UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____________ to _____________.

Commission file number 000-29981

TRISTAR WELLNESS SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 91-2027724 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

10 Saugatuck Ave. Westport CT | | 06880 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (203) 226-4449

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Aggregate market value of the voting stock held by non-affiliates: $11,131,130 as based on last reported sales price of such stock. The voting stock held by non-affiliates on that date consisted of 4,077,338 shares of common stock.

Applicable Only to Registrants Involved in Bankruptcy Proceedings During the Preceding Five Years:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 28, 2013, there were 44,452,338 shares of common stock, $0.001 par value, issued and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

TriStar Wellness Solutions, Inc.

TABLE OF CONTENTS

| PART I |

| | | | | |

| ITEM 1 – | BUSINESS | | | 2 | |

| ITEM 1A – | RISK FACTORS | | | 10 | |

| ITEM 1B – | UNRESOLVED STAFF COMMENTS | | | 15 | |

| ITEM 2 ‑ | PROPERTIES | | | 15 | |

| ITEM 3 ‑ | LEGAL PROCEEDINGS | | | 15 | |

| ITEM 4 – | MINE SAFETY DISCLOSURES | | | 15 | |

| | | | | | |

| PART II |

| | | | | | |

| ITEM 5 – | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | | | 16 | |

| ITEM 6 – | SELECTED FINANCIAL DATA | | | 17 | |

| ITEM 7 – | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | | | 18 | |

| ITEM 7A – | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | | 22 | |

| ITEM 8 – | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | | 22 | |

| ITEM 9 – | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | | | 22 | |

| ITEM 9A – | CONTROLS AND PROCEDURES | | 24 | |

| ITEM 9B – | OTHER INFORMATION | | | 25 | |

| | | | | | |

| PART III |

| | | | | | |

| ITEM 10 – | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNACE | | | 26 | |

| ITEM 11 – | EXECUTIVE COMPENSATION | | | 30 | |

| ITEM 12 – | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | | | 33 | |

| ITEM 13 ‑ | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | | | 35 | |

| ITEM 14 – | PRINCIPAL ACCOUNTING FEES AND SERVICES | | | 36 | |

| | | | | | |

| PART IV |

| | | | | | |

| ITEM 15 ‑ | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | | | 37 | |

This Annual Report includes forward-looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward-looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading “Management's Discussion and Analysis of Financial Condition or Plan of Operation.” Forward-looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider,” or similar expressions are used.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties, and assumptions. The Company's future results and shareholder values may differ materially from those expressed in these forward-looking statements. Readers are cautioned not to put undue reliance on any forward-looking statements.

ITEM 1 – BUSINESS

Corporate History

We were incorporated on August 28, 2000 in the state of Nevada under the name “Quadric Acquisitions”. Following our incorporation we were not actively engaged in any business activities. On April 25, 2001, we were acquired by Zkid Network Company and changed our name to ZKid Network Co. As a result, we became engaged in the business of providing media content for children through the use of our proprietary software. On February 8, 2006, we announced that we would be unable to raise the necessary funds to continue with our then-existing business model and plan. Accordingly, we decided to seek an active company to acquire.

On May 8, 2006, we closed a share exchange agreement with Star Metro Group Limited, which became our wholly-owned subsidiary. Under the terms of the share exchange agreement we exchanged 60,000 shares of our company for 100% of the issued and outstanding shares of Star Metro Group at a ratio of 1 share of our common stock for each 2,000 shares of Star Metro Group Limited’s stock. As a result of the share exchange agreement, we became engaged in the development, production and sale of a line of biodegradable, single use, food and beverage containers. On March 20, 2006, we changed our name from ZKid Network Co. to Eatware Corporation.

On November 27, 2006, we changed our name from “Eatware Corporation” to “Star Metro Corp.” We were required to effect this name change by the terms of an agreement we entered into on November 13, 2006, with Glory Team Industrial Limited and Eddie Chou, an ex-director of our company. We effected this name change by merging Star Metro Corp., our newly incorporated and wholly-owned subsidiary that was created for this purpose, into our company, with our company carrying on as the surviving corporation under the name “Star Metro Corp.”

On February 26, 2007, we changed our name from “Star Metro Corp.” to “Biopack Environmental Solutions Inc.” This name change was effected by merging Biopack Environmental Solutions Inc., our newly incorporated and wholly-owned subsidiary that was created for this purpose, into our company, with our company carrying on as the surviving corporation under the name “Biopack Environmental Solutions Inc.”.

On March 27, 2007, we completed a share exchange with the shareholders of Roots Biopack Group Limited, a company formed under the laws of the British Virgin Islands. Under the terms of the share exchange agreement we acquired all of the issued and outstanding common shares of Roots Biopack Group in exchange for the issuance by our company of 90,000,000 common shares to the former shareholders of Roots Biopack Group.

On November 3, 2011, the People’s Court of Guandong Jiangmen Pengjiang District held a hearing relating to our landlord’s claim for unpaid rent for our factory plus penalty interest and other claims. The landlord had made a claim for payment of overdue rent in the amount of RMB 1,236,000, penalty interest in the amount of RMB 1,067,930 and a claim for potential loss of income in the amount of RMB 618,000, for a total amount claimed of RMB 2,921,930 (approximately $451,379). At the hearing, the Court ruled that after two unsuccessful attempts to auction the factory’s assets at the minimum level set by the Court appointed independent valuation company’s fair market assessment price, the Court set the reference value at RMB 3,613,139.20 (approximately $569,359) and transferred all the assets to the landlord. The landlord is legally responsible for settling any claims made by creditors, and the case has been closed.

On April 27, 2012, we entered into an agreement whereby Rockland Group, LLC, a Texas limited liability company (“Rockland”), purchased Six Hundred and Twenty Thousand (620,000) shares of Biopack Environmental Solutions, Inc. Series A Convertible Preferred Stock (“Series A Preferred Shares”), One Million (1,000,000) shares of Biopack Environmental Solutions, Inc. Series B Convertible Preferred Stock (“Series B Preferred Shares”) and Seven Hundred Ten Thousand (710,000) shares of Biopack Environmental Solutions, Inc. Series C Convertible Preferred Stock (“Series C Preferred Shares”) from the holders of those shares. The Series A Preferred Shares and Series B Preferred Shares were issued prior to December 31, 2011. The Series C Preferred Shares were issued in April 2012. Together the Shares represented approximately 63% of our outstanding votes on all matters brought before the holders of our common stock for approval and, therefore, represented a change of control. Each share of Series A, B and C Convertible Preferred Stock is convertible into 5 shares of common stock on the date of this transaction. The transaction closed on April 27, 2012.

