For a list of financial statements and supplementary data filed as part of this Annual Report, see the Index to Financial Statements beginning at page F-1 of this Annual Report.

* Filed herewith.

** XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

INDEX

| | | Page | |

| Financial Statements: | | | |

| Report of Independent Registered Public Accounting Firm | | | F-2 | |

| Consolidated Balance Sheets | | | F-3 | |

| Consolidated Statements of Operations | | | F-4 | |

| Consolidated Statements of Changes in Stockholders' Deficit | | | F-5 | |

| Consolidated Statements of Cash Flows | | | F-6 | |

| Consolidated Notes to the Financial Statements | | | F-7 | |

| | | | | |

| Supplementary Data | | | | |

| Not applicable | | | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

TriStar Wellness Solutions, Inc.

We have audited the accompanying consolidated balance sheets of TriStar Wellness Solutions, Inc. as of December 31, 2013 and 2012, and the related consolidated statements of operations, changes in stockholders' deficit and cash flows for the years then ended. These consolidated financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of TriStar Wellness Solutions, Inc. as of December 31, 2013 and 2012, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the Unites States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the consolidated financial statements, the Company has suffered reoccurring losses from operations, and has an accumulated deficit and working capital deficit as of December 31, 2013. These conditions raise substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 3. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

April 15, 2014

Houston, TX

www.mkacpas.com

TRISTAR WELLNESS SOLUTIONS, INC.

CONSOLIDATAED BALANCE SHEETS

(dollars in thousands, except per share amounts)

| | | As of December 31, | |

| | | 2013 | | | 2012 | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 193 | | | $ | 11 | |

| Accounts receivables, net | | | 638 | | | | - | |

| Prepaid expenses and other | | | 178 | | | | - | |

| Other receivables | | | 1,500 | | | | - | |

| Inventories, net | | | 1,144 | | | | 12 | |

| Total current assets | | | 3,653 | | | | 23 | |

| Non-current assets | | | | | | | | |

| Property and equipment, net | | | 997 | | | | 1 | |

| Intangible assets, net | | | 867 | | | | - | |

| Other non-current assets | | | 41 | | | | - | |

| Total non-current assets | | | 1,905 | | | | 1 | |

| TOTAL ASSETS | | $ | 5,558 | | | $ | 24 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 1,321 | | | $ | 33 | |

| Accounts payable and accrued expenses due to related parties | | | 973 | | | | 285 | |

| Current liabilities related to assets sold | | | 1,500 | | | | - | |

| Short-term notes (net of debt discount $497 and $0 as of December 31, 2013 and 2012, respectively) | | | 714 | | | | 50 | |

| Short-term notes - related party | | | 3,970 | | | | 525 | |

| Convertible notes | | | 356 | | | | - | |

| Deferred revenue | | | 306 | | | | - | |

| Total current liabilities | | | 9,140 | | | | 893 | |

| Non-current Liabilities | | | | | | | | |

| Deferred revenue, net of current portion | | | 48 | | | | - | |

| Total non-current liabilities | | | 48 | | | | - | |

| TOTAL LIABILITIES | | | 9,188 | | | | 893 | |

| | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | |

| Convertible preferred stock, $0.001 par value; 10,000,000 shares authorized; 5,621,667 and 6,120,000 shares issued and outstanding as of December 31, 2013 and 2012, respectively | | | 6 | | | | 6 | |

| Common stock; $0.0001 par value; 50,000,000 shares authorized; 22,041,713 and 41,032 shares issued and outstanding as of December 31, 2013 and 2012, respectively | | | 2 | | | | - | |

| Additional paid-in capital | | | 18,823 | | | | 8,939 | |

| Other comprehensive loss | | | (19 | ) | | | - | |

| Accumulated deficit | | | (22,442 | ) | | | (9,814 | ) |

| TOTAL STOCKHOLDERS' DEFICIT | | | (3,630 | ) | | | (869 | ) |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | | $ | 5,558 | | | $ | 24 | |

See accompanying notes to the consolidated financial statements

TRISTAR WELLNESS SOLUTIONS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in thousands)

| | | For the Years Ended | |

| | | December 31, | |

| | | 2013 | | | 2012 | |

| Sales revenue | | $ | 3,776 | | | $ | - | |

| Cost of Goods Sold | | | 3,074 | | | | - | |

| Gross profit | | | 702 | | | | - | |

| | | | | | | | | |

| Continuing operations | | | | | | | | |

| Operating expenses: | | | | | | | | |

| General and administrative | | | 7,331 | | | | 999 | |

| Sales, marketing and development expenses | | | 2,462 | | | | 700 | |

| Amortization on intangible assets | | | 59 | | | | 84 | |

| Impairment of intangible assets | | | 15 | | | | | |

| Total operating expenses | | | 9,867 | | | | 1,783 | |

| | | | | | | | | |

| Loss from operations | | | (9,165 | ) | | | (1,783 | ) |

| | | | | | | | | |

| Other income and (expenses) | | | | | | | | |

| Interest expense | | | (2,609 | ) | | | (35 | ) |

| Gain on sale of assets and liabilities | | | 2 | | | | - | |

| Inducement expense | | | (802 | ) | | | - | |

| Other | | | (54 | ) | | | - | |

| Total other income and (expenses) | | | (3,463 | ) | | | (35 | ) |

| | | | | | | | | |

| Loss for the period from continuing operations | | | (12,628 | ) | | | (1,818 | ) |

| Loss for the period from discontinued operations | | | - | | | | (430 | ) |

| | | | | | | | | |

| Net loss | | | (12,628 | ) | | | (2,248 | ) |

| | | | | | | | | |

| Other comprehensive loss | | | | | | | | |

| Foreign currency translation loss | | | (19 | ) | | | - | |

| | | | | | | | | |

| Total comprehensive loss | | $ | (12,647 | ) | | $ | (2,248 | ) |

| | | | | | | | | |

| Continuing operations | | | | | | | | |

| Loss per share | | $ | (0.43 | ) | | $ | (44.32 | ) |

| Diluted loss per share | | $ | (0.43 | ) | | $ | (44.32 | ) |

| | | | | | | | | |

| Discontinued operations | | | | | | | | |

| Loss per share | | $ | 0.00 | | | $ | (10.48 | ) |

| Diluted loss per share | | $ | 0.00 | | | $ | (10.48 | ) |

| | | | | | | | | |

| Total | | | | | | | | |

| Loss per share | | $ | (0.43 | ) | | $ | (54.79 | ) |

| Diluted loss per share | | $ | (0.43 | ) | | $ | (54.79 | ) |

| | | | | | | | | |

| Weighted average common shares outstanding | | | 29,576,522 | | | | 41,032 | |

| Diluted weighted average common shares outstanding | | | 29,576,522 | | | | 41,032 | |

