, the Committee considered Mr. Fowler’s experience in investment banking in the biotechnology and health care fields, including his broad-based experience in healthcare deal-making and his potential to enable the Company to accelerate efforts to establish new collaborations and close other revenue-generating transactions.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of their executive officers, to the extent that compensation exceeds $1 million per covered officer in any fiscal year. The limitation applies only to compensation that is not considered to be performance-based. Non-performance based compensation paid to the Company’s executive officers for the 2002 fiscal year did not exceed the $1 million limit for any officer, and the Committee does not anticipate that the non-performance based compensation to be paid to the Company’s executive officers for fiscal 2003 will exceed that limit. The Company’s 2000 Stock Incentive Plan has been structured so that any compensation deemed paid in connection with the exercise of option grants made under that plan with an exercise price equal to the fair market value of the option shares on the grant date will qualify as performance-based compensation that will not be subject to the $1 million limitation.

18

Other Elements of Executive Compensation

Executives are eligible for corporation-wide medical and dental benefits, participation in a 401(k) plan under which the Company currently provides matching contributions up to $3,000 per year and participation in the Company Employee Stock Purchase Plan. In addition, executives participate in a corporation-wide short and long-term disability insurance program and a group term life insurance program.

It is the opinion of the Committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align our performance and interests of our stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short- and long-term.

Submitted by the Compensation Committee of the

Board of Directors

Marvyn Carton

Sol Levine

Bernard Grosser, M.D.

19

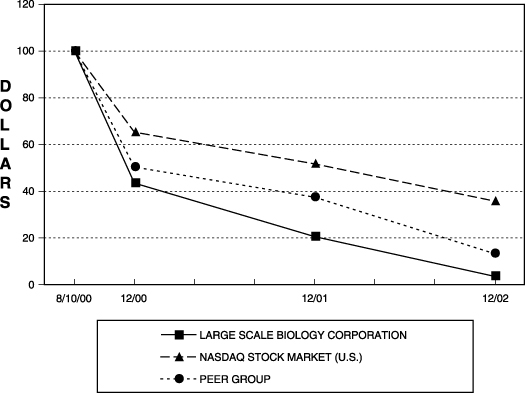

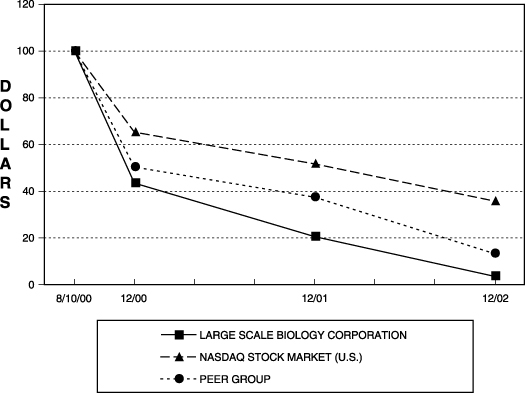

STOCK PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return of the Company’s common stock with the cumulative total return of the NASDAQ Stock Market-U.S. Index and of a peer group of companies for the period beginning August 10, 2000 (the first NASDAQ trading day of the Company’s common stock) through December 31, 2002. This graph assumes the investment of $100 on August 10, 2000 in each of the common stock of the Company, the NASDAQ Stock Market-U.S. Index, and our peer group, and that all dividends were reinvested. Our peer companies are: Applera Corporation, Ciphergen Biosystems, Inc., Diversa Corporation, Dyax Corporation, Exelixis, Inc., Illumina, Inc., Incyte Genomics, Inc., Lexicon Genetics Inc., Paradigm Genetics, Inc., and Rigel Pharmaceuticals, Inc.

The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of the Company’s common stock.

COMPARISON OF 29-MONTH CUMULATIVE TOTAL RETURN*

AMONG LARGE SCALE BIOLOGY CORPORATION,

THE NASDAQ STOCK MARKET-U.S. INDEX AND A PEER GROUP

* $100 invested on 8/10/00 in stock and index, including reinvestment of dividends.

Cumulative Total Return

| | | 8/10/00

| | 12/00

| | 12/01

| | 12/02

|

Large Scale Biology Corporation | | 100.00 | | 43.44 | | 20.58 | | 3.66 |

NASDAQ Stock Market-U.S. Index | | 100.00 | | 65.27 | | 51.78 | | 35.80 |

Peer Group | | 100.00 | | 50.34 | | 37.44 | | 13.32 |

20

AUDIT COMMITTEE REPORT

In accordance with its written charter adopted by the board of directors, the Audit Committee oversees the quality and integrity of the Company’s accounting and financial reporting practices and the audit of the Company’s consolidated financial statements by its independent auditors.

The Audit Committee has reviewed and discussed the Company’s audited consolidated financial statements for the year ended December 31, 2002 with the Company’s management and its independent auditors, Deloitte & Touche LLP, prior to public release. The Audit Committee has discussed with Deloitte & Touche LLP the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees”, as amended, which includes, among other items, matters related to the conduct of the audit of the Company’s consolidated financial statements.

The Audit Committee has received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees”, and the Audit Committee discussed with Deloitte & Touche LLP their independence from the Company.