After the Agreement with Rockland, during 2012, we entered into the following agreements and transactions:

· On April 27, 2012, we entered into a Subsidiary Acquisition Option Agreement (“Subsidiary Option Agreement”) with Xinghui Ltd., a Chinese entity (“Purchaser“), under which sold all the shares in the BPAC Subsidiaries to the Purchaser, effective July 11, 2012, in exchange for the Purchaser assuming all our liabilities as of April 25, 2012, which included all of the liabilities and obligations of ours except for a $400,000 principal amount convertible note that was owed to Trilane Limited as of April 27, 2012. As a result of us exercising our rights under the Subsidiary Option Agreement, we no longer own the BPAC Subsidiaries, including any of their assets or liabilities.

· On June 25, 2012, we entered into a License and Asset Purchase Option Agreement (the “Agreement”) with NorthStar Consumer Products, LLC, a Connecticut limited liability company (“NCP”), under which we, acquired the exclusive license to develop, market and sell, NCP’s Beaute de Maman™ product line, which is a line of skincare and other products specifically targeted for pregnant women. In addition, we acquired the exclusive license rights to develop, market and sell NCP’s formula being developed for itch suppression, which would be sold as an over-the-counter product, if successful. In exchange for these license rights we agreed to issue NCP 225,000 shares of our Series D Convertible Preferred Stock. This transaction closed on June 26, 2012. Additionally, under the Agreement, in connection with our license rights and to ensure we could fulfill any immediate orders timely, we purchased all existing finished product of the Beaute de Maman™ product line currently owned by NCP. In exchange for the inventory we agreed to issue NCP 25,000 shares of Series D Convertible Preferred Stock. Each share is convertible into twenty five shares of common stock.

· On July 11, 2012, we entered into a Marketing and Development Services Agreement (the “Marketing Agreement”) with InterCore Energy, Inc. (“ICE”). Under the Marketing Agreement we were retained to market and develop certain assets referred to as the Soft & Smooth Assets held by ICE. The Soft & Smooth Assets include all rights, interests and legal claims to that certain invention entitled “Delivery Device with Invertible Diaphragm” which is a novel medical applicator that is capable of delivering medicants and internal devices within the body in an atraumatic fashion (without producing injury or damage). In addition, we were also granted the exclusive option, in our sole discretion, to purchase the Soft & Smooth Assets from ICE for warrants to purchase One Hundred Fifty Thousand (150,000) shares of our common stock at One Dollar ($1) per share, with a four (4) year expiration period. On February 12, 2013, we entered into an Asset Purchase Agreement (the “HLBCDC Asset Purchase Agreement”) with HLBC Distribution Company, Inc. (“HLBCDC”), under which we exercised our option to purchase the Soft & Smooth Assets held by HLBCDC, which had acquired the Soft & Smooth Assets from ICE. In exchange for the Soft and Smooth Assets we agreed to issue to HLBCDC warrants enabling HLBCDC to purchase One Hundred Fifty Thousand (150,000) shares of our common stock at One Dollar ($1) per share, with a four (4) year expiration period.

As a result of the above transactions, as of December 31, 2012, we were a company involved in developing, marketing and selling, NCP’s Beaute de Maman™ product line, which is a line of skincare and other products specifically targeted for pregnant and nursing women, as well as developing the Soft and Smooth Assets.

Subsequent to December 31, 2012, on March 7, 2013, we entered into an Exclusive Manufacturing, Marketing and Distribution Definitive License Agreement (the “Argentum Agreement”) with Argentum Medical, LLC, a Delaware limited liability company (“Argentum”), under which we acquired an exclusive license to develop, market and sell products based on a technology called “Silverlon”, a proprietary silver coating technology providing superior performance related to OTC wound treatment. The license is for 15 years, with a possible 5 year extension. Under the Agreement, we are obligated to order a certain amount of proprietary Silverlon film each contract year and if the minimums are not met Argentum could cancel the Agreement. In exchange for these license rights we agreed to pay Argentum royalty payments based on the adjusted gross revenues generated by product sales, as well as issue Argentum a warrant to purchase up to 750,000 shares of our common stock with an exercise price of $0.50 per share. The warrant vests in two equal installments of 375,000 shares each, with the vesting based on product’s success in obtaining certain approvals from the Food and Drug Administration. The warrants expire five (5) years after they vest.

As a result of the Argentum Agreement we plan to proceed with product development during 2013, as well as locate other potential acquisition targets in the woundcare space.

Business Overview

All of our operations as of December 31, 2012 related to the operations of the Beaute de Maman™ product line and developing the Soft and Smooth Assets. Earlier in 2012, prior to the above-described transactions, we were in the business of developing, manufacturing, distributing and marketing bio-degradable food containers and disposable industrial packaging for consumer products. However, since our operations in the latter half of 2012, as well as moving forward, will focus on the high interest “Over the Counter” (OTC) packaged goods market the remainder of the disclosure in this Annual Report focuses on Company plans within the OTC industry.

Moving forward our management intends to focus on developing and marketing proprietary health and wellness products within targeted categories using in-house product development and R&D expertise combined with targeted acquisitions or licensing rights to provide access to patented technologies that support product features and performance. In all cases our plan is to own the unique formulas or processes via internal development, direct acquisition or license. As appropriate we will pursue and defend patents on each product offering to help protect from competitive incursion.

Industry Overview

We target the consumer health and wellness (CH&W) marketplace. We believe this market represents a long-term, high growth and profitable opportunity. Conservatively estimated at $29 Billion in ex-factory sales in the U.S. in 2012 ($51 Billion in retail sales), the CH&W market has consistently grown at +3-4% annually despite the recent economic downturn and is forecasted to maintain or exceed that level of growth in the future.1 We believe we have entered the market uniquely aligned to important demographic and economic drivers underlying dramatically changing consumer behavior related to personal healthcare.

Fueling market growth is a “perfect storm” of consumer, industry, and government dynamics:

| · | The exploding costs of institutional and provider-based healthcare (growing at 1.5 times the rate of the national GDP); |

| · | The growing demand for care due to epidemic levels of obesity and related conditions (such as diabetes and heart disease); |

| · | An increasing number of insured Americans resulting from the Affordable Care Act reforms, and an aging population. The aging population holds new expectations for a healthy, active long life. “Boomers” will redefine the senior market as we know it today; |

| · | The industry faces a projected shortage in physicians and a healthcare service provider community that is permanently shifting the delivery and responsibility of care to the consumer. |

The combined impact of these factors provides the fuel for the “perfect storm”.

________________________________

1 JD Ford & Company Investment Bankers: Global Health & Wellness: State of the Industry. Resilience and Continued Growth Expected in Global Health & Wellness Industry: Copyright 2009.