See accompanying notes to the consolidated financial statements

TRISTAR WELLNESS SOLUTIONS, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

(dollars and shares in thousands)

| | | Preferred Stock | | | Common Stock | | | Accumulated | | | Additional Paid-in- | | | Other Comprehensive Income/ | | | Total Stockholders’ | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Deficit | | | capital | | | Loss | | | Deficit | |

| Balance at January 1, 2012 | | | 1,620 | | | $ | 2 | | | | 41 | | | $ | - | | | $ | (7,565 | ) | | $ | 5,034 | | | $ | 228 | | | | (2,301 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2nd Quarter - Series C Preferred issued to founders in connection with the change of control transaction | | | 710 | | | | 1 | | | | - | | | | - | | | | - | | | | (1 | ) | | | - | | | | - | |

| 2nd Quarter - Issuance of Series D Convertible Preferred for the acquisition of an intangible asset | | | 225 | | | | - | | | | - | | | | - | | | | - | | | | 84 | | | | - | | | | 84 | |

| 2nd Quarter - Issuance of Series D Convertible Preferred for the acquisition of inventory | | | 25 | | | | - | | | | - | | | | - | | | | - | | | | 5 | | | | - | | | | 5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3rd Quarter - Issuance of Series D Convertible Preferred for research and development | | | 2,000 | | | | 2 | | | | - | | | | - | | | | - | | | | 698 | | | | - | | | | 700 | |

| 3rd Quarter - Issuance of Series D Convertible Preferred for cash | | | 1,047 | | | | 1 | | | | - | | | | - | | | | - | | | | 208 | | | | - | | | | 209 | |

| 3rd Quarter - Issuance of Series D Convertible Preferred for services | | | 493 | | | | - | | | | - | | | | - | | | | - | | | | 354 | | | | - | | | | 354 | |

| Beneficial conversion charge on short term convertible debt | | | - | | | | - | | | | - | | | | - | | | | - | | | | 400 | | | | - | | | | 400 | |

| Imputed interest on note payable | | | - | | | | - | | | | - | | | | - | | | | - | | | | 34 | | | | - | | | | 34 | |

| Spin-off of Subsidiaries | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,123 | | | | (228 | ) | | | 1,895 | |

| Net Loss | | | | | | | - | | | | - | | | | - | | | | (2,249 | ) | | | - | | | | - | | | | (2,249 | ) |

| Balance at December 31, 2012 | | | 6,120 | | | $ | 6 | | | | 41 | | | $ | - | | | $ | (9,814 | ) | | $ | 8,939 | | | $ | - | | | $ | (869 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1st Quarter - Issuance of warrants for services | | | - | | | | - | | | | - | | | | - | | | | - | | | | 688 | | | | - | | | | 688 | |

| 1st Quarter - Issuance of warrants for research development | | | - | | | | - | | | | - | | | | - | | | | - | | | | 921 | | | | - | | | | 921 | |

| 1st Quarter - Issuance of common stock in exchange for convertible notes and accrued interest | | | - | | | | - | | | | 4,035 | | | | - | | | | - | | | | 32 | | | | - | | | | 32 | |

| 1st Quarter - Conversion of Series A Convertible Preferred into common stock | | | (215 | ) | | | - | | | | 1,075 | | | | - | | | | - | | | | - | | | | - | | | | - | |

| 1st Quarter - Conversion of Series C Convertible Preferred into common stock | | | (710 | ) | | | (1 | ) | | | 3,550 | | | | 1 | | | | - | | | | - | | | | - | | | | - | |

| 1st Quarter - Conversion of Series D Convertible Preferred into common stock | | | (1,430 | ) | | | (1 | ) | | | 35,750 | | | | 3 | | | | - | | | | (2 | ) | | | - | | | | - | |

| 1st Quarter - Issuance of Series D Convertible Preferred for research and development and acqusition of Beute de Maman | | | 750 | | | | 1 | | | | - | | | | - | | | | - | | | | 2,812 | | | | - | | | | 2,813 | |

| 1st Quarter - Issuance of Series D Convertible Preferred for cash | | | 67 | | | | - | | | | - | | | | - | | | | - | | | | 250 | | | | - | | | | 250 | |

| 1st Quarter - Conversion of notes payable to Series D Convertible Preferred | | | 60 | | | | - | | | | - | | | | - | | | | - | | | | 225 | | | | - | | | | 225 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2nd Quarter - Issuance of common stock for cash | | | - | | | | - | | | | 295 | | | | - | | | | - | | | | 227 | | | | - | | | | 227 | |

| 2nd Quarter - Issuance of warrants in conjunction with promissory notes | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,651 | | | | - | | | | 1,651 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3rd Quarter - Cancellation of common stock in exchange for Series D convertible Preferred Stock | | | 980 | | | | 1 | | | | (24,500 | ) | | | (2 | ) | | | - | | | | 1 | | | | - | | | | - | |

| 3rd Quarter - Issuance common stock for cash | | | - | | | | - | | | | 100 | | | | - | | | | - | | | | 100 | | | | - | | | | 100 | |

| 3rd Quarter - Issuance of warrants in conjunction with promissory notes | | | - | | | | - | | | | - | | | | - | | | | - | | | | 225 | | | | - | | | | 225 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 4th Quarter - Issuance common stock for debt conversion | | | - | | | | - | | | | 1,500 | | | | - | | | | - | | | | 12 | | | | - | | | | 12 | |

| 4th Quarter - Issuance common stock for cash | | | - | | | | - | | | | 195 | | | | - | | | | - | | | | 175 | | | | - | | | | 175 | |

| 4th Quarter - Issuance warrants for accrued salaries conversion | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,902 | | | | | | | | 1,902 | |

| 4th Quarter - Issuance of warrants in conjunction with promissory notes | | | - | | | | - | | | | - | | | | - | | | | - | | | | 556 | | | | - | | | | 556 | |

| Imputed interest on notes payable | | | - | | | | - | | | | - | | | | - | | | | - | | | | 31 | | | | - | | | | 31 | |

| Cumulative translation adjustment | | | | | | | | | | | | | | | | | | | | | | | | | | | (19 | ) | | | (19 | ) |

| Adjustment for the forgiveness of accounts payable to NCP | | | | | | | | | | | | | | | | | | | | | | | 78 | | | | | | | | 78 | |

| Net loss | | | | | | | | | | | | | | | | | | | (12,628 | ) | | | | | | | | | | | (12,628 | ) |

| Balance at December 31, 2013 | | | 5,622 | | | $ | 6 | | | | 22,041 | | | $ | 2 | | | $ | (22,442 | ) | | $ | 18,823 | | | $ | (19 | ) | | $ | (3,630 | ) |

See accompanying notes to the consolidated financial statements

TRISTAR WELLNESS SOLUTIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in thousands)

| | | For the Years Ended December 31, | |

| | | 2013 | | | 2012 | |

| Cash flows from operating activities: | | | | | | |

| Loss for the period from continuing operations | | $ | (12,628 | ) | | $ | (1,818 | ) |

| Loss for the period from discontinued operations | | | - | | | | (430 | ) |

| Adjustments to reconcile net profit/loss from continuing operations to net cash provided by operating activities: | | | | | | | | |

| Non-cash research and development expenses | | | 3,726 | | | | 700 | |

| Depreciation expenses | | | 196 | | | | - | |

| Inducement expenses | | | 802 | | | | - | |

| Amortization of debt discount | | | 2,002 | | | | - | |

| Issuance of series D convertible preferred stock for services | | | - | | | | 355 | |

| Issuance of warrants for services | | | 688 | | | | - | |

| Intangible asset amortization | | | 59 | | | | 84 | |

| Intangible asset impairment | | | 15 | | | | - | |

| Imputed interest on note payable | | | 31 | | | | 34 | |

| Accounts receivables | | | 15 | | | | - | |

| Inventory | | | 278 | | | | (7 | ) |

| Prepaid expenses | | | (22 | ) | | | - | |

| Accounts payable and accruals | | | 489 | | | | 25 | |

| Other non-current assets | | | (18 | ) | | | - | |

| Deferred revenue | | | (72 | ) | | | - | |

| Accounts payable and accrued expenses - related party | | | 1,866 | | | | 285 | |

| Net cash used in operating activities from continuing operations | | | (2,573 | ) | | | (342 | ) |

| Net cash provided by operating activities from discontinued operations | | | - | | | | (30 | ) |