Based on the review and discussions referred to above, the Audit Committee recommended to the Company’s board of directors and the board of directors has approved that the audited consolidated financial statements for the year ended December 31, 2002 be included in the Company’s Annual Report on Form 10-K.

Submitted by the Audit Committee of the

Board of Directors

Marvyn Carton

Sol Levine

Kevin J. Ryan*

| * | | Mr. Ryan is no longer a member of the Audit Committee. |

21

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

From January 1, 2002 to the present, there are no transactions in which the amount involved exceeds $60,000 to which we or any of our subsidiaries is a party and in which any executive officer, director, 5% beneficial owner of our common stock or member of the immediate family of any of the foregoing persons has a direct or indirect material interest, except for payments set forth under “Executive Compensation and Related Information.”

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The members of the board of directors, our executive officers and persons who hold more than 10% of our outstanding common stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, which require them to file reports with respect to their ownership of our common stock and their transactions in such common stock. Based solely upon the review of the Forms 3, 4 and 5 furnished to the Company and certain representations made to the Company, the Company believes that during 2002, all members of the board of directors, our executive officers and person(s) who hold more than 10% of our outstanding common stock timely filed all reports required to be filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 with respect to transactions in equity securities of the Company.

STOCKHOLDER PROPOSALS

Deadline for receipt of stockholder proposals for the 2004 Annual Meeting of Stockholders

Proposals of our stockholders that are intended to be included in our proxy statement and presented by such stockholders at our 2004 Annual Meeting of Stockholders must be received no later than January 3, 2004. Stockholders wishing to nominate directors or propose other business at the 2004 Annual Meeting of Stockholders, but not intending to include such nomination or proposal in the Company’s proxy statement for such meeting, must give advance written notice to the Company pursuant to our bylaws. Our bylaws provide that notice of any such nomination or proposal must be received at our principal executive offices not less than 120 days prior to the date of the 2004 Annual Meeting of Stockholders and must contain the information specified by our bylaws. If this notice is not timely, then the nomination or proposal will not be brought before the 2004 Annual Meeting of Stockholders.

22

DETACH HERE

PROXY

LARGE SCALE BIOLOGY CORPORATION

Annual Meeting of Stockholders—May 29, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Kevin J. Ryan, Ronald J. Artale and John S. Rakitan, and each of them, as proxies of the undersigned, with full power to appoint substitutes, and hereby authorizes them to represent and to vote all shares of stock of Large Scale Biology Corporation which the undersigned is entitled to vote, as specified on the reverse side of this card at the Annual Meeting of Stockholders of Large Scale Biology Corporation (the “Meeting”) to be held on May 29, 2003 at 10:00 a.m. local time, at the Embassy Suites Hotel, Chicago-O’Hare, 5500 North River Road, Rosemont, Illinois and at any adjournment or postponement thereof.

WHEN THIS PROXY IS PROPERLY EXECUTED, THE SHARES TO WHICH THIS PROXY RELATES WILL BE VOTED AS SPECIFIED AND, IF NO SPECIFICATION IS MADE, WILL BE VOTED FOR ALL NOMINEES FOR DIRECTORS IN PROPOSAL 1 AND FOR PROPOSAL 2, AND THIS PROXY AUTHORIZES THE ABOVE DESIGNATED PROXIES TO VOTE IN THEIR DISCRETION ON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF TO THE EXTENT AUTHORIZED BY RULE 14a-4(c) PROMULGATED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

SEE REVERSE SIDE

| | (CONTINUED AND TO BE SIGNED ON REVERSE SIDE) | |

SEE REVERSE SIDE

|

DETACH HERE

x Please mark votes as in this example.

The Board of Directors recommends a vote FOR proposals 1 and 2.

1.

| | Election of Directors Nominees: (01) Robert L. Erwin, (02) Marvyn Carton, (03) Bernard I. Grosser, M.D., (04) Sol Levine, and (05) Kevin J. Ryan. | | 2. | | To ratify the selection of Deloitte & Touche LLP as Large Scale Biology Corporation’s independent accountants for the year ending December 31, 2003. | | FOR ¨

| | AGAINST ¨

| | ABSTAIN ¨ |

¨ | | FOR ALL NOMINEES | | ¨ | | WITHHELD FROM ALL NOMINEES | | | | | | | | |

¨ | |

(Instruction: to withhold authority to vote for any individual nominee, write that nominee’s name on the space provided above.) | | 3. | | To transact such other business as may properly come before the Meeting and any adjournment or postponement thereof. |

| | | | | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT | | ¨ | | MARK HERE IF YOU PLAN TO ATTEND THE MEETING | | ¨ |

|

| | | | | Please sign exactly as your name(s) appear(s) on this Proxy. If shares of stock stand of record in the names of two or more persons or in the name of husband and wife, whether as joint tenants or otherwise, both or all of such persons should sign this Proxy. If shares of stock are held of record by a corporation, this Proxy should be executed by the president or vice president and the secretary or assistant secretary. Executors, administrators or other fiduciaries who execute this Proxy for a deceased stockholder should give their full title. Please date this Proxy. |

Signature: | | Date: | | Signature: | | Date: |