The “Perfect Storm” Of Consumer Healthcare Trends

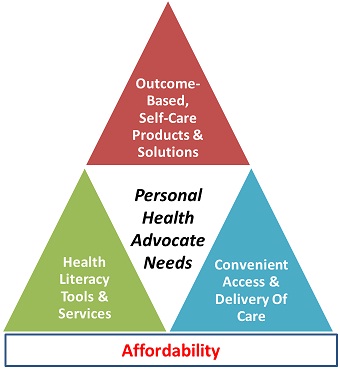

This “down-streaming” of care to the consumer is resulting in the transformation of consumer healthcare: fueling long-term growth and transforming the consumer from being a passive patient to being their own personal health advocate. With this transformation is increased demand for:

1) New outcome-based, self-care products and solutions;

2) New health literacy tools to enable the consumer to be an effective and self-directed health advocate; and

3) New and more convenient access and delivery of consumer health products, solutions, and services often avoiding the traditional “Gatekeepers” in the healthcare system.

Core needs of the new “Personal Health Advocate”

Meeting the core needs of the new personal health advocate is our management’s primary strategic focus for TriStar Wellness Solutions, Inc. We are targeting high growth and margin opportunity categories that provide a fundamental linkage back to the new consumer needs for brands and products that encourage high personal involvement/engagement and are consistent with personal health advocacy trends. More specifically, we are focused on categories and market space opportunities that represent:

| • | Outcome-based cost effective solutions with demonstrable results both in therapeutic relief and quality of life (QOL) improvement; |

| • | High personal involvement in care management (for self or caregiver); |

| • | Chronic versus episodic conditions and therapies. |

Our management is committed to the concept that companies will win with a consumer centric focus when they are able to efficiently convert consumer trends and defined gaps in product needs to actual innovation and product solutions strongly tied to a scientific foundation.

Principal Products

Initially our priority direct-to-consumer target markets are focused on women’s health and wound care.

In the year ended December 31, 2012, our focus is on women’s health. Women’s health is projected to achieve 5.9% compounded annual growth rate from 2010 to 2016.2 Our management believes the incremental pace of market expansion within this category, combined with the traditional role for women as the household-family health decision maker, supports the company’s commercial initiative. By introducing our brands to this critical wellness consumer we believe we are building a positive relationship for our future brands and product solutions.

Our first acquisition, Beauté de Maman™, represents our initial entry into the $500M category of products specifically targeted to Pregnancy & New Mothers (P&NM). We define the category as pregnancy support, nursing products, delivery products and other post-partum products. This category addresses unique needs of ~ 4 million pregnant women and over 20 million caregivers (sisters, mothers, other female relatives, friends, etc.) actively supporting each pregnant woman at any one time in the U.S.3 Beauté de Maman™ has been launched on a direct-to-consumer platform via the web, with the plan to expand in 2013 into drug and mass retail to reach a wider consuming public.

___________________________

2 Euromonitor Research & ACNielson Market Projects Expecting Mothers and Womens Health-GAGR: Trade Sources & National Statistics: Copyright June 2012.

Beaute de Maman™ represents a broad range of premium products targeted to meet the routine hygiene and unique symptomatic needs of pregnant and nursing women (e.g. Acne, nausea, stretch marks, etc.). Each product in this line is developed to deliver superior product performance while also being formulated with natural ingredients to be safe for the mother and developing baby. We conduct extensive research with leading medical databases to ensure each ingredient is proven to be safe. The composition of each product is formulated with over 95% natural ingredients. The products do not contain Parabens, BPA or Phthalates and are never tested on animals. The company is planning on important new line extensions in 2013 to extend the portfolio into new segments. Each year we plan on introducing 2-3 new items to the brand line. Ongoing product development activities are supported by extensive testing and formula optimization.

The second core product area is directed at the Direct-to-Consumer (DTC) wound care market space. We have both a detailed acquisition strategy and a comprehensive internal development program to offer significant technology-based enhancements to wound care solutions in this underserviced category.

Within the wound care category we plan to target the large population of consumers suffering from nuisance bleeding, typically associated with patients on anticoagulants (blood thinners) such as Coumadin and Plavix. The special health concerns of this substantial and rapidly expanding group is not being served well by today’s highly commoditized product selection.4

Sales and Marketing

In the year ended December 31, 2012, we focused the sales and marketing resources for the Beaute de Maman™ brand on efficient internet portals via the brand website and selected web-based retailers. Going forward we plan to expand distribution into the conventional retail channels. Concurrent with this sales channel expansion we plan to invest in more traditional marketing elements that can drive important awareness and trial incentives for target consumers.

We retained the services of a nationally recognized broker organization to represent the sales of the product line to conventional retailers. Additionally the company retained the services of a recognized advertising agency to lead in the development of effective digital and conventional advertising materials and media plans.

Research and Development

Research and development has been focused on fundamental product design and testing supporting the future portfolio plans of the business. Within the Beauté de Maman™ brand we are planning to launch in 2013 a new line of hair care products for pregnant and nursing women. We currently have several additional product development initiatives underway supporting retail launches in 2014 and beyond. We rely on our internal product development team and external technology providers working under confidentiality agreements to facilitate all development initiatives. Other than the confidentiality agreements, we do not have agreements with these external technology providers and we pay them on an “as we go” basis.

_____________________________3 CDC, National Vital Statistics Report, August 28, 2012, Volume 61, Number 1

4 TriStar Wellness Solutions, Inc. Concept Test conducted November 28, 2012

Employees

As of December 31, 2012, we had no direct employees. Our core operating management team was working under individual consulting agreements. In early 2013 we executed employment contracts with our core management members. Our Chief Financial Officer is the only member of our management that continues to perform services on a consulting basis.

Available Information

We are a fully reporting issuer, subject to the Securities Exchange Act of 1934. Our Quarterly Reports, Annual Reports, and other filings can be obtained from the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. You may also obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission at http://www.sec.gov.

ITEM 1A. – RISK FACTORS.

As a smaller reporting company we are not required to provide a statement of risk factors. However, we believe this information may be valuable to our shareholders for this filing. We reserve the right to not provide risk factors in our future filings. Please note that these risk factors relate to our current business of operating the business of Beaute de Maman™ pursuant to our License and Asset Purchase Option Agreement with NorthStar Consumer Products, LLC, and our development of the Soft and Smooth Assets pursuant to our Marketing and Development Services Agreement with InterCore Energy, Inc., since risk factors related to our prior operations are not relevant as of the date of this filing. Our primary risk factors and other considerations include:

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, have a limited operating history. We may not successfully address these risks and uncertainties or successfully market our existing and new products. If we fail to do so, it could materially harm our business and impair the value of our common stock. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate. To date we only have limited revenues from the Beaute de Maman™ operations and currently our future revenues are dependent upon the future sales of the Beaute de Maman™ product line, as well as successfully developing a marketable product based on the Soft and Smooth Assets. Unanticipated problems, expenses, and delays are frequently encountered in establishing and developing new products in the medical technology field. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development setbacks, and inadequate sales and marketing. The failure by us to address satisfactorily any of these conditions could have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

We may not be able to meet our future capital needs.