| | | | | | | | | |

| Cash flow from investing activities: | | | | | | | | |

| Purchase of computer equipment | | | - | | | | (1 | ) |

| Acquisition of HemCon | | | (3,139 | ) | | | - | |

| Net cash used in investing activities | | | (3,139 | ) | | | (1 | ) |

| | | | | | | | | |

| Cash flow from financing activities: | | | | | | | | |

| Proceeds from issuance of short-term notes | | | 1,646 | | | | 175 | |

| Proceeds from issuance of short-term notes - related party | | | 4,110 | | | | - | |

| Proceeds from issuance of convertible notes - related party | | | 50 | | | | - | |

| Repayment of notes | | | (400 | ) | | | - | |

| Repayment of notes - related party | | | (245 | ) | | | - | |

| Proceeds from issuance of common stock | | | 502 | | | | - | |

| Proceeds from issuance of Series D convertible preferred stock | | | 250 | | | | 209 | |

| Net cash generated from financing activities from continuing operations | | | 5,913 | | | | 384 | |

| | | | | | | | | |

| Cumulative translation adjustment | | | (19 | ) | | | - | |

| Net change in cash | | | 182 | | | | 11 | |

| | | | | | | | | |

| Cash and cash equivalent, beginning | | | 11 | | | | - | |

| Cash and cash equivalent, ending | | $ | 193 | | | $ | 11 | |

| | | | | | | | | |

| Supplemental disclosure | | | | | | | | |

| Interest Paid | | $ | 31 | | | $ | - | |

| | | | | | | | | |

| Supplemental schedule of non-cash activities | | | | | | | | |

| Beneficial conversion feature on convertible debentures | | $ | - | | | $ | 400 | |

| Spinoff of assets and liabilities | | | - | | | | 2,123 | |

| Issuance of preferred shares for asset purchase option | | | - | | | | 784 | |

| Issuance of preferred shares for inventory | | | | | | | 5 | |

| Conversion of notes payable to preferred stock | | | 225 | | | | - | |

| Debt discount on promissory note | | | 2,432 | | | | - | |

| Conversion of preferred stock to common stock | | | 2 | | | | - | |

| Conversion of common stock to preferred stock | | | 2 | | | | - | |

| Conversion of accrued salaries to warrants | | | 1,100 | | | | - | |

| Issuance of common stock in exchange for convertible notes and accrued interest | | | 44 | | | | - | |

| Adjustment for the forgiveness of accounts payable to NCP - Related Party | | | 78 | | | | - | |

| Acquisition of Beaute de Maman for Series D Convertible Preferred Stock | | | 8 | | | | - | |

See accompanying notes to the consolidated financial statements

TRISTAR WELLNESS SOLUTIONS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(in thousands except per share)

1. The Company

Corporate History

Tristar Wellness Solutions, Inc. (“the Company”) was incorporated on August 28, 2000 in the state of Nevada under the name “Quadric Acquisitions”. Following its incorporation, the Company was not actively engaged in any business activities. On April 25, 2001, the Company was acquired by ZKid Network Company and changed its name to ZKid Network Co. As a result, the Company became engaged in the business of providing media content for children through the use of its proprietary software.

On April 12, 2006, the Company changed its name from " ZKid Network Co." to "EATware Corporation"; and effected a four thousand (4000) for one (1) reverse stock split.

On May 8, 2006, the Company closed a share exchange agreement with Star Metro Group Limited, which became a wholly-owned subsidiary. As a result of the share exchange agreement, the Company became engaged in the development, production and sale of a line of biodegradable, single use, food and beverage containers.

On November 27, 2006, the Company changed its name from “EATware Corporation” to “Star Metro Corp.” On February 26, 2007, the Company changed the name from “Star Metro Corp.” to “Biopack Environmental Solutions Inc.” This name change was effected by merging Biopack Environmental Solutions Inc., a newly incorporated and wholly-owned subsidiary that was created for this purpose, into the Company, with the Company carrying on as the surviving corporation under the name “Biopack Environmental Solutions Inc.”

On March 27, 2007, the Company completed a share exchange with the shareholders of Roots Biopack Group Limited, a company formed under the laws of the British Virgin Islands. Under the terms of the share exchange agreement the Company acquired all of the issued and outstanding common shares of Roots Biopack Group and the Company was engaged in the development, manufacture, distribution and marketing of bio-degradable food containers and disposable industrial packaging for consumer products.

On November 3, 2011, the People’s Court of Guandong Jiangmen Pengjiang District held a hearing relating to the Company’s landlord’s claim for unpaid rent for factory plus penalty interest and other claims. The landlord had made a claim for payment of overdue rent in the amount of RMB 1,236, penalty interest in the amount of RMB 1,068 and a claim for potential loss of income in the amount of RMB 618, for a total amount claimed of RMB 2,922 (approximately $451). At the hearing, the Court ruled that after two unsuccessful attempts to auction the factory’s assets at the minimum level set by the Court-appointed independent valuation company’s fair market assessment price, the Court set the reference value at RMB 3,613 (approximately $569) and transferred all the assets to the landlord. The landlord became legally responsible for settling all claims made by creditors, and the case was closed.

On April 27, 2012, the holders of our preferred stock, which account for the voting control of the company, entered into an Agreement for the Purchase of Preferred Stock (the “Agreement”) by Rockland Group, LLC, a Texas limited liability company (“Rockland”), under which Rockland purchased Six Hundred Twenty Thousand (620,000) shares of the Company, Inc. Series A Convertible Preferred Stock (the “Series A Preferred Shares”), One Million Shares (1,000,000) shares of the Company Series B Convertible Preferred Stock (the “Series B Preferred Shares”) and Seven Hundred Ten Thousand (710,000) shares of the Company Series C Convertible Preferred Stock (the “Series C Preferred Shares”, and together with the Series A Preferred Shares and the Series B Preferred Shares, the “Shares”). These shares represent approximately 63% of our outstanding votes on all matters brought before the holders of our common stock for approval and, therefore, represented a change of control. The transaction closed on April 27, 2012.

On April 27, 2012, we entered into a Subsidiary Acquisition Option Agreement (“Subsidiary Option Agreement”) with Xinghui Ltd., a Chinese entity (“Purchaser“), under which sold all the shares in the BPAC Subsidiaries to the Purchaser, effective July 11, 2012, in exchange for the Purchaser assuming all our liabilities as of April 25, 2012, which included all of the liabilities and obligations of ours except for a $400 principal amount convertible note that was owed to Trilane Limited as of April 27, 2012. As a result of us exercising our rights under the Subsidiary Option Agreement, we no longer own the BPAC Subsidiaries, including any of their assets or liabilities.

On June 25, 2012, the Company entered into a License and Asset Purchase Option Agreement (the “Agreement”) with NorthStar Consumer Products, LLC, a Connecticut limited liability company (“NCP”), under which the Company, acquired the exclusive license to develop, market and sell, NCP’s Beaute de Maman™ product line, which is a line of skincare and other products specifically targeted for pregnant women. In addition, the Company acquired the exclusive license rights to develop, market and sell NCP’s formula being developed for itch suppression, which would be sold as an over-the-counter product, if successful. In exchange for these license rights the Company agreed to issue NCP 225,000 shares of the Company’s Series D Convertible Preferred Stock. This transaction closed on June 26, 2012. Additionally, under the Agreement, in connection with its license rights and to ensure the Company could fulfill any immediate orders timely, the Company purchased all existing finished product of the Beaute de Maman™ product line currently owned by NCP. In exchange for the inventory the Company agreed to issue NCP 25,000 shares of Series D Convertible Preferred Stock. Each share is convertible into twenty five shares of the Company’s common stock.