To date, we have only generated limited revenue from the Beaute de Maman™ operations and we have no cash liquidity or capital resources. Our future capital requirements will depend on many factors, including our ability to grow Beaute de Maman™’s operations, develop the Soft and Smooth Assets, identify and acquire solid companies, our ability to generate positive cash flow from operations, and the effect of competing market developments. We will need additional capital in the near future. Any equity financings will result in dilution to our then-existing stockholders. Sources of debt financing may result in high interest expense. Any financing, if available, may be on terms deemed unfavorable.

If we are unable to meet our future capital needs, we may be required to reduce or curtail operations.

Since our change of control transaction closed on April 27, 2012, we have relied on financing from investors and our officers and directors to fund operations, and we have only generated limited revenue. We have limited cash liquidity and capital resources. Our future capital requirements will depend on many factors, including our ability to market our products successfully, our ability to generate positive cash flow from operations, and our ability to obtain financing in the capital markets. Our business plan requires additional financing beyond our anticipated cash flow from current operations. Consequently, although we currently have no specific plans or arrangements for financing, we intend to raise funds through private placements, public offerings, or other such means. Any equity financings would result in dilution to our then-existing stockholders. Sources of debt financing may result in higher interest expense and may expose us to liquidity problems. Any financing, if available, may be on terms deemed unfavorable. If adequate funds are not obtained, we may be required to reduce or curtail operations.

If we are unable to attract and retain key personnel, we may not be able to compete effectively in our market.

Our success will depend, in part, on our ability to attract and retain key management, both including and beyond what we have today. We will attempt to enhance our management and technical expertise by recruiting qualified individuals who possess desired skills and experience in certain targeted areas. If we are unable to retain staff and to attract and retain sufficient additional employees, and the requisite information technology, engineering, and technical support resources, could have a material adverse effect on our business, financial condition, results of operations, and cash flows. The loss of key personnel could limit our ability to develop and market our products.

Competition could have a material adverse effect on our business.

Our current investments are in the medical device and products field. The medical products industry is a highly competitive industry and the products that we currently have an interest in may not compete well in the marketplace, which could cause our revenues to be less than expected, and/or may cause us to increase the number of our personnel or our advertising or promotional expenditures to maintain our competitive position or for other reasons.

An increase in government regulations could have a material adverse effect on our business.

The U.S. and certain other countries in which we operate impose certain federal and state or provincial regulations, and also require warning labels and signage on medical products. New or revised regulations or increased licensing fees, requirements, or taxes could also have a material adverse effect on our financial condition or results of operations.

If we fail to obtain or maintain applicable regulatory clearances or approvals for our products, or if such clearances or approvals are delayed, we will be unable to distribute our products in a timely manner, or at all, which could significantly disrupt our business and materially and adversely affect our sales and profitability.

The sale and marketing of our products are subject to regulation in the countries where we intend to conduct business. For a significant portion of our products, we need to obtain and renew licenses and registrations with the Food and Drug Administration (FDA), and its equivalent in other markets. The processes for obtaining regulatory clearances or approvals can be lengthy and expensive, and the results are unpredictable. If we are unable to obtain clearances or approvals needed to market existing or new products, or obtain such clearances or approvals in a timely fashion, our business would be significantly disrupted, and our sales and profitability could be materially and adversely affected.

In particular, as we enter foreign markets, we lack the experience and familiarity with both the regulators and the regulatory systems, which could make the process more difficult, more costly, more time consuming and less likely to succeed.

If we fail to comply with regulatory requirements, regulatory agencies may take action against us, which could significantly harm our business.

Marketed products, along with the manufacturing processes, post-approval clinical data, labeling, advertising and promotional activities for these products, are subject to continual requirements and review by the FDA and other regulatory bodies. In addition, regulatory authorities subject a marketed product, its manufacturer and the manufacturing facilities to ongoing review and periodic inspections. We will be subject to ongoing FDA requirements, including required submissions of safety and other post-market information and reports, registration requirements, current Good Manufacturing Practices (“cGMP”) regulations, requirements regarding the distribution of samples to physicians and recordkeeping requirements.

The cGMP regulations also include requirements relating to quality control and quality assurance, as well as the corresponding maintenance of records and documentation. Regulatory agencies may change existing requirements or adopt new requirements or policies. We may be slow to adapt or may not be able to adapt to these changes or new requirements.

We may be unable to adequately protect our proprietary rights.

Our ability to compete partly depends on the superiority, uniqueness, and value of our intellectual property and technology. To protect our proprietary rights, we will rely on a combination of patent, copyright, and trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions. Despite these efforts, any of the following occurrences may reduce the value of our intellectual property:

| | · | Our applications for patents relating to our business may not be granted or, if granted, may be challenged or invalidated; |

| | · | Issued patents may not provide us with any competitive advantages; |

| | · | Our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology; |

| | · | Our efforts may not prevent the development and design by others of products or technologies similar to, competitive with, or superior to, those we develop; or |

| | · | Another party may obtain a blocking patent and we would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products. |

We may be forced to litigate to defend our intellectual property rights, or to defend against claims by third parties against us relating to intellectual property rights.

We may be forced to litigate to enforce or defend our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of other parties’ proprietary rights. Any such litigation could be expensive and could distract our management from focusing on operating our business. The existence and/or outcome of any such litigation could harm our business.

We may not be able to effectively manage our growth and operations, which could have a material adverse effect on our business.

We may experience rapid growth and development in a relatively short period of time. Should this happen, the management of this growth could require, among other things, continued development of our financial and management controls and management information systems, stringent control of costs, increased marketing activities, the ability to attract and retain qualified management personnel, and the training of new personnel. We intend to retain additional personnel as appropriate to manage our expected growth and expansion. Failure to successfully manage our possible growth and development could have a material adverse effect on our business and the value of our common stock.

Our future research and development projects may not be successful.

The successful development of products can be affected by many factors. Products that appear to be promising at their early phases of research and development may fail to be commercialized for various reasons, including the failure to obtain the necessary regulatory approvals. In addition, the research and development cycle for new products for which we may obtain such approvals certificate typically is long.

There is no assurance that any of our future research and development projects will be successful or completed within the anticipated time frame or budget or that we will receive the necessary approvals from relevant authorities for the production of these newly developed products, or that these newly developed products will achieve commercial success. Even if such products can be successfully commercialized, they may not achieve the level of market acceptance that we expect.

Any products we develop, acquire, or invest in may not achieve or maintain widespread market acceptance.

The success of any products we develop, acquire, or invest in will be highly dependent on market acceptance. We believe that market acceptance of any products will depend on many factors, including, but not limited to:

| | · | the perceived advantages of our products over competing products and the availability and success of competing products; |

| | · | the effectiveness of our sales and marketing efforts; |

| | · | our product pricing and cost effectiveness; |

| | · | the safety and efficacy of our products and the prevalence and severity of adverse side effects, if any; and |

| | · | publicity concerning our products, product candidates, or competing products. |

If our products fail to achieve or maintain market acceptance, or if new products are introduced by others that are more favorably received than our products, are more cost effective, or otherwise render our products obsolete, we may experience a decline in demand for our products. If we are unable to market and sell any products we develop successfully, our business, financial condition, results of operations, and future growth would be adversely affected.

Developments by competitors may render our products or technologies obsolete or non-competitive.

The medical device industry is intensely competitive and subject to rapid and significant technological changes. A large number of companies are pursuing the development of medical devices for markets that we are targeting. We face competition from pharmaceutical and biotechnology companies in the United States and other countries. In addition, companies pursuing different but related fields represent substantial competition. Many of the organizations competing with us have substantially greater capital resources, larger research and development staffs and facilities, longer medical device development history in obtaining regulatory approvals, and greater manufacturing and marketing capabilities than do we. These organizations also compete with us to attract qualified personnel and parties for acquisitions, joint ventures, or other collaborations.

If we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls over financial reporting, we may not be able to report our financial results accurately or timely or to detect fraud, which could have a material adverse effect on our business.

An effective internal control environment is necessary for us to produce reliable financial reports and is an important part of our effort to prevent financial fraud. We are required to periodically evaluate the effectiveness of the design and operation of our internal controls over financial reporting. Based on these evaluations, we may conclude that enhancements, modifications, or changes to internal controls are necessary or desirable. While management evaluates the effectiveness of our internal controls on a regular basis, these controls may not always be effective. There are inherent limitations on the effectiveness of internal controls, including collusion, management override, and failure of human judgment. In addition, control procedures are designed to reduce rather than eliminate business risks. If we fail to maintain an effective system of internal controls, or if management or our independent registered public accounting firm discovers material weaknesses in our internal controls, we may be unable to produce reliable financial reports or prevent fraud, which could have a material adverse effect on our business, including subjecting us to sanctions or investigation by regulatory authorities, such as the Securities and Exchange Commission. Any such actions could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of our financial statements, which could cause the market price of our common stock to decline or limit our access to capital.

Our common stock may be affected by limited trading volume and may fluctuate significantly.

There has been a limited public market for our common stock and there can be no assurance that an active trading market for our common stock will develop. This could adversely affect our shareholders’ ability to sell our common stock in short time periods or possibly at all. Our common stock has experienced and is likely to continue to experience significant price and volume fluctuations that could adversely affect the market price of our common stock without regard to our operating performance. Our stock price could fluctuate significantly in the future based upon any number of factors such as: general stock market trends; announcements of developments related to our business; fluctuations in our operating results; announcements of technological innovations, new products, or enhancements by us or our competitors; general conditions in the U.S. and/or global economies; developments in patents or other intellectual property rights; and developments in our relationships with our customers and suppliers. Substantial fluctuations in our stock price could significantly reduce the price of our stock.

Our common stock is traded on the OTC Markets which may make it more difficult for investors to resell their shares due to suitability requirements.

Our common stock is currently traded on the OTC Markets (Pink Sheets) where we expect it to remain for the foreseeable future. Broker-dealers often decline to trade in OTC Markets stocks given that the market for such securities is often limited, the stocks are often more volatile, and the risk to investors is often greater. In addition, OTC Markets’ stocks are often not eligible to be purchased by mutual funds and other institutional investors. These factors may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of their shares. This could cause our stock price to decline.

ITEM 1B – UNRESOLVED STAFF COMMENTS

This Item is not applicable to us as we are not an accelerated filer, a large accelerated filer, or a well-seasoned issuer; however, we have not received written comments from the Commission staff regarding our periodic or current reports under the Securities Exchange Act of 1934 within the last 180 days before the end of our last fiscal year.

ITEM 2 – PROPERTIES

Our office space is approximately 2,500 square feet and we lease the space rent-free from NorthStar Consumer Products, LLC, an entity controlled by John Linderman and James Barickman, two of our executive officers. Beginning in 2013 it is anticipated that we will begin paying a pro rata portion of the rent for our office space, expected to be 2,900 per month.

ITEM 3 – LEGAL PROCEEDINGS

We are not a party to any litigation. In the ordinary course of business, we may from time to time be involved in various pending or threatened legal actions. The litigation process is inherently uncertain and it is possible that the resolution of such matters might have a material adverse effect upon our financial condition and/or results of operations. However, in the opinion of our management, other than as set forth herein, matters currently pending or threatened against us are not expected to have a material adverse effect on our financial position or results of operations.

ITEM 4 – MINE SAFETY DISCLOSURES

There is no information required to be disclosed under this Item.

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is currently listed for trading on OTC Markets (Pink Sheets), OTCQB tier, under the trading symbol “TWSI”. Our common stock was originally listed on the OTC Bulletin Board on May 28, 2002, but was delisted on September 19, 2011, due to our failure to file our Quarterly Report on Form 10-Q for June 30, 2011. We are now current in our ’34 Act reporting obligations. If management elects to attempt to re-list on the OTC Bulletin Board we must have a market maker file a 15c2-11 application on our behalf and be approved by FINRA.

The following table sets forth the high and low bid information for each quarter within the fiscal years ended December 31, 2011 and 2012, as best we could estimate from publicly-available information. The information reflects prices between dealers, and does not include retail markup, markdown, or commission, and may not represent actual transactions. On January 18, 2013, we effected a 1-for-1,000 reverse stock split. The numbers below reflect the reverse stock split.

| Fiscal Year Ended | | | | Bid Prices | |

| December 31, | | Period | | High | | | Low | |

| | | | | | | | | |

| 2011 | | First Quarter | | $ | 40.00 | | | $ | 24.00 | |

| | | Second Quarter | | $ | 27.90 | | | $ | 7.10 | |

| | | Third Quarter | | $ | 9.00 | | | $ | 2.20 | |

| | | Fourth Quarter | | $ | 6.00 | | | $ | 2.00 | |

| | | | | | | | | | | |

| 2012 | | First Quarter | | $ | 5.00 | | | $ | 0.90 | |

| | | Second Quarter | | $ | 28.50 | | | $ | 1.00 | |

| | | Third Quarter | | $ | 22.00 | | | $ | 4.00 | |

| | | Fourth Quarter | | $ | 13.00 | | | $ | 6.00 | |

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to a few exceptions which we do not meet. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

Holders

As of December 31, 2012, there were approximately 41,032 (adjusted to reflect the 1-for-1,000 reverse stock split) shares of our common stock outstanding held by 1,408 holders of record and numerous shares held in brokerage accounts. As of March 28, 2013, there were 44,452,338 shares of our common stock outstanding. Of these shares, 4,077,338 were held by non-affiliates. On the cover page of this filing we value the 4,077,338 shares held by non-affiliates at $11,131,130. These shares were valued at $2.73 per share, based on our share price on March 28, 2013.