On July 11, 2012, the Company entered into a Marketing and Development Services Agreement (the “Marketing Agreement”) with InterCore Energy, Inc. (“ICE”). Under the Marketing Agreement the Company was retained to market and develop certain assets referred to as the Soft & Smooth Assets held by ICE. The Soft & Smooth Assets include all rights, interests and legal claims to that certain invention entitled “Delivery Device with Invertible Diaphragm” which is a novel medical applicator that is capable of delivering medicants and internal devices within the body in an atraumatic fashion (without producing injury or damage). In addition, the Company was also granted the exclusive option, in its sole discretion, to purchase the Soft & Smooth Assets from ICE for warrants to purchase One Hundred Fifty Thousand (150,000) shares of its common stock at One Dollar ($1) per share, with a four (4) year expiration period. On February 12, 2013, the Company entered into an Asset Purchase Agreement (the “HLBCDC Asset Purchase Agreement”) with HLBC Distribution Company, Inc. (“HLBCDC”), under which we exercised our option to purchase the Soft & Smooth Assets held by HLBCDC, which had acquired the Soft & Smooth Assets from ICE. In exchange for the Soft and Smooth Assets we agreed to issue to HLBCDC warrants enabling HLBCDC to purchase One Hundred Fifty Thousand (150,000) shares of its common stock at One Dollar ($1) per share, with a four (4) year expiration period. In April 2012, the Company changed its name from “Biopack Environmental Solutions, Inc.” to “Tristar Wellness Solutions, Inc.” This name changes was effected by the agreement between the holders of its preferred stock, which account for the voting control of the Company with Rockland Group, LLC (“Rockland”), under which Rockland purchased shares of TriStar Wellness Solutions, Inc. These shares represent approximately 63% of its outstanding votes on all matters brought before the holders of our common stock for approval and, therefore, represented a change of control.

Effective January 2013 all common shares of the Company's common stock issued and outstanding were combined and reclassified on a one-for-one thousand basis. The effect of this reverse stock split has been retroactively applied to all periods presented.

On February 2013, the Company, and its wholly-owned subsidiary, TriStar Consumer Products, Inc., a Nevada corporation (“TCP”), closed an Asset Purchase Agreement (the “Asset Purchase Agreement”) with NorthStar Consumer Products, LLC, a Connecticut limited liability company (“NCP”), and John Linderman and James Barickman, individuals (the “Shareholders”), under which the Company exercised its option to purchase the Beaute de Maman™ product line, in addition to the over-the-counter itch suppression formula (together, the “Business”). As consideration for the purchase of the Business the Company agreed to issue NCP, or its assignees, Seven Hundred Fifty Thousand (750,000) shares of its Series D Convertible Preferred Stock.

On March 7, 2013, the Company entered into an Exclusive Manufacturing, Marketing and Distribution Definitive License Agreement (the “Agreement”) with Argentum Medical, LLC, a Delaware limited liability company (“Argentum”), under which the Company acquired an exclusive license to develop, market and sell products based on a technology called “Silverlon”, a proprietary silver coating technology providing superior performance related to OTC wound treatment. The license is for 15 years, with a possible 5 year extension. Under the Agreement, the Company is obligated to order a certain amount of proprietary Silverlon film each contract year and if the minimums are not met Argentum could cancel the Agreement. In exchange for these license rights the Company agreed to pay Argentum royalty payments based on the adjusted gross revenues generated by product sales, as well as issue Argentum a warrant to purchase up to 750,000 shares of its common stock with an exercise price of $0.50 per share.

On May 6, 2013, the Company closed the acquisition of HemCon Medical Technologies Inc., an Oregon corporation (“HemCon”), pursuant to the terms of an Agreement for Purchase and Sale of Stock entered into by and between us and HemCon (the “Agreement”). The Agreement was entered into as part of HemCon’s Fifth Amended Plan of Reorganization in its bankruptcy proceeding (United States Bankruptcy Court, District of Oregon, Case No. 12-32652-elp11) and was approved by the Court as part of HemCon’s approved Plan of Reorganization. Under the Agreement, the Company purchased 100 shares of HemCon’s common stock, representing 100% of HemCon’s then-outstanding voting securities, in exchange for $3,139 in cash (the “Purchase Price”). The Purchase Price was paid to the Court and the Trustee of the bankruptcy proceeding to be distributed to HemCon’s creditors in accordance with the Plan of Reorganization.

Prior to closing the acquisition of HemCon the Company borrowed money from several different parties, primarily the following:

| 1) | A Promissory Note with DayStar Funding, LP, a Texas limited partnership and a party controlled by Frederick A. Voight one of our officers and directors, in the principal amount of $2,950. The note has an interest rate of 1.5% per month and is due on or before November 6, 2013. Additionally, a loan fee of 2% of the principal amount is due and payable by us to lender on or before the maturity date. In connection with this promissory note, we issued DayStar Funding, LP, warrants to purchase 1,770,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. |

| 2) | A Promissory Note with the Lawrence K. Ingber Trust, dated June 14, 1980, as amended and restated March 6, 2006, in the principal amount of $100. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, we issued the Lawrence K. Ingber Trust warrants to purchase 50,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. |

| 3) | A Promissory Note with James Linderman, the father of one of our officers and directors, in the principal amount of $100. The note has an interest rate of 1.5% per month, simple interest, and is due on or before August 6, 2013. In connection with this promissory note, we issued Mr. James Linderman warrants to purchase 50,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. |

| 4) | A Promissory Note with James Barickman, one of our officers and directors, in the principal amount of $50. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, we issued Mr. James Barickman warrants to purchase 25,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. |

| 5) | A Promissory Note with John Linderman, one of our officers and directors, in the principal amount of $50. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, we issued Mr. John Linderman warrants to purchase 25,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. |

| 6) | A Loan Agreement with an unaffiliated third party for $400 was paid in connection with the closing of the acquisition of HemCon. The loan has an interest rate of 10% per annum and is due on or before November 6, 2013 and was repaid in 2013. |

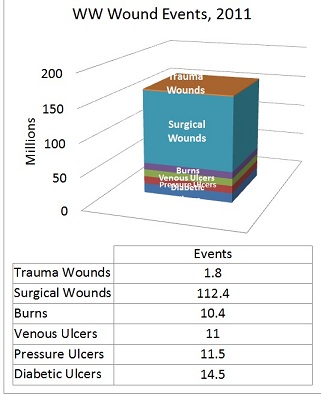

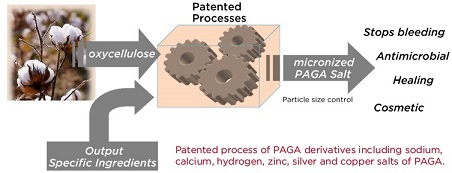

HemCon, founded in 2001, is a diversified life sciences company that develops, manufactures and markets innovative wound care/infection control medical devices. These products target the emergency medical, surgical, dental, military and over‐the‐counter (OTC), markets in the US and globally. HemCon’s advanced wound care and infection control products are designed to quickly stop moderate to severe hemorrhaging in OTC, surgery, trauma, battlefield injuries, and surgical wounds. The company’s wound care products are presently either chitosan-based or oxidized cellulose. Chitosan has long been recognized as a robust hemostat and provides natural antibacterial properties. Historically chitosan has been difficult to reliably incorporate into manufactured wound care products. HemCon has overcome these historical limitations and has been granted patents for its proprietary lyophilized and gauze-based manufacturing processes that allow for consistent and reliable commercial grade wound care and infection control products. HemCon’s original medical device product, the HemCon Bandage, was developed in partnership with the U.S. Army. Between 2003 and 2008, the bandage was the standard issue hemorrhage control bandage for all U.S. Army soldiers and is credited with saving hundreds of lives on the battlefield. Under the Reorganization Plan, HemCon kept its wound care/infection control medical devices business and all assets related thereto. The other segment of its operations, called the “LyP Product" which related to HemCon’s proprietary lyophilized human plasma and universal lyophilized plasma technology were spun out into a newly formed corporation and are not part of our acquisition of HemCon.

As a result of the above transactions, the Company was involved in developing, manufacturing and marketing HemCon’s innovative wound care/infection control medical devices, as well as, developing, marketing and selling, NCP’s Beaute de Maman™ product line, which is a line of skincare and other products specifically targeted for pregnant women.

2. Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The Company’s consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Company’s consolidated financial statements include the accounts of the Company and its 100% owned subsidiaries. All intercompany balances and transactions have been eliminated.

Cash and Cash Equivalents

Cash consists of funds deposited in checking accounts. While cash held by financial institutions may at times exceed federally insured limits, management believes that no material credit or market risk exposure exists due to the high quality of the institutions that have custody of the Company’s funds. The Company has not incurred any losses on such accounts.

Accounts Receivable

The Company extends credit to its customers in the normal course of business and performs ongoing credit evaluations of its customers. Accounts receivable are stated at amounts due from customers net of an allowance for doubtful accounts. Accounts that are outstanding longer than the contractual payment terms are considered past due. The Company determines its allowance for doubtful accounts by considering a number of factors, including the length of time trade accounts receivable are past due and the customer's current ability to pay its obligation to the Company. The Company writes off accounts receivable when they become uncollectible. Accounts receivable are net of an allowance for doubtful accounts of $8 and $0, at December 31, 2013 and December 31, 2012, respectively.

Use of Estimates

In preparing financial statements in conformity with U.S. GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of expenses during the reporting period. Due to inherent uncertainty involved in making estimates, actual results reported in future periods may be affected by changes in these estimates. On an ongoing basis, the Company evaluates its estimates and assumptions. These estimates and assumptions include valuing equity securities in share-based payment arrangements, estimating the fair value of equity instruments upon issuance, and estimating the useful lives of depreciable assets and whether impairment charges may apply.

Revenue Recognition

Product Sales Revenue

The Company recognizes product sales revenue when there is persuasive evidence of an arrangement, prices are fixed and determinable, the product is shipped or delivered, title and risk of loss have passed to the customer, and collection is reasonably assured. Certain of its product sales are made to distributors. The Company's distributor arrangements do not provide distributors with product return rights or pricing adjustments. The Company recognizes product sales to distributors on a sell-in basis, when the product is delivered

Deferred Revenue

The Company defers nonrefundable up-front payments received from distributors. These fees are recognized on a straight-line basis over the contractual term of the related contract.

Inventories

Inventories are stated at the lower of standard cost (which approximates average cost) or market.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided using the straight-line method for financial reporting purposes based on the estimated useful lives of the various assets ranging from three to ten years. Maintenance and repair costs are charged to current earnings. Upon disposal of assets, the costs of assets and the related accumulated depreciation are removed from the accounts. Gains or losses are reflected in current earnings.

Intangible assets

Intangible assets consist of patents, customer lists, non-compete arrangements and a trade name. Patents, customer lists, non-compete arrangements and a trade name acquired in business combinations under the purchase method of accounting are recorded at fair value net of accumulated amortization since the acquisition date. Amortization is calculated using the straight line method over the estimated useful lives at the following annual rates:

| | | Useful Lives | |

| Patents | | | 12 | |

| Customer lists | | | 14 | |

| Non-compete arrangements | | | 4 | |

| Trade name | | | 16 | |

The Company reviews its finite-lived intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of finite-lived intangible asset may not be recoverable. Recoverability of a finite-lived intangible asset is measured by a comparison of its carrying amount to the undiscounted future cash flows expected to be generated by the asset. If the asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds the fair value of the asset, which is determined based on discounted cash flows.

Other Receivables and Current Liabilities Related to Assets Sold

Prior to the Company acquisition of HemCon, on February 6, 2013, HemCon concluded an asset sale with Bard Access Systems for its GuardIVa™ product plus associated intellectual property and trademark for $4,500 following on from a license and supply agreement in October 2012 for $500. GuardIVa™ has been classified as a discontinued operation in the Consolidated Statement of Operations. This sale and the proceeds which were realized facilitated the Company in emerging from Chapter 11 Bankruptcy. An amount of $1.5 million remains outstanding as deferred consideration which is payable on achieving certain regulatory requirements. This deferred consideration will be paid to the Secured Creditors under the bankruptcy case 12-32652-ELP11 pursuant to the HemCon Sale and purchase agreement on receipt of same. GuardIVa™ is a hydrophilic foam based IV site dressing for use at Catheter insertion sites. The dressing incorporates HemCon micro dispersed oxidized cellulose technology an active hemostatic ingredient along with CHG a generic antibacterial agent.

Accumulated Other Comprehensive Income

Comprehensive income is defined as the change in equity of a company during the period resulting from transactions and other events and circumstances excluding transactions resulting from investments by owners and distributions to owners. The primary difference between net income and comprehensive income for the Company results from foreign currency translation adjustments. Accumulated other comprehensive loss was $19 for the period ended December 31, 2013 and $0 at December 31, 2012. The financial position of foreign subsidiaries is translated using the exchange rates in effect at the end of the period, while income and expense items are translated at average rates of exchange during the period. The net losses resulting from foreign currency transactions are recorded in the consolidated statements of operations in the period incurred were $19 for the year ended December 31, 2013 and $0 for the year ended December 31, 2012.

Concentration of Source of Materials

The Company uses a raw material that must meet specific quality standards in its production process, which is currently purchased from one vendor. The Company mitigates the risk to its production process through purchasing quantities sufficient to meet its production needs in the near term and by having identified alternative sources of supply of an equivalent standard should they become necessary.

Stock-Based Compensation

Compensation expense for all stock-based awards is measured on the grant date based on the fair value of the award and is recognized as an expense, on a straight-line basis, over the employee's requisite service period (generally the vesting period of the equity award). The fair value of each option award is estimated on the grant date using a Black-Scholes option valuation model. Stock-based compensation expense is recognized only for those awards that are expected to vest using an estimated forfeiture rate. We estimate pre-vesting option forfeitures at the time of grant and reflect the impact of estimated pre-vesting option forfeitures in compensation expense recognized. For options and warrants issued to non-employees, the Company recognizes stock compensation costs utilizing the fair value methodology over the related period of benefit.

Segment Reporting

The Company operates as one segment, in which management uses one measure of profitability. The Company is managed and operated as one business. The Company does not operate separate lines of business or separate business entities with respect to any of its product candidates. Accordingly, the Company does not have separately reportable segments. The Company generated $790 revenue from Europe and Asia and $2,986 from North America during 2013.

Accounting for Warrants

The Company accounts for the issuance of common stock purchase warrants issued in connection with equity offerings in accordance with the provisions of ASC 815, Derivatives and Hedging (“ASC 815”). The Company classifies as equity any contracts that (i) require physical settlement or net-share settlement or (ii) gives the Company a choice of net-cash settlement or settlement in its own shares (physical settlement or net-share settlement). The Company classifies as assets or liabilities any contracts that (i) require net-cash settlement (including a requirement to net-cash settle the contract if an event occurs and if that event is outside the control of the Company) or (ii) gives the counterparty a choice of net-cash settlement or settlement in shares (physical settlement or net-share settlement).

The Company assessed the classification of its common stock purchase warrants as of the date of each transaction and determined that such instruments met the criteria for equity classification. The warrants are reported on the consolidated balance sheet as a component of stockholders’ equity at fair value using the Black-Scholes valuation method.

Income Taxes

The Company adopted the provisions of ASC 740-10, which prescribes a recognition threshold and measurement process for financial statements recognition and measurement of a tax position taken or expected to be taken in a tax return.

Management has evaluated and concluded that there were no material uncertain tax positions requiring recognition in the Company’s financial statements as of December 31, 2013. The Company does not expect any significant changes in its unrecognized tax benefits within twelve months of the reporting date.

The Company’s policy is to classify assessments, if any, for tax related interest as interest expense and penalties as general and administrative expenses in the statements of operations.

Loss per Share

Basic loss per share is computed on the basis of the weighted average number of shares outstanding for the reporting period. Diluted loss per share is computed on the basis of the weighted average number of common shares (including redeemable shares) plus dilutive potential common shares outstanding using the treasury stock method. Any potentially dilutive securities are anti-dilutive due to the Company’s net losses. For the years presented, there is no difference between the basic and diluted net loss per share.

Recently Issued Accounting Pronouncements

Management does not believe that any recently issued, but not yet effective accounting pronouncements, if adopted, would have a significant effect to the accompanying consolidated financial statements.

Revenue Concentrations

The Company considers significant revenue concentrations to be counterparties who account for 10% or more of the total revenues generated by the Company during the period. For the year ended December 31, 2013, the amount of revenue derived from counterparties representing more than 10% of our total revenues was 13%. As of December 31, 2013 two customers owed a total of 33% of accounts receivable.

3. Going Concern and Management's Plans

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America (GAAP) applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenue sufficient to cover its operating costs and allow it to continue as a going concern. In addition, as of December 31, 2013, the Company had an accumulated deficit of $22,4442, had incurred a net loss for the year ended December 31, 2012 of $12,647 and had negative working capital of $5,487. Funding has been provided by related parties as well as new investors committed to make it possible to maintain, expand, and ensure the advancement of the TriStar Wellness products. The Company anticipates that the same related parties may fund the Company on an as needed basis or will seek to obtain financing from other outside parties.

The independent registered public accounting firm’s report on the financial statements for the fiscal year ended December 31, 2013 states that because the Company has suffered recurring operating losses from operations, there is substantial doubt about the Company’s ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming the Company will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty.

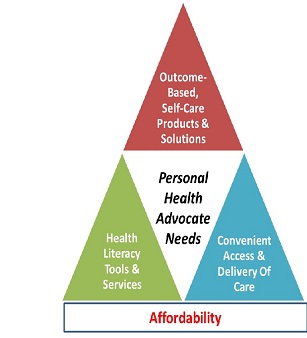

Strategy

The Company intends to focus on purchasing or licensing rights to various health and wellness products using in-house expertise to develop, test, bring to market, and market a variety of health and wellness products. The Company is currently aggressively completing development of product lines that the Company believes address important market needs in target categories. The Company plans to primarily rely on internal R&D expertise complimented by an extensive network of product development specialists to optimize the product development and testing in advance of market launch. In all cases the Company’s plan is to own the unique formulas or processes via direct acquisition or license. As appropriate the Company will pursue and defend patents on each product offering to help protect from competitive incursion.

4. Business Combinations

NorthStar Consumer Products, LLC

In February, 2013, the Company closed an Asset Purchase Agreement (the “Asset Purchase Agreement”) with NorthStar Consumer Products, LLC, a Connecticut limited liability company (“NCP”), and John Linderman and James Barickman, individuals (the “Shareholders”), under which the Company exercised an option to purchase a brand of skincare and other products specifically targeted for pregnant women (the Beaute de Maman product line), in addition to an over-the-counter itch suppression formula (together, the “Business”). Previously, the Company entered into to that certain License and Asset Purchase Option Agreement dated June 25, 2012 with NCP (the “License Agreement”), under with the Company licensed the Business from NCP and had the option to purchase the Business from NCP upon certain conditions being satisfied. As set forth in the Asset Purchase Agreement those conditions were either satisfied or renegotiated to the satisfaction of the parties and the Company exercised an option, and purchased, the Business from NCP. As consideration for the purchase of the Business the Company agreed to issue NCP, or its assignees, Seven Hundred Fifty Thousand (750,000) shares of Series D Convertible Preferred Stock. The fair value of the consideration given was $2,813 and the value of the assets received was $15, liability was $7 and such fair value of assets was impaired during 2013. There was no acquired assets other than intangible assets and therefore no purchase price is being presented. The fair values for acquired intangible assets of NCP were determined by the Company using a valuation performed by an independent valuation specialist. In addition, the Company also recorded an additional $2,805 expense based on the valuation of the Series D Convertible Preferred Stock determined by a valuation specialist. This transaction was recorded as a component of research and development expenses during 2013 because the viability of an alternative future use was uncertain.

HemCon

On May 6, 2013, the Company closed the acquisition of HemCon, an Oregon corporation (“HemCon”), pursuant to the terms of an Agreement for Purchase and Sale of Stock entered into by and between us and HemCon (the “Agreement”). The Agreement was entered into as part of HemCon’s Fifth Amended Plan of Reorganization in its bankruptcy proceeding (United States Bankruptcy Court, District of Oregon, Case No. 12-32652-elp11) and was approved by the Court as part of HemCon’s approved Plan of Reorganization. Under the Agreement, the Company purchased 100 shares of HemCon’s common stock, representing 100% of HemCon’s then-outstanding voting securities, in exchange for approximately $3.1 million (the “Purchase Price”). The Purchase Price was paid to the Court and the Trustee of the bankruptcy proceeding to be distributed to HemCon’s creditors in accordance with the Plan of Reorganization.

The acquisition has been accounted for under the acquisition method of accounting. Accordingly, the assets and liabilities of the acquired entity were recorded at their estimated fair values at the date of the acquisition. The operating results for HemCon have been included in the Company's consolidated financial statements since the acquisition date.

The purchase price allocation is based on estimates of fair value as follows (in thousands):

| Accounts receivables | | $ | 653 | |

| Other receivables | | | 1,500 | |

| Inventory | | | 1,410 | |

| Other current assets | | | 23 | |

| Prepaid expenses | | | 156 | |

| Fixed assets | | | 1,193 | |

| Accounts payable and accrued expenses | | | (341 | ) |

| Current liabilities related to assets held for sale | | | (1,500 | ) |

| Deferred revenue | | | (882 | ) |

| Patents | | | 336 | |

| Customer list | | | 198 | |

| Trade name | | | 266 | |

| Non-compete agreement | | | 127 | |

| Total acquisition cost allocated | | $ | 3,139 | |

Management assigned fair values to the identifiable intangible assets through a combination of the relief from royalty method and the multi-period excess earnings method.

The useful lives of the acquired intangibles are as follows:

| | | Useful Lives | |

| Patents | | | 12 | |

| Customer lists | | | 14 | |

| Non-compete arrangements | | | 4 | |

| Trade name | | | 16 | |

During year ended December 31, 2013, the Company incurred $100 of acquisition costs, all of which were expensed in operations during the second quarter of 2013.

The following unaudited pro forma financial information presents results as if the acquisition of HemCon had occurred on January 1, 2013 and January 1, 2012 (in thousands):

| Year Ended December 31 , | |

| (Unaudited) | | 2013 | | 2012 | |

| | | | | | |

| Total revenue | | $ | 5,469 | | | $ | 4,943 | |

| Net loss | | $ | (13,336 | ) | | $ | (9,751 | ) |

For purposes of the pro forma disclosures above, the primary adjustments for the year ended December 31, 2013 and December 31, 2012 include the elimination of acquisition-related charges of $100 and additional interest expense.

5. Inventories

Inventories, net consist of the following at December 31, 2013 and December 31, 2012 (in thousands):

| | | December 31, | |

| | | 2013 | | | 2012 | |

| Raw materials | | $ | 318 | | | $ | - | |

| Work in Progress | | | 251 | | | | - | |

| Finished Goods | | | 575 | | | | 12 | |

| | | $ | 1,144 | | | $ | 12 | |

Reserve for obsolescence was approximately $251 for year ended December 31, 2013 and $0 for December 31, 2012.

6. Property and Equipment

Property and equipment consist of the following at December 31, 2013 and December 31, 2012 (in thousands):

| | | Estimates Useful Life | | | December 31, | |

| | | (Years) | | | 2013 | | | 2012 | |

| Manufacturing Equipment | | 7-10 | | | $ | 623 | | | $ | - | |

| Leasehold Improvements | | 7 | | | $ | 520 | | | | - | |

| Office Furniture and Equipment | | 3-7 | | | $ | 32 | | | | - | |

| Computer Equipment and Software | | 1-5 | | | $ | 12 | | | | 1 | |

| Construction in Progress | | | | | | 6 | | | | - | |

| | | | | | | 1,193 | | | | 1 | |

| Less: Accumulated Depreciation, amortization and impairments | | | | (196 | ) | | | - | |

| | | | | | $ | 997 | | | $ | 1 | |

Depreciation expense was approximately $196 for the year ended December 31, 2013, respectively and $0 for the year ended December 31, 2012, respectively.

7. Loans Payable

| | | December 31, | | | December 31, | |

| | | 2013 | | | 2012 | |

Short-term notes (net of debt discount $497 and $0 as December 31, 2013 and December 31, 2012, respectively) | | $ | 714 | | | $ | 50 | |

| Short-term notes - related party | | | 3,970 | | | | 525 | |

| | | $ | 4,684 | | | $ | 575 | |

| | | December 31, | | | December 31, | |

| | | 2013 | | | 2012 | |

| Convertible notes | | $ | 356 | | | | - | |

| | | | 356 | | | $ | - | |

Promissory Notes

2012 Activity

During July 2012, The Company retained short term loans on demand of $400 to a related party (Sue Alter) as a result of the sale of the Company’s BPAC Subsidiaries. The note was modified in July 2012 to include a beneficial conversion feature. The conversion price of the modified note is $0.008 per share.

During the fourth quarter of 2012, the Company issued convertible demand notes to a related party for $125 which is convertible into 33,333 shares of Series D Convertible Preferred Stock. The notes do not bear interest. In February 2013, the notes were converted into 33,333 shares of Series D Convertible Preferred Stock.

During the fourth quarter of 2012, the Company issued convertible demand notes to a third party for $50 which is convertible into 13,333 shares of Series D Convertible Preferred Stock. The notes do not bear interest. In February 2013, the notes were converted into 13,333 shares of Series D Convertible Preferred Stock.

2013 Activity

During the first quarter of 2013, the Company issued convertible demand notes to a related party for $50 which is convertible into 13,333 shares of Series D Convertible Preferred Stock. The notes do not bear interest. In February 2013, the notes were converted into 13,333 shares of Series D Convertible Preferred Stock.

During the first quarter of 2013, Sue Alter, a related party, sold her convertible notes with accrued interest with a principal balance of $400 to three separate non-related parties. Subsequent to this sale, the new holders partially converted their notes payable, in accordance with the original terms of the notes, with a principal amount of $32 into 4,029,200 common shares.

During the second quarter of 2013, a third party partially converted their notes payable, in accordance with the original terms of the notes, with a principal amount of $8 into 1,000,000 common shares.

During the second quarter of 2013, the Company issued promissory notes to DayStar Funding, LP, a Texas limited partnership and a party controlled by Frederick A. Voight one of our officers and directors, in the principal amount of $2,950. The note has an interest rate of 1.5% per month and is due on or before November 6, 2013. In connection with this promissory note, we issued DayStar Funding, LP, warrants to purchase 1,770,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. This note is currently past due.

During the second quarter of 2013, the Company issued a promissory note with Mr. Frederick A. Voight, the chief investment officer and director, in the principal amount of $15. The note has an interest rate of 1.5% per month, simple interest, and is due on or before August 6, 2013. In connection with this promissory note, we issued Mr. Frederick A. Voight warrants to purchase 9,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. The warrants were valued at approximately $1.77 per warrant using the Black-Scholes model. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.04%, volatility – 92.45%, expected term – 4 years, expected dividends– N/A. This note is currently past due.

During the second quarter of 2013, the Company issued a promissory note with James Linderman, the father of one of our officers and directors, in the principal amount of $100. The note has an interest rate of 1.5% per month, simple interest, and is due on or before August 6, 2013. In connection with this promissory note, we issued Mr. James Linderman warrants to purchase 50,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. The warrants were valued at approximately $1.77 per warrant using the Black-Scholes model. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.04%, volatility – 92.45%, expected term – 4 years, expected dividends– N/A. This note is currently past due.

During the second quarter of 2013, the Company issued a promissory note with James Barickman, one of our officers and directors, in the principal amount of $50. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, we issued Mr. James Barickman warrants to purchase 25,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. The warrants were valued at approximately $1.77 per warrant using the Black-Scholes model. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.04%, volatility – 92.45%, expected term – 4 years, expected dividends– N/A. This note is currently past due.

During the second quarter of 2013, the Company issued a promissory note with John Linderman, one of our officers and directors, in the principal amount of $50. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, we issued Mr. John Linderman warrants to purchase 25,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. The warrants were valued at approximately $1.77 per warrant using the Black-Scholes model. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.04%, volatility – 92.45%, expected term – 4 years, expected dividends– N/A. This note is currently past due.

During the second quarter of 2013, the Company issued a promissory note with Lawrence Ingber, an unaffiliated third party, in the principal amount of $100. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, the Company issued to the holder warrants to purchase 50,000 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. The warrants were valued at approximately $1.77 per warrant using the Black-Scholes model. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.04%, volatility – 92.45%, expected term – 4 years, expected dividends– N/A. This note is currently past due.

During the second quarter of 2013, the Company issued a promissory note with Harry Pond in the principal amount of $36. The note has an interest rate of 1.5% per month, simple interest, and is due on or before November 6, 2013. In connection with this promissory note, the Company issued to the holder warrants to purchase 21,600 shares of our common stock at an exercise price $2.74 per share, which was the fair market value of our common stock on the date of issuance. The warrants were valued at approximately $1.77 per warrant using the Black-Scholes model. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.04%, volatility – 92.45%, expected term – 4 years, expected dividends– N/A. This note is currently past due.

During the second quarter of 2013, the Company entered into a Loan Agreement with Combat Medical Systems, an unaffiliated third party for a loan of up to $400, payable in two tranches, $400 was paid in connection with the closing of the acquisition of HemCon, and $350 payable in the future subject to contingencies. The loan has an interest rate of 10% per annum and is due on or before November 6, 2013. The note was repaid in full on November 26, 2013.

During the second quarter of 2013, the Company recorded 2% loan fees in aggregate for approximately $60 in connection with the promissory notes issued in May 2013. In connection with note issuances during the second quarter of 2013, the Company recorded a $1,726 discount at issuance and recorded debt discount amortization of $1,726 during the year ended December 31, 2013. Of the $1,726 discount recorded at issuance the portion relating to the detachable warrants of $1,666 was credited to additional paid in capital and the $60 loan fee described above was credited to the loan principal.

During the third quarter of 2013, the Company issued a promissory note with John Linderman, one of our officers and directors, in the principal amount of $175. The note has an interest rate of 22% per annum, simple interest, and is due on or before October 18, 2013. No warrants were issued in connection with the promissory note. This note was repaid in full during the fourth quarter of 2013.

During the third quarter of 2013, the Company issued promissory notes to DayStar Funding, LP, a Texas limited partnership and a party controlled by Frederick A. Voight one of our officers and directors, in the principal amount of $470. The note has an interest rate of 1.5% per month and is due on or before November 6, 2013. In connection with this promissory note, we issued DayStar Funding, LP, warrants to purchase 282,000 shares of our common stock at an exercise price $2.69 per share, which was the fair market value of our common stock on the date of issuance. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 0.96% to 1.35%, volatility – 78.06% to 80.75%, expected term – 4 years, expected dividends– N/A.

During the third quarter of 2013, the Company recorded 2% loan fees in aggregate for approximately of $10 in connection with the promissory notes issued in August 2013. In connection with note issuances during the third quarter of 2013, the Company recorded a $220 discount at issuance and recorded debt discount amortization of $220 for the year ended December 31, 2013. Of the $220 discount recorded at the issuance the portion relating to the detachable warrants of $210 was credited to additional paid in capital and the $10 loan fee described above was credited to the loan principal.

During the fourth quarter of 2013, a third party partially converted their notes payable, in accordance with the original terms of the notes, with a principal amount of $4 into 500,000 common shares.

During the fourth quarter of 2013, the Company paid the second payment against the Loan Agreement with Combat Medical System in the amount of $400, in connection with the closing of the acquisition of HemCon.

During the fourth quarter of 2013 the Company issued promissory notes to DayStar Funding, LP, a Texas limited partnership and a party controlled by Frederick A. Voight one of our officers and directors, in the principal amount of $300. The note has an interest rate of 18% per annum, simple interest and is due on or before May 1, 2014. No warrants were issued in connection with the promissory note. The Company repaid $70 of this promissory note during 2013.

During the fourth quarter of 2013 the Company issued a promissory note to a third party, in the principal amount of $1,100. The note has an interest rate of 21% per annum, simple interest and is due on or before November 30, 2014. In connection with this promissory note, the Company issued warrants to purchase 1,000,000 shares of our common stock at an exercise price $1.80 per share, which was the fair market value of our common stock on the date of issuance. The relative fair value of the warrants compared to the debt was recorded as a component of stockholders’ equity with the offset recorded as a discount on the promissory notes and included as a component of promissory notes in the accompanying consolidated balance sheet as of December 31, 2013. The fair value of the warrants was determined using the Black-Scholes model with the following assumptions: risk free interest rate – 1.39%, volatility – 85.8%, expected term – 4 years, expected dividends– N/A. The debt discount related to the warrants are being amortized over a one year period (through maturity) on a straight-line basis. The Company recorded a debt discount related to the warrants of $556 by crediting additional paid in capital. Amortization expense on the debt discount was $56 for the year ended December 31, 2013.

The Company recorded imputed interest on convertible debentures and interest expense of $31 and $34 for year ended December 31, 2013 and 2012 respectively, based upon a market interest rate of 8% and accrued interest based on the stated rate of 0.5%.

8. Stockholders’ Equity

Series A, B and C Convertible Preferred Stock – Change of Control Transaction

On April 27, 2012, the Company was party to an agreement whereby Rockland Group, LLC, a Texas limited liability company (“Rockland”), purchased six hundred and twenty thousand (620,000) shares of Biopack Environmental Solutions, Inc. Series A Convertible Preferred Stock (“Series A Preferred Shares”), one million (1,000,000) shares of Biopack Environmental Solutions, Inc. Series B Convertible Preferred Stock (“Series B Preferred Shares”) and seven hundred ten thousand (710,000) shares of Biopack Environmental Solutions, Inc. Series C Convertible Preferred Stock (“Series C Preferred Shares”) from the holders of those shares. The Series A Preferred Shares and Series B Preferred Shares were issued prior to December 31, 2011. The Series C Preferred Shares were issued in April 2012. Together the Shares represented approximately 63% of our outstanding votes on all matters brought before the holders of our common stock for approval and, therefore, represented a change of control. Each share of Series A, B and C Convertible Preferred Stock is convertible into 5 shares of common stock on the date of this transaction.

Intangible Asset and Inventory Acquisition in Exchange for Series D Convertible Preferred Stock

On June 25, 2012, the Company entered into a License and Asset Purchase Option Agreement (the “Agreement”) with NorthStar Consumer Products, LLC, a Connecticut limited liability company (“NCP”), under which TriStar Consumer Products, Inc., acquired the exclusive license to develop, market and sell, NCP’s Beaute de Maman product line, which is a line of skincare and other products specifically targeted for pregnant women. In addition, the Company acquired the exclusive license rights to develop, market and sell NCP’s formula being developed for itch suppression, which would be sold as an over-the-counter product, if successful. These licenses are for a period of up to one year, subject to earlier termination upon specified events. During the term of the license, the assets and being licensed will be run by management of NCP pursuant to a consulting agreement. As a result of these license rights the Company are now responsible for developing, marketing and selling the “Beaute de Maman” products, as well as NCP’s anti-itch formula, including all expenses, contractual arrangements, etc., related to product development, manufacturing, marketing, selling, bottling and packaging, and shipping. The Company will also receive all proceeds derived from sales of the products, other than the amounts owed to Dr. Michelle Brown, from whom NCP purchased the “Beaute de Maman” assets. Such proceeds were recorded as a reduction of general and administrative expenses. Under the arrangement with Dr. Brown she is entitled to approximately seven percent (7%) of net revenue for all products sold under the Beaute de Maman brand name and derived from formulas transferred under the agreement with NCP for a 20 year period ending December 31, 2031. In exchange for these license rights the Company agreed to issue NCP 225,000 shares of our Series D Convertible Preferred Stock. This transaction closed on June 26, 2012. Additionally, under the Agreement, in connection with the Company’s license rights and to ensure it can fulfill any immediate orders timely, the Company purchased all existing finished product of the Beaute de Maman product line currently owned by NCP. In exchange for the inventory the Company agreed to issue NCP 25,000 shares of Series D Convertible Preferred Stock. Each share is convertible into twenty five shares of common stock. The fair value of the shares amounted to $89 and was based on the closing common stock price of common stock and the conversion ratio (each share of Series D Convertible Preferred Stock is convertible into 25 shares of common stock) on the date of this transaction. The Company recorded $84 as an intangible asset and $5 as inventory on the date of the transaction.

Issuance of Series D Convertible Preferred Stock for Cash and Services

On June 29, 2012, the Company entered into a Stock Purchase Agreement with Rockland Group, LLC, an entity owned and controlled by Harry Pond, one the Company’s officers and directors (the “Stock Purchase Agreement”). Under the Stock Purchase Agreement, Rockland Group agreed to purchase 1,540,000 shares of our Series D Convertible Preferred Stock. The value of the shares was based upon the cash received and expenses contributed.

The Company issued 1,046,760 shares of Series D Convertible Preferred Stock in exchange for $209,352 in cash. In addition, the Company issued 493,240 shares of Series D Convertible Preferred Stock in exchange for $354,983 of expenses contributed by Rockland on behalf of the Company (total Series D Preferred shares issued is 1,540,000). The value of the expenses contributed was based on the closing common stock price of common stock and the conversion ratio (each share of Series D Convertible Preferred Stock is convertible into 25 shares of common stock) the date of this transaction.

Issuance of Series D Convertible Preferred Stock for Research and Development