Warrants

As of December 31, 2012, we did not have any warrants to purchase our common stock outstanding.

On February 12, 2013, we entered into an Asset Purchase Agreement with HLBC Distribution Company, Inc. (“HLBCDC”), under which we exercised our option to purchase the Soft & Smooth Assets held by HLBCDC. In exchange for the Soft and Smooth Assets we agreed to issue to HLBCDC warrants enabling HLBCDC to purchase One Hundred Fifty Thousand (150,000) shares of our common stock at One Dollar ($1) per share, with a four (4) year expiration period.

Dividends

There have been no cash dividends declared on our common stock, and we do not anticipate paying cash dividends in the foreseeable future. Dividends are declared at the sole discretion of our Board of Directors.

Securities Authorized for Issuance Under Equity Compensation Plans

There are no outstanding options or warrants to purchase shares of our common stock under any equity compensation plans.

Currently, we do not have any equity compensation plans. As a result, we did not have any options, warrants or rights outstanding as of December 31, 2012.

Recent Issuance of Unregistered Securities

We did not have any recent issuances of unregistered securities as of December 31, 2012.

If our stock is listed on an exchange we will be subject to the Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to a few exceptions which we do not meet. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

ITEM 6 – SELECTED FINANCIAL DATA

As a smaller reporting company we are not required to provide the information required by this Item.

ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward-Looking Statements

This Annual Report on Form 10-K of TriStar Wellness Solutions, Inc. for the period ended December 31, 2012 contains forward-looking statements, principally in this Section and “Business.” Generally, you can identify these statements because they use words like “anticipates,” “believes,” “expects,” “future,” “intends,” “plans,” and similar terms. These statements reflect only our current expectations. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy and actual results may differ materially from those we anticipated due to a number of uncertainties, many of which are unforeseen, including, among others, the risks we face as described in this filing. You should not place undue reliance on these forward-looking statements which apply only as of the date of this annual report. To the extent that such statements are not recitations of historical fact, such statements constitute forward-looking statements that, by definition, involve risks and uncertainties. In any forward-looking statement where we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation of belief will be accomplished.

We believe it is important to communicate our expectations to our investors. There may be events in the future; however, that we are unable to predict accurately or over which we have no control. The risk factors listed in this filing, as well as any cautionary language in this annual report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Factors that could cause actual results or events to differ materially from those anticipated, include, but are not limited to: our ability to successfully obtain financing for product acquisition; changes in product strategies; general economic, financial and business conditions; changes in and compliance with governmental regulations; changes in various tax laws; and the availability of key management and other personnel.

Overview

We were incorporated on August 28, 2000 in the state of Nevada under the name “Quadric Acquisitions”. Following our incorporation we were not actively engaged in any business activities. On April 25, 2001, we were acquired by Zkid Network Company and changed our name to ZKid Network Co. As a result, we became engaged in the business of providing media content for children through the use of our proprietary software. On February 8, 2006, we announced that we would be unable to raise the necessary funds to continue with our then-existing business model and plan. Accordingly, we decided to seek an active company to acquire.

On May 8, 2006, we closed a share exchange agreement with Star Metro Group Limited, which became our wholly-owned subsidiary. Under the terms of the share exchange agreement we exchanged 60,000,000 shares of our company for 100% of the issued and outstanding shares of Star Metro Group at a ratio of 1 share of our common stock for each 2,000 shares of Star Metro Group Limited’s stock. As a result of the share exchange agreement, we became engaged in the development, production and sale of a line of biodegradable, single use, food and beverage containers. On March 20, 2006, we changed our name from ZKid Network Co. to Eatware Corporation.

On November 27, 2006, we changed our name from “Eatware Corporation” to “Star Metro Corp.” We were required to effect this name change by the terms of an agreement we entered into on November 13, 2006, with Glory Team Industrial Limited and Eddie Chou, an ex-director of our company. We effected this name change by merging Star Metro Corp., our newly incorporated and wholly-owned subsidiary that was created for this purpose, into our company, with our company carrying on as the surviving corporation under the name “Star Metro Corp.”

On February 26, 2007, we changed our name from “Star Metro Corp.” to “Biopack Environmental Solutions Inc.” This name change was effected by merging Biopack Environmental Solutions Inc., our newly incorporated and wholly-owned subsidiary that was created for this purpose, into our company, with our company carrying on as the surviving corporation under the name “Biopack Environmental Solutions Inc.”.

On March 27, 2007, we completed a share exchange with the shareholders of Roots Biopack Group Limited, a company formed under the laws of the British Virgin Islands. Under the terms of the share exchange agreement we acquired all of the issued and outstanding common shares of Roots Biopack Group in exchange for the issuance by our company of 90,000,000 common shares to the former shareholders of Roots Biopack Group.

On November 3, 2011, the People’s Court of Guandong Jiangmen Pengjiang District held a hearing relating to our landlord’s claim for unpaid rent for our factory plus penalty interest and other claims. The landlord had made a claim for payment of overdue rent in the amount of RMB 1,236,000, penalty interest in the amount of RMB 1,067,930 and a claim for potential loss of income in the amount of RMB 618,000, for a total amount claimed of RMB 2,921,930 (approximately $451,379). At the hearing, the Court ruled that after two unsuccessful attempts to auction the factory’s assets at the minimum level set by the Court appointed independent valuation company’s fair market assessment price, the Court set the reference value at RMB 3,613,139.20 (approximately $569,359) and transferred all the assets to the landlord. The landlord is legally responsible for settling any claims made by creditors, and the case has been closed.

On April 27, 2012, the holders of our preferred stock, which account for the voting control of the company, entered into an Agreement for the Purchase of Preferred Stock (the “Agreement”) with Rockland Group, LLC, a Texas limited liability company (“Rockland”), under which Rockland purchased Six Hundred Twenty Thousand (620,000) shares of TriStar Wellness Solutions, Inc. Series A Convertible Preferred Stock (the “Series A Preferred Shares”), One Million Shares (1,000,000) shares of TriStar Wellness Solutions, Inc. Series B Convertible Preferred Stock (the “Series B Preferred Shares”) and Seven Hundred Ten Thousand (710,000) shares of TriStar Wellness Solutions, Inc. Series C Convertible Preferred Stock (the “Series C Preferred Shares”, and together with the Series A Preferred Shares and the Series B Preferred Shares, the “Shares”). These shares represent approximately 63% of our outstanding votes on all matters brought before the holders of our common stock for approval and, therefore, represented a change of control. The transaction closed on April 27, 2012.

After the Agreement with Rockland, during 2012, we entered into the following agreements and transactions:

· On April 27, 2012, we entered into a Subsidiary Acquisition Option Agreement (“Subsidiary Option Agreement”) with Xinghui Ltd., a Chinese entity (“Purchaser“), under which sold all the shares in the BPAC Subsidiaries to the Purchaser, effective July 11, 2012, in exchange for the Purchaser assuming all our liabilities as of April 25, 2012, which included all of the liabilities and obligations of ours except for a $400,000 principal amount convertible note that was owed to Trilane Limited as of April 27, 2012. As a result of us exercising our rights under the Subsidiary Option Agreement, we no longer own the BPAC Subsidiaries, including any of their assets or liabilities.

· On June 25, 2012, we entered into a License and Asset Purchase Option Agreement (the “Agreement”) with NorthStar Consumer Products, LLC, a Connecticut limited liability company (“NCP”), under which we, acquired the exclusive license to develop, market and sell, NCP’s Beaute de Maman™ product line, which is a line of skincare and other products specifically targeted for pregnant women. In addition, we acquired the exclusive license rights to develop, market and sell NCP’s formula being developed for itch suppression, which would be sold as an over-the-counter product, if successful. In exchange for these license rights we agreed to issue NCP 225,000 shares of our Series D Convertible Preferred Stock. This transaction closed on June 26, 2012. Additionally, under the Agreement, in connection with our license rights and to ensure we could fulfill any immediate orders timely, we purchased all existing finished product of the Beaute de Maman™ product line currently owned by NCP. In exchange for the inventory we agreed to issue NCP 25,000 shares of Series D Convertible Preferred Stock. Each share is convertible into twenty five shares of common stock.

· On July 11, 2012, we entered into a Marketing and Development Services Agreement (the “Marketing Agreement”) with InterCore Energy, Inc. (“ICE”). Under the Marketing Agreement we were retained to market and develop certain assets referred to as the Soft & Smooth Assets held by ICE. The Soft & Smooth Assets include all rights, interests and legal claims to that certain invention entitled “Delivery Device with Invertible Diaphragm” which is a novel medical applicator that is capable of delivering medicants and internal devices within the body in an atraumatic fashion (without producing injury or damage). In additiona, we were also granted the exclusive option, in our sole discretion, to purchase the Soft & Smooth Assets from ICE for warrants to purchase One Hundred Fifty Thousand (150,000) shares of our common stock at One Dollar ($1) per share, with a four (4) year expiration period. On February 12, 2013, we entered into an Asset Purchase Agreement (the “HLBCDC Asset Purchase Agreement”) with HLBC Distribution Company, Inc. (“HLBCDC”), under which we exercised our option to purchase the Soft & Smooth Assets held by HLBCDC, which had acquired the Soft & Smooth Assets from ICE. In exchange for the Soft and Smooth Assets we agreed to issue to HLBCDC warrants enabling HLBCDC to purchase One Hundred Fifty Thousand (150,000) shares of our common stock at One Dollar ($1) per share, with a four (4) year expiration period.

As a result of the above transactions, as of December 31, 2012, we were a company involved in developing, marketing and selling, NCP’s Beaute de Maman™ product line, which is a line of skincare and other products specifically targeted for pregnant women, as well developing the Soft and Smooth Assets.

Discontinued Operations

As a result of the successful action by our prior landlord, as well as our election under the Subsidiary Acquisition Option Agreement, our operations during the year ended December 31, 2011 are included in the accompanying financial statements as discontinued operations. It is important to note that although we did have operations during 2011, we are required to classify those operations as discontinued operations in the attached financial statements due to the subsequent actions taken by us and others. The details related to our operations during these periods can be found in Note 8 to the attached financial statements.

Results of Operations for the Years Ended December 31, 2012 and 2011

Net profit (loss)

Our loss for the year ended December 31, 2012 totaled $2,248,519, with $1,818,357 derived from continuing operations and $430,162 attributed to discontinued operations, compared to a net loss for the year ended December 31, 2011 of $288,546, with a loss of $81,711 derived from continuing operations and a loss of $206,835 derived from operations that are now discontinued. Our loss of $2,248,519 for the year ended December 31, 2012 was primarily the result of $700,001 of research and development expenses recorded due to the purchase of the Soft & Smooth products on July 11, 2012, $383,750 of general and administrative expenses related to related party consulting contracts, and $400,000 related to the beneficial conversion feature on convertible debt issued as part of the recapitalization of our assets and liabilities.

Research and Development

For the year ended December 31, 2012 and 2011, we had research and development expenses of $700,001 and $0, respectively. The increase in research and development expenses is related to the purchase of the Soft & Smooth products on July 11, 2012 in exchange for 2,000,000 shares of our Series D Convertible Preferred Stock. The fair value of the shares amounted to $700,001 and was based on the closing stock price on the date of this transaction. This transaction was recorded as a component of research and development expenses during 2012 because the viability of an alternative future use was uncertain.

General and Administrative

Our general and administrative expenses for the year ended December 31, 2012 were $999,348, compared to $90,502 for the year ended December 31, 2011. The increase in operating expenses from the period ended December 31, 2012 compared to the prior year period was due to increased related party consulting expense and professional fees incurred related to the Change of Control transaction on April 27, 2012.

Loss from Discontinued Operations

Loss from discontinued operations for the year ended December 31, 2012 were $430,162, compared to $206,835 for the year ended December 31, 2011. The increase in loss from discontinued operations from the period ended December 31, 2012 compared to the prior year period was due to $400,000 related to the beneficial conversion feature on convertible debt issued as part of the recapitalization of our assets and liabilities, offset, by expenses related to general and administrative and impairment, depreciation and amortization.

Liquidity and Capital Resources

The following is a summary of our cash flows provided by (used in) operating, investing and financing activities from continuing operations during the periods indicated:

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | |

| | | | | | | |

| Cash at beginning of period | | $ | 0 | | | $ | 0 | |

| Net cash used in operating activities | | | (341,963 | ) | | | (68,835 | ) |

| Net cash provided by (used in) discontinued operations | | | (30,162 | ) | | | 110,171 | |

| Net cash (used in) investing activities | | | (1,057 | ) | | | 0 | |

| Net cash provided by (used in) financing activities | | | 384,352 | | | | (29,628 | ) |

| Effect of exchange rate on the balance of cash | | | 0 | | | | (11,708 | ) |

| Cash at end of period | | $ | 11,170 | | | $ | 0 | |

Cash Flows from Operating Activities – For the year ended December 31, 2012, net cash used in continuing operations was $341,963 compared to net cash used in continuing operations of $68,835 for the year ended December 31, 2011. Net cash used in continuing operations for the year ended December 31, 2012 was primarily related to start-up related professional fees as well as payments to related parties.

Cash Flows from Discontinued Operations – For the year ended December 31, 2012, net cash used in discontinued operations was $30,162 as compared to $110,171 in cash provided by discontinued operations.

Cash Flows from Investing Activities –Net cash used in investing activities from continuing operations for the year ended December 31, 2012 was due to the purchase of computer equipment for $1,057.

Cash Flows from Financing Activities – Net cash flows provided by financing activities from continuing operations in the year ended December 31, 2012 was $384,352, compared to net cash used in financing activities of $29,628 in the same period in 2011. For the twelve months in 2012, the cash flows provided by financing activities from continuing operations were from $175,000 in proceeds from notes payable and $209,352 in proceeds from issuance of our Series D Convertible Preferred Stock. For the twelve months in 2011, the cash flows used in financing activities from continuing operations were entirely from debt redemptions.

Our existing liquidity is not sufficient to fund our operations, anticipated capital expenditures, working capital and other financing requirements for the foreseeable future. We will need to seek to obtain additional debt or equity financing, especially if we experience downturns or cyclical fluctuations in our business that are more severe or longer than anticipated, or if we experience significant increases in the cost of raw material and manufacturing, lose a significant customer, or increases in our expense levels resulting from being a publicly-traded company. If we attempt to obtain additional debt or equity financing, we cannot assure you that such financing will be available to us on favorable terms, or at all.

Our financial statements for the year ended December 31, 2012 indicate there is substantial doubt about our ability to continue as a going concern as we are dependent on our ability to retain short term financing and ultimately to generate sufficient cash flow to meet our obligations on a timely basis in order to attain profitability, as well as successfully obtain financing on favorable terms to fund the company’s long term plans. We can give no assurance that our plans and efforts to achieve the above steps will be successful.

Contractual Obligations

The following table summarizes our contractual obligations as of December 31, 2012:

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | Total | |

| Debt obligations | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ - | | | $ | - | |

| Service contracts | | $ | - | | | $ | - | | | $ | - | | | $ - | | | $ | - | | | $ | - | |

| Operating leases | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Off Balance Sheet Arrangements

We have no off balance sheet arrangements.

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a smaller reporting company we are not required to provide the information required by this Item.

ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

For a list of financial statements and supplementary data filed as part of this Annual Report, see the Index to Financial Statements beginning at page F-1 of this Annual Report.

ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Dismissal of Previous Independent Registered Public Accounting Firm

On February 22, 2013, our Board of Directors approved the dismissal of Wong Lam Leung & Kwok CPA Limited as our independent auditor, effective immediately, and notified them of such dismissal.

Wong Lam Leung & Kwok CPA Limited audited our financial statements, including our balance sheets as of December 31, 2011, 2010 and 2009, and our related statements of operations, changes in stockholders’ equity, and statements of cash flows for the annual periods then ended. The audit report of Wong Lam Leung & Kwok CPA Limited on our financial statements for the period stated above (the “Audit Period”) did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles, but the reports of Wong Lam Leung & Kwok CPA Limited, for the Audit Period contained an emphasis of a matter paragraph which indicated conditions existed which raised substantial doubt about our ability to continue as a going concern.

During the fiscal years ended December 31, 2011, 2010 and 2009, and through Wong Lam Leung & Kwok CPA Limited’s dismissal on February 22, 2013, there were (1) no disagreements with Wong Lam Leung & Kwok CPA Limited on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Wong Lam Leung & Kwok CPA Limited, would have caused Wong Lam Leung & Kwok CPA Limited to make reference to the subject matter of the disagreements in connection with its reports, and (2) no events of the type listed in paragraphs (A) through (D) of Item 304(a)(1)(v) of Regulation S-K.

We furnished Wong Lam Leung & Kwok CPA Limited with a copy of this disclosure on February 22, 2013, providing Wong Lam Leung & Kwok CPA Limited with the opportunity to furnish the Company with a letter addressed to the Commission stating whether it agrees with the statements made by us herein in response to Item 304(a) of Regulation S-K and, if not, stating the respect in which it does not agree. A copy of Wong Lam Leung & Kwok CPA Limited’s letter to the SEC is filed as Exhibit 16.1 to our Current Report on Form 8-K filed with Commission on February 26, 2013.

Engagement of New Independent Registered Public Accounting Firm

Concurrent with the decision to dismiss Wong Lam Leung & Kwok CPA Limited as our independent auditor, the Board of Directors appointed M&K CPAS, PLLC (“M&K”) as our independent auditor.

During the year ended December 31, 2011 and through the date hereof, neither the Company nor anyone acting on its behalf consulted M&K with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided to the Company or oral advice was provided that M&K concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a disagreement or reportable events set forth in Item 304(a)(1)(iv) and (v), respectively, of Regulation S-K.

ITEM 9A – CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures (as defined) in Exchange Act Rules 13a – 15(c) and 15d – 15(e)). Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer, who are our principal executive officer and principal financial officers, respectively, concluded that, as of the end of the period ended December 31, 2012, our disclosure controls and procedures were not effective (1) to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms and (2) to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to us, including our chief executive and chief financial officers, as appropriate to allow timely decisions regarding required disclosure.

Our Chief Executive Officer and Chief Financial Officer do not expect that our disclosure controls or internal controls will prevent all error and all fraud. No matter how well conceived and operated, our disclosure controls and procedures can provide only a reasonable level of assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented if there exists in an individual a desire to do so. There can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

Furthermore, smaller reporting companies face additional limitations. Smaller reporting companies employ fewer individuals and find it difficult to properly segregate duties. Often, one or two individuals control every aspect of the company's operation and are in a position to override any system of internal control. Additionally, smaller reporting companies tend to utilize general accounting software packages that lack a rigorous set of software controls.

(b) Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rules 13a-15(f) and 15d-15(f) promulgated under the Exchange Act, as amended, as a process designed by, or under the supervision of, our Chief Executive Officer and Chief Financial Officer, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles in the United States and includes those policies and procedures that:

| • | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and any disposition of our assets; |

| | |

| • | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| | |

| • | